Bridge Report:(4494)Vario Secure Fiscal Year February 2021

Yoshihiko Inami, CEO | Vario Secure Inc. (4494) |

|

Company Information

Exchange | 2nd section of Tokyo Stock Exchange |

Industry | Information and Communications |

CEO | Yoshihiko Inami |

Address | Sumitomo Corporation Nishiki-cho Bldg., 5F, 1-6, Kanda-Nishiki-cho, Chiyoda-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE (Act.) | Trading Unit | |

¥1,565 | 3,766,620 shares | ¥5,894 million | 13.4% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥40.44 | 2.6% | ¥134.79 | 11.6x | ¥1,048.52 | 1.5x |

*The share price is the closing price on May 27. All figures are taken from the brief financial report for the term ended February 2021.

Earnings Trends

Fiscal Year | Revenue | Operating Profit | Profit before tax | Profit | EPS | DPS |

February 2020 Act. | 2,513 | 789 | 723 | 498 | 133.70 | 0.00 |

February 2021 Act. | 2,545 | 764 | 707 | 491 | 131.78 | 39.44 |

February 2022 Est. | 2,649 | 782 | 732 | 507 | 134.79 | 40.44 |

* Unit: million-yen, yen. Estimates calculated by the company. IFRS applied.

This document will showcase the company overview and growth strategy of Vario Secure Inc., along with an interview of CEO Inami.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year February 2021 Earnings Results

3. Fiscal Year February 2022 Earnings Forecasts

4. Growth Strategy

5. Interview with CEO Inami

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The company offers comprehensive network security services through which their customers can safely use the Internet, under the mission: “To ensure that all enterprises using the Internet can easily and securely carry out their business, we will offer the very best services to Japan and to the world.”

- Their specialties and strengths include (1) an original business model, which offers a one-step solution with the procurement of devices used for security services, the development of key software installed into those devices, installation and setting up of those devices, and monitoring and operation of the devices after installation, (2) a stable earnings model, which is based on a recurring revenue business, whose revenues increase year by year through an increase in the number of companies installing their products with a monthly charging system, and on a low cancellation rate, (3) a strong marketing channel covering the entire country with 29 partnered companies in OEM and 54 partnered companies in resale, and (4) a high share among small and medium sized enterprises, which appraises the ease of installation of their products.

- The revenue for the term ended February 2021 was 2,545 million yen, up 1.3% from the end of the previous term. Managed Security Services grew steadily. Operating profit was 764 million yen, down 3.1% from the end of the previous term. Travelling and entertainment expenses decreased because of the novel coronavirus, but in addition to the added expenses for preparation for listing on the stock exchange, they also incurred maintenance expenses for the integration of the security operations center and for preparations to adapt to online workstyles. Both revenue and profit were almost in line with their estimates.

- The revenue for the term ending February 2022 is estimated to be 2,649 million yen, up 4.1% from the end of the previous term and operating profit is projected to be 782 million yen, up 2.4% from the end of the previous term. Expecting an increase in personnel recruitment to strengthen the marketing and sales department and strengthen the legal department following the listing on the stock exchange, an increase in advertisement expenses, and an augmentation of advisory fees, operating profit margin is projected to decrease 0.5 points from the end of the previous term, but a growth of profit is expected. The dividend is to be 40.44 yen per share. The estimated payout ratio is 30.0% on the IFRS base.

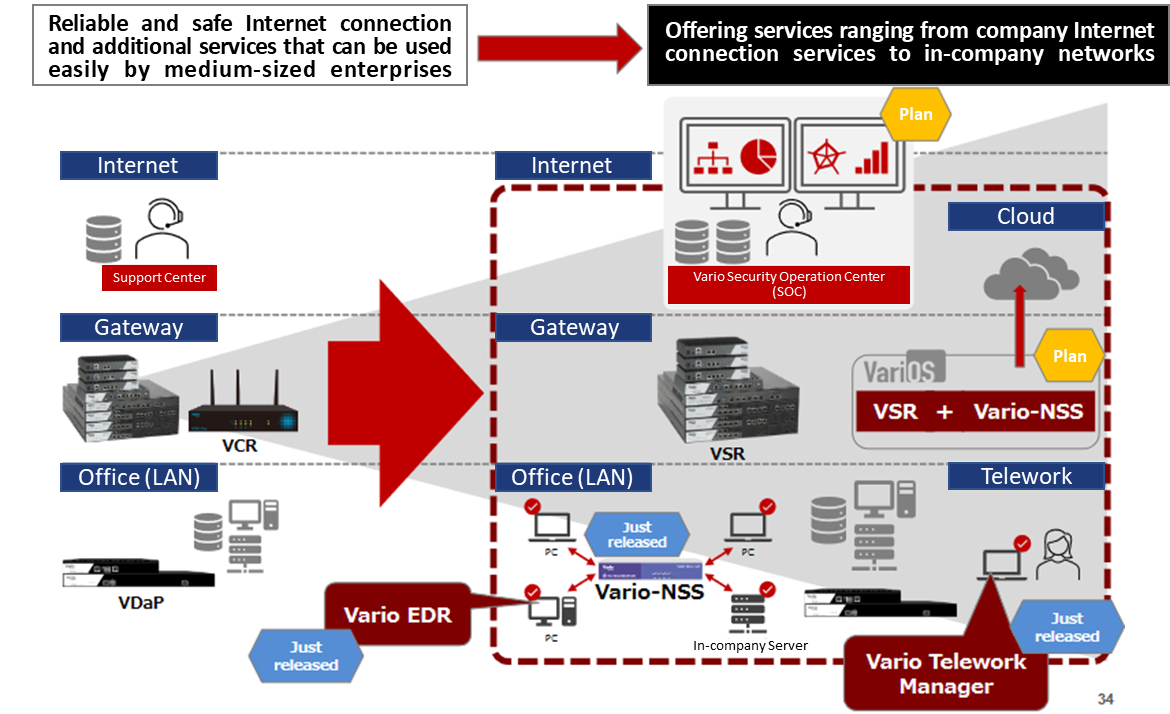

- The company, which has created a business foundation by offering reliable and safe internet connection and additional services that can be used easily by medium-sized enterprises, will now move beyond internet services and herald a concept of, “Information System as a Service”, offering services by expanding their reach to in-company network infrastructure as a whole. They aim to implement this concept by focusing on the sale of EDR service, which is expected to grow rapidly, as well as new services in network platform vulnerability management.

- CEO Inami was asked about the competitive edge of his company, future growth strategies, and his message to stockholders and investors. He emphasized, “We would appreciate it if all of you would recognize our company’s societal reason for existence, business contents, and specialties and strengths, and continue to provide your mid- to long-term support.”

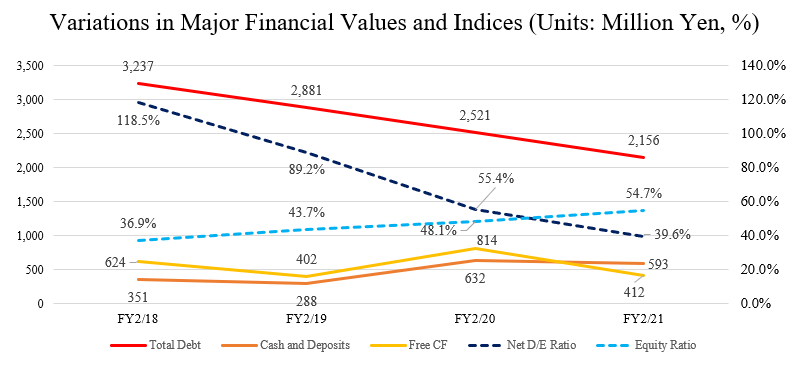

- In the Securities Report for New Listing Application (Section I), submitted in October 2020, the company has brought up “Regarding Borrowing Large Sums of Money, Changing Interest Rates and Conflict of other Financial Covenants” as risks, but loans are reduced through free cash flow created from a stable revenue base, and net D/E ratio and equity ratio are also steadily improving.

- The company is aware of the capital cost, and we believe it is entering a stage where it shifts its cash usage from focusing on the repayment of loans to investments towards the realization of the “Information System as a Service” concept, offering services by expanding their reach to in-company network infrastructure as a whole. While PER has reached 10 and its stock price has hit a new low since listing, we would like to pay attention to whether they can meet emerging needs through this concept and meet the expectations of investors by improving their brand value.

1. Company Overview

[1-1 Corporate History]

In June 2001, Ambisys Inc. — the predecessor of the company — was founded with the business objectives to develop and operate information, communication, and security systems and provide consulting services on them. In May 2002, the company launched the managed security services using the integrated Internet security appliance equipment. In June 2003, the company name was changed to Vario Secure Networks Inc. As an independent Internet security service company, the company steadily expanded its businesses and was listed on the Nippon New Market “Hercules” at the Osaka Securities Exchange in June 2006.

In the ensuing period, the company’s growth slowed down with a higher churn rate from existing customers and the increase in service installation locations stagnating, as a result of the deterioration in corporate profits and the decline in private capital investments triggered by the bankruptcy of Lehman Brothers.

In order to make speedy management decisions and improve corporate value under a dynamic and flexible management system in the constantly changing network security market, the company realized that upfront investments were unavoidable, which might temporarily deteriorate profits. Under such a condition, the company took a decision to delist shares and concentrate on improving corporate value, and in December 2009 duly delisted the shares on Hercules.

After delisting, the company renewed its management structure amid several major shareholder reshuffles, and increased its internal cost awareness, while working to expand its businesses by strengthening the existing sales force and developing new sales agents, as well as continuously conducting R&D to improve the quality of security services. As a result, the company was able to increase corporate value, which was the purpose of delisting, by strengthening its sales structure, creating new businesses, and strengthening the service menu. The company name was changed to its current name, Vario Secure, Inc. in September 2016.

To realise a sustainable growth and corporate value enhancement, the company was convinced of the importance of securing the flexible and diverse financing methods and also that by relisting, the company could further improve social credibility, secure excellent human resources, improve employees’ motivation to work, and aim for appropriate stock price formation and liquidity, the company got listed on the Second Section of the Tokyo Stock Exchange in November 2020.

[1-2 Corporate Philosophy, etc.]

The company’s mission is “to ensure that all enterprises using the Internet can easily and securely carry out their business, the company will offer the very best services to Japan and to the world.”

Under this mission, as a company that provides Internet-related security services, it provides comprehensive network security services to assist with the safer use of the Internet by protecting the customers’ networks from attacks from the Internet, intrusions into internal networks, and various threats such as virus infections and data thefts.

[1-3 Market Environment]

◎ Growing demand for cybersecurity

In December 2020, the Ministry of Economy, Trade and Industry (METI) issued a report urging business owners to strengthen cybersecurity efforts in response to the ever-increasing cyberattack entry points as well as the severities of the attacks.

This report identified the following current issues:

• In recent years, the attack entry points in the supply chain used by attackers have been constantly increasing. These include overseas bases of business partners including SMEs and companies expanding overseas, as well as gaps created by the increase in telework due to the spread of the novel coronavirus.

• In addition to demanding ransoms to recover encrypted data, ransomware that uses the so-called “double threats” — threatens to release the data that was stolen in advance before encrypting unless ransom is paid — are rapidly increasing in Japan. This is due to the establishment of an ecosystem which enables attackers to systematically provide ransomware as well as collecting ransoms systematically, allowing them to operate easily without having to be highly skilled.

• With the globalization of businesses, more and more systems that are closely linked with overseas bases are being built; however, as a result of linking the Japanese domestic systems to those of overseas without sufficient measures, the risk of intrusion is increased as this enabled the attackers to construct intrusion routes at overseas bases where security measures are insufficient.

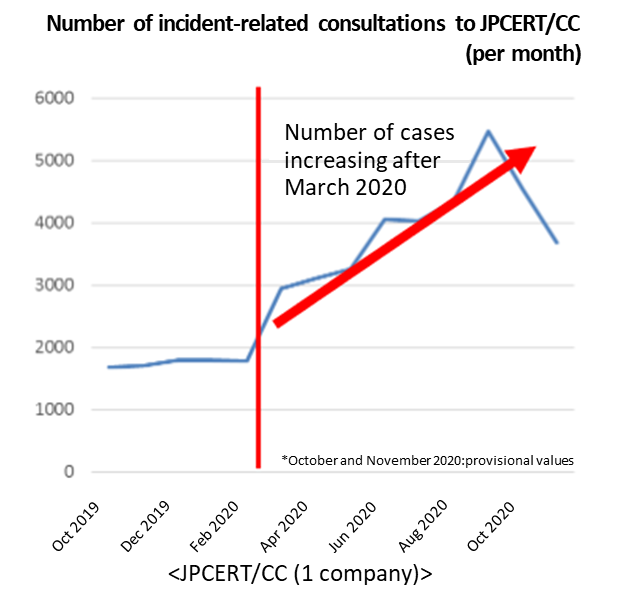

As shown in the graph below, since March 2020 when the novel coronavirus began spreading, the number of consultations concerning those unexpected events that would quickly spiral out of control without immediate counteractions has been increasing.

(From the Ministry of Economy, Trade and Industry’s “Warning to Managers Concerning the Recent Cyberattacks (Summary Edition)”

Based on these, the report urges corporate managers to act on the following responses and initiatives:

• The severity of damage caused by cyberattacks is increasingly more serious and the damages are also more complex: management needs to be involved even more than previously.

• Responding to the damages caused by ransomware attacks is an important issue directly related to corporate trust, and sweeping management leadership is required from proactive prevention to postvention.

Under these conditions, the security service market is seeing an increase in demand.

The security service market requires advanced security measures, but companies that find it difficult to operate and manage in-house security measures tend to outsource operations and monitoring to security vendors, leading to an increase in the service usage.

The market size is expected to expand from 223.7 billion yen in the fiscal 2019 to about 322.2 billion yen in the fiscal 2025, with an average annual growth rate of 6.3% (from the company’s securities report. Source: Fuji Chimera Research Institute, Inc. “2020 Network Security Business Survey Overview (Market Edition)” published on November 17, 2020).

◎ IT personnel shortage

The METI ran a trial calculation of the output gap in IT human resources due primarily to the expansion of IT investment by companies using AI.

According to the report, if the productivity growth rate is 0.7%, the shortage in the number of IT workers in 2030 is estimated at 787,000 in the high-level scenario (3-9% growth in IT demand), 449,000 in the medium level scenario (2-5% of the same), and 164,000 in the low-level scenario (1%). Even if productivity were to rise to 2.4%, the high-level scenario still predicts a shortfall of 438,000 people.

Under these circumstances, it is difficult for companies to secure sufficient IT human resources within their companies, therefore a steady increase is expected for the demand for “managed service” that provide not only the functions but also combine the operation management as one when using IT systems.

* Gap in demand for IT personnel in 2030 (number of workers)

Productivity Growth Rate | Low-level scenario | Medium-level scenario | High-level scenario |

0.7% | 164,000 | 449,000 | 787,000 |

2.4% | -72,000 | 161,000 | 438,000 |

*Created by Investment Bridge based on the Ministry of Economy, Trade and Industry’s “Survey on Supply and Demand of IT Human Resource (Summary)” (April 2019).

[1-4 Business Contents]

(1) Service category

The company provides two security services: Managed Security Services and Integration Services (segment: single segment of Internet security service business).

These services cover every step in the security framework: construction, identification, defense, detection, response, and recovery.

① Managed Security Services

In addition to the integrated Internet security service using VSR and the data backup service (VDaP), since the term ended February 2021, the company has been offering Vario EDR service that help detect and respond to cyberattacks at lower operational costs, and Vario-NSS, which detects abnormal terminals and provides vulnerability management.

<Integrated Internet Security Service Using VSR>

Overview

This service provides comprehensive network security that protects corporate networks from the attacks from the Internet, intrusions into internal networks, and threats such as virus infections and data thefts, and enables customers to use the Internet safely.

The company’s integrated Internet security service uses VSR (Vario Secure Router) — a network security device developed by the company which integrates various security functions such as firewalls, IDS (intrusion detection system), and ADS (automatic defense system) into one unit — which is installed between the Internet and customers’ internal networks, and acts as a filter to remove threats such as attacks, intrusions, and viruses.

VSR is automatically managed and monitored by a proprietary operational monitoring system run by the company’s data center, and operational information statistics and various alerts are processed in real time without human interventions.

Statistics and alerts are provided in real time to user company administrators over the Internet via a reporting function called, the Control Panel. In addition, the company has established a 24/7 support center, and a maintenance network covering all 47 prefectures in Japan and an operation support system such as changing the equipment settings.

Since they are manufactured at several factories in Taiwan while the core software is developed in-house, it is more cost-effective than purchasing hardware and adding services, and this is one of the reasons contributing to VSR’s high operating income margin.

(Source: the company’s website)

Merits

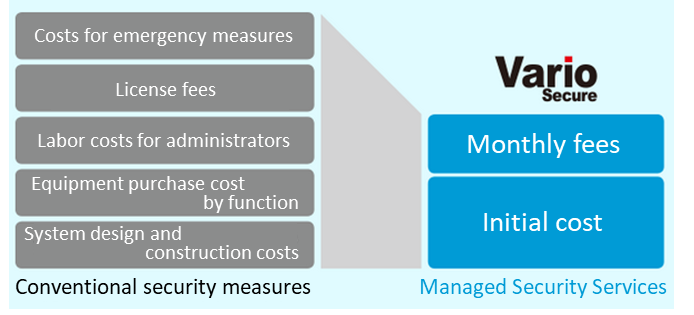

Previously, to introduce the security system such as above, it was necessary to install various security devices in-house and maintain them, making it more difficult for many companies to introduce sufficient network security measures because they required highly skilled engineers and high investments.

In addition, even after the introduction of the security system, monitoring, quick response to alerts, software updates, inquiries in the event of trouble, etc. required a great deal of effort and time, and the operational burden was extremely large.

In contrast, the company’s Managed Security Services, which provides the one-stop solution from initial introduction to operation and maintenance of VSR, a unique in-house product, provides significant benefits to customers in the following respects:

As VSR boasts 23 different security features per unit, it eliminates the need to purchase equipment and instead provides the security system via the rental equipment. |

A monthly fee is set for each security feature, allowing customers to choose the options they need from a variety of security features. |

By simply paying the initial cost incurred only at the start of the contract and monthly fees, it is possible to outsource most of the man-hours required for the operation of network security, such as using the control panel, changing settings, updating software, and local maintenance through monitoring and business trip support, reducing the burden of work. |

In addition to inquiries from customers (end-users) to the company or distributors, the company actively detects and supports problems through remote monitoring. Operation and maintenance are remotely handled as much as possible by the company’s engineers, making it possible to respond more quickly compared to general on-site responses via call centers. |

To deal with hardware failures, the company deploys inventory at warehouses of subcontractors throughout the country, and aims to replace the equipment within the target timeframe of four hours. |

The ease of introduction and the clarity of the menu are highly evaluated by mid-tier enterprises and MSEs.

(Source: materials provided by the company)

Customers

Most of their customers are mid-sized and small businesses who would struggle to employ IT managers with expertise on their own. As of the end of February 2021, 2,917 companies use the services and are operating at 7,372 locations nationwide (number of VSR-installed locations).

It has a high market share amongst the mid-tier enterprises and SMEs.

<Data Backup Service (VDaP)>

The company provides a backup service that combines VDaP, where backup data are stored on a device, and the storage in a data center.

After temporarily backing up corporate digital data to VDaP, data are automatically transferred to the data center to further increase the fault resistance.

In addition, since the latest and past data are kept as version-managed backup data, it is easy to select and recover the necessary digital data by providing an interface for the customers that are easy to use when recovering data.

Utilizing its experiences in monitoring and operating services for integrated Internet security service using VSR, the company also provides the service that efficiently covers the whole country by utilizing the system for installing equipment and responding to failures.

<Vario EDR Service>

Vario EDR Service visualizes cyberattacks that try to penetrate through antivirus measures and avoid security incidents before they happen. It adopts highly accurate detection methods using AI and machine learning, and against the high-risk incidents, it would conduct automatic isolation of terminals and initiate investigations by security specialists.

<Vario-NSS>

As the shortage of IT personnel in companies becomes more serious, the company will support the efficient operation of internal systems and promote the concept of “Information System as a Service.” Vario-NSS automatically scans terminals connected to the corporate network by simply installing a dedicated terminal in the network for asset management, visualizes terminal information, and understands vulnerability response. This enables it to respond to terminals with security risks early and monitor unauthorized terminals, reducing the burden and risk on the IT asset management which tends to rely on personal operations. Through continuous updates, it can not only manage Windows terminals, but also centrally manage Red Hat Linux terminals which are widely used for internal servers, etc. reducing the burden on personnel in the information systems departments at customer companies.

② Integration Services

This consists of sales of Vario Communicate Router (VCR), an integrated security device (UTM) for small and medium-sized enterprises, and Network Integration Services (IS) for procurement and construction of network equipment.

<Sales of integrated security equipment VCR for small and medium-sized enterprises>

The company sells VCR, a security appliance device, in response to the growing security awareness among smaller businesses and clinics with fewer than 50 employees, due to regulatory changes such as revisions of the Basic Act on Cybersecurity among others.

Unlike Managed Security Services, UTM products are imported as their own brands from overseas manufacturers and sold to end-users through distributors specializing in small and medium-sized enterprises.

Throughout the warranty period, the manufacturers provide support on sold equipment and hardware failures, through the company’s and/or distributors’ support desk.

<Network Integration Services (IS)>

Their engineers cover the whole areas of designing, procuring, and building the network according to the needs of end-users, and are working to expand the business into the wider corporate network areas.

As with the VCR sales, the manufacturers provide support on sold equipment and hardware failures, through the company’s and/or distributors’ support desk.

(2) Revenue model

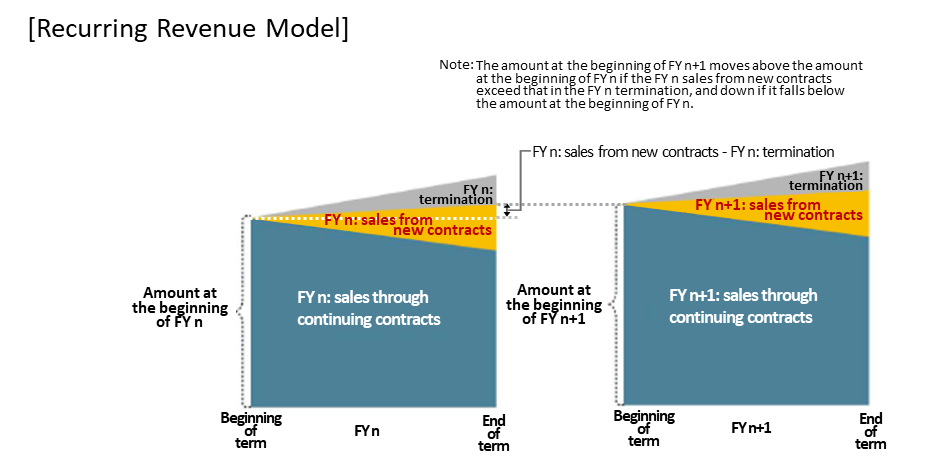

Managed Security Services provide one-stop service from the introduction of network security to management, operation, and maintenance, and is a stacked recurring business model that collects initial costs and fixed monthly costs from users.

There is a one-time charge for the Integration Services, associated with the sale of VCRs and the procurement and construction of network equipment.

(3) Sales channels

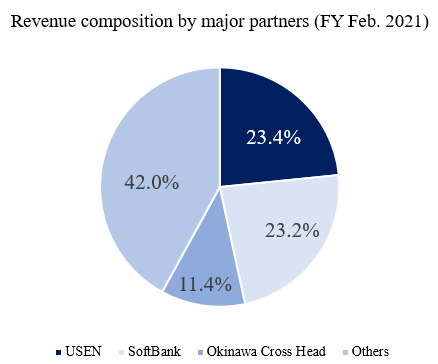

Sales are mainly indirect sales through distributors.

The company has signed contracts with distributors such as telecommunications carriers, Internet service providers, data center operators, etc., who are looking to provide added value to customers by attaching Vario Secure services, and has built a sales network covering the whole country. The company has established a system that can continuously create opportunities.

The company’s distributors are divided into the original equipment manufacturers (OEM partners) and the reselling partners.

An OEM partner is a partner that provides security services under the distributor’s own brand and enters contracts directly with the customers (end users). As of the term ended February 2021, the company has signed agreements with 29 companies with 2,688 end user companies.

A reselling partner is a partner that develops customers (end users) and engages in sales activities as an agent of Vario Secure, through which Vario Secure remains as the contracting entity with customers. As of the term ended February 2021, the company has signed agreements with 54 companies with 113 end user companies.

In addition to the above, to promote sales activities, Vario Secure as a security expert provides sales representatives who directly explain technical aspects to customers on behalf of distributors, and provides one-stop support from introduction to installation of services.

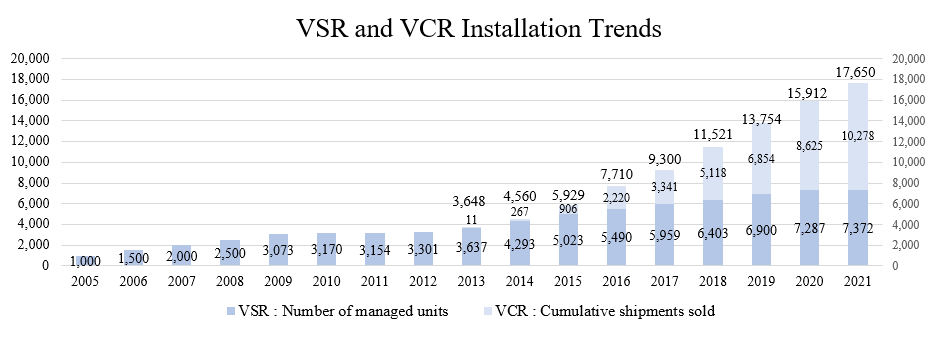

(4) Numbers of VSR and VCR installations

As of the end of February 2021, there were 7,372 VSR managed units and the VCR cumulative shipments were 10,278 units. It is installed in all 47 prefectures nationwide.

[1-5 Characteristics and Strengths]

(1) Unique business model

The company provides one-stop service for (1) procurement of equipment used in security services, (2) development of core software to be installed on equipment, (3) installation/setting of equipment, and (4) monitoring and operation after installation of equipment. There is no need for end-users to individually consider equipment selection and operation services, and they can quickly start using the service. In addition, since the service is provided as one-stop, the company can easily investigate the cause of a problem and respond.

Support is available 24/7, allowing end-users to quickly receive support for inquiries and troubles. The company aims to reach customers within four hours if it deems that equipment needs replacing, and in the term ended February 2021, it almost achieved the target at 99%.

(2) Stable revenue model

As mentioned above, Managed Security Services are recurring business in which profits accumulate year by year due to the increase in the number of companies introduced by monthly billing, and as of the end of February 2021, Managed Security Services were provided at approximately 7,300 locations (number of VSR-installed locations) in all 47 prefectures nationwide.

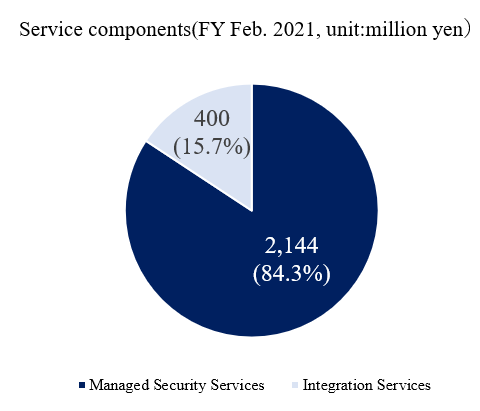

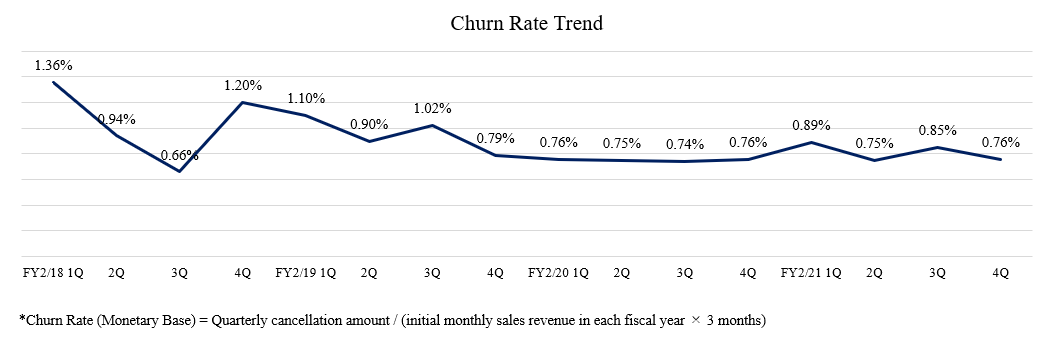

In the term ended February 2021, Managed Security Services accounted for 84.3% of the company’s total sales revenue. With a low churn rate of 0.81% (in the term ended February 2021), a stable earnings model has been built, and it is possible to forecast revenues at a relatively early stage in the fiscal year.

(Source: material provided by the company)

(3) Strong sales channels

As mentioned above, it has built strong sales channels with 29 OEM partners and 54 reselling partners, covering the whole country.

It is an important asset for efficient sales for the company, which mainly targets small and medium-sized enterprises.

In addition, since there are many OEM partners in the telecommunication industry and the company’s services are incorporated as an option in the menu of the operating company, it is easy for users to select and introduce when the Internet connections are newly installed or altered, leading to a high order rate.

(4) High market share

With its easy implementation of high-level security services as well as the operation and management, the company is the market leader in all following categories by employee numbe 300 to 999, 100 to 299, and 0-99 in the Firewall/UTM* operational monitoring service market.

* Firewall/UTM operational monitoring service market: Sales Amount and Market Share by Employee Size (FY2019)

| 0 – 99 employees | 100 – 299 employees | 300 – 999 employees |

No. 1 | Vario Secure 31.2% | Vario Secure 24.7% | Vario Secure 23.2% |

No. 2 | Company A 15.8% | Company A 14.2% | Company A 9.8% |

No. 3 | Company B 13.5% | Company B 9.4% | Company B 8.9% |

* Created by Investment Bridge based on the company’s financial results briefing materials (source: ITR “ITR Market Vie Gateway Security-Based SOC Service Market 2020”)

* UTM: Unified Threat Management. A network security measure operated by combining multiple security functions into one.

2. Fiscal Year February 2021 Earnings Results

(1) Overview of business results

| FY 2/20 | Ratio to sales | FY 2/21 | Ratio to sales | YoY | Ratio to forecast |

Revenue | 2,513 | 100.0% | 2,545 | 100.0% | +1.3% | +0.6% |

Gross profit | 1,549 | 61.6% | 1,560 | 61.3% | +0.7% | - |

SG&A and others | 760 | 30.2% | 796 | 31.3% | +4.7% | - |

Operating profit | 789 | 31.4% | 764 | 30.0% | -3.1% | +0.5% |

Profit before tax | 723 | 28.8% | 707 | 27.8% | -2.2% | +0.3% |

Profit | 498 | 19.8% | 491 | 19.3% | -1.3% | +0.3% |

*Unit: million yen

Increase in revenue and decrease in profits almost in line with estimates.

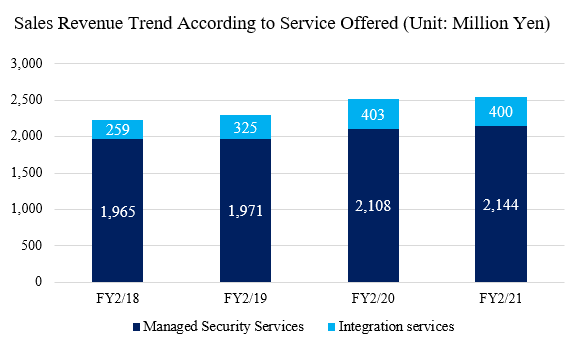

The revenue for the term ended February 2021 was 2,545 million yen, up 1.3% from the end of the previous term. Managed Security Services grew steadily.

Operating profit was 764 million yen, down 3.1% from the end of the previous term. Travelling and entertainment expenses decreased due to the effects of the novel coronavirus, but in addition to the added expenses for preparation for listing on the stock exchange, they also incurred maintenance expenses for the integration of the security operations center and preparations in order to adapt to online workstyles.

Both revenue and profit were almost in line with their estimates.

(2) Major index trends

◎ Recurring revenue

The Managed Security Services, which are sources of recurring sales revenue, grew steadily.

In particular, remote VPNs, which provide secure connections for working from home, saw an increase. Further, following the circuit reinforcement due to the companies’ adaptation to online workstyles, upgrades to the superior models also increased.

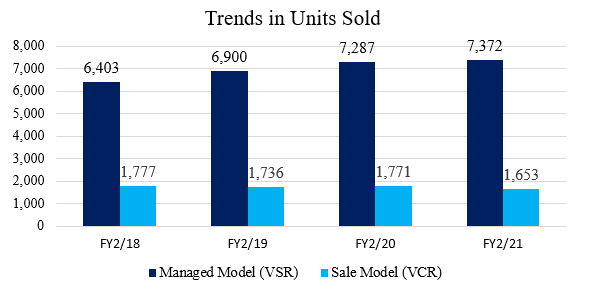

◎ Units shipped

The number of Sales Model (VCR) units shipped declined slightly, due to the spread of the novel coronavirus. The number of Managed Model (VSR) units shipped increased by 85, which was less than the 387 units increase in the previous term due to the reorganization of the base in the aftermath of the novel coronavirus as well as a decrease in the addition of new facilities.

◎ Sales revenue composition

| FY 2/20 | FY 2/21 |

Number of transactions |

|

|

Existing | 54% | 67% |

New | 46% | 33% |

Amount (Monthly) |

|

|

Existing | 47% | 55% |

New | 53% | 45% |

The revenues from continued subscriptions increased through the addition of a remote access option and upgrades to the superior models for existing customers, and average spending per customer also increased, making up for the downturn in the increase of units shipped.

◎ Churn rate

The churn rate remained low.

(3) Financial position and cash flows

◎ Main Balance Sheet

| End of February 2020 | End of February 2021 | Increase/ decrease |

| End of February 2020 | End of February 2021 | Increase/ decrease |

Current Assets | 1,302 | 1,319 | +17 | Current Liabilities | 1,096 | 992 | -103 |

Cash and Cash Equivalents | 632 | 593 | -38 | ST Interest Bearing Liabilities | 365 | 369 | +4 |

Trade and Other Receivables | 440 | 461 | +20 | Trade and Other Payables | 127 | 108 | -19 |

Non-current Assets | 5,778 | 5,896 | +118 | Noncurrent Liabilities | 2,575 | 2,274 | -301 |

Tangible Assets | 259 | 293 | +34 | LT Interest Bearing Liabilities | 2,156 | 1,786 | -369 |

Goodwill | 5,054 | 5,054 | 0 | Total Liabilities | 3,672 | 3,266 | -405 |

Intangible Assets | 99 | 173 | +74 | Total Equity | 3,408 | 3,949 | +540 |

Total Assets | 7,081 | 7,216 | +135 | Retained Earnings | 1,507 | 1,999 | +491 |

|

|

|

| Total Liabilities and Net Assets | 7,081 | 7,216 | +135 |

|

|

|

| Balance of Interest-bearing Liabilities | 2,521 | 2,156 | -365 |

*Unit: million yen.

Balance of interest-bearing liabilities decreased by 365 million yen from the end of the previous term. Net D/E ratio decreased 15.8% from the end of the previous term to 39.6%.

Equity ratio increased 6.6% from the end of the previous term to 54.7% due to the decrease in liabilities and an increase in retained earnings.

◎ Cash Flows

| FY 2/20 | FY 2/21 | Increase/decrease |

Operating Cash Flow | 963 | 524 | -439 |

Investing Cash Flow | -149 | -112 | +37 |

Free Cash Flow | 814 | 412 | -402 |

Financing Cash Flow | -470 | -450 | +20 |

Balance of Cash and Equivalents | 632 | 593 | -38 |

*Unit: million yen

The surpluses of operating CF and free CF decreased mainly due to the impact of large-scale projects in the term ended February 2020 (increase in advance received) and an increase in corporate income tax paid in the term ended February 2021, along with the impact of replacement with new products.

The cash position remained at approximately the same level as the end of the previous term.

(4) Topics

① New services and features of Managed Security Services

The company has started offering the following new services and features.

Title | Outline |

Vario EDR* Service | Visualizes any cyberattack that tries to make its way in by evading all virus countermeasures, and preemptively avoids a security incident. Uses a high-precision detection method through AI and machine learning and automatically isolates the device and implements an examination by a security specialist in case of an incident with a high-risk level. |

Vario Telework Manager | A telework solution that can manage PCs being operated through telework and respond to the task conditions of employees in one step, through monitoring the login/logout times of employees working from home, app usage conditions and communication traffic during tasks, update conditions of security updates, etc. |

Vario-NSS | As the shortage of IT personnel in companies aggravates, it is promoting the concept of, “Information System as a Service,” which supports the effective application of in-company systems. Under Vario-NSS, simply by installing an exclusive-use terminal in the network that performs asset management, one can automatically scan the devices connected to the in-company network and visualize device information and grasp vulnerability responses. For that purpose, prompt response to devices with security risks and the monitoring of unauthorized devices become possible, reducing the risk and burden of IT asset management, which tends to be an individual task. In addition to continuous updates, Vario-NSS reduces the burden on specialists in the companies’ Information System Department by uniformly managing not just devices operating on Windows, but the uniform management of Red Hat Linux devices, which are widely used in the companies’ internal servers. |

Vario-NSS and IntraGuardian2+ | The company initiated a system linkage between Vario Network Security Suite and IntraGuardian2+, which is the unauthorized device connection prevention solution of Net Chart Japan Inc. Through this linkage, if an unauthorized device is detected by Vario-NSS, its device information is forwarded to IntraGuardian2+. It will implement the efficient exclusion of unauthorized devices and strengthen each company’s security. |

10G Compatible VSR4003 (New Appliance) | To make sure that each company’s Internet circuits will be compatible with 10G, the company began offering new models that can be equipped with 10G metal cable ports and fiber optic cables. It also matches the need for strengthened Internet circuits compatible with online workstyles. |

*EDR, which is an acronym for Endpoint Detection and Response, means detecting and responding to cyberattacks from targeted attacks and ransomware at the endpoint.

In recent years, cyber-attack methods have become increasingly sophisticated and 100% protection from malware attacks is thought to be impossible. For that reason, it is important to not just have a countermeasure for the prevention of malware attacks, but also countermeasures to immediately detect the presence of malware and eliminate the threat in case a malware attack is crucial.

Through the implementation of EDR, each company will be able to immediately detect the presence of malware and eliminate the threat before the malware or ransomware can begin its activity and aggravate the problem. Further, one can easily grasp the root cause and extent of the impact by utilizing the visualization feature of EDR, making future responses swifter and more optimal.

3. Fiscal Year February 2022 Earnings Forecasts

(1) Earnings forecasts

| FY 2/21 | Ratio to sales | FY 2/22 Est. | Ratio to sales | YoY |

Revenue | 2,545 | 100.0% | 2,649 | 100.0% | +4.1% |

Gross profit | 1,560 | 61.3% | 1,657 | 62.6% | +6.2% |

Operating profit | 764 | 30.0% | 782 | 29.5% | +2.4% |

Profit before tax | 707 | 27.8% | 732 | 27.6% | +3.4% |

Profit | 491 | 19.3% | 507 | 19.2% | +3.3% |

*Unit: million yen

Increase in revenue and profit estimated.

Revenue is estimated to be 2,649 million yen, up 4.1% from the previous term and operating profit is projected to be 782 million yen, up 2.4% from the previous term.

Expecting an increase in personnel recruitment to strengthen the marketing and sales department and strengthen the legal department following the listing on the stock exchange, an increase in advertisement expenses, and an augmentation of advisory fees, operating profit margin is projected to decrease 0.5 points from the end of the previous term, but an increase in profit is expected.

The company is aiming for a dividend payout ratio of 30.0% on the IFRS base. The dividend for the term ended February 2021 is 39.44 yen per share. The estimated payout ratio is 29.9% on the IFRS base, with that on the standard Japanese base being 53.4%.

(2) Major policies

All staff members of the company will join hands to increase recurring revenues from new commodities and strengthen marketing and sales projects.

Further, the company will cultivate new customers further through establishing a team exclusively for selling new products, implementing inside sales (the style of business that mainly engages in long-distance sales with phone calls and emails), and offering business support by their technical staff.

The company recognizes the following three points as their challenges.

① Opening a new sales channel

• System Integrator / Network Integrator

• Direct Sales (The style of sales where the company directly attends to customers without any agents)

• Specified Industry Type (Medical, Education, and Public)

② Improving visibility of service

• Improvement of service visibility for end users

• Appeal of service titles

③ Enhancement of content

• Offering video content proactively

• Revision to the website

4. Growth Strategy

The company, which has created a business foundation by offering reliable and safe Internet connection and additional services that can be used easily by medium-sized enterprises, will now move beyond Internet services and herald a concept of “Information System as a Service,” offering services by expanding their reach to in-company network infrastructure as a whole, and work towards its implementation.

In addition, the company will improve the overall strength of its services by focusing on the following three points. The company will work towards increasing its earnings and securing profit by combining specialized devices with the cloud and offering network services to companies.

Theme | Aim | Methods |

User Interface Integration | Expansion of Cross-Selling | Integrating the User Interface with the aim of increasing convenience and promoting mutual usage • Control Panel of the integrated Internet security service (VSR) • Control Panel of the data backup service (VDaP) • Dashboard of Vario-NSS (in-company network administration) • Dashboard of VarioTelework Manager |

Strengthening/Linkage of the Key Software | Expansion of the Channel | Performance Boost and System Linkage of Key Software • Integration of the exclusive software for integrated Internet security service and the exclusive software for Vario-NSS (in-company network service) • Promoting cloud compatibility for the new key software • Linkage with the network service of other companies |

Optimization/Automation of the Security Operation Center | Cost Reduction | Realization of a Security Operation Center Which Meets the Needs of the New Normal • Integration of the support for services offered • Implementation of the cloud migration for the center using the cloud environment • Digitization of the voice data, automation of the process from setting finalization till confirmation of operation |

(Taken from the reference material of the company)

5. Interview with CEO Inami

CEO Yoshihiko Inami was asked about the competitive edge of his company, future growth strategies, and his message to stockholders and investors.

Q: “Firstly, would you kindly talk about the characteristics, strengths, and competitiveness of your company?”

I would like to mention two points.

The first point is the uniqueness of our business model, which offers a one-step solution with the procurement of devices used for Internet security, the development of key software installed into those devices, installation and setting up of those devices, and monitoring and operation of the devices after installation.

I believe that we might be the only company in not just Japan but the whole world which procures and offers both hardware and software and covers operation and maintenance all by itself.

If you just consider the cost, it might be cheaper for a company to purchase devices and then depreciate the cost over the next three to five years, but in case there are any defects in hardware manufactured overseas, the procedures for resolving the issue take a lot of time and the company also has to hold a special enquiry regarding the software, which I believe can be very time consuming.

In that regard, I think one of our greatest advantages is being able to consistently offer the procurement of devices as well as a maintenance service 24/7, to small and medium sized enterprises which might otherwise struggle in acquiring personnel with a high level of knowledge, especially regarding IT.

Further, procurement of hardware and development of your own company software is not an easy task even for companies that are larger in scale than ours.

In particular, I think it is difficult for any large-scale company to spend the appropriate cost and develop a profitable business for small and medium enterprises, which constitute our customer base.

The other point is our strong relationship with our partner companies.

We have about-20-year-long relations with our core partner companies. We have received high appraisals for our business support including the permanent stationing offered by our company.

In particular, we have many telecommunications carriers within our partner companies, which is why it is extremely important to keep their business going by providing non-stop Internet connections to their customers. For that, our company’s technical prowess and maintenance systems are proving to be useful.

Further, when offering communication service to the customers of our partner companies in the communications industry, we can have them introduce our services incorporated into their company menus in case the customers require security services as well. Because of that, there are many cases in which we receive orders without running into competition, which is extremely beneficial to our company. In this way, our company and our partner companies have formed a strong win-win relationship.

Q: “Please tell us about your company’s growth strategy taking into account the future prospects of the Internet security market.”

Till now, our company had only offered services related to corporate Internet access, but by installing VSR, we can also monitor and manage the internal LAN, addition to the external Internet.

We are thinking of using our advantage of having installed VSR in almost 3,000 companies across the country till now and offering various services tailored toward the in-company networks of those 3,000 companies.

As the first step, we acquired a company specialized in data backup called Blue Shift Technology Inc. and took over its business in 2019.

Even within the Internet security market, the provided services are extremely widespread.

While the comprehensive security monitoring service that our company has worked on since its foundation has started to mature, we are expecting rapid growth in EDR service, which detect and respond to cyberattacks from targeted attacks and ransomware at the endpoint, as well as in network platform vulnerability management.

We believe this trend will further strengthen as online workstyles become common under the effects of the novel coronavirus, because of which we want to expand our service lineup through the linkage among Vario EDR service, Vario Telework Manager, Vario-NSS, Vario-NSS and IntraGuardian2+, etc., all of which were released in the previous term, and reliably meet these new needs.

In our company, offering services by expanding our reach to the entire in-company network infrastructure is referred to as the “Information System as a Service” concept and we are aiming for medium to long term growth through its implementation.

Q: “Could you tell us a bit about the structure and direction of your business?”

We want to continue to serve small and medium sized enterprises, which are facing a shortage of IT resources.

To that end, we will continue to pursue relationships with new partner companies. In particular, we are approaching large-scale agencies that have created a strong business foundation in local areas.

We also want to continue our efforts in business support through visits to customers for marketing and organizing study sessions.

Q: “On the other hand, what do you consider as challenges for your company? And what do you think is needed to overcome those challenges?”

The first challenge is the strengthening of the marketing feature.

Fundamentally, sales through agents will continue to be our central marketing policy, but in order for our company to further grow and to increase profitability, I believe we need to create a brand image of Vario Secure strong enough to have our customers specifically ask for our service to agents.

To achieve that, we will strengthen our marketing team and promote digital marketing by offering video content proactively and revising our website.

Further, the sales department is taking initiatives to directly approach potential customers through phone or mail and advertising the value of our company and leading prospective clients to our agents.

Q: “What are your thoughts on personnel recruitment especially engineers?”

We recruit personnel with a focus on engineers every year and this year we recruited personnel for sales positions as well, with the number of freshly graduated recruits increasing to three to four times as much as last year.

Mid-career recruitment also showed favorable growth and we were surprised at the extent of the effect of being listed on the stock exchange.

The growth of our employees who took an interest in our company and joined us will lead to an increase in our corporate value, which is why I feel it is an important duty as a manager to offer an environment that can facilitate their growth.

As an initiative to create such environment, to have our employees share the values of Vario Secure, our company has created certain conduct guidelines called “Requests as a Vario Employee” and are working toward their diffusion by mentioning them during various occasions.

[Requests as a Vario Employee]

① Not confusing aims with methods |

② Using your creativity when interacting with customers, imagining the reason for the customers’ question, and creating a solution for it |

③ Don’t look for the reasons why you can’t do something, but look for ways to accomplish it |

④ Showing daily improvement through consistent effort |

⑤ Offering the best service |

Further, the company is managing a system called Vario Master, which helps improve the skills of our employees.

It is a training/educational system to teach enough knowledge regarding the company’s products and services, which is obviously necessary for a company like ours, which procures and develops its own hardware and software.

It has three levels: Bronze, Silver, and Gold, with all employees being required to reach the Bronze level and the technical staff and operation center employees required to reach at least the Silver level.

The system has been effective in increasing our reliability among our agents and we will continue to aim for further improvement of our company.

Q: “Thank you very much. Finally, do you have a message for your stockholders and investors?”

As more small and medium-sized enterprises are facing a shortage in IT personnel, our company is offering them an environment where they can focus on their main business without any worry, by providing 24/7 support to common network infrastructure that functions normally.

We want you to understand that by doing this, we are providing safety and peace of mind not just to our customers but occasionally also to everyone who uses the services offered by them.

Further, the company has created an extremely stable earnings model through a recurring revenue business that charges a monthly fee.

Since this is an accumulative model, annual revenue growth rate rarely reaches 20% or 30%, but we want to display a stable and steady growth to our customers without any major fluctuations.

On the other hand, while we have intended to be one of Japan’s hidden capable companies as an unsung hero, we have been maintaining and developing strong relationships of trust with our partner companies and want to take initiatives towards the creation of Vario Secure brand, using the listing on the stock exchange as a good opportunity.

For that, we must first improve the visibility of our company.

We would appreciate it if all of you would recognize our company’s societal reason for existence, business contents, specialties, and strengths, and continue to provide your medium and long-term support.

6. Conclusions

In the Securities Report for New Listing Application (Section I) submitted in October 2020, the company has brought up “Regarding Borrowing Large Sums of Money, Changing Interest Rates and Conflict of other Financial Covenants” as a risk to its business, stating “as the principal has a floating interest rate, the company’s management results can be affected in case the market interest rate increases” and “the debt possessed by the company can become a hindrance with regards to quick fundraising, leading to a disadvantage for the company compared to competitors with a more enhanced financial foundation, possibly impacting the company’s performance.”

Of course, there is always risk with borrowed capital, but free CF from a stable revenue base is decreasing loan and net D/E ratio and equity ratio are steadily improving.

The company is aware of the capital cost, and we believe it is entering a stage where it shifts its cash usage from focusing on the repayment of loans to investments towards the realization of the “Information System as a Service” concept, offering services by expanding their reach to in-company network infrastructure as a whole.

While PER has reached 10 and its stock price has hit a new low since listing, we would like to pay attention to whether they can meet emerging needs through this concept and meet the expectations of investors by improving their brand value.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors | 7 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report

Last update date: November 30, 2020

<Basic Policy>

Our company’s mission is “to ensure that all enterprises using the Internet can easily and securely carry out their business, we will offer the very best services to Japan and to the world,” and have conducted our business to meet the expectations of our various stakeholders. Business management based on corporate governance, which forms the core of our business, is the most important administrative category and through a highly transparent, optimized management with a strengthened monitoring system, we are aggressively taking initiatives to improve our corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosed Content |

<Supplementary Principle 4-1② Information Disclosure Related to the Medium-Term Management Plan> | The company formulates its target amounts based on a medium to long term point of view, but does not publicly announce those amounts. As the scale of the company is still small, it refrains from disclosing for any quick changes in strategy can be possible. The company will disclose the information once it reaches a certain scale. |

Principle 5-2. Formulation and Public Announcement of Management Strategy and Plan | The company formulates management strategies and earning plans, which it shares with its board members. Regarding earning capacity and capital efficiency, as the scale of the company is still small, it refrains from disclosing for any quick changes in strategy can be possible. The company will disclose the information once it reaches a certain scale. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosed Content |

<Principle 1-4. Strategically Held Shares> | The company does not possess any strategically held shares. Further, the company will not hold any such shares, unless the alliance with invested companies would contribute to the improvement of the medium or long-term corporate value and is considered to contribute to the benefits of shareholders based on objective discussions, such as the comparison between the benefits and risk of ownership and the company’s capital cost. |

<Principle 3-1. Information Disclosure Enhancement> | In addition to the timely and appropriate legal disclosure of information, the company also publishes the following policies: (i) Management Philosophy, Strategy, and Plan The company’s corporate ethos is described on its website: https://www.variosecure.net/company/mission/ (ii) Basic Policies and Way of Thinking Regarding Corporate Governance Kindly refer to “I.1. Basic Way of Thinking” of this report for details on the company’s basic policies and way of thinking regarding corporate governance. (iii) The Board of Directors’ Policies and Procedures for Determining the Compensation for Management Staff and Directors The Board of Directors consults a discretionary compensation committee regarding the compensation system and policies for Directors, the calculation method for determining the exact compensation amount, and individual compensation amounts. The Board of Directors has decided that the Representative Director will make the final decision on the individual compensation amounts reported by the discretionary compensation committee, within the compensation amount limit approved in the Stockholders’ General Meeting through a resolution. (iv) Policies and Procedures for the Selection and Removal of a Management Staff Member by the Board of Directors and the Nomination of a Candidate for a Director Regarding the selection and removal of a Director, the Board of Directors will hold a final resolution based on the comprehensive decision on each employee’s character as a manager as well as their experience, results, and expertise as a manager. (v) Explanation Regarding the Individual Nomination and Appointment During the Appointment or Removal of a Management Staff or the Nomination of a Candidate for the Board of Directors The reasoning behind each individual nomination is recorded in the regular General Meeting of Stockholders held every term, or in an extraordinary General Meeting of Stockholders. |

<Principle 5-1. Policies Regarding Constructive Dialogue with Stockholders> | The company uses its IR Department as a medium to promote dialogue with stockholders every day instead of only during Stockholders’ General Meetings and offers information through its website and through phone calls. Further, the company has a system where the opinions of investors and stockholders obtained through these dialogues are reported to the Management Staff every time. |

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the company and come from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |