Bridge Report:(4549)EIKEN CHEMICALFiscal year March 2021

President Morifumi Wada | EIKEN CHEMICAL (4549) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Pharmaceuticals (manufacturing and sales) |

President | Morifumi Wada |

HQ Address | 7 Yamaguchi building, 4-19-9 Taito, Taito-ku, Tokyo 110-8408, Japan |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

2,097 yen | 43,541,438 Shares | 91,306 Million yen | 12.9% | 100 Shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

41.00 | 2.0% | 132.95 yen | 15.8 times | 1,120.36 yen | 1.9 times |

*Share price is as of the end of May 19. All figures are from the FY March 2021 financial settlement report.

Business Performance Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 Actual | 34,991 | 3,478 | 3,549 | 2,608 | 71.21 | 25.00 |

March 2019 Actual | 35,761 | 4,611 | 4,681 | 3,447 | 93.63 | 30.00 |

March 2019 Actual | 36,585 | 4,622 | 4,723 | 3,538 | 95.95 | 30.00 |

March 2021 Actual | 38,667 | 6,612 | 6,808 | 5,044 | 136.65 | 41.00 |

March 2022 Est. | 40,400 | 6,370 | 6,430 | 4,910 | 132.95 | 41.00 |

*Unit: Million yen, Yen. The definition for net income means net income attributable to owners of parent. On April 1st, 2018, a two-for-one split of the stock was performed. EPS and DPS adjusted retroactively.

This Bridge Report presents EIKEN CHEMICAL’s earnings results for the fiscal year March 2021.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year March 2021 Earnings Results

3.Fiscal Year March 2022 Earnings Estimates

4. Conclusions

<Reference 1: EIKEN ROAD MAP 2019 and the New Medium-Term Management Plan >

<Reference 2: Regarding Corporate Governance>

Key Points

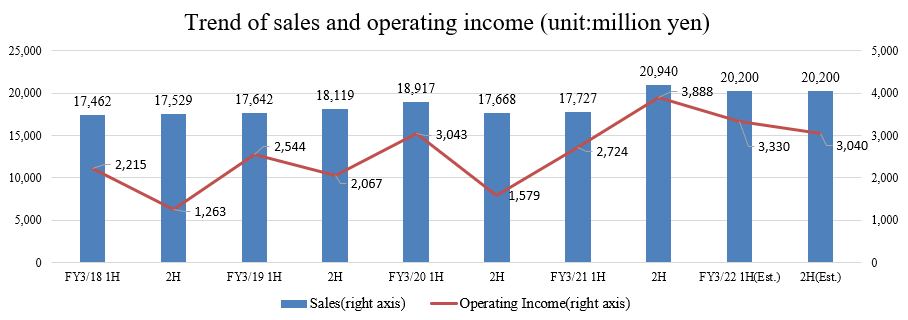

- For the fiscal year (FY) 2021, sales increased 5.7% year on year to 38.6 billion yen. The sales of novel coronavirus detection reagents and genetic testing devices grew sharply. Although the screening market has not reached the normal level, it has almost recovered both in Japan and overseas. Operating income increased 43.0% year on year to 6.6 billion yen. Profit increased significantly, primarily due to the novel coronavirus detection reagents. Operating income margin also widened 4.5 points, exceeding the company’s revised forecast announced in January 2021. The year-end dividend was raised by 5 yen/share from 21 yen/share to 26 yen/share. Combined with the interim dividend of 15 yen/share, the total annual dividend became 41 yen/share. The payout ratio was 30.0%.

- The sales for FY 2022 are forecast to be 40.4 billion yen, up 4.5% year on year, while operating income is expected to decrease 3.7% to 6.37 billion yen. The company plans to pay a dividend of 41 yen/share, like in the previous term. The estimated payout ratio is 30.8%. In terms of profits, the company anticipates an increase in the COGS ratio due to changes in the sales mix, and an increase in SG&A expenses due to business process reforms utilizing IT.

- In line with the company’s expectations, in the latter half of the previous fiscal year, profit increased significantly even though sales growth rate was only in the single digits amid a recovery in the number of clinical tests. The company expects strong sales and profits in the first half of the current term thanks to boosts continuing on from the previous term. Sales and profits are expected to decline in the second half, but reach sales and profit levels higher than those before the COVID-19 pandemic.

- In the current term, the final year of the medium-term management plan, the company needs to lay solid groundwork for the next three years (from the term ending March 2023 to that ending March 2025) with an eye on the fiscal year ending March 2029, which is the 90th anniversary of the company’s founding. Our attention will not only be on the novel coronavirus detection reagent, which is expected to grow in succession, but also on the steady launch of Simprova and how much the sales of the mainstay fecal occult blood test reagent grow.

1.Company Overview

EIKEN CHEMICAL is a general manufacturer of clinical diagnostics, including immunological and serological, microbiological, clinical chemistry, urine analysis and genetic screening test. It also develops and sells medical devices.

It offers many products that occupy high market share including fecal immunochemical test that occupy about 60% of the domestic share, Urinalysis test, Microbiological test and so on. Its unique gene amplification technology, “LAMP”, is recognized in the world. With the fecal immunochemical test reagents, urinalysis test strips and LAMP, EIKEN is aiming to become a global corporation.

1-1 History

Founded as Koa Kagakukogyo Co., Ltd. in 1939, the company started manufacturing and selling nutritional foods and pharmaceuticals made from livestock organs. In 1949, it was the first company in Japan to successfully commercialize a powdered agar for the detection of bacteria (Salmonella-Shigella [SS] agar). In 1961, it established the Clinical Diagnostics Division and began R&D on in-vitro diagnostics.

In 1989, the company launched “OC-sensor,” the world's first fully automated fecal occult blood analyzer. This led to the establishment of its current overwhelming lead in this field.

After that, while expanding its business domains such as reagents for urinalysis testing and microbiological testing, in 1998, the company developed the LAMP method, a new gene amplification technology. It has launched various products using the LAMP method that are simpler, faster, and more accurate than conventional testing methods.

In 2005, the company concluded a joint development contract with FIND (Foundation for Innovative New Diagnostics) for a rapid genetic tuberculosis detection method, based on the LAMP method. It then proceeded with joint development related to testing for malaria, HIV, etc.

In March 2020, the company released a novel coronavirus detection reagent utilizing the LAMP method to be used against the novel coronavirus, which has been spreading worldwide.

*For further information about the LAMP method and FIND, please refer to “2. Characteristics and Strengths (4) Competitive Advantages of the LAMP Method.”

1-2 Management Philosophy

“Management Philosophy”: Protect the health of the public through health care services.

“Management Vision”: EIKEN group is dedicated to leveraging expertise as a medical testing pioneer to increase corporate value by protecting the health of the public with products and services that customers can trust.

“Motto”: We EIKEN provide trustworthy quality and develop with technology.

EIKEN group formulates “EIKEN WAY” as its attitude toward each stakeholder, centering these philosophy vision, and motto.

(Source: EIKEN CHEMICAL)

1-3 Market Environment

Domestic Market

The market scale of clinical reagents is about 358.7 billion yen and 612.8 billion yen (including research reagents and diagnostic devices) as of 2019 (survey by the Japan Association of Clinical Reagents Industries, or JACRI. Eiken Chemical Data.).

To control rising medical costs, the Japanese government is focusing on preventive medicine such as special health check-ups (metabolic check-ups) and cancer screenings. It is expected that this, along with the aging population, will lead to an increase in the number of samples (number of specimens).

Some negative factors include the impact of population decline because of decreasing birth rates and revision of medical treatment fees (reduction). However, the trends of laboratory test fees which had been subject to revision of insurance (medical laboratory test fees) show that, even though they were cut by some 40% from 1997 to 2006, the fees have been stable or only slightly reduced after 2007. (Laboratory test fee in fiscal 2020: -1.12%)

This is a result of the activities for emphasizing the importance of prevention and checkups in the industry, including the company. In the medium term, the domestic market is expected to grow with an annual rate of around 2%.

Out of 139 member companies (as of April 2021) of JACRI mentioned above, about 80 are manufacturers, and there are about 15 companies with over 10 billion yen in sales. Most of them are small to medium sized companies. Because the test items of diagnostic tests range widely, each company has its own field of strength, and business segregation is already established in the industry. As a result, collaboration, such as supplying raw materials and products from other companies and manufacturing and selling them, is often observed. Against such a backdrop, the market is modestly growing. Therefore, there is currently no apparent trend of weeding out uncompetitive corporations.

Overseas Market

The global clinical laboratory test reagent/device market is estimated to be US$ 67.2 billion and, by region, the market is occupied by the USA at 36%, followed by Europe at 28% and Asia at 24% (As of 2018) (Fuji Keizai "2019 World Wide Clinical Testing Market" Eiken Chemical Co., Ltd.).

The overseas market is over ten times larger than the domestic market. In developed countries, the number of tests is increasing as aging of population progresses. Furthermore, in emerging countries, the needs for medical services are expanding because of economic and income growth. As a result, the annual growth rate of overseas market is expected to be over 5%, which is much higher than that of the domestic market. Therefore, the Japanese companies in the industry are vigorously undertaking globalization of their businesses.

In the global market, however, Roche being the most dominant with the sales of $61.4 billion in 2019, large global companies such as Abbott, SIEMENS, and Beckman are the main players, and in order to survive the competition, Japanese companies must strengthen their competitiveness by, for example, developing unique products or systems.

1-4 Business Description

1. What are Clinical Tests?

One type of clinical tests is the “Biological test” that directly examines the body using medical equipment such as X-ray, CT, MRI, electrocardiogram, and ultrasound. Another type of clinical tests is the “Laboratory test” that examines biological samples (specimens) obtained from people such as blood, urine/feces, and cells.

The clinical test reagents made by EIKEN CHEMICAL are the ones used for medical laboratory tests. For example, they are used to test infectious diseases or to measure small amounts of blood contained in stool. They are made to support diagnosis. Most of these reagents are called in vitro diagnostics (IVD) and are regulated by the Pharmaceutical and Medical Device Act so reagent manufacturers file applications with PMDA (Pharmaceuticals and Medical Devices Agency) and obtain its approval. Users include hospitals, clinics, medical offices, medical test centers that carry out tests commissioned by medical institutions, health screening centers, public health centers, and institutions for health research, and others.

2. Major Products

EIKEN CHEMICAL mainly manufactures and sells the following types of reagents and medical devices.

As they deal with a wide range of reagents, they not only sell their in-house products but also purchase and sell products from other companies.

Major in-house products include fecal immunochemical test reagents, microbiological reagents, immunological and serological reagents, urinalysis test strips, genetic testing reagents, etc. The sales ratio of in-house products to other companies’ products is approximately 60:40. The gross profit margin is approximately 55% for in-house products and approximately 35% for other companies’ products.

Product Name | Sales | Sales Proportion |

Fecal immunochemical test reagents (FIT) | 9,632 | 24.9% |

Immunological and serological reagents (excluding fecal immunochemical test reagents) | 9,117 | 23.6% |

Urinalysis test strips | 3,380 | 8.7% |

Microbiological test reagents | 3,989 | 10.3% |

Biochemical test reagents | 594 | 1.5% |

Equipment/Culture medium related to food and environmental | 2,125 | 5.5% |

Related molecular genetics (LAMP), (including its devices) | 6,390 | 16.5% |

Medical Devices (excluding molecular genetics related devices) | 3,437 | 8.9% |

Total sales | 38,667 | 100.0% |

*Results for the fiscal year ended March 2021. Unit: Million Yen

Fecal immunochemical test reagents

The major products for EIKEN CHEMICAL are reagents and sampling bottles for fecal immunochemical tests to specifically detect and measure human hemoglobin in feces as a colorectal cancer screening and diagnosis and are sold globally.

Immunological and serological reagents (excluding Fecal immunochemical test reagents)

EIKEN CHEMICAL develops, manufactures, and sells reagents for various tests, such as LZ Test EIKEN, a reagent for general-purpose automatic analyzers used for diagnosing rheumatism and inflammatory disorders and gastric cancer risk stratification test(the ABC method). The company also procures reagents for fully automated enzyme immunoassay devices and reagents for automatic glycohemoglobin analyzers from Tosoh Corporation, and sells them.

Urinalysis test strips

EIKEN CHEMICAL develops, manufactures, and sells “UROPAPER III ‘EIKEN’,” a urinalysis test strip for testing various items such as occult blood, protein and glucose, as well as the “UROPAPER III ‘EIKEN’,” a specialized test strip for fully automated urine analyzers.

Outside Japan, the company formed a business tie-up with Sysmex Corporation in 2017 and has sales.

Microbiological test reagents

Since its establishment, EIKEN CHEMICAL has been developing biological specimens as well as reagents for microbiological tests for food and environment in order to prevent infectious diseases and food poisoning. Currently, it develops, manufactures, and sells various reagents that are effective for diagnosis and treatment of microorganism infection, such as mediums, powder mediums, antimicrobial susceptibility tests, and rapid test reagents.

Clinical chemistry test reagents

EIKEN CHEMICAL develops, manufactures and sells reagents for clinical chemistry tests including “EXDIA XL ‘EIKEN’” series that assist to measure and analyze biological components in blood serum and urine, with a focus on the test items that are related to lifestyle related diseases.

Equipment/ Culture mediums related to food and environment

EIKEN CHEMICAL sells reagents for microbiological tests on food to detect food poisoning bacteria as well as reagents for environmental microbiological tests and equipment and devices to measure contamination of work environments.

Molecular genetics (LAMP)

In 1998, EIKEN CHEMICAL developed and patented an innovative gene amplification technology called “LAMP.” The LAMP is “simple, rapid, and accurate” and is a critical tool for Eiken’s future global expansion of its business. (Details are described below)

Medical devices

EIKEN CHEMICAL sells various types of automated analyzers. They contract manufacturing specialized equipment that uses their in-house reagent. Since beginning sales of “OC Sensor” in 1989, they have worked continuously on technological innovation and quality improvement of this fecal immunochemical test analyzer. Also, they offer the “US,” an automated urine analysis device that uses Eiken’s proprietary image processing system, the “BLEIA-1200,” a fully automated biochemistry photogenetic immunoassay device that was the world’s first of its kind in the clinical testing field, and “Loopamp EXIA,” a LAMP-based real time turbidity measuring device.

3. Sales structure

EIKEN CHEMICAL has 10 sales divisions in Japan. Its academic department supports sales promotion.

Out of 733 employees (consolidated) during FY 2021, about 300 belong to the sales department.

As for the sales channels for medical institutions such as hospitals, the Company’s direct sales partners are medical wholesale companies, and it has businesses with almost all the wholesale companies in the medical industry.

For overseas sales, EIKEN CHEMICAL has basically 1 agency per country, and the sales and maintenance are commissioned to the agencies.

EIKEN’s products are exported to 44 countries (FY 2020). The high proportion of overseas sales is occupied by the sales in the USA, Germany, Italy, Spain, England, France, Australia, South Korea, and Taiwan.

In addition to the Europe Branch in Amsterdam (the Netherlands), the Company is strengthening its manufacturing and sales structure through its consolidated subsidiary, “EIKEN CHINA CO., LTD.,” as well as aiming to expand its businesses by setting a business office in China. In the future, it will explore the possibility of making the office as a local corporation, as the size expands.

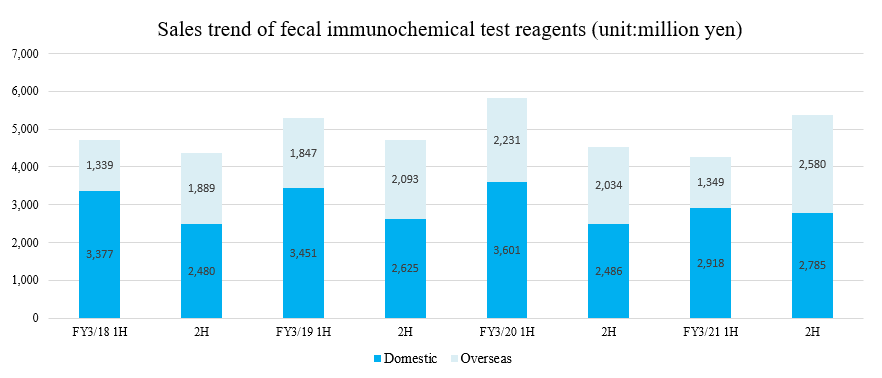

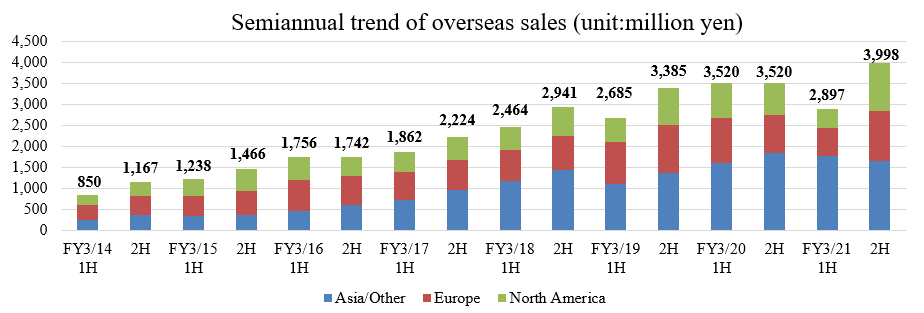

The overseas sales for FY 2021 are 6,895 million yen, out of which 3,929 million yen, 57.0%, is from the sales of fecal immunochemical test reagents.

1-5 ROE Analysis

| FY3/12 | FY3/13 | FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 | FY3/21 |

ROE (%) | 7.0 | 10.9 | 8.3 | 8.3 | 8.9 | 10.0 | 8.3 | 10.3 | 9.9 | 12.9 |

Net Profit Margin | 5.27 | 8.56 | 6.61 | 6.77 | 7.55 | 8.77 | 7.45 | 9.64 | 9.67 | 13.04 |

Asset Turnover Ratio | 0.84 | 0.84 | 0.84 | 0.83 | 0.83 | 0.80 | 0.78 | 0.77 | 0.75 | 0.73 |

Leverage | 1.58 | 1.52 | 1.50 | 1.47 | 1.42 | 1.43 | 1.43 | 1.38 | 1.36 | 1.35 |

*Unit: %, times, x

The increase in the net profit margin in FY 2021 was due partly to the booking of 110 million yen associated with the receipt of a settlement under extraordinary profit. Meanwhile, operating income margin increased 4.5% year on year, due to growth for novel coronavirus detection reagents and genetic testing devices.

The company intends to continue fortifying priority measures, including developing high value-added products, creating new businesses and new markets, and improving profitability and productivity by reducing the COGS and SG&A ratios. By doing so, the company plans to maintain ROE above the cost of capital.

1-6 Characteristics and Strengths

(1) Products that Occupy High Share in the Market

The share of Eiken’s fecal immunochemical test reagents is ranked top (63%) in the domestic market. Furthermore, many of their in-house products occupy high market share in the market, for example, urinalysis test strips occupying approximately 27% (ranked second) of the market, and microbiological reagents occupying approximately 16% (ranked fourth) of the market.

The background to how Eiken’s fecal immunochemical test reagents have come to hold such a high share of the market includes that in 1987, Eiken began sales of “OC-Hemodia,” a visual determination method fecal immunochemical test reagents, a product that more closely conformed to user needs when compared to competitor’s products, and that in 1989 they adopted the latex photometric immunoassay method and began sales of “OC-Sensor,” the world’s first fully automated analyzer.

Also, the Health and Medical Service Act for the Aged was revised in 1992, making it possible to have fecal immunochemical test reagents as a method in colon cancer screening and diagnosis using public funds (no cost to the patient) which led to an accelerated spread and increased competition. But in 2001, Eiken began sales of the “OC-Sensor neo,” with completely remodeled functions, which increased its market share.

(Source:Eiken Chemical)

As for fecal immunochemical tests, Eiken will expand its business globally based on the above characteristics.

The immunochemical method used in Japan applies reagents that react only to human hemoglobin and can process a large volume simultaneously.

Meanwhile, in other countries, reagents for the chemical method (Guaiac method) based on old measuring principles are still used, which presents accuracy challenges. In 2011, the test guidelines in Europe have finally begun recommending automated analyzers that use the immunochemical method. As a result, the market is beginning to undergo a dramatic change.

Furthermore, although the chemical method is also still common in the United States, which has the largest potential market, trends show a gradual shift toward the immunochemical method. Additionally, new guidelines on colorectal cancer screening by USPSTF (US Preventive Medicine Special Committee) was published in June 2016. These guidelines pointed that the immunization method is superior to the conventional chemical method and pursuantly, and assessed Eiken’s fecal immunochemical test product, "the OC FIT-CHEK family of FITs" has the utmost inspection performance with high sensitivity and specificity. Besides, the large markets which are underdeveloping exist on the leading and emerging countries in Asia and South America.

Because the fecal immunochemical test market is a niche market, Japanese companies, the forerunners of the immunochemical method, own the most advanced technique, and hence Eiken’s reagents and equipment are the global standard.

(2) Focusing on research and development

EIKEN CHEMICAL is focusing on research and development of unique technologies as a research and development corporation, and the development of original products that respond to customers’ needs, using the unique technologies. The number of staff assigned for research and development is about 110.

The demand from the customers is higher quality of medicine. Specifically, they demand for higher differential diagnosis accuracy with high sensitivity and high quality and improved detection rate. In addition, easier usage will lead to reduction in the work of medical staff. Responding to such needs is critical.

Since its establishment in 1939, EIKEN CHEMICAL has accumulated unique technologies for manufacturing reagents. Their unique technologies are applied to the measuring principles of their devices such as fecal occult blood test analyzer, automated urine analyzer, and biochemiluminescent immunoassay analyzer “BLEIA” that are designed to optimize the performance of the reagents.

(3) Development of various types of products in various fields through alliance strategy

Because clinical test reagents have wide range of subjects and items, it is not possible for one company to develop, manufacture and sell all types of reagents. The other companies in the industry are focusing on the technologies and products that they are specialized in. However, as an integrated manufacturer of clinical test reagents, EIKEN CHEMICAL aims at stabilizing profit structure, expanding their own strengths through alliance strategy, and pursuing synergy effects such as complementing functions and acquiring new technologies, while dealing with a wide range of products and responding to the needs of customers and users such as medical institutions.

Another reason why they cover various types of products in various fields is that they believe that covering wide range of clinical tests is their social responsibility to protect the health of the public, as is stated in their management philosophy: “protect the health of the public through health care services”.

(4) Competitive Advantages of the “LAMP”

Thus, far the mainstream technology for amplifying genes as a process of gene tests has been what is called “PCR” Under such circumstances, in 1998, EIKEN CHEMICAL developed a unique technology called the “LAMP.”

Compared to the PCR, the “LAMP” offers the following superior characteristics and allows users to carry out simple, rapid, and accurate gene tests.

Simple | Amplification response occurs at a constant temperature (with the PCR, the temperature needs to be changed for amplification). |

Rapid | High amplification efficiency, with genes being detected within 30 to 60 minutes (with the general PCR, it takes 2 to 3 hours). |

Accurate | Extremely high specificity. |

Currently in the medical field, the LAMP is used to diagnose infectious diseases such as tuberculosis, mycoplasma (a genus of bacteria, it can also cause pneumonia), legionella, pertussis, etc.

EIKEN CHEMICAL is making focused efforts on infectious disease diagnostic test in order to establish the status of the LAMP. At the same time, it is promoting the use of the LAMP in other fields such as food production and processing, environment, agriculture/veterinary to spread and enhance recognition of the LAMP. In fact, the LAMP-based products have been commercialized one after another since 2002.

Furthermore, for the same purposes, EIKEN CHEMICAL is actively giving licenses to external companies to build the LAMP camp.

One of the major actions to spread the LAMP in the world is an alliance with “FIND.”

“FIND” stands for “Foundation for Innovative New Diagnostics” and is a non-profit organization recognized by the Swiss government, launched at a meeting of the United Nations World Health Assembly in May 2003. In its initial five years of existence, it received a grant from the Bill & Melinda Gates Foundation to start up their activities.

Their goal is to develop and introduce affordable, simple, and advanced diagnostic tests to eradicate infectious diseases in developing countries.

FIND’s scope of activities includes tuberculosis, malaria, and African sleeping disease. With tuberculosis, collaborative research between EIKEN CHEMICAL and FIND for a tuberculosis test using the LAMP began in July 2005. The purpose of this research is to improve the accuracy of tests by replacing the microscopy test (sputum smear test), which is the current practice in developing countries.

As a result of this collaboration, improvements which are not possible with the conventional PCR such as simplified pretreatment (PURE), improved reagents storage (store at room temperature) and simplified devices have been made to enable the developing countries to carry out the procedure (TB-LAMP).

This LAMP-based product was already launched in Japan in 2011.

After that, in order to obtain endorsement from the WHO (World Health Organization), FIND has completed its clinical evaluation in 14 developing countries and submitted this information to the WHO.

In consequence, the company has acquired the recommendation by WHO as an evaluation replaces with microscopic examination or as an inspection reinforcing microscopic examination in August 2016.

According to a report on global tuberculosis announced by WHO in November 2017, the number of patients suffering from tuberculosis in 202 countries all over the world in 2016 was 10.4 million, an increase of 0.8 million from 9.6 million in 2014. Additionally, the number of deceases was 1.7 million, an increase of 0.2 million from 1.5 million in 2014.

Most of them are inferred as matters of undiagnosed or untreated, and WHO indicates "the enforcement of countermeasures for the countries where access to diagnosis and treatment is not yet maintained is demanded".

Following these situations, the company expects that dissemination and penetration of TB - LAMP contribute greatly to solve these problems.

In addition to tuberculosis and other diseases listed above, EIKEN CHEMICAL and FIND also conduct collaborative research of reagents for leishmaniasis and Chagas disease.

Also, EIKEN CHEMICAL completed the development of a testing system “Simprova” that uses a next-generation compact fully automated genetic testing device and multi-item testing chip using the LAMP and started selling it in April 2020.

This equipment fully automates the process from specimen preprocessing (nucleic acid extraction and purification) to amplification and detection. By developing the unique protocol that exploits the LAMP’s characteristics, the operation time that used to take over 2 hours with a conventional high purity nucleic acid extraction and purification device and an amplification and detection device combined, is now shortened to less than an hour.

At first, the company plans to release the respiratory organ infections panel and then the acid-fast bacterium disease panel and respiratory viruses panel, and will gradually increase the number of test items.

It is anticipated that “Simprova” will accelerate the spread of the LAMP and establish its position as the global standard in a newly created market.

*Gene amplification technology

Since the number of genes found in a genetic test sample is extremely small, to detect genes, the targeted gene must be amplified first. Gene amplification technology, therefore, is crucially important for genetic testing.

*African trypanosomiasis

An endemic found in tropical Africa; African trypanosomiasis is a serious tropical disease transmitted to HUMAN mbH by a protozoa called Trypanosoma brucei. The disease is transmitted by a tsetse fly. Trypanosoma in HUMAN mbH blood sucked by a tsetse fly develops and propagates inside the HUMAN mbH body in 2 to 5 weeks, before turning itself into a terminal Trypanosoma-type, which becomes a source of next round of infection. The disease causes fever, headache, and vomiting, and the patient falls into constant sleep. Since the patient cannot take meals, he or she becomes thin and complain of generalized weakness and, in many cases, leads to a complication and dies.

*Leishmaniasis

Leishmaniasis is a disease transmitted by a protozoon called leishmania, and has various types such as visceral leishmaniasis (also known as black fever), Brazilian leishmaniasis that affects skin and mucous membranes, and tropical leishmaniasis which affects skin. All these types are transmitted by blood-sucking insects, especially sandflies. Visceral leishmaniasis, after about three months incubation period, causes fever, sweating, diarrhea, etc. and, in about one month, causes a swollen liver and spleen, the patient develops an anemia and becomes weak if untreated, and may die in half a year to two years.

*Chagas disease

Found in southern U.S. as well as Central and South America, Chagas disease is an infectious disease transmitted by Reduviidae, a kind of blood-sucking Triatominae. The disease does not develop symptoms immediately after infection; it usually has a latency period of about 30 years. It causes symptoms such as inflammation of sinews, liver and spleen, myalgia, myocarditis, cardiomegalia encephalomyelitis, cardiac disturbance.

2.Fiscal Year March 2021 Earnings Results

(1) Overview of consolidated results

| FY 3/20 | Share | FY 3/21 | Share | YOY | Compared with forecast (1) | Compared with forecast (2) |

Sales | 36,585 | 100.0% | 38,667 | 100.0% | +5.7% | +13.4% | +4.2% |

Domestic | 29,545 | 80.8% | 31,772 | 82.2% | +7.5% | +13.2% | +5.2% |

Overseas | 7,040 | 19.2% | 6,895 | 17.8% | -2.1% | +14.3% | -0.1% |

Gross margin | 16,230 | 44.4% | 18,526 | 47.9% | +14.1% | - | - |

SG&A | 11,608 | 31.7% | 11,914 | 30.8% | +2.6% | - | - |

Operating income | 4,622 | 12.6% | 6,612 | 17.1% | +43.0% | +61.3% | +19.4% |

Ordinary income | 4,723 | 12.9% | 6,808 | 17.6% | +44.1% | +62.1% | +20.1% |

Net income | 3,538 | 9.7% | 5,044 | 13.0% | +42.5% | +52.8% | +17.0% |

*Unit: million yen. Compared with forecast (1) and (2) are changes from the October 2020 and January 2021 forecasts, respectively.

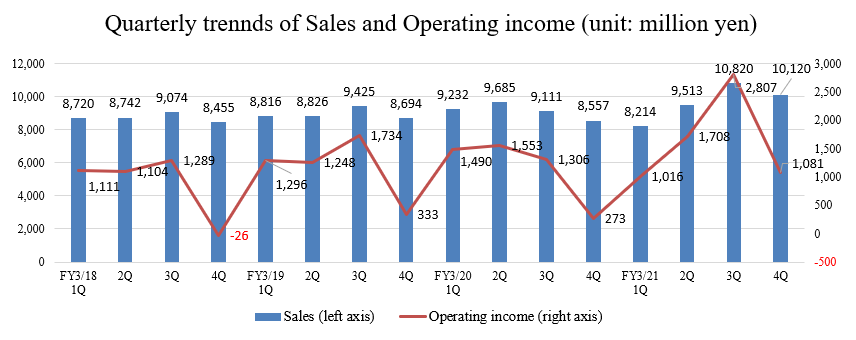

Both domestic and overseas sales recovered in the second half, and sales and profits increased. Exceeded the forecast.

For the fiscal year (FY) 2021, sales increased 5.7% year on year to 38.6 billion yen. The sales of novel coronavirus detection reagents and genetic testing devices grew sharply. Although the screening market has not reached the normal level, it has almost recovered both in Japan and overseas.

Operating income increased 43.0% year on year to 6.6 billion yen. Profit increased significantly, primarily due to the novel coronavirus detection reagents. Operating income margin also widened 4.5 points, exceeding the company’s revised forecast announced in January 2021.

The year-end dividend was raised by 5 yen/share from 21 yen/share to 26 yen/share. Combined with the interim dividend of 15 yen/share, the total annual dividend became 41 yen/share. The payout ratio was 30.0%.

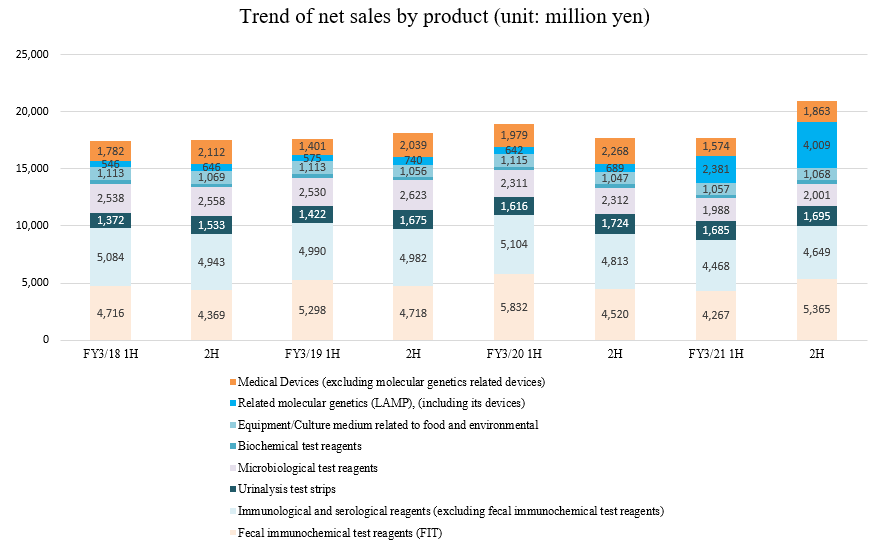

(2) Sales by product

Products | FY 3/20 | FY 3/21 | YoY | Compared with forecast (1) | Compared with forecast (2) |

Fecal immunochemical test reagents (FIT) | 10,352 | 9,632 | -7.0% | +16.5% | +0.5% |

Immunological and serological reagents (excluding fecal immunochemical test reagents) | 9,917 | 9,117 | -8.1% | +3.7% | +2.4% |

Urinalysis test strips | 3,340 | 3,380 | +1.2% | +4.6% | -0.8% |

Microbiological test reagents | 4,623 | 3,989 | -13.7% | -1.7% | -1.8% |

Biochemical test reagents | 609 | 594 | -2.5% | +2.4% | +1.2% |

Equipment/Culture medium related to food and environmental | 2,162 | 2,125 | -1.7% | +4.7% | +3.1% |

Related molecular genetics (LAMP), (including its devices) | 1,331 | 6,390 | +379.9% | +49.3% | +17.2% |

Medical Devices (excluding molecular genetics related devices) | 4,247 | 3,437 | -19.1% | +20.2% | +13.0% |

Total sales | 36,585 | 38,667 | +5.7% | +13.4% | +4.2% |

*Unit: million yen. Compared with forecast (1) and (2) are changes from the October 2020 and January 2021 forecasts, respectively.

○Fecal immunochemical test reagents (FIT)

Domestic sales decreased 6.3% year on year while overseas sales fell 7.9%. Due to the impact from the suspension of various screening programs and a drop in the number of outpatients stemming from the spread of COVID-19, the recovery in the second half of the term was unable to offset the decrease in the first half.

| FY 3/20 | FY 3/21 | YoY |

Domestic | 6,087 | 5,703 | -6.3% |

Overseas | 4,265 | 3,929 | -7.9% |

Total | 10,352 | 9,632 | -7.0% |

*Unit: million yen.

○Immunological and serological reagents (excluding fecal immunochemical test reagents) microbiological test reagents

Sales declined due to a decrease in the number of outpatients caused by the spread of COVID-19 and the suspension of various clinical examinations.

○Urinalysis test strips

Sales increased thanks to higher sales to Sysmex offsetting the overall decrease.

○Related molecular genetics (LAMP)

The sales of novel coronavirus detection reagents and genetic testing devices increased significantly. The total number of facilities introducing reagents has reached about 800.

Topics related to novel coronavirus detection reagents are as follows.

*In April 2020, the company launched "Loopamp Novel Coronavirus 2019 (SARS-CoV-2) Detection Reagent Kit,” an in-vitro diagnostic. It can detect the virus in 35 minutes from the RNA extracted from specimens.

*In October 2020, the company started shipping the said reagent kit (improved version), enabling testing using saliva as a sample.

*In September 2020, the company completed the development of a production system that enables a stable supply of 500,000 tests per month.

*In October 2020, the company started supplying the reagent to India. It obtained CE Marking for in-vitro diagnostic devices (in compliance with the In-Vitro Diagnostic Devices Directive) and has stepped up overseas expansion.

The company intends to contribute to the prevention of the spread of COVID-19 by providing a stable supply of testing reagents using the LAMP method and expanding this rollout globally.

|

|

|

For TB-LAMP, guidelines for high tuberculosis burden countries were listed. It was also adopted to receive funding from the Global Fund.

License/patent fee income soared 729 million yen year on year to 1,285 million yen.

(3) Overseas trends

| FY 3/20 | FY 3/21 | YoY |

Overseas sales | 7,040 | 6,895 | -2.1% |

North America | 1,592 | 1,598 | +0.4% |

Europe | 2,002 | 1,853 | -7.4% |

Asia, others | 3,445 | 3,443 | -0.1% |

For OC | 4,265 | 3,929 | -7.9% |

Others | 2,775 | 2,966 | +6.9% |

*Unit: million yen.

Although screening programs in various countries have resumed and are on a recovery trend as a whole, annual sales of fecal occult blood test reagents decreased, due to the heavy impact from performance in the first half of the term.

In Europe and the U.S., the demand for FIT (fecal immunochemical test reagents) is increasing due to screening scheme changes caused by the COVID-19 pandemic. Also, an increasing number of screening programs are being provided through a mobile environment, creating a favorable operating environment.

In the U.S., the USPSTF colorectal cancer screening guidelines recommended lowering the starting age from 50 to 45. In England, the national screening age for colorectal cancer has been lowered from 60 to 50 (from FY 2021). As such, the company will aggressively pursue orders.

The national colorectal cancer screening contract in Australia has been renewed.

The sales of urinalysis test strips and devices for Sysmex rose significantly.

(4) Capital investment, R&D, Depreciation

| FY 3/19 | FY 3/20 | FY 3/21 | FY 3/21 (Initial Est.) |

R&D | 2,904 | 3,332 | 3,086 | 3,160 |

Capital investment | 1,685 | 2,985 | 2,876 | 3,350 |

Depreciation | 1,594 | 1,627 | 1,711 | 1,860 |

*Unit: million yen. Estimate is for October 2020 release.

R&D expenses were mainly costs associated with developing succeeding products to fecal occult blood tests and urine analysis devices. Capital investments were mainly in core system development and COVID-19 test reagent production equipment.

(5) Financial status

◎Major BS

| End of March, 2020 | End of March, 2021 | Increase/ Decrease |

| End of March, 2020 | End of March, 2021 | Increase/ Decrease |

Current assets | 28,903 | 29,983 | +1,079 | Current liabilities | 11,740 | 12,772 | +1,032 |

Cash and deposits | 10,098 | 9,150 | -948 | Notes and accounts payable trade | 7,324 | 6,680 | -644 |

Notes and accounts receivable-trade | 11,017 | 12,298 | +1,281 | Income tax payable | 702 | 1,373 | +671 |

Inventory | 7,173 | 7,765 | +592 | Noncurrent liabilities | 1,278 | 1,239 | -38 |

Noncurrent assets | 21,418 | 25,701 | +4,283 | Total liabilities | 13,018 | 14,012 | +994 |

Property, plant and equipment | 12,041 | 12,768 | +727 | Net assets | 37,303 | 41,672 | +4,369 |

Intangible assets | 1,019 | 1,450 | +431 | Shareholder equity | 25,302 | 29,166 | +3,864 |

Investment and other assets | 8,357 | 11,481 | +3,123 | Total liabilities and net assets | 50,322 | 55,685 | +5,362 |

Total assets | 50,322 | 55,685 | +5,362 | Equity ratio | 73.5% | 74.3% |

|

*Unit: million yen. Accounts payable includes Electronically recorded monetary claims

Total assets increased 5,362 million yen from the end of the previous fiscal year to 55,685 million yen due to an increase in notes and accounts receivable-trade and investment and other assets (long-term deposits).

Total liabilities increased 994 million yen to 14,012 million yen.

Net assets increased 4,369 million yen to 41,672 million yen due to a rise in retained earnings.

As a result, equity ratio rose 0.8% from the end of the previous fiscal year to 74.3%.

(6)Topics

The following new products have been released.

April 2020 | “Loopamp kit of reagents for detecting the novel coronavirus 2019 (SARS-CoV-2)” |

“Fully automated nucleic acid testing device Simprova”, “Simprova Respiratory Infection Panels BP, LP, and MP” | |

September 2020 | Hammock-shaped stool collection sheet “Bentorikun” |

October 2020 | “OC-Calprotectin ‘Eiken’ |

January 2021 | “OC-FcaReagent” (CE Mark) *Fecal calprotectin test launched overseas |

February 2021 | Automated urine analyzer “US-2300” |

Fecal occult blood analyzer “OC-Sensor Ceres” | |

March 2021 | “Simprova Mycobacteriosis Panel MTB, MAI” |

“Simprova Respiratory Virus Panel SARS-CoV-2, FluA, FluB” |

3.Fiscal Year March 2022 Earnings Estimates

(1) Estimate of consolidated results

| FY 3/21 | Share | FY 3/22 (Est.) | Share | YoY |

Sales | 38,667 | 100.0% | 40,400 | 100.0% | +4.5% |

Domestic | 31,772 | 82.2% | 31,310 | 77.5% | -1.5% |

Overseas | 6,895 | 17.8% | 9,090 | 22.5% | +31.8% |

Operating income | 6,612 | 17.1% | 6,370 | 15.8% | -3.7% |

Ordinary income | 6,808 | 17.6% | 6,430 | 15.9% | -5.6% |

Net income | 5,044 | 13.0% | 4,910 | 12.2% | -2.7% |

*Unit: million yen

Sales increased and profits decreased

The sales for FY 2022 are forecast to be 40.4 billion yen, up 4.5% year on year, while operating income is expected to decrease 3.7% to 6.37 billion yen.

The domestic screening market is expected to recover to about the same level as before the Corona disaster, but the hospital market is expected to decrease by about 5%.

The overseas colorectal cancer screening (FIT) is expected to become more widespread than before the coronary disaster. In addition to expanding awareness of the usefulness of FIT triage as a means of avoiding the risk of infection during endoscopic examinations, we will work to increase awareness of the loss of opportunities for early detection due to lack of screening, as well as the materialization of web and mail screening. We will develop the market in response to the lowering of the medical examination age in the U.S. and England.

It expects demand for genetic testing for novel coronavirus infections to continue, but although demand for testing in Japan will remain constant, the installation of genetic testing equipment has run its course. On the other hand, it will continue to respond to the demand for testing in various countries overseas.

The company plans to pay a dividend of 41 yen/share, like in the previous term. The estimated payout ratio is 30.8%. In terms of profits, the company anticipates an increase in the COGS ratio due to changes in the sales mix, and an increase in SG&A expenses due to business process reforms utilizing IT.

(2) Intensive Measures

In the current term, the final year of the medium-term management plan (FY 3/2020 to FY 3/2022), the company will mainly implement the following measures.

Issue | Measures |

1. Genetic testing | *Further expansion of genetic testing, which grew significantly in the previous term *Provide a stable supply and promote sales of novel coronavirus detection reagents *Development of fully-automated equipment with high processing capabilities using the LAMP method *Domestic expansion of the Simprova system and development of new panels *Development of companion diagnostic systems using next-generation sequencers |

2. Screening tests, etc. | *Enhance the market penetration of colorectal cancer screening tests and improve consultation rate during the COVID-19 pandemic *Promote calprotectin sales (domestic/overseas) *Promote urinalysis reagents/analyzers *Promote market penetration and establishment of testing for tuberculosis and malaria, etc. |

3. Establishment of a foundation for increasing management efficiency | *Integration of core systems: Operation of new production systems (scheduled for August 2021) *Start of construction of a new research building (scheduled for June 2021) |

4. Strengthen initiatives for sustainability management | *Promote SDGs. Priority themes are “Improving global health and extending healthy life expectancy” and “Development and provision of environmentally-friendly products.” The company is also enhancing the disclosure of sustainability-related information on its website. |

(3)R&D・Capital investment・Depreciation costs

| FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22(Est.) |

R&D | 2,904 | 3,332 | 3,086 | 3,400 |

Capital investment | 1,685 | 2,985 | 2,876 | 5,900 |

Depreciation costs | 1,594 | 1,627 | 1,711 | 2,080 |

*Unit: million yen

R&D expenses were mainly for the ongoing development of succeeding products to follow on from fecal occult blood tests and urine analysis devices.

Capital investment is expected to increase significantly due to the start of construction of the new research building. Depreciation costs will also increase.

The new research building to be constructed at the Nogi Plant will be positioned as a facility to help realize growth strategies, including "establish a global brand for gastrointestinal cancer," "create fundamental technologies to realize a diagnostic system for the three major infectious diseases," "develop high-value-added products," and "establish production technology in pursuit of quality and cost.”

The company will also pursue the achievement of breakthroughs by concentrating new information and technologies, for example, by improving creativity through open innovation in cooperation with third parties and consolidating dispersed laboratories. It is to be “A Place for Achieving Dreams,” somewhere that makes dreams come true and enables the pursuit of infinite possibilities.

It is scheduled to start operation in October 2022.

4. Conclusions

In line with the company’s expectations, in the latter half of the previous fiscal year, profit increased significantly even though sales growth rate was only in the single digits amid a recovery in the number of clinical tests. The company expects strong sales and profits in the first half of the current term thanks to boosts continuing on from the previous term. Sales and profits are expected to decline in the second half, but reach sales and profit levels higher than those before the COVID-19 pandemic.

In the current term, the final year of the medium-term management plan, the company needs to lay solid groundwork for the next three years (from the term ending March 2023 to that ending March 2025) with an eye on the fiscal year ending March 2029, which is the 90th anniversary of the company’s founding. Our attention will not only be on the novel coronavirus detection reagent, which is expected to grow in succession, but also on the steady launch of Simprova and how much the sales of the mainstay fecal occult blood test reagent grow.

<Reference1:EIKEN ROAD MAP 2019 and the New Medium-Term Management Plan>

(1) EIKEN ROAD MAP 2019

The company is projecting a target in 10-year intervals and constructing and promoting a basic strategy to achieve that target. For that, the company newly formulated “EIKEN ROAD MAP 2019” that will start from FY 3/20 in order to continue growing and speed up and expand business.

The grand vision of “EIKEN ROAD MAP 2019” is the “Saving Your Health: Continuing to protect your health as a global clinical test agent manufacturer” in FY 3/2029, which is the 90th anniversary of foundation.

Aiming to achieve the vision, the company formulated the following 3 basic strategies.

Basic Strategy | Outline |

(1) Basic Strategy 1: To enhance growth and profits | ① Promoting global operation ② Maintenance of domestic sales and increase of market shares ③ Increasing profits |

(2) Basic strategy 2: Creation of a new Business | ① Strategic partnership through open innovation ②Creation and advancement of new businesses and new markets |

(3) Basic strategy 3: Development of a Foundation | ① Increase in productivity through IoT and AI ② Nurturing and procurement of personnel and structural reform ③ Development of sales networks and strengthening of marketing |

Under “EIKEN ROAD MAP 2019,” the company will divide a 10-year period into 3 stages and set a theme in each stage.

Period | Theme |

FY 3/2020 – FY 3/2022 | Structural Reform Period: Firmly forging a foundation |

FY 3/2023 – FY 3/2025 | Brand Value Improvement Period: Nurturing brand value that can circulate globally through a strong system |

FY 3/2026 – FY 3/2029 | Sustainable Growth Period: Firm growth based on the newly created value |

(2) The New “Medium-Term Management Plan” (FY 3/2020 – FY 3/2022)

The company formulated a medium-term management plan that would become the first stage of the “EIKEN ROAD MAP 2019.”

Recognizing it as the Structural Reform Period, the company develops the corporate structure to become a global enterprise “EIKEN”, contribute to the world through healthcare, and aims for continuous growth and an increase in profitability.

①Intensive Measures

The company set the following 4 intensive measures under “Structural Reform Period: Firmly Forging a Foundation”

Intensive Measure | Outline |

(1) Establishment of a foundation for increasing management efficiency

| * Offering high value-added services by integrating mission-critical systems and applying IT to quality systems and the operation services department. Continuing IT application in the entire company. * A simple and flat reform of organizational function and structure in order to promote global business development * An increase in efficiency by strengthening and consolidation of production and distribution bases. Currently planning for an expansion of Nogi Office. |

(2) Promoting global business development | * Promotion of colorectal cancer screening, the winning of government screening transactions, and cultivation of the markets of emerging nations *Spread of fecal immunochemical test reagents, especially gastric cancer risk stratification test(ABC classification) * Expanding sales in the urine qualitative examination field by forming a marketing tie-up with Sysmex Corporation * Speeding up the business of tests for tuberculosis complex and malaria using the LAMP method. Promoting the application of the Cameroon-Philippines model in mainly Africa and Asia |

(3) Maintenance of domestic sales and increase of market shares | * Steady growth due to expansion of the company’s product lineup. Focusing on construction of a market for screening of early stage kidney diseases and medical checkups of school children. * Promotion of reagents for colorectal cancer tests and the ABC classification (evaluating the health of the stomach), and establishment of a screening for cancer in digestive organs. * Marketing for a compact, fully automated genetic testing device (Simprova) |

(4) Strengthening of research and development

| * Development of a new panel for a small-sized automatic genetic test system (Simprova) * Development of a new biomarker through open innovation * Development of a new POCT platform for the primary care area, etc. |

②R&D・Capitala Investment

It was disclosed at the time of formulating the medium-term management plan but is undecided at the moment under the current environment.

The basic policy is to make aggressive investments to build a solid foundation.

The main themes in research and development are “Brushing up of core technology and evolution to new technology,” “Promoting development of new reagents and technology and antibody production technology,” “Enrichment of the multiple item chip lineup under Simprova” and “Development of a later model of the fecal occult blood analysis measuring device.”

As for capital investment, the company will be focusing on “Integration of mission-critical systems: application of IT in quality systems and the operation services department,” “New manufacturing system,” “Reconstruction of Nogi Office including adjoining areas” and “Manufacturing system of Simprova.”

③Performance Targets

It was disclosed at the time of formulating the medium-term management plan but is undecided now under the current environment.

④Shareholder Returns

The company will continue to aim for a stable dividend with a payout ratio of more than 30%.

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization Type | Company with a nominating committee and others |

Directors | 9, including 6 outside ones |

Nominating Committee | 3, including 2 outside ones |

Compensation Committee | 3, including 2 outside ones |

Audit Committee | 3, including 3 outside ones |

◎ Corporate Governance Report

Last updated: submitted on June 24, 2020

<Basic Policy>

Our policy for corporate governance is based on our management philosophy, management vision, and motto.

*Management philosophy

We protect the health of people through healthcare services.

*Management vision

In order to protect the health of people, EIKEN Group offers reliable products and services as a pioneer in checkups, to improve its corporate value.

*Motto

“EIKEN” winning trust with quality and growing with technology

To improve our corporate value by enhancing the soundness, speed, and transparency of our business administration, we are enriching our corporate governance while emphasizing the viewpoint of shareholders and recognizing it as an important managerial mission.

Our company has adopted a corporate structure that has a nominating committee, separating the business execution function and the supervisory function of the management. Important items regarding the basic policy for business administration are determined through the deliberation of the board of directors, and business execution is conducted swiftly and smoothly under the appropriate chain of command, in accordance with our in-company regulations and rules.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has implemented every principle detailed in the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure content |

[Principle 1-3 Objective of Capital Policy]

| Our company has designated improving capital efficiency and continuous and stable returns to shareholders as the objective for our capital policy in order to maintain and boost shareholder value. As a concrete index, we will aim to achieve ROE of 10% in FY March 2020, which is the final fiscal year in the Medium-Term Management Plan. In addition, in terms of returns to shareholders, we have set a goal of continuing to have a consolidated payout ratio of 30% or more after taking into the account the extension of the necessary internal reserves for improving the financial structure and actively expanding business. When we implement a capital policy that brings about changes in authority and large-scale dilution (including increase in capital and MBO), we will adequately consider the necessity and rationality of it at the board of directors meeting and ensure that the proper procedures take place. Moreover, we will strive to thoroughly brief shareholders and investors. |

[Principle 1-4 So-called Strategically Held Shares] | 1. Objective Regarding Policy to Strategically Held Listing Shares Our company has set up the basic policy of holding shares of business partners so long as it is within the scope of rationality for ensuring smooth operations, maintaining relationships in transactions, and upholding business and capital alliances and of continuing to hold it so long as these strategically held shares are deemed to contribute towards the development of our company’s business. To verify the significance of the holding, the board of directors holds a discussion every year on whether the return (comprehensive judgments are made on strategical importance, business relationships, etc., in addition to quantitative factors such as dividends and trading conditions) and risks are commensurate with the company’s cost of capital. The company sells shares that are considered to be of little significance to hold, by considering share price trends, etc. Concerning the listed shares, the board of directors decided on a policy to sell five stocks and continue holding five stocks during the FY 2019 after conducting a review at its meeting on April 25, 2019. 2. Standard on Exercising Voting Right of Strategically Held Shares Our company exercise voting rights of strategically held shares by comprehensively considering the circumstances of maintaining the Corporate Governance of the firm, whether a bill will contribute to improve the shareholders’ value, and how it will affect our company. |

[Supplementary Principle 4-11-3 Evaluation of Effectiveness of the Board of Directors and Disclosure of Results] | Our company analyzed and evaluated the effectiveness of the board of directors in 2019, and will disclose an outline of the results. 1. Goal of the analyzation and evaluation To objectively check whether the board of directors is functioning adequately and operating effectively as well as to make improvements to issues presented, as necessary. 2. Target and Method A free description questionnaire with their name applied to all directors was used. 3. Questionnaire Items (1) Formation of Board of Directors; (2) Administration of Board of Directors (3) State of Observation and Supervision of Board of Directors 4. Summary of Results of Analysis and Evaluation We have taken into consideration the following points and have ensured that the board of directors is functioning adequately and is sufficiently effective. (1) The current number of directors comprises a suitable ratio of internal and external members, and possesses a perfect balance of experience, knowledge and diversity. (2) Active and smooth discussions take place with all the directors, including outside directors, actively stating their opinions from their respective viewpoints. Meanwhile, we have resolved the following actions regarding issues that were brought up. (1) In response to the previous year’s questionnaire results, we are working to enhance the functions of the board of directors by adding one person with experience of corporate management and a female lawyer to the board of directors to ensure the diversity of knowledge and experience that cannot be gained by in-house directors alone. (2) Strive to further improve the administration of the board of directors by creating reference material and delivering briefings with more concise points and continuing to send updates on the progress of the important items regularly to increase the effectiveness of debates. |

[Principle 5-1 Objective Regarding Constructive Dialogue with Shareholders] | Our company has formulated a disclosure policy approved by the board of directors and has released details about fundamental objectives, disclosed information, disclosure methods, and a quiet period, and has conversed with shareholders within a reasonable range to contribute to sustainable growth and increasing the mid- to long-term value of the company. Our company has designated the public affairs division to be responsible for IR and set up an IR framework which has the executive manager of general management in charge of the public affairs division as the executive officer of IR, and has established a place to engage in dialogue with shareholders and investors to gain their understanding and trust. The executive manager of general management also has control over posts that are relevant to the IR such as general affairs department, accounting department, and Dept. of Human Resources and General Affairs and links the departments together by closely sharing information between them. Regarding dialogue with shareholders, financial results briefing is conducted twice a year, when the earnings of the fiscal year and the second quarter of the fiscal year are announced, for analysts and institutional investors, and involves a conference held in which the representative director and president will brief and interact with. The public affairs division engage in dialogue with shareholders and investors individually. Within the scope of rationality, management executives or directors will meet up with shareholders and investors themselves depending on their requests or the number of shares they hold. On a regular basis, the executive responsible for IR will report the key ideas, understood from conversations with the shareholder or investor, to the board of directors. Our company has been interacting with shareholders and investors based on the disclosure policy and adequately managing information based on internal corporate regulations formulated taking into consideration the prescribed laws as well as sufficiently ensuring that no insider information has been included. |

Disclaimer This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of Bridge Report (EIKEN CHEMICAL : 4549) and the contents of Bridge Salon (IR seminar) can be found at www.bridge-salon.jp/ for more information.