Bridge Report:(4549)EIKEN CHEMICAL the fiscal year March 2023

President Tsugunori Notomi | EIKEN CHEMICAL CO.,LTD.(4549) |

|

Company Information

Exchange | TSE Prime |

Industry | Pharmaceuticals (manufacturing and sales) |

President | Tsugunori Notomi |

HQ Address | 7 Yamaguchi building, 4-19-9 Taito, Taito-ku, Tokyo, Japan |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

1,591yen | 43,541,438Shares | 69,274 million yen | 12.1% | 100 Shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

51.00yen | 3.2% | 114.78yen | 13.9 times | 1,327.47 yen | 1.2 times |

* Share price is as of the end of May 24. All figures are from the FY March 2023 financial settlement report.

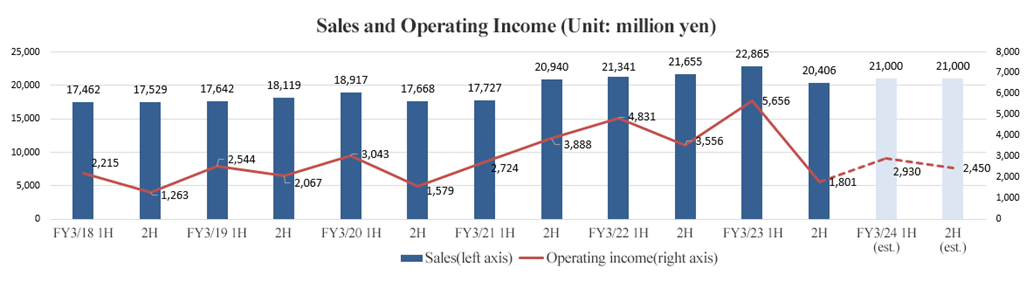

Business Performance Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2020 Act. | 36,585 | 4,622 | 4,723 | 3,538 | 95.95 | 30.00 |

March 2021 Act. | 38,667 | 6,612 | 6,808 | 5,044 | 136.65 | 41.00 |

March 2022 Act. | 42,996 | 8,387 | 8,508 | 6,218 | 168.28 | 51.00 |

March 2023 Act. | 43,271 | 7,457 | 7,568 | 5,736 | 155.17 | 51.00 |

March 2024 Est. | 42,000 | 5,380 | 5,400 | 4,250 | 114.78 | 51.00 |

* Unit: Million-yen, Yen. The definition for net income means net income attributable to owners of parent.

This Bridge Report presents EIKEN CHEMICAL’s earnings results for the fiscal year March 2023 etc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended March 2023 Earnings Results

3. Fiscal Year Ending March 2024 Earnings Estimates

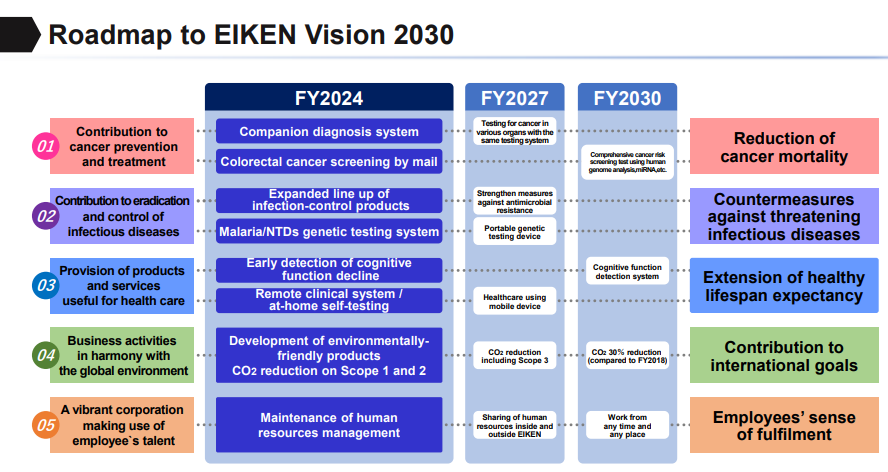

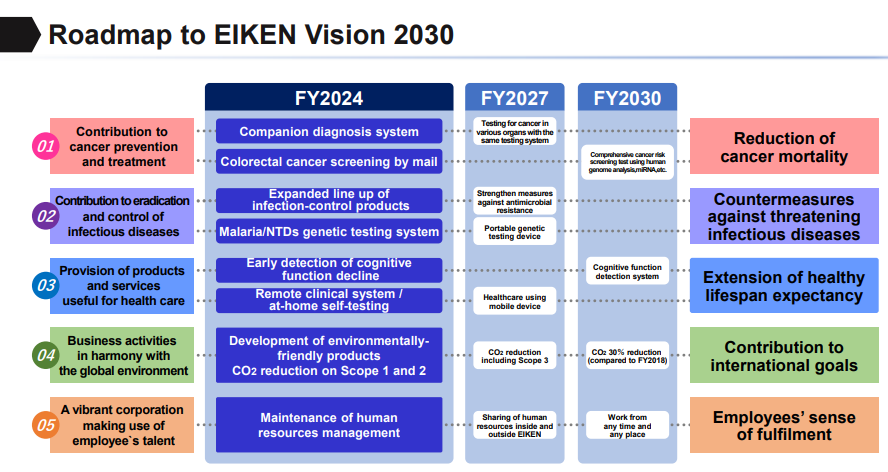

4. Progress of “EIKEN ROAD MAP 2030”

5. Interview with President Notomi

6. Conclusions

<Reference 1:“EIKEN ROAD MAP 2030” and New Medium-Term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

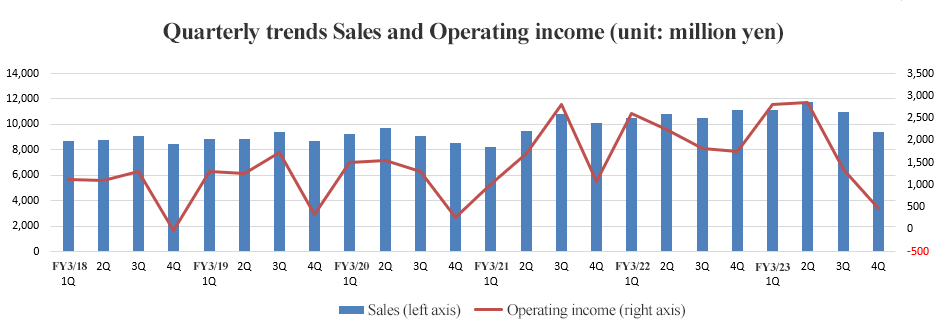

- In the fiscal year (FY) 2023, sales increased 0.6% year on year to 43.2 billion yen. Although sales of reagents for genetic testing for COVID-19 using the LAMP method decreased due to a sharp decline in the number of newly infected patients with COVID-19 in the fourth quarter, sales of reagents for urinalysis and immunoserological tests grew slightly from the previous year, due to the resumption of various medical checkups and testing programs and continued recovery in the number of outpatients. Operating income declined 11.1% year on year to 7.4 billion yen. Gross profit declined 0.3% year on year due to higher costs for raw materials and resources, while SG&A expenses, including R&D expenses, increased 7.1% year on year. Both sales and profit were largely in line with forecasts.

- The company is forecasting lower sales and profit for FY 2024. Net sales are expected to decrease 2.9% year on year to 42 billion yen, and operating income is projected to decline 27.9% to 5.3 billion yen. COVID-19-related sales and patent income are projected to decline, while overseas sales are expected to increase by double digits. The company expects sales of reagents for fecal occult blood tests to recover, as well as sales of urinalysis reagents to Sysmex Corporation to remain strong. Gross profit margin is forecast to decline due to a change in the product mix. The company is expecting increased investment for growth and higher costs due to higher prices of resources. Based on its basic policy of paying stable and consistent dividends, the company plans to pay a dividend of 51.00 yen/share, like in the previous year. Payout ratio is expected to be 44.4%.

- Significant progress has been made on sustainability. In January 2023, the company was selected for the first time as a constituent of the FTSE Blossom Japan Sector Relative Index, a leading index for ESG investing. The FTSE Blossom Japan Sector Relative Index, which was created by the global index provider FTSE Russell, reflects the relative performance of Japanese companies that excel in environmental, social and governance (ESG) performance in their respective sectors. The index is also used as a passive ESG management index for Japan's Government Pension Investment Fund (GPIF), the world's largest pension fund. In addition to this, the company has expressed its support for the TCFD and disclosed more information on climate change, and adopted "Tochigi-Furusato Electric Power Supply Service," a renewable energy source derived from hydroelectric power generation, at its Nogi and Nasu Offices to become carbon neutral. This has made it possible to reduce CO2 emissions from electricity used at both facilities to zero.

- In addition to a decline in COVID-19-related sales, the company expects a decline in sales and profit in FY 2024 due to increased investment in growth and higher costs due to higher prices of resources. However, the company has completed inventory adjustments for fecal occult blood test reagents overseas and is expecting double-digit revenue growth for the current fiscal year. The companion diagnostic system is well on its way to being released in the market, and sample stabilization reagents have already been developed, indicating that the company is building a foundation for solid growth except for COVID-19-related areas.

- The new entrusted testing business that will be started with the companion diagnostic system will lead to the promotion of proprietary cancer gene tests and speed up the development of new products. We would like to pay attention to the progress and results of this business.

1. Company Overview

EIKEN CHEMICAL is a general manufacturer of clinical diagnostics, including immunological and serological, microbiological, clinical chemistry, urine analysis and genetic screening test. It also develops and sells medical devices.

It offers many products that occupy high market share including fecal immunochemical test that occupy about 60% of the domestic share, Urinalysis test, Microbiological test and so on. Its unique gene amplification technology, “LAMP”, is recognized in the world. With the fecal immunochemical test reagents, urinalysis test strips and LAMP, EIKEN is aiming to become a global corporation.

1-1 History

Founded as Koa Kagakukogyo Co., Ltd. in 1939, the company started manufacturing and selling nutritional foods and pharmaceuticals made from livestock organs. In 1949, it was the first company in Japan to successfully commercialize a powdered agar for the detection of bacteria (Salmonella-Shigella [SS] agar). In 1961, it established the Clinical Diagnostics Division and began R&D on in-vitro diagnostics.

In 1989, the company launched “OC-sensor,” the world's first fully automated fecal occult blood analyzer. This led to the establishment of its current overwhelming lead in this field.

After that, while expanding its business domains such as reagents for urinalysis testing and microbiological testing, in 1998, the company developed the LAMP method, a new gene amplification technology. It has launched various products using the LAMP method that are simpler, faster, and more accurate than conventional testing methods.

In 2005, the company concluded a joint development contract with FIND (Foundation for Innovative New Diagnostics) for a rapid genetic tuberculosis detection method, based on the LAMP method. It then proceeded with joint development related to testing for malaria, HIV, etc.

In March 2020, the company released COVID-19 detection reagent utilizing the LAMP method to be used against COVID-19, which has been spreading worldwide.

*For further information about the LAMP method and FIND, please refer to “1-6 Characteristics and Strengths (4) Competitive Advantages of the LAMP Method.”

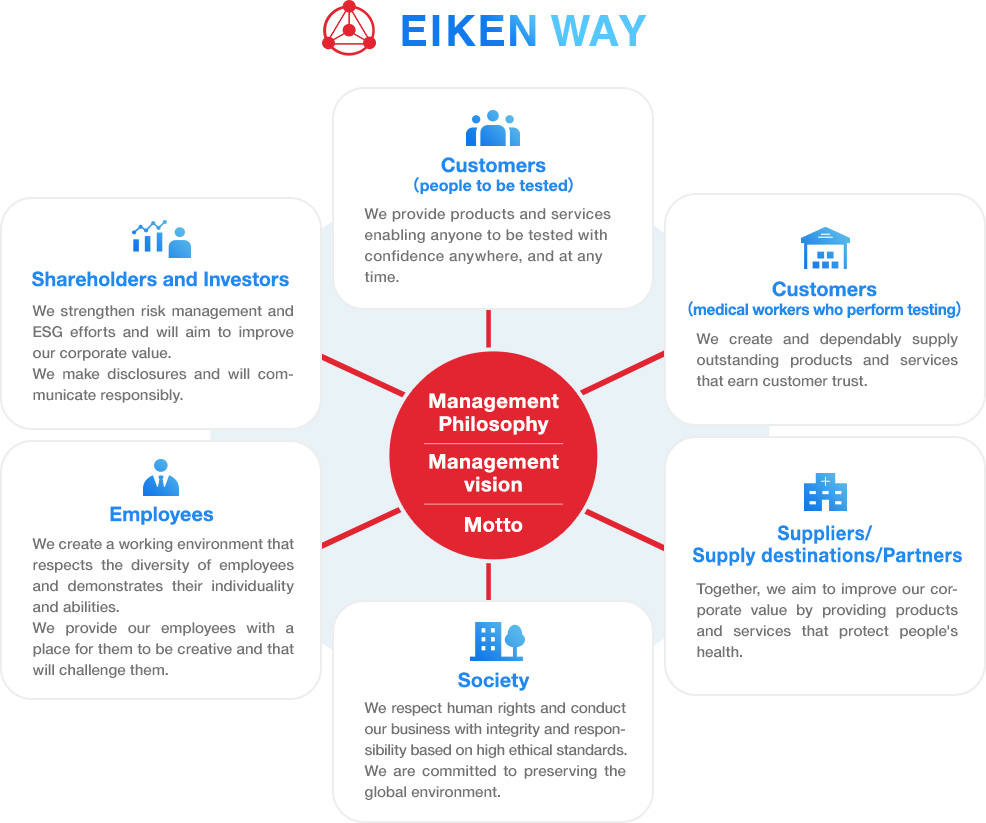

1-2 Management Philosophy

“Management Philosophy”: Protect the health of the public through health care services.

“Management Vision”: EIKEN group is dedicated to leveraging expertise as a medical testing pioneer to increase corporate value by protecting the health of the public with products and services that customers can trust.

“Motto”: We EIKEN provide trustworthy quality and develop with technology.

EIKEN group formulates “EIKEN WAY” as its attitude toward each stakeholder, centering these philosophy vision, and motto.

(Source: EIKEN CHEMICAL)

1-3 Market Environment

Domestic Market

The market scale of clinical reagents is about 490.2 billion yen and 792.3billion yen (including research reagents and diagnostic devices) as of 2021 (survey by the Japan Association of Clinical Reagents Industries, or JACRI. Eiken Chemical Data.).

To control rising medical costs, the Japanese government is focusing on preventive medicine such as special health check-ups (metabolic check-ups) and cancer screenings. It is expected that this, along with the aging population, will lead to an increase in the number of samples (number of specimens).

Some negative factors include the impact of population decline because of decreasing birth rates and revision of medical treatment fees (reduction). However, the trends of laboratory test fees which had been subject to revision of insurance (medical laboratory test fees) show that, even though they were cut by some 40% from 1997 to 2006, the fees have been stable or only slightly reduced after 2007. (Laboratory test fee in fiscal 2022: -1.14%)This is the result of industry-wide efforts to emphasize the importance of prevention and testing, and the domestic market is expected to continue to grow modestly by about 2% per year over the medium term, if the impact of COVID-19 is not taken into account.

Out of 140 member companies (as of April 2022) of JACRI mentioned above, about 80 are manufacturers, and there are about 15 companies with over 10 billion yen in sales. Most of them are small to medium sized companies. Because the test items of diagnostic tests range widely, each company has its own field of strength, and business segregation is already established in the industry. As a result, collaboration, such as supplying raw materials and products from other companies and manufacturing and selling them, is often observed. Against such a backdrop, the market is modestly growing. Therefore, there is currently no apparent trend of weeding out uncompetitive corporations.

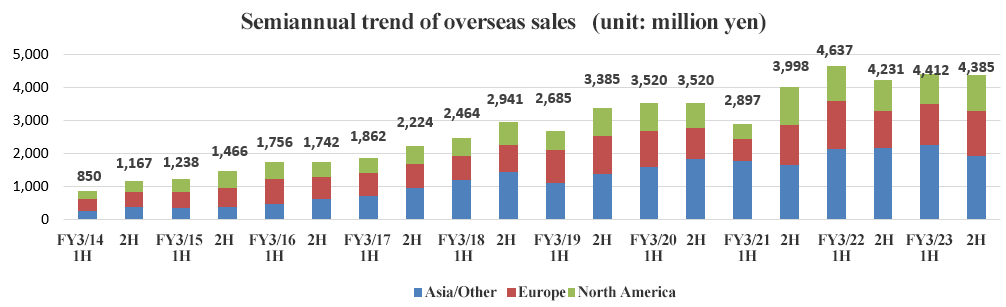

Overseas Market

The global clinical laboratory test reagent/device market is estimated to be US$ 98.2 billion and, by region, the market is occupied by the USA at 39.8%, followed by Europe at 28.0% and Asia at 22.9% (As of 2021) (Markets and Markets “In Vitro Diagnostics Market” Eiken Chemical Co., Ltd.).

The overseas market is over ten times larger than the domestic market. In developed countries, the number of tests is increasing as aging of population progresses. Furthermore, in emerging countries, the needs for medical services are expanding because of economic and income growth. As a result, the annual growth rate of overseas market is expected to be over 3%, which is much higher than that of the domestic market. Therefore, the Japanese companies in the industry are vigorously undertaking globalization of their businesses.

In the global market, however, Roche being the most dominant with the sales of $61.4 billion in 2019, large global companies such as Roche, Abbott, SIEMENS, and Danaher are the main players, and in order to survive the competition, Japanese companies must strengthen their competitiveness by, for example, developing unique products or systems.

1-4 Business Description

1. What are Clinical Tests?

One type of clinical tests is the “Biological test” that directly examines the body using medical equipment such as X-ray, CT, MRI, electrocardiogram, and ultrasound. Another type of clinical tests is the “Laboratory test” that examines biological samples (specimens) obtained from people such as blood, urine/feces, and cells.

The clinical test reagents made by EIKEN CHEMICAL are the ones used for medical laboratory tests. For example, they are used to test infectious diseases or to measure small amounts of blood contained in stool. They are made to support diagnosis. Most of these reagents are called in vitro diagnostics (IVD) and are regulated by the Pharmaceutical and Medical Device Act so reagent manufacturers file applications with PMDA (Pharmaceuticals and Medical Devices Agency) and obtain its approval. Users include hospitals, clinics, medical offices, medical test centers that carry out tests commissioned by medical institutions, health screening centers, public health centers, and institutions for health research, and others.

2. Major Products

EIKEN CHEMICAL mainly manufactures and sells the following types of reagents and medical devices.

As they deal with a wide range of reagents, they not only sell their in-house products but also purchase and sell products from other companies.

Major in-house products include fecal immunochemical test reagents, microbiological reagents, immunological and serological reagents, urinalysis test strips, genetic testing reagents, etc. The sales ratio of in-house products to other companies’ products is approximately 60:40. The gross profit margin is approximately 55% for in-house products and approximately 35% for other companies’ products.

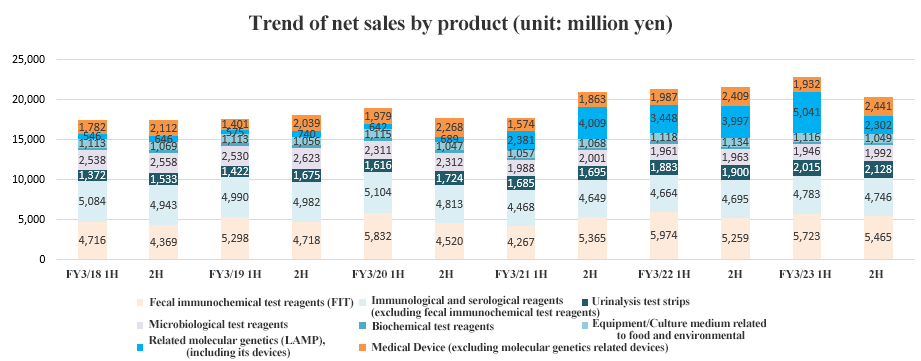

Product Name | Sales | Sales Proportion |

Fecal immunochemical test reagents (FIT) | 11,188 | 25.9% |

Immunological and serological reagents (excluding fecal immunochemical test reagents) | 9,529 | 22.0% |

Urinalysis test strips | 4,143 | 9.6% |

Microbiological test reagents | 3,938 | 9.1% |

Biochemical test reagents | 590 | 1.4% |

Equipment/Culture medium related to food and environmental | 2,165 | 5.0% |

Related molecular genetics (LAMP), (including its devices) | 7,343 | 17.0% |

Medical Devices (excluding molecular genetics related devices) | 4,373 | 10.1% |

Total sales | 43,271 | 100.0% |

*Results for the fiscal year ended March 2023.Unit: Million Yen

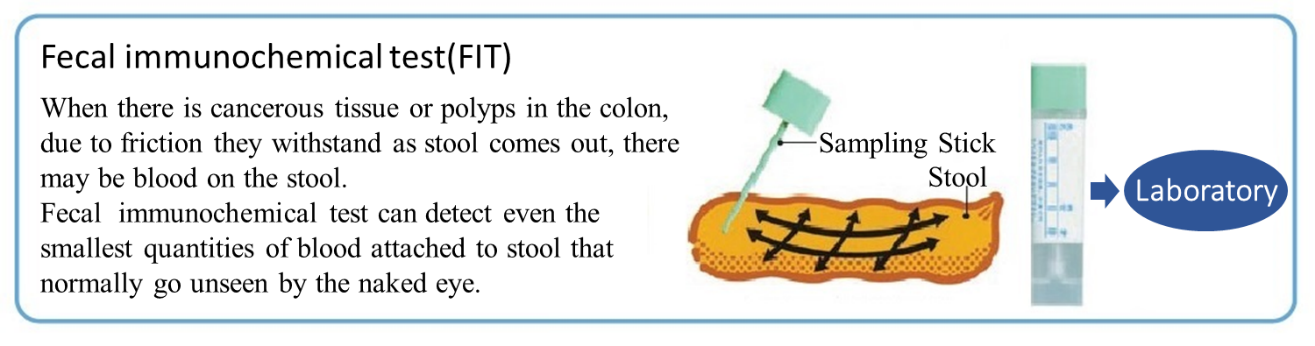

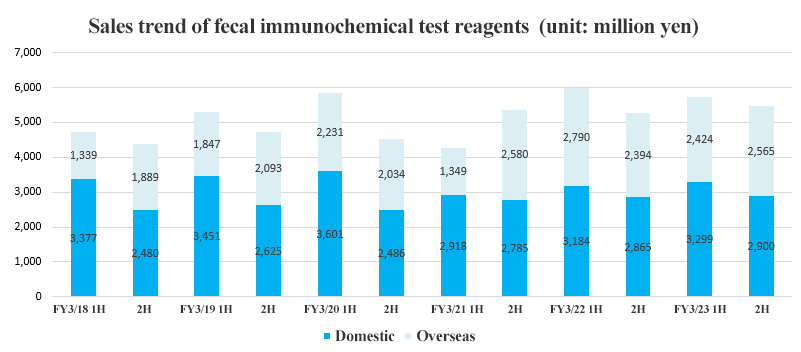

Fecal immunochemical test reagents

The major products for EIKEN CHEMICAL are reagents and sampling bottles for fecal immunochemical tests to specifically detect and measure human hemoglobin in feces as a colorectal cancer screening and diagnosis and are sold globally.

Immunological and serological reagents (excluding Fecal immunochemical test reagents)

EIKEN CHEMICAL develops, manufactures, and sells reagents for various tests, such as LZ Test EIKEN, a reagent for general-purpose automatic analyzers used for diagnosing rheumatism and inflammatory disorders and gastric cancer risk stratification test (the ABC method). The company also procures reagents for fully automated enzyme immunoassay devices and reagents for automatic glycohemoglobin analyzers from Tosoh Corporation, and sells them.

Urinalysis test strips

EIKEN CHEMICAL develops, manufactures, and sells “UROPAPER III ‘EIKEN’,” a urinalysis test strip for testing various items such as occult blood, protein and glucose, as well as the “UROPAPER III ‘EIKEN’,” a specialized test strip for fully automated urine analyzers.

Outside Japan, the company formed a business tie-up with Sysmex Corporation in 2017 and has sales.

Microbiological test reagents

Since its establishment, EIKEN CHEMICAL has been developing biological specimens as well as reagents for microbiological tests for food and environment in order to prevent infectious diseases and food poisoning. Currently, it develops, manufactures, and sells various reagents that are effective for diagnosis and treatment of microorganism infection, such as mediums, powder mediums, antimicrobial susceptibility tests, and rapid test reagents.

Clinical chemistry test reagents

EIKEN CHEMICAL develops, manufactures and sells reagents for clinical chemistry tests including “EXDIA XL ‘EIKEN’” series that assist to measure and analyze biological components in blood serum and urine, with a focus on the test items that are related to lifestyle related diseases.

Equipment/ Culture mediums related to food and environment

EIKEN CHEMICAL sells reagents for microbiological tests on food to detect food poisoning bacteria as well as reagents for environmental microbiological tests and equipment and devices to measure contamination of work environments.

Molecular genetics (LAMP)

In 1998, EIKEN CHEMICAL developed and patented an innovative gene amplification technology called “LAMP.” The LAMP is “simple, rapid, and accurate” and is a critical tool for Eiken’s future domestic and global expansion of its business. (Details are described below)

Medical devices

EIKEN CHEMICAL sells various types of automated analyzers. They contract manufacturing specialized equipment that uses their in-house reagent. Since beginning sales of “OC Sensor” in 1989, they have worked continuously on technological innovation and quality improvement of this fecal immunochemical test analyzer. Also, they offer the “US,” an automated urine analysis device that uses Eiken’s proprietary image processing system, the “BLEIA-1200,” a fully automated biochemistry photogenetic immunoassay device that was the world’s first of its kind in the clinical testing field, and “Loopamp EXIA,” a LAMP-based real time turbidity measuring device.

3. Sales structure

EIKEN CHEMICAL has 10 sales divisions in Japan. Its academic department supports sales promotion.

Out of 754 employees (consolidated) during FY 2022, about 350 belong to the sales department.

As for the sales channels for medical institutions such as hospitals, the Company’s direct sales partners are medical wholesale companies, and it has businesses with almost all the wholesale companies in the medical industry.

For overseas sales, EIKEN CHEMICAL has basically 1 agency per country, and the sales and maintenance are commissioned to the agencies.

EIKEN’s products are exported to 40 countries (FY 2021). The high proportion of overseas sales is occupied by the sales in the USA, Germany, Italy, Spain, England, France, Australia, South Korea, and Taiwan.

In addition to the Europe Branch in Amsterdam (the Netherlands), the Company is strengthening its manufacturing and sales structure through its consolidated subsidiary, “EIKEN CHINA CO., LTD.,” as well as aiming to expand its businesses by setting a business office in China. In the future, it will explore the possibility of making the office as a local corporation, as the size expands.

The overseas sales for FY 2023 are 8,797 million yen, out of which 4,989 million yen, is from the sales of fecal immunochemical test reagents.

1-5 ROE Analysis

| FY3/13 | FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

ROE (%) | 10.9 | 8.3 | 8.3 | 8.9 | 10.0 | 8.3 | 10.3 | 9.9 | 12.9 | 14.4 | 12.1 |

Net Profit Margin | 8.56 | 6.61 | 6.77 | 7.55 | 8.77 | 7.45 | 9.64 | 9.67 | 13.04 | 14.46 | 13.26 |

Asset Turnover Ratio | 0.84 | 0.84 | 0.83 | 0.83 | 0.80 | 0.78 | 0.77 | 0.75 | 0.73 | 0.73 | 0.67 |

Leverage | 1.52 | 1.50 | 1.47 | 1.42 | 1.43 | 1.43 | 1.38 | 1.36 | 1.35 | 1.36 | 1.36 |

*Unit: %, times, x

The company has achieved a high ROE.

The company intends to continue fortifying priority measures, including developing high value-added products, creating new businesses and new markets, and improving profitability and productivity by reducing the COGS and SG&A ratios. By doing so, the company plans to maintain ROE above the cost of capital.

1-6 Characteristics and Strengths

(1) Products that Occupy High Share in the Market

The share of Eiken’s fecal immunochemical test reagents is ranked top (64%) in the domestic market. Furthermore, many of their in-house products occupy high market share in the market, for example, urinalysis test strips occupying approximately 29% (ranked top) of the market, and microbiological reagents occupying approximately 14% (ranked fourth) of the market.

The background to how Eiken’s fecal immunochemical test reagents have come to hold such a high share of the market includes that in 1987, Eiken began sales of “OC-Hemodia,” a visual determination method fecal immunochemical test reagents, a product that more closely conformed to user needs when compared to competitor’s products, and that in 1989 they adopted the latex photometric immunoassay method and began sales of “OC-Sensor,” the world’s first fully automated analyzer.

Also, the Health and Medical Service Act for the Aged was revised in 1992, making it possible to have fecal immunochemical test reagents as a method in colon cancer screening and diagnosis using public funds (no cost to the patient) which led to an accelerated spread and increased competition. But in 2001, Eiken began sales of the “OC-Sensor neo,” with completely remodeled functions, which increased its market share.

(Source: EIKEN CHRMICAL)

As for fecal immunochemical tests, Eiken will expand its business globally based on the above characteristics.

The immunochemical method used in Japan applies reagents that react only to human hemoglobin and can process a large volume simultaneously.

Meanwhile, in other countries, reagents for the chemical method (Guaiac method) based on old measuring principles are still used, which presents accuracy challenges. In 2011, the test guidelines in Europe have finally begun recommending automated analyzers that use the immunochemical method. As a result, the market is beginning to undergo a dramatic change.

Furthermore, although the chemical method is also still common in the United States, which has the largest potential market, trends show a gradual shift toward the immunochemical method. Additionally, new guidelines on colorectal cancer screening by USPSTF (US Preventive Medicine Special Committee) was published in June 2016. These guidelines pointed that the immunization method is superior to the conventional chemical method and pursuantly, and assessed Eiken’s fecal immunochemical test product, "the OC FIT-CHEK family of FITs" has the utmost inspection performance with high sensitivity and specificity. Besides, the large markets which are underdeveloping exist on the leading and emerging countries in Asia and South America.

Because the fecal immunochemical test market is a niche market, Japanese companies, the forerunners of the immunochemical method, own the most advanced technique, and hence Eiken’s reagents and equipment are the global standard.

(2) Focusing on research and development

EIKEN CHEMICAL is focusing on research and development of unique technologies as a research and development corporation, and the development of original products that respond to customers’ needs, using the unique technologies. The number of staff assigned for research and development is about 150.

The demand from the customers is higher quality of medicine. Specifically, they demand for higher differential diagnosis accuracy with high sensitivity and high quality and improved detection rate. In addition, easier usage will lead to reduction in the work of medical staff. Responding to such needs is critical.

Since its establishment in 1939, EIKEN CHEMICAL has accumulated unique technologies for manufacturing reagents. Their unique technologies are applied to the measuring principles of their devices such as fecal occult blood test analyzer, automated urine analyzer, and biochemiluminescent immunoassay analyzer “BLEIA” that are designed to optimize the performance of the reagents.

(3) Development of various types of products in various fields through alliance strategy

Because clinical test reagents have wide range of subjects and items, it is not possible for one company to develop, manufacture and sell all types of reagents. The other companies in the industry are focusing on the technologies and products that they are specialized in. However, as an integrated manufacturer of clinical test reagents, EIKEN CHEMICAL aims at stabilizing profit structure, expanding their own strengths through alliance strategy, and pursuing synergy effects such as complementing functions and acquiring new technologies, while dealing with a wide range of products and responding to the needs of customers and users such as medical institutions.

Another reason why they cover various types of products in various fields is that they believe that covering wide range of clinical tests is their social responsibility to protect the health of the public, as is stated in their management philosophy: “protect the health of the public through health care services”.

(4) Competitive Advantages of the “LAMP”

Thus, far the mainstream technology for amplifying genes as a process of gene tests has been what is called “PCR” Under such circumstances, in 1998, EIKEN CHEMICAL developed a unique technology called the “LAMP.”

Compared to the PCR, the “LAMP” offers the following superior characteristics and allows users to carry out simple, rapid, and accurate gene tests.

Simple | Amplification response occurs at a constant temperature (with the PCR, the temperature needs to be changed for amplification). |

Rapid | High amplification efficiency, with genes being detected within 30 to 60 minutes (with the general PCR, it takes 2 to 3 hours). |

Accurate | Extremely high specificity. |

Currently in the medical field, the LAMP is used to diagnose infectious diseases such as COVID-19, tuberculosis, mycoplasma (a genus of bacteria, it can also cause pneumonia), legionella, pertussis, etc.

EIKEN CHEMICAL is making focused efforts on infectious disease diagnostic test in order to establish the status of the LAMP. At the same time, it is promoting the use of the LAMP in other fields such as food production and processing, environment, agriculture/veterinary to spread and enhance recognition of the LAMP. In fact, the LAMP-based products have been commercialized one after another since 2002.

Furthermore, for the same purposes, EIKEN CHEMICAL is actively giving licenses to external companies to build the LAMP camp.

One of the major actions to spread the LAMP in the world is an alliance with “FIND.”

“FIND” stands for “Foundation for Innovative New Diagnostics” and is a non-profit organization recognized by the Swiss government, launched at a meeting of the United Nations World Health Assembly in May 2003. In its initial five years of existence, it received a grant from the Bill & Melinda Gates Foundation to start up their activities.

Their goal is to develop and introduce affordable, simple, and advanced diagnostic tests to eradicate infectious diseases in developing countries.

FIND’s scope of activities includes tuberculosis, malaria, and African sleeping disease. With tuberculosis, collaborative research between EIKEN CHEMICAL and FIND for a tuberculosis test using the LAMP began in July 2005. The purpose of this research is to improve the accuracy of tests by replacing the microscopy test (sputum smear test), which is the current practice in developing countries.

As a result of this collaboration, improvements which are not possible with the conventional PCR such as simplified pretreatment (PURE), improved reagents storage (store at room temperature) and simplified devices have been made to enable the developing countries to carry out the procedure (TB-LAMP).

This LAMP-based product was already launched in Japan in 2011.

After that, in order to obtain endorsement from the WHO (World Health Organization), FIND has completed its clinical evaluation in 14 developing countries and submitted this information to the WHO.

In consequence, the company has acquired the recommendation by WHO as an evaluation replaces with microscopic examination or as an inspection reinforcing microscopic examination in August 2016.

According to a report on global tuberculosis announced by WHO in November 2017, the number of patients suffering from tuberculosis in 202 countries all over the world in 2016 was 10.4 million, an increase of 0.8 million from 9.6 million in 2014. Additionally, the number of deceases was 1.7 million, an increase of 0.2 million from 1.5 million in 2014.

Most of them are inferred as matters of undiagnosed or untreated, and WHO indicates "the enforcement of countermeasures for the countries where access to diagnosis and treatment is not yet maintained is demanded".

Following these situations, the company expects that dissemination and penetration of TB - LAMP contribute greatly to solve these problems.

In addition to the aforementioned diseases other than tuberculosis, the company is collaborating with FIND on a reagent for neglected tropical diseases (NTDs) such as Leishmaniasis and Chagas diseases.

Also, EIKEN CHEMICAL completed the development of a testing system “Simprova” that uses a next-generation compact fully automated genetic testing device and multi-item testing chip using the LAMP and started selling it in April 2020.

Due to the supply issues at overseas manufacturing contractors for equipment, the company is currently in the process of changing over to a domestic manufacturing partner and the new sales promotions are temporarily suspended.

This equipment fully automates the process from specimen preprocessing (nucleic acid extraction and purification) to amplification and detection. By developing the unique protocol that exploits the LAMP’s characteristics, the operation time that used to take over 2 hours with a conventional high purity nucleic acid extraction and purification device and an amplification and detection device combined, is now shortened to less than an hour.

At first, the company plans to release the respiratory organ infections panel and then the acid-fast bacterium disease panel and respiratory viruses panel, and will gradually increase the number of test items.

It is anticipated that “Simprova” will accelerate the spread of the LAMP and establish its position as the global standard in a newly created market.

*Gene amplification technology

Since the number of genes found in a genetic test sample is extremely small, to detect genes, the targeted gene must be amplified first. Gene amplification technology, therefore, is crucially important for genetic testing.

*African trypanosomiasis

An endemic found in tropical Africa; African trypanosomiasis is a serious tropical disease transmitted to HUMAN mbH by a protozoa called Trypanosoma brucei. The disease is transmitted by a tsetse fly. Trypanosoma in HUMAN mbH blood sucked by a tsetse fly develops and propagates inside the HUMAN mbH body in 2 to 5 weeks, before turning itself into a terminal Trypanosoma-type, which becomes a source of next round of infection. The disease causes fever, headache, and vomiting, and the patient falls into constant sleep. Since the patient cannot take meals, he or she becomes thin and complain of generalized weakness and, in many cases, leads to a complication and dies.

*Leishmaniasis

Leishmaniasis is a disease transmitted by a protozoon called leishmania, and has various types such as visceral leishmaniasis (also known as black fever), Brazilian leishmaniasis that affects skin and mucous membranes, and tropical leishmaniasis which affects skin. All these types are transmitted by blood-sucking insects, especially sandflies. Visceral leishmaniasis, after about three months incubation period, causes fever, sweating, diarrhea, etc. and, in about one month, causes a swollen liver and spleen, the patient develops an anemia and becomes weak if untreated, and may die in half a year to two years.

*Chagas disease

Found in southern U.S. as well as Central and South America, Chagas disease is an infectious disease transmitted by Reduviidae, a kind of blood-sucking Triatominae. The disease does not develop symptoms immediately after infection; it usually has a latency period of about 30 years. It causes symptoms such as inflammation of sinews, liver and spleen, myalgia, myocarditis, cardiomegalia encephalomyelitis, cardiac disturbance.

1-7 Return of earnings to shareholders

Positioning the return of earnings to shareholders as one of the most important management objectives, the company’s basic stance is to implement a stable dividend policy in consideration of strengthening the financial position and enriching internal reserves necessary for active business development. It aims to achieve a consolidated dividend payout ratio of 30% or higher.

The dividend payout ratio for FY ended March 2023 was 32.9%, and for FY ending March 2024, it is expected to be 44.4%, up from the previous year.

1-8 Sustainability

"EIKEN ROAD MAP 2030" clarifies the ideal state of the EIKEN Group in 2030 as "EIKEN Vision 2030" and sets "Beyond the Field-Team × Challenge" as its slogan.

Individual employees will enhance their own abilities and expand the fields in which they can play an active role, and then these enhanced individual strengths will be combined to create new possibilities by taking on new challenges across various fields as a team. In addition, the company will step out of its current business domain and create the future of testing by bringing innovation to the medical process.

Based on this vision, in its personnel strategy, the company is introducing a new personnel system and expanding investment in human resources to increase employees' willingness to take on new challenges, aiming to "trigger innovation through personnel-focused management."

The outline of the new personnel system introduced in April 2023 is as follows.

* | A multilayered career design based on expertise and aptitude for the job |

* | Remuneration system linked to roles and competencies, based on work-based remuneration |

* | Linking of remuneration with the authority delegated to younger employees |

* | Evaluation system that encourages teamwork and challenges. |

* | Promotional system to promote high performing personnel as early as possible |

2. Fiscal Year Ended March 2023 Earnings Results

(1) Overview of consolidated results

| FY 3/22 | Share | FY 3/23 | Share | YoY | Compared with revised forecast |

Sales | 42,996 | 100.0% | 43,271 | 100.0% | +0.6% | -0.8% |

Domestic | 34,128 | 79.4% | 34,474 | 79.7% | +1.0% | -0.7% |

Overseas | 8,868 | 20.6% | 8,797 | 20.3% | -0.8% | -0.8% |

Gross margin | 20,572 | 47.8% | 20,506 | 47.4% | -0.3% | -1.3% |

SG&A | 12,184 | 28.3% | 13,049 | 30.2% | +7.1% | -1.9% |

Operating income | 8,387 | 19.5% | 7,457 | 17.2% | -11.1% | -0.2% |

Ordinary income | 8,508 | 19.8% | 7,568 | 17.5% | -11.0% | +0.5% |

Net income | 6,218 | 14.5% | 5,736 | 13.3% | -7.8% | -1.1% |

*Unit: million yen. Forecasts are ratios to the earnings forecasts announced in September 2022.

Both sales and profit were largely in line with forecasts

In the fiscal year (FY) 2023, sales increased 0.6% year on year to 43.2 billion yen. Although sales of reagents for genetic testing for COVID-19 using the LAMP method decreased due to a sharp decline in the number of newly infected patients with COVID-19 in the fourth quarter, sales of reagents for urinalysis and immunological tests grew slightly from the previous year, due to the resumption of various medical checkups and testing programs and continued recovery in the number of outpatients. Operating income declined 11.1% year on year to 7.4 billion yen. Gross profit declined 0.3% year on year due to higher costs for raw materials and resources, while SG&A expenses, including R&D expenses, increased 7.1% year on year.

Both sales and profit were largely in line with forecasts.

(2) Sales by product

| Products | FY 3/22 | FY 3/23 | YoY |

(a) | Fecal immunochemical test reagents (FIT) | 11,233 | 11,188 | -0.4% |

(b) | Immunological and serological reagents (excluding fecal immunochemical test reagents) | 9,359 | 9,529 | +1.8% |

(c) | Urinalysis test strips | 3,783 | 4,143 | +9.5% |

(d) | Microbiological test reagents | 3,924 | 3,938 | +0.4% |

(e) | Biochemical test reagents | 599 | 590 | -1.5% |

(f) | Equipment/Culture medium related to food and environmental | 2,252 | 2,165 | -3.9% |

(g) | Related molecular genetics (LAMP), (including its devices) | 7,445 | 7,343 | -1.4% |

(h) | Medical Devices (excluding molecular genetics related devices) | 4,396 | 4,373 | -0.5% |

| Total sales | 42,996 | 43,271 | +0.6% |

*Unit: million yen.

○Fecal immunochemical test reagents (FIT)

Domestic sales increased 2.5% year on year. Overseas sales declined 3.8% year on year. While domestic sales almost recovered to the pre-COVID-19 level, overseas sales declined due to the lingering effects of inventory adjustments in Europe following the COVID-19 pandemic.

The company believes that the market will continue to grow due to market expansion from the spread of mail, web, pharmacy, and endoscopic triage examinations, promotion of the switch from chemical to immunological methods in the U.S., and the acquisition of new tenders.

| FY 3/22 | FY 3/23 | YoY |

Domestic | 6,049 | 6,199 | +2.5% |

Overseas | 5,184 | 4,989 | -3.8% |

Total | 11,233 | 11,188 | -0.4% |

*Unit: million yen.

○Immunological and serological reagents (excluding fecal immunochemical test reagents) microbiological test reagents

Sales increased due to a recovery in the number of outpatient examinations.

○Urinalysis test strips

Both the domestic health checkup market and the number of outpatients are recovering, and sales to Sysmex continue to be favorable.

○Microbiological testing reagents

Sales increased slightly due to a recovery trend in tests other than those for COVID-19.

○Related molecular genetics (LAMP)

Annual sales of COVID-19-related reagents decreased slightly due to a sharp decline in the number of infected patients in the fourth quarter, despite continued demand in response to the seventh and eighth waves and for pre-operative testing at hospital facilities regardless of infection status.

|

|

|

License/patent fee income increased 389 million yen from the previous period to 1,554 million yen.Patent fee income from the LAMP method temporarily increased in the first half of the year.

(3) Overseas trends

| FY 3/22 | FY 3/23 | YoY |

Overseas sales | 8,868 | 8,797 | -0.8% |

North America | 1,983 | 2,019 | +1.8% |

Europe | 2,611 | 2,596 | -0.6% |

Asia, others | 4,272 | 4,181 | -2.1% |

For OC | 5,184 | 4,989 | -3.8% |

Others | 3,684 | 3,808 | +3.4% |

*Unit: million yen.

*Europe

The excess inventory of reagents for fecal occult blood tests, in anticipation of a sharp increase in medical examinations post-COVID-19, was almost eliminated by the second quarter, but sales declined over the entire year.

For calprotectin, the company is accumulating evidence and promoting sales.

*U.S.

As in Europe, sales increased due to recovery in demand despite temporary inventory adjustment of reagents for fecal occult blood tests.

*Asia, etc.

Sales decreased mainly due to the impact of lockdown and the Zero-COVID policy in China. Sales of reagents for fecal occult blood test in Oceania, South Korea, and Taiwan increased as the impact of COVID-19 faded away.

Sales of urinalysis test strips and analyzers for Sysmex continued to be strong.

(4) Capital investment, R&D, Depreciation

| FY 3/21 | FY 3/22 | FY 3/23 |

R&D | 3,086 | 3,408 | 4,065 |

Capital investment | 2,876 | 4,347 | 3,792 |

Depreciation | 1,711 | 2,058 | 2,125 |

* Unit: million yen.

(5) Financial status

◎Major BS

| End of March, 2022 | End of March, 2023 | Increase/ Decrease |

| End of March, 2022 | End of March, 2023 | Increase/ Decrease |

Current assets | 37,039 | 39,217 | +2,178 | Current liabilities | 12,533 | 12,443 | -90 |

Cash and deposits | 16,121 | 18,317 | +2,196 | Notes and accounts payable trade | 7,456 | 7,618 | +162 |

Notes and accounts receivable-trade | 11,956 | 11,122 | -834 | Income tax payable | 1,305 | 827 | -478 |

Inventory | 8,230 | 8,412 | +182 | Noncurrent liabilities | 4,175 | 4,296 | +121 |

Noncurrent assets | 25,473 | 27,058 | +1,585 | Total liabilities | 3,000 | 3,000 | 0 |

Property, plant and equipment | 15,275 | 17,202 | +1,927 | Net assets | 16,708 | 16,740 | +32 |

Intangible assets | 1,350 | 1,057 | -293 | Shareholder equity | 45,803 | 49,535 | +3,732 |

Investment and other assets | 8,847 | 8,802 | -45 | Total liabilities and net assets | 33,162 | 36,865 | +3,703 |

Total assets | 62,512 | 66,275 | +3,763 | Equity ratio | 62,512 | 66,275 | +3,763 |

*Unit: million yen. Accounts payable includes Electronically recorded monetary claims

Total assets increased 3,763 million yen from the end of the previous fiscal year to 66,275 million yen due to an increase in cash and deposit, inventory, buildings and structures.

Total liabilities increased 32 million yen to 16,740 million yen.

Net assets increased 3,732 million yen to 49,535 million yen due to a rise in retained earnings etc.

As a result, equity ratio increased 1.4% from the end of the previous fiscal year to 74.2%

(6) Topics

◎Participated in the G7 Health Ministers' Meeting as a Global Health Promotion Company

The company participated in the G7 Health Ministers' Meeting held in Nagasaki, Japan on May 13 and 14, 2023, as a global health promotion company.

(Overview of G7 Health Ministers' Meeting)

This is one of the ministerial meetings of the G7 Summit to discuss issues in the health sector with a focus on global health.

At this meeting, the G7 health ministers reaffirmed their commitment to achieve Universal Health Coverage (UHC) by 2030, a system to ensure that everyone in the world has access to appropriate health care at a reasonable cost. To achieve this goal, the ministers discussed the promotion of health innovation, and adopted the "G7 Nagasaki Health Ministers' Declaration," which outlines the direction and action guidelines for the G7.

In addition, in order to respond to health needs during a pandemic, including basic services and facilities as well as the production cycle from research and development to last mile supply of medical products for coping with the infectious disease crisis, there is a large and urgent demand for rapid financing, which is why the G7 reached a common understanding on financial areas such as strengthening finance and health coordination as well as PPR (prevention, preparedness, and response).

As a global health promotion company, the company will continue to contribute to the achievement of UHC by promoting efforts to improve the lives and health of people around the world.

(From the material of the company)

◎ Sustainability

The most recent initiatives and achievements related to sustainability are as follows

* | Establishment of Sustainability Committee |

* | Inclusion in the FTSE Blossom Japan Sector Relative Index for the first time |

* | Signed the "Kigali Declaration" for the control of NTDs (Neglected Tropical Diseases) |

* | Received the Judges' Committee's Special Award at the "Japan's Most Valuable Companies" Awards. |

* | Endorsed the TCFD and disclosed information. |

* | Adopted "Tochigi-Furusato Electric Power Supply Service," a renewable energy source derived from hydroelectric power generation, to become carbon neutral. (Zero CO₂ emissions from electric power at the Nogi and Nasu Offices) |

* | Recognized as an organization that supports the conservation of the Watarase Retarding Basin in Oyama City, Tochigi Prefecture. -Contribution to the restoration of biodiversity and ecosystems |

3. Fiscal Year Ending March 2024 Earnings Estimates

(1) Estimate of consolidated results

| FY 3/23 | Share | FY 3/24 (Est.) | Share | YoY |

Sales | 43,271 | 100.0% | 42,000 | 100.0% | -2.9% |

Domestic | 34,474 | 79.7% | 31,730 | 75.5% | -8.0% |

Overseas | 8,797 | 20.3% | 10,270 | 24.5% | +16.7% |

Gross profit | 20,506 | 47.4% | 18,750 | 44.6% | -8.6% |

SG&A | 13,049 | 30.2% | 13,370 | 31.8% | +2.5% |

Operating income | 7,457 | 17.2% | 5,380 | 12.8% | -27.9% |

Ordinary income | 7,568 | 17.5% | 5,400 | 12.9% | -28.6% |

Net income | 5,736 | 13.3% | 4,250 | 10.1% | -25.9% |

*Unit: million yen

Forecast lower sales and profit

The company is forecasting lower sales and profit for FY 2024. Net sales are expected to decrease 2.9% year on year to 42 billion yen, and operating income is projected to decline 27.9% to 5.3 billion yen.

COVID-19-related sales and patent income are projected to decline, while overseas sales are expected to increase by double digits. The company expects sales of reagents for fecal occult blood tests to recover, as well as sales of urinalysis reagents to Sysmex Corporation to remain strong.

Gross profit margin is forecast to decline due to a change in the product mix. The company is expecting increased investment for growth and higher costs due to higher prices of resources. Based on its basic policy of paying stable and consistent dividends, the company plans to pay a dividend of 51.00 yen/share, like in the previous year. Payout ratio is expected to be 44.4%

(3)R&D・Capital investment・Depreciation costs

| FY 3/21 | FY 3/22 | FY 3/23 | FY 3/24(Est.) |

R&D | 3,086 | 3,408 | 4,065 | 4,000 |

Capital investment | 2,876 | 4,347 | 3,792 | 2,200 |

Depreciation costs | 1,711 | 2,058 | 2,125 | 2,500 |

*Unit: million yen

R&D expenses are mainly for the development of equipment.

Capital investment decreased year on year in FY 2024 due to the completion of the new research building.

Depreciation and amortization expenses will increase in FY 2024, mainly due to the start of depreciation related to the new research building.

4. Progress of “EIKEN ROAD MAP 2030”

(1) Business Fields to Focus on for the Three Years of the Mid-term Plan

While maintaining the current business domain as the core one, the company has set three priority business fields: "contribution to cancer prevention and treatment," "contribution to the eradication and control of infectious diseases," and "provision of products and services useful in healthcare.”

(From the reference material of the company)

(2) Priority measures

The three specific priority measures are as follows.

① To improve colorectal cancer testing uptake rate and develop fecal cancer gene test

◎Overview of the Global Fecal Occult Blood Test Market

The COVID-19 pandemic has accelerated the spread of the fecal occult blood test, a non-contact test.

One of the reasons for this is the limited testing capacity due to the shortage of endoscopists, and the use of the fecal occult blood test as an endoscopic triage method is progressing.

The cost-effectiveness of the fecal occult blood test has also been recognized, and the test has been increasingly included in guidelines and published in papers in various countries. In addition, the switch from the chemical method to the immunological method is accelerating, and in the U.S. and the U.K., the starting age for medical examinations is being lowered.

In addition, in developing countries, the use of medical checkups is expected to spread in the future.

Under these circumstances, the company will work to improve access to testing and develop next-generation fecal occult blood tests to increase the testing uptake rate.

Improvement of test accuracy is also an important factor, and the company will focus on value-added improvements and the development of high-precision testing technology.

Currently, 44 countries are implementing screening, but the company aims to expand it to 57 by FY 2030.

The company believes that the global spread of fecal occult blood tests will lead to important outcomes such as reduced risk of death from colorectal cancer, reduced medical costs due to early treatment, QOL improvement, and extension of healthy life expectancy.

◎ Initiatives

The most recent initiatives and progress are as follows.

*Improvement of colorectal cancer testing uptake rate

In order to improve access to testing through the spread of mailed and online testing, initiatives are being taken to "develop an application for recommending testing by mail" and "develop a reagent to stabilize specimens."

Stabilizing reagents are in the final stages of development.

Improvement of test accuracy

The company aims to develop highly accurate testing technology with added value, such as detecting cancer in its early stages and reducing the error rate.

②Launch of Companion Diagnostic System (Contracted Testing)

The company is developing a companion diagnostic system, "Mutation Investigator using the Next-era Sequencer (MINtS)," which is a comprehensive genetic mutation testing system.

The company is currently in the process of submitting an application to the Japanese Ministry of Health, Labour and Welfare for regulatory approval, with the goal of launching the product in FY 2024.

In anticipation of the commercialization of contract testing, the company established the Eiken Chemical Clinical Laboratory.

In addition to promoting its own cancer gene tests, this business provides opportunities to constantly introduce new tests (products) to the market and review them.

The features of this testing system include: "detection of multiple gene abnormalities and drug selection in lung cancer," "testing of cytology specimens as well as tissue (faster reporting of results)," and "high sensitivity (smaller specimen volume required). In the future, the company aims to add target genes compatible with new molecular-targeted drugs, expand the range of cancer types for which the system can be used, and expand the system to include liquid biopsy.

The system is already being implemented as an advanced medical treatment at 20 facilities centering on the North East Japan Study Group (NEJSG), a certified non-profit organization, and the company plans to expand sales to approximately 200 facilities participating in the NEJSG.

③ Developments of Fecal Calprotectin

Fecal calprotectin is a non-invasive marker that reflects the degree of inflammation of the intestinal tract.

The company's fecal occult blood test system (OC sensor and stool collection container), which boasts a high share of the global market, is also compatible with fecal calprotectin and can be used to assist in the diagnosis of inflammatory bowel disease (IBD) and in understanding the pathology of ulcerative colitis disease and Crohn's disease.

It will be developed as a non-invasive adjunctive test for IBD, which is said to affect approximately 5 million patients worldwide and will contribute to reducing the patient burden of endoscopic examinations.

5. Interview with President Notomi

Q: Please give us an overview of the previous fiscal year and a self-evaluation of your various initiatives.

Regarding reagents for COVID-19, there remained a certain level of demand for responding to the 7th and 8th waves and for pre-surgical testing at hospital facilities, but the number of infected patients declined sharply in the fourth quarter, resulting in a slight decrease in annual sales.

The development of the companion diagnostic system, “Comprehensive Genetic Mutation Testing System,” is progressing smoothly, and we aim to bring it to market within this fiscal year. We have high expectations for the future of the contract testing.

The construction of our new research building at the Nogi Office was completed last summer and full-scale operations began in the fall. By bringing together most of our researchers in this research center, we are working to improve research efficiency and integrate knowledge. It has been well received by our researchers as a comfortable working space.

We believe this will greatly contribute to the creation of new products and technologies that are essential for future growth.

Inventory adjustment of fecal occult blood test reagents in Europe took a little longer than expected, but is almost complete at this point, so we are expecting steady growth this fiscal year.

In China, we could not operate at all due to the lockdown caused by the COVID-19 pandemic, but I think this term is off to a good start.

Our business within Japan has also recovered to pre-COVID levels.

Q: What is your outlook for this fiscal year?

As I mentioned earlier, we expect steady growth of sales of fecal occult blood test reagents, mainly outside Japan.

Due to the increase in the number of health checkups and medical examinations in Japan, we expect urinalysis reagents and fecal occult blood test reagents to perform well.

On the other hand, COVID-19 has been recategorized into Category 5, but the response varies from hospital to hospital, and the trend of COVID-19 detection reagents is very difficult to predict.

Despite the decrease in sales and profit, we plan to pay a dividend of 51.00 yen per share, like in the previous fiscal year, based on our basic policy of stable and continuous dividend payments.

Q: Next, I would like to know about the progress of the “EIKEN ROAD MAP 2030.” It seems that the companion diagnostic system is well on its way to release in the market.

Yes, we expect to obtain approval during the first half of the fiscal year, and we are currently working to start contract testing by the end of the year.

As the system’s features and advantages, it can detect multiple gene abnormalities in lung cancer and select the appropriate medication at once, and quickly report results by testing cytology samples in addition to tissue samples, and requires only a small amount of sample due to its high sensitivity. With the cooperation of major testing centers and highly reputed medical doctors, we are working to expand sales by actively advertising these points and developing a sales network.

We believe that contract testing will help speed up the development of new products.

Until now, we have only sold reagents for testing specimens, and it has been difficult to access the specimens themselves, but with contract testing, we can access the specimens and expand into serological and microbiological testing. For example, in the past, it was difficult to predict the market for a new reagent, but by conducting contract testing, we can obtain useful data in-house, which allows us to commercialize the product based on those data.

Q: What are your thoughts on fecal calprotectin?

Fecal calprotectin is a non-invasive marker that reflects the level of inflammation in the intestinal tract, but its measurement is not as widespread yet.

It is well known that the late Prime Minister Abe had ulcerative colitis, which afflicts about 5 million people worldwide.

Now that good medicines are available, patients would be very happy if they could be examined quickly and easily without the use of an endoscope.

Our fecal occult blood testing system (OC sensor and stool collection device), which boasts a large share of the global market, can also test specimens for fecal calprotectin without sending them to a testing center, so we are considering expanding this system globally.

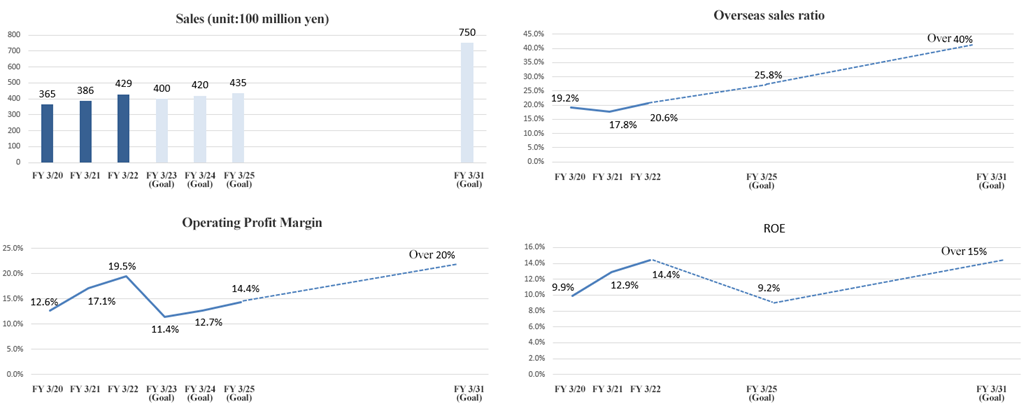

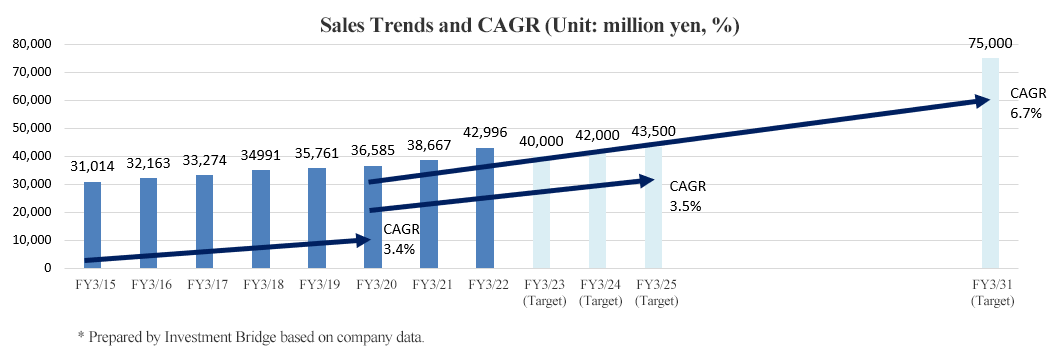

Q: Your medium to long-term financial targets for the fiscal year ending March 31, 2031, include “net sales of 75 billion yen, an overseas sales ratio of 40% or higher, an operating income margin of 20% or higher, and an ROE of 15% or higher.” The financial results for the fiscal year ended March 31, 2023 were “net sales of 43.2 billion yen, an overseas sales ratio of 20.3%, an operating income margin of 17.2%, and an ROE of 12.1%.” What are your key points for achieving these figures?

The first and foremost is the global expansion of fecal occult blood test reagents.

We are now beginning to expand our business beyond Europe and the U.S., which are the current business areas for us, to the Middle East, Asia, South America, and other regions. In doing so, the stabilization of specimens will be essential, so we are working on the development of new reagents.

Furthermore, we are considering opening an office in the U.S., in order to speedily absorb local information and utilize it in our product development in order to fully develop the huge market in the U.S.

In addition, due to transportation costs and tariffs, we are considering opening offices in Europe and Asia, apart from the U.S., to improve profitability, and are also considering local production.

In addition to reagents for fecal occult blood tests, we need to develop new value-added products related to cancer and infectious diseases, as well as the fecal calprotectin test and immunological reagents I mentioned earlier.

Q: You have also made a lot of progress in terms of sustainability. Do you have any comments in that regard?

We promote sustainability management based on our management strategies of “business activities in harmony with the global environment” and “a vibrant corporation making use of employee’s talent.”

We have identified 11 material issues that should be prioritized for the realization of a sustainable society and disclosed specific action plans to further enhance corporate value and realize a sustainable society through the resolution of social issues.

As a result of various initiatives based on these ideas, in January 2023, we were selected for the first time as a constituent of the FTSE Blossom Japan Sector Relative Index, which is a major index for ESG investment.

The FTSE Blossom Japan Sector Relative Index, created by the global index provider FTSE Russell, reflects the relative environmental, social, and governance (ESG) performance of Japanese companies in each sector. The index has also been adopted as a passive ESG management index by Japan’s Government Pension Investment Fund (GPIF), the world's largest pension fund, and we believe this is a result of their evaluation of our sustainability efforts.

In addition, we announced our support for the TCFD and expanded our disclosure of information on climate change. We have also adopted the “Tochigi-Furusato Electric Power Supply Service,” which is a renewable energy source derived from hydroelectric power generation, at our Nogi and Nasu Offices, as part of efforts to become carbon neutral. Through this, we were able to reduce our CO2 emissions from electricity used at both plants to zero.

6. Conclusions

In addition to a decline in COVID-19-related sales, the company expects a decline in sales and profit in FY 2024 due to increased investment in growth and higher costs due to higher prices of resources. However, the company has completed inventory adjustments for fecal occult blood test reagents overseas and is expecting double-digit revenue growth for the current fiscal year. The companion diagnostic system is well on its way to being released in the market, and sample stabilization reagents have already been developed, indicating that the company is building a foundation for solid growth except for COVID-19-related areas.

The new entrusted testing business that will be started with the companion diagnostic system will lead to the promotion of proprietary cancer gene tests and speed up the development of new products. We would like to pay attention to the progress and results of this business.

<Reference 1:“EIKEN ROAD MAP 2030” and New Medium-Term Management Plan>

To respond to the unfolding changes in its business environment and operate form a perspective of sustainability management, the company revamped its existing management framework “EIKEN ROAD MAP 2019” and redefined it as “EIKEN ROAD MAP 2030” with 2030 as the target year for its fulfillment. In addition, the company formulated its first Medium-Term Management Plan to achieve its goals.

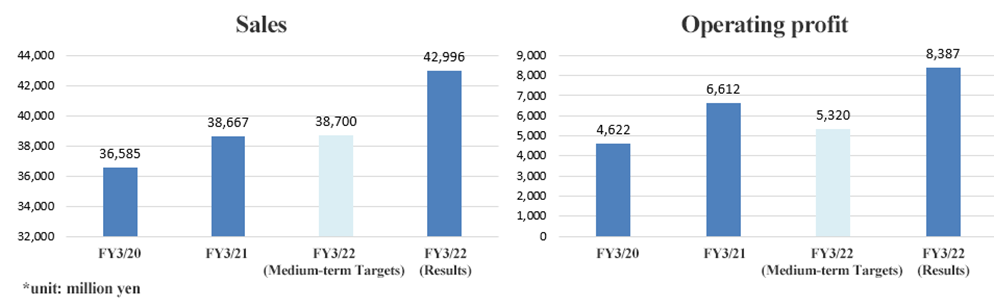

(1) Review of the Previous Medium-Term Management Plan (FY 2020 – FY 2022)

Both net sales and operating income significantly exceeded the targets for FY 2022, the final fiscal year of the Medium-Term Management Plan. Sales increased for the 22nd consecutive year and operating income reached a record high.

Operating income margin was 19.5% (target: 13.7%) and ROE was 14.3% (target: 10%), both exceeding the targets.

Externally, the drop in health screening and outpatients visits due to COVID-19 were negative factors, but positive factors such as increase in demand for products related to COVID-19 testing, temporary increase in royalty income from LAMP method, and expansion of online and postal health screening using fecal occult blood tests overseas contributed significantly.

Internal factors include the unused budget for SG&A expenses due to COVID-19.

The company has steadily promoted business growth and strengthening of its base under the following basic strategies: (1) Developing foundations to increase management efficiency, (2) Promoting global expansion, (3) Maintaining domestic sales and increasing market share, and (4) Strengthening R&D ability. Within each of these targets, the company also identifies the following as its future issues and believes making these changes is essential for further growth: (1) Advancement of DX and human resource system reform; (2) Improvement of rates of uptake of colorectal cancer screening; search for demand for online screening, screening by post and endoscopic triage; and spread and establishment of testing for tuberculosis and malaria; (3) Improvement of rate of uptake of health checkups and screening ; and establishment and cultivation of the market for cognitive-function screening; (4) Improvement of the efficiency and speed of R&D; strengthening of core technologies and production technologies; and development of next-generation colorectal cancer screening tests.

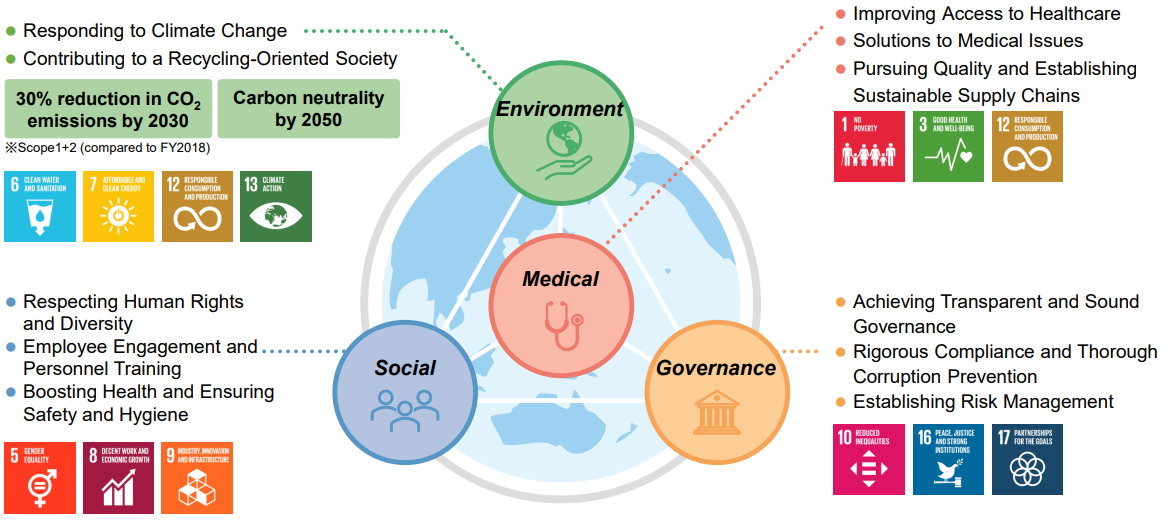

(2) EIKEN ROAD MAP 2030

Based on the above recognition, the management concept has been redefined as EIKEN ROAD MAP 2030.

The EIKEN Vision 2030 clarifies the group’s vision for 2030 and sets forth Beyond the Field ~Team × Challenge~ as its slogan.

Each employee enhances their own abilities and expands the areas in which they can play an active role and creates new possibilities by bringing together the enhanced individual power beyond the boundaries and taking on challenges as a team. In addition, the company will take a step forward from its current business domain, innovate medical processes, and create the future of testing.

(From the reference material of the company)

(1)-1 Business strategy: the priority business fields

While the current domain remains as its core business, the company has also set three focus business areas: ① Contribution to cancer prevention and treatment, ② Contribution to the eradication and control of infectious diseases, and ③ Provision of products and services useful for health care.

① Contribution to cancer prevention and treatment

The company has focused more on screening (prevention and early detection) so far, and especially for colorectal cancer it has built a global screening program, contributing to the reduction of mortality and the suppression of medical expenses through early detection.

On the other hand, selecting appropriate treatment is essential due to the significant medical expenses of cancer treatments. In addition to the prevention and early detection of cancer, to respond to these medical issues, the company aims to further reduce the mortality rate from cancer by developing and providing a testing system that covers the selection of therapeutic drugs and the determination of treatment effectivity.

② Contribution to the eradication and control of infectious diseases

As the countermeasures against threatening infectious diseases, the company will boost its product line-up and develop global genetic testing systems for tuberculosis, malaria, etc. In addition, by developing a simpler, faster, and more accurate infectious disease diagnosis system that can be used by anyone anywhere, the company wants to contribute to increasing access to medical care.

③ Provision of products and services useful for health care

To extend healthy lifespan expectancy, the company will expand remote clinical system and at-home self-testing areas and develop them into healthcare using mobile device. Ultimately, it aims to develop a monitoring system that can notify users of their health conditions around the clock even if they are not conscious of it.

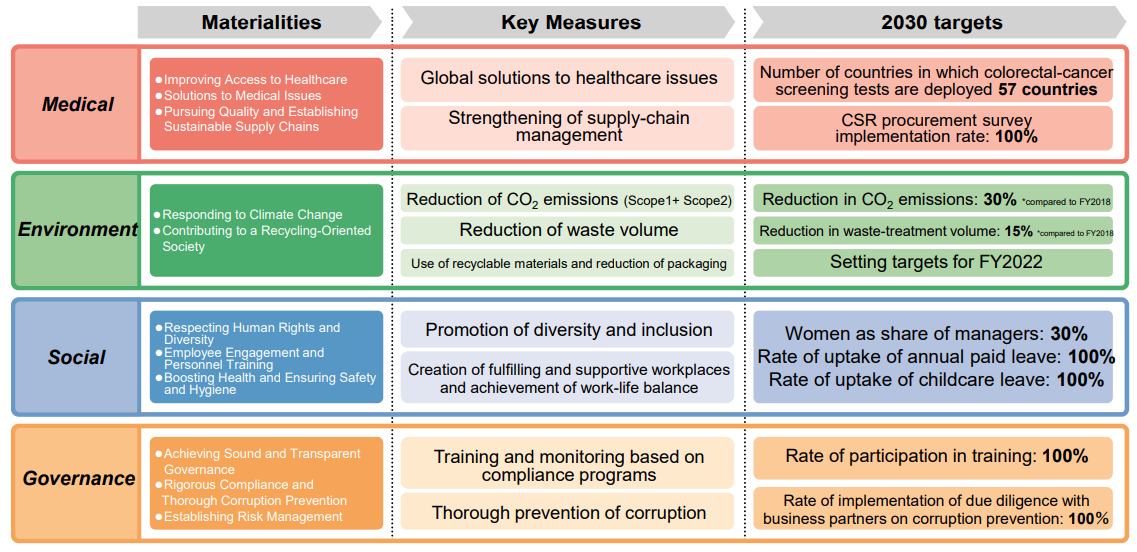

(1)-2 Advancement of Sustainable Management

The company will promote sustainable management with setting their management strategies on business activities in harmony with the global environment and a vibrant corporation making use of employee’s talent.

The company believes being a vibrant corporation making use of employee’s talent will be the growth driver.

To realize a sustainable society, 11 materialities to be prioritized were identified, and specific action plans were put in place. Through resolving social issues, the company will aim to achieve the further enhancement of corporate value and the realization of a sustainable society.

(From the reference material of the company)

Materialities and KPI in detail: https://www.eiken.co.jp/en/sustainability/eiken/

(1)-3 Objectives

① Financial targets

The targets for FY 2031 are as follows. The targets until FY 2025 are the figures according to the Medium-Term Management Plan (FY 2023 - FY 2025) described further down.

② Non-financial targets

As a company protecting the health of people worldwide, it is addressing issues not only of health care but also of the environment, society, and governance. For each materiality, it sets key performance indicators (KPIs) and monitors its progress toward achieving them. In addition to tracking its performance on the KPIs, the company reflects this performance in its evaluation of Executive Officers’ performance and in their remuneration.

Materialities and KPI in detail: https://www.eiken.co.jp/en/sustainability/eiken/

(From the reference material of the company)

(3) Medium-term Management Plan (from FY 2023 to FY 2025)

This is the first Medium-Term Management Plan for EIKEN ROAD MAP 2030 and a three-year growth strategy.

The Plan outlines key measures in accordance with the vision of EIKEN ROAD MAP 2030 and responds to the currently accelerating paradigm shift in healthcare.

The company aims to advance the establishment management platform, promote personnel-focused management, enhance employee satisfaction and motivation, furnish an environment that fosters innovation and boost sustainable growth with steady improvement in profitability.

(3)-1 Principal fields and key measures

The key measures taken in the priority business areas of (i) contribution to cancer prevention and treatment, (ii) contribution to the eradication and control of infectious diseases, and (iii) provision of products and services useful for health care are as follows.

(From the reference material of the company)

In the field of colorectal cancer testing, to improve rates of uptake of colorectal cancer screening, the company will improve access to screening by expanding the number of screenings by mail and online screening. It will also develop a next generation fecal immunochemical test. The company aims to develop highly accurate medical laboratory technology to improve accuracy of colorectal cancer screening by increasing value-added of testing, for example, by cancer detection at earlier stages, and also, to narrow dawn the endoscopy target person and to develop tests to reduce patient’s physical burden.

The company will also focus on the development of a comprehensive genetic mutation testing system that detect multiple cancer gene mutations at once with next-generation sequencer (NGS). This system requires a shorter time to report results, is highly sensitive, and does not require many specimens. This system is expected to add target genes supporting new molecular targeted drugs and expand applications for many other cancers, help decide direction of cancer treatment (selection of molecularly targeted drugs) by blood tests.

(3)-2 Establishing a management platform for sustainable growth

The company will further strengthen its management platform through the following five initiatives.

① Human resources strategy

The company is shifting to a wage system that focuses on job responsibilities and expertise and an evaluation system that brings out teamwork and challenges employees to pursue employee satisfaction and meaningful work.

② Structural reform

Based on the common understanding that our business field is the global market, the company is optimizing business processes and overhauling its systems with a view to speeding up decision-making.

③ IT strategy

The company is actively introduce and utilize AI and robots to promote DX in a wide range of business processes, including products and services, research and development, and manufacturing, to cultivate DX experts, and internal dissemination of DX.

④ Financial and capital strategies

By setting a target for cash conversion cycle, improving funding efficiency for business investment and diversifying its fundraising, the company will make agile and flexible investments to balance a sound financial base with operational expansion.

The company plans to spend a total of 28.4 billion yen in strategic investments over the next three years, including R&D, DX, work style reform, and facilities and equipment.

For M&A, rather than set a specific figure, this matter is considered separately.

Pursuit of stability and continuity in recognition of the importance of the return of earnings to shareholders as a management issue. The target dividend payout ratio is 30% or higher.

⑤ Governance

The company is strengthening its measures on ESG, with the aim of ensuring sound management that improves long-term corporate value. In addition, the company is advancing proactive IR and PR with high transparency, for example through the publication of integrated reports.

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization Type | Company with a nominating committee and others |

Directors | 8, including 5 outside ones (Including 1 female) |

Nominating Committee | 3, including 2 outside ones |

Compensation Committee | 3, including 2 outside ones |

Audit Committee | 4, including 3 outside ones (Including 1 female) |

◎ Corporate Governance Report

Last updated: submitted on June 22, 2022

<Basic Policy>

Our policy for corporate governance is based on our management philosophy, management vision, and motto.

*Management philosophy

We protect the health of people through healthcare services.

*Management vision

In order to protect the health of people, EIKEN Group offers reliable products and services as a pioneer in checkups, to improve its corporate value.

*Motto

“EIKEN” winning trust with quality and growing with technology

To improve our corporate value by enhancing the soundness, speed, and transparency of our business administration, we are enriching our corporate governance while emphasizing the viewpoint of shareholders and recognizing it as an important managerial mission.

Our company has adopted a corporate structure that has a nominating committee, separating the business execution function and the supervisory function of the management. Important items regarding the basic policy for business administration are determined through the deliberation of the board of directors, and business execution is conducted swiftly and smoothly under the appropriate chain of command, in accordance with our in-company regulations and rules.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has implemented every principle detailed in the Corporate Governance Code.

Disclosure Based on Each Principle of the Corporate Governance Code (Excerpts)

Principles | Disclosure content |

[Principle 1-3 Objective of Capital Policy] | Our company's basic capital policy is to improve capital efficiency and provide sustainable and stable shareholder returns to maintain and increase shareholder value. With respect to shareholder returns, we aim to maintain a consolidated dividend payout ratio of 30% or higher, taking into consideration the enrichment of internal reserves necessary for strengthening our financial position and aggressive business operation. When implementing capital policies (including capital increase, MBO, etc.) that would result in a change in control or significant dilution, the Board of Directors will fully discuss the necessity and rationality of the policy and ensure that appropriate procedures are followed. In addition, we will make efforts to provide sufficient explanations to shareholders and investors. |

[Principle 1-4 Strategically Held Shares] | 1. Policies on Strategic Holding of Listed Stocks Our basic policy is to hold shares of business partners only when we deem it reasonable to do so for the smooth promotion of business activities, maintenance of business relationships, business affairs, and capital alliances, and to continue to strategically hold these shares as long as we judge that they will contribute to the development of our business. To assess the value of holding these shares, the Board of Directors discusses annually whether the return (based on quantitative factors such as dividends and trading conditions, as well as a comprehensive assessment of importance in terms of management strategy and business relationships) is commensurate with the risk, in light of the cost of capital. We will sell off stocks that are deemed to have little benefit in holding, taking into consideration stock price trends and other factors. As for listed stocks, the Board of Directors discussed the issue at its meeting on April 28, 2021, and decided to continue holding the stocks of five companies in the fiscal year 2021. 2. Standards for Exercising Voting Rights for Strategically Held Stocks Our company exercises the voting rights for strategically held shares based on a comprehensive judgment of factors such as the state of corporate governance of the company concerned, whether the proposal contributes to improving shareholder value, and the impact on our company. |

Supplementary Principle 2-4 (i) Ensuring diversity in the appointment of core personnel | The company actively and continuously hires personnel and appoints them to various positions without regard to nationality, gender, or time of hire. As of April 1, 2022, there were 19 female executives, representing 14.8% of the total number of directors. In addition, 37 mid-career hires accounted for 28.9% of the total number of executives. From now on, from the viewpoint of further promoting diversity, the company aims to increase the ratio of female executives to 30% by 2030. Under this policy, the company has formulated a "Vision for Talent Development" as the image of the personnel it is aiming for and is promoting the activities of a diverse range of personnel regardless of nationality, gender, or age. In addition, the company has adopted various working systems, including a telework work system and a flextime system with no core hours, to increase the diversity of work styles and create an environment in which employees can maximize their abilities. |

Supplementary Principle 3-1(iii) Sustainability Initiatives | The company has been striving to solve various social issues through its business activities based on its management philosophy of "Protecting people's health through healthcare." In order to more proactively promote sustainability throughout the Group, the company has formulated a Sustainability Policy and established a Sustainability Committee, chaired by the President and composed of executive officers in charge of each function and business group, to promote sustainability activities. The contents of the Sustainability Committee are reported to and supervised by the Board of Directors. Under the "EIKEN ROAD MAP 2030," EIKEN identifies material issues and develops specific action plans to realize a sustainable society, and monitors the progress of these plans by setting indicators (KPIs). Information on the company's approach to sustainability, its policies, promotion system, and initiatives is disclosed on the company's website. https://www.eiken.co.jp/sustainability/ In addition, recognizing the risks that climate change poses to the financial markets, the company is further promoting its existing initiatives on climate change and disclosing information based on the TCFD recommendations. It will continue to analyze and discuss the issues and expand the disclosure of information in due course. Details are available on the company's website. https://www.eiken.co.jp/sustainability/environment/weather/ Regarding investment in human capital, the company will promote personnel-focused management, create an environment that increases employees' motivation and fulfillment at work to let them bring forth their innovation, with the aim of achieving sustainable growth and steady profitability. Details are available on the company's website. https://www.eiken.co.jp/sustainability/social/engagement/ Regarding investment in intellectual property, the company will steadily grow its existing businesses and allocate management resources to expanding the company's core technologies into peripheral businesses and developing new businesses through open innovation with external parties. Details are available on the company's website. |