| Solasia Pharma K.K. (4597) |

|

||||||||

Company |

Solasia Pharma K.K. |

||

Code No. |

4597 |

||

Exchange |

TSE Mothers |

||

Industry |

Pharmaceutical products (manufacturing) |

||

President & CEO |

Yoshihiro Arai |

||

Address |

Shiodome Building, 1-2-20, Kaigan, Minato-ku, Tokyo |

||

Year-end |

End of December |

||

URL |

|||

*The share price is the closing price on July 12. The number of shares issued and ROE were the values for the previous term. BPS is the values as of the end of the previous quarter.

|

||||||||||||||||||||||||

|

|

*The forecast is from the company. IFRS adopted. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

|

| Key Points |

|

| Company Overview |

|

Its significant strengths and features are the development staff with abundant practical experience led by President Arai, high rate of successful development, the stable business foundation, feasibility of business model, and so on. *Specialty Pharma: A new drug developing enterprise possessing research and development capabilities which has a certain standard in its field of expertise, both domestically and internationally.    As research and development is preceding, will have to rely on financing CF now, but they plan to make operating CF positive soon and build a strong basis to achieve continuous growth. Regarding the "death rate (the number of deaths per 100,000 people)" which takes account of the change in the total population, in 1981, cancer overtook cerebrovascular diseases, the former number one cause of death, with the death rate from cancer being 142.0 and that from cerebrovascular diseases being 134.3. Since then, cancer has been the leading cause of death for the 30 consecutive years and keeps going up every year with the rate being 295.5 in 2015. The changes in lifestyles, including food, is allegedly one of the factors in the incidence of cancer, and the number of patients and deaths regarding cancer is rising in China as well. Currently, the U.S. has the largest pharmaceuticals market followed by China; however, the Chinese market is expected to grow in its scale as large as that of the U.S. by 2020.   (New anti-cancer drug) In cancer treatment provided using anticancer drug, it is said that the polytherapy which uses multiple anticancer drug brings about stronger effects than the monotherapy which uses a single anticancer drug. In addition, although it depends on cancer types, there is significant risk of relapses. Besides, in case of intractable cancers, it is difficult to cure such cancers only with a single treatment method, which means that a single medicine is not always an absolute cure, and therefore, other therapeutic medications will hardly be direct "competing products." Although molecular target drugs and immunotherapy attract attention nowadays, concerning the efficacy and penetration rate, they have just started and thus the conventional cytotoxic anticancer agents will still be deemed as the standard of care. (Cancer supportive care) Anticancer drugs are potent medicine that attacks cancer cells, and side effects are inevitable. If the side effects on patients cannot be controlled, anticancer therapy through drug administration must be stopped, resulting in cancer progression. As a result, expectations for drugs and medical devices which control such side effects are increasing in order to avoid treatment discontinuation and complete cancer treatment. In addition, while therapeutic drugs for cancer must be approved for each cancer type, supportive care can be provided to a wide range of patients regardless of cancer types, which means that there will be strong needs and markets. In summary, needs for cancer treatment in Japan and China are growing and there are great expectations for new anticancer drugs and cancer supportive care . Solasia Pharma is establishing business model and business strategy to incorporate such needs and boost earnings. (1) Business model

Before the launch of new medicines, it is usual to go through the processes spanning from "basic research" to "pharmaceutical research," "nonclinical development (tests conducted using animals to examine medicinal and pharmacological action, in-vivo pharmacokinetic properties, adverse effects, etc.)," and "clinical development (scientific tests carried out to examine the effects of pharmaceuticals and treatment techniques on human beings), obtain approval from the authorities, and then conduct "manufacture" and "sale, marketing, and post-marketing surveillance."Although major pharmaceutical companies are propelling outsourcing to CROs at the stage of clinical development to make considerable amounts of research and development costs variable, they basically perform all of the above-mentioned processes internally. Such a system has supported high profitability of pharmaceutical companies. The life science field, however, is currently advancing and becoming complicated and diverse at a rapid rate, and there is an increasing possibility that each company's unique drug discovery technology quickly become obsolete. In addition, there are a myriad of cases where practical application of new drugs is given up before clinical development, regardless of costs and time spent from the stage of basic research, and therefore new drug is not established in the end. In other words, pharmaceutical development is facing high risks at all times. Accordingly, Solasia Pharma does not conduct the processes from basic research to nonclinical development on its own which has high failure rate. By in-licensing promising pharmaceuticals that are still under development from outside companies, it embarks on development starting from clinical development. It utilizes its strength and reduces risk by focusing management resources on the business activities subsequent to the development stage. At the moment, it plans not to do manufacturing due to the large cost burden.  In general, pharmaceutical companies have realized high gross profit margins which are attributed to their own sales activities.  Accordingly, Solasia Pharma uses both "self-selling model" and "licensing-out model" (sales rights are granted to other companies for pharmaceuticals that have completed clinical development).  Solasia Pharma will establish its own sales channels and sales structure in "Beijing, Shanghai, and Guangzhou," the 3 major cities in China. Although the total population of the 3 cities accounts for only about 5% of the entire population of China, a number of large hospitals with advanced medicine which uses anticancer drugs are located in the above 3 cities, making them huge markets which account for 30% of the Chinese anticancer drug market. Furthermore, whether new pharmaceuticals are used and popularized depends highly on judgment and decision made by influential doctors, and thus, it is extremely important to make sales activities targeting large hospitals where such influential doctors work. In addition, such self-selling activities will be done not in a large scale throughout China but in a small scale in each of the 3 cities, which makes it possible to cover with a relatively small number of staff. Currently, the company is endeavoring to increase the number of sales staff to perform sales activities toward about 50 - 60 large hospitals.  (2) Development pipeline

Solasia Pharma currently owns the following 3 development pipelines in accordance with the above-mentioned management policy:

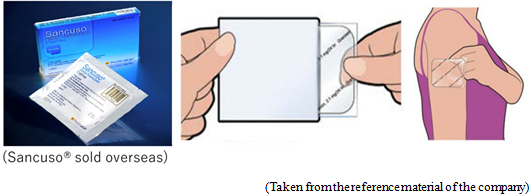

Administration of anticancer agents damage cells called Chromaffin cells in the small intestine. The damaged Chromaffin cells produce serotonin, a neurotransmitter, which is taken in by the 5-HT3 receptors in the peripheral vagus nerve. This stimulus is transmitted through the peripheral vagus nerve to the medulla oblongata via the chemoreceptor trigger zone (CTZ) in the area postrema of the fourth ventricle of the brain, stimulating the vomiting center which gives living organisms commands to develop nausea and vomiting, and then symptoms of nausea and vomiting appear. It is necessary to disrupt the stimuli generated by serotonin to the 5-HT3 receptors in order to control nausea and vomiting. There are a variety of "5-HT3 receptor antagonists" which are drugs used for the above purpose, and one of the representative agent is Granisetron. "SP-01" is a transdermal 5HT3 receptor antagonist containing Granisetron and is the world's only patch-type antagonist.  Another advantage is that transdermal type drugs can be administered even to patients who are facing difficulty in taking oral medicines due to various symptoms including nausea, vomiting, and stomatitis. Earning reputation for the above-mentioned advantages, "SP-01" is recommended for prescription in the American NCCN clinical practice guidelines and the Chinese clinical practice guidelines. Areas where "SP-01" has currently been launched or approved include America, the United Kingdom, Germany, the Netherlands, Denmark, Spain, Finland, Norway, Sweden, Kuwait, Lebanon, Qatar, Bahrain, the United Arab Emirates, Libya, Saudi Arabia, Korea, Taiwan, Hong Kong, the Philippines, and Australia. Solasia Pharma is planning potential extension of indication of "SP-01" from current CINV(Chemotherapy Induced Nausea and Vomiting) to RINV (Radiation Induced Nausea and Vomiting).  The types of lymphocytes include B cells, T cells, and NK cells, and when these cells become cancerous and continues uncontrolled growth , malignant lymphoma develops. Peripheral T-cell lymphoma (PTCL) is one kind of malignant lymphoma which arises from T cells in lymphocytes and is categorized into the "intermediate-grade lymphoma" where the disease progresses monthly, and it is said to account for 10 - 15% of the intermediate-grade lymphoma. The five-year survival rate from malignant lymphoma is lower than that from B-cell lymphoma, with the ratio being around 25%. The development of "SP-02" started aiming for peripheral T-cell lymphoma (PTCL) indication as mentioned above. Injections were administered to 187 subjects by October, 2015. The early second phase clinical trials in the U.S. were completed in April, 2012 and have shown certain efficacy in Caucasians. In the first phase clinical trial completed in April, 2015 in Japan and Korea, it was confirmed that the drug is highly safe compared to competitive drugs and has certain efficacy in Asians. It is known that malignant lymphoma often recurs. Accordingly, Solasia Pharma believes that multiple medicines with different mechanisms of action are necessary and the market scale is significant. In addition, the company is aiming to extend indication of "SP-02" not only to peripheral T-cell lymphoma but also to other hematologic cancers (lymphoma, leukemia) and solid carcinoma.  Stomatitis can be divided into 2 types: the primary stomatitis, which is "stomatitis caused by chemotherapy directly affecting the oral mucosa" or "stomatitis resulted from local infection due to the salivary gland tissue disorder and deterioration of intraoral self-cleansing action because of impaired saliva secretion attributed to radiation exposure" and the secondary stomatitis, which is "attributed to intraoral infection due to myelosuppression resulting from a decline in the number of white blood cells." The incident rate of stomatitis developing during treatment using anticancer drugs is 30-40%, and the incident rate of stomatitis when anticancer radiation therapy for head and neck cancer is provided simultaneously with anticancer drug is almost 100%. Stomatitis occurs together with 300-500 inflammations arising in the course of chemotherapy or radiation therapy. The pain makes oral intake of food and water by patients difficult, which results in a decrease in physical strength. In case the symptom is severe, it will adversely affect or halt the progress of cancer treatment. At present, however, there is no standard method to handle the symptom, and the way of treatment relies heavily on the symptomatic treatment by each hospital, such as making the patient take a huge amount of ice orally to paralyze the pain and then eat a meal in one go. "SP-03" is a lipid-based liquid, which is applied on the oral mucosa, which the company has been developing under the category of medical device.  Solasia Pharma submitted application for approval in Japan in 2016 and was given an approval for New Medical Device of "SP-03"in Japan by the Ministry of Health, Labour and Welfare on July 6, 2017. Following reimbursement listing, it is scheduled to be launched by Meiji Seika Pharma, which is the licensee who holds the exclusive sales rights of "SP-03" in Japan. The current situation and future plans regarding development and commercialization of the above-mentioned 3 pipelines are as follows:  ① History of establishment

Solasia Pharma started as "JapanBridge (Ireland) Limited" established jointly by ITOCHU Corporation and MPM Capital, an American VC specializing in bio business, and set up its business by licensing-in new drugs from several biotech companies and propelling development of such drugs. At first, it mainly considered business transfer to pharmaceutical companies as its exit plan; however, 4 - 5 years ago, taking account of the business potential and promise, the company shifted its business strategy to persistent business expansion as an independent company and took the path to public stock offering because it was essential to raise funds for research and development. As the company's original plan was to sell the company to other companies, the pipelines it owned were comprised of prime assets that could potentially be sold to other companies for encashment even during clinical development. This means that Solasia Pharma has already established a firm business foundation since its inception. ② Experienced Clinical development team

Solasia Pharma does not conduct basic research or preclinical trials but in-license assets and specializes in drug creation processes carried out subsequent to the clinical development phase. The most essential thing to achieve in the end in drug discovery is to obtain approval from the authorities. This requires skills and know-how in the stage of clinical development, especially clinical trials after phase two. Although there are a number of biotech companies in Japan, President Arai stands out with his deep experience and knowledge in clinical development. The experienced clinical development team, led by President Arai, is a significant factor in differentiating Solasia Pharma from other companies and plays a role as a competitive edge. ③ High rate of successful development

Since its establishment, Solasia Pharma has introduced3 pipelines, including "SP-01," "SP-02," and "SP-03," without suspending or failing at any development process, and all of the 3 pipelines have reached the final stage towards commercialization (one pipeline has already been approved in Japan, application for approval of another pipeline was submitted, and the other pipeline is undergoing the final clinical trial). Such a high rate of successful development is made possible due to the following 2 points: its business model that handles only in-licensed products with a low risk of failure, and its in-house team which can handle all kinds of roles in clinical development. As mentioned above, the development staff is well aware of what are necessary for obtaining approval and therefore can conduct screening of whether or not an in-licensed product will be approved. Their so-called "connoisseur (for screening pipelines)" has been realized by the combination of the above 2 strengths, and lowers the risk of abandoning development which is the source of such a high success rate. ④ Stable business foundation

Solasia Pharma, as mentioned above, has successfully conducted licensing-out of the sales rights of all of the aforementioned 3 pipelines to pharmaceutical companies, which means that in combination with the self-selling system, a portfolio for risk hedge has already been established.

⑤ Self-selling system for securing large profit

The reason why pharmaceutical companies have succeeded in securing large profit is that they engage in both manufacturing and selling. At the moment, Solasia Pharma does not own any manufacturing equipment but is building a self-selling system to increase profitability in the 3 major cities in China (Beijing, Shanghai, and Guangzhou) which has a large market scale and allows effective sales activities. ⑥ Early feasibility of business

Because biotech companies in general post losses in the stage of new drug development, it is not rational to use profit and loss statements for calculating stock prices and enterprise value, and thus the DCF (discount cash flow) model is used. In case of biotech companies, however, in addition to the discount rate based on "time" which is used in the general DCF model, the success rate for each stage of clinical trials of new drugs is used as another discount rate. In this case, the most important point is when approval is obtained. However, among the 3 pipelines "SP - 03" has already been approved and "SP-01" is expected to be approved in FY2017. It would be appropriate to assume that the company's discount rate concerning new drug development will be lower than those of other biotech companies. In addition to the above 6 points, the high potential for growth in the Chinese market, too, is one of the characteristics of Solasia Pharma. Understandably, large-scale pharmaceutical companies all over the world have established bases at various Asian countries including China; however, as described in its management policy, Solasia Pharma's target of development is new products in the field of cancer and rare diseases which major pharmaceutical companies do not enter from the performance-based perspective. Such products, which nowadays attract high attention, were originally developed by biotech companies, and because major companies do not engage in this area, Solasia Pharma will become an invaluable company that can offer access to the thriving Asian market with its self-selling structure in Beijing, Shanghai, and Guangzhou. Solasia Pharma is given another advantage in that it can use the network of ITOCHU Corporation, its leading shareholder which has strengths in business in China. |

| 1Q of Fiscal Year December 2017 Earnings Results |

Upfront investment is ongoing, and loss augmented.

Sales revenue was 3,579 thousand yen from the sales of SP-01. Gross profit was equal to the sales revenue, indicating a significant year-on-year decrease. The company incurred an operating loss of 243 million yen. It made progress in R&D, while strengthening the pharmaceutical development pipeline by implementing of clinical trials, and also incurred cost for establishing system for product development and stock offering, increasing the deficit.  Equity ratio (ratio of equity that belongs to the owners of the parent company) was 96.2%.  The cash position rose about 2 billion yen year on year. |

| Fiscal Year December 2017 Earnings Estimates |

Loss is forecasted to augment due to the drop in sales and the investment for sales systems

Sales revenue is estimated to decline 15.6% year on year to 423 million yen. Under the assumption that "SP-01" and "SP-03" will be approved by the Chinese and Japanese authorities this year, respectively, the company will receive milestone income from Lee's Pharmaceutical (HK) Limited after the approval for "SP-01" and Meiji Seika Pharma Co., Ltd. after the approval for "SP-03." The company is forecasted to incur an operating loss of 1,787 million yen. Research and development expenses, mainly clinical trial expenses of "SP-02" which is conducting the final phase of clinical development, is estimated to rise by 70.8% to 812 million yen. SG&A expenses are estimated to rise 186.3% year on year to 1,398 million yen. Until the previous term, the primary cost had been fixed costs, including personnel and rental expenses, in the development and management divisions. However, as the company plans to launch "SP-01" and "SP-03" from the next term onwards, expenses for marketing in the Chinese market, the strengthening of management and development team in Japan and China, and the increase of employees for sales marketing at Chinese subsidiaries will be the cause of cost increase. |

| Interview with the President & CEO Arai |

|

President Arai has engaged in developing and obtaining approval for numerous pharmaceuticals and medical devices, and led the company in licensing-in of pipelines and clinical development with his rich experience and deep knowledge. We asked President Arai about the reasons why he entered Solasia Pharma, the company's strengths, and message to investors. Q: "Could you tell us the reasons why you decided to enter Solasia Pharma in 2007?"

A: "I considered it as an attractive opportunity for starting up a pharmaceutical company from the scratch and giving my utmost best at challenging myself."

Solasia Pharma started from a company named JapanBridge established jointly by ITOCHU Corporation and MPM Capital in the U.S., pursuing a new pharmaceuticals business. The company's original exit plan was to sell the company to major pharmaceutical companies; however, taking account of the business potential, the company decided to expand the business by itself. When asked to enter the company as a person in charge of development, I thought that I would never be given such an opportunity for starting up a pharmaceutical company from scratch in Japan, and besides, the company's business and financial foundations had already been firm. Deeming the invitation as an attractive chance of giving my utmost best at challenging myself, I decided to accept the offer. Q: "What do you think are the strengths of Solasia Pharma?"

A: "It is the superior staff with plenty of experience who makes it possible to realize such a high rate of successful development."

Our company does not conduct the phase spanning from basic research to nonclinical development due to higher risk of failure. Instead we concentrate management resources on licensing-in of promising pharmaceuticals, and business activities subsequent to the clinical development stage in order to highlight our strengths and reduce risks. Under this business model, 3 pipelines have reached the final stage toward commercialization. It is our high-level development staff that realizes such high rates of successful development, and the staff is the greatest strength our company takes pride in. Our staff members consist of those who have cultivated diverse experiences in development and obtaining marketing approval regarding various pharmaceuticals and medical equipment in large-scaled pharmaceutical companies in and outside Japan, including myself. I believe that our greatest competitive edge is that our company can proceed accurately with the following 2 activities: "licensing-in of promising pipelines with high success rates" and "design and operation of clinical trials based on successful experiences to certainly obtain approval." Q: "Please give your message to shareholders and investors."

A: "I would like to ask shareholders and investors to understand the social meaning of our existence, our low-risk business model for drug discovery venture companies, and the path to becoming profitable as soon as possible and support us from the mid- to long-term perspectives."

As is often the case, biotech companies develop pipelines to a certain degree and then sell the sales rights of the pipelines to major pharmaceutical companies in order to make profit through milestones; however, I believe that if a company introduces itself as a pharmaceutical company, it is indispensable to complete development, obtain approval, and do marketing on its own. Although our corporate scale is not large, we plan to own self-selling structure. This displays our belief that it is the social duty of Solasia Pharma as a pharmaceutical company to responsibly supply useful medicines as close to patients as possible by ourselves, which I think is another significant characteristic or difference of Solasia Pharma. Some investors may worry about our business performance because our company has currently reported losses; however, sales of "SP-01" and "SP-03" will be recorded from next term onwards and therefore we expect to see financial results for FY2019 turn positive. I would like to ask shareholders and investors to understand the social meaning of our existence, our low-risk business model for drug discovery venture companies, and the path we are taking to become profitable as soon as possible and support us from mid- to long-term perspective. |

| Conclusions |

|

It is still unclear when and how much it will contribute to sales and profit, but we can say the company has already shown 5 out of 6 of the aforementioned "six characteristics" of the company. The timing of approval for "SP-01" and "SP-03" in China is noteworthy, but also when the outlook for revenue in the three major cities in China, which would produce significant revenues, will become clear and how significant it will contribute to revenue is the key factor we would like to pay attention. In addition, we would like to pay attention to what kind of development pipeline will be introduced after the third product. |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last update date: Mar. 24, 2017<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)> Solasia Pharma has stated, "Our company implements all the basic principles stipulated in the Corporate Governance Code." Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017, Investment Bridge Co., Ltd. All Rights Reserved. |