As a specialty pharma* specializing in cancer, Solasia Pharma develops and sells medicines for cancer treatment and supportive care, etc. in Asia, mainly Japan and China, which has promising markets.

Its significant strengths and features are the development staff with abundant practical experience led by President Arai, high rate of successful development, the stable business foundation, feasibility of business model, and so on.

*Specialty Pharma: A new drug developing enterprise possessing research and development capabilities which has a certain standard in its field of expertise, both domestically and internationally.

【1-1 Corporate history】

【1-2 Corporate philosophy/management philosophy】

【1-2 Corporate philosophy/management philosophy】

The company's name, SOLASIA, is a coined word combining Sol (the Sun in Spanish) and Asia (Asian counties). It represents the company's mission which is to be the Sun brightening the future of various people facing many challenges of cancer in Japan and other Asian countries.

The company will focus on developing new drugs to solve unmet medical needs (medical needs for diseases for which no treatment has been developed), which is a niche market but has many troubled patients.

As research and development is preceding, they will have to rely on financing CF now, but they plan to make operating CF positive soon and build a strong basis to achieve continuous growth.

【1-3 Environment surrounding Solasia Pharma】

According to "Vital Statistics, 2015" published by the Ministry of Health, Labour and Welfare, in 2015, the leading cause of death was malignant neoplasm (cancer) of which 370,346 people died, accounting for 28.7% of the total of 1,290,444 deaths.

Regarding the "death rate (the number of deaths per 100,000 people)" which takes account of the change in the total population, in 1981, cancer overtook cerebrovascular diseases, the former number one cause of death, with the death rate from cancer being 142.0 and that from cerebrovascular diseases being 134.3. Since then, cancer has been the leading cause of death for the 30 consecutive years and keeps going up every year with the rate being 295.5 in 2015.

As it is said that the incidence rate of cancer is rising due to aging and changes in lifestyles including diet, the number of patients and deaths regarding cancer is rising in China as well.

Currently, the U.S. has the biggest pharmaceutical market, followed by China after it overtook Japan. In the future, it is said that the market in China will expand to the point where it will share the top position with the U.S.

As the death rate from cancer increases as shown above, expectations for "new anticancer drug" and "cancer supportive care" are growing.

(New anti-cancer drug)

In cancer treatment provided using anticancer drug, it is said that a majority of hospitals use the polytherapy which uses multiple anticancer more than the monotherapy which uses a single anticancer drug.

In addition, although it depends on cancer types, there is significant risk of relapses. Besides, in case of intractable cancers, it is difficult to cure such cancers only with a single treatment method, which means that a single medicine is not always an absolute cure, and therefore, other therapeutic medications will hardly be direct "competing products."

Molecular targeted drugs and immunotherapy have also attracted attention in recent years, however chemotherapeutic agents still hold an important position for treatment of many cancer types. Standard therapy involves a regimen containing a cytotoxic anticancer drug, for which a high medical demand is expected in the future as well.

(Cancer supportive care)

Anticancer drugs are potent medicine that attacks cancer cells, and side effects are inevitable.

If the side effects on patients cannot be controlled, anticancer therapy through drug administration must be stopped, which has a risk of resulting in cancer progression.

As a result, expectations for drugs and medical devices which control such side effects are increasing in order to avoid treatment discontinuation and complete cancer treatment.

In addition, while therapeutic drugs for cancer must be approved for each cancer type, supportive care can be provided to a wide range of patients regardless of cancer types, which means that there will be strong needs and markets.

In summary, needs for cancer treatment in Japan and China are growing and there are great expectations for new anticancer drugs and cancer supportive care. Solasia Pharma is establishing business model and business strategy to incorporate such needs and boost earnings.

【1-4 Business contents】

(1) Business model

Before the launch of new medicines, it is usual to go through the processes spanning from "basic research" to "pharmaceutical research," "nonclinical development (tests conducted using animals to examine medicinal and pharmacological action, in-vivo pharmacokinetic properties, adverse effects, etc.)," and "clinical development (scientific tests carried out to examine the effects of pharmaceuticals and treatment techniques on human beings), obtain approval from the authorities, and then conduct "manufacture" and "sale, marketing, and post-marketing surveillance."

Although major pharmaceutical companies are propelling outsourcing to CROs at the stage of clinical development to make considerable amounts of research and development costs variable, they basically perform all of the above-mentioned processes internally.

Such a system has supported high profitability of pharmaceutical companies. The life science field, however, is currently advancing and becoming complicated and diverse at a rapid rate, and there is an increasing possibility that each company's unique drug discovery technology quickly become obsolete.

In addition, there are a myriad of cases where practical application of new drugs is given up before clinical development, regardless of costs and time spent from the stage of basic research, and therefore new drug is not established in the end. In other words, pharmaceutical development is facing high risks at all times.

Accordingly, Solasia Pharma does not conduct the processes from basic research to nonclinical development on its own which has high failure rate. By in-licensing promising pharmaceuticals that are still under development from outside companies, it embarks on development starting from clinical development. It utilizes its strength and reduces risk by focusing management resources on the business activities subsequent to the development stage.

At the moment, it plans not to do manufacturing due to the large cost burden.

Regarding the sales and marketing structure, the company has set up a system that takes into account the balance between high profitability and risk control.

In general, pharmaceutical companies hold gross profit margins to high standards, which is considered to be attained by their in-house manufacture and sales activities.

On the other hand, coverage of sales territories (e.g., to cover all over Japan) is required for pharmaceuticals, and therefore, a rise in fixed costs is inevitable for establishing a company's own sales network.

Accordingly, Solasia Pharma uses both "self-selling model" and "licensing-out model" (sales rights are granted to other companies for pharmaceuticals that have completed clinical development).

(Self-selling model)

Solasia Pharma will establish its own sales channels and sales structure in "Beijing, Shanghai, and Guangzhou," the 3 major cities in China.

Although the total population of the 3 cities accounts for only about 5% of the entire population of China, a number of large hospitals with advanced medicine which uses anticancer drugs are located in the above 3 cities, making them huge markets which account for 30% of the Chinese anticancer drug market.

Furthermore, whether new pharmaceuticals are used and popularized depends highly on judgment and decision made by influential doctors, and thus, it is extremely important to make sales activities targeting large hospitals where such influential doctors work.

In addition, such self-selling activities will be done not in a large scale throughout China but in a small scale in each of the 3 cities, which makes it possible to cover with a relatively small number of staff. Currently, the company is endeavoring to increase the number of sales staff to perform sales activities toward about 50 - 60 large hospitals.

(Licensing-out model)

The major partners to which Solasia Pharma has currently granted rights include the following 2 companies:

Solasia Pharma plans to create licensing-out partnerships with a focus on mid-sized pharmaceutical companies which it can fall in line easily and forge win-win relationships.

(2) Products/Development pipeline

Solasia Pharma currently owns the following 4 products/development pipelines in accordance with the above-mentioned management policy:

History of development pipeline and operationalization, current situation and future projection are as follows. (As of August 2018)

(Overview of indications)

(Overview of indications)

Nausea and vomiting are widely known as typical side effects caused by anticancer drug.

Administration of anticancer drug damage cells called Chromaffin cells in the small intestine.

The damaged Chromaffin cells produce serotonin, a neurotransmitter, which is taken in by the 5-HT3 receptors in the peripheral vagus nerve. This stimulus is transmitted through the peripheral vagus nerve to the medulla oblongata via the chemoreceptor trigger zone (CTZ) in the area postrema of the fourth ventricle of the brain, stimulating the vomiting center which gives living organisms commands to develop nausea and vomiting, and then symptoms of nausea and vomiting appear.

It is necessary to disrupt the stimuli generated by serotonin to the 5-HT3 receptors in order to control nausea and vomiting. There are a variety of "5-HT3 receptor antagonists" which are drugs used for the above purpose, and one of the representative agent is Granisetron.

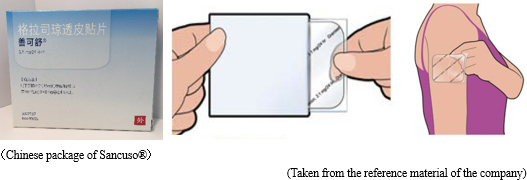

(Overview of "SP-01")

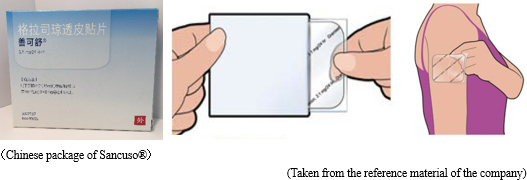

"SP-01" is a transdermal 5-HT3 receptor antagonist containing Granisetron and is the world's only patch-type antagonist.

Anticancer drugs are administered over 5 days in most cases, but injections and oral antiemetic agents are effective only for about 1 to 2 days and must be injected multiple times within the anticancer drug administration period. On the other hand, "SP-01" maintains the concentration level of Granisetron in blood on a stable basis for 5 days. Therefore, once a patch of "SP-01" is attached, there is no need to add antiemetics, which enables cancer treatment not through hospitalization but through outpatient care, and contributes significantly to the improvement of patients' quality of life.

Another advantage is that transdermal type drugs can be administered even to patients who are facing difficulty in taking oral medicines due to various symptoms including nausea, vomiting, and stomatitis. Earning reputation for the above-mentioned advantages, "SP-01" is recommended for prescription in the American NCCN clinical practice guidelines and the Chinese clinical practice guidelines.

(Current situation of development and commercialization)

Development Areas where "SP-01" has currently been launched or approved include America, the United Kingdom, Germany, Italy, the Netherlands, Denmark, Finland, Norway, Sweden, Kuwait, Lebanon, Qatar, Bahrain, the United Arab Emirates, Saudi Arabia, South Korea, the Philippines (sold by originators and others), as well as Taiwan, Hong Kong, Singapore and Macau(sold by a sublicensee, Kyowa Hakko Kirin Co., Ltd.).

Solasia Pharma is planning potential extension of indication of "SP-01" from current CINV (Chemotherapy Induced Nausea and Vomiting) to RINV (Radiotherapy Induced Nausea and Vomiting).

In China, the company finalized their application for approval in June 2014, and obtained approval in July 2018, along with permission to import drug license.

After obtaining approval for SP-01, the company adopted a sales manager and has been promoting the development of the sales marketing structure in order to maximize profit; that is to say, an independent sales structure managed by approximately 30 MRs in the large cities of Beijing, Shanghai, and Guangzhou.

Using the characteristics and advantages to the competitive drugs listed above, the company aims to increase a share in the CINV market in China (said to be worth roughly 75-80 billion yen) through two-way sales activities, by providing knowledge to the physician, and by approaching top-level doctors (also called Key Opinion Leaders).

(Overview of indications)

(Overview of indications)

Malignant lymphoma is one type of hematologic cancer where lymphocytes in white blood cells become cancerous.

The types of lymphocytes include B cells, T cells, and NK cells, and when these cells become cancerous and continues uncontrolled growth, malignant lymphoma develops.

Peripheral T-cell lymphoma (PTCL) is one kind of malignant lymphoma which arises from T cells in lymphocytes and is categorized into the "intermediate-grade lymphoma" where the disease progresses monthly, and it is said to account for 10 - 15% of the intermediate-grade lymphoma. The five-year survival rate from malignant lymphoma is lower than that from B-cell lymphoma, with the ratio being around 25%.

(Current situation of development and commercialization)

The development of "SP-02" started aiming for recurring/intractable peripheral T-cell lymphoma (PTCL) indication as mentioned above. There are already results showed that injections were administered to 187 subjects in the U.S., Japan and Korea by October 2015.

The early second phase clinical trials in the U.S. were completed in April, 2012 and have shown certain efficacy in Caucasians.

In the first phase clinical trial completed in April 2015 in Japan and Korea, safety and tolerability of the drug were confirmed, with certain efficacy in Asians suggested.

The global phase II clinical trial, which is to be the final trial, was started in 2016 in Japan, Korea, Taiwan, and Hong Kong and is currently in progress for 65 patients (as planned) with peripheral T-cell lymphoma. The trial will close by the end of 2018, and Solasia Pharma plans to announce the results in 2019. If the results are promising, they intend to submit an application for approval to the authorities.

In China, the second and third phase clinical trial, which is the final trial, is in preparation.

It is known that malignant lymphoma often relapses. Accordingly, Solasia Pharma believes that multiple medicines with different mechanisms of action are necessary and the market scale is significant.

In addition, the company is aiming to extend indication of "SP-02" not only to peripheral T-cell lymphoma but also to other hematologic cancers (lymphoma, leukemia) and solid carcinoma and planning to start development in or after 2019.

The company has already out-licensed the development and sales rights in Japan to Meiji Seika Pharma, and is discussing to which companies in the United States, Europe, and China it should out-license the rights.

In August 2018, the company out-licensed the exclusive commercialization rights of "SP-02: darinaparsin" in Columbia, Peru, Ecuador, Venezuela, Chile, Panama, Costa Rica and Guatemala to the Colombia-based company HB Human BioScience SAS.

(Overview of indications)

(Overview of indications)

In addition to nausea and vomiting due to anticancer agents, oral mucositis are also serious side effects caused by chemotherapy or radiotherapy.

Stomatitis can be divided into 2 types: the primary stomatitis, which is "stomatitis caused by chemotherapy directly affecting the oral mucosa" or "stomatitis resulted from local infection due to the salivary gland tissue disorder and deterioration of intraoral self-cleansing action because of impaired saliva secretion attributed to radiation exposure" and the secondary stomatitis, which is "attributed to intraoral infection due to myelosuppression resulting from a decline in the number of white blood cells."

The incident rate of stomatitis developing during treatment using anticancer drugs is 30-40%, and that of stomatitis developing during anticancer drug treatment provided together with radiotherapy to the head and neck is nearly 100%.

Stomatitis occurs together with 300-500 inflammations arising in the course of chemotherapy or radiotherapy. The pain makes oral intake of food and water by patients difficult, which results in a decrease in physical strength. In case the symptom is severe, it will adversely affect or halt the progress of cancer treatment. Up until now, the majority of hospitals conducted palliative treatment.

(Overview of "SP-03")

"SP-03" is a lipid-based liquid, which is dropped and applied on the oral mucosa, which the company has been developing under the category of medical device.

In a few minutes after application of a proper dose to the oral mucosa, the liquid absorbs the water in the oral cavity and transforms to a bioadhesive gel which mechanically protects the affected area. The effect of mitigating the pain of stomatitis has been clinically shown to last for 8 hours.

(Current situation of development and commercialization)

Solasia Pharma submitted an application for approval in Japan in 2016 and obtained an approval of "SP-03" as new medical device in Japan by the Ministry of Health, Labour and Welfare on July 6, 2017. In January 2018, SP-03 was approved at the 388th general meeting of the Central Social Insurance Medical Council for being covered by insurance, starting in April 2018. Following reimbursement listing, in May 2018, it was launched by Meiji Seika Pharma, which is the licensee who holds the exclusive sales rights of "SP-03" in Japan.

The company submitted the New Medical Device Application to the authorities in May 2016 in China, and is planning to obtain the approval of SP-03 within 2018, and launch SP-03 after approval.

Solasia Pharma is selling "SP-03" by itself in Beijing, Shanghai and Guangzhou, while in other regions in China, the sales right has been out-licensed to Lee's Pharmaceutical.

In August 2018, the company signed a contract with Camurus AB in which they were granted exclusive development and sales rights for "SP-03" in Korea.

In other regions than Japan, which include the United States, United Kingdom, Germany, Denmark, Norway, Sweden, and France, SP-03 has been sold by other companies and the originator.

While steady progress in general was being made in development of the three preceding products, the company, which had been considering in-licensing the fourth pipeline since it became listed, sought for a new drug that satisfies the following three criteria: "it is aimed for the oncology," "certain progress has been made in clinical trials," and "the company can gain the development right both in Japan and in China." Then, in November 2017, the company was granted the exclusive rights to development and commercialization of "PledOx®," a drug for treating CIPN, in Japan, China, South Korea, Taiwan, Hong Kong, and Macau by PledPharma AB (hereinafter referred to as "PledPharma") of Sweden. Aiming to obtain the approval as early as possible, the company will forge ahead with clinical development in Eastern Asia, such as Japan and China, with an initial focus on peripheral neuropathy caused by administering "oxaliplatin," a typical anticancer drug for treatment of colorectal cancer.

(Overview of indications)

Chemotherapy-induced side effects occur not only nausea and vomiting, and oral mucositis, but also peripheral neuropathy. It is known that peripheral neuropathy is caused pronouncedly by major drugs for chemotherapy, such as platinum- and taxane-containing drugs.

The FOLFOX treatment, which is a typical medical treatment in chemotherapy and adjuvant chemotherapy against advanced and recurrent colorectal cancer (stage III and IV) that is difficult to cure by surgery, uses three drugs, including fluorouracil, folinic acid, and oxaliplatin. About 90% of patients have reported that prescription of oxaliplatin caused peripheral neuropathy accompanied by the following symptoms: "dysesthesia on hands and feet, parts around the lips, and others," "tightness in the pharynx and larynx accompanied by difficulty in breathing and dysphagia," "numbness of hands and feet," "hypoesthesia," and "sensory ataxia."

If these side effects appear, by suspension of administering the drugs, some of the symptoms are alleviated in 80% of the cases and completely recovered in 6 to 8 months in 40% of the case; however, as discontinuation of administration of the drugs may mean suspension of cancer chemotherapy and change in the treatment policy, treatment of peripheral neuropathy is one of the crucial medical issues. There is currently no approved drug to prevent or treat CIPN.

(Overview of "SP-04")

PledPharma, the originator of "SP-04: PledOx®" is listed on Stockholm Stock Exchange and has strengths in development of pharmaceuticals against oxidative stress-related diseases.

"PledOx®" (commonly known as Calmangafodipir) is a new active ingredient created based on "Mangafodipir," an MRI contrast medium, which had sold in the United States and Europe.

As described later, "SP-04:PledOx®" is a drug for treatment of peripheral neuropathy with the most forward progress as the phase IIb study was completed and the global phase III study is scheduled. Success in its development will not only bring considerable first-mover advantage but also make enormous social contributions, such as improvement of cancer patients' quality of life (QOL).

*Marketability

According to Solasia Pharma, the number of colorectal cancer patients who undergo the FOLFOX treatment is estimated to be around 60,000 - 100,000 in Japan and about 200,000 in China per year.

The FOLFOX treatment is made up with a treatment cycle that continues for 14 days in total, including "3 days for medical care and 11 days as a washout period," and patients are required to repeat the cycle 12 times.

Although the indication which the FOLFOX treatment is aimed at is colorectal cancer whose patients receive cancer chemotherapy, including administration of oxaliplatin, it is known that peripheral neuropathy is caused conspicuously by other major pharmaceuticals used in cancer chemotherapy, such as platinum- and taxane-containing drugs. The company expects that, if other solid cancers than colorectal cancer, such as breast, lung, ovarian, and pancreatic cancers, are added to the indication, the marketability will become higher.

(Current situation of development and commercialization)

PledPharma has carried out research and development of PledOx® against peripheral neuropathy in the United States and Europe and it has been suggested, based on the results of the phase II study and the preceding trials, that PledOx® is effective and safe in advanced colorectal cancer patients who are receiving the FOLFOX treatment; in other words, it improves peripheral neuropathy and does not influence the cancer treatment using the FOLFOX treatment. Upon consideration of out-licensing "SP-04" to Japan, PledPharma was convinced of the necessity to hold study involving Japanese, therefore, it conducted the phase I study of PledOx® in the United States with Japanese as the subjects. The trial was closed in Feb. 2018, and excellent safety and tolerability of SP-04 in Japanese has been confirmed.

Solasia Pharma is intended to take over subsequent study together with the results of other research and development done by PledPharma; therefore, it will embark on the next phase study in this term based on the results of the phase I study. Although discussion as to pharmacokinetic properties is also included in the objectives of the trial, such properties are currently being analyzed.

Meanwhile, PledPharma has announced that it will, in the second half (July to Dec.) of 2018, start the enrollment of the global phase III study finalized the design which consulted with the Food and Drug Administration (FDA) and European Medicines Agency (EMA).

Solasia Pharma, which closed the phase I study of Japanese, is considering participating into the global phase III study subject to the consultation with the Japanese authorities.

Based on the consultation with the Pharmaceuticals and Medical Devices Agency (PMDA) in June 2018, SP-04 was permitted to participate into the global study in Japan, Korea, Taiwan, and Hong Kong.

※ Placebo-controlled study

In clinical study for medicine, subjects are divided into a control group and a treatment group, and the control group is given a placebo. A "placebo" resembles the test drug as much as possible, including color, weight, taste and smell, and does not contain pharmaceutical agents.

By participating into the global phase III study, the time and cost required to commercialize SP-04 is expected to be far less than if Solasia were to conduct study on its own. Solasia also plans to conduct clinical study in China in the future.

【1-5 6 Characteristics as a Biotech Company】

※ Placebo-controlled study

In clinical study for medicine, subjects are divided into a control group and a treatment group, and the control group is given a placebo. A "placebo" resembles the test drug as much as possible, including color, weight, taste and smell, and does not contain pharmaceutical agents.

By participating into the global phase III study, the time and cost required to commercialize SP-04 is expected to be far less than if Solasia were to conduct study on its own. Solasia also plans to conduct clinical study in China in the future.

【1-5 6 Characteristics as a Biotech Company】

The following 6 points characterize Solasia Pharma as a biotech company:

① History of establishment

Solasia Pharma started as "JapanBridge (Ireland) Limited" established jointly by ITOCHU Corporation and MPM Capital, an American VC specializing in bio business, and set up its business by licensing-in new drugs from several biotech companies and propelling development of such drugs.

At first, it mainly considered business transfer to pharmaceutical companies as its exit plan; however, 4 - 5 years ago, taking account of the business potential and promise, the company shifted its business strategy to persistent business expansion as an independent company and took the path to public stock offering because it was essential to raise funds for research and development. As the company's original plan was to sell the company to other companies, the pipelines it owned were comprised of prime assets that could potentially be sold to other companies for encashment even during clinical development. This means that Solasia Pharma has already established a firm business foundation since its inception.

② Experienced Clinical development team

Solasia Pharma does not conduct basic research or preclinical trials but in-license assets and specializes in drug creation processes carried out subsequent to the clinical development phase. The most essential thing to achieve in the process of research and development toward commercialization of pharmaceuticals is to eventually obtain approval from the authorities. This requires skills and know-how in the stage of clinical development, especially clinical trials after phase II.

Although there are a number of biotech companies in Japan, President Arai stands out with his deep experience and knowledge in clinical development.

The experienced clinical development team, led by President Arai, is a significant factor in differentiating Solasia Pharma from other companies and plays a role as a competitive edge.

③ High rate of successful development

Prior to the latest "SP-04," Solasia Pharma has introduced 3 pipelines including "SP-01," "SP-02" and "SP-03" without suspending or failing at any development process, and all of the 3 pipelines have reached the final stage towards commercialization (one pipeline has already entered into sales phase in Japan, application for approval of another pipeline was obtained in China, and the other pipeline is undergoing the final clinical trial).

Such a high rate of successful development is made possible due to the following 2 points: its business model that handles only in-licensed products with a low risk of failure, and its in-house team which can handle all kinds of roles in clinical development. As mentioned above, the development staff is well aware of what are necessary for obtaining approval and therefore can conduct screening of whether or not an in-licensed product will be approved.

Their so-called "connoisseur (for screening pipelines)" has been realized by the combination of the above 2 strengths, and lowers the risk of abandoning development which is the source of such a high success rate.

Analysis of the cash inflow of a new drug based on the discount cash flow (DCF) model has indicated what comprise of a majority of the total cash inflow is not contract money or milestone income, but royalties which, obviously, will be earned only after successful development of the new drug and expansion of the sales volume.

When making a proposal to PledPharma, Solasia Pharma did not necessarily have advantages over a number of its competitors in terms of prices, including contract money; nevertheless, it succeeded in in-licensing "SP-04." The reason behind the success is that PledPharma has thought highly of Solasia Pharma's capabilities, including the strength of the team for producing distinct clinical trial designs, the results of development of the three preceding products, and the business performance in Asia, including Japan and China, reaching a decision that Solasia Pharma will be the best partner that will bring success in "PledOx®" in Asia.

④ Stable business foundation

Solasia Pharma, as mentioned above, has successfully conducted licensing-out of the sales rights of all of the aforementioned 3 pipelines to pharmaceutical companies, which means that in combination with the self-selling system, a portfolio for risk hedge has already been established.

⑤ Self-selling system for securing large profit

The reason why pharmaceutical companies have succeeded in securing large profit is that they engage in both manufacturing and selling.

At the moment, Solasia Pharma does not own any manufacturing equipment but is building a self-selling system to increase profitability in the 3 major cities in China (Beijing, Shanghai, and Guangzhou) which has a large market scale and allows effective sales activities.

⑥ Early feasibility of business

Because biotech companies in general post losses in the stage of new drug development, it is not rational to use profit and loss statements for calculating stock prices and enterprise value, and thus the DCF model is used. In case of biotech companies, however, in addition to the discount rate based on "time" which is used in the general DCF model, the success rate for each stage of clinical trials of new drugs is used as another discount rate.

In this case, the most important point is when approval will be gained. Among the four products, "SP-01" was approved in China and "SP-03" was launched in Japan, and so the discount rate regarding the company's development of new drugs should be estimated lower than that of other bio-ventures.

In addition to the above 6 points, the high potential for growth in the Chinese market, too, is one of the characteristics of Solasia Pharma.

Understandably, large-scale pharmaceutical companies all over the world have established bases in various Asian countries including China; however, as described in its management policy, Solasia Pharma's target of development is new products in the field of cancer and rare diseases which major pharmaceutical companies do not enter from the performance-based perspective.

Such products, which nowadays attract high attention, were originally developed by biotech companies, and because major companies do not engage in this area, Solasia Pharma will become an invaluable company that can offer access to the thriving Asian market with its self-selling structure in Beijing, Shanghai, and Guangzhou. What is more, the company has entered into a contract for sales by agent in China, excluding Hong Kong and Macau, with ITOCHU Corporation, the largest shareholder that has strengths in business in China. This contract conclusion has offered Solasia Pharma an enormous advantage, that is, it can use ITOCHU Corporation's network.

【1-2 Corporate philosophy/management philosophy】

The company's name, SOLASIA, is a coined word combining Sol (the Sun in Spanish) and Asia (Asian counties). It represents the company's mission which is to be the Sun brightening the future of various people facing many challenges of cancer in Japan and other Asian countries.

【1-2 Corporate philosophy/management philosophy】

The company's name, SOLASIA, is a coined word combining Sol (the Sun in Spanish) and Asia (Asian counties). It represents the company's mission which is to be the Sun brightening the future of various people facing many challenges of cancer in Japan and other Asian countries.

The company will focus on developing new drugs to solve unmet medical needs (medical needs for diseases for which no treatment has been developed), which is a niche market but has many troubled patients.

As research and development is preceding, they will have to rely on financing CF now, but they plan to make operating CF positive soon and build a strong basis to achieve continuous growth.

【1-3 Environment surrounding Solasia Pharma】

According to "Vital Statistics, 2015" published by the Ministry of Health, Labour and Welfare, in 2015, the leading cause of death was malignant neoplasm (cancer) of which 370,346 people died, accounting for 28.7% of the total of 1,290,444 deaths.

Regarding the "death rate (the number of deaths per 100,000 people)" which takes account of the change in the total population, in 1981, cancer overtook cerebrovascular diseases, the former number one cause of death, with the death rate from cancer being 142.0 and that from cerebrovascular diseases being 134.3. Since then, cancer has been the leading cause of death for the 30 consecutive years and keeps going up every year with the rate being 295.5 in 2015.

As it is said that the incidence rate of cancer is rising due to aging and changes in lifestyles including diet, the number of patients and deaths regarding cancer is rising in China as well.

Currently, the U.S. has the biggest pharmaceutical market, followed by China after it overtook Japan. In the future, it is said that the market in China will expand to the point where it will share the top position with the U.S.

The company will focus on developing new drugs to solve unmet medical needs (medical needs for diseases for which no treatment has been developed), which is a niche market but has many troubled patients.

As research and development is preceding, they will have to rely on financing CF now, but they plan to make operating CF positive soon and build a strong basis to achieve continuous growth.

【1-3 Environment surrounding Solasia Pharma】

According to "Vital Statistics, 2015" published by the Ministry of Health, Labour and Welfare, in 2015, the leading cause of death was malignant neoplasm (cancer) of which 370,346 people died, accounting for 28.7% of the total of 1,290,444 deaths.

Regarding the "death rate (the number of deaths per 100,000 people)" which takes account of the change in the total population, in 1981, cancer overtook cerebrovascular diseases, the former number one cause of death, with the death rate from cancer being 142.0 and that from cerebrovascular diseases being 134.3. Since then, cancer has been the leading cause of death for the 30 consecutive years and keeps going up every year with the rate being 295.5 in 2015.

As it is said that the incidence rate of cancer is rising due to aging and changes in lifestyles including diet, the number of patients and deaths regarding cancer is rising in China as well.

Currently, the U.S. has the biggest pharmaceutical market, followed by China after it overtook Japan. In the future, it is said that the market in China will expand to the point where it will share the top position with the U.S.

As the death rate from cancer increases as shown above, expectations for "new anticancer drug" and "cancer supportive care" are growing.

(New anti-cancer drug)

In cancer treatment provided using anticancer drug, it is said that a majority of hospitals use the polytherapy which uses multiple anticancer more than the monotherapy which uses a single anticancer drug.

In addition, although it depends on cancer types, there is significant risk of relapses. Besides, in case of intractable cancers, it is difficult to cure such cancers only with a single treatment method, which means that a single medicine is not always an absolute cure, and therefore, other therapeutic medications will hardly be direct "competing products."

Molecular targeted drugs and immunotherapy have also attracted attention in recent years, however chemotherapeutic agents still hold an important position for treatment of many cancer types. Standard therapy involves a regimen containing a cytotoxic anticancer drug, for which a high medical demand is expected in the future as well.

(Cancer supportive care)

Anticancer drugs are potent medicine that attacks cancer cells, and side effects are inevitable.

If the side effects on patients cannot be controlled, anticancer therapy through drug administration must be stopped, which has a risk of resulting in cancer progression.

As a result, expectations for drugs and medical devices which control such side effects are increasing in order to avoid treatment discontinuation and complete cancer treatment.

In addition, while therapeutic drugs for cancer must be approved for each cancer type, supportive care can be provided to a wide range of patients regardless of cancer types, which means that there will be strong needs and markets.

In summary, needs for cancer treatment in Japan and China are growing and there are great expectations for new anticancer drugs and cancer supportive care. Solasia Pharma is establishing business model and business strategy to incorporate such needs and boost earnings.

【1-4 Business contents】

(1) Business model

Before the launch of new medicines, it is usual to go through the processes spanning from "basic research" to "pharmaceutical research," "nonclinical development (tests conducted using animals to examine medicinal and pharmacological action, in-vivo pharmacokinetic properties, adverse effects, etc.)," and "clinical development (scientific tests carried out to examine the effects of pharmaceuticals and treatment techniques on human beings), obtain approval from the authorities, and then conduct "manufacture" and "sale, marketing, and post-marketing surveillance."

Although major pharmaceutical companies are propelling outsourcing to CROs at the stage of clinical development to make considerable amounts of research and development costs variable, they basically perform all of the above-mentioned processes internally.

Such a system has supported high profitability of pharmaceutical companies. The life science field, however, is currently advancing and becoming complicated and diverse at a rapid rate, and there is an increasing possibility that each company's unique drug discovery technology quickly become obsolete.

In addition, there are a myriad of cases where practical application of new drugs is given up before clinical development, regardless of costs and time spent from the stage of basic research, and therefore new drug is not established in the end. In other words, pharmaceutical development is facing high risks at all times.

Accordingly, Solasia Pharma does not conduct the processes from basic research to nonclinical development on its own which has high failure rate. By in-licensing promising pharmaceuticals that are still under development from outside companies, it embarks on development starting from clinical development. It utilizes its strength and reduces risk by focusing management resources on the business activities subsequent to the development stage.

At the moment, it plans not to do manufacturing due to the large cost burden.

As the death rate from cancer increases as shown above, expectations for "new anticancer drug" and "cancer supportive care" are growing.

(New anti-cancer drug)

In cancer treatment provided using anticancer drug, it is said that a majority of hospitals use the polytherapy which uses multiple anticancer more than the monotherapy which uses a single anticancer drug.

In addition, although it depends on cancer types, there is significant risk of relapses. Besides, in case of intractable cancers, it is difficult to cure such cancers only with a single treatment method, which means that a single medicine is not always an absolute cure, and therefore, other therapeutic medications will hardly be direct "competing products."

Molecular targeted drugs and immunotherapy have also attracted attention in recent years, however chemotherapeutic agents still hold an important position for treatment of many cancer types. Standard therapy involves a regimen containing a cytotoxic anticancer drug, for which a high medical demand is expected in the future as well.

(Cancer supportive care)

Anticancer drugs are potent medicine that attacks cancer cells, and side effects are inevitable.

If the side effects on patients cannot be controlled, anticancer therapy through drug administration must be stopped, which has a risk of resulting in cancer progression.

As a result, expectations for drugs and medical devices which control such side effects are increasing in order to avoid treatment discontinuation and complete cancer treatment.

In addition, while therapeutic drugs for cancer must be approved for each cancer type, supportive care can be provided to a wide range of patients regardless of cancer types, which means that there will be strong needs and markets.

In summary, needs for cancer treatment in Japan and China are growing and there are great expectations for new anticancer drugs and cancer supportive care. Solasia Pharma is establishing business model and business strategy to incorporate such needs and boost earnings.

【1-4 Business contents】

(1) Business model

Before the launch of new medicines, it is usual to go through the processes spanning from "basic research" to "pharmaceutical research," "nonclinical development (tests conducted using animals to examine medicinal and pharmacological action, in-vivo pharmacokinetic properties, adverse effects, etc.)," and "clinical development (scientific tests carried out to examine the effects of pharmaceuticals and treatment techniques on human beings), obtain approval from the authorities, and then conduct "manufacture" and "sale, marketing, and post-marketing surveillance."

Although major pharmaceutical companies are propelling outsourcing to CROs at the stage of clinical development to make considerable amounts of research and development costs variable, they basically perform all of the above-mentioned processes internally.

Such a system has supported high profitability of pharmaceutical companies. The life science field, however, is currently advancing and becoming complicated and diverse at a rapid rate, and there is an increasing possibility that each company's unique drug discovery technology quickly become obsolete.

In addition, there are a myriad of cases where practical application of new drugs is given up before clinical development, regardless of costs and time spent from the stage of basic research, and therefore new drug is not established in the end. In other words, pharmaceutical development is facing high risks at all times.

Accordingly, Solasia Pharma does not conduct the processes from basic research to nonclinical development on its own which has high failure rate. By in-licensing promising pharmaceuticals that are still under development from outside companies, it embarks on development starting from clinical development. It utilizes its strength and reduces risk by focusing management resources on the business activities subsequent to the development stage.

At the moment, it plans not to do manufacturing due to the large cost burden.

Regarding the sales and marketing structure, the company has set up a system that takes into account the balance between high profitability and risk control.

In general, pharmaceutical companies hold gross profit margins to high standards, which is considered to be attained by their in-house manufacture and sales activities.

Regarding the sales and marketing structure, the company has set up a system that takes into account the balance between high profitability and risk control.

In general, pharmaceutical companies hold gross profit margins to high standards, which is considered to be attained by their in-house manufacture and sales activities.

On the other hand, coverage of sales territories (e.g., to cover all over Japan) is required for pharmaceuticals, and therefore, a rise in fixed costs is inevitable for establishing a company's own sales network.

Accordingly, Solasia Pharma uses both "self-selling model" and "licensing-out model" (sales rights are granted to other companies for pharmaceuticals that have completed clinical development).

On the other hand, coverage of sales territories (e.g., to cover all over Japan) is required for pharmaceuticals, and therefore, a rise in fixed costs is inevitable for establishing a company's own sales network.

Accordingly, Solasia Pharma uses both "self-selling model" and "licensing-out model" (sales rights are granted to other companies for pharmaceuticals that have completed clinical development).

(Self-selling model)

Solasia Pharma will establish its own sales channels and sales structure in "Beijing, Shanghai, and Guangzhou," the 3 major cities in China.

Although the total population of the 3 cities accounts for only about 5% of the entire population of China, a number of large hospitals with advanced medicine which uses anticancer drugs are located in the above 3 cities, making them huge markets which account for 30% of the Chinese anticancer drug market.

Furthermore, whether new pharmaceuticals are used and popularized depends highly on judgment and decision made by influential doctors, and thus, it is extremely important to make sales activities targeting large hospitals where such influential doctors work.

In addition, such self-selling activities will be done not in a large scale throughout China but in a small scale in each of the 3 cities, which makes it possible to cover with a relatively small number of staff. Currently, the company is endeavoring to increase the number of sales staff to perform sales activities toward about 50 - 60 large hospitals.

(Licensing-out model)

The major partners to which Solasia Pharma has currently granted rights include the following 2 companies:

(Self-selling model)

Solasia Pharma will establish its own sales channels and sales structure in "Beijing, Shanghai, and Guangzhou," the 3 major cities in China.

Although the total population of the 3 cities accounts for only about 5% of the entire population of China, a number of large hospitals with advanced medicine which uses anticancer drugs are located in the above 3 cities, making them huge markets which account for 30% of the Chinese anticancer drug market.

Furthermore, whether new pharmaceuticals are used and popularized depends highly on judgment and decision made by influential doctors, and thus, it is extremely important to make sales activities targeting large hospitals where such influential doctors work.

In addition, such self-selling activities will be done not in a large scale throughout China but in a small scale in each of the 3 cities, which makes it possible to cover with a relatively small number of staff. Currently, the company is endeavoring to increase the number of sales staff to perform sales activities toward about 50 - 60 large hospitals.

(Licensing-out model)

The major partners to which Solasia Pharma has currently granted rights include the following 2 companies:

Solasia Pharma plans to create licensing-out partnerships with a focus on mid-sized pharmaceutical companies which it can fall in line easily and forge win-win relationships.

(2) Products/Development pipeline

Solasia Pharma currently owns the following 4 products/development pipelines in accordance with the above-mentioned management policy:

History of development pipeline and operationalization, current situation and future projection are as follows. (As of August 2018)

Solasia Pharma plans to create licensing-out partnerships with a focus on mid-sized pharmaceutical companies which it can fall in line easily and forge win-win relationships.

(2) Products/Development pipeline

Solasia Pharma currently owns the following 4 products/development pipelines in accordance with the above-mentioned management policy:

History of development pipeline and operationalization, current situation and future projection are as follows. (As of August 2018)

(Overview of indications)

Nausea and vomiting are widely known as typical side effects caused by anticancer drug.

Administration of anticancer drug damage cells called Chromaffin cells in the small intestine.

The damaged Chromaffin cells produce serotonin, a neurotransmitter, which is taken in by the 5-HT3 receptors in the peripheral vagus nerve. This stimulus is transmitted through the peripheral vagus nerve to the medulla oblongata via the chemoreceptor trigger zone (CTZ) in the area postrema of the fourth ventricle of the brain, stimulating the vomiting center which gives living organisms commands to develop nausea and vomiting, and then symptoms of nausea and vomiting appear.

It is necessary to disrupt the stimuli generated by serotonin to the 5-HT3 receptors in order to control nausea and vomiting. There are a variety of "5-HT3 receptor antagonists" which are drugs used for the above purpose, and one of the representative agent is Granisetron.

(Overview of "SP-01")

"SP-01" is a transdermal 5-HT3 receptor antagonist containing Granisetron and is the world's only patch-type antagonist.

(Overview of indications)

Nausea and vomiting are widely known as typical side effects caused by anticancer drug.

Administration of anticancer drug damage cells called Chromaffin cells in the small intestine.

The damaged Chromaffin cells produce serotonin, a neurotransmitter, which is taken in by the 5-HT3 receptors in the peripheral vagus nerve. This stimulus is transmitted through the peripheral vagus nerve to the medulla oblongata via the chemoreceptor trigger zone (CTZ) in the area postrema of the fourth ventricle of the brain, stimulating the vomiting center which gives living organisms commands to develop nausea and vomiting, and then symptoms of nausea and vomiting appear.

It is necessary to disrupt the stimuli generated by serotonin to the 5-HT3 receptors in order to control nausea and vomiting. There are a variety of "5-HT3 receptor antagonists" which are drugs used for the above purpose, and one of the representative agent is Granisetron.

(Overview of "SP-01")

"SP-01" is a transdermal 5-HT3 receptor antagonist containing Granisetron and is the world's only patch-type antagonist.

Anticancer drugs are administered over 5 days in most cases, but injections and oral antiemetic agents are effective only for about 1 to 2 days and must be injected multiple times within the anticancer drug administration period. On the other hand, "SP-01" maintains the concentration level of Granisetron in blood on a stable basis for 5 days. Therefore, once a patch of "SP-01" is attached, there is no need to add antiemetics, which enables cancer treatment not through hospitalization but through outpatient care, and contributes significantly to the improvement of patients' quality of life.

Another advantage is that transdermal type drugs can be administered even to patients who are facing difficulty in taking oral medicines due to various symptoms including nausea, vomiting, and stomatitis. Earning reputation for the above-mentioned advantages, "SP-01" is recommended for prescription in the American NCCN clinical practice guidelines and the Chinese clinical practice guidelines.

(Current situation of development and commercialization)

Development Areas where "SP-01" has currently been launched or approved include America, the United Kingdom, Germany, Italy, the Netherlands, Denmark, Finland, Norway, Sweden, Kuwait, Lebanon, Qatar, Bahrain, the United Arab Emirates, Saudi Arabia, South Korea, the Philippines (sold by originators and others), as well as Taiwan, Hong Kong, Singapore and Macau(sold by a sublicensee, Kyowa Hakko Kirin Co., Ltd.).

Solasia Pharma is planning potential extension of indication of "SP-01" from current CINV (Chemotherapy Induced Nausea and Vomiting) to RINV (Radiotherapy Induced Nausea and Vomiting).

In China, the company finalized their application for approval in June 2014, and obtained approval in July 2018, along with permission to import drug license.

After obtaining approval for SP-01, the company adopted a sales manager and has been promoting the development of the sales marketing structure in order to maximize profit; that is to say, an independent sales structure managed by approximately 30 MRs in the large cities of Beijing, Shanghai, and Guangzhou.

Using the characteristics and advantages to the competitive drugs listed above, the company aims to increase a share in the CINV market in China (said to be worth roughly 75-80 billion yen) through two-way sales activities, by providing knowledge to the physician, and by approaching top-level doctors (also called Key Opinion Leaders).

Anticancer drugs are administered over 5 days in most cases, but injections and oral antiemetic agents are effective only for about 1 to 2 days and must be injected multiple times within the anticancer drug administration period. On the other hand, "SP-01" maintains the concentration level of Granisetron in blood on a stable basis for 5 days. Therefore, once a patch of "SP-01" is attached, there is no need to add antiemetics, which enables cancer treatment not through hospitalization but through outpatient care, and contributes significantly to the improvement of patients' quality of life.

Another advantage is that transdermal type drugs can be administered even to patients who are facing difficulty in taking oral medicines due to various symptoms including nausea, vomiting, and stomatitis. Earning reputation for the above-mentioned advantages, "SP-01" is recommended for prescription in the American NCCN clinical practice guidelines and the Chinese clinical practice guidelines.

(Current situation of development and commercialization)

Development Areas where "SP-01" has currently been launched or approved include America, the United Kingdom, Germany, Italy, the Netherlands, Denmark, Finland, Norway, Sweden, Kuwait, Lebanon, Qatar, Bahrain, the United Arab Emirates, Saudi Arabia, South Korea, the Philippines (sold by originators and others), as well as Taiwan, Hong Kong, Singapore and Macau(sold by a sublicensee, Kyowa Hakko Kirin Co., Ltd.).

Solasia Pharma is planning potential extension of indication of "SP-01" from current CINV (Chemotherapy Induced Nausea and Vomiting) to RINV (Radiotherapy Induced Nausea and Vomiting).

In China, the company finalized their application for approval in June 2014, and obtained approval in July 2018, along with permission to import drug license.

After obtaining approval for SP-01, the company adopted a sales manager and has been promoting the development of the sales marketing structure in order to maximize profit; that is to say, an independent sales structure managed by approximately 30 MRs in the large cities of Beijing, Shanghai, and Guangzhou.

Using the characteristics and advantages to the competitive drugs listed above, the company aims to increase a share in the CINV market in China (said to be worth roughly 75-80 billion yen) through two-way sales activities, by providing knowledge to the physician, and by approaching top-level doctors (also called Key Opinion Leaders).

(Overview of indications)

Malignant lymphoma is one type of hematologic cancer where lymphocytes in white blood cells become cancerous.

The types of lymphocytes include B cells, T cells, and NK cells, and when these cells become cancerous and continues uncontrolled growth, malignant lymphoma develops.

Peripheral T-cell lymphoma (PTCL) is one kind of malignant lymphoma which arises from T cells in lymphocytes and is categorized into the "intermediate-grade lymphoma" where the disease progresses monthly, and it is said to account for 10 - 15% of the intermediate-grade lymphoma. The five-year survival rate from malignant lymphoma is lower than that from B-cell lymphoma, with the ratio being around 25%.

(Current situation of development and commercialization)

The development of "SP-02" started aiming for recurring/intractable peripheral T-cell lymphoma (PTCL) indication as mentioned above. There are already results showed that injections were administered to 187 subjects in the U.S., Japan and Korea by October 2015.

The early second phase clinical trials in the U.S. were completed in April, 2012 and have shown certain efficacy in Caucasians.

In the first phase clinical trial completed in April 2015 in Japan and Korea, safety and tolerability of the drug were confirmed, with certain efficacy in Asians suggested.

The global phase II clinical trial, which is to be the final trial, was started in 2016 in Japan, Korea, Taiwan, and Hong Kong and is currently in progress for 65 patients (as planned) with peripheral T-cell lymphoma. The trial will close by the end of 2018, and Solasia Pharma plans to announce the results in 2019. If the results are promising, they intend to submit an application for approval to the authorities.

In China, the second and third phase clinical trial, which is the final trial, is in preparation.

It is known that malignant lymphoma often relapses. Accordingly, Solasia Pharma believes that multiple medicines with different mechanisms of action are necessary and the market scale is significant.

In addition, the company is aiming to extend indication of "SP-02" not only to peripheral T-cell lymphoma but also to other hematologic cancers (lymphoma, leukemia) and solid carcinoma and planning to start development in or after 2019.

The company has already out-licensed the development and sales rights in Japan to Meiji Seika Pharma, and is discussing to which companies in the United States, Europe, and China it should out-license the rights.

In August 2018, the company out-licensed the exclusive commercialization rights of "SP-02: darinaparsin" in Columbia, Peru, Ecuador, Venezuela, Chile, Panama, Costa Rica and Guatemala to the Colombia-based company HB Human BioScience SAS.

(Overview of indications)

Malignant lymphoma is one type of hematologic cancer where lymphocytes in white blood cells become cancerous.

The types of lymphocytes include B cells, T cells, and NK cells, and when these cells become cancerous and continues uncontrolled growth, malignant lymphoma develops.

Peripheral T-cell lymphoma (PTCL) is one kind of malignant lymphoma which arises from T cells in lymphocytes and is categorized into the "intermediate-grade lymphoma" where the disease progresses monthly, and it is said to account for 10 - 15% of the intermediate-grade lymphoma. The five-year survival rate from malignant lymphoma is lower than that from B-cell lymphoma, with the ratio being around 25%.

(Current situation of development and commercialization)

The development of "SP-02" started aiming for recurring/intractable peripheral T-cell lymphoma (PTCL) indication as mentioned above. There are already results showed that injections were administered to 187 subjects in the U.S., Japan and Korea by October 2015.

The early second phase clinical trials in the U.S. were completed in April, 2012 and have shown certain efficacy in Caucasians.

In the first phase clinical trial completed in April 2015 in Japan and Korea, safety and tolerability of the drug were confirmed, with certain efficacy in Asians suggested.

The global phase II clinical trial, which is to be the final trial, was started in 2016 in Japan, Korea, Taiwan, and Hong Kong and is currently in progress for 65 patients (as planned) with peripheral T-cell lymphoma. The trial will close by the end of 2018, and Solasia Pharma plans to announce the results in 2019. If the results are promising, they intend to submit an application for approval to the authorities.

In China, the second and third phase clinical trial, which is the final trial, is in preparation.

It is known that malignant lymphoma often relapses. Accordingly, Solasia Pharma believes that multiple medicines with different mechanisms of action are necessary and the market scale is significant.

In addition, the company is aiming to extend indication of "SP-02" not only to peripheral T-cell lymphoma but also to other hematologic cancers (lymphoma, leukemia) and solid carcinoma and planning to start development in or after 2019.

The company has already out-licensed the development and sales rights in Japan to Meiji Seika Pharma, and is discussing to which companies in the United States, Europe, and China it should out-license the rights.

In August 2018, the company out-licensed the exclusive commercialization rights of "SP-02: darinaparsin" in Columbia, Peru, Ecuador, Venezuela, Chile, Panama, Costa Rica and Guatemala to the Colombia-based company HB Human BioScience SAS.

(Overview of indications)

In addition to nausea and vomiting due to anticancer agents, oral mucositis are also serious side effects caused by chemotherapy or radiotherapy.

Stomatitis can be divided into 2 types: the primary stomatitis, which is "stomatitis caused by chemotherapy directly affecting the oral mucosa" or "stomatitis resulted from local infection due to the salivary gland tissue disorder and deterioration of intraoral self-cleansing action because of impaired saliva secretion attributed to radiation exposure" and the secondary stomatitis, which is "attributed to intraoral infection due to myelosuppression resulting from a decline in the number of white blood cells."

The incident rate of stomatitis developing during treatment using anticancer drugs is 30-40%, and that of stomatitis developing during anticancer drug treatment provided together with radiotherapy to the head and neck is nearly 100%.

Stomatitis occurs together with 300-500 inflammations arising in the course of chemotherapy or radiotherapy. The pain makes oral intake of food and water by patients difficult, which results in a decrease in physical strength. In case the symptom is severe, it will adversely affect or halt the progress of cancer treatment. Up until now, the majority of hospitals conducted palliative treatment.

(Overview of "SP-03")

"SP-03" is a lipid-based liquid, which is dropped and applied on the oral mucosa, which the company has been developing under the category of medical device.

(Overview of indications)

In addition to nausea and vomiting due to anticancer agents, oral mucositis are also serious side effects caused by chemotherapy or radiotherapy.

Stomatitis can be divided into 2 types: the primary stomatitis, which is "stomatitis caused by chemotherapy directly affecting the oral mucosa" or "stomatitis resulted from local infection due to the salivary gland tissue disorder and deterioration of intraoral self-cleansing action because of impaired saliva secretion attributed to radiation exposure" and the secondary stomatitis, which is "attributed to intraoral infection due to myelosuppression resulting from a decline in the number of white blood cells."

The incident rate of stomatitis developing during treatment using anticancer drugs is 30-40%, and that of stomatitis developing during anticancer drug treatment provided together with radiotherapy to the head and neck is nearly 100%.

Stomatitis occurs together with 300-500 inflammations arising in the course of chemotherapy or radiotherapy. The pain makes oral intake of food and water by patients difficult, which results in a decrease in physical strength. In case the symptom is severe, it will adversely affect or halt the progress of cancer treatment. Up until now, the majority of hospitals conducted palliative treatment.

(Overview of "SP-03")

"SP-03" is a lipid-based liquid, which is dropped and applied on the oral mucosa, which the company has been developing under the category of medical device.

In a few minutes after application of a proper dose to the oral mucosa, the liquid absorbs the water in the oral cavity and transforms to a bioadhesive gel which mechanically protects the affected area. The effect of mitigating the pain of stomatitis has been clinically shown to last for 8 hours.

(Current situation of development and commercialization)

Solasia Pharma submitted an application for approval in Japan in 2016 and obtained an approval of "SP-03" as new medical device in Japan by the Ministry of Health, Labour and Welfare on July 6, 2017. In January 2018, SP-03 was approved at the 388th general meeting of the Central Social Insurance Medical Council for being covered by insurance, starting in April 2018. Following reimbursement listing, in May 2018, it was launched by Meiji Seika Pharma, which is the licensee who holds the exclusive sales rights of "SP-03" in Japan.

The company submitted the New Medical Device Application to the authorities in May 2016 in China, and is planning to obtain the approval of SP-03 within 2018, and launch SP-03 after approval.

Solasia Pharma is selling "SP-03" by itself in Beijing, Shanghai and Guangzhou, while in other regions in China, the sales right has been out-licensed to Lee's Pharmaceutical.

In August 2018, the company signed a contract with Camurus AB in which they were granted exclusive development and sales rights for "SP-03" in Korea.

In other regions than Japan, which include the United States, United Kingdom, Germany, Denmark, Norway, Sweden, and France, SP-03 has been sold by other companies and the originator.

In a few minutes after application of a proper dose to the oral mucosa, the liquid absorbs the water in the oral cavity and transforms to a bioadhesive gel which mechanically protects the affected area. The effect of mitigating the pain of stomatitis has been clinically shown to last for 8 hours.

(Current situation of development and commercialization)

Solasia Pharma submitted an application for approval in Japan in 2016 and obtained an approval of "SP-03" as new medical device in Japan by the Ministry of Health, Labour and Welfare on July 6, 2017. In January 2018, SP-03 was approved at the 388th general meeting of the Central Social Insurance Medical Council for being covered by insurance, starting in April 2018. Following reimbursement listing, in May 2018, it was launched by Meiji Seika Pharma, which is the licensee who holds the exclusive sales rights of "SP-03" in Japan.

The company submitted the New Medical Device Application to the authorities in May 2016 in China, and is planning to obtain the approval of SP-03 within 2018, and launch SP-03 after approval.

Solasia Pharma is selling "SP-03" by itself in Beijing, Shanghai and Guangzhou, while in other regions in China, the sales right has been out-licensed to Lee's Pharmaceutical.

In August 2018, the company signed a contract with Camurus AB in which they were granted exclusive development and sales rights for "SP-03" in Korea.

In other regions than Japan, which include the United States, United Kingdom, Germany, Denmark, Norway, Sweden, and France, SP-03 has been sold by other companies and the originator.

While steady progress in general was being made in development of the three preceding products, the company, which had been considering in-licensing the fourth pipeline since it became listed, sought for a new drug that satisfies the following three criteria: "it is aimed for the oncology," "certain progress has been made in clinical trials," and "the company can gain the development right both in Japan and in China." Then, in November 2017, the company was granted the exclusive rights to development and commercialization of "PledOx®," a drug for treating CIPN, in Japan, China, South Korea, Taiwan, Hong Kong, and Macau by PledPharma AB (hereinafter referred to as "PledPharma") of Sweden. Aiming to obtain the approval as early as possible, the company will forge ahead with clinical development in Eastern Asia, such as Japan and China, with an initial focus on peripheral neuropathy caused by administering "oxaliplatin," a typical anticancer drug for treatment of colorectal cancer.

(Overview of indications)

Chemotherapy-induced side effects occur not only nausea and vomiting, and oral mucositis, but also peripheral neuropathy. It is known that peripheral neuropathy is caused pronouncedly by major drugs for chemotherapy, such as platinum- and taxane-containing drugs.

The FOLFOX treatment, which is a typical medical treatment in chemotherapy and adjuvant chemotherapy against advanced and recurrent colorectal cancer (stage III and IV) that is difficult to cure by surgery, uses three drugs, including fluorouracil, folinic acid, and oxaliplatin. About 90% of patients have reported that prescription of oxaliplatin caused peripheral neuropathy accompanied by the following symptoms: "dysesthesia on hands and feet, parts around the lips, and others," "tightness in the pharynx and larynx accompanied by difficulty in breathing and dysphagia," "numbness of hands and feet," "hypoesthesia," and "sensory ataxia."

If these side effects appear, by suspension of administering the drugs, some of the symptoms are alleviated in 80% of the cases and completely recovered in 6 to 8 months in 40% of the case; however, as discontinuation of administration of the drugs may mean suspension of cancer chemotherapy and change in the treatment policy, treatment of peripheral neuropathy is one of the crucial medical issues. There is currently no approved drug to prevent or treat CIPN.

(Overview of "SP-04")

PledPharma, the originator of "SP-04: PledOx®" is listed on Stockholm Stock Exchange and has strengths in development of pharmaceuticals against oxidative stress-related diseases.

"PledOx®" (commonly known as Calmangafodipir) is a new active ingredient created based on "Mangafodipir," an MRI contrast medium, which had sold in the United States and Europe.

As described later, "SP-04:PledOx®" is a drug for treatment of peripheral neuropathy with the most forward progress as the phase IIb study was completed and the global phase III study is scheduled. Success in its development will not only bring considerable first-mover advantage but also make enormous social contributions, such as improvement of cancer patients' quality of life (QOL).

*Marketability

According to Solasia Pharma, the number of colorectal cancer patients who undergo the FOLFOX treatment is estimated to be around 60,000 - 100,000 in Japan and about 200,000 in China per year.

The FOLFOX treatment is made up with a treatment cycle that continues for 14 days in total, including "3 days for medical care and 11 days as a washout period," and patients are required to repeat the cycle 12 times.

Although the indication which the FOLFOX treatment is aimed at is colorectal cancer whose patients receive cancer chemotherapy, including administration of oxaliplatin, it is known that peripheral neuropathy is caused conspicuously by other major pharmaceuticals used in cancer chemotherapy, such as platinum- and taxane-containing drugs. The company expects that, if other solid cancers than colorectal cancer, such as breast, lung, ovarian, and pancreatic cancers, are added to the indication, the marketability will become higher.

(Current situation of development and commercialization)

PledPharma has carried out research and development of PledOx® against peripheral neuropathy in the United States and Europe and it has been suggested, based on the results of the phase II study and the preceding trials, that PledOx® is effective and safe in advanced colorectal cancer patients who are receiving the FOLFOX treatment; in other words, it improves peripheral neuropathy and does not influence the cancer treatment using the FOLFOX treatment. Upon consideration of out-licensing "SP-04" to Japan, PledPharma was convinced of the necessity to hold study involving Japanese, therefore, it conducted the phase I study of PledOx® in the United States with Japanese as the subjects. The trial was closed in Feb. 2018, and excellent safety and tolerability of SP-04 in Japanese has been confirmed.

Solasia Pharma is intended to take over subsequent study together with the results of other research and development done by PledPharma; therefore, it will embark on the next phase study in this term based on the results of the phase I study. Although discussion as to pharmacokinetic properties is also included in the objectives of the trial, such properties are currently being analyzed.

Meanwhile, PledPharma has announced that it will, in the second half (July to Dec.) of 2018, start the enrollment of the global phase III study finalized the design which consulted with the Food and Drug Administration (FDA) and European Medicines Agency (EMA).

Solasia Pharma, which closed the phase I study of Japanese, is considering participating into the global phase III study subject to the consultation with the Japanese authorities.

Based on the consultation with the Pharmaceuticals and Medical Devices Agency (PMDA) in June 2018, SP-04 was permitted to participate into the global study in Japan, Korea, Taiwan, and Hong Kong.

While steady progress in general was being made in development of the three preceding products, the company, which had been considering in-licensing the fourth pipeline since it became listed, sought for a new drug that satisfies the following three criteria: "it is aimed for the oncology," "certain progress has been made in clinical trials," and "the company can gain the development right both in Japan and in China." Then, in November 2017, the company was granted the exclusive rights to development and commercialization of "PledOx®," a drug for treating CIPN, in Japan, China, South Korea, Taiwan, Hong Kong, and Macau by PledPharma AB (hereinafter referred to as "PledPharma") of Sweden. Aiming to obtain the approval as early as possible, the company will forge ahead with clinical development in Eastern Asia, such as Japan and China, with an initial focus on peripheral neuropathy caused by administering "oxaliplatin," a typical anticancer drug for treatment of colorectal cancer.

(Overview of indications)

Chemotherapy-induced side effects occur not only nausea and vomiting, and oral mucositis, but also peripheral neuropathy. It is known that peripheral neuropathy is caused pronouncedly by major drugs for chemotherapy, such as platinum- and taxane-containing drugs.

The FOLFOX treatment, which is a typical medical treatment in chemotherapy and adjuvant chemotherapy against advanced and recurrent colorectal cancer (stage III and IV) that is difficult to cure by surgery, uses three drugs, including fluorouracil, folinic acid, and oxaliplatin. About 90% of patients have reported that prescription of oxaliplatin caused peripheral neuropathy accompanied by the following symptoms: "dysesthesia on hands and feet, parts around the lips, and others," "tightness in the pharynx and larynx accompanied by difficulty in breathing and dysphagia," "numbness of hands and feet," "hypoesthesia," and "sensory ataxia."

If these side effects appear, by suspension of administering the drugs, some of the symptoms are alleviated in 80% of the cases and completely recovered in 6 to 8 months in 40% of the case; however, as discontinuation of administration of the drugs may mean suspension of cancer chemotherapy and change in the treatment policy, treatment of peripheral neuropathy is one of the crucial medical issues. There is currently no approved drug to prevent or treat CIPN.

(Overview of "SP-04")

PledPharma, the originator of "SP-04: PledOx®" is listed on Stockholm Stock Exchange and has strengths in development of pharmaceuticals against oxidative stress-related diseases.

"PledOx®" (commonly known as Calmangafodipir) is a new active ingredient created based on "Mangafodipir," an MRI contrast medium, which had sold in the United States and Europe.

As described later, "SP-04:PledOx®" is a drug for treatment of peripheral neuropathy with the most forward progress as the phase IIb study was completed and the global phase III study is scheduled. Success in its development will not only bring considerable first-mover advantage but also make enormous social contributions, such as improvement of cancer patients' quality of life (QOL).

*Marketability

According to Solasia Pharma, the number of colorectal cancer patients who undergo the FOLFOX treatment is estimated to be around 60,000 - 100,000 in Japan and about 200,000 in China per year.

The FOLFOX treatment is made up with a treatment cycle that continues for 14 days in total, including "3 days for medical care and 11 days as a washout period," and patients are required to repeat the cycle 12 times.