Bridge Report:(4597)Solasia Pharma second quarter of the Fiscal Year ending December 2022

President Yoshihiro Arai | Solasia Pharma K.K. (4597) |

|

Company Information

Market | TSE Growth Market |

Industry | Pharmaceutical products (manufacturing) |

President | Yoshihiro Arai |

HQ Address | 4F SUMITOMO FUDOSAN SHIBA-KOEN TOWER, 2-11-1, Shiba-koen, Minato-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding (End of term) | Total Market Cap | ROE Act. | Trading Unit | |

¥56 | 150,092,310 shares | ¥8,405 million | -79.4% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR |

¥0.00 | - | ¥-8.02 | - | ¥17.31 | 3.2x |

*The share price is the closing price on September, 20. Number of shares outstanding, DPS, EPS, and BPS are taken from the brief financial report for the second quarter of FY December 2022. EPS represents the lower limit of the forecasted range. ROE are based on actual results of the previous term end.

Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

December 2018 Act. | 318 | -2,420 | -2,445 | -2,422 | -25.98 | 0.00 |

December 2019 Act. | 1,310 | -1,762 | -1,797 | -1,867 | -17.75 | 0.00 |

December 2020 Act. | 454 | -4,116 | -4,159 | -4,127 | -35.16 | 0.00 |

December 2021 Act. | 559 | -2,419 | -2,442 | -2,478 | -19.04 | 0.00 |

December 2022 Est. | 2,300 ~3,800 | -1,100 ~150 | -1,100 ~150 | -1,200 ~50 | -8.02 ~0.33 | 0.00 |

* The forecast is from the company. IFRS application. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines Solasia Pharma’s second quarter of the Fiscal Year ending December 2022 earnings results etc.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year Ending December 2022 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts and Future Goals

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In 2Q of FY December 2022, sales revenue decreased 88 million yen year on year to 189 million yen. It is composed of mainly revenues from product sales of "Sancuso® (SP-01)" and "Episil® (SP-03).” R&D expenses decreased 269 million yen year on year to 347 million yen, mainly due to expenses related to the marketing approval of DARVIAS® (SP-02) and clinical development investment in the final phase III clinical trial of arfolitixorin (SP-05). SG&A expenses increased 142 million yen year on year to 1,008 million yen. The increase was due in part to one-time expenses related to the dissolution of the China-based sales system. Among SG&A expenses, amortization expenses amounted to 219 million yen for intangible assets for Sancuso® (SP-01) and Episil® (SP-03), etc. As a result, operating loss decreased 133 million yen year on year to 1,228 million yen.

- There is no change for the FY 2022 earnings forecasts. Sales revenue is expected to be around 2.3 to 3.8 billion yen, and operating profit is forecasted to range from a loss of 1.1 billion yen to a profit of 150 million yen. The company's revenue is expected to include the sales revenue of Sancuso® (SP-01) and episil® (SP-03), the sales revenue of darinaparsin (SP-02) and the revenue from the overseas licensing-out contracts, and the income from licensing out arfolitixorin (SP-05) in Japan.

- As initially expected, the company obtained manufacturing and marketing approval for "DARVIAS® (SP-02)" and started its sales in August. The company also concluded a capital and business alliance with Nippon Kayaku and procured a fund of approximately 1 billion yen. The company believes that it has gained a powerful partner in development and sales.

- On the other hand, the impact of the COVID-19 pandemic lockdown in China was significant, and the company dissolved its own sales system in three Chinese cities (Beijing, Shanghai, and Guangzhou) because it judged it necessary to cut costs in the face of lower-than-expected sales. The sales rights in the three cities were transferred to Lee's Pharmaceutical (HK) Limited, which had been responsible for sales outside the three cities. Solasia Pharma will supply Sancuso® (SP-01) and Episil® (SP-03) to Lees, which will be provided to all Chinese markets.

- In August 2022, reports on top-line results of a Phase III trial of arfolitixorin (SP-05) were released. Unfortunately, the ORR (overall response rate, primary endpoint) and PFS (progression-free survival, secondary endpoint) in the global data showed that the arfolitixorin combination group did not have statistically significant improvement compared to the standard therapy group.

- However, the company believes that there is a good chance for the practical application of arfolitixorin (SP-05). The company will work with Isofol to determine the results of additional analyses, including subgroup analysis focused on Japanese patients, updated PFS analysis, and OS analysis (overall survival). We will await the results of additional analysis because, if analysis results for Japanese patients are quickly revealed and good, there are possibilities to make contract for licensing-out and receive contract money during this term or the first half of the next term. We will also keep a close eye on the sales performance of "DARVIAS® (SP-02)," the third product to be commercialized as planned, and the progress of its out-licensing overseas.

1. Company Overview

As a specialty pharma* specializing in oncology, Solasia Pharma develops and sells medicines for cancer treatment and supportive care, etc. in Asia, mainly Japan and China, each of which has a promising market.

Its significant strengths and features are the development staff with abundant practical experience led by CEO Arai, high rate of successful development, the stable business foundation, feasibility of business model, and so on.

*Specialty Pharm A new drug developing enterprise possessing research and development capabilities which has a certain standard in its field of expertise, both domestically and internationally.

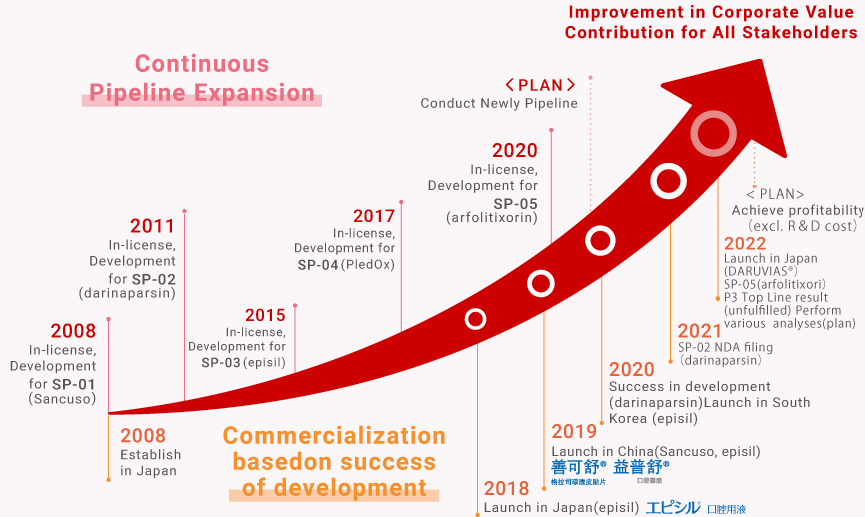

1-1 Corporate History

Its predecessor is Japan Bridge Inc., which was established as a foothold for preparing for the business of developing pharmaceutical products in the U.S. in December 2006 jointly by ITOCHU Corporation and MPM Capital, a U.S. venture capital specializing in bio business.

In May 2008, the company introduced the exclusive right to develop and sell the first product “Sancuso® (SP-01)” in Japan, Taiwan, Singapore, Malaysia, and China, including Hong Kong and Macau.

In September 2008, the company was renamed Solasia Pharma K.K.

Then, the company introduced the exclusive right to develop and sell “DARVIAS® (SP-02)” in the Asia-Pacific region (March 2011), introduced the exclusive right to develop and sell it around the world, including the U.S. and Europe (July 2014), and introduced the exclusive right to develop and sell “episil® (SP-03)” in Japan and China (March 2015), to enrich pipelines. The company also provided Kyowa Kirin Co., Ltd. with the exclusive license to develop and sell “Sancuso® (SP-01)” in Taiwan, Hong Kong, and so on. (February 2010), and provided Lee's Pharmaceutical (HK) Limited with the exclusive license to sell “Sancuso® (SP-01)” at the time of the conclusion of the contract in China (excluding Beijing, Shanghai, Guangzhou, Hong Kong, and Macau) . All these paved the way for monetization.

In 2016, the company applied for the approval for manufacturing and sales of medical apparatus for “episil® (SP-03)” in China and Japan, and provided Meiji Seika Pharma Co., Ltd. with the exclusive distributorship in Japan and provided Lee’s Pharmaceutical (HK) Limited with the exclusive distributorship at the time of the conclusion of the contract in China (excluding Beijing, Shanghai, and Guangzhou).

As the company was expected to grow as a pharmaceutical company specializing in cancer, it was listed in Mothers of Tokyo Stock Exchange in March 2017.

In November 2017, the company acquired the exclusive right to develop and sell for "PledOx® (SP-04)" in Japan, China, South Korea, Taiwan, Hong Kong, and Macau. In August 2020, it also introduced exclusive right to develop and sell for "arfolitixorin (SP-05)" in Japan, and currently has five pipeline products.

In May 2018, “episil® (SP-03)” was released in Japan, as the first product released by the company. Next, Sancuso® (SP-01) and Episil® (SP-03) were launched in China in 2019, followed by Episil® (SP-03) in South Korea in 2020, and DARVIAS® (SP-02) in Japan in August 2022, thus moving from the "development" stage to the "sales and commercialization" stage.

In April 2022, the company got listed on the Growth Market of the Tokyo Stock Exchange in accordance with market reorganization.

1-2 Corporate Philosophy・Management Philosophy

The company’s name, SOLASIA, is a coined word combining Sol (the Sun in Latin) and Asia (Asian counties). It represents the company’s mission which is to be the Sun brightening the future of various people facing many challenges of cancer in Japan and other Asian countries.

The management philosophy adopts the following mission, vision, and values.

Role to Fulfill (Mission) | *Better medicine for a brighter tomorrow |

Ideal Situation (Vision) | *To be recognized domestically and overseas and gain a high level of trust from all stakeholders. |

*To be recognized as a specialty pharma developing innovative medicine, where each employee possesses passion, ambition, and a sense of morality, strives to better themselves, maintains a high level of expertise, and continuously endeavors for new value and creation for the future. | |

*To meet the needs of people (medical practitioners and patients) who need our products and contribute to them. | |

Shared Values (Value) | *Create value for patients. |

*Have high ethical standards. | |

*Trust and respect each other. | |

*Work as a team. |

In addition, the following two points are listed as management policy.

① For the time being, we will continue the in-licensing of new products in cancer and rare disease field where major pharmaceutical companies do not emphasize from a performance-based approach and contribute to patients without adequate medication. |

② Through the commercialization of products, we will promptly establish the financial stability needed to realize our management philosophy, and secure independence. |

The company will focus on developing new drugs to solve unmet medical needs (medical needs for diseases for which no treatment has been developed), which is a niche market but has many troubled patients. As research and development is proceeding, they will have to rely on financing CF now, but they plan to make operating CF positive soon and build a strong basis to achieve continuous growth.

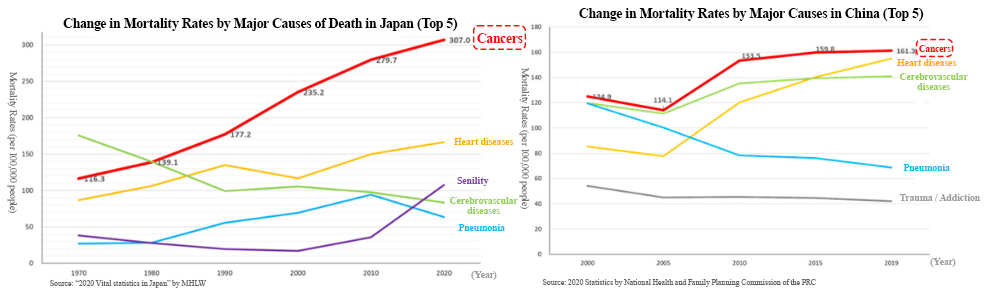

1-3 Environment Surrounding Solasia Pharma

According to “Vital Statistics, 2020” published by the Ministry of Health, Labour and Welfare, in 2020, the leading cause of death was malignant neoplasm (cancer), 307.0 per 100,000 people. In 1981, cancer overtook cerebrovascular diseases, the former number one cause of death, with the mortality rates from cancer being 142.0 and that from cerebrovascular diseases being 134.3. Since then, cancer has been the leading cause of death for the 30 consecutive years and keeps going up every year.

As it is said that the incidence rate of cancer is rising due to aging and changes in lifestyles including diet, the number of patients and deaths regarding cancer is rising in China as well.

(Source: Solasia Pharma)

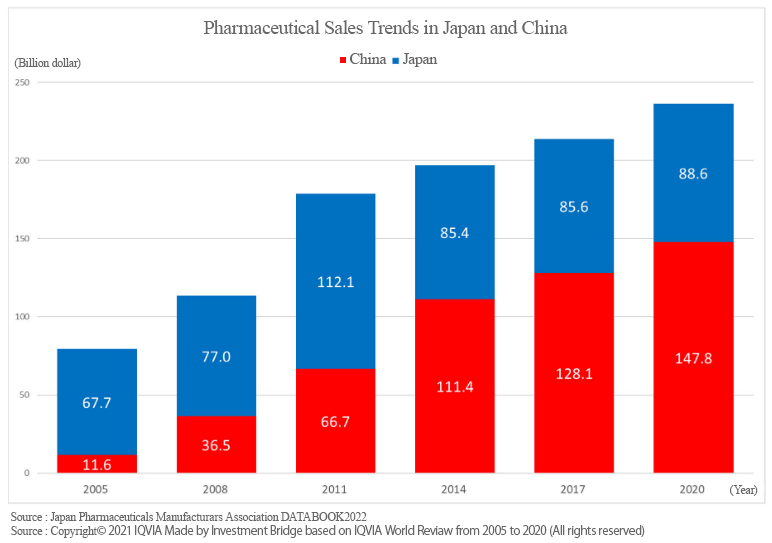

Amid such situation, the sales of the world’s pharmaceutical market in 2020 were 1,305.4 billion US dollars (approximately 170 trillion yen). The U.S. has the largest pharmaceutical market, followed by China, which overtook Japan in 2013, and Japan, which has the third largest market.

In the future, it is said that the market in China will expand to the point where it will share the top position with the U.S.

The total market size of China, the second biggest country, and Japan, the third biggest country, is 229.8 billion dollars (about 25 trillion yen). For the time being, this huge market will be the company’s main target.

(Source: Solasia Pharma)

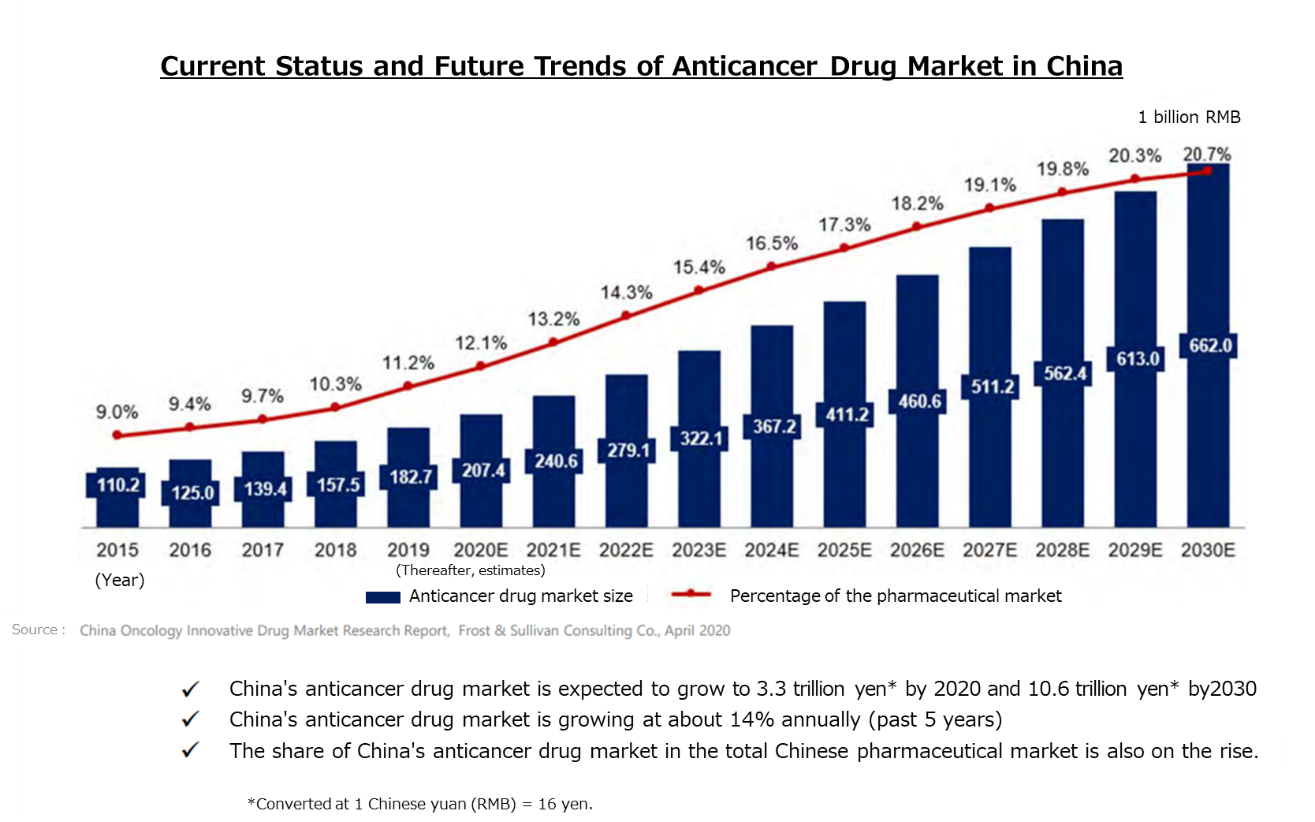

In addition, the anticancer drug market in China is over 3 trillion yen, accounting for more than 10% of the total pharmaceutical market, and it has grown at a CAGR of approximately 14% over the past five years.

(Source: Solasia Pharma)

As the mortality rates from cancer increases as shown above, expectations for “new anticancer drug” and “cancer supportive care” are growing all over the world.

(New anti-cancer drug)

In cancer treatment provided using anticancer drug, it is said that a majority of hospitals use the polytherapy which uses multiple anticancer more than the monotherapy which uses a single anticancer drug.

In addition, although it depends on cancer types, there is significant risk of relapses. Besides, in case of intractable cancers, it is difficult to cure such cancers only with a single treatment method, which means that a single medicine is not always an absolute cure, and therefore, other therapeutic medications will hardly be direct “competing products.” Molecular targeted drugs and immunotherapy have also attracted attention in recent years, however chemotherapeutic agents still hold an important position for treatment of many cancer types. Standard therapy involves a regimen containing a cytotoxic anticancer drug, for which a high medical demand is expected in the future as well.

(Cancer supportive care)

Anticancer drugs are potent medicine that attacks cancer cells, and side effects are inevitable.

If the side effects on patients cannot be controlled, anticancer therapy through drug administration must be stopped, which has a risk of resulting in cancer progression.

As a result, expectations for drugs and medical devices which control such side effects are increasing in order to avoid treatment discontinuation and complete cancer treatment. In addition, while therapeutic drugs for cancer must be approved for each cancer type, supportive care can be provided to a wide range of patients regardless of cancer types, which means that there will be strong needs and markets.

In summary, needs for cancer treatment in Japan and China are growing and there are great expectations for new anticancer drugs and cancer supportive care. Solasia Pharma is establishing business model and business strategy to incorporate such needs and boost earnings.

1-4 Business Description

(1) Business Model

Before the launch of new medicines, it is usual to go through the processes spanning from “basic research” to “pharmaceutical research,” “nonclinical development (trials conducted using animals to examine medicinal and pharmacological action, in-vivo pharmacokinetic properties, adverse effects, etc.),” and “clinical development (scientific trials carried out to examine the effects of pharmaceuticals and treatment techniques on human beings), obtain approval from the authorities, and then conduct “manufacture” and “sales, marketing, and post-marketing surveillance.”

Although major pharmaceutical companies are propelling outsourcing to CROs at the stage of clinical development to make considerable amounts of research and development costs variable, they basically perform all of the above-mentioned processes internally.

Such a system has supported high profitability of pharmaceutical companies. The life science field, however, is currently advancing and becoming complicated and diverse at a rapid rate, and there is an increasing possibility that each company’s unique drug discovery technology quickly becomes obsolete.

In addition, there are a myriad of cases where practical application of new drugs is given up before clinical development, regardless of costs and time spent from the stage of basic research, and therefore new drug is not established in the end. In other words, pharmaceutical development is facing high risks at all times.

Accordingly, Solasia Pharma does not conduct the processes from basic research to nonclinical development on its own which has high failure rate. By in-licensing promising pharmaceuticals that are still under development from outside companies, it embarks on development starting from clinical development. It utilizes its strength and reduces risk by focusing management resources on the business activities subsequent to the development stage. At the moment, it plans not to do manufacturing due to the large cost burden.

Regarding the sales and marketing structure, the company has set up a system that takes into account the balance between high profitability and risk control.

In general, pharmaceutical companies hold gross profit margins to high standards, which is considered to be attained by their in-house manufacture and sales activities.

| Sales Revenue | Gross Profit | Gross Profit Margin |

Astellas Pharma | 1,296,163 | 1,043,154 | 80.5% |

Daiichi Sankyo | 1,044,892 | 691,563 | 66.2% |

*Unit: million yen. The values are the results from FY March 2022.

On the other hand, coverage of sales territories (e.g., to cover all over Japan) is required for pharmaceuticals, and therefore, a rise in fixed costs is inevitable for establishing a company’s own sales network. Accordingly, Solasia Pharma uses “licensing-out model” (sales rights are granted to other companies for pharmaceuticals that have completed clinical development).

(Self-selling model)

The current major licensing-out partners are the following four companies.

Meiji Seika Pharma Co., Ltd. | *A pharmaceutical company of the Meiji Group. It is a specialty pharma in the fields of cancer, infections, and the central nervous system and has yielded sales results of multifarious products in the cancer field. *Japanese partner with the rights of “episil® (SP-03)” |

Nippon Kayaku Co., Ltd | *Founded in 1916. The company specializes in cancer-related products in the pharmaceutical business, handles everything from new drugs to biosimilars and generics, and provides medical institutions with highly reliable information necessary for anticancer drugs. *Japanese partner with the rights of DARVIAS® (SP-02) |

Lee’s Pharmaceutical (HK) Limited | *A Chinese pharmaceutical company listed on the Hong Kong market. It sells multiple pharmaceutical products in fields including the cancer field across China through about 30 bases. *Chinese partner with the rights of “Sancuso® (SP-01)” (excluding Beijing, Shanghai, and Guangzhou) *Chinese partner with the rights of “episil® (SP-03)” (excluding Beijing, Shanghai, and Guangzhou) |

Maruho Co., Ltd. | *A pharmaceutical company that was founded in 1915 and engages in the research, development, production, and sale of pharmaceutical products, etc. It is especially excellent in the dermatological field. |

Solasia Pharma plans to create licensing-out partnerships with a focus on mid-sized pharmaceutical companies which it can fall in line easily and forge win-win relationships.

(2) Marketing structure in China

The company, aiming to cultivate the huge Chinese pharmaceutical market, had initially planned to establish its own sales system in the three major Chinese cities of Beijing, Shanghai, and Guangzhou to maximize profits from product sales and control fixed costs, and develop a self-sales model. However, the impact of the urban lockdown for coping with the spread of COVID-19 was so great that the company decided to abandon the in-house sales model, judging that it would be difficult to achieve its earnings plan as expected.

Lee's Pharmaceutical (HK) Limited will sell Sancuso® (SP-01) and Episil® (SP-03) in Beijing, Shanghai, and Guangzhou.

Point : Highly regarded by Chinese medical community

The judgement and decision of influential physicians greatly affect the outcome of the use and distribution of new medicines, and China is no exception.

Under these circumstances, “Sancuso® (SP-01)” is already recommended as one of the standard treatments for nausea and vomiting in the Chinese version of the NCCN guidelines for cancer treatment, which is referenced in the clinical sites.

In addition, at Chinese Society of Clinical Oncology (CSCO), prominent clinicians who are leading the field of cancer treatment in China highly valued “Sancuso® (SP-01)” for its feature of easily suppressing nausea and vomiting in the entire chemotherapy process. In response to this, “Sancuso® (SP-01)” is listed as a standard antiemetic treatment option for cancer treatment in the first guideline for proper use of antiemetics issued by CSCO.

The company is receiving such a high rating because of the superior efficacy of “Sancuso® (SP-01)”. But it is obvious that the strong relationship with the Chinese clinical network that the management team had been building since their times with Roche is also playing a key role, and it is a major advantage of the company that other bio-ventures do not have.

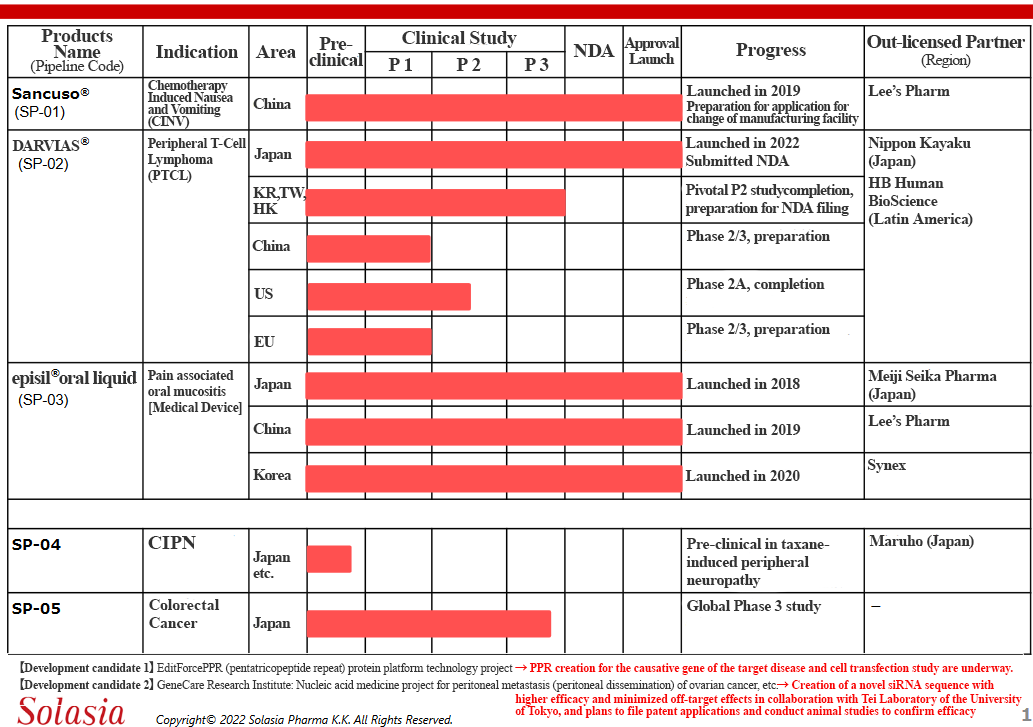

3) Products/Development Pipeline

Solasia Pharma currently owns the following 5 products/development pipelines in accordance with the above-mentioned management policy. (As of August 19, 2022)

In addition to SP-05 introduced in 2020, the company is striving to enrich pipelines. The target area is basically the cancer-related one, but the company will enhance the research function by the collaborative research with the alliance partners: EditForce and GeneCare Research Institute, in addition to the introduction from the outside, and aim to expand the target area.

(Source: Solasia Pharma)

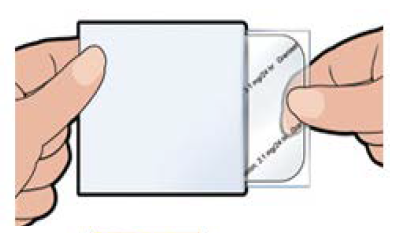

1) “SP-01: Transdermal Delivery System Sancuso®” (Sales name in Chin 善可舒®)

Item | Overview |

Efficacy/effect | Chemotherapy Induced Nausea and Vomiting (CINV) |

Characteristics/Strength compared with competitive drugs | *The world’s only transdermal patch type 5-HT3 receptor antagonist |

*The effect per administration (patch) lasts for 5 days, which covers the administration period of the general chemotherapy regimen (provided for 1 - 5 days). It can also be used for outpatients. | |

*In June 2019 (3 months after its launch), it was listed as a standard antiemetic treatment option for cancer treatment in the first guideline for proper use of antiemetics issued by CSCO. |

(※)CSCO(Chinese Society of Clinical Oncology) : The most prominent and largest academic conference related to cancer in China

◎ Overview of indications

Nausea and vomiting are widely known as typical side effects caused by anticancer drug.

Administration of anticancer drug damage cells called Chromaffin cells in the small intestine.

The damaged Chromaffin cells produce serotonin, a neurotransmitter, which is taken in by the 5-HT3 receptors in the peripheral vagus nerve. This stimulus is transmitted through the peripheral vagus nerve to the medulla oblongata via the chemoreceptor trigger zone (CTZ) in the area postrema of the fourth ventricle of the brain, stimulating the vomiting center which gives living organisms commands to develop nausea and vomiting, and then symptoms of nausea and vomiting appear.

It is necessary to disrupt the stimuli generated by serotonin to the 5-HT3 receptors in order to control nausea and vomiting. There are a variety of “5-HT3 receptor antagonists” which are drugs used for the above purpose, and one of the representative agents is Granisetron.

◎ Overview of “Sancuso® (SP-01)”

“Sancuso® (SP-01)” is a transdermal 5-HT3 receptor antagonist containing Granisetron and is the world’s only patch-type antagonist.

|

|

|

*Chinese package of Sancuso® |

|

|

(Source: Solasia Pharma)

Anticancer drugs are administered over 5 days in most cases, but injections and oral antiemetic agents are effective only for about 1 to 2 days and must be injected multiple times within the anticancer drug administration period. On the other hand, “Sancuso® (SP-01)” maintains the concentration level of Granisetron in blood on a stable basis for 5 days. Therefore, once a patch of “Sancuso® (SP-01)” is attached, there is no need to add antiemetics, which enables cancer treatment not through hospitalization but through outpatient care and contributes significantly to the improvement of patients’ quality of life.

Another advantage is that transdermal type drugs can be administered even to patients who are facing difficulty in taking oral medicines due to various symptoms including nausea, vomiting, and stomatitis. Earning reputation for the above-mentioned advantages, “Sancuso® (SP-01)” is recommended for prescription in the American NCCN clinical practice guidelines and the Chinese clinical practice guidelines.

◎ Current situation of development and commercialization

Currently, it has been released (distributed by other companies) in more than 20 countries and regions such as the U.S., Europe, and South Korea, etc. Solasia Pharma is planning potential extension of indication of “Sancuso® (SP-01)” from current CINV (Chemotherapy Induced Nausea and Vomiting) to RINV (Radiotherapy Induced Nausea and Vomiting).

In China, the company finalized their application for approval in June 2014, and obtained approval in July 2018, along with permission to import drug license. It received milestone payments in the third quarter of FY December 2018, and the sales revenue was recorded.

Thereafter, the manufacturing process for commercial products was established, and manufacturing the products for the first shipment completed. In November 2018, the company began shipping the products to the direct sales destination, ITOCHU Corporation, with which the company entered into a dealership contract for the Chinese market.

Then, the Chinese customs clearance procedures also completed, and sales began as planned in March 2019.

As mentioned above, Lee's Pharma, the marketing rights licensee, will conduct sales activities throughout China.

Evaluation comments from major Chinese clinicians

On March 16, 2019, the company held (co-sponsored) the “ Sancuso® China national launching meeting” in Shanghai.

The chairman of Chinese Society of Clinical Oncology (CSCO), Professor Li Jin, and the vice chairman, Professor Qin Shukui and Professor Ma Jun were chairmen of the meeting, a total of approximately 200 oncologists from all over China attended the meeting. At that meeting, Chinese key opinion leaders made remarks on “SP-01: Sancuso®” as follows.

Professor Qin Shukui (Vice Chairman of CSCO)

“Without any anti-emetic measures, 70%-80% of chemotherapy patients would experience CINV which would severely affect their quality of life. Often, patients will have to be treated with reduced dosage or even withdrawn from chemotherapy, with negative impacts on the treatment outcomes. The traditional CINV prevention methods are mainly short-term intravenous injection, which due to great fluctuation in blood concentration, requires repeated administration which is inconvenient for patients. With unique transdermal system, Sancuso® gradually releases granisetron into blood every day for up to 7 days. With one patch per one chemotherapy cycle, it is a new non-invasive treatment choice for chemotherapy patients.”

Professor Ma Jun (Vice Chairman of CSCO)

“The emetic risk in patients receiving HEC and MEC chemotherapy will continue for 2-3 days after last dose of chemotherapy. For multi-day chemotherapy, there is an overlap between acute and delayed vomiting, which requires more stable and long-lasting drug. Sancuso® covers different emetic stages including expected, acute and delayed nausea and vomiting. The 7 days stable efficacy makes the whole process CINV management possible and allows patients to feel at ease throughout the entire chemotherapy cycle.”

Professor Li Jin (Chairman of CSCO)

“The successful launching of Sancuso provides a long-lasting, stable and non-invasive new choice for the prevention of nausea and vomiting in Chinese chemotherapy patients. As a new choice for the prevention and treatment of chemotherapy related vomiting, with one patch, which is simple and easy, it makes CINV whole process management more convenient, it helps to standardize clinical treatment of CINV and further improves the treatment rate of CINV.”

CSCO’s first guideline for proper use of antiemetics was issued.

In June 2019, three months after Sancuso® (SP-01) was launched, CSCO issued the first guideline for proper use of antiemetics, and it was listed as a standard antiemetic treatment option for cancer treatment.

Prof. Qin Shukui, deputy director of CSCO and Guideline team leader, said, “This guideline recommends Sancuso® for an antiemetic treatment against highly and moderately emetogenic chemotherapy, providing a non-invasive and tolerable treatment option to cancer patients.”

The company plans to grow 6% on the basis of quantity and aims to increase share in China’s 5-HT3 RA antiemetic market, which is said to be 80 billion yen or more, through upper and lower streams of sales activities, including gaining recognition from the leading clinicians called Key Opinion Leaders on the characteristics of “Sancuso® (SP-01)” and its advantage over competitors and providing the information to clinicians.

2) “SP-02:novel chemotherapeutic agent DARVIAS® ”

Item | Overview |

Indication | Relapsed or Refractory Peripheral T-cell Lymphoma (PTCL) |

Characteristics/Strength compared with competitive drugs | *There are no approved drugs for PTCL indication in Europe (Other drugs are on the market in Japan and America). |

*Compared to the drugs approved in Japan and America, no severe side effect (myelosuppression, stomatitis) has been reported, which means that “SP-02” is highly safe and can be expected for a longer period of time of administration or co-administration. |

(Overview of indications)

Malignant lymphoma is one type of hematologic cancer where lymphocytes in white blood cells become cancerous.

The types of lymphocytes include B cells, T cells, and NK cells, and when these cells become cancerous and continues uncontrolled growth, malignant lymphoma develops.

Peripheral T-cell lymphoma (PTCL) is one kind of malignant lymphoma which arises from T cells in lymphocytes and is categorized into the “intermediate-grade lymphoma” where the disease progresses monthly, and it is said to account for 10-15% of the intermediate-grade lymphoma. The five-year survival rate from malignant lymphoma is lower than that from B-cell lymphoma, with the ratio being around 25%.

Estimated number of PTCL patients (Japan): Approximately 4,000/year*

(Current situation of development and commercialization)

The development of “ DARVIAS® (SP-02)” started aiming for recurring/intractable peripheral T-cell lymphoma (PTCL) indication as mentioned above.

The early second phase clinical trials in the U.S. were completed in April 2012 and have shown certain efficacy in Caucasians.

In the first phase clinical trial completed in April 2015 in Japan and Korea, safety and tolerability of the drug were confirmed, with certain efficacy in Asians suggested.

In addition, the international phase II study, which was started in Japan, South Korea, Taiwan, and Hong Kong in was completed in September 2019.

As originally planned, the trial results were announced in June 2020 following statistical analysis. In addition to meeting the requirements for the primary endpoint which is antitumor effect, no safety concerns were noted regarding secondary endpoints either. As positive results were achieved, the company applied for the approval for manufacturing and sales in Japan in June 2021 for the first time in the world.

On June 20, 2022, DARVIAS®, an anti-cancer agent/organic arsenic preparation, was approved for the treatment of relapsed or refractory peripheral T-cell lymphoma (PTCL) by the Japanese Ministry of Health, Labour and Welfare, and was launched on August 22 through its sales partner Nippon Kayaku after being listed in the NHI drug price list.

The company is planning to apply for approval in South Korea, Taiwan, and Hong Kong following the conclusion of a contract for offering the sales rights.

In China, phase II and III clinical trials, which are the final trials, as well as the licensing-out of the rights are under consideration. The phase II clinical trial was completed in the U.S. In Europe, preclinical trials have been completed, and the company is preparing for phase II and III clinical trials and is negotiating for licensing out the rights in each region. However, the licensing-out agreements are expected to be concluded after the drug is approved in Japan.

Solasia Pharma holds an exclusive worldwide license to develop and commercialize. For the Japanese market, Solasia has already derived an exclusive right to develop and sell to Nippon Kayaku and for Republic of Colombia, Peru, Ecuador, Venezuela, Chile, Panama, Costa Rica, and Guatemala, an exclusive right to sell etc. to the Colombian company HB Human BioScience SAS.

Licensing activities are continuing, including out-licensing in the U.S. and evaluation in Europe and India through the introduction of the Named Patient Program (a system whereby products that have already been approved and marketed can be imported at the discretion of patients and physicians).

It is known that malignant lymphoma often relapses. Accordingly, Solasia Pharma believes that multiple medicines with different mechanisms of action are necessary, and the market scale is significant.

In addition to seeking to expand the use of the drug by verifying and proposing synergistic effects when combined with other drugs for peripheral T-cell lymphoma, the company is also aiming to expand the indications to other hematologic cancers (ATLL (adult T-cell leukemia/lymphoma) and AML (acute myeloid leukemia)) and solid tumors, and is currently conducting non-clinical studies in parallel.

At the 79th Annual Meeting of the Japanese Cancer Association held in October 2020, the possibility that it will become a medicine against adult T-cell leukemia lymphoma (ATL) was suggested.

Future growth is expected as it is currently the only anticancer drug whose development has been completed among the pipelines of the company, which engages primarily in the development of anticancer drugs and cancer supportive care (drugs supporting cancer treatment, etc.).

3) “SP-03:episil® oral liquid”

Item | Overview |

Purpose of its use | Control and relief pain of oral mucositis caused by chemotherapy or radiotherapy – Medical Device |

Characteristics/Strength compared with competitors | *As there is no standard treatment for stomatitis caused by chemotherapy and radiotherapy, how to relieve the symptom relies on symptomatic treatment by each hospital. There is strong demand for new treatment. |

* “episil® (SP-03)” contains no pharmaceutical agent, so there is no side effect nor interaction with anticancer agents. |

(Overview of indications)

In addition to nausea and vomiting due to anticancer agents, oral mucositis are also serious side effects caused by chemotherapy or radiotherapy.

Stomatitis can be divided into 2 types: the primary stomatitis, which is “stomatitis caused by chemotherapy directly affecting the oral mucosa” or “stomatitis resulted from local infection due to the salivary gland tissue disorder and deterioration of intraoral self-cleansing action because of impaired saliva secretion attributed to radiation exposure” and the secondary stomatitis, which is “attributed to intraoral infection due to myelosuppression resulting from a decline in the number of white blood cells.”

The incident rate of stomatitis developing during treatment using anticancer drugs is 30-40%, and that of stomatitis developing during anticancer drug treatment provided together with radiotherapy to the head and neck is nearly 100%.

Stomatitis occurs together with 300-500 inflammations arising in the course of chemotherapy or radiotherapy. The pain makes oral intake of food and water by patients difficult, which results in a decrease in physical strength. In case the symptom is severe, it will adversely affect or halt the progress of cancer treatment. Up until now, there is no established standard treatment therefore the majority of hospitals conducted palliative treatment.

(Overview of “episil® (SP-03)”)

“ Episil® (SP-03)” is a lipid-based liquid, which is dropped and applied on the oral mucosa, which the company has been developing under the category of medical device.

(Source: Solasia Pharma)

In a few minutes after application of a proper dose to the oral mucosa, the liquid absorbs the water in the oral cavity and transforms to a bioadhesive gel which mechanically protects the affected area. The effect of mitigating the pain of stomatitis has been clinically shown to last for about 8 hours.

(Current situation of development and commercialization)

Solasia Pharma submitted an application for approval in Japan in 2016 and obtained an approval of “episil® (SP-03)” as new medical device in Japan by the Ministry of Health, Labour and Welfare on July 6, 2017. In January 2018, “episil® (SP-03)” was approved at the 388th general meeting of the Central Social Insurance Medical Council for being covered by insurance, starting in April 2018. Following reimbursement listing, 7,660 yen per bottle(10ml) as of October in 2019, in May 2018, it was launched by Meiji Seika Pharma, which is the licensee who holds the exclusive sales rights of “episil® (SP-03)” in Japan.

In China, the company applied for approval in May 2016 and obtained the approval to import and sell medical equipment in February 2019. It began sales of the products in July 2019.

As mentioned above, Lee's Pharma, the sales right licensee, is conducting sales activities throughout China.

In May 2021, episil® (SP-03) was included in the Expert Guidelines on the Diagnosis and Prevention of Acute Oral Mucositis Caused by Antineoplastic Therapy newly published by Chinese Society of Clinical Oncology (CSCO), and recommended as a new treatment option.

This Guideline is regarded as having “increased the attention of clinical oncologists to oral mucositis and standardized the treatment of oral mucositis in antitumor therapy, which is of great significance,” and as episil® (SP-03) was specifically featured, the company anticipates that this will give momentum to sales promotion in China.

Due to the product characteristics of “episil® (SP-03),” the company will “create a market” instead of entering into the existing market.

The market is estimated to be 20 to 30 billion yen in Japan and China, and the company is aiming to acquire a 30-50% market share.

In South Korea, the company concluded a contract for introducing the exclusive right to develop and sell the medical device in South Korea with Camurus AB, which is the licensing-out company, in August 2018, applied for approval to authorities in March 2019, and acquired the approval for import and sale of medical device in South Korea in October 2019. In January 2020, the company concluded a contract for exclusive dealership with Synex Consulting Ltd. as a sales partner in South Korea.

In September 2020, the sales started as initially planned.

In addition, despite a temporary disagreement with Camurus AB regarding product supply, the company acquired worldwide business rights, including manufacturing rights, in July 2022. The business transfer is scheduled to be completed in 2024.

For the time being, the company will focus on supplying products in Japan, China, and Korea. Solasia Pharma plans to determine its commercialization policy for regions other than Japan, China, and South Korea by the end of the business transfer.

With the acquisition of manufacturing rights, Solasia Pharma has begun evaluating the possibility of reducing product procurement costs by, for example, changing the location of the manufacturing facility from Sweden to Japan and purchasing directly from the manufacturer.

4) “SP-04: Intracellular superoxide scavenger PledOx®”

Item | Overview |

Indication | Chemotherapy induced peripheral neuropathy (CIPN) |

Characteristics/Strength compared with competitive drugs | *There is currently no approved drug to prevent or treat CIPN |

*Superoxide dismutase mimetics to discompose and remove superoxide as one of reactive oxygen substance (ROS). |

While steady progress in general was being made in development of the three preceding products, the company, which had been considering in-licensing the fourth pipeline since it became listed, sought for a new drug that satisfies the following three criteri “it is aimed for the oncology,” “certain progress has been made in clinical trials,” and “the company can gain the development right both in Japan and in China.” Then, in November 2017, the company was granted the exclusive rights to development and commercialization of “PledOx®,” a drug for treating CIPN, in Japan, China, South Korea, Taiwan, Hong Kong, and Macau by Egetis Therapeutics AB (Formerly PledPharma AB, hereinafter referred to as “Egetis”) of Sweden.

(Overview of indications)

Chemotherapy-induced side effects occur not only nausea and vomiting, and oral mucositis, but also peripheral neuropathy (CIPN). CIPN is known to manifest considerable symptoms such as dysesthesia in the hands, feet, the area around lips, etc., tightness in the pharynx and larynx accompanied by difficulty in breathing and dysphagia, numbness of the limbs, hypoesthesia, and sensory ataxia, caused by major chemotherapy drugs such as platinum-based drugs and taxanes.

If these side effects appear, by suspension of administering the drugs, some of the symptoms are alleviated in 80% of the cases and completely recovered in 6 to 8 months in 40% of the case; however, as discontinuation of administration of the drugs may mean suspension of cancer chemotherapy and change in the treatment policy, treatment of CIPN is one of the crucial medical issues. There is currently no approved drug to prevent or treat CIPN.

Estimated number of patients (Japan): Approximately 70,000-180,000/year*2 (taxane preparation administration)

(Overview of “PledOx® (SP-04)”)

Egetis, the originator of “ PledOx® (SP-04)” is listed on Stockholm Stock Exchange and has strengths in development of pharmaceuticals against oxidative stress-related diseases. “PledOx®” (active ingredient name:calmangafodipir) is a new active ingredient created based on “Mangafodipir,” an MRI contrast medium, which had sold in the United States and Europe.

(Current situation of development and commercialization)

◎ Development status

The global phase III clinical trial concerning peripheral neuropathy caused by the administration of Oxaliplatin, in which Japan, South Korea, Taiwan, and Hong Kong participated alongside U.S. and European countries, began in December 2018. However, a suspension of the trial was ordered by several authorities as French National Security Agency of Medicines and Health Products (ANSM) issued a clinical hold order in addition to FDA ordering a clinical hold of the POLAR-M study conducted by Egetis in January 2020, etc.

Afterwards, Data Safety Monitoring Board performed a new safety evaluation and recommended the cessation of the registration of new study subjects and administration of the drug used in the clinical trial as multiple cases of severe allergic reactions and hypersensitivity were manifested after repeated administrations of Oxaliplatin and SP-04. As a result, Solasia Pharma and Egetis made changes to the originally planned process, implemented “data cut off” — early closing of the case data collection — in the third quarter (July-September) of 2020, following which it decided to end the global phase III clinical trial.

Moreover, as Solasia Pharma recognizes that securing the safety of study subjects is the most important regarding conducting clinical trials, it declared its policy to formulate the plan concerning PledOx® (SP-04) after performing a detailed and solid evaluation of mainly information obtained after the end of the trial regarding safety and effectiveness.

Then, on December 2020, the flash report on the global phase III clinical trial was announced.

The major evaluation items regarding efficacy were not achieved. The frequency and details of adverse effects were almost consistent with the expected ones attributable to colorectal cancer, which is the target of chemotherapy and this trial.

Since the results of this trials are limited to the data on major evaluation items, Solasia Pharma K.K. and Egetis will evaluate the details of trials results regarding secondary evaluation items, etc. and discuss the strategy for developing PledOx® (SP-04).

Amid such situation, Solasia Pharma has withheld the development concerning Oxaliplatin, which is a platinum-based drug, and is conducting additional animal experiments to explore the possibilities of development aimed at peripheral neuropathy brought about by taxanes.

At this time, while some endpoints defined in the study protocol suggest that PledOx® (SP-04) may have an inhibitory effect on taxane-induced peripheral neuropathy, others do not, and the interpretation of the overall results of the study is complex and has yet to confirm a clear inhibitory effect of PledOx® (SP-04) on the incidence of taxane-induced peripheral neuropathy.

◎ Licensing-out plan

Solasia Pharma plans to give licenses in Japan and other Asian countries. In Japan, it concluded a contract for exclusive distributorship of “PledOx® (SP-04)” in Japan with Maruho Co., Ltd. (Osaka-shi, Osaka) in December 2019.

The economic conditions specified by the contract are (1) Maruho shall pay a lump-sum amount of 1 billion yen to Solasia Pharma, (2) Maruho shall pay up to 18.0 billion yen as milestone payments to Solasia Pharma according to the progress of development and sale, and (3) Solasia Pharma shall exclusively sell PledOx® (SP-04) to Maruho.

5) “SP-05:arfolitixorin”

Item | Overview |

Indication | Increase in antitumor efficacy of the anticancer drug "fluorouracil" (for various cancer treatments, especially for colorectal cancer) |

Characteristics/Strength compared with competitive drugs | *Phase I/IIa studies suggested enhanced antitumor effect compared to the standard chemotherapy treatment regimen for colorectal cancer. |

*Based on the results of the ongoing Phase III study, the company aims arfolitixorin to be added for the colorectal cancer chemotherapy regimen as a "new standard treatment." |

In August 2020, as a new pipeline, the company has signed an exclusive in-license agreement with Isofol Medical AB (Sweden) to develop and commercialize arfolitixorin (Solasia Pharma development product code: SP-05, generic name: arfolitixorin) in Japan.

It is estimated that the company will pay a total of up to 10.4 billion yen to Isofol as a payment that includes an upfront payment and milestones according to the development progress and sales achievement after successful development and development investment. Additionally, the company will pay royalties to Isofol according to the proceeds after the starting of sales.

(Overview of "arfolitixorin (SP-05)")

The existing anticancer drug "fluorouracil (5-FU)" is used for various cancer treatments, especially for colorectal cancer. It kills tumor cells by inhibiting DNA synthesis through depleting the chemical substance thymidine necessary for DNA synthesis.

As a standard therapy for colorectal cancer (colon and rectal cancers), "fluorouracil" is often used in combination with the folic acid preparation "levofolinate/folinate," which is used to enhance the antitumor effect of the formulation. However, in that case, a stable effect cannot always be expected since it needs a complex active metabolite conversion.

On the other hand, when "arfolitixorin (SP-05)" was used with "fluorouracil," the action of thymidine shortage was enhanced by administering "arfolitixorin (SP-05)," which is the final active metabolite. Thus, it can be expected that the antitumor effect of "fluorouracil" will be enhanced by combining it with "arfolitixorin (SP-05)" more than when combined with "levofolinate/folinate."

As a result of clinical trials up to phase II conducted by Isofol, it has been suggested that "arfolitixorin (SP-05)" enhances the effectiveness of fluorouracil in patients with advanced colorectal cancer (colon and rectal cancers).

Since it does not require a complex metabolic activation, it can be effective not only in treating all patients with advanced colorectal cancer but patients with pancreatic cancer, small intestinal cancer, breast cancer, gastric cancer, etc., too.

(Overview of Isofol)

Isofol is a Swedish biotechnology company researching and developing the drug arfolitixorin, which aims to enhance the efficacy of standard chemotherapy for advanced colorectal cancer and improve tumor response and progression-free survival period. It has a worldwide exclusive license agreement with one of the big pharmaceutical companies, Merck KGaA, Darmstadt, Germany, to develop and commercialize arfolitixorin's cancer indications. Isofol is listed on the Stockholm Stock Exchange.

(Developmental status)

Since December 2018, Isofol has been conducting phase III studies of "arfolitixorin (SP-05)" in the U.S., Canada, Europe, Australia, and Japan. Solasia Pharma will take over the trials in Japan under this licensing agreement and has been conducting the trials since August 2020.

The target number of cases was set at 440-660 and the company planned to conduct interim analysis with 330 cases. The number of cases reached 330 in July 2020, and 440 in December 2020.

In the interim analysis, the Data Safety Monitoring Board, which was established in this trial, was supposed to determine whether or not this trial should be continued based on the evaluation of safety and efficacy and the number of registered subjects (between 440 to 660 cases) if this trial was to be continued. On March 22, 2021, the Board recommended the company to continue the trial with the minimum number of cases being 440, based on the evaluation of safety and effectiveness in interim analysis (Overall Response Rate (ORR) and Progression-Free Survival (PFS)).

The company considers that this recommendation indicates that there is no sign of toxicity enhancement with SP-05, and by continuing the trial without adding cases to the minimum number of cases set in the clinical trial plan: 440 cases, it is possible to achieve ORR, which is a major item for evaluating efficacy, and PFS, which is a secondary evaluation item.

They expect that by continuing the trial with the minimum number of cases, it is possible to proceed with development in the shortest period of time for the next stage to apply SP-05 to actual treatments.

Afterwards, in May 2021 the enrollment of trial subjects was completed in Japan as well, and the enrollment of trial subjects for the whole study was completed. The results of the interim analysis were also confirmed. Following the announcement of the topline results of the phase III clinical trial in the first half of 2022, the company plans to apply to the authorities for approval in the second half of the same year. The company is also working on the licensing-out of rights in Japan, but it is expected to conclude these agreements after the announcement of the top-line results of phase III clinical trial.

In November 2021, Isofol announced that the U.S. Food and Drug Administration (FDA) designated the fast track for advanced colorectal cancer indications to arfolitixorin (SP-05).

The FDA's fast track designation is a system established to promote the development of drugs for serious diseases that fill unmet medical needs and review them promptly. Companies can collaborate closely with the FDA through this process, and sequential review of approval applications is possible. Thus, it provides a chance for a priority review in the U.S. if relevant criteria are met.

Isofol explained that the FDA evaluated the potential of arfolitixorin as a new treatment for advanced colorectal cancer, which has high morbidity and mortality, and decided to grant it the fast-track designation.

Solasia Pharma believes that this designation will be an essential step toward providing arfolitixorin (SP-05) to the medical field at an earlier stage.

In April 2022, Isofol announced that it had started data analysis of the Phase III trial. The decision to begin data analysis was based on discussions with the U.S. Food and Drug Administration (FDA) regarding the number of events (disease progression or death) necessary to begin analysis of progression-free survival, a secondary endpoint of the trial.

In August 2022, reports on top-line results of the Phase III trial were released. Unfortunately, the global data did not show statistically significant improvement in ORR (overall response rate, primary endpoint) and PFS (progression-free survival, secondary endpoint) in the arfolitixorin combination group versus the standard therapy group, according to the announcement.

Despite these results, the company believes that a path to commercialization of arfolitixorin (SP-05) is still possible, and it will work with Isofol to determine the results of subgroup analyses focused on Japanese patients, updated PFS analysis, OS analysis (overall survival), etc., and decide on the development policy, including whether to commercialize the drug.

Solasia Pharma views SP-05 as a vital drug that could further expand the company's innovative cancer treatment portfolio.

More than 150,000 patients are diagnosed annually with colorectal cancer in Japan. The company plans to provide new treatment options for patients with advanced colorectal cancer in Japan through its development partnership with Isofol.

1-5 Envisioned Growth

The company will forge ahead with the sales and development of the above pipelines as planned, work toward commercialization, and achieve a positive operating profit excluding early R&D expenses. In addition, they will keep engaging in new development and continue to grow, aiming to improve the corporate value and contribute to all stakeholders including patients and shareholders.

(Source: Solasia Pharma)

1-6 “6 Characteristics” as a Biotech Company

The following 6 points characterize Solasia Pharma as a biotech company:

(1)History of establishment

Solasia Pharma started as “JapanBridge (Ireland) Limited” established jointly by ITOCHU Corporation and MPM Capital, an American VC specializing in bio business, and set up its business by licensing-in new drugs from several biotech companies and propelling development of such drugs.

At first, it mainly considered business transfer to pharmaceutical companies as its exit plan; however, taking account of the business potential and promise, the company shifted its business strategy to persistent business expansion as an independent company and took the path to public stock offering because it was essential to raise funds for research and development. Later, in March 2017, it made a public offering. As the company’s original plan was to sell the company to other companies, the pipelines it owned were comprised of prime assets that could potentially be sold to other companies for encashment even during clinical development. This means that Solasia Pharma has already established a firm business foundation since its inception.

(2) Experienced Clinical development team

Solasia Pharma does not conduct basic research or preclinical trials but in-license assets and specializes in drug creation processes carried out subsequent to the clinical development phase. The most essential thing to achieve in the process of research and development toward commercialization of pharmaceuticals is to eventually obtain approval from the authorities. This requires skills and know-how in the stage of clinical development, especially clinical trials after phase II.

Although there are a number of biotech companies in Japan, CEO Arai stands out with his deep experience and knowledge in clinical development.

The experienced clinical development team, led by CEO Arai, is a significant factor in differentiating Solasia Pharma from other companies and plays a role as a competitive edge.

(3) High rate of successful development

So far, five products including “Sancuso® (SP-01),” “DARVIAS® (SP-02)”, “episil® (SP-03)”, “PledOx® (SP-04)”and “arfolitixorin® (SP-05)” were introduced. Four products are commercialized or have reached the final stage towards commercialization.

(Sancuso® (SP-01) was released in China, the application for approval for DARVIAS® (SP-02)is in preparation, and episil® (SP-03) was released in Japan, China, and South Korea. As for arfolitixorin® (SP-05), global phase III clinical trial is ongoing.

Such a high rate of successful development is made possible due to the following 2 points: its business model that handles only in-licensed products with a low risk of failure, and its in-house team which can handle all kinds of roles in clinical development. As mentioned above, the development staff is well aware of what are necessary for obtaining approval and therefore can conduct screening of whether or not an in-licensed product will be approved.

Their so-called “connoisseur (for screening pipelines)” has been realized by the combination of the above 2 strengths and lowers the risk of abandoning development which is the source of such a high success rate.

Analysis of the cash inflow of a new drug based on the discount cash flow (DCF) model has indicated what comprise of a majority of the total cash inflow is not contract money or milestone income, but royalties which, obviously, will be earned only after successful development of the new drug and expansion of the sales volume.

When making a proposal to Egetis (Sweden), Solasia Pharma did not necessarily have advantages over a number of its competitors in terms of prices, including contract money; nevertheless, it succeeded in in-licensing “PledOx®(SP-04).” The reason behind the success is that Egetis has thought highly of Solasia Pharma’s capabilities, including the strength of the team for producing distinct clinical trial designs, the results of development of the three preceding products, and the business performance in Asia, including Japan and China, reaching a decision that Solasia Pharma will be the best partner that will bring success in “PledOx®” in Asia.

SP-05 has also been highly acclaimed and introduced as a result of these achievements.

(4) Stable business foundation

Solasia Pharma has successfully conducted licensing-out of the sales rights of the aforementioned 4 pipelines to pharmaceutical companies, which means that in combination with the self-selling system, a portfolio for risk hedge has already been established.

(5) Early feasibility of business

Because biotech companies in general post losses in the stage of new drug development, it is not rational to use profit and loss statements for calculating stock prices and enterprise value, and thus the DCF model is used. In case of biotech companies, however, in addition to the discount rate based on “time” which is used in the general DCF model, the success rate for each stage of clinical trials of new drugs is used as another discount rate.

In this case, the most important point is when approval can be obtained. Of the five products developed, "Episil® (SP-03)" has been launched in Japan, China, and Korea, followed by "Sancuso® (SP-01)" in China, and "DARVIAS® (SP-02)" in Japan. So, the discount rate regarding the company’s development of new drugs should be estimated lower than that of other bio-ventures.

In addition to these six points, the company has high growth potential in the Chinese market.

Understandably, large-scale pharmaceutical companies all over the world have established bases in various Asian countries including China; however, as described in its management policy, Solasia Pharma’s target of development is new products in the field of cancer and rare diseases which major pharmaceutical companies do not enter from the performance-based perspective.

These products, which have been attracting attention in the pharmaceutical market in recent years, originate from biotech ventures, but are not handled by major pharmaceutical companies, so the company, which is already highly regarded by the Chinese medical community, will be valuable in providing access to the rapidly growing Asian market for biotech ventures worldwide.

2. Second Quarter of the Fiscal Year Ending December 2022 Earnings Results

2-1 Overview of consolidated results

| FY 12/ 21 2Q | FY 12/ 22 2Q | YoY |

Revenue | 278 | 189 | -88 |

Gross Profit | 120 | 127 | +6 |

R&D Expenses | 617 | 347 | -269 |

SG&A Expenses | 865 | 1,008 | +142 |

Operating Profit | -1,362 | -1,228 | +133 |

Profit before Tax | -1,383 | -1,233 | +150 |

Quarterly Profit | -1,394 | -1,247 | +147 |

*Unit: million yen. Quarterly profit is profit attributable to owners of the parent.

Sales revenue decreased 88 million yen year on year to 189 million yen.

It is composed of mainly revenues from product sales of "Sancuso® (SP-01)" and "Episil® (SP-03).”

R&D expenses decreased 269 million yen year on year to 347 million yen, mainly due to expenses related to the marketing approval of DARVIAS® (SP-02) and clinical development investment for the final phase III clinical trial of arfolitixorin (SP-05). SG&A expenses increased 142 million yen year on year to 1,008 million yen. The increase was due in part to one-time expenses related to the dissolution of the China-based sales system. Among SG&A expenses, amortization expenses amounted to 219 million yen for intangible assets for Sancuso® (SP-01) and Episil® (SP-03), etc.

As a result, operating loss decreased 133 million yen year on year to 1,228 million yen.

2-2 Financial standing and cash flows

◎Main Balance Sheet

| End of December 2021 | End of June 2022 | Increase /Decrease |

| End of December 2021 | End of June 2022 | Increase /Decrease |

Current assets | 894 | 1,046 | +152 | Current liabilities | 489 | 442 | -47 |

Cash, etc. | 714 | 973 | +259 | Trade payables | 386 | 333 | -53 |

Trade Receivables etc. | 126 | 35 | -91 | Noncurrent Liabilities | 67 | 39 | -28 |

Inventories etc. | 0 | 2 | +2 | Total Liabilities | 556 | 482 | -74 |

Noncurrent Assets | 2,249 | 2,025 | -224 | Total Equity | 2,587 | 2,590 | +3 |

Intangible Assets | 2,079 | 1,866 | -213 | Retained Earnings | -5,204 | 1,077 | +6,281 |

Total Assets | 3,144 | 3,072 | -72 | Total Liabilities and Net Assets | 3,144 | 3,072 | -72 |

*Unit: million yen. “Cash, etc.” means cash and cash equivalents. “Trade receivables” means trade receivables and other receivables. “Trade payables” mean trade payables and other payables.

Due to the decreases in intangible assets etc. by writing off Sancuso® (SP-01) and Episil® (SP-03), total assets decreased 72 million yen from the end of the previous term to 3,072 million yen.

Through the decreases in trade payable etc., total liabilities decreased 74 million yen from the end of the previous term to 482 million yen.

Due to the transfer from capital reduction and capital surplus to retained earnings, total assets increased 3 million yen from the end of the previous term to 2,590 million yen. Capital-to-asset ratio increased 2.0% from the end of the previous term to 84.3%.

2-3 Topics

(1) “DARVIAS® (SP-02)" received approval and went on sale.

In June 2022, "DARVIAS® (SP-02)" received approval and was launched in August 2022.

(For details, please refer to "Company Overview - Business - (3) Products and Development Pipeline")

(2) Worldwide business rights for "Episil® (SP-03)" were acquired.

In July 2022, the company acquired the worldwide business rights for Episil® (SP-03), including the manufacturing rights, from Camurus AB, the company from which the product was licensed out. The disagreements that had once existed between the two companies have now been resolved.

(For details, please refer to "Company Overview - Business - (3) Products and Development Pipeline")

(3) The preliminary results of Phase III multinational clinical trial of "arfolitixorin (SP-05)" were announced.

A preliminary report on Phase III multinational study of arfolitixorin (SP-05) was released, showing no statistically significant improvement in ORR (overall response rate, primary endpoint) and PFS (progression-free survival, secondary endpoint) in the arfolitixorin combination group versus the standard therapy group in the global data.

(For details, please refer to "Company Overview - Business - (3) Products and Development Pipeline")

(4) Dissolution of its own sales system in China

In July 2022, the company dissolved its own sales system in three major cities in China (Beijing, Shanghai, and Guangzhou).

(Background of the dissolution)

The company launched sales of Sancuso® (SP-01) and Episil® (SP-03) in 2019, but the impact of the spread of COVID-19 in Wuhan in early 2020 (lockdown) limited the sales at the time of the launch and subsequent scale expansion.

Of the 37 large oncology hospitals in Shanghai, 30 were closed for both inpatient and outpatient care, and the remaining facilities were almost exclusively for inpatients undergoing surgery. As a result, MRs had fewer opportunities to visit hospitals, and fewer patients received cancer treatment.

As a result, shipments to hospitals/pharmacies in the three cities from January to June 2022 were down 8% year on year for Sancuso® (SP-01) and down 33% year on year for Episil® (SP-03), and although currently on a recovery trend, sales have remained weak compared to initial expectations, and the maintenance of its own sales system was the main reason for the recurring loss recorded.

(Future actions)

Sales activities of Sancuso® (SP-01) and Episil® (SP-03) in the three cities since August have been transferred to Lees Pharm, as in other regions of China. Solasia Pharma will supply products to Lees Pharm.

The dissolution of its own sales system will reduce fixed costs by about 1 billion yen per year and create a structure in which fixed costs with expenditures will be reduced to about 1 billion yen per year.

The number of consolidated employees decreased from 77 (as of March 31, 2022) to 28.

(5) Capital and Business Alliance with Nippon Kayaku Co., Ltd.

In July 2022, Solasia Pharma concluded a capital and business alliance agreement with Nippon Kayaku Co., Ltd.

Under the business alliance, Solasia Pharma granted Nippon Kayaku preferential negotiating rights for out-licensing opportunities for developed products and preferential negotiating rights for manufacturing products and developed products.

In the capital alliance, Solasia Pharma raised 1,020 million yen by issuing 12 million shares of Solasia Pharma stock to Nippon Kayaku through a third-party allotment. Assuming long-term shareholding by Nippon Kayaku, Solasia Pharma considers Nippon Kayaku a strong partner in both development and sales.

Solasia Pharma believes that it has built a stable financial base by reducing costs by 1 billion yen through the elimination of its own sales structure in China and by raising approximately 1 billion yen.

(6) The sales agency agreement with ITOCHU Corporation was terminated. Changes in Shareholdings

In September 2022, the distributorship agreement with ITOCHU Corporation for the distribution of Sancuso® (SP-01) and Episil® (SP-03) in China expired.

ITOCHU has been a shareholder of Solasia Pharma since its establishment, and Solasia Pharma has built a logistics system by utilizing ITOCHU's business know-how in exporting and transporting both products from the manufacturing countries (Europe and the U.S.) to China, import customs clearance operations in China, and building a distribution system in China.

Under these circumstances, following the aforementioned decision to dissolve the in-house sales system mainly to reduce fixed costs, Solasia Pharma will sell both products directly to Lee's Pharm, and the distributorship agreement with ITOCHU will expire at the end of the contract period on September 12, 2022.

Under these circumstances, ITOCHU has been discussing the relationship regarding the holding of Solasia Pharma shares by ITOCHU. ITOCHU has informed the company that it plans to transfer 6.3 million of the Solasia Pharma shares it holds (approximately 4% of the total number of outstanding shares) to a major Japanese securities company. ITOCHU plans to change from being the major shareholder to the largest shareholder.

In addition, Solasia Pharma's President Arai and Director Miyashita are separately considering purchasing a portion of ITOCHU's equity.

3. Fiscal Year Ending December 2022 Earnings Forecasts and Future Goals

3-1 Full-year earnings forecast

| FY 12/ 21 | FY 12/ 22 Est. |

Revenue | 559 | 2,300~3,800 |

R&D Expenses | 845 | 830~950 |

SG&A Expenses | 1,948 | 2,170~2,300 |

Operating Profit | -2,419 | -1,100~150 |

Pretax profit | -2,442 | -1,100~150 |

Net Profit | -2,478 | -1,200~50 |

*Unit: million yen. Net profit is profit attributable to owners of the parent.

The feasibility of turning profit with sales revenue and licensing-out of rights

◎Revenue

- Revenue from Sancuso® (SP-01)

- Revenue from DARVIAS® (SP-02)

- Revenue from overseas licensing-out contracts for DARVIAS® (SP-02)

- Revenue from episil® (SP-03)

- Revenue from licensing-out arfolitixorin (SP-05) in Japan

◎R&D expenses

- Expenses of DARVIAS® (SP-02) for preparing for applying to the authorities

- Expenses of DARVIAS® (SP-02) for manufacture development and development in China

- Development investment for the phase III clinical trial (final trial) of arfolitixorin (SP-05)

◎SG&A expenses

- Marketing costs including surveys after release.

- System operating costs for the Chinese independent sales system, etc.

- Amortization of intangible assets for released products

(Goal as a company)

In addition to achieving the goals for each pipeline, the company is developing a portfolio of multiple items after introducing new items at the appropriate timing for improving pipelines. The goals for 2022 and onward are as follows.

Product | Targets for the FY December 2022 and onward |

Sancuso® (SP-01) | Expansion of sales in China (marketing activities such as the listing in clinical practice guidelines) Change of manufacturing facility(2024) |

DARVIAS® (SP-02) | Out-licensing of rights in other Asian regions (from 2022), development for expanded indications and development in China (from 2022), out-licensing of rights in the U.S., Europe, China, and other regions (from 2022) |

episil® (SP-03) | Expansion of sales in China, Japan, and South Korea |

PledOx® (SP-04) | Conducting clinical trials based on non-clinical animal test results (2023-) |

arfolitixorin(SP-05) | Evaluation and strategy discussion, including Phase III international study subgroup analysis (2022-2023) |

Overall business | Achievement of positive operating income excluding R&D and amortization expenses and in-licensing newly developed products |

4. Conclusions

In August 2022, reports on top-line results of a Phase III trial of arfolitixorin (SP-05) were released. Unfortunately, the ORR (overall response rate, primary endpoint) and PFS (progression-free survival, secondary endpoint) in the global data showed that the arfolitixorin combination group did not have statistically significant improvement compared to the standard therapy group.

However, the company believes that there is a good chance for the practical application of arfolitixorin (SP-05). The company will work with Isofol to determine the results of additional analyses, including subgroup analysis focused on Japanese patients, updated PFS analysis, and OS analysis (overall survival). We will await the results of additional analysis because, if analysis results for Japanese patients are quickly revealed and good, there are possibilities to make contract for licensing-out and receive contract money during this term or the first half of the next term. We will also keep a close eye on the sales performance of "DARVIAS® (SP-02)," the third product to be commercialized as planned, and the progress of its out-licensing overseas.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 5 directors, including 3 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report

Last update date: March 28, 2022

<Basic policy>

We believe that our mission is to contribute to the medical front including patients through our business activities as a drug development company. We also recognize that raising corporate value and returning profits to our shareholders through these business activities and fulfilling our accountability to the stakeholders are important events for achieving our mission. For these reasons, our basic policy is to effectively function corporate governance by securing “compliance” and “transparency” of management, while enhancing the monitoring and supervisory system of external directors and the audit system of corporate auditors.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Solasia Pharma has stated, “Our company implements all the basic principles stipulated in the Corporate Governance Code.”

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgement. Copyright(C), All Rights Reserved by Investment Bridge Co., Ltd. |