Bridge Report:(4668)MEIKO NETWORK JAPAN the first half of Fiscal Year August 2020

Kazuhito Yamashita, President | MEIKO NETWORK JAPAN CO., LTD.(4668) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Service |

President | Kazuhito Yamashita |

HQ Address | Sumitomo Fudosan Nishi-Shinjuku Bldg., Nishi-Shinjuku 7-20-1, Shinjuku-Ku, Tokyo |

Year-end | August |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Market Cap. | ROE (Act.) | Trading Unit | |

¥733 | 26,557,026 shares | ¥19,466 million | 6.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥30.00 | 4.1% | - | - | ¥542.21 | 1.4 x |

*The share price is the closing price on April 16. The number of shares outstanding was obtained by subtracting the number of treasury shares from the number of shares outstanding as of the end of the latest quarter. ROE and BPS are the actual values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

August 2016 (Act.) | 18,672 | 2,175 | 2,325 | 944 | 35.25 | 38.00 |

August 2017 (Act.) | 19,383 | 2,615 | 2,806 | 2,042 | 76.92 | 40.00 |

August 2018 (Act.) | 19,116 | 1,441 | 1,558 | 657 | 24.74 | 42.00 |

August 2019 (Act.) | 19,967 | 1,775 | 1,907 | 958 | 36.08 | 30.00 |

August 2020 (Est.) | - | - | - | - | - | - |

*The full-year earnings forecast is still to be disclosed. Unit: Million yen

This Bridge Report includes the overview of the financial results of MEIKO NETWORK JAPAN CO., LTD. for the first half of fiscal year ending August 2020 and the outlook for full-year results.

Table of Contents

Key Points

1. Company Overview

2. The First Half of Fiscal Year ending August 2020 Earnings Results

3. Fiscal Year ending August 2020 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of FY ending Aug. 2020, sales grew 3.3% year on year, while operating profit declined 17.2% year on year. As a franchisee was reorganized into a subsidiary in the previous term, the sales from Meiko Gijuku directly operated schools increased, and the sales from Japanese language schools, etc. grew. As for profit, operating expenses augmented through the increase of employees and consolidated subsidiaries. As of the end of the first half, the number of Meiko Gijuku classrooms was 1,932, down 88 year on year, and the number of students was 112,064, down 5,240 year on year.

- The full-year earnings forecast is still to be disclosed, because estimation is currently difficult due to the spread of the COVID-19. As soon as estimation becomes possible, the company plans to disclose it. As for dividends, the company plans to pay an interim dividend of 15 yen/share as announced at the beginning of the term, but a term-end dividend (15 yen/share) will be determined after seeing the outlook of the second half. If it is revised, the company will announce it immediately.

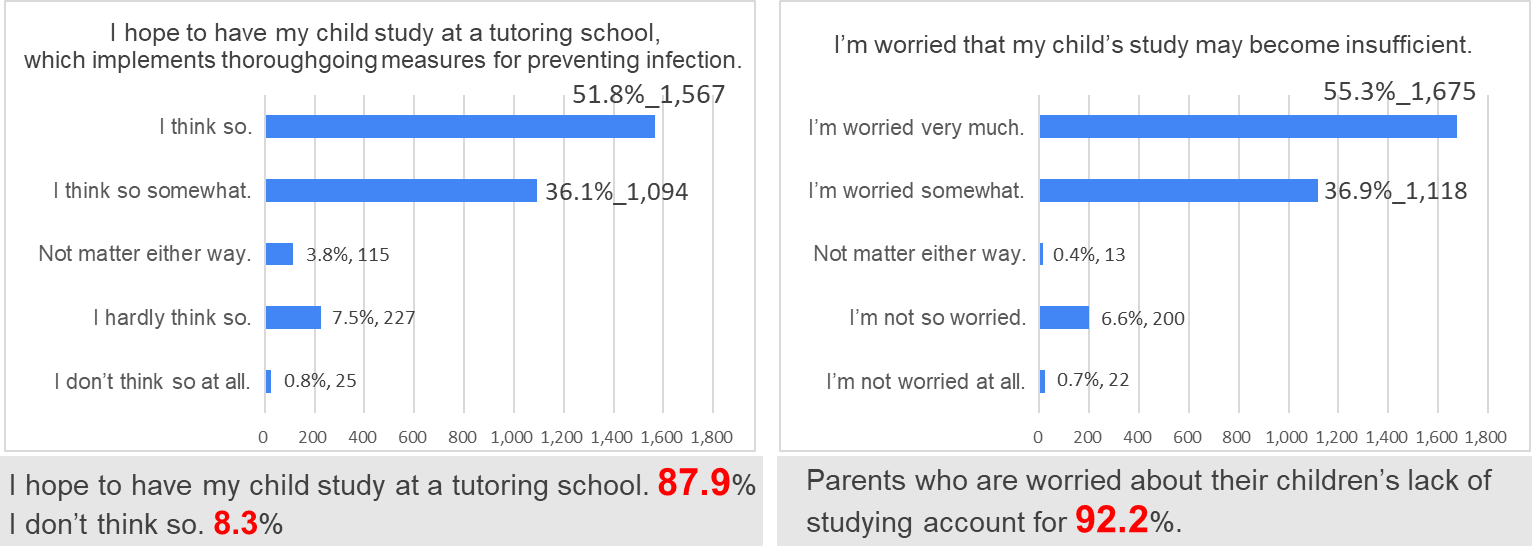

- Due to the impact of the spread of the COVID-19, the outlook for the second half is bleak. In the first half, the investments for creating new businesses and expanding existing businesses progressed, although they were hindered by the pandemic, and the enrollment of students was on a recovery trend. In the middle of March, the company conducted a questionnaire survey targeted at guardians of students of Meiko Gijuku schools, and confirmed strong needs toward tutoring schools, as their answers reflected the guardians’ worries over “the insufficiency of learning,” “the decrease in learning hours,” “the diminishing of learning habits,” etc. The outlook is unclear, but if fee-charging services based on ICT teaching materials and online tutoring see the light at the end of the tunnel, their activities for catching up from the next term on will gain momentum.

1. Company Overview

MEIKO NETWORK JAPAN is a top-brand enterprise running the private tutoring school Meiko Gijuku as a pioneer in private tutoring since the start of its business in 1984. Private tutoring is attracting a lot of attention as a method for nurturing a sense of independence, autonomy, and creativity of children, and the company operates Meiko Gijuku directly and with a franchise system around Japan. In addition, the company conducts a broad range of businesses, including the after-school childcare business, the Japanese language school business, the school support business, etc. via subsidiaries while focusing on the fields of education and culture.

【Management principles, educational ethos, and basic policy】

“We aim to nurture human resources through our contribution to educational and cultural programs.”

“We help achieve goals through our development and diffusion of franchise know-how”.

Under the above two management principles, MEIKO NETWORK JAPAN aims to contribute to society by fulfilling its role as “a private-sector educational business” and “a business assisting in goal achievement,” growing to become a business with high social existential value acknowledged by society.

Moreover, in its role as a part of a private-sector educational business, MEIKO NETWORK JAPAN has established the educational philosophy which is “To nurture creative, independently-minded human resources for 21st century society through an individual tutoring service that promotes self-motivated learning”, to enable the company to respond to various needs for diversified education and nurture creative and independently-minded human resources for 21st century society.

Furthermore, all staff members join hands to actualize “an ideal company,” under the basic policy of “achieving the prosperity of customers, shareholders, and employees by contributing to the educational and cultural businesses.”

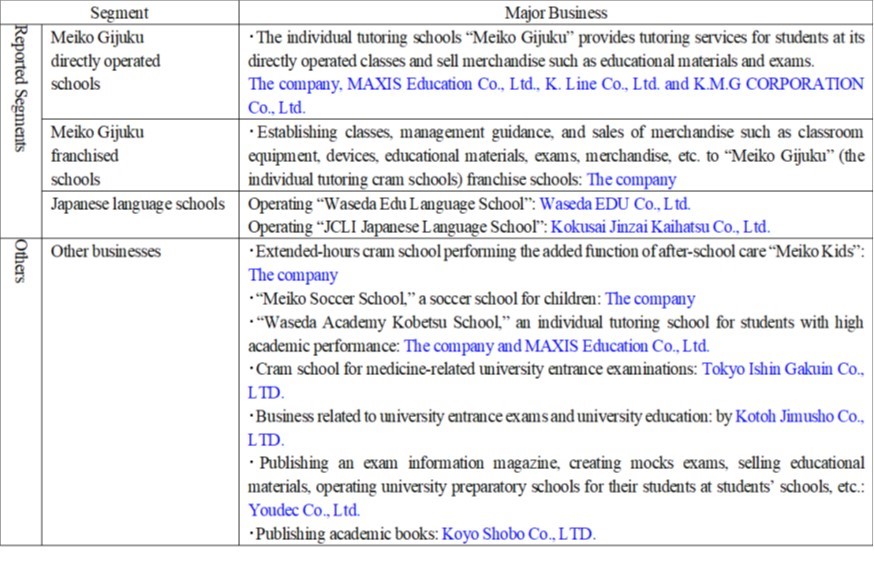

1-1 Business description

The reported segments are the three following businesses: Meiko Gijuku directly operated schools, Meiko Gijuku franchised schools, and Japanese language schools. The company operates Meiko Gijuku as a directly operated business using self-study and individual tutoring approaches based on the academic abilities of each student for all grade levels. Also, based on their unique franchise system, the company provides support for establishing classes and continuous guidance to their franchisees and also sell merchandise such as classroom equipment, devices, educational materials, exams, and goods, etc. to them.

As for the Japanese language schools, their consolidated subsidiary, Waseda EDU Co., LTD., manages “Waseda Edu Language School,” which has art classes. Also, Kokusai Jinzai Kaihatsu Co., Ltd. operates “JCLI Japanese Language School,” which has Japanese teacher training seminars for as well as Japanese language courses, etc. for the “Specified skills” visa system.

Aside from these businesses, there are other businesses such as extended-hours cram school performing the added function of after-school care “Meiko Kids,” “Meiko Soccer School,” which provides training by professional coaches, “Waseda Academy Kobetsu School,” which is an individual tutoring school for students with high academic performance, a cram school for medicine-related university entrance examinations operated by Tokyo Ishin Gakuin Co., LTD., business-related to university entrance exams and education-related business operated by Kotoh Jimusho Co., LTD., Youdec Co., Ltd., which creates mock exams and sells educational materials and an academic publishing business operated by Koyo Shobo Co., Ltd.

Business segments and group companies

* Besides the above companies, there are the affiliated companies NEXCUBE Corporation, Inc. (South Kore it operates a private tutoring school), the affiliated company Meiko Culture and Education Ltd (Taiwan: it operates a private tutoring school) and the non- consolidated subsidiary COCO-RO PTE LTD (Singapore: it operates a nursery school).

1-2 Strengths

The company's strengths are “Brand power of Meiko Gijuku” and “the unique franchise system that thrives to achieve prosperous coexistence with owners.” Meiko Gijuku operates in all prefectures and is recognized as familiar and accommodating cram schools. This sort of high reputation and brand power are the company's strengths.

Furthermore, as for the company’s franchise system, the headquarters (the company) and the affiliated owners share the same philosophy and work together with the Meiko Owners Club, where all owners are members. Through this cooperation, they hold regular training and study sessions to improve and share the know-how of success, etc. leading them to achieve a prosperous coexistence.

1-3 Market trends

Market trends

According to a research firm, in FY 2018, the market size of cram schools and university preparatory schools was 972 billion yen. Among this, the market size of the individual tutoring school, which is the company’s battlefield, was 445 billion yen and constituted 45.8% of the cram school and university preparatory school market. Also, there are many new entrants in the individual tutoring school market. Hence, the individual tutoring school market share in the cram school and university preparatory school market expanded in FY 2019 as well.

2. The First Half of Fiscal Year ending August 2020 Earnings Results

2-1 Consolidated results for the first half

| 1H of FY 8/19 | Ratio to sales | 1H of FY 8/20 | Ratio to sales | YoY | Initial estimate | Difference from the estimate |

Sales | 10,092 | 100.0% | 10,422 | 100.0% | +3.3% | 10,600 | -1.7% |

Gross Profit | 3,501 | 34.7% | 3,278 | 31.5% | -6.4% | - | - |

SG&A | 1,954 | 19.4% | 1,997 | 19.2% | +2.2% | - | - |

Operating Profit | 1,547 | 15.3% | 1,280 | 12.3% | -17.2% | 1,070 | +19.7% |

Ordinary Profit | 1,608 | 15.9% | 1,384 | 13.3% | -13.9% | 1,130 | +22.5% |

Profit attributable to owners of parent | 971 | 9.6% | 791 | 7.6% | -18.5% | 590 | +34.2% |

* Unit: Million yen

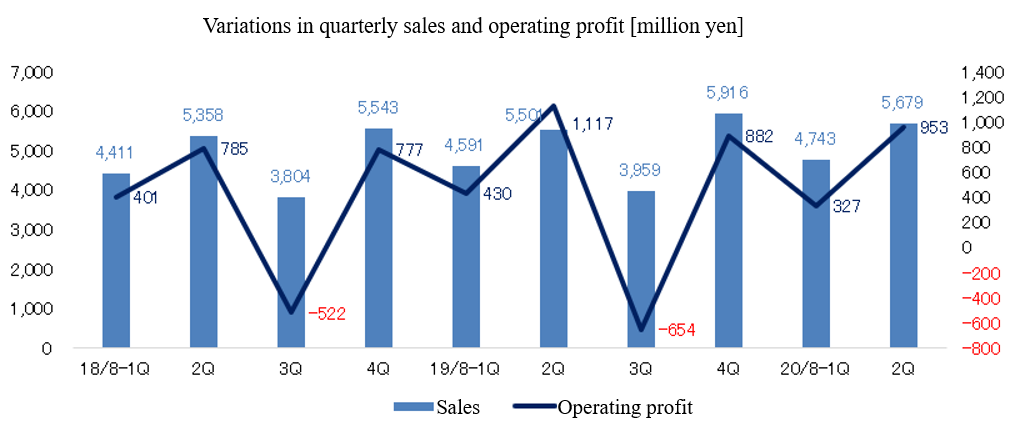

Sales grew 3.3% year on year, while operating profit dropped 17.2% year on year.

Sales were 10,422 million yen, up 3.3% (329 million yen) year on year. The sales from Meiko Gijuku directly operated schools increased 7.7% year on year, thanks to the contribution of K.M.G CORPORATION Co., Ltd. (hereinafter called “KMG”), whose profit-and-loss statement was incorporated into the consolidated one in the third quarter of the previous term (boosting sales by 460 million yen). In addition, the sales from Japanese language schools rose 9.6% year on year, and the sales from other businesses increased 2.2% year on year, but the sales from franchised Meiko Gijuku schools declined 6.8% year on year, due to the reorganization of a franchisee into a subsidiary and the decrease of students.

As of the end of the first half, the number of Meiko Gijuku classrooms, which are composed of directly operated and franchised ones, was 1,932, down 88 from the end of the same period of the previous year, and the number of students was 112,064, down 5,240 from the end of the same period of the previous year.

Operating profit was 1,280 million yen, down 17.2% year on year. Cost of sales augmented 8.4% (553 million yen) year on year to 7,143 million yen, as KMG was reorganized into a subsidiary (increasing cost of sales by 197 million yen), the personnel of the company (non-consolidated) were strengthened (raising cost of sales by 109 million yen), and expenses, such as commissions paid for staffing and ICT (up 82 million yen) and rents (up 53 million yen), augmented (increasing cost of sales by 168 million yen). SGA rose 2.2% (43 million yen) year on year to 1,997 million yen, due to the augmentation of personnel costs (up 34 million yen), goodwill amortization (up 12 million yen), rents (up 19 million yen), etc.

Reason for the difference from the initial estimate

Due to the decrease of students of Meiko Gijuku schools, sales declined, but due to the control of all kinds of expenses, including personnel costs and sales promotion expenses, and the postponement of investments to the following term, operating profit and other profits exceeded the initial estimates.

2-2 Segment Earnings Trends

| 1H of FY 8/19 | Ratio to total sales; profit rate | 1H of FY 8/20 | Ratio to total sales; profit rate | YoY |

Meiko Gijuku directly operated school business | 5,273 | 52.2% | 5,679 | 54.5% | +7.7% |

Meiko Gijuku franchised school business | 2,568 | 25.4% | 2,393 | 23.0% | -6.8% |

Japanese language school business | 674 | 6.7% | 739 | 7.1% | +9.6% |

Other Business | 1,575 | 15.6% | 1,610 | 15.4% | +2.2% |

Consolidated sales | 10,092 | 100.0% | 10,422 | 100.0% | +3.3% |

Meiko Gijuku directly operated school business | 657 | 12.5% | 672 | 11.8% | +2.3% |

Meiko Gijuku franchised school business | 1,184 | 46.1% | 1,003 | 41.9% | -15.3% |

Japanese language school business | 105 | 15.6% | 116 | 15.7% | +10.1% |

Other business | 146 | 9.3% | 75 | 4.7% | -48.8% |

Adjustments | -546 | - | -586 | - | - |

Consolidated operating profit | 1,547 | 15.3% | 1,280 | 12.3% | -17.2% |

* Unit: Million yen

Meiko Gijuku directly operated school business

Sales were 5,679 million yen, up 7.7% year on year, and operating profit was 672 million yen in a segment, up 2.3% year on year. The non-consolidated sales of the company decreased year on year from 3,205 million yen to 3,107 million yen, but the sales of consolidated subsidiaries increased from 2,068 million yen (earned by two companies) to 2,572 million yen (earned by three companies), through the reorganization of K.M.G Corporation (hereinafter called “KMG”) into a consolidated subsidiary. The non-consolidated profit of the company declined from 554 million yen to 546 million yen, but the profit from consolidated subsidiaries grew from 204 million yen to 240 million yen. In addition, goodwill amortization was 114 million yen (101 million yen in the same period of the previous year).

As of the end of the first half, the number of classrooms was 403 (367 as of the end of the same period of the previous year) and the number of students was 26,974 (24,884 as of the end of the same period of the previous year).

Sales | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease | Operating Profit | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease |

Directly operated schools | 3,205 | 3,107 | -98 | Directly operated schools | 554 | 546 | -8 |

MAXIS | 1,459 | 1,500 | +41 | MAXIS | 88 | 93 | +4 |

K. Line | 609 | 610 | +1 | K. Line | 14 | 11 | -3 |

KMG | - | 460 | +460 | KMG | - | 21 | +21 |

Total | 5,273 | 5,679 | +405 | Total | 657 | 672 | +14 |

*Unit: Million yen. The expenses of MAXIS, K. Line, and KMG include royalties and goodwill amortization.

Directly operated schools | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease | MAXIS | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease |

No. of classrooms (as of the end of the first half) | 231 | 223 | -8 | No. of classrooms (as of the end of the first half) | 94 | 94 | 0 |

No. of students (average in the term) | 15,933 | 15,536 | -397 | No. of students (average in the term) | 6,672 | 7,025 | +353 |

Average No. of students per classroom (average in the term) | 68.9 | 69.6 | +0.6 | Average No. of students per classroom (average in the term) | 71.6 | 76.1 | +4.5 |

Sales per student | 201.2 | 200.0 | -1.2 | Sales per student | 218.7 | 213.6 | -5.1 |

|

|

|

|

|

|

|

|

K. Line | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease | KMG | 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease |

No. of classrooms (as of the end of the first half) | 42 | 43 | +1 | No. of classrooms (as of the end of the first half) | - | 43 | +43 |

No. of students (average in the term) | 2,791 | 2,688 | -103 | No. of students (average in the term) | - | 2,312 | +2,312 |

Average No. of students per classroom (average in the term) | 66.5 | 65.0 | -1.4 | Average No. of students per classroom (average in the term) | - | 53.8 | +53.8 |

Sales per student | 218.2 | 227.2 | +9.0 | Sales per student | - | 199.3 | +199.3 |

*Unit: Classroom, name, thousand yen.

Meiko Gijuku franchised school business

Sales were 2,393 million yen, down 6.8% year on year, and profit was 1,003 million yen in a segment, down 15.3% year on year. Both sales and profit declined, due to the decrease of students and the reorganization of KMG, which had been a franchisee, into a consolidated subsidiary. In value terms, sales dropped 174 million yen. In detail, the revenue from royalties decreased 113 million yen, the sales from contracts declined 33 million yen, and the sales of FC equipment dropped 19 million yen. As for profits, personnel costs augmented through the strengthening of personnel systems, while sales decreased.

The number of classrooms, excluding those of the 3 consolidated subsidiaries, as of the end of the first half was 1,529 (1,653 as of the end of the same period of the previous year) and the number of students was 85,090 (92,420 as of the end of the same period of the previous year). As for the reasons for the decrease of classrooms (down 124), 82 classrooms were closed due to closure, temporary closure and cancellation, 43 classrooms were excluded as KMG became a subsidiary, and 10 classrooms were transformed into directly operated ones. On the other hand, 7 classrooms were newly built, enlarged, or reopened, and 4 directly operated classrooms were transferred to franchisees.

| 1H of FY 8/19 | 1H of FY 8/20 | Increase/ decrease | YoY |

No. of classrooms (as of the end of the first half, classroom) | 1,653 | 1,529 | -124 | -7.5% |

No. of students (average in the term, name) | 95,115 | 88,407 | -6,708 | -7.1% |

Average No. of students per classroom (average in the term, name) | 57.5 | 57.8 | +0.3 | +0.5% |

Revenue from royalties [million yen] | 1,651 | 1,537 | -113 | -6.9% |

Average revenue from royalties per classroom [thousand yen] | 997.7 | 1,004.8 | +7.1 | +0.7% |

Japanese language school business

Sales were 739 million yen, up 9.6% year on year, and profit was 116 million yen in a segment, up 10.1% year on year. The company runs Waseda EDU Language School and JCLI Japanese Language School. As of the end of the first half, the number of students was 744 for Waseda EDU Language School (643 as of the end of the same period of the previous year), and 1,252 for JCLI Japanese Language School (1,231 as of the end of the same period of the previous year). The total number was 1,996 (1,874 as of the end of the same period of the previous year). In the first half of this term, the company made efforts to raise the rate of advancement to higher education by giving guidance for academic courses, and implemented measures against the spread of COVID-19, including a 2 week self-quarantine after traveling from China to Japan and the cancellation of some events.

Other businesses

Sales grew 2.2% year on year to 1,610 million yen, mainly thanks to Waseda Academy Kobetsu School and the business targeted at kids, but profit dropped 48.8% year on year to 75 million yen in a segment, due to the upfront investment in Jiritsu Gakushu RED, tyotto juku, Meiko Kids e, etc.

Waseda Academy Kobetsu School earned sales of 313 million yen, up 17.9% year on year, and an operating profit of 45 million yen (18 million yen in the same period of the previous year). As of the end of the first half, the number of school buildings was 48 (35 as of the end of the same period of the previous year). Out of them, 8 schools are directly run by the company (7 schools as of the end of the same period of the previous year), 5 schools are operated by MAXIS Education Co., Ltd. (5 schools as of the end of the same period of previous year), 25 schools are directly operated by Waseda Academy (12 schools as of the end of the same period of the previous year), and 10 schools are franchised ones (11 schools as of the end of the same period of the previous year). The number of students is 3,918 (2,577 as of the end of the same period of the previous year). The records of passing entrance exams for competitive schools are healthy, as over 100 students passed the entrance exams for Keio Senior High School, Keio Shiki Senior High School, Keio Girls Senior High School, Keio Shonan Fujisawa Senior High School, Waseda University Senior High School, Waseda Jitsugyo Senior High School, and Waseda University Honjo Senior High School.

The after-school childcare business earned sales of 196 million yen, up 17.4% year on year, and an operating profit of 0 million yen (4 million yen in the same period of the previous year). As of the end of the first half, the number of schools was 25 (19 as of the end of the same period of the previous year). Out of them, 7 schools were directly operated by the company (7 schools as of the end of the same period of the previous year), 3 facilities were ones for pupils’ clubs (1 school as of the end of the same period of the previous year), and 15 facilities were franchised or entrusted ones (11 schools as of the end of the same period of the previous year). The number of students was 1,263 (1,009 as of the end of the same period of the previous year). By utilizing the know-how the company has accumulated so far, it adopted various operation types, including franchise, operation of public facilities in the private sector, and undertaking of operation from private elementary schools and kindergartens, and increased the number of schools.

As for the sports business (soccer schools, etc.), sales were 55 million yen, down 14.9% year on year, and operating loss was 11 million yen (an operating profit of 5 million yen in the same period of the previous year). As of the end of the first half, the number of schools was 16, including 1 franchised one (13 as of the end of the same period of the previous year, including 1 franchised one). The number of students was 786 (906 as of the end of the same period of the previous year). As new topics, the company cultivated new markets, for example, by opening comprehensive sports schools for kids.

School support, academic book publication, and preparatory school businesses, etc.

| 1H of FY 8/19 | 1H of FY 8/20 | YoY | Special notes |

Kotoh Jimusho Co., Ltd. | 416 | 438 | +5.2% | The sales and profit of the university education-related business were as planned. |

Youdec Co., Ltd. | 276 | 254 | -7.8% | In-school preparatory classes, mock exams, etc. The sales from mock exams declined. |

Tokyo Ishin Gakuin Co., Ltd. | 216 | 164 | -24.1% | No. of school buildings: 2 No. of students: 63 (down 16) |

Koyo Shobo Co., Ltd. | 116 | 121 | +4.5% | Academic book publication business |

Other | 50 | 64 | +28.9% | Study Club, ESL Club, overseas business, etc. |

* Unit: Million yen

Number of classrooms of Meiko Gijuku, number of students of Meiko Gijuku, Total system-wide sales from Meiko Gijuku schools

| 1H of FY 8/19 | Increase/ decrease | 1H of FY 8/20 | Increase/ decrease |

No. of classrooms directly operated by the company | 231 | -2 | 223 | -8 |

No. of MAXIS classrooms | 94 | -1 | 94 | - |

No. of K. LINE classrooms | 42 | +42 | 43 | +1 |

No. of K.M.G classrooms | - | - | 43 | +43 |

Total No. of classrooms directly operated by Meiko Gijuku | 367 | +39 | 403 | +36 |

No. of franchised classrooms of Meiko Gijuku | 1,653 | -85 | 1,529 | -124 |

Total number of classrooms of Meiko Gijuku | 2,020 | -46 | 1,932 | -88 |

No. of students of schools directly operated by the company | 15,584 | -799 | 15,070 | -514 |

No. of students of MAXIS | 6,548 | -60 | 7,078 | +530 |

No. of students of K. LINE | 2,752 | +2,752 | 2,598 | -154 |

No. of students of K.M.G | - | - | 2,228 | 2,228 |

Total No. of students of schools directly operated by Meiko Gijuku | 24,884 | +1,893 | 26,974 | +2,090 |

No. of students of franchised schools of Meiko Gijuku | 92,420 | -9,634 | 85,090 | -7,330 |

Total number of students of Meiko Gijuku [person] | 117,304 | -7,741 | 112,064 | -5,240 |

Sales of the Meiko Gijuku directly operated school business | 5,273 | +450 | 5,679 | +405 |

Sales of the Meiko Gijuku franchised school business | 16,049 | -1,235 | 14,950 | -1,099 |

Total system-wide sales from Meiko Gijuku schools [million yen] | 21,323 | -784 | 20,629 | -694 |

* Total system-wide sales from Meiko Gijuku schools is the sum of the tuition of directly run classrooms, expenses for teaching materials, costs for exams, the tuition for franchised classes (excluding the expenses for teaching materials and exams), etc.

* The sales of the Meiko Gijuku franchise business include the revenue from royalties and the sales of products.

2-3 Financial standing

| Aug. 2019 | Feb. 2020 |

| Aug. 2019 | Feb. 2020 |

Cash | 7,495 | 7,911 | Accounts payable/accrued expenses | 1,355 | 1,239 |

Securities | 200 | 399 | Advances received | 1,480 | 1,118 |

Current Assets | 9,734 | 10,189 | Asset retirement obligations | 300 | 309 |

Intangible Assets | 3,311 | 3,109 | Liabilities | 5,350 | 5,254 |

Investments, Others | 5,497 | 5,822 | Net Assets | 14,414 | 15,111 |

Noncurrent Assets | 10,030 | 10,176 | Total Liabilities, Net Assets | 19,765 | 20,366 |

* Unit: Million yen

The total assets as of the end of the first half were 20,366 million yen, up 601 million yen from the end of the previous term. In the debit side, while seeing the increase in cash & deposits, securities, and investment securities due to the rises in share prices (up 312 million yen), the company decreased goodwill by 236 million yen. In the credit side, the advances received at 2 Japanese language schools decreased due to seasonal fluctuations, but net assets grew. Capital-to-asset ratio was 74.2% (72.9% at the end of the previous term).

As for cashflows, the company secured an operating CF of 1,031 million yen (1,903 million yen in the same period of the previous year), while posting a pretax profit of 1,384 million yen (1,608 million yen in the same period of the previous year), etc. Investing CF was negative 310 million yen (negative 13 million yen in the same period of the previous year), due to the acquisition of investment securities, time deposits, etc. Financing CF was negative 404 million yen (negative 453 million yen in the same period of the previous year), due to the payment of dividends, etc.

3. Fiscal Year ending August 2020 Earnings Forecasts

3-1 The full-year earnings forecast is still to be disclosed.

Considering the purpose of the request for temporary closure of all schools, the company temporarily closed its schools around Japan from March 2 to March 15. From April 8 on, all 861 classrooms in 7 prefectures were temporarily closed, in response to the declaration of a state of emergency. Most of them are Meiko Gijuku (791 classrooms), and the other schools are Study Club, ESLclub, Meiko Soccer School, Waseda Academy Kobetsu School, and Japanese language schools. The temporary closure is estimated to continue until May 6, when the declaration of a state of emergency expires.

As for Meiko Kids, which is a business for kids (looking after pupils after school), directly operated schools looked after pupils from 8:00 am (normally from 17:00) to meet a request from the Ministry of Health, Labour and Welfare, but in April, 11 out of 32 schools were temporarily closed (6 schools entrusted by elementary schools and kindergartens, and 5 schools entrusted by other institutions). After the declaration of a state of emergency, the company started promoting customers to refrain from using its schools that are still open.

As for the Japanese language school business, over 500 international students of two schools who had been scheduled to be enrolled in April have to wait until July due to immigration control, and the pandemic reportedly led to the cancellation by existing students and the restraint of enrollment in tutoring schools and spots clubs.

Due to the above-mentioned impact, the company judged that “it is still difficult to estimate annual results,” so the full-year earnings forecast is still to be disclosed. As soon as estimation becomes possible, the company plans to disclose the earnings forecast.

3-2 The annual dividend of 30 yen/share (composed of an interim dividend of 15 yen/share and a term-end dividend of 15 yen/share) is unchanged.

As for dividends, the company announced that it would pay an interim dividend of 15 yen/share and a term-end dividend of 15 yen/share for a total of 30 yen/share per year (From the earnings forecast at the beginning of the term, payout ratio is estimated to be 94.8%). The interim dividend is to be paid as announced, but the term-end dividend is still to be determined while considering the effects of COVID-19 and the declaration of a state of emergency on the business outlook. If it is revised, the company will disclose it immediately.

3-3 Activities during the temporary closure of Meiko Gijuku schools and emergency measures

As activities during the temporary closure of Meiko Gijuku schools, the company started “online tutoring” by utilizing “Zoom” an online conference app that enables interactive communication, and released ICT teaching materials, including “MEIKOMUSE,” which enables high school students to learn at home by watching videos via the Internet. In addition, the company started providing students of temporarily closed schools with “Monoxer,” an app for memorization, free of charge, shifting to online services.

“Online tutoring” based on “Zoom”

The company started “online tutoring,” which reproduces real tutoring in a classroom, by utilizing “Zoom.” In “online tutoring,” students can receive lessons from tutors at home by using a smartphone or a tablet. Since tutors who normally teach at the school give lessons to individual students on a real-time basis by using “Zoom,” the same effects of learning as tutoring at a school can be expected from online lessons.

Installation of “Monoxer”

“Monoxer” is a smartphone app for providing students ranging from third graders to third-year high school students with questions regarding the Japanese language, arithmetic, the English language, and mathematics at each individual’s appropriate levels until they master them. While students are solving problems with that app, it conducts analysis automatically, and suggests necessary steps for mastering each subject to each student. In addition, it helps manage the progress of learning each subject.

Emergency measures

As lessons are scheduled to be resumed on March 16, the company conducted a questionnaire survey targeted at the guardians of students of Meiko Gijuku schools, and obtained answers from 3,028 respondents. The answers reflected the guardians’ worries over “the insufficiency of learning,” “the decrease in learning hours,” and “the diminishing of learning habits.” From this, the company confirmed strong needs for tutoring schools.

After seeing the results of the questionnaire, the company launched the campaign titled “Let’s catch up on studies! Campaign for supporting learning in Meiko,” in which the one-month tutoring fees for all subjects would be free exclusively for students who have been enrolled in April, as an emergency measure (In response to the government’s declaration of a state of emergency, the company is discussing plans from May).

(Taken from the reference material of the company)

3-4 Creation of new businesses and expansion of existing businesses

From February to April, the company opened Jiritsu Gakushu RED and tyotto juku as a new business, increased schools in the after-school childcare business, and opened two schools of Meiko Kids e, facilities that care for pupils where the second foreign language can also be learned (online lessons were started for both, but these schools are to be closed until May 6).

Jiritsu Gakushu RED and tyotto juku opened

Based on the business alliance with SPRIX Co., Ltd. in October 2019, the company opened 9 classrooms of “Jiritsu Gakushu RED,” a tutoring school that utilizes ICT without relying on lecturers, from February to April 2020. The operation of “Jiritsu Gakushu RED” is aimed at offering new educational services to meet diversified needs from customers.

Based on the business alliance with tyotto Inc. in October 2019, the company opened 6 classrooms of “tyotto juku,” a tutoring school specializing in university entrance exams, in which coaching would encourage students to learn, from February to April 2020.

| Directly operated | FC | Total (Apr. 2020) |

Jiritsu Gakushu RED | 4 (Chiba, Saitama, 2 in Osaka) | 5 (Chiba, Aichi, Hyogo, Kochi, Tottori) | 9 |

Tyotto juku | 1 (Saitama) | 5 (2 in Chiba, Kanagawa, Gifu, Osaka) | 6 |

After-school childcare business

In addition to the directly operated after-school facilities “Meiko Kids,” the company operates the business in various ways, including private pupil care (subsidized), operation of public facilities in the private sector, entrusted operation of private elementary schools, franchise, and entrusted operation of learning classrooms. This spring, the company opened 9 schools, including the entrusted operation of a city elementary school in Nara Prefecture. As of April 2020, the company runs 32 schools.

| Directly operated | Subsidized | Public facility operated in the private sector | Entrusted operation of private elementary schools | FC | Entrusted | Total |

End of February 2020 | 7 | 2 | 1 | 3 | 1 | 11 | 25 |

End of April 2020 | 7 | 3 | 1 | 7 | 1 | 13 | 32 |

2 facilities of “Meiko Kids e” for English-only pupil care opened.

On April 1, 2020, the company opened 2 facilities of “Meiko Kids e” for English-only pupil care, where pupils can learn the second foreign language, too, in Tokyo (Ario Kitasuna and Shimoigusa). The company received 367 inquiries (for two schools; as of the end of March), and 122 pupils were enrolled.

“Meiko Kids e” offers the course for preschoolers, including junior and senior kindergarten pupils, and the course for elementary school pupils, ranging from first graders to sixth graders. It is characterized by the development of global personnel through multilingual education, the improvement in basic academic skills, the fostering of individuality by offering options, and the anxiety-free, safe, hygienic classroom environment.

3-5 Organizational reform of the Meiko Gijuku business

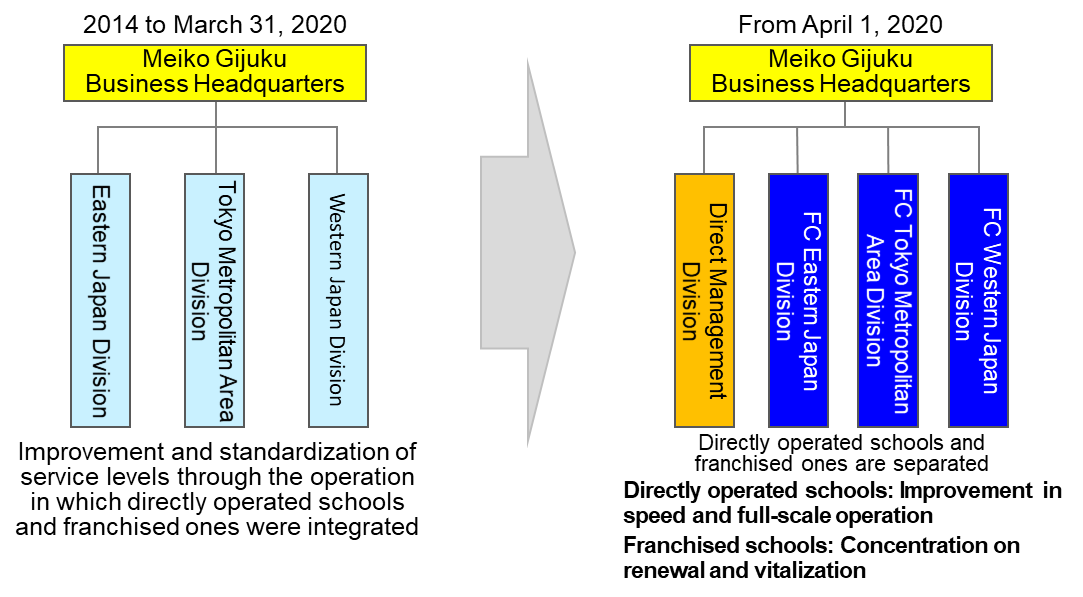

The organization of Meiko Gijuku had been aimed at improving and standardizing its service level through operation in which directly operated schools and franchised ones were integrated, but the company reformed it on April 1, for the purposes of increasing speed and furthering full-scale operation at directly operated schools and renewing and vitalizing franchised schools. The direct operation division will be a flat organization composed of division chiefs and area managers. In FC divisions, the division chiefs in respective areas will strive to improve the business administration of FC as the chiefs specializing in FC business.

(Taken from the reference material of the company)

4. Conclusions

In the first half, profit exceeded the estimate and the number of students was on a recovery track, but the outlook for the second half is bleak, due to the spread of COVID-19. It seems that the temporary closure of schools around Japan from March 2 to 15 and the declaration of a state of emergency produced adverse effects and caused cancellations by existing students and would-be students to cancel enrollment. Expected risks include the prolongation of the period for the declaration of a state of emergency and the sluggishness of summer lessons, which would significantly affect business performance.

Effects of the suspension of lectures, etc.

Since the declaration of a state of emergency, the company has been promoting the shift to fee-charging services by utilizing ICT teaching materials and online tutoring. When customers demand face-to-face lectures, the company gives substitute lessons. We are worried about the prolongation of the period of the state of emergency. As for Meiko Kids, which runs 32 schools, 11 schools were temporarily closed, according to the situations of the operation entrusted by private schools, etc. and entrustees, such as schools in shopping centers.

As for Japanese language schools, it may become difficult to compensate for the delay in learning by offering supplementary lessons if immigration control and the state of emergency are prolonged.

Impact of behavioral changes of customers

The enrollment by new students, which was recovering, was stymied by the spread of COVID-19. As a sense of urgency grew through the voluntary restraint of going out on holidays and at night and the declaration of a state of emergency, people became more anxious, and consumer confidence weakened. Reportedly, an increasing number of students express their intention to suspend their attendance.

Due to the impact of the spread of COVID-19, the outlook for the second half is bleak. In the first half, the company steadily proceeded with investments for creating new businesses and expanding existing businesses and the enrollment by new students was on a recovery track, but they were affected by the spread of the COVID-19. In the middle of March, the company conducted a questionnaire survey targeted at the guardians of Meiko Gijuku students which confirmed strong needs toward tutoring schools, as their answers reflected the guardians’ worries over “the insufficiency of learning,” “the decrease in learning hours,” “the diminishing of learning habits,” etc. The outlook is unclear, but if online communication becomes common after the lifting of the declaration of a state of emergency and online tutoring becomes feasible in addition to face-to-face tutoring in classrooms, their activities for catching up from the next term on will gain momentum.

<Reference: Regarding Corporate Governance>

◎Organizational form and the composition of the boards of directors and auditors

Organizational form | Company with audit and supervisory board |

Directors | 6 directors, including 2 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎ Corporate governance reports

Last updated on Apr 13, 2020.

Basic policy

Our company continuously promotes managerial structure reforms to construct a flexible and transparent management organization that adapts to the new era. Moreover, our company plans to further strengthen corporate governance focused on the shareholder value by ensuring the transparency, soundness, and fairness of its management, implementing thorough risk management and improving accountability. Furthermore, our company's basic policy is to maximize the corporate value for all stakeholders including shareholders through the sustainable growth of our company group, the enhancement of the business model which demonstrates unique added value, and the strengthening of profitability via the collaboration of all the group companies. Our company’s basic policy also includes the improvement of management transparency and efficiency. Hence, the company is working to establish a swift and efficient management and execution systems while balancing the management supervision and business execution systems. The company is also making efforts to achieve highly transparent management through the participation of outside directors. Additionally, the company established “The MEIKO NETWORK JAPAN Group Corporate Governance Code Guideline” and published it on the company website to clarify the status of the efforts and policies related to each principle of the corporate governance code, fulfill the fiduciary responsibilities and to provide accountability.

https://www.meikonet.co.jp/investor/governance/index.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company follows all the principles of the corporate governance code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [The So-Called Strategically Held Shares]

The strategically held shares are shares held for purposes other than investment. We hold the shares of business partners for purposes such as business alliances, maintaining and strengthening transactions, and stabilizing shares. The board of directors examines the necessity of reducing these shares appropriately through considering whether these shares are important for the company’s growth, whether there is a more effective use of funds, etc. Moreover, as for exercising voting rights for these shares, the approval for a proposal is decided by having the department in charge examine carefully the proposal content taking into consideration the conditions of the invested companies and the business relationship with these companies, etc.

Principle 1-7 [Transactions between Related Parties]

Transactions that would constitute competition or conflict of interest for the directors and the corporations that the directors substantially control should be deliberated and decided by the board of directors. Additionally, transaction conditions and policies for determining transaction conditions, etc. are disclosed in the notice of convocation of the general meeting of shareholders and annual securities reports, etc. The company has established a system that will not be disadvantageous to it in case the corporations that the company's officers and directors substantially control and major shareholders do business as clients of the company.

Principle 5-1 [Policy on Constructive Dialogue with Shareholders]

Our company's corporate planning department is responsible for IR. The company holds financial results briefings for shareholders and investors once every six months and conducts regular individual interviews.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (MEIKO NETWORK JAPAN: 4668), etc. at www.bridge-salon.jp/.