Bridge Report:(4668)MEIKO NETWORK JAPAN 3Q of fiscal year ending August 2020

Kazuhito Yamashita, President | MEIKO NETWORK JAPAN CO., LTD.(4668) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Service |

Rresident | Kazuhito Yamashita |

HQ Address | Sumitomo Fudosan Nishi-Shinjuku Bldg., Nishi-Shinjuku 7-20-1, Shinjuku-Ku, Tokyo |

Year-end | August |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Market Cap. | ROE (Act.) | Trading Unit | |

¥771 | 26,557,026 shares | ¥20,475million | 6.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥30.00 | 3.9% | ¥9.16 | 84.2x | ¥542.21 | 1.4x |

*The share price is the closing price on July 17. The number of shares outstanding was obtained by subtracting the number of treasury shares from the number of shares outstanding as of the end of the latest quarter. ROE and BPS are the actual values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

August 2016 (Act.) | 18,672 | 2,175 | 2,325 | 944 | 35.25 | 38.00 |

August 2017 (Act.) | 19,383 | 2,615 | 2,806 | 2,042 | 76.92 | 40.00 |

August 2018 (Act.) | 19,116 | 1,441 | 1,558 | 657 | 24.74 | 42.00 |

August 2019 (Act.) | 19,967 | 1,775 | 1,907 | 958 | 36.08 | 30.00 |

August 2020 (Est.) | 18,220 | -80 | 100 | 240 | 9.16 | 30.00 |

*The forecasted values were provided by the company. Unit: Million yen

This Bridge Report includes the overview of the financial results of MEIKO NETWORK JAPAN CO., LTD. for 3Q of fiscal year ending August 2020 and the outlook for full-year results.

Table of Contents

Key Points

1. Company Overview

2. The Third Quarter of Fiscal Year ending August 2020 Earnings Results

3. Fiscal Year ending August 2020 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

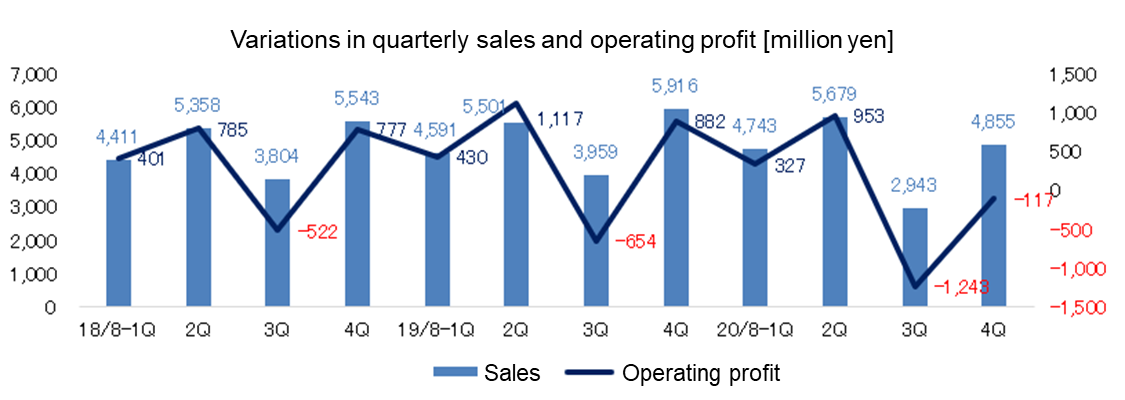

- In the third quarter (Mar-May) of FY ending Aug 2020, sales decreased 25.7% year on year, while an operating loss of 1,240 million yen was recorded (650 million yen in the same period in the previous year). In a typical year, the third quarter sees the number of students drop as the students preparing for entrance exams will have graduated and also the anticipatory investments and advertising expenses for recruiting new students for the following academic year will mount up. This year, the education shutdown due to COVID-19 meant the student recruitment activities for the new academic year were restricted and also a higher-than-usual number of students withdrew from membership. Consequently, in the first 9 months of FY, the Meiko Gijuku directly-operated school business and other businesses suffered an operating loss, and Meiko Gijuku franchised school business witnessed its profit shrink 23.9% over the same period. All in all, sales were down 4.9% year on year while operating profit was down 95.8% year on year.

- According to the full-year earnings forecast, sales will fall 8.8% year on year, and an operating loss of 80 million yen will be posted (1,770 million yen in the same period in the previous year). Because the company could not secure the necessary number of days for the summer courses within the usual July-August timeframe, they will be run over the period of 3 months from July till September instead. The sales from the summer courses this year is expected to be about 70% of the previous year. The impact of COVID-19 is still being felt in the fourth quarter (Jun-Aug) – for example the Japanese language school business has a backlog of new student intakes from both April and July – but the company’s net profit projection is 240 million yen because of the sound results during the first two quarters and the appropriation of profits on the sales of investment securities. The company intends to pay a term-end dividend of 15 yen/share as announced at the beginning of the term (30 yen/share annual dividend total when combined with the interim dividend paid at the end of the second quarter). On the other hand, the face value of QUO Cards provided as shareholder incentives (varies according to the number of shares held as well as the length of continuous ownership) will be halved across the board.

- While the operation of the classrooms and the schools is gradually returning to normal, it is impossible to predict the end of COVID-19 and it looks as though the company will be searching for the ways to adapt to the “new normal” for quite a while.

1. Company Overview

MEIKO NETWORK JAPAN is a top-brand enterprise running the private tutoring school Meiko Gijuku as a pioneer in private tutoring since the start of its business in 1984. Private tutoring is attracting a lot of attention as a method for nurturing a sense of independence, autonomy, and creativity of children, and the company operates Meiko Gijuku directly and with a franchise system around Japan. In addition, the company conducts a broad range of businesses, including the after-school childcare business, the Japanese language school business, the school support business, etc. via subsidiaries while focusing on the fields of education and culture.

【Management principles, educational ethos, and basic policy】

“We aim to nurture human resources through our contribution to educational and cultural programs.”

“We help achieve goals through our development and diffusion of franchise know-how”.

Under the above two management principles, MEIKO NETWORK JAPAN aims to contribute to society by fulfilling its role as “a private-sector educational business” and “a business assisting in goal achievement,” growing to become a business with high social existential value acknowledged by society.

Moreover, in its role as a part of a private-sector educational business, MEIKO NETWORK JAPAN has established the educational philosophy which is “To nurture creative, independently-minded human resources for 21st century society through an individual tutoring service that promotes self-motivated learning.”

Furthermore, all staff members join hands to actualize “an ideal company,” under the basic policy of “achieving the prosperity of customers, shareholders, and employees by contributing to the educational and cultural businesses.”

1-1 Business description

The reported segments are the three following businesses: Meiko Gijuku directly operated schools, Meiko Gijuku franchised schools, and Japanese language schools. The company operates Meiko Gijuku as a directly operated business using self-study and individual tutoring approaches based on the academic abilities of each student for all grade levels. Also, based on their unique franchise system, the company provides support for establishing classes and continuous guidance to their franchisees and also sell merchandise such as classroom equipment, devices, educational materials, exams, and goods, etc. to them.

As for the Japanese language schools, their consolidated subsidiary, Waseda EDU Co., LTD., manages “Waseda Edu Language School,” which has art classes. Also, Kokusai Jinzai Kaihatsu Co., Ltd. operates “JCLI Japanese Language School,” which has Japanese teacher training seminars for as well as Japanese language courses, etc. for the “Specified skills” visa system.

Aside from these businesses, there are other businesses such as extended-hours cram school performing the added function of after-school care “Meiko Kids,” “Meiko Soccer School,” which provides training by professional coaches, “Waseda Academy Kobetsu School,” which is an individual tutoring school for students with high academic performance, a cram school for medicine-related university entrance examinations operated by Tokyo Ishin Gakuin Co., LTD., business-related to university entrance exams and education-related business operated by Kotoh Jimusho Co., LTD.,.

Business segments and group companies

Segment | Major Business | |

Reported Segments | Meiko Gijuku directly operated schools | ・The individual tutoring schools “Meiko Gijuku” provides tutoring services for students at its directly operated classes and sell merchandise such as educational materials and exams. The company, MAXIS Education Co., Ltd., K. Line Co., Ltd. and K.M.G CORPORATION Co., Ltd. |

Meiko Gijuku franchised schools | ・Establishing classes, management guidance, and sales of merchandise such as classroom equipment, devices, educational materials, exams, merchandise, etc. to “Meiko Gijuku” (the individual tutoring cram schools) franchise schools: The company | |

Japanese language schools | Operating “Waseda Edu Language School”: Waseda EDU Co., Ltd. Operating “JCLI Japanese Language School”: Kokusai Jinzai Kaihatsu Co., Ltd. | |

Others | Other businesses | ・Extended-hours cram school performing the added function of after-school care “Meiko Kids”: The company ・“Meiko Soccer School,” a soccer school for children: The company ・“Waseda Academy Kobetsu School,” an individual tutoring school for students with high academic performance: The company and MAXIS Education Co., Ltd. ・Cram school for medicine-related university entrance examinations: Tokyo Ishin Gakuin Co., LTD. ・Business related to university entrance exams and university education: by Kotoh Jimusho Co., LTD. |

* Besides the above companies, there are the affiliated companies NEXCUBE Corporation, Inc. (South Kore it operates a private tutoring school), the affiliated company Meiko Culture and Education Ltd (Taiwan: it operates a private tutoring school) and the non- consolidated subsidiary COCO-RO PTE LTD (Singapore: it operates a nursery school).

1-2 Strengths

The company's strengths are “Brand power of Meiko Gijuku” and “the unique franchise system that thrives to achieve prosperous coexistence with owners.” Meiko Gijuku operates in all prefectures and is recognized as familiar and accommodating cram schools. This sort of high reputation and brand power are the company's strengths.

Furthermore, as for the company’s franchise system, the headquarters (the company) and the affiliated owners share the same philosophy and work together with the Meiko Owners Club, where all owners are members. Through this cooperation, they hold regular training and study sessions to improve and share the know-how of success, etc. leading them to achieve a prosperous coexistence.

1-3 Market trends

Market trends

According to a research firm, in FY 2018, the market size of cram schools and university preparatory schools was 972 billion yen. Among this, the market size of the individual tutoring school, which is the company’s battlefield, was 445 billion yen and constituted 45.8% of the cram school and university preparatory school market. Also, there are many new entrants in the individual tutoring school market. Hence, the individual tutoring school market share in the cram school and university preparatory school market is growing in FY 2019 as well.

2. The Third Quarter of Fiscal Year ending August 2020 Earnings Results

2-1 Consolidated results for the third quarter (March to May)

| 19/8-1Q | 2Q | 3Q | 4Q | 20/8-1Q | 2Q | 3Q |

Sales | 4,591 | 5,501 | 3,959 | 5,916 | 4,743 | 5,679 | 2,943 |

Gross Profit | 1,364 | 2,137 | 523 | 2,198 | 1,260 | 2,018 | -215 |

SG&A | 933 | 1,021 | 1,177 | 1,316 | 932 | 1,065 | 1,028 |

Operating Profit | 430 | 1,117 | -654 | 882 | 327 | 953 | -1,243 |

Ordinary Profit | 453 | 1,155 | -630 | 929 | 398 | 986 | -1,203 |

Profit attributable to owners of parent | 261 | 710 | -510 | 497 | 195 | 596 | -800 |

* Unit: Million yen

Sales down 25.7% year on year; operating loss at ¥1,240 million (¥650 million in same period of the previous year)

Sales were down 25.7% at 2,940 million yen. Due to COVID-19, the Meiko Gijuku directly-operated schools and the Meiko Gijuku franchised schools both suspended all their classes for two weeks in March, and while the state of emergency was in place, the classroom teaching was suspended in accordance with the instructions given by relevant local authorities. Since then the online individual lessons were rolled out, and presently they are available almost everywhere, except for the small number of franchisees. However, the missed classes that could not be made up by offering alternative dates resulted in reimbursements, and the number of students also decreased as a higher-than-usual number of students withdrew from membership amid the restricted student recruitment activities for the new academic year.

The company also felt the impact as its Japanese language school, KIDS, sport, and Waseda Academy Kobetsu School businesses were all profoundly affected, and as Youdec Co., Ltd., as well as its wholly-owned subsidiary Koyo Shobo Co., Ltd., were eliminated from the company consolidation in the third quarter, as the company sold off all the previously-owned shares of Youdec Co., Ltd.

Sales and Profit by Segment

| 19/8-1Q | 2Q | 3Q | 4Q | 20/8-1Q | 2Q | 3Q |

Meiko Gijuku directly operated school business | 2,215 | 3,058 | 1,954 | 3,411 | 2,392 | 3,286 | 1,532 |

Meiko Gijuku franchised school business | 1,192 | 1,375 | 1,052 | 1,415 | 1,101 | 1,291 | 871 |

Japanese language school business | 343 | 331 | 343 | 343 | 381 | 358 | 230 |

Other Business | 839 | 735 | 609 | 745 | 867 | 742 | 308 |

Consolidated sales | 4,591 | 5,500 | 3,959 | 5,915 | 4,743 | 5,678 | 2,943 |

Meiko Gijuku directly operated school business | -7 | 665 | -469 | 705 | -30 | 703 | -756 |

Meiko Gijuku franchised school business | 561 | 622 | 189 | 620 | 498 | 504 | 42 |

Japanese language school business | 28 | 77 | -23 | 1 | 43 | 73 | 3 |

Other business | 123 | 22 | -63 | -9 | 117 | -42 | -233 |

Adjustments | -275 | -270 | -287 | -435 | -301 | -284 | -298 |

Consolidated operating profit | 430 | 1,117 | -654 | 882 | 327 | 953 | -1,243 |

* Unit: Million yen

2-2 Consolidated results for the third quarter (cumulative)

| 3Q of FY19/8 (cumulative) | Ratio to sales | 3Q of FY20/8 (cumulative) | Ratio to sales | YoY |

Sales | 14,051 | 100.0% | 13,365 | 100.0% | -4.9% |

Gross Profit | 4,024 | 28.6% | 3,063 | 22.9% | -23.9% |

SG&A | 3,131 | 22.3% | 3,025 | 22.6% | -3.4% |

Operating Profit | 893 | 6.4% | 37 | 0.3% | -95.8% |

Ordinary Profit | 978 | 7.0% | 181 | 1.4% | -81.4% |

Profit attributable to owners of parent | 461 | 3.3% | -9 | - | - |

* Unit: Million yen

Sales down 4.9% and ordinary profit down 81.4% year on year

Sales were down 4.9 % year on year at 13,360 million yen. Because of the reorganization of franchisees into subsidiaries, the Meiko Gijuku directly-operated school business managed to maintain the similar sales level to the previous year, but the sales of the Meiko Gijuku franchised school business went down 9.8% year on year because of the lower student number, and COVID-19 and the reduction in the number of consolidated subsidiaries contributed to a 12.2% drop year on year in other sales.

On the profit front, due to COVID-19 the Meiko Gijuku directly-operated school business and other businesses racked up an operating loss, while the profit of the Meiko Gijuku franchised school business – the leading force for the company profits – also saw a 23.9% profit reduction year on year, resulting in an operating profit of 30 million yen, a 95.8% drop year on year. Helped by the increased reversal of allowance for doubtful accounts among others however, non-operating income recovered and achieved an ordinary profit of 180 million yen, but taxation ultimately brought about a loss of 9 million yen.

2-3 Sales and Profit by Segment

| 3Q of FY19/8 (cumulative) | Ratio to sales, profit rate | 3Q of FY20/8 (cumulative) | Ratio to sales, profit rate | YoY |

Meiko Gijuku directly operated school business | 7,228 | 51.4% | 7,211 | 54.0% | -0.2% |

Meiko Gijuku franchised school business | 3,620 | 25.8% | 3,264 | 24.4% | -9.8% |

Japanese language school business | 1,017 | 7.2% | 970 | 7.3% | -4.6% |

Other Business | 2,185 | 15.6% | 1,918 | 14.4% | -12.2% |

Consolidated sales | 14,051 | 100.0% | 13,365 | 100.0% | -4.9% |

Meiko Gijuku directly operated school business | 188 | 2.6% | -84 | - | - |

Meiko Gijuku franchised school business | 1,373 | 37.9% | 1,045 | 32.0% | -23.9% |

Japanese language school business | 81 | 8.0% | 119 | 12.3% | +46.9% |

Other business | 83 | 3.8% | -158 | - | - |

Adjustments | -833 | - | -885 | - | - |

Consolidated operating profit | 893 | 6.4% | 37 | 0.3% | -95.8% |

* Unit: Million yen

Meiko Gijuku directly-operated school business

Sales were 7,211 million yen, down 0.2% year on year, and the segment’s operating loss was 84 million yen. In order to stop the spread of COVID-19, the company rolled out the one-on-one online individual lessons that are similar to individual instructions in the classroom settings, the damages from the classroom shutdown and the fact that the makeup lessons could not be offered until June meant that the third quarter sales were significantly lower (Mar-May) and also the profits were down.

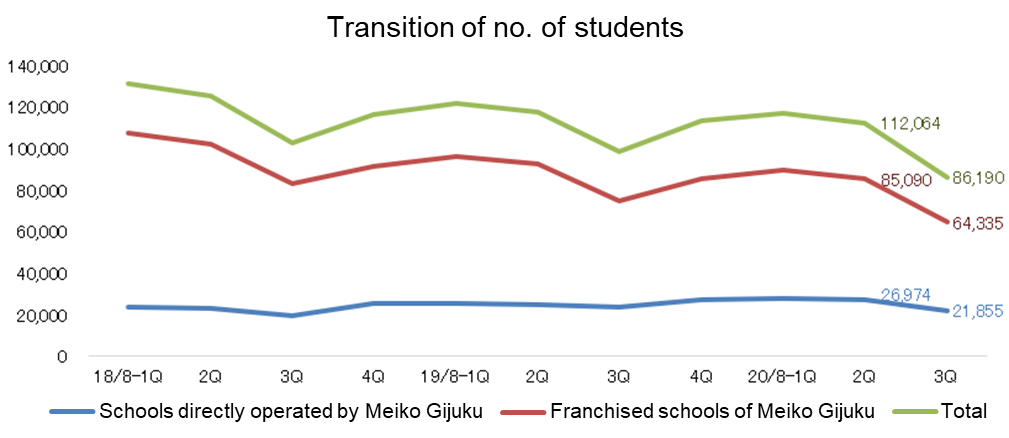

Breakdown of sales was as follows – Meiko Gijuku directly-operated schools: 3,910 million yen (4,260 million yen in the same period in the previous year); 3 consolidated subsidiaries total 3,290 million yen (2,950 million yen in the same period in the previous year). Breakdown of profits was as follows – Meiko Gijuku directly-operated schools: 140 million yen (330 million yen in the same period in the previous year); 3 consolidated subsidiaries total: -50 million yen (10 million yen in profit in the same period in the previous year). Goodwill amortization was 170 million yen (150 million yen in the same period in the previous year). As of the end of the third quarter, the total number of classrooms was 421 (397 in the same period in the previous year); Meiko Gijuku directly-operated schools: 243 (221 at the end of the same period in the previous year); 3 consolidated subsidiaries total: 178 (176 in the same period in the previous year). The number of students was as follows – Meiko Gijuku directly-operated schools: 12,521 (13,719 in the same period in the previous year); 3 consolidated subsidiaries total: 9,334 (10,128 in the same period in the previous year); segment total: 21,855 (23,847 in the same period in the previous year). Compared to the end of the second quarter this represents a reduction of 5,119 students (1,037 in the same period in the previous year).

Meiko Gijuku franchised school business

Sales: 3,260 million yen (down 9.8% year on year); segment’s operating profit: 1,040 million yen (down 23.9% year on year). To stop the spread of COVID-19, the company shut down its classrooms in response to the local authorities’ instructions and pushed for the online individual lessons and the full use of the ICT teaching resources, but the downward trend in the number of classrooms and the students continued.

The number of classrooms, excluding those of the 3 consolidated subsidiaries, at the end of the third quarter was 1,450 (1,549 at the end of the same period in the previous year) and the number of students was 64,335 (74,591 at the end of the same period in the previous year). There were 20,755 fewer students compared to the end of the second quarter (17,829 fewer over the same period in the previous year).

Number of classrooms of Meiko Gijuku, number of students of Meiko Gijuku, Total system-wide sales from Meiko Gijuku schools

| 3Q 19/8(cumulative) | Increase/ decrease | 3Q 20/8(cumulative) | Increase/ decrease |

No. of classrooms directly operated by the company | 221 | -13 | 243 | +22 |

No. of MAXIS classrooms | 92 | -1 | 94 | +2 |

No. of K. LINE classrooms | 41 | +41 | 42 | +1 |

No. of K.M.G classrooms | 43 | +43 | 42 | -1 |

Total No. of classrooms directly operated by Meiko Gijuku | 397 | +70 | 421 | +24 |

No. of franchised classrooms of Meiko Gijuku | 1,549 | -156 | 1,450 | -99 |

Total number of classrooms of Meiko Gijuku | 1,946 | -86 | 1,871 | -75 |

No. of students of schools directly operated by the company | 13,719 | -217 | 12,521 | -1,198 |

No. of students of MAXIS | 5,787 | +169 | 5,406 | -381 |

No. of students of K. LINE | 2,397 | +2,397 | 2,217 | -180 |

No. of students of K.M.G | 1,944 | +1,944 | 1,711 | -233 |

Total No. of students of schools directly operated by Meiko Gijuku | 23,847 | +4,293 | 21,855 | -1,992 |

No. of students of franchised schools of Meiko Gijuku | 74,591 | -8,500 | 64,335 | -10,256 |

Total number of students of Meiko Gijuku [person] | 98,438 | -4,207 | 86,190 | -12,248 |

Sales of the Meiko Gijuku directly operated school business | 7,228 | +782 | 7,211 | -16 |

Sales of the Meiko Gijuku franchised school business | 3,620 | -208 | 3,264 | -355 |

Sales of the Japanese language school business | 1,017 | +36 | 970 | -47 |

Sales of the other business | 2,185 | -131 | 1,918 | -266 |

Total Sales [million yen] | 14,051 | +478 | 13,365 | -686 |

Sales of the Meiko Gijuku directly operated schools | 7,228 | +782 | 7,211 | -16 |

Sales of the Meiko Gijuku franchised schools | 21,414 | -1,830 | 19,402 | -2,012 |

Total system-wide sales from Meiko Gijuku schools [million yen] | 28,643 | -1,047 | 26,614 | -2,029 |

* The sales of the Meiko Gijuku franchised school business include the revenue from royalties and the sales of products.

* Total system-wide sales from Meiko Gijuku schools signifies the sum of lesson fees at the directly-operated classrooms, purchase cost of teaching materials, exam fees, and the lesson fees at the franchised classrooms. Purchase cost of teaching materials and exam fees at the franchised classrooms are not included.

Japanese language school business

Sales were 970 million yen, down 4.6% year on year, and the segment’s operating profit was 110 million yen, up 46.1% year on year. Because the overseas students who were poised to start in April 2020 could not travel to Japan because of the travel ban due to the spread of COVID-19, the total number of students decreased resulting in a lower sales (online follow-ups were offered during the schools shutdown). However, as the ‘agent fees’ (commissions paid to the agents who introduced the students) that are paid at the point of the students’ commencement of studies did not materialize, the profit increased.

At the end of the third quarter, the number of schools was unchanged from the end of the same period in the previous year – Waseda EDU Japanese Language School: 1, and JCLI Japanese Language School: 1 The number of students was Waseda EDU: 402 (568 at the end of the same period in the previous year); JCLI: 619 (926 at the end of the same period in the previous year); and the segment total: 1,021 (1,494 at the end of the same period in the previous year), which represents a decrease of 975 students compared to the end of the second quarter (380 in the same period in the previous year).

Incidentally in May, the company’s online Japanese language learning kit “Japany Language” was accepted by Chiba Chiiki Kaihatsu Kyodo Kumiai (Chiba Regional Development Cooperative) which runs the overseas technical intern training business, and Hitachi Sakura Japanese Language School, a Japanese language school operator. Chiba Chiiki Kaihatsu Kyodo Kumiai is intending to employ this as the supporting materials for the trainees after they arrive in Japan, while Hitachi Sakura Japanese Language School is keen to offer the opportunity to learn Japanese online to the overseas students while they are unable to travel due to COVID-19.

Other businesses

Sales were 1,910 million yen, down 12.2% year on year, and the segment’s operating profit was 150 million yen (80 million yen in the same period in the previous year).

In the KIDS (after-school) business, sales were 290 million yen (260 million yen in the same period in the previous year) and operating profit was 30 million yen (6 million yen in the same period in the previous year). The business had newly opened 9 schools in the spring but with the declaration of the state of emergency, the directly-operated schools and the kids’ clubs were forced to suspend their operations, and some after-schools that were subcontracted by private primary schools also had to close. At the end of the third quarter, the number of schools was as follows – directly-operated schools: 9 (7 at the end of the same period in the previous year); kids’ club facilities: 4 (3 at the end of the same period in the previous year); franchised and subcontracting facilities: 21 (15 at the end of the same period in the previous year); and the segment total: 34 (25 at the end of the same period in the previous year). The number of students was 1,222 (1,122 in the same period in the previous year), which represents a decrease of 41 students compared to the end of the second quarter (in the same period in the previous year there was an increase of 113 students).

In the sport business, (soccer schools, etc.), sales were 70 million yen (100 million yen in the same period in the previous year) and operating loss was 20 million yen (8-million-yen operating profit in the same period in the previous year). Sales were down due to the schools shutdown and the cancellation of events such as the spring holiday camps due to COVID-19, as well as the closure of 3 unprofitable schools. At the end of the third quarter, the number of schools was 20 including 1 franchisee (14 in the same period in the previous year), and the number of students was 709 (873 in the same period in the previous year), which represents a decrease of 77 students compared to the end of the second quarter (33 in the same period in the previous year).

The Waseda Academy Kobetsu School business made 380 million yen in sales (370 million yen in the same period in the previous year) while recording an operating loss of 1 million yen (8 million yen in the same period in the previous year). With the spread of COVID-19, between 2nd and 15th of March and later while the state of emergency was in place, all in-person individual lessons were suspended before the online individual lessons were rolled out from May. At the end of the third quarter, the number of school buildings was as follows - Meiko Gijuku directly-operated schools: 7 (8 at the end of the same period in the previous year); MAXIS Education 6 (5 at the end of the same period in the previous year); Waseda Academy directly-operated schools 27 (12 at the end of the same period in the previous year); franchised schools 11 (10 at the end of the same period in the previous year); and segment total 51 (35 at the end of the same period in the previous year). The number of students across the board was 2,807 (2,435 at the end of the same period in the previous year) which represents a decrease of 1,111 students compared to the end of the second quarter (142 in the same period in the previous year).

Sales of the schools supporting business operated by Kotoh Jimusho Co., LTD. was 860 million yen (1,080 million yen in the same period in the previous year) and operating profit 120 million yen (100 million yen in the same period in the previous year). Its entrance-exam-questions solution business delivered more or less as planned. In addition, Youdec Co., Ltd. (school supporting business) and Koyo Shobo Co., Ltd. (academic publications business) were eliminated from the company consolidation from the third quarter.

Sales from the cram school business operated by Tokyo Ishin Gakuin Co., LTD. was 200 million yen (270 million yen in the same period of the previous year), and operating loss 50 million yen (20 million yen in the same period in the previous year). From 20th of April, both the classroom and individual lessons were switched to online due to COVID-19. They also offered online new entry consultations and learning consultations, but the number of students still decreased, in part affected by the intensifying competition among the medical cram schools. At the end of the third quarter, the number of school buildings was 2 (unchanged from the same period in the previous year), and the number of students 54 (62 in the same period in the previous year), which represents a decrease of 9 students compared to the end of the second quarter (17 in the same period in the previous year).

2-4 Financial standing

| Aug. 2019 | May. 2020 |

| Aug. 2019 | May. 2020 |

Cash | 7,495 | 6,256 | Accounts payable/accrued expenses | 1,355 | 871 |

Trade receivables | 1,294 | 529 | Accrued corporate tax and consumption tax, etc | 797 | 290 |

Inventory | 417 | 173 | Advances received | 1,480 | 1,541 |

Current Assets | 9,734 | 8,189 | Asset retirement obligations | 300 | 306 |

Tangible Assets | 1,220 | 1,209 | Interest-bearing liabilities | 196 | - |

Intangible Assets | 3,311 | 2,975 | Liabilities | 5,350 | 4,429 |

Investments, Others | 5,497 | 5,830 | Net Assets | 14,414 | 13,774 |

Noncurrent Assets | 10,030 | 10,015 | Total Liabilities, Net Assets | 19,765 | 18,204 |

* Unit: Million yen

The total assets as of the end of the third quarter was 18,200 million yen, down 1,560 million yen from the end of the previous term. Cash has diminished as the company cleared the interest-bearing debts, etc. but its liquidity on hand based on the full-year earnings forecast remains high at 4.1 months (4.3 if including securities). Equity ratio was 75.7% (72.9% at the end of the previous quarter).

In addition, the company purchased 1,473,400 treasury shares through Tokyo Stock Exchange’s “Off-Auction Own Share Repurchase Trading System (ToSTNeT-3)” at 1,259,757,000 yen (5.84% of issued shares @ 855 yen/share).

3. Fiscal Year ending August 2020 Earnings Forecasts

3-1 Consolidated estimates for the fourth quarter (June to August)

| 4Q FY19/8 (Act.) | Ratio to total sales | 4Q FY20/8 (Est.) | Ratio to total sales | YoY |

Sales | 5,915 | 100.0% | 4,855 | 100.0% | -17.9% |

Operating Profit | 882 | 14.9% | -117 | - | - |

Ordinary Profit | 929 | 15.7% | -81 | - | - |

Profit attributable to owners of parent | 497 | 8.4% | 249 | 5.1% | -49.9% |

* Unit: Million yen

With COVID-19’s impact still felt, 110 million yen operating loss forecast

For Meiko Gijuku and Waseda Academy Kobetsu School, the number of registered students decreased, and the summer course sales were low; the Japanese language schools witnessed the number of students dwindling as there was no new intakes in April and July due to the travel ban. In addition, both the KIDS and sport businesses are suffering from the lower student number as well as the canceled summer holiday events. All these contributed to the lower sales of 4,850 million yen, down 17.9% year on year.

In terms of profits, an operating loss of 110 million yen is forecast due to the decreased sales of the high-return summer courses and the summer holiday events; increased costs arising from opening the new schools and the greater personnel expenses from a larger intake of new graduates (April); and the TV adverts running as previously planned. Despite this, as the company expects the profits on the sales of securities will be appropriated as extraordinary profits, the net profit is projected to be 240 million yen.

In terms of the new schools, Since February, the company opened 17 new Jiritsu Gakushu RED classrooms, including 8 opened in July, and 7 tyotto juku classrooms, including 1 opened in July.

In the Meiko Gijuku business, 100% of the company’s directly-operated schools and the franchised schools have managed to go online. After the state of emergency was lifted, the company has been proffering the hybrid of in-person and online meetings as per the students’ needs. With a high demand for in-person meetings, the company is operating the classrooms with the highest level of infection controlling measures in place. With many local authorities opting for a shorter summer holiday period, it has been clear that the company would not be able to secure the necessary number of days for the summer courses within the usual July – August timeframe. In the light of this the company decided to operate the courses over the period of 3 months from July till September. The sales from the summer courses in FY ending Aug 2020 is expected to drop by about 30% year on year, partly because the courses will stretch into September (= first quarter of FY ending Aug 2021), although the drop is only about 20% if the September sales are taken into consideration.

Transition of quarterly sales・operating profit

| 18/8-1Q | 2Q | 3Q | 4Q | 19/8-1Q | 2Q | 3Q | 4Q | 20/8-1Q | 2Q | 3Q | 4Q Est. |

Sales | 4,411 | 5,358 | 3,804 | 5,543 | 4,591 | 5,501 | 3,959 | 5,915 | 4,743 | 5,678 | 2,943 | 4,855 |

Operating profit | 401 | 785 | -522 | 777 | 430 | 1,117 | -654 | 882 | 327 | 953 | -1,243 | -117 |

* Unit: Million yen

3-2 Full year estimates

| FY19/8 (Act.) | Ratio to total sales | FY20/8 (Est.) | Ratio to total sales | YoY |

Sales | 19,967 | 100.0% | 18,220 | 100.0% | -8.8% |

Operating Profit | 1,775 | 8.9% | -80 | - | - |

Ordinary Profit | 1,907 | 9.6% | 100 | 0.5% | -94.8% |

Profit attributable to owners of parent | 958 | 4.8% | 240 | 1.3% | -75.0% |

* Unit: Million yen

Sales down 8.8% year on year and 80 million yen operating loss forecasted

Although an operating loss of 80 million yen is forecast due to the COVID-19 downturn in the third quarter, and its impact is still being felt in the fourth quarter, a 100-million-yen ordinary profit is expected when the reversal of allowance for doubtful accounts and others are appropriated. With the profit on the sales of securities considered, the net profit is expected to be 240 million yen.

The company intends to pay a term-end dividend of 15 yen/share as announced at the beginning of the term, making the annual dividend total of 30 yen/share when combined with the interim dividend paid at the end of the second quarter. On the other hand, the face value of QUO Cards provided as the shareholder incentives (varies according to the number of shares held as well as the length of continuous ownership) will be halved across the board.

4. Conclusions

While the operation of the classrooms and the schools is gradually returning to normal, it is impossible to predict the end of COVID-19 and it looks as though the company will be searching for the ways to adapt to the “new normal” for quite a while.

The entry of new students to the Japanese language schools occur four times a year in April, July, October, and January, but many prospective students are waiting at their respective home countries due the COVID-19 travel ban in place. If the ban is lifted before October, the original April and July intakes as well as the October ones would all start at once; while this might have a positive effect on the sales, the agent fees would become a significant burden.

With a good initiative, the company has been able to establish the system for working from home, which in turn floated the possibility of reducing the office spaces. Certain temporary expenses for restoration would be incurred, the rent for the headquarter building is expected to decrease in FY ending Aug 2021.

<Reference: Regarding Corporate Governance>

◎Organizational form and the composition of the boards of directors and auditors

Organizational form | Company with audit and supervisory board |

Directors | 6 directors, including 2 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎ Corporate governance reports

Last updated on Apr 13, 2020.

Basic policy

Our company continuously promotes managerial structure reforms to construct a flexible and transparent management organization that adapts to the new era. Moreover, our company plans to further strengthen corporate governance focused on the shareholder value by ensuring the transparency, soundness, and fairness of its management, implementing thorough risk management and improving accountability. Furthermore, our company's basic policy is to maximize the corporate value for all stakeholders including shareholders through the sustainable growth of our company group, the enhancement of the business model which demonstrates unique added value, and the strengthening of profitability via the collaboration of all the group companies. Our company’s basic policy also includes the improvement of management transparency and efficiency. Hence, the company is working to establish a swift and efficient management and execution systems while balancing the management supervision and business execution systems. The company is also making efforts to achieve highly transparent management through the participation of outside directors. Additionally, the company established “The MEIKO NETWORK JAPAN Group Corporate Governance Code Guideline” and published it on the company website to clarify the status of the efforts and policies related to each principle of the corporate governance code, fulfill the fiduciary responsibilities and to provide accountability.

https://www.meikonet.co.jp/investor/governance/index.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company follows all the principles of the corporate governance code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [The So-Called Strategically Held Shares]

The strategically held shares are shares held for purposes other than investment. We hold the shares of business partners for purposes such as business alliances, maintaining and strengthening transactions, and stabilizing shares. The board of directors examines the necessity of reducing these shares appropriately through considering whether these shares are important for the company’s growth, whether there is a more effective use of funds, etc. Moreover, as for exercising voting rights for these shares, the approval for a proposal is decided by having the department in charge examine carefully the proposal content taking into consideration the conditions of the invested companies and the business relationship with these companies, etc.

Principle 1-7 [Transactions between Related Parties]

Transactions that would constitute competition or conflict of interest for the directors and the corporations that the directors substantially control should be deliberated and decided by the board of directors. Additionally, transaction conditions and policies for determining transaction conditions, etc. are disclosed in the notice of convocation of the general meeting of shareholders and annual securities reports, etc. The company has established a system that will not be disadvantageous to it in case the corporations that the company's officers and directors substantially control and major shareholders do business as clients of the company.

Principle 5-1 [Policy on Constructive Dialogue with Shareholders]

Our company's corporate planning department is responsible for IR. The company holds financial results briefings for shareholders and investors once every six months and conducts regular individual interviews.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (MEIKO NETWORK JAPAN: 4668), etc. at www.bridge-salon.jp/.