Bridge Report:(4668)MEIKO NETWORK JAPAN Fiscal Year ended August 2020

Kazuhito Yamashita, President | MEIKO NETWORK JAPAN CO., LTD.(4668) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Service |

President | Kazuhito Yamashita |

HQ Address | Sumitomo Fudosan Nishi-Shinjuku Bldg., Nishi-Shinjuku 7-20-1, Shinjuku-Ku, Tokyo |

Year-end | August |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Market Cap. | ROE (Act.) | Trading Unit | |

¥618 | 25,083,626 shares | ¥15,501million | -18.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥10.00 | 1.6% | ¥10.76 | 57.4x | ¥377.67 | 1.6x |

*The share price is the closing price on October 29. The number of shares outstanding was obtained by subtracting the number of treasury shares from the number of shares outstanding as of the end of the latest quarter. ROE and BPS are the actual values as of the end of the previous term.

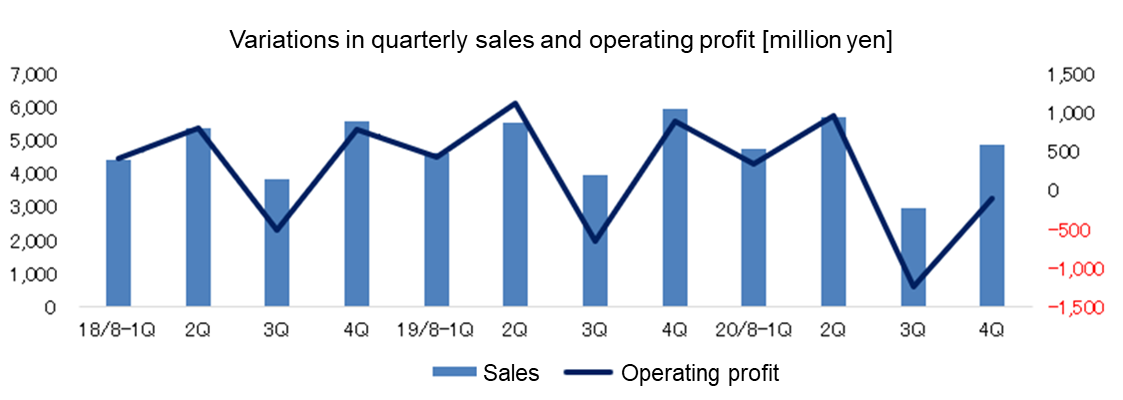

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

August 2017 (Act.) | 19,383 | 2,615 | 2,806 | 2,042 | 76.92 | 40.00 |

August 2018 (Act.) | 19,116 | 1,441 | 1,558 | 657 | 24.74 | 42.00 |

August 2019 (Act.) | 19,967 | 1,775 | 1,907 | 958 | 36.08 | 30.00 |

August 2020 (Act.) | 18,218 | 214 | 451 | -2,232 | -85.21 | 30.00 |

August 2021 (Est.) | 18,300 | 264 | 319 | 270 | 10.76 | 10.00 |

*The forecasted values were provided by the company. Unit: Million yen

This Bridge Report includes the overview of the financial results of MEIKO NETWORK JAPAN CO., LTD. of Fiscal Year ended August 2020 and the outlook of Fiscal Year ending August 2021.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended August 2020 Earnings Results

3. Fiscal Year ending August 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In FY ended Aug 2020, sales and operating profit fell 8.8% and 87.9% year on year, respectively. Both sales and profit declined due to a decrease in students and the suspension of classes caused by the spread of COVID-19, but operating and ordinary profit beat expectations on the back of cost control measures. At the end of the fiscal year, the number of classrooms at Meiko Gijuku fell 75 year on year to 1,862 and the number of students fell 11,808 year on year to 101,273. The company plans to pay a year-end dividend of 15 yen/share, or an annual dividend of 30 yen/share when combined with the interim dividend paid at the end of the second quarter. At the same time, the face value of QUO Cards provided as shareholder incentives (varies according to the number of shares held as well as the length of continuous ownership) are to be halved across the board.

- For FY ending Aug 2021, the company estimates year on year increases of 0.4% for sales and 22.9% for operating profit. It expects the impact from the exclusion of a subsidiary from the scope of consolidation and a decline in sales in the Japanese language school business amid restrictions on entering Japan to be offset by the growth in sales of MEIKO NETWORK JAPAN owing to contributions from the KIDS business and new businesses. Its projects operating profit growth even amid upfront investments aimed at restoring growth in the next fiscal year and beyond. The company has positioned FY ending Aug 2021 as “a period for strengthening internal systems in order to restore growth in FY ending Aug 2022 onward.” It plans to pay an interim dividend of 5 yen/share at the end of the second quarter and a term-end dividend of 5 yen/share for a total annual dividend of 10 yen/share (the estimated payout rati 92.9%). Shareholder incentives are to be unchanged from the FY ended Aug 2020.

- In FY ended Aug 2020, while the company struggled amid a drop in the number of students, the total number of students, which slumped 64.4% year on year in February-May, rebounded 92.7% year on year in June-August, shining a positive light on earnings going forward. However, earnings over the next year will be swayed by the intake of new students in spring, which is when new enrollments are concentrated. While earnings growth is expected for FY ending Aug 2021 following the bottom in the previous term, the company is concerned over the possibility of cooling consumer sentiment impacting household expenditure on education. As such, it plans to increase promotional spending (TV commercials, online advertisements, campaigns, etc.) and step up student recruitment activities. For now, it is targeting a total number of students in line with the figure at the end of FY ended Aug 2019.

1. Company Overview

MEIKO NETWORK JAPAN is a top-brand enterprise running the private tutoring school Meiko Gijuku as a pioneer in private tutoring since the start of its business in 1984. Private tutoring is attracting a lot of attention as a method for nurturing a sense of independence, autonomy, and creativity of children, and the company operates Meiko Gijuku directly and with a franchise system around Japan. In addition, the company conducts a broad range of businesses, including the after-school childcare business, the Japanese language school business, the school support business, etc. via subsidiaries while focusing on the fields of education and culture.

【Management principles, educational ethos, and basic policy】

“We aim to nurture human resources through our contribution to educational and cultural programs.”

“We help achieve goals through our development and diffusion of franchise know-how”.

Under the above two management principles, MEIKO NETWORK JAPAN aims to contribute to society by fulfilling its role as “a private-sector educational business” and “a business assisting in goal achievement,” growing to become a business with high social existential value acknowledged by society.

Moreover, in its role as a part of a private-sector educational business, MEIKO NETWORK JAPAN has established the educational philosophy which is “To nurture creative, independently-minded human resources for 21st century society through an individual tutoring service that promotes self-motivated learning.”

Furthermore, all staff members join hands to actualize “an ideal company,” under the basic policy of “achieving the prosperity of customers, shareholders, and employees by contributing to the educational and cultural businesses.”

1-1 Business description

The reported segments are the three following businesses: Meiko Gijuku directly operated schools, Meiko Gijuku franchised schools, and Japanese language schools. The company operates Meiko Gijuku as a directly operated business using self-study and individual tutoring approaches based on the academic abilities of each student for all grade levels. Also, based on their unique franchise system, the company provides support for establishing classes and continuous guidance to their franchisees and also sell merchandise such as classroom equipment, devices, educational materials, exams, and goods, etc. to them.

As for the Japanese language schools, their consolidated subsidiary, Waseda EDU Co., LTD., manages “Waseda Edu Language School,” which has art classes. Also, Kokusai Jinzai Kaihatsu Co., Ltd. operates “JCLI Japanese Language School,” which has Japanese teacher training seminars for as well as Japanese language courses, etc. for the “Specified skills” visa system.

Aside from these businesses, there are other businesses such as extended-hours cram school performing the added function of after-school care “Meiko Kids,” “Meiko Soccer School,” which provides training by professional coaches, “Waseda Academy Kobetsu School,” which is an individual tutoring school for students with high academic performance, a cram school for medicine-related university entrance examinations operated by Tokyo Ishin Gakuin Co., LTD., business-related to university entrance exams and education-related business operated by Kotoh Jimusho Co., LTD.,.

Business segments and group companies

Segment | Major Business | |

Reported Segments | Meiko Gijuku directly operated schools | ・The individual tutoring schools “Meiko Gijuku” provides tutoring services for students at its directly operated classes and sell merchandise such as educational materials and exams. The company, MAXIS Education Co., Ltd., K. Line Co., Ltd, K.M.G CORPORATION Co. Ltd. And One link Co., Ltd. |

Meiko Gijuku franchised schools | ・Establishing classes, management guidance, and sales of merchandise such as classroom equipment, devices, educational materials, exams, merchandise, etc. to “Meiko Gijuku” (the individual tutoring cram schools) franchise schools: The company | |

Japanese language schools | Operating “Waseda Edu Language School”: Waseda EDU Co., Ltd. Operating “JCLI Japanese Language School”: Kokusai Jinzai Kaihatsu Co., Ltd. | |

Others | Other businesses | ・Extended-hours cram school performing the added function of after-school care “Meiko Kids”: The company ・“Meiko Soccer School,” a soccer school for children: The company ・“Waseda Academy Kobetsu School,” an individual tutoring school for students with high academic performance: The company and MAXIS Education Co., Ltd. ・Cram school for medicine-related university entrance examinations: Tokyo Ishin Gakuin Co., LTD. ・Business related to university entrance exams and university education: by Kotoh Jimusho Co., LTD. |

* Besides the above companies, there are the affiliated companies NEXCUBE Corporation, Inc. (South Kore it operates a private tutoring school), the affiliated company Meiko Culture and Education Ltd (Taiwan: it operates a private tutoring school) and the non- consolidated subsidiary COCO-RO PTE LTD (Singapore: it operates a nursery school).

1-2 Strengths

The company's strengths are “Brand power of Meiko Gijuku” and “the unique franchise system that thrives to achieve prosperous coexistence with owners.” Meiko Gijuku operates in all prefectures and is recognized as familiar and accommodating cram schools. This sort of high reputation and brand power are the company's strengths.

Furthermore, as for the company’s franchise system, the headquarters (the company) and the affiliated owners share the same philosophy and work together with the Meiko Owners Club, where all owners are members. Through this cooperation, they hold regular training and study sessions to improve and share the know-how of success, etc. leading them to achieve a prosperous coexistence.

1-3 Market trends

Market trends

According to a research firm, in FY 2020, the forecast of the market size of cram schools and university preparatory schools as of Sep 2020 is 960 billion yen. Among this, the market size of the individual tutoring school, which is the company’s battlefield, was 445 billion yen and constituted 46.4% of the cram school and university preparatory school market. Also, there are many new entrants in the individual tutoring school market. Hence, the individual tutoring school market share in the cram school and university preparatory school market is growing.

2. Fiscal Year ended August 2020 Earnings Results

Response to the government’s state of emergency declaration and the impact on operations

In accordance with the government and the Ministry of Economy, Trade and Industry’s request for nationwide school closures, the company took measures to suspend classes at all classrooms from March 2 to 15, 2020. Also, in response to the government’s declaration of a state of emergency, classrooms at Meiko Gijuku schools, Waseda Academy Kobetsu School, Meiko Soccer School, Study Club, ESL club, and Japanese language schools in Tokyo, Kanagawa, Chiba, Saitama, Osaka, Hyogo, and Fukuoka (861 classrooms in total) closed from April 8 to May 6. In the KIDS (after-school) business, subcontracted after-school operations were suspended, but directly-operated schools continued to provide services, mainly for the children of healthcare providers and government and police officials.

During the closures, the company provided free ICT-based learning materials and individual online lessons. It also implemented the “Catch up on learning! Meiko support campaign,” in which students that newly enroll at Meiko Gijuku schools in April were offered one month of free lessons in every subject. A TV commercial was also aired, where the head of the school gave a message of encouragement.

When reopening classrooms, the company thoroughly implemented 11 infection prevention measures, such as temperature and health management card checks prior to lessons, disinfection and social distancing. It also provided support for health centers by collecting and managing virus outbreak information on the schools its students attend and their families at the headquarters. It continues to carry out these measures for all classrooms across Japan.

Impact on the Meiko Gijuku school business

The COVID-19 pandemic has had a major impact on student recruitment activities. The number of new student enrollments at Meiko Gijuku schools in February-August fell 11,439 year on year (down 22.7%) to 39,075. As of August, the number of registered students is 101,273, down 11,808 (10.4%) year on year. Also, 95% of the local governments shortened summer vacations at schools, resulting in roughly a 30% drop in summer course sales (July-August for Meiko Gijuku directly-operated schools).

| Spring(February-May) | Summer(June-August) |

No. of newly enrolled students | 17,612 | 21,463 |

YoY comparison | 64.4% | 92.7% |

No. of registered students | 86,190(May) | 101,273(August) |

YoY comparison | 87.6% | 89.6% |

Impact on the Japanese language school business

In the first half of the fiscal year, the business saw the number of students grow year on year (up 123), and also reported solid earnings. In the second half, however, restrictions on entering Japan were put in place due to the spread of the coronavirus, meaning that overseas students poised to start in April and July 2020 could not travel to Japan, weighing heavily on earnings (online lessons were provided to existing students). As of the end of FY ended Aug 2020, the number of students came to 954, down 828 (46.5%) year on year.

New businesses

The company opened three new schools in the spring of 2020: Jiritsu Gakushu RED, where students learn through a curriculum optimized for their individual needs via AI technology, tyotto juku, a cram school specialized in one-on-one coaching for university entrance exams, and Meiko Kids e, which offers English-only after-school childcare. RED and tyotto juku struggled, as their student recruitment period coincided with the COVID-19 outbreak (the number of students is gradually increasing). Meanwhile, Meiko Kids e managed to secure the number of students expected upon opening, but ended up becoming an up-front investment due partly to temporary closures caused by the pandemic.

Jiritsu Gakushu RED | Opened a total of 20 classrooms (12 directly operated, 8 franchised) Niizashiki classroom, Shinmatsudo classroom, Kasugai Kozoji classroom, etc. |

tyotto juku | Opened a total of 7 classrooms (2 directly operated, 5 franchised) Omiya classroom, Kawasaki classroom, Kashiwa classroom, Gifu classroom, etc. |

Meiko Kids e | Opened two directly-operated schools Ario Kitasuna (Koto Ward), Shimoigusa (Suginami Ward) |

2-1 Consolidated results

| FY 8/19 | Ratio to sales | FY 8/20 | Ratio to sales | YoY | Forecasts in 3Q | Ratio to Forecasts |

Sales | 19,967 | 100.0% | 18,218 | 100.0% | -8.8% | 18,220 | -0.0% |

Gross Profit | 6,222 | 31.2% | 4,401 | 24.2% | -29.3% | - | - |

SG&A | 4,447 | 22.3% | 4,187 | 23.0% | -5.9% | - | - |

Operating Profit | 1,775 | 8.9% | 214 | 1.2% | -87.9% | -80 | - |

Ordinary Profit | 1,907 | 9.6% | 451 | 2.5% | -76.3% | 100 | +351.9% |

Profit attributable to owners of parent | 958 | 4.8% | -2,232 | - | - | 240 | - |

* Unit: Million yen

Sales and operating profit down 8.8% and 87.9% year on year, respectively

Sales fell 8.8% year on year to 18.21 billion yen. This owed to sales declines of (1) the Meiko Gijuku directly-operated and franchised school businesses due in part to a decline of the number of students and lower sales for summer courses due to makeup lessons offered for those missed during school closures, and (2) the Japanese language school business due to the decrease of students stemming from restrictions on entering Japan and the exclusion of some subsidiaries from the scope of consolidation.

On the profit front, cost of sales increased 0.5% year on year due to measures to strengthen the workforce at the company and the booking of personnel costs incurred by K.M.G (added to consolidated accounts in the third quarter of the previous fiscal year) on a full-year basis (purchases decreased 280 million yen, but personnel costs increased 370 million yen). Meanwhile, efficient cost control measures centered on advertising/promotional expenses (down 130 million yen) and remuneration for executives (down 37 million yen) resulted in a 5.9% year on year reduction in SG&A expenses. However, as this was insufficient to offset the major drag from the decline in sales, operating profit plummeted 87.9% year on year to 214 million yen. Non-operating profit grew on the back of an increase in provisions of alliance for doubtful accounts and the booking of subsidy income, and the company booked 990 million in gains on the sale of investment securities under extraordinary profit. However, this was outweighed by the extraordinary loss of 2.98 billion yen associated with the booking of impairment losses and losses on the sale of investment securities, causing a net loss of 2.23 billion yen.

The aforementioned extraordinary loss breaks down to (1) 2.29 billion yen in goodwill amortization and a 150 million yen impairment loss for tangible fixed assets for the three group companies that help operate the Meiko Gijuku directly-operated school business (MAXIS Education, K. Line, K.M.G ) and the two that run the Japanese language school business (Waseda EDU, Kokusai Jinzai Kaihatsu), (2) a 460 million yen loss on the valuation of investment securities (the valuation of 5 startups invested in), and (3) a 50 million yen loss on sales of stocks of subsidiaries and affiliates (Youdec and Koyo Shobo).

The company plans to pay a term-end dividend of 15 yen/share, or an annual dividend of 30 yen/share when combined with the interim dividend paid at the end of the second quarter. At the same time, the face value of QUO Cards provided as shareholder incentives (varies according to the number of shares held as well as the length of continuous ownership) are to be halved across the board.

Factors behind differences from forecasts

Sales were largely in line with estimates, but efforts to control group-wide SG&A costs (including personnel costs and sales promotion expenses) led to better-than-expected operating and ordinary profit. However, the firm ended up booking a much bigger net loss than anticipated due to the booking of above-mentioned impairment losses.

2-2 Sales and Profit by Segment

| FY 8/19 | Composition Ratio/ Ratio to sales | FY 8/20 | Composition Ratio/ Ratio to sales | YoY |

Meiko Gijuku directly operated school business | 10,639 | 53.3% | 10,297 | 56.5% | -3.2% |

Meiko Gijuku franchised school business | 5,035 | 25.2% | 4,349 | 23.9% | -13.6% |

Japanese language school business | 1,361 | 6.8% | 1,156 | 6.3% | -15.1% |

Other Business | 2,931 | 14.7% | 2,414 | 13.3% | -17.6% |

Consolidated sales | 19,967 | 100.0% | 18,218 | 100.0% | -8.8% |

Meiko Gijuku directly operated school business | 894 | 8.4% | 294 | 2.9% | -67.1% |

Meiko Gijuku franchised school business | 1,993 | 39.6% | 1,428 | 32.9% | -28.3% |

Japanese language school business | 82 | 6.1% | 54 | 4.7% | -34.1% |

Other business | 73 | 2.5% | -276 | - | - |

Adjustments | -1,269 | - | -1,287 | - | - |

Consolidated operating profit | 1,775 | 8.9% | 214 | 1.2% | -87.9% |

* Unit: Million yen

Meiko Gijuku directly-operated school business

Sales stood at 10.29 billion yen (down 3.2% year on year) and profit (operating profit) at 294 million yen (down 67.1% year on year). While also providing individual online lessons, after the government’s state of emergency was lifted, the company gradually began reopening classrooms depending on the situation at each local government and region, implementing individual lessons in person while thoroughly taking coronavirus infection prevention measures (preparing a safe classroom environment, health management, etc.). However, sales fell because of a decrease in students and lower sales for summer courses due to makeup lessons offered for those missed during school closures, and profit plummeted due to heavy fixed cost burdens.

Sales break down to (1) 5.63 billion yen (down 8.2% year on year) at Meiko Gijuku directly-operated schools and (2) a total of 4.65 billion yen (up 3.6% year on year) for the 3 consolidated subsidiaries. Sales growth for the latter owed to full-year contributions from K.M.G, added to consolidated accounts in the third quarter of the previous year. Profit breaks down to (1) 430 million yen (down 44.9% year on year) at Meiko Gijuku directly-operated schools and (2) a total of 84 million yen (down 73.3% year on year) for the 3 consolidated subsidiaries. Goodwill amortization was 220 million yen (210 million yen in the previous fiscal year). As of the end of the term, the total number of classrooms was 421, up 24 year on year (244 at Meiko Gijuku directly-operated schools, a total of 177 for the 3 consolidated subsidiaries). The number of students came to 26,317, down 1,113 year on year (14,961 at Meiko Gijuku directly-operated schools, a total of 11,356 at the 3 consolidated subsidiaries).

Meiko Gijuku directly-operated schools | FY 8/19 | FY 8/20 | Increase Decrease |

| MAXIS Education | FY 8/19 | FY 8/20 | Increase Decrease |

Sales | 6,143 | 5,639 | -504 |

| Sales | 2,867 | 2,703 | -163 |

Operating profit | 795 | 438 | -356 |

| Operating profit | 102 | -83 | -185 |

No. of classrooms (end of August) | 221 | 244 | +23 |

| No. of classrooms (end of August) | 92 | 94 | +2 |

No. of students (FY avg.) | 15,281 | 14,491 | -791 |

| No. of students (FY avg.) | 6,482 | 6,533 | +51 |

Avg. no. of students per classroom (FY avg.) | 67.4 | 63.0 | -4.5 |

| Avg. no. of students per classroom (FY avg.) | 69.8 | 70.1 | +0.4 |

Sales per student | 402.0 | 389.2 | -12.9 |

| Sales per student | 442.4 | 414.2 | -28.2 |

|

|

|

|

|

|

|

|

|

K. Line | FY 8/19 | FY 8/20 | Increase Decrease |

| K.M.G | FY 8/19 3/4Q | FY 8/20 | Increase Decrease |

Sales | 1,214 | 1,145 | -68 |

| Sales | 414 | 808 | +394 |

Operating profit | 14 | -28 | -42 |

| Operating profit | -17 | -32 | -14 |

No. of classrooms (end of August) | 41 | 41 | 0 |

| No. of classrooms (end of August) | 43 | 42 | -1 |

No. of students (FY avg.) | 2,689 | 2,535 | -154 |

| No. of students (FY avg.) | 2,143 | 2,089 | -55 |

Avg. no. of students per classroom (FY avg.) | 64.5 | 61.0 | -3.6 |

| Avg. no. of students per classroom (FY avg.) | 49.8 | 49.1 | -0.8 |

Sales per student | 451.6 | 452.1 | +0.6 |

| Sales per student | 193.4 | 388.0 | +194.5 |

* Unit: Million yen, classrooms, students, thousand yen

Meiko Gijuku franchised school business

Sales stood at 4.34 billion yen (down 13.6% year on year) and profit to 1.42 billion yen (down 28.3%). Excluding the 3 consolidated subsidiaries, the number of classrooms at the end of the fiscal year was 1,441, down 99 year on year. This decrease is due partly to the closure of unprofitable classrooms and the transfer of some franchises into directly-operated schools. The number of students came to 74,956, down 10,695 year on year.

The company flexibly conducted classroom operations in response to changes to schedules and shortened summer vacations at schools owing to the spread of COVID-19. Despite these efforts, sales fell due to classroom closures and the decrease of students amid the pandemic, and measures to strengthen the workforce pushed up personnel costs, weighing on profit.

| FY 8/19 | FY 8/20 | Increase/ decrease |

No. of classrooms (end of August) | 1,540 | 1,441 | -99 |

No. of students (FY avg.) | 87,387 | 78,991 | -8,396 |

Avg. no. of students per classroom (FY avg.) | 54.4 | 52.8 | -1.6 |

Royalty income (million yen) | 3,069 | 2,727 | -341 |

Sales per classroom (thousand yen) | 1,911.5 | 1,823.2 | -88.4 |

* Unit: classrooms, students

Japanese language school business

Sales came to 1.15 billion yen (down 15.1% year on year) and profit to 54 million yen (down 34.1% year on year). At the end of the fiscal year, the number of schools was unchanged year on yea Waseda EDU Japanese language school: 1 and JCLI Japanese language school: 1. The number of students was 954, down 828 year on year (386 at Waseda EDU Japanese language school, 568 at JCLI Japanese language school).

Due to restrictions on entering Japan, overseas students poised to start in April and July 2020 could not travel to Japan, resulting in a sharp drop in the number of students. The company conducted hybrid lessons (a combination of in-person and online lessons) as a way to prevent the spread of the coronavirus, and also provided online lessons for students waiting to enroll. Students meant to enroll in April, July, and October are scheduled to enroll in April 2021.

Other businesses

Sales stood at 2.41 billion yen (down 17.6% year on year), hurt by the decline in sales for the sports business and Tokyo Ishin Gakuin, as well as the exclusion of Youdec and Koyo Shobo from the scope of consolidation in the third quarter. Drags from the sales decline and upfront investments in new businesses (Jiritsu Gakushu RED, tyotto juku, Meiko Kids e, etc.) resulted in a 270 million yen loss in profit (a profit of 73 million yen in the previous fiscal year).

In the KIDS (after-school) business, the company reported sales of 410 million yen (up 6.7% year on year) and an operating loss of 37 million (a profit of 23 million yen in the previous term). At the end of the fiscal year, the number of schools was 34, up 9 year on year. This broke down to 9 directly-operated schools (up 2), 4 kids’ club facilities (up 1), 21 franchised and subcontracting facilities (up 6). The number of students was 1,399, up 255 year on year.

Due to the spread of COVID-19, the company was hit with delays with acquiring new students/customers for the new school year in the spring, as well as refrained use of its schools/facilities and school closures. This resulted in a drop in sales as well as cost burdens associated with newly opened schools and other facilities.

The sports business (football schools, etc.) reported sales of 80 million yen (140 million yen in the previous term) and an operating loss of 33 million (a profit of 9 million yen in the previous term). At the end of the fiscal year, the number of schools remained flat year on year at 14 and the number of students came to 535, down 335 year on year.

The company reported a sales decline and operating losses due to the impact from school closures and event cancellations and a sharp drop in the number of students caused by the COVID-19 pandemic. As such, it pushed forward with the restructuring of the business, closing six unprofitable schools and turning three directly-operated schools into franchises at the end of the fiscal year.

In the Waseda Academy Kobetsu School business, sales were 530 million yen (down 0.2% year on year) and operating profit was 17 million yen (17 million yen in the previous term). At the end of the fiscal year, the number of schools was 51, up 16 year on year (7 Meiko Gijuku directly-operated schools, 5 schools at MAXIS Education, 28 Waseda Academy directly-operated schools, and 11 franchised schools.) There was 1 additional Meiko Gijuku directly-operated school, 16 additional Waseda directly-operated schools, and 1 less franchised school. The number of students at the end of the term across all schools was 4,126, up 1,006.

In the third quarter, the number of students dropped significantly (2,807 at the end of the same period in the previous year) due to the impact from the COVID-19 pandemic. However, the adoption of a new system in which students were given the option of choosing online or face-to-face lessons, keeping schools open during the Obon holiday (excluding some schools) to provide summer courses and makeup lessons for those missed during school closures, helped keep sales and profit largely on par with year-earlier levels as well as increased the number of students in the fourth quarter.

In the school supporting and academic publications businesses, sales stood at 930 million yen (down 32.4% year on year) and operating profit at 110 million yen (up 80.3% year on year). Deliveries for the entrance-exam-questions solutions business, part of the school supporting business operated by the consolidated subsidiary Kotoh Jimusho, were more or less as planned. However, Youdec (school supporting business) and Koyo Shobo (academic publications business), previously consolidated subsidiaries, were eliminated from the company’s scope of consolidation in the third quarter, resulting in a decline in sales.

The cram school business operated by Tokyo Ishin Gakuin reported sales of 300 million yen (down 18.1% year on year) and an operating loss of 30 million yen (a loss of 29 million yen in the previous term). At the end of the fiscal year, the number of schools was 2, in line with the year-earlier figure, while the number of students fell 13 year on year to 56. Amid a decrease in the number of students due to intensifying competition among medical cram schools, the business was also hit with the impact from the COVID-19 pandemic. Since June 2020, the business has resumed face-to-face lessons, and has worked to improve the grades of its students by carrying out special summer courses for high school students, English and Math study camps, and summer study camps to help high school graduates pass entrance exams, among others.

In addition, the other business (including the Study Club, ESL Club, Jiritsu Gakushu RED, tyotto juku, Meiko Kids e, overseas operations, etc.) booked sales of 140 million yen (up 34.0% year on year).

2-3 Financial standing and cash flows

Financial standing

| Aug. 2019 | Aug. 2020 |

| Aug. 2019 | Aug. 2020 |

Cash | 7,495 | 7,015 | Accounts payable/accrued expenses | 1,355 | 1,189 |

Trade receivables | 1,294 | 845 | Accrued corporate tax and consumption tax, etc. | 797 | 485 |

Inventory | 417 | 155 | Advances received | 1,480 | 1,537 |

Current Assets | 9,734 | 8,848 | Asset retirement obligations | 300 | 346 |

Tangible Assets | 1,220 | 1,142 | Interest-bearing liabilities | 196 | 0 |

Intangible Assets | 3,311 | 545 | Liabilities | 5,350 | 4,568 |

Investments, Others | 5,497 | 3,504 | Net Assets | 14,414 | 9,473 |

Noncurrent Assets | 10,030 | 5,192 | Total Liabilities, Net Assets | 19,765 | 14,041 |

* Unit: Million yen

The total assets at the end of the fiscal year was 14.04 billion yen (down 5.72 billion yen year on year). In addition to a decrease in impairment losses and goodwill amortization (from 3.04 billion yen to 270 million yen), investment securities decreased (from 4.07 billion yen to 2.12 billion yen) due to lower unrecognized gains and the booking of losses on the sale and valuation of these investments. Cash also diminished, but its liquidity on hand based on the full-year earnings forecast remains high at 4.8 months. In addition to the eradication of interest-bearing debt, the company booked a net loss, resulting in a decrease in retained earnings. Equity ratio was 67.5% (72.9% at the end of the previous term).

Cash Flow

| FY 8/19 | FY 8/20 | Increase/ decrease | |

Operating Cash Flow(A) | 2,505 | 140 | -2,364 | -94.4% |

Investing Cash Flow(B) | -347 | 1,243 | +1,590 | - |

Free Cash Flow(A+B) | 2,158 | 1,383 | -775 | -35.9% |

Financing Cash Flow | -829 | -2,063 | -1,234 | - |

Term End Cash and Equivalents | 7,445 | 6,765 | -679 | -9.1% |

Operating cash flow (CF) came to positive 140 million yen, due partly to a pre-tax loss of 1.53 billion (a pre-tax income of 1.85 billion in the previous term), a depreciation of 190 million yen (180 million yen in the previous term), impairment losses of 2.45 billion yen (42 million yen in the previous term), and income tax payments of 1.03 billion yen (410 million yen in the previous term). Investing CF was mainly for the sale of investment securities, and financing CF for the purchase of treasury stock and dividend payments.

3. Fiscal Year ending August 2021 Earnings Forecasts

3-1 Consolidated Business Results

| FY 8/20 (Act.) | Ratio to total sales | FY 8/21 (Est.) | Ratio to total sales | YoY |

Sales | 18,218 | 100.0% | 18,300 | 100.0% | +0.4% |

Operating Profit | 214 | 1.2% | 264 | 1.4% | +22.9% |

Ordinary Profit | 451 | 2.5% | 319 | 1.7% | -29.4% |

Profit attributable to owners of parent | -2,232 | - | 270 | 1.5% | - |

* Unit: Million yen

Operating profit is estimated to rise 22.9% year on year by offsetting upfront investments for restoring growth in FY ending Aug 2022 and beyond

In FY ending Aug 2021, sales are projected to edge up 0.4% (or 80 million yen) year on year to 18.3 billion yen. Although sales for consolidated subsidiaries are forecast to fall 340 million yen year on year due to lower sales for the Japanese language school business owing to the impact from the exclusion of Youdec and Koyo Shobo from the scope of consolidation and restrictions on entering Japan, the company expects this to be offset by a 420 million yen increase in sales of MEIKO NETWORK JAPAN, owing to sales growth for the KIDS business and new businesses.

As for MEIKO NETWORK JAPAN, the incorporation-type company split for One link (Minoh City, Osaka Prefecture) is anticipated to work as a 140 million yen drag on sales, while the KIDS business and new businesses are expected to work as boosts of 180 million yen and 360 million yen, respectively. As for consolidated subsidiaries, One link is forecast to work as a 360 million yen boost on sales, while the exclusion of Youdec and Koyo Shobo from the scope of consolidation is anticipated to work as a 410 million yen drag. The Japanese school business is also expected to see sales fall 340 million yen year on year.

In the Meiko Gijuku school business, as part of efforts to enable swift decision making and the clarification of responsibilities by adopting self-supporting accounting in order to enhance regional strategies, the company established One link in September 2020 through an incorporation-type company split and transferred part of parent MEIKO NETWORK JAPAN’s Meiko Gijuku school business to it.

Operating profit is forecast to jump 22.9% (50 million yen) year on year to 260 million yen. While the company expects profit for the Japanese language school business to decrease 510 million yen, it sees goodwill amortization falling 390 million yen, and profit at parent MEIKO NETWORK JAPAN and the four consolidated subsidiaries outweighing the 650 million yen in costs associated with preventing the spread of COVID-19 to grow 130 million yen. Furthermore, the exclusion of Youdec and Koyo Shobo from the scope of consolidation is forecast to boost profit by 50 million yen. Costs associated with preventing the spread of COVID-19 break down to (1) franchise support (for recruiting students, etc.) costs of 440 million yen, (2) digital transformation and customer data platform (CDP) related costs of 150 million yen, and (3) 60 million yen for preparing a safe classroom environment (including infection prevention measures). The company has labeled them as costs for preventing the spread of COVID-19, but they are actually forward-looking investments geared towards the growth for the next fiscal year and beyond.

The company plans to pay an interim dividend of 5 yen/share at the end of the second quarter and a term-end dividend of 5 yen/share for a total annual dividend of 10 yen/share (the estimated payout rati 92.9%). As in the previous term, the face value of QUO Cards provided as shareholder incentives (varies according to the number of shares held as well as the length of continuous ownership) are to be halved across the board.

3-2. Initiatives for FY ending Aug 2021

The company has outlined four key policies: (1) the creation of a new Meiko Gijuku school business, (2) adapting to the “new normal” and improving productivity, (3) expanding the scope of the Japanese language school business, and (4) the enhancement/expansion of new franchised businesses.

Creation of a new Meiko Gijuku school business

The company plans to adopt GAIA, a registrar and classroom management system for individual teaching, as well as create a customer data platform (CDP) to deploy marketing strategies. It is also aiming to bolster its ICT teaching resources.

Given the shift toward ICT amid educational reforms and work-style reforms at cram schools and the increasing importance of communication with students and parents/guardians, the company is going to completely overhaul its registrar system and classroom management system to integrate the management of students’ attendance, lesson reports, grade management, and learning progress. As part of such efforts, the company has developed the registrar and classroom management system GAIA, which it has begun rolling out at directly operated classrooms in October 2020, and plans to roll out at franchised classrooms in May 2021.

It will also create a customer data platform that integrates various data, such as classroom and student data acquired through GAIA, call center information, web information, and GIS information, and utilize this to improve marketing strategies (for recruiting students, etc.) and the services offered.

In addition to the above, the company will work to bolster its ICT teaching resources in response to educational reforms. In particular, the company will implement the full-scale adoption of MonoXer (drills for home learning), which provides drill and listening resources focused on memorization for home learning, as it is expected to generate synergies between individual learning.

Also, the company will adopt a system specialized for online lessons in a bid to improve the quality of online lessons. Online lessons carried out due to the COVID-19 pandemic were previously done via Zoom, but as Zoom is a system geared toward regular business meetings, carrying out lessons in the same manner as face-to-face lessons proved difficult. The specialized system should enable more efficient learning, such as by allowing students to watch videos during lessons, and improve the overall quality of online lessons. While face-to-face lessons will remain the basic teaching method, the company will also provide online lessons on an as-needed basis.

Adapting to the “new normal” and improving productivity

In August 2020, the company reduced the number of floors in its headquarters and has also been promoting work-style reforms by introducing a telecommuting system. In April-August 2020, 40-50% of the work at the headquarters was carried out at home. It has achieved various working styles not restricted by location or time, and is also working to improve results and productivity through the individual working style of each employee.

Expanding the scope of the Japanese language school business

At present, the Japanese language school business operates two Japanese language schools. However, due to the impact from restrictions on entering Japan caused by the spread of COVID-19, the company anticipated difficulties in enrolling new students in October 2020 and January 2021. As such, the students slated to enroll in these periods are now scheduled to enroll in the next round of enrollments in April 2021. This is projected to result in a decrease in the number of students, and thus a sharp decline in sales and profit for FY ending Aug 2021.

In addition to the two Japanese language schools in operation, the company is carrying out Japanese language lessons using online Japanese learning source “Japany” (to support non-Japanese people in working in Japan). It also plans to expand the scope of its business into the recruitment field with the brand MEIKO GLOBAL and provide integrated services spanning from Japanese language learning to employment support. MEIKO GLOBAL is the ultimate one-stop service that helps solve problems in Japanese language education and law violations (centered on education and compliance), the biggest issues faced by overseas personnel, to enable safe and reliable employment. The company plans to accelerate the launch of this service going forward.

Enhancement/expansion of new franchised businesses

As for the new businesses started up in the spring of 2020, in FY ended Aug 2020 the company primarily opened directly-operated schools aimed at accumulating know-how. In FY ending Aug 2021, however, it will step up the development of its franchised school business. Namely, it plans to open 40 franchised classrooms a year at Jiritsu Gakushu RED, where students learn through a curriculum optimized for their individual needs via AI technology and 4 new franchised classrooms at Meiko Kids e, which offers English-only after-school childcare. The company is currently receiving a number of inquiries from potential affiliates. Meanwhile, at tyotto juku, a cram school specialized in one-on-one coaching for university entrance exams, the company opened 7 new classrooms (2 directly operated classrooms, 5 franchised classrooms) in the previous fiscal year, but as there have been inconsistencies with the startup of these classrooms, it is planning to shore up this business before expanding further.

4. Conclusions

In FY ended Aug 2020, the company struggled amid a drop in the number of students. However, the total number of students, which slumped 64.4% year on year in spring (February-May), rebounded 92.7% year on year in summer (June-August), recovering in the lead-up to summer courses. Students are enrolled throughout the year, but earnings over the next year will be swayed by the intake of new students in spring, which is when enrollments are concentrated. As the number of students has bottomed out, as mentioned above, the company expects growth in the intake of new students in FY ending Aug 2021. However, the company is concerned over the possibility of cooling consumer sentiment impacting household expenditure on education. As such, it plans to provide support for franchised schools/classrooms (for recruiting new students, etc.). For now, it is targeting a total number of students in line with the figure for the end of the previous term.

In addition to lower fixed costs thanks to the reduction of the number of floors in its headquarters, through the adoption of teleworking and work-style reforms, the company has provided a work environment that enables various working styles not restricted by location or time, and also promotes the individual working style of each employee. Through the adoption of GAIA and the creation of a customer data platform (CDP), the company also plans to utilize IT in its operations and optimize its marketing activities through digital transformation. As such, an upturn in sales should result in a sharp improvement in profitability. Developments on this front are expected to bear fruit going forward.

<Reference: Regarding Corporate Governance>

◎Organizational form and the composition of the boards of directors and auditors

Organizational form | Company with audit and supervisory board |

Directors | 6 directors, including 2 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎ Corporate governance reports

Last updated on Apr 13, 2020.

Basic policy

Our company continuously promotes managerial structure reforms to construct a flexible and transparent management organization that adapts to the new era. Moreover, our company plans to further strengthen corporate governance focused on the shareholder value by ensuring the transparency, soundness, and fairness of its management, implementing thorough risk management and improving accountability. Furthermore, our company's basic policy is to maximize the corporate value for all stakeholders including shareholders through the sustainable growth of our company group, the enhancement of the business model which demonstrates unique added value, and the strengthening of profitability via the collaboration of all the group companies. Our company’s basic policy also includes the improvement of management transparency and efficiency. Hence, the company is working to establish a swift and efficient management and execution systems while balancing the management supervision and business execution systems. The company is also making efforts to achieve highly transparent management through the participation of outside directors. Additionally, the company established “The MEIKO NETWORK JAPAN Group Corporate Governance Code Guideline” and published it on the company website to clarify the status of the efforts and policies related to each principle of the corporate governance code, fulfill the fiduciary responsibilities and to provide accountability.

https://www.meikonet.co.jp/investor/governance/index.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company follows all the principles of the corporate governance code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [The So-Called Strategically Held Shares]

The strategically held shares are shares held for purposes other than investment. We hold the shares of business partners for purposes such as business alliances, maintaining and strengthening transactions, and stabilizing shares. The board of directors examines the necessity of reducing these shares appropriately through considering whether these shares are important for the company’s growth, whether there is a more effective use of funds, etc. Moreover, as for exercising voting rights for these shares, the approval for a proposal is decided by having the department in charge examine carefully the proposal content taking into consideration the conditions of the invested companies and the business relationship with these companies, etc.

Principle 1-7 [Transactions between Related Parties]

Transactions that would constitute competition or conflict of interest for the directors and the corporations that the directors substantially control should be deliberated and decided by the board of directors. Additionally, transaction conditions and policies for determining transaction conditions, etc. are disclosed in the notice of convocation of the general meeting of shareholders and annual securities reports, etc. The company has established a system that will not be disadvantageous to it in case the corporations that the company's officers and directors substantially control, and major shareholders do business as clients of the company.

Principle 5-1 [Policy on Constructive Dialogue with Shareholders]

Our company's corporate planning department is responsible for IR. The company holds financial results briefings for shareholders and investors once every six months and conducts regular individual interviews.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (MEIKO NETWORK JAPAN: 4668), etc. at www.bridge-salon.jp/.