Bridge Report:(4668)MEIKO NETWORK JAPAN the first quarter of fiscal year ending August 2021

Kazuhito Yamashita, President | MEIKO NETWORK JAPAN CO., LTD.(4668) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Service |

President | Kazuhito Yamashita |

HQ Address | Sumitomo Fudosan Nishi-Shinjuku Bldg., Nishi-Shinjuku 7-20-1, Shinjuku-Ku, Tokyo |

Year-end | August |

HP |

Stock Information

Share Price | Shares Outstanding (end of the term) | Market Cap. | ROE (Act.) | Trading Unit | |

¥586 | 27,803,600 shares | ¥16,292 million | -18.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥10.00 | 1.7% | ¥10.76 | 54.5 x | ¥377.67 | 1.6 x |

*The share price is the closing price on January 25. The number of shares outstanding, DPS, and EPS are the values as of the end of the latest quarter. ROE and BPS are the actual values as of the end of the previous term.

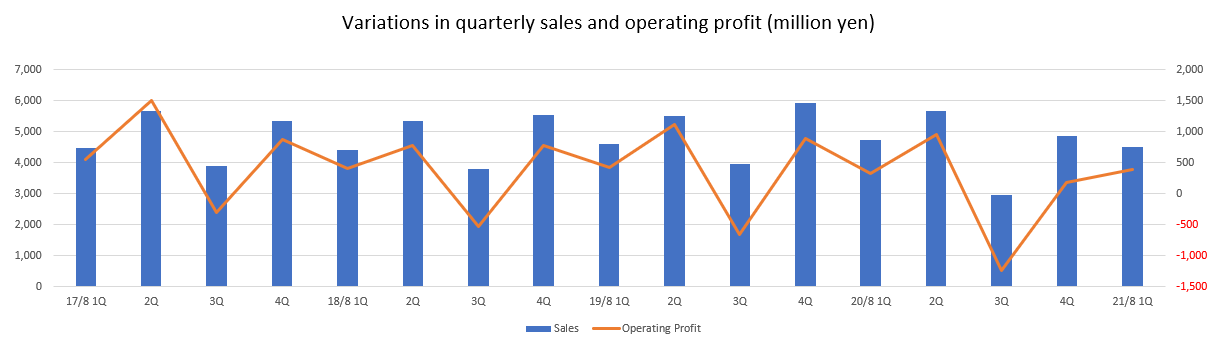

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Income | EPS (¥) | DPS (¥) |

August 2017 (Act.) | 19,383 | 2,615 | 2,806 | 2,042 | 76.92 | 40.00 |

August 2018 (Act.) | 19,116 | 1,441 | 1,558 | 657 | 24.74 | 42.00 |

August 2019 (Act.) | 19,967 | 1,775 | 1,907 | 958 | 36.08 | 30.00 |

August 2020 (Act.) | 18,218 | 214 | 451 | -2,232 | -85.21 | 30.00 |

August 2021 (Est.) | 18,300 | 264 | 319 | 270 | 10.76 | 10.00 |

*The forecasted values were provided by the company. Unit: Million yen, yen. Net profit means the profit attributable to owners of parent hereinafter.

This Bridge Report includes the overview of the financial results of MEIKO NETWORK JAPAN CO., LTD. for the first quarter of fiscal year ending August 2021.

Table of Contents

Key Points

1. Company Overview

2. The First Quarter of Fiscal Year ending August 2021 Earnings Results

3. Fiscal Year ending August 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales of the first quarter of FY ending Aug 2021 were 4,502 million yen, down 5.1% year on year. The sales of Meiko Gijuku directly operated school business increased as the summer course period was extended from Jul.-Aug. to Jul.-Sep., but the sales of Meiko Gijuku franchised school business, which are located mainly in local areas, declined, because the speed of recovery was gentle compared with the schools in urban areas. Operating profit rose 21.0% year on year to 396 million yen. Due to the drop in sales, gross profit and gross profit margin decreased, but thanks to the cost reduction at the headquarters and the disappearance of goodwill amortization, which was posted in the same period of the previous year for Meiko Gijuku directly operated school business, profit increased. The profit from Meiko Gijuku directly operated school business improved year on year from the negative value to a positive value, while the profit from Meiko Gijuku franchised school business dropped. Net profit grew 59.0% year on year to 311 million yen, thanks to the posting of gain on sale of investment securities, the decrease of tax burdens, etc.

- The full-year earnings forecast for FY ending Aug 2021 is unchanged. It is estimated that sales will be 18.3 billion yen, up 0.4% year on year, operating profit will be 264 million yen, up 22.9% year on year, and net profit will move into the black, standing at 270 million yen. In addition, the number of students has been recovering since August, the year-on-year decrease has shrunk, and the sales and profit in the first quarter have exceeded the estimates slightly, but at the beginning of 2021, the government declared a state of emergency for the second time, so the rate of increase in the number of students is now sluggish. For the shift from franchise to direct supervision of management in Kyushu, it is estimated that costs will be posted earlier than sales. As for dividends, the company plans to pay an interim dividend of 5 yen/share and a term-end dividend of 5 yen/share for 10 yen/share per year (the estimated payout rati 92.9%). As for shareholder incentives, the company will give QUO cards according to the number of shares held and the number of years of shareholding.

- In the first quarter (Sep. to Nov.), the number of students recovered, and sales and profit exceeded the estimates, but as the government declared a state of emergency again in response to the spread of COVID-19, the outlook for the period from the second quarter is becoming unclear. In the short term, the business of the company will be affected by the state of the pandemic and governmental and municipal responses.

- In the medium term, we would like to pay attention to the progress of “strengthening and expansion of the new FC business,” which is one of their intensive measures. The company thinks that the “expansion of the FC business” is the bedrock of the original business model and growth factor of the company, and in order to return to a growth track, it is the most important to allocate managerial resources to the expansion of FC. We would like to see how speedily “Jiritsugakusyu RED,” in which students can learn through individually optimized curricula based on AI, and “Meiko Kids e,” which offers English-only after-school childcare, will expand and contribute to revenues, as well as the expansion of the existing business.

1. Company Overview

MEIKO NETWORK JAPAN is a top-brand enterprise running the private tutoring school Meiko Gijuku as a pioneer in private tutoring since the start of its business in 1984. Private tutoring is attracting a lot of attention as a method for nurturing a sense of independence, autonomy, and creativity of children, and the company operates Meiko Gijuku directly and with a franchise system around Japan. In addition, the company conducts a broad range of businesses, including the after-school childcare business, the Japanese language school business, the school support business, etc. via subsidiaries while focusing on the fields of education and culture.

【Management principles, educational ethos, and basic policy】

“We aim to nurture human resources through our contribution to educational and cultural programs.”

“We help achieve goals through our development and diffusion of franchise know-how”.

Under the above two management principles, MEIKO NETWORK JAPAN aims to contribute to society by fulfilling its role as “a private-sector educational business” and “a business assisting in goal achievement,” growing to become a business with high social existential value acknowledged by society.

Moreover, in its role as a part of a private-sector educational business, MEIKO NETWORK JAPAN has established the educational philosophy which is “To nurture creative, independently-minded human resources for 21st century society through an individual tutoring service that promotes self-motivated learning.”

Furthermore, all staff members join hands to actualize “an ideal company,” under the basic policy of “achieving the prosperity of customers, shareholders, and employees by contributing to the educational and cultural businesses.”

1-1 Business description

The reported segments are the three following businesses: Meiko Gijuku directly operated schools, Meiko Gijuku franchised schools, and Japanese language schools. The company operates Meiko Gijuku as a directly operated business using self-study and individual tutoring approaches based on the academic abilities of each student for all grade levels. Also, based on their unique franchise system, the company provides support for establishing classes and continuous guidance to their franchisees and also sell merchandise such as classroom equipment, devices, educational materials, exams, and goods, etc. to them.

As for the Japanese language schools, their consolidated subsidiary, Waseda EDU Co., LTD., manages “Waseda Edu Language School,” which has art classes. Also, Kokusai Jinzai Kaihatsu Co., Ltd. operates “JCLI Japanese Language School,” which has Japanese teacher training seminars for as well as Japanese language courses, etc. for the “Specified skills” visa system.

Aside from these businesses, there are other businesses such as extended-hours cram school performing the added function of after-school care “Meiko Kids,” “Meiko Soccer School,” which provides training by professional coaches, “Waseda Academy Kobetsu School,” which is an individual tutoring school for students with high academic performance, a cram school for medicine-related university entrance examinations operated by Tokyo Ishin Gakuin Co., LTD., business-related to university entrance exams and education-related business operated by Kotoh Jimusho Co., LTD.,.

Business segments and group companies

Segment | Major Business | |

Reported Segments | Meiko Gijuku directly operated schools | ・The individual tutoring schools “Meiko Gijuku” provides tutoring services for students at its directly operated classes and sell merchandise such as educational materials and exams. The company, MAXIS Education Co., Ltd., K. Line Co., Ltd, K.M.G CORPORATION Co. Ltd. And One link Co., Ltd. |

Meiko Gijuku franchised schools | ・Establishing classes, management guidance, and sales of merchandise such as classroom equipment, devices, educational materials, exams, merchandise, etc. to “Meiko Gijuku” (the individual tutoring cram schools) franchise schools: The company | |

Japanese language schools | Operating “Waseda Edu Language School”: Waseda EDU Co., Ltd. Operating “JCLI Japanese Language School”: Kokusai Jinzai Kaihatsu Co., Ltd. | |

Others | Other businesses | ・Extended-hours cram school performing the added function of after-school care “Meiko Kids”: The company ・“Meiko Soccer School,” a soccer school for children: The company ・“Waseda Academy Kobetsu School,” an individual tutoring school for students with high academic performance: The company and MAXIS Education Co., Ltd. ・Cram school for medicine-related university entrance examinations: Tokyo Ishin Gakuin Co., LTD. ・Business related to university entrance exams and university education: by Kotoh Jimusho Co., LTD. |

* Besides the above companies, there are the affiliated companies NEXCUBE Corporation, Inc. (South Kore it operates a private tutoring school), the affiliated company Meiko Culture and Education Ltd (Taiwan: it operates a private tutoring school)

1-2 Strengths

The company's strengths are “Brand power of Meiko Gijuku” and “the unique franchise system that thrives to achieve prosperous coexistence with owners.” Meiko Gijuku operates in all prefectures and is recognized as familiar and accommodating cram schools. This sort of high reputation and brand power are the company's strengths.

Furthermore, as for the company’s franchise system, the headquarters (the company) and the affiliated owners share the same philosophy and work together with the Meiko Owners Club, where all owners are members. Through this cooperation, they hold regular training and study sessions to improve and share the know-how of success, etc. leading them to achieve a prosperous coexistence.

1-3 Market trends

Market trends

According to a research firm, in FY 2020, the forecast of the market size of cram schools and university preparatory schools as of Sep 2020 is 960 billion yen. Among this, the market size of the individual tutoring school, which is the company’s battlefield, was 445 billion yen and constituted 46.4% of the cram school and university preparatory school market. Also, there are many new entrants in the individual tutoring school market. Hence, the individual tutoring school market share in the cram school and university preparatory school market is growing.

2. The First Quarter of Fiscal Year ending August 2021 Earnings Results

2-1 Consolidated results for the 1st quarter (Sep. to Nov.)

| 1Q of FY 8/20 | Ratio to sales | 1Q of FY 8/21 | Ratio to sales | YoY |

Sales | 4,743 | 100.0% | 4,502 | 100.0% | -5.1% |

Gross Profit | 1,260 | 26.6% | 1,166 | 25.9% | -7.5% |

SG&A | 932 | 19.7% | 769 | 17.1% | -17.5% |

Operating Profit | 327 | 6.9% | 396 | 8.8% | +21.0% |

Ordinary Profit | 398 | 8.4% | 450 | 10.0% | +13.0% |

Profit attributable to owners of parent | 195 | 4.1% | 311 | 6.9% | +59.0% |

* Unit: Million yen

Sales dropped 5.1% year on year, while operating profit grew 21.0% year on year

The sales of the first quarter of FY ending Aug 2021 were 4,502 million yen, down 5.1% year on year. The sales of Meiko Gijuku directly operated school business increased as the summer course period was extended from Jul.-Aug. to Jul.-Sep., but the sales of Meiko Gijuku franchised school business, which are located mainly in local areas, declined, because the speed of recovery was gentle compared with the schools in urban areas. Operating profit rose 21.0% year on year to 396 million yen. Due to the drop in sales, gross profit and gross profit margin decreased, but thanks to the cost reduction at the headquarters and the disappearance of goodwill amortization, which was posted in the same period of the previous year for Meiko Gijuku directly operated school business, profit increased. The profit from Meiko Gijuku directly operated school business improved year on year from the negative value to a positive value, while the profit from Meiko Gijuku franchised school business dropped. Net profit grew 59.0% year on year to 311 million yen, thanks to the posting of gain on sale of investment securities, the decrease of tax burdens, etc.

2-2 Sales and Profit by Segment

| 1Q of FY 8/20 | Ratio to sales | 1Q of FY 8/21 | Ratio to sales | YoY |

Meiko Gijuku directly operated school business | 2,392 | 50.4% | 2,605 | 57.9% | +8.9% |

Meiko Gijuku franchised school business | 1,101 | 23.2% | 1,026 | 22.8% | -6.8% |

Japanese language school business | 381 | 8.0% | 191 | 4.3% | -49.6% |

Other Business | 867 | 18.3% | 679 | 15.1% | -21.8% |

Consolidated sales | 4,743 | 100.0% | 4,502 | 100.0% | -5.1% |

Meiko Gijuku directly operated school business | -30 | - | 145 | 5.6% | - |

Meiko Gijuku franchised school business | 498 | 45.3% | 462 | 45.0% | -7.4% |

Japanese language school business | 43 | 11.3% | -22 | - | - |

Other business | 117 | 13.6% | 77 | 11.4% | -34.4% |

Adjustments | -301 | - | -265 | - | - |

Consolidated operating profit | 327 | 6.9% | 396 | 8.8% | +21.1% |

* Unit: Million yen.

Meiko Gijuku directly operated school business

Sales grew, moving into the black. In response to the coronavirus crisis, the company extended the summer course period from Jul.-Aug. to Jul.-Sep. (3 months). This measure contributed to sales and profit.

As a primary measure, the company offered mainly face-to-face lessons while taking measures for preventing the spread of the novel coronavirus, including the improvement of the classroom environment and health management. The schools tried to share the know-how to improve the academic performance of each student and enable students to pass the exam to enter the school of each student’s choice and standardize classroom operation, to pursue the increase in customer satisfaction level.

In the first quarter, sales were 2,605 million yen, up 8.9% year on year, and profit was 145 million yen (a loss of 30 million yen in the same period of the previous year).

The number of classrooms was 405, up 6 year on year. The number of registered students was 27,320, down 384 year on year.

Meiko Gijuku franchised school business

Sales and profit dropped. This business was strongly affected by the decrease of students in the previous term due to the coronavirus crisis. As primary measures, the company promoted the use of ICT contents for offering new value in addition to face-to-face lessons, and the headquarters distributed information and offered lessons and training via ZOOM, to share information and diffuse measures.

In the first quarter, sales were 1,026 million yen, down 6.8% year on year, and profit was 462 million yen, down 7.4% year on year.

The number of classrooms was 1,437, down 93 year on year. The number of registered students was 81,310, down 7,983 year on year.

Japanese language school business

Sales and profit declined. The easing of the restriction on entry to Japan was limited, so the number of students nosedived year on year. As a measure for preventing infection, the company organized hybrid classes combining classrooms and online lessons, and gave online lessons to students before entry to the school.

In the first quarter, sales were 191 million yen, down 49.6% year on year, and loss was 22 million yen (a profit of 43 million yen in the same period of the previous year).

The number of school buildings was 2, unchanged year on year, and the number of registered students was 883, down 1,128 year on year.

Other business

Sales and profit declined.

◎ KIDS (after-school) business

While adopting a variety of operation styles, including the directly managed school “Meiko Kids,” private after-school clubs (subsidized), publicly established and privately operated schools, and the facilities entrusted by private elementary schools, the company offered services whose customer satisfaction level is high, and proceeded with preparation and marketing for the opening of new schools in the next spring.

In the first quarter, sales were 126 million yen (99 million yen in the same period of the previous year), and operating loss was 2 million yen (a profit of 3 million yen in the same period of the previous year).

The number of schools was 34 (25 in the same period of the previous year), and the number of registered students was 1,496 (1,240 in the same period of the previous year).

◎ Waseda Academy Kobetsu School business

As an individual tutoring brand for competitive entrance examinations, the company implemented measures for improving the academic performance of students and enabling them to pass the examinations for schools they want to enter, in cooperation with WASEDA ACADEMY CO., LTD. through the meetings for school affairs and advertisement.

In the first quarter, sales were 143 million yen (137 million yen in the same period of the previous year), and operating profit was 13 million yen (11 million yen in the same period of the previous year).

The number of school buildings was 52 (47 in the same period of the previous year), and the total number of students was 4,857 (4,726 in the same period of the previous year).

◎ Jiritsugakusyu RED business

In cooperation with SPRIX CO., LTD., the company operated classrooms as independent tutoring schools where students learn through curricula optimized individually based on AI.

In the first quarter, sales were 17 million yen, and operating loss was 42 million yen.

The number of classrooms was 24 (14 directly managed ones and 10 franchised ones).

◎ Meiko Kids e business

As preschools that offers English-only after-school childcare, the company opened 2 directly managed schools in April 2020, to respond to the growth of interests in early childhood education of English due to the expansion of demand for after-school childcare and educational reform, and proceeded with preparation and marketing before the opening of several facilities in April 2021.

In the first quarter, sales were 14 million yen, operating loss was 18 million yen, and the number of directly managed schools was 2.

◎ School support business

Deliveries for the entrance-exam-questions solutions business were put off slightly, but the business condition was healthy as a whole.

In the first quarter, sales were 276 million yen, and operating profit was 166 million yen.

◎ Cram school business

With the curricula designed based on accumulated data, the company strived to improve the academic performance of students, but the number of students was stagnant, due to the intensification of competition among medical cram schools.

In the first quarter, sales were 66 million yen (74 million yen in the same period of the previous year), and operating loss was 4 million yen (a loss of 12 million yen in the same period of the previous year).

Trend of numbers of Meiko Gijuku schools and registered students and system-wide sales

| 1Q of FY 8/20 | YoY | 1Q of FY 8/21 | YoY |

Number of Meiko Gijuku directly operated schools | 223 | -8 | 208 | -15 |

Number of Meiko Gijuku directly operated schools (MAXIS) | 92 | -1 | 93 | +1 |

Number of Meiko Gijuku directly operated schools (KLINE) | 41 | -1 | 41 | 0 |

Number of Meiko Gijuku directly operated schools (KMG) | 43 | +43 | 42 | -1 |

Number of Meiko Gijuku directly operated schools (One link) | - | - | 21 | +21 |

Number of Meiko Gijuku directly operated schools | 399 | +33 | 405 | +6 |

Number of Meiko Gijuku franchised schools | 1,530 | -125 | 1,437 | -93 |

Total number of Meiko Gijuku schools | 1,929 | -92 | 1,842 | -87 |

Number of registered students of Meiko Gijuku directly operated schools | 15,636 | -433 | 14,523 | -1,113 |

Number of registered students of Meiko Gijuku directly operated schools (MAXIS) | 7,008 | +296 | 6,977 | -31 |

Number of registered students of Meiko Gijuku directly operated schools (KLINE) | 2,709 | -106 | 2,766 | +57 |

Number of registered students of Meiko Gijuku directly operated schools (KMG) | 2,351 | +2,351 | 2,187 | -164 |

Number of registered students of Meiko Gijuku directly operated schools (One link) | - | - | 867 | +867 |

Number of registered students of Meiko Gijuku directly operated schools | 27,704 | +2,108 | 27,320 | -384 |

Number of registered students of Meiko Gijuku franchised schools | 89,293 | -6,815 | 81,310 | -7,983 |

Total number of registered students of Meiko Gijuku schools | 116,997 | -4,707 | 108,630 | -8,367 |

Sales from Meiko Gijuku directly operated schools | 2,392 | +177 | 2,605 | +213 |

Sales from Meiko Gijuku franchised schools | 1,101 | -90 | 1,026 | -75 |

Sales from Japanese language schools | 381 | +37 | 191 | -189 |

Sales from others | 867 | +28 | 679 | -188 |

Total Sales (million yen) | 4,743 | +151 | 4,502 | -240 |

Sales from Meiko Gijuku directly operated schools | 2,392 | +177 | 2,605 | +213 |

System-wide sales from Meiko Gijuku franchised schools | 6,911 | -493 | 6,408 | -502 |

Total system-wide sales from Meiko Gijuku schools (million yen) | 9,303 | -316 | 9,014 | -288 |

* Sales from Meiko Gijuku franchised schools represent royalty revenues and sales of products.

* Total system-wide sales from Meiko Gijuku schools represent the sum of total sales of Meiko Gijuku directly operated schools, including tuition, materials fees, and examination fees, and the total sales of Meiko Gijuku franchised schools, including tuition. Materials fees and examination fees of franchised schools are excluded.

2-3 Financial standing and cash flows

Financial standing

| Aug. 2020 | Nov. 2020 |

| Aug. 2020 | Nov. 2020 |

Cash | 7,015 | 7,237 | Accounts payable/accrued expenses | 1,189 | 901 |

Trade receivables | 845 | 886 | Accrued corporate tax and consumption tax, etc. | 485 | 494 |

Inventory | 155 | 148 | Advances received | 1,537 | 1,568 |

Current Assets | 8,848 | 9,028 | Asset retirement obligations | 346 | 347 |

Tangible Assets | 1,142 | 1,142 | Liabilities | 4,568 | 4,603 |

Intangible Assets | 545 | 508 | Net Assets | 9,473 | 9,399 |

Investments, Others | 3,504 | 3,323 | Total Liabilities, Net Assets | 14,041 | 14,002 |

Noncurrent Assets | 5,192 | 4,974 |

|

|

|

Total Assets | 14,041 | 14,002 |

|

|

|

* Unit: Million yen

Term-end total assets stood at 14,002 million yen, down 38 million yen from the end of the previous term. While cash and deposits increased 222 million yen from the end of the previous term, investments and other assets declined 180 million yen from the end of the previous term.

Total liabilities stood at 4,603 million yen, up 34 million yen from the end of the previous term. Due to the decline in retained earnings, etc., net assets dropped 73 million yen from the end of the previous term to 9,399 million yen.

As a result, equity ratio was 67.1%, down 0.4 points from the end of the previous term.

2-4 Topics

(1) Declaration of Health and Productivity Management

In the coronavirus crisis, the company realized again that “health” is the most important for the company and employees to survive the novel coronavirus-ridden age, find chances in a pinch, and make a leap forward, and declared “Health and Productivity Management ” for clarifying the stance of actively working on the maintenance and enhancement of health of employees.

The policy for Health and Productivity Management , which was announced at the same time, mentions concrete measures for maintaining mental and physical health, promoting workstyle reform, etc.

The company will aim to obtain the certification as an excellent corporation that carries out Health and Productivity Management in “the system for certifying excellent corporations for Health and Productivity Management ,” which was designed by the Ministry of Economy, Trade, and Industry.

Declaration of Health and Productivity Management | As a company that fulfills the social mission of developing independent personnel, Meiko Network Japan will work on the maintenance and enhancement of health of employees who support the growth of the company under the ethos of “development of personnel,” which has been unchanged since business start-up. By developing a working environment where employees can exert their respective individuality and skills to the maximum and work lively while being mental and physical “well-being,”(healthy and happy) we aim to be a company that contributes to society broadly.

January 4, 2021 Kazuhito Yamashita, Representative Director and President Meiko Network Japan Co., Ltd. |

Policy for Health and Productivity Management | 1. To maintain the mental and physical health of employees

We will find any mental or physical disorder of each employee early, and develop a healthy working environment in cooperation with section chiefs and industrial doctors. |

2. To reform workstyles

We will promote flexible workstyles, with which diverse employees can feel that their jobs are comfortable and worthwhile, and support employees in maintaining and enhancing their health voluntarily. | |

3. To foster the corporate culture in which the health of each employee is cared for.

Through the measures for Health and Productivity Management the company will diffuse “the corporate climate or culture in which health is cared for,” and develop an environment in which individual employees are in good shape and can work vigorously. |

(2) Received a petition for a provisional disposition order

On January 8, 2021, Meiko Network Kyushu Co., Ltd., with which the company concluded an area franchise contract, and Meiko Gijuku Kyushu Co., Ltd., to which the company gave a franchise, filed a petition for a provisional disposition order for status confirmation against Meiko Network Japan, and on January 22, 2021, Tokyo District Court sent a notice to the company.

(Overviews of Meiko Network Kyushu Co., Ltd. and Meiko Gijuku Kyushu Co., Ltd.)

Meiko Network Kyushu Co., Ltd. (headquartered in Fukuoka City, Fukuoka Prefecture) | It had jurisdiction over 144 Meiko Gijuku classrooms and 47 franchisees (as of the end of Nov. 2020) in all prefectures in Kyushu, Okinawa Prefecture, and Yamaguchi Prefecture, where it has an area franchise right. As an agent of Meiko Network Japan, it was entitled to look for franchisees, give instructions for opening and operating franchised classrooms, collect fees for franchise, classroom enlargement, renewal, etc., and collect royalties, information system fees, etc. from franchisees. |

Meiko Gijuku Kyushu Co., Ltd. (headquartered in Fukuoka City, Fukuoka Prefecture) | Operating 34 Meiko Gijuku schools (as of the end of November 2020). The company provided it with the franchise right to operate Meiko Gijuku classrooms. |

* The two companies are represented by Mr. Masatsugu Koikawa.

(Background and the contents of the request)

Meiko Network Japan provided the two companies with an area franchise right and operated business, but found that the two companies had a serious default on debt. . Accordingly, on December 15, 2020, the company notified them that the area franchise agreements would be cancelled on December 17, 2020 (timely disclosure on December 24, 2020), and has been coordinating to give management guidance directly since January 2021.

Meanwhile, the two companies claimed that the cancellation of the area franchise agreement was invalid, and filed for a provisional disposition order for confirming the status, including whether they still have the area franchise right in accordance with the area franchise agreement.

(Future outlook)

Meiko Network Japan considers that the notification on cancellation was valid and the petition from Meiko Network Kyushu and Meiko Gijuku Kyushu is invalid.

In the court procedure from now on, the company will state the legitimacy of its claims and refute the claims of the two companies.

The company believes that the impact on its consolidated business results will be minimal at the current time. However , the company will make a prompt announcement if matters that need to be reported arise.

3. Fiscal Year ending August 2021 Earnings Forecasts

3-1 Consolidated Business Results

| FY 8/20 (Act.) | Ratio to total sales | FY 8/21 (Est.) | Ratio to total sales | YoY |

Sales | 18,218 | 100.0% | 18,300 | 100.0% | +0.4% |

Operating Profit | 214 | 1.2% | 264 | 1.4% | +22.9% |

Ordinary Profit | 451 | 2.5% | 319 | 1.7% | -29.4% |

Net Income | -2,232 | - | 270 | 1.5% | - |

* Unit: Million yen

No change in earnings forecast. Sales to increase, net income to return to the Black.

The full-year earnings forecast for FY ending Aug 2021 is unchanged. It is estimated that sales will be 18.3 billion yen, up 0.4% year on year, operating profit will be 264 million yen, up 22.9% year on year, and net profit will move into the black, standing at 270 million yen. As for dividends, the company plans to pay an interim dividend of 5 yen/share and a term-end dividend of 5 yen/share for 10 yen/share per year (the estimated payout rati 92.9%). As for shareholder incentives, the company will give QUO cards according to the number of shares held and the number of years of shareholding.

Each business is operating as usual with thorough infection prevention measures in place.

In addition, the number of students has been recovering since August, the year-on-year decrease has shrunk, and the sales and profit in the first quarter have exceeded the estimates slightly, but at the beginning of 2021, the government declared a state of emergency for the second time, so the rate of increase in the number of students is now sluggish. For the shift from franchise to direct supervision of management in Kyushu, it is estimated that costs will be posted earlier than sales.

(Updated information on intensive measures for the current term)

* Establishment of a new Meiko Gijuku

The company totally renewed the systems for school affairs and classroom operation, and started the prototype of “GAIA,” a system for school affairs and classroom operation for managing the attendance of students, reports on classes, academic results, and progress of learning, to test it.

* Adaptation to the new normal and improvement in productivity

In August 2020, the company decreased the floor of the headquarters, and integrated offices, including those of subsidiaries, to optimize the business operations of the corporate group.

While adopting the telework system, the company is reforming workstyles based on the declaration of Health and Productivity Management, for example, by paying an allowance to jobs that cannot be conducted through telework.

* Expansion of the domain of the Japanese language school business

This business is affected by the restriction on the entry to Japan, but the company has already developed a system for achieving the target number of students if there is no such restriction. Since costs, such as the fees for introducing international students, are posted earlier than sales (monthly school charges), this business model should be evaluated in a span of 2-3 years.

* Strengthening and expansion of the new FC business

The company aims to strengthen and expand the new FC business, mainly “Jiritsugakusyu RED,” in which students learn through individually optimized curricula based on AI, and “Meiko Kids e,” which offers English-only after-school childcare.

As for “Meiko Kids e,” the company decided to open the first FC school in Wakayama Prefecture this spring. It is positioned as a touchstone for local business operation, and the company hopes to accumulate know-how and promote the FC business.

4. Conclusions

In the first quarter (Sep. to Nov.), the number of students recovered, and sales and profit exceeded the estimates, but as the government declared a state of emergency again in response to the spread of COVID-19, the outlook for the period from the second quarter is becoming unclear. In the short term, the business of the company will be affected by the state of the pandemic and governmental and municipal responses.

In the medium term, we would like to pay attention to the progress of “strengthening and expansion of the new FC business,” which is one of their intensive measures. The company thinks that the “expansion of the FC business” is the bedrock of the original business model and growth factor of the company, and in order to return to a growth track, it is the most important to allocate managerial resources to the expansion of FC. We would like to see how speedily “Jiritsugakusyu RED,” in which students can learn through individually optimized curricula based on AI, and “Meiko Kids e,” which offers English-only after-school childcare, will expand and contribute to revenues, as well as the expansion of the existing business.

<Reference: Regarding Corporate Governance>

◎Organizational form and the composition of the boards of directors and auditors

Organizational form | Company with audit and supervisory board |

Directors | 6 directors, including 2 outside directors |

Auditors | 2 auditors, including 2 outside auditors |

◎ Corporate governance reports

Last updated on Nov. 25, 2020.

Basic policy

Our company continuously promotes managerial structure reforms to construct a flexible and transparent management organization that adapts to the new era. Moreover, our company plans to further strengthen corporate governance focused on the shareholder value by ensuring the transparency, soundness, and fairness of its management, implementing thorough risk management and improving accountability. Furthermore, our company's basic policy is to maximize the corporate value for all stakeholders including shareholders through the sustainable growth of our company group, the enhancement of the business model which demonstrates unique added value, and the strengthening of profitability via the collaboration of all the group companies. Our company’s basic policy also includes the improvement of management transparency and efficiency. Hence, the company is working to establish a swift and efficient management and execution systems while balancing the management supervision and business execution systems. The company is also making efforts to achieve highly transparent management through the participation of outside directors. Additionally, the company established “The MEIKO NETWORK JAPAN Group Corporate Governance Code Guideline” and published it on the company website to clarify the status of the efforts and policies related to each principle of the corporate governance code, fulfill the fiduciary responsibilities and to provide accountability.

https://www.meikonet.co.jp/investor/governance/index.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company follows all the principles of the corporate governance code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [The So-Called Strategically Held Shares]

The strategically held shares are shares held for purposes other than investment. We hold the shares of business partners for purposes such as business alliances, maintaining and strengthening transactions, and stabilizing shares. The board of directors examines the necessity of reducing these shares appropriately through considering whether these shares are important for the company’s growth, whether there is a more effective use of funds, etc. Moreover, as for exercising voting rights for these shares, the approval for a proposal is decided by having the department in charge examine carefully the proposal content taking into consideration the conditions of the invested companies and the business relationship with these companies, etc.

Principle 1-7 [Transactions between Related Parties]

Transactions that would constitute competition or conflict of interest for the directors and the corporations that the directors substantially control should be deliberated and decided by the board of directors. Additionally, transaction conditions and policies for determining transaction conditions, etc. are disclosed in the notice of convocation of the general meeting of shareholders and annual securities reports, etc. The company has established a system that will not be disadvantageous to it in case the corporations that the company's officers and directors substantially control, and major shareholders do business as clients of the company.

Principle 5-1 [Policy on Constructive Dialogue with Shareholders]

Our company's corporate planning department is responsible for IR. The company holds financial results briefings for shareholders and investors once every six months and conducts regular individual interviews.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2021 Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (MEIKO NETWORK JAPAN: 4668), etc. at www.bridge-salon.jp/.