Bridge Report:(4668)MEIKO NETWORK JAPAN Second quarter of fiscal year ending August 2021

Kazuhito Yamashita, President | MEIKO NETWORK JAPAN CO., LTD.(4668) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Service |

President | Kazuhito Yamashita |

HQ Address | Sumitomo Fudosan Nishi-Shinjuku Bldg., Nishi-Shinjuku 7-20-1, Shinjuku-Ku, Tokyo |

Year-end | August |

HP |

Stock Information

Share Price | Shares Outstanding (end of the term) | Market Cap. | ROE (Act.) | Trading Unit | |

¥600 | 27,803,600 shares | ¥16,682 million | -18.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥15.00 | 2.5% | ¥27.91 | 21.5x | ¥377.67 | 1.6x |

*The share price is the closing price on April 26. The number of shares outstanding, DPS, and EPS are from the financial results for the second quarter of the Fiscal Year ending August 2021 . ROE and BPS are the actual values as of the end of the previous term.

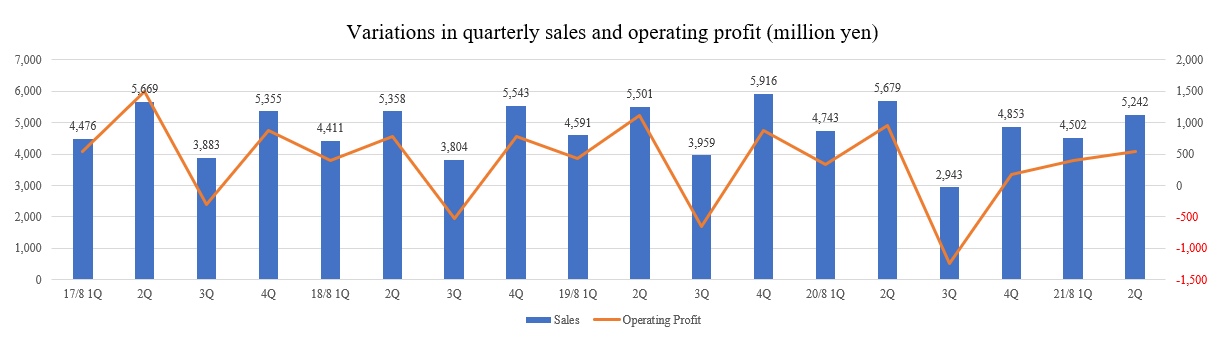

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Income | EPS (¥) | DPS (¥) |

August 2017 (Act.) | 19,383 | 2,615 | 2,806 | 2,042 | 76.92 | 40.00 |

August 2018 (Act.) | 19,116 | 1,441 | 1,558 | 657 | 24.74 | 42.00 |

August 2019 (Act.) | 19,967 | 1,775 | 1,907 | 958 | 36.08 | 30.00 |

August 2020 (Act.) | 18,218 | 214 | 451 | -2,232 | -85.21 | 30.00 |

August 2021 (Est.) | 18,600 | 630 | 760 | 700 | 27.91 | 15.00 |

*The forecasted values were provided by the company. Unit: Million yen, yen. Net profit means the profit attributable to owners of parent hereinafter.

This Bridge Report includes the overview of the financial results of MEIKO NETWORK JAPAN CO., LTD. for the second quarter of fiscal year ending August 2021.

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of Fiscal Year ending August 2021 Earnings Results

3. Fiscal Year ending August 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

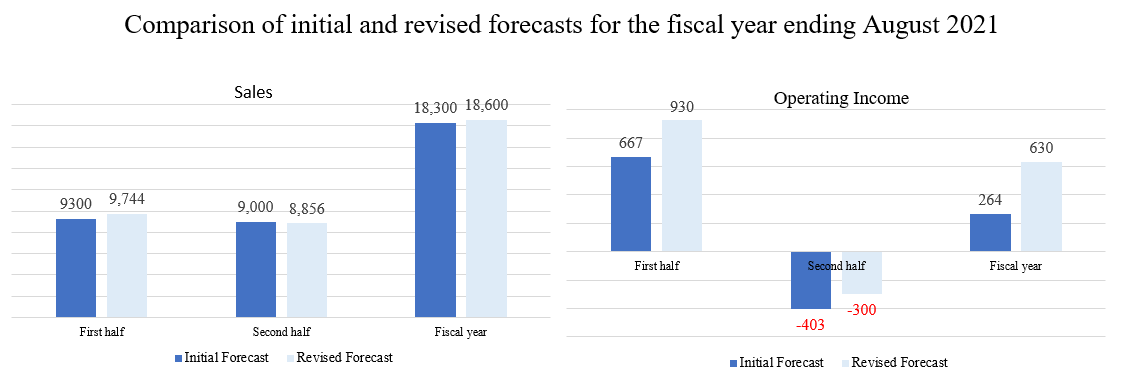

- For the second quarter of FY ending Aug 2021, sales decreased 6.5% year on year to 9,744 million yen. The sales in the Meiko Gijuku directly operated schools business increased, but the sales in the Meiko Gijuku franchised schools business decreased due to the slow pace of recovery, particularly in regional areas. Operating income dropped 27.4% year on year to 930 million yen. Cost of sales, such as procurement expenses, and labor costs decreased, but sales promotion expenses for franchise support augmented. The company upwardly revised its Q2 forecast on March 31, 2021, as it began to show signs of a recovery in business performance due to the continued implementation of various measures to cope with the COVID-19 pandemic. Based on performance trends, the company raised its interim dividend from 5 yen/share to 10 yen/share.

- In line with the upward revision of the first-half earnings forecast for FY ending Aug 2021, the full-year forecast has also been revised upward. Sales are expected to grow 2.1% year on year to 18.6 billion yen, and operating income is projected to increase 193.3% year on year to 630 million yen. Along with the increase in the interim dividend from 5 yen/share to 10 yen/share, the estimated annual dividend was revised upward from 10 yen/share to 15 yen/share. The estimated payout ratio is 53.8%.

- The company upwardly revised its first-half and full-year forecasts. The decline in the number of enrolled students from the same month of the previous year has shrunk, and the company appears to be on the road to recovery, mainly through direct management. However, the increased amount of the full-year forecast is not significantly different from the increased amount of first-half forecast, showing that the company remains cautious about the second half. Amidst the third state of emergency declaration, it will be interesting to see how the full-year financial results, as well as the trend of student recruitment for the new school year will turn out.

- Meanwhile, from a medium-term perspective, one of the priority measures is to "strengthen and expand new franchise businesses." The key to this is the progress of "Jiritsu Gakushu RED," which uses AI to optimize the curriculum for each student, and "Meiko Kids e," an English-only school childcare program. Both of them are at the stage where they are yet to contribute to earnings, but we will keep an eye on the speed of their expansion. Although the company has a strong image as a supplementary school for junior high school students to improve their academic performance, it also has an extensive track record of successful applicants to famous universities for high school students, and the company is considering strengthening the dissemination of information in order to increase revenues.

1. Company Overview

MEIKO NETWORK JAPAN is a top-brand enterprise running the private tutoring school Meiko Gijuku as a pioneer in private tutoring since the start of its business in 1984. Private tutoring is attracting a lot of attention as a method for nurturing a sense of independence, autonomy, and creativity of children, and the company operates Meiko Gijuku directly and with a franchise system around Japan. In addition, the company conducts a broad range of businesses, including the after-school childcare business, the Japanese language school business, the school support business, etc. via subsidiaries while focusing on the fields of education and culture.

【Management principles, educational ethos, and basic policy】

“We aim to nurture human resources through our contribution to educational and cultural programs.”

“We help achieve goals through our development and diffusion of franchise know-how”.

Under the above two management principles, MEIKO NETWORK JAPAN aims to contribute to society by fulfilling its role as “a private-sector educational business” and “a business assisting in goal achievement,” growing to become a business with high social existential value acknowledged by society.

Moreover, in its role as a part of a private-sector educational business, MEIKO NETWORK JAPAN has established the educational philosophy which is “To nurture creative, independently-minded human resources for 21st century society through an individual tutoring service that promotes self-motivated learning.”

Furthermore, all staff members join hands to actualize “an ideal company,” under the basic policy of “achieving the prosperity of customers, shareholders, and employees by contributing to the educational and cultural businesses.”

1-1 Business description

The reported segments are the three following businesses: Meiko Gijuku directly operated schools, Meiko Gijuku franchised schools, and Japanese language schools. The company operates Meiko Gijuku as a directly operated business using self-study and individual tutoring approaches based on the academic abilities of each student for all grade levels. Also, based on their unique franchise system, the company provides support for establishing classes and continuous guidance to their franchisees and also sell merchandise such as classroom equipment, devices, educational materials, exams, and goods, etc. to them.

As for the Japanese language schools, their consolidated subsidiary, Waseda EDU Co., LTD., manages “Waseda Edu Language School,” which has art classes. Also, Kokusai Jinzai Kaihatsu Co., Ltd. operates “JCLI Japanese Language School,” which has Japanese teacher training seminars for as well as Japanese language courses, etc. for the “Specified skills” visa system.

Aside from these businesses, there are other businesses such as extended-hours cram school performing the added function of after-school care “KIDS,” “Waseda Academy Kobetsu School,” which is an individual tutoring school for students with high academic performance, the "Jiritsu Gakushu RED" business, which uses AI to optimize the curriculum for each student; the "Meiko Kids e" business, which offers English-only childcare for schoolchildren; the business related to university entrance examinations and university education conducted by KOTOH & COMPANY CO., LTD.; and the business of prep schools specializing in medical school entrance examinations conducted by Tokyo Ishin Gakuin Co., LTD, etc.

Business segments and group companies

Segment | Major Business | |

Reported Segments | Meiko Gijuku directly operated schools | ・The individual tutoring schools “Meiko Gijuku” provides tutoring services for students at its directly operated classes and sell merchandise such as educational materials and exams. The company, MAXIS Education Co., Ltd., K. Line Co., Ltd, K.M.G CORPORATION Co. Ltd. And One link Co., Ltd. |

Meiko Gijuku franchised schools | ・Establishing classes, management guidance, and sales of merchandise such as classroom equipment, devices, educational materials, exams, merchandise, etc. to “Meiko Gijuku” (the individual tutoring cram schools) franchise schools: The company | |

Japanese language schools | Operating “Waseda Edu Language School”: Waseda EDU Co., Ltd. Operating “JCLI Japanese Language School”: Kokusai Jinzai Kaihatsu Co., Ltd. | |

Others | Other businesses | ・Extended-hours cram school performing the added function of after-school care “KIDS”: The company ・“Waseda Academy Kobetsu School,” an individual tutoring school for students with high academic performance: The company and MAXIS Education Co., Ltd. ・“Jiritsugakusyu RED,” where students learn through individually optimized curricula based on AI: The company ・“Meiko Kids e,” which offers English-only after-school childcare: The company ・Business related to university entrance exams and university education: by Kotoh Jimusho Co., LTD. ・Cram school for medicine-related university entrance examinations: Tokyo Ishin Gakuin Co., LTD. (liquidation in process ) |

* As of the end of Feb 2021. Besides the above companies, there are the affiliated companies NEXCUBE Corporation, Inc. (South Kore it operates a private tutoring school), the affiliated company Meiko Culture and Education Ltd (Taiwan: it operates a private tutoring school)

1-2 Strengths

The company's strengths are “Brand power of Meiko Gijuku” and “the unique franchise system that thrives to achieve prosperous coexistence with owners.” Meiko Gijuku operates in all prefectures and is recognized as familiar and accommodating cram schools. This sort of high reputation and brand power are the company's strengths.

Furthermore, as for the company’s franchise system, the headquarters (the company) and the affiliated owners share the same philosophy and work together with the Meiko Owners Club, where all owners are members. Through this cooperation, they hold regular training and study sessions to improve and share the know-how of success, etc. leading them to achieve a prosperous coexistence.

1-3 Market trends

Market trends

According to a research firm, in FY 2020, the forecast of the market size of cram schools and university preparatory schools as of Sep 2020 is 960 billion yen. Among this, the market size of the individual tutoring school, which is the company’s battlefield, was 445 billion yen and constituted 46.4% of the cram school and university preparatory school market. Also, there are many new entrants in the individual tutoring school market. Hence, the individual tutoring school market share in the cram school and university preparatory school market is growing.

2. The Second Quarter of Fiscal Year ending August 2021 Earnings Results

2-1 Consolidated results

| 2Q of FY 8/20 | Ratio to sales | 2Q of FY 8/21 | Ratio to sales | YoY | Compared to Forecast | Value revised |

Sales | 10,422 | 100.0% | 9,744 | 100.0% | -6.5% | +4.8% | +444 |

Gross Profit | 3,278 | 31.5% | 2,846 | 29.2% | -13.2% | - | - |

SG&A | 1,997 | 19.2% | 1,916 | 19.7% | -4.1% | - | - |

Operating Profit | 1,280 | 12.3% | 930 | 9.5% | -27.4% | +39.4% | +263 |

Ordinary Profit | 1,384 | 13.3% | 1,016 | 10.4% | -26.6% | +47.5% | +327 |

Quarterly Net Income | 791 | 7.6% | 666 | 6.8% | -15.8% | +100.0% | +333 |

* Unit: Million yen. The forecast ratio is against the initial forecast announced in October 2020.

Sales and Profit dropped but exceeded forecasts

Sales decreased 6.5% year on year to 9,744 million yen. The sales in the Meiko Gijuku directly operated schools business increased, but the sales in the Meiko Gijuku franchised schools business decreased due to the slow pace of recovery, particularly in regional areas.

Operating income dropped 27.4% year on year to 930 million yen. Cost of sales, such as procurement expenses, and labor costs decreased, but sales promotion expenses for franchise support augmented.

The company upwardly revised its Q2 forecast on March 31, 2021, as it began to show signs of a recovery in business performance due to the continued implementation of various measures to cope with the COVID-19 pandemic.

Based on performance trends, the company raised its interim dividend from 5 yen/share to 10 yen/share.

2-2 Sales and Profit by Segment

| 2Q of FY 8/20 | Ratio to sales | 2Q of FY 8/21 | Ratio to sales | YoY |

Meiko Gijuku directly operated school business | 5,679 | 54.5% | 5,877 | 60.3% | +3.5% |

Meiko Gijuku franchised school business | 2,393 | 23.0% | 2,159 | 22.2% | -9.8% |

Japanese language school business | 739 | 7.1% | 475 | 4.9% | -35.7% |

Other Business | 1,610 | 15.4% | 1,231 | 12.6% | -23.5% |

Consolidated sales | 10,422 | 100.0% | 9,744 | 100.0% | -6.5% |

Meiko Gijuku directly operated school business | 672 | 11.8% | 878 | 15.0% | +30.7% |

Meiko Gijuku franchised school business | 1,003 | 41.9% | 671 | 31.1% | -33.0% |

Japanese language school business | 116 | 15.7% | -71 | - | - |

Other business | 75 | 4.7% | 7 | 0.6% | -90.6% |

Adjustments | -586 | - | -556 | - | - |

Consolidated operating profit | 1,280 | 12.3% | 930 | 9.5% | -27.4% |

* Unit: Million yen. The composition of profit is the ratio of profit to net sales.

Meiko Gijuku directly operated school business

Sales and profit increased. Despite the impact of the COVID-19 pandemic, there was a gradual recovery due to the following measures. The extension of the summer semester period from two months (July to August) to three months (July to September), in response to the pandemic, also contributed to the results.

The main measures are face-to-face tutorials while thoroughly implementing measures to prevent the spread of the novel coronavirus infection, including improvement of the classroom environment and health management. In addition, through the implementation of online training for classroom managers, they have standardized classroom operations and shared know-how to improve efficiency and strengthen their ability to respond to customer needs.

The number of classrooms was 405, up 2 year on year. The number of registered students was 26,824, down 150 year on year.

Meiko Gijuku franchised school business

Sales and profit dropped. This business was strongly affected by the decrease of students in the previous term due to the coronavirus crisis.

The main measures were to provide students with optimal learning plans and to thoroughly manage their progress to achieve their goals through the effective use of ICT content as well as face-to-face tutoring to improve their academic performance. In addition, along with the dissemination of measures from headquarters and the implementation of training and drills, they are actively promoting FC support measures such as information sharing according to the characteristics of each region. Moreover, the company worked to strengthen the profit structure of its franchise schools.

The number of classrooms was 1,404, down 125 year on year. The number of registered students was 75,935, down 9,155 year on year.

Japanese language school business

Sales declined, losses were recorded. The easing of the restriction on entry to Japan was limited, so the number of students nosedived year on year. As a measure for preventing infection, the company organized hybrid classes combining face to face lessons and online lessons, and gave online lessons to students before entry to the school.

The number of school buildings was 2, unchanged year on year, and the number of registered students was 1,298 down 698 year on year.

Other business

Sales and profit declined.

◎ KIDS (after-school) business

In addition to the directly operated schools, “Meiko Kids”, the company is working to provide services with a high level of customer satisfaction through a variety of management formats, including subsidized private school children's clubs, public and private management, consignment from private elementary schools and kindergartens, and franchise affiliation. At the same time, the company conducted sales activities to attract new enrollments at existing schools for the new fiscal year, as well as preparations and sales activities for the opening of new schools in April 2021.

In the second quarter, sales were 248 million yen (up 52 million yen from the same period of the previous year), and operating income was 0 million yen (unchanged as the same period of the previous year).

The number of schools was 34 (9 schools increased from the same period of the previous year), and the number of registered students was 1,806 (543 students increased from the same period of the previous year).

◎ Waseda Academy Kobetsu School business

As an individual tutoring brand for competitive entrance examinations, the company implemented measures for improving the academic performance of students and enabling them to pass the examinations for schools they want to enter. Furthermore, in order to meet the needs of customers amid the COVID-19 pandemic, the school has established a system that allows students to choose between face-to-face classes at the school building and online classes at home.

This fiscal year, too, the company was able to produce a large number of students who passed the entrance exam to difficult-to-enter schools. In particular, the number of students accepted by the prestigious junior high schools (Kaisei Junior High School, Azabu Junior High School, Musashi Junior High School, Ouin Junior High School, Joshigakuin Junior High School, and Futaba Junior High School) was 28, marking a significant increase from last year and a record high. In addition, the school was making steady achievements in helping students pass the entrance exams for Waseda and Keio high schools.

In the second quarter, sales were 307 million yen (down 6 million yen from the same period of the previous year), and operating profit was 27 million yen (down 18 million yen from the same period of the previous year).

The number of school buildings was 52 (4 school buildings increased from the same period of the previous year), and the total number of students was 4,195 (277 students increased from the same period of the previous year).

◎ Jiritsugakusyu RED business

While using AI to provide individually optimized learning contents based on each student's academic ability and characteristics, the company worked with SPRIX Co., Ltd. to operate classrooms.

In the second quarter, sales were 42 million yen, and operating loss was 72 million yen.

The number of classrooms was 28 (14 directly managed ones and 14 franchised ones).

◎ Meiko Kids e business

As preschools that offers English-only after-school childcare, since the company opened 2 directly managed schools in April 2020, they have responded to the growing of interests in early childhood education of English due to the expansion of demand for after-school childcare and educational reform. In addition to the opening of Meiko Kids e Wakayama Ekimae (franchise) as the third school in February 2021, preparations and sales activities for the opening of a new school in April 2021 are underway.

In the second quarter, sales were 38 million yen, operating loss was 42 million yen, and the number of schools was 3(2 directly managed, 1 franchised).

◎ School support business

There were no major changes in the trend of orders received, and business conditions were healthy as a whole.

In the second quarter, sales were 414 million yen, and operating profit was 187 million yen.

◎ Crams school business

Although the company made efforts to improve student performance by providing guidance that thoroughly addresses each student, the number of students remained stagnant due to the significant impact of intensifying competition among medical prep schools.

In the second quarter, sales were 113 million yen (down 50 million yen from the same period of the previous year), and operating loss was 50 million yen (a loss of 22 million yen in the same period of the previous year).

They resolved to dissolve and liquidate it, and liquidation procedures are currently underway.

Trend of numbers of Meiko Gijuku schools and registered students and system-wide sales

| 2Q of FY 8/20 | YoY | 2Q of FY 8/21 | YoY |

Number of Meiko Gijuku directly operated schools | 223 | -8 | 208 | -15 |

Number of Meiko Gijuku directly operated schools (MAXIS) | 94 | - | 93 | -1 |

Number of Meiko Gijuku directly operated schools (KLINE) | 43 | +1 | 41 | -2 |

Number of Meiko Gijuku directly operated schools (KMG) | 43 | +43 | 42 | -1 |

Number of Meiko Gijuku directly operated schools (One link) | - | - | 21 | +21 |

Number of Meiko Gijuku directly operated schools | 403 | +36 | 405 | +2 |

Number of Meiko Gijuku franchised schools | 1,529 | -124 | 1,404 | -125 |

Total number of Meiko Gijuku schools | 1,932 | -88 | 1,809 | -123 |

Number of registered students of Meiko Gijuku directly operated schools | 15,070 | -514 | 14,315 | -755 |

Number of registered students of Meiko Gijuku directly operated schools (MAXIS) | 7,078 | +530 | 6,824 | -254 |

Number of registered students of Meiko Gijuku directly operated schools (KLINE) | 2,598 | -154 | 2,694 | +96 |

Number of registered students of Meiko Gijuku directly operated schools (KMG) | 2,228 | +2,228 | 2,159 | -69 |

Number of registered students of Meiko Gijuku directly operated schools (One link) | - | - | 832 | +832 |

Number of registered students of Meiko Gijuku directly operated schools | 26,974 | +2,090 | 26,824 | -150 |

Number of registered students of Meiko Gijuku franchised schools | 85,090 | -7,330 | 75,935 | -9,155 |

Total number of registered students of Meiko Gijuku schools | 112,064 | -5,240 | 102,759 | -9,305 |

Sales from Meiko Gijuku directly operated schools | 5,679 | +405 | 5,877 | +198 |

Sales from Meiko Gijuku franchised schools*1 | 2,393 | -174 | 2,159 | -233 |

Sales from Japanese language schools | 739 | +64 | 475 | -264 |

Sales from others | 1,610 | +34 | 1,231 | -378 |

Total Sales (million yen) | 10,422 | +329 | 9,744 | -677 |

Sales from Meiko Gijuku directly operated schools | 5,679 | +405 | 5,877 | +198 |

System-wide sales from Meiko Gijuku franchised schools | 14,950 | -1,099 | 13,424 | -1,525 |

Total system-wide sales from Meiko Gijuku schools *2(million yen) | 20,629 | -694 | 19,302 | -1,326 |

*1 Sales from Meiko Gijuku franchised schools represent royalty revenues and sales of products.

*2 Total system-wide sales from Meiko Gijuku schools represent the sum of total sales of Meiko Gijuku directly operated schools, including tuition, materials fees, and examination fees, and the total sales of Meiko Gijuku franchised schools, including tuition. Materials fees and examination fees of franchised schools are excluded.

2-3 Financial standing and cash flows

◎Financial standing

| Aug. 2020 | Feb. 2021 | Increase/decrease |

| Aug. 2020 | Feb. 2021 | Increase/decrease |

Current Assets | 8,848 | 10,297 | +1,448 | Current Liabilities | 3,847 | 4,768 | +921 |

Cash | 7,015 | 8,493 | +1,477 | Accounts payable | 119 | 167 | +48 |

Trade receivables | 845 | 693 | -152 | Short term loans payable | - | 1,000 | +1,000 |

Noncurrent Assets | 5,192 | 4,990 | -201 | Noncurrent Liabilities | 720 | 722 | +1 |

Tangible Assets | 1,142 | 1,184 | +41 | Asset retirement Obligation | 346 | 342 | -4 |

Intangible Assets | 545 | 475 | -70 | Total Liabilities | 4,568 | 5,490 | +922 |

Investments, Other Assets | 3,504 | 3,330 | -173 | Net Assets | 9,473 | 9,797 | +324 |

Investment securities | 2,120 | 2,014 | -106 | Retained earnings | 10,140 | 10,430 | +290 |

Total Assets | 14,041 | 15,288 | +1,247 | Total Liabilities, Net Assets | 14,041 | 15,288 | +1,247 |

* Unit: Million yen

Term-end total assets increased 1,247 million yen from the end of the previous fiscal year to 15,288 million yen. Cash and deposits rose 1,477 million yen from the end of the previous fiscal year.

Total liabilities augmented 922 million yen from the end of the previous fiscal year to 5,490 million yen. Short-term loans increased 1 billion yen. Net assets increased 324 million yen to 9,797 million yen due to an increase in retained earnings, etc.

As a result, equity ratio was 64.1%, down 3.4 points from the end of the previous term.

◎Cash Flow

| 2Q of FY 8/20 | 2Q of FY 8/21 | Increase/decrease |

Operating CF (A) | 1,031 | 588 | -443 |

Investing CF (B) | -310 | 365 | +676 |

Free CF(A+B) | 721 | 953 | +232 |

Financing CF | -404 | 623 | +1,028 |

Cash and Equivalents at Term End | 7,761 | 8,343 | +581 |

* Unit: Million yen

The surplus of operating CF shrank due to a decrease in income before income taxes and other adjustments, but investing CF turned positive and free CF remained positive. Financing CF turned positive due to proceeds from short-term borrowings.

The cash position improved.

2-4 Topics

(1) Announced "MEIKO GLOBAL," a service that provides comprehensive support for hiring non-Japanese people

In March 2021, the company started offering "MEIKO GLOBAL," a service that provides comprehensive support for companies that employ non-Japanese people, including recruitment support, training, and Japanese language education for them, and management training for foreign human resource managers.

(Overview of "MEIKO GLOBAL")

The concept is to provide "the ultimate one-stop service for safe and secure employment by ensuring Japanese language education and legal compliance, which are the biggest challenges for overseas human resources.

The company provides recruitment and training services for companies that employ non-Japanese people.

MEIKO GLOBAL's recruiting service proposes the most suitable status of residence after interviewing about the client's needs and then introduces human resources to the client.

(Features of the service)

Able to introduce personnel with any type of resident status | The company can introduce personnel with any type of resident status and will propose the most appropriate resident status for the client. |

Suggest the most suitable country from all over the world to look for human resources for companies. | Based on the interview about the requested country or the desired conditions of potential human resources, etc., the most suitable country will be proposed. |

Thoroughly take care of communication skills in Japanese | By evaluating the Japanese communication skills of candidates and providing Japanese language education, they will solve the problem with communication in Japanese that companies are worried about. |

Ensuring the level of human resources through skill checks | The company checks and accurately conveys the skills possessed by the personnel to be introduced. Growth potential after joining the company is also predicted, so it can be used for hiring decisions. |

Application for the status of residence by full-time administrative scriveners | A full-time administrative scrivener will apply for resident status on the client's behalf. The renewal process will also be supported. |

Settlement of legal issues by legal advisors | If legal issues arise, Meiko Network Japan's legal advisory team will handle them. |

(2) Launch of an employment support program utilizing recruitment support and training services for foreign personnel employment in the medical and nursing care fields

In March 2021, through a comprehensive business alliance with the social medical corporation Aijinkai Healthcare Corporation(Osaka City), the company began offering employment support programs utilizing its recruitment support and training services for foreign personnel employment in the medical and nursing care fields. This is a concrete action taken in conjunction with the launch of MEIKO GLOBAL, a service that provides comprehensive support for the employment of non-Japanese people.

(Background of the Business Alliance)

Currently, the employment situation of foreigners living in Japan is particularly deteriorating amid the coronavirus pandemic. According to data from the Ministry of Health, Labor and Welfare, the number of new foreign job seekers has increased by about 10-20% over the previous year due to the new coronavirus infection.

On the other hand, as the super-aging society progresses, there is a chronic shortage of nursing assistants (nursing support staff) to support nurses and nursing staff at nursing homes. Due to the recent coronavirus outbreak, the shortage of human resources in the field has become even more serious, making it difficult to provide adequate quality care.

(Outline of the Comprehensive Business Alliance)

In order to solve the two issues of "the difficulty of finding jobs for foreigners living in Japan due to the coronavirus pandemic" and "the chronic shortage of human resources in the medical and nursing care industries," the company aims to establish a one-stop service system that includes cooperation in educational programs in Japan and abroad, career education, and career guidance for those who wish to work in the medical and nursing care industries.

As the first step in the business alliance, the company will launch the "KAIGO Smile Project" to support people in finding employment as nursing care workers.

(Overview of the KAIGO Smile Project)

This is a one-stop employment support program that covers basic knowledge and social etiquette for working in the medical and nursing care industries, part-time work opportunities as work experience, and a step-up program to become an employee while working part-time, mainly for foreigners in Japan.

Meiko Network Japan will provide online learning materials and study support services free of charge to foreigners who need to take the Specific Skills Care and JFT-Basic exams due to their status of residence.

While deepening their understanding of working in medical and nursing care facilities through part-time work, project participants aim to acquire specific technical qualifications and specialized knowledge and skills in order to work as employees in medical and nursing care facilities.

At this time, the end of the application period has not been determined. Participation by Japanese nationals is also welcome.

(3) Signed a cooperation and collaboration agreement with Hanoi University, one of the top foreign language education institutions in Vietnam

In April 2021, the company concluded a Memorandum of Understanding (MOU) with the University of Hanoi, one of the top-ranked foreign language education institutions in Vietnam, on the exchange of human resources and the enhancement of Japanese language education in Vietnam.

In the "MEIKO GLOBAL" employment support service for foreign nationals, the company will work with Hanoi University to strengthen Japanese language education in Vietnam for Japanese companies and develop excellent global human resources.

(Background of the Cooperation and Collaboration Agreement)

Vietnam is one of the fast-growing emerging countries in Southeast Asia with high expectations for future economic development. More than 1,900 Japanese companies have set up operations in Vietnam in pursuit of the country's expanding market potential, low production costs, and abundant and talented human resources.

In addition, Vietnam has continued to attract attention as a destination for overseas expansion, as it has succeeded in controlling the spread of the novel coronavirus.

On the other hand, in Japan, the total number of Vietnamese people residing in Japan as of the end of December 2020 was 448,000, the second largest after China, supporting the Japanese labor market. In both Japan and Vietnam, Vietnamese human resources are expected to be more active in Japanese companies in the future.

However, the ability to communicate in Japanese is the main barrier to hiring Vietnamese personnel, and in many cases, recruitment activities have not been sufficiently developed or appropriate matchmaking has not been achieved.

To this end, MEIKO GLOBAL, which has expertise in introducing foreign human resources and offering Japanese language education, and Hanoi University, one of the best foreign language education institutions in Vietnam, have signed a cooperation and collaboration agreement with the aim of providing Japanese language education and human resource development for Vietnamese people in Japanese companies.

(Overview of Hanoi University)

A national university that is famous for its language education, established in 1959 as Hanoi University of Foreign Languages (now Hanoi University). It is now a comprehensive university with faculties of IT and economics in addition to language education. In the Department of Japanese Language at the University of Hanoi, the requirement for graduation is to obtain N2 (advanced level of the Japanese language; in addition to understanding Japanese used in everyday situations, students can understand Japanese used in a wider range of situations to some extent) of JLPT (Japanese Language Proficiency Test). Many of the students have studied abroad in Japan and are practicing Japanese language education at a high level, and some of them have obtained N1 (the highest level, capable of understanding Japanese used in a wide range of situations) upon graduation. As a result, not only do they find employment in Japanese companies in Vietnam, but many of them also find employment in Japan.

(Details of the Cooperation and Collaboration Agreement)

Support for human resource development and exchange | To provide high-level Japanese language education for talented local Vietnamese people who are interested in working in Japan, and to develop global human resources. MEIKO GLOBAL will also work to promote human resource exchange by introducing talented Vietnamese personnel who match the job openings of Japanese companies. |

Joint development of Japanese language education programs | Meiko Network Japan will create a "top-level Japanese language education program for Vietnamese people" by combining the strengths of Meiko Network Japan, such as education by Japanese teachers and its know-how, with the strengths of Hanoi University, such as Japanese language education methods for Vietnamese people and Japanese language education in Vietnamese, and the know-how of online education conducted by Meiko Network Japan. |

Jointly hold contests to promote Japanese language education and provide opportunities for learners to present their achievements. | In order to provide opportunities for Vietnamese people who are learning Japanese to present their learning results, the company will jointly hold a contest to present the results of Japanese language learning in Vietnam. |

Supporting students who wish to study abroad in their host countries | For Vietnamese students who wish to study in Japan, the program provides support for studying in Japan. |

(4) Decision to dismiss the petition for a provisional disposition order

On March 25, 2021, Meiko Network Kyushu Inc. and Meiko Gijuku Kyushu Inc. received a decision from the Tokyo District Court to dismiss the petition for a provisional disposition order to confirm the status of Meiko Network Japan Inc. (See the previous Bridge Report for the background)

(Future outlook)

The company believes that the impact on its consolidated business results will be minimal at the current time. However , the company will make a prompt announcement if matters that need to be reported arise.

3. Fiscal Year ending August 2021 Earnings Forecasts

3-1 Consolidated Business Results

| FY 8/20 (Act.) | Ratio to total sales | FY 8/21 (Est.) | Ratio to total sales | YoY | Compared to revised Forecasts | Value Revised |

Sales | 18,218 | 100.0% | 18,600 | 100.0% | +2.1% | +1.6% | +300 |

Operating Profit | 214 | 1.2% | 630 | 3.4% | +193.3% | +138.6% | +366 |

Ordinary Profit | 451 | 2.5% | 760 | 4.1% | +68.2% | +138.2% | +441 |

Net Income | -2,232 | - | 700 | 3.8% | - | +159.3% | +430 |

* Unit: Million yen

Upwardly revised earnings forecast

In line with the upward revision of the first-half earnings forecast for FY ending Aug 2021, the full-year forecast has also been revised upward. Sales are expected to grow 2.1% year on year to 18.6 billion yen, and operating income is projected to increase 193.3% year on year to 630 million yen. Along with the increase in the interim dividend from 5 yen/share to 10 yen/share, the estimated annual dividend was revised upward from 10 yen/share to 15 yen/share. The estimated payout ratio is 53.8%.

(Update on the current situation and priority measures for the current fiscal year, etc.)

*Trend in the number of students

Although the year-on-year change in the number of enrolled students remains negative, the range of the change is steadily decreasing.

In addition, as a result of efforts to air TV commercials and strengthen online advertising, the number of inquiries via the website in the period from January to March has recovered to the 2019 level before the coronavirus pandemic

The key will be to ensure that the increase in inquiries leads to membership.

* Strengthening and expansion of the new FC business

The company aims to strengthen and expand the new FC business, mainly “Jiritsugakusyu RED,” in which students learn through individually optimized curricula based on AI, and “Meiko Kids e,” which offers English-only after-school childcare.

The first Meiko Kids e franchise opened in Wakayama Prefecture, and the second franchise opened in Musashi Kosugi (Kanagawa Prefecture) in April. The Company will accumulate operational know-how at its directly managed schools (currently three schools) and accelerate the development of franchises in the future. The key is to promote and spread the concept that the school is not just an English crams school. Unlike other English schools for children, it fosters global human resources who have learned a second foreign language in addition to English.

As of the end of February 2021, the company had 28 "Jiritsu Gakushu RED" schools (14 directly operated and 14 franchised), and it plans to expand this number to 41 (16 directly operated and 25 franchised) by the end of August 2021.

The company will accelerate the pace of opening franchise schools, especially in rural areas where there is a shortage of instructors, by emphasizing the fact that it does not need to secure instructors of the conventional level due to its AI-based individualized and optimized curriculum and that it can offer learning at a reasonable fee structure.

The company has received many inquiries from people in other industries who wish to join the franchise, and it will strengthen its corporate sales activities.

*Promotion of DX

The company has established a DX Promotion Office to promote the automation and restructuring of business processes based on data.

In addition to centralized customer management through MA (Marketing Automation: automation of marketing activities)/CRM (Customer Relationship Management: methods and tools for building good relationships with customers) as a marketing integration platform for all businesses, the company aims to visualize the process from an efficient digital approach to the enrollment of students. The company will also work to ensure compliance and thorough implementation of various security guidelines to promote DX.

4. Conclusions

The company upwardly revised its first-half and full-year forecasts. The decline in the number of enrolled students from the same month of the previous year has shrunk, and the company appears to be on the road to recovery, mainly through direct management. However, the increased amount of the full-year forecast is not significantly different from the increased amount of first-half forecast, showing that the company remains cautious about the second half. Amidst the third state of emergency declaration, it will be interesting to see how the full-year financial results, as well as the trend of student recruitment for the new school year will turn out.

Meanwhile, from a medium-term perspective, one of the priority measures is to "strengthen and expand new franchise businesses." The key to this is the progress of "Jiritsu Gakushu RED," which uses AI to optimize the curriculum for each student, and "Meiko Kids e," an English-only school childcare program. Both of them are at the stage where they are yet to contribute to earnings, but we will keep an eye on the speed of their expansion. Although the company has a strong image as a supplementary school for junior high school students to improve their academic performance, it also has an extensive track record of successful applicants to famous universities for high school students, and the company is considering strengthening the dissemination of information in order to increase revenues.

<Reference: Regarding Corporate Governance>

◎Organizational form and the composition of the boards of directors and auditors

Organizational form | Company with audit and supervisory board |

Directors | 6 directors, including 2 outside directors |

Auditors | 4 auditors, including 4 outside auditors |

◎ Corporate governance reports

Last updated on Apr.12, 2021

Basic policy

Our company continuously promotes managerial structure reforms to construct a flexible and transparent management organization that adapts to the new era. Moreover, our company plans to further strengthen corporate governance focused on the shareholder value by ensuring the transparency, soundness, and fairness of its management, implementing thorough risk management and improving accountability. Furthermore, our company's basic policy is to maximize the corporate value for all stakeholders including shareholders through the sustainable growth of our company group, the enhancement of the business model which demonstrates unique added value, and the strengthening of profitability via the collaboration of all the group companies. Our company’s basic policy also includes the improvement of management transparency and efficiency. Hence, the company is working to establish a swift and efficient management and execution systems while balancing the management supervision and business execution systems. The company is also making efforts to achieve highly transparent management through the participation of outside directors. Additionally, the company established “The MEIKO NETWORK JAPAN Group Corporate Governance Code Guideline” and published it on the company website to clarify the status of the efforts and policies related to each principle of the corporate governance code, fulfill the fiduciary responsibilities and to provide accountability.

https://www.meikonet.co.jp/investor/governance/index.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company follows all the principles of the corporate governance code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [The So-Called Strategically Held Shares]

The strategically held shares are shares held for purposes other than investment. We hold the shares of business partners for purposes such as business alliances, maintaining and strengthening transactions, and stabilizing shares. The board of directors examines the necessity of reducing these shares appropriately through considering whether these shares are important for the company’s growth, whether there is a more effective use of funds, etc. Moreover, as for exercising voting rights for these shares, the approval for a proposal is decided by having the department in charge examine carefully the proposal content taking into consideration the conditions of the invested companies and the business relationship with these companies, etc.

Principle 1-7 [Transactions between Related Parties]

Transactions that would constitute competition or conflict of interest for the directors and the corporations that the directors substantially control should be deliberated and decided by the board of directors. Additionally, transaction conditions and policies for determining transaction conditions, etc. are disclosed in the notice of convocation of the general meeting of shareholders and annual securities reports, etc. The company has established a system that will not be disadvantageous to it in case the corporations that the company's officers and directors substantially control, and major shareholders do business as clients of the company.

Principle 5-1 [Policy on Constructive Dialogue with Shareholders]

Our company's corporate planning department is responsible for IR. The company holds financial results briefings for shareholders and investors once every six months and conducts regular individual interviews.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (MEIKO NETWORK JAPAN: 4668), etc. at www.bridge-salon.jp/.