Bridge Report:(4762)XNET Fiscal Year ended March 2025

Takehiko Motani, President | XNET Corporation (4762) |

|

Company Information

Market | TSE Standard |

Industry | Information and Communication |

President | Takehiko Motani |

HQ Address | Sumitomofudosan-building 4th Floor 13-4 Araki-cho Shinjuku-ku Tokyo, Japan |

Year-end | March |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥1,341 | 8,261,600 shares | ¥11,078 million | 10.2% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥45.00 | 3.4% | ¥150.72 | 8.9 x | ¥699.00 | 1.9x |

* The share price is the closing price on June 23. Figures are from the summary of financial results for the fiscal year ended March 2025.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2022 Act. | 5,419 | 968 | 995 | 718 | 86.95 | 28.00 |

March 2023 Act. | 5,357 | 950 | 985 | 694 | 84.00 | 30.00 |

March 2024 Act. | 5,547 | 1,066 | 1,101 | 741 | 89.74 | 30.00 |

March 2025 Act. | 5,300 | 860 | 849 | 581 | 128.74 | 45.00 |

March 2026 Est. | 5,600 | 950 | 960 | 630 | 150.72 | 45.00 |

*Unit: million yen. Estimates are those of the company.

This report outlines XNET Corporation's financial results for the fiscal year ended March 2025.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2025 Earnings Results

3. Fiscal Year ending March 2026 Earnings Forecasts

4. Conclusions

<Reference 1: Medium-term Management Plan 2022-2025>

<Reference 2: Regarding Corporate Governance>

Key Points

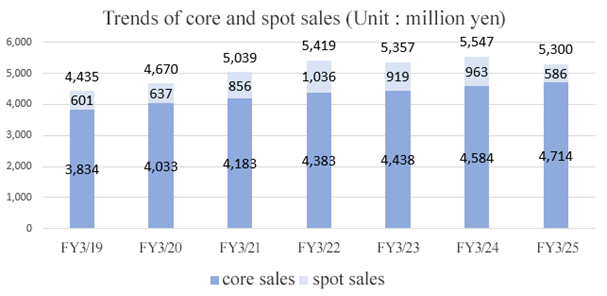

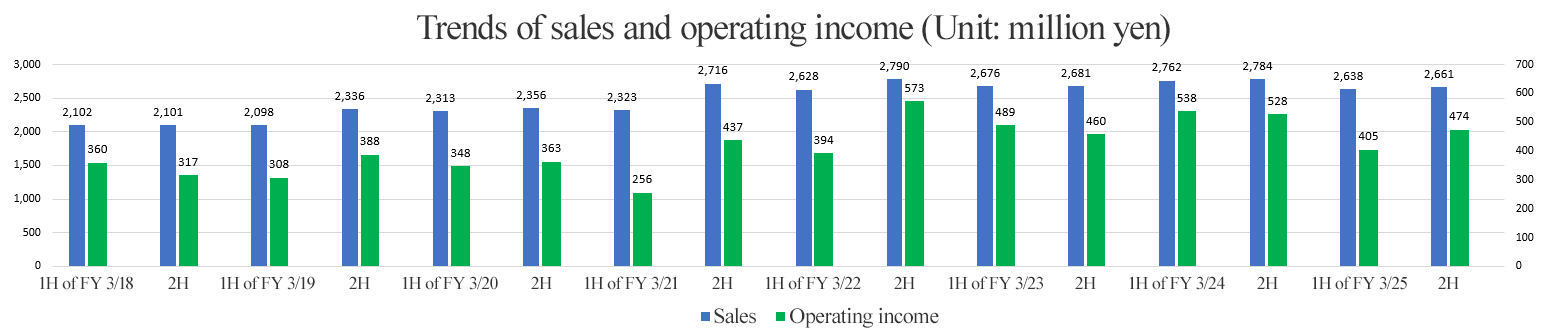

- In the fiscal year ended March 2025, sales decreased 4.5% year on year to 5.3 billion yen. The sales of application services remained unchanged from the previous fiscal year, while AMO services saw a decrease in both the number and scale of projects. Operating income decreased 19.3% year on year to 860 million yen. Gross profit decreased 11.5% year on year due to the decrease in sales, and gross profit margin declined 2.2 points. The increase in SG&A expenses could not be offset. In addition to internal system development costs associated with the separation from the NTT DATA Group, recruitment costs have augmented due to the aggressive recruitment of employees with the aim of expanding business and maintaining or improving service quality. All of the cost increases associated with the separation from the NTT Data Group are temporary and limited to the fiscal year ended March 2025.

- In the first quarter (Apr. to Jun.), operating income margin, whose target was set in the medium-term management plan, was 14.8%, falling below the target: 15%, but thanks to the reduction of outsourcing expenses, etc., it gradually improved, and annual operating income margin stood at 16.2%. Both sales and profit were almost in line with the forecast.

- For the fiscal year ending March 2026, sales and profit are expected to grow. Sales are projected to rise 5.6% year on year to 5.6 billion yen, and operating income is forecast to increase 10.4% year on year to 950 million yen. As every service is expected to keep performing well, core sales and spot sales are projected to grow. In the fiscal year ending March 2026, which is the final fiscal year of the medium-term management plan, they aim to achieve core sales of 5 billion yen, an operating income margin of 15.0% or higher, and an ROE of 8.0% or higher. There will be no significant extraordinary costs, so profit and profit margin are expected to increase. They pursue stable and active shareholder return based on their dividend policy “being a company that does not decrease dividends.” For the dividends for the fiscal year ending March 2026, they plan to pay an interim dividend of 22.50 yen/share and a year-end dividend of 22.50 yen/share for a total of 45.00 yen/share per year. The expected payout ratio is 29.9%.

- For the fiscal year ended March 2025, sales and profit were first projected to decline, but core sales increased while overall sales dropped, as assumed. For the fiscal year ending March 2026, which is the final fiscal year of the medium-term management plan, their noteworthy goal is “to achieve core sales of 5 billion yen.” The core sales in the fiscal year ended March 2025 were 4,714 million yen. To achieve the goal, it is necessary to increase core sales by 286 million yen or 6.1%. The average annual sales growth in the past 5-6 years is around 170 million yen. Accordingly, it seems somewhat difficult to attain the goal, but they are enriching their service lineup, so we would like to pay attention to quarterly progress to see whether they can receive more orders from major existing clients, with whom they are cementing relationships.

1. Company Overview

The company operates the “XNET Service,” which mainly provides securities management systems to more than 180 institutional investors, including life and non-life insurance companies, investment trust advisors, trust banks, and banks, for a monthly usage fee. Since its establishment, the company has led the industry as the de facto standard, holding a market share of around 90% in the life and non-life insurance industry in Japan. Currently, in addition to its securities business, it is expanding its management targets to include individual trusts and loans. It is also actively offering “SO service,” in which it not only provides systems, but also undertakes accounting and other tasks, aiming to further expand its business operations.

[1-1 Corporate History up to stock listing]

The company was established in June 1991 and began offering “XNET Service,” its current mainstay service. In October of the same year, Nippon Life Insurance Company adopted the “XNET Service” for its middle-office operations, which was the first major order received by the company. Based on this achievement, it expanded its service domain to include back-office services for life and non-life insurance companies. The convenience and economic benefits of these services were highly evaluated, due to which the number of clients using it increased at leading firms in the asset management industry, resulting in the expansion of its business. It was listed on NASDAQ Japan of Osaka Exchange in June 2000, and on the First Section of the Tokyo Stock Exchange in March 2004.

In April 2022, it got listed on the standard market of Tokyo Stock Exchange due to market restructuring.

*In March 2009, NTT DATA Corporation officially acquired the shares of XNET Corporation, making it a wholly-owned subsidiary of NTT DATA Corporation, but in May 2024, the capital and business alliance agreement was terminated and a new business alliance agreement was concluded.

[1-2 Corporate Philosophy]

The company aims to be an “eXcellent Company” that can continue to grow while collaborating with its clients.

Its objectives as an “eXcellent Company” are as follows.

1. Become a “One-Stop Solution Company for Asset Management.” |

2. Continue to make efforts to bring smiles to clients' faces by transforming “Impossible” into “Possible.” |

3. Create a better society by developing “new frameworks” and “new value.” |

4. Implement management practices while being mindful of the well-being of employees and their families and the profit returns to shareholders. |

In addition, the company aims to become “an ecosystem orchestrator* in the asset management industry” by “becoming a master of asset management industry operations” and “further reducing costs associated with the asset management industry,” with the mission of “contributing to building Japanese people's overall assets.”

Furthermore, its vision is to achieve “Four-Way Satisfaction,” i.e., “Good for the Buye the asset management industry as a client,” “Good for the Selle the company,” “Good for the Society: The Japanese economy and people,” and “Good for the Future: Three-Way Satisfaction.”

(*) Ecosystem Orchestrator

It is a role to create an ecosystem (a structure to create significant value through symbiosis) in the asset management industry. For this, it is necessary to become familiar with all information and elements related to asset management. The company aims to create a symbiotic environment by connecting it with any service or system that the customer requires without owning all the solutions.

In June 2024, the company announced its “Purpose” of existence, which serves as the foundation for the above mission and vision.

Purpose: “Create new value for the asset management industry to support society today and tomorrow.”

As a unique organization in the asset management industry, they aim to build a better foundation for society and further develop it. By incorporating the expression of creating new value that aligns with their corporate philosophy, they reaffirmed their purpose to consistently contribute to the asset management industry.

[1-3 Business Environment]

The amount of money management in Japanese asset management companies is on an increasing trend. As a result of the " Asset Management Nation" concept discussed below, the company's client market is expected to continue to expand steadily.

(From "Basic Data on Asset Management Nation (October 4, 2023)," Cabinet Secretariat)

Meanwhile, the company's clients are being affected by shifts in the business environment and facing resource shortages while being forced to focus on their core businesses, resulting in growing needs for below-mentioned services of undertaking tasks such as AMO and SO services as well as a growing market for these services.

Life & Non-Life Insurance | With the advancement of information technology, the demand for developing advanced insurance-related services is increasing. The company would like to focus its resources on developing these services more than operation. |

Investment Trust Advisors | Making profits with conventional management methods is becoming increasingly challenging, and the business volume for Investment Trust Advisors is increasing due to the expansion of investments in alternative assets, etc., and compliance with new financial regulations. |

Local Banks | The environment with extremely low interest rates continues, making it increasingly difficult to earn profits from providing loans, which is the core business of banks. The top priority is to increase profits through securities investment to compensate for this, however, there is a shortage of appropriate personnel, and the administrative burden is increasing. |

The Japanese government's " Asset Management Nation" concept is also likely to be a tailwind for the company's business.

In the Big-boned Policy 2023, approved by the Cabinet in June 2023, the government clearly stated that it will realize an Asset Management Nation that contributes to sustainable growth by releasing 2,000 trillion yen in household financial assets.

The goal is to redirect household savings to investment, leading to "an increase in financial asset income" and "supplying high-risk high return funds to support corporate growth."

The main points of the "Basic Data on the Asset Management Nation" (October 4, 2023), prepared by the Administration Office for the Realization of New Capitalism, Cabinet Secretariat, are as follows.

◎Asset Income Doubling Plan

Target | (1) Doubling the total number of NISA accounts (regular and savings) from 17 million to 34 million and doubling the amount of NISA purchases (from 28 trillion yen to 56 trillion yen) in 5 years (2) Subsequently, the goal is to double the amount invested by households (total balance of stocks, investment trusts, bonds, etc.). Through achieving these goals, the long-term objective is to double the asset management income itself. |

Seven Pillar Initiatives | Pillar 1: Fundamentally promoting the expansion and permanent utilization of NISA to shift household financial assets from savings to investments Pillar 2: Reform the iDeCo system, for example, by raising the age of membership Pillar 3: Establish a mechanism to encourage the provision of neutral and reliable advice to consumers Pillar 4: Strengthen asset accumulation for employers Pillar 5: Enhance financial and economic education to promote the importance of stable asset formation Pillar 6: Creation of an international financial center that is open to the world Pillar 7: Ensure customer-oriented business operations |

◎Lecture by Prime Minister Kishida, hosted by the Economic Club of New York (September 21, 2023), Related part (extract)

① | Funds managed by the asset management sector in Japan are 800 trillion yen and have surged 1.5-fold over the past three years. Aiming to improve this performance, we will promote the sophistication of investment management and encourage new entrants. First, we will correct Japan's unique business practices, eliminate barriers to entry, and develop support programs for new entrants. In addition, deregulation will be implemented to allow outsourcing of back-office operations. |

② | In order to promote the entry of foreign investors, we will create a special zone for asset management, and we will reform regulations so that administrative actions can be completed only in English and focus on improving the business and living environment. In order to promote reforms in line with the needs of investors worldwide, we would like to establish an asset management forum based in Japan and the U.S., with your participation. |

◎Household Financial Assets

① | From 2002 to the end of 2022, household financial assets (cash, deposits, bonds, stocks, etc.) in the U.S. and the U.K. have grown 3.3 times and 2.3 times, respectively, while in Japan they have increased only 1.5 times through June this year. |

② | In Japan, cash and deposits account for a large share of household financial assets. Therefore, there is room for further asset management growth through the reform of the asset management industry and the promotion of new entrants and competition. |

◎Asset Management Companies

① | The amount under management (gross) by Japanese asset management companies is approximately 800 trillion yen. It has been increasing every year, and at present, after bottoming out due to the novel coronavirus, it has increased 1.5 times in 3 years. It has also increased 2.8 times in 10 years. |

② | If we look at the number of asset management companies in Japan in recent years, we will see that the number has hardly changed, and new entrants into the investment trust management business have been limited. |

③ | In Japan, there is a unique practice (double calculation) in which an asset management company and a trust bank each calculate the NAV of an investment trust and reconcile them daily. This is pointed out as a factor of high costs and barriers to entry in the asset management business, such as the introduction of investment trust accounting systems by asset management companies. In Europe and the United States, on the other hand, double calculation is rare, and in many cases, trust banks and specialized firms are responsible for this practice. |

◎Promoting New Entry and Competition

① | In Japan, there is a unique practice (double calculation) in which an asset management company and a trust bank each calculate the NAV of an investment trust and reconcile them daily. This is pointed out as a factor of high costs and barriers to entry in the asset management business, such as the introduction of investment trust accounting systems by asset management companies. In Europe and the United States, on the other hand, double calculation is rare, and in many cases, trust banks and specialized firms are responsible for this practice. |

② | The public sales network through which asset management companies exchange daily information on investment trusts with distributors is operated by a small number of system vendors, each with its own specifications, and in some cases, requires manual work and multiple terminals for information exchange due to incompatibility in data linkage. An oligopoly is also developing for the investment trust accounting system used to calculate NAVs of investment trusts by offering the system as a package with terminals. |

③ | The Financial Services Agency/Finance Bureau provides prior consultation, registration procedures, and post-registration supervision in English for the registration of foreign asset management companies newly entering the Japanese market, and the Support Office for Establishing Bases in Japan was opened on January 12, 2021, to provide comprehensive services for these operations. To date, 27 business registrations and notifications have been completed. |

④ | In June 2021, Japan launched a project to provide free, comprehensive information, consultation, and support in terms of business start-up and daily life in English for foreign financial businesses (investment management companies, investment advisors/agents, etc.) that are establishing a base in Japan. A total of 35 businesses have been selected for support under the project so far, 15 of which have completed business registration and notification. |

The increase in assets under management and the rise in the number of new asset management companies are entirely positive factors for the company's business.

As the number of assets under management grows, the diversification of assets under management, such as alternative investments, is also expected to increase. As asset management firms seek to focus their resources more than ever on improving their operational capabilities, task undertaking services are expected to provide them with more opportunities to meet such needs.

Regarding new entrants, in addition to foreign-affiliated asset management companies, an increase in the number of start-up asset management companies is also expected in Japan.

The company has already built up a significant track record by providing start-up support services in cooperation with external partners in areas such as legal aspects, which is another positive factor.

The above abolition of double calculation and elimination of oligopoly in the public sales network are also noteworthy.

It is expected that NAV calculations for investment trusts will be performed by trust banks, and daily investment trust information exchange with distributors will be performed by trust banks. Trust banks are currently outside the framework of the public sales network. This is an opportunity to point out issues such as the lack of easy connections, and there are strong calls for a review of the public sales network, which has become an oligopoly.

The market share of the top vendors of the investment trust accounting system is about 70%. The company also provides accounting management services for investment trusts, but its market share is not large. The elimination of double calculation and the revision of the public sales network are expected to lead to share fluctuations, and for the company, the impact of these changes may be more positive than negative.

As described above, the Asset Management Nation may work positively for the company in macroeconomic terms, and it can also benefit from the actual policy management.

[1-4 Business Description]

The company provides “XNET Service,” a specialized asset management system developed by the company, to over 180 institutional investors, including life and non-life insurance companies, investment trust companies, investment advisors, trust banks, and banks.

It has a single business segment, the XNET service business. The services can be categorized into “XNET Service” and “Equipment Sales.” However, “Equipment Sales” service is provided to clients who wish to install computers and other equipment while adopting “XNET Service” and accounts for about 0-1% of total sales.

◎XNET Service

1.Clients' Situation

The institutional investors who are the company's clients invest in thousands of securities, including stocks and bonds, and have invested in various high-cost systems to manage their securities, including transactions, balances, profits/losses, and accounting processes.

(Taken from the company’s documents)

Many Japanese companies have conventionally built such systems and used them exclusively in-house. In cases of system outsourcing, where development and management are outsourced to an external company, the system is often the company-specific system, with all development and maintenance costs borne by the company.

In response to this situation, the company developed its own information system since its foundation and came up with a unique business model, which it named “XNET Service,” to offer this system to multiple clients for a monthly fee only.

It also provides comprehensive support for asset management operations from front to back office, including providing the stock information.

The company currently has approximately 180 clients.

(2) Main Service Lineup

①Front Office for Securities | A service for institutional investors and securities companies to provide functions related to placing and receiving orders for securities. |

②Middle Office for Securities | A service to provide performance analysis, reporting to beneficiaries, and other functions for financial products invested by institutional investors. |

③Back Office for Securities | A service to provide management functions such as journal entries, deposits, withdrawals, and actual item storage for financial products invested by institutional investors. |

④Back Office for IM | A service to provide investment trust advisory companies with functions for investment trust accounting operations (calculating base prices of investment trusts and creating management reports and other forms). |

⑤Center-type Indicative STP | A service allowing investors to electronically send trust instructions to a managing trust bank. |

⑥Disclosure of Trust-linked Data | A service allowing users to receive portfolio data (transactions, balances, portfolio attributes) in XNET format for special funds, fund trusts, etc., which are re-trusted by the managing trust bank. |

⑦Loan Management | A service that offers functions to manage all loan-related operations, including primary, secondary, syndicated, and mortgage loans, on a uniform platform regardless of the loan type. |

⑧Stewardship Solutions | A service providing functions to support the administrative operations of shareholder voting rights. |

⑨Report Manager | Support services for preparing external forms required in the investment trust and investment advisory business. In addition to providing application service (basic service), it offers data creation support (optional service) services. |

⑩XNET-AMO (Application Management Outsourcing) Service

| A service in which dedicated CEs provide comprehensive support from “installation” “operation /maintenance” to “design/development” related to XNET application use from the customer's perspective, supporting the business operation of XNET applications suitable for the clients. |

⑪SO (Smart Outsourcing) Service | A service using XNET services (back-office, middle-office, investment trust, etc.) to execute work duties, such as accounting and producing reports, in place of clients. |

⑫Remuneration Management Service | Support services for managing operations related to remuneration for investment advisory companies. |

⑬Trust Management for Individuals | It is possible to provide “beneficial interest management” and “jointly managed money trust/investment account management” for a representative trust for wills. It can be used independently by a trust bank or by a trust bank in partnership with a local financial institution as an agent. |

⑭Support Service for Investment Trust Management Business | Comprehensive support services for launching an investment trust management business, starting from establishing a company and preparing investment applications to starting the business. |

⑮Support Service for Discretionary Investment Business | Comprehensive support services for launching a discretionary investment business, starting from establishing a company and preparing investment applications to starting the business. |

In addition to providing software customized to customer needs, the company is focusing on expanding its outsourced system management and business process services, including “10) XNET-AMO Service” and “11) Smart Outsourcing (SO) Service.”

By having the company's professional human resources undertake front, middle, and back-office operations, clients are able to focus their resources on other tasks.

In particular, the “SO Service” provides users with the following advantages: “reducing administrative and system costs,” “securing support staff and outsourcing administrative processing,” “access to benefits of industry-standard services based on standardized business flows and administrative handling manuals,” and “flexible support to financial product accounting and various system changes specific to insurance companies.”

The company views SO services as their second pillar, following application services.

(3)Business Model: Adopting a subscription model

Since its launch in 1991, the “XNET Service” has been offering its services on a subscription model, receiving a fixed monthly subscription fee on a continuous basis.

It is a pioneer in the “subscription” business model, an innovative business model distinct from the “in-house development type,” in which SI vendors and software houses develop software on contract, and the “package type,” in which package vendors provide packages.

In the “in-house development type,” all costs are borne by the ordering company, and the risk of unsuccessful development is borne solely by one company.

In the “package type,” it is cheaper to install a pre-existing system, but the cost of modification and additional development is high.

In contrast, the “XNET Service,” developed under the concept of “collaboration with clients,” differs significantly from the “in-house development” and “package type” services. The reason for this is that after the launch, it is improved and refined with clients, with no initial cost and additional investment required.

The company owns the copyrights to the application and provides it to other users, thereby increasing profitability as the number of users grows.

In addition, a major advantage for both the clients and the company is that all the know-how accumulated through collaboration with multiple clients can be stored in the XNET application to facilitate knowledge sharing.

Merits for users | * No initial investment required * Quick installment period * No additional investment required * Overall cost is low because many users pay for one system * Incorporate ideas from many users so advanced know-how can be shared (knowledge sharing) * Constantly updated so the system does not get outdated |

Merits for the company | * Stable revenue due to monthly fees, unlike selling the entire system outright. * Discontinuation of the service is difficult * High profitability due to collaborative use of the same application |

Another feature of the “XNET Service” is the low number of service cancellations owing to the fact that users are unlikely to switch to another company's system due to the significant burden of transferring historical data once the XNET system has been installed.

[1-5 Features, Strengths, Competitive Advantages]

(1)Largest Market Share

XNET utilization accounts for 82% of the total amount of securities under management for all companies affiliated with The Life Insurance Association of Japan and 97% of non-life insurance.

The convenience and economic advantages of the comprehensive XNET service are evaluated highly, and the track record of the company's asset management system, including front, middle, and back-office services, is ranked predominantly No. 1 in the life and non-life insurance industry.

(Taken from the company’s documents)

The source of this competitive advantage is extensive information on securities and applications updated constantly to reflect the information and know-how.

In addition to revising rules and systems in the securities investment and management industry, it is necessary to stay updated on new investment targets, such as cryptocurrencies. Additionally, it is essential to incorporate the information into logic and reflect it in the application rather than simply having it as information.

The “XNET System” incorporates not only the information and know-how accumulated by the company, but also the know-how acquired by its clients through securities management into the application, making it the best and most up-to-date application that accumulates a variety of know-how at any time.

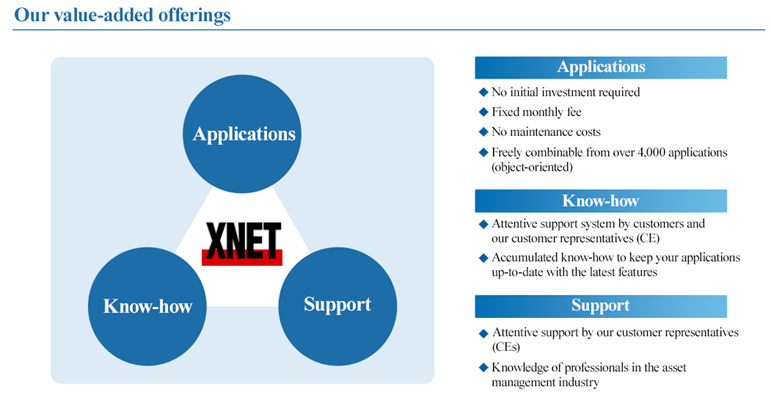

(2)Provide High-added Value

The company creates high-added value by providing high-level “applications,” “know-how,” and “support” as an integrated package.

(3)Stable Profit Structure

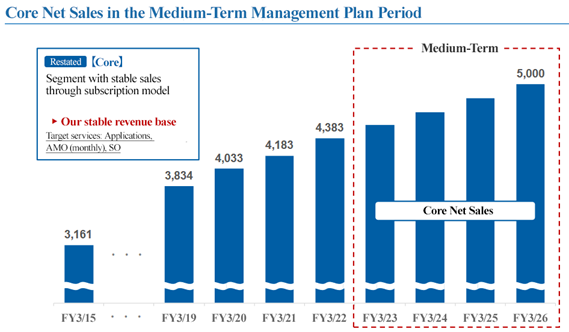

Core sales account for about 80% of the company's sales. It is striving to establish a stable revenue base by expanding its core sales.

The Medium-term Management Plan targets core sales of 5 billion yen for the fiscal year ending March 2026.

Sales Type | Summary | Target Service |

Core | Stable sales through a subscription model | Application, AMO (monthly), SO |

Spot | Sales from one-time transactions only, although necessary to maintain core | AMO (spot) *New installation and platform renewal |

[1-6 ROE Analysis]

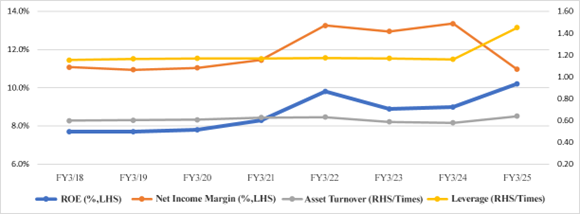

| FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 | FY 3/23 | FY 3/24 | FY 3/25 |

ROE (%) | 7.7 | 7.7 | 7.8 | 8.3 | 9.8 | 8.9 | 9.0 | 10.2 |

Net income margin (%) | 11.08 | 10.94 | 11.04 | 11.44 | 13.25 | 12.95 | 13.36 | 10.97 |

Total asset turnover (times) | 0.60 | 0.60 | 0.61 | 0.63 | 0.63 | 0.59 | 0.58 | 0.64 |

Leverage (x) | 1.15 | 1.17 | 1.17 | 1.17 | 1.17 | 1.17 | 1.16 | 1.45 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

In the fiscal year ended March 2025, net income margin dropped, but leverage rose through the acquisition of treasury shares for cancelling the alliance with NTT Data and the increase in short-term debt for acquiring the treasury shares, and ROE exceeded 10%. Profitability is expected to rise further.

[1-7 Shareholder return]

The company considers the securing of stable management foundations and the elevation of shareholder profits based on dividends as an important management measure and their policy was to provide return to shareholders stably and proactively while “being a company that does not decrease dividends.”

2. Fiscal Year ended March 2025 Earnings Results

[2-1 Overview of Financial Results]

| FY 3/24 | Ratio to sales | FY 3/25 | Ratio to sales | YoY | Compared with forecast |

Sales | 5,547 | 100.0% | 5,300 | 100.0% | -4.5% | +0.0% |

Gross Profit | 1,698 | 30.6% | 1,503 | 28.4% | -11.5% |

|

SG&A | 631 | 11.4% | 642 | 12.1% | +1.7% |

|

Operating Income | 1,066 | 19.2% | 860 | 16.2% | -19.3% | -2.2% |

Ordinary Income | 1,101 | 19.8% | 849 | 16.0% | -22.9% | -0.1% |

Net Income | 741 | 13.4% | 581 | 11.0% | -21.6% | +2.0% |

*Unit: million yen.

Sales and profit dropped but the results were largely in line with forecasts

Sales decreased 4.5% year on year to 5.3 billion yen. The sales of application services remained unchanged from the previous fiscal year, while AMO services saw a decrease in both the number and scale of projects.

Operating income decreased 19.3% year on year to 860 million yen. Gross profit decreased 11.5% year on year due to the decrease in sales, and gross profit margin declined 2.2 points. The increase in SG&A expenses could not be offset. In addition to internal system development costs associated with the separation from the NTT DATA Group, recruitment costs have augmented due to the aggressive recruitment of employees with the aim of expanding business and maintaining or improving service quality. All of the cost increases associated with the separation from the NTT Data Group are temporary and limited to this fiscal year.

In the first quarter (Apr. to Jun.), operating income margin, whose target was set in the medium-term management plan, was 14.8%, falling below the target: 15%, but thanks to the reduction of outsourcing expenses, etc., it gradually improved, and annual operating income margin stood at 16.2%.

Both sales and profit were almost in line with the forecast.

[2-2 Trend of each service]

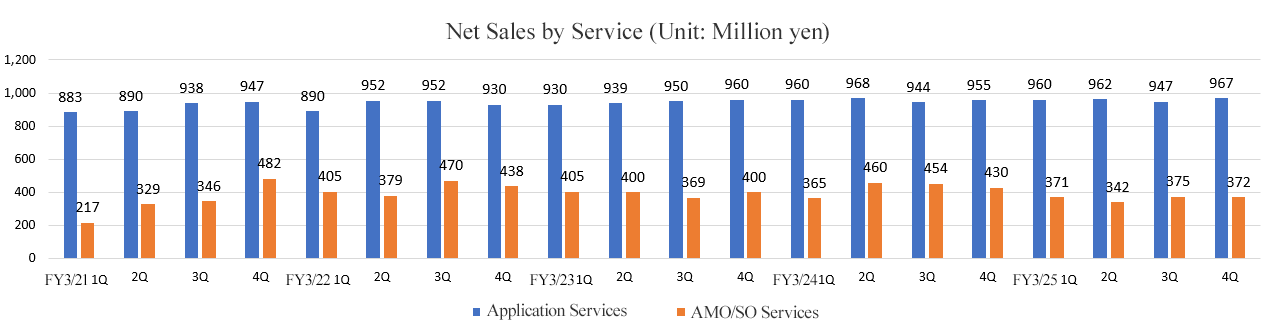

| FY 3/24 | Composition ratio | FY 3/25 | Composition ratio | YoY |

XNET services | 5,536 | 99.8% | 5,297 | 99.9% | -4.3% |

Application services | 3,827 | 69.0% | 3,836 | 72.4% | +0.3% |

AMO/SO service | 1,709 | 30.8% | 1,460 | 27.5% | -14.5% |

Equipment sales, etc. | 11 | 0.2% | 3 | 0.1% | -73.6% |

Total sales | 5,547 | 100.0% | 5,300 | 100.0% | -4.5% |

*Unit: million yen.

◎Application services

Sales grew slightly.

The securities management system, which is the mainstay, offers services stably, and they are constantly creating new services by actively linking the system with other companies’ systems. This system is increasingly adopted in local banks and shinkin banks in addition to the fields of consultancy for investment trust and life and non-life insurance, and there are few cancellations by existing clients, so its performance remains healthy.

The functions of their trust management system for individuals have improved, as trust products offered by financial institutions, such as local banks, have become diverse. The pace of increasing new clients has declined, but the scale of services has expanded, due to the provision of optional services, such as trust management with restrictions on cancellation, to existing clients.

The loan management system, which is one of new pillars, is operated steadily, offering services stably. Preparations for installing this system in multiple companies are progressing, and it is also increasingly adopted by local banks. Through the shift to “the interest-imposing world,” the importance of loans is increasing as a means of asset management, and the loan management system is expected to expand its scale further, among life and non-life insurance companies, banks, etc.

◎AMO services

While continuous system maintenance projects are increasing, they withdrew from less profitable spot transactions for some AMO services, because their profit margin is lower than that of application services. In addition, transactions for upgrading the infrastructure decreased from the fiscal year ended March 2024, in which they received many orders, so sales dropped.

◎SO services

They keep offering stable services, while expanding the scale of services, as they have started offering services to the third client company in the life and non-life insurance fields. SO services for the life and non-life insurance fields are expected to be adopted further, and the Japanese government upheld “to ease the requirements for starting investment management business (including the outsourcing of clerical work)” as a measure to realize an “asset management nation,” so it is expected that there will be more opportunities to offer services in the field of consultancy for investment trust.

The company continues to work to increase core sales, which consist of the sales from application services, monthly application management services, and task undertaking services, and which ensure stable sales through a subscription model. Although spot sales decreased due to the start of withdrawal from spot projects with relatively low profitability as part of optimizing the use of human capital, the “core sales” in the fiscal year ended March 2025 was 4,714 million yen, up 2.8% year on year. They account for 88.9% of total sales.

[2-3 Financial Standing and Cash Flows]

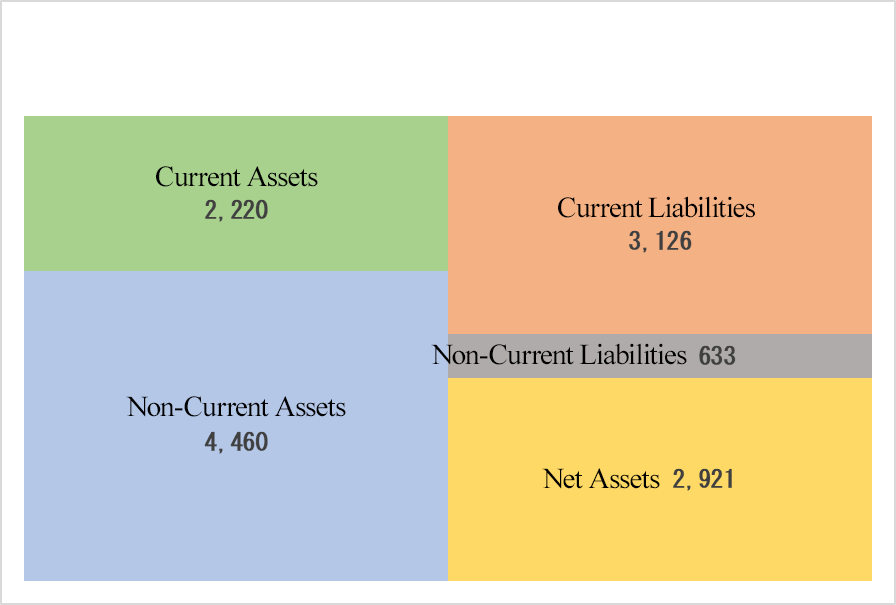

◎Main Balance Sheet

| End of March 2024 | End of March 2025 | Increase/ Decrease |

| End of March 2024 | End of March 2025 | Increase/ Decrease |

Current assets | 5,040 | 2,220 | -2,819 | Current liabilities | 795 | 3,126 | +2,330 |

3,038 | 1,456 | -1,582 | Short-term borrowings | - | 2,500 | +2,500 | |

Deposit paid in subsidiaries and affiliates | 1,481 | - | -1,481 | Payables | 306 | 319 | +13 |

Non-current assets | 4,870 | 4,460 | -410 | Non-current liabilities | 597 | 633 | +35 |

Intangible assets | 1,136 | 1,221 | +85 | Total liabilities | 1,393 | 3,759 | +2,365 |

Software | 1,135 | 1,220 | +85 | Net assets | 8,517 | 2,921 | -5,595 |

Investment, others | 3,642 | 3,146 | -496 | Retained earnings | 6,273 | 6,636 | +363 |

Total assets | 9,910 | 6,680 | -3,229 | Treasury Stock | - | -5,959 | -5,959 |

|

|

|

| Total liabilities and net assets | 9,910 | 6,680 | -3,229 |

*Unit: million yen. The software contains temporary accounts.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets decreased 3.2 billion yen year on year to 6.6 billion yen, mainly due to a decrease in cash and deposits for the acquisition of treasury shares.

Total liabilities increased 2.3 billion yen year on year to 3.7 billion yen, mainly due to an increase in short-term borrowings.

Net assets decreased 5.5 billion yen year on year to 2.9 billion yen, mainly due to an increase in treasury shares.

Equity ratio was 42.7%, down 42.2 points from the end of the previous term.

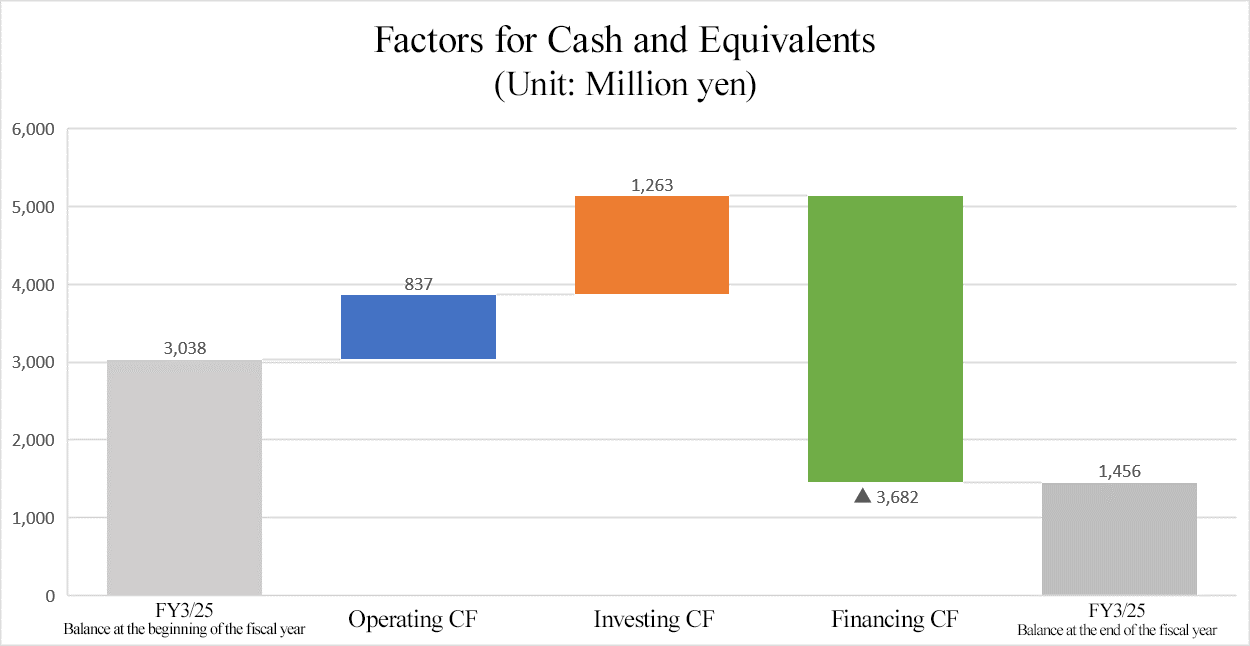

◎CF

| FY 3/24 | FY 3/25 | Increase/Decrease |

Operating Cash Flow | 1,443 | 837 | -606 |

Investing Cash Flow | -416 | 1,263 | +1,679 |

Free Cash Flow | 1,027 | 2,100 | +1,073 |

Financing Cash Flow | -247 | -3,682 | -3,434 |

Balance of Cash and Equivalents | 3,038 | 1,456 | -1,582 |

*Unit: million yen.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

The cash outflow from financing activities increased through the augmentation of short-term debt and the acquisition of treasury shares. The cash position declined.

[2-4 Topics]

◎ Adoption of a performance-linked stock-based compensation system

In May 2025, they resolved to adopt a performance-linked stock-based compensation system “Board Benefit Trust-Restricted Stock (BBT-RS).”

(Outline of the performance-linked stock-based compensation system “Board Benefit Trust-Restricted Stock (BBT-RS).”)

The shares of XNET are acquired through trust with the money provided by the company, and directors and others receive the shares of XNET and money converted from said shares, whose amount is calculated from the market stock price of XNET, through this trust in accordance with the company’s regulations for providing executives with shares. In principle, directors and others receive the shares of XNET during a certain period of time every year, and money converted from said shares, whose amount is calculated from the market stock price of XNET, at the time of resignation. When a director or the like receives the shares of XNET during his/her term of office, he/she shall sign a transfer restriction contract with the company before receiving said shares, so that the shares of XNET provided during the term of office shall not be transferred until his/her resignation.

(Background and purpose of the adoption)

The board of directors of the company resolved to adopt the system for the purposes of clarifying the linkage between the remuneration for directors, excluding outside directors and directors who belong to the audit and supervisory committee, and executive officers and the company’s performance and share value, and sharing the merit from the rise in share price and the risk of a decline in share price with shareholders, so that directors and executive officers will be motivated to improve medium/long-term performance and increase corporate value. (Approval at a general meeting of shareholders is required for official adoption.)

This performance-linked stock-based compensation system applies to directors and executive officers, but in order to secure excellent personnel, the company is planning to adopt the Japanese version of Employee Stock Ownership Plan (J-ESOP), as an incentive plan for providing employees with the shares of the company. The date and details of adoption of this incentive plan for employees will be disclosed as soon as they are determined.

3. Fiscal Year ending March 2026 Earnings Forecasts

[3-1 Earnings Forecast]

| FY 3/25 | Ratio to sales | FY3/26 (Est) | Ratio to sales | YoY |

Sales | 5,300 | 100.0% | 5,600 | 100.0% | +5.6% |

Operating Income | 860 | 16.2% | 950 | 17.0% | +10.4% |

Ordinary Income | 849 | 16.0% | 960 | 17.1% | +13.0% |

Net Income | 581 | 11.0% | 630 | 11.3% | +8.4% |

*Unit: million yen. Estimates are those of the company.

Sales and profit are expected to increase.

Sales are projected to rise 5.6% year on year to 5.6 billion yen, and operating income is forecast to increase 10.4% year on year to 950 million yen.

As every service is expected to keep performing well, core sales and spot sales are projected to grow. In the fiscal year ending March 2026, which is the final fiscal year of the medium-term management plan, they aim to achieve core sales of 5 billion yen, an operating income margin of 15.0% or higher, and an ROE of 8.0% or higher.

There will be no significant extraordinary costs, so profit and profit margin are expected to increase.

They pursue stable and active shareholder return based on their dividend policy “being a company that does not decrease dividends.” For the dividends for the fiscal year ending March 2026, they plan to pay an interim dividend of 22.50 yen/share and a year-end dividend of 22.50 yen/share for a total of 45.00 yen/share per year. The expected payout ratio is 29.9%.

4. Conclusions

For the fiscal year ended March 2025, sales and profit were first projected to decline, but core sales increased while overall sales dropped, as assumed.

For the fiscal year ending March 2026, which is the final fiscal year of the medium-term management plan, their noteworthy goal is “to achieve core sales of 5 billion yen.”

The core sales in the fiscal year ended March 2025 were 4,714 million yen. To achieve the goal, it is necessary to increase core sales by 286 million yen or 6.1%. The average annual sales growth in the past 5-6 years is around 170 million yen. Accordingly, it seems somewhat difficult to attain the goal, but they are enriching their service lineup, so we would like to pay attention to quarterly progress to see whether they can receive more orders from major existing clients, with whom they are cementing relationships.

<Reference 1: Medium-term Management Plan 2022-2025>

The company, which achieved record sales and profit in the fiscal year ended March 2022, plans to promote growth strategies and effectively utilize its assets to refine its “earning” and “spending” capabilities” in order to continue to improve its corporate value and sustainable growth.

To this end, the company has formulated a Medium-term Management Plan with the fiscal year ended March 2023, as its first year. This is the first Medium-term Management Plan made public.

[1. Sources of Added Value of the Company]

The three sources of added value of the company are “applications,” “know-how,” and “support.” The company generates higher added value by fusing all the above at an advanced level.

(Taken from the company’s documents)

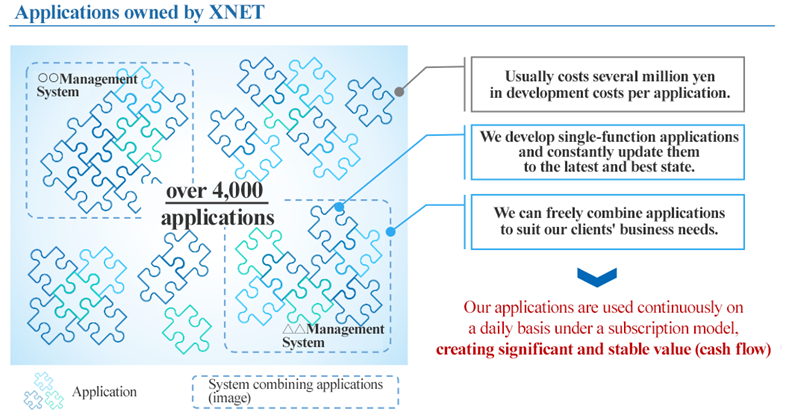

(1) Application

As mentioned in “1. Company Overview,” the company’s “XNET service” is an application service with a fixed monthly fee and no additional charges.

It is a pioneering subscription model and an advanced business model, distinct from the services of other companies.

The company currently has approximately 4,000 applications.

It possesses the latest and best applications by accumulating know-how over the applications it develops.

The development cost per application is typically 2-3 million yen, but the value of each application goes beyond this amount, when it is considered that it is the latest application with accumulated know-how.

The 4,000 high-value-added applications generate stable high value or cash flow through the subscription model.

(Taken from the company’s documents)

(2) Know-how

The company’s applications are improved and mounted with new functions, reflecting not only the voices of customers, but also the latest needs that the company’s employees grasp on site, and changed on a daily basis according to the operational and institutional changes.

In addition, as the company owns the copyrights to the applications and has accumulated various types of in-house know-how, it can provide the “latest and the best” at all times, ensuring that its applications do not become obsolete.

(3) Support

The company is more deeply customer-oriented than its competitors. It assigns a Client Executive (CE) for each customer to meticulously serve them and offer expertise-based support.

In many cases, the call centers of general system companies are either unaware of whether they can handle emergency requests received over a phone call or are incapable of providing an immediate response if professional support is required.

In contrast, the company’s CEs can directly respond to customers in an emergency. It can also provide immediate, specialized support and meticulously serve the customers as per the customer’s unique circumstances.

[2 Key Business Domains for Sustainable Growth]

To further strengthen its “earning capacity,” the company aims to become a “one-stop solution company” that not only provides applications, but also offers a full range of solutions for asset management.

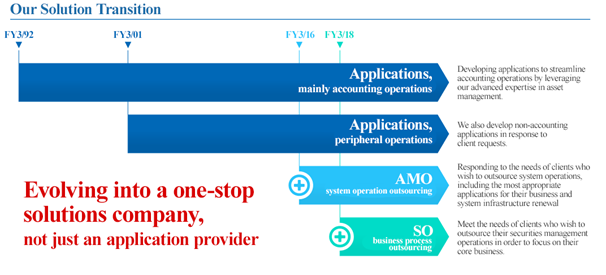

(1) Evolution into a One-Stop Solution Company

In addition to the provision of applications (software), the company provides further added value by AMO (undertaking application management) and SO (undertaking business operations) services.

(Taken from the company’s documents)

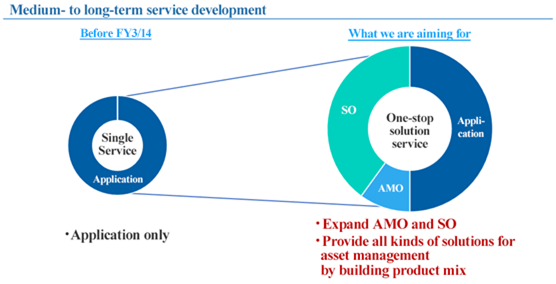

(2) Medium- to Long-Term Service Deployment: Growth of the businesses of AMO and SO

Over the medium to long term, the company will grow the businesses of AMO (undertaking application management) and SO (undertaking business operations) services to become a true one-stop solution company.

By achieving significant growth of these businesses, the company will create a product mix that meets the needs for asset management.

(Taken from the company’s documents)

(3) Business Strategy During the Medium-Term Management Plan

The company will further strengthen its “core” segment, which secures stable sales through a subscription model, and maintain high profitability.

Focusing on the “core” will provide the basis for “earning capacity,” strengthen the management base, and further increase corporate value.

(Taken from the company’s documents)

[3. Investment Strategy]

The company will actively invest in applications, systems, and human resources while refining the “spending capacity.”

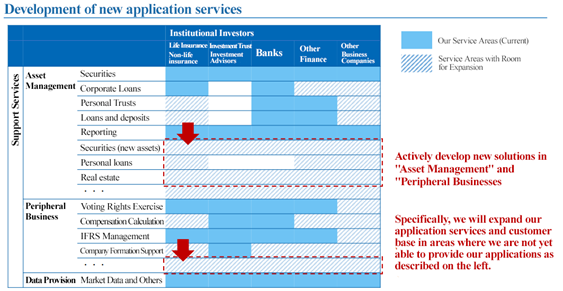

(1) Development of New Application Services

The company will actively develop new solutions and further expand its application service, one of its sources of added value.

It intends to actively promote the development of new solutions in uncultivated areas of “asset management” and “peripheral businesses.”

(Taken from the company’s documents)

(2) System Investment

The company will invest “aggressively” and “defensively” in its existing services.

*Aggressive Investment

The company will invest for improving and upgrading over 4,000 existing applications, which are their high-quality assets, to develop new solution services and improve convenience for customers.

*Defensive Investment

The company will ensure that the system is updated with the upgraded operating system to maintain a high level of service.

(3) Human Resources Strategy

The company will actively invest in human resources, which are vital.

The company will continue to focus on actively recruiting experienced personnel.

At the same time, it will utilize the expertise of veterans and the know-how accumulated in the applications to train young personnel for the future. In addition, the company will create an improved environment to enhance productivity.

The company’s strength is its ability to recruit industry veterans ready to work immediately in the face of the shortage of IT personnel.

[4. Management Goals]

The following targets have been set for the final year of the plan, that is, the fiscal year ending March 2026.

Core Sales | 5 billion yen |

Operating Income Margin | 15.0% or higher |

ROE | 8.0% or higher |

[5. Shareholder Return]

The company considers the securing of stable management foundations and the elevation of shareholder profit based on dividends as an important management measure and their policy was to provide return to shareholders stably and proactively. However, they decided to take another step in the fiscal year ending March 2025 and pursue stable and proactive shareholder return while “being a company that does not decrease dividends” as a new dividend policy.

They have a shareholder benefit program to express their gratitude to shareholders, deepen their understanding of the Medium-term Management Plan, and encourage them to hold shares over the medium to long term.

(Overview of the Shareholder Benefit Plan)

*Effective Period

In line with the period of the Medium-term Management Plan (April 1, 2022, to March 31, 2026).

*Eligible Shareholders

Shareholders whose names are recorded in the shareholder’s register on the record date, that is, the end of September or the end of March of each year during the effective period, and who have held at least one trading lot (100 shares) of the company.

*Benefits

All shareholders with at least 1 trading lot will receive a QUO Card worth 500 yen.

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside directors (of which 3 are independent directors) |

Audit and supervisory committee member | 3 members, including 3 outside directors (of which 3 are independent directors) |

◎ Corporate Governance Report

Last update date: July 5, 2024

<Basic Policy>

We recognize that continuous improvement of business performance contributes to the development of society, enhances corporate value, and meets the expectations of our shareholders and other stakeholders. To this end, we believe that it is important for corporate governance to function effectively, realize a system that can appropriately respond to changes in the business environment, and conduct fair and transparent corporate management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Supplementary Principle 3-1-2]

Considering the company's foreign shareholder ratio (0.9% as of March 2024), the scale of its business, and the cost of disclosure in English, the company has determined that it is premature to disclose and provide information in English at this time.

It will discuss the necessity of English-language disclosure at meetings of the Board of Directors and other forums while taking into consideration the trends in the ratio of foreign shareholders, the scale of its business, and the status of its overseas business operations.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

Currently, we do not hold any listed shares for strategic shareholding.

Although we do not plan to hold such shares in the future, if the possibility of holding listed shares should arise, we will take sufficient time to thoroughly examine and verify the purpose, benefits, and risks in advance, based on this principle, and will disclose the results of such examination and establish and disclose the criteria for exercising voting rights.

[Supplementary Principle 2-4-1]

(1) Human resources development and in-company environment development policies, and their statuses

Our approach to human resources development is based on on-the-job training (OJT), which is supplemented by off-the-job training (OffJT), mainly the training programs listed below, to proactively support employees in strengthening their skills.

・ Group training for new employees

・ Business training by level・ Training on basic financial knowledge ・ Training on individual themes ・ Introductory training in system development ・ Others

In addition, as an initiative to complement employee development, we are promoting the hiring of the following people・ Hiring people who want to give back to the industry, such as veterans and retirees who have been active in the asset management industry for many years・ Hiring women left the industry after maternity or childcare and resigned employees who are experienced in the asset management industry・ Rehiring highly skilled and highly motivated former employees who are recognized by all・ Hiring people (such as temporary staff) who are employed with us and who love our corporate culture and values ・ Hiring fresh graduates from high schoolWe actively hire people who understand our corporate culture and values, and we will continue to upgrade their skills as we integrate them within the company.

(2) Ensuring diversity

In order to create and provide services that continue to be sought after in the asset management industry, we continuously hire diverse human resources, including mid-career hires with a variety of work experience, and allocate them in a manner that respects their motivation and abilities so that each and every employee can grow to become a professional.

<Promoting women in managerial positions>

We believe that diversity in human resources, or diversity in values, is essential for maintaining the vitality of an organization. In this context, we are developing and improving various support systems to promote the active participation of women and enable them to work in a more flexible and diverse manner. As a result, the ratio of women in managerial positions is increasing and will continue to do so in the future.

<Promoting non-Japanese employees in managerial positions>

At present, the percentage of non-Japanese employees is very low due to the fact that our business domain is limited to the domestic domain, and we have no track record of promoting non-Japanese employees to managerial positions. For the same reason, we do not set or disclose targets for the ratio of non-Japanese managers. However, it is our basic policy to evaluate employees based on their abilities and achievements regardless of their nationality.

<Promoting mid-career hires to managerial positions>

In order to secure diverse human resources, our company has adopted mid-career hiring as a general rule since its founding, and mid-career hires account for 100% of our managerial positions. We will continue to focus on mid-career hiring based on our policy of cultivating and securing diverse human resources specializing in asset management IT and maintain the high ratio of mid-career hires in managerial positions, which is one of our company's unique characteristics.

Please refer to our website for information on the status of our employees, managers, and our training policy.

Development of IT human resources for asset management https://www.xnet.co.jp/if/sus2.html

[Supplementary Principle 3-1-3]

(1) Initiatives for sustainability

Recognizing the importance of ESG (Environmental, Social, and Corporate Governance) in improving corporate value over the medium term, we have posted our policy on sustainability and other initiatives for sustainable growth on our website. For more information on our approach toward sustainability, policies, and initiatives, please visit our website.

Sustainability https://www.xnet.co.jp/if/index_sus.html

(2) Investment in human capital

In addition to supporting the diverse work styles of our diverse human resources, we are developing and improving our work-life balance support system to enable our employees to realize their ideal work styles in order to meet the demand from society, such as promoting the active participation of women and rectifying long working hours.

In addition, human resources are essential for creating and providing services that continue to be sought after in the asset management industry. To this end, we actively support the growth of each employee so that they can become professionals. Please refer to our website for more information on our efforts to provide diverse work styles and human resources development initiatives.

https://www.xnet.co.jp/if/sus2.html

(3) Investment in intellectual property

As a provider of securities management systems and related services, we recognize that intellectual property is an important corporate asset. Our policy is to maintain and manage these assets appropriately and utilize them effectively as our strength. By securing intellectual property rights that are beneficial to our business as needed, and working on intellectual property activities, we aim to differentiate our services and secure a competitive advantage in the market, as well as to prevent infringement of intellectual property rights of third parties, including customers and business partners, and intend to reduce legal risks in our business operations. In addition to maintaining regulations in the divisions in charge, we are working to raise awareness of intellectual property rights by providing educational and enlightening opportunities for employees.

[Principle 5-1]

Our company proactively responds to requests for individual interviews, including those from shareholders, taking into consideration the equality of information disclosure and the necessity from the perspective of improving corporate value, and the President and Representative Director responds to such requests.

Our policy for dialogue with shareholders and other stakeholders is as follows.

(i) The President and Representative Director oversees IR activities and promotes activities to promote dialogue with shareholders.(ii) In conducting IR activities, the personnel in charge of corporate planning, IR, legal affairs, general affairs, accounting, and other areas within the Administration Division, under the direction of the President and Representative Director, are directly involved in everything from the preparation of IR materials to company briefings and interviews with individual shareholders, in an effort to ensure continuous internal information coordination while paying close attention to insider information and to ensure fairness of information in dialogues.

(iii) The President and Representative Director reports to the Board of Directors on the opinions received from shareholders and others during IR activities and discusses how to respond to them after sharing and exchanging opinions on the requirements and issues.

[Principle 5-2]

We have formulated a medium-term management plan for the four years from 2022 and disclosed our management and growth strategy, investment strategy, shareholder return policy, etc. In addition, we disclosed "measures to realize business administration conscious of capital cost and share price" in the "review of the second year of the medium-term management plan for the fiscal year ending March 2024" published on May 29, 2024.

For details, see below.

https://www.xnet.co.jp/if/ceomesfiles/ceomes6_20240529.pdf

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |