Bridge Report:(4783)Nippon Computer Dynamics the first half of the term ending March 2021

President Osamu Shimojo | Nippon Computer Dynamics Co., Ltd. (4783) |

|

Company Information

Exchange | JASDAQ |

Industry | Information and communications |

President | Osamu Shimojo |

Address | 4-32-1 Nishi-gotanda, Shinagawa Ward, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥547 | 8,071,068 shares | ¥4,415 million | 17.7% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥14.00 | 2.6% | ¥18.66 | 29.3 times | ¥490.66 | 1.1 times |

* The share price is the closing price on December 18. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. Figures are rounded off.

* ROE and BPS are the actual values for FY3/2020. DPS and EPS are estimates for FY3/2021.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 (Actual) | 13,843 | 382 | 389 | 205 | 23.59 | 10.00 |

March 2017 (Actual) | 15,405 | 347 | 333 | 249 | 30.00 | 12.00 |

March 2018 (Actual) | 16,237 | 783 | 807 | 526 | 66.31 | 14.00 |

March 2019 (Actual) | 17,007 | 1,045 | 1,089 | 615 | 77.45 | 14.00 |

March 2020 (Actual) | 18,390 | 936 | 953 | 648 | 81.62 | 14.00 |

March 2021 (Estimate) | 17,800 | 200 | 230 | 150 | 18.66 | 14.00 |

(Unit: Million yen, yen)

* The estimated values were provided by the company.

The overview of the earnings results of Nippon Computer Dynamics in the first half of the term ending March 2021 and its future outlook will be reported by the Bridge Report.

Table of Contents

Key Points

1. Company Overview

2. 1H of Fiscal Year Ending March 2021 Earnings Results

3. Fiscal Year Ending March 2021 Earnings Forecasts

4. Mid-term Management Plan “Vision 2023”

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

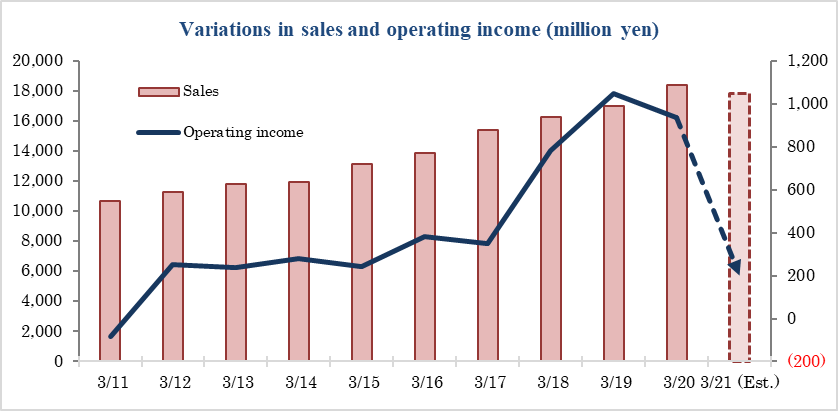

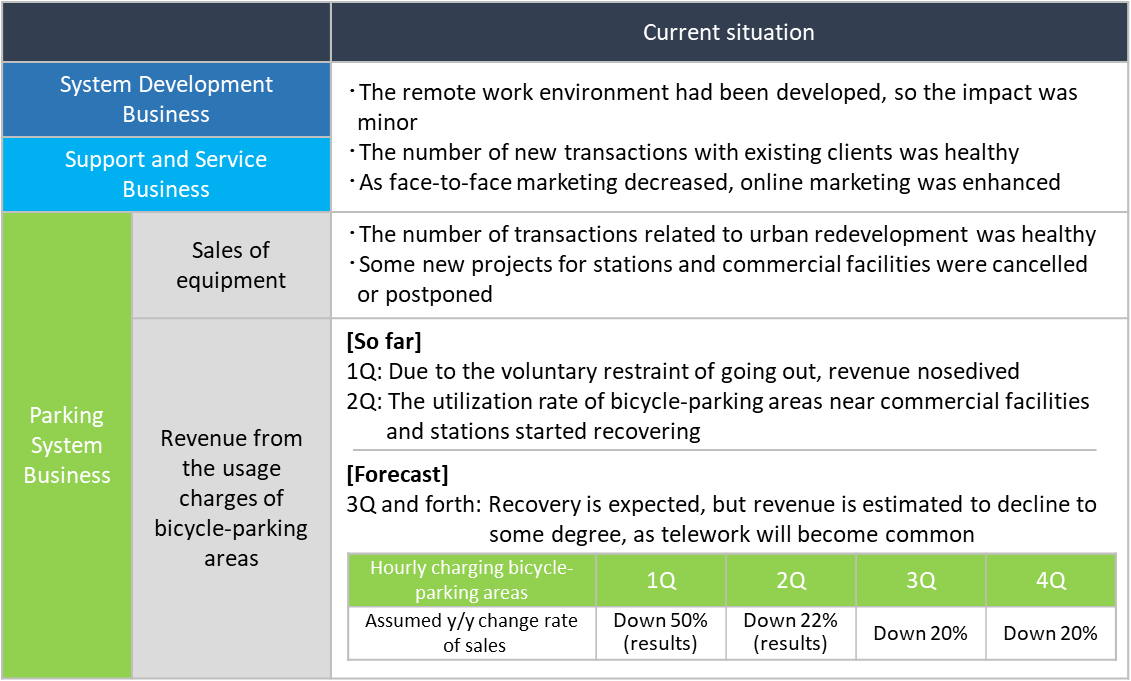

- For the first half of the term ending March 2021, sales dropped 4.3% year on year, and an operating loss of 102 million yen (an operating income of 325 million yen in the same period of the previous year) was posted. As for the IT-related business (the System Development Business and the Support and Service Business), sales and profit grew as already-received development projects progressed steadily, and the company received new orders in new fields from existing clients. Especially, in the Support and Service Business, the company received new orders in addition to continued large-scale orders, which improved profitability, so sales rose and profit increased considerably. On the other hand, the Parking System Business was significantly affected by COVID-19 (hereinafter referred to as "the infection"), so sales decreased 22.5% and an operating loss of 30 million yen (an operating income of 461 million yen in the same period of the previous year) was posted. The company posted an operating loss of 134 million yen in the first quarter, but posted an operating income of 31 million yen in the second quarter, indicating some improvement.

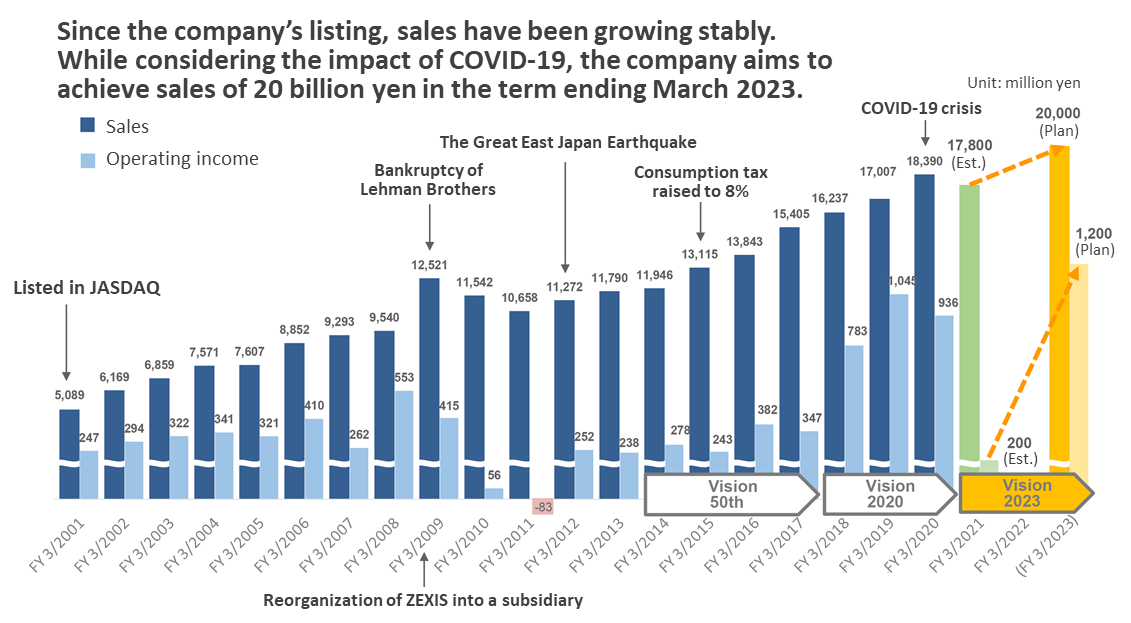

- The company leave the full-year forecast unchanged, and it is estimated that sales and ordinary income will decline 3.2% and 75.9% in the term ending March 2021, respectively, year on year. In the IT-related business, the company aims to further cultivate the life insurance domain by developing business models for maintenance and operation services, and by utilizing the operational knowledge. In the parking system business, the revenue from bicycle-parking areas in the second half is estimated to decline 20%, but the company aims to reduce fixed costs by reforming the revenue structure, and curtail outsourcing costs by producing equipment in house. The dividend is to be 14.00 yen/share (interim dividend: 7.00 yen/share), unchanged from the term ended March 2020. In the mid-term plan, the company aims to achieve sales of 20 billion yen and an operating income of 1.2 billion yen in the term ending March 2023.

- The parking system business, which had been the moneymaker until the term ended March 2020, was significantly affected by the infection. However, seeing the sales from pay-by-the-hour bicycle-parking areas, the impact of the infection seems to be weaker than the company’s assumption. The IT-related business performed well in the first half, and is expected to keep performing well, as the demand for investing in IT is strong, thanks to the needs for automation and labor saving for enhancing productivity to cope with the changes in the labor environment, the demand for renewal of mission-critical systems, etc. Considering all businesses comprehensively, it can be said that the COVID-19 crisis is generating advantage for the company. In the next term, their profit is estimated to grow considerably, motivated by active investment in bicycle-parking areas, further cost cut, and the continuing good performance of the IT-related business. If the mid-term plan is completed, EPS will reach around 100 yen. The share price remains three-digits and is quite undervalued.

1. Company Overview

Nippon Computer Dynamics is a pioneer in independent software development. It operates the System Development Business, which offers consulting and system operation services, the Support and Service Business, which mainly operates and manages systems and gives technical support, and the parking system business, which develops and operates systems for bicycle-parking areas. The System Development Business and the Support and Service Business are characterized by continuous transactions with good clients. In addition, the parking system business, which constructed the largest number of electromagnetic lock-type bicycle-parking areas in Japan, has great potential for growth and high profitability.

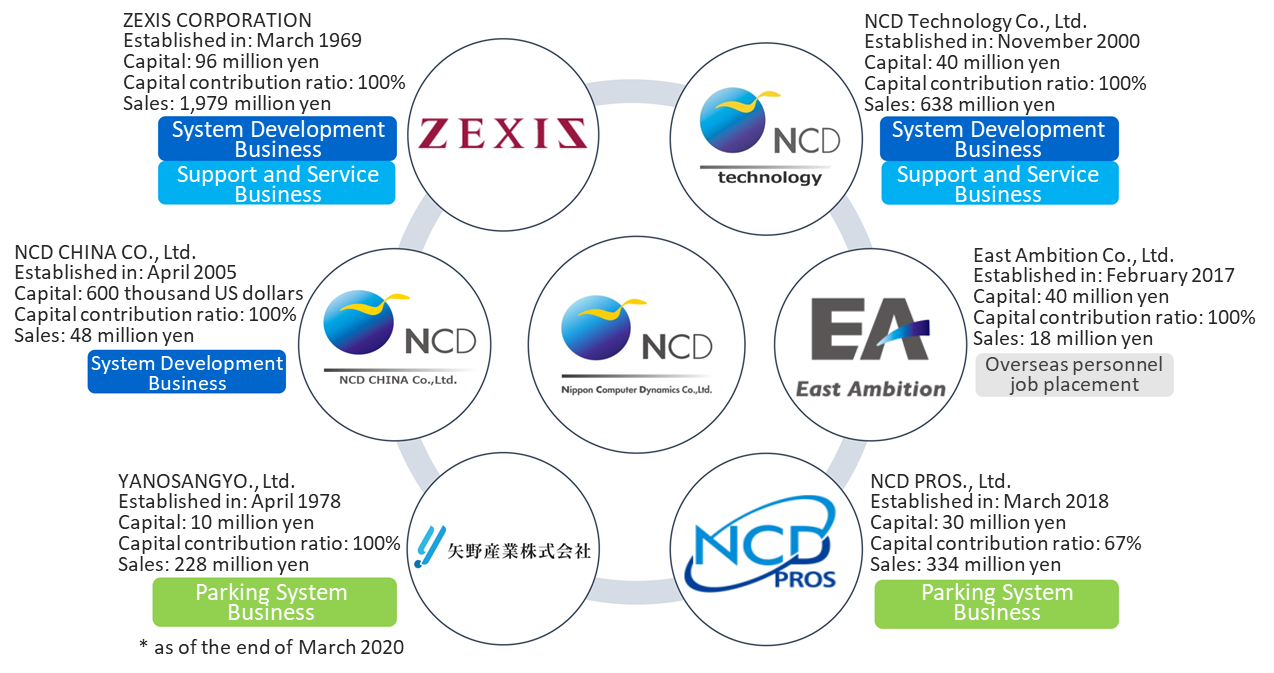

The business establishments of the company are the headquarters (Shinagawa Ward, Tokyo), Koto Service Center (Koto Ward, Tokyo), Fukuoka Sales Office (Fukuoka City, Fukuoka Pref.), Nagasaki Sales Office (Nagasaki City, Nagasaki Pref., including Managed Service Center (MSC) opened in April 2018), and Odaiba Office (Koto Ward, Tokyo). The consolidated subsidiaries in Japan are NCD Technology Co., Ltd. (Shinagawa Ward, Tokyo), which operates IT-related business, ZEXIS CORPORATION (Osaka City, Osaka), which conducts IT-related business mainly in the Kansai area, East Ambition Co., Ltd. (Shinagawa Ward, Tokyo), which introduces personnel from Asian countries, and NCD PROS., Ltd. (Shinagawa Ward, Tokyo), which was established in March 2018 for actualizing high-quality management of bicycle-parking areas. In addition, the company acquired YANOSANGYO., Ltd. (Fukuoka City, Fukuoka Pref.) as a subsidiary in April 2019, which operates the parking system business. The overseas subsidiary is NCD CHINA CO., Ltd. located in Tianjin, China, which offers services to Japanese-affiliated companies in Asia and engages in offshore development for Japan.

Overview of the Nippon Computer Dynamics Group

(Taken from the reference material of the company)

The corporate name, Nippon Computer Dynamics, is infused with their initial ambition to “Contribute to society through the dynamic use of computers”.

In the term ended March 2020, sales composition ratio was as follows: The System Development Business accounted for 38.4%, the Support and Service Business 24.8%, the parking system business 36.4%, and other businesses 0.4%. The operating income composition ratio was as follows: The System Development Business made up 40.6%, the Support and Service Business 11.4%, and the Parking System Business 48.0%.

[Characteristics and strengths of the IT-related business]

One of the strengths of the System Development Business and the Support and Service Business is good client assets characterized by long-term relationships with large client companies. The company not only maintains transactions with clients for a long period of time, but also has recently increased new clients.

In addition, the ratio of direct transactions is high.

Periods of transactions with major clients

Transactions over 50 years or longer | Takasago Thermal Engineering, Tokyo Gas Group, Panasonic Group |

Transactions over 30 years or longer | SRL, Saibugas Group, Nippon Life Group, Fujifilm Group, MetLife Insurance |

Transactions over 20 years or longer | KADOKAWA, Dentsu Group, Fukuoka Prefectural Government, Mitsui Sumitomo Insurance |

Transactions over 10 years or longer | JA Osaka Densan, Kyudenko, Mitsui O.S.K. Lines, Tokyo Tekko, Nippon Suisan Manulife Life Insurance |

Recent transactions | Aflac Life Insurance Japan, ORIX Life Insurance, JTB Asset Management, Sonny Group Takumi Otsuka, Tokio Marine & Nichido Fire Insurance, FWD Fuji Life Insurance, Marubeni Nisshin Feed, Yakult Honsha, Mitsubishi Corporation Life Sciences, LIXIL Group, etc. |

The navy color represents life and non-life insurance business companies (Produced by Investment Bridge with reference to the material of the company)

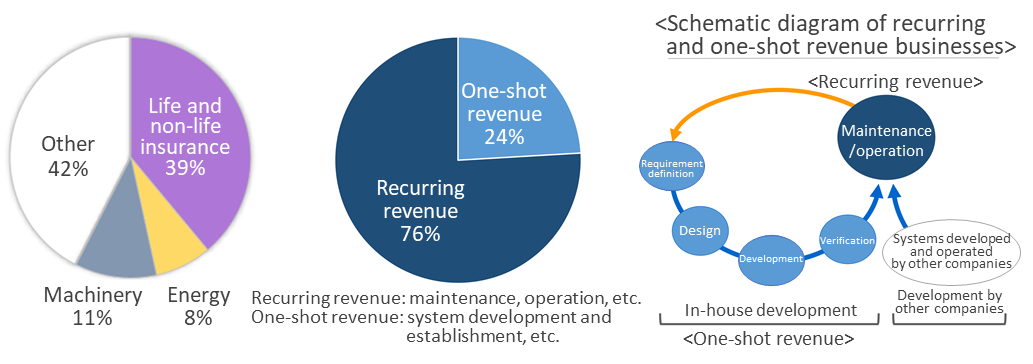

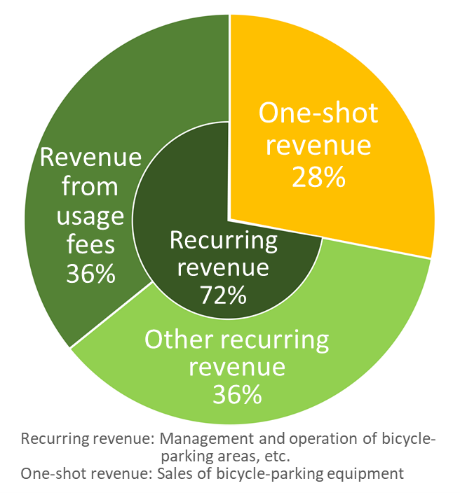

The ratio of sales to life and non-life insurance companies is high. Thanks to long-term contracts, the ratio of recurring sales of maintenance, operation, etc. is high. Accordingly, the business foundation is stable.

Ratio of sales for each business category in the IT-related business, and the ratio of recurring/one-shot sales (FY3/20)

(Taken from the reference material of the company)

■ Characteristics and strengths of the System Development Business

The number of orders in the life/non-life insurance field is healthy -Further promotion targeted at existing clients As the recurring-revenue business was highly evaluated, the company received orders in new fields from existing clients. -Promotion targeted at new clients in uncultivated fields Utilizing the knowledge nurtured in the life insurance field, the company approached new clients.

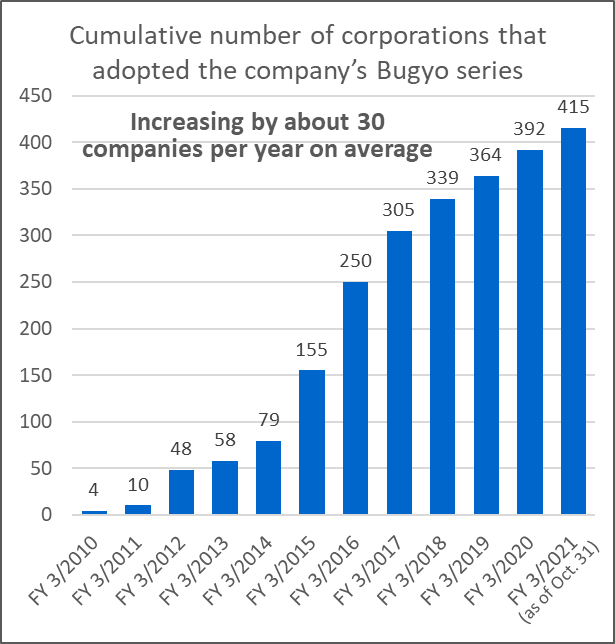

The package installation with the company’s knowledge was highly evaluated -As the Bugyo Series* was adopted by many companies, the company received OBC Partner Award 2020 -The company responded to the growth of demand for sharing accounting processes among large group companies

*Bugyo Series: One of the leading ERP software in Japan, produced by Obic Business Consultants (OBC). |

(Taken from the reference material of the company) |

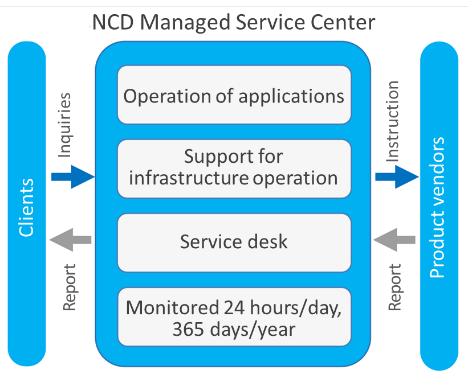

■ Characteristics and strengths of the Support and Service Business

Utilization of Managed Service Centers (Tokyo and Nagasaki) -Built an organizational structure for smooth maintenance and operation of systems adopted by the company -Utilizing the two bases in Tokyo and Nagasaki, the company helps execute each client’s business continuity plan (BCP) at the time of disaster or the like -Service desk for large companies, utilizing the base in Nagasaki -Compatible with implementation of both cloud service of Amazon Web Service and Microsoft Azure

Maintenance and operation available for apps developed by other companies

|

(Taken from the reference material of the company) |

[Characteristics and strengths of the Parking System Business]

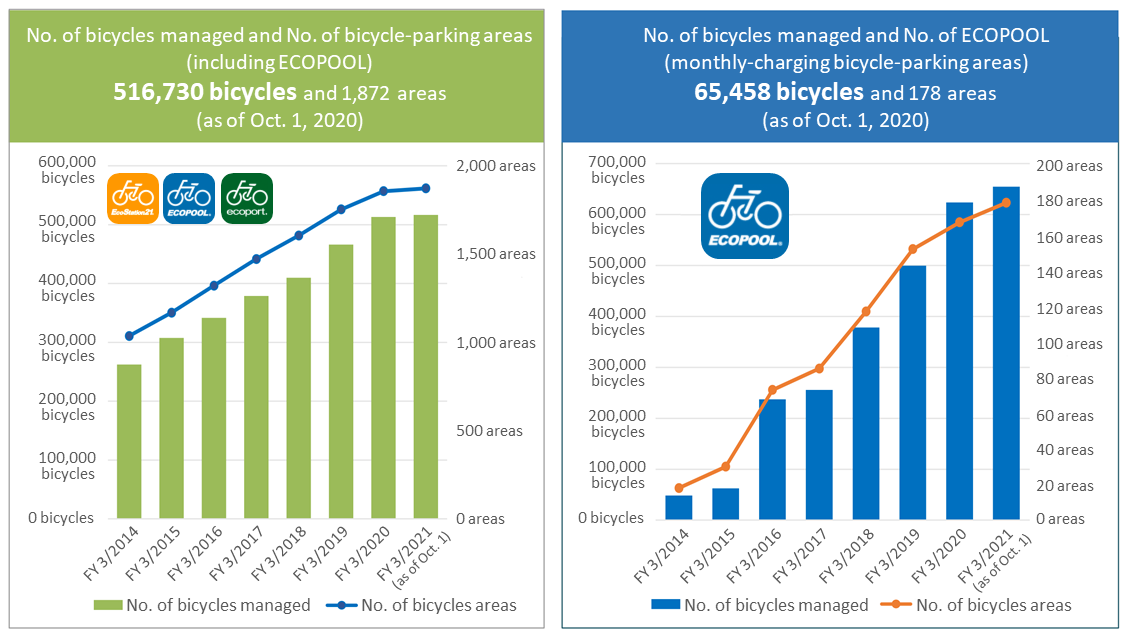

The company is a pioneer in IT-based bicycle-parking platforms. It has constructed the largest number of electromagnetic lock-type bicycle-parking areas in Japan.

-In 1992, the company worked on the digitalization of municipal bicycle-parking areas with monthly charges utilizing the QR code

-In 1999, the company started “EcoStation21”, a business providing systems for electromagnetic lock-type bicycle-parking areas, to solve the social issue of illegal bicycle parking

-In 2009, the company launched “ecoport”, a business for community cycle systems

-In 2013, the company launched “ECOPOOL”, a business providing systems for managing bicycle-parking areas with monthly charges

<Factors in the growth of EcoStation21>

-The support center that responds to customers 24 hours a day, 365 days a year

-A model in which the company provides bicycle-parking equipment (no need of initial investment for clients)

<Other types of bicycle-parking areas>

(Taken from the reference material of the company)

(Taken from the reference material of the company)

As clients in the public and private sectors increased, it became possible to implement wide-range marketing strategies rather than pinpoint ones

Major clients

Municipalities | Arakawa Ward, Itabashi Ward, Edogawa Ward, Ota Ward, Katsushika Ward, Kita Ward, Koto Ward, Shinagawa Ward, Shibuya Ward, Shinjuku Ward, Suginami Ward, Setagaya Ward, Taito Ward, Chuo Ward, Toshima Ward, Nakano Ward, Nerima Ward, Bunkyo Ward, Minato Ward, Meguro Ward, Asaka City, Ichikawa City, Kashiwa City, Kawaguchi City, Kawasaki City, Komae City, Saitama City, Sagamihara City, Tachikawa City, Tama City, Toda City, Narashino City, Fujimino City, Fuchu City, Yokohama City, Wako City, Nagoya City*,Kyoto City*, Fukuoka City, etc. |

Commercial facilities, etc. | atre, Aeon Retail, Ito-Yokado, Daimaru Matsuzakaya, Comodi-iida, XYMAX, Sumisho Urban Development, Sumitomo Realty & Development, Seiyu, Daiei, Times 24, Takashimaya, Tokyu Store, Tokyu Land, Tokyo Tatemono, Parco, Bic Camera, Marui, Mitsukoshi Isetan, Yodobashi Camera, etc. |

Railway operators | Odakyu Electric Railway, Keio, Keisei Electric Railway, Keikyu, Sagami Railway, Seibu Railway, Tokyu, Tobu Railway, East Japan Railway, Hanshin Electric Railway*, Hankyu*, Keihan Electric Railway*, etc. (including related subsidiaries) |

* represents the cooperation with business partners. The blue color represents a designated administrator. (as of April 1, 2020)(Taken from the reference material of the company)

-As for transactions with municipalities, financial soundness and the quality of management and operation tend to be evaluated. The company also offers service in the Kansai, Chubu, Kyushu, and other regions.

-As for transactions with commercial facilities, etc., the company made deals related to urban development. In addition, the company continues to give proposals utilizing IT technologies, such as cashless settlement.

-As for transactions with railway operators, the company covers major railway operators.

Stable revenue structure in which recurring sales account for 72%

Sales composition (results in FY 3/20)

(Taken from the reference material of the company) | <Cases of installation> -2007: Aoi Avenue, Shibuya Ward (Shinjuku Station) Pioneer in constructing bicycle-parking areas on sidewalks -2011: Terrace Mall Shonan (Tsujido Station) Capacity of 3,000 bicycles, the largest class in Japan -2019: Minami-machida Grandberry Park Tokyu Group’s redevelopment project (about 1,300 bicycles) -2020: Grand Emio Tokorozawa Seibu Group’s redevelopment project (about 1,700 bicycles) -2020: Redevelopment of the area around West Exit of Jujo Station (order received) Temporarily about 700 bicycles; 2 bicycle conveyors

|

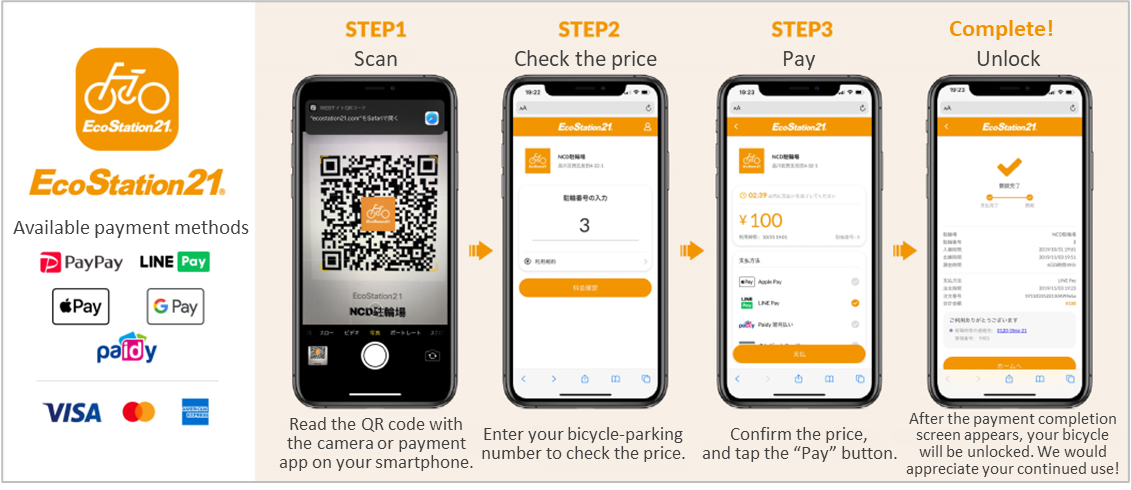

The QR code-based settlement function, which does not require the usage of a charging machine, is evaluated for the prevention of the infection.

(Taken from the reference material of the company)

-Improved users’ convenience

Users do not need to move between their bicycles and the charging machine. Touchless payment (for preventing the spread of the infection) is accomplished, and is compatible with several QR settlement services.

-Reduced management costs

As cash payment decreases, both the number of charging machines, and the frequency of money collecting and machine maintenance can be reduced.

2. 1H of Fiscal Year Ending March 2021 Earnings Results

(1) Consolidated Business Result

| 1H of FY3/20 | Ratio to sales | 1H of FY3/21 | Ratio to sales | YoY |

Net sales | 8,752 | 100.0% | 8,376 | 100.0% | -4.3% |

Gross profit | 1,452 | 16.6% | 1,074 | 12.8% | -26.1% |

SG&A expenses | 1,126 | 12.9% | 1,177 | 14.1% | +4.4% |

Operating income | 325 | 3.7% | -102 | - | - |

Ordinary income | 343 | 3.9% | -1 | - | - |

Quarterly profit attributable to owners of parent | 230 | 2.6% | -12 | - | - |

(Unit: Million yen)

* The figures include numbers calculated by Investment Bridge Co., Ltd. for reference, and may differ from actual figures (The same hereafter).

Sales declined 4.3% year on year, and an operating loss of 102 million yen was posted.

Sales decreased 4.3% year on year to 8,376 million yen. The sales of the System Development Business increased 6.7%, and the sales of the Support and Service Business rose 9.2%, but the sales of the Parking System Business dropped 22.5%.

The company posted an operating loss of 102 million yen (an operating income of 325 million yen in the same period of the previous year). The profit from the System Development Business grew 19.6%, and the profit from the Support and Service Business increased 188.6%, but the Parking System Business saw a loss of 30 million yen (an operating income of 461 million yen in the same period of the previous year).

In the information service field, some companies curtail the investment in IT, but the needs for automation and labor saving, and the demand for renewal of mission-critical systems exists. Namely, the willingness to invest in IT remains strong. In the field of bicycles and bicycle-parking areas, there were some effects of the infection, such as the decrease in use of bicycle-parking areas due to the voluntary restraint of going out in the wake of the declaration of a state of emergency, but after the lifting of the declaration, there is a sign of recovery in the use of bicycle-parking areas. In addition, bicycles are increasingly reevaluated in the new normal era, including the use of bicycles as an alternate transportation means for avoiding the contact with people in public transportation.

In the IT-related business in the first half, development projects received in the term ended March 2020 progressed steadily, and the company is receiving orders in new fields from existing clients. As for maintenance and operation services, the company mainly engages in mission-critical tasks, such as personnel affairs and accounting, so the impact of the infection was minor, resulting in the growth of sales and profit year on year.

As for the Parking System Business, the utilization rate of bicycle-parking areas is recovering, as the number of commuting customers using railways, and the number of visitors to commercial facilities that resumed operation are recovering after the lifting of the declaration of a state of emergency. However, sales and profit dropped significantly year on year, due to the record level continuous rain in July.

As for quarterly performance, sales of 4,077 million yen and an operating loss of 134 million yen were posted in the first quarter (Apr. to Jun.), and sales of 4,299 million yen and an operating income of 31 million yen were posted in the second quarter (Jul. to Sep.). This indicates the improvement from the first quarter. The interim dividend was 7.00 yen/share.

(2) Trend of Each Business Segment

Sales and Profit of Each Business Segment

| 1H of FY3/20 | Composition ratio | 1H of FY3/21 | Composition ratio | YoY |

System Development Business | 3,275 | 37.4% | 3,495 | 41.7% | +6.7% |

Support and Service Business | 2,179 | 24.9% | 2,379 | 28.4% | +9.2% |

Parking System Business | 3,221 | 36.8% | 2,497 | 29.8% | -22.5% |

Other, adjustment | 76 | 0.9% | 4 | 0.1% | -93.7% |

Consolidated sales | 8,752 | 100.0% | 8,376 | 100.0% | -4.3% |

System Development Business | 321 | 38.3% | 384 | 74.0% | +19.6% |

Support and Service Business | 57 | 6.8% | 165 | 31.8% | +188.6% |

Parking System Business | 461 | 54.9% | -30 | - | - |

Other, adjustment | -514 | - | -622 | - | - |

Operating income | 325 | 100.0% | -102 | - | - |

(Unit: Million yen)

As for the System Development Business, sales were 3,495 million yen, up 6.7% year on year, and operating income was 384 million yen, up 19.6% year on year. Since the company had been developing the remote work environment from before the pandemic, the impact of the infection was minor. In addition, new transactions were healthy as major clients resumed IT investment, so sales and profit grew year on year.

As for the Support and Service Business, sales were 2,379 million yen, up 9.2% year on year, and operating income was 165 million yen, up 188.6% year on year. System operation and operational support for client companies are conducted remotely in most cases, so the impact of the infection was minor. In addition, the company kept receiving large-scale orders and new orders in their experienced field by utilizing the knowledge nurtured through transactions with existing clients, so sales grew year on year. As for profit, it grew considerably year on year, thanks to the good management of progress and profit.

As for the Parking System Business, sales were 2,497 million yen, down 22.5% year on year, and operating loss was 30 million yen (a profit of 461 million yen in the same period of the previous year). As for the sales of equipment, the company steadily made transactions for bicycle-parking areas in urban redevelopment, but the opening of some bicycle-parking areas attached to stations and commercial facilities were cancelled or postponed. As for the revenue from the usage charges of bicycle-parking areas, commuters using railways and visitors to commercial facilities decreased, due to the voluntary restraint of going out and opening stores in the wake of the declaration of a state of emergency in early April, so the utilization rate of bicycle-parking areas attached to stations and commercial facilities dropped considerably. As a result, the revenue from the usage charges of bicycle-parking areas in the first quarter declined about 50% year on year but, as the declaration of a state of emergency was lifted, the utilization rate recovered gradually from June, and the decrease rate of utilization rate was only about 20% year on year in August and September, although it was temporarily stagnant due to the record level prolonged rain in July. In urban areas where office buildings are concentrated, the utilization rate of bicycle-parking areas ceased to fall, as commuters who go to their workplaces by bicycle increased, but in the suburbs, where many users switched to working from home, the utilization rate declined. Consequently, sales decreased year on year. As for profit, to reduce fixed costs, the company optimized the frequencies of money collection and maintenance, and started the production of equipment which had been outsourced. They also implemented measures for improving the profitability of less profitable bicycle-parking areas. These curbed the diminution in operating income but the company posted an operating loss.

(3) Financial Conditions and Cash Flows

Financial Conditions

| March 2020 | September 2020 |

| March 2020 | September 2020 |

Cash and deposits | 2,610 | 3,263 | Trade payables | 812 | 592 |

Trade receivables | 2,782 | 2,171 | Short-term loans payable | 992 | 1,474 |

Inventories | 223 | 203 | Current liabilities | 4,311 | 4,113 |

Current assets | 6,644 | 6,590 | Long-term loans payable | 1,884 | 1,520 |

Property, plant, and equipment | 1,385 | 1,341 | Noncurrent liabilities | 3,392 | 2,970 |

Intangible assets | 112 | 139 | Net assets | 3,913 | 3,981 |

Investments and others | 3,474 | 2,994 | Total liabilities and net assets | 11,617 | 11,065 |

Noncurrent assets | 4,972 | 4,475 | Total interest-bearing liabilities | 2,877 | 2,995 |

(Unit: Million yen)

*Interest-bearing liabilities = Borrowings + Lease obligations (long-term only)

As of the end of the first half of the term ending March 2021, the total assets stood at 11,065 million yen, down 552 million yen from the end of the previous term. Major decreased items were trade notes and accounts receivable (down 611 million yen), and lease receivables and lease investment assets (down 313 million yen). On the other hand, a major increased item was cash and deposits (up 652 million yen). Liabilities stood at 7,083 million yen, down 620 million yen from the end of the previous term. Major decreased items were lease obligations (down 333 million yen), trade accounts payable (down 219 million yen), and reserve for bonus payment (down 128 million yen). Net assets grew 67 million yen from the end of the previous term to 3,981 million yen.

Capital-to-asset ratio rose from 33.5% at the end of the previous term to 35.8%.

Cash Flow (CF)

| 1H of FY 3/20 | 1H of FY 3/21 | Increase/decrease | YoY |

Operating Cash Flow (A) | -182 | 206 | +388 | - |

Investing Cash Flow (B) | -145 | 156 | +301 | - |

Free Cash Flow (A + B) | -327 | 362 | +689 | - |

Financing Cash Flow | -189 | 316 | +506 | - |

Cash and Equivalents at Term End | 2,063 | 3,099 | +1,036 | +50.2% |

(Unit: Million yen)

Cash and equivalents at the end of the first half stood at 3,099 million yen, up 678 million yen from the end of the previous term.

Compared to the end of the first half in the previous term, operating CF increased 388 million yen to positive 206 million yen. The major factors in inflow were a drop in trade receivables of 610 million yen, and a depreciation of 129 million yen. On the other hand, the major factors in outflow were a drop in trade payables of 213 million yen, a drop in reserve for bonus payment of 128 million yen, and a payment of income tax and others of 126 million yen.

Investing CF increased 301 million yen to positive 156 million yen. The major factors in inflow were a drop of reserve for insurance of 169 million yen, and proceeds from sales of property, plant, and equipment of 139 million yen. The major factor in outflow was a purchase of property, plant, and equipment amounting to 117 million yen.

Financing CF augmented 506 million yen to positive 316 million yen. The major factor in inflow was a net increase in short-term debts of 506 million yen.

* The reason why profit dropped in the term ended March 2017 is that there emerged an actuarial difference due to the drop in the discount rate used for retirement benefit obligations caused by the decline in interest rate, and the difference was to be amortized in the next term. Excluding such special factors, profit increased. In the term ending March 2021, the Parking System Business is estimated to be affected by the infection.

3. Fiscal Year Ending March 2021 Earnings Forecasts

Consolidated Earnings Estimates

| FY 3/20 Results | Ratio to sales | FY 3/21 Estimates | Ratio to sales | YoY | Initial estimates |

Net sales | 18,390 | 100.0% | 17,800 | 100.0% | -3.2% | 18,900 |

Operating income | 936 | 5.1% | 200 | 1.1% | -78.6% | 900 |

Ordinary income | 953 | 5.2% | 230 | 1.3% | -75.9% | 900 |

Profit attributable to owners of parent | 648 | 3.5% | 150 | 0.8% | -76.9% | 650 |

(Unit: Million yen)

* The initial estimates are the estimates for the term ending March 2021, which were deliberated by the board of directors in the term ended March 2020.

The full-year forecasts, which is estimated that sales and ordinary income will be drop 3.2% and 75.9%, respectively, year on year, remains unchanged.

For the term ending March 2021, the company forecasts that sales will decline 3.2% year on year to 17.8 billion yen, operating income will drop 78.6% year on year to 200 million yen, ordinary income will fall 75.9% year on year to 230 million yen, and profit attributable to owners of parent will decrease 76.9% year on year to 150 million yen. As for bicycle-parking areas, it is assumed that the utilization rate will recover, but the revenue from bicycle-parking areas will decline year on year to some degree, because in the new normal era, telework and delivery services will take root.

The term-end dividend is projected to be 7.00 yen/share, and the annual dividend is estimated to be 14.00 yen/share.

The measures for each segment are as follows.

■ IT-related business

-Development of business models for maintenance and operation services

-Further cultivation of the life insurance domain by utilizing operational knowledge

-Acquiring new domain with an account plan targeted at existing clients

-Acquiring orders of maintenance and operation from large companies

-Further upgrading the functions of Managed Service Centers

■ Parking System Business

-Reduction of fixed costs through reform of the revenue structure (optimization of money collection and frequencies of visiting)

-Curtailment of outsourcing costs through in-house production (expansion of the business of NCD PROS)

-Increase of orders received for urban redevelopment and municipal projects

-Expansion of the monthly-charging bicycle-parking area system ECOPOOL (for municipalities and railway companies)

-Advertisement of the QR code-based settlement function

-Development of bicycle-parking areas considering the changes in the traffic lines of bicycle users in the new normal era

The actual and estimated effects of the infection are as follows.

(Taken from the reference material of the company)

Strategies of the planning and management section

Establish an optimal formation of group companies

Exertion of synergetic effects by clarifying regions and roles

NCD PROS (specializing in the management and operation of bicycle-parking areas mainly in the Tokyo metropolitan area)

ZEXIS (Kansai area) / YANOSANGYO (Kyushu area)

Enhance the group’s management function

Establish the management strategy department and the personnel development division (April 2020)

Intensify planning management and marketing strategies, and IR activities

Restructuring of personnel education and career development, and intensifying organizational development

Enhance compliance and risk management

Strengthen the compliance management system

Sophisticate the risk control system

4. Mid-term Management Plan “Vision 2023”

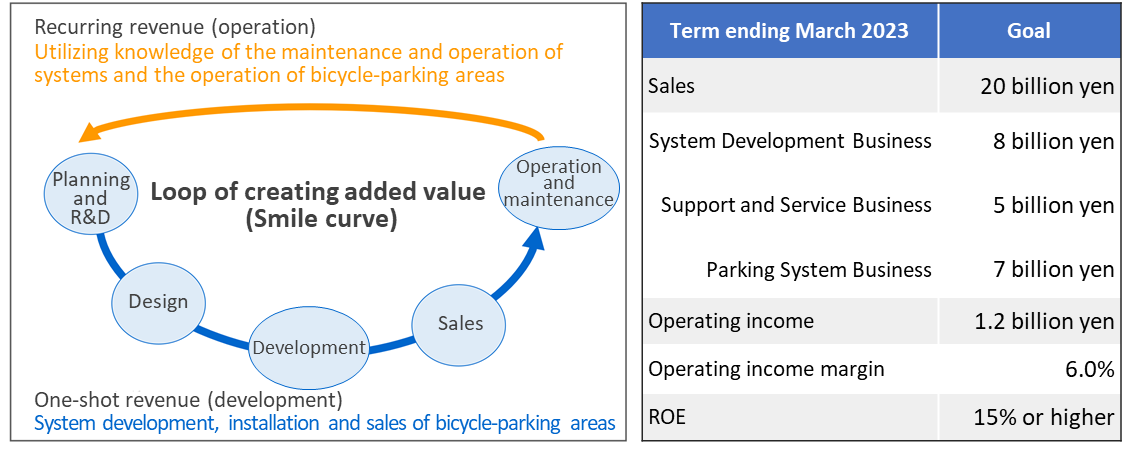

In the term ending March 2021, which is the first fiscal year of the mid-term plan, the company estimates to be affected by the infection but make a V-shaped recovery from the sluggishness caused by the infection in the term ending March 2022, and aims to achieve sales of 20 billion yen and an operating income of 1.2 billion yen in the term ending March 2023, which is the last fiscal year of the mid-term plan. The sales of 20 billion yen will be composed of 8 billion yen from the System Development Business, 5 billion yen from the Support and Service Business, and 7 billion yen from the Parking System Business.

Slogan: Change & Challenge for Smile

Value: To further improve added value by enhancing the linkage between recurring and one-shot revenue businesses

(Taken from the reference material of the company)

Variation in consolidated earnings

(Taken from the reference material of the company)

5. Conclusions

The Parking System Business, which had been the moneymaker until the term ended March 2020, was significantly affected by the infection. However, seeing the sales from pay-by-the-hour bicycle-parking areas, the impact of the infection seems to be weaker than the company’s assumption. The IT-related business performed well in the first half, and is expected to keep performing well, as the demand for investing in IT is strong, thanks to the needs for automation and labor saving for enhancing productivity to cope with the changes in the labor environment, the demand for renewal of mission-critical systems, etc. Considering all businesses comprehensively, it can be said that the COVID-19 crisis is generating advantage for the company. In the next term, their profit is estimated to grow considerably, motivated by active investment in bicycle-parking areas, further cost cut, and the continuing good performance of the IT-related business. If the mid-term plan is completed, EPS will reach around 100 yen. The share price remains three-digits and is quite undervalued.

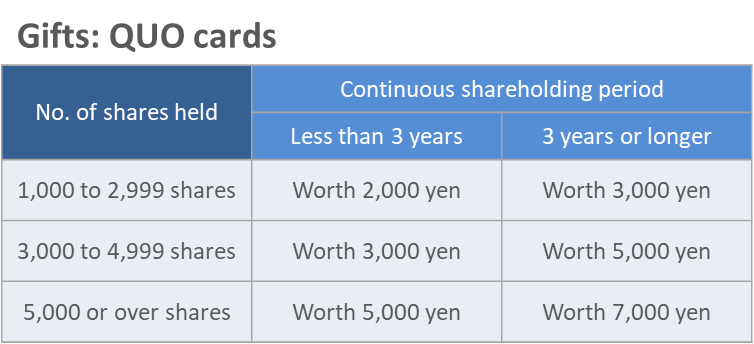

The company offers shareholder benefits and advantages to long-term shareholders.

(Taken from the reference material of the company)

<Conditions for the continuous shareholding period>

-Shareholders listed in the company’s register of shareholders as of the reference date, which is the end of September every year, will receive benefits.

-The shareholders who remain listed in the register of shareholders for the 7th consecutive half-year period or more (confirmed at the end of March and at the end of September every year) will be deemed to keep holding shares for 3 years or longer.

<Reference: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors (excluding audit and supervisory committee) | 10 directors, including 5 outside ones |

Audit and supervisory committee | 4 members, including 3 outside ones |

Corporate Governance Report

The latest update: June 29, 2020.

<Basic policy>

The basic policy of Nippon Computer Dynamics for corporate governance is to improve internal control for flexible business execution systems and compliance-oriented business administration in order to achieve continuous prosperity.

<Regarding the observance of the principles of the Corporate Governance Code>

We follow all the basic principles as a company listed in the JASDAQ market.

<Other>

Establishment of the Nomination and Remuneration Committee

To reinforcing the corporate governance structure, we established a Nomination and Remuneration Committee as an arbitrary committee in June 2017. As an advisory body for the board of directors, this Committee deliberates the policies for appointing and dismissing executives, their remunerations, etc. and secures the objectivity and transparency of those decision-making processes.

Composition of the Nomination and Remuneration Committee

Three members (including two independent outside directors; the head of the committee is selected from independent outside directors)

Supplementary information

The Nomination and Remuneration Committee, which is an advisory body for the board of directors, held four meetings in fiscal 2019, to select candidate directors and executive officers, determine the remunerations of respective directors and executive officers, evaluate the effectiveness of the board of directors, and so on. The participation rate of the committee members was 100%.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Report (Nippon Computer Dynamics Co., Ltd.: 4783) and the contents of Bridge Salon (IR Seminar) can be viewed here: www.bridge-salon.jp/