| Nihon Enterprise Co., Ltd. (4829) |

|

||||||||

Company |

Nihon Enterprise Co., Ltd. |

||

Code No. |

4829 |

||

Exchange |

Tokyo Stock Exchange, First Section |

||

Industry |

Information, Communications |

||

President |

Katsunori Ueda |

||

HQ Address |

Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

||

Year-end |

May |

||

Home Page |

|||

* Share price as of close on July 13, 2016.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. Effective from fiscal year May 2016, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

* A 100 for 1 stock split was conducted on December 1, 2013. This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the fiscal year May 2016. |

|

| Key Points |

|

| Company Overview |

|

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014. <Corporate Philosophy>

Nihon Enterprise's employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its "Mission Statement, Doctrine, and Five Spirits" and "Nihon Enterprise Management Principles." President Katsunori Ueda believes that it is Nihon Enterprise's obligation to maximize "shareholder value" and "make effective use of capital by not wasting a single yen".President Katsunori Ueda founded Nihon Enterprise with the strong motivation of "contributing to society through its businesses" and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services. Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children's institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan. Mission Statement

Nihon Enterprise's main mission is to contribute to society through its activities as a merchant, and to contribute to development of culture.

Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

<Overview of Business Segments>

The Contents Service Segment and the Solutions Segment accounted for 39.7% and 60.3% of total sales respectively in fiscal year May 2016.

<Corporate Group: 9 Consolidated Subsidiaries, 5 Non-Consolidated Subsidiaries>

The Nihon Enterprise Group is comprised of a total of nine consolidated subsidiaries with seven within Japan including the company Dive Co., Ltd., which provides advertising business, At The LOUNGE Co., Ltd. which provides music related services, Advanced Traffic Information Services, Corporation (ATIS Corp.), which provides traffic and other information services, 4QUALIA Co., Ltd., which provides web and mobile site development and maintenance services and contents development, HighLab Co., Ltd., which conducts native application development as part of the mobile contents business, and One Inc., which provides voice communications related solutions, and Aizu Laboratory, Inc., which conducts smartphone application planning and development. The two overseas subsidiaries include Enterprise (Beijing) Information Technology Co., Ltd., which oversees the operations in China and operates cellular telephone retail shops, and Rice CZ (Beijing) New media technology Co., Ltd., which provides IT related educational services in China. The Group also maintains five non-consolidated subsidiaries of which three operate in Japan including Yamaguchi Regenerative Energy Factory Co., Ltd., which was established in June 2015 to conduct smart community business, Promote, Inc., which conducted a third party placement funding in July 2015 and provides development of applications for smartphones and automated kitting tools, and NE Yinrun Co., Ltd., which was established in October 2015 to provide wholesale services in China. In addition, two non-consolidated subsidiaries are operated in overseas markets including Rise MC (Beijing) Digital Information Technology Co., Ltd., which provides mobile contents distribution and character licensing services in China, and NE Mobile Services (India) Private Limited, which is a company operating in India.  * ROE is an indicator reflective of the three indicators of net income margin (Net income / Sales), asset turnover ratio (Sales/Total assets), and leverage (Total assets/Equity, or the invers of equity ratio). ROE: Net income margin X Asset turnover ratio X Leverage

* Data in the above table are derived from the earnings announcement statement and financial filing reports, and ROE, asset turnover ratio and leverage are calculated using the average of total assets and equity during the term (Adding the values at the end of the previous and current terms and dividing by two. The value for leveage may not necessary be a direct calculation as the inverse of the equity ratio as the equity ratio shown in both the earnings announcement and financial filing reports are calculated using the current term end value.) |

| Fiscal Year May 2016 Earnings Results |

Sales, Ordinary Income Rise 8.1%, 23.4%

Sales rose by 8.1% year-on-year to ¥5.530 billion during fiscal year May 2016. Weak sales of contents sold to carriers due to dilution of advertising effectiveness caused sales of the Contents Service Segment to decline by 12.4% year-on-year. Higher sales recorded in the solutions (Consigned development and others), advertising (Advertising agency services), and overseas divisions (Operations of cellular telephone sales shops in China) allowed sales of the Solutions Segment to rise by 27.8% year-on-year.With regards to profits, an increase in the sales composition of low profitability Solutions Segment (Rose from 51.0% to 60.3%) which suffered from the burden of anticipatory investments caused gross income margin to decline by 3.7% points year-on-year. However, a decline in sales, general and administrative expenses of 5.4% year-on-year arising from optimization of advertising allowed operating income to rise by 15.7% year-on-year to ¥219 million. Furthermore, improvement in non-operating income arising from declines in commissions and reductions in taxes due to the sales of equity accounting method affiliate in China allowed parent net income to rise by 84.2% year-on-year to ¥327 million.    Sales, Ordinary Income Rise 9.6%, 7.9% Year-On-Year

During the fourth quarter between March to May, sales rose to a record high level on a quarterly basis on the back of strength in the Solutions Segment, allowing sales to grow on both year-on-year and quarter-on-quarter basis. With regards to profits, reductions in advertising expenses derived from changes in advertising strategy allowed sales, general and administrative expenses margin to improve. At the same time, increases in sales and anticipatory investments of the solution business led to a rise in the cost of sales margin and caused operating income to decline on both a year-on-year and quarter-on-quarter basis. However, the booking of subsidy income allowed ordinary income to rise on a year-on-year basis.

Consigned Development

Regional Revitalization Business

|

| Fiscal Year May 2017 Earnings Estimates |

Estimates Call for Sales to Fall 4.2%, Ordinary Income to Rise 38.6%

Nihon Enterprise's earnings estimates call for sales to decline by 4.2% year-on-year to ¥5.3 billon on the back of continued difficult conditions in the Contents Service Segment caused by changes in the contents market environment and despite the outlook for continued strong demand for the Solutions Segment (Consigned development and others). At the same time, these estimates also includes expectations of a decline in advertising sales due to the disappearance of extraordinary demand recorded during the term just ended and a conservative outlook for the overseas division.With regards to profits, a peaking of developmental investments and changes sales composition are expected to allow gross margin of the Solutions Segment to improve. Also, reductions in sales, general and administrative expenses derived from changes in advertising strategy are expected to allow operating income to rise by 50.2% year-on-year to ¥330 million. Net income attributable to the parent company is expected to decline due to the disappearance of extraordinary income arising from the sale of investment securities booked in the previous term. Dividend payment of ¥3 per share is anticipated at the term end. (2) Fiscal Year May 2017 Business Strategy

Nihon Enterprise provides five main contents within its Contents Service Segment. And within the Solutions Segment, application development, system creation, audio and new technologies are provided as part of a total solutions package that positions Nihon Enterprise as a "one stop" comprehensive solutions services provider that can leverage its group's strengths to cultivate demand.

Contents Service Segment

Nihon Enterprise has strengthened its alliances to the expand the healthcare application "Woman's DIARY", flea market application "Dealing", and messenger application "Fivetalk" within its lifestyle category of contents, comprehensive digital publications service "Booksmart" within its entertainment category, and traffic information "ATIS" as constituents of its five main contents categories. At the same time, efforts are being made to introduce new contents and fortify services, along with measures to produce hit contents and promote platforms.

Lifestyle

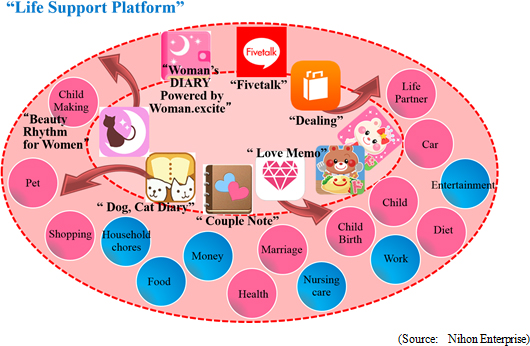

Efforts are being conducted to "strengthen alliances" and "expand coverage", and to promote the formation of a life support platform. With regards to alliances, a collaborative agreement was formed with Tanita Corporation for the healthcare application "Women Rhythm Pocketbook" on January 21, 2016 for cooperation on body composition devices (Tanita body composition meter will be connected to the "Women Rhythm Pocketbook" by Bluetooth to provide health support function service). On April 4, 2016, joint operations for "Women Rhythm Pocketbook" Powered by Woman.excite" was started through a collaborative agreement formed with Excite Japan Co., Ltd.. In addition, the messenger application "Fivetalk" began being provided across Toyota Motor Corporation's next generation telematics service "T-Connect" on June 25, 2015. In the future, efforts to strengthen alliances will continue to be implemented. In addition, the business realm coverage will be expanded by leveraging know-how in the healthcare, intellectual training application development to expand coverage to the marriage and child raising services realms. Furthermore, efforts are being made to create an individual electronic commerce system based upon the flea market application "Dealing" which was acquired on December 1, 2015.

Entertainment

In addition to increasing the popularity of carrier fixed rate services including "Sugo Toku Contents", and the simple to play native game applications "Chokotto Game", which have been introduced as part of the advertising strategy and as new games, efforts are being made to strengthen cooperation with the "Tokyo City Book Shop Association" and services are being fortified to expand member numbers as part of efforts to strengthen the digital publication "Booksmart" service. The "Tokyo Book Award" writer cultivation and development support project "Tokyo City Book Shop Association" will be started on June 10, 2016 (Projected date) through a collaborative effort with the "Tokyo City Book Shop Association". In addition, efforts to expand member numbers by provision of browser viewers to smartphone, tablets and personal computers have also been launched, while provision had traditionally been limited to only application viewers. Furthermore, rental and all you download services have also begun being provided. Aside from these developments, Nihon Enterprise became a partnering company in Sharp's mobile type robot telephone called "RoBoHon" from May 10, 2016. In the future, the Company will begin distributing contents across Softbank's new platform called "Pepper".

Traffic Information

The monthly fees received the some 200,000 registered users of traffic information is part of the stable earnings base of Nihon Enterprise, and efforts are being made to grow earnings and stability provided by this revenue stream by increasing customer engagement through the addition of new functions and by distributing this contents across new platforms (Currently distributed across carrier platforms). In addition to the traditional BtoB distribution (Contents Service Segment), efforts are being made in the realm of BtoBtoC (Solutions Segment). As part of the BtoBtoC distribution service, the bus location service of the Keihin Kyuko Bus Co., Ltd., and data transmission service of Television Kanagawa Inc. have been started in March and April 2016 respectively.

Solutions Segment

Application development, system creation, audio and new technologies capabilities provided as part of a total solutions package will be leveraged to cultivate consigned development demand for customized versions of corporate messenger application "BizTalk", IP application "AplosOne", reverse auction "Profair" and other applications, and to invigorate regional economies and expand the advertising (Ad agency services) services realm.

Solutions Segment (Consigned development, others)

In light of the expansion in corporate investments for information system development, the strength of comprehensive solutions services is being leveraged to cultivate new clients in the realm of consigned development and has led to demand for "declining birthrate countermeasure" and "tourism promotion" measures from parties concerned with regional economy invigoration. With regards to regional economy invigoration, the capital participation agreement with Smart Value Co., Ltd. (JASDAQ Listing, code number 9471), which conducts cloud solutions and mobile communications businesses in the Kansai region, is being leveraged to cultivate projects and pursue synergies.With regards to packaged services, functionality and usability of the corporate messenger application "BizTalk" and IP application "AplosOne" are being strengthened as a means of expanding the user base. In addition, seminars are being conducted to cultivate customers for the reverse auction "Profair" application. Efforts are also being made to expand sales of the kitting support tool "Concerto" for smartphones along with the introduction of partner systems as a means of expanding sales channels. Moreover, measures are being conducted to cultivate new users of the educational cloud "e Manabi (Learn)" service launched in July 2016. Advertising Business (Advertising Agency Service)

"All You Can View Movies, Drama, Animation", "Travel Guide", and other services as part of the superior contents provision service launched in fiscal year May 2016 will leverage the characteristics of each content to cultivate new sales channels. Furthermore, ongoing efforts to fortify the superior contents and form alliances will be conducted.

Overseas

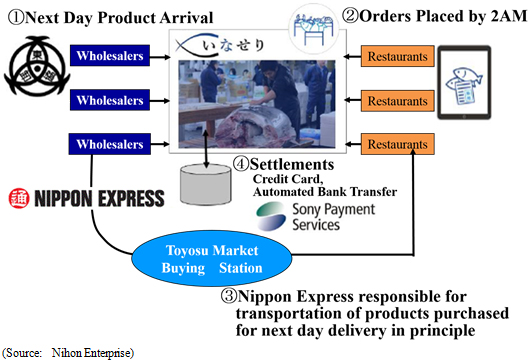

Sustained corporate sales efforts will be conducted to expand sales. In addition, the third shop called "Yuqiao Road Branch" was opened on April 21, 2016 (The period under review for fiscal year May 2017 in China is from April 1, 2016 to March 31, 2017.)Aside from the above-mentioned developments, efforts to develop home energy management system (HEMS), smart agriculture, and drone research are being conducted.  Inaseri Co., Ltd. was established on June 3, 2016 as a 100% owned subsidiary of Nihon Enterprise for planning, development and operations of the electronic commerce service called "Inaseri". Inaseri Co., Ltd. has formed a collaborative partnership with the Tsukiji Fish Market of the Metropolitan Central Wholesale Market and the Wholesale Cooperative of Tokyo Fish Market. In this collaboration, "Inaseri" e-commerce service will begin providing services for the Tsukiji Fish Market of the Metropolitan Central Wholesale Market from November 2016 upon its relocation from the Tsukiji to Toyosu region of central Tokyo. "Inaseri" is a service of the Wholesale Cooperative of Tokyo Fish Market that allows for fresh fish and seafood suppliers to conduct e-commerce transactions directly with restaurant operators. Wholesalers post information about products expected to be sold on the next day on the "Inaseri" website for customers to order. If orders are placed by 2AM, seafood products will be delivered within the same day. The fresh fish and seafood posted on the website are processed by wholesalers handlers, then aggregated at the purchasing station within the Toyosu Market, and in the final step of the process shipped to clients using Nippon Express Co., Ltd. for arrival at restaurants within the next day. Sony Payment Services Inc.'s system called "e-SCOTT Smart" will be used and allows for payments by credit card or bank account automated transfer. The Wholesale Cooperative of Tokyo Fish Market will leverage this "Inaseri" service to promote transactions of products with restaurant operators through sales representatives as a service of the site (http://inaseri.net/), which will be responsible for planning, development and operations, in addition to the provision of customer support. Moreover, marketing and public relations will be conducted along with cultivation of new customers within the restaurant industry. Initially, the service will be provided to restaurant operators within the Kanto region (Tokyo and the surrounding seven prefectures), with the prospect of expanding operations throughout Japan and overseas in the medium- to long-term. Inaseri Co., Ltd. Overview Headquarters: Shibuya 1-17-8, Shibuya Ward, Tokyo Representative: Yoshikatsu Hagiwara Capitalization: ¥75 million (Apart from capital reserves ¥75 million) Shareholder: Nihon Enterprise Co., Ltd. (100% ownership)  |

| Conclusions |

|

While the large increase in profits derived from optimization of advertising expenses stood out during fiscal year May 2016, the launch of the "Inaseri" electronic commerce service and regional economy invigoration services contributed to a large decline in profitability of the Solutions Segment. However, the anticipatory investments are expected to have peaked and profitability of the Solutions Segment is expected to recover. And while Nihon Enterprise's earnings estimates call for sales to decline by 4.2% and operating income to rise significantly by 50.2% year-on-year in the coming fiscal year, further efforts to optimize advertising expenses are expected to allow this rise in profits to be achieved despite a decline in sales. |

| <Reference: Regarding corporate governance> |

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016, All Rights Reserved by Investment Bridge Co., Ltd. |