Nihon Enterprise the first half of fiscal year ending May 2018

Katsunori Ueda, President | Nihon Enterprise Co., Ltd. (4829) |

|

Corporate Information

Market | TSE 1st Section |

Industry | Information, Communications |

President | Katsunori Ueda |

HQ Address | Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

Year-end | May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥218 | 40,567,200 shares | ¥8.844 billion | 2.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥2.00 | 0.9% | ¥2.71 | 80.4x | ¥121.59 | 1.8x |

* Share price as of close on February 13, 2018.

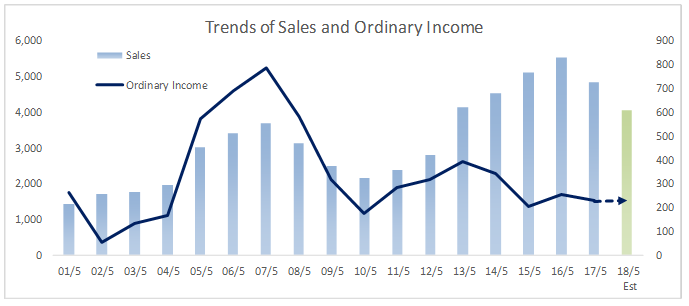

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

May 2014 | 4,508 | 335 | 340 | 437 | 11.59 | 3.00 |

May 2015 | 5,116 | 189 | 204 | 177 | 4.57 | 3.00 |

May 2016 | 5,530 | 219 | 252 | 327 | 8.07 | 3.00 |

May 2017 | 4,838 | 192 | 229 | 99 | 2.45 | 2.00 |

May 2018 Est. | 4,040 | 145 | 230 | 110 | 2.71 | 2.00 |

* Estimates are those of the Company. Effective from fiscal year March 2016, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the first half of fiscal year May 2018 and the fiscal year May 2018 earnings estimates.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year May 2018 Earnings Results

3. Segment Overview

4. Fiscal Year May 2018 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Strength in the "business support system" and "system development and operational services" allowed sales to rise by 7.4% quarter-on-quarter basis during the second quarter of fiscal year May 2018. Ordinary income rose by 99.8% quarter-on-quarter for the second consecutive quarter of increases on the back of restraint in overall costs. "Contents services," "ad agency services," and a decline of cellular telephone sales in China caused sales and ordinary income during the second half of the fiscal year to fall by 19.0% and 39.8% year-on-year respectively.

- Nihon Enterprise revised its outstanding earnings estimates on January 31, 2018, and now calls for a 16.5% year-on-year decline in sales and a 10.5% year-on-year increase in net income. Sales are expected to decline due to contraction in contents market for carrier platforms, fresh seafood electronic commerce “Inaseri” service arising from a delay in the move of the fish market to Toyosu, restraint in underperforming sales of cellular telephones in China, and sale of "storefront affiliate services" business. Against the backdrop of lower sales, ordinary income is expected to rise slightly due to the booking of subsidy income resulting from validation services, and despite the appearance of research and development expenses for validation services in new business realms. The booking of extraordinary profits from gains on the sale of the "storefront affiliate services" allowed net income to rise by 4.8% above its initial estimates and 105% above the previous year’s level. The Company is expected to maintain its dividend payment forecast of ¥2 per share at the end of the term.

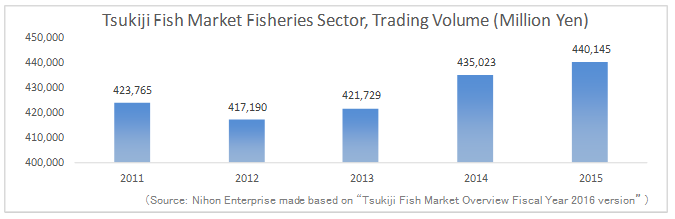

- The Toyosu Fish Market has been set to open on October 11, 2018. The operation of the fresh seafood electronic commerce "Isenari" platform will be freed from the constraints of Tsukiji market along with the opening of the new Toyosu Market and will allow the order process to be sped up due to dedicated product shipment processing area for "Isenari" and to the support of the Wholesale Cooperative of Tokyo Fish Market. The delivery area coverage is being expanded from Honshu and Shikoku (exclude some isolated islands) to other parts of Japan, and a collaborative business arrangement was formed with the alcoholic beverage trading firm “Kawachiya”, which has distribution channels within restaurants, in June 2017 to accelerate cultivation of restaurant clients. Moreover, efforts are being made to strengthen collaboration with the Wholesale Cooperative of Tokyo Fish Market to expand the number of products and distribution network. Future development should be closely watched.

1. Company Overview

Nihon Enterprise is a “mobile solutions company” providing services that includes development of smartphone applications for consumers, enterprise system development, mobile kitting, e-commerce, AI chatbot, and other services. Its two main business segments include the "creation business," where applications and systems using in-house IP (Intellectual Property) are provided, and the "solutions business," where institutional software and system development are conducted. Furthermore, Nihon Enterprise works actively on validation businesses including IoT, blockchain, and wired drones.

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014.

<Corporate Philosophy>

Nihon Enterprise’s employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its “Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.” President Katsunori Ueda believes that it is Nihon Enterprise`s obligation to maximize “shareholder” in the long run, thus “enables to make effective use of capital and maximize it by not wasting a single yen” below its appropriate belief and action. In the first place, president Katsunori Ueda founded Nihon Enterprise with the strong motivation of “contributing to society through its businesses” and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services.

Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children’s institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan.

Mission Statement

Nihon Enterprise’s main mission is to contribute to society through its activities as a merchant, and to contribute to development of culture.

Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

The Commitments of Nihon Enterprise - Commitment to Business - Commitments of selfless Devotion - Commitment to Grow Earnings - Commitment to Take on New Challenges - Commitment to Always Being Appreciative

| The Management Principles of Nihon Enterprise 1. Raise the Spirit of Our Management 2. Leverage the Collective Knowledge in Management of Our Company 3. Pursue Profits Fairly 4. Comply with Principles 5. Always Place Customers Interests First 6. Maintain a Family Management Style 7. Strict Adherence to Performance 8. Promote Work Based upon “Relationships of Cooperation and Trust”

|

<Corporate Group: 10 Consolidated Subsidiaries, 3 Non-Consolidated Subsidiaries>

Nihon Enterprise is comprised of a total of ten consolidated subsidiaries, with eight operating in Japan including One Inc., which provides voice communications related solutions, 4QUALIA Co., Ltd., which provides applications and system development and operations and debugging, Promote Inc., which provides smartphone kitting support tools, Dive Co., Ltd., Inaseri Co., Ltd., which conducts planning, development and operations of the electronic commerce service called “Inaseri”, Advanced Traffic Information Services, Corporation (ATIS Corp.), which provides traffic and other information services, Aizu Laboratory, Inc., which conducts application and system development, HEMS, and drones, and Yamaguchi Regenerative Energy Factory Co., Ltd., which participates in the “Smart Community” business. The two overseas subsidiaries include Enterprise (Beijing) Information Technology Co., Ltd., which oversees the operations in China and operates cellular telephone retail shops, and Rice CZ (Beijing) New media technology Co., Ltd., which provides IT related educational services in China. The Nihon Enterprise Group also maintains three non-consolidated subsidiaries, two operating in Japan including Argo Corporation and NE Yinrun Co., Ltd., which provide wholesale services, and one in China Rise MC (Beijing) Digital Information Technology Co., Ltd., which provides mobile contents distribution and character licensing services.

<Business Overview>

Creation Business

The creation business will be divided between contents services, business support services and other services, which include operations of the Shizen Energy Group solar power generating facilities and energy business (smart community business) of Yamaguchi Regenerative Energy Factory Co., Ltd. Within contents services, the booking of profits in traffic information, entertainment, life-style, and application advertisement are recorded. Within business support services, information license (“ATIS Traffic Information Service”), escrow service (fresh seafood electronic commerce “Inaseri” service), cloud service (educational cloud "e Manabi-", car location management cloud “iGPS on NET”, and tourism cloud “Yubi Sashi Navigation”), package service (internet provider telephone “A plosOne” service, business messaging "BizTalk" service, chat engine “Fivetalk”, and kitting tool “Certino”), audio service (internet voice and audio series “Primus”) are provided. Furthermore, IoT block chain validation service for developing new businesses and services are also provided.

Solutions Business

The solutions business is divided between system development and operation services, storefront affiliate advertising agency service, and overseas business services. Application development, website creation, server design and creation, debugging, operational supervision, customer support, consulting and other services are conducted within the system development and operation services.

1H FY5/18 Segment Sales and Operating Incomes

| Sales | Share | Operating Income | Share |

Creation Segment | 1,007 | 49.9% | 299 | 95.6% |

Solutions Segment | 1,013 | 50.1% | 15 | 4.9% |

Adjustments | - | - | -231 | - |

Consolidated Sales | 2,021 | 100.0% | 84 | 100.0% |

(Units: ¥mn)

2. First Half of Fiscal Year May 2018 Earning Results

(1) 2Q Consolidated Earnings

| FY5/17-1Q | 2Q | 3Q | 4Q | FY5/18-1Q | 2Q |

Sales | 1,245 | 1,249 | 1,168 | 1,174 | 974 | 1,046 |

Cost of Sales | 728 | 744 | 688 | 715 | 584 | 629 |

SG&A | 449 | 405 | 422 | 492 | 356 | 366 |

Advertising | 72 | 62 | 57 | 46 | 28 | 46 |

Operating Income | 67 | 99 | 58 | -33 | 33 | 50 |

Ordinary Income | 80 | 104 | 59 | -14 | 37 | 74 |

COS Margin | 58.5% | 59.6% | 58.9% | 60.9% | 60.0% | 60.1% |

SG&A Margin | 36.1% | 32.4% | 36.1% | 42.0% | 36.6% | 35.0% |

(Units: ¥mn)

Sustained Improvement in Ordinary Loss since Bottoming in 4Q of Fiscal Year May 2017

"Business support services" and "system development and operational services" helped to drive sales up by 7.4% quarter-on-quarter. With regards to profits, sales, general and administrative expenses to sales ratio improved by 1.6% points from the previous term on the back of increases in sales and restraint in overall costs, and despite of a 0.1% point quarter-on-quarter increase in cost of sales margin resulting from a rise in the sales composition of the solutions business. This allowed ordinary income to rise for the second consecutive quarter.

Creation Segment Earnings

| 17/5-1Q | 2Q | 3Q | 4Q | 18/5-1Q | 2Q |

Contents Service | 503 | 473 | 460 | 421 | 382 | 376 |

Business Support | 85 | 108 | 119 | 139 | 97 | 119 |

Others | 18 | 12 | 10 | 16 | 18 | 13 |

Total Sales | 606 | 595 | 589 | 577 | 498 | 509 |

(Units: ¥mn)

The pace of decline in sales of carrier platform services is slowing and fell by 1.5% quarter-on-quarter due in part to gradual decline in sales of "contents services". At the same time, kitting and chat applications development contributed to a 23.0% quarter-to-quarter rise in sales of "business support services".

Solutions Segment Earnings

| 17/5-1Q | 2Q | 3Q | 4Q | 18/5-1Q | 2Q |

System Development, Operating | 268 | 309 | 287 | 376 | 296 | 358 |

Advertisement Agency | 256 | 256 | 240 | 178 | 173 | 175 |

Others | 113 | 87 | 51 | 42 | 6 | 4 |

Total | 638 | 653 | 579 | 597 | 476 | 537 |

(Units: ¥mn)

Sales of "ad agency services" and "system development and operational system" rose by 0.9% and 20.7% quarter-on-quarter respectively.

(2) 1H FY5/18 Consolidated Earnings

| 1H FY5/17 | Share | 1H FY 5/18 | Share | YOY |

Sales | 2,494 | 100.0% | 2,021 | 100.0% | -19.0% |

CGS | 1,021 | 40.9% | 807 | 39.9% | -21.0% |

SG&A | 854 | 34.2% | 723 | 35.8% | -15.4% |

Ad Agency | 166 | 6.7% | 84 | 4.2% | -49.6% |

Operating Income | 185 | 7.4% | 111 | 5.5% | -39.8% |

Parent Net Income | 70 | 2.8% | 45 | 2.3% | -35.2% |

(Units: ¥mn)

※ Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

Sales, Ordinary Income Fall 19.0%, 39.8% Year-On-Year

Sales fell by 19.0% year-on-year to ¥2.021 billion. Sales of the creation business fell by 16.2% year-on-year on the back of difficult conditions of the "content services" arising from carrier platform service, and despite strength in the "business support services". Sales of the solution business fell by 21.6% year-on-year due to declines in advertising agency services resulting from a contraction in the market and restraint in the sale of cellular telephones.

With regard to profits, gross income fell by 21.0% year-on-year on the back of a 1.0% point decline in gross income margin resulting from server transition cost arising from implementation of cloud and a rise in software amortization expense. A 15.4% year-on-year reduction in sales, general and administrative expenses due to ongoing restraint in advertising investments for career platform services and reductions in expenses in creation business could not absorb the decline in gross income.

Creation Segment Sales and Income

| 1H FY5/17 | Share | 1H FY 5/18 | Share | YOY |

Contents | 977 | 81.3% | 758 | 75.3% | -22.3% |

Business Supports | 194 | 16.2% | 216 | 21.5% | +11.5% |

Others (Solar Power Generation) | 30 | 2.5% | 32 | 3.2% | +4.4% |

Segment Sales | 1,202 | 100.0% | 1,007 | 100.0% | -16.2% |

Income before Consolidation Adjustments | 418 | 34.8% | 299 | 29.7% | -28.4% |

(Units: ¥mn)

The corporate client business services, which includes traffic information licensing, kitting, institutional-use application development and solar power generation, grew. However, a contraction in the carrier platform market contributed a decline in individual services.

Solutions Business sales and income

| 1H FY5/17 | Share | 1H FY 5/18 | Share | YOY |

System Developing, Operating | 577 | 44.7% | 654 | 64.6% | +13.3% |

Advertising Agency | 513 | 39.7% | 348 | 34.4% | -32.1% |

Others (Overseas) | 201 | 15.6% | 10 | 1.0% | -94.9% |

Segment Sales | 1,292 | 100.0% | 1,013 | 100.0% | -21.6% |

Income before Consolidation Adjustments | 24 | 1.9% | 15 | 1.5% | -36.0% |

(Units: ¥mn)

While sales rose by 13.3% year-on-year on the back of strong operation and collaboration with technology subsidiaries, a decline in the number of stores arising from changes in contents sales policies at storefront and competition with mobile network operators caused sales of "Ad agency services" to fall by 32.1% year-over-year. Furthermore, sales of the others (overseas) segment fell by 94.9% year-on-year due to restraint in cellular telephone sales resulting from a shift to more concentrated focus upon profits.

(3) Financial Conditions and Cash Flaw

Balance Sheet Summary

| 5/17 | 11/17 |

| 5/17 | 11/17 |

Cash, Equivalents | 4,168 | 4,039 | Payables | 183 | 154 |

Current Assets | 4,927 | 4,813 | Unpaid Taxes | 140 | 73 |

Tangible Fixed Assets | 413 | 414 | Interest Bearing Liabilities | 308 | 297 |

Intangible Fixed Assets | 538 | 523 | Liabilities | 957 | 857 |

Investments, Others | 298 | 308 | Net Assets | 5,221 | 5,201 |

Noncurrent Assets | 1,250 | 1,246 | Total Liabilities, Net Assets | 6,178 | 6,059 |

(Units: ¥mn)

Cash Flow Summary

| 1H FY 5/17 | 1H FY5/18 | YY Change | |

Operating Cash Flow (A) | 152 | 79 | -72 | -47.5% |

Investing Cash Flow (B) | -685 | 196 | +881 | - |

Financing Cash Flow (C) | -144 | -105 | +39 | - |

Cash, Equivalents at Term End | 2,596 | 3,560 | +963 | +37.1% |

(Units: ¥mn)

3. Segment Overview

Creation Segment

Contents Services Segment

The main contents lineup includes " Women Rhythm Pocketbook" (health care service), "Flea-Ma.jp" (flea market service), "Booksmart" (comprehensive digital publications service), "ATIS Traffic Information Services" (traffic information service), and "Chokotto Game" (portal games). The main source of revenues is derived from subscription services (carrier monthly, fixed, paid applications, add-ons, and point system), advertising ("Women Rhythm Pocketbook"), and transaction fee ("Flea-Ma.jp").

During the first half of fiscal year May 2018, efficient operation continued to contribute to profits despite a contraction in the overall market for contents provided to carrier platforms on a monthly and fixed rate subscription basis. "Women Rhythm Pocketbook" is used primarily by “F1” category of demographic users (Female, aged between 20-34) who have a strong appetite for consumption and are sensitive to new market trends, and who have a growing interest in health management logging, which includes weight, menstrual cycles, and other health monitoring information. Nihon Enterprise facilitates the booking of advertising revenue through its free application. "Flea-Ma.jp", which provides a safe and secure environment for private markets, decreased fees at the time of sale from 10% to 8% for promotion of utilization (listing goods are free). The Company will offer an extended range of goods and implement other measures to improve its services. Furthermore, customizable contents for institutional use leverage the strong knowhow accumulated in individual use contents. The realm of "Booksmart" services is being expanded to B-B-C from the fiercely competitive B-C. Furthermore, "Booksmart all-you-can-read" service has begun being provided at hybrid cafe "Kaikatsu Club" (362 stores nationwide) from November 15, 2017.

Business Support Services Segment

Provide Applications on an OEM Basis

This service provides applications on an OEM basis. The provision of "BizTalk" (business messaging service) and "AplosOne" (IP telephone service) applications on an OEM basis is expanding as their additional functionality meets the needs of customers. At the same time, the number of inquiries is increasing from companies seeking to introduce mobile applications and outsourcing, and provision of application validation tools for OS updates for kitting tool "Certino" has begun. Traffic information services generate steady revenue stream on the back of licensing to CATV channels, bus companies, and others users. Furthermore, car location management cloud “iGPS on NET Premium", which is an extended version of "iGPS on NET", began being offered from October 25, 2017. Aside from these services, internet provider voice service “Primus”, educational cloud “e-MyNavi”, reverse auction "Profair", tourism promotion cloud “Yubi Sashi Navigation” service, and chat application "Fivetalk" are also provided.

One-Stop Solution of Electronic Commerce

An increasing number of inquiries is being seen for store based electronic commerce one-stop solutions which provides consulting and operating functions. Also, the outlook for the of fresh seafood electronic commerce platform "Isenari" has turned to be positive due to the newly determined opening date for the new Toyosu Fish Market of October 11, 2018.

Service Business Cycles

Consulting - application development - server design - store based CRM - user support - operations - consulting - application development

Fresh Seafood Electronic Commerce "Isenari"

Fresh seafood electronic commerce "Isenari" is best suited for purchasing small and medium lots of seafood to leverage quality as its advantage by providing direct access to the wholesale cooperative. Currently, it is constrained by the move from Tsukiji, but the opening of new Toyosu market is set to take place on October 11, 2018. Moving to Toyosu allows speedy order processing at the dedicated product processing area dedicated to "Isenari" with support of the Metroporitan Central Wholesale Market Cooperative Association (Product processing area is a dedicated area that has combined features of goods processing by orders for ship to restaurants and with transport functionality).

This service was launched on December 2016 but limited to deliveries to parts of the Kanto (Greater Tokyo) region (Within the 23 wards of central Tokyo, Tama area and Utsunomiya City) due to delays in the move of the market from Tsukiji to Toyosu. However, the area of delivery has been expanded to Tokyo and seven prefectures in February 2017, then to all of Honshu and Shikoku (excluding some isolated islands) in September 2017. Furthermore, a collaborative business arrangement was formed with the alcoholic beverage trading firm “Kawachiya”, which has channels within restaurants, in June 2017 to accelerate cultivation of restaurant users. Moreover, efforts are being made to strengthen of collaboration with the Metroporitan Central Wholesale Market Cooperative Association to expand the number of products and the distribution network.

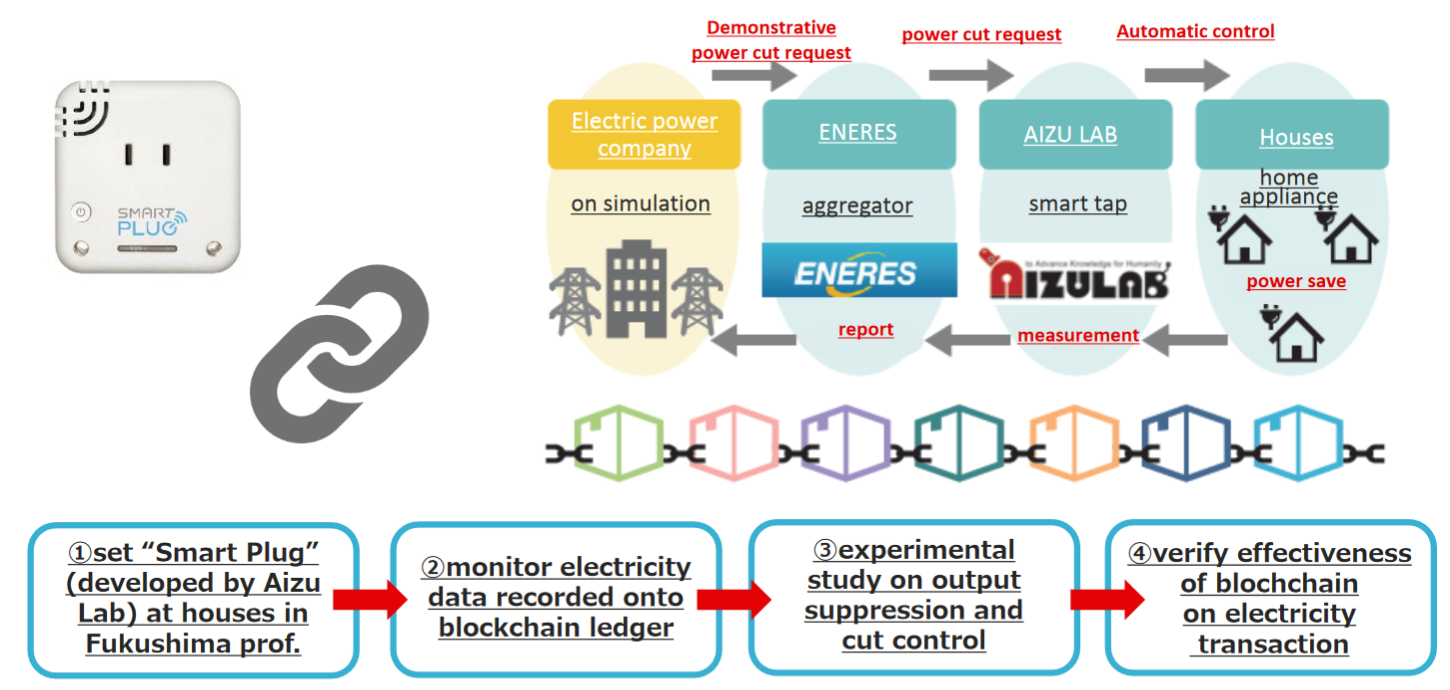

Demonstration Experiments

Nihon Enterprise is conducting "electric power transaction using blockchain and multifunction ‘Smart Plug’" and "facility inspection using wired drones" as demonstration experiments of HEMS, blockchain, drones, and other services.

"Electric Power Transactions using Blockchain and Multi-Function ‘Smart Plug’"

Aizu Laboratory, Inc. (Aizu Wakamatsu city, Fukushima), which develops energy management systems (HEMS) for home-use, and Eneres Co., Ltd. (Chiyoda, Tokyo), which conducts energy related business, have started to conduct demonstration experiments for "electric power transactions using blockchain and multi-functional "Smart Plug". This demonstration experiment was adopted for the "Renewable Energy Related Technologies Demonstration Research Project" sponsored by Fukushima Prefecture, and as part of these efforts demonstration experiments of “watch over elderly service” using electric power data has been scheduled to start from February 2018 in Namie, Fukushima.

(Source: Nihon Enterprise)

“Facility Inspection Using Wired Drones”

Business-academia collaboration with the University of Aizu allowed drone technology development that enables prolonged flight of cable-connected drones with feeding facility. Jointly conducted validation work with Suzuyo Matai Co., Ltd. January 2017 with a goal of achieving commercialization from fiscal year 2018 has been started for "facility inspection using wired drones" with commercialization of wind power generation facility inspection in mind.

Others (Solar Electric Power Generation)

The solar electric power generating equipment were installed on gymnasium rooftops of two of elementary and junior high schools in Ube City, Yamaguchi Prefecture. They started electric power sales from December 2017, in addition to the start of operations by “Higashi Kiwason Solar Power Generation Facility” since May 2016. These moves are intended to provide opportunities for children and students to learn about the environment and renewable energy, and to contribute to the rejuvenation of the regional economy within Yamaguchi City through renewable energy.

Solutions Business

System Development and Operation Services

Acquisition of projects and proposals has progressed because of the wealth of knowhow and track record in smartphone applications and server creation. Nihon Enterprise’s track record includes application development, electronic commerce, point management, chat support, client analysis, carrier payment, quality assurance, debugging and MSP (operational supervision) provided to clients in the distribution, retail, services, and information technology industries, and to regional governments. Furthermore, creation of CRM (Customer relation management) systems for recycled product shop facility operators is one of focus points.

Development Cases

Touch-screen POS cash register integrated systems, retouching software, air freight operational control systems, medical checkup systems, used car management systems, pharmaceutical operation support systems, operation support systems, assessment systems, smartphone payment systems, quality control report systems, line quality management and product management systems, CRM for sales distributors, incident management systems for shipping companies, smartphone POP systems, day-care center reservation systems, and logistics attendance management systems.

| Left Image Partner Agent Inc. Marriage Party Activity Service “OTOCON” Application Development

Right Image Furansudo No Taka Haikukai, Haiku Application Development |

(Source: Nihon Enterprise)

Ad agency Services

"Storefront affiliate service" (contract between Nihon Enterprise and contents providers in the “storefront affiliate services”) was sold to Telestation Co. Ltd. (Chuo Ward, Tokyo). “Storefront affiliate service” encountered difficult operating conditions due to administrative guidance motivated policy change regarding cellular telephone retail shop operation companies and to competition with mobile network operators. Sale of the “storefront affiliated services” at a price of ¥143 million allowed for accelerated deployment of “Advertising ASP”. “Storefront affiliate services” recorded ¥945 million in sales and ¥157 million in net income in fiscal year May 2017.

4. Fiscal Year May 2018 Earnings Estimates

Consolidated Earnings

| FY5/17 | Share | FY5/18 Est. | Share | YY Change | Initial Est. | Initial Est. Change |

Sales | 4,838 | 100.0% | 4,040 | 100.0% | -16.5% | 4,770 | -15.3% |

Operating Income | 192 | 4.0% | 145 | 3.6% | -24.5% | 250 | -42.0% |

Ordinary Income | 229 | 4.7% | 230 | 5.7% | +0.0% | 255 | -9.8% |

Net Income | 99 | 2.0% | 110 | 2.7% | +10.5% | 105 | +4.8% |

(units: ¥mn)

Full Year Estimates Revised on January 31, Sales Expected to Fall by 16.5%, Net Profits to Rise by 10.5%

Sales are expected to fall by 16.5% year-on-year to ¥4.040 billion. Despite favorable trends in consigned development on the back of active IT investments, a contraction in the contents market for carrier platforms, the influence of delays in the move to the new market location in Toyosu upon fresh seafood electric commerce "Isenari", restraint in unprofitable cellular telephone sales in China, and other factors are expected to cause sales to fall by ¥630 million. At the same time, ¥100 million of loss in sales from the sale of the "storefront affiliate service" have been factored into estimates.

With regards to profits, while sales are expected to fall, operating income is also expected to fall by 24.5% year-on-year to ¥145 million, which is ¥105 million lower than initial estimates, due to research and development costs arising from IoT, blockchain, wired drones, and other new business realms. However, ordinary income is expected to increase from the previous term to ¥230 million due to the booking of subsidy income arising from demonstration experiments. Net income attributable to the parent company is expected to grow by 10.5% year-on-year to ¥105 million, 4.8% higher than initial estimates, on the back of gain from the sale of the “storefront affiliate service” booked as extraordinary profit.

Nihon Enterprise is expected to pay a yearend dividend of ¥2 per share.

5. Conclusions

Nihon Enterprise contributed to the expansion of mobile market as contents providers by distributing mobile contents from the early days of the mobile internet. During the smartphone rapid expansion period, the Company completed its facilitation of the smartphone application lineup including healthcare, digital publications and traffic information, and entered the mobile commerce business through the launch of its fresh seafood e-commerce "Isenari" and flea market application “Flea Ma-jp”. Currently, Nihon Enterprise is making a strong effort in various enterprise solutions including educational cloud, IP phone applications, application and server creation, kitting, electric commerce, AI chatbot, and other applications for key smartphone devices that meet demands of the new IoT era. At the same time, validation services in HEMS, blockchain, AI, drones, IoT, and other new realms are actively being pursued to help sustain growth. Efforts to make “effective use of operating resources” and “maximize group synergies” between the 10 consolidated subsidiaries and 3 non-consolidated subsidiaries will allow the Company to return to a growth path.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on Aug. 25, 2017

Basic Policy

The corporate group believes that, with respect to decision-making by the board of directors to attain its management goals, corporate governance means maximization of shareholder interests by monitoring legality by the audit and supervisory board, deterring unlawful business execution of the directors, and establishing an organizational system that realizes more expeditious company decision-making and clarifies management responsibility, while seeking to avoid or mitigate business risks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has conducted all the principles based on the corporate governance.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 3-1】Information Disclosure

(1) Corporate philosophy, strategy and plan

The company publishes its corporate philosophy (“Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.”) on its website. The company makes the medium-term (three fiscal years) business plan based on a fiscal year business plan. However, the mobile contents market which the company is in, is very unpredictable and changeable. The company does not disclose medium-term business plan because it would change frequently and lead confusion, but publishes earnings summaries including business development on its web site.

【Principle 5-1】Policy on constructive dialogue with shareholders

The company has established the IR basic policy which is composed of “Basic attitude to IR activities and disclosure criteria,” “Methods for disclosing information and information fairness,” “Future outlook,” and “IR quiet period” and publishes the policy through its website.

● IR Basic Policy URL: https://www.nihon-e.co.jp/ir/management/line.html

Currently, the company proactively takes the following action based on the above-mentioned IR basic policy from the perspective of constructive dialogue with its shareholders:

(1) The company encourages day-to-day cooperation among departments by designating the Executive Managing Director and general manager of the Administration Department as a person in charge of internal information management and having him govern departments involved in IR activities, including the Accounting Department, the General Affairs Department, the Human Resources and Public Relations Department.

(2) In the company, the person in charge of internal information management responsibly grasps and manages information on each department of the company and, based on accurate management decision, efforts are exerted to make organic cooperation and information are frequently shared with other departments related to IR activities, so that cooperation among departments can be enhanced.

(3) The division engaged in public relations and IR activities not only proactively responds to inquiries made from its shareholders and investors on the phone and through IR events such as small meetings, but also hosts financial results briefings for analysts where explanations are given by the president or the executive managing directors.

(4) The company reports to the board of directors on IR activities and feedback on such activities as well as situations of shareholder transfer at all times in order to share information with the directors and the auditors.

(5) The company pays attention to management of insider information, and therefore, in communicating with investors, it brings up topics concerning improvement of corporate value as the subject of discussion, using previously published information of the company.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2017, All Rights Reserved by Investment Bridge Co., Ltd.

For further information regarding Bridge Reports on Nihon Enterprise (4829) and related information, please refer to the website at the URL listed below.

www.bridge-salon.jp/