Bridge Report: (4829) Nihon Enterprise

Katsunori Ueda, President | Nihon Enterprise Co., Ltd. (4829) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Information and communications |

President | Katsunori Ueda |

HQ Address | Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

Year-end | May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥230 | 40,132,400 shares | ¥9,230 million | 3.4% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥2.00 | 0.9% | ¥4.36 | 52.8x | ¥122.89 | 1.9x |

*The stock price is the closing price on July 27. The Shares Outstanding is calculated by deducting the number of treasury stock from the number of outstanding shares at the end of the latest quarter. ROE and BPS are results at the end of the previous fiscal year.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

May 2015 | 5,116 | 189 | 204 | 177 | 4.57 | 3.00 |

May 2016 | 5,530 | 219 | 252 | 327 | 8.07 | 3.00 |

May 2017 | 4,838 | 192 | 229 | 99 | 2.45 | 2.00 |

May 2018 | 3,892 | 174 | 257 | 166 | 4.11 | 2.00 |

May 2019 Est. | 3,895 | 285 | 345 | 175 | 4.36 | 2.00 |

* Estimates are those of the Company. Effective from fiscal year May 2016, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the fiscal year May 2018 and the fiscal year May 2019 earnings estimates.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year May 2018 Earnings Results

3. Segment Overview

4. Fiscal Year May 2019 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year May 2018, sales declined 19.5% year on year, and ordinary income increased 11.9% year on year. The decline is partially due to struggling of the Contents Service associated with shrinking of the career platform service market, but the main reasons are the struggle of the In-Store affiliate business and the control of smartphone sales in China. For the In-Store affiliate business, the Company transferred the business in February 2018, and for the smartphone sales in China, the Company transferred the equity interest of the Chinese subsidiary in March 2018. Both are positive actions for contributing to profit improvement in the fiscal year May 2019. Operating income of the 4th quarter was a surplus of 101 million yen, greatly improved from the loss of 10 million yen in the 3rd quarter.

- Sales and ordinary income for the fiscal year May 2019 are expected to increase 0.1% and 34.0% year on year, respectively. Loss of sales due to transfer of the In-Store affiliate business with high sales cost ratio is a factor for declined sales and increased profit (improvement in profitability). Withdrawal of sales of smartphones in China will also positively affect profits. On the sales side, the Company plans to perform well in the Business Support Service and System Development and Operation Service. On the profit side, the break-even point will drop, and operating income will increase 62.9% year on year. Despite a decline in subsidy income, ordinary income is expected to grow at a high rate. The Company plans to pay a year-end dividend of 2 yen per share (expected dividend payout ratio of 45.9%).

- The Company will work on rebuilding the business portfolio to realize the growth strategy. The System Development and Operation Service and Business Support Service will be the pillars of the strategy. The point of the fiscal year May 2019 is how much the Company can cover the factors of decreased sales in both services. If sales can be secured as expected, there is little anxiety about profits. In the medium term, promotion of businesses through “effective utilization of management resources” and “maximization of group synergies” is the key point

1. Company Overview

Nihon Enterprise is a “mobile solutions company” providing services that includes development of smartphone applications for consumers, enterprise system development, mobile kitting, e-commerce, AI chatbot, and other services. Its two main business segments include the "creation segment," where applications and systems using in-house IP (Intellectual Property) are provided, and the "solutions segment," where institutional software and system development are conducted. Furthermore, Nihon Enterprise works actively on validation businesses including IoT, blockchain, and wired drones.

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014.

<Corporate Philosophy>

Nihon Enterprise’s employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its “Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.” President Katsunori Ueda believes that it is Nihon Enterprise`s obligation to maximize “shareholder” in the long run, thus “enables to make effective use of capital and maximize it by not wasting a single yen” below its appropriate belief and action. In the first place, president Katsunori Ueda founded Nihon Enterprise with the strong motivation of “contributing to society through its businesses” and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services.

Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children’s institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan.

Mission Statement

Nihon Enterprise’s main mission is to contribute to society through its activities as a merchant, and to contribute to development of culture.

Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

The Commitments of Nihon Enterprise

- Commitment to Business

- Commitment to Altruism

- Commitment to Grow Earnings

- Commitment to Take on New Challenges

- Commitment to Always Being Appreciative

The Management Principles of Nihon Enterprise

1. Raise the Spirit of Our Management

2. Leverage the Collective Knowledge in Management of Our Company

3. Pursue Profits Fairly

4. Comply with Principles

5. Always Place Customers Interests Firs

6.Maintain a Family Management Style

7.Strict Adherence to Meritocratic Performance

8.Promote Work Based on “Cooperate and Trust Fellow Workers”

<Corporate Group: 8 Consolidated Subsidiaries, 2 Non-Consolidated Subsidiaries (As of May 31, 2018) >

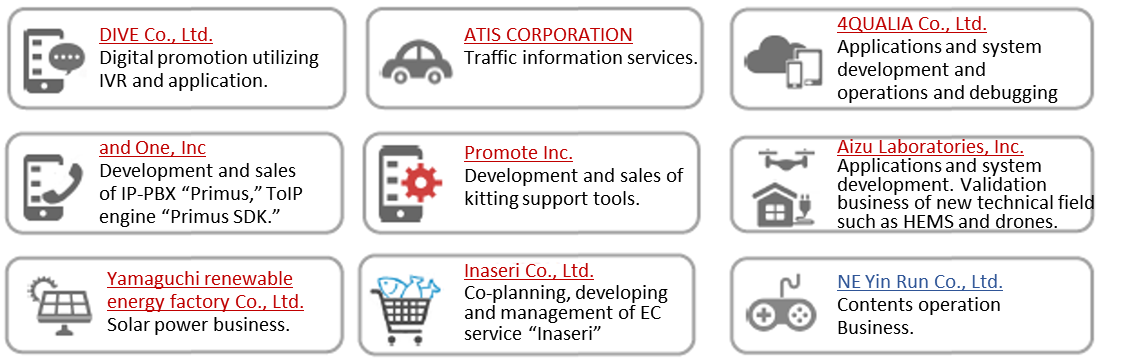

The Company has 8 domestic subsidiaries including Dive Co., Ltd., which provides digital promotion using IVR and applications, ATIS CORPORATION, which provides traffic information, etc., 4QUALIA Co., Ltd., which provides applications and system development and operations and debugging, etc., and One, Inc., which provides voice communication related solutions, Promote Inc., which provides kitting support tools, etc., Aizu Laboratories, Inc., which provides services related to application and system development, HEMS, and drones, Yamaguchi renewable energy factory Co., Ltd., which carries out the Smart Communications Business, and Inaseri Co., Ltd, which handles planning, development and management of electric business transaction service, “Inaseri.” The domestic non-consolidated subsidiary is NE Yin Run Co., Ltd., which carries out the Contents Operation Business. The non-consolidated subsidiary, ARGO Corporation, was absorbed by Dive Co., Ltd. in June 2018.

(Source: Nihon Enterprise)

<Business Overview>

The businesses are divided into the Creation Segment and the Solutions Segment, and the sales composition ratio in the fiscal year ended May 2018 was 51.6% and 48.4%, respectively.

Creation Segment Providing application systems using its own Intellectual Property (IP)

The creation segment will be divided between contents services, business support services and other services, which include operations of the Shizen Energy Group solar power generating facilities and energy business (smart community business) of Yamaguchi Regenerative Energy Factory Co., Ltd. Within contents services, the booking of profits in traffic information, entertainment, life-style, and application advertisement are recorded. Within business support services, information license (“ATIS Traffic Information Service”), escrow service (fresh seafood electronic commerce “Inaseri” service), cloud service (educational cloud "e Manabi", car location management cloud “iGPS on NET”, and tourism cloud “Yubi Sashi Navigation”), package service (internet provider telephone “AplosOne” service, business messaging "BizTalk" service, chat engine “Fivetalk”, and kitting tool “Certino”), audio service (internet voice and audio series “Primus”) are provided. Furthermore, IoT block chain validation service for developing new businesses and services are also provided.

Solution Segment Consigned development of business software and systems for corporations

The solutions segment is divided between system development and operation services, In-Store (affiliate advertising) agency service, and overseas business services. Application development, website creation, server design and creation, debugging, operational supervision, customer support, consulting and other services are conducted within the system development and operation services.

2. Fiscal Year May 2018 Earning Results

(1) Consolidated Earnings

| FY5/17 | Share | FY5/18 | Share | YY | Initial Est. | Divergence |

Sales | 4,838 | 100.0% | 3,892 | 100.0% | -19.5% | 4,040 | -3.6% |

Gross Income | 1,961 | 40.5% | 1,634 | 42.0% | -16.7% | - | - |

SG&A | 1,769 | 36.6% | 1,459 | 37.5% | -17.5% | - | - |

Operating Income | 192 | 4.0% | 174 | 4.5% | -8.9% | 145 | +20.7% |

Ordinary Income | 229 | 4.8% | 257 | 6.6% | +11.9% | 230 | +11.9% |

Parent Net Income | 99 | 2.1% | 166 | 4.3% | +66.9% | 110 | +51.0% |

*Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report). Units: ¥mn

Sales decreased 19.5% year on year and ordinary income grew 11.9% year on year.

Sales decreased 19.5% year on year to 3,892 million yen. The Company’s Contents Service Segment struggled due to the shrinking of the career platform services market. The larger negative impact on the decline of sales came from the transfer of the In-Store affiliate (advertisement agency service) business (February 28, 2018) and transfer of the equity interest of the Chinese subsidiary that was handling smartphone sales (March 30, 2018). Both are positive actions that contribute to profit improvement in the fiscal year May 2019.

As for profit, while gross income decreased 16.7% year on year due to a decline in sales, SG&A expenses also decreased 17.5% year on year due to a fall in provision for allowance for doubtful receivables (108 million yen) as well as reduction in personnel expenses (-113 million yen) and advertising expenses (-66 million yen). As a result, operating income decreased only 8.9% year on year, and an increase in subsidy income (24 million yen 82 million yen) was absorbed, leading to an increase of ordinary income by 11.9% year on year to 257 million yen. The profit of 143 million yen generated from transfer of the In-Store affiliate business was recorded as extraordinary income, and the net income increased 66.9% year on year to 166 million yen.

Although operating income decreased, operating margin improved. This is because gross income margin improved 1.5 points to 42.0% due to declining advertising agency service and smartphone sales with high sales cost ratio as well as cost reduction in the System Development and Operation Services.

Creation Segment Sales and Income

| FY5/17 | Share | FY5/18 | Share | YOY |

Contents | 1,853 | 78.4% | 1,486 | 74.1% | -19.8% |

Business Supports | 452 | 19.2% | 461 | 23.0% | +1.9% |

Others (Solar Power Generation) | 57 | 2.4% | 59 | 2.9% | +3.4% |

Segment Sales | 2,363 | 100.0% | 2,007 | 100.0% | -15.1% |

Income before Consolidation Adjustments | 748 | 31.7% | 513 | 25.6% | -31.5% |

*Units: ¥mn

Although sales of the Business Support Service, which remained steady through consigned development using its own services, and others (Solar power generation) increased, the Company failed to cover the decline of the Contents Service Segment which was affected by the shrinking carrier platform market.

Solutions Segment sales and income

| FY5/17 | Share | FY5/18 | Share | YOY |

System Developing, Operating | 1,247 | 50.4% | 1,369 | 72.6% | +9.8% |

Advertising Agency | 932 | 37.7% | 502 | 26.6% | -46.1% |

Others (Overseas) | 295 | 11.9% | 13 | 0.7% | -95.3% |

Segment Sales | 2,475 | 100.0% | 1,885 | 100.0% | -23.8% |

Income before Consolidation Adjustments | -55 | - | 155 | 8.2% | - |

(Units: ¥mn)

Although sales of the System Development and Operation Services that took advantage of companies’ vigorous IT investment demand increased 9.8% year on year, they could not cover the reduction in the number of handling stores affected by the changes in contents sales policies at stores, sales reduction of advertising agency service (In-Store affiliate business) due to competition with mobile network operators, and other declines due to control of unprofitable sales of smartphones in China. The Company transferred the In-Store affiliate business on February 28, 2018, and it also withdrew from the smartphone sales business in China after transferring the equity interest of the Chinese subsidiary on March 30, 2018.

(2) Quarterly Earnings Trend

| 17/5-1Q | 2Q | 3Q | 4Q | 18/5-1Q | 2Q | 3Q | 4Q |

Sales | 1,245 | 1,249 | 1,168 | 1,174 | 974 | 1,046 | 968 | 902 |

CGS | 728 | 744 | 688 | 715 | 584 | 629 | 567 | 476 |

SG&A | 449 | 405 | 422 | 492 | 356 | 366 | 411 | 324 |

Advertising | 72 | 62 | 57 | 46 | 28 | 46 | 54 | 41 |

Operating Income | 67 | 99 | 58 | -33 | 33 | 50 | -10 | 101 |

Ordinary income | 80 | 104 | 59 | -14 | 37 | 74 | 30 | 115 |

COS Margin | 58.5% | 59.6% | 58.9% | 60.9% | 60.0% | 60.1% | 58.6% | 52.8% |

SG&A Margin | 36.1% | 32.4% | 36.1% | 42.0% | 36.6% | 35.0% | 42.5% | 36.0% |

(Units: ¥mn)

Despite a decline in sales from the previous quarter, the Business Support Segment and corporate services for the System Development and Operation Segment increased.

Although sales of the Creation Segment increased 2.7% from the previous quarter as the struggle of the Contents Service was absorbed by the Business Support Service, sales of the Solutions Segment, in which In-Store affiliate business (advertising agency service) was transferred, decreased 16.6% from the previous quarter. However, in the Solutions Segment, sales of the System Development and Operation that the Company is focusing on increased 21.2% from the previous quarter due to strengthening sales and group collaboration.

On the profit side, while the sales cost ratio improved by 5.8 points from the previous quarter due to transfer of the In-Store affiliate business with high sales cost ratio, operating loss of 10 million yen in the previous quarter turned to operating profit of 101 million yen due to reduction of R&D expenses (-51 million yen) through promotion of demonstration project and reduction of personnel expenses and advertising expenses.

Creation Segment Sales and Income

| 17/5-1Q | 2Q | 3Q | 4Q | 18/5-1Q | 2Q | 3Q | 4Q |

Contents | 503 | 473 | 460 | 415 | 382 | 376 | 376 | 351 |

Business Supports | 85 | 108 | 119 | 139 | 97 | 119 | 107 | 137 |

Others | 18 | 12 | 10 | 16 | 18 | 13 | 9 | 17 |

Segment Sales | 606 | 595 | 589 | 571 | 498 | 509 | 493 | 506 |

(Units: ¥mn)

Despite sales of contents services decreased 6.6% from the previous quarter due to the shrinking of career platform market, those of business supports increased 27.8% due to consigned development using chat applications and EC services.

Solutions Segment sales and income

| 17/5-1Q | 2Q | 3Q | 4Q | 18/5-1Q | 2Q | 3Q | 4Q |

System Developing, Operating | 268 | 309 | 287 | 382 | 296 | 358 | 323 | 391 |

Advertising Agency | 256 | 256 | 240 | 178 | 173 | 175 | 151 | 2 |

Others | 113 | 87 | 51 | 42 | 6 | 4 | 1 | 2 |

Segment Sales | 638 | 653 | 579 | 603 | 476 | 537 | 475 | 396 |

Sales of the Advertising Agency Services declined sharply from the previous quarter due to transfer of the In-Store affiliate business, but sales of the System Development and Operation Services grew 21.2% from the previous quarter as a result of strengthening sales and group collaboration.

(3) Financial Conditions and Cash Flaw

Balance Sheet Summary

| 5/17 | 5/18 |

| 5/17 | 5/18 |

Cash, Equivalents | 4,168 | 4,205 | Current Liabilities | 603 | 436 |

Current Assets | 4,927 | 4,849 | Noncurrent Liabilities | 353 | 353 |

Noncurrent Assets | 1,250 | 1,154 | Net Assets | 5,221 | 5,213 |

Total assets | 6,178 | 6,004 | Total Liabilities | 308 | 306 |

(Units: ¥mn)

Free CF was 940 million yen (264 million yen in the previous term) by securing operating CF of 457 million yen (429 million yen in the previous term) and receiving a refund of fixed-term deposits. Cash and deposits accounted for 70% of total assets, and equity ratio was 82.1% (80.2% at of the end of the previous fiscal year).

3. Business Strategies by Segment

【Creation Segment Provision of services using own IP.】

Content Service Segment

Regarding the Content Service Segment that focuses on smartphone applications, further reductions in the service market for carrier platforms are inevitable. Therefore, the Company will build a profitable structure that does not depend on carrier platforms while securing profits through efficient operation. For this reason, it will work on developing and providing new contents by establishing alliances with other companies, as well as developing new platforms including existing applications.

Efforts by Application

For “Woman’s DIARY” (Healthcare application) which is popular among the “F1” category (female, 20 to 34 years old) where women have high consumer confidence and are highly sensitive to new trends, the Company will enhance the content power by evolving “Women’s DIARY” to a service that supports women’s “beauty” and “health” while seeking tie-up advertising and will increase the number of users. For the Traffic Information Service “ATIS,” the Company will enhance the functions of the application. For “Flea-Ma.jp” (flea market service) that provides a safe and secure personal trading environment, it will continue to expand services, such as expanding the product lineup, and create new business models through collaboration with partner companies. For “BOOKSMART” (Comprehensive E-book application), it will enhance the product lineup based on user needs and lead to sales expansion.

Business Support Service

In the fiscal year May 2019, the Company plans to launch a new traffic information service, “ATIS on Cloud,” targeting new corporate customers (the service is already contributing as stock type business by providing licenses to CATV and bus companies, etc.). Contribution from the services using own products is also expected through consignment development of e-commerce related applications as well as applications that utilize chat functions. In addition, the Company will work on developing and strengthening kitting services through the kitting support tool “Certino.” The on-line seafood sales service “Inaseri” for wholesalers belonging to the Metropolitan Central Wholesale Market Cooperative Association will also become full scale. In addition, it will continue to work on demonstration projects related to AI/IoT and automatic driving.

Developing and strengthening kitting services through the kitting support tool “Certino”

Kitting means to set and customize terminals of computers and smartphones and their peripherals used by employees in a corporation in the optimum state for each environment. In the company group, consolidated subsidiary Promote, Inc. provides the kitting support tool “Certino,” and will offer licensing of “Certino” and BPO services of the kitting business. “Certino” has the following features: (1) it is possible to simultaneously operate multiple setting devices (20 units on one computer), (2) it is compatible with Windows, iOS and Android, and (3) individual setting for each device is easy.

Full scale implementation of the on-line seafood sales service “Inaseri” for wholesalers belonging to the Metropolitan Central Wholesale Market Cooperative Association

Due to postponement of relocation of the Tsukiji market to Toyosu, the “Inaseri” service started only in a part of the Kanto area (Tokyo 23 wards and Tama area) in December 2016. However, in September 2017, it was expanded to the main island of Japan and Shikoku (except for some isolated islands). In addition, in order to accelerate expansion of eating and drinking establishments, in June 2017, the Company also made a business tie-up with “Kawachiya” which is specialized in handling alcoholic beverages for commercial use and has a sales channel to eating and drinking establishments, but the work at the Tsukiji market was limited due to lack of freight handling space, and burdens from rent and personnel expenses were heavy. However, with the opening of the Toyosu market on October 11, 2018, the business is expected to come into full swing. It seems that the Company is also planning a new service development.

Demonstration Projects

One of the Company’s subsidiaries, Aizu Laboratory, Inc. is implementing demonstration experiments on ‘Smart Plug” targeting the EU market in collaboration with a German company and practical application of automatic driving.

SMART PLUG targeting the EU market

The Company applied for the public offering of the “Overseas Collaborative Renewable Energy Related Research and Development Support Project for FY 2018” sponsored by Fukushima Prefecture, and its “Development of SMART PLUG Prototypes for the EU Market” was accepted (subsidized project). The Company is planning to develop prototypes by improving “SMART PLUG” that is already developed for Japan to be used in the EU countries and carry out on-site demonstration tests in cooperation with a local German company.

Since the standard of the AC plug is common (excluding the UK) in the EU countries, if practical use of “SMART PLUG” is realized, it is possible to sell it in the EU countries without being restricted by the standards.

Automatic driving

Demonstration experiment (2nd phase) of the “Construction of Information Infrastructure Related to Automatic Driving and Practical Use of Town Cruising Vehicles” which was adopted by the “Area Rehabilitation Practical Development Promotion Project” implemented by Fukushima Prefecture is ongoing. Using a 3-dimensional map around Namie-machi station acquired in the first phase, the Company verifies level 3 (automatic driving in a state where the driver can intervene) on a public road in collaboration with Fukushima TOYOPET.

【Solutions Segment Suggesting new value to its clients’ business through development of IT solutions】

Favorable business environment will continue due to companies’ active IT investments, work style reforms, and 2020 Olympics. Particularly, demand for AI, IoT, and security-related systems are strong. Taking advantage of knowhow gained through creation segment, the company plans to focus on providing total solutions services which is centered on consigned development (scratch development).

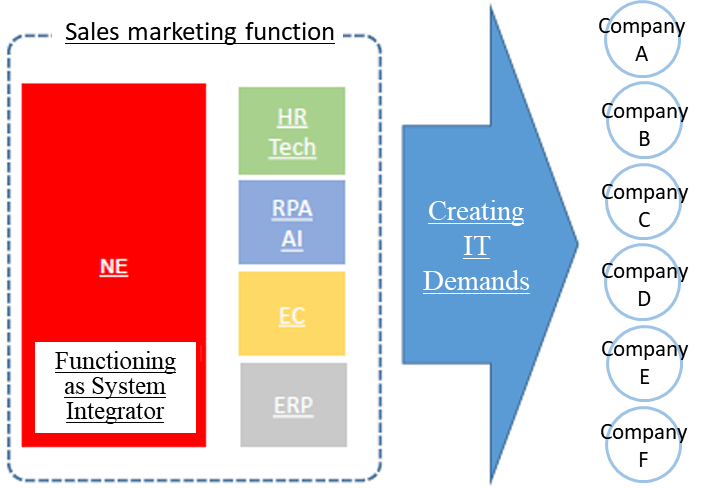

The company will work on creating IT demands and cultivating peripheral device business as new business, with reconstruction of business portfolio in mind. It will create demands by package development in cooperation with others and sales marketing (it will promote creating IT demands). For peripheral device business, it will use management resources of advertisement agency services.

(Source: Nihon Enterprise)

4. Fiscal Year May 2019 Earnings Estimates

Consolidated Earnings

| FY5/18 | Share | FY5/19 Est. | Share | YY Change |

Sales | 3,892 | 100.0% | 3,895 | 100.0% | +0.1% |

Operating Income | 174 | 4.5% | 285 | 7.3% | +62.9% |

Ordinary Income | 257 | 6.6% | 345 | 8.9% | +34.0% |

Parent Net Income | 166 | 4.3% | 175 | 4.5% | +5.3% |

(units: ¥mn)

The Company anticipates an increase of sales by 0.1% year on year and an increase of ordinary income by 34.0% year on year.

The impact of transfer of the In-Store affiliate business will be absorbed by the Business Support Services (Creation Segment) and the System Development and Operation Services (Solutions Segment), and sales are expected to increase 0.1% to 3,895 million yen. On the profit side, operating income is expected to grow 62.9% to 285 million yen due to the transfer of the In-Store affiliate business and improvement of profitability by transfer of the equity interest of the Chinese subsidiary. Despite a decline in subsidy income, ordinary income is expected to increase 34.0% year on year to 345 million yen.

5. Conclusion

The Company will work on rebuilding the business portfolio to realize the growth strategy. The point of the fiscal year May 2019 is how much the Company can cover the impact of business transfer of the Advertising Agency Service by expansion of the Business Support Service and System Development and Operation Service. If the company can secure sales as expected, there is little concern over profits. In addition, as a result of the relocation of Toyosu in October, it is expected that sales of “Inaseri” will increase and profitability will improve. Kitting services including BPO works are also receiving inquiries from the carriers. In the medium term, promotion of businesses by “effective utilization of management resources” and “maximization of group synergies” is the key point.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

Updated on Aug. 25, 2017

Basic Policy

The corporate group believes that, with respect to decision-making by the board of directors to attain its management goals, corporate governance means maximization of shareholder interests by monitoring legality by the audit and supervisory board, deterring unlawful business execution of the directors, and establishing an organizational system that realizes more expeditious company decision-making and clarifies management responsibility, while seeking to avoid or mitigate business risks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has conducted all the principles based on the corporate governance.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 3-1】 Information Disclosure

Corporate philosophy, strategy and plan

The company publishes its corporate philosophy (“Mission Statement, Doctrine, and Five Commitments” and “Nihon Enterprise Management Principles.”) on its website. The company makes the medium-term (three fiscal years) business plan based on a fiscal year business plan. However, the mobile contents market which the company is in, is very unpredictable and changeable. The company does not disclose medium-term business plan because it would change frequently and lead confusion, but publishes earnings summaries including business development on its web site.

【Principle 5-1】 Policy on constructive dialogue with shareholders

The company has established the IR basic policy which is composed of “Basic attitude to IR activities and disclosure criteria,” “Methods for disclosing information and information fairness,” “Future outlook,” and “IR quiet period” and publishes the policy through its website.

● IR Basic Policy

URL: |

Currently, the company proactively takes the following action based on the above-mentioned IR basic policy from the perspective of constructive dialogue with its shareholders:

(1) The company encourages day-to-day cooperation among departments by designating the Executive Managing Director and general manager of the Administration Department as a person in charge of internal information management and having him govern departments involved in IR activities, including the Accounting Department, the General Affairs Department, the Human Resources and Public Relations Department.

(2) In the company, the person in charge of internal information management responsibly grasps and manages information on each department of the company and, based on accurate management decision, efforts are exerted to make organic cooperation and information are frequently shared with other departments related to IR activities, so that cooperation among departments can be enhanced.

(3) The division engaged in public relations and IR activities not only proactively responds to inquiries made from its shareholders and investors on the phone and through IR events such as small meetings, but also hosts financial results briefings for analysts where explanations are given by the president or the executive managing directors.

(4) The company reports to the board of directors on IR activities and feedback on such activities as well as situations of shareholder transfer at all times in order to share information with the directors and the auditors.

(5) The company pays attention to management of insider information, and therefore, in communicating with investors, it brings up topics concerning improvement of corporate value as the subject of discussion, using previously published information of the company.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved.