Bridge Report:(4829)Nihon Enterprise the first half of Fiscal Year May 2019

Katsunori Ueda, President | Nihon Enterprise Co., Ltd. (4829) |

|

Company Information

Market | TSE 1st Section |

Industry | Information, Communications |

President | Katsunori Ueda |

HQ Address | Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

Year-end | May |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

183yen | 40,133,000 shares | 7,344 million | 3.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

2.00yen | 1.1% | 4.36yen | 42.0 x | 121.40yen | 1.5 x |

*The share price is the closing price on November 16.。The Shares Outstanding is calculated by deducting the number of treasury stock from the number of outstanding shares at the end of the latest quarter.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May. 2015 Act. | 5,116 | 189 | 204 | 177 | 4.57 | 3.00 |

May. 2016 Act. | 5,530 | 219 | 252 | 327 | 8.07 | 3.00 |

May. 2017 Act. | 4,838 | 192 | 229 | 99 | 2.45 | 2.00 |

May. 2018 Act. | 3,892 | 174 | 257 | 166 | 4.11 | 2.00 |

May. 2019 Est. | 3,895 | 285 | 345 | 175 | 4.36 | 2.00 |

*Estimates are those of the Company. Effective from fiscal year May 2016, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

*Unit: million yen

This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the first half of fiscal year ended May 2019 and the fiscal year May 2019 earnings estimates.

Table of Contents

Key Points

1.Company Overview

2.First Half of Fiscal Year ended May 2019 Earnings Results

3.Segment Overview

4.Fiscal Year ending May 2019 Earnings Forecasts

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

For the first half of the fiscal year May 2019, sales and operating income decreased 20.3% and 8.3%, respectively, year on year. The sales from the business support and system development and operation services increased, but could not offset the effects of the transfer of the storefront affiliate services and the sluggishness of the contents services, and sales and operating income dropped. However, operating margin improved, as the profitability of the storefront affiliate services is low and the company withdrew the business of selling smartphones in China (transferring the equity of the Chinese subsidiary).There is no revision to the full-year earnings forecast, and it is estimated that sales and operating income will grow 0.1% and 62.9%, respectively, year on year. In the second half, it is projected that sales will grow 1.4 times from the first half thanks to the new business, while the business support services and system development and operation services will be healthy. Since the break-even point has dropped due to the transfer of the equities of the business and the subsidiary, etc., operating income is estimated to double compared with the first half. As for dividends, the company plans to pay a term-end dividend of 2 yen/share (the estimated payout rati 45.9%).

The company started the service of buying and selling used terminals. As strengths, the company has the experience of making transactions with cell phone carriers and the business partners for kitting, on which the company concentrates, could become major suppliers of used terminals. As part of efforts for decreasing cell phone charges, the possibility of selling terminals and SIM cards separately is being discussed. If this is realized, the distribution amount of used terminals is expected to increase, vitalizing the market and expanding business chances. In the medium term, the commercialization of 5G may give the company some advantage. 5G is considered as the communications technology that can meet a broad range of needs for users’ devices and IoT, and the company plans to expand its comprehensive solution service by utilizing the know-how nurtured through the creation business.

1.Company Overview

Nihon Enterprise is a “mobile solutions company” providing services that includes development of smartphone applications for consumers, enterprise system development, mobile kitting, e-commerce, AI chatbot, and other services. Its two main business segments include the "creation segment," where applications and systems using in-house IP (Intellectual Property) are provided, and the "solutions segment," where institutional software and system development are conducted. Furthermore, Nihon Enterprise works actively on validation businesses including IoT, blockchain, and wired drones.

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014.

1-1 Management Philosophy

Nihon Enterprise’s employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its “Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.” President Katsunori Ueda believes that it is Nihon Enterprise`s obligation to maximize “shareholder” in the long run, thus “enables to make effective use of capital and maximize it by not wasting a single yen” below its appropriate belief and action. In the first place, president Katsunori Ueda founded Nihon Enterprise with the strong motivation of “contributing to society through its businesses” and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services.

Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children’s institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan.

1-2 Mission Statement

Nihon Enterprise’s main mission is to contribute to society through its activities as a merchant, and to contribute to development of culture.

1-3 Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

1-4 The Commitments of Nihon Enterprise

- Commitment to Business

- Commitment to Altruism

- Commitment to Grow Earnings

- Commitment to Take on New Challenges

- Commitment to Always Being Appreciative

1-5 The Management Principles of Nihon Enterprise

1. Raise the Spirit of Our Management

2. Leverage the Collective Knowledge in Management of Our Company

3. Pursue Profits Fairly

4. Comply with Principles

5. Always Place Customers Interests Firs

6.Maintain a Family Management Style

7.Strict Adherence to Meritocratic Performance

8.Promote Work Based on “Cooperate and Trust Fellow Workers”

1-6 Corporate Group: 8 Consolidated Subsidiaries, 1 Non-Consolidated Subsidiaries

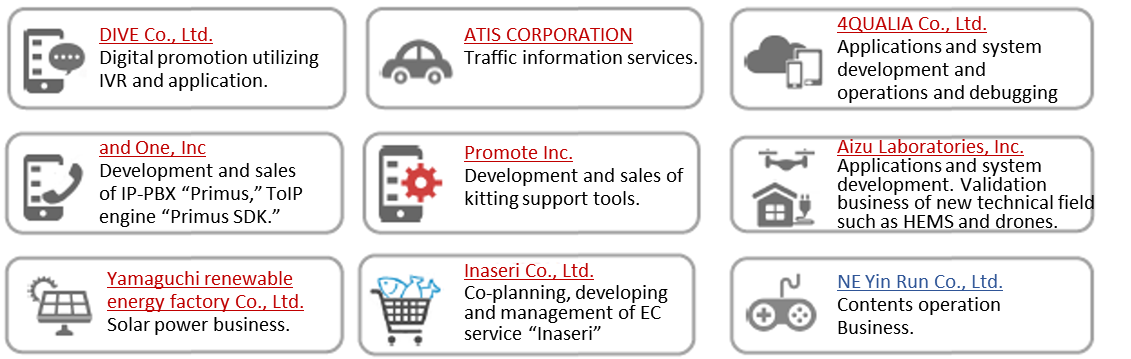

The Company has 8 domestic subsidiaries including Dive Co., Ltd., which provides digital promotion using IVR and applications, ATIS CORPORATION, which provides traffic information, etc., 4QUALIA Co., Ltd., which provides applications and system development and operations and debugging, etc., and One, Inc., which provides voice communication related solutions, Promote Inc., which provides kitting support tools, etc., Aizu Laboratories, Inc., which provides services related to application and system development, HEMS, and drones, Yamaguchi renewable energy factory Co., Ltd., which carries out the Smart Communications Business, and Inaseri Co., Ltd, which handles planning, development and management of electric business transaction service, “Inaseri.” The domestic non-consolidated subsidiary is NE Yin Run Co., Ltd., which carries out the Contents Operation Business.

(Source: Nihon Enterprise)

1-7 Outline of the business

The businesses are divided into the Creation Segment and the Solutions Segment, and the sales composition ratio in the fiscal year ended May 2018 was 51.6% and 48.4%, respectively.

1-7-1 Creation Segment

Providing application systems using its own Intellectual Property (IP)

The creation segment will be divided between contents services, business support services and other services, which include operations of the Shizen Energy Group solar power generating facilities and energy business (smart community business) of Yamaguchi Regenerative Energy Factory Co., Ltd. Within contents services, the booking of profits in traffic information, entertainment, life-style, and application advertisement are recorded. Within business support services, information license (“ATIS Traffic Information Service”), escrow service (fresh seafood electronic commerce “Inaseri” service), cloud service (educational cloud "e Manabi", car location management cloud “iGPS on NET”, and tourism cloud “Yubi Sashi Navigation”), package service (internet provider telephone “AplosOne” service, business messaging "BizTalk" service, chat engine “Fivetalk”, and kitting tool “Certino”), audio service (internet voice and audio series “Primus”) are provided. Furthermore, IoT block chain validation service for developing new businesses and services are also provided.

1-7-2 Solution Segment

Consigned development of business software and systems for corporations

The solutions segment is divided between system development and operation services, In-Store (affiliate advertising) agency service, and overseas business services. Application development, website creation, server design and creation, debugging, operational supervision, customer support, consulting and other services are conducted within the system development and operation services.

2.First Half of Fiscal Year ended May 2019 Earnings Results

2-1 First Half Consolidated Earnings

| H1 FY May 18 | Ratio to sales | H1 FY May 19 | Ratio to sales | YoY |

Sales | 2,021 | 100.0% | 1,611 | 100.0% | -20.3% |

Gross profit | 807 | 39.9% | 747 | 46.4% | -7.4% |

SG&A | 723 | 35.8% | 670 | 41.6% | -7.3% |

Operating Income | 84 | 4.2% | 77 | 4.8% | -8.3% |

Ordinary Income | 111 | 5.5% | 96 | 6.0% | -13.3% |

Net Income | 45 | 2.3% | 27 | 1.7% | -39.1% |

*Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

*Unit: million yen

Sales and operating income declined 20.3% and 8.3%, respectively, year on year.

Sales were 1,611 million yen, down 20.3% year on year. In detail, the sales from the creation business decreased 9.0% year on year to 917 million yen due to the decline of contents services, while the sales from the solutions business dropped 31.5% year on year to 694 million yen, due to the transfer of the storefront affiliate services business and the withdrawal of the smartphone sale business in China (transferring the equity of the Chinese subsidiary). As for profits, gross income margin rose 6.5 points to 46.4%, due to the transfer of the storefront affiliate services business (whose cost rate is 80-85%) and the transfer of the equity of the Chinese subsidiary, while SG&A decreased 7.3% year on year due to natural decline, the reduction of personnel cost (down 28 million yen) due to the transfer of the equity of the Chinese subsidiary, the curtailment of advertisement cost (which decreased from 74 million yen to 56 million yen), etc.; accordingly, operating income margin grew 0.6 points. The reason why net income declined 39.1% year on year is that the revenue from subsidies for new businesses decreased from 27 million yen to 13 million yen and corporate income tax, etc. augmented from 47 million yen to 50 million yen.

2-1-1 Creation Segment Sales and Income

| H1 FY May 18 | Ratio to sales | H1 FY May 19 | Ratio to sales | YoY |

Contents | 758 | 75.3% | 640 | 69.9% | -15.6% |

Business Supports | 216 | 21.5% | 241 | 26.3% | +11.2% |

Others (Solar Power Generation) | 32 | 3.2% | 34 | 3.7% | +8.7% |

Segment Sales | 1,007 | 100.0% | 917 | 100.0% | -9.0% |

Income before Consolidation Adjustments | 299 | 29.7% | 271 | 29.6% | -9.5% |

*Unit: million yen

Thanks to the good performance of entrusted development utilizing original services, the sales from the business support services grew, but the decline of contents services due to the shrinkage of the carrier platform market produced negative effects.

2-1-2 Solutions Segment sales and income

| H1 FY May 18 | Ratio to sales | H1 FY May 19 | Ratio to sales | YoY |

System Developing, Operating | 654 | 64.6% | 690 | 99.6% | +5.5% |

Others (Overseas) | 358 | 35.4% | 3 | 0.4% | -98.9% |

Segment Sales | 1,013 | 100.0% | 694 | 100.0% | -31.5% |

Income before Consolidation Adjustments | 15 | 1.5% | 75 | 10.8% | +383.2% |

*Unit: million yen

Thanks to the active IT investment by enterprises, the sales from system development and operation services increased, but sales from others dropped considerably (in the first half, the sales from online ads were posted), due to the transfer of the storefront affiliate services business on Feb. 28, 2018 and the transfer of the equity of the Chinese subsidiary on Mar. 30, 2018.

2-2 Second Quarter Consolidated Earning

| Q1-5/18 | Q2 | Q3 | Q4 | Q1-5/19 | Q2 |

Sales | 974 | 1,046 | 968 | 902 | 775 | 835 |

CGS | 584 | 629 | 567 | 476 | 405 | 458 |

SG&A (Advertising) | 356(28) | 366(46) | 411(54) | 324(41) | 337(29) | 332(26) |

Operating Income | 33 | 50 | -10 | 101 | 32 | 44 |

Ordinary Income | 37 | 74 | 30 | 115 | 43 | 52 |

COS Margin | 60.0% | 60.1% | 58.6% | 52.8% | 52.3% | 54.9% |

SG&A Margin | 36.6% | 35.0% | 42.5% | 36.0% | 43.6% | 39.8% |

As for sales, the sales from the creation business declined 6.4% from the first quarter, but the sales from the solutions business grew 30.0% from the first quarter. As for profits, cost rate rose 2.6 points due to the increase of the ratio of sales from the solutions business, but the augmentation of R&D cost, etc. was offset by the optimization of advertisement investment and cost reduction; consequently, SG&A margin decreased 3.8 points.

2-2-1 Creation Segment Sales and Income

| Q1-5/18 | Q2 | Q3 | Q4 | Q1-5/19 | Q2 |

Contents | 382 | 376 | 376 | 351 | 331 | 309 |

Business Supports | 97 | 119 | 107 | 137 | 122 | 118 |

Others (Overseas) | 18 | 13 | 9 | 17 | 19 | 15 |

Sales | 498 | 509 | 493 | 506 | 473 | 443 |

Operating Income | 153 | 146 | 141 | 72 | 145 | 125 |

Due to the shrinkage of the carrier platform market, the sales from the contents services decreased 6.6% from the first quarter. As the entrusted development utilizing original services performed well, but inspection items decreased, the sales from the business support services dropped 3.5% from the first quarter. Due to the decrease in sunshine duration (fall season), the sales from others (solar power generation) declined 20.3% from the first quarter.

2-2-2 Solutions Segment sales and income

| Q1-5/18 | Q2 | Q3 | Q4 | Q1-5/19 | Q2 |

System Developing, Operating | 296 | 358 | 323 | 391 | 300 | 390 |

Others (Overseas) | 179 | 179 | 152 | 4 | 1 | 2 |

Sales | 476 | 537 | 475 | 396 | 301 | 392 |

Operating Income | 2 | 13 | -32 | 172 | 28 | 46 |

Through the enhanced sales promotion based on proposals and in-group cooperation, the company met enterprises’ demand for IT investment, and the sales of system development and operation services, mainly for app development and CRM, increased 29.9% from the first quarter.

2-3 Financial Conditions and Cash Flaw

2-3-1 Financial Conditions

| May 18 | Nov. 18 |

| May 18 | Nov. 18 |

Cash | 4,205 | 4,166 | Payables | 94 | 100 |

Receivables | 434 | 487 | Taxes Payable | 96 | 69 |

Current Assets | 4,827 | 4,909 | Net defined benefit liabilities | 51 | 54 |

Tangible Assets | 405 | 391 | Interest-bearing liabilities | 300 | 289 |

Intangible Assets | 432 | 415 | Liabilities | 790 | 822 |

Investments and Others | 339 | 267 | Net Assets | 5,213 | 5,160 |

Noncurrent Assets | 1,177 | 1,073 | Total Liabilities and Net Assets | 6,004 | 5,983 |

*Unit: million yen

The total assets as of the end of the first half stood at 5,983 million yen, down 21 million yen from the end of the previous term. Capital-to-asset ratio was 81.4% (82.1% as of the end of the previous term).

2-3-2 Cash Flow(CF)

| H1 FY May. 18 | H1 FY May. 19 | YoY | |

Operating cash flow(A) | 79 | 111 | +31 | +39.3% |

Investing cash flow (B) | 196 | -61 | -257 | - |

Free・Cash Flow(A+B) | 275 | 49 | -226 | -82.0% |

Financing cash flow | -105 | -105 | +0 | - |

Cash and Equivalents at the end of term | 3,560 | 4,077 | +517 | +14.5% |

*Unit: million yen

Operating income declined, but operating CF grew 39.3% year on year, due to the decrease in working capital caused by the transfer of the storefront affiliate services business, the transfer of equity of the Chinese subsidiary, etc.

3.Segment Overview

3-1 Creation Segment

3-1-1 Content Service Segment

As for smartphone apps, the market of services for carrier platforms will shrink inevitably. Accordingly, the company will develop a revenue structure that does not depend on carrier platforms, while striving to secure profits through efficient operation. The company will proceed with the development of new content based on the alliances with other companies, and target new platforms, including existing apps.

1) Efforts by Application

For “Woman’s DIARY” (Healthcare application) which is popular among the “F1” category (female, 20 to 34 years old) where women have high consumer confidence and are highly sensitive to new trends, the Company will enhance the content power by evolving “Women’s DIARY” to a service that supports women’s “beauty” and “health” while seeking tie-up advertising and will increase the number of users.

As for the “ATIS Traffic Information Service” (traffic information), the company plans to upgrade the functions of apps and launch new services for drivers. As for “Flea-Ma.jp” (flea market service), which provides a safe, reliable environment for personal transactions, the company will continuously enrich services by increasing products, etc. and create a new business model in cooperation with business partners. As for services for carrier platforms (monthly charges, fixed charges), the company will make efforts to secure profits based on efficient operation.

In addition, the company will start operating a new portal site (platform) on January 17, 2019. It will start as a portal site for e-books to distribute comics and photo books, but the company plans to offer not only books but also various contents, including games and live chats, in the medium term.

3-1-2 Business Support Service

In the traffic information service, from which the company earns recurring revenue by offering licenses to CATV channels, bus companies, etc., the company released “ATIS on Cloud,” a new service for corporations, on September 26. In the service of undertaking some tasks by utilizing original products, the company is developing a system for e-commerce and an app utilizing the chat function, and it is expected that the original brands and packaged services developed by the Nihon Enterprise group, such as kitting and Inaseri, will grow. In addition, the company started demonstration experiment for the automated driving level 3 on actual public roads in Namie-machi, Fukushima Prefecture.

1) Traffic Information Service

On September 26, 2018, the company released “ATIS on Cloud,” a traffic information service. This is a cloud-type traffic information service that enables users to check the latest traffic events, such as congestion, accidents, and traffic controls, on expressways and ordinary roads nationwide on a map, and it is targeted at corporations in the fields of transportation, including express and chartered buses, distribution, delivery, and moving.

“ATIS on Cloud” has five features: (1) “ATIS Map,” which can check the time required to reach each expressway exit, (2) “Live videos and images,” which enable users to grasp the conditions of congestion and road surfaces, (3) detailed map data for grasping traffic information, (4) a map for large-sized vehicles, such as trucks, and (5) the function to compare the travel time for a registered route in normal times and that when the route is congested.

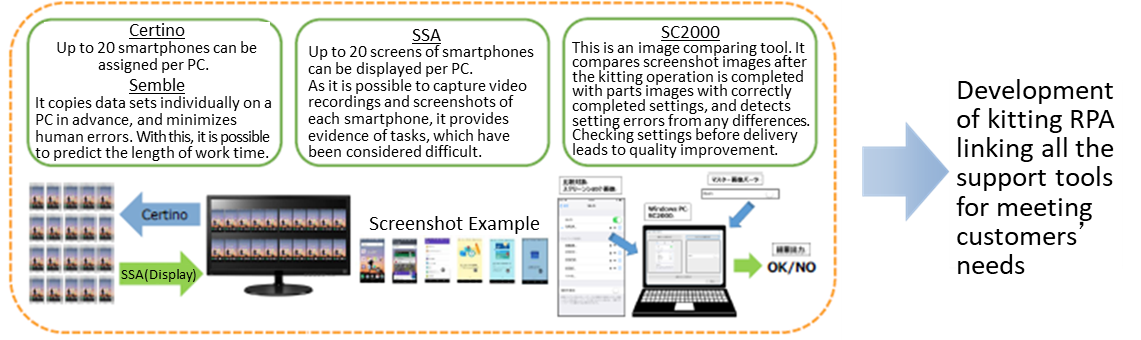

2) Improvement of the Kitting Service (Development of the RPA of the kitting linked with all supporting tools)

Kitting means the setting and customization of terminals, such as PCs and smartphones, and peripheral devices used by employees, for optimized configuration at companies. In the Nihon Enterprise group, the consolidated subsidiary Promote Inc. developed RPA (Robotic Process Automation) for kitting by combining “Certino,” a tool for supporting kitting, “SSA,” a tool for supporting evidence (certification of work) (released on Aug. 23, 2018), and “SC2000,” a tool for comparing images (released on Aug. 23, 2018). The company will offer a one-stop solution that covers all processes from kitting to the confirmation of quality problems (setting errors and mistakes).

3) Commencement of a Service for General Consumers in Inaseri (Inaseri Market) (Nov. 2018)

In December 2016, the company started “Inaseri,” a service of online sale of marine products for wholesalers (launched in the Toyosu Market on October 12, 2018), and in August 2018, the company started the operation of “Ina-oku,” a reverse auction for major clients. For “Ina-oku,” a reverse auction system of the company was adopted, to offer services that can realize bidding-down. Furthermore, the company started offering the services to general consumers, too, and released “Inaseri Market,” an EC site for general consumers to purchase seafood that has satisfied wholesalers in November 2018. In addition, the company will directly sell fresh fish to general consumers at “Inaseri Marché,” an actual store outside the Toyosu Market, every Saturday during a limited period from January to March 2019.

“Inaseri Market”

This is an EC site where general consumers can purchase high-quality seafood of the Toyosu Market handpicked by wholesalers via the Internet. As the products are directly delivered from the Toyosu Market to each purchaser’s house, customers can savor the genuine taste at home.

“Inaseri Marché”

At “Toyosu Market Oishii Marché,” which will be held every Saturday from January 12 to March 30, 2019, the company will sell fresh fish bought from wholesalers of Toyosu Market by using a selling truck. “Inaseri Marché” is the first store where general visitors can purchase fresh fish from the Toyosu Market.

3-2 Demonstration business

3-2-1 Test for demonstrating automated driving

As this was adopted as a “project for promoting development, etc. for regional reconstruction in fiscal 2018” implemented by Fukushima Prefecture, “a demonstration test for developing an information base for automated driving and putting a city patrol vehicle to practical use” is underway. In cooperation with Fukushima Toyopet, the company is testing Level 3 (automated driving with the driver standing by), which is the level of actual driving on a public road. On December 3, 2018, the company held the ceremony for commencing a demonstration test on public roads in Namie-machi, Fukushima Prefecture, and demonstrated automated driving for about 1 km on public roads connecting Namie-ekimae and Namiemachi-yakuba. From now on, the company plans to extend the demonstration range, develop software for automated driving, acquire know-how for operation, and then create new businesses.

3-2-2 Solution Segment

As enterprises are actively investing in IT and the reform of ways of working and the Olympics in 2020 will produce positive effects, the business environment is expected to remain favorable. Especially, the demand for systems related to AI, IoT, and security is estimated to grow. In these circumstances, the company will offer comprehensive solution services, including entrusted development (development from scratch) by utilizing the know-how nurtured through the creation business, and develop the peripheral business for terminals (service of buying and selling used terminals).

3-2-3 Track Records of Comprehensive Solution Services

・Development of an app for CtoC flea markets

・Development of an app for communication exclusively for sports

・Development of an EC site and a system for educating and managing employees・Development of an AI chatbot app

・Development of an app for supporting daily life for municipalities

3-3 Service of buying and selling used terminals

(Source: the company)

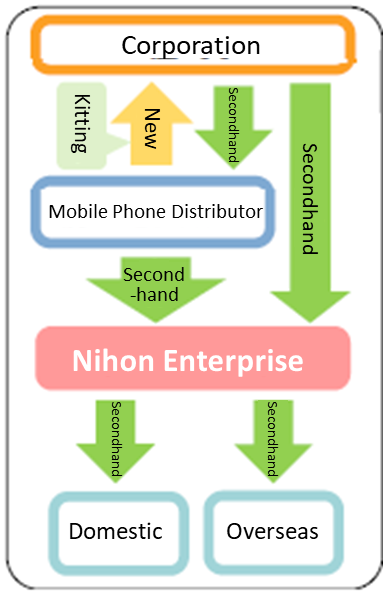

The company will expand the service of buying and selling used terminals, and develop the peripheral business of terminals.

In September 2018, the company started the service of buying and selling used terminals, such as secondhand smartphones, cellphones, tablet PCs, and other PCs, owned by enterprises for corporations.

By utilizing connections the company has fostered, the company has been buying used terminals from cell phone dealers steadily. Since the kitting tool developed by the Nihon Enterprise group was adopted, the company has been increasing the suppliers of used terminals, mainly cell phone dealers.

The company aims to stabilize the volume of transactions, and plans to increase business partners and expand its business.

4.Fiscal Year ending May 2019 Earnings Forecasts

4-1 Consolidated Earnings

| FY May 18 Act. | Ratio to sales | FY May 19 Est. | Ratio to sales | YoY |

Sales | 3,892 | 100.0% | 3,895 | 100.0% | +0.1% |

Operating Income | 174 | 4.5% | 285 | 7.3% | +62.9% |

Ordinary Income | 257 | 6.6% | 345 | 8.9% | +34.0% |

Net Income | 166 | 4.3% | 175 | 4.5% | +5.3% |

*Unit: million yen

The Company anticipates an increase of sales by 0.1% year on year and an increase of ordinary income by 34.0% year on year.

The impact of transfer of the In-Store affiliate business will be absorbed by the Business Support Services (Creation Segment) and the System Development and Operation Services (Solutions Segment), and sales are expected to increase 0.1% to 3,895 million yen. On the profit side, operating income is expected to grow 62.9% to 285 million yen due to the transfer of the In-Store affiliate business and improvement of profitability by transfer of the equity interest of the Chinese subsidiary. Despite a decline in subsidy income, ordinary income is expected to increase 34.0% year on year to 345 million yen.

For dividends, the company plans to pay a term-end dividend of 2 yen/share (estimated payout rati 45.9%).

5.Conclusions

The progress rate toward the full-year forecast is 41.4% for sales, 27.0% for operating income, 28.0% for ordinary income, and 16.0% for net income. Progress is delayed, but for the second half the company aims to increase sales 1.4 times compared with the first half and double operating income compared with the first half. As for sales, the negotiation for two large-scale kitting projects is ongoing, and the company expects the contribution of the new portal site for distributing comics and photo books and the Toyosu-related business, including “Inaseri.” As for profits, profitability is projected to improve due to the transfer of the storefront affiliate services business and the “Chinese subsidiary.”

In addition, the service of buying and selling used terminals is expected to grow. Its strengths are the experience of making transactions with cell phone carriers and the possibility that the business partners for kitting, on which the company concentrates, will become major suppliers of used terminals. As part of efforts for decreasing cell phone charges, the possibility of selling terminals and SIM cards separately is being discussed. If this is realized, the distribution amount of used terminals is expected to increase, vitalizing the market and expanding business chances. In the medium term, the commercialization of 5G may give the company some advantage. In 5G communications, it is possible to transmit a 1000 times larger volume of data than 4G, and multi-connection and low-delay modes can be achieved. 5G is considered as the communications technology that can meet a broad range of needs for users’ devices and IoT, and the company plans to expand its comprehensive solution service by utilizing the know-how nurtured through the creation business.

Reference: Regarding Corporate Governance

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎Corporate Governance Report

Updated on December 18, 2018

Basic Policy

The corporate group believes that, with respect to decision-making by the board of directors to attain its management goals, corporate governance means maximization of shareholder interests by monitoring legality by the audit and supervisory board, deterring unlawful business execution of the directors, and establishing an organizational system that realizes more expeditious company decision-making and clarifies management responsibility, while seeking to avoid or mitigate business risks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 4-1-3 Plan for developing successors to the CEO and others

Our company runs “Ueda-juku (workshop)” for executives, with the aim of fostering qualities required for managers, such as “strategic thinking” and “leadership,” but we have not produced a plan for successors to the CEO and others. From now on, we will think of producing a plan for developing candidate successors and supervising them. When producing plans, we will take a sufficient amount of time and resources to realize the development of candidate successors.

Principle 5-2 Design and announcement of managerial strategies and plans

Our company does not announce a mid-term management plan, but at the beginning of each term, we disclose target figures for the term. Target figures are determined while considering capital cost, reviewing our business portfolio, and allocating management resources to equipment, R&D, and human resources investments. We will make efforts to explain concrete measures for attaining target figures to shareholders in an understandable manner via brief financial reports, briefing sessions, and daily IR activities.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 3-1 Information Disclosure

1) Corporate philosophy, strategy and plan

The company publishes its corporate philosophy (“Mission Statement, Doctrine, and Five Commitments” and “Nihon Enterprise Management Principles.”) on its website. The company makes the medium-term (three fiscal years) business plan based on a fiscal year business plan. However, the mobile contents market which the company is in, is very unpredictable and changeable. The company does not disclose medium-term business plan because it would change frequently and lead confusion, but publishes earnings summaries including business development on its web site.

●Corporate philosophy (Mission Statement, Doctrine, and Five Spirits), Nihon Enterprise Management Principles, and Our code of conduct:

http://www.nihon-e.co.jp/company/concept.html="xbrl_cgau">URL:

http://www.nihon-e.co.jp/ir/data.html="xbrl_cgau"> ●Reference material for briefing financial results: URL:

Principle 5-1 Policy on constructive dialogue with shareholders

The company has established the IR basic policy which is composed of “Basic attitude to IR activities and disclosure criteria,” “Methods for disclosing information and information fairness,” “Future outlook,” and “IR quiet period” and publishes the policy through its website.

●Basic IR policy: URL:http://www.nihon-e.co.jp/ir/management/line.html

Currently, the company proactively takes the following action based on the above-mentioned IR basic policy from the perspective of constructive dialogue with its shareholders:

1) The company encourages day-to-day cooperation among departments by designating the Executive Managing Director and general manager of the Administration Department as a person in charge of internal information management and having him govern departments involved in IR activities, including the Accounting Department, the General Affairs Department, the Human Resources and Public Relations Department.

2) In the company, the person in charge of internal information management responsibly grasps and manages information on each department of the company and, based on accurate management decision, efforts are exerted to make organic cooperation and information are frequently shared with other departments related to IR activities, so that cooperation among departments can be enhanced.

3) The division engaged in public relations and IR activities not only proactively responds to inquiries made from its shareholders and investors on the phone and through IR events such as small meetings, but also hosts financial results briefings for analysts where explanations are given by the president or the executive managing directors.

4) The company reports to the board of directors on IR activities and feedback on such activities as well as situations of shareholder transfer at all times in order to share information with the directors and the auditors.

5) The company pays attention to management of insider information, and therefore, in communicating with investors, it brings up topics concerning improvement of corporate value as the subject of discussion, using previously published information of the company.

TSE Corporate Governance Information Service:http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved.

To view back numbers of Bridge Reports on Nihon Enterprise Co., Ltd. (4829) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/