Bridge Report:(4829)Nihon Enterprise the Fiscal Year May 2019

Katsunori Ueda, President | Nihon Enterprise Co., Ltd. (4829) |

|

Corporate Information

Market | TSE 1st Section |

Industry | Information, Communications |

President | Katsunori Ueda |

HQ Address | Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

Year-end | May |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥170 | 40,133,000 shares | 6,822 million | 2.0% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥2.00 | 1.2% | ¥3.99 | 42.6 x | ¥122.48 | 1.4 x |

*The share price is the closing price on July 19. Number of shares issued is calculated by deducting the number of treasury stock from the number of outstanding shares at the end of the latest quarter. ROE and BPS are the values at the end of the pervious term.

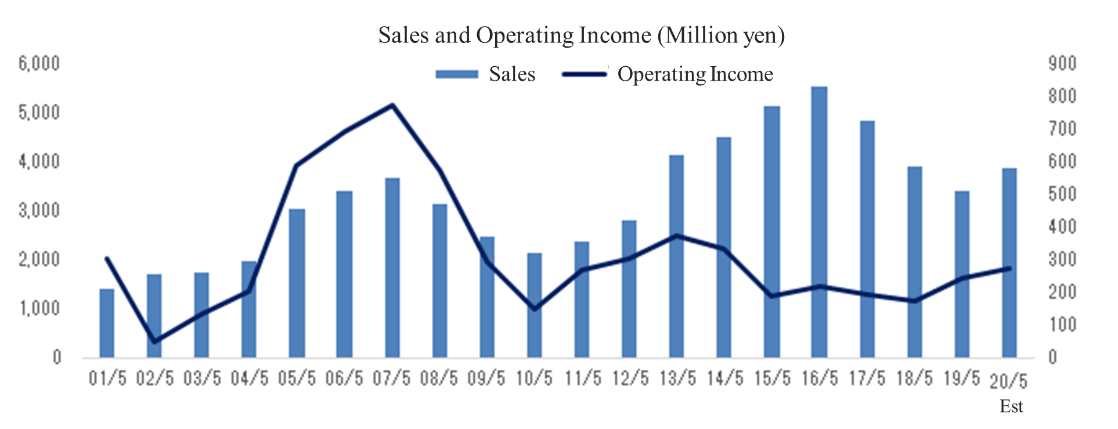

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May. 2016 Act. | 5,530 | 219 | 252 | 327 | 8.07 | 3.00 |

May. 2017 Act. | 4,838 | 192 | 229 | 99 | 2.45 | 2.00 |

May. 2018 Act. | 3,892 | 174 | 257 | 166 | 4.11 | 2.00 |

May. 2019 Act. | 3,413 | 242 | 292 | 97 | 2.44 | 2.00 |

May. 2020 Est. | 3,850 | 275 | 300 | 160 | 3.99 | 2.00 |

*Estimates are those of the Company.

*Unit: million yen, yen

This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the fiscal year ended May 2019 and the fiscal year May 2020 earnings forecast.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended May 2019 Earnings Results

3. Overview of Each Segment

4. Fiscal Year ending May 2020 Earnings Forecast

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the fiscal year May 2019, sales decreased 12.3% and operating income increased 38.5% year on year. While the effects of the dropped sales from the contents services due to the shrinkage of the carrier platform market and the transfer of the storefront affiliate services and the transfer of the equity of the Chinese subsidiary could not be offset, the sales from the priority areas, i.e., the business support and system development and operation services rose. The profitability also improved through cost reduction and the transfer of the low-profit businesses and the subsidiary. In the fourth quarter, sales increased 26.8% from the third quarter and operating income grew from one million yen to 163 million yen.

- The forecast for the fiscal year May 2020 expects sales and operating income to rise 12.8% and 13.5% respectively, year on year. The sales from the business support and system development and operation services are projected to continue to increase, and the company is expected to increase sales from the content and kitting services for which the company is making efforts to end dependency on carrier platforms and the peripheral business of buying and selling used terminals. As for dividends, the company plans to pay a term-end dividend of 2 yen/share (the estimated payout rati 50.2%).

- The kitting tool was installed in some mobile carriers in the fiscal year May 2019, and its area of installation is expected to expand in the fiscal year May 2020. As replacement and renewal of terminals must be carried out on a continuous basis, they have potential to become a stable source of income supporting the company’s revenue. Currently, the company is the only company providing this type of tool. The company expects synergies between the kitting service and the business of buying and selling used terminals.

1. Company Overview

Nihon Enterprise is a “mobile solutions company” providing services that includes development of smartphone applications for consumers, enterprise system development, mobile kitting, e-commerce, AI chatbot, and other services. Its two main business segments include the "creation segment," where applications and systems using in-house IP (Intellectual Property) are provided, and the "solutions segment," where institutional software and system development are conducted. Furthermore, Nihon Enterprise works actively on validation businesses including IoT, and blockchain.

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014.

1-1 Management Philosophy

Nihon Enterprise’s employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its “Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.” President Katsunori Ueda believes that it is Nihon Enterprise`s obligation to maximize “shareholder” in the long run, thus “enables to make effective use of capital and maximize it by not wasting a single yen” below its appropriate belief and action. In the first place, president Katsunori Ueda founded Nihon Enterprise with the strong motivation of “contributing to society through its businesses” and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services.

Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children’s institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan.

Mission Statement

Nihon Enterprise’s main mission is to contribute to society through its activities as a merchant, and to contribute to development of culture.

Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

1-2 Corporate Group: 8 Consolidated Subsidiaries, 1 Non-Consolidated Subsidiaries

The Company has 8 domestic subsidiaries including Dive Co., Ltd., which provides digital promotion using IVR and applications, ATIS CORPORATION, which provides traffic information, etc., 4QUALIA Co., Ltd., which provides applications and system development and operations and debugging, etc., and One, Inc., which provides voice communication related solutions, Promote Inc., which provides kitting support tools, etc., Aizu Laboratories, Inc., which provides services related to application and system development, and HEMS, Yamaguchi renewable energy factory Co., Ltd., which carries out the Smart Communications Business, and Inaseri Co., Ltd, which handles planning, development and management of electric business transaction service, “Inaseri.” The domestic non-consolidated subsidiary is NE Yin Run Co., Ltd., which carries out the Contents Operation Business.

1-3 Outline of the business

The businesses are divided into the Creation Segment and the Solutions Segment, and the sales composition ratio in the fiscal year ended May 2019 was 54.3% and 45.7%, respectively.

Creation Segment

Providing application systems using its own Intellectual Property (IP)

The creation segment will be divided between contents services, business support services and other services, which include operations of the Shizen Energy Group solar power generating facilities and energy business (smart community business) of Yamaguchi Regenerative Energy Factory Co., Ltd.

Within contents services, the company provides contents and services such as “Woman’s Rhythm Diary (healthcare),” “ATIS Traffic Information Service (traffic information),” “Flea-Ma.jp (flea market),” a comprehensive e-book service “BOOKSMART (monthly payment, flat-rate plan),” “Carrier (monthly payment, flat-rate plan),” which provides services for carrier platforms mainly related to lifestyle and entertainment, and “Inaseri Market,” fresh seafood EC site for consumers.

Within business support services, services such as “ATIS Traffic Information Service,” which established a recurring-revenue-type business through data distribution for cable television, etc. and provides car location management cloud “iGPS on NET,” etc., entrusted development related to e-commerce using the company’s own products, and operation of “Inaseri,” a service of online sale of marine products of intermediate wholesalers who belong to the Wholesales Co-operative of Tokyo Fish Market, are provided. Furthermore, the company handles validation service of IoT, block chain, automated driving, etc. for developing new businesses and services.

Original brands developed by the company and packaged services

(Source: the company)

Solution Segment

Consigned development of business software and systems for corporations

The solutions segment is divided between system development and operation services, and other services. Application development, website creation, server design and creation, debugging, operational supervision, customer support, consulting and other services are conducted within the system development and operation services.

The company puts efforts in the comprehensive solutions services focusing on entrusted development (development from scratch) by utilizing the know-how nurtured in the creation business, and also takes steps in growing the service of buying and selling used terminals. The business partners, mainly cell phone carriers and companies installing the kitting tool developed by the Group, of the creation business might become important suppliers of used terminals. The company plans to expand the business by stabilizing the number of transactions and increasing the number of new business partners.

2. Fiscal Year ended May 2019 Earnings Results

2-1 Consolidated Earnings

| FY May 18 | Ratio to Sales | FY May 19 | Ratio to Sales | YoY | Forecast | Difference from the forecast |

Sales | 3,892 | 100.0% | 3,413 | 100.0% | -12.3% | 3,895 | -12.4% |

Gross profit | 1,634 | 42.0% | 1,557 | 45.6% | -4.7% | - | - |

SG&A | 1,459 | 37.5% | 1,314 | 38.5% | -9.9% | - | - |

Operating Income | 174 | 4.5% | 242 | 7.1% | +38.5% | 285 | -15.0% |

Ordinary Income | 257 | 6.6% | 292 | 8.6% | +13.7% | 345 | -15.2% |

Net Income | 166 | 4.3% | 97 | 2.9% | -41.1% | 175 | -44.1% |

*Unit: million yen

Sales declined 12.3% and operating income increased 38.5% year on year.

Sales dropped 12.3% year on year to 3,413 million yen. While the effects of the dropped sales from the contents services due to the shrinkage of the carrier platform market and the transfer of the storefront affiliate services (responsible for 475 million yen-drop in sales) and the transfer of the equity of the Chinese subsidiary could not be offset, the sales from the priority areas, i.e., the business support and system development and operation services rose.

Operating income rose 38.5% year on year to 242 million yen. As a result of putting efforts for the transfer of the storefront affiliate service business with a high cost rate and cost reduction, the cost rate improved 3.6 points and gross income margin dropped only 4.7% year on year. On the other hand, SG&A expenses decreased 9.9% year on year due to the drop in personnel cost resulting from the sale of the Chinese subsidiary and natural decline, the reduction of R&D cost of the consolidated subsidiary Aizu Laboratory, Inc. and the curtailment of advertisement cost through efficient advertising, etc. Operating income margin grew 2.6 points to 7.1%.

Net income declined 41.1% year on year to 97 million yen due to the decrease in non-operating income resulting from the decreased revenue from subsidies (which dropped from 82 million yen to 42 million yen), the rebound from recording extraordinary gain of 143 million yen in the previous fiscal year because of the transfer of the storefront affiliate service business and the recording of impairment loss of software assets of the consolidated subsidiary Inaseri Co., Ltd. amounting to 45 million yen in the extraordinary loss.

Creation Segment Sales and Income

| FY May 18 | Ratio to Sales | FY May 19 | Ratio to Sales | YoY |

Content Service Segment | 1,486 | 74.1% | 1,291 | 69.6% | -13.1% |

Business Supports | 461 | 23.0% | 500 | 27.0% | +8.5% |

Others (Solar Power Generation) | 59 | 2.9% | 62 | 3.3% | +5.7% |

Segment Sales | 2,007 | 100.0% | 1,855 | 100.0% | -7.6% |

Income before Consolidation Adjustments | 513 | 25.6% | 549 | 29.6% | +7.0% |

*Unit: million yen

Thanks to the good performance of entrusted development utilizing original services and installation of IP phones, the sales from the business support services grew 8.5% year on year and the sales from the solar power generation (other services) rose 5.7% year on year due to a long sunshine duration, but they could not offset the decline in the sales from the contents services due to the shrinkage of the carrier platform market.

Solutions Segment sales and income

| FY May 18 | Ratio to Sales | FY May 19 | Ratio to Sales | YoY |

System Developing, Operating | 1,369 | 72.6% | 1,551 | 99.6% | +13.3% |

Others (Overseas) | 515 | 27.4% | 6 | 0.4% | -98.7% |

Segment Sales | 1,885 | 100.0% | 1,558 | 100.0% | -17.3% |

Income before Consolidation Adjustments | 155 | 8.2% | 198 | 12.7% | +27.9% |

*Unit: million yen

The sales from others dropped 98.7% year on year due to the transfer of the storefront affiliate services business on Feb. 28, 2018 and the transfer the equity of the Chinese subsidiary on Mar. 30, 2018, but thanks to the active IT investment by enterprises, the sales from system development and operation services increased 13.3% year on year.

2-2 Fourth Quarter (March-May) Consolidated Earning

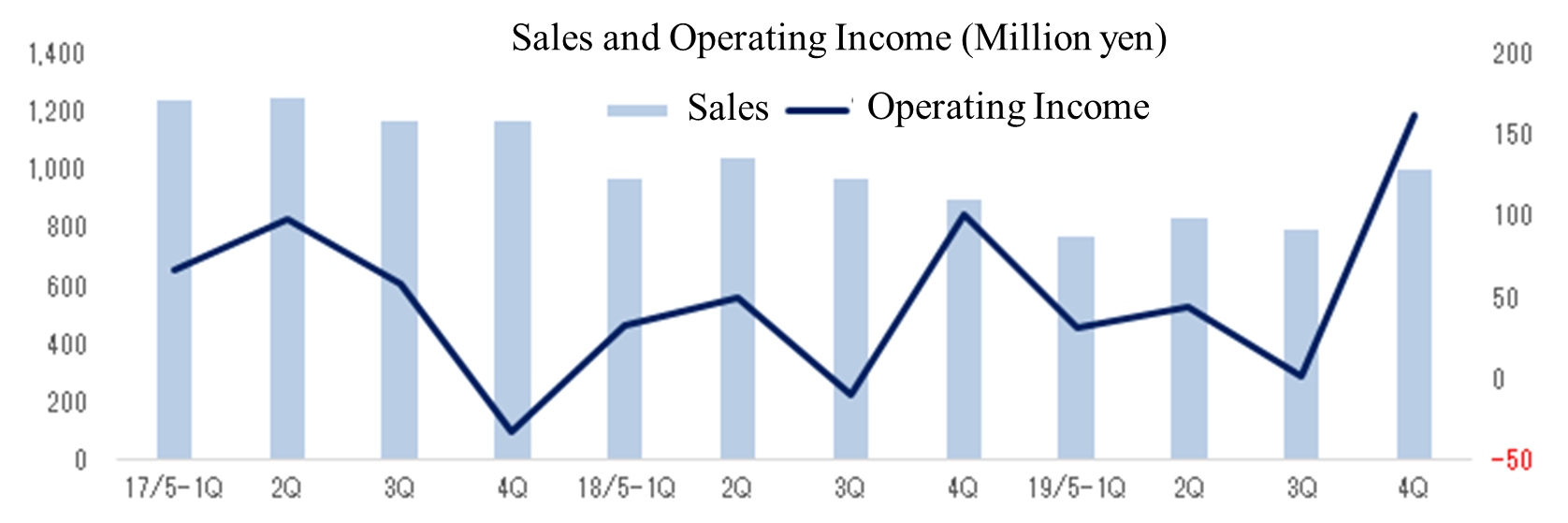

| 18/5-1Q | 2Q | 3Q | 4Q | 19/5-1Q | 2Q | 3Q | 4Q |

Sales | 974 | 1,046 | 968 | 902 | 775 | 835 | 794 | 1,007 |

CGS | 584 | 629 | 567 | 476 | 405 | 458 | 456 | 536 |

SG&A (Advertising) | 356(28) | 366(46) | 411(54) | 324(41) | 337(29) | 332(26) | 337(35) | 307(41) |

Operating Income | 33 | 50 | -10 | 101 | 32 | 44 | 1 | 163 |

Ordinary Income | 37 | 74 | 30 | 115 | 43 | 52 | 31 | 164 |

COS Margin | 60.0% | 60.1% | 58.6% | 52.8% | 52.3% | 54.9% | 57.4% | 53.3% |

SG&A Margin | 36.6% | 35.0% | 42.5% | 36.0% | 43.6% | 39.8% | 42.4% | 30.5% |

*Unit: million yen

In the fourth quarter (from March to May), the sales from the contents services, which were in a decreasing trend for a while, grew, thanks to the efforts to end dependency on carrier platforms, and the performance of services for corporations such as the business support services (creation segment) and system development and operation services (solutions segment) was also steady. As a result, sales increased 26.8% from the previous quarter to 1,007 million yen, exceeding 1 billion yen.

Operating income grew from one million yen in the previous quarter to 163 million yen. Cost rate improved with a significant increase in sales and SG&A rate also improved as a result of continuous reduction in cost and decrease in R&D cost.

Creation Segment Sales and Income

| 18/5-1Q | 2Q | 3Q | 4Q | 19/5-1Q | 2Q | 3Q | 4Q |

Content Service Segment | 382 | 376 | 376 | 351 | 331 | 309 | 303 | 347 |

Business Supports | 97 | 119 | 107 | 137 | 122 | 118 | 106 | 152 |

Others (Overseas) | 18 | 13 | 9 | 17 | 19 | 15 | 10 | 17 |

Sales | 498 | 509 | 493 | 506 | 473 | 443 | 420 | 517 |

Operating Income | 153 | 146 | 141 | 72 | 145 | 125 | 96 | 181 |

*Unit: million yen

The sales from the creation business increased 23.1% from the previous quarter. While the sales from the business support services augmented 43.0% due to the good performance of the entrusted development utilizing original services, installation of IP phones, etc., the sales from the contents services also grew 14.7% from the previous quarter as the company put efforts in promoting usage of contents on platforms operated not by carriers but App Store, Google Play, etc. and developing new contents. Due to the seasonal factors (such as the increase in sunshine duration), the sales from others (solar power generation) improved 65.9% from the previous quarter.

Solutions Segment sales and income

| 18/5-1Q | 2Q | 3Q | 4Q | 19/5-1Q | 2Q | 3Q | 4Q |

System Developing, Operating | 296 | 358 | 323 | 391 | 300 | 390 | 373 | 487 |

Others (Overseas) | 179 | 179 | 152 | 4 | 1 | 2 | 1 | 2 |

Sales | 476 | 537 | 475 | 396 | 301 | 392 | 374 | 489 |

Operating Income | 2 | 13 | -32 | 172 | 28 | 46 | 32 | 91 |

*Unit: million yen

The sales from the solutions business grew 30.9% from the previous quarter. As the company increasingly acquired projects for app development, such as chatbots, by enhancing sales promotion through in-group cooperation, the sales of system development and operation services increased 30.7% from the previous quarter (it is the highest for the same services in the fourth quarter since the fiscal year May 2017 when the business segments were reclassified).

2-3 Financial Conditions and Cash Flaw

Financial Conditions

| End of May 2018 | End of May 2019 |

| End of May 2018 | End of May 2019 |

Cash | 4,205 | 4,345 | Payables | 94 | 130 |

Receivables | 434 | 567 | Taxes Payable | 96 | 79 |

Current Assets | 4,827 | 5,144 | Net defined benefit liabilities | 51 | 55 |

Tangible Assets | 405 | 372 | Liabilities | 790 | 822 |

Intangible Assets | 432 | 334 | Net Assets | 5,213 | 5,213 |

Investments and Others | 339 | 174 | Total Liabilities and Net Assets | 6,004 | 6,035 |

Noncurrent Assets | 1,177 | 881 | Total Interest-Bearing Liabilities | 300 | 277 |

*Unit: million yen

The total assets as of the end of the term stood at 6,035 million yen, up 30 million yen from the end of the previous term. In addition to cash and deposits, trade receivables and payables grew due to the increased orders and sales. On the other hand, software decreased through the posting of impairment loss, and investment securities, too, dropped as they were sold off. The company virtually operates business without borrowings, as cash deposits occupied 72.0% of the total assets (70.0% as of the end of the previous term). Capital-to-asset ratio was 81.4% (82.1% as of the end of the previous term).

Cash Flow(CF)

Operating cash flow(A) | FY May 18 | FY May 19 | YoY | |

Investing cash flow (B) | 314 | 289 | -24 | -7.9% |

Free・Cash Flow(A+B) | 626 | -46 | -673 | - |

Financing cash flow | 940 | 242 | -697 | -74.2% |

Cash and Equivalents at the end of term | -215 | -119 | +95 | - |

Operating cash flow(A) | 4,115 | 4,255 | +140 | +3.4% |

Operating CF was 289 million yen with pre-tax income amounting to 269 million yen (340 million yen in the previous term), depreciation cost of 193 million yen (224 million yen in the previous term), tax expenses of 108 million yen (135 million yen in the previous term), etc. Investing CF was affected mainly by the acquisition of intangible assets, sale of investment securities, etc. and financing CF by the repayment of long-term borrowings, payment of dividends, etc.

| FY May 15 | FY May 16 | FY May 17 | FY May 18 | FY May 19 |

ROE | 3.83% | 6.44% | 1.99% | 3.36% | 1.99% |

Net income margin | 3.47% | 5.91% | 2.06% | 4.27% | 2.87% |

Total asset turnover [times] | 0.87 | 0.90 | 0.79 | 0.64 | 0.57 |

Leverage [times] | 1.27 | 1.21 | 1.22 | 1.23 | 1.22 |

*ROE = Net income margin × Total asset turnover [times] × Leverage [times].

*Both Net Assets and Capital, which are used in calculation are the average value for the term.

3. Overview of Each Segment

3-1 Creation Segment

In addition to the increase in the sales from the business support services, mainly ATIS traffic information service, consignment services utilizing original products and the kitting service, the sales from the contents services increased in the fourth quarter compared with the previous quarter due to the promotion of usage of contents on platforms operated not by carriers but App Store, Google Play, etc., development of new contents, etc.

ATIS Traffic Information Service

The company released “ATIS on Cloud,” a cloud-type traffic information service that enables users to check the latest traffic events, such as congestion, accidents, and traffic controls, on expressways and ordinary roads nationwide on a map, and it is targeted at corporations in the fields of transportation, including express and chartered buses, distribution, delivery, and moving. As for general users, the company improved the service menu in order to enhance usability, which led to the increased number of fee-paying members.

Entrusted development utilizing original products

Entrusted development related to e-commerce, entrusted development of app services utilizing chat functions, entrusted development of automatic validation systems to improve operational efficiency, etc. grew.

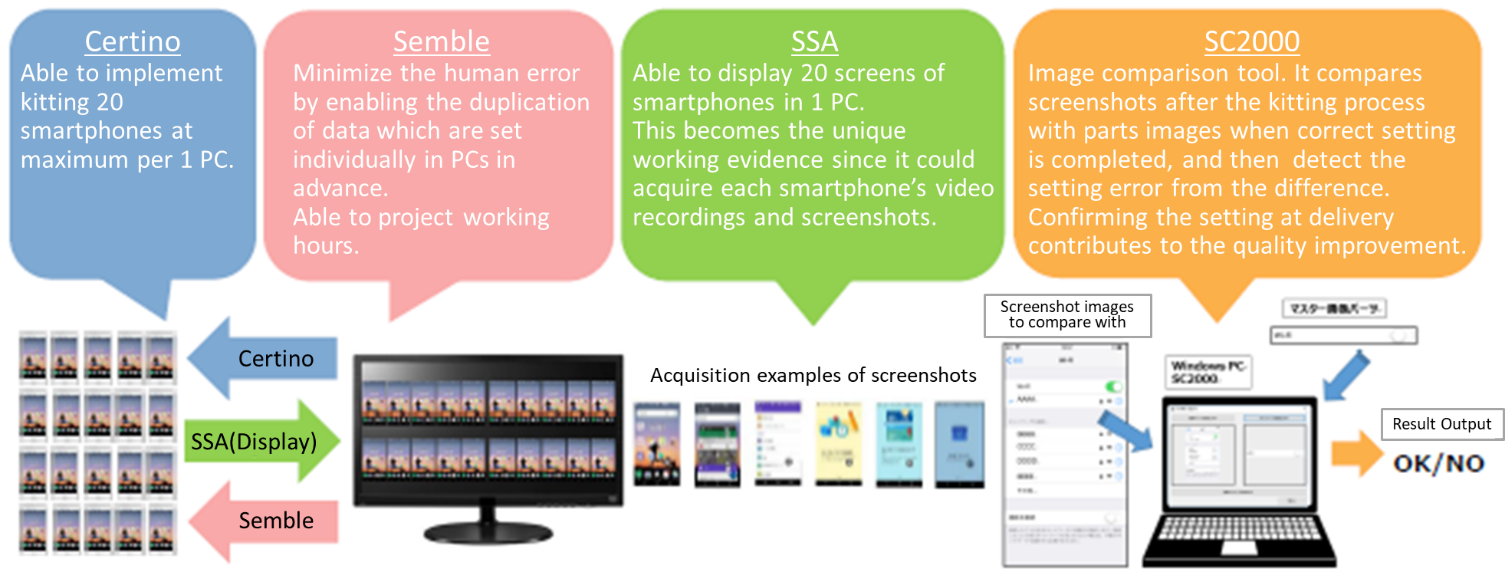

Kitting

A major carrier installed “Kitting-One” and started its operation. It was installed in some stores in the fiscal year May 2019, but it will be installed in major stores nationwide in the fiscal year May 2020. Furthermore, the company will enhance sales promotion for its installation by other carriers. “Kitting-One” is an RPA (Robotic Process Automation) tool for kitting combining “Certino,” “Semble,” “SSA” and “SC2000.” It is a one-stop solution that covers all processes from kitting to the check of quality problems (setting errors and mistakes).

While the growth of the domestic mobile communication market centered on smartphones targeting consumers is at pause, the market targeting corporates is expanding with popularization of “Workstyle Reform” and “IoT.” Also, in the kitting market, a demand for bringing operational efficiency by utilizing tools is on a rise in place of performing simple work where one provides individual services for setting manually for each device. The company expects the kitting market to grow further with an increasing number of corporations utilizing IT devices, such as smartphones, tablets, and PC, and the rising demand for switching to new terminals, and an expansion of demand for tools to bring efficiency in kitting operation is also anticipated.

(Source: the company)

Expansion of “Inaseri,” establishment of “Volunteer Management System for Municipality,” etc.

As for sale of fresh fish in cooperation with the intermediate wholesalers who belong to the Wholesales Co-operative of Tokyo Fish Market, the company carries out development and operation of “Isenari” (B2B), a service of online sale of marine products for restaurants of intermediate wholesalers who belong to the Wholesales Co-operative of Tokyo Fish Market, and also Inaseri Market (B2C), an EC site where general consumers can purchase high-quality seafood of Toyosu Market handpicked by wholesalers, and also started “Inaseri Marche,” an actual store, as a new area of the services business. The company takes efforts in expanding customer base and transaction volume.

In addition, the company established “Volunteer Management System for Municipality” that allows each municipality to operate volunteer work smoothly and efficiently as Tokyo 2020 Olympics and Paralympics are approaching, and also, IP-PBX software (Primus III) cleared all the connection tests and technical confirmation by a major domestic carrier.

3-2 Solutions Segment

Sales in the comprehensive solution services centered on consigned development (development from scratch) utilizing the know-how nurtured in the creation segment augmented in various fields, and the company started a service for buying and selling used terminals (the peripheral business of terminals) for which the company expects synergies with the kitting service.

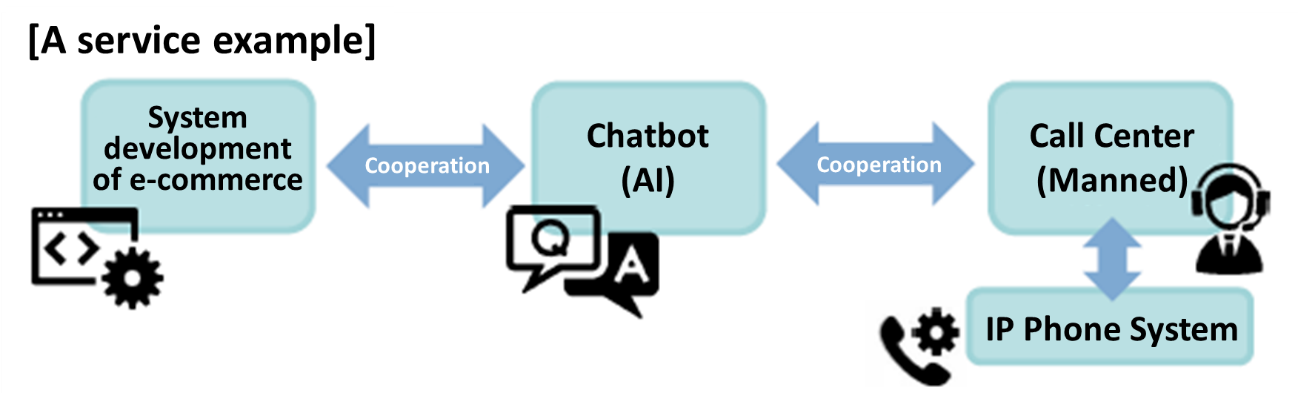

Comprehensive Solution Services

As enterprises are actively investing in IT and the reform of ways of working and the Olympics in 2020 will produce positive effects, the demand for systems related to AI, IoT and security is growing. The company is successfully taking in the demand by offering services of a high level of customer satisfaction through independent system development and by providing seamless services with cross-sectoral approaches.

(Source: the company)

Undertaking of test operation of a chatbot for the official website of Tokyo metropolitan cemetery “TOKYO Cemetery Walk”

The company took over the test operation of the chatbot “Repl-AI” (an automatic dialogue system responding to enquiries) for the Tokyo Metropolitan Park Association during the period for promoting the use of Tokyo metropolitan cemetery in 2019 on the official website of the metropolitan cemetery “TOKYO Cemetery Walk.” The company’s “chatbot construction service” combines AI, automatic answering programs, etc. and constructs a system according to its application in a short period of time.

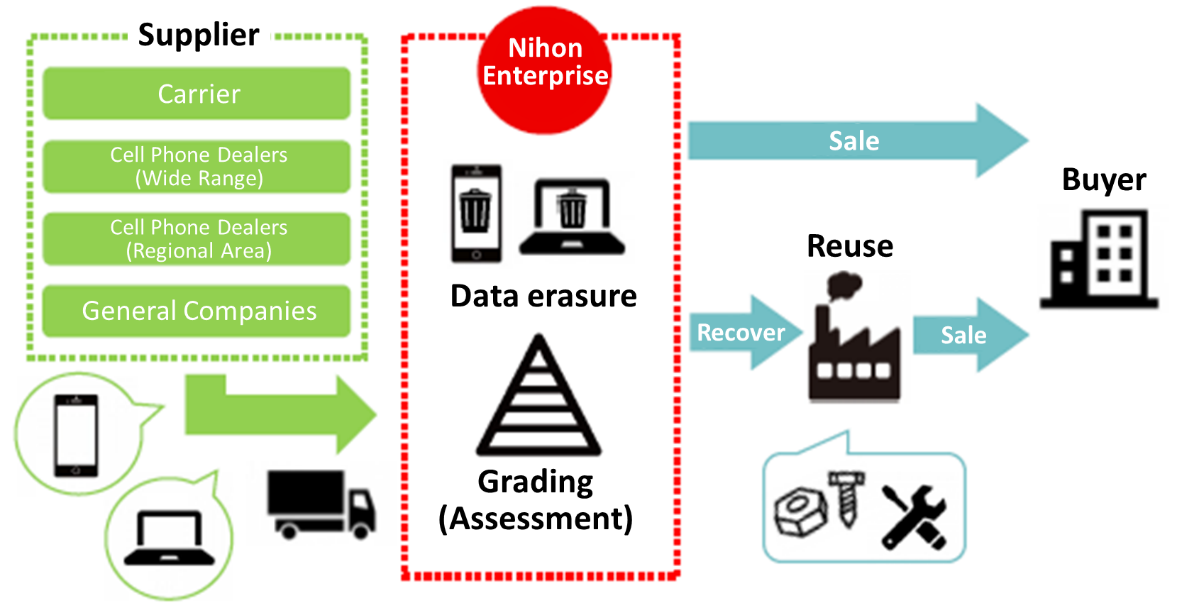

Service of buying and selling used terminals (the peripheral business of terminals)

The company is steadily increasing suppliers, mainly cell phone dealers and business partners for installing support tools or contracting kitting work, and also acquiring new customers by expanding the number of devices handled. In addition, the company joined Reuse Mobile Japan (on June 28, 2019), an industrial body, in order to provide services like “data erasure,” which is inevitable for sale of used terminals, “grading,” which influences price, etc. Reuse Mobile Japan is a business body established with a purpose to ensure the healthy growth of the reused mobile terminal market and consumer protection by formulating guidelines for reused mobiles, etc. The company has already started the development of a data erasure software acknowledged by Reuse Mobile Japan.

(Source: the company)

4. Fiscal Year ending May 2020 Earnings Forecast

4-1 Consolidated Earnings

| FY May 19 Act. | Ratio to Sales | FY May 20 Est. | Ratio to Sales | YoY |

Sales | 3,413 | 100.0% | 3,850 | 100.0% | +12.8% |

Operating Income | 242 | 7.1% | 275 | 7.1% | +13.5% |

Ordinary Income | 292 | 8.6% | 300 | 7.8% | +2.5% |

Net Income | 97 | 2.9% | 160 | 4.2% | +63.6% |

*Unit: million yen

The company estimates an increase of sales by 12.8% year on year and an increase of operating income by 13.5% year on year.

Sales are expected to be 3,850 million yen, up 12.8% year on year. The sales from the business support services and system development and operation services are projected to continue to grow, and the sales from the contents services are also expected to increase by promoting platforms excluding carriers. Also, the company anticipates the new business, i.e., kitting and the peripheral business of purchase and sale of used terminals, to grow.

As for profit, operating income is projected to rise 13.5% year on year to 275 million yen. While ordinary income will grow only 2.5% year on year due to the decrease in revenue from subsidies, net income will augment 63.6% year on year to 160 million yen with extraordinary losses subsiding, etc.

For dividends, the company plans to pay a term-end dividend of 2 yen/share (estimated payout rati 50.2%).

5. Conclusions

The kitting tool was installed in a major mobile carrier. It was installed in some stores in the fiscal year May 2019, but major stores nationwide will install it in the fiscal year May 2020. The company normally charges one license per device, but it was installed by specifying an upper limit. However, as replacement and renewal of terminals must be carried out on a continuous basis, they have potential to become a stable source of income supporting the company’s revenue in a medium-to-long term. The company is the only one providing this type of tool as kitting requires analysis of OS (iOS, Android, etc.) and tracking of version upgrade, which act as the barriers for market access. Other companies seem unable to follow them. The company hopes to establish a position as a de facto standard sooner than any other company.

Furthermore, the company anticipates synergies between the kitting service and the business of buying and selling used terminal. This is because the business partners of the kitting service might become the important suppliers of used terminals. As terminals and SIM cards will be sold separately in October 2019 as part of reduction in cell phone charges, the used terminal market is projected to be more active with an increase in distribution amount.

While promoting cost reduction, sales from the important products are growing. We will pay attention to future developments.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎Corporate Governance Report

Updated on December 18, 2018

Basic Policy

The corporate group believes that, with respect to decision-making by the board of directors to attain its management goals, corporate governance means maximization of shareholder interests by monitoring legality by the audit and supervisory board, deterring unlawful business execution of the directors, and establishing an organizational system that realizes more expeditious company decision-making and clarifies management responsibility, while seeking to avoid or mitigate business risks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 4-1-3 Plan for developing successors to the CEO and others

Our company runs “Ueda-juku (workshop)” for executives, with the aim of fostering qualities required for managers, such as “strategic thinking” and “leadership,” but we have not produced a plan for successors to the CEO and others. From now on, we will think of producing a plan for developing candidate successors and supervising them. When producing plans, we will take a sufficient amount of time and resources to realize the development of candidate successors.

Principle 5-2 Design and announcement of managerial strategies and plans

Our company does not announce a mid-term management plan, but at the beginning of each term, we disclose target figures for the term. Target figures are determined while considering capital cost, reviewing our business portfolio, and allocating management resources to equipment, R&D, and human resources investments. We will make efforts to explain concrete measures for attaining target figures to shareholders in an understandable manner via brief financial reports, briefing sessions, and daily IR activities.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 Policy on constructive dialogue with shareholders

The company has established the IR basic policy which is composed of “Basic attitude to IR activities and disclosure criteria,” “Methods for disclosing information and information fairness,” “Future outlook,” and “IR quiet period” and publishes the policy through its website.

●Basic IR policy: URL: http://www.nihon-e.co.jp/ir/management/line.html

Currently, the company proactively takes the following action based on the above-mentioned IR basic policy from the perspective of constructive dialogue with its shareholders:

1) The company encourages day-to-day cooperation among departments by designating the Executive Managing Director and general manager of the Administration Department as a person in charge of internal information management and having him govern departments involved in IR activities, including the Accounting Department, the General Affairs Department, the Human Resources and Public Relations Department.

2) In the company, the person in charge of internal information management responsibly grasps and manages information on each department of the company and, based on accurate management decision, efforts are exerted to make organic cooperation and information are frequently shared with other departments related to IR activities, so that cooperation among departments can be enhanced.

3) The division engaged in public relations and IR activities not only proactively responds to inquiries made from its shareholders and investors on the phone and through IR events such as small meetings, but also hosts financial results briefings for analysts where explanations are given by the president or the executive managing directors.

4) The company reports to the board of directors on IR activities and feedback on such activities as well as situations of shareholder transfer at all times in order to share information with the directors and the auditors.

5) The company pays attention to management of insider information, and therefore, in communicating with investors, it brings up topics concerning improvement of corporate value as the subject of discussion, using previously published information of the company.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Nihon Enterprise Co., Ltd. (4829) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/