Bridge Report:(4826)Nihon Enterprise the first half of fiscal year ending May 2020

Katsunori Ueda, President | Nihon Enterprise Co., Ltd. (4829) |

|

Corporate Information

Market | TSE 1st Section |

Industry | Information, Communications |

President | Katsunori Ueda |

HQ Address | Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

Year-end | May |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥256 | 40,133,000 shares | ¥10,274 million | 2.0% | 100shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥2.00 | 0.8% | ¥3.99 | 64.2 x | ¥123.18 | 2.1 x |

*The share price is the closing price on January 17. ROE is the values at the end of the pervious term. BPS is from the second quarter financial report.

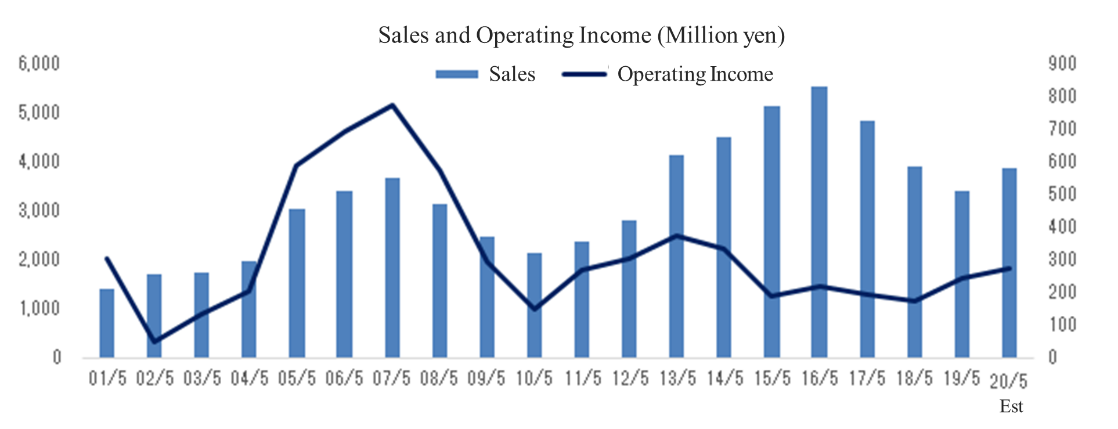

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May. 2016 Act. | 5,530 | 219 | 252 | 327 | 8.07 | 3.00 |

May. 2017 Act. | 4,838 | 192 | 229 | 99 | 2.45 | 2.00 |

May. 2018 Act. | 3,892 | 174 | 257 | 166 | 4.11 | 2.00 |

May. 2019 Act. | 3,413 | 242 | 292 | 97 | 2.44 | 2.00 |

May. 2020 Est. | 3,850 | 275 | 300 | 160 | 3.99 | 2.00 |

*Estimates are those of the Company.

*Unit: million-yen, yen

This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the first half of fiscal year ending May 2020 and the fiscal year ending May 2020 earnings forecast.

Table of Contents

Key Points

1. Company Overview

2. The First Half of Fiscal Year ending May 2020 Earnings Results

3. Overview of Each Segment

4. Fiscal Year ending May 2020 Earnings Forecast

5. Conclusions

<Reference: CSR and ESG activities>

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the fiscal year May 2020, sales and operating income grew 9.2% and 74.6%, respectively, year on year. The sales of the Creation business increased 13.4%, due to the growth of kitting services and the bottoming-out of contents for ending dependency on carrier platforms, and the sales of the Solutions business, which offers comprehensive solutions, rose 3.6% year on year mainly thanks to the entrusted development of systems. While sales grew, SGA decreased due to the reversal of provision for doubtful receivables, etc. Accordingly, the operating income rate increased 2.8 points to 7.6%.

- There is no revision to the full-year forecast, and it is estimated that sales and operating income will increase by 12.8% and 13.5%, respectively, year on year. In the second half, it is expected that kitting services and system development in the fields of AI, IoT, and security will keep performing well, the quarterly sales of contents services will increase, and the peripheral business of terminals (Solutions business), which buys and sells used terminals, will grow. The term-end dividend is to be 2 yen/share (estimated payout rati 50.2%).

- The progress rate toward the full-year forecast is 45.7% for sales (for the same period of the previous year, the progress rate toward the full-year results: 47.2%) and 48.9% for operating income (for the same period of the previous year, the progress rate toward the full-year results: 31.8%). There are no concerns over the future of kitting services and system development, which are driving forces for business, and it is expected that the shift to non-carrier platforms in contents services will progress and the peripheral business of terminals will be carried out on a full-scale basis. Considering them, there is a high possibility that full-year results will be better than the forecast. The momentum of these businesses is good, so the outlook for not only the current term but also the following terms is bright. Accordingly, investors have keen interests in the company, and at the session for briefing the results for the second quarter held on January 15, questions and answers were exchanged actively. We would like to expect from their future developments.

1. Company Overview

Nihon Enterprise is a “mobile solutions company” providing services that includes development of smartphone applications for consumers, enterprise system development, mobile kitting, e-commerce, AI chatbot, and other services. Its two main business segments include the "creation segment," where applications and systems using in-house IP (Intellectual Property) are provided, and the "solutions segment," where institutional software and system development are conducted. Furthermore, Nihon Enterprise works actively on validation businesses including IoT, and blockchain.

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014.

[Management Philosophy]

Nihon Enterprise’s employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its “Mission Statement, Doctrine, and Five Spirits” and “Nihon Enterprise Management Principles.” President Katsunori Ueda believes that it is Nihon Enterprise`s obligation to maximize “shareholder” in the long run, thus “enables to make effective use of capital and maximize it by not wasting a single yen” below its appropriate belief and action. In the first place, president Katsunori Ueda founded Nihon Enterprise with the strong motivation of “contributing to society through its businesses” and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services.

Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children’s institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan.

1-1 Corporate Group: 8 Consolidated Subsidiaries, 1 Non-Consolidated Subsidiaries

The Company has 8 domestic subsidiaries including Dive Co., Ltd., which plans, develops, and operates apps and websites, supports business, etc. ,which provides traffic information, etc., 4QUALIA Co., Ltd., which provides applications and system development and operations and debugging, etc., and One, Inc., which provides voice communication related solutions, Promote Inc., which provides kitting support tools, etc., Aizu Laboratories, Inc., Yamaguchi renewable energy factory Co., Ltd., which operates the business of solar power generation, which carries out the Smart Communications Business, and Inaseri Co., Ltd, which handles planning, development and management of electric business transaction service, “Inaseri.” The domestic non-consolidated subsidiary is NE Yin Run Co., Ltd., which carries out the Contents Operation Business.

1-2 Outline of the business

The businesses are divided into the Creation Segment and the Solutions Segment, and the sales composition ratio in the fiscal year ended May 2019 was 54.3% and 45.7%, respectively.

Creation Segment: Providing application systems using its own Intellectual Property (IP)

The company offers services utilizing its own rights and assets, including contents services, business support services, and solar power generation.

In contents services, the company offers a comprehensive e-book service, entertainment contents, such as video games, and lifestyle contents, such as “ATIS Traffic Information Service (traffic information),” “Woman’s Rhythm Diary (healthcare),” “Flea-Ma.jp (flea market),” and “Inaseri Market,” a fresh seafood EC site for consumers.

Content services | Entertainment | ・A comprehensive e-book service, which covers various genres, including popular comics, novels, business-related books, how-to books, magazines, and photo collections, and entertainment contents

|

Lifestyle | ・Practical app mounted with helpful functions for users who want to know detailed information on expressways and general roads around Japan, including the detailed congestion map, which estimates time required for traveling between ICs, and live traffic videos, which show the conditions of roads users will reach on a real-time basis ・A support app for “beauty” and “health” of women, which has been downloaded by 200,000 users, and flea market app that handles all genres of products, including brand goods, fashion items, and electrical appliances ・An EC site where general consumers can purchase seafood products handpicked by wholesalers

|

On the other hand, in the business support service, the company develops and sells “Kitting-One,” a tool for supporting the reduction of workload and the improvement in productivity and accuracy in kitting, and offers “Kitting Service (provision of services),” in which the company conducts kitting with “Kitting-One” on behalf of clients, “ATIS Traffic Information Service,” which also offers “iGPS on NET,” a vehicle dynamics control cloud, “Sound Solution,” in which the company develops and sells the IP-PBX software “Primus” for providing a business environment that is excellent in operability and flexibility, and the operation of “Inaseri,” an online seafood shop of wholesalers belonging to Tokyo Fish Market Wholesale Cooperative. In order to develop new businesses and services, the company engages in demonstration projects for IoT, blockchain, etc.

Business support service | Kitting | ・Development and sale of “Kitting-One,” a tool for supporting kitting that could reduce workload and improve “productivity” and “accuracy,” and provision of kitting services based on “Kitting-One” |

ATIS Traffic Information | ・Provision of “ATISon Cloud,” a cloud-type traffic information service, which enables users to check the latest traffic conditions, including congestions, accidents, and traffic controls of expressways and general roads around Japan with a map, to corporations that operate businesses of transportation, such as expressway buses and chartered buses, logistics, delivery and moving ・Recurring-revenue business, including the provision of data to cable television, community FM, newspaper publishers, etc. ・“iGPSonNET Premium,” which combines GPS (IP wireless), the road traffic information-linked vehicle dynamics control service, and the function to manage estimated results | |

Sound Solution | ・Development and sale of “Primus,” IP-PBX software that offers a business phone environment that is excellent in operability and flexibility, and “Primus SDK,” a VoIP engine | |

Education, procurement, and sightseeing | ・e-learning, reverse auction, promotion of sightseeing, etc. | |

Inaseri | ・Seafood selling service based on the linkage between “Inaseri,” e-commerce of fresh fish for restaurant operators, and the wholesalers of Tokyo Fish Market Wholesale Cooperative | |

Demonstration project | ・Demonstration project for electric power transactions utilizing the blockchain and the multi-functional “SMART PLUG” (collaborative project with ENERES Co., Ltd.) | |

Other | Solar power generation | ・Regional vitalization project with renewable energy in Yamaguchi Prefecture. Provision of an environment where it is possible to learn the environment and renewable energy by utilizing solar panels set on the roofs of gymnasiums of elementary and middle schools |

(Source: the company)

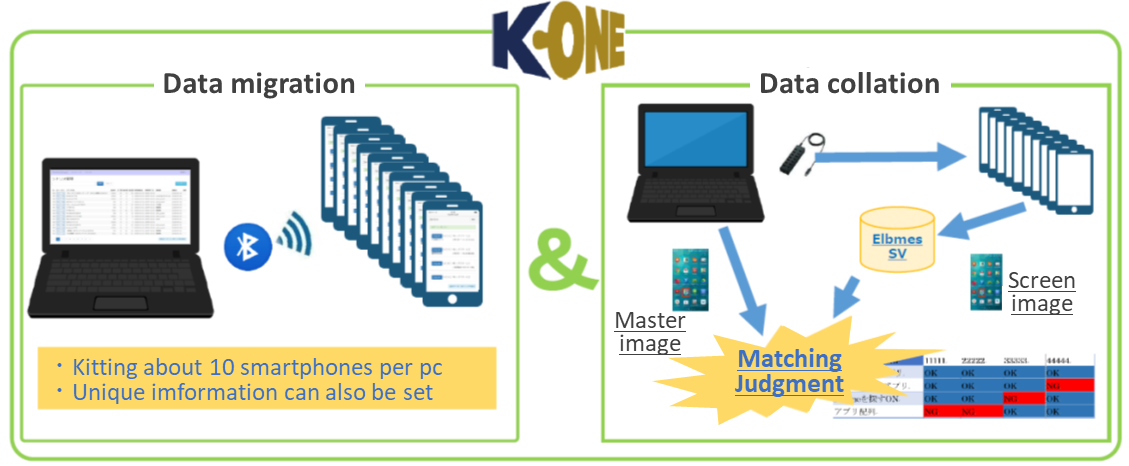

“Kitting-One,” a tool for supporting kitting

The kitting support tool “Kitting-One” is an RPA tool for supporting individual settings at the time of installation of terminals (setting of terminals, installation of necessary apps, etc.), which has been conducted manually for each unit. The processes from kitting to the identification of quality problems (setting errors and mistakes) are covered on a one-stop basis. “Kitting-One” is installed in users’ PCs, and the users conduct kitting by using “Kitting-One.” The company gains revenue from the license for every terminal for which a user conducted kitting. The clients of the company include telecommunications carriers and leading dealers of cellphones, and the kitting support tool is used when these clients conduct kitting in response to requests from buyers of terminals, such as enterprises and financial institutions. It contributes to the reduction of workload and the improvement in productivity and accuracy, and it is the only one kitting support tool for smartphones, which has no competing products. It has been adopted by leading enterprises, and the number of terminals for which kitting was conducted amounts to about 50,000. In August 2019, the company obtained the patent (No. 6560065).

While the growth of the domestic mobile communication market centered on smartphones targeting consumers is at pause, the market targeting corporates is expanding with popularization of “Workstyle Reform” and “IoT.” Also, in the kitting market, a demand for bringing operational efficiency by utilizing tools is on a rise in place of performing simple work where one provides individual services for setting manually for each device. The company expects the kitting market to grow further with an increasing number of corporations utilizing IT devices, such as smartphones, tablets, and PC, and the rising demand for switching to new terminals, and an expansion of demand for tools to bring efficiency in kitting operation is also anticipated.

(Source: the company)

Solutions Business: Undertaking the development of business software and systems for enterprises

It can be classified into system development/operation services and other services. In the system development/operation services, the company concentrates on comprehensive solution services, mainly entrusted development (from scratch) utilizing the know-how nurtured through the Creation business, and engages in the development of service of buying and selling used terminals. In the comprehensive solution services, the company undertakes the development of apps, websites, etc., and offers one-stop services, including the design and development of servers, operation monitoring, debugging, customer support, and consulting.

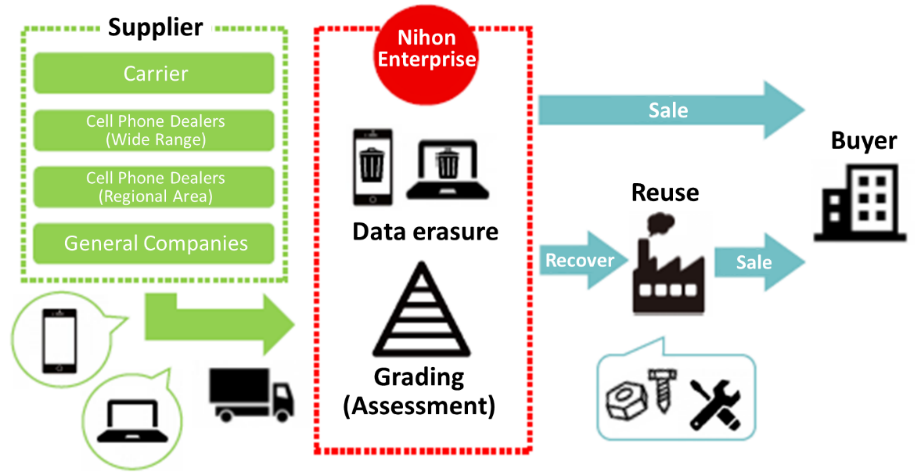

On the other hand, the clients of the service of buying and selling used terminals (peripheral business of terminals) are steadily increasing, as the main clients are enterprises and cell phone distributors that have adopted the kitting service (provision of services) and the support tool. The efforts for procuring terminals stably are progressing. In addition, the company is increasing new clients, as it deals with an increasing number of products.

On June 28, 2019, the company joined Reuse Mobile Japan, with the aim of offering services, such as “deletion of data,” which is indispensable for the sale of used terminals, and “grading,” which determines prices. The Telecommunications Business Act was partially amended, to separate mobile terminals and communication charges fully from October 2019. Accordingly, the discounting of prices of mobile terminals is curbed, so the demand for used terminals is expected to grow (The market of used terminals is already expanding mainly for smartphones.).

System development and operation services | Solution services The company focuses on the systems related to AI, IoT, and security, whose demand is growing, and offers comprehensive solution services, including consulting, development, maintenance, and operation, according to market needs. |

Service of buying and selling used terminals This service is to buy used terminals and sell them to buyers. In addition to rigorous grading, the company aims to offer refurbishment services (to make used terminals, etc. look like brand new ones). | |

Other | Ad agency business, etc. |

(Produced based on the reference material of the company)

2. The First Half of Fiscal Year ending May 2020 Earnings Results

2-1 First Half of Consolidated Earnings

| 1H of FY May 19 | Ratio to Sales | 1H of FY May 20 | Ratio to Sales | YoY |

Sales | 1,611 | 100.0% | 1,759 | 100.0% | +9.2% |

Gross profit | 747 | 46.4% | 772 | 43.9% | +3.3% |

SG&A | 670 | 41.6% | 637 | 36.2% | -4.9% |

Operating Income | 77 | 4.8% | 134 | 7.6% | +74.6% |

Ordinary Income | 96 | 6.0% | 154 | 8.8% | +60.3% |

Net Income | 27 | 1.7% | 107 | 6.1% | +286.1% |

*Unit: million yen

Sales and operating income grew 9.2% and 74.6%, respectively, year on year.

Sales were 1,759 million yen, up 9.2% year on year. The sales of the Creation business increased 13.4%, due to the growth of kitting services and the bottoming-out of contents for ending dependency on carrier platforms, and the sales of the Solutions business, which offers comprehensive solutions in the fields of AI, IoT, security, etc., rose 3.6% year on year.

Operating income was 134 million yen, up 74.6% year on year. Cost rate rose, due to the making of large-scale kitting transactions, the shift to non-communications carrier platforms in the contents services, etc., but it was offset by sales growth, and gross profit increased 3.3% year on year. On the other hand, SGA declined 4.9% year on year, as advertisement cost augmented 19 million yen, but there were the reverse of provision for doubtful receivables (32 million yen), the drop in personnel costs (12 million yen), etc.

Net income was 107 million yen, significantly larger than that in the same period of the previous yea 27 million yen. This is because tax burden ratio dropped from 52.3% to 22.9% thanks to the improvement of profits and losses of subsidiaries, etc.

Creation Segment Sales and Income

| 1H of FY May 19 | Ratio to Sales | 1H of FY May 20 | Ratio to Sales | YoY |

Content Service Segment | 640 | 69.9% | 639 | 61.5% | -0.2% |

Business Supports | 241 | 26.3% | 367 | 35.4% | +52.5% |

Others (Solar Power Generation) | 34 | 3.8% | 32 | 3.1% | -6.0% |

Segment Sales | 917 | 100.0% | 1,040 | 100.0% | +13.4% |

Income before Consolidation Adjustments | 271 | 29.6% | 336 | 32.4% | +24.2% |

*Unit: million yen

As for contents services, the company concentrated on platforms for non-communications carriers, such as AddStore and GooglePlay, while the market of platforms operated by communications carriers was shrinking. As a result, the sales of entertainment content, mainly video games, increased. As for business support services, sales increased 52.5% year on year, due to the significant growth of kitting services thanks to the increase in the provision of services and revenue from license fees. As for other services (solar power generation), performance remains stable, although it slightly fluctuates due to weather, etc.

Solutions Segment sales and income

| 1H of FY May 19 | Ratio to Sales | 1H of FY May 20 | Ratio to Sales | YoY |

System Developing, Operating | 690 | 99.4% | 719 | 99.9% | +4.1% |

Others (Overseas) | 3 | 0.6% | 0 | 0.1% | -84.7% |

Segment Sales | 694 | 100.0% | 719 | 100.0% | +3.6% |

Income before Consolidation Adjustments | 75 | 10.8% | 94 | 13.1% | +25.5% |

*Unit: million yen

As for system operation and development, the company offered comprehensive solutions based on the capability of the corporate group while enterprises actively invested in IT, and then made some transactions. In the section of other businesses in the first half of the fiscal year of May 2019, revenue from advertisement agency business (3 million yen) was posted.

2-2 Second Quarter (September-November) Consolidated Earning

| 19/5-1Q | 2Q | 3Q | 4Q | 20/5-1Q | 2Q |

Sales | 775 | 835 | 794 | 1,007 | 871 | 888 |

CGS | 405 | 458 | 456 | 536 | 484 | 502 |

SG&A | 337 | 332 | 337 | 307 | 304 | 333 |

Advertising | 29 | 26 | 35 | 41 | 36 | 38 |

Operating Income | 32 | 44 | 1 | 163 | 82 | 52 |

Ordinary Income | 43 | 52 | 31 | 164 | 93 | 60 |

COS Margin | 52.3% | 54.9% | 57.4% | 53.3% | 55.6% | 56.6% |

SG&A Margin | 43.6% | 39.8% | 42.4% | 30.5% | 34.9% | 37.6% |

*Unit: million yen

The sales for the 2nd quarter (Sep. to Nov.) were 888 million yen, up 1.9% from the previous quarter. The sales of the Creation business declined 11.7% year on year, due to the decline of kitting services as a recoil from large-scale transactions, but the sales of the Solution business grew 25.4% year on year, as the company met the strong demand for IT investment by offering comprehensive solutions.

Operating income was 52 million yen, down 37.0% year on year. While the cost rate rose due to the increase in the ratio of sales of the Solution business, SGA augmented due to the recoil from the reverse of provision for doubtful receivables (32 million yen) in the first quarter. Accordingly, operating income dropped. Considering these effects, operating income virtually increased. As profitability improved steadily, operating income increased 16.4% year on year.

Creation Segment Sales and Income

| 19/5-1Q | 2Q | 3Q | 4Q | 20/5-1Q | 2Q |

Content Service Segment | 331 | 309 | 303 | 347 | 322 | 317 |

Business Supports | 122 | 118 | 106 | 152 | 211 | 156 |

Others | 19 | 15 | 10 | 17 | 19 | 13 |

Sales | 473 | 443 | 420 | 517 | 552 | 487 |

Operating Income | 145 | 125 | 96 | 181 | 178 | 158 |

*Unit: million yen

For the second quarter (Sep. to Nov.), sales were 487 million yen, down 11.7% from the previous quarter, and profit was 158 million yen, down 11.3% from the previous quarter. In contents services, the company is shifting to non-communication carrier platforms. Sales declined 1.4% from the previous quarter, but the rate of decline is lower than that in the first quarte 7.4%. From the same period of the previous year, sales grew by 10.0%. As for business support services, sales dropped 25.9% from the previous quarter due to the recoil from the large-scale transactions for kitting in the first quarter, but the revenue from licenses of “Kitting-One,” a tool for supporting kitting, doubled, and the sales for the second quarter hit a record high (since the fiscal year May 2017).

Solutions Segment sales and income

| 19/5-1Q | 2Q | 3Q | 4Q | 20/5-1Q | 2Q |

System Developing, Operating | 300 | 390 | 373 | 487 | 319 | 400 |

Others (Overseas) | 1 | 2 | 1 | 2 | 0 | 0 |

Segment Sales | 301 | 392 | 374 | 489 | 319 | 400 |

Income before Consolidation Adjustments | 28 | 46 | 32 | 91 | 45 | 49 |

*Unit: million yen

For the second quarter (Sep. to Nov.), sales were 400 million yen, up 25.4% from the previous quarter, and profit was 49 million yen, up 7.9% from the previous quarter. In the system development and operation services, the company focused on the fields of AI, IoT, security, etc., and exerted the synergy of the corporate group based on the development capacities of subsidiaries, meeting enterprises’ demand for IT investment.

2-3 Financial Conditions and Cash Flow (CF)

Financial Conditions

| May 2019 | November 2019 |

| May 2019 | November 2019 |

Cash | 4,345 | 4,571 | Payables | 130 | 116 |

Receivables | 567 | 486 | Taxes Payable | 79 | 97 |

Current Assets | 5,154 | 5,281 | Net defined benefit liabilities | 55 | 59 |

Tangible Assets | 372 | 363 | Interest-Bearing Liabilities | 277 | 317 |

Intangible Assets | 334 | 312 | Liabilities | 822 | 890 |

Investments and Others | 174 | 175 | Net Assets | 5,213 | 5,242 |

Noncurrent Assets | 881 | 851 | Total Liabilities and Net Assets | 6,035 | 6,133 |

*Unit: million yen

The total assets as of the end of the second quarter were 6,133 million yen, up 97 million yen from the end of the previous term. Cash and deposits increased due to the improvement in operating CF thanks to favorable performance and collection of accounts receivable. The capital-to-asset ratio was 80.6% (81.4% as of the end of the previous term).

Cash Flow(CF)

| 1H of FY May 19 | 1H of FY May 20 | YoY | |

Operating cash flow(A) | 111 | 331 | +220 | +198.0% |

Investing cash flow (B) | -61 | -39 | +21 | - |

Free・Cash Flow(A+B) | 49 | 291 | +242 | +488.0% |

Financing cash flow | -105 | -55 | +49 | - |

Cash and Equivalents at the end of term | 4,077 | 4,492 | +414 | +10.2% |

*Unit: million yen

An operating CF of 331 million yen was secured as pretax profit was 161 million yen (96 million yen in the same period of the previous year), depreciation was 88 million yen (96 million yen in the same period of the previous year), and corporate income tax was negative 38 million yen (negative 56 million yen in the same period of the previous year).

3. Overview of Each Segment

3-1.Creation Segment

Content services

While shifting to platforms operated by non-communications carriers, such as AppStore and GooglePlay, the company endeavors to offer trendy content.

For “ATIS Traffic Information Service” provided by the consolidated subsidiary ATIS Corporation, the company added the dashcam function to “ATIS Traffic Information,” a personal app with which users can check traffic conditions, such as congestions, accidents, and traffic controls, of expressways and general roads around Japan in real-time with map view (December 25, 2019). It can be used just by activating the app after setting a smartphone at a commercially available smartphone holder (The duration of recording at the time of detection of shock can be set at 10 sec., 30 sec., or 60 sec. and manual recording is also possible). The company plans to enhance the functionality of the dashcam and enrich the services of the app “ATIS Traffic Information” further.

(Source: the company)

Kitting

As for the domestic mobile communication market centered around smartphones, the market targeted at corporations is growing, due to the “reform of ways of working” and “IoT” while the growth of the market targeted at consumers lost some steam. In the kitting industry, there is a growing demand for streamlining with tools breaking away from the manual setting of each unit. Since enterprises will utilize IT devices, such as smartphones, tablet devices, and PCs, more frequently and replace old terminals with new ones, the kitting market is expected to grow further, and the demand for tools for streamlining kitting work is estimated to increase. Under these circumstances, “Kitting-One” was adopted by leading carriers, and an increasing number of leading distributors of cell phones, etc. use it as well as kitting services (provision of services).

“Inaseri”

The consolidated subsidiary Inaseri Co., Ltd. operates “Inaseri (BtoB),” a site for e-commerce of fresh fish for restaurant operators, and “Inaseri (BtoC),” a site for e-commerce of fresh fish for general consumers, where customers can purchase high-quality seafood of the Toyosu Market. In “Inaseri,” the company started selling fruit and vegetables to be served with fish dishes in December 2019, to meet the demand for the enrichment of the product lineup. The company will make efforts to increase the number of registered shops and promote sales further. On the other hand, in the “Inaseri Market,” the company released the subscription-type “Mystery package including products handpicked by wholesalers of the Toyosu Market (6,000 yen per month)” in November 2019. The company plans to increase users by enhancing PR activities while creating SNS accounts.

IP-PBX service

The consolidated subsidiary “and One Inc.,” which offers the IP-PBX software “Primus,” formed an alliance with Cronos Inc. (Minato-ku, Tokyo; representative directo Yoshiki Maezawa), and released “T-Macss,” a cloud-type call system, which was developed by combining a cloud system, IVR (automatic audio response), and SMS (Short Mail), in December 2019.

“T-Macss” is equipped with IVR, which forwards incoming calls to operators with an automatic response, ACD (automatic call distributor), which gives audio messages to request calling customers to wait, and functions for SMS. When there are too many incoming calls, the system will call back as soon as an operator becomes available or notify customers of the URL of a website, to alleviate the stress of customers, and it can be expected to retain potential customers by sending SMS messages that are opened with a high probability (The event in which the number of incoming calls exceeds the number of telephone lines of a call center is considered as a problem because it leads to the loss of opportunities to retain potential customers). and One Inc. can offer integrated services, including switching equipment, IVR, ACD, and SMS, by selling the IP-PBX software “Primus” and “T-Macss” together.

Cronos Inc. is a software developer that excels in the design and operation of infrastructure and offers services while using SMS as a communication tool. In addition, “T-Macss” has been adopted for “bizpla,” a recruitment management system of FUCHART Co., Ltd., and it is used for recruitment activities of enterprises as “T-Macss for bizpla,” a CTI system for recruitment management.

Demonstration experiment

The consolidated subsidiary Aizu Laboratory, Inc. has participated in “the project for supporting the demonstrative research on technologies related to renewable energy” hosted by Fukushima Prefecture for 3 years since 2017. As part of this project, the company started “demonstrative demand response (DR) simulation” in Fukushima Prefecture, etc. in December 2019. DR means, at the time of skyrocketing of wholesale prices or the decline in power system reliability, the change of patterns of electric power consumption by consumers (curtailment of power consumption) under the assumption that electricity charges are set and incentives are paid. In “demonstrative DR simulation,” the company distributes about 1,500 “SMART PLUGs” to about 300 general households in Fukushima Prefecture, etc., requests power saving via a dedicated smartphone app, studies the effects of incentives that are offered according to the power-saving state and the effects of recording and analysis of power consumption, and gauges the effectiveness of DR.

3-2 Solutions Segment

Sales in the comprehensive solution services centered on consigned development (development from scratch) utilizing the know-how nurtured in the creation segment augmented in various fields, and the company started a service for buying and selling used terminals (the peripheral business of terminals) for which the company expects synergies with the kitting service.

Comprehensive Solution Services

While enterprises are increasing investments in IT, the company focuses on the systems related to AI, IoT, and security, whose demand is growing due to the reform of ways of working, the Olympics, etc. and strengthens comprehensive solution services covering consulting, development, maintenance, and operation.

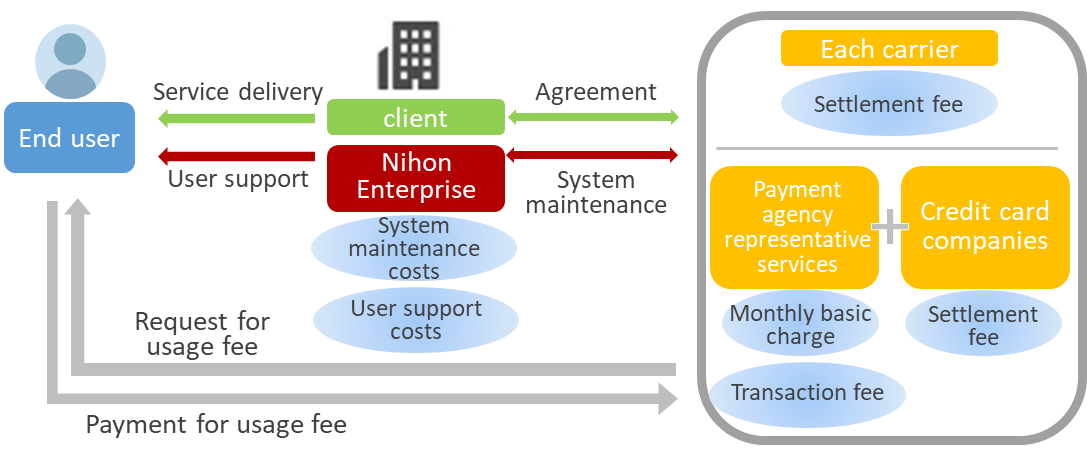

It has already produced some results for leading companies in the fields of electronics, amusement, security, etc. For example, in the system for the “monthly payment settlement service,” the company offers consulting services and then one-stop services, including the development, operation, and maintenance of systems.

Monthly payment service introduction development support

(Source: the company)

| A payment system that enables us to deal with the individual payment procedure more easily with ID of contracted communication carriers. Not only this system it easy to use, but it also reduces exits on EC sites. In addition, Because the Company contacts with carriers, it can streamline the procedure. |

Conclusion of a contract for introducing clients with the U.S. headquarters of Zoom

In January 2020, the consolidated subsidiary Dive Co., Ltd., which plans, develops, and operates apps and websites and supports business operation, concluded a contract for introducing clients with the U.S. headquarters of Zoom (California, the U.S.).

Zoom Video Communications, Inc. operates a unified communication platform mainly handling videos. Especially, “Zoom,” which is a software-based web/video conference solution, is highly evaluated for its high quality, high definition, and usability that allows users to attend a conference anywhere with any device. It has been adopted by many enterprises and groups around the world, and it is being spread rapidly in Japan.

This contract is aimed at introducing Japanese enterprises that plan to adopt “Zoom” to Zoom Video Communications and was signed because Dive’s capability of marketing targeted at corporations was recognized. Dive, which develops apps for leading corporations, concentrates on the alliances with North American enterprises in order to differentiate its business from competitors’ and the conclusion of this contract is the first one with a North American enterprise.

Service of buying and selling used terminals (the peripheral business of terminals)

According to a research firm, the number of used terminals circulated in Japan is about 1.3 million in 2018 (1.17 million in 2017). In 2020, the number of used terminals in the market is estimated to reach 3 million. The scale of the global market is about 10 times that of the domestic market, and the scale of the U.S. market is about 2 times that of the domestic market, so the domestic market has a significant potential for growth. Since there are concerns over the leakage of personal information, the refurbishment of terminals is conducted in the service of buying and selling used terminals. For suppliers that are indispensable for business expansion, the company plans to utilize existing clients in existing businesses and find new suppliers from a wide range of fields.

(Source: the company)

4. Fiscal Year ending May 2020 Earnings Forecast

4-1 Consolidated Earnings

| FY May 19 Act. | Ratio to Sales | FY May 20 Est. | Ratio to Sales | YoY |

Sales | 3,413 | 100.0% | 3,850 | 100.0% | +12.8% |

Operating Income | 242 | 7.1% | 275 | 7.1% | +13.5% |

Ordinary Income | 292 | 8.6% | 300 | 7.8% | +2.5% |

Net Income | 97 | 2.9% | 160 | 4.2% | +63.6% |

*Unit: million yen

There is no revision to the full-year forecast, and it is estimated that sales and operating income will increase by 12.8% and 13.5%, respectively, from the previous term.

Sales are estimated to be 3,850 million yen, up 12.8% from the previous term. In the second half, too, the business support service, including kitting services (Creation business), and the service of undertaking system development and operation in the fields of AI, IoT, and security (Solution business) are estimated to perform well. In addition, through the shift to non-communications carrier platforms, the sales of content services will increase, and the revenue from the peripheral business of terminals will start contributing gradually.

As for profit, operating income is projected to rise 13.5% year on year to 275 million yen. While ordinary income will grow only 2.5% year on year due to the decrease in revenue from subsidies, net income will augment 63.6% year on year to 160 million yen with extraordinary losses subsiding, etc.

For dividends, the company plans to pay a term-end dividend of 2 yen/share (estimated payout rati 50.2%).

5. Conclusions

The progress rate toward the full-year forecast is 45.7% for sales (the progress rate to the full-year results in the same period of the previous yea 47.2%), 48.9% for operating income (31.8%), 51.6% for ordinary income (33.0%) and 67.5% for net income (28.6%). There are no concerns over the future of kitting services and system development, which are driving forces for business, and it is expected that the shift to non-carrier platforms in contents services will progress and the peripheral business of terminals will be carried out on a full-scale basis. Considering them, there is a high possibility that full-year results will be better than the forecast. The momentum of these businesses is good, so the outlook for not only the current term but also the following terms is bright. Furthermore, the company will launch subscription-model services of “ATIS Traffic Information,” a personal app mounted with the dashcam function, and “Inaseri Market,” and so on. Accordingly, investors have keen interests in the company, and at the session, for briefing, the results for the second quarter held on January 15, questions and answers were exchanged actively. We would like to expect from their future developments.

<Reference: CSR and ESG activities>

The company recognizes that its group’s social mission is to contribute to the physical and mental happiness of all stakeholders, including customers, business partners, shareholders, investors, local communities, and employees, through its business under its corporate ethos: “Our true purpose is to pursue professionalism as a merchant and contribute to society and cultural development through our activities,” which has been upheld since the start-up of business, and engages in the following activities as part of its CSR and ESG activities.

In the environmental (E) aspect, the company makes efforts to actualize a sustainable society through power generation with solar panels (Ube-shi, Yamaguchi Prefecture) for environmental conservation.

In the social (S) aspect, the company concentrates on the support for creation of new technologies, and sponsors “INNO-vation Program,” which was organized by the Ministry of Internal Affairs and Communications and is operated by KADOKAWA ASCII Research Laboratories, Inc. as an institution for conducting tasks for supporting innovators (pioneers) who will develop a future Japan. In addition, since it donated almost all of the ordinary income in the initial year of business to the Japanese Red Cross Society, social welfare councils, orphanages, etc., it has been donating 1% of net income every year. At the time of the Great East Japan Earthquake, the company gave donations via the Japanese Red Cross Society, while hoping that the conditions of victims will get better as soon as possible. In addition, the company puts energy into sound information transmission, by obtaining the DCA qualification approved by Internet-Rating observation Institute (I-ROI), etc.

(Source: the company)

In the aspect of governance (G), upholds “To stick to the customer-first policy” as one of the management principles for satisfying customers, and makes sincere efforts to meet the needs of customers regarding quality, prices, and services. As a commitment to quality, the company strives to offer value exceeding customers’ expectations under the slogan: “Unrivaled Quality,” and operates a “Customer Support Center” by itself, to meet customers’ requests accurately and swiftly and reflect them in services and products. Like this, the company makes efforts to improve business and quality.

For stakeholders, the company makes efforts to disclose the situations of management and business activities timely and appropriately, to deepen their understanding of the company.

Especially for shareholders, the company holds a general meeting of shareholders at a hotel in Tokyo in August every year so that many shareholders can attend, while considering it is a valuable opportunity to directly communicate with shareholders. In addition, in order to deepen their understanding of the company, the company sets a space for experiencing the company’s services and introduces its products and services with videos at the venues of general meetings of shareholders. For employees, the company strives to develop a working environment caring for their work-life balance, including “Two overtime-free days per week” and “Childcare support,” so that employees can exert their respective abilities to a sufficient degree, and supports in-house club activities, to help nurture friendships among employees and enhance their health.

In addition, as measures for protecting information, the company set the “basic policy for information security” and the “policy for protecting personal information,” to appropriately protect and manage information assets handled by the company. Furthermore, the company acquired “ISO27001 Certification,” which is an international standard of the information security management system (ISMS).

|

|

(Source: the company)

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎Corporate Governance Report

Updated on August 23, 2019

Basic Policy

The corporate group believes that, with respect to decision-making by the board of directors to attain its management goals, corporate governance means maximization of shareholder interests by monitoring legality by the audit and supervisory board, deterring unlawful business execution of the directors, and establishing an organizational system that realizes more expeditious company decision-making and clarifies management responsibility, while seeking to avoid or mitigate business risks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 4-1-3 Plan for developing successors to the CEO and others. Our company runs “Ueda-juku (workshop)” for executives, with the aim of fostering qualities required for managers, such as “strategic thinking” and “leadership,” but we have not produced a plan for successors to the CEO and others. From now on, we will think of producing a plan for developing candidate successors and supervising them. When producing plans, we will take a sufficient amount of time and resources to realize the development of candidate successors.

<Principle 4-11: Preconditions for securing the effectiveness of the board of directors and the board of auditors>

The board of directors of our company is composed of up to 7 directors and up to 4 auditors. Our basic policy is to have about 2 outside directors and have outside auditors make up a majority auditors. At present, there are no female or non-Japanese directors or auditors in the board of directors of our company, but we think that diversity and an appropriate scale have been secured so that the board of directors could fulfill its roles and duties effectively. From now on, we will make efforts to secure diversity in the aspects of gender and internationality. Our company also appoints a certified public accountant as an auditor who possesses appropriate knowledge of financial accounting.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 Policy on constructive dialogue with shareholders

The company has established the IR basic policy which is composed of “Basic attitude to IR activities and disclosure criteria,” “Methods for disclosing information and information fairness,” “Future outlook,” and “IR quiet period” and publishes the policy through its website.

●Basic IR policy: URL:http://www.nihon-e.co.jp/ir/management/line.html

Currently, the company proactively takes the following action based on the above-mentioned IR basic policy from the perspective of constructive dialogue with its shareholders:

1) The company encourages day-to-day cooperation among departments by designating the Executive Managing Director and general manager of the Administration Department as a person in charge of internal information management and having him govern departments involved in IR activities, including the Accounting Department, the General Affairs Department, the Human Resources and Public Relations Department.

2) In the company, the person in charge of internal information management responsibly grasps and manages information on each department of the company and, based on accurate management decision, efforts are exerted to make organic cooperation and information are frequently shared with other departments related to IR activities, so that cooperation among departments can be enhanced.

3) The division engaged in public relations and IR activities not only proactively responds to inquiries made from its shareholders and investors on the phone and through IR events such as small meetings, but also hosts financial results briefings for analysts where explanations are given by the president or the executive managing directors.

4) The company reports to the board of directors on IR activities and feedback on such activities as well as situations of shareholder transfer at all times in order to share information with the directors and the auditors.

5) The company pays attention to management of insider information, and therefore, in communicating with investors, it brings up topics concerning improvement of corporate value as the subject of discussion, using previously published information of the company.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved.

To view back numbers of Bridge Reports on Nihon Enterprise Co., Ltd. (4829) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/