Bridge Report:(6058)VECTOR fiscal year ended February 2022

Keiji Nishie Founder and Chairman | VECTOR INC. (6058) |

|

Company Information

Marketing | TSE Prime Market |

Industry | Service |

President | Keiji Nishie |

HQ Address | Akasaka Garden City 18th Floor, 4-15-1 Akasaka, Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,278 | 47,674,039 shares | ¥60,927 million | 17.1% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥18.00 | 1.4% | ¥62.93 | 20.3x | ¥259.38 | 4.9x |

*The share price is the closing price on April 20. Each figure is from the financial results for the Fiscal Year ended February 2022.

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2019 (Actual) | 29,693 | 2,575 | 2,738 | -2,421 | -52.29 | 0.00 |

Feb. 2020 (Actual) | 36,821 | 2,891 | 3,322 | -199 | -4.20 | 0.00 |

Feb. 2021 (Actual) | 37,273 | 2,314 | 2,797 | 486 | 10.21 | 2.00 |

Feb. 2022 (Actual) | 47,351 | 5,248 | 5,201 | 2,071 | 43.46 | 13.00 |

Feb. 2023 (Forecast) | 53,100 | 6,200 | 6,100 | 3,000 | 62.93 | 18.00 |

*Unit: million yen, yen. The forecasts are from the company. Net income is profit attributable to owners of parent. The same applies below.

This Bridge Report reviews on the outlook of Vector Inc.’s earnings results for the fiscal year ended February 2022, its forecast of the fiscal year ending February 2023.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended February 2022 Earnings Results

3. Fiscal Year ending February 2023 Earnings Forecasts

4. Medium-Term Profit Plan

5. Management Strategies

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Under the vision: “Making People Happy by Delivering Excellent Products, Services and Solutions to the World,” Vector supports corporate communication strategies in a multifaceted manner mainly in the PR and advertising business. With the competitive advantage of having a broad range of infrastructure for distributing products, the company aims to secure the No. 1 position in the global PR field as a “fast company in the advertisement field” targeting an advertisement market with a scale of 6 trillion yen.

- In the term ended February 2022, sales increased 27.0% year on year to 47,351 million yen. The PR and advertising business, press release business, and media business posted double-digit sales growth. Operating income increased 126.8% year on year to 5,248 million yen. The PR and advertising business and press release distribution business were growth drivers, while the HR business move into the black. The fund business also contributed. Both sales and profit exceeded the revised forecasts. The dividend forecast was revised upward from 8 yen/share to 13 yen/share, as the company produced strong financial results and raised its payout ratio target from 20% to 30%.

- For the term ending February 2023, the company forecasts a 12.1% year-on-year rise in sales to 53.1 billion yen and a 18.1% year-on-year increase in operating income to 6.2 billion yen, a double-digit increase in both sales and profit. The company expects the impact of the novel coronavirus pandemic to be about the same as in the previous term. The dividend is expected to be 18.00 yen/share, up 5.00 yen/share from the previous term. The payout ratio is expected to be 28.6%.

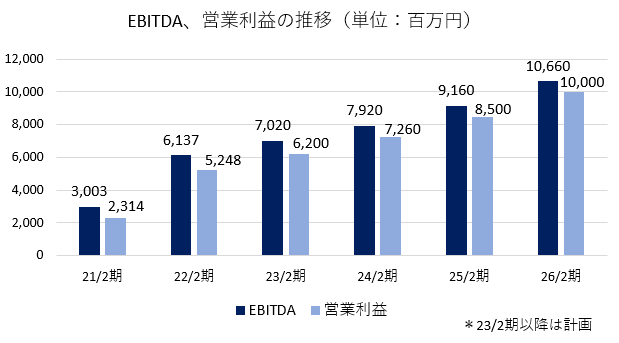

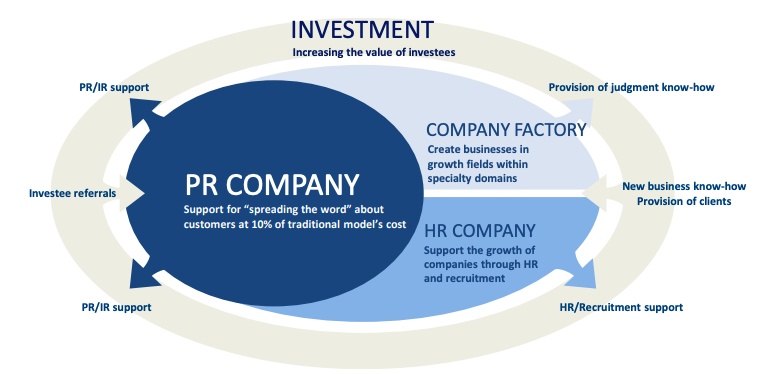

- EBITDA and operating income for the term ending February 2026 are projected to be 10.7 billion yen and 10 billion yen, respectively. The company aims to support the growth of client companies through the four areas of PR COMPANY, which aims to help companies promote their products, HR COMPANY, which provides support in the areas of human resources and recruitment, COMPANY FACTORY, which creates new businesses, and INVESTMENT, which grows investment business, with the aim of achieving a continuous expansion of the corporate group.

- While some businesses were affected by the novel coronavirus pandemic, the company's unique features, such as its extensive infrastructure for distributing "things," ensured them to capture corporate marketing demand, and profitability improved with the completion of structural reforms in the HR business, resulting in significant increases in sales and profit. The company expects to continue its strong performance in the current term and expects both the video release business and the media CMS business to move into the black after posting losses in the previous term.

- The company's goal is to become the "fast company" in the advertising industry, targeting the advertising market, which is said to have a scale of 6 trillion yen, while aiming for the top position in the global PR industry. We would like to keep an eye on their progress on measures toward their four areas.

1. Company Overview

Under the vision: “Making People Happy by Delivering Excellent Products, Services and Solutions to the World,” Vector supports corporate communication strategies in a multifaceted manner mainly in the PR and advertising business. With the competitive advantage of having a broad range of infrastructure for distributing products, the company aims to secure the No. 1 position in the global PR field as a “fast company in the advertisement field” targeting an advertisement market with a scale of 6 trillion yen.

1-1 Corporate History

Established in March 1993 by Mr. Keiji Nishie (Founder and Chairman) for the purpose of operating sales promotion business. To conduct businesses with higher growth potential, the company shifted to a business structure centered on the PR business in April 2000 and began to aggressively operate its business with the goal of becoming the No. 1 company in the PR industry. He has established various companies to support PR from a wide range of aspects. Furthermore, in recent years, the company has been continuously expanding its services and strengthening its structure to provide comprehensive support for corporate communication strategies, beyond the conventional field of PR services.

Listed on the Mothers of Tokyo Stock Exchange in 2012. In 2014, the company stepped up to the First Section of the Tokyo Stock Exchange.

In April 2022, the company got listed on the TSE Prime Market.

1-2 Management Philosophy

The company's vision is “Making People Happy by Delivering Excellent Products, Services and Solutions to the World.”

In addition, the company presents Vector's Rock, a list of thoughts and ideas employees should have and actions they should take.

Become Professional | To become a professional in this industry, one must be incredibly well versed in all its intricacies. Recognize the way you are, have strong confidence, apply yourself diligently each day, contribute to customers, and by doing so control the industry. That’s what being professional means to us. |

Restrained Passion | We have passion and we understand how important that is. Cold pizza is out of the question to eat. Of course, we are also careful not to get overly excited though. That’s why we praise employees for showing what we call “restrained passion.” |

Take Action | You can’t create anything without first taking the initiative. Don't ask with a serious face whether to act before thinking or think before acting. Vector is made up of a group of people who take action, with speed. |

Clear Goals | We have clear objectives and recognize this as critical to our operations. We constantly look to get creative by using our imagination. A cornerstone of our philosophy is to let go of everything and receive success, because we know in that way, success is sure to come. |

Entrepreneurial Spirit | We value creating new business and we have gotten where we are today by adopting an entrepreneurial spirit. We take great joy in building something from nothing, and we like to share this enjoyment with others. We prefer this to losing ourselves as can happen to big companies. |

Simplicity | We like to keep work simple. Humans often tend to overcomplicate things, but we believe that people who succeed lead extremely simple lives. That’s something we aspire to. |

Evolution | We are an organization that makes precise plans for everything we do. That’s why we always do the work we are asked to do perfectly. On top of this, we continually read the trends of the times and look to create and improve. This leads to the development of innovative and creative services that revolutionize the industry. |

Be Giving | Our first thought is to give. We understand it’s only natural to want to go out and take. But from the outset we try and see what we have to give. It may seem paradoxical, but good fortune starts with giving. |

Be Genuine | Being genuine is a trait that we see as essential and one of the most important components needed to grow at work. Any problem or issue can be overcome if we just remain genuine. That’s the way we choose to live. It’s simple, yet profound.

|

Think Straight | It’s not as easy as it sounds to think straight, but it can help us solve most problems when it comes to human-related issues. Remember this Vector’s Rock when you feel like complaining. Just remain silent when you feel like saying something hard to express. Dignity is a characteristic that we can develop on our own. |

Client First | Although there are various principles listed in Vector’s Rock, we are well aware that our prosperity is based on those of our clients’. Success in business is gained from contributing to customers, a point we thoroughly understand. |

Be in Tune with the Times | No matter how hard you try, you still need to be in tune with the times. That means reading current trends, being thoroughly prepared and making your own luck. It also means recognizing the potential of a period and tapping into it. This will help to nurture one’s own potential at the same time. Deep contemplation is often a good way of unearthing latent capabilities. |

Full and Beautiful | Both work and life are meant to be fun. Goals are important, but so too is enjoying the moment. Lead a full and beautiful life. These are wonderful words to live by. |

Glory | This is what we are aiming for. Although it seems like a simple concept, it is something that we endeavor to obtain in all facets of our existence. |

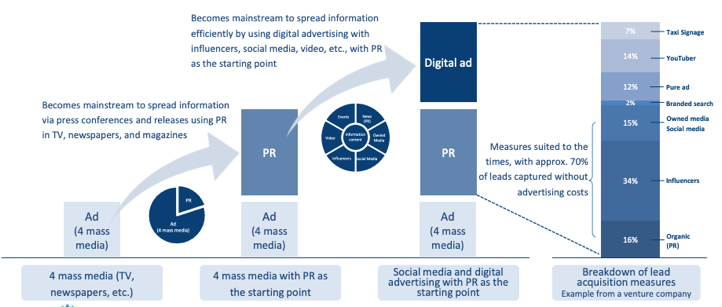

1-3 Business Environment

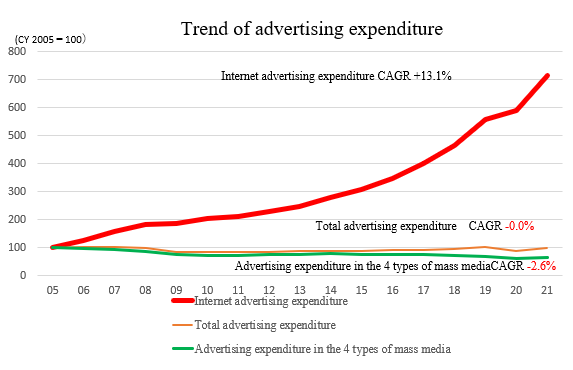

According to Advertising Expenditures in Japan in 2021 (Dentsu Inc.), total advertising expenditures in Japan in 2021 (January-December) recovered significantly to 6,799.8 billion yen, up 10.4% from the previous year, due to the strong growth of Internet advertising expenditures amid the ongoing digitization of society, in addition to the easing of the impact of the novel coronavirus in the second half of the year. While advertising expenditures in the four mass media (newspapers, magazines, radio, and television) increased 8.9% year on year, Internet advertising expenditures grew significantly by 21.4% year on year, exceeding advertising expenditures in the four mass media for the first time since 1996. In terms of the long-term trend since 2005, the growth of Internet advertising has been outstanding.

Out of Internet advertising, Vector expects that the market of video advertisement will expand dramatically as the commercialization of 5G has made it possible to convey richer content than before by improving communication speed and marketing strategies using video content will increase.

(Produced by Investment Bridge)

1-4 Business Description

The company engages in PR and advertising, press release distribution, video release distribution, and media businesses that provide comprehensive support for corporate clients' communication with consumers using the media. The company also engages in the direct marketing business, which focuses on online sales of goods; the HR business, which provides cloud services for personnel evaluation; and the fund business, which invests in venture companies to support their growth.

The basic principle is having a PR retainer contract that provides ongoing consulting services for a certain period. Based on this contract, the company provides a variety of advertising and PR methods owned by the group. The company is currently working on about 2,600 projects a year.

(Produced by Investment Bridge)

The group consists of 50 companies, including Vector Inc. Subsidiaries are responsible for providing services to customers, and Vector Inc. collectively manages various administrative functions for the entire group, including corporate planning, human resources, general affairs, legal affairs, finance, and accounting.

From this term, the fund business will be renamed to the "investment business" in conjunction with the commercialization of investments made in the investment venture business, and the media business will be renamed as the "media CMS business" to better reflect the actual business situation.

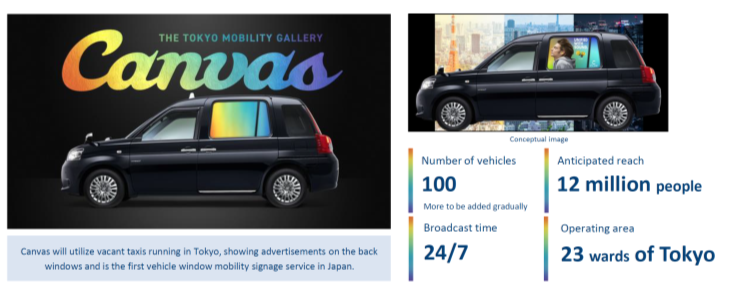

(1) PR and advertising business

In addition to its conventional public relations services, the company offers consulting services to support PR for clients' products and services through strategic PR, which utilizes PR in the advertising and publicity fields. The company also sells advertising through IoT signage services using tablets installed in taxicabs. Most of the work is provided to clients through group companies, each of which has its own specialties such as existing media, blogs, and social media, and operates in different areas such as Japan, China, and ASEAN countries.

|

|

(Taken from the reference material of the company)

(2) Press release distribution business

In response to publicity requests from clients, the company distributes information about client products and services as press releases and is operating a platform business that connects companies and consumers through press releases.

The number of companies using the press release platform PR TIMES is over 65,000 making it the No. 1 platform in Japan, used by 50% of listed companies.

(Taken from the reference material of the company)

(3) Video release distribution business

The company converts news about clients' companies, products, and services into video content and distributes the video to appeal to the target audience via the Internet.

The company has produced and distributed a cumulative total of more than 3,500 videos since the service was launched in 2015.

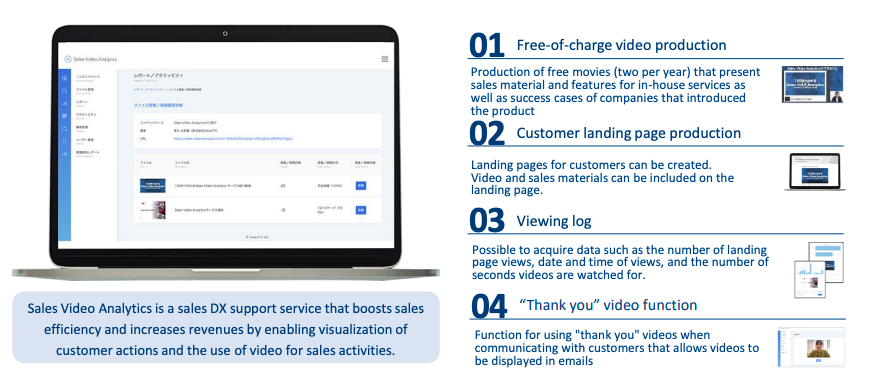

Capturing the change in communication methods due to the impact of the novel coronavirus, the company has developed a new video-based service, Sales Video Analytics, which it began offering in January 2022. Sales Video Analytics is the first SaaS model product that uses the power of video and data for DX in sales activities.

(Taken from the reference material of the company)

(4) Direct marketing business

The company operates the D2C (Direct to Consumer) business, which develops and sells health and beauty-related products and services via the Internet.

Sales of the Vitabrid C series, one of the company's core products, have grown rapidly, by about four times in four years.

The company is also generating synergies by utilizing the knowledge and experience gained from its own D2C business for its PR and advertising business.

(Taken from the reference material of the company)

(5)Media CMS business

In addition to providing services of supporting the building and operation of owned media for clients, the company operates its own media with the aim of generating advertising revenues.

The company is focusing on SaaS-type CMS sales in anticipation of future growth.

(6) HR business

The company provides consulting services to companies to support the installation and operation of HR evaluation systems and HR evaluation cloud services.

(7) Fund business

The company invests in venture companies to support their growth. In addition to the investment, the company provides PR and IR support to help increase corporate value.

Twenty-seven companies, including PR TIMES and its subsidiaries, have gone public so far.

(Taken from the reference material of the company)

1-6 Characteristics, Strengths, and Competitiveness

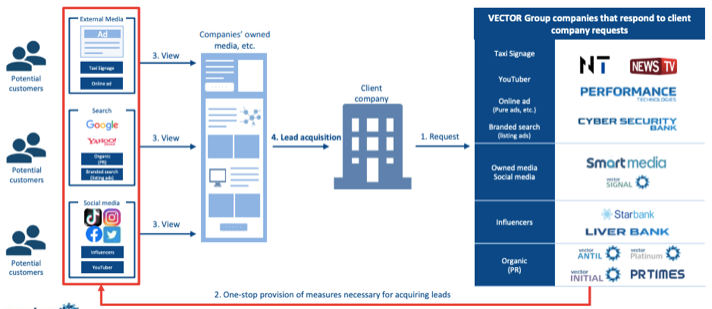

Extensive infrastructure for distributing products

There are a wide variety of ways for companies to popularize their new products and services, including the rapidly expanding Internet, mass media (TV, newspapers, magazines, and radio), events such as presentations and press conferences, and in-store sales promotions.

On the other hand, because of the high degree of division of labor in the advertising industry, when companies try to use each method, they have to place orders with different companies, which is time-consuming and expensive in many cases.

The company, on the other hand, has a group of 50 companies that provide a wide range of infrastructures necessary for promoting products and can provide one-stop services, thereby reducing costs. The company receives many orders from major advertising agencies, and rather than competing with them, they are differentiating their areas of expertise.

Another of the company's strong competitive advantages is its ability to propose and provide advertising and PR methods that match the needs of companies and the characteristics of their products and services, based on accurate consulting.

2. Fiscal Year ended February 2022 Earnings Results

2-1 Business Results

| FY 2/21 | Ratio to Sales | FY 2/22 | Ratio to Sales | YoY | Ratio to Revised Forecast |

Sales | 37,273 | 100.0% | 47,351 | 100.0% | +27.0% | +4.1% |

Gross Profit | 24,448 | 65.6% | 29,669 | 62.7% | +21.4% | - |

SG&A | 22,134 | 59.4% | 24,420 | 51.6% | +10.3% | - |

Operating Income | 2,314 | 6.2% | 5,248 | 11.1% | +126.8% | +9.4% |

Ordinary Income | 2,797 | 7.5% | 5,201 | 11.0% | +85.9% | +4.0% |

Net Income | 486 | 1.3% | 2,071 | 4.4% | +326.1% | +3.6% |

*Unit: million yen. Net income is profit attributable to owners of parent. The same applies below.

Sales increased, and profit grew considerably.

Sales increased 27.0% year on year to 47,351 million yen. The PR and advertising business, the press release business, and the media business achieved double-digit sales growth.

Operating income rose 126.8% year on year to 5,248million yen. The PR and advertising business and the press release distribution contributed, and the HR business became profitable. Fund business also contributed.

Both sales and income exceeded the revised forecast.

In addition to the strong financial results, the company has raised its dividend forecast for FY2/22 from 8 yen/share to 13 yen/share, as it has raised its dividend payout ratio target from 20% to 30%.

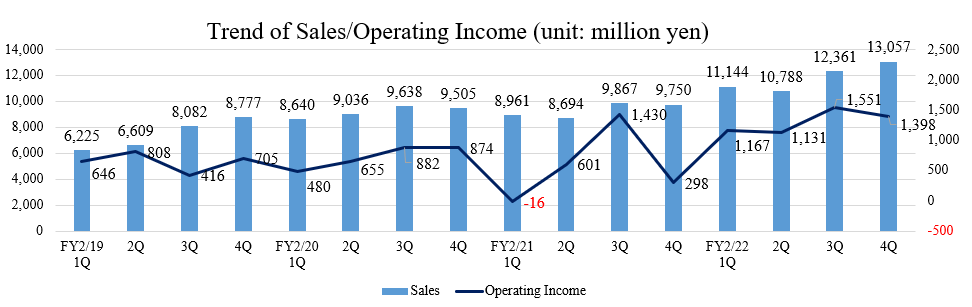

Quarterly sales hit a record high in the fourth quarter, like in the third quarter. Operating income was the highest in the fourth quarter.

2-2 Trend by Segments

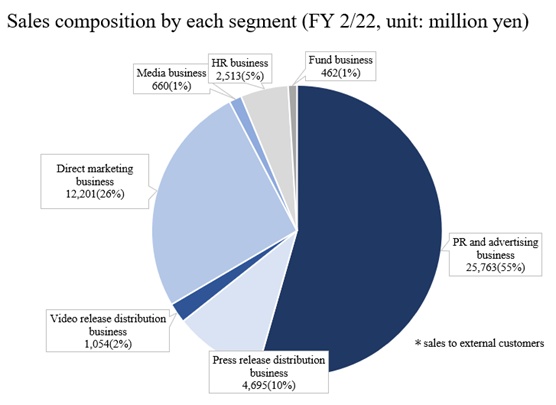

| FY 2/21 | Composition Ratio | FY 2/22 | Composition Ratio | YoY |

Sales |

|

|

|

|

|

PR and advertising business | 17,483 | 46.9% | 25,763 | 54.4% | +47.4% |

Press release distribution business | 3,615 | 9.7% | 4,695 | 9.9% | +29.9% |

Video release distribution business | 1,093 | 2.9% | 1,054 | 2.2% | -3.6% |

Direct marketing business | 11,325 | 30.4% | 12,201 | 25.8% | +7.7% |

Media business | 599 | 1.6% | 660 | 1.4% | +10.2% |

HR business | 2,678 | 7.2% | 2,513 | 5.3% | -6.2% |

Fund business | 477 | 1.3% | 462 | 1.0% | -3.1% |

Total | 37,273 | 100.0% | 47,351 | 100.0% | +27.0% |

Profit of each segment |

|

|

|

|

|

PR and advertising business | 1,159 | 6.6% | 2,125 | 8.2% | +83.3% |

Press release distribution business | 1,301 | 36.0% | 1,834 | 39.1% | +41.0% |

Video release distribution business | -157 | - | -72 | - | - |

Direct marketing business | 716 | 6.3% | 774 | 6.3% | +8.1% |

Media business | 103 | 17.2% | -22 | - | - |

HR business | -905 | - | 236 | 9.4% | - |

Fund business | 102 | 21.4% | 376 | 81.4% | +268.6% |

Adjustment | -5 | - | -3 | - | - |

Total | 2,314 | 6.2% | 5,248 | 11.1% | +126.8% |

*Unit: million yen

*The following sales increase/decrease refers to sales to external customers.

(1) PR and advertising business

Sales and profit grew.

The intermittent declaration of a state of emergency produced some effects, including the partial restriction on corporate marketing activities, but the company actively offered new services in the digital field, including online PR events and support for live commerce utilizing SNS, in which the company has engaged since the previous term, so domestic performance remained healthy.

Taxicab signage, too, performed well. Despite the impact of the novel coronavirus, which includes city blockades in overseas, the company posted its highest sales ever.

(2) Press release distribution business

Sales and profit rose.

Amid the novel coronavirus pandemic, the platform was used by many enterprises as infrastructure, and the number of enterprises using the platform exceeded 65,000 in February 2022. Both sales and profit grew significantly, both hitting record highs.

(3) Video release distribution business

Sales dropped, and loss shrank.

The shift to consulting-type sales, in which video is used to solve corporate marketing issues, on which the company had been working since the previous term, proved effective, and the company remained profitable through the second quarter despite being severely affected by the novel coronavirus. However, sales activities were severely curtailed due to the intermittent declaration of a state of emergency, preventing the company from acquiring a large number of potential customers. Furthermore, the company posted an operating loss from the third quarter onward. Even under such circumstances, the company looked ahead to future growth, and began offering Sales Video Analytics, a support service to DX for its clients' sales activities, in January 2022 to address the challenges posed by changes in communication methods during the pandemic, and to create new businesses.

(4) Direct marketing business

Sales and profit grew.

Aggressive advertising spending in the third quarter bore fruit, with the number of newly acquired customers increasing in the fourth quarter, resulting in record-high quarterly sales. The company posted record-high sales and operating income for the full term. The mainstay Vitabrid C brand continued to perform well. They started selling new body-makeup supplement.

(5) Media business

Sales grew, and loss was posted.

The sales of owned media building services were favorable, but the company posted an operating loss due to prior investments to expand the functions of its SaaS-type CMS in anticipation of future growth.

(6) HR business

Sales dropped, but profit turned positive.

Sales declined due to the termination of sales of the indefinite right to use cloud systems as a measure to prevent the recurrence of the accounting handling problem that occurred in the previous term, but despite the intermittent declaration of a state of emergency, sales of SaaS-type products remained steady, and the effects of the improvement and optimization of the business structure that had been undertaken since the previous term began to show. As a result, the company achieved profitability in the second quarter and for the first time in the full term.

(7)Fund business

Sales dropped, but profit increased.

In the shares held by 100 Capital No. 1 Limited Liability Partnership for Investment, the company posted a loss on the valuation of investment securities, mainly for some of its investees affected by the novel coronavirus, but the company sold some of its shares, and the gain from the sale contributed to the increase in operating income.

2-3 Financial Standing and Cash Flows

◎Balance Sheet Summary

| End of February 2021 | End of February 2022 | Increase/ decrease |

| End of February 2021 | End of February 2022 | Increase/ decrease |

Current Assets | 18,410 | 22,241 | +3,831 | Current Liabilities | 8,930 | 10,820 | +1,890 |

Cash and equivalents | 10,860 | 13,522 | +2,662 | Accounts Payable | 1,039 | 1,827 | +788 |

Accounts Receivable | 4,695 | 6,090 | +1,395 | ST Interest Bearing Liabilities | 1,976 | 2,084 | +108 |

Noncurrent Assets | 11,646 | 9,333 | -2,313 | Noncurrent Liabilities | 6,272 | 4,576 | -1,696 |

Tangible Assets | 720 | 972 | +252 | LT Interest Bearing Liabilities | 4,481 | 3,631 | -850 |

Intangible Assets | 1,302 | 1,077 | -225 | Total Liabilities | 15,202 | 15,397 | +195 |

Investments and Other Assets | 9,624 | 7,283 | -2,341 | Net Assets | 14,854 | 16,178 | +1,324 |

Total Assets | 30,057 | 31,575 | +1,518 | Retained Earnings | 2,590 | 7,076 | +4,486 |

|

|

|

| Total Liabilities and Net Assets | 30,057 | 31,575 | +1,518 |

*Unit: million yen.

Total assets grew 1,518 million yen from the end of the previous term, due to the increases in cash and equivalents and accounts receivable.

Liabilities augmented 195 million yen, due to the rise in accounts payable, etc.

Net assets grew 1,324 million yen.

Capital-to-asset ratio decreased 0.2 points from the end of the previous term to 39.2%.

◎Cash Flows

| FY 2/21 | FY 2/22 | Increase/decrease |

Operating CF | 2,129 | 4,672 | +2,543 |

Investing CF | 644 | -1,002 | -1,646 |

Free CF | 2,773 | 3,670 | +897 |

Financing CF | 209 | -1,060 | -1,269 |

Cash and Equivalents | 10,852 | 13,522 | +2,670 |

*Unit: million yen.

Operating CF and free CF turned positive, and the cash position improved.

2-4 Topics

① Adopting a compensation system with transfer-restricted shares

In April 2022, the company reviewed its executive compensation system and decided to adopt a system for compensation with transfer-restricted shares for directors (excluding outside directors). The plan is subject to approval at the 30th Annual Meeting of Shareholders scheduled to be held on May 26, 2022.

(Purpose of adoption)

The purpose of the plan is to motivate eligible directors to contribute more than before to the enhancement of corporate value over the long term while sharing the benefits and risks of stock price fluctuations with shareholders, to achieve the medium-term profit plan of 10 billion yen in consolidated operating income for the term ending February 2026, and to contribute to the enhancement of corporate value over the medium to long term through the implementation of the plan.

After the end of the General Meeting of Shareholders, the company plans to adopt a remuneration system utilizing transfer-restricted shares to some of the executives and employees of the corporate group for the same purpose as the introduction of the said system.

② Abolishment of shareholders’ special benefit program

In April 2022, the company announced the abolition of its shareholders’ special benefit program.

The company has been implementing the VECTOR Premium Benefits Club, a shareholder benefits program in the form of points, but after careful consideration from the perspective of fair return of profits to shareholders, the company has decided that it is more appropriate to enhance the direct return of profits through dividends.

The company intends to raise the target consolidated dividend payout ratio from 20% to 30% starting with the term-end dividend for the term ended February 2022 and will continue to pay dividends.

The company will continue to position the return of profits to shareholders as an important management issue and work to increase corporate value.

The company terminated the granting of new points after granting points to shareholders holding at least three lots (300 shares) of stock as of February 28, 2022.

The points can be carried over only once (to the next fiscal year). If the points are carried over to the next fiscal year, they can be used during next year's exchange period for preferential products (exchange deadline: the end of July 2023), but they must continue to be listed in the shareholders' register at the end of February 2023.

3. Fiscal Year ending February 2023 Earnings Forecasts

3-1 Earnings Forecasts

| FY 2/22 | Ratio to Sales | FY 2/23(Est.) | Ratio to Sales | YoY |

Sales | 47,351 | 100.0% | 53,100 | 100.0% | +12.1% |

Operating Income | 5,248 | 11.1% | 6,200 | 11.7% | +18.1% |

Ordinary Income | 5,201 | 11.0% | 6,100 | 11.5% | +17.3% |

Net Income | 2,071 | 4.4% | 3,000 | 5.6% | +44.9% |

*Unit: million yen. The forecasted values were provided by the company.

Sales and profit grew

Sales are projected to grow 12.1% year on year to 53.1 billion yen, and operating income is forecast to rise 18.1% year on year to 6.2 billion yen.

The impact of the coronavirus pandemic is assumed to be about the same as in the previous period.

The dividend forecast, too, has been revised upwardly to 18.00 yen/share, up 5.00 yen/share from the previous term.

The expected payout ratio is 28.6%.

3-2 Outlook for each Segment

From this term, the fund business will be renamed to the "investment business" in conjunction with the commercialization of investments made in the investment venture business, and the media business will be renamed as the "media CMS business" to better reflect the actual business situation.

PR and advertising business

The company aims to increase the number of retainer contracts, which is the basis of earnings, and increase average spending per customer through cross-selling.

Targeting 1,000 retainer contracts this term, the company will strengthen customer engagement. For the term ending February 2026, the company aims for 1,750 contracts.

In overseas business, although the impact of the novel coronavirus will remain throughout this term, the company aims for growth beyond the previous term.

Press release distribution business

Aggressive investments will be made to expand new businesses, including PR TIMES, to achieve further growth.

The company plans to make sales of 5,950 million yen (up 22.6% year on year) and an operating income of 1.6 billion yen (down 12.8% year on year). The company positions this as a phase of upfront investment.

The company plans to spend approximately 1.2 billion yen, 3.5 times the amount in the previous term, on advertising to increase the number of users of PR TIMES and other services, as well as 200 million yen to expand PR TIMES into the U.S.

Video release distribution business

The company aims to move into the black for the full term by strengthening its new Sales Video Analytics service.

By training sales personnel, the company will strengthen its ability to make proposals that draw out customer needs, thereby expanding its customer base and improving the average spending per customer.

In the tern ending February 2026, in addition to video release, the company aims to expand Sales Video Analytics and achieve an operating income of 500 million yen.

Direct marketing business

As in the term ended February 2021, the company will conduct advertising at the beginning of the term to maximize revenue and profit for the full term.

Media CMS business (former Media business)

The company will further strengthen the sales of CMS in addition to sales of owned media, aiming to achieve profitability for the full term.

The number of CMS contracts, which will serve as a stable revenue base for the recurring-revenue business model, is targeted at 400 for the current term. The company aims to acquire a cumulative total of more than 1,000 contracts by the term ending February 2026.

HR business

The company aims for an operating income of 350 million yen while making investments to strengthen sales and functions of SaaS-type products.

In the term ending February 2026, the company aims to expand this to 648 million yen by building up recurring earnings.

Investment business (former Fund business)

Based on market trends and the status of investees, the company will sell shares and write down shares to maximize profits.

(Profit Plan by Segment)

| FY2/22 | FY2/23 (Est.) | YoY |

PR and advertising | 2,125 | 2,634 | +23.9% |

Press release distribution | 1,834 | 1,600 | -12.8% |

Video release distribution | -72 | 50 | - |

Direct marketing | 774 | 835 | +7.7% |

Media CMS | -22 | 51 | - |

HR | 236 | 350 | +48.1% |

Investment | 376 | 680 | +80.7% |

Consolidated | 5,248 | 6,200 | +18.1% |

*Unit: million yen.

3-3 Changes in Accounting Processes for the Commercialization of Investments

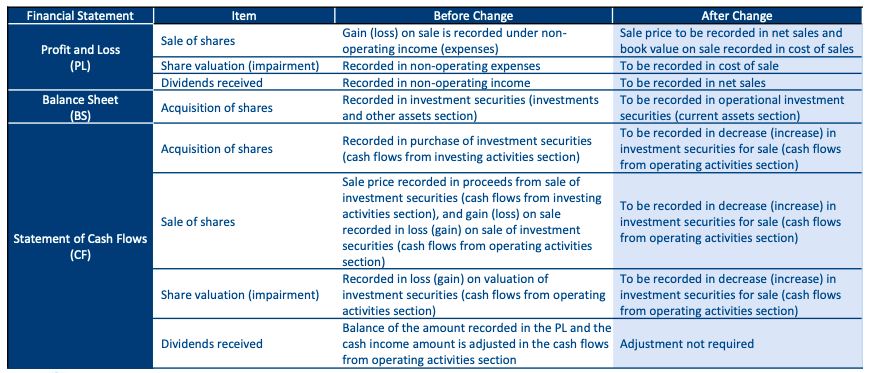

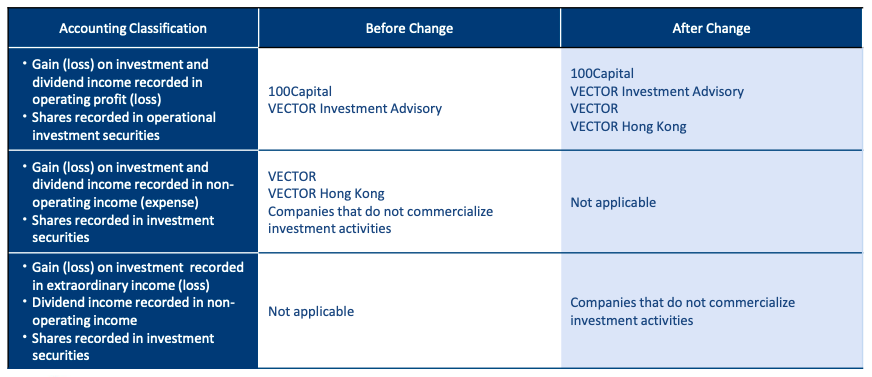

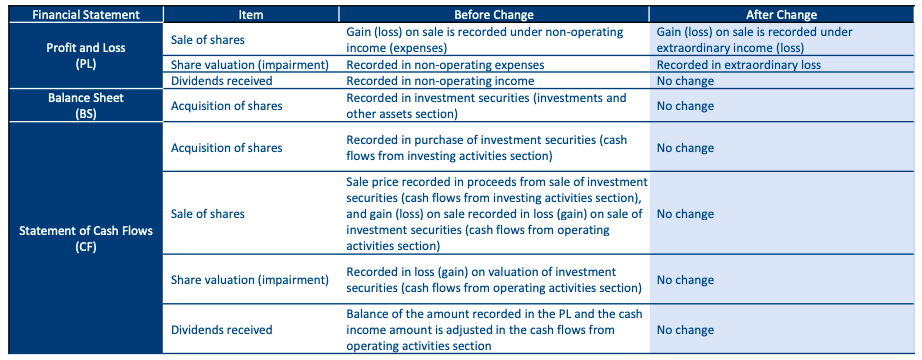

The company will strengthen its structure by increasing the number of employees, etc., and position investment as one of its main businesses by commercializing it. In line with this, the company commercializing the investment will make the following changes in the accounting handling.

(Taken from the reference material of the company)

The four companies that will commercialize investment will be 100 Capital Fund, Vector Investment Advisory, Vector, and Vector Hong Kong.

(Taken from the reference material of the company)

For the companies that do not commercialize their investments, the group's accounting policies were used before the change, but due to the commercialization of the above investments, their accounting policies will be changed as follows to conform to the actual conditions of each company.

(Taken from the reference material of the company)

If the change in accounting processes was applied retroactively to the term ended February 2022, sales would increase 771 million yen to 48,122 million yen, cost of sales would increase 891 million yen to 18,573 million yen, and gross income and operating income would each decrease 120 million yen to 29,549 million yen and 5,128 million yen, respectively, from the pre-change figures.

Non-operating income and expenses will decrease 642 million yen and 770 million yen, respectively, and ordinary income will increase 7 million yen to 5,208 million yen.

4. Medium-term Profit Plan

4-1 Profit Plan

Forecasts for EBITDA and operating income until the term ending February 2026 are as follows. Neither of them includes stock compensation expenses.

They will be updated, when necessary, based on future market conditions and actual results.

EBITDA、営業利益の推移 | Transition of EBITDA and operating profit |

営業利益 | Operating profit |

*23/2期以降は計画 | *FY2/23 and beyond are plans |

単位:百万円 | Unit: million yen |

4-2 Vector Group Business Concept Chart

The company aims to support the growth of client companies through the four areas of PR COMPANY, which aims to help companies promote their products, HR COMPANY, which provides support in the areas of human resources and recruitment, COMPANY FACTORY, which creates new businesses, and INVESTMENT, which grows investment business, with the aim of achieving a continuous expansion of the corporate group.

|

|

(Taken from the reference material of the company)

5. Management Strategies

5-1 Vector Group Business Concept Chart

The vision, initiatives, and measures in the four areas are as follows.

(1) Expansion of the PR COMPANY domain

① Vision and ideal state

Vector was selected as the No. 1 PR company in Asia, according to a global survey on PR.

It has set a new goal of occupying the No. 1 position in the global PR field.

The scale of the domestic PR market is expected to be 100 billion yen, but the company aims to become a fast company in the advertisement field, targeting the global advertisement market, whose scale is estimated to be 6 trillion yen, to expand its domain further.

A “fast company in the advertisement field” implies that it will trigger the revolution of the advertisement industry like a fast fashion company in the apparel industry, with low cost, middle quality, and speedy business.

In addition, the company aims to become “a disrupter in the advertisement field.”

Namely, it is positioned as a player that destroys the order and business models of the existing industry, by utilizing digital technologies, including cloud computing, big data, IoT, and AI.

The company's vision is to "spread good products to the world and make people happy," and it believes that the current era is one in which PR is the starting point for efficiently spreading products through the use of digital advertising, and that they are the only company that can provide a one-stop solution for the measures necessary to acquire prospective client companies. Another of the company's strengths as a fast company is its ability to provide marketing initiatives that are appropriate for the times at less than one-tenth the cost of conventional marketing initiatives.

|

|

(Taken from the reference material of the company)

② Priority items

The company believe that the key areas of focus for strengthening the foundation of the "fast company" concept are 1.DX, 2.Talent, and 3.VC × PR.

1. DX: DX in the advertising industry

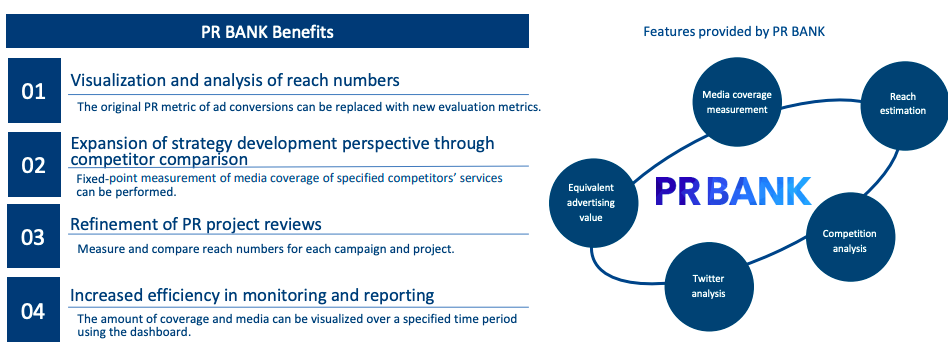

The company aims to increase productivity while improving the cost per client through HIROMERU (Spread) and PR BANK, which will improve business efficiency and provide new value to clients.

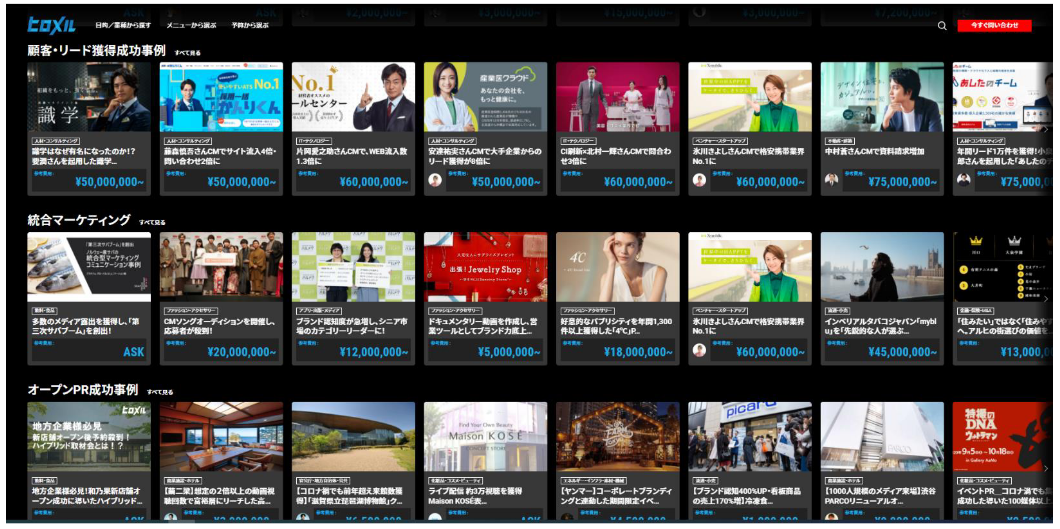

*Hiromeru, an E-commerce site in the advertisement field

A platform for placing an order for a PR service of the Vector Group online, Hiromeru, provide abundant menu with one-stop service and streamline its selling process.

It allows clients to get to know successful cases of popularization that match them and discuss how to promote their products according to their purposes. In addition, they can consult experts via the Internet, before placing an order.

The company aims to obtain 350 inquiries and 35 orders as its immediate goals while increasing brand recognition and functionality.

|

|

(Taken from the reference material of the company)

*Cloud-based PR effectiveness measurement and analysis service, PR PRBANK

The company supports data-driven PR activities for their clients. By utilizing digital data accumulated by the Vector Group and visualizing advertising effects, more precise and effective advertising and PR strategies can be proposed to client companies. The client companies will also be able to allocate their budgets appropriately.

(Taken from the reference material of the company)

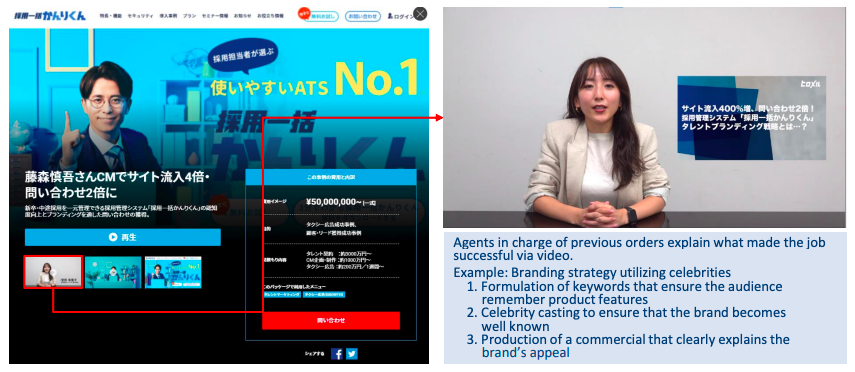

2. Talent: talent communication

The company utilizes well-known celebrities to create a sense of major presence while focusing on the content of the message to raise awareness and maximize the appealing effect. They use celebrities and simple words to make the content of the message concise and promote the service. The company aims to increase the cost per client with a target of 300 companies per year for talent communication.

In April 2022, the company also began offering Talent Bank, which allows companies to use portraits of celebrities in media other than TV, to lower the barrier for companies to use celebrities and create opportunities for celebrities to sign contracts to appear in advertisements.

|

|

(Taken from the reference material of the company)

3. VC x PR: VC that can provide both investment and PR support

The company seeks to maximize the leverage effect of investment by providing PR and IR support, rather than only the financial support provided by conventional VC.

A total of 27 IPOs has been completed.

(2) Creation of COMPANY FACTORY domain

The company will work on the creation of new businesses.

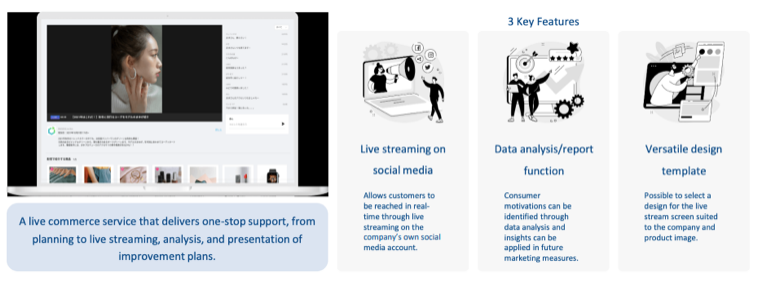

*Live commerce tool, In-house Live Commerce Dekiru-kun

The company is focusing on the future growth potential of live commerce.

In March 2022, the company began offering a live commerce tool, In-house Live Commerce Dekiru-Kun. The company will provide comprehensive support for live communication for client companies by utilizing its PR know-how.

*LIVER BANK (Influencer Works)

In October 2021, the company started offering Influencer Works, a matching platform that connects the various needs of companies with influencers to build new relationships.

In-house Live Commerce Dekiru-Kun

| 「Influencer Works」

|

(Taken from the reference material of the company)

(3) Developing the HR COMPANY domain

*The recruitment matching platform, JOBTV

JOBTV, which completes the entrance to the job-hunting/recruiting process through video, is a service that solves problems faced by both job seekers and companies, utilizing video as the gateway to the recruiting process to achieve speedy matching.

In the job-hunting/recruiting process, job seekers have voiced concerns that "it is difficult to convey one's true value through documents alone" and "it takes time and money to go to information sessions and interviews," while companies have voiced concerns that "it is difficult to understand an applicant's personality until the actual interview" and "it takes time from recruiting to hiring."

With JOBTV, both job seekers and companies upload videos. Job seekers can easily search for company information videos with a design similar to that of major video streaming sites. The companies can also reduce mismatches by confirming their impressions of applicants based on the self-promotion videos uploaded by job seekers.

Since the service was launched in November 2021, more than 1,000 companies have participated.

Utilizing the PR know-how, it has accumulated over the years, the company intends to help revitalize the job hunting market by efficiently and clearly communicating the potential and value of companies and job seekers to better match job seekers with companies.

|

|

(Taken from the reference material of the company)

6. Conclusions

While some businesses were affected by the novel coronavirus pandemic, the company's unique features, such as its extensive infrastructure for distributing "things," ensured them to capture corporate marketing demand, and profitability improved with the completion of structural reforms in the HR business, resulting in significant increases in sales and profit. The company expects to continue its strong performance in the current term, and expects both the video release business and the media CMS business to move into the black after posting losses in the previous term.

The company's goal is to become the "fast company" in the advertising industry, targeting the advertising market, which is said to have a scale of 6 trillion yen, while aiming for the top position in the global PR industry. We would like to keep an eye on their progress on measures toward their four areas.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 9 directors, including 5 independent outside ones |

Auditors | 3 directors, including 2 independent outside ones |

◎Corporate Governance ReportUpdated on December 15, 2021

<Basic Policy>

Our company recognizes being thorough with corporate governance is the most important issue, from the viewpoint that it is indispensable to increase the efficiency and soundness of business administration and develop a fair and highly transparent management system, to achieve stable corporate growth and advance amid the rapidly changing business environment.

In addition, we will upgrade our system for improving the effectiveness of corporate governance, according to changes in the social environment and the enforcement of laws, regulations, etc.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The reasons for non-compliance with the principles of the corporate governance code revised in June 2021 are described below.

【Principle 1-2. Exercise of rights at a general meeting of shareholders】

Supplementary Principle 1-2 ②

Our company makes efforts to dispatch convocation notices for general meetings of shareholders as soon as possible while securing the accuracy of the information mentioned in the notices. For the annual meeting of shareholders held in May 2021, we made an announcement in our website and TDnet prior to the dispatch of convocation notices. We will make continuous efforts to speed up dispatching convocation notices and making electronic announcements that shareholders can ponder matters to be discussed at a general meeting of shareholders to a sufficient degree.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The information regarding the principles of the corporate governance code revised in June 2021 is described below.

Principles | Disclosure contents |

【Principle 1-4. Strategically held shares】 | When our company acquires securities, including shares, the board of directors, the investment committee, or the like deliberate it according to investment scale in accordance with “the regulations on investment management,” “the regulations on authority,” etc. while discussing whether it would contribute to the mid/long-term improvement in our corporate value. After the acquisition, it will be reported to the board of directors regularly. When exercising voting rights for the shares we hold, we discuss each proposal in detail while comprehensively checking whether the exercise of voting rights would contribute to the improvement of the corporate value of the share-issuing company and our company. As of the last update date of this report, our company does not hold any listed shares as strategically held shares that fall under the so-called “cross-held” shares. |

【Principle 2-4. Securing of diversity inside the company including the empowerment of women, etc.】 Supplementary Principle 2-4 ① | Our company considers that the securing of diversity of core personnel would contribute to the mid/long-term improvement in corporate value, and is recruiting and training personnel while eliminating all kinds of discrimination. To secure diversity, we are working on the development of an employment system for actualizing a comfortable working environment for women. Accordingly, the ratio of female employees exceeds 50% in many group companies, and many women are flourishing as managers. We will keep aiming to secure the diversity of core personnel and strive to secure diversity from other aspects, including non-Japanese employees and mid-career workers, while maintaining the current level of services. |

【Supplementary Principle 3-1 ③. Disclosure regarding sustainability】 | Our company launched Vector SDGs PROJECT in October 2021, specified concrete actions, etc. for solving social issues, and disclosed their outline in our website. Regarding the investment in human capital and intellectual property, etc., we put importance on the investment in human capital, which is a major growth driver of our corporate group, and are developing a comfortable working environment through the development of personnel by improving training programs, the upgrade of in-house systems, etc. For measures against climate change, we are currently collecting and analyzing data for climate change scenario analysis. By June 2022, we will analyze the effects of the risk of climate change and earning opportunities on our business activities, revenues, and financial plans, set mid/long-term goals for coping with climate change, and disclose them in accordance with TCFD or an equivalent framework. |

Principle 5-1 【Policy for constructive dialogue with shareholders】 | Our company recognizes the business administration department as a section in charge of IR for promoting constructive dialogue with investors, including shareholders, and strives to communicate with investors, including shareholders, in a constructive manner, based on the organic cooperation among the divisions of our corporate group. We reply positively to requests for dialogue from shareholders and investors, and hold online meetings with investors inside and outside Japan when necessary. Furthermore, we produce reference material for briefing quarterly financial results and disclose it in TDnet and our website, to distribute more practical information. We report the opinions of shareholders, investors, analysts, and others we have received through IR activities, etc. to executives and the board of directors when necessary. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |