Bridge Report:(6090)Human Metabolome Technologiesthe second quarter of the fiscal year June 2020

Katsuhito Hashizume President | Human Metabolome Technologies (6090) |

|

Company Information

Market | Mothers of Tokyo Stock Exchange |

Industry | Service Industry |

President | Katsuhito Hashizume |

HQ Address | 246-2 Mizukami, Kakuganji, Tsuruoka-city, Yamagata |

Year-end | End of June |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥475 | 5,861,300 shares | ¥2,784 million | -41.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR( x) |

¥0.00 | - | ¥-51.59 | - | ¥193.11 | 2.5 x |

*The share price is the closing price on the end of March 16. Number of shares outstanding, DPS and EPS are estimated based on actual results of the brief financial report for the latest period. ROE and BPS are based on actual results of the previous term end of June.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 Act. | 780 | -70 | -71 | -71 | -13.41 | 0.00 |

March 2017 Act. | 914 | -43 | -40 | -61 | -10.86 | 0.00 |

March 2018 Act. | 938 | -140 | -149 | -156 | -26.92 | 0.00 |

June 2019 Act. | 989 | -526 | -515 | -596 | -101.92 | 0.00 |

June 2020 Est. | 920 | -300 | -299 | -302 | -51.59 | 0.00 |

*Unit: million yen. Forecasts are those of the Company. Due to the change in the fiscal year end, the fiscal year ended June 2019 is 15 months. Net income is net income attributable to owners of the parent. The same applies hereinafter.

This Bridge Report provides a business and financial overview of the second quarter of the fiscal year ending June 2020 of Human Metabolome Technologies Inc.

Table of Contents

Key Points

1.Company Overview

2.The Second Quarter of the Fiscal Year ending June 2020 Earnings Results

3.Fiscal Year ending June 2020 Earnings Forecasts

4.Progress and efforts of the two businesses

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

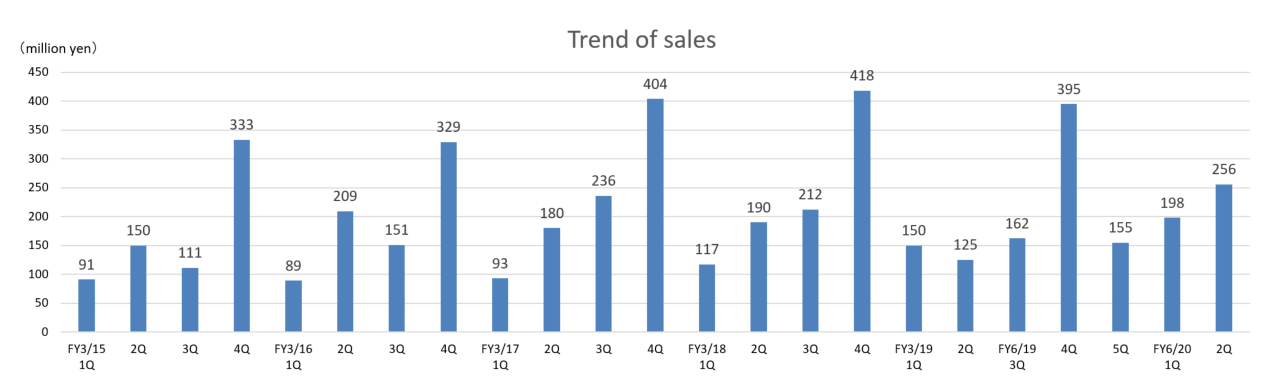

- In the second quarter of the FY ending June 2020, the net sales of the company increased to 454 million yen, and the operating loss decreased to 123 million yen. . The metabolomics business contributed to the sales growth. By strengthening its sales structure both in Japan and overseas and enhancing the productivity of the metabolomics business, the company achieved the sales increase in all industries and the profit improvement. In the biomarker business, the company has been continuing to develop measurement methods and evaluate the clinical performance to commercialize biomarkers for psychiatric disorders including depression. The operating loss in the biomarker business was on par with that in the same period of the previous year.

- For the FY ending June 2020, it is estimated that sales will be 920 million yen and operating loss will be 300 million yen. The company aims to increase sales to the level of the FY ended March 2018 (940 million yen), which was a 12-month accounting period. While making the new analysis plan contribute to the company’s full-year performance and cultivating the new market of metabolomics, the company aims to develop a new portfolio including the depression biomarker, mental health, and exosome-related businesses, into which the company will make inroads for the first time.

- The metabolomics business performed poorly in the previous term, however, the company has kept the advantage over the competitors in the metabolome analysis market. In addition to that, the company strengthened its sales structure, therefore the company made a V-shaped recovery in sales in all industries and in Japan and overseas. There still remains plenty of room for new markets and new customers, and robust growth would be expected in the future.

- On the other hand, the biomarker business has been delayed in monetization. However, the challenges of this business have been identified, so the company has implemented the business development from a new perspective. Monetization may take some time, but we would like to pay attention to their quarterly activities and progress.

1.Company Overview

Human Metabolome Technologies Inc. is a venture company originated from Keio University, its metabolome analysis technology is highly recognized throughout the world as a basic methodology. Its business model is to steadily generate profit through the commissioned metabolome business while investing in and working on research and development of biomarkers which estimates future prospects. The company is pursuing continuous growth with a stable revenue base under this strategy.

1-1 Corporate History

In 2001, Professor Tomoyoshi Soga of Keio University, Institute for Advanced Biosciences, developed a system to measure broad species of small-molecule metabolites (metabolome), which is called the CE-MS system. The new innovative system realized to capture a wide range of metabolites at once, while none of the conventional approaches do not, which means it used to be necessary to involve multiple experimental conditions, each of which has a small coverage.

Since before that, the metabolome analysis technology had been used for fundamental biological research, medicine creation, development of disease biomarkers, etc. and the growth of social needs for it was expected. Therefore, as the CE-MS method was established, Human Metabolome Technologies Inc. was founded in July 2003 by Professor Soga and Professor Masaru Tomita of the same university, Keio University, etc. for the purpose of commercializing it. It was the first venture company originated from Keio University, with a financial support from Keio University’s entrepreneurship fund.

The Company promoted research and development of its core technologies and also began organizing and establishing more specific commercialization process and business models in order to accelerate its growth speed through enhancing its visibility and raising funds for research and development. The Company got listed on the Mothers Section of the Tokyo Stock Exchange in December 2013, ten years after its establishment.

1-2 Corporate Philosophy

The Company defines the meaning of its existence as follows.

“To contribute to people’s health and joyful lives through research and development using the up-to-date metabolome analysis technologies for children in the future.”

The Company also sets the following 5 “Common Values”

1. We walk together with our customers. In order to respond to the current and future needs of our customers, we understand the workflow of our customers’ research and development and develop solutions that meet our customers’ satisfaction. We communicate with our customers with passion wholeheartedly. |

2. We value the latest technology development and high quality. We never forget the venture spirit and will continuously make efforts and investments in order to always develop the world’s leading metabolomics. We will also attempt to quickly produce high quality results that go beyond our customer’s expectation. |

3. We value teamwork. We will try to have open communication, trust our colleagues and respect for various opinions in order to maximize the power of teamwork. We will also work on self-development and elevate individual capacity in order to enhance the overall capacity of the team. |

4. We act fairly and honestly. As good citizens, we will comply with laws and ordinance and continue taking honest, ethical and responsible acts, in order to acquire trust from our customers, shareholders, and local communities and families. |

We contribute to the future of children. We will achieve appropriate life and work balance in order to pursue children’s happiness in families. |

1-3 Points to Understand the Company

The Company’s business overview is described later in this report together with the explanation of key words, “metabolomics” and “biomarker”; however, many technical terms show up in the section, and that may prevent the readers from understanding. Here are three points briefly provided before jumping to the section to glancing at the Company’s business scope.

① Significance of Social Presence

Biomarkers are in vivo compounds that are used as indicators to assess the current state of specific diseases. Blood sugar” for diabetes, “γ-GPT” for liver function disorder, and “uric acid” for gout are the representative examples of well-known and widely used biomarkers.

The Company discovered a biomarker for “major depressive disorder”, one of the current major social issues, and is researching developing diagnostic agents etc. to quantify the condition of the disease.

Because there is no prevailing method to objectively measure the status of depression, despite the increase in the number of patients with depression, some serious problems are emerging regarding the therapy of depression. For example, patients who would have been cured if they had properly treated are still suffering or in over-prescription. If the diagnostic agents using the Company’s biomarker become to be widely used, these issues are expected to be solved, and social loss will be subsequently reduced. This social significance cannot be overlooked to understand the Company.

② Excellent Technological Capacities

The Company is highly recognized thanks to the “metabolome analysis technology” which is used to examine the complicated behavior of metabolites in human bodies to identify biomarkers.

The biomarker for depression is just an example. In Oct. 2017, the biomarker for acute encephalopathy was patented in Japan. With the technology, the Company is expected to identify and develop various new biomarkers in the future.

③ Stable Business Model

The Company’s current core business is the “commissioned metabolome business”, supporting research and development activities of research institutions and pharmaceutical companies that occupy the greater part of its sales. Sales of FY June 2019 were 988 million and operating income was 232 million, showing steady income. On the other hand, the “biomarker business”, which is expected to achieve significant growth in the mid- to long-term, is still operated in a small scale and experiencing losses. However, the Company has already established a balanced business model, in which the profit generated from the commissioned metabolome analysis business is invested into the biomarker business for its growth. This model is notable among many bio-venture companies that are suffering from gaining profit.

1-4 About depression

In the biomarker business, the company's future growth driver, the current target disease is depression. This summarized the outline and the current situation in Japan about depression and major depressive disorder.

◎What is Depression?

Depression is a type of mood disorder and is a brain dysfunctional state for various reasons such as accumulated physical and mental stress. Because the brain is not functioning properly, people in the depressed mood feel negative and low-esteem. This causes a vicious cycle in which people with depression feel more stress for matters that they could otherwise handle.

The “major depressive disorder” refers to the state in which depression mood continues even after the sources of stress are removed. In this regard, it is distinguished from adjustment disorders or some anxiety disorders and is considered a brain dysfunction, instead of a mere response to stress.

(Note: “Major” of the major depressive disorder means “primary” and does not mean “serious” depression.)

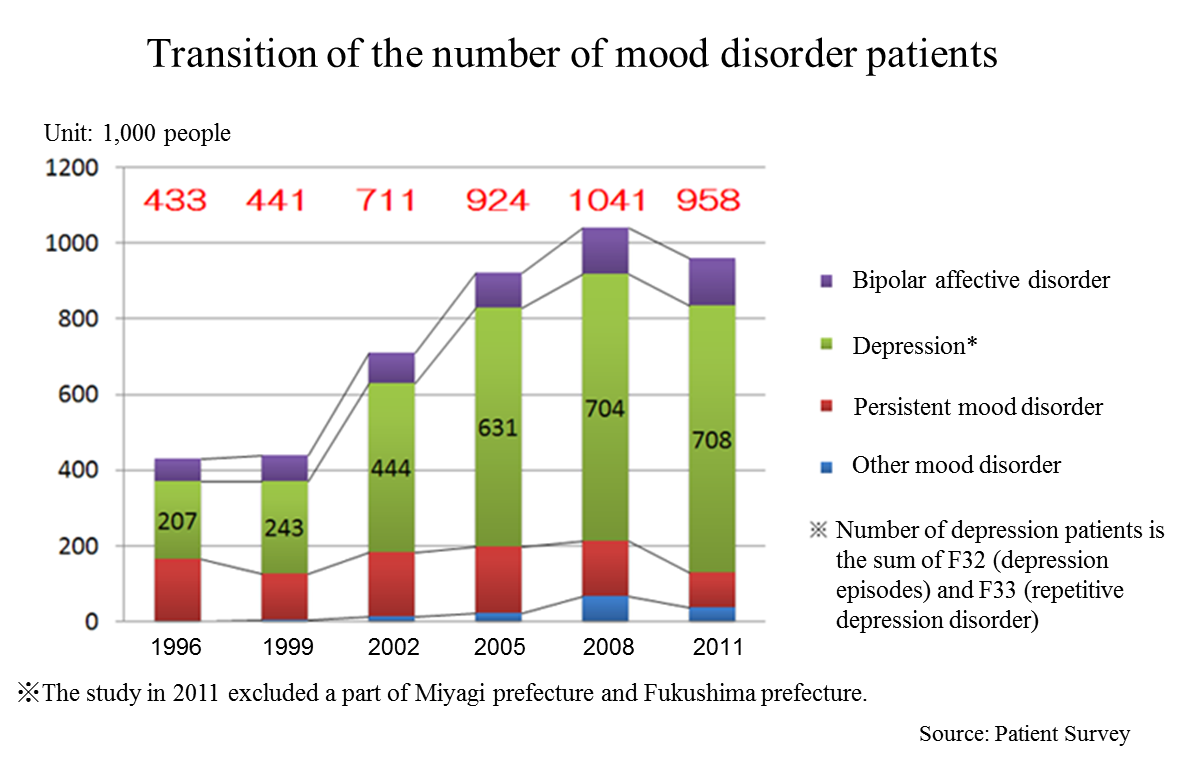

◎Number of depression patients in World and Japan

In 2012, the World Health Organization (WHO) announced that at least 350 million people were with depression which is a mental disorder. Almost 1 million lives are lost due to suicide every year, and over half of them are assumed to be due to depression.

According to the “Patient Survey” conducted by the Ministry of Health, Labor, and Welfare (MHLW) every three years targeting health facilities across the country, the total number of patients with mood disorders including depression increased from 430,000 in 1996 to 950,000 in 2011 (2.2x). The “Patient Survey” shows statistical data of the number of patients who visit health facilities. It is known that the consultation rate of patients with depression is low. Thus, according to the MHLW, it is suspected that the actual number of depression patients might be larger.

It is said that majority of depression patients are women and young people, however, in Japan, it is also frequently found among middle-aged people, and the social and economic impact of depression is significant. Needless to say, that depression distresses both patients and their families, and its social aspects cannot be passed over either; it leads reduction on the productivity of organizations and even suicide.

In Japan, economic losses due to depression and suicide are estimated to be about 3 trillion yen. If there were no such losses, GDP would increase about 2 trillion yen (an estimate by the Ministry of Health, Labor and Welfare, 2010).

Economic losses around the world are estimated to be about 62 trillion yen in 2002 (Screening for Depression in Adults: A Summary of the Evidence. Ann Intern Med. 2002.). The current economic losses are estimated to be over 100 trillion yen.

◎Treatment of Depression

If someone is diagnosed as having depression, the common treatment is prescription of “antidepressant drugs.” The antidepressant drugs can be categorized into several groups such as selective serotonin reuptake inhibitor (SSRI), serotonin-noradrenaline reuptake inhibitor (SNRI), and tricyclic antidepressant. In addition, anti-anxiety drugs or sleep-inducing drugs can be used, depending on the symptom.

The important thing under drug therapy is that the patients comply with the prescribed amount and frequency after they are informed about the effects and side effects. However, patients with depression often reduce the amount or frequency without doctors’ permission as they do not feel the symptom to be very serious, they worry side effects, etc. In these cases, the patients do not show improvement as doctors expect, and the doctors prescribe more drugs or change the types of drugs. That would often result in the delay of recovery or excessive administration of drugs, for lack of trust between doctors and patients. Therefore, it is essential to have objective assessment standards quantifying the state of depression or proving the depression has been cured. The biomarker and diagnostic agents of the depression that the Company is currently working on are extremely important for prompt and appropriate treatment of the disease.

1-5 Metabolomics and Biomarker

In order to understand the outline of the Company’s business activities, it is necessary to have a certain understanding of two key words, “metabolomics” and “biomarker”.

<What is metabolomics?>

Living organisms including human beings consist of some parts with various functions such as muscles, internal organs, and bones. “Metabolites” such as amino acids, fatty acids, and nucleic acids are common and major components of these organs. Metabolites play crucial roles for entire life activities.

Metabolites are provided by food and are consumed in the process of daily actions such as exercise. They move in a body and cells in accordance with their functions and are converted into new compounds through various chemical reactions, which are called “metabolism”. Adjusting body temperature, breathing, moving heart, digesting and absorbing food, transforming old cells into new ones are all operated by metabolism. The “compound conversion” to a new compound is based on a certain flow called metabolic pathway.

One of well-known approaches to understand the mechanisms of a human body is “genomics”, analyzing genes. Now, automated sequencing and computer analysis of genetic information (DNA base sequences) is available, and nearly all the information in the human genome has already been deciphered. However, much about the relationship between the roles of genes and diseases remains unknown. Recently, more researchers lean towards investigating metabolic profiles, in addition to genetic information coming out of genome analysis, in order to understand the relationships between a human body and diseases. Consequently, research and use of “metabolomics (metabolome analysis)” targeting all metabolites is becoming increasingly popular.

The metabolome analysis is mainly used in the following fields:

Research on pathological mechanisms at research institutions such as universities. |

Exploration and pharmacological and toxicological studies by pharmaceutical companies. |

Improvement of productivity by companies that manufactures products using fermentation. |

Component analysis as well as exploration and confirmation of functionality at food companies |

<What are biomarkers?>

A human body puts various vital functions under high-sophisticated manipulation to minimize internal and external influences, and subsequently keeps the body condition stable. That mechanism is called “homeostasis”. For example, body temperature and heartbeat may change temporarily, but return to regular ranges.

Diseases lead abnormal homeostasis and metabolic compound, which are different from those in healthy conditions. This metabolite compound is called a biomarker. By measuring a biomarker, the current status of a specific disease can be objectively assessed.

Blood sugar as a pancreas function indicator, γ-GTP as a liver function indicator, biomarker PSA for prostatic cancer and biomarker CA19-9 for pancreatic cancer are examples of well-known biomarkers.

Biomarkers have been studied for a long time in order to monitor the status of diseases. These days, with new methods to analyze multiple compounds with higher sensitivity all at once, study results of various new biomarkers have been publishing one after another. Among the biomarkers that are explored through metabolomics technologies are the followings:

Biomarkers to diagnose the presence of diseases |

Biomarkers to assess effects of treatments |

Biomarkers to predict side effects caused by drug administration |

Biomarkers to predict effects of drug administration |

1-6 Business Contents and Business Model

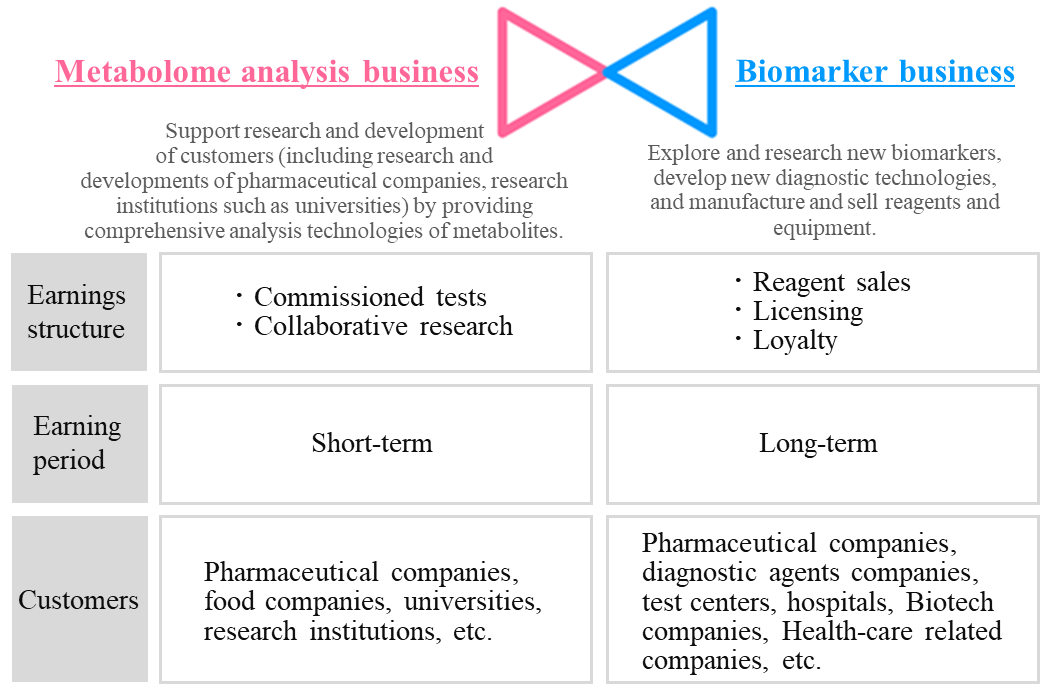

The main businesses pillars of the Company are the “metabolome business” and “biomarker business”. It is trying to expand the metabolome study related market by disseminating the excellence of its CE-MS system, the Company’s core technology, to research institutions and pharmaceutical companies, and securing income base by expanding the metabolome business in Japan and overseas.

Previously, the company allocated the profit from the “metabolome business,” which is the current mainstay business, to the investment in the R&D of the promising “biomarker business,” and applied the intellectual property obtained through the R&D to the development of medicines and disease diagnosis, with the goal of growing in the mid to long terms. From the term ended Mar. 2017, the company will accelerate the investment in the biomarker business by procuring funds from the outside in order to flourish in the future.

Earnings structure and customers of each business are as follows.

(Source: the company)

① Metabolome Business

“Sales were 988 million yen and operating income was 232 million yen for FY June 2019”

The Company receives orders from various customers, e.g., private companies such as pharmaceutical companies and food companies as well as universities and public research institutes.

The scheme of the service is as follows. A customer sends samples to the Company, and then metabolites are extracted from the samples. The extracted metabolites are measured by the CE-MS system, and the acquired data is analyzed. After all, the report is delivered to the customer. The data obtained from the service are used for various purposes; basic biological study, assessment of drug effectiveness and toxicity assessment by pharmaceutical companies, universities, and research institutions, analysis of fermentation process and functional evaluation of functional foods by food companies. The data is contributing to the progress of research and development activities of customers. In recent years, not only healthcare, food, but also interest towards health-related companies is emerging rapidly. The Company has not only accumulated a wealth of achievements with about 5,540 tests since the foundation up to the fiscal year June 2019, but also receives a high reputation from customers for their quality.

◎Deployment in the Overseas Market

In order to distribute the commissioned metabolome analysis service in Asia, the Company concluded an exclusive sales authority agreement with Young In Frontier Co., Ltd. in South Korea in June 2011. Moreover, the Company hired a sales representative in charge of Asia-Pacific area to develop Asian market including Singapore and Hong Kong, outside of South Korea. Furthermore, in order to expand its business in the North American market, it also established its sales subsidiary, Human Metabolome Technologies America, Inc., in October 2012 at Cambridge, Massachusetts, USA, home to many medical research institutions.

In order to further accelerate overseas development, in May 2017, the company established a subsidiary (sub-subsidiary) "Human Metabolome Technologies Europe B.V." in Europe (Netherlands) through HMT-A.

◎”C-SCOPE” –a service package of the commissioned metabolome analysis service for cancer study

In August 2012, the Company launched “C-SCOPE”, a service package of the commissioned metabolome analysis service well organized for cancer study. C-SCOPE was developed to respond to the needs; they would like to measure concentrations of specific metabolites changing inside cancer cells with higher sensitivity and higher accuracy. Its technologies are based on unique and efficient metabolites extraction method from cancer cells and highly sensitive analytical system.

Cancer is the number one cause of death in Japan since 1981 and occupies about 30% of the recent total causes of death. According to the MHLW, the costs for cancer research are increasing year by year; in 2012, ¥35.7 billion were spent. It is an urgent task for many pharmaceutical companies to develop effective new anticancer drugs.

The “Warburg effect” is the phenomenon that most cancer cells have glycolytic rates of several to dozens of times to that of normal cells. Although this effect was proposed as far back as over 80 years ago, the research on the effect made little progress since there was no method to comprehensively measure metabolites back then.

Thanks to the dramatic advancement in metabolomics technologies in recent years, development of anticancer drugs which act as metabolic inhibitors are underway.

The Company’s metabolome analysis technology based on the CE-MS system is considered as one of the effective analysis systems applicable at each stage of cancer research; from the basic study of cancer biology to clinical application in the process of anticancer drugs development.

② Biomarker Business

“Sales were 0.4 million JPY and operating loss was 204 million JPY for FY June 2019”

The Company considers the business related to biomarkers, which play an important role in occasions such as early diagnosis or monitoring treatment effects, as a driver for future growth, and is proceeding with biomarker discovery and development of clinical test drugs through collaborative research and development with universities, pharmaceutical companies, and diagnostic drugs companies.

The Company develops new diagnostic methods by using biomarkers, which were acquired through its own R&D, or biomarkers introduced from outside. Additionally, through the process of product development and clinical development, the Company produces and sells in vivo diagnostic drugs and diagnostic equipment.

The sales in this business are composed of cooperation money for R&D from pharmaceutical companies in cooperative research, milestone revenues, and loyalty gained from the sales of the drugs when they are commercialized.

Furthermore, in order to make the business profitable early, the company is developing 3 new business portfolios: “the mental health (mentality evaluation) project,” “the exosome project,” and “the project for developing health condition and disease risk prediction models.”

◎Intellectual Property Policy

The personnel in charge of intellectual property and contracts works on patent application and requests for examination of all projects and are in close collaboration with the patent attorneys of the Company and its collaborative research institution. They are also responsible for negotiation concerning collaboration research agreements and development of agreement documents. The Company attempts to maximize its rights when obtaining a patent of newly discovered biomarkers.

Since the scope of the rights differs depending on the marker, the Company generates patent application documents in a way that would cover a wide scope of the rights such as chemical structure of the biomarker, usage for diagnostics and drug development, detection method and measurement equipment. Furthermore, the Company makes it a principle to file international patent applications in accordance with the Patent Cooperation Treaty, in anticipation for the future license agreement and market based on the information of clinical test drugs, test equipment companies and pharmaceutical companies of various countries.

As of June 2017, the "basic patent" on the method of biomarkers of depression diagnosis etc. has been registered in Japan, the US and China. It has been filed in Europe and it is undergoing the patent evaluation there. The patent is pending in Europe where the application was filed. The patent on the method of measuring ethanolamine phosphate (PEA) has been registered at all four stations in Japan, the US, China and Europe.

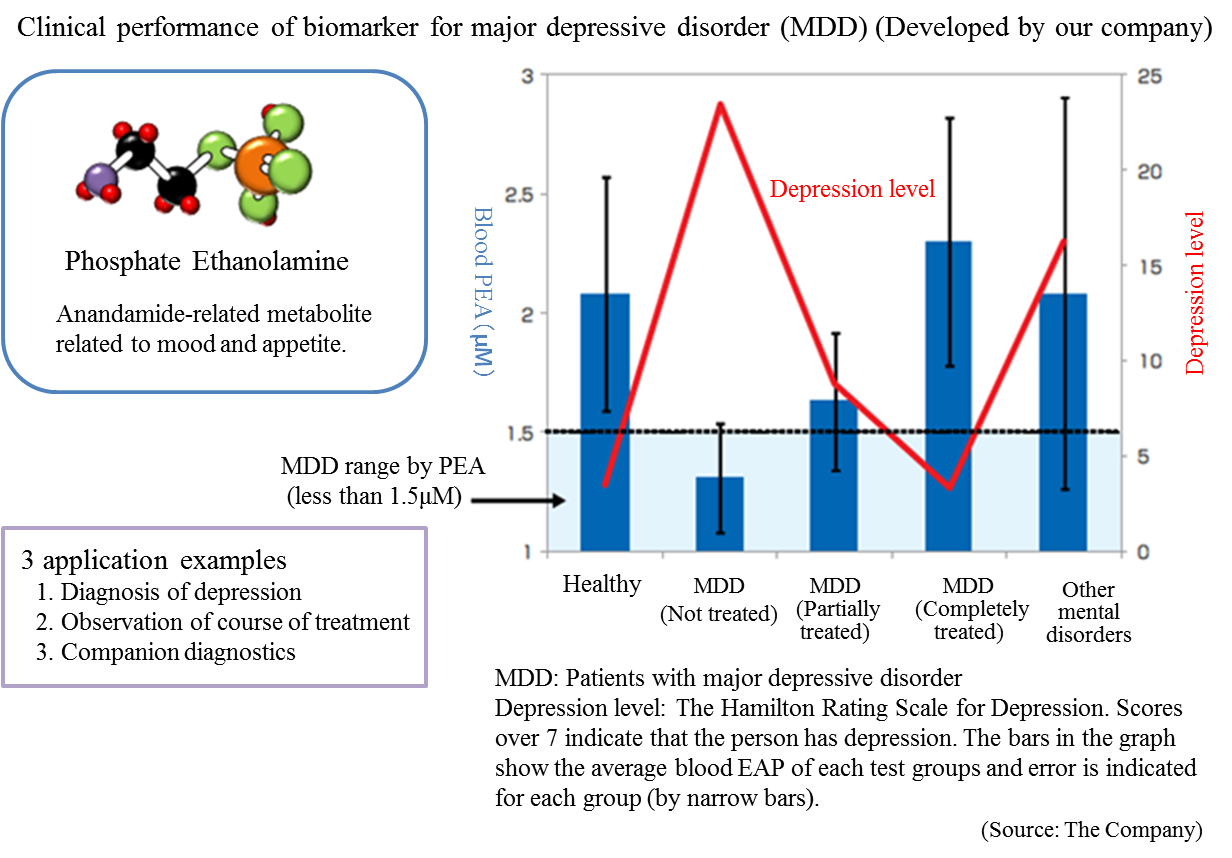

◎Example of Biomarker Business: Depression Biomarker

The Company especially focuses its research and development on a) the central nervous system disorder such as depression (e.g. mood disorder and mental disorder) for which there are few objective diagnosis methods b) diseases that

have become social problems such as metabolic syndrome, including hepatitis and diabetes, and their related diseases. Its current focus is the biomarker for depression.

Diagnosis of the major depressive disorder is conducted using the diagnostic standards provided by the American Psychiatric Association or the standards of the World Health Organization (WHO). However, both of them largely reflect the subjective view of the doctor or patient, and unlike other diseases, no diagnostic method has been established on the basis of objective indicators.

The Company conducted collaborative research with the National Center of Neurology and Psychiatry and discovered a blood biomarker of the major depressive disorder.

Blood samples were collected from approximately 30 patients and 30 healthy people, and the blood components were compared through metabolome analysis using the CE-MS system. As a result, the patients with major depressive disorder showed lower concentration of (PEA) in their serum.

Through further analysis, it was found that a) PEA is a specific biomarker for major depressive disorder, and b) PEA level will return to the healthy standard range when MDD is treated.

*Companion diagnostics: Refers to clinical tests to predict effects and side effects of pharmaceutical products before administration. By checking the responses of individual patients towards a drug before treatment, more effective drug administration can be provided.

◎Identification of Disease Biomarkers

The Company uses the following three connections and systems for identifying biomarkers in order to expand biomarker development pipelines.

<Connection with the Customers for Commissioned Analysis or Collaborative Development>

The Company accepts requests from universities and companies for the tests for finding biomarkers. The Company also receives proposals for collaborative development before or after the tests. Currently, a collaborative development project for diabetic nephropathy biomarkers is ongoing.

<Direct Proposal to Researchers and Physicians>

The Company’s researchers directly propose research plans for the development of disease biomarkers to researchers or physicians and establish collaborative study agreement with the institution based on approvals from the collaborative researchers or physicians. The target diseases are chosen according to the number of patients, compatibility to the analysis technologies of the Company, degree of social contribution, and necessity of biomarkers. In addition to major depressive disorder, the Company is working on the development of biomarkers for non-alcoholic steatohepatitis and fibromyalgia.

<HMT Research Grant for Young Leaders in Metabolomics>

The Company offers a grant (HMT Research Grant for Young Leaders in Metabolomics) to graduate students to disseminate the usefulness of metabolomics in the society and nurture young researchers. From the research themes submitted from graduate students across the world, the Company chooses excellent proposals, and supports their research by awarding metabolome analysis service without a fee. Fourteen students have been awarded in the last 4 years. Some of these study results actually led to the identification of biomarkers and evolved to collaborative study with the Company, for example, infectious disease-related encephalopathy biomarker.

2.The Second Quarter of the Fiscal Year ending June 2020 Earnings Results

(1) Consolidated Business Results

| FY 6/19 (Jul - Dec) | FY 6/20 (Jul - Dec) | Change |

Sales | 287 | 454 | +167 |

Operating Income | -316 | -123 | +193 |

Ordinary Income | -313 | -119 | +194 |

Quarterly Net Income | -315 | -118 | +197 |

*Unit: million yen. Compared the same period, because FY 6/19 is the 15-month term from April 2018 to June 2019.

The metabolomics business fared well, Sales grew and Losses narrowed.

Sales were 454 million yen and operating loss was 123 million yen. In the metabolomics business, the company strengthened its sales structure both in Japan and overseas, and the sales increased in all industries. The company also improved productivity of the metabolomics business, which led to profit increase. In the biomarker business, the company has been continuing to develop measurement methods and evaluate the clinical performance to commercialize biomarkers for psychiatric disorders including depression, etc. As a result the operating loss in the biomarker business was on par with that in the same period of the previous year.

(2) Highlights by Major Segment

◎Metabolome business

| FY 6/19 (Jul - Dec) | FY 6/20 (Jul - Dec) | Change |

Sales | 287 | 453 | +166 |

Operating Income | -10 | 128 | +138 |

*Unit: million yen. Compared the same period, because FY 6/19 is a 15-month period from April 2018 to June 2019.

The company tackled to strengthen its sales strategies and structure, and focused on developing new markets centered on the healthcare and medical industries.

The company concentrated on improving measurement technology and menu development, and the profits rose due to sales increase and productivity improvement.

◎Biomarker business

| FY 6/19 (Jul - Dec) | FY 6/20 (Jul - Dec) | Change |

Sales | 0 | 1 | +1 |

Operating Income | -87 | -80 | +7 |

*Unit: million yen. Compared the same period, because FY 6/19 is a 15-month period from April 2018 to June 2019.

The company continued developing measurement methods and evaluating clinical performance for the commercialization of biomarkers for psychiatric disorders including depression.

In addition to entering into a joint research agreement for exploring biomarkers with the University of California, San Francisco, the company launched a contract service of exosome purification. The company also executed a business collaboration agreement with J-VPD, INC.

(3) Financial standing and cash flows

◎Main BS

| End of June 2019 | End of December 2019 |

| End of June 2019 | End of December 2019 |

Current Assets | 1,214 | 1,208 | Current liabilities | 116 | 217 |

Cash | 948 | 832 | Lease obligations | 10 | 9 |

Receivables | 70 | 176 | Noncurrent liabilities | 37 | 32 |

Securities | 100 | 100 | Lease obligations | 20 | 14 |

Noncurrent Assets | 153 | 152 | Total Liabilities | 152 | 249 |

Tangible Assets | 131 | 133 | Net Assets | 1,214 | 1,111 |

Intangible Assets | 10 | 8 | Shareholders’ Equity | 1,112 | 998 |

Investment, Others | 12 | 11 | Total liabilities and net assets | 1,367 | 1,361 |

Total assets | 1,367 | 1,361 |

|

|

|

*Unit: million yen

Cash and deposits declined, but total assets were 1,361 million yen, almost unchanged from the end of the previous term due to increase in receivables. Total liabilities rose to 249 million yen from 152 million yen in the end of the previous term. Net assets decreased to 1,111 million yen from 1,214 million yen in the end of the previous term due to negative balance increase in retained earnings.

As a result, capital-to-asset ratio fell by 8.2 percent points from 82.7 to 74.5%% at the end of the previous term to 74.5%.

3.Fiscal Year ending June 2020 Earnings Forecasts

(1) Earnings Forecasts

| FY 6/19 | FY 6/20 Est. |

Sales | 989 | 920 |

Operating Income | -526 | -300 |

Ordinary Income | -515 | -299 |

Net Income | -596 | -302 |

*Unit: million yen. The forecasted values were provided by the company. FY 6/19 is a 15-month period from April 2018 to June 2019.

No change in the forecasts. The company will work on the sustainable growth of sales, the improvement in productivity of the metabolomics business, and the redevelopment of portfolios in the biomarker business.

It is estimated that sales will be 920 million yen and operating loss will be 300 million yen. The company aims to increase sales to the level of the FY ended March 2018 (940 million yen), which was a 12-month accounting period.

While diffusing the new analysis plan and cultivating the new market of metabolomics, the company aims to develop new portfolios including the depression biomarker, mental health, and exosome-related businesses, into which the company will make inroads for the first time.

The 4 major managerial policies are as follows.

① Sustainable growth of sales and attainment of budget targets

The company will develop a foundation for a mid-term leap by cultivating new domains and regions with new products and analysis plans and developing new businesses.

② Improvement in productivity of the metabolomics business

The company will streamline sales activities by revising sales methods, etc., and improve productivity by shortening analysis time, etc.

③ Redevelopment of portfolios in the biomarker business

The company will proceed with the practical application and commercialization of depression biomarkers and develop new pipelines and biomarker-related businesses with the aim of making the business profitably early.

④ Securing of loyal shareholders and retention of them through dialogues

The company will continue IR activities for institutional and individual investors.

(2) Trends by segment

◎Metabolome analysis business

| FY 6/19 | FY 6/20 Est. |

Sales | 988 | 908 |

Operating Income | 232 | 161 |

*Unit: million yen. The forecasted values were provided by the company. FY 6/19 is a 15-month period from April 2018 to June 2019.

Major activities are as follows.

(In Japan)

* | To cultivate new healthcare markets in the food product and chemical fields in addition to targeting research institutes, academia, and pharmaceutical companies. |

* | To expand the range of clients by enhancing sales activities and sales support, and make small and medium-scale transactions, without sticking to large-scale ones. |

* | To improve the productivity of processes from the transportation of specimens to the submission of reports, including analysis, and reduce costs after receiving orders. |

(Overseas)

* | To cultivate the markets of medicine creation and academia via distributors in Europe. |

* | To increase the rate of utilization of analysis equipment in a period from April to November, and enhance price elasticity strategically, for the purpose of boosting sales in Europe and the U.S. |

* | To establish a new tie-up model in the Chinese market, where laws and regulations have been amended. |

◎Biomarker business

| FY 6/19 | FY 6/20 Est. |

Sales | 0 | 12 |

Operating Income | -204 | -172 |

*Unit: million yen. The forecasted values were provided by the company. FY 6/19 is a 15-month period from April 2018 to June 2019.

(3) Priority investment items

Items | FY 6/19 | FY 6/20 Est. | Overview |

R & D expenses | 189 | 150 | Development associated with the mental health project and the commercialization of depression biomarkers. |

Capital investment | 155 | 56 | The focus is on investments to increase the sensitivity of metabolome analysis. The investment for the new market has settled down. |

*Unit: million yen. The budget is announced by the company 6/19 is a 15-month period from April 2018 to May 2019.

4. Progress and efforts of the two businesses

(1) Metabolomics business

① External environment

Metabolomics technology has evolved from initially being a technology for academia, such as universities and laboratories, into a technology for various industrial fields.

On the other hand, health-conscious market, which includes health foods such as functional foods, sports, sleep, and stress, are expanding. An increasing number of enterprises are interested in the usefulness of metabolomics for learning human health conditions and aim to develop new businesses related to healthcare. Hence, a new market is emerging, and the opportunities to acquire new clients are being increased.

In pharmaceutical R&D, there are growing needs for various things, including the research into intestinal bacteria, the development of early detection, diagnosis, and treatment methods for neuropsychiatric disorders, such as dementia and Alzheimer's disease, the practical application of medical technologies, including pharmaceuticals for refractory diseases, and biomarker discovery for anticancer companion diagnostics, and metabolomics increasingly becomes to be considered effective.

As for overseas situations, the size of the U.S. market is 5 times larger than that of the Japanese market. The average annual growth rate of the Chinese market is 10-20%, and the Chinese market is estimated to become larger than the Japanese market from 2020 to 2022. Accordingly, this business can be expected to grow significantly inside and outside Japan.

Assumed metabolomics market size

The year 2017

The U.S. | 6.24 billion yen |

Germany | 1.35 billion yen |

The U.K. | 1.21 billion yen |

France | 0.85 billion yen |

Japan | 1.23 billion yen |

China | 0.91 billion yen |

(Taken from the reference material of the company)

② Key measures and progress

Main measures implemented in the FY ended June 2019Theme | Measures |

(1) To increase sales by launching new products in growing markets | 【Enhancement of sales promotion in food and chemical fields】 To develop new markets in the healthcare industry To acquire large-scale transactions by intervening in clinical trials To offer comprehensive solutions by creating new health value To strengthen value proposition to conclude annual base contracts 【Enhancement of sales promotion in pharmaceutical field】 To cultivate the neuropsychiatric, emerging, and re-emerging infectious disease areas by releasing new products Sales promotion focused on refractory disease area Enhancement of activities for making large-scale transactions for finding biomarkers 【Business structure】 To strengthen sales and support systems To improve workflow productivity |

(2) Further focus on overseas expansion --Accelerate overseas expansion by creating global brand power | 【U.S.】 To make large-scale transactions targeting mainly clinical research and pharmaceutical companies, expand target areas and utilize agents To fortify the organizational base with a new structure

【Europe】 To enhance activities for acquiring clinical transactions focused on specific diseases To enter the food product field To find agents 【Asia】 To enter the Chinese market, cultivate the Asian market further, and expand the target teritories To establish a new alliance model after implementation of the new laws and regulations |

(3) To develop new businesses | To develop mid-term businesses other than the contract service of metabolome analysis |

◎ Efforts in the Q2 of the FY ending June 2020

Field | Measures and progress |

(1) Healthcare and medical industry | Due to the impact of the new analysis menu, sales of entrusted comprehensive metabolic analysis, including lipids and large-scale tests. Large-scale testing increased from 3 to 13 projects. Sales increased in all fields: academia, chemistry, food, and pharmaceuticals. |

(2) Strengthening sales force | The company established the sales planning department, strengthened user support, and developed promotions that meet customer needs. |

(3) Utilizing agents | As a result of focusing on developing large-scale projects and using overseas agents, sales and purchase orders increased in all regions. |

(2) Biomarker business

The company became technically able to offer the PEA testing to 350 million patients suffering from depression around the world through developing the “PEA measurement reagent kit based on the enzyme method,” and is developing a foundation for commercialization. However, as some issues have emerged, the company has made new efforts to address them and to achieve early profitability of the business.

① Challenges and countermeasures

The following challenges have been confirmed from the progress and results of the PEA measurements (clinical feasibility studies) on multiple specimens conducted inside Japan so far.

Challenge 1 | Some healthy volunteers have a low PEA value like depression patients, due to the differences among individuals. |

Challenge 2 | Since the difference in PEA concentration between healthy individuals and depression patients is relatively small, it is crucial to obtain a stable PEA measurement value. To do so, it is necessary to appropriately manage specimens in sampling, storing and any other processes. It is essential to overcome the problems with specimen management in the use for clinical practice. |

PEA remains a promising candidate for a biomarker for depression. The company is undertaking the following measures to tackle these problems.

<Countermeasures>

Considering the standardization of specimen collection at clinical laboratories |

Conducting researches focused on verification of treatment effect (monitoring) |

Developing a method to detect the characteristics of healthy individuals with low PEA |

Moreover, the company is working on a research paper elucidating the mechanism of the decrease in plasma PEA with animal model of depression. Also, the company has commenced a joint study with the University of California, San Francisco (UCSF).

② New initiatives

◎Development of detection technology

Initiation of the contract measurement for research use by using liquid chromatography measurement method |

Developing a reagent kit of the enzyme method for large-scale versatile biochemical analysis equipment, aiming to reduce measurement costs. |

There still remain unmet needs in prevention, early detection, and treatment of depression. The contract measurement service for research use would be addressed to mental illness related research institutions, pharmaceutical companies, and organizations actively promoting health management, which are interested in measuring PEA level, and this service would support research and development of drug discovery.

◎Mental health (mentality evaluation)

Development of an evaluation index of the mental state as a preventive measure for mental disorders such as depression |

Development of a mild cognitive impairment (MCI) biomarker for social implementation as a way to prevent dementia |

Execution of an agreement with J-VPD for collaborative businesses of research and clinical tests using advanced biomarkers related to “mental illness, lifestyle-related diseases, etc.” |

*Mild cognitive impairment (MCI)

The number of dementia patients over 65 years of age in Japan is currently about 30 million. Of those, about 4.6 million people, 15% of the total, have dementia, and about 4 million people, 13% of the total, are patients with mild cognitive impairment (MCI).

Mild cognitive impairment (MCI) is an intermediate state between normal state and dementia, with forgetfulness but no hindrance to daily life.

However, 10-30% of MCI patients annually progress to dementia. On the other hand, some patients recover to normal levels, with 38.5% reported to have normalized after five years.

The number of dementia patients is expected to reach 8 million in Japan and 130 million worldwide in 2050, and controlling it is a global challenge.

HMT is a participant in the Hirosaki COI-related “Iwaki Health Promotion Project”. The company applied jointly for a patent for the MCI marker discovered under the “COI Young Researcher Collaboration Fund (big data multi-layer analysis for prevention and early detection of dementia)” at Hirosaki University and Tohoku University that uses multi-item big data, and is aiming for the practical application.

This would lead to effective prevention of dementia at the early stage before the onset of dementia and establishment of a very early diagnosis method for dementia.

◎Health condition and disease risk prediction models

The company is exploring biomarkers for early diagnosis of diabetic nephropathy through joint research with Japanese universities and is verifying the biomarkers for diabetic nephropathy, which it possesses.

Also, the company established a joint research course, “Metabolomics Innovation Course”, in the Graduate School of Medicine, Hirosaki University.

The company is building a multi-marker health condition prediction model using machine learning and a future disease risk prediction model, by analyzing super-multi-item big data and omics data, mainly metabolomics, obtained from biological samples of the Iwaki Health Promotion Project, etc.

◎Research support for biomarker discovery

As mentioned above, in addition to introducing the PEA research measurement service, the company started the exosome purification service using “ExoIntact™ Exosome Purification Reagent Kit” launched in 2019 (developed by Siliconbio Inc.), to support research and development in the exosome-related fields, which is attracting attention as a treasure house of biomarkers,

5.Conclusions

The metabolomics business performed poorly in the previous term, the company has kept the advantage over the competitors in the metabolome analysis market. In addition to that, the company strengthened its sales structure, therefore the company made a V-shaped recovery in sales in all industries in Japan and overseas. There still remains plenty of room for new markets and new customers, and robust growth would be expected in the future. On the other hand, the biomarker business has been delayed in monetization. However, as the challenges of this business have been identified, the company has implemented business development from a new perspective. Monetization may take some time, but we would like to pay attention to their quarterly activitiess and progress.

<Reference: Regarding Corporate Governance>

◎Organization type

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 3 outside ones |

◎Corporate Governance Report

Updated on September 25, 2019

<Basic policy>

The group's corporate philosophy is to contribute to the healthy and affluent living of people by conducting research and development based on cutting-edge metabolome analysis technology for the sake of future children. To realize this corporate philosophy and enhance corporate value, the company is working on improving the soundness, transparency, and efficiency of management. The company is working on doing so by strengthening the supervision function of overall management, checking and managing the effectiveness, efficiency, and legal compliance of business execution through the internal control system. Moreover, the company promotes harmonious behavior with all the stakeholders by ensuring the executives' and employees’ awareness of the company’s “shared values” and thorough legal compliance from a long-term perspective.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

It is mentioned that “Our company follows all of the basic principles of the Corporate Governance Code.”

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |