Bridge Report:(6094)FreakOut the Fiscal Year September 2019

Yuzuru Honda Founder & Global CEO | FreakOut Holdings, inc. (6094) |

|

Company Information

Exchange | TSE Mothers |

Industry | Service |

President | Yuzuru Honda |

Address | Roppongi Hills Cross Point, 6-3-1 Roppongi, Minato-ku, Tokyo |

Year-end | End of September |

URL |

Stock Information

Share Price | Number of Shares Issued | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,657 | 15,760,390 shares | ¥26,115 million | - | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥0.00 | - | - | - | ¥280.12 | 5.9x |

* The share price is the closing price on November 29.. The number of shares issued is from the brief financial report for the latest period. BPS are the values from the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Sep. 2016 (Actual) | 5,792 | 358 | 561 | 394 | 30.72 | 0.00 |

Sep. 2017 (Actual) | 12,019 | 601 | 1,208 | 842 | 64.12 | 0.00 |

Sep. 2018 (Actual) | 14,745 | -532 | 307 | 25 | 1.94 | 0.00 |

Sep. 2019 (Actual) | 21,709 | -1,270 | -1,497 | -3,512 | - | 0.00 |

Sep. 2020(Estimated) | 27,000 | 200 | 200 | undecided | undecided | 0.00 |

*The forecasted values were provided by the company. On Sep. 1, 2016, the company conducted a 2-for-1 stock split.

EPS was adjusted retroactively.

This Bridge Report presents an overview of FreakOut Holdings, inc.'s earnings results for the term ended September 2019, and more.

Table of Contents

Key points

1. Company Overview

2. Fiscal Year September 2019 Earnings Results

3. Fiscal Year September 2020 Earnings Estimates

4. Progress in Each Business

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- FreakOut Holdings, inc. is a marketing technology company that helps advertisers convey the right message to the right consumers at the right moment, with its cutting-edge technology based on artificial intelligence (AI). The company mainly operates “Demand Side Platform (DSP),” a platform for purchasing and distributing online ads effectively for maximizing the profits of advertisers (including ad agencies), and conducts the “DSP business” for offering OEM services. Its major strengths and characteristics include “holding vast amounts of data,” “capability of securing good-quality ad space,” and “active investment for developing a superior algorithm.” The company’s philosophy is to “Give People Work That Requires A Person” with its technologies in various fields not limited to advertising, and to contribute to the development of a creative society.

- For the term ended September 2019, sales grew 47.2% year on year, an ordinary loss of 1,497 million yen (a profit of 307 million yen in the previous term) was posted, and EBITDA was negative 491 million yen. Sales increased considerably, as Playwire was included in the scope of consolidation outside Japan. As for profit, the company incurred a loss due to the posting of allowance for doubtful accounts, the inclusion of an affiliate company as an equity-method affiliate, etc. An extraordinary loss was posted due to the impairment of goodwill, etc. Consequently, profit attributable to owners of parent was negative 3,512 million yen.

- For the term ended September 2019, sales increased considerably, but EBITDA turned negative, and profit attributable to owners of parent was negative 3.5 billion yen. However, it can be considered the company just suffered the “birth pangs.” Through impairment accounting, amortization will be reduced from the term ending September 2020. In the mid-term plan, the target EBITDA has not been achieved, and is still to be achieved, but sales have grown steadily, and invested businesses have produced some results. EV/EBITDA is around 9 under the assumption that the mid-term goals have been achieved although some goals are still to be achieved. Accordingly, the stock of the company is considered to be undervalued, considering the fact that the company is growing rapidly.

1. Company Overview

FreakOut Holdings, inc. is a marketing technology company that solves advertisers’ challenges of conveying the right message to the right consumers at the right moment with its cutting-edge technology using AI (artificial intelligence). Its chief business is the “DSP business,” including the operation of “DSP (demand-side platform)”– a platform that enables advertisers and advertising agencies to buy Internet advertisements efficiently and distribute them to maximize profit – and OEM.

Its major strengths and characteristics include “holding vast amounts of data,” “capability of securing good-quality ad space,” and “active investment for developing a superior algorithm.”

The company’s philosophy is to “Give People Work That Requires A Person” with its technologies in various fields not limited to advertisement, and to contribute to the development of a creative society.

【1-1 Corporate History】

FreakOut was founded in October 2010 by its Founder & Global CEO Yuzuru Honda, an engineer with the previous experience of engaging in advertising businesses at Yahoo! Japan Corporation, who wanted to bring about a game change in advertising in Japan by introducing RTB(Real-Time Bidding) - a distribution method that automatically trades advertisement spaces in the form of bidding according to the number of times an Internet advertisement is displayed -, which already became a norm in the USA about a year earlier than in Japan. Joined the start-up by the Representative Director, Yusuke Sato, also an engineer who worked on advertisement products at Google Japan, the company was the first in Japan to commercialize the RTB technologies in January 2011.

Helped by the feature of high sensitivity to new products of the advertising industry, the company gained numerous corporate clients soon after its launch while its customer satisfaction level has remained high, pushing both its sales and profits constantly upward. In June 2014, the company was listed on TSE Mothers in less than four years after its founding.

In January 2017, the company changed its structure to a holding company to actualize faster decision-making and more dynamic business development.

2010 | Oct. | FreakOut is established. |

2011 | Jan. | Released DSP FreakOut using RTB technology, the first of its kind in Japan. |

2012 | May | Launched service for smartphones. |

2013 | Jun. | A joint venture (currently a consolidated subsidiary) “Intimate Merger, Inc.” is established. |

2013 | Oct. | Launched a video advertisement distribution service using videos hosted on YouTube. |

Dec. | A joint venture “M.T. Burn, Inc.” is established with LINE Corporation. | |

2014 | Jun. | Listed shares on TSE Mothers. |

Jun. | M.T. Burn released AppDavis (currently renamed Hike), a native advertising platform. | |

2016 | Jan. | Started a system connection through RTB with Hike provided by M.T.Burn, Inc. |

May | Released RED, a mobile marketing platform. | |

2017 | Jan. | The company changed its structure to a holding company, and was renamed FreakOut Holdings, inc. |

Mar. | Gardia, Inc. is established, and enters the Fintech field. | |

2019 | Jan. | The advertising businesses operated in Japan and abroad are integrated. |

May | M.T.Burn, Inc. is dissolved. | |

Nov. | The subsidiary Intimate Merger, Inc. was listed in Mothers of TSE. |

【1-2 Philosophy】

FreakOut’s philosophy is “Give People Work That Requires A Person.”

As shown in the corporate history section, the company has its origin in the first commercialization of real-time transactions of Internet advertisements in Japan, with the aim of gradually changing the system of advertising transactions from manual operations to inter-computer transactions.

With the use of technologies, advertisers are now able to communicate with each and every consumer, approaching the true 1-to-1 marketing that was not possible with conventional mass-advertising.

At the same time, the “people” engaged in the advertising business are becoming freer from the transaction-related chores, and instead they are now able to dedicate more time to creative works such as planning more human-like communications and creating sympathetic messages.

The company believes its mission to be “generate surplus labor (the time for people to dedicate to their creativity) by letting computers do what they are good at.”

The company is striving to contribute to a more creative society by “Giving People Work That Requires A Person” through the use of its advanced technologies in more diverse fields than just advertising.

【1-3 Overview of the Internet Advertising Market】

To understand FreakOut’s businesses, it is necessary to have some knowledge of environmental and constituent elements surrounding the operation of the “Internet advertisement,” such as the changing needs of advertisers and media, and advertising markets, as well as the technologies and the main players. A few essential points are outlined below.

≪Changing advertising market≫

In the conventional advertising market, especially with the advertising businesses that exploited the mass media such as television and newspapers, monopolization and exclusivity of stock were of paramount importance in terms of business development for the supply side (i.e. the media and advertising agencies).

Major advertising agencies would have a near-total monopoly over the limited television ad spaces, enabling them to hold onto their pricing leadership against advertisers to continually generate huge profits in tandem with the media.

However, with the end of the era of strong economic growth and the advent of Internet advertising characterized by its interactivity and low-cost, compared to the conventional media, the demand for mass advertising via TV and newspapers is apt to decline.

While Japan’s total advertising spending has not grown in the last 10 years, Internet advertising expenses of 377.7 billion yen in 2005, which was less than 20% of Terrestrial TV and 40% of Newspapers, has grown over 12.0% per year on average and reached 1,758.9 billion yen in 2018, which was 80% of Terrestrial TV and 30% of Newspapers. (Data from Dentsu “Japan’s Advertising Market in 2018”)

Meanwhile, the needs from advertisers for even more effective advertisements keep growing, creating a significant challenge in delivering “the right message” to “the right consumers” at “the right moment.”

In this situation, there appeared a marketplace with open advertisement space called “Ad Exchange.”

This is indeed a “marketplace” in which advertisers, the media and advertising agencies can freely trade advertisement space. For advertisers, this means that it has become even more important that they buy optimal advertisement space for an even better advertisement performance and one of the key technologies that enable this is “RTB,” which was commercialized by the company for the first time in Japan.

≪Real-time transaction of advertisement space through RTB≫

RTB (Real-Time Bidding) is a distribution method that performs automatic transactions of advertisement space through bidding per impression (the number of times an advertisement is displayed).

Before RTB debuted, “a pure advertising transaction” was the norm. This was, as it were, a ‘set menu’ in which the space for display advertisements (advertisements utilizing images, flash, videos, etc. displayed on websites) were sold to the media and advertising agencies as a package with impression guarantees and period guarantees attached.

In contrast, RTB analyzes the attributes of the user who accessed a display advertisement per impression, and performs a transaction by bidding as “an advertisement for a user with specific attributes” per impression.

The RTB technologies enable advertisers to engage with potential consumers whom it was previously difficult to reach through conventional pure advertising (buying advertisement space of specific websites at a pre-fixed price) or search advertising (relating to the keywords searched), and also make it possible to take recognition measures through a more effective advertisement distribution to elicit further interests and curiosity of users.

How RTB works

① | At the instant when an Internet user visits a website with advertisement space, Ad Exchanges, SSP, *adnetworks, or other systems that manage the advertisement space send out visiting user information and advertisement space information (bidding request) to multiple DSP operators. |

② | Each DSP operator analyzes the database and bidding is carried out. |

③ | The DSP operator that wins the bid for the advertisement space distributes the space. |

④ | As soon as the auction is completed, the company buys the advertisement space from the SSP, etc. and distributes the advertisement space with a new price adding price margin on top of the bidding price. |

*Adnetwork: advertisement space from multiple media sites are united as a network so that advertisement sales and distribution can be integrally managed in order to generate profits.

“RTB” requires two main players: “DSP (the demand-side system)” and “SSP (the supply-side system)” of advertisement space.

What is DSP (Demand Side Platform)?

DSP is a platform on which advertisers and advertising agencies can effectively purchase and distribute Internet advertisements so that they can maximize their profits.

More specifically, it is a platform where advertisers and advertising agencies perform an automatic bidding transaction and advertisement distribution per impression utilizing the RTB technologies and their own algorithms with Ad Exchanges, SSP, adnetworks and others.

Advertisers first determine the attributes of their target users and the maximum bidding price, and when a user who satisfies their criteria is found, bidding is instantaneously (within roughly 0.05 second) carried out and the advertisement with the highest bid is distributed on the medium.

Before RTB appeared, advertisers were forced to make an assumption as to which websites might be visited by the target users and then purchase specific advertisement slots at a pre-fixed price. However, DSP enables advertisers to make an assessment in real-time about the user to whom they want to distribute an advertisement. Furthermore, the advertisement can be distributed at a reasonable price through the bidding process, optimizing the cost effectiveness of the advertisement for the advertisers.

FreakOut’s main businesses are the sales of its uniquely developed DSPs “Red” and “FreakOut” as well as the “DSP business” that supplies OEM.

To be able to regularly distribute advertisements to the right users and bid at the best price requires building highly advanced algorithms and training the AI (artificial intelligence) to be “even more intelligent” through repeated machine learning based on vast amounts of data. The company has a powerful competitive advantage on this matter (for more details, please refer to 【1-6 Characteristics & Strengths】).

What is SSP (Supply Side Platform)?

SSP is a system that supports the maximization of advertisement effectiveness from the viewpoint of the media. It is a platform used by the media to manage and sell advertisement space and has the technologies to respond to real-time biddings from DSP.

This type of cost-effective advertising, based on the RTB technologies, which cleared the hurdles of optimization that were difficult to realize with conventional pure advertising is termed “performance-based advertising” and it is growing at a speed that is faster than that of Internet advertising as a whole.

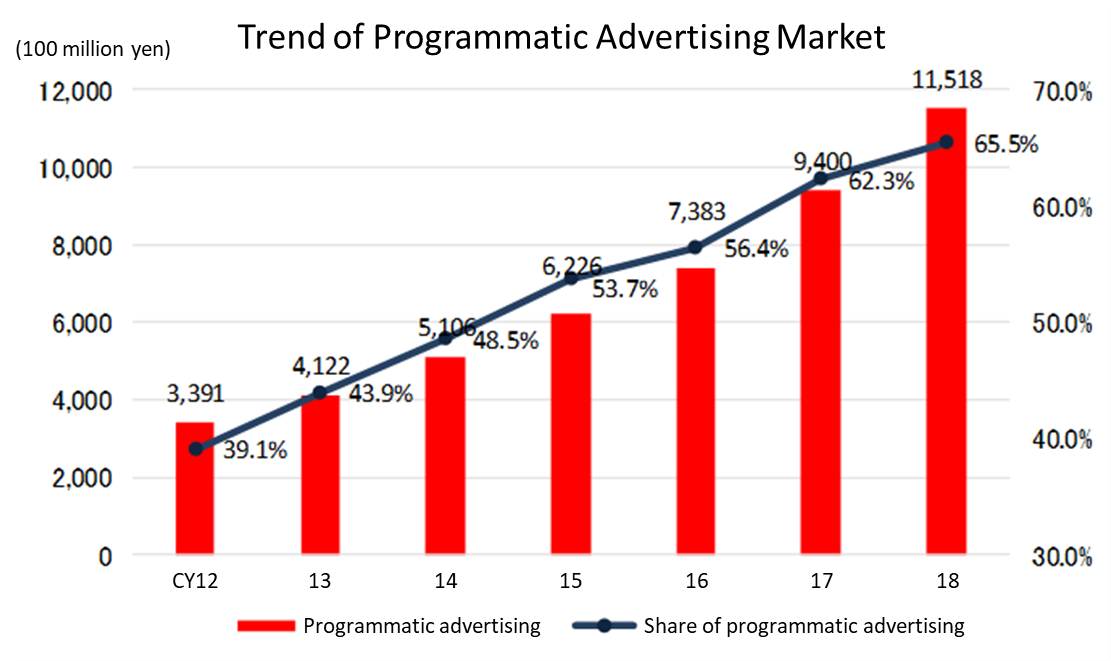

In 2018, 65.5% of Internet advertising in Japan was performance-based advertising.

(Data from Dentsu “Japan’s Advertising Market in 2018”)

*Performance-based advertising: an advertising method which utilizes platforms that employ ad technologies processing vast amounts of data to provide automatic or instantaneous optimization of advertising. In addition to search engine advertising and some ad networks, major types include recently developed demand-side platforms (DSPs), ad exchanges, and supply-side platforms (SSPs). Performance-based advertising does not include ad space sales, tie-up ads, or affiliate advertising

The company’s RTB commercialized in Japan is currently only less than 10% in size of its US counterpart, but it is growing rapidly.

As seen here, “performance-based advertising” based on the remarkably fast-growing RTB technologies even within the Internet advertising, the sector showing the highest growth compared to the other media, is the company’s main field. It is assuredly capitalizing on the robust demands and expanding its business operations.

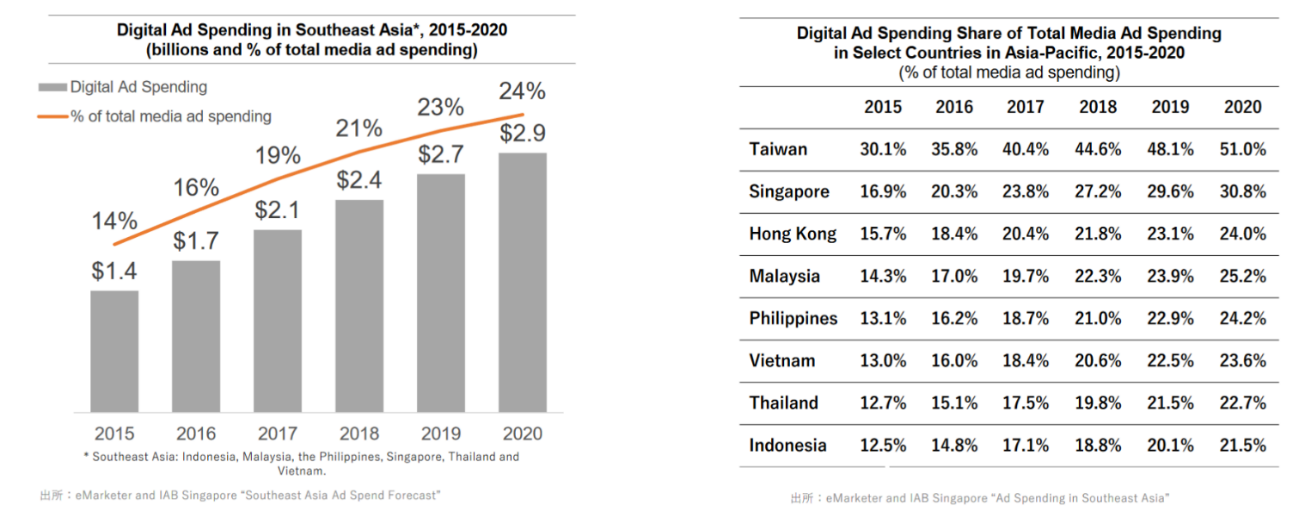

In addition, while the company is actively working on expanding the overseas business mainly in Southeast Asia, as described later, the proportion of digital advertising expenses in the advertising market in each Southeast Asian country including Taiwan is also rising and the market is expanding continuously.

(Reference material of the company)

【1-4 Business contents】

1. Business segments

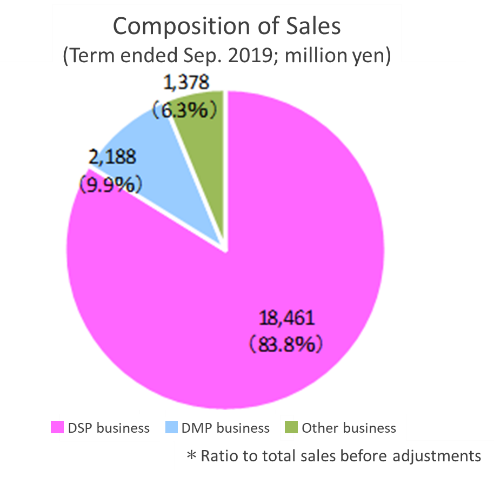

There are three business segments: “DSP business,” “DMP business,” and “Other business.”

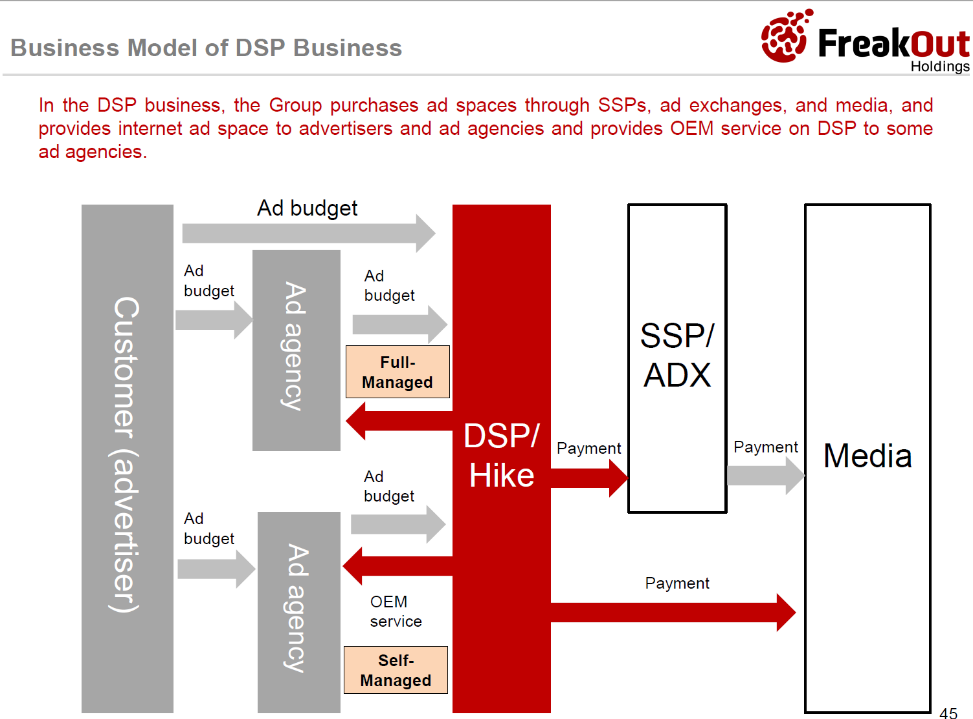

①DSP business

Business model

The Group purchases ad spaces through SSPs, ad exchanges, and media, and provides internet ad spaces to advertisers and ad agencies and provides the OEM service on DSP to some ad agencies.

(Reference material of the company)

Major products and services

The company aims to maximize the effect of ad distribution via DSP “Red” and “FreakOut,” by utilizing the private DMP “MOTHER,” an original analysis software which analyzes big data such as access data to each advertiser’s website, ad distribution data, membership data, and purchase data.

“Red” and “FreakOut” have various methods for ad distribution, in order for advertisers to target prospective customers. In detail, they distribute ads that choose targets based on the behaviors of consumers using the following methods: (1) methods such as “Audience Expansion” for reaching “those who do not know the advertiser’s products/services (prospective customers),” (2) methods such as “Keyword Match” for reaching “those who know advertisers’ products/services (people who have interests),” and (3) methods such as “Retargeting” for promoting “those who want advertisers’ products/services (expected customers)” to take action by purchasing products, requesting a brochure, getting registered as a member, etc.

Product/service | Outline |

Red | Marketing platform specializing in mobile devices, for which the cutting-edge technology for optimizing ad distribution was adopted with the aim of maximizing the effect of ads in the smartphone file, while considering the shift from PCs to smartphones for accessing the Internet, and the excellent stocks of ad spaces have been secured. Released in May 2016.

Features: ・Mounted with the cutting-edge original engine for machine learning ・Securing of mobile and infeed ad spaces worth tens of billions of impressions, one of the largest scales in this field ・Securing of stocks of mobile ad spaces worth 130 billion impressions per month, one of the largest scales in this field The company will operate a platform that enables advertisers to reach their target customers efficiently through the mobile media globally in Japan, Southeast Asia, the Middle and Near East. |

Red for Publishers | Technology and service package supporting sales, operations, development, and launching unique advertisement platform in terms of administrating the project for Premium Media (media with major traffic) and advertisers. Released in September, 2017.

The media owners entrust the task of profit maximization through ad distribution to “Red for Publishers,” so that they can concentrate on improving the content that they should originally be using resources for and attracting customers. Advertisers, too, are able to pursue further maximization of advertising value, which has always been the objective of “Red,” by preferential connection of DSP “Red” to the advertisement space of excellent media owners.

In addition to sales from the DSP business, “ad distribution system usage fee” received from the premium media is monetized. The latter contributes to profit largely as 100% of that fee becomes gross profit. |

Poets | Premium advertising platform that can provide advertisement experiences without compromising the user experience by utilizing an advertisement format highly compatible with the content UI. Because it possesses carefully selected media that can be expected to maximize advertisement effectiveness in direct response, advertisers can obtain high advertisement effectiveness according to the target KPI through a format that matches with the content. In addition, it will use advertisement distribution technology of Red for Publishers to match media advertisers with high tender offers. |

Trading desk service | Service aimed at improving the outcome of online marketing by advertisers. The company designs online marketing strategies utilizing new marketing technologies and supports the ad management, which is becoming more sophisticated and more complex. |

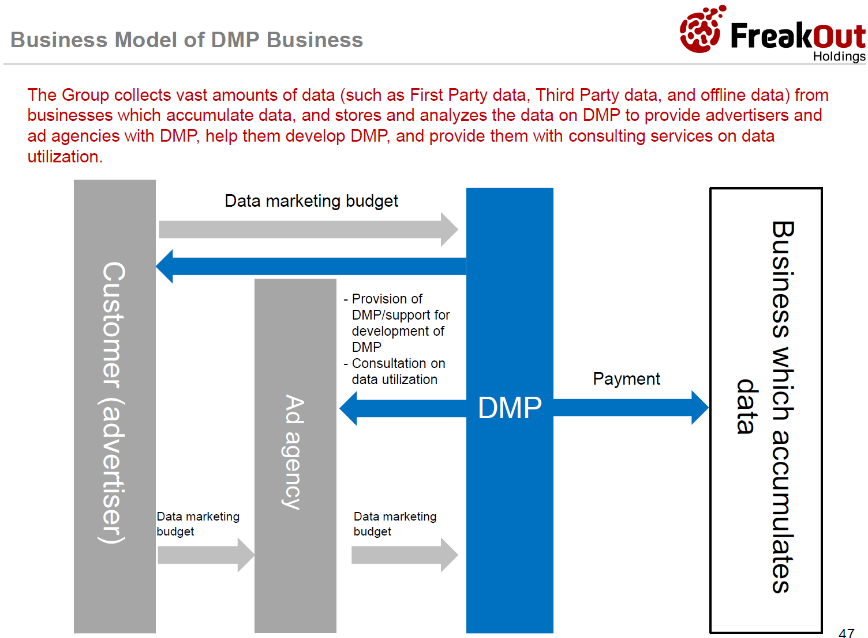

②DMP business

DMP stands for Data Management Platform, which is a data integration management tool for managing and analyzing the data of access to advertisers’ websites, ad distribution, membership, etc. and enabling the use of the data in cooperation with data utilization channels, for email distribution, analysis, surveys, etc.

In order to actualize the optimization of data marketing conducted by client companies and ad agencies, the company collects vast amounts of data from data providers, including media companies and research firms, and stores and analyzes data on DMP to provide the unique DMP for an enormous amount of public data, support the development of the DMP for large-scale portal sites, and offer consulting services utilizing the company’s own data with optimal marketing channels, etc.

③Other business

This is a new business segment established in the term ended Sep. 2017, as the company shifted to the holdings company system. New businesses and business administration in the group companies inside and outside Japan are included in this segment.

【1-5 Group companies】

Under the management of the holdings company FreakOut Holdings, inc., establishes the corporate group.

As for the overseas business, they have been mainly operating the native ad platform business with FreakOut Pte. Ltd. (headquartered in Singapore) serving as the headquarters.

Since a native ad platform was released for the first time in Southeast Asia in 2015, the company has formed tie-ups with mainly the leading media in each country, and currently over 700 advertisers use the service of FreakOut.

In July 2017, the company entered the Hong Kong market and established local subsidiaries in Vietnam, Malaysia, the Philippines, and India, as new bases in Southeast Asia, following the existing ones in Singapore, Thailand, and Indonesia. Also, the company actively promotes M&A and forms alliances with the premium media in each country.

【1-6 Characteristics and strengths】

As mentioned above, in order to distribute ads to the right users and submit a bid at the best price, it is necessary to develop an extremely advanced algorithm and repeat machine learning based on a large amount of data to actualize “smart artificial intelligence (AI).” At this point, the company possesses a significant competitive advantage. Having good ad spaces is its advantage as well.

①The largest amount of data

Since the company commercialized the RTB technology for the first time in Japan, it possesses the largest amount of data in Japan. No matter how superior AI is, it will not grow to a practical and effective AI, unless machine learning is repeated with vast amounts of data. The company, which “knows about smartphone owners the most in Japan”, with accurate data of 3 million users (5%) out of 60 million mobile users in Japan, it is possible to predict the thoughts and behaviors of the remaining 57 million users according to age and gender. Therefore, the satisfaction level of advertisers towards this strength of the company is high.

②Securing of good-quality ad spaces

After RTB debuted, the “smartness” of a platform in an open environment has become important, whereas the gap in technology levels shrank over a certain period of time. As a result, the quality and exclusiveness of ad spaces, in particular, became the major competitive conditions in the mobile field again.

③Active investment for developing a superior algorithm

For targeting advertisement, it is possible to win a bid by submitting the highest bid. As the company aims to expand sales, it wants to purchase as many ad spaces as possible, but if ad performance is poor, advertisers will not evaluate it highly, which will make it difficult to continue transactions with them.

This indicates that it is essential to produce reasonable results for clients even when the ad cost was high.

Therefore, the company has developed “a model for predicting rate of clicking” and “a model for predicting rate of conversion,” boosting the capability of giving proposals to advertisers, and constantly carries out investment for further improving the accuracy of these models.

The data science team of the company has top-level abilities among Japanese mid-sized companies, so their accumulated active investment is leading to continuous high performance.

④Securing of talented personnel

In a survey called “popularity ranking of companies among the students of Tokyo and Kyoto Universities” conducted by a magazine, the company has been ranked high along with some renowned large IT companies, foreign financial institutions and other global manufacturers at 28th, which is 79 ranks higher than the previous year’s 107th rank.

In addition to active utilization of the internship system to increase the contact points with students, possibilities to work in wider and new fields such as HR tech and Fintech despite having the adverting as the core business and being able to work with some renowned and excellent engineers of the industry as an engineer, are reasons why they are attracted to the company.

Also, the company considers the incentive system that evaluates the challenges to the maximum is one of the factors for its popularity.

【1-7 Capital and business alliance with ITOCHU Corporation】

FreakOut Holdings announced conclusion of a capital and business alliance with ITOCHU Corporation in December of last year.

FreakOut Holdings and ITOCHU Corporation cooperate with each other widely by combining a myriad of the tangible and intangible assets possessed by ITOCHU Corporation with the technology infrastructure of FreakOut Holdings, such as joint development of new services in the digital marketing field and expansion of business overseas mainly in Asia.

2. Fiscal Year September 2019 Earnings Results

(1) Overview of Business Results (Total)

| FY 9/18 | Ratio to sales | FY 9/19 | Ratio to sales | YoY | Forecast in May | Difference from the forecast |

Sales | 14,745 | 100.0% | 21,709 | 100.0% | +47.2% | 19,000 | +14.3% |

Gross profit | 3,848 | 26.1% | 5,405 | 24.9% | +40.5% | - | - |

SG&A expenses | 4,381 | 29.7% | 6,676 | 30.8% | +52.4% | - | - |

Operating income | -532 | - | -1,270 | - | - | 100 | - |

Ordinary income | 307 | 2.1% | -1,497 | - | - | 200 | - |

EBITDA | 843 | 5.7% | -491 | - | - | 700 | - |

Net income | 25 | 0.2% | -3,512 | - | - | - | - |

*unit: million yen

*Some data is calculated by Investment Bridge, and some data contained within this report may vary from actual results. (Applies to all data in this report)

Sales grew 47.2% year on year, and EBITDA was negative 491 million yen.

The sales for the term ended September 2019 were 21,709 million yen, up 47.2% year on year. Sales have been growing at a high rate of over 30%. The sales in 4Q (July to Sep.) were 6,204 million yen, up 48.6% year on year, but down 4.2% from 3Q (Jan. to Mar.). This is attributable to the recoil from the temporary significant growth of sales in new businesses, including FinTech, in 3Q. The sales of the domestic ad DSP, etc. (the media that have No.1 traffic volume) are declining.

( Reference material of the company)

Operating loss was 1,270 million yen (a loss of 532 million yen in the previous term). Gross profit rate shrank 1.2 points to 24.9%, while SGA ratio rose 1.1 points to 30.8%. SG&A expenses have been on the rise owing mainly to labor cost.

( Reference material of the company)

As for non-operating revenue, profit from investment gain on equity method decreased from 891 million yen in the previous term to 138 million yen. In addition, exchange loss increased from 23 million yen in the previous term to 241 million yen. Ordinary loss was 1,497 million yen (a profit of 307 million yen in the previous term).

EBITDA was negative 491 million yen (positive 843 million yen in the previous term). While the domestic advertising business moved into the black again, the overseas advertising business stayed in the red. In addition, the new businesses, including FinTech, incurred a loss. The start of application of the equity method to Zeals produced some effects.

As for adGeek, The Studio By CtrlShift, etc., the company posted an impairment loss of 1,168 million yen early, for monetizing them in the next term. Consequently, the loss attributable to owners of parent was 3,512 million yen (a profit of 25 million yen in the previous term).

(2) Trends by segment

Sales and Profit by Business Segment

| FY Sep. 2018 | Ratio to sales・ Profit margin | FY Sep. 2019 | Ratio to sales・ Profit margin | YoY |

DSP business | 12,995 | 84.3% | 18,461 | 83.8% | +42.1% |

DMP business | 1,646 | 10.7% | 2,188 | 9.9% | +32.9% |

Other business | 766 | 5.0% | 1,378 | 6.3% | +79.9% |

Groups and adjustment | -662 | - | -318 | - | - |

Consolidated Sales | 14,745 | 100.0% | 21,709 | 100.0% | +47.2% |

DSP business | 209 | 1.6% | -284 | - | - |

DMP business | 62 | 3.8% | 128 | - | +106.8% |

Other business | -604 | - | -1,116 | - | - |

Adjustments | -199 | - | 2 | - | - |

Consolidated Operating Income | -532 | - | -1,270 | - | - |

*Unit: million yen

*the ratio shown in the operating income is profit margin.

DSP business

Sales were 18,461 million yen, up 42.1% year on year, loss was 284 million yen (a profit of 209 million yen in the previous term), and EBITDA was 376 million yen, down 71.6% year on year.

By offering the mobile marketing platform “Red,” the system for supporting the development and operation of ad platforms “Red for Publishers,” native ad platforms, and trading disks, the company worked on the maximization of the effects of ads for advertisers and the revenue of media providers. In the term ended September 2019, the mobile marketing platform “Red” and the native ad platform “poets” kept performing well. However, sales and EBITDA declined, due to seasonal factors and the significant decrease of transactions with some media that have significant traffic volume. As for overseas subsidiaries, Playwire, LLC started contributing to revenue as they joined the corporate group, while the upfront investment in new footholds and subsidiaries augmented costs, and the company incurred a loss through some M&A projects. Consequently, sales grew considerably, but EBITDA dropped.

DMP business

Sales were 2,188 million yen, up 32.9% year on year, profit was 128 million yen, up 106.8% year on year, and EBITDA was 148 million yen, up 61.3% year on year.

The performance of the DMP business, which solves marketing issues of client enterprises by utilizing data, improved, as its popularity in the data marketing utilizing data was enhanced and the number of companies that have adopted its service increased.

Other business

Sales were 1,378 million yen, up 79.9% year on year and loss was 1,116 million yen (in the previous term, a loss of 604 million yen posted) and EBITDA was negative 1,018 million yen (in the previous term, negative 512 million yen).

In the other business segment, the company offers new businesses and business administration functions in the group companies inside and outside Japan.

( Reference material of the company)

Qualitative trends at home and abroad

≪Domestic Advertising Business≫

It was in the red in 3Q, but moved into the black, as it recovered steadily after the transactions with major media were discontinued.

This time, the equity method was applied to the company named Zeals. The company had kept investing in Zeals actively since early days, and became a major shareholder with an ownership ratio of over 20%. On the other hand, the equity method had not been applied to Zeals from the viewpoint of significance, etc. However, it has grown quite rapidly, and a possibility of significant dilution lowered, so the company decided to apply the equity method. Zeals is a company that is growing while appearing in the media and posting mainly ads in transportation systems.

As the cost in the past one year was posted at once, the company does not expect that this level of loss will be posted in a single quarter in the future.

≪Foreign Advertising Business≫

As a favorable fact, Playwire, which was acquired at the beginning of this year, kept performing well, and posted an EBITDA of 100 million yen by itself. In the summer season, sales and profit tend to drop, but their profit did not decline, and they are producing results steadily. Since this business thrives around the end of each year, we can expect that the results for 1Q of the term ending September 2020 will be good.

On the other hand, the EBITDA for the businesses in Thailand, Indonesia, and Taiwan, where the company started business early, was negative 70 million yen. In Taiwan, monetization was completed, but the profit in Indonesia was negative, but annual profit remained positive, and it has just moved into the black again. In Thailand, monetization is delayed, due to political issues, etc., but the acquired Thai corporations, such as digitiv and DotGF, are performing well. Accordingly, the company is further discussing whether or not to maintain the footholds in Thailand and so on.

In Malaysia, Vietnam, the Philippines, India, China, etc., where the company is investing, the company incurred a loss of a total of 50 million yen. In the Philippines and China, the company earned profit in a single month. In other countries, it is highly likely that some subsidiaries will earn profit in a single month soon, but for some companies, monetization is a watershed. After seeing the next quarterly results, the company will discuss whether to conduct further restructuring.

( Reference material of the company)

(3) Financial condition and Cash Flow

Main BS

| September 2018 | September 2019 |

| September 2018 | September 2019 |

Cash and deposits | 3,174 | 5,690 | Trade payables | 1,494 | 2,854 |

Trade receivables | 2,602 | 4,454 | Short-term loans payable | 3,544 | 3,358 |

Current assets | 8,026 | 14,511 | Current liabilities | 6,182 | 11,498 |

Property, plant and equipment | 265 | 239 | Long-term interest-bearing debts | 4,920 | 6,809 |

Intangible assets | 1,334 | 2,615 | Total liabilities | 11,141 | 18,353 |

Investment securities | 5,157 | 5,830 | Net assets | 4,495 | 5,885 |

Investments and other assets | 6,010 | 6,872 | Total liabilities and net assets | 15,636 | 24,239 |

Noncurrent assets | 7,609 | 9,727 | Balance of interest-bearing debts | 8,464 | 10,168 |

*unit: million yen

*Interest-bearing debts = loans + lease obligation

The total assets as of the end of the term ended September 2019 were 24,239 million yen, up 8,602 million yen from the end of the previous term, as cash and deposits increased 2,515 million yen, trade accounts receivable rose 1,852 million yen, other accounts receivable grew 2,237 million yen, customer-related assets increased 1,213 million yen through the inclusion of new companies in the scope of consolidation, and assets grew 673 million yen through the acquisition of investment securities.

Liabilities augmented 7,211 million yen from the end of the previous term to 18,353 million yen, as trade accounts payable increased 1,360 million yen, other accounts payable rose 3,350 million yen, and borrowings, etc. rose 1,706 million yen.

Net assets were 5,885 million yen, up 1,390 million yen from the end of the previous term, as capital and capital surplus increased 3,895 million yen mainly due to the allocation of new shares to a third party, etc. while the company posted a loss attributable to owners of parent of 3,512 million yen.

Capital-to-asset ratio was 18.2% (26.9% at the end of the previous term).

Cash Flow

| FY September 18 | FY September 19 | YoY | |

Operating cash flow(A) | -1,921 | 1,759 | +3,681 | - |

Investing cash flow (B) | -3,157 | -5,352 | -2,194 | - |

Free・Cash Flow(A+B) | -5,079 | -3,592 | +1,486 | - |

Financing cash flow | 5,062 | 6,130 | +1,067 | +21.1% |

Cash and Equivalents at the end of term | 3,174 | 5,690 | +2,515 | +79.2% |

*Unit: million yen

The cash and cash equivalent as of the end of the term ended September 2019 amounted to 5,690 million yen, up 2,515 million yen from the end of the previous term.

As for operating CF, there was an inflow of 1,759 million yen (an outflow of 1,921 million yen in the previous term), mainly because other accounts payable increased 3,555 million yen, impairment loss was 1,168 million yen, and the cash received from interest and dividends amounted to 1,591 million yen, although other accounts receivable augmented 2,201 million yen and net loss before taxes and other adjustments was 2,973 million yen.

As for investing CF, there was an outflow of 5,352 million yen (an outflow of 3,157 million yen in the previous term), mainly due to purchase of investment securities amounting to 1,944 million yen, the purchase of shares of subsidiaries and associates amounting to 529 million yen, and the purchase of shares of subsidiaries resulting in change in scope of consolidation amounting to 2,474 million yen.

As for financing CF, there was an inflow of 6,130 million yen (an inflow of 5,062 million yen in the previous term), mainly because borrowings amounted to 1,610 million yen and shares were issued for procuring 3,785 million yen.

3. Fiscal Year September 2020 Earnings Estimates

(1) Full-year earnings forecast

| FY 9/19 | Ratio to sales | FY 9/20 (forecast) | Ratio to sales | YOY |

Sales | 21,709 | 100.0% | 27,000 | 100.0% | +24.4% |

Operating income | -1,270 | - | 200 | 0.7% | - |

Ordinary income | -1,497 | - | 200 | 0.7% | - |

EBITDA | -491 | - | 500 | 1.9% | - |

Net income | -3,512 | - | undecided | - | - |

(unit: million yen)

For the term ending September 2020, sales are estimated to rise 24.4% and EBITDA is expected to turn positive.

For the term ending September 2020, sales are estimated to rise 24.4% to 27 billion yen, and EBITDA is projected to be 500 million yen.

Setting the corporate vision “To offer people human jobs,” the company will strive to improve its corporate value further. In detail, in the domestic Internet ad market, where growth is expected to continue, the company will contribute to revenue via “TVer PMP” as well as “Red For Publishers” and “Poets” in addition to the DSP and DMP businesses, which have been the mainstay. In addition, the company will accelerate growth through the collaborative business with ITOCHU Corporation and large-scale alliances aimed at acquiring new media and data, and so on.

In the rapidly growing Internet ad market outside Japan, the company has made inroads into major countries in Southeast Asia and South Asia, and will strive to enhance its earning capacity by selecting businesses and footholds further, to advance from the investment phase to the earning phase. Especially, the company will pursue business synergy with the acquired companies.

Furthermore, the company will make efforts to upgrade its corporate value for the future, by actively investing in not only the Internet ad business in which the company has been engaged, but also the FinTech and RetailTech fields based on the technological foundation, and selecting businesses for which it is difficult to earn profits in a short period of time.

(2) Medium-term plan

The three-year medium-term plan aims at “sales of 33 billion yen and EBITDA of 3 billion yen” in the term ending Sep. 2020. The company pursues sales and EBITDA growth in FY2020 that are 2.8 times and 2.1 times higher than the actual results of FY2017, respectively.

As for sales, if Kanmu, Inc. (which will be described later) is taken into account as it will be included in the scope of consolidation, the target sales of 33 billion yen in the mid-term plan will get within reach. While the forming of alliances with specific business partners inside Japan was finished earlier than expected, the overseas subsidiaries acquired via M&A contributed to sales more than estimated. The outlook for sales in the final year of the 3-year plan is becoming bright. Meanwhile, EBITDA is forecasted to be 500 million yen, while it first aimed to achieve an EBITDA of 3 billion yen. It is projected to reach 3 billion yen in around 2022, two years later than planned. In order to attain mid-term goals, it was necessary to develop a new source of revenue in a short period of time. The company implemented the strategy of achieving rapid corporate growth by acquiring, investing in, and supporting burgeoning companies. The company changes the ways of response according to whether its capital alliance partners excel at selling capacity or technology. The response to companies that are expected to exert their selling capacity is relatively simple. If their businesses grow as planned, sales revenue will increase correspondingly. Such partners include Dencco in Japan and Playwire in the U.S. Meanwhile, there exist also companies whose businesses did not grow as expected considering their selling capacities, such as those put into impairment loss. For such companies, FreakOut Holdings, as a parent company, plans to interfere with their business operations and responsibly deal with them for improving their profitability. The period for it is a factor that has delayed the achievement of mid-term goals. As for companies that offer services with technology, FreakOut Holdings concluded that some of them should invest in R&D and marketing as of now.

From the long-term viewpoint, the performance of the company is not bad at all, but can be expected to improve more than initially estimated. However, from the viewpoint of EBITDA, it became necessary to put it on ice. This can be said also for Zeals, for which the company holds around 30% of shares, and decided to apply the equity method. Like this, FreakOut Holdings obtained the equities of companies that are potentially valuable at the best timing, so we can expect that the company will earn profit in the future.

4. Progress in Each Business

◎ Release of TVer PMP

The distribution of in-stream video ads to one of the largest catchup services in Japan, which boasts a total of 37 million downloads for TVer and apps of commercial TV stations, is expected to grow further in the healthy video ad market. This market has a problem that the stocks of videos that can be streamed by brands without worry are insufficient. TVer PMP is in-stream video ad that is inserted into high-quality TV programs, which are strictly produced and managed by broadcasting stations. Accordingly, the company plans to develop a video ad environment where brand advertisers can streamline video ads without worry and accelerate the digital shift of brand ad posting. In late October, the company started sales activities, and has received many business inquiries. It is expected to contribute to revenue gradually from 1Q of the term ending September 2020.

(Reference material of the company)

◎ Growth of Playwire

The acquisition of Playwire was announced in December last year, and its results have been included in consolidated results from April. The fiscal year of Playwire starts in January and ends in December. For the fiscal year ended December 2019, sales, including the estimates for the period from October to December, increased 60% year on year to 5.96 billion yen and EBITDA rose 40% year on year to 560 million yen. Namely, its business grew steeply in the U.S. market, where competition is fierce. For the fiscal year 2020, sales and profit are projected to increase, although the growth rates are lower than those in the fiscal year 2019. In the fiscal year 2019, Playwire contributed to consolidated performance only for the half of the year, but in the fiscal year 2020, it will contribute to consolidated performance for the full year, boosting the sales and EBITDA in the term ending September 2020.

(Reference material of the company)

◎ Consideration of the inclusion of Kanmu, Inc., which is growing rapidly, in the scope of consolidation

In new businesses, including FinTech, the company concentrates on the investment in promising companies in a few fields. One of the representative companies in which the company invested is Kanmu, Inc., which operates Vandle Card, a VISA prepaid card app for smartphones. Since 2017, FreakOut Holdings has invested in Kanmu. It has not been included in the scope of consolidation, but FreakOut Holdings plans to include it in the scope of consolidation after judging the right timing.

As a global trend, unlisted technology firms in the field of financial services targeted at people who do not have bank accounts called “the unbanked” are burgeoning and a large number of unicorn companies are emerging there. In Japan, the number of consumers who do not have any bank accounts or cannot create them is not large. Instead, there exist those who are reluctant to use convenient financial services because they are anxious and afraid and lack financial literacy. They are called “the psychologically unbanked.” Its business is to remove various psychological barriers, such as the fear of squandering, and offer convenient financial services to psychological unbanked users.

One and a half months before the end of this year, Kanmu is in the fiscal year 2019 and estimated to have an income from commissions amounting to over 2.2 billion yen as sales for this term. In the ranking of rapidly growing enterprises titled “fast 50” announced every year by Deloitte, Kanmu ranked top with its 3-year growth rate being 3,592%. It has been over 2 years since FreakOut Holdings started investment and support for its growth, and during that period, it grew rapidly and was recognized by an external institution.

In the fiscal year 2020, Kanmu is expected to keep growing at a high rate, although the growth rate may decline. The number of downloads of its app is projected to be 2 million, indicating steady growth. Its services are targeted at consumers, but its sales come from mainly repeat users. It keeps increasing new users by actively investing in marketing, but the ratio of repeat users remains very high. It is increasing recurring revenue.

The company strictly limits the period for recouping the investment in marketing with its gross profit and plans to continue active investment in marketing while it can increase customers during the recoupment period. How much Kanmu can keep growing with the investment within an economically rational range is important for determining the timing of inclusion of Kanmu in the scope of consolidation. FreakOut Holdings will plan to reorganize Kanmu into a consolidated subsidiary when it is expected to contribute to profit surely.

The business of Kanmu

(Reference material of the company)

5. Conclusions

For the term ended September 2019, sales increased considerably, but EBITDA turned negative, and profit attributable to owners of parent was negative 3.5 billion yen. However, it can be considered the company just suffered the “birth pangs.” Through impairment accounting, amortization will be reduced from the term ending September 2020. In the mid-term plan, the target EBITDA has not been achieved, and is still to be achieved, but sales have grown steadily, and invested businesses have produced some results. EV/EBITDA is around 9 under the assumption that the mid-term goals have been achieved although some goals are still to be achieved. Accordingly, the stock of the company is considered to be undervalued, considering the fact that the company is growing rapidly.

Due to the posting of a loss, capital-to-asset ratio dropped from 26.9% to 18.2% between the end of the previous term and the end of the current term, but it is expected to improve considerably thanks to the latent profit of Intimate Merger, which was listed in November.

<Reference: Regarding corporate governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 3 external ones |

◎Corporate Governance Report

Last modified: December 26, 2019.

<Basic Policy>

The company believes that improving management efficiency, management soundness, transparency and compliance will enhance the corporate value from a long-term perspective, and by doing so, it can return profits to many stakeholders including shareholders. In order to enhance the management soundness, transparency and compliance, it is important to build an organizational structure that can respond swiftly and flexibly to changes in the business environment while improving the corporate governance. The company carries out efficient management based on the viewpoints of shareholder who are the owners of the company.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

It is mentioned that “our company follows all of the basic principles of the Corporate Governance Code.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on FreakOut Holdings, inc. (6094) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/