Bridge Report:(6181)Partner Agent Fiscal Year March 2019

President Shigeru Sato | Partner Agent, Inc.(6181) |

|

Company Information

Market | TSE Mothers |

Industry | Service industry |

President | Shigeru Sato |

HQ Address | IMAS Osaki Building, 1-20-3 Osaki, Shinagawa-ku, Tokyo |

Year-end | End of March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥293 | 10,432,800 shares | ¥3,056 million | 9.8% | 100 shares | |

DPS(Est.) | Dividend Yield(Est.) | EPS(Est.) | PER(Est.) | BPS(Act.) | PBR(Act.) |

¥0.00 | - | ¥12.80 | 22.9 x | ¥96.39 | 3.0 x |

*The share price is the closing price on July 3.

*The number of shares issued, and ROE, and BPS were taken from the brief financial report in March 2019.

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2014 Act. | 2,164 | 51 | 39 | 17 | 2.04 | - |

March 2015 Act. | 2,664 | 146 | 132 | 79 | 8.98 | - |

March 2016 Act. | 3,644 | 445 | 434 | 285 | 30.95 | - |

March 2017 Act. | 3,812 | 204 | 231 | 107 | 11.37 | 0.00 |

March 2018 Act. | 4,102 | 195 | 325 | 117 | 12.15 | 0.00 |

March 2019 Act. | 4,151 | 216 | 208 | 90 | 8.99 | 0.00 |

March 2020 Est. | 9,100 | 230 | 170 | 130 | 12.80 | 0.00 |

*Unit: million yen., yen.

*The estimated values were provided by the company. On January 1, 2017, the company conducted a 3-for-1 stock split. EPS was adjusted retroactively.

*From the term ended March 2016, net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

We would like to report an overview of earnings results for Fiscal Year March 2019 of Partner Agent, Inc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year March 2019 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for FY March 2019 were 4,151 million yen, up 1.2% year on year. The sales of the Partner Agent Business, the company’s mainstay, were unchanged from the previous fiscal year, the sales of the Fast Matching Service Business grew steadily, and the sales of the Solution Business grew by double digit due to the development of matching support services targeting nursery teachers. Labor cost decreased along with the transfer of the Nursery Business while selling, general and administrative expenses were unchanged from the previous term as the postponed advertisement was carried out as planned, and operating income increased by 10.9% year on year to 216 million yen. In addition to the absence of the subsidy income that was posted in the previous term, the depreciation of deposit caused ordinary income to decrease by 36% year on year to 208 million yen. The net income fell to 90 million yen, down 23.2% year on year since the change in the posting method related to matching support parties caused 20 million yen to be transferred as allowance for doubtful accounts. Regarding to the Partner Agent Business, sales and profit were lower than the initial estimates due to the decrease in the number of new members who joined in the third quarter (October-December).

- The sales for FY March 2020 are estimated to increase by 119.2% year on year to 9.1 billion yen. The sales will grow significantly along with the inclusion of Mation Inc. in the corporate group. Operating income is estimated to be 230 million yen, up 6.3% year on year. The increase in operating income is expected to remain single-digit as it is estimated to be a total of 170 million yen including the goodwill concerning the company’s stock acquisition of around 70 million and the amortization of intangible assets of around 100 million yen. However, the real earning capacity would be around 400 million yen. Further, the goodwill expenditure from the next term until FY March 2029 will be only posted as 70 million yen every term. As for non-operating expenses, the upfront investment by en-konkatsu agent Inc. (investment loss by equity method) is expected, leading to an expected decline in ordinary income.

- FY March 2019 recorded an increase in sales for eight consecutive terms, though it was slight, and operating income increased for the first time in 3 terms. The number of new members per quarter in the Partner Agent Business reached 2100 for the first time in 8 quarters, and for this term, the company is expecting the business bottoming out and recovery such as an increase in the annual base for the first time in 4 terms. The company will focus on the extent of the momentum of recovery while competition is becoming more intense. At the same time, it is also paying attention to the amount of synergy and value addition realized by the M&A and alliance strategy it has been actively engaged in since the previous term.

1. Company Overview

The company provides various services starting from marriage support. Their key business, the “Partner Agent Business,” supports the matching efforts of the registered members. The “Fast Matching Service Business” manages planning and operation of matchmaking events. The “Solution Business” provides “CONNECT-ship”, an open platform that enables the matchmaking between its members and those of other competitors’ marriage support services, and to corporations and local governments that are promoting matchmaking, it organizes matchmaking events as well as provides a matching system called “parms.” It also operates the “QOL Business” that supports new daily lives to each life stage after the marriage such as introduction of wedding halls, sales of marriage rings and review of insurance contracts. The company offers various services based on the corporate philosophy of “Bringing more smiles and happiness to the world.” The company’s major feature is its high marriage rate which is achieved by matching supports through detailed follow-ups by dedicated concierges and unique systems.

【1-1 Corporate history】

In June 2004, the company was established to start a marriage support business as a 100% subsidiary of Take and Give Needs, Co. Ltd. (4331, Tokyo Stock Exchange 1st Section, hereinafter “T&G”), which is specialized in wedding planning and wedding hall operation. At the time of the company establishment, Mr. Shigeru Sato was appointed to be the President for his abundant experiences and achievements at a major matchmaking company.

Later, when the business of T&G slowed down and it became difficult to invest continuously, President Sato, the executive staff and the employees collaboratively purchased the shares of Partner Agent, Inc., and the company became independent from the T&G Group in May 2008. The company’s business has been growing steadily because the customers highly regard the company’s high marriage rate, which is the result of “pursuing customers’ goals” and. It was listed on the TSE Mothers in October 2015.

【1-2 Corporate ethos】

“Pursuing the customers’ goals” has been the philosophy of President Sato since the establishment of the company. Based on this philosophy, the company holds the following mission and visions.

Our mission | Bringing more smiles and happiness to the world. |

Our visons | 1. We will keep on creating “values” as an innovator of the matchmaking industry and offering more opportunities for the customers to meet their marriage partners. 2. As life-long supporters to walk with people, we aim at helping our customers to have happy lives by making their “thoughts” a “reality.” |

Our action guideline | ・ Judgment criteria are the customers. ・ Professional mind ・ Passion supremacist ・ Walk on the right path ・ Grow with its own initiative ・ Team Partner Agent ・ Pursue one’s own happiness |

President Sato believes that these philosophies will penetrate into the employees only by remembering the philosophy and thinking based on it whenever they encounter specific issues or troubles.

【1-3 Market environment】

<Situations of unmarried people>

*Growing percentage of unmarried people

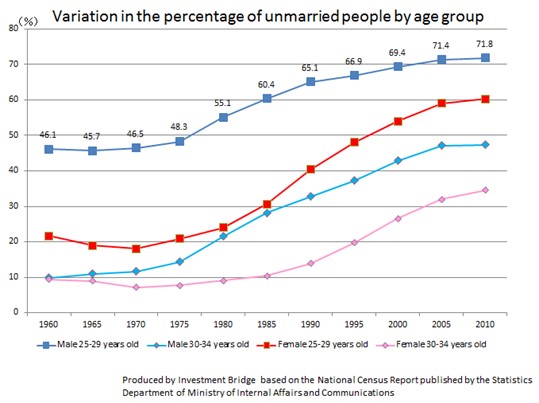

According to the national census conducted by the Ministry of Internal Affairs and Communications, the percentage of unmarried people between ages 25 and 34 has been increasing for both men and women in Japan.

*Intention to marry among unmarried people: “Intention to marry” remains at a high level.

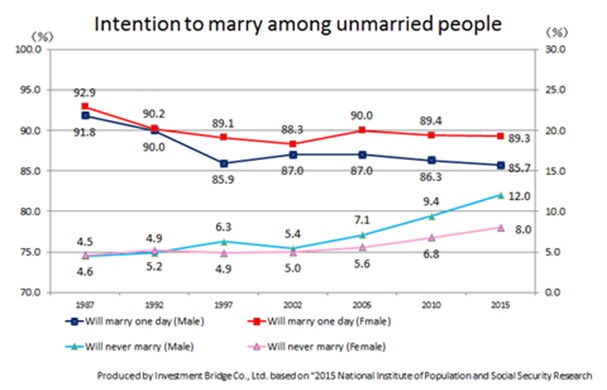

According to the “2016 National Institute of Population and Social Security Research <National Survey on Marriage and Childbirth>, the 15th Basic Survey on Childbirth Trend,” the percentage of unmarried people between ages 18 and 34 who want to marry were: male 85.7%, female 89.3% . These data indicate that there are still many unmarried people who “want to marry.”

Although the percentages of unmarried men and women who responded “Never intend to marry” have been rising, among them, 44.1% of men and 49.8% of women responded that they might eventually change their intention to “Intend to marry.” This indicates that about half of the people who currently do not intend to marry may change their mind and start to look for their marriage partners in the future.

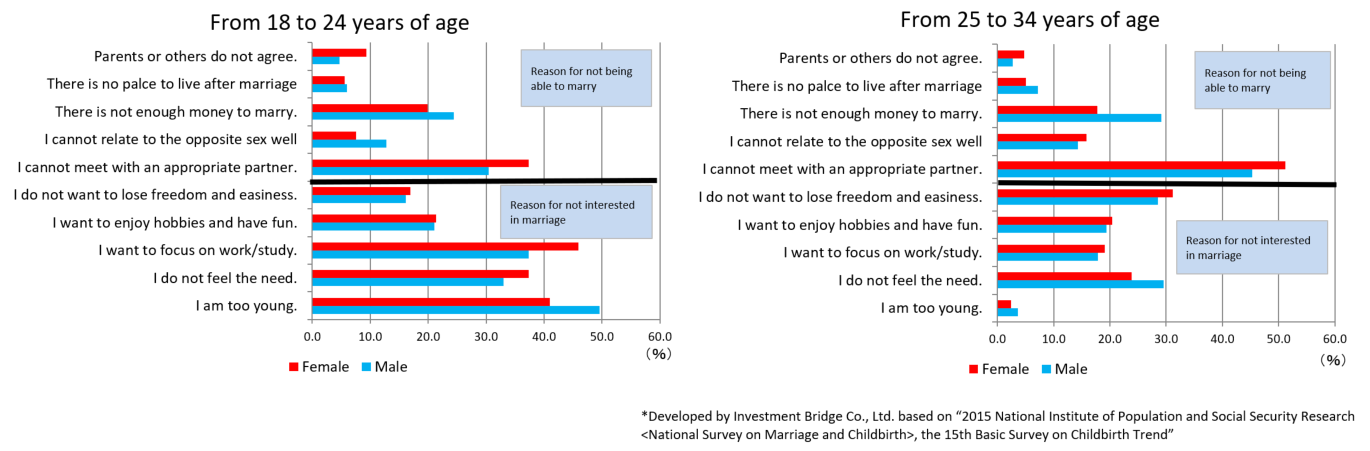

*Reasons for being single: Unable to find the appropriate person for marriage after 25 years of age

The reasons for the unmarried people between ages 18 and 24 to stay single were “I am still too young” and “I do not feel the need,” indicating that their motivation for marriage is not so high. On the other hand, a higher percentage of unmarried people between ages 25 and 34 responded that “I have not met an appropriate person yet,” indicating that the needs for the opportunities to meet potential partners are high in this age group.

<Other companies in the industry>

About 3,000 marriage agencies etc. are engaged in marriage support activities across Japan. However, 90% of them are operated by individual business owners. There are only a few agencies including the company that run such businesses across Japan.

Following are the companies listed on the stock exchange in the matchmaking industry, including Partner Agent.

Code | Company name | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income margin | Aggregate market value | PER | PBR |

2417 | ZWEI | 3,700 | +4.8 | 110 | - | 3.0% | 2,768 | 115.3 | 0.8 |

6071 | IBJ | 15,055 | +27.4 | 1,800 | +21.9 | 12.0% | 36,969 | 28.4 | 10.1 |

6181 | Partner Agent | 9,100 | +119.2 | 230 | +6.3 | 2.5% | 2,869 | 21.5 | 2.9 |

*Sales and profit are the estimates by the company for this fiscal year. Units are million yen, % and times.

*The aggregate market value is “the term end number of shares issued as stated in the most recent financial statement” x “closing price on June 10, 2019.”

【1-4 Business contents】

As a reporting segment, the company carries out four businesses, which are the Partner Agent Business, the Fast Matching Service Business, the Solution Business and the QOL Business.

① Partner Agent Business

The Partner Agent Business provides information, introduces potential partners and provides opportunities of the encounter to the registered members.

An exclusive concierge is assigned to each member. The concierge develops plans for actions and supports the member professionally. Also, in order to provide opportunities of the encounter, the company plans and hosts matchmaking events for the members.

There are more female members, with the member composition ratio of male to female being between 4:6 and 3:7.

(Characteristics of services)

A concierge with high coaching skills works with a “customer who wants to find a marriage partner within 1 year.” The concierge designs the activities based on the PDCA cycle to meet the needs of the customer who desires cost-effective services without wasting time and effort.

The concierges are mostly women who are done raising children, willing to help others through marriage support and share joys. As of the end of March 2019, there are 128 concierges. The company has the motto of “pursuing customers’ goals” so the concierges are evaluated based on the “customer satisfaction” including the engagement rate and the early withdrawal rate.

<Image of support based on the PDCA cycle>

(1) Before sign-up: Clarifying service contents and fee structures

A customer who is considering to be a member and comes to the store is greeted by an account executive whose role is to encourage him/her to become a member. The account executive explains the service contents and fee structures in details so that the customer can accurately understand them. If it seems difficult to continue introducing partners to the customer based on certain criteria, the customer may be declined to be a member. This is to avoid the situations where the customers are not satisfied with the services in cases where they cannot reach a contact (marriage meeting) or go steady with a partner, even though they pay monthly membership fees.

(2) After sign-up: Support by an exclusive concierge who is assigned to a member

Once a customer signs up for the membership, an interview will be conducted by a concierge in charge of the customer to understand the customer’s sense of value and expectations.

At this time, using the coaching skills, the concierge tries to identify the customer’s expectations and ideal model of marriage as clearly as possible. This way, instead of helping the customers find their partners abstractly, the concierges can help them find someone based on specific criteria.

In addition to the conventional matching mechanism through data, the company offers concierge services. This has differentiated the company’s service from the others. With this system, the company can offer cost-effective services without wasting time and efforts of the customers.

During the activities, the exclusive concierges help the members modify the path as needed using a PDCA cycle. This way, the members can proactively work on the activities, even if they fail in the process.

Furthermore, the concierges ask for comments and impression from the members after each contact (marriage meeting), providing consultation to the members during dating period in addition to follow-ups after engagement (*) to walk with the members until they reach engagement.

The follow-up period after the engagement is 1 year. This way, they can support the members for a long time until marriage.

(*) Engagement (Withdrawal from the membership) This means that members withdraw from the membership after both members expressed their intention to continue dating with the intent to marry the partners they are dating.

(3) Setting up contact (marriage meeting):Support by the staff other than the exclusive concierges

As the process advances, the members have contacts (marriage meetings) with the matched members. The specialized team supports them to coordinate the date, time and place of these contacts so that they can have their contacts set up effortlessly and efficiently.

The support team helps the members to carry out the activities smoothly. For example, even if the members are lost on the way to the contact venue or cannot find the person that they are supposed to meet, the company’s staff provides support via phone or e-mail so that the members do not miss the chance to meet. Furthermore, when the customers seek second opinions, the company provides third-party advice through a service desk.

<Service fee structure>

Registration fee | Cost related to new member registration |

Initial fee | Cost related to activities including interviews done by a designated concierge, planning activity and writing recommendation. |

Monthly fee | Cost for matchmaking and activity support |

Engagement fee | Incentive fee for leaving the membership at the time of the engagement. |

Others | Cost related to participation in events and seminars, purchase of option services and other activities. |

The company introduces about 2 to 6 members per customer per month, depending on the course chosen by customers. However, this figure is an obligation under the service contract and not the upper limit. Therefore, the company may introduce more members at its direction.

(Additional services)

(1) Events for the members

In addition to the introduction by a concierge, the company develops and hosts various events such as matchmaking parties.

Having spaces for holding events within the company’s stores makes it possible to flexibly hold parties without requiring expenses of renting a hall for events.

(2) Option services

☆The company offers a photo shoot (fee-based) for the members with extra charges. Since the first impression is crucial for matchmaking, in collaboration with professional photographers and make-up artists, the company offers photo shoots in their studios or within the company’s premises. Because the photography is specifically for matchmaking, the company can offer advice concerning appropriate clothing and facial expressions based on their experiences.

☆To provide the preliminary knowledge and information about matchmaking to the members, the company offers seminars (fee-based) on color coordination, fashion advisor, communication and others for the members.

②Fast Matching Service Business

The Fast Matching Service Business is based on the concept of “affordable matchmaking services which people can start using casually”.

(1) “OTOCON” matchmaking parties

Matchmaking parties for the general public are called “OTOCON” are planned and operated under this business.

Although these parties are targeting the public, some non-members show interest in the company through these events and become members. Thus, OTOCON is also functioning as a venue to increase new members.

Furthermore, similar to the event services for the members of the Partner Agent Business, there are staff members who are dedicated to event planning, and the events take place in the spaces within the company’s premises. The events promote efficient utilization of the company facilities and also work as a channel to solicit new members. In other words, the OTOCON parties not only bring earnings to the Fast Matching Service Business but also work in synergy with other services.

(2) Alliance Model Marriage Support Service

The company offers marriage support services by establishing alliances with other companies that have many customers and membership organizations and designing various services according to their needs.

It manages to realize low price unique to online matching, while offering comprehensive support for matching activities from introduction of partners by a dedicated concierge to provision of support through “contact (marriage meeting),” “dating” and “marriage,” based on the members’ marriage conditions and activity status, etc.

By using CONNECT-ship, it is striving to increase the number of matching and opportunities of the encounter among the members and maximize the possibility of finding a partner and leading to marriage.

③ Solution Business

(1) “CONNECT-ship,” a platform for mutual introduction of members among agencies

The “CONNECT-ship” is an open platform that enables mutual introduction of members between marriage support agencies. It launched in June 2017.

(Overview)

The platform started off with 6 companies and 7 services. As of March 2019, 8 companies and 12 services are participating.

Name of the companies | Management service name |

en-konkatsu agent Inc. | ・en-konkatsu agent |

Senior Life, Inc. | ・MARRIX |

Japan Bridal Association | ・JBA (Japan Bridal Association) |

Nihon Nakodo Renmei | ・NNR (Nihon Nakodo Renmei) |

Recruit Zexy Navi, Co., Ltd. | ・Zexy Enmusubi |

Kekkonjoho center, Inc. | ・NOZZE |

Partner Agent, Inc. | ・Partner Agent ・OTOCON Matching Concierge (former Yahoo! Matching Concierge Plan) ・Excite. Bridal Agency powered by Partner Agent ・Ichie ・OTOCON Matching Concierge Global Kids |

Zenkoku Nakodo Rengokai Co., Ltd. | ・Zenkoku Nakodo Rengokai |

The “CONNECT-ship” has more than 50,000 members (total members of all participating agencies). It is the first attempt in the matching support industry to enhance marriage rate through the mutual introduction of a large number of members between businesses with a certain scale to find their partners and enhance the results and customer satisfaction. The platform (system) to achieve mutual introduction among members was developed by the company. The other agencies will use the “CONNECT-ship” service, which is being operated and maintained by the company. The company is also in charge of operating the executive office of the “CONNECT-ship.”

It will increase its scale by including other companies that have the same vision (i.e. to maximize the marriage opportunities), which is the ultimate goal of the customers.

Each participating agency can offer its unique services and operations without being interfered by other participating agencies including the executive office (the company).

The revenue source of the company, which provides and operates the system, is the remuneration for realizing the contact (marriage meeting) between members, which is received from enterprises using this system.

(Purposes)

The purposes of the “CONNECT-ship” for the company are to develop the industry by facilitating sales competition among the participating companies and by learning from each other in an effort to promote marriage among the members to raise customer satisfaction, within a new framework. At the same time, the company is aiming to bring about changes in the industry so that healthy competition on service quality will be created.

As of the beginning of April 2019, the number of members increased by 36.9% year on year to 26,868.

The number of contacts (marriage meetings) that realized using the “CONNECT-ship” was 318,842.

(2) Operation of a website to share information on matching parties

The company launched a website called “Parties” (URL: https: // parties.jp/) in July 2018 in collaboration with the Marriage Support Project, which is a general incorporated association and aiming to realize a society where marriage support services can be used more openly. The website “Parties” posts information on matchmaking parties across Japan that are sound and in compliance with laws and regulations.

The service is managed by ichie Co., Ltd., a newly established consolidated subsidiary of Partner Agent, through a joint investment with Partner Agent and Vector, Inc., which is in charge of the operation of the Marriage Support Project.

(3) Consultation services for business enterprises and local governments

The company offers the original marriage supporting system called “parms” as ASP to both enterprises that consider entering into the matchmaking industry and local governments planning to offer marriage support activities to residents.

“parms” is a system that combines several functions, such as supporting its user activities and streamlining tasks of operating staff in addition to basic functions such as member registration, membership management and partner matching, which are all necessary in the marriage support business. The system operators can customize the system depending on the needs.

The number of institutions for which the company developed the marriage supporting system for companies increased by 2 to 3 from March 2018 to March 2019. In February 2019, the company started to provide the marriage supporting system for nursery teachers.

The major achievements with the local governments are as follows.

Local government | Contents |

Mie Prefecture | Operation of the “Support to Strengthen Bond between Married/Unmarried Couples” project in the “Marriage Positive Campaign” (a project to create a positive trend for marriage)” |

Kyoto Prefecture | Provision of a marriage support system to the companies that received business from “Kyoto Matching Support Center” |

Fukushima Prefecture | Comprehensive operation of a marriage support business on behalf of “Fukushima Marriage/Child-Raising Support Center” |

④Quality of Life (QOL) Business

To the customers who became members through the Partner Agent Business, the company offers various services at their major life events by maintaining relationship with the members even after they withdraw from the membership for their engagement. This is to enhance customer satisfaction and increase revenue opportunities.

The members of the “Anniversary Club” are the ones who withdrew from the membership after their engagement. To those members, the following services are provided.

Introduction of wedding halls |

Sales of items related to wedding |

Sales of engagement rings/ marriage rings |

Review of insurance contracts associated with changes in life stages |

Provision of various discount services that can be used for matchmaking activities and others (through business collaboration with other companies). |

As for introducing wedding halls, the company had tied up directly with wedding halls and introduced them to engaged members in the Kanto area so far, but they began introducing them to the "Zexy Consultation Counter" operated by Recruit Zexy Navi. With this, it became possible to offer a wedding hall introduction service to engaged members nationwide. Also for housing, the company had been sending customers to rental housing brokerage services only, but it started introducing “SUUMO Counter,” which is operated by Recruit Sumai Company Ltd., to engaged members who are planning to buy custom-built houses.

As of the end of June 2018, it has transferred the entire Nursery Business to Global Kids Co., Ltd., a wholly owned subsidiary of Global Group Corp. with which the company has entered a capital and business alliance.

In addition, they opened IROGAMI, a hall exclusively for reserved parties which can be used for informal parties after wedding ceremony in Ginza on October 2018.

【1-5 Characteristics and strengths】

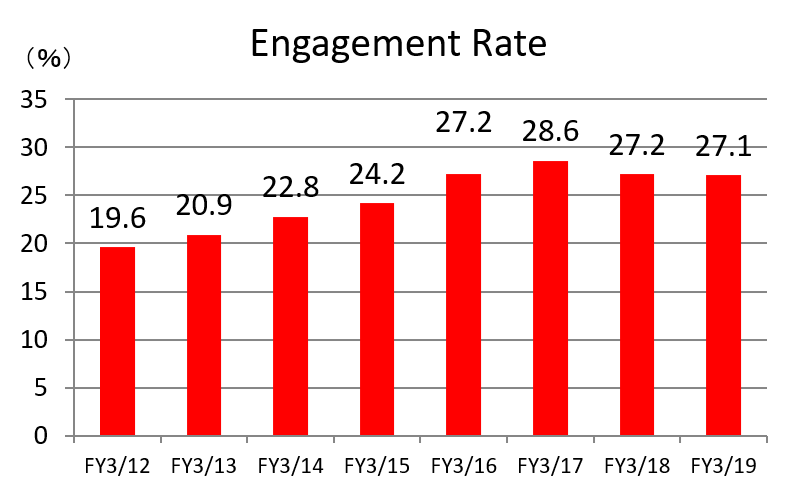

High engagement rate as a result of “pursuing customers’ goal”

One of the key features of the company is its “high engagement rate.”

The engagement rate for FY March 2019 was 27.1%.

Although other companies in the industry are not announcing exact figures, the average engagement rate is suspected to be about 10%. In comparison, the company’s engagement rate is exceptionally high.

The “engagement rate” shows a rate of members who withdrew from the membership after their engagement during a specific period. Because the rate may also raise a question about the need for matchmaking companies, many companies in the matchmaking industry prefer not to use the engagement rate as an indicator.

However, President Sato has been focusing on the idea of “pursuing customers’ goals” as a corporate strategy and philosophy from the foundation of the company.

He believes the goal that the customers want to reach through the company’s services is the “marriage.” Thus, making efforts to reach the highest rate of “getting married” is the social value of the company.

In order to achieve this purpose, the company carries out all activities including employment, education, development, training, knowledge sharing, management, and evaluation system based on the philosophy of “pursuing customers’ goals.” This stance leads to the outstanding “engagement rate” in this field.

2. Fiscal Year March 2019 Earnings Results

(1) Consolidated earnings (cumulative)

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YoY | Compared with the initial forecasts |

Sales | 4,102 | 100.0% | 4,151 | 100.0% | +1.2% | -5.2% |

Gross profit | 2,357 | 57.5% | 2,372 | 57.2% | +0.6% | - |

SG&A | 2,162 | 52.7% | 2,156 | 51.9% | -0.3% | - |

Operating Income | 195 | 4.8% | 216 | 5.2% | +10.9% | -20.0% |

Ordinary Income | 325 | 7.9% | 208 | 5.0% | -36.0% | -24.6% |

Net Income | 117 | 2.9% | 90 | 2.2% | -23.2% | -50.4% |

*Unit: million yen

Increase in Sales and Operating Income. Lower than estimated

The sales for FY March 2019 were 4,151 million yen, up 1.2% year on year. The sales of the Partner Agent Business, the company’s mainstay, were unchanged from the previous fiscal year, the sales of the Fast Matching Service Business grew steadily, and the sales of the Solution Business grew by double digit due to the development of marriage support services targeting nursery teachers.

Labor cost decreased along with the transfer of the Nursery Business while selling, general and administrative expenses were unchanged from the previous term as the postponed advertisement was carried out as planned, and operating income increased by 10.9% year on year to 216 million yen.

In addition to the absence of the subsidy income that was posted in the previous term, the depreciation of deposit caused ordinary income to decrease by 36% year on year to 208 million yen.

The net income fell to 90 million yen, down 23.2% year on year since the change in the posting method related to matching support parties caused 20 million yen to be transferred as allowance for doubtful accounts.

Regarding to the Partner Agent Business, sales and profit were lower than the initial estimates due to the decrease in the number of new members who joined in the third quarter (October-December).

(2) Trend in each segment

| FY 3/18 | Composition rate | FY 3/19 | Composition rate | YoY |

Sales |

|

|

|

|

|

Partner Agent Business | 3,011 | 73.4% | 3,015 | 72.6% | +0.1% |

Fast Matching Service Business | 702 | 17.1% | 732 | 17.6% | +4.3% |

Solution Business | 320 | 7.8% | 385 | 9.3% | +20.4% |

QOL Business | 146 | 3.6% | 175 | 4.2% | +20.0% |

Others | 1 | 0.0% | - | - | - |

Adjustment | -79 | - | -157 | - | - |

Total | 4,102 | 100.0% | 4,151 | 100.0% | +1.2% |

Profit in each segment |

|

|

|

|

|

Partner Agent Business | 680 | 22.6% | 613 | 20.3% | -9.9% |

Fast Matching Service Business | 73 | 10.5% | 112 | 15.4% | +53.2% |

Solution Business | 131 | 41.2% | 165 | 43.0% | +25.7% |

QOL Business | -69 | - | -10 | - | - |

Others | -3 | - | -2 | - | - |

Adjustment | -618 | - | -661 | - | - |

Total | 195 | 4.8% | 216 | 5.2% | +10.9% |

*Unit: million yen. The composition rate of the profit in each segment means return on sales.

Partner Agent Business

Sales were almost the same as the previous year. Profit decreased.

In April 2018, the company started a new matchmaking service called “Team Konkatsu x Smart Konkatsu Program” and worked on the development and launch of new products in order to develop new customers. “Konkatsu” means matchmaking activities.

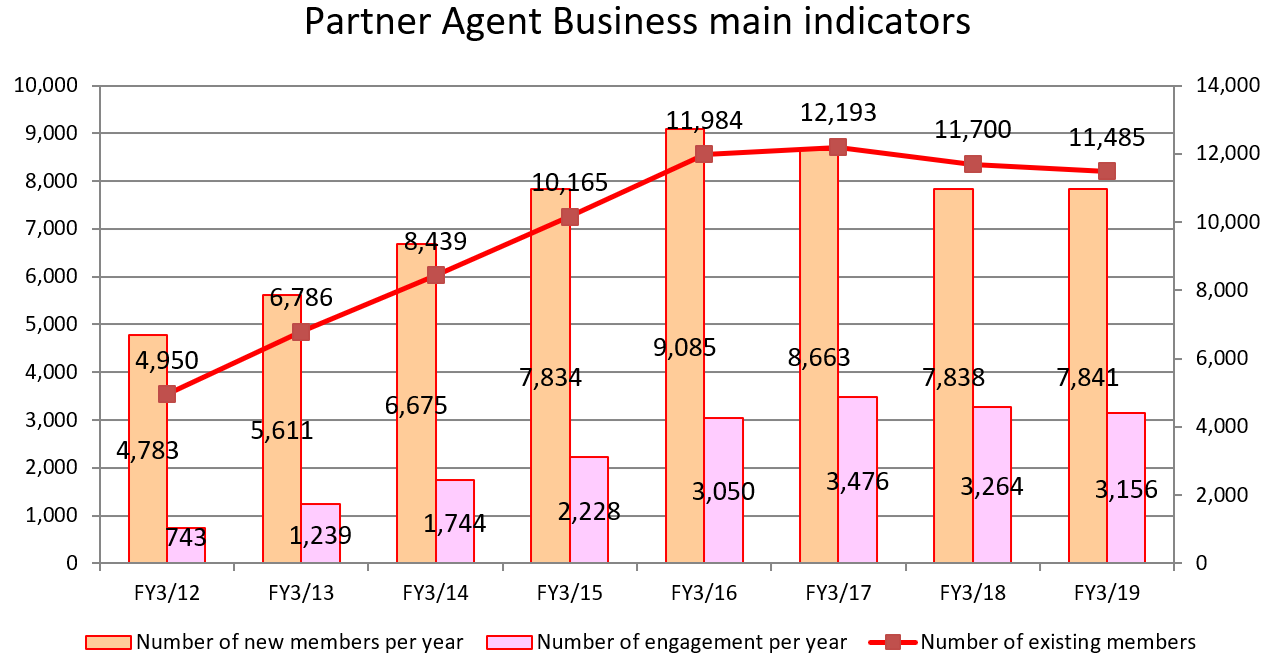

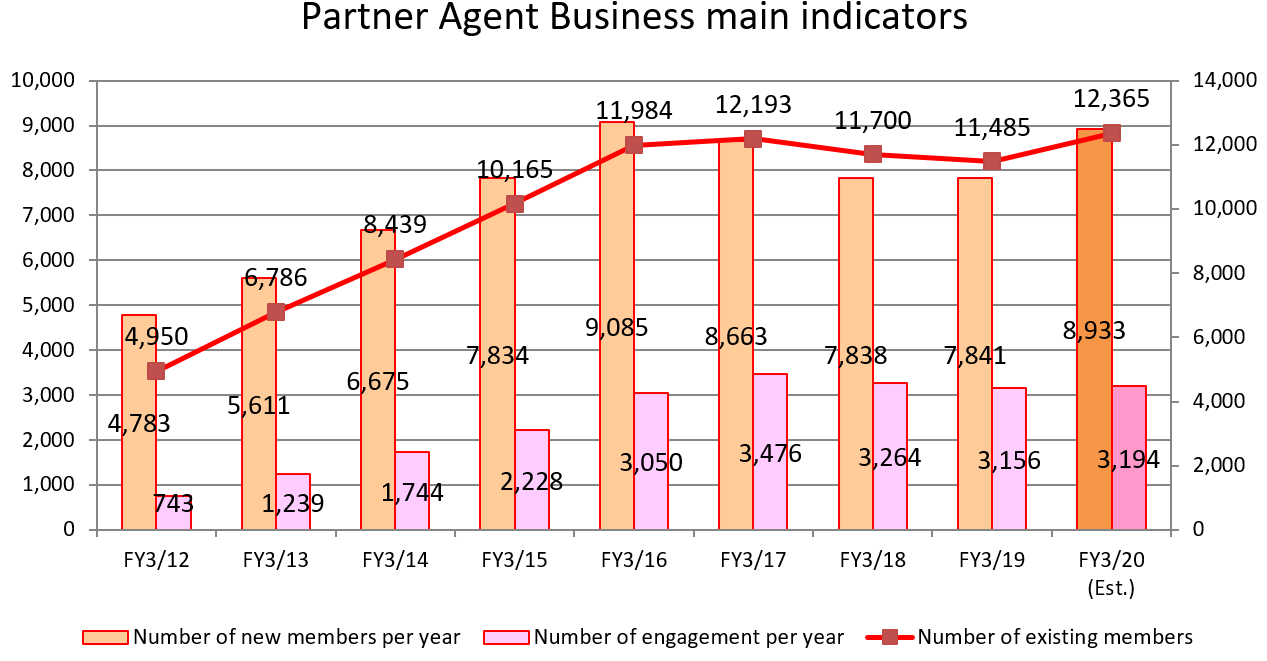

The number of new members went down temporarily in the third quarter (October-December) due to changes in the external environment, but it exceeded 2,100 for the first time in 8 quarters as a result of the success of various policies in the fourth quarter (January-March). Thus, the number of new members in the previous term was 7,841, unchanged from the previous year.

Furthermore, the number of members went down by 1.8% year on year to 11,485 in the beginning of April 2019 since some members cancelled their membership as they completed the special course (pay-per-performance type).

*Major Indicators

| FY 3/18 | FY 3/19 | YOY |

Number of new members | 7,838 | 7,841 | +0.0% |

Number of existing members as of the beginning of January | 11,700 | 11,485 | -1.8% |

Number of members who withdrew membership after engagement | 3,264 | 3,156 | -3.3% |

Engagement Rate | 27.2% | 27.1% | -0.1 point |

Fast Matching Service Business

Both sales and profit increased. Profit rate also improved.

They remodeled and expanded 3 stores in popular areas (Shinjuku store, Shinsaibashi store, and Yokohama store) and adjusted the number of parties held at other stores to optimize the operation of the matchmaking party and improve the service quality. As a result, the profit margin increased.

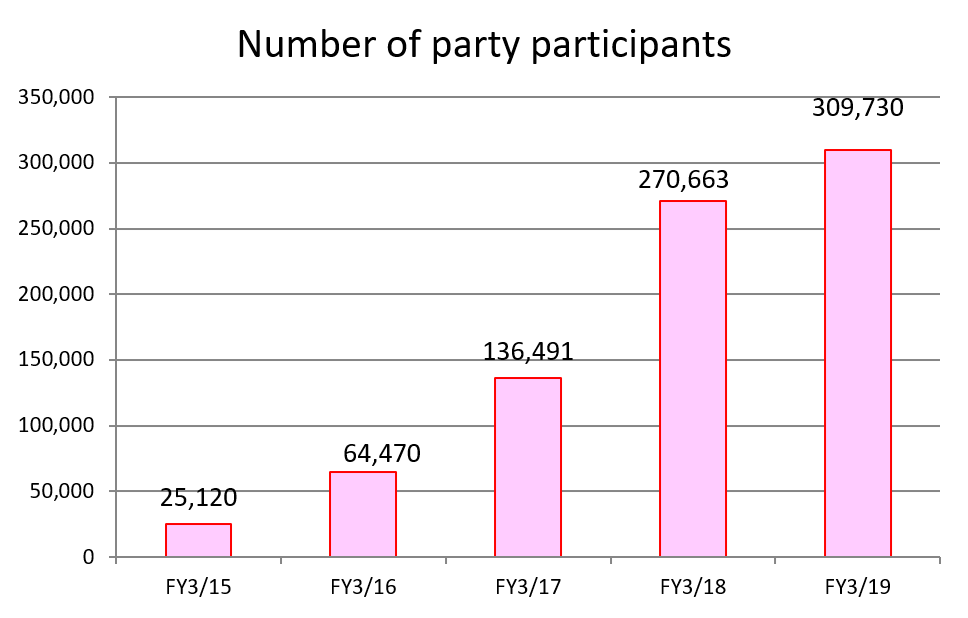

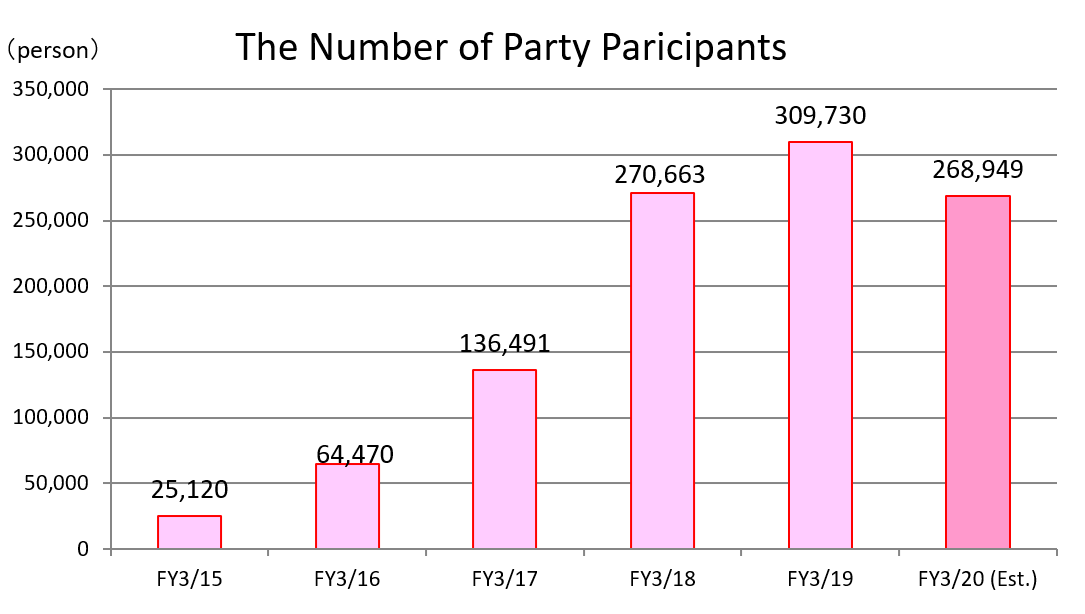

They also endeavored to develop collaboration plans with the entertainment industry and food industry as a means of attracting new customers. Consequently, the total number of participants rose by 14.4% from the previous term to 309,730. In addition, they have been enhancing the introduction of the Partner Agent Services, resulting in the total number of customer sent of 595.

*Major Indicators

| FY 3/18 | FY 3/19 | YOY |

Number of party attendees | 270,663 | 309,730 | +14.4% |

Solution Business

Both sales and profit increased. Profit rate also improved.

CONNECT-ship was used by 8 companies to offer 12 services in the FY March 2019.

The number of marriage meetings that realized using the “CONNECT-ship” was 318,842, and the number of users as of the beginning of April 2019 was 26,868, up 36.9% year on year. Regarding company support, they developed and provided the system of marriage support services for 3 companies engaged in marriage support (previously only 1 company) where the operation of the marriage support service targeting nursery teachers started in February 2019.

QOL Business

As for the wedding service, Anniversary Club brand service was enriched and its target area was expanded. In particular, the marketing of bridal jewelry significantly exceeded the initial plan due to the sales promotion policy utilizing the Partner Agent stores from the third quarter. Further, they opened a hall exclusively for reserved parties which can be used for informal parties after wedding ceremony in Ginza on October 2018, expecting the popularization of new wedding styles that would replace traditional wedding ceremonies and receptions.

As for services contributing to improvement in the quality of life, they promoted various policies aimed at developing a “Partner Agent Insurance Clinic Second Store” to provide high quality insurance to members who see their marriage as an opportunity to review their insurance and who use the company group’s wedding services. In addition, they implemented consulting related to the transfer of management control along with the transfer of the Nursery Business.

(3) Financial condition and cash flow

◎Main BS

| End of March 2018 | End of March 2019 |

| End of March 2018 | End of March 2019 |

Current Assets | 1,552 | 2,059 | Current liabilities | 1,076 | 1,132 |

Cash | 549 | 1,207 | ST Interest-Bearing Liabilities | 740 | 771 |

Receivables | 783 | 723 | Noncurrent liabilities | 866 | 1,271 |

Noncurrent Assets | 1,241 | 1,322 | LT Interest-Bearing Liabilities | 733 | 1,135 |

Tangible Fixed Assets | 403 | 328 | Total Liabilities | 1,942 | 2,404 |

Intangible Fixed Assets | 336 | 335 | Net Assets | 852 | 978 |

Investment, Others | 501 | 658 | Retained earnings | 850 | 981 |

Total assets | 2,794 | 3,382 | Total Liabilities and Net Assets | 2,794 | 3,382 |

*Unit: million yen

With the increase in cash and deposits, current assets increased 507 million yen from the end of the previous term to 2,059 million yen. Fixed assets rose 80 million yen from the end of the previous term to 1,322 million yen due to the increase in investment securities, and total assets rose 588 million yen from the end of the previous term to 3,382 million yen. Total liabilities went up 461 million yen from the end of the previous term to 2,404 million yen due to the increased long-term debt, etc. Net assets increased 126 million yen from the end of the previous term to 978 million yen caused by the increase in retained earnings. As a result, equity ratio decreased 1.4 points from the end of the previous term to 28.9%.

◎Cash Flow

| FY 3/18 | FY 3/19 | Increase/decrease |

Operating Cash Flow | 202 | 374 | +172 |

Investing Cash Flow | -524 | -180 | +344 |

Free Cash Flow | -322 | 194 | +517 |

Financing Cash Flow | 374 | 464 | +89 |

Term End Cash and Equivalents | 549 | 1,207 | +658 |

*Unit: million yen

Free cash flow turned positive, and the cash position improved.

(4) Topics

◎ Acquisition of the Dating App “dately”

In April 2019, the company acquired the dating app “dately” that was developed and operated by STRACT Inc.

(Outline of STRACT Inc.)

Founded in July 2017. Managed the planning, development and operation of smartphone apps as well as the research and development of IoT hardware. Developed the next-generation dating app “dately.”

(Background of the Acquisition)

Partner Agent is planning on a further cultivation of the marriage support domain as well as entering new domains, and implements various policies such as acquisition of a part of the marriage counselling business, capital tie-up, and the inclusion of Mation Inc. in the corporate group, aiming for achieving middle and long-term growth.

As part of these policies, the company promptly implements new development methods in the dating app market that is expected to grow in the future, and also acquired the next-generation dating app “dately,” which successfully arranged a greater number of dates.

The company shall endeavor to create a new matching support style in the future with the experiences and know-how it acquired.

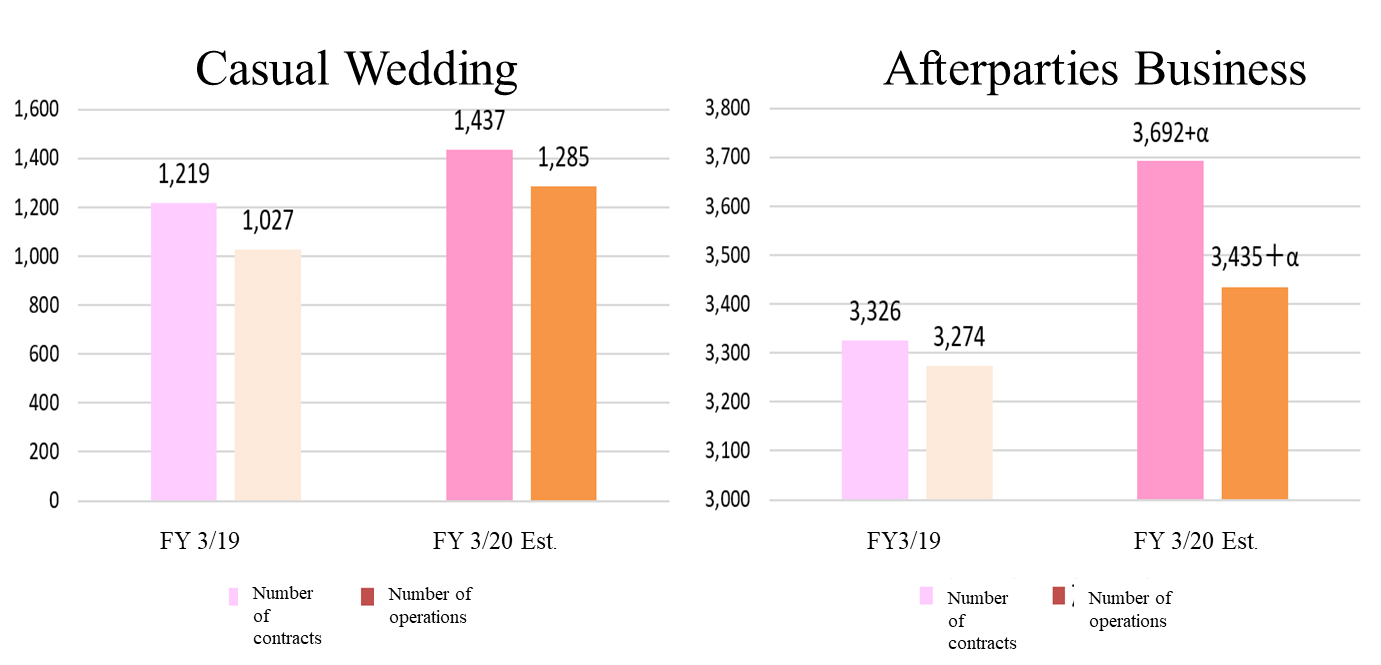

◎ Comprehensive Business Partnership in the Casual Wedding Industry

In May 2019, the subsidiary, Mation Inc., agreed to form a comprehensive business partnership with Authemotion Products Co., Ltd. in the Casual Wedding Industry.

(Outline of Authemotion Products Co., Ltd.)

Since their establishment in November 2005, they have been expanding their business centered around party production including wedding afterparties and informal parties after wedding ceremonies.

Especially in the wedding afterparties field, they have produced best-in-class parties in the industry (30,000 in total) in a similar fashion to Mation Inc., using their unique scheme of customer acquisition through corporation with banquet halls.

(Background of the comprehensive business partnership)

Mation Inc. and Authemotion Products Co., Ltd., which boast the best afterparties and production results in the industry, will construct a new partnership system that will drive economic growth of the casual wedding industry which is expected to expand in the future, and have agreed to mutually access to affiliated banquet halls and clients, new developments, response to customer needs through reciprocal customer transfer between services, and video production. Partner Agent will also fully cooperate in this partnership.

◎ Enhancement of the Shareholder Special Benefit Plan

Along with welcoming Mation Inc. into the group in this term, they decided to enhance the shareholder special benefit plan in order to convey their deepest gratitude to their shareholders as well as to encourage them to gain a further understanding of the company’s group.

In addition to the shareholder special benefits, they are presenting complimentary tickets, which can be used at Suma-kon and 2jikai-kun sponsored by Mation Inc., as well as complimentary points, which can be used at the shareholder-exclusive “Partner Agent Premium Special Benefits Club.”

Applicable to those shareholders who own more than 1 unit (100 stocks) of the company’s stocks listed in the shareholder registry every year on September 30.

For more details regarding the company’s shareholder special benefit plan, please refer to the website below.

https://www.p-a.co.jp/ir/stock/dividend.html

3. Fiscal Year March 2020 Earnings Estimates

(1) Consolidated earnings Estimates

| FY 3/19 | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Sales | 4,151 | 100.0% | 9,100 | 100.0% | +119.2% |

Operating Income | 216 | 5.2% | 230 | 2.5% | +6.3% |

Ordinary Income | 208 | 5.0% | 170 | 1.9% | -18.4% |

Net Income | 90 | 2.2% | 130 | 1.4% | +44.3% |

*Unit: million yen. The estimated values were provided by the company.

Increase in Sales and Operating Income

The sales for FY March 2020 are estimated to increase by 119.2% year on year to 9.1 billion yen. The sales will grow significantly along with the inclusion of Mation Inc. in the corporate group.

Operating income is estimated to be 230 million yen, up 6.3% year on year. The increase in operating income is expected to remain single-digit as it is estimated to be a total of 170 million yen including the goodwill concerning the company’s stock acquisition of around 70 million and the amortization of intangible assets of around 100 million yen. However, the real earning capacity would be around 400 million yen. Further, the goodwill expenditure from the next term until FY March 2029 will be only posted as 70 million yen every term.

As for non-operating expenses, the upfront investment by en-konkatsu agent Inc. (investment loss by equity method) is expected, leading to an expected decline in ordinary income.

(2) Business Policies for the Present Term

They are taking the following initiatives regarding the marriage support domain and wedding services domain respectively.

① Marriage Support Services Domain

Marriage support services will be revitalized in every direction.

In particular, they shall promote the improvement in quality regarding the Partner Agent Brand in the marriage agency field that has high added value to implement greater customer satisfaction in the Partner Agent Business.

As for the entry type marriage agency, matching support parties, and dating apps, they shall unfold a streamlined marketing policy, newly positioned as entry services.

Other than that, regarding services contributing to the operation of CONNECT-ship and improvement in quality of life after marriage, they shall enhance the operation system and plan to increase the number of users.

The marriage agency department is expected to exceed its previous term in every index and head for a recovery.

As the number of parties held is planned to decrease to optimize the operation of matchmaking parties continuously from the previous term, the number of participants is expected to decline.

A collaboration project with the entertainment industry (JRA etc.) and the food industry is being planned.

② Wedding Service Domain

In response to the lately growing category, casual wedding (holding a reception party at a reasonable price, pay-your-own-way parties, photo weddings etc.), they shall expand their product lineup centered around “Suma-Kon” and “2jikai-kun” to respond to various customer needs.

Further, they shall enhance ties with Authemotion Products Co., Ltd., an influential company in the wedding industry, through reciprocal customer transfers and strive to increase the sales orders as well as demonstrating synergy with the marriage support service domain.

③ Management Domain

They are reinforcing the management system and optimizing group resources including reorganization.

In March 2019, they reformed the organization, modified the management of company directors, and nominated company executives to further optimize the organizational system and realize further business growth.

President Sato was promoted from President and CEO to President, CEO and General Manager of the Marriage Support Business. He shall display greater leadership than ever in pursuit of growth.

(3) Progress of the Announced Policies

The company has been vigorously promoting M&A and business partnerships since January 2019. The current progress status is as follows.

① Marriage Support Service Domain

*Senior Life, Inc.

MARRIX Osaka, Nagoya and Fukuoka were acquired, and customers began to shift in April 2019.

*STRACT Inc.

Dating App was acquired. Renewal is planned for sometime this term.

② Wedding Services Domain

*Mation Inc.

Joined the group company in April 2019, and the number of sales orders is increasing due to synergy.

* Authemotion Products Co., Ltd.

They constructed a new partnership system and are taking part in reciprocal customer transfers in casual weddings and afterparties.

③ Management Domain

*en-konkatsu agent Inc.

Became an associated company in April 2019 using equity method. In the upfront investment (advertisement revitalization) phase this term.

4. Conclusions

FY March 2019 recorded an increase in sales for eight consecutive terms, though it was slight, and operating income increased for the first time in 3 terms. The number of new members per quarter in the Partner Agent Business reached 2,100 for the first time in 8 quarters, and for this term, the company is expecting the business bottoming out and recovery such as an increase in the annual base for the first time in 4 terms. The company will focus on the extent of the momentum of recovery while competition is becoming more intense. At the same time, it is also paying attention to the amount of synergy and value addition realized by the M&A and alliance strategy it has been actively engaged in since the previous term.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎Corporate Governance Report

The Latest Update: June 26, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company states that it will carry out all basic principles of corporate governance code as a company listed on the TSE Mothers.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |