Bridge Report:(6181)Partner Agent the first quarter of Fiscal Year ending March 2021

President Shigeru Sato | Partner Agent, Inc.(6181) |

|

Company Information

Market | TSE Mothers |

Industry | Service industry |

President | Shigeru Sato |

HQ Address | IMAS Osaki Building, 1-20-3 Osaki, Shinagawa-ku, Tokyo |

Year-end | End of March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (actual) | Trading Unit | |

¥187 | 10,726,800shares | 2,005million | 0.3% | 100shares | |

DPS(Est) | Dividend Yield(Est) | EPS(Est) | PER(Est) | BPS(Act) | PBR(Act) |

¥0.00 | - | TBD | - | ¥97.81 | 1.9x |

*The share price is the closing price on August 27.

*Shares Outstanding and DPS were taken from the brief financial report in the first quarter of fiscal year ending March 2021.

*ROE and BPS were taken from the brief financial report in the fiscal year ended March 2020.

*It is difficult to rationally calculate the impact of the novel coronavirus at this stage. Thus, the forecast for this term is still to be determined.

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 Act. | 3,812 | 204 | 231 | 107 | 11.37 | 0.00 |

March 2018 Act. | 4,102 | 195 | 325 | 117 | 12.15 | 0.00 |

March 2019 Act. | 4,151 | 216 | 208 | 90 | 8.99 | 0.00 |

March 2020 Act. | 8,187 | 78 | 41 | 2 | 0.25 | 0.00 |

March 2021 Est. | - | - | - | - | - | 0.00 |

*Unit: million yen., yen. On January 1, 2017, the company conducted a 3-for-1 stock split. EPS was adjusted retroactively.

*From the term ended March 2016, net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

*It is difficult to rationally calculate the impact of the novel coronavirus at this stage. Thus, the forecast for this term is still to be determined.

We would like to report an overview of earnings results for the first quarter of Fiscal Year ending March 2021 of Partner Agent, Inc.

Table of Contents

Key Points

1. Company Overview

2. The First Quarter of Fiscal Year ending March 2021 Earnings Results

3. Fiscal Year ending March 2021 Earnings Forecasts

4. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- For the first quarter of FY ending March 2021, sales decreased 64.6% year on year to 701 million yen. Due to the substantial impact of the novel coronavirus, many customers reconsidered the timing of enrollment in the marriage support agencies, and most of the matching parties were put off. In the casual wedding business, most wedding receptions and after-parties were postponed or canceled. There was an operating loss of 824 million yen. Gross profit fell 75.5% year on year. On the other hand, SG&A expenses from two new subsidiaries were added. EBITDA also turned into a loss.

- For FY ending March 2021, it is difficult to reasonably calculate the impact of the novel coronavirus at this stage. Thus, the forecast for this term is undecided. As for the current situation, the marriage support agencies have been on a recovery trend since late May in the matching business. In the casual wedding business, photo weddings are performing well. However, it is difficult to forecast its performance as wedding receptions and wedding reception after-parties are continuing to be postponed and canceled due to the second wave of the novel coronavirus.

- Under these circumstances, the company is working to stabilize its financial foundation by securing liquidity on hand. On the business side, the company is proceeding with its unique initiatives with the theme "utilizing the Internet" and will focus its management resources on areas where demand is expected to grow in the future. After changing the company name on October 1, 2020, the company plans to announce the medium-term management plan in November 2020.

- The forecast for the current term remains undecided due to the difficulty of reasonably calculating the impact of the novel coronavirus at this stage. However, it seems that the worst period is over as the marriage support agencies have been on a recovery trend since late May. That being said, the recovery speed remains unclear. We want to pay attention to the vision and goals in the financial results for the second quarter and the medium-term management plan to see what measures the company would adopt to overcome this difficulty.

1. Company Overview

Based on the corporate philosophy of “We produce more smiles, more happiness, for people's life,” the company has three businesses including the mainstay “Matching Segment” that supports marriage activities of registered members by operating “Partner Agent,” a matching agency and “CONNECT-ship,” a platform that enables the matching between its members and those of other matching companies, the “Casual wedding Segment” that produces casual weddings, such as wedding receptions at prices that suit customer needs, weddings with entrance fees for meals and photo weddings in response to growing needs in recent years, and “Other Segment” in which services related to matching and weddings are provided. The company’s major feature is its high marriage rate which is achieved by matching through detailed follow-ups by dedicated concierges and unique systems.

Partner Agent will change its corporate name to Tameny Inc. on October 1, 2020, and they will aim to strengthen organizational capability, maximize business synergies, create new value, and improve profitability by utilizing management resources and enhancing operational efficiency, while expanding its service areas together with the group companies.

【1-1 Corporate history】

In June 2004, the company was established to start a matching business as a 100% subsidiary of Take and Give Needs, Co. Ltd. (4331, Tokyo Stock Exchange 1st Section, hereinafter “T&G”), which is specialized in wedding planning and wedding hall operation. At the time of the company establishment, Mr. Shigeru Sato was appointed to be the President for his abundant experiences and achievements at a major matching company.

Later, when T&G became difficult to invest continuously, President Sato, the executive staff and the employees collaboratively purchased the shares of Partner Agent, Inc., and the company became independent from the T&G Group in May 2008. The company’s business has been growing steadily because the customers highly regard the company’s high marriage rate, which is the result of “pursuing customers’ goals”. It was listed on the TSE Mothers in October 2015.

The company is focusing on growing its service areas and strengthening its business foundation. As part of its efforts to achieve these goals, the company included Mation Inc., which offers new wedding styles such as “Suma-Kon” and “Nijikai-Kun,” in its corporate groups, to enter the casual wedding field on a full-scale basis and reorganized M Creative Works Inc., which operates a wedding photo studio, and pma Inc., which produces wedding reception after parties, into subsidiaries.

【1-2 Corporate ethos】

“Pursuing the customers’ goals” has been the philosophy of President Sato since the establishment of the company. Based on this philosophy, the company holds the following mission and visions.

Our mission | We produce more smiles, more happiness, for people's life. |

Our visons | 1. As an innovator of the matching industry, we continue creating more values, and more marriage opportunities. 2. Making steps alongside with people as a lifelong supporter, we aim to contribute to a life with full of happiness through the business of our belief. |

Our action guideline | ・Judgment criteria are the customers. ・Professional mind ・Passion supremacist ・Walk on the right path ・Grow with its own initiative ・Team Partner Agent ・Pursue one’s own happiness |

President Sato believes that these philosophies will penetrate into the employees only by remembering the philosophies and thinking based on it whenever they encounter specific issues or troubles.

【1-3 Market environment】

<Situations of unmarried people>

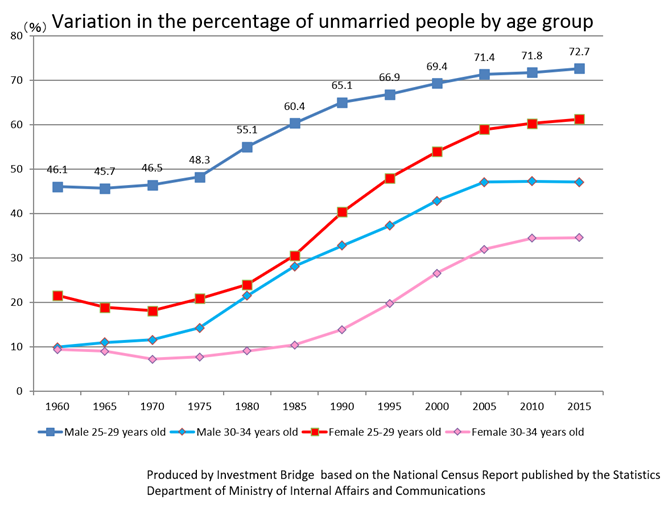

*Growing percentage of unmarried people

According to the national census conducted by the Ministry of Internal Affairs and Communications, the percentage of unmarried people between ages 25 and 34 has been increasing for both men and women in Japan.

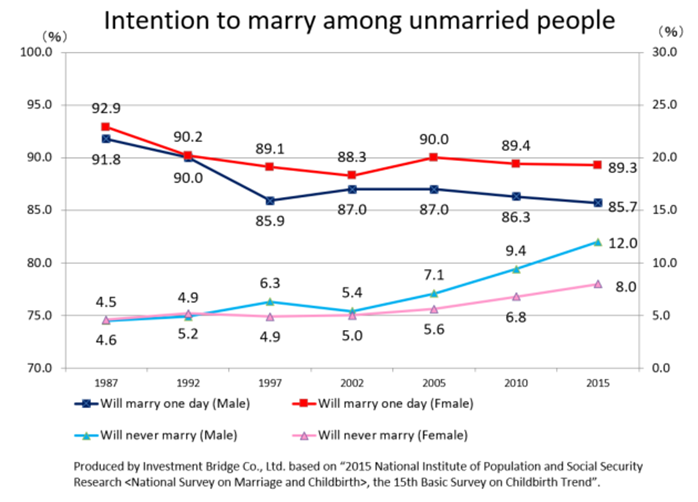

*Intention to marry among unmarried people: “Intention to marry” remains at a high level.

According to the “2016 National Institute of Population and Social Security Research <National Survey on Marriage and Childbirth>, the 15th Basic Survey on Childbirth Trend,” the percentage of unmarried people between ages 18 and 34 who want to marry were: male 85.7%, female 89.3%. These data indicate that there are still many unmarried people who “want to marry.”

Although the percentages of unmarried men and women who responded “Never intend to marry” have been rising, among them, 44.1% of men and 49.8% of women responded that they might eventually change their intention to “Intend to marry.” This indicates that about half of the people who currently do not intend to marry may change their mind and start to look for their marriage partners in the future.

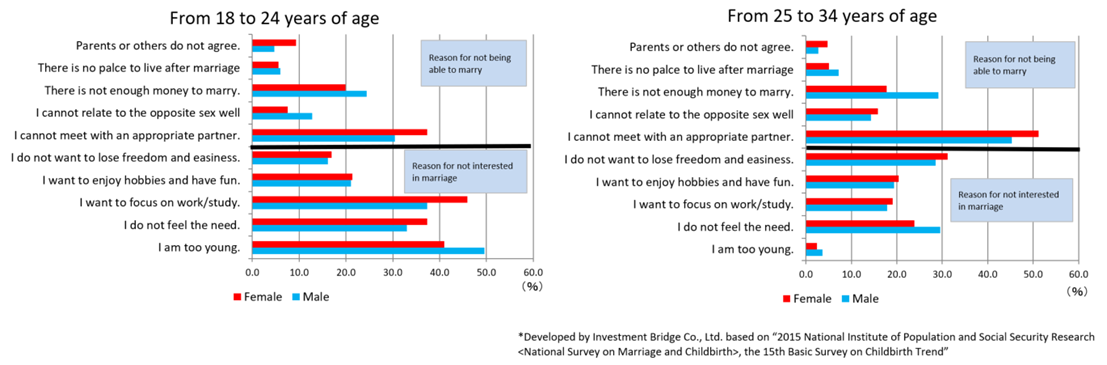

*Reasons for being single: Unable to find the right person for marriage after 25 years of age

The reasons for the unmarried people between ages 18 and 24 to stay single were “I am still too young” and “I do not feel the need,” indicating that their motivation for marriage is not so high. On the other hand, a higher percentage of unmarried people between ages 25 and 34 responded that “I have not met a right person yet,” indicating that the needs for the opportunities to meet potential partners are high in this age group.

Other companies in the industry

About 3,000 marriage support agencies etc. are engaged in matching activities across Japan. However, 90% of them are operated by individual business owners. There are only a few agencies including the company that run such businesses across Japan.

In the broad sense, listed matching companies are Partner Agent, IBJ, Linkbal, Net Marketing, and Ignis.

【1-4 Business contents】

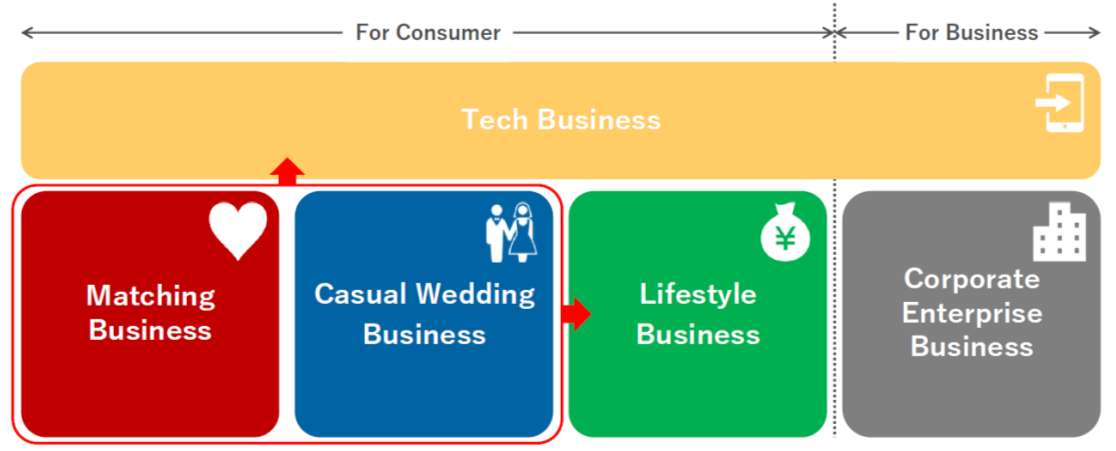

From the first quarter of FY ending March 2021, to categorize its future strategic businesses, the company decided to disclose the company's efforts and sales in five businesses: Matching Business, Casual Wedding Business, Tech Business, Lifestyle Business, and Corporate Enterprise Business.

(The reporting segments are the Matching Segment, Casual Wedding Segment, and Other Segment.)

(taken from the company’s material)

(1) Matching Business

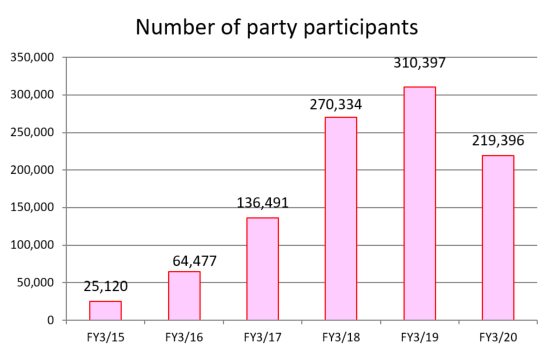

The company operates high value-added marriage support agencies, and plans, develops, and manages entry-type marriage support agencies and matching parties.

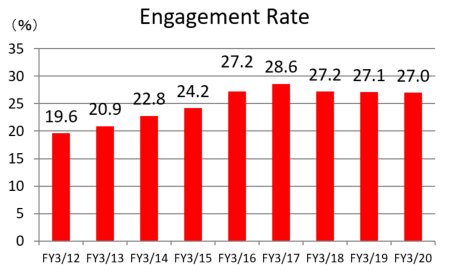

①Marriage support agency

The company operates one of its greatest features, a high-value-added marriage support agency.

The Matching service provides information, introduces potential partners and provides opportunities of the encounter to the registered members.

An exclusive concierge is assigned to each member. The concierge develops plans for actions and supports the member professionally. Also, in order to provide opportunities of the encounter, the company plans and hosts matching events for the members.

There are more female members, with the member composition ratio of male to female being between 4:6 and 3:7

(Characteristics of services)

A concierge with high coaching skills works with a “customer who wants to find a marriage partner within 1 year.” The concierge designs the activities based on the PDCA cycle to meet the needs of the customer who desires cost-effective services without wasting time and effort.

The concierges are mostly women who are done raising children, willing to help others through matching and share joys. There are about 140 concierges. The company has the motto of “pursuing customers’ goals” so the concierges are evaluated based on the “customer satisfaction” including the engagement rate and the early withdrawal rate.

<Image of support>

①Before sign-up: Clarifying service contents and fee structures

A customer who is considering being a member and comes to the store is greeted by an account executive whose role is to encourage him/her to become a member. The account executive explains the service contents and fee structures in details so that the customer can accurately understand them. If it seems difficult to continue introducing partners to the customer based on certain criteria, the customer may be declined to be a member. This is to avoid the situations where the customers are not satisfied with the services in cases where they cannot reach an initial meeting or go steady with a partner, even though they pay monthly membership fees.

②After sign-up: Support by an exclusive concierge who is assigned to a member

Once a customer signs up for the membership, an interview will be conducted by a concierge in charge of the customer to understand the customer’s sense of value and expectations.

At this time, using the coaching skills, the concierge tries to identify the customer’s expectations and ideal model of marriage as clearly as possible. This way, instead of helping the customers find their partners abstractly, the concierges can help them find someone based on specific criteria.

In addition to the conventional matching mechanism through data, the company offers concierge services. This has differentiated the company’s service from the others. With this system, the company can offer cost-effective services without wasting time and efforts of the customers.

During the activities, the exclusive concierges help the members modify the path as needed using a PDCA cycle. This way, the members can proactively work on the activities, even if they fail in the process.

Furthermore, the concierges ask for comments and impression from the members after each initial meeting, providing consultation to the members during dating period in addition to follow-ups after engagement (*) to walk with the members until they reach engagement.

The follow-up period after the engagement is 1 year. This way, they can support the members for a long time until marriage.

(*) Engagement (Withdrawal from the membership)This means that members withdraw from the membership after both members expressed their intention to continue dating with the intent to marry the partners they are dating.

③Setting up initial meeting:Support by the staff other than the exclusive concierges

As the process advances, the members have contacts (initial meeting) with the matched members. The specialized team supports them to coordinate the date, time and place of these contacts so that they can have their contacts set up effortlessly and efficiently.

The support team helps the members to carry out the activities smoothly. For example, even if the members are lost on the way to the contact venue or cannot find the person that they are supposed to meet, the company’s staff provides support via phone or e-mail so that the members do not miss the chance to meet. Furthermore, when the customers seek second opinions, the company provides third-party advice through a service desk.

<Service fee structure>

Registration fee | Fees for enrollment costs |

Initial fee | Fees for preparation work |

Monthly fee | Fees for member management and to secure membership rights |

Engagement fee | Contingent fee payable upon engagement |

Others | Cost related to participation in events and seminars, purchase of option services and other activities. |

The company introduces about 2 to 6 members per customer per month, depending on the course chosen by customers. However, this figure is an obligation under the service contract and not the upper limit. Therefore, the company may introduce more members at its direction.

The following services are also provided as ancillary services.

◎Events for the members

In addition to the introduction by a concierge, the company develops and hosts various events such as matching parties.

Having spaces for holding events within the company’s stores makes it possible to flexibly hold parties without requiring expenses of renting a hall for events.

◎Option services

☆The company offers a photo shoot (fee-based) for the members with extra charges. Since the first impression is crucial for matching, in collaboration with professional photographers and make-up artists, the company offers photo shoots in their studios or within the company’s premises. Because the photography is specifically for matching, the company can offer advice concerning appropriate clothing and facial expressions based on their experiences.

☆To provide the preliminary knowledge and information about matchmaking to the members, the company offers seminars (fee-based) on color coordination, fashion advisor, communication and others for the members.

②Entry service

Based on the concept of “affordable matching services which people can start using without hesitation,” the company plans, develops and operates entry-type matching agencies, matching parties, and matching apps.

◎ “OTOCON” matching parties

It plans and operates matching parties called “OTOCON” for the general public.

Although these parties are targeting the public, some non-members show interest in the company through these events and become members of the matching agency. Thus, OTOCON is also functioning as a venue to increase new members.

Furthermore, similar to the event services for the members of the matching agency, there are staff members who are dedicated to event planning, and the events take place in the spaces within the company’s premises. The events promote efficient utilization of the company facilities and also work as a channel to solicit new members it also creates synergies with other services.

(2) Casual Wedding Business

The company produces casual weddings (casual wedding receptions, small-group weddings, weddings with membership fees, photo weddings, and wedding reception after-parties) that have expanded in recent years.

① Casual wedding

In response to the increasing needs in recent years, the company produces casual weddings such as wedding receptions at prices which meet with customers’ requirements, weddings with membership fees, and photo weddings.

“Suma-Kon,” the main product to support weddings in Japan, is a service operated by Mation, Inc., which joined the Group in April 2019. It provides reasonable wedding receptions with the concept that couples do not need to give up on having wedding ceremonies due to prices which meet with customers’ requirements.

In addition to being able to have a party at high-end venues with a reasonable fee, the venue and plan can be selected flexibly, and convenience such as no carry-in fees and the option of payment after party are being valued by the customers.

A similar concept, “Suma-Kon Resort” is also available, which provides overseas weddings at prices which meet with customers’ requirements.

Mation, Inc. also offers the “1.5th wedding party,” a wedding style that is not as formal as a reception and is not as casual as an after-party.

A 1.5th wedding party planner proposes a party plan that suits the couple’s needs, such as plans and costs. In addition to a wide range of choices, such as gift money style or entrance-fee style and course meal or buffet meal, there are no carry-in fees and payment after the party is also possible just like “Suma-Kon.”

The service is used for various purposes, such as a party after an overseas wedding ceremony, a formal party with a wedding ceremony, and a casual party with entrance fee.

② After-party

Just like “Suma-Kon,” “Nijikai-Kun” provided by Mation, Inc. upholds the theme of “Making the wedding after-party the best party in your life” and offers services including venue search, party planning, management on the day, and follow-up after the party.

Mation, Inc. is consistently achieving top-class results in terms of the number of after-party agency services.

Also, the company is working on diversifying revenues by promoting in-house production of videos used during "Suma-Kon" and "Nijikai-Kun."

(3) Tech Business

The company engages in the planning, development, and provision of matching and wedding technology services that utilize IT and technology.

◎”CONNECT-ship”: an open platform that enables mutual introduction of members between matching agencies.

The main service in this business is the “CONNECT-ship,” a platform that enables mutual introduction of members.

The “CONNECT-ship” is an open platform that enables mutual introduction of members between matching agencies. It launched in June 2017.

(Overview)

Matching companies and target service that use “CONNECT-ship” and their services are following 11 companies and 15 services as of August 2020.

Name of the companies | Management service name |

en-konkatsu agent Inc. | ・en-konkatsu agent |

Senior Life, Inc. | ・MARRIX |

Japan Bridal Association | ・JBA (Japan Bridal Association) |

Nihon Nakodo Renmei | ・NNR (Nihon Nakodo Renmei) |

Recruit Marketing Partners Co., Ltd. | ・Zexy Enmusubi Agent |

Kekkonjoho center, Inc. | ・NOZZE |

Partner Agent, Inc. | ・Partner Agent ・OTOCON Matching Concierge (former Yahoo! Matching Concierge Plan) ・Excite. Bridal Agency powered by Partner Agent ・Ichie ・OTOCON Matching Concierge Global Kids |

Zenkoku Nakodo Rengokai Co., Ltd. | ・Zenkoku Nakodo Rengokai |

Kankocho Marriage, Inc. | ・Kankocho Marriage |

Measures of Falling Birthdate (MFB) | ・K Marriage |

SE Mobile and Online Co., Ltd. | ・S Marriage |

The “CONNECT-ship” has more than 50,000 members (total members of all participating agencies). It is the first attempt in the matching industry to enhance marriage rate through the mutual introduction of a large number of members between businesses with a certain scale to find their partners and enhance the results and customer satisfaction.The platform (system) to achieve mutual introduction among members was developed by the company. The other agencies will use the “CONNECT-ship” service, which is being operated and maintained by the company. The company is also in charge of operating the executive office of the “CONNECT-ship.”

It will increase its scale by including other companies that have the same vision (i.e. to maximize the marriage opportunities), which is the ultimate goal of the customers.

Each participating agency can offer its unique services and operations ca being interfered by other participating agencies including the executive office (the company).

The revenue source of the company, which provides and operates the system, is the remuneration for realizing the initial meeting between members, which is received from enterprises using this system.

(Purposes)

The purposes of the “CONNECT-ship” for the company are to develop the industry by facilitating sales competition among the participating companies and by learning from each other in an effort to promote marriage among the members to raise customer satisfaction, within a new framework. At the same time, the company is aiming to bring about changes in the industry so that healthy competition on service quality will be created.

(4) Lifestyle Business

The company aims to provide services (insurance, finance, real estate, etc.) that contribute to improving the quality of life after marriage, such as insurance sales and housing information services.

To the members married through the matching services and customers of “Suma-Kon” and “Nijikai-Kun,” the company offers various services at their major life events by maintaining relationship with the customers. This is to enhance customer satisfaction and increase revenue opportunities.

Regarding insurance sales, the company offers high-quality insurance to married members and customers of casual wedding services who are considering reviewing their insurance, in alliance with IRRC Corporation, at three "Partner Agent × Hoken Clinic" stores.

As for housing, the company introduces “Suumo Counter” operated by Recruit Sumai Company Ltd. to engaged couples who are considering purchasing custom-built homes. It has also entered into a business alliance agreement on customer collaboration with Dualtap Co., Ltd., which has a track record of condominium development in Tokyo to provide high-quality housing information services.

(5) Corporate Enterprise Business

The company produces corporate events such as company initiation ceremonies, award ceremonies, and employees’ general assemblies, and sells the matching support system "parms" to local governments.

①"evemon" corporate event service

"evemon" is an in-house event producing service provided by M Creative Works Inc. to support the vitalization of the organization and the development of the company through the execution of various in-house events.

The group's strength is its cumulative production record of more than 35,000 events and unique know-how.

② “parms” a matching support system for local governments

The company offers the original matching system called “parms” as ASP to local governments planning to offer matching activities to residents.

“parms” is a system that combines several functions, such as supporting its user activities and streamlining tasks of operating staff in addition to basic functions such as member registration, membership management and partner matching, which are all necessary in the matching business. The system operators can customize the system depending on the needs.

“parms” has been installed in Fukushima, Kyoto, Saitama Prefectures, and Akita Prefecture so far.

The major achievements with the local governments are as follows.

Local government | Contents |

Mie Prefecture | Operation of the “Support to Strengthen Bond between Married/Unmarried Couples” project in the “Marriage Positive Campaign” (a project to create a positive trend for marriage)” |

Kyoto Prefecture | Provision of a matching system to the companies that received business from “Kyoto Matching Support Center” |

Saitama Prefecture | Provision of a marriage support system to "SAITAMA Matching Support Center." |

Fukushima Prefecture | Comprehensive operation of a matching business on behalf of “Fukushima Marriage/Child-Raising Support Center” |

Akita Prefecture | Provision of a matching system to Akita Matching Center. |

In addition to the above, the company has been offering seminars and solutions such as training to support the operation of matching events organized by local governments in 10 prefectures since 2017.

【1-5 Characteristics and strengths】

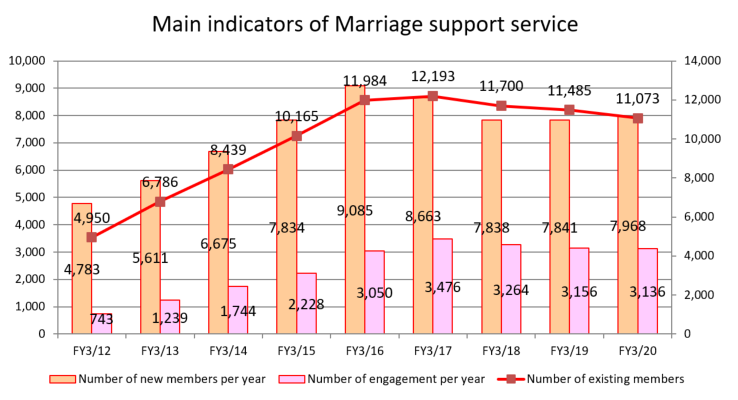

High engagement rate as a result of “pursuing customers’ goal”

One of the key features of the company is its “high engagement rate.”

The engagement rate for FY March 2020 was 27.0%.

Although other companies in the industry are not announcing exact figures, the average engagement rate is suspected to be about 10%. In comparison, the company’s engagement rate is exceptionally high.

The “engagement rate” shows a rate of members who withdrew from the membership after their engagement during a specific period. Because the rate may also raise a question about the need for matchmaking companies, many companies in the matchmaking industry prefer not to use the engagement rate as an indicator.

However, President Sato has been focusing on the idea of “pursuing customers’ goals” as a corporate strategy and philosophy from the foundation of the company.

He believes the goal that the customers want to reach through the company’s services is the “marriage.” Thus, making efforts to reach the highest rate of “getting married” is the social value of the company.

In order to achieve this purpose, the company carries out all activities including employment, education, development, training, knowledge sharing, management, and evaluation system based on the philosophy of “pursuing customers’ goals.” This stance leads to the outstanding “engagement rate” in this field.

2. The First Quarter of Fiscal Year ending March 2021 Earnings Results

(1) Consolidated earnings

| 1Q FY 3/20 | Ratio to sales | 1Q FY 3/21 | Ratio to sales | YoY |

Sales | 1,981 | 100.0% | 701 | 100.0% | -64.6% |

Gross profit | 1,025 | 51.7% | 250 | 35.8% | -75.5% |

SG&A | 936 | 47.3% | 1,075 | 153.3% | +14.8% |

Operating Income | 88 | 4.5% | -824 | - | - |

Ordinary Income | 90 | 4.5% | -821 | - | - |

Net Income | 65 | 3.3% | -821 | - | - |

EBITDA | 163 | 8.2% | -729 | - | - |

*Unit: million yen

Significant decrease in sales and profit due to the impact of the novel coronavirus

Sales decreased 64.6% year on year to 701 million yen. Due to the impact of the novel coronavirus, many customers reconsidered the timing of enrollment in marriage support agencies, and most of the matching parties were put off. In the casual wedding business, most wedding receptions and after-parties were postponed or canceled.

There was an operating loss of 824 million yen. Gross profit fell 75.5% year on year. On the other hand, SG&A expenses from two newly subsidized companies were added. EBITDA also turned into a loss.

(2) Trends in each business

As mentioned above, in the first quarter of this year, to newly categorize its future strategic businesses, the company decided to disclose the company's efforts and sales in five businesses: Matching Business, Casual Wedding Business, Tech Business, Lifestyle Business, and Corporate Enterprise Business.

Trend in each segment

| 1Q FY3/20 | 1Q FY3/21 | YOY |

Matching Business | 874 | 573 | -34.4% |

Casual Wedding Business | 1,020 | 69 | -93.2% |

Tech Business | 44 | 41 | -8.2% |

Lifestyle Business | 6 | 9 | +50.9% |

Corporate Enterprise Business | 22 | 1 | -92.4% |

*Unit: million yen

①Matching Business

Sales dropped.

Due to the impact of the novel coronavirus, the matching business was heavily affected, as clients reconsidered the timing of enrollment in marriage support agencies and matching parties were postponed.

However, the monthly memberships of the marriage support agencies have been recovering since the second half of May.

(Efforts)

Based on the business foundation fortified by returning to the basics, the company promoted various measures with its strength of having the top marriage rates.

In advertising, the company appointed the female idol group SKE48 to foster momentum for matching activities in general. As for services, the company has started a coordination service for members of the marriage support agencies.

Also, in response to the novel coronavirus, the company promoted initiatives that eliminated the need to visit the stores, such as online services and postal mail.

For the second quarter, the company is preparing to open the Sendai store and preparing to hold better matching parties that require a certificate of single status.

*Major Indicators

| 1Q FY3/20 | 1Q FY 3/21 | YOY |

Number of new members | 2,227 | 927 | -58.4% |

Number of existing members at the end of June | 11,653 | 10,606 | -9.0% |

Number of members withdrawn after engagement | 779 | 435 | -44.2% |

Engagement Rate (%) | 26.9% | 16.2% | -10.7pt |

Number of party participants | 66,831 | 5,506 | -91.8% |

Number of parties held | 5,989 | 442 | -92.6% |

② Casual Wedding Business

Sales dropped.

Due to the impact of the novel coronavirus, the postponement and cancellation of wedding receptions and wedding reception after-parties occurred.

(Efforts)

The company strove to enhance further the quality of its main product, the "Suma-Kon Series." Also, it focused on creating new wedding styles expecting the era in which people will live while coping with the novel coronavirus.

In terms of quality, the company has established a system that can stably secure high-quality venues. As for the creation of new wedding styles, the company gradually launched "LUMINOUS" photo weddings at high-quality locations and wedding receptions and after-parties that combine the face-to-face and the online.

Also, the company opened a completely private photo wedding studio in Ginza.

For the second quarter, the company is preparing for the renewal and brand redevelopment of the "Suma-Kon Series."

LUMINOUS photo wedding has been highly regarded as the new wedding style in the era in which people will live while coping with the novel coronavirus, and the number of contracts has recovered rapidly since June.

*Major Indicators

| 1Q FY3/20 | 1Q FY3/21 | YOY |

(Number of contracts) |

|

|

|

Suma-Kon series | 449 | 138 | -69.3% |

Nijikai-Kun | 955 | 198 | -79.3% |

LUMINOUS | 102 | 100 | -2.0% |

(Number of enforcement) |

|

|

|

Suma-Kon series | 334 | 21 | -93.7% |

Nijikai-Kun | 892 | 1 | -99.9% |

LUMINOUS | 75 | 64 | -14.7% |

*unit: cases

* M Creative Works Inc. has joined the Group in March 2020. The number of implemented cases for LUMINOUS in the first quarter of FY March, 2020 is not included in the results for the first quarter of FY March, 2020.

③ Tech Business

Sales declined.

Due to the impact of the novel coronavirus, the number of matches established through "CONNECT-ship," a platform that enables the matching between its members of other matching companies, decreased.

(Efforts)

To meet the demand for matching in a new lifestyle, the company promoted various online initiatives.

In particular, the company independently developed and started to provide an automatic online matching system that allows you to find matches without being restricted by the location, on the "CONNECT-ship," a mutual member introduction platform between matching companies.

Also, the company has released "Suma-Kon Date," a completely free matching application that provides the users with everything online starting from matching to the first date.

For the second quarter, the company has been working on measures to expand the number of users of "CONNECT-ship," and in August 2020, the "S marriage" operated by SE Mobile and Online Co., Ltd. has joined the company. Thus, the number of user companies has become 11, and the number of services has reached 15.

The number of monthly "CONNECT-ship" matches has recovered after hitting the lowest point in May.

*Major Indicators

| 1Q FY3/20 | 1Q FY3/21 | YOY |

Number of the “CONNECT-ship” users (end of fourth quarter) | 28,378 | 28,146 | -0.8% |

Number of initial meetings via “CONNECT-ship” | 78,496 | 54,928 | -30.0% |

Number of the “CONNECT-ship” user company | 8 | 10 | +25.0% |

④ Lifestyle Business

Sales increased.

Insurance sales were favorable due to the expansion of coverage areas in the second half of the previous year.

(Efforts)

In the first quarter, the company focused on expanding its future services and building a foundation for external sales to customers other than the group's customers.

In particular, the company invited human resources with in-depth knowledge in this business and launched a new business headquarters to expand the service areas from insurance sales (agents) and provision of housing information services to general insurance, finance, real estate, etc.

From the second quarter, the company plans to hold asset formation seminars for customers in the businesses of matching and casual weddings.

⑤ Corporate Enterprise Business

Sales decreased.

Due to the impact of the novel coronavirus, face-to-face corporate events decreased, and orders for "evemon" corporate event services were sluggish.

(Efforts)

In the first quarter, the company planned and developed services to meet the demand for corporate events that fit the new lifestyles. It also strengthened the proposal for "parms," which is the matching support system targeting local governments that are considering enhancing their support for matching support.

As for evemon," which is the corporate event service, the company started accepting orders for its online social gathering service with a video feature and an application and has been doing well since June.

*Major Indicators

| 1Q FY 3/20 | 1Q FY 3/21 | YOY |

(evemon’s number of contracts) | 26 | 5 | -80.8% |

(evemon’s number of enforcements) | 23 | 2 | -91.3% |

(Reference: Sales and profits of previous reporting segments)

| 1QFY 3/20 | Composition rate | 1QFY 3/21 | Composition rate | YoY |

Sales |

|

|

|

|

|

Matching Business | 915 | 46.2% | 614 | 87.6% | -32.9% |

Casual Wedding Business | 1,044 | 52.7% | 62 | 8.9% | -94.0% |

Other Business | 26 | 1.3% | 18 | 2.7% | -28.1% |

Adjustment | -6 | - | 5 | - | - |

Total | 1,981 | 100.0% | 701 | 100.0% | -64.6% |

Profit in each segment |

|

|

|

|

|

Matching Business | 205 | 22.5% | -31 | - | - |

Casual Wedding Business | 55 | 5.3% | -536 | - | - |

Other Business | -4 | - | -24 | - | - |

Adjustment | -168 | - | -231 | - | - |

Total | 88 | 4.5% | -824 | - | - |

*Unit: million yen. The composition rate of the profit in each segment means return on sales.

(3) Financial condition and cash flow

◎Main BS

| End of March 2020 | End of June 2020 |

| End of March 2020 | End of June 2020 |

Current Assets | 1,999 | 1,826 | Current liabilities | 1,873 | 1,776 |

Cash | 1,040 | 986 | ST Interest-Bearing Liabilities | 1,368 | 1,238 |

Receivables | 682 | 510 | Noncurrent liabilities | 2,579 | 3,422 |

Noncurrent Assets | 3,477 | 3,589 | LT Interest-Bearing Liabilities | 2,326 | 3,179 |

Tangible Fixed Assets | 585 | 622 | Total Liabilities | 4,452 | 5,199 |

Intangible Fixed Assets | 1,412 | 2,039 | Net Assets | 1,025 | 216 |

Investment, Others | 1,479 | 927 | Retained earnings | 1,027 | 217 |

Total assets | 5,478 | 5,416 | Total Liabilities and Net Assets | 5,478 | 5,416 |

*Unit: million yen

While cash and deposits and trade receivables declined, total assets declined 61 million yen to 5,416 million yen from the end of the previous fiscal year due to an increase in intangible fixed assets.

Due to a rise in long-term interest-bearing debt, total liabilities increased 746 million yen year on year to 5,199 million yen. Net assets dropped 808 million yen year on year to 216 million yen due to a decrease in retained earnings.

As a result, equity ratio fell 14.7 points from the end of the previous fiscal year to 4.0%.

(4) Topics

◎ To expand shareholder benefits

Continuing from the previous term, the company has decided to change (enhance) the shareholder benefit program for FY ending March 2021.

To thank its shareholders for their support and to promote understanding of its business activities, the company has implemented a shareholder benefit program from FY ended March 2017. In FY ended March 2020, the company started offering a special ticket that can be used at "Suma-Kon" and "Nijikai-Kun" provided by Mation, Inc. and special points that can be used at the "Partner Agent Premium Special Club" exclusively for shareholders.

Continuing from the previous term, the company decided to expand its shareholder benefit program as it welcomed M Creative Works Inc. to the group this term and as a way to express its gratitude to its shareholders and to deepen the shareholders' understanding of the group even further.

A new 10% discount ticket for "LUMINOUS," which is a wedding photo shooting service, will be presented to shareholders who own 100 shares or more.

3. Fiscal Year ending March 2021 Earnings Forecasts

(1) Earnings Forecast

Since it is difficult to reasonably calculate the impact of the novel coronavirus at this stage, the forecast for this term is undecided.

In the matching business, the marriage support agencies have been on a recovery trend since late May.

In the casual wedding business photo weddings are performing well. Still, it is difficult to predict its performance as the wedding receptions and after-parties continue to be postponed or canceled due to the second wave of the coronavirus.

(2) Future Measures

The company is working to stabilize its financial foundation by securing liquidity on hand.

On the business side, the company is proceeding with its unique initiatives with the theme "utilizing the Internet" and will focus its management resources on areas where demand is expected to grow in the future.

The company plans to announce the medium-term management plan in November 2020.

4.Conclusions

The forecast for the current term remains undecided due to the difficulty of reasonably calculating the impact of the novel coronavirus at this stage. However, it seems that the worst period is over as the marriage support agencies have been on a recovery trend since late May. That being said, the recovery speed remains unclear. We want to pay attention to the vision and goals in the financial results for the second quarter and the medium-term management plan to see what measures the company would adopt to overcome this difficulty.

<Reference:Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 7 directors, including 2 external ones |

Auditors | 3 auditors, including 3 external ones |

Corporate Governance Report

The latest update: July 6,2020

<Basic policy>

In order to maximize corporate value, the basic policies of the corporate governance initiatives are to strengthen relationships with each stakeholder and enhance management governance and internal control functions, and they are positioned as the most important management actions. The Company is striving to secure transparency and fairness and disclose right information to each stakeholder in a timely manner by speeding up and revitalizing decision making, strengthening the supervisory function for business execution, strengthening the management oversight function for directors, and establishing an internal control system.

The Company operates a marriage information service business and believes that the corporate value is based on the trust of society. The Company recognizes that corporate governance is indispensable for the Group to maintain such trust from society.

The Company believes that “separation of execution and supervision” in management is the most effective way to meet the expectations of each stakeholder and continuously increase corporate value. Therefore, in addition to having the Board of Directors and the Board of Auditors as the supervisory bodies of the Group’s management team, the Management Council is established. The purposes of the Management Council include to determine important matters regarding business execution, deliberate important management matters, facilitate communication and common understanding of information, and review risks. In order to enhance the internal audit function, the company has established the Internal Audit Office, which reports directly to the President and Representative Director, as an auditing body for each director and business unit.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company states that it will carry out all basic principles of corporate governance code as a company listed on the TSE Mothers.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (Partner Agent, Inc.:6181) and contents of Bridge Salon (IR seminars) can be seen at https://www.bridge-salon.jp/