Bridge Report: (6183) BELLSYSTEM24 Holdings

President Ichiro Tsuge | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service business |

President | Ichiro Tsuge |

Address | 8-11 Harumi 1-chome, Chuo-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,571 | 73,515,620 shares | ¥115,493 million | 12.1% | 100 shares | |

DPS Est. | Dividend yield (Est.) Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥42.00 | 2.7% | ¥93.86 | 16.7 x | ¥622.14 | 2.5 x |

*The share price is the closing price on April 19. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS were the values for the previous term.

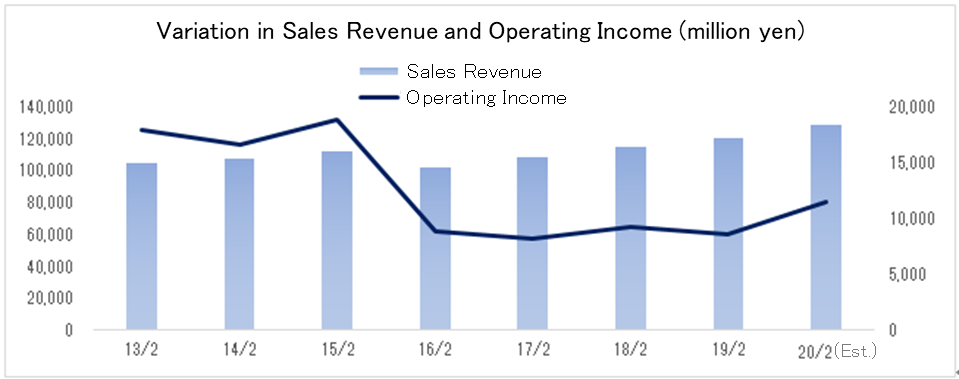

Consolidated Earnings Trends (IFRS)

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income* | EPS | DPS |

Feb. 2016 (Actual) | 102,540 | 8,884 | 7,875 | 5,031 | 71.00 | 18.00 |

Feb. 2017 (Actual) | 108,916 | 8,172 | 7,196 | 4,304 | 58.86 | 36.00 |

Feb. 2018 (Actual) | 115,618 | 9,319 | 8,502 | 5,604 | 76.39 | 36.00 |

Feb. 2019 (Actual) | 121,113 | 8,580 | 7,944 | 5,397 | 73.37 | 36.00 |

Feb. 2020 (Forecast) | 129,000 | 11,500 | 10,850 | 6,900 | 93.86 | 42.00 |

*The forecasted values were provided by the company. Net income is profit attributable to owners of the parent. Hereinafter the same apply.

* Unit: million yen、

This Bridge Report overviews the business performance for the ended February 2019 and describes the earnings forecast for the term ending February 2020, for BELLSYSTEM24 Holdings, Inc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year February 2019 Earnings Results

3. Fiscal Year February 2020 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended February 2019, sales grew 4.8% year on year, but operating income declined 7.9% year on year, due to the impairment loss from the restructuring of the pharmaceutical business. Existing and new businesses grew steadily, increasing sales, but the financial results were affected by the posting of impairment loss due to the transfer of the CSO business of BI Medical, Inc. (transforming it into a 100% subsidiary after the transfer) and the sale of Bell24 Cell Product, Inc., which conducts the SMO business, for the purpose of concentrating managerial resources onto the CRM business, which is their core business. Excluding this effect, operating income rose 9.7% year on year, as the growth of sales revenue, the streamlining of business operation, etc. offset the augmentation of operating cost, including personnel expenses and investment in human resources. As for dividends, the term-end dividend is to be 18 yen/share, so the annual dividend amount will be 36 yen/share, combined with the interim dividend of 18 yen/share (payout rati 49.1%).

- In the term ending February 2020, sales and operating income are estimated to increase 6.5% and 34.0%, respectively, year on year. Sales are projected to keep growing thanks to the healthy demand for outsourcing. As for profit, operating income rate is forecasted to rise to 8.9%, due to sales growth and profitability improvement as well as the rebound from the impairment loss from the restructuring of the pharmaceutical business in the previous term. Even when the rebound from the restructuring of the pharmaceutical business is excluded, operating income is estimated to rise 12% year on year. The interim and term-end dividends are to be both 21 yen/share, so that the annual dividend will be 42 yen/share, up 8 yen/share from the previous year (estimated payout rati 44.7%). The company plans to curb the fluctuations due to temporary factors, while aiming to achieve a consolidated payout ratio of 50%.

- The strengths of the company are not limited to the large corporate scale, but include loyal clients, mainly innovative enterprises in each field, and the on-site competence for meeting the needs of such loyal clients (such as the know-how for recruitment, training, and prevention of resignation, and analysis skills and experience of service provision). The company aims to become a next-generation CX partner that operates a contact center for satisfying the needs of client enterprises with competent personnel, who are the source of “on-site competence,” and its original AI, and grows together with client enterprises. We would like to pay attention to the progress of business strategies.

1.Company Overview

The company, which is the holding company, and its 6 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services.

The company’s subsidiaries are the following 6 companies: (1) BELLSYSTEM24, Inc., which engages in operation of contact centers and auxiliary tasks, (2) CTC First Contact Corporation (capital contribution rati 51%) specia6lizing in IT service desks and Business Process Outsourcing (BPO), (3) BI Medical, Inc., which conducts the CRM business for pharmaceutical products, etc., (4) POCKE INC., which sells contents, (5) BELL SOLEIL INC., a special subsidiary aimed at raising employment of people with disabilities, and (6) BELLSYSTEM24 ? HOASAO (capital contribution rati 49%), which engages in the contact center business in Vietnam.

ITOCHU Corporation holds 40.79% of the company’s voting rights and deems the company as a company accounted for using the equity method (the company has accepted 8 temporarily loaned workers). In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

1-1 Corporate Philosophy

Our mission

To support social affluence with innovation and communication

Our code of conduct

We will develop a comfortable workplace (community) where each employee can keep working happily witHomepageeace of mind while constantly taking on new challenges.

We will fulfill corporate social responsibility, and aim to achieve sustainable healthy growth.

We will return the value we would create to society, to contribute to the development of a beautiful future.

1-2 CSR activities

One of sustainable development goals of SDGs is to “actualize various ways of workings for a broad range of personnel.” The company makes efforts to decrease the working poor, provide disabled people with workplaces, and develop an environment where female workers, who account for over 70% of communicators of the company, can flourish. The company has been recognized as “Platinum Kurumin” and “Nadeshiko Brand” for the first time in the call center industry. For providing disabled people with workplaces, the company established a chocolate factory employing 10 disabled people in Toyohashi-shi, Aichi Prefecture, for the purpose of actualizing various ways of working for a broad range of personnel, in cooperation with Quon Chocolate (operated by La Brca Group, which is headquartered in Toyohashi-shi, Aichi Prefecture), which creates business models for disabled people and supports a variety of workstyles. In addition, the company opened a “cafe run by disabled people,” which was produced by Mi Cafeto Co., Ltd. (headquartered in Minato-ku, Tokyo; representative director and president: Yoshiaki Kawashima), which is the only Japanese enterprise participating in Sustainable Coffee Challenge, in its office.

In the term ended February 2019, the company established “CSR Division” in the Business Strategy Section. As it belongs to “Business Strategy Section,” which designs business strategies, conducts M&A, and adopt new technologies, including AI, it can integrate business strategies and CSR activities to improve its corporate value further.

1-3 Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales. Other businesses include the Contract Sales Organization (CSO) business and the Medical Information Service (MIS) business of BI Medical, Inc., the Site Management Organization (SMO) business of BELL24-Cell Product, Inc., and sale of contents of POCKE INC.

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up slightly over 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for slightly over 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

Others

BI Medical, Inc. conducts the CRM business, mainly contact center services, for pharmaceutical enterprises, including drug manufacturers. In the section of other businesses, the revenue from Pocke, Inc. and Belle Soleil, Inc. has been posted. Pocke, Inc. sells content to general consumers via mobile devices, PCs, etc. (monthly charges) and offers weather forecasts to enterprises. Belle Soleil, Inc. is an exceptional subsidiary for promoting the employment of disabled people and mainly undertakes general affairs and clerical tasks of the corporate group.

1-4 Corporate History

Exploiting the potential of a secretarial agency business using telephones, the company started a business of 24-hour call center services using call diverters, and night-time and holiday call center services for credit card application in October 1982. Then, it expanded the business by starting to offer call center services for receiving orders through mail order and call center services for receiving reports about car accidents. The company was registered as an over-the-counter registered stock by Japan Securities Dealers Association (JSDA) in December 1994, listed on the Second Section of Tokyo Stock Exchange (TSE) in February 1997, and was assigned to the First Section of TSE in November 1999. In order to develop group strategies based on more agile business judgment, the company was delisted from the First Section of TSE in January 2005. After the delisting, the company carried out corporate restructuring several times, through which the present form of the corporate group was developed. In October 2014, ITOCHU Corporation took a stake in the company (acquired 49.9% of the number of issued stocks). The company changed its name to BELLSYSTEM24 Holdings, Inc. in September 2015, and got listed on the First Section of TSE in November of the same year.

2. Fiscal Year February 2019 Earnings Results

2-1 Consolidated Earnings(IFRS)

| FY Feb. 18 | Ratio to sales revenue | FY Feb. 19 | Ratio to sales revenue | YOY | Forecast | Difference from the forecast |

Sales revenue | 115,618 | 100.0% | 121,113 | 100.0% | +4.8% | 124,700 | -2.9% |

Gross profit | 22,014 | 19.0% | 23,635 | 19.5% | +7.4% | 24,300 | -2.7% |

SG&A expenses | 12,666 | 11.0% | 13,369 | 11.0% | +5.6% | 14,000 | -4.5% |

Operating income | 9,319 | 8.1% | 8,580(10,224) | 7.1%(8.4%) | -7.9%(+9.7%) | 10,300 | -16.7%(-0.7%) |

Income before Income Taxes | 8,502 | 7.4% | 7,944(9,588) | 6.6%(7.9%) | -6.6%(+12.8%) | 9,660 | -17.8%(-0.7%) |

Net income | 5,604 | 4.8% | 5,397(6,273) | 4.5%(5.2%) | -3.7%(+11.9%) | 6,190 | -12.8%(+1.3%) |

* The number inside ( ) are excluded effects by restructuring of the pharmaceutical business

* Unit: million yen

While operating income decreased 7.9% year on year due to losses incurred from restructuring of the pharmaceutical business, profitability improved as the core business expanded steadily.

Sales revenue was 121,113 million yen, up 4.8% year on year. While sales from the “Existing operations (former BB Call)” declined 5.5% year on year due to customer’s circumstances and sales of the spot operations dropped 9.0% year on year in reaction to the election, along with other operations for which sales decreased 6.8% year on year due to restructuring of the pharmaceutical business, they were offset by sales from the “existing operations and new operations,” which increased 8.8% year on year.

Operating income fell 7.9% year on year to 8,580 million yen. While the increases in personnel costs (factors for declining profit by 740 million yen), upfront investment and other investments in personnel and new business areas (factors for declining profit by 520 million yen) including the new personnel system-related costs (factors for declining profit by 270 million yen) that started in December, and other operating expenses (factors for declining profit by 270 million yen) were offset by the improved profitability (a factor for increasing profit by 1,450 million yen) resulting from the effect on increased sales (a factor for increasing profit by 880 million yen), price improvement and increased efficiency in on-site operations, and the company was able to secure an operating income of 10,224 million yen before deducting impairment losses, operating income was negatively impacted by impairment losses, which amounted to 1,644 million yen due to restructuring of the pharmaceutical business. The amount of impact of losses on profit attributable to owners of the parent company was 877 million yen.

Selling, general and administrative expenses (13.37 billion yen) were composed of personnel expenses of back-office departments of 6.95 billion yen, depreciation costs of 720 million yen, outsourcing expenses (business consignment, etc.) of 680 million yen, equipment-related costs of 1.67 billion yen, communication cost of 250 million yen and other expenses amounting to 3.1 billion yen. Personnel expenses of back-office departments, which accounted for the greater part of selling, general and administrative expenses, were under control and within the expected range.

Sales revenue / operating income

| FY Feb. 18 | Ratio to sales revenue | FY Feb. 19 | Ratio to sales revenue | YOY | ||

Sales revenue | 115,618 | 100.0% | 121,113 | 100.0% | +4.8% | ||

CRM business | 108,868 | 94.2% | 114,824 | 94.8% | +5.5% | ||

Continuing operations | Existing operations + New operations | 85,421 | 73.9% | 92,944 | 76.7% | +8.8% | |

Existing (former BB Call) operations | 15,264 | 13.2% | 14,429 | 11.9% | -5.5% | ||

Spot operations |

| 8,183 | 7.1% | 7,450 | 6.2% | -9.0% | |

Others | 6,750 | 5.8% | 6,289 | 5.2% | -6.8% | ||

Operating income | 9,319 | 8.1% | 8,580(10,224) | 7.1% | -7.9%(+9.7%) | ||

CRM business | 8,962 | 8.2% | 10,038 | 8.7% | +12.0% | ||

Others | 357 | 5.3% | -1,458(186) | -(-3.0%) | -(-47.9%) | ||

* Unit: million yen

Restructuring of pharmaceutical business

In order to utilize management resources concentratedly in the CRM business, which is the company’s core business, the company transferred BI Medical’s CSO business, which is a joint venture with ITOCHU and whose it has 55% share. After that, the company made BI Medical Inc., a wholly owned subsidiary. In addition, the company sold all the stocks of its wholly owned subsidiary Bell24-Cell Product, Inc., which used to engage in the SMO business.

As for the CSO (Contract Sales Organization) business, which provides support in MR operations (MR dispatch service) for pharmaceutical companies, its single-handed expansion became difficult considering its scale, due to lack of sufficient synergy between it and the core business, and the worsening situation of the MR dispatch market resulting from the changes in the business environment of pharmaceutical companies, which were the main customers for the CSO business. The SMO (Site Management Organization) business, which supports medical institutions performing clinical trials, did not demonstrate sufficient synergy with the core business and its single-handed expansion became difficult considering its scale.

Transfer of the CSO business to BI Medical, Inc. was the factor for declining operating income by 1.56 billion yen and for decreasing profit attributable to owners of the parent company by 800 million yen, and the sale of Bell24-Cell Product, Inc. was the factor for declining operating income and profit attributable to owners of the parent company by 80 million yen each.

BI Medical, Inc., which was made into a wholly owned subsidiary, aims to realize group synergies by utilizing management resources concentratedly in the CRM business offering contact center services associated with medicine and health 24 hours a day, 7 days a week, through qualified personnel, and allocation of investigational drugs/arrangement of clinical study of the subject.

2-2 Efforts in Mid-term Management Plan

The Mid-term Management Plan, which will end in February 2020, is underway. It is composed of three growth strategies: “Expansion of Existing Business,” “Expansion in New Areas,” and “More Advanced Management of Human Resources,” and aims to achieve sales of 131.5 billion yen, an operating income of 11.5 billion yen (operating income rati 8.8%), an ROE of 14.3% and a NET DER of 1.20 in the fiscal year ending February 2020. The company also plans to invest a total of over 10 billion yen in all areas within five years up to the term ending February 2022, which is beyond the term of the Mid-term Management Plan.

“Expansion of existing business”

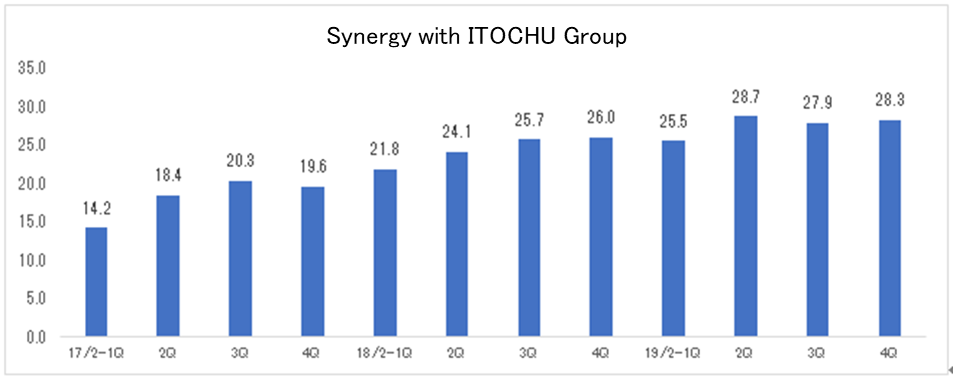

Continued enhancement of synergy with ITOCHU

The scale of synergy with ITOCHU grew from 9.76 billion yen in the term ended February 2018 to 11.04 billion yen, up 13% year on year. Also, not all were the results of synergy with ITOCHU, but due to the recent growth in the operations of mainly communication and information services, the number of clients with annual sales revenue exceeding 500 million yen and sales in the existing business continued to be on an increasing trend (including former BB Call): 37 client companies and sales of 53.2 billion yen in the term ended February 2017, 38 client companies and sales of 58.8 billion yen in the term ended February 2018, and 40 client companies and sales of 61.7 billion yen in the term ended February 2019.

(Taken from the material of the company)

Sales by business industry (regarding top 300 companies with highest sales in the CRM Business, excluding former BB Call operations)

| FY Feb. 18 | Composition ratio | FY Feb. 19 | Composition ratio | YoY |

Broadcasting/publishing/information services | 257.2 | 30% | 272.6 | 30% | +6.0% |

Finance | 176.6 | 20% | 188.4 | 21% | +6.7% |

Distribution(retail/wholesale) | 200.3 | 23% | 203.2 | 22% | +1.4% |

Transport/communication | 112.5 | 13% | 134.1 | 15% | +19.2% |

Manufacturing | 67.5 | 8% | 65.4 | 7% | -3.0% |

Utilities | 20.6 | 2% | 21.4 | 2% | +4.1% |

Other | 27.3 | 3% | 28.7 | 3% | +5.4% |

Total | 862.0 | 100% | 913.8 | 100% | +6.0% |

* Unit: million yen

New center with multilingual support opened in Ikebukuro

A new center with multilingual support was opened in Ikebukuro in April 2018. This center is the 32nd base in the country, the largest in Japan, and the 7th base in the Tokyo metropolitan area, and it offers multilingual support, mainly in English, Chinese and Korean. It was opened to meet the demand from foreign tourists in Japan, which is expected to grow further as Tokyo Olympics will be held, and the company plans to increase the number of communicators further from 150.

New center opened in Nishitokyo and Minami-osawa

“Minami-osawa Solution Center” in Tama Minami-osawa (Minami-osawa, Hachioji-shi, Tokyo), where a large number of daytime population of homemakers is found, was opened in January 2019. It is the 8th center to be opened in the Tokyo metropolitan area with 200 seats, and it plans to take in around 300 new employees for fintech-related operations, which started in February 2019. The company opened this center in a view that offering operations with a flexible shift pattern, such as short working hours, in Minami-osawa area, a university town with the increased number of homemakers due to an influx of families with small children, would resolve unmatching requirements of the work and job seekers, and create “an environment where diverse personnel can work comfortably for a longer period of time.”

“Expansion in new areas”

The company promoted the adoption of RPA to meet the needs of the existing clients to increase operational efficiency, and was able to secure 600-700 million yen in the “Digital Customer Service,” which was started in cooperation with Toppan Printing Co., Ltd., (it depends on how it is counted, but a two-fold growth is expected in the term ending February 2020). In addition, the company established a business partnership with Supreme System Co., Ltd. (Toshima-ku, Tokyo. CEO: Takuya Sakuma), which offers marketing automation tools.

Business alliance with Supreme System Co., Ltd.

The aim of this business tie-up is to establish a new CRM business providing consistent support throughout the process, from handling of consumers, their analysis and marketing, to enhancement of customer strategies, by combining multichannel (phone, e-mail, SNS, etc.) contact center operations and Business Source Outsourcing (BPO) operations of BELLSYSTEM24 Holdings, Inc. with Supreme System Co., Ltd.’s “Aimstar”, a marketing automation tool with analysis and targeting functions utilizing AI.

As the contact points between the company and customers are becoming increasingly diverse with channel expansion including online channel, the company is expected to provide centralized management of customers’ opinions and deliver personalized messages or services through the best possible method (call, chat, e-mail, direct message, etc.) at the most appropriate time to ensure advanced customer experience. BELLSYSTEM24 Holdings, Inc. is currently promoting provision of optimized services through a combination of AI and humans, in the areas of contact between the company and customers, such as Web chat and calls, through the contact center business and BPO business. On the other hand, Supreme System Co., Ltd. has successfully installed a significant number of “Aimstar,” a marketing automation tool that utilizes AI instead of requiring specialized knowledge, in major companies of various industries since its establishment in 2000.

This business alliance will enable the company to make and implement the best scenario to approach customers and marketing plan through centralized integration and analysis of customers’ opinions from various channels by combining the functions of BELLSYSTEM24 Holdings, Inc. and Supreme System Co., Ltd. The company aims to offer new CRM solutions realizing a speedy practice of PDCA cycle by allowing seamless coordination among the work processes through combination of the fields of expertise of both the companies.

In future, the company plans to jointly expand the business related to utilization of digital marketing, analytics, IoT and other advanced science and technology, encourage development of services offering new values and make efforts in providing services in the overseas market.

“Enhancement of personnel management”

“New Personnel System” started

Currently, the new system is being familiarized within the company and it will substantially get reflected in personnel expenses from the second half of the fiscal year ending February 2020, however, the award system for commendation of continuous service for workers, including communicators, has already started (the first commendation was carried out in January 2019, and 120 million yen was posted as expenses).

Establishment of “SUDAchi” for securing personnel who lack skills and training them to make them helpful in business

“SUDAchi” is an education facility for recruiting and educating job seekers who are short in skills such as computer skills and foreign job seekers who wish to work at the company’s multilingual call center. It is an effort that focuses on applicants who have not been recruited before because their skills did not satisfy the recruitment criteria. By closely communicating with trainers in charge of education, the participants will gain deep understanding of business contents and corporate culture of the company before they start working (and wages are paid to the employment preparation staff even during the preparation period). In the case of the company that employs 8,000 to 9,000 people (including time-limited short-term tasks) every term, about 50% of the people who apply for the company’s jobs are interviewed, and about 50% of the applicants who are interviewed are employed. This means that, every term, 8,000 to 9,000 people, namely, the same number of people who are employed, are not able to work at the company, while wishing for employment. By operating “SUDAchi,” it becomes possible to broaden the opening of employment on the premise of skill improvement after employment. It is said that its retention rate is higher than that of ordinary employees.

Establishment of an in-house nursery inside Fukuoka Branch

For the purpose of supporting employees’ return to work after childbirth and childcare leaves and achieving the good balance between child-raising and work, the company established “Bell Kids Tenjin Nursery,” an in-house nursery available to all employees regardless of employment type and gender, inside the solution center in Fukuoka. This is the second one after “Bell Kids Toyosaki Nursery” (Tomigusuku-shi, Okinawa Prefecture), and the company plans to establish another nursery in Sapporo in the term ending February 2020.

Release of “AI-Chat for Staff,” an AI-utilized tool for employees

The company started offering “AI-Chat for Staff.” This is a communication tool between AI and employees, which boasts enriched features for 400 scenarios and 4000 patterns, including the functions to cross-check and confirm shifts, leaves, and working hours, exchange greetings, have a chat, and collect opinions and requests, and a percentage of correct answers of as high as 98%. Half of communicators are registered. It is said that it is used mainly late at night. The company plans to increase scenarios and patterns, and enrich the features.

Furthermore, the company established “CSR Division” as a CSR activity, and opened a cafe and a chocolate factory operated by disabled people as part of CSR and CSV (creating shared value, to enhance economic value and social value at the same time).

Summary: Measures for fortifying the business base progressed.

“For expanding and strengthening its business,” the company established large-scale footholds in Sapporo (600 seats) and Fukuoka (750 seats), a small office (100 seats), and Minami-osawa Branch (200 seats), enriching its network, and fortified its system by adopting the profit center approach and establishing the business planning division. In addition, the company formed a business tie-up with ITOCHU Techno-Solutions and capital and business tie-ups with Toppan Printing, and a business tie-up with Supreme System Co., Ltd., for the purpose of advancing services. Furthermore, the company invested in Hoa Sao in Vietnam, and restructured the pharmaceutical business.

As efforts to develop human resources and employment environments, the company adopted a new personnel system, started indefinite-term employment, revised recruitment methods, and adopted a new training method “SUDAchi.” In addition, the company improved the working environment by opening in-house nurseries in Okinawa and Fukuoka and enriching welfare for contract employees.

For “enhancing CSR activities,” the company established CSR Division, made a donation to Center for iPS Cell Research and Application, Kyoto University, recruited more disabled people, participated in “the project for developing personnel in ASEAN countries (the Ministry of Economy, Trade and Industry),” exhibited its products at KidZania, and gave a lecture in communication in college.

For “improving corporate governance,” the company evaluated the effectiveness of the board of auditors, strengthened and enriched the business management section, distributed “whistle-blowing cards,” and posted “corporate ethics hotline posters,” as educational and enlightening activities.

2-3 Financial condition and Cash Flow (CF)

Financial condition

| Feb. 18 | Feb. 19 |

| Feb. 18 | Feb. 19 |

Cash and deposits | 5,324 | 5,971 | Accrued employee benefits | 8,604 | 8,778 |

Trade receivables | 18,477 | 17,402 | Borrowings | 76,412 | 70,986 |

Total current assets | 26,095 | 25,589 | Total liabilities | 97,586 | 93,247 |

Goodwill | 97,642 | 96,250 | Total asset | 44,851 | 46,492 |

Total noncurrent assets | 116,342 | 114,150 | Total shareholders' equity | 142,437 | 139,739 |

* Unit: million yen

Term-end total assets were 139,739 million yen, down 2,698 million yen from the end of the previous term, due to the decrease in goodwill and debts. While debts declined, the equity that belongs to the owners of the parent company rose. Accordingly, capital-to-asset ratio increased 2.2 points from 30.5% at the end of the previous term to 32.7%. NET DER improved 0.21 points from 1.63 at the end of the previous term to 1.42.

Cash Flow (CF)

| FY Feb. 18 | FY Feb. 19 | YoY | |

Operating Cash Flow | 8,948 | 11,981 | +3,033 | +33.9% |

Investing Cash Flow | -4,508 | -2,483 | +2,025 | - |

Financing Cash Flow | -4,734 | -8,759 | -4,025 | - |

Cash and Equivalents at Term End | 5,324 | 5,971 | +647 | +12.2% |

* Unit: million yen

As an impairment loss of 1,644 million yen was posted, operating income dropped 7.9% year on year to 8,582 million yen, but operating CF increased 33.9% year on year to 11,981 million yen, partially because the impairment loss does not include cash expenditures. Free CF grew over two times to 9,498 million yen, as the deficit of investment CF shrank due to the acquisition of intangible fixed assets and the decline in M&A expenses.

Trend of ROE

| FY Feb. 15 | FY Feb. 16 | FY Feb. 17 | FY Feb. 18 | FY Feb. 19 |

ROE | 25.5% | 15.6% | 11.0% | 13.4% | 12.1% |

Net Profit Ratio Margin | 8.81% | 4.91% | 3.95% | 4.85% | 4.46% |

Total Asset Turnover | 0.85 | 0.75 | 0.79 | 0.82 | 0.86 |

Leverage | 3.42 | 4.22 | 3.56 | 3.37 | 3.16 |

*ROE=Net Profit Ratio Margin × Total Asset Turnover × Leverage. Total asset and Equity are balance at the end of term.

* Unit: million yen

ROE remained as high as 12.1%, but declined from 13.4% in the previous term, because net income margin decreased due to the posting of impairment loss and leverage dropped due to the repayment of debts.

3.Fiscal Year February 2020 Earnings Forecasts

3-1 Consolidated Earnings(IFRS)

| FY Feb. 19 Act. | Ratio to sales revenue | FY Feb. 20 Est. | Ratio to sales revenue | YOY |

Sales revenue | 121,113 | 100.0% | 129,000 | 100.0% | +6.5% |

Operating income | 8,580 | 7.1% | 11,500 | 8.9% | +34.0% |

Income before Income Taxes | 7,944 | 6.6% | 10,850 | 8.4% | +36.6% |

Net income | 5,397 | 4.5% | 6,900 | 5.3% | +27.9% |

* Unit: million yen

Sales and operating income are estimated to grow 6.5% and 34.0%, respectively, year on year.

Sales revenue is projected to increase 6.5% year on year to 129 billion yen. Thanks to the healthy demand for outsourcing, the major items of the CRM business are expected to see sales growth. The sales from “existing and new business operations” are estimated to grow by 4.9%, as its good performance offset the effect of the withdrawal of some projects for improving profitability and sophisticating business operation (which decreased sales by about 2 billion yen). The sales of “the existing business (former BB Call),” which declined in the previous term due to the cost curtailment by a major client that was about to be listed, increased 23.4%, due to the recovery of the conventional business and new transactions for settlement (dealt with by Minami-osawa Solution Center). The sales from one-time transactions, mainly collaborative ones with Toppan Printing Co., Ltd., are estimated to rise 20.9% year on year, and the demand related to the election of the House of Councillors (400 to 500 million yen) was taken into account. On the other hand, the sales of other businesses are estimated to decline 26.1% year on year, due to the restructuring of the pharmaceutical business.

Operating income is projected to be 11.5 billion yen, up 34.0% year on year. The factors in decreasing profit, including the augmentation of personnel cost (which will decrease profit by 800 million yen), the establishment of large-scale business establishments (which will decrease profit by 300 million yen), the expenses for new personnel systems (which will decrease profit by 200 million yen), the investment in personnel and new fields, including the establishment of an in-house nursery in Sapporo, and upfront investment (which will decrease profit by 620 million yen), and others (which will decrease profit by 150 million yen) are forecasted to be offset by the factors in increasing profit, including sales growth (which will increase profit by 1.84 billion yen), the improvement in profitability through continued business streamlining and prevention of resignation (which will increase profit by 950 million yen), the rebound from the loss due to the restructuring of the pharmaceutical business in the previous term (which will increase profit by 1.64 billion yen), and other temporary factors (which will raise profit by 50 million yen).

The cost related to new human resources systems for securing personnel is estimated to augment 200 million yen to about 470 million yen (about 5% of operating income), and the company plans to keep investing about 5% of operating income in the next term.

Breakdown of sales revenue

| FY Feb. 18 | Composition ratio/profit ratio | FY Feb. 19 | Composition ratio/profit ratio | YOY | ||

Sales revenue | 121,113 | 100.0% | 129,000 | 100.0% | +6.5% | ||

CRM business | 114,824 | 94.8% | 124,350 | 96.4% | +8.3% | ||

Continuing operations | Existing operations + new operations | 92,944 | 76.7% | 97,540 | 75.6% | +4.9% | |

Existing (former BB Call) operations | 14,429 | 11.9% | 17,800 | 13.8% | +23.4% | ||

Spot operations |

| 7,450 | 6.2% | 9,010 | 7.0% | +20.9% | |

Others | 6,289 | 5.2% | 4,650 | 3.6% | -26.1% | ||

* Unit: million yen

4. Conclusions

Business performance remains healthy as the CRM outsourcing market is growing. The company plans to establish a large-scale center with 800 seats in the term ending February 2020, and allocated a budget amounting to about 300 million yen. Enterprises are required to closely communicate with each consumer and improve lifetime value, and the demand toward the CRM industry has become difficult to satisfy. In order to meet such needs, the company plans to brush up its on-site competence and advance its business operation by utilizing new technologies, including AI and RPA. To polish the on-site competence, the company will accelerate its activities in the term ending February 2020, as the development of systems for recruiting and training personnel and a working environment have progressed. For advanced business operation, the company will offer marketing support services on a full-scale basis based on the linkage between the CRM system of the contact center and marketing automation tools, which were developed by Supreme System Co., Ltd.

The strengths of the company are not limited to the large corporate scale, but include loyal clients, mainly innovative enterprises in each field, and the on-site competence for meeting the needs of such loyal clients (such as the know-how for recruitment, training, and prevention of resignation, and analysis skills and experience of service provision). In the next mid-term management plan, the company aims to become a next-generation CX partner that operates a contact center for satisfying the needs of client enterprises with competent personnel, who are the source of “on-site competence,” and its original AI, and grows together with client enterprises. For the term ending February 2020, the main themes of the company are new clients, new services, and new technologies, and this term is positioned as “the period for preparing for the next mid-term management plan.”

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 9 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

Updated on November 28, 2018

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. As for strategically held shares, the board of directors discusses whether or not to keep holding them every year. We have not specified concrete criteria for exercising the voting rights of strategically held shares, but our basic policy is to comprehensively judge whether the synergy, which is the purpose of investment, will be exerted to the maximum degree and contribute to the improvement in value of our corporate group, discuss proposed bills, and exercise voting rights.

【Supplementary principle 4-1-3 Appropriate overseeing of a plan for the successor to CEO, etc.】

The board of directors has not set a plan for a successor to the president and executive officer serving also as representative director who is the chief executive officer, but we select the successor while comprehensively considering his/her personality, knowledge, experience, etc. and the opinions of independent outside directors, after recognizing the importance of the roles of the CEO expected by stakeholders.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 3-1 Full Disclosure】

(4) Board policies and procedures in the appointment and dismissal of senior executives and nomination of candidates for directors and corporate auditors.

As for candidates for senior executives (executive directors), the nominating committee consisting mostly of multiple independent external directors develops the list of candidates regardless of whether they are from within or outside of the company, without having to distinguish gender, age, nationality, etc., from the persons who have extensive experience, high insight and advanced expertise, in accordance with the appointment criteria approved by the Board of Directors and obtains approval on the list of candidates from the Board of Directors (especially, external directors shall be those who meet the criteria for independence defined by the company based on the “independence standard” set by the Tokyo Stock Exchange and those who can utilize their knowledge and experience in their respective fields and independently express their opinions from a professional point of view). As for the dismissal of management personnel (executive directors), the nominating committee produces a dismissal proposal in accordance with the criteria for dismissing a director, which have been approved by the board of directors, and obtains the approval of the board of directors.

Furthermore, at least one of the candidates for corporate auditors shall be a qualified certified public accountant or have knowledge in the field of tax and accounting. The nomination committee develops a list of candidates in accordance with the criteria for the appointment of the corporate auditors approved by the Board of Directors among those who can secure the appropriateness of the audit in the field of tax and accounting which play an important role of the audit. After obtaining the consent of the Board of Corporate Auditors, the committee obtain approval on the list of candidates from the Board of Directors.

(5) Explanation with respect to the individual appointment and dismissal at the time when the Board of Directors appoints senior executives and nominates candidates for directors and corporate auditors based on (4).

Our company discloses the reasons for appointment of candidates for directors and corporate auditors in the notice of convocation of a general shareholders’ meeting.

The reason for the dismissal of management personnel (executive directors) is disclosed through a convocation notice for a general meeting of shareholders.

【Principe 5-1 Policy for constructive dialogue with shareholders】

In an effort to contribute to sustainable growth and medium- to long-term improvement of corporate value, our company will have the constructive dialogue with shareholders, in the scope and to the extent reasonable, in accordance with the following policies:

(3) Our company holds a session for briefing financial results at the time of announcing financial results for the second quarter and the full business year, in order to enrich means of dialogue with shareholders.

(4) Our company notifies, at any time, the director in charge of IR activities and related departments of opinions obtained from shareholders through dialogue, and shares such opinions with the board of directors as necessary.

(5) Our company engages in dialogue with shareholders in accordance with the regulation for prevention of insider trading that stipulates prohibition of acts of conveying information and encouraging transactions, and measures necessary for restricting re-conveyance of insider information.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved.