Bridge Report:(6183)BELLSYSTEM24 the Fiscal Year February 2020

President Ichiro Tsuge | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service business |

President | Ichiro Tsuge |

Address | 8-11 Harumi 1-chome, Chuo-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,077 | 73,516,882 shares | ¥79,177 million | 14.8% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

- | - | - | - | ¥668.77 | 1.6 x |

*The share price is the closing price on April 16. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter.

Earnings Trend(IFRS)

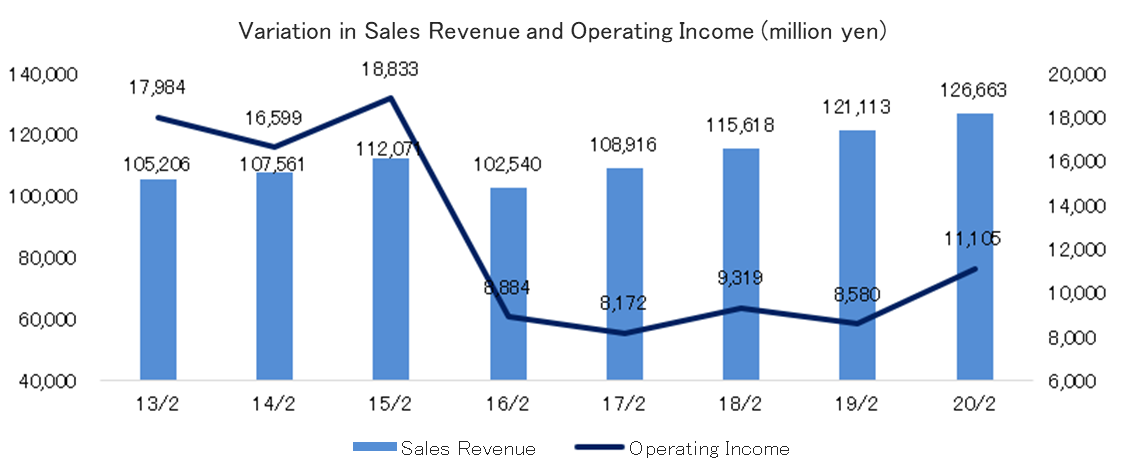

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income | EPS | DPS |

February 2017 Act. | 108,916 | 8,172 | 7,196 | 4,304 | 58.86 | 36.00 |

February 2018 Act. | 115,618 | 9,319 | 8,502 | 5,604 | 76.39 | 36.00 |

February 2019 Act. | 121,113 | 8,580 | 7,944 | 5,397 | 73.37 | 36.00 |

February 2020 Act. | 126,663 | 11,105 | 10,534 | 7,006 | 95.29 | 42.00 |

February 2021 Est. | - | - | - | - | - | - |

* Unit: million yen, yen.

* The consolidated earnings forecast for the term ending February 2021 is still to be announced, because it is difficult to reasonably estimate the impact of the novel coronavirus.

This Bridge Report overviews the business performance for the fiscal year ended February 2020 and describes the earnings forecast for the term ending February 2021, for BELLSYSTEM24 Holdings, Inc.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended February 2020 Earnings Results

3.Progress of Mid-term Management Plan

4.Fiscal Year ending February 2021 Earnings Forecasts

5.Conclusions

<Reference: Initiatives for CSR>

<Reference: Regarding Corporate Governance>

Key Points

- For the term ended February 2020, sales and operating income grew 4.6% and 29.4%, respectively, year on year. The sales of the CRM business increased 6.5% year on year thanks to the continuous orders for campaigns related to the consumption tax, cashless payment, and the synergy with Toppan Printing, although the sales of other businesses dropped 58.3% year on year, due to business transfer, the decrease of consolidated enterprises, etc. As for profit, there was a significant rebound from the drop in profit in the previous term due to the loss for restructuring the medical business, and even when this rebound was not taken into account, operating income grew 8.6% year on year. The company plans to pay a term-end dividend of 21 yen/share, up 3 yen/share (payout rati 44.1%).

- As the spread of the novel coronavirus is estimated to affect business performance in various ways, the company judged that “it is difficult to estimate business results,” and postponed the disclosure of the earnings forecast for the term ending February 2021. The company will promptly disclose the earnings forecasts and the dividend forecasts when it becomes possible to estimate business results.

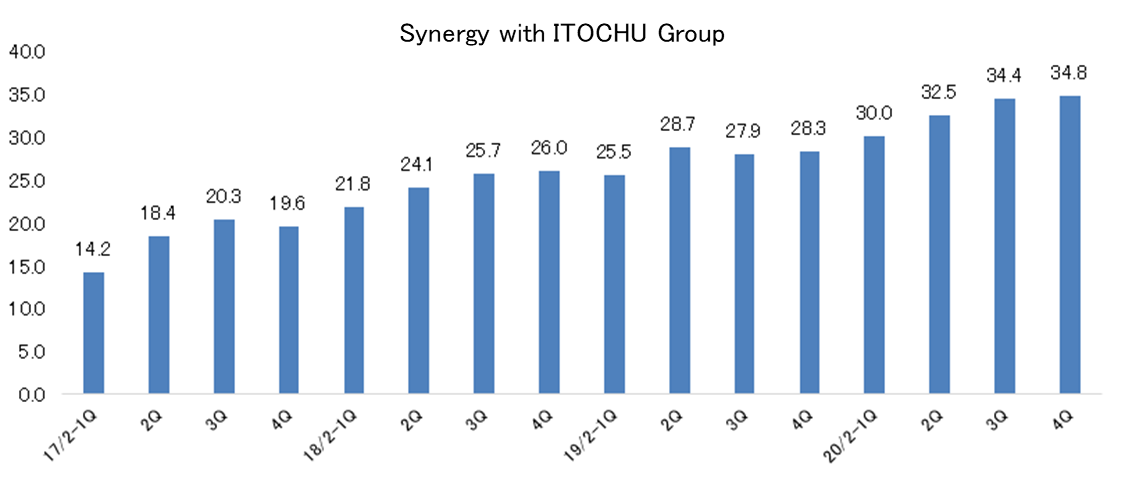

- In the term ended February 2020, there was the impact of the novel coronavirus, but the mid-term management plan was almost achieved. In the new mid-term management plan, which started in the term ending February 2021, the company will further enhance the activities for becoming “the best CX partner” and actualizing “workstyle innovation.” The point is the promotion of “utilization of data,” and to do so, it is necessary to further cement the cooperation with ITOCHU and CTC and training of people who use data. For creating shared value (CSV), the company will keep concentrating on CSR. The new mid-term management plan is to be announced when the results for the second quarter are disclosed.

1.Company Overview

The company, which is the holding company, and its 6 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services.

The company’s subsidiaries are the following 6 companies: BELLSYSTEM24, Inc., which engages in operation of contact centers and auxiliary tasks, CTC First Contact Corporation (capital contribution rati 51%) specializing in IT service desks and Business Process Outsourcing (BPO), POCKE INC., which sells contents, BELL SOLEIL INC., a special subsidiary aimed at raising employment of people with disabilities, and BELLSYSTEM24 – HOASAO (capital contribution rati 49%), which engages in the contact center business in Vietnam, etc.

ITOCHU Corporation holds 40.79% of the company’s voting rights and deems the company as a company accounted for using the equity method (the company has accepted 8 temporarily loaned workers). In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

【Corporate Philosophy】

Our mission

To support social affluence with innovation and communication

Our code of conduct

・We will develop a comfortable workplace (community) where each employee can keep working happily with peace of mind while constantly taking on new challenges.

・We will fulfill corporate social responsibility, and aim to achieve sustainable healthy growth.

・We will return the value we would create to society, to contribute to the development of a beautiful future.

1-1 Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales. Other businesses include the sale of contents of POCKE INC.

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up slightly over 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for slightly over 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

Others

The revenue from Pocke, Inc. and Belle Soleil, Inc. has been posted. Pocke, Inc. sells content to general consumers via mobile devices, PCs, etc. (monthly charges) and offers weather forecasts to enterprises. Belle Soleil, Inc. is an exceptional subsidiary for promoting the employment of disabled people and mainly undertakes general affairs and clerical tasks of the corporate group.

Sales revenue by segment

| FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

CRM business | 1,015.2 | 1,088.6 | 1,174.6 | 1,251.4 |

Others | 73.9 | 67.5 | 36.4 | 15.2 |

Consolidated Sales Revenue | 1,089.1 | 1,156.1 | 1,211.1 | 1,266.6 |

* Unit: 100 million yen

Sales by business industry

| FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

Broadcasting/Publishing/Information services | 246.1 | 257.2 | 280.0 | 289.3 |

Transport/Communications | 82.4 | 112.5 | 278.0 | 279.2 |

Distribution (retail/wholesale) | 189.4 | 200.3 | 206.1 | 211.8 |

Finance | 173.8 | 176.6 | 188.4 | 201.7 |

Manufacturing | 66.3 | 67.5 | 65.4 | 102.7 |

Electricity, gas, water, etc. | 17.7 | 20.6 | 21.4 | 22.9 |

Other | 28.5 | 27.3 | 29.2 | 33.3 |

Total | 804.2 | 862.0 | 1,068.5 | 1,140.9 |

* Unit: 100 million yen

* For the top 300 companies with respect to the sales revenue of the CRM business, excluding the former BB Call

2.Fiscal Year ended February 2020 Earnings Results

2-1 Consolidated Earnings

| FY 2/19 | Ratio to sales | FY 2/20 | Ratio to sales | YoY | Mid-term plan | Compared with the plan |

Sales revenue | 121,113 | 100.0% | 126,663 | 100.0% | +4.6% | 129,000 | -1.8% |

Gross profit | 23,635 | 19.5% | 24,996 | 19.7% | +5.8% | - | - |

SG&A expenses | 13,369 | 11.0% | 13,754 | 10.9% | +2.9% | - | - |

Operating income | 8,580 | 7.1% | 11,105 | 8.8% | +29.4% | 11,500 | -3.4% |

Income before Income Taxes | 7,944 | 6.6% | 10,534 | 8.3% | +32.6% | 10,850 | -2.9% |

Net income | 5,397 | 4.5% | 7,006 | 5.5% | +29.8% | 6,900 | +1.5% |

* Unit: million yen

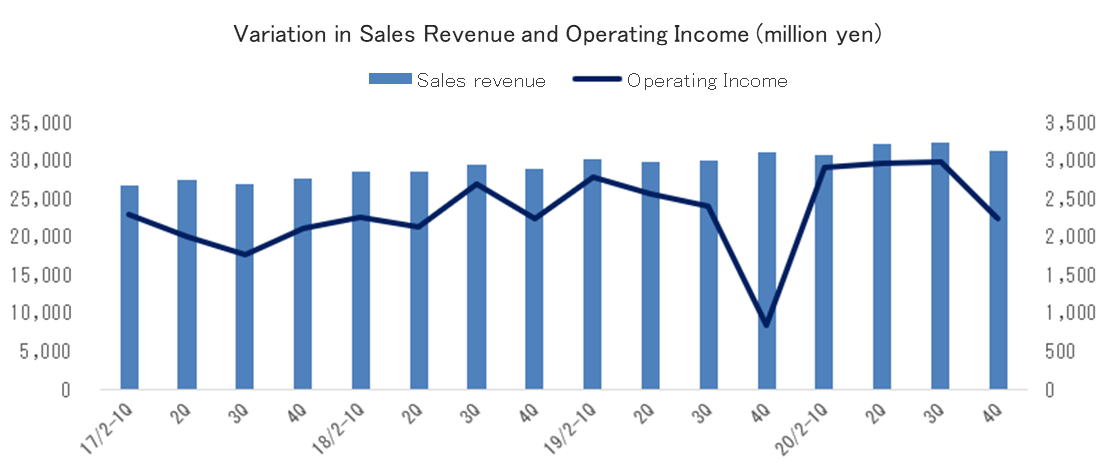

Sales and operating income grew 4.6% and 29.4%, respectively, year on year

Sales revenue was 126,663 million yen, up 4.6% year on year. The sales of the CRM business increased 6.5% year on year to 125,142 million yen, although the sales of other businesses dropped 58.3% year on year due to business transfer, the decrease of consolidated enterprises, etc. As for the CRM business, the sales of the existing businesses, new businesses, etc. increased 3.1% due to the withdrawal from less profitable businesses, the sales from spot transactions grew 33.5% year on year thanks to the continuous orders for campaigns related to the consumption tax, cashless payment, and the synergy with Toppan Printing, and the sales from BB Call rose 14.6% year on year.

As for profit, operating income increased 29.4% year on year to 11,105 million yen, as the augmentation of personnel costs for improving the treatment of operators (760 million yen) and the costs for strategic and upfront investments (240 million yen, including the adoption of a new HR system) was offset by the effect of sales growth (1.27 billion yen), the improvement in profitability (680 million yen) through the rationalization of contract prices (revision to less profitable transactions), the streamlining and rationalization of human resources, and a rebound from the loss for restructuring the medical business in the previous term (increasing the operating income for the term ended February 2020 by 1.64 billion yen).

The operating income in the previous term, excluding the loss for restructuring the medical business, was 10,224 million yen (10,011 million yen for CRM; 213 million yen for other businesses). Accordingly, the operating income growth rate for the term ended February 2020, excluding the loss, was 8.6%.

The term-end dividend is to be 21 yen/share, up 3 yen/share. Combined with the end-of-half dividend, the annual dividend is to be 42 yen/share, up 6 yen/share (payout rati 44.1%).

Sales revenue / operating income by segment

| FY 2/19 | Ratio to sales | FY 2/20 | Ratio to sales | YoY | Mid-term plan | Ratio to plan | ||

Sales revenue | 121,113 | 100.0% | 126,663 | 100.0% | +4.6% | 129,000 | -1.8% | ||

CRM business | 117,469 | 97.0% | 125,142 | 98.8% | +6.5% | 124,350 | +0.6% | ||

| Continuing operations | Existing operations + New operations | 95,144 | 78.6% | 98,057 | 77.4% | +3.1% | 97,540 | +0.5% |

| Existing (former BB Call) operations | 14,429 | 11.9% | 16,540 | 13.1% | +14.6% | 17,800 | -7.1% | |

| Spot operations | 7,896 | 6.5% | 10,545 | 8.3% | +33.5% | 9,010 | +17.0% | |

Others | 3,644 | 3.0% | 1,521 | 1.2% | -58.3% | 4,650 | -67.3% | ||

Operating Income | 8,580 | 7.1% | 11,105 | 8.8% | +29.4% | 11,500 | -3.4% | ||

CRM business | 10,011 | 8.5% | 10,978 | 8.8% | +9.7% |

|

| ||

Others | -1,431 | - | 127 | 8.3% | - |

|

| ||

* Unit: million yen

BI Medical, Inc., which operates the pharmaceutical CRM business that had been categorized into the “Others” business segment, was acquired by BELLSYSTEM24, Inc. through absorption-type merger on November 1, 2019, so the figures for the pharmaceutical CRM business are categorized into “Existing operations + New operations, etc.” and “Spot operations” in the above tables for the term ended February 2019 and the term ended February 2020. As of the end of the term ended February 2020, the subsidiaries included in “Others” are POCKE INC. and BELL SOLEIL INC.

In the fourth quarter of the term ended February 2020, spot operations decreased due to the spread of COVID-19, and operating income was affected by temporary expenses for renewing bases, replacing equipment companywide, etc.

2-2 Financial condition and Cash Flow (CF)

Financial condition

| Feb. 19 | Feb. 20 |

| Feb. 19 | Feb. 20 |

Cash and deposits | 5,971 | 7,767 | Trade debt | 5,396 | 6,144 |

Total current assets | 25,589 | 26,957 | Accrued employee benefits | 8,778 | 9,941 |

Tangible assets | 6,446 | 32,674 | Borrowings | 70,986 | 68,178 |

Goodwill | 96,250 | 96,250 | Total liabilities | 93,247 | 118,971 |

Total noncurrent assets | 114,150 | 141,551 | Total shareholders' equity | 45,737 | 49,168 |

Total assets | 139,739 | 168,508 | Total capital | 46,492 | 49,537 |

* Unit: million yen

Term-end total assets stood at 168,508 million yen, up 28,769 million yen from the end of the previous term. Tangible fixed assets grew, because cash and deposits increased through the rise in operating CF and operating lease, which had not been posted as lease transactions, was posted in the balance sheet, after the application of IFRS16 (Then, the depreciation of the right-of-use asset and the interest expense related to the lease liability were recorded). Capital-to-asset ratio was 29.2% (32.7% at the end of the previous term).

Cash Flow

| FY 2/19 | FY 2/20 | YoY | |

Operating Cash Flow | 11,981 | 16,717 | +4,736 | +39.5% |

Investing Cash Flow | -2,483 | -3,213 | -730 | - |

Financing Cash Flow | -8,759 | -11,799 | -3,040 | - |

Cash and Equivalents at Term End | 5,971 | 7,767 | +1,796 | +30.1% |

* Unit: million yen

The company secured an operating CF of 16,717 million yen, as pretax profit was 10,534 million yen (7,944 million yen in the previous term), the depreciation of tangible fixed assets was 5,925 million yen (1,245 million yen in the previous term), the amortization of intangible fixed assets was 1,089 million yen (1,020 million yen in the previous term), etc. Investing CF is attributable to the acquisition of tangible and intangible fixed assets, etc., while financing CF is attributable to the repayment of long-term debts, the payment of dividends, etc.

3.Progress of Mid-term Management Plan

The term ended February 2020 is the final fiscal year of the mid-term management plan, which was started in the term ended February 2018. Offsetting the effects of the transfer of the CSO business of BI Medical, Inc., the exclusion of Bell24Cellproduct, Inc. from the scope of consolidation, etc., sales, profit, ROE (estimate: 14.5%; result: 14.8%), and NET DER (estimate: 1.23 x; result: 1.23 x) reached the estimates.

Changes in ROE and NET DER

| FY 2/16 | FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

ROE | 15.6% | 11.0% | 13.4% | 12.1% | 14.8% |

Ratio of net income to sales | 4.91% | 3.95% | 4.85% | 4.46% | 5.53% |

Total assets turnover | 0.75 times | 0.79 times | 0.82 times | 0.86 times | 0.82 times |

leverage | 4.22 x | 3.56 x | 3.37 x | 3.16 x | 3.25 x |

NET DER | 1.94 x | 1.80 x | 1.63 x | 1.42 x | 1.23 x |

3-1 Activities in the mid-term management plan

To achieve the goals of the mid-term management plan, the company carried out 3 activities: the expansion of existing businesses, the expansion into new areas, and the more advanced management of human resources.

Expansion of existing businesses

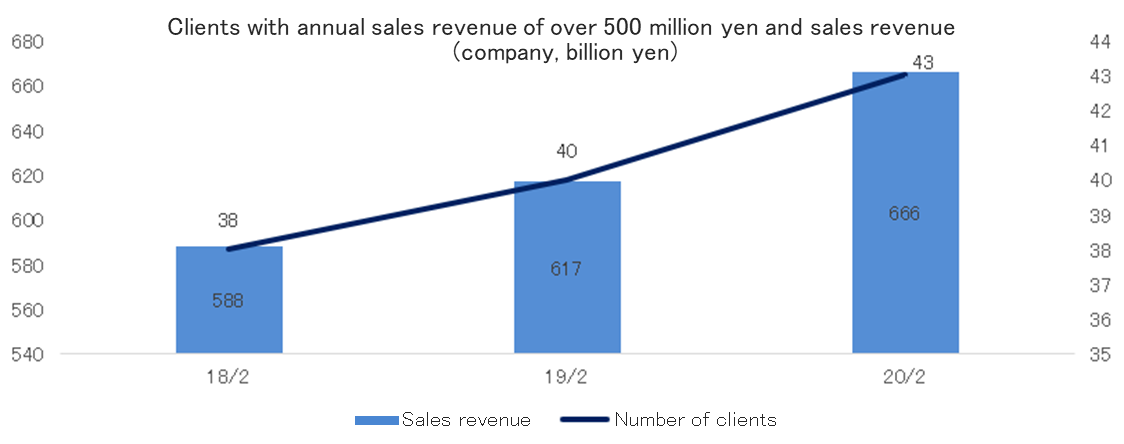

In order to evolve from an outsourcer to a partner by renewing transactions, the company strived to increase client companies for annual sales of over 500 million yen per client and pursued the synergy with ITOCHU. As for client companies for annual sales of over 500 million yen per client, the company increased orders for new businesses, including cashless payment, the number of client companies rose from 40 in the term ended February 2019 to 43 in the term ended February 2020, and sales revenue grew from 61.7 billion yen to 66.6 billion yen. As for the synergy with ITOCHU, the related business grew, earning an annual sales revenue of over 13 billion yen, and the cooperation progressed through the utilization of new means, including investment and alliance.

In cooperation with ITOCHU, the company established business foundations in Thailand and Taiwan. In Thailand, the company formed capital and business alliances with True Corporation Public Co., Ltd., a leading provider of communications services, acquired 49.99% of outstanding shares of TrueTouch Co., Ltd., which is its subsidiary and a leading contact center, and launched the contact center in Thailand. On the other hand, in Taiwan, the company formed a business alliance with HongHwa International Corp., which is a 100% subsidiary of Chunghwa Telecom, the largest general communications company in Taiwan, and operates the contact center business, for the purpose of carrying out the contact center business in the Taiwanese market. Under this business alliance, the consolidated subsidiary BELLSYSTEM24, Inc. plans to establish Taiwan Branch. The company aims to cultivate the contact center outsourcing market and expand its business in Taiwan, by fusing the know-how to operate contact centers and local needs.

Expansion into new areas

This overlaps with the expansion of existing businesses, but the company worked on the integration and streamlining of call center operations and launched digital marketing services in cooperation with Toppan Printing, with which the company formed capital and business tie-ups. Furthermore, the company established footholds in Vietnam, Thailand, and Taiwan, and adopted marketing automation (MA).

MA means a system for streamlining corporate marketing activities by automating manual routine tasks, cumbersome processes, and an enormous volume of work that would cost money and time if handled manually, or software for automating them.

More advanced management of human resources

This overlaps with the expansion of new business domains, but the company started offering AI and RPA solutions and using them inside the company. In addition, the company adopted a new HR system, etc. for reducing turnover rate, and worked on the reduction of recruitment costs and the improvement in retention rate with new recruitment methods, including SUDAchi, which educates employees after recruitment.

In addition, in order to actualize “workstyle innovation,” the company launched “Call Center Workstyle Innovation Project,” a cutting-edge in-home call center project utilizing the mixed reality (MR) technology. This project is aimed at actualizing new ways of working for call center operations beyond the limits of time and places by utilizing the latest digital technologies in cooperation with Microsoft Japan Co., Ltd., DataMesh Consulting LLC, and De'Longhi Japan Corp., which is a client company. In detail, the company collaboratively developed solutions for offering customer support for products of De'Longhi outside call centers by combining “MicrosoftHoloLens2,” a head-mounted display of Microsoft Japan for actualizing MixedReality, and the MR app utilizing the 3D hologram technology of DataMesh Consulting (The cutting-edge in-home call center utilizing the MR technology), and started demonstrative experiments.

External certification

External certifications and rates obtained | Certifying/ranking organization |

Ranked the highest in “Eruboshi” based on the Law for Promoting the Advancement of Women | Minister of Health, Labour and Welfare |

Certified as a gold-ranked enterprise in “PRIDE Index 2019,” which evaluates activities for LGBT, for the first time in the call center field | “Work with Pride,” a voluntary group for supporting the promotion and establishment of diversity management |

Obtained “DBJ health-oriented management rank” (for the first time in the call center field) | Development Bank of Japan Inc. |

Certified as “Platinum Kurumin*” (for the first time in the call center field) | Ministry of Health, Labour and Welfare |

Certified as “Nadeshiko Brand” (for the first time in the call center field) | Ministry of Economy, Trade and Industry and Tokyo Stock Exchange, Inc. |

* “Platinum Kurumin”

If an enterprise that has produced a general business action plan in accordance with the law for facilitating the development of next-generation people achieves the goals set in the plan and meets certain criteria, the enterprise will be certified by the Minister of Health, Labour and Welfare as “an enterprise that supports childcare” after application.

CSR activities

The company established CSR Division, and made efforts to create opportunities for disabled employees to flourish.

In Funabashi City, Chiba Prefecture, employees with disabilities started operating agricultural farms

Employees with disabilities started the operation of agricultural farms as a new initiative for offering opportunities to flourish for the purposes of attaining SDGs and actualizing various ways of working of a broad range of people.

Opened the second “café operated by disabled people” produced by Mi Cafeto Co., Ltd. inside Sapporo Call Center.

The company opened a premium café where disabled people brew coffee with high-quality coffee beans under the supervision of Mi Cafeto, which strives to attain SDGs with coffee, in Sapporo Call Center, after the first café in Tokyo. The company sold products in carts inside the company, creating a new kind of communication.

Held “Kids & Family Chocolate Academy” involving parents and children, as part of employee training for learning CSR

In collaboration with La Barca Group, the company held “Kids & Family Chocolate Academy,” which is a collaborative event where employees and their family members learn CSR at Quon Chocolate Toyohashi Factory, where disabled employees produce chocolate.

4.Fiscal Year ending February 2021 Earnings Forecasts

4-1 Announcement of the earnings forecast postponed

COVID-19 is spreading inside and outside Japan. The company has 36 call centers around Japan, and operates about 32,000 seats, including the booths of operators working at client companies (about 17,000 seats in house). Since call centers are located in multiple regions, risks are dispersed to some degree from the viewpoint of BCPs, but the spread of the novel coronavirus is estimated to affect business performance in various ways, so the company judged that it is difficult to estimate financial results for the term ending February 2021 and decided to put off the announcement of the earnings forecast. As soon as it is estimated, the company plans to announce it.

In addition, a new mid-term management plan has started in the term ending February 2021, and the details of the plan is to be announced by the new president, who will take office in May, at the time of announcement of results for the second quarter in October 2020.

Operators of some call centers were infected, and the company suspended the operation for about 3 weeks after consulting with client companies while considering the safety of employees and the prevention of infection. In addition, considering the contents of the declaration of the state of emergency issued by the government, the company will keep warning all employees and instructing them to check their health conditions thoroughly to prevent infection inside and outside the company, take measures, such as the downsizing of business when necessary, and conduct appropriate business operation and information disclosure in cooperation with relevant municipalities, healthcare centers, etc. while following requests from the government to fulfill its corporate social responsibility.

4-2 Basic dividend policy and dividend forecast for the term ending February 2021

The company considers the sharing of profit with shareholders as one of the most important issues and set two basic policies. One is to pay the dividend of surplus twice a year, that is, an interim dividend and a term-end dividend, stably and continuously while comprehensively considering the payout ratio, the enrichment of a necessary internal reserve, etc. according to the progress of business. The other is to aim to achieve a consolidated payout ratio of 50% based on net income attributable to owners of the parent in the medium term.

The dividend forecast for the term ending February 2021 is to be announced with the earnings forecast for the term ending February 2021.

4-3 Future policies

The ultimate missions of the company are to optimize the contact points between “client companies” and “consumers” to make them valuable, and to become “the best customer experience (CX) partner” for client companies. Communication channels, including telephone, emails, and chats, are being diversified, and the quality of communication, too, is changing considerably through the commercialization of 5G, the utilization of AI and marketing automation (MA), etc. While proactively applying such new technologies to business, the company believes that “human feelings in communication and dialogue techniques will remain essential.” For the company, it is important to develop people, actualize complex, emotional, and fulfilling dialogues that cannot be imitated by AI, and continue them as well as adopt new technologies and streamline business operation.

On the other hand, “workstyle innovation,” which was started in the previous term, does not merely mean the promotion of telework, etc. after installing a video conference system, but the drastic change in ways of working. It includes the promotion of in-home call centers, which has been already started. The company will actualize “ways of working beyond the limits of time and places” utilizing the latest technologies and provide a working environment where employees can work without worry for a long period of time, for those who want to work in their spare time while rearing a child, caring for a parent, or the like, but cannot work due to the constraint of the commute time, those who have no choice but to retire due to relocation, and others. In order to actualize them, the company has already secured security with the face recognition technology and started the operation of in-home call centers utilizing the MR technology, etc. These efforts are expected to improve the quality of business operations and make the contact points between client companies and consumers “more valuable” (= the best CX partner) in the end.

“The best CX partner” and “workstyle innovation” are like two sides of a coin. The company thinks that it is indispensable to utilize data, in order to become “the best CX partner” and realize “workstyle innovation” while “everything is being digitized,” and it is more necessary than ever to enhance and increase the utilization of data. By producing data on an enormous number of accumulated “voices of consumers” and analyzing them, the company will become able to propose effective marketing measures without relying on experience or instinct and contribute to the development of new products for client companies. In addition, the company will support the business operation of communicators with the automatic production of FAQs. To do so, the company will cement the cooperation with ITOCHU and CTC, develop personnel versed in data utilization, and so on.

Even if communication changes due to new technologies 5 or 10 years from now, the company’s mission will remain “to optimize the contact points between client companies and consumers, and make them more valuable,” and the company will keep growing, to follow Corporate Philosophy: “to support social affluence with innovation and communication.”

(From the company’s materials)

5.Conclusions

In the mid-term management plan, which ended in the term ended February 2020, the company advanced toward the goal of becoming the “best CX partner” by conducting the existing businesses and expanding new business domains. In addition, the company laid the foundation for achieving “workstyle innovation” by starting the use of AI and RPA solutions and adopting a new HR system, “SUDAchi,” etc. to sophisticate the management of human resources. Furthermore, the company put energy into CSR, worked on the creation of opportunities for disabled employees to flourish, established CSR Division, and defined and clearly stated the basic concept for business administration of the corporate group.

As for the new mid-term management plan starting in the term ending February 2021, we have to wait for the announcement in October, but the company is expected to enhance efforts to become the “best CX partner” and actualize “workstyle innovation.” The point is the “utilization of data,” and to do so, it is necessary to cement the cooperation with ITOCHU and CTC and develop personnel versed in data utilization more. As for CSR, the company is expected to realize “CSV” (Creating Shared Value) beyond CSR. They carry out business activities that would solve social issues while pursuing profit as an enterprise. In other words, the company will contribute to the settlement of social issues, by expanding the CRM business by becoming the “best CX partner” and achieving “workstyle innovation.” We would like to expect from their future developments.

On April 7, the government declared a state of emergency in accordance with Article 32 of the Act on Special Measures against Novel Influenza, etc. In response to this declaration, prefectural governors “requested voluntary restraint on going out” pursuant to Article 45 of that act. Accordingly, when necessary, the company will conduct the “downsizing of business operations,” by carrying out only minimum business operations required for business continuity and adopting telework, etc. that do not require going out. As for business operations that are difficult to adjust, such as “essential services for maintaining society and economic life,” the company plans to implement measures for preventing infection as much as possible, such as the business operation with a shift system.

<Reference: Initiatives for CSR>

Aiming for More Sustainable Growth by Pursuing Corporate Philosophy

More than 30,000 employees working in the company presently are implementing a multitude of workstyles which are suited to their respective circumstances and environments, without being restricted by time and place. In order to help them acquire necessary business skills with ease after joining the company, the new recruitment/training system “SUDAchi” was adopted, along with the opening of an in-company café and a chocolate factory which are operated by disabled employees. Further, through initiatives like opening an in-company nursery at the main base, they are promoting the creation of a working environment where all types of personnel can work without worry for long periods of time while having fun. Regarding the system, they started an initiative for promoting fixed-term employees that have been working continuously for a certain period of time to indefinite-term employment, as well as starting a “a new HR system” that will facilitate the career advancement of short-term employees and recognize employees with high expertise as specialists. Further, they are also making various societal contributions like donating to the Center for iPS Cell Research and Application in Kyoto University and exhibiting a “Call Center” Pavilion in KidZania Tokyo. As a result of such initiatives, not only was the company nominated for the “Nadeshiko Brand” which is awarded to businesses that push for female employee participation, but the company was also nominated for “Platinum Kurumin” and “Eruboshi,” while also garnering critical acclaim from outside the company.

Improvement of Shared Value through Activities in the CSR Division United with Business Strategy

A CSR Division has been set up in the Business Strategy Department where they define and document the concepts that will be forming the base of our company group’s operation, such as determining “the important challenges that we share with society (materiality),” human rights policies, environmental policies and policies regarding societal contribution. They plan to inform their employees and stakeholders, and conduct concrete activities and reporting.

However, the long-term aim of their company group is what is considered the next phase of CSR, that is “CSV” (Creating Shared Value). CSV is an approach to expand economic value and societal value at the same time, which would mean pursuing business activities that would result in profit-making as a business while also emphasizing the solving of societal challenges. The reason the company set up the CSR Division in the Business Strategy Department which is in charge of the business strategy for the entire group, instead of in the General Affairs Department or the Public Relations Department, was that the company considered such an ideal state in the future.

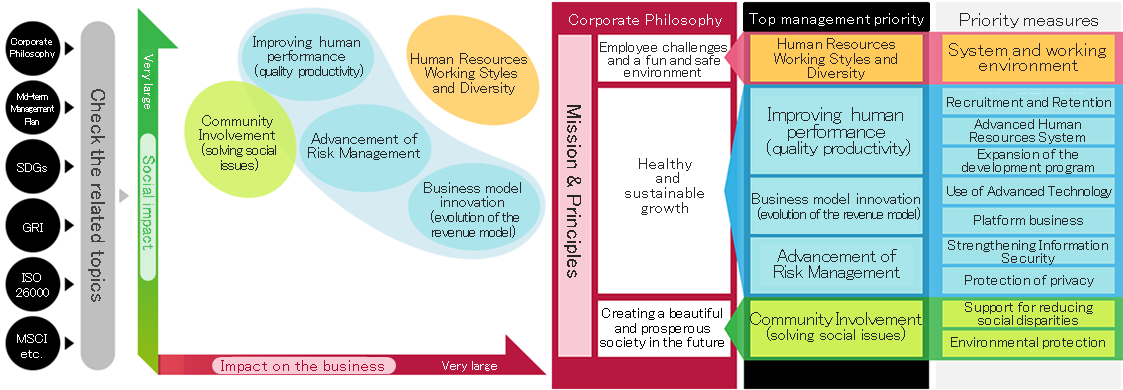

Important Challenges Faced in Common with BELLSYSTEM24 Holdings, Inc. and Society

In order to realize this company’s mission, which is “to support social affluence with innovation and communication,” they defined important challenges they face in common with society by linking the company’s activities to their impact on society. By referring to the various external standards along with the company’s strategic direction in the process of defining these challenges, in particular by creating a statistical population with 86 relevant factors, and further by discussing them with stakeholders and experts, the challenges were narrowed down to the following 5: The diversity in personnel and workstyles, performance improvement of the personnel (quality and productivity), innovation of the business model (evolution of the earnings model), enhancement of risk management and participation in the planning of regional communities (solving societal challenges).

They defined policies that will be focusing on the solution to these important challenges. In the future, they will set the objectives and measurement indices regarding each policy and appropriately check the situations and report to stakeholders. Further, they will construct a system that will suitably adopt necessary measures by monitoring the change in the business environment.

(From the company’s website)

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 9 directors, including 5 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on May 29, 2019

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. As for strategically held shares of listed companies, the Board of Directors discussed whether or not to keep holding the shares of a company (balance sheet amount 12 million yen) and decided to continuously hold it. We have not specified concrete criteria for exercising the voting rights of strategically held shares, but our basic policy is to comprehensively judge whether the synergy, which is the purpose of investment, will be exerted to the maximum degree and contribute to the improvement in value of our corporate group, discuss proposed bills, and exercise voting rights.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-7 Related party transactions】

We have stipulated the rules regarding the management of related party transactions, etc., and the standards were established that require or do not require approval by the Board of Directors depending on the scale and nature of transactions. Regardless of the approval of the Board of Directors, it is requested to approve related party transactions at the beginning of each fiscal year, and it monitors the appropriateness of transactions. At present, we do not have a parent company. However, when a parent company is established and a need to have a transaction with the parent company arises, if the judgment of the Board of Directors differs from the opinion of an external director, that opinion will be disclosed in the business report.

【Supplementary principle 4-11-3 Analysis and evaluation of the effectiveness of the entire Board of Directors】

The Board of Directors again analyzed and evaluated the effectiveness of the entire Board of Directors based on the self-evaluation of each director and each auditor through a questionnaire during this fiscal year. A summary of the results is disclosed on our website.

https://www.bell24hd.co.jp/jp/about/detail/governance/corporategovernance/

Based on the results of this year, we will stimulate discussions at the Board of Directors by giving detailed prior explanations of important matters more carefully, enhance discussions on management strategies and business strategies with a more conscious awareness of profitability and capital efficiency, improve reports on the status of the progress, implement effective performance monitoring based on factor analysis on competitors and business environment, appoint officers in the Nomination Committee and Compensation Committee, and work on issues recognized by paying close attention to the status and involvement of independent external officers in the process of appointment and evaluation of officers at the Nominating Committee and Compensation Committee. The Board of Auditors also evaluated the effectiveness of the Board of Auditors during this fiscal year. Three auditors (one full-time auditor and two external auditors) reviewed the effectiveness of this term to discuss, evaluate, and analyze the activities of the auditors. The results are disclosed on our website.

https://www.bell24hd.co.jp/jp/about/detail/governance/corporategovernance/

During this fiscal year, with the aim of making the three-party audit liaison meeting attended by the internal audit department, accounting auditors, and full-time auditors held from the previous fiscal year more effective, the current situation and issues in the three-party audit collaboration were discussed by the three parties and possible cooperation was proactively explored. As a result, common recognition for collaboration was achieved and a certain effect was observed. In recent years, many corporate scandals have surfaced and have been reported. We are committed to further strengthening our corporate governance system in collaboration with the Board of Directors by striving to monitor and verify the risk management system more than ever and monitoring and verifying the effectiveness of IT governance and the effectiveness of information disclosure.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Reports (BELLSYSTEM24 Holdings, Inc.:6183) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/