Bridge Report:(6183)BELLSYSTEM24 the term ending February 2021

President Shunsuke Noda | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service business |

President | Shunsuke Noda |

Address | 8-11 Harumi 1-chome, Chuo-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,677 | 73,521,702 shares | ¥123,295 million | 14.8% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥42.00 | 2.5% | ¥97.94 | 17.1x | ¥668.77 | 2.5x |

*The share price is the closing price on October 16. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS were taken from the previous term results.

Earnings Trend(IFRS)

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income | EPS | DPS |

February 2017 Act. | 108,916 | 8,172 | 7,196 | 4,304 | 58.86 | 36.00 |

February 2018 Act. | 115,618 | 9,319 | 8,502 | 5,604 | 76.39 | 36.00 |

February 2019 Act. | 121,113 | 8,580 | 7,944 | 5,397 | 73.37 | 36.00 |

February 2020 Act. | 126,663 | 11,105 | 10,534 | 7,006 | 95.29 | 42.00 |

February 2021 Est. | 132,000 | 11,500 | 11,050 | 7,200 | 97.94 | 42.00 |

* The forecast was made by the company. Unit: million yen, yen.

This Bridge Report overviews the business performance for the second quarter of the Fiscal Year ending February 2021 and describes the earnings forecast for the term ending February 2021, for BELLSYSTEM24 Holdings, Inc.

Table of Contents

Key Points

1.Company Overview

2.The Second Quarter of Fiscal Year ending February 2021 Earnings Results

3.Mid-Term Management Plan 2022 (FY2/21~FY2/23)

4.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending February 2021, sales and operating income grew 6.1% and 12.6%, respectively, year on year. New transactions in continuing operations were delayed amid the coronavirus pandemic, but the company received orders for large-scale spot operations related to the novel coronavirus, and sales revenue grew. As for profit, profit margin improved thanks to the sales growth and the curtailment of costs due to the decrease in retirement rate, etc.

- As for full-year forecasts, sales and operating income are estimated to increase 4.2% and 3.6%, respectively, year on year. The progress rate toward the full-year forecasts is 50.7% for sales, and 57.6% for operating income. Especially, profit has progressed well, but large-scale spot operations, which contributed to the performance in the first half, are to be finished in the third quarter, and the recruitment environment, which was relatively good in the first half, is uncertain in the second half. Accordingly, the full-year earnings forecasts are unchanged. The annual dividend is to be 42 yen/share (composed of an interim dividend of 21 yen/share and a term-end dividend of 21 yen/share), and the estimated payout ratio is 42.9%.

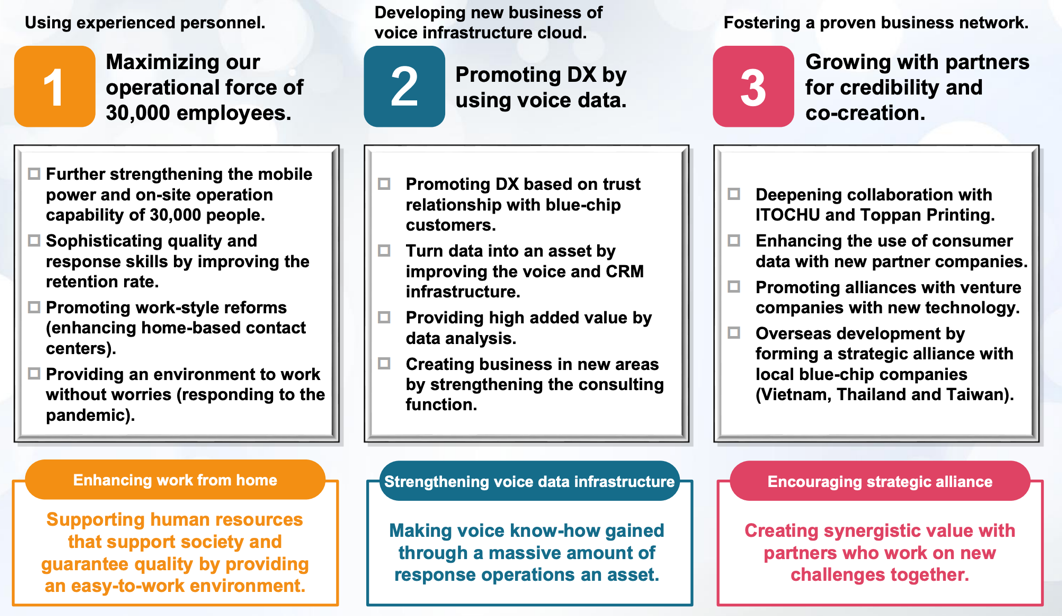

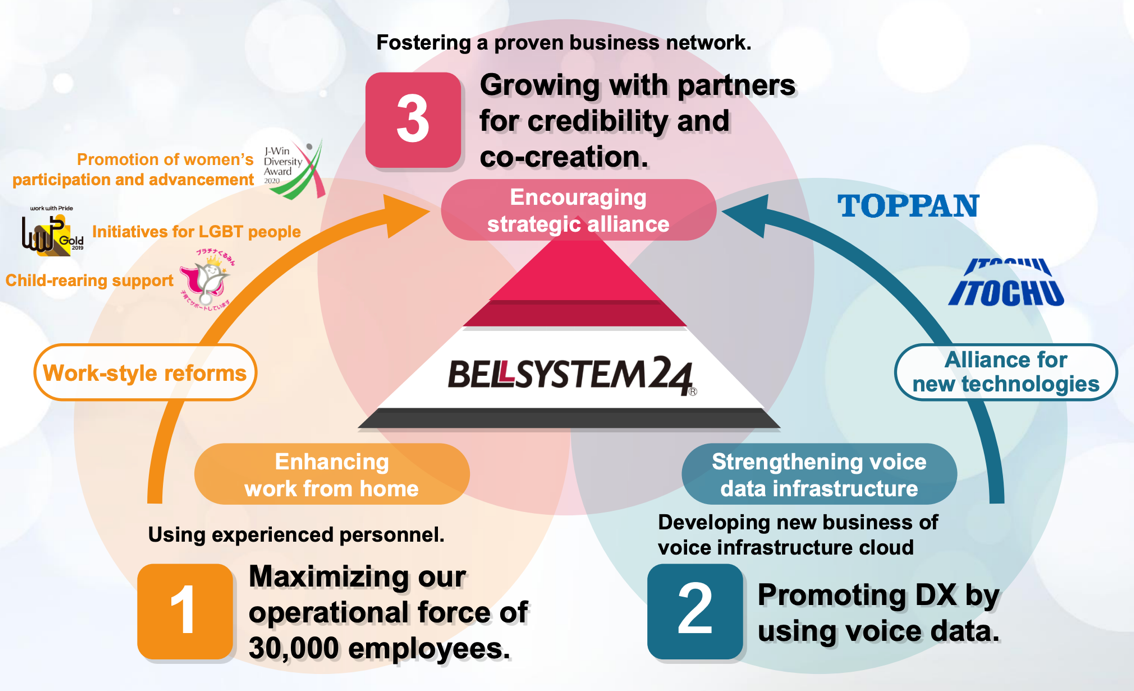

- The intensive measures in the mid-term management plan 2022, which started this term, are (1) maximization of competence of 30,000 employees (strengthening human resources), (2) promotion of digital transformation (DX) by utilizing voice data, and (3) growth and cooperation with partners based on trust and co-creation. The strengths of the company are on-site operation by 30,000 operators and enormous on-site data. In the new mid-term plan, the company will promote DX while utilizing its strengths in cooperation with client companies. By combining voice data and customer data owned by client companies, the company says that various things can be achieved. As client companies will design plans and BELLSYSTEM24 Holdings will put them into practice, the findings and knowledge obtained through operation will be shared with client companies, which will lead to the creation of new businesses. We would like to pay attention to the strengthening of human resources, the cooperation with partners, and the outcomes of their efforts.

1.Company Overview

The company, which is the holding company, and its 6 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services. The company’s subsidiaries are the following: BELLSYSTEM24, Inc., which engages in operation of contact centers and auxiliary tasks, CTC First Contact Corporation (capital contribution rati 51%) specializing in IT service desks and Business Process Outsourcing (BPO), POCKE INC., which sells contents, BELL SOLEIL INC., a special subsidiary aimed at raising employment of people with disabilities, and BELLSYSTEM24 – HOA SAO (capital contribution rati 49%), which engages in the contact center business in Vietnam, True Touch Co., Ltd., in Thailand, (capital contribution ratio:49.9%) etc.

ITOCHU Corporation holds 40.79% of the company’s voting rights and deems the company as a company accounted for using the equity method (the company has accepted 9 temporarily loaned workers). In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

【Corporate Philosophy】

Our mission

To support social affluence with innovation and communication

Code of conduct

・We will develop a comfortable workplace (community) where each employee can keep working happily with peace of mind while constantly taking on new challenges.

・We will fulfill corporate social responsibility, and aim to achieve sustainable healthy growth.

・We will return the value we would create to society, to contribute to the development of a beautiful future.

1-1 Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales. Other businesses include the sale of contents of POCKE INC.

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up slightly over 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for slightly over 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

Others

The revenue from Pocke, Inc. and Belle Soleil, Inc. has been posted. Pocke, Inc. sells content to general consumers via mobile devices, PCs, etc. (monthly charges) and offers weather forecasts to enterprises. Belle Soleil, Inc. is an exceptional subsidiary for promoting the employment of disabled people and mainly undertakes general affairs and clerical tasks of the corporate group.

Sales revenue by segment

| FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

CRM business | 1,015.2 | 1,088.6 | 1,174.6 | 1,251.4 |

Others | 73.9 | 67.5 | 36.4 | 15.2 |

Consolidated Sales Revenue | 1,089.1 | 1,156.1 | 1,211.1 | 1,266.6 |

* Unit: 100 million yen

Sales by business industry

| FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

Broadcasting/Publishing/Information services | 246.1 | 257.2 | 280.0 | 289.3 |

Transport/Communications | 82.4 | 112.5 | 278.0 | 279.2 |

Distribution (retail/wholesale) | 189.4 | 200.3 | 206.1 | 211.8 |

Finance | 173.8 | 176.6 | 188.4 | 201.7 |

Manufacturing | 66.3 | 67.5 | 65.4 | 102.7 |

Electricity, gas, water, etc. | 17.7 | 20.6 | 21.4 | 22.9 |

Other | 28.5 | 27.3 | 29.2 | 33.3 |

Total | 804.2 | 862.0 | 1,068.5 | 1,140.9 |

* Unit: 100 million yen

* For the top 300 companies with respect to the sales revenue of the CRM business, excluding the former BB Call

2.The Second Quarter of Fiscal Year ending February 2021 Earnings Results

2-1 Consolidated Earnings

| FY 2/20 2Q | Ratio to sales | FY 2/21 2Q | Ratio to sales | YoY | Full year Forecast | Progress Rate |

Sales revenue | 63,036 | 100.0% | 66,871 | 100.0% | +6.1% | 132,000 | 50.7% |

Gross profit | 12,661 | 20.1% | 13,809 | 20.7% | +9.1% | - | - |

SG&A expenses | 6,736 | 10.7% | 7,267 | 10.9% | +7.9% | - | - |

Operating income | 5,880 | 9.3% | 6,623 | 9.9% | +12.6% | 11,500 | 57.6% |

Income before Income Taxes | 5,614 | 8.9% | 6,416 | 9.6% | +14.3% | 11,050 | 58.1% |

Net income | 3,707 | 5.9% | 4,250 | 6.4% | +14.7% | 7,200 | 59.0% |

*Unit: million yen

Sales revenue / operating income by segment

| FY 2/20 2Q | Ratio to sales | FY 2/21 2Q | Ratio to sales | YoY |

Sales revenue | 63,036 | 100.0% | 66,871 | 100.0% | +6.1% |

CRM business | 62,160 | 98.6% | 66,269 | 99.1% | +6.6% |

└Continuing Operations | 57,057 | 91.8% | 59,010 | 89.0% | +3.4% |

└Spot Operations | 5,103 | 8.2% | 7,259 | 11.0% | +42.2% |

Other Businesses | 876 | 1.4% | 602 | 0.9% | -31.3% |

Operating Income | 5,880 | 9.3% | 6,623 | 9.9% | +12.6% |

CRM business | 5,831 | 9.4% | 6,493 | 9.8% | +11.4% |

Other Businesses | 49 | 5.6% | 130 | 21.6% | +165.3% |

*Unit: million yen. The ratio to sales of operating income means operating income margin.

The ratios to sales of continuing and spot operations mean the ratio to the sales revenue of the CRM business.

Sales and operating income grew 6.1% and 12.6%, respectively, year on year

Sales revenue increased 6.1% (3.83 billion yen) year on year to 66.87 billion yen. The sales of spot operations rose 42.2% (2.15 billion yen) year on year, thanks to the receipt of large-scale orders related to the project of subsidies for coping with the novel coronavirus, while the sales of continuing operations grew 3.4% (1.95 billion yen) year on year thanks to the good performance of businesses related to EC, mail order, food delivery, etc., despite the delay in new operations amid the coronavirus pandemic.

Operating income rose 12.6% (740 million yen) year on year to 6.62 billion yen. The SG&A expenses of the CRM business augmented 490 million yen, due to the expenses for coping with the novel coronavirus (partitions for blocking droplets, face masks, disinfectants, non-contact thermometers, etc. costing about 100 million yen), the rise in personnel costs, etc., but it was offset by the sales growth and profitability improvement (1.05 billion yen) in the CRM business thanks to large-scale spot operations, the decrease in strategic and upfront investments in the CRM business (100 million yen), and the rise in profits from other businesses (80 million yen).

Continuing operations were affected by the concentration on the swift start of large-scale spot operations, the stagnation of face-to-face marketing amid the coronavirus crisis, etc., but the company is enhancing marketing targeted at client companies for receiving orders in the second half and the next term. As for spot operations, large-scale projects are to be finished in the third quarter, which is expected to increase annual sales by around 1 billion yen.

2-2 Financial condition and Cash Flow (CF)

Financial condition

| Feb. 20 | Aug. 20 |

| Feb. 20 | Aug. 20 |

Cash and deposits | 7,767 | 7,544 | Trade debt | 6,144 | 5,395 |

Trade Receivables | 17,967 | 18,596 | Accrued employee benefits | 9,941 | 9,967 |

Total current assets | 26,957 | 27,322 | Net Interest-bearing Liabilities | 60,411 | 59,818 |

Tangible assets | 32,674 | 36,046 | Total liabilities | 118,971 | 120,149 |

Goodwill | 96,250 | 96,250 | Total shareholders' equity | 49,168 | 51,766 |

Total noncurrent assets | 141,551 | 144,930 | Total capital | 49,537 | 52,103 |

Total assets | 168,508 | 172,252 | Capitalization Ratio | 29.2% | 30.1% |

|

|

| NET DER | 1.23x | 1.16x |

*Unit: million yen

Due to increases in trade receivables and tangible assets, total assets increased 3.74 billion yen from the end of the previous term to 172.25 billion yen. Total liabilities augmented 1.17 billion yen to 120.14 billion yen, from the end of the previous term. Capitalization ratio and net debt-equity ratio improved, as the equity ratio attributable to owners of the parent increased while net interest-bearing liabilities decreased.

Cash Flow

| FY 2/20 2Q | FY 2/21 2Q | YoY | |

Operating Cash Flow | 8,053 | 6,664 | -1,389 | -17.2% |

Investing Cash Flow | -1,015 | -1,742 | -727 | - |

Financing Cash Flow | -5,023 | -5,139 | -116 | - |

Cash and Equivalents at Term End | 8,077 | 7,544 | -533 | -6.6% |

*Unit: million yen

The company secured an operating CF of 6.66 billion yen, as income before income taxes was 6.41 billion yen, depreciation and amortization stood at 3.78 billion yen, the payment of corporate income tax was 2.72 billion yen, and working capital increased.

Investing CF is attributable to the purchase of property, plant and equipment, acquisition of investments in associates and joint ventures, lease and guarantee deposits, etc. Financing CF is attributable to the repayment of lease liabilities, the payment of dividends, the repayment of long-term debts, etc.

3. Mid-Term Management Plan 2022 (FY2/21~FY2/23)

3-1 Looking Back on the Previous Mid-Term Management Plan (FY 2/18 to FY 2/20)

Quality

As for revenue, the company reformed its mindset in focusing on profit rather than sales, which was reflected in the improvement of operating income margin. As for business, the company succeeded in expanding the business infrastructure due to the capital and business alliances with Toppan Printing Co., Ltd., and also laid the foundations for entering the global market, making inroads into Vietnam, Thailand, and Taiwan. All of them are expected to significantly contribute to the revenue during the period of the new mid-term management plan. In the field of human resources, the company reviewed the existing recruitment and working environment for securing staff. In addition to newly building an in-house nursery and thus strengthening childcare support, the company revised its HR system in order to create an environment where diverse personnel can utilize their skills. These measures have led to the improvement of employee retirement rate. Furthermore, in addition to promoting telework and diversity, the company strived to offer a workplace rich in variety.

Quantity

Due to the selling of a subsidiary, which was not originally planned, sales revenue (estimate: 131 billion yen, result: 126.6 billion yen) and operating income (estimate: 11.5 billion yen, result: 11.1 billion yen) were both slightly below the planned amount. However, in the unfavorable labor supply-and-demand condition, the company achieved an average growth rate of 10.6% in operating income and reached an operating income margin of 8.8% as planned, through an appropriate price revisioning, securing stable recruitment, preventing retirement, and expanding the synergy with ITOCHU Corporation and Toppan Printing. Furthermore, improvements were also seen in ROE (from 11.0% to 14.8%) and Net DER (from 1.80 to 1.23).

3-2 Mid-term Management Plan 2022

Environmental Change Estimated in the New Mid-term Management Plan

The current coronavirus crisis is bringing significant changes to daily life and the market is also changing greatly in reaction to this. Specifically, the decrease in face-to-face contact and the rise of online systems will lead to the accumulation of daily actions in the form of data, and from now on the success or failure of enterprises will be determined by how they can utilize this data. In this situation, the company will be expected to establish a new contact center with importance placed on BCP, utilize the data from consumers and become a true best partner who makes it possible to create a new business model along with the client who is not a mere outsourcer.

Concept of the New Mid-term Management Plan

In accordance with its corporate philosophy “To support social affluence with innovation and communication”, the company supports social infrastructure, such as medical and elderly care, electricity, gas and water supply, politics and government, finance and insurance, telecommunications and mobile services, and food products and daily supplies. As going out was difficult in the coronavirus crisis, online communication with enterprises and individuals arose. The contact center, supporting an important part of the back office of those communications, was able to boost its performance and the company recognized once again that the contact center operations are indispensable. The company aims to assume the role of receiving the voices of worries and anxieties from consumers who use social infrastructure.

Three Priority Measures of the New Mid-term Management Plan

(From the company’s materials)

Three priority measures stated as the pillars of the mid-term management plan are, (1) maximization of competence of 30,000 employees (strengthening human resources), (2) promotion of digital transformation (DX) by utilizing voice data, and (3) growth and cooperation with partners based on trust and co-creation.

With regard to the maximization of competence of 30,000 employees, the company will boost the service quality by creating a comfortable working environment for its 30,000 operators, raising the retention rate, and increasing the number of veteran employees. Furthermore, the company will make efforts to improve work efficiency by taking advantage of new technology such as AI. Until now, the company has been recruiting more communicators in response to the increase in sales, but from now on they will establish a system utilizing new technologies to efficiently carry out the work.

With regard to DX promotion by utilizing voice data, the company will develop solutions utilizing the direct opinions of consumers (voice data) which are its greatest asset. Specifically, a consulting team with extensive hands-on knowledge will discern issues among the direct opinions of consumers, prepare the optimal solution, and implement it on-site.

With regard to partner cooperation and growth, the company will further elevate the cooperation with strong partner companies such as ITOCHU Cooperation and Toppan Printing. Furthermore, thanks to the partnership with Sony Computer Science Laboratories, Inc., the company has also started to provide AI services specialized for contact center businesses.

The company will produce results through certain and quick implementation of these three priority measures.

Three Priority Measures and Mission

(From the company’s materials)

These three measures are not stand-alone, but closely intertwined. It seems that the promotion of the advancement of women, childcare support, LGBT initiatives, etc. in which the company has been engaged for the past several years has begun to garner critical acclaim from outside. The company will continue to create a comfortable working environment, including in-home work, and promoting workstyle innovation in order to improve staff retention rate, develop human resources with high-level skills, and provide high quality service to client companies.

Furthermore, based on the cooperation with partner companies such as Sony Computer Science Laboratories and start-up companies, the company plans to incorporate new technologies and promote DX mainly focused on the utilization of voice data, which is the company’s forte. The company plans to present the image of a new contact center, which will fuse high-grade human resources and new technology, within the period of this mid-term management plan.

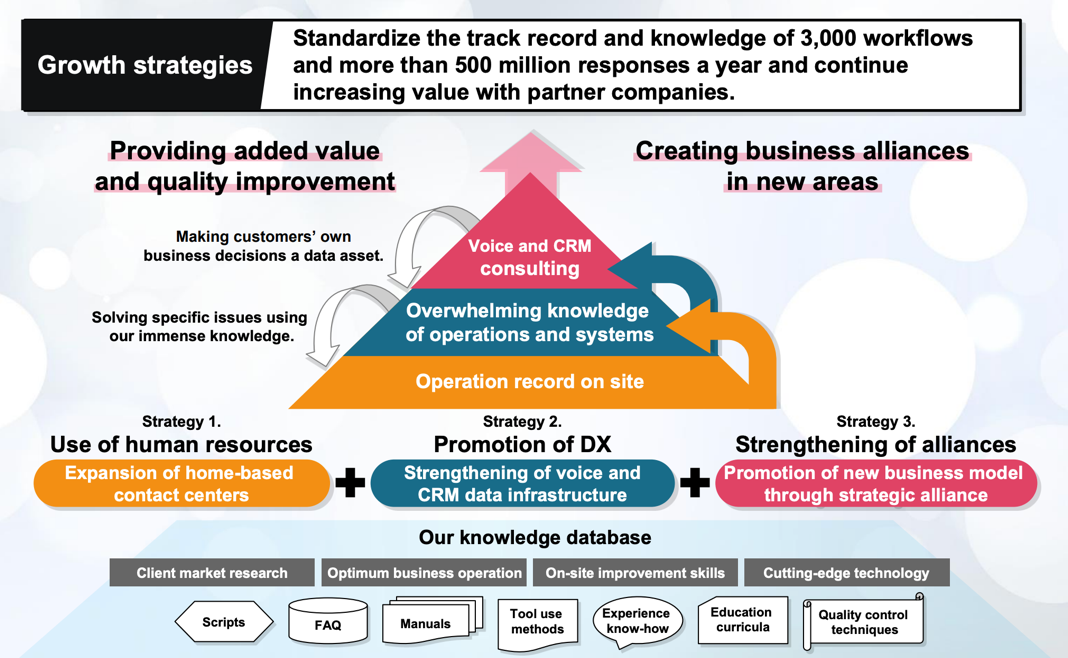

Growth Story for Quality Improvement and Business Creation

(From the company’s materials)

The company deals with 3,000 tasks and 500 million inquiries every year. From now on, it will utilize these as its original knowledge database. Furthermore, the company will aim for differentiation through spot operations which cannot be imitated by consulting companies, the development and operation of the optimal contact center system, and new proposals which take marketing and other activities into consideration. During the period of this mid-term management plan, the company plans to broaden the consulting range and start creating business in new areas with client companies.

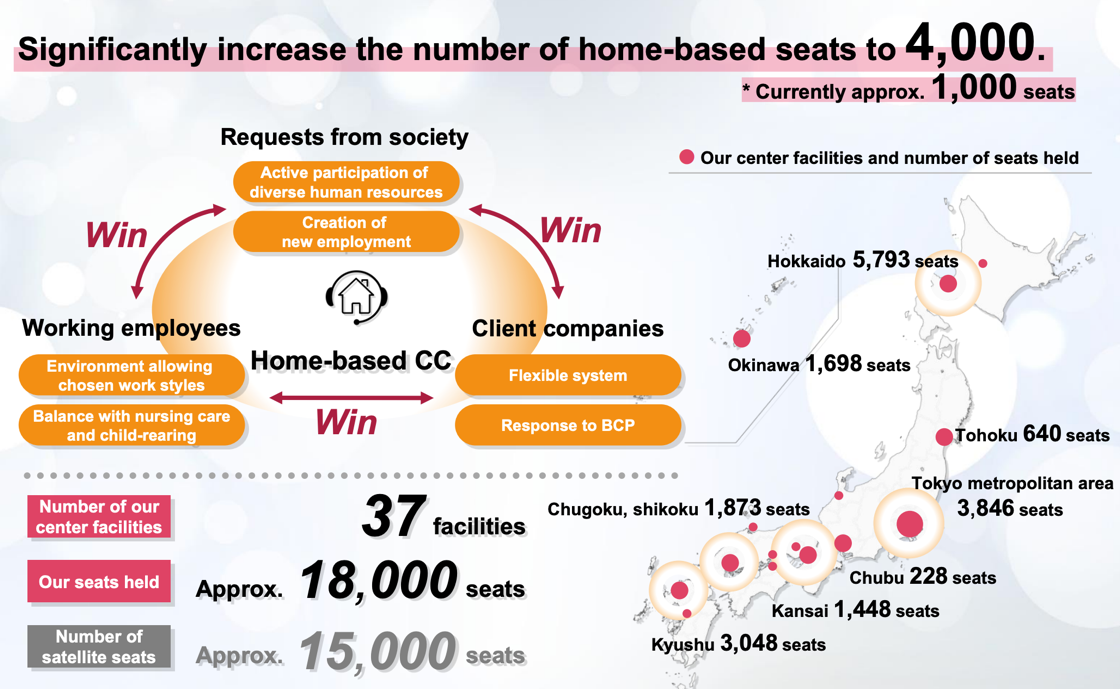

Pivotal Initiatives of the Three Measures

Human resources utilization: Expanding in-home contact centers

(From the company’s materials)

The company will expand the number of in-home contact center seats in operation from 1,000 to 4,000 (accounting for over 10% of the whole). Amid the coronavirus crisis, the mindset of the client companies has changed, and in-home work has been on the rise from the viewpoint of BCP, but the company had been pushing for in-home contact centers since before the outbreak of the novel coronavirus to realize diverse workstyles. The company’s policy is to continuously promote in-home work and realize diverse workstyles for diverse human resources. Based on this, the company will establish advantages for recruitment, which will lead to securing outstanding human resources and improving retention rate.

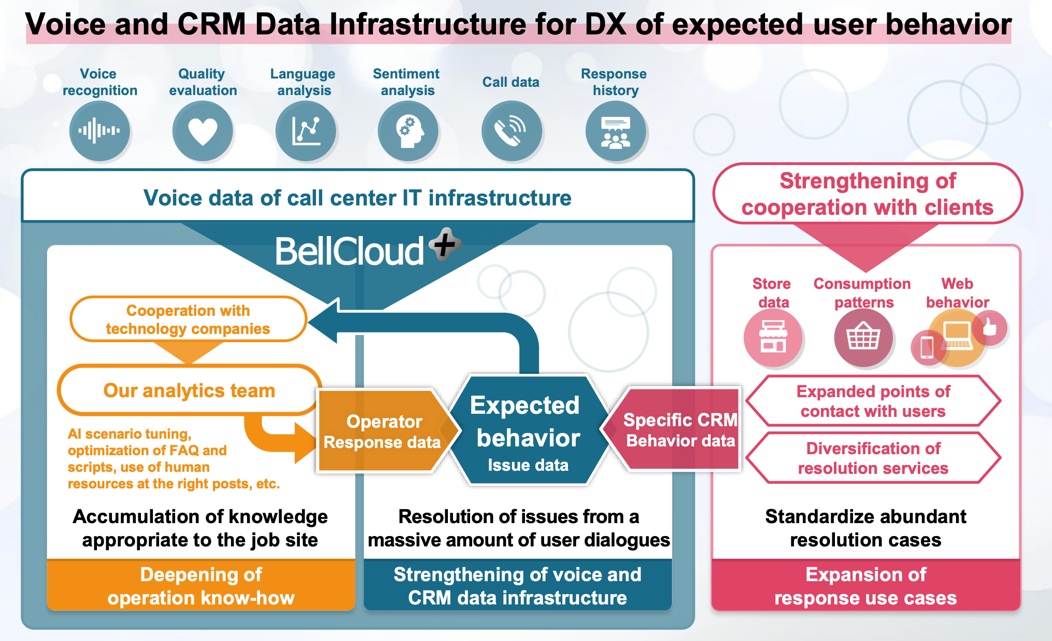

DX promotion: Fortification of voice/CRM data infrastructure

(From the company’s materials)

The company is already in the progress of developing human resources to utilize data and within the period of the new mid-term management plan, it will release comprehensive services for acquisition, utilization, analysis, and consultation of the consumers’ voice data. This is data utilization in its true meaning, which could not be accomplished by conventional contact centers. Direct opinions of consumers or voice data received by the communicators are analyzed, and through consolidation with CRM data owned by the client companies, they are converted into data of expected actions required by consumers. This can be utilized to discern and grasp actual issues and solve those issues. By executing this chain process continuously at high speed and spiraling it up, the company aims for newer and advanced cooperation with client companies.

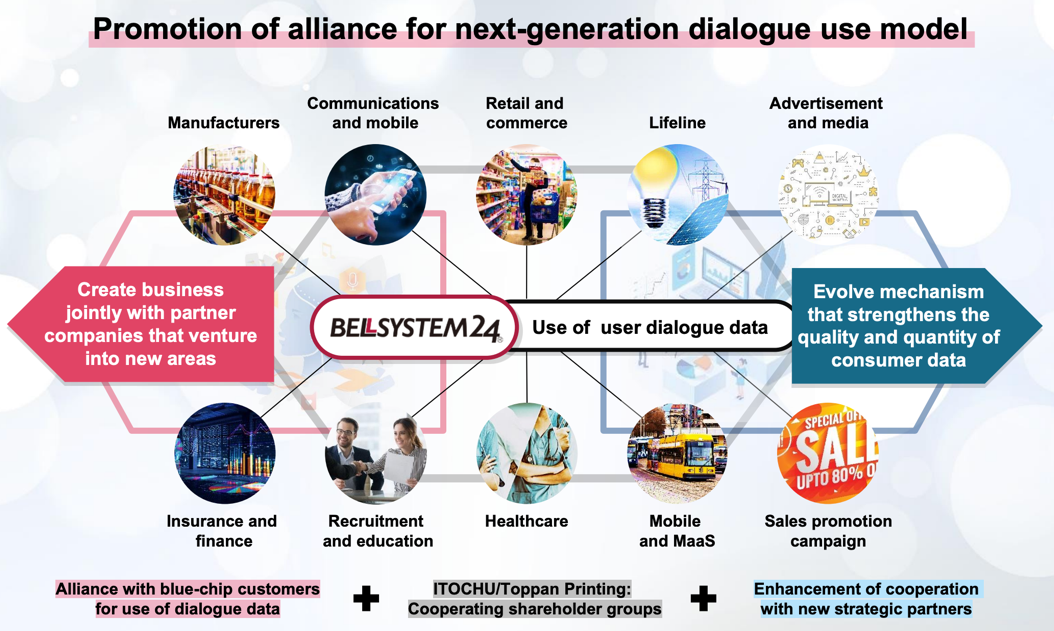

Alliance solidification: Promotion of a new business model in strategic cooperation

(From the company’s materials)

The company is currently making transactions with client companies from a wide range of industries and many of these are the leading companies in their respective fields. These companies consider the company to be a vital business partner who functions as the last one mile for direct contact with consumers. Client companies expect the company to establish a higher-level contact center utilizing new technology and in order to fulfil these expectations, the company will take advantage of the resources ITOCHU Cooperation and Toppan Printing have to the fullest, such as client infrastructure, business infrastructure, business power, information related to new technologies, international network, etc. Furthermore, the company will provide its data to ITOCHU Cooperation and Toppan Printing. The information acquired through utilizing these business networks will be feedbacked to client companies.

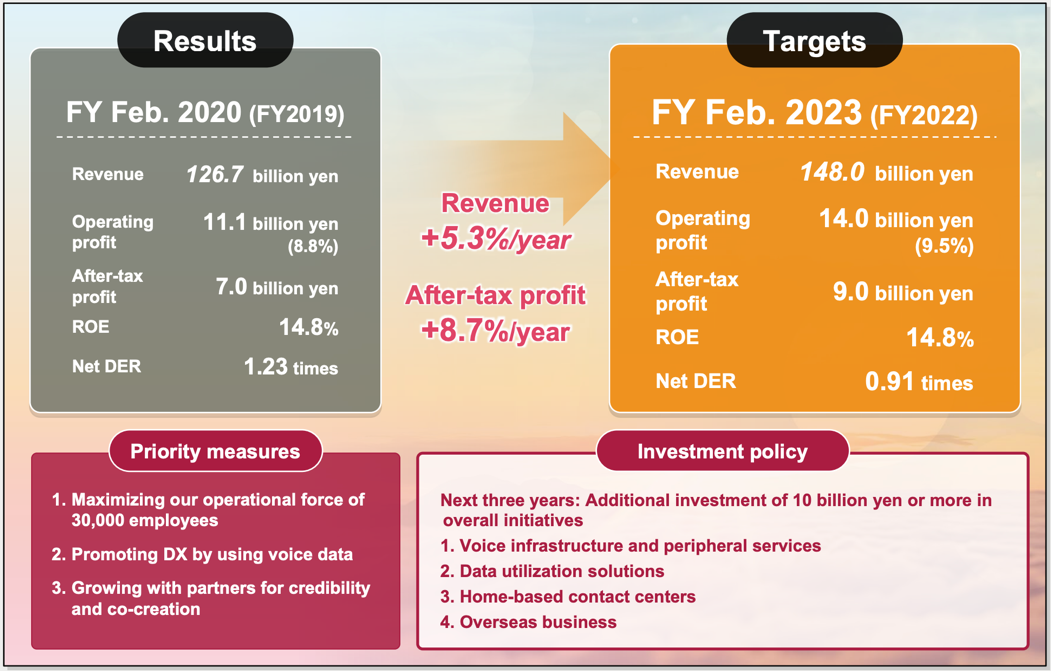

Quantitative Goals of the New Mid-term Management Plan

(From the company’s materials)

The company states its target for the term ending February 2023 to be 148 billion yen for sales, 14 billion yen for operating income (operating income margin of 9.5%), 9 billion yen for income after tax, an annual rate of 5.3% for sales growth, and an annual rate of 8.7% for income growth (income after tax). As for investments, the company is planning over 10 billion yen in total in following three years, and in cases where synergy can be expected in strategic fields, it will also proactively invest in venture firms and M&A.

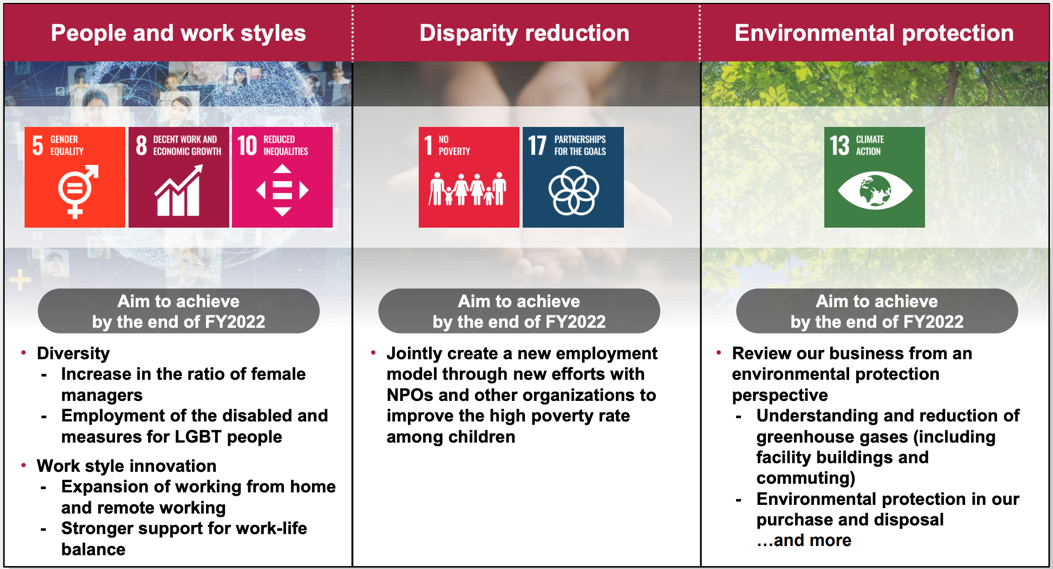

Initiatives Regarding Societal Challenges

(From the company’s materials)

Taking into the account their corporate philosophy and important issues as well as SDGs, the company will engage in activities to solve societal challenges. With regard to SDGs, the company will contribute to achieve goals under three themes, which is, (1) people and workstyle (initiatives related to Goals 5, 8 and 10 of the SDGs17), (2) inequality reduction (initiatives related to Goals 1 and 17 thereof), and (3) environment protection (initiatives related to Goal 13 thereof).

4.Conclusions

The primary strengths of the company are the centers with 30,000 operators and enormous data obtained there. In the new mid-term management plan, the company will promote DX by utilizing its strengths, in cooperation with client companies. By combining voice data and the customer data owned by client companies, it is expected to conduct various things. For example, preventing cancellation by combining voice data and the data of attributes of customers who cancelled EC services, and enabling efficient outbound connection by combining voice data and data of insurance subscriptions. As client companies will design plans and BELLSYSTEM24 Holdings will put them into practice, the findings and knowledge obtained through operation will be shared with client companies, which will lead to the creation of new businesses.

The President Noda said, “It is challenging to achieve the numerical goals in the new mid-term management plan, but it is not impossible, so we will rack our brains to achieve them.” We would like to pay attention to the fruit of their efforts.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 9 directors, including 5 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on May 22, 2020

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. Furthermore, on respective stock which does not have dividends or with sluggish performance, we examine whether we should keep holding or reduce their shares for capital efficiency improvement every year, by analyzing expected business performance and recoverability from the viewpoints of economic reasonability.

As for strategically held shares of listed companies, the Board of Directors discussed whether or not to keep holding the shares of a company (balance sheet amount 12 million yen) and decided to continuously hold it.

We have not specified concrete criteria for exercising the voting rights of strategically held shares, but our basic policy is to comprehensively judge whether the synergy, which is the purpose of investment, will be exerted to the maximum degree and contribute to the improvement in value of our corporate group, discuss proposed bills, and exercise voting rights.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 5-1 Policy for constructive dialogue with shareholders]

In order to achieve sustainable growth and improve mid/long-term corporate value, our company will conduct constructive dialogues with shareholders within an appropriate range and an appropriate method in accordance with the following policies.

(1) Directors in charge of IR will be designated, and said Directors will manage all dialogues with shareholders.

(2) The IR division will be established under the supervision of Directors in charge of IR, and promote the appropriate exchange of information and organic cooperation among the management planning division, the accounting/financial division, and other related divisions.

(3) In order to enrich the means of dialogues with shareholders, a session for briefing financial results will be held at the time of announcement of interim and full-year results.

(4) Shareholders’ opinions, etc. grasped through dialogues will be reported to the Directors in charge of IR and relevant divisions, and shared with the Board of Directors when necessary.

(5) We will conduct dialogues with shareholders pursuant to the regulations for preventing insider trading, which stipulate the prohibition of information transmission and promotion of transactions, and necessary measures for limiting the forwarding of insider information

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Reports (BELLSYSTEM24 Holdings, Inc.:6183) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/