Bridge Report:(6183)BELLSYSTEM24 Second quarter of Fiscal Year ending February 2022

President Shunsuke Noda | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service business |

President | Shunsuke Noda |

Address | 1-1 Toranomon 4-chome, Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,546 | 73,679,947 shares | ¥113,909 million | 14.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥48.00 | 3.1% | ¥105.90 | 14.6x | ¥722.69 | 2.1x |

*The share price is the closing price on October 25. DPS and EPS are from the financial results for the second quarter of fiscal year ending February 2022.

*ROE and BPS are from the financial results for the previous term.

Earnings Trend(IFRS)

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income | EPS | DPS |

February 2018 Act. | 115,618 | 9,319 | 8,502 | 5,604 | 76.39 | 36.00 |

February 2019 Act. | 121,113 | 8,580 | 7,944 | 5,397 | 73.37 | 36.00 |

February 2020 Act. | 126,663 | 11,105 | 10,534 | 7,006 | 95.29 | 42.00 |

February 2021 Act. | 135,735 | 11,799 | 11,305 | 7,252 | 98.64 | 42.00 |

February 2022 Est. | 139,000 | 12,200 | 11,869 | 7,800 | 105.90 | 48.00 |

* The forecast was made by the company. Unit: million yen, yen. Net income is profit attributable to owners of parent. Hereinafter the same applies.

This Bridge Report overviews the business performance for the second quarter of Fiscal Year ending February 2022 and others for BELLSYSTEM24 Holdings, Inc.

Table of Contents

Key Points

1.Company Overview

2.Second Quarter of Fiscal Year ending February 2022 Earnings Results

3.Fiscal Year ending February 2022 Earnings Forecasts

4.Progress of Mid-Term Management Plan 2022 (FY2/21~FY2/23)

5.Conclusions

<Reference1: Mid-Term Management Plan 2022 (FY2/21~FY2/23)>

<Reference2: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending February 2022, sales revenue increased 9.3% year on year to 73,110 million yen. Spot operations related to the benefit program for coping with the novel coronavirus grew significantly. Ongoing work is at the same level as that of last year, but new projects for the second half of the year are progressing steadily. Operating income increased 8.7% year on year to 7.2 billion yen. The increase in sales offset the upfront investment in the CRM business (investment in DX, head office relocation expenses, etc.) and the increase in SG&A expenses. Net income increased 15.7% year on year to 4,918 million yen. A double-digit profit increase was recorded due to the addition of equity in earnings of affiliates.

- The sales revenue for the term ending February 2022 is estimated to be 139 billion yen, up 2.4% year on year. Spot operations will decrease, but continuing operations will grow, due to the healthy demand for outsourcing for BCPs, non-face-to-face transactions, etc. In the first half of the previous term, resources were allocated to spot operations related to the novel coronavirus, but in the second half, a new section for increasing clients was established, and the number of orders received is increasing. Operating income is projected to rise 3.4% year on year to 12.2 billion yen. Continuing operations will grow stably through the enhancement of new initiatives, etc. Strategic and upfront investments will augment due to the promotion of DX such as adopting the technologies for data analysis, security fortification, and voice recognition, but operating income is expected to increase, due to the rebound from the impairment loss in the previous term. The dividend is to be 48.00 yen/share, up 6.00 yen/share from the previous term. The estimated payout ratio is 45.3%.

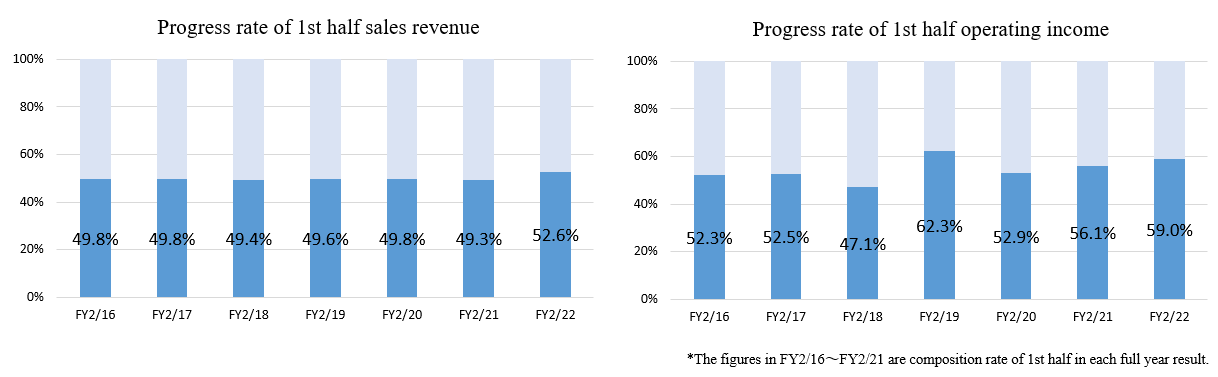

- The progress rate in the first half was 52.6% for sales revenue and 59.0% for operating income, which are high compared to those in the past several years. The expansion of coronavirus-related spot operations has made a significant contribution. Although the state of emergency has been lifted and the number of new infections announced on a daily basis has decreased significantly, the third round of vaccination is being planned, and coronavirus-related spot operations are expected to continue to grow steadily. We will see how much sales and profits will increase in the second half and beyond. Regarding the progress of the Medium-term Management Plan 2022, we will be watching how the progress of the three key measures will lead to results.

1. Company Overview

The company, which is the holding company, and its 6 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services. The company’s subsidiaries are the following: BELLSYSTEM24, Inc., which engages in operation of contact centers and auxiliary tasks, CTC First Contact Corporation (capital contribution rati 51%) specializing in IT service desks and Business Process Outsourcing (BPO), POCKE INC., which sells contents, BELL SOLEIL INC., a special subsidiary aimed at raising employment of people with disabilities, and BELLSYSTEM24 – HOA SAO (capital contribution rati 49%), which engages in the contact center business in Vietnam, True Touch Co., Ltd., in Thailand, (capital contribution ratio:49.9%) etc.

ITOCHU Corporation holds 40.79% of the company’s voting rights and deems the company as a company accounted for using the equity method (the company has accepted 9 temporarily loaned workers). In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

【Corporate Philosophy】

Our mission

To support social affluence with innovation and communication

Code of conduct

・We will develop a comfortable workplace (community) where each employee can keep working happily with peace of mind while constantly taking on new challenges.

・We will fulfill corporate social responsibility, and aim to achieve sustainable healthy growth.

・We will return the value we would create to society, to contribute to the development of a beautiful future.

1-1 Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales. Other businesses include the sale of contents of POCKE INC.

Sales by segment

| FY 2/21 |

CRM business | 134,559 |

Other | 1,176 |

Consolidated sales revenue | 135,735 |

* Unit: million yen

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up slightly over 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for slightly over 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

Sales by business industry

| FY 2/21 | Composition ratio |

Broadcasting/Publishing/Information services | 342.4 | 27.6% |

Transport/Communications | 307.0 | 24.7% |

Commerce (retail/wholesale) | 199.0 | 16.0% |

Finance | 213.5 | 17.2% |

Manufacturing | 114.7 | 9.2% |

Electricity, gas, water, etc. | 31.2 | 2.5% |

Other | 33.0 | 2.7% |

Total | 1,240.8 | 100.0% |

* Unit: 100 million yen.

* For the top 300 companies with respect to the sales revenue of the CRM business.

Others

The revenue from Pocke, Inc. and Belle Soleil, Inc. has been posted. Pocke, Inc. sells content to general consumers via mobile devices, PCs, etc. (monthly charges) and offers weather forecasts to enterprises. Belle Soleil, Inc. is an exceptional subsidiary for promoting the employment of disabled people and mainly undertakes general affairs and clerical tasks of the corporate group.

2. Second Quarter of Fiscal Year ending February 2022 Earnings Results

2-1 Consolidated Earnings

| FY 2/21 2Q | Ratio to sales | FY 2/22 2Q | Ratio to sales | YoY |

Sales revenue | 66,871 | 100.0% | 73,110 | 100.0% | +9.3% |

Gross profit | 13,809 | 20.7% | 15,367 | 21.0% | +11.3% |

SG&A expenses | 7,267 | 10.9% | 8,311 | 11.4% | +14.4% |

Operating income | 6,623 | 9.9% | 7,200 | 9.8% | +8.7% |

Income before Income Taxes | 6,416 | 9.6% | 7,346 | 10.0% | +14.5% |

Quarterly net income | 4,250 | 6.4% | 4,918 | 6.7% | +15.7% |

*Unit: million yen

Sales and profit grew

Sales revenue increased 9.3% year on year to 73,110 million yen. Spot operations related to the benefit program for coping with the novel coronavirus grew significantly. Ongoing work is at the same level as that of last year, but new projects for the second half of the year are progressing steadily. Operating income increased 8.7% year on year to 7.2 billion yen. The increase in sales offset the upfront investment in the CRM business (investment in DX, head office relocation expenses, etc.) and the increase in SG&A expenses. Net income increased 15.7% year on year to 4,918 million yen. A double-digit profit increase was recorded due to the addition of equity in earnings of affiliates.

2-2 Sales revenue /Operating income by segment

| FY 2/21 2Q | Ratio to sales | FY 2/22 2Q | Ratio to sales | YoY |

Sales revenue | 66,871 | 100.0% | 73,110 | 100.0% | +9.3% |

CRM business | 66,269 | 99.1% | 72,599 | 99.3% | +9.6% |

└Continuing Operations | 59,010 | 88.2% | 59,508 | 81.4% | +0.8% |

└Spot Operations | 7,259 | 10.9% | 13,091 | 17.9% | +80.3% |

Other Businesses | 602 | 0.9% | 511 | 0.7% | -15.0% |

Operating income | 6,623 | 9.9% | 7,200 | 9.8% | +8.7% |

CRM business | 6,493 | 9.8% | 6,987 | 9.6% | +7.6% |

Other Businesses | 130 | 21.6% | 213 | 41.7% | +63.8% |

*Unit: million yen. The ratio to sales of operating income means operating income margin.

The ratios to sales of continuing and spot operations mean the ratio to the sales revenue of the CRM business.

(1) CRM business

Despite the impact of the spread of the novel coronavirus, the spot demand for CRM as social infrastructure and sales of existing continuous transactions that began in the previous term grew, and the synergetic transactions were healthy thanks to the enhanced cooperation with ITOCHU and Toppan Printing. Profit rose, as personnel costs augmented due to the policy of equal pay for equal jobs, but sales grew and efforts for improving earnings paid off.

ITOCHU Synergy

| FY 2/18 2Q | FY 2/19 2Q | FY 2/20 2Q | FY 2/21 2Q | FY 2/22 2Q |

Sales revenue | 45.9 | 54.2 | 62.5 | 72.8 | 77.5 |

*Unit: 100 million yen. Spot operations are included.

Sales continued to be strong, up 6.5% from the previous term.

Trend by Industry

| FY 2/22 2Q | YoY |

Broadcasting/Publishing/Information services | 185.1 | +15.6% |

Transport/Communications | 169.6 | +10.7% |

Commerce (retail/wholesale) | 97.2 | -3.5% |

Finance, insurance | 103.4 | -0.1% |

Manufacturing | 78.6 | +14.2% |

Electricity, gas, water, etc. | 17.5 | +14.4% |

Other | 14.4 | +17.1% |

Total | 665.8 | +8.5% |

*Unit: 100 million yen. Top 300 companies contributing to the sales revenue of the CRM business are considered

Growth was seen mainly in the service field and the transportation and communications field.

(2) Other businesses

While revenue from content sales declined, profitability improved due to careful examination of expenses.

2-3 Financial condition and Cash Flow (CF)

Financial condition

| Feb. 21 | Aug. 21 | Increase/ decrease |

| Feb. 21 | Aug.21 | Increase/ decrease |

Current assets | 26,381 | 29,328 | +2,947 | Current liabilities | 48,952 | 38,170 | -10,782 |

Cash and deposits | 5,518 | 7,770 | +2,252 | Trade debt | 6,141 | 5,475 | -666 |

Trade Receivables | 19,644 | 20,348 | +704 | Loans payable | 20,235 | 9,736 | -10,499 |

Noncurrent assets | 146,507 | 145,994 | -513 | Noncurrent liabilities | 70,426 | 80,049 | +9,623 |

Tangible assets | 37,284 | 36,652 | -632 | Long-term loans payable | 42,907 | 53,444 | +10,537 |

Goodwill | 95,396 | 95,396 | 0 | Total liabilities | 119,378 | 118,219 | -1,159 |

Total assets | 172,888 | 175,322 | +2,434 | Total capital | 53,510 | 57,103 | +3,593 |

|

|

|

| Equity capital | 53,113 | 56,690 | +3,577 |

|

|

|

| Total loans payable | 63,142 | 63,180 | +38 |

*Unit: million yen. Equity capital is total equity attributable to owners of the parent.

Total assets increased 2,434 million yen from the end of the previous term due to an increase in cash and deposits. Total liabilities decreased 1,159 million yen from the end of the previous term. Total capital increased 3,593 million yen from the end of the previous term due to an increase in retained earnings. Capital-to-asset ratio increased 1.6 points from the end of the previous term to 32.3%.

Cash Flow

| FY 2/21 2Q | FY 2/22 2Q | Increase/decrease |

Operating Cash Flow | 6,664 | 8,369 | +1,705 |

Investing Cash Flow | -1,742 | -1,502 | +240 |

Free Cash Flow | 4,922 | 6,867 | +1,945 |

Financing Cash Flow | -5,139 | -4,620 | +519 |

Cash and Equivalents at Term End | 7,544 | 7,770 | +226 |

*Unit: million yen

The increase in operating CF and free CF expanded due to an increase in profit before tax.

The cash position inclined.

2-4 Major topics

① Revamping the service menu system for automated response solutions to strengthen support for DX of corporate contact centers

With the aim of enhancing the support for DX of contact centers, the company has revamped the service menu structure of its existing automated response solutions using voice bots and chatbots.

As a new addition to the ekubot™ series, the company has begun offering ekubot Voice PRO, a voice-bot designed for medium- to large-scale contact center operations with 50 to several hundred seats or more.

② Starting offshore operations in Vietnam, specializing in supervisor support

In collaboration with Bellsystem24 - Hoa Sao Joint Stock Company, a group company in Vietnam, the company has started offshore operations in Vietnam specializing in supervisor support for contact center operations.

The company will build a system that allows domestic resources to be allocated to core operations such as business improvement and operator training and will accelerate the improvement of operator skills and response quality to operate contact centers with high customer loyalty.

3. Fiscal Year ending February 2022 Earnings Forecasts

3-1 Consolidated Earnings forecast

| FY 2/21 | Ratio to sales | FY 2/22 (Est) | Ratio to sales | YoY | Progress rate |

Sales revenue | 135,735 | 100.0% | 139,000 | 100.0% | +2.4% | 52.6% |

Operating income | 11,799 | 8.7% | 12,200 | 8.8% | +3.4% | 59.0% |

Income before Income Taxes | 11,305 | 8.3% | 11,869 | 8.5% | +5.0% | 61.9% |

Net income | 7,252 | 5.3% | 7,800 | 5.6% | +7.6% | 63.1% |

*Unit: million yen.

Earnings forecasts are unchanged and forecast is forecasted to increase in sales and profit

Earnings forecasts are unchanged. The sales revenue for the term ending February 2022 is estimated to be 139 billion yen, up 2.4% year on year. Spot operations are forecasted to decrease towards the second half of this term, but continuing operations will grow, due to the healthy demand for outsourcing for BCPs, non-face-to-face transactions, etc. In the first half of the previous term, resources were allocated to spot operations related to the novel coronavirus, but from this term, a new section for increasing clients was established, and the number of orders received is increasing. Operating income is projected to rise 3.4% year on year to 12.2 billion yen. Continuing operations will grow stably through the enhancement of new initiatives, etc. Strategic and upfront investments will augment due to the promotion of DX such as adopting the technologies for data analysis, security fortification, and voice recognition, but operating income is expected to increase, due to the rebound from the impairment loss in the previous term. The dividend is to be 48.00 yen/share, up 6.00 yen/share from the previous term. The estimated payout ratio is 45.3%.

Sales by segment

| FY 2/21 | FY 2/22 (Est) | YoY | Progress rate |

Sales revenue | 1357.4 | 1390.0 | +32.6 | 52.6% |

CRM business | 1345.6 | 1377.0 | +31.4 | 52.7% |

continuing operations | 1171.1 | 1247.0 | +75.9 | 47.7% |

spot operations | 174.5 | 130.0 | -44.5 | 100.7% |

Other | 11.8 | 13.0 | +1.2 | 39.3% |

*Unit: 100 million yen. Developed by Investment Bridge Co., Ltd. based on the Company data.

4. Progress of Mid-Term Management Plan 2022 (FY 2/21 to FY 2/23)

(From the company’s materials)

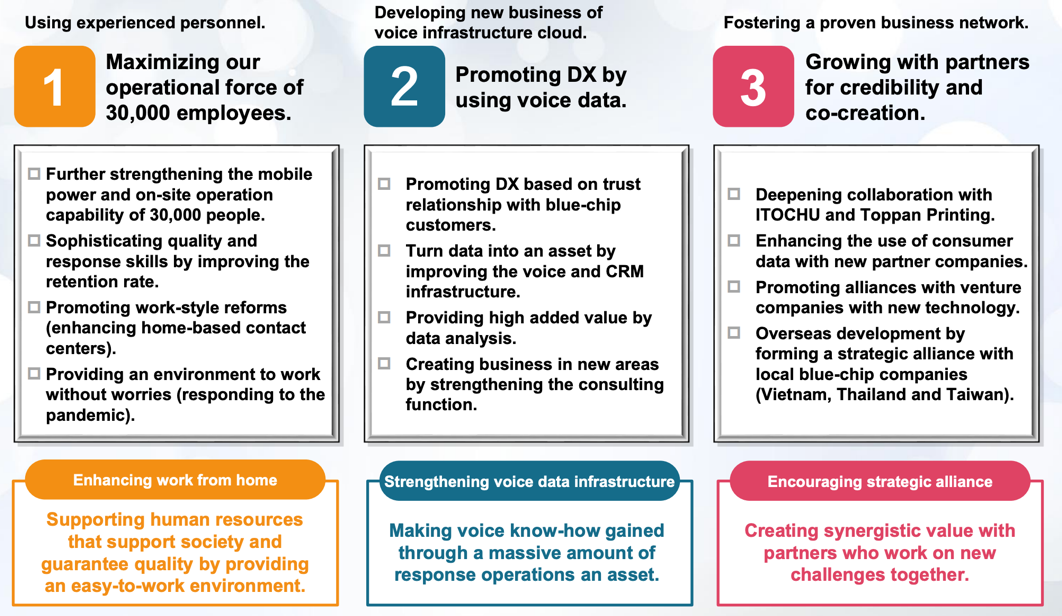

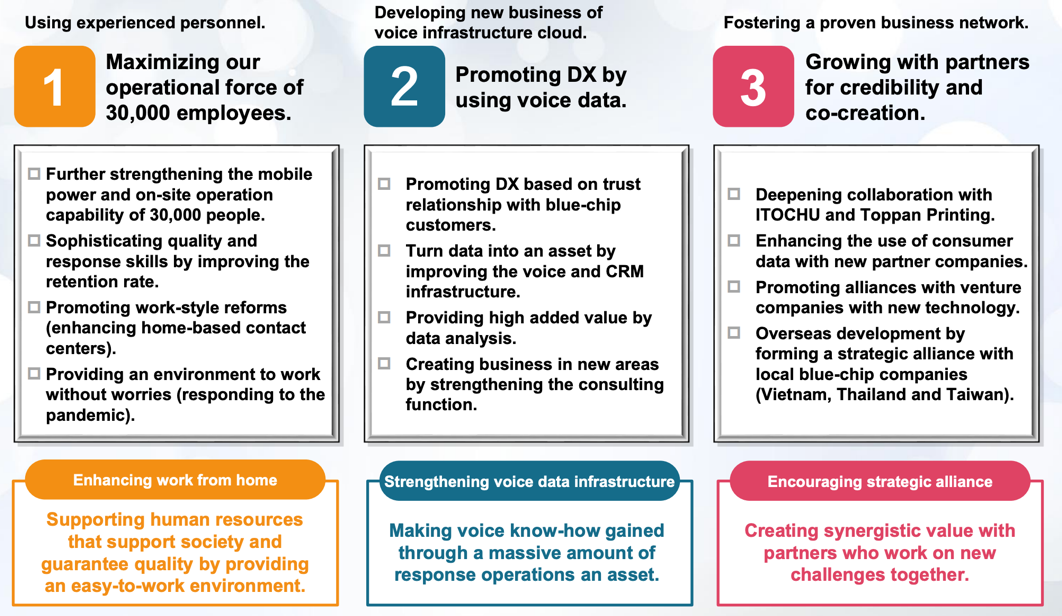

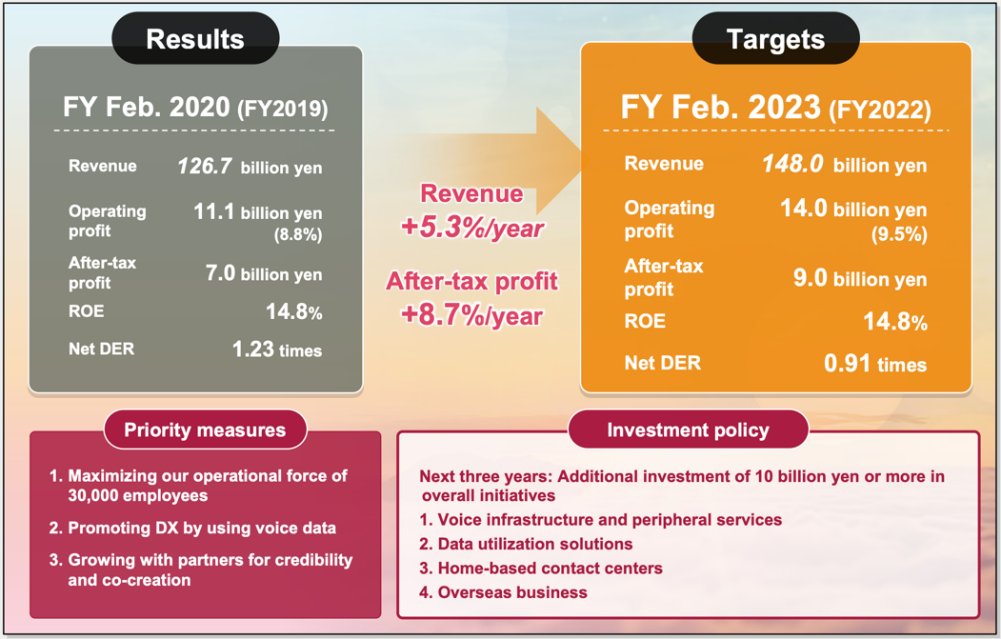

Three priority measures are stated as the pillars of the mid-term management plan: (1) Maximization of the performance of 30,000 employees (workforce strengthening), (2) DX promotion utilizing voice data, and (3) growth of partnerships based on trust and co-creation (cooperation with partners).

Examples of the progress of each measure are as follows.

4-1 Maximization of the performance of 30,000 employees

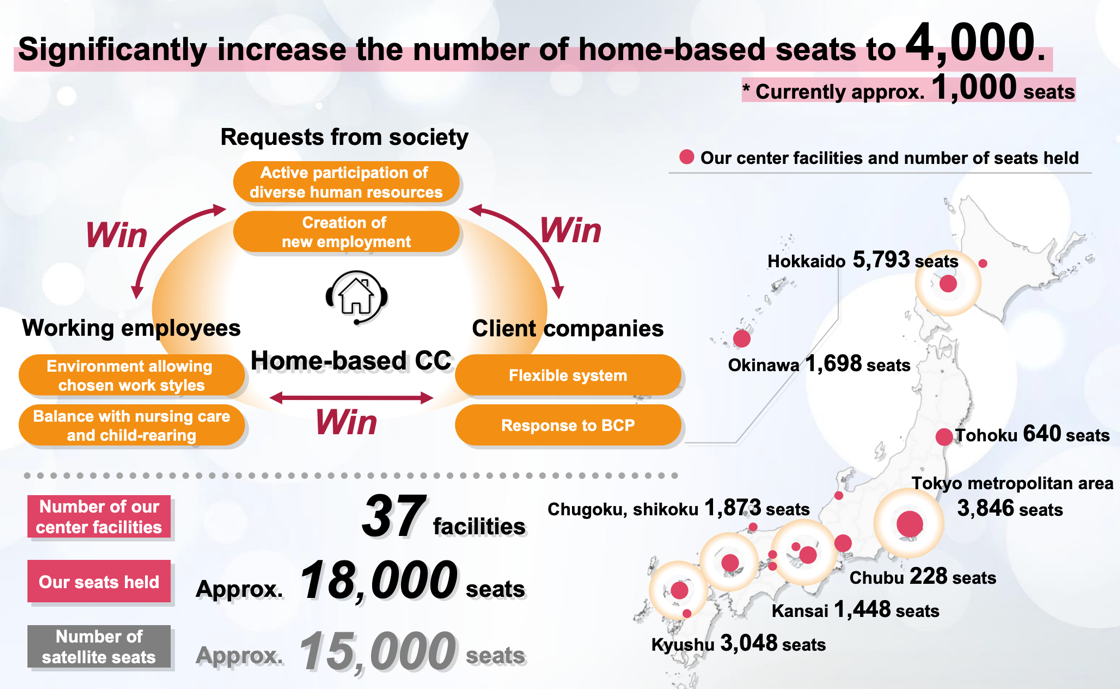

The number of seats in the contact center increased from 1,300 at the end of February 2021 to approximately 2,000 at the end of August 2021. The company plans to have over 2,500 seats by the end of this term. By the end of the next term (end of February 2023), this number will be increased to 4,000 seats or above.

In addition to securing stable human resources, in the wake of the pandemic, the company believes it is important to be resilient and not close the contact center under any circumstances from the perspective of BCP.

Specific measures include strengthening the contact center operated by telework using Bell@Home which is the company's call center infrastructure, responding to the New Normal by providing office layouts that minimize the face-to-face contact, and providing home time bonuses, as well as making the contact center completely home-based.

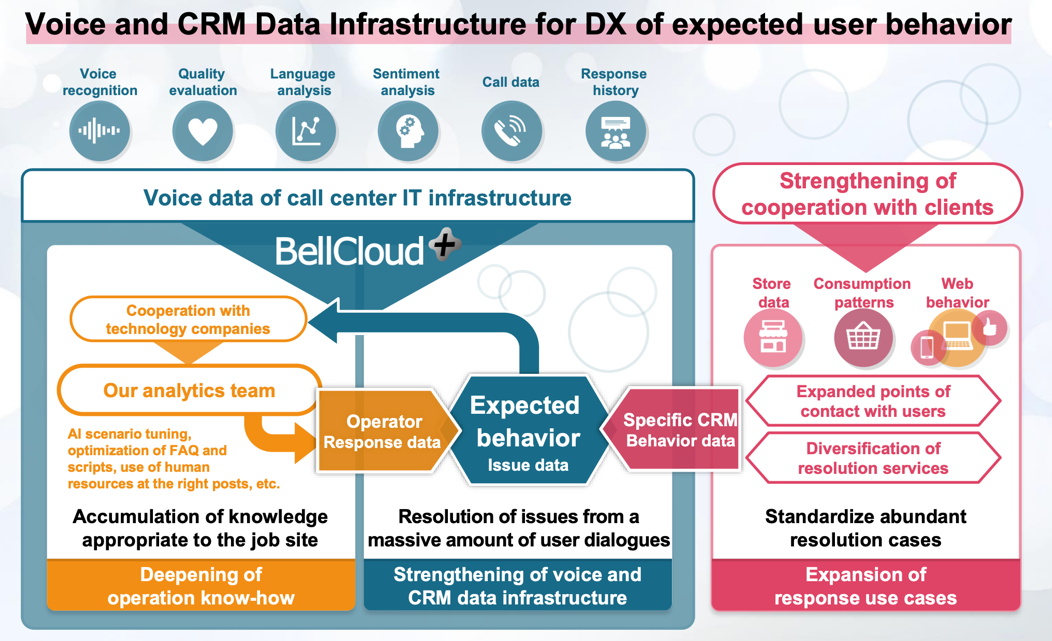

4-2 DX promotion utilizing voice data

To implement DX promotion utilizing voice data, the company will utilize a cloud voice infrastructure, BellCloud+, and voice recognition solution infrastructure, AmiVoice.

The company plans to increase the number of seats from 1,100 at the end of August 2021 to over 3,000 at the end of February, and to 7,000 by the end of the next term (end of February 2023).

By making voice recognition an operating system, all voices will be utilized as data.

As for services aimed at client enterprises, the company will provide added values such as the expansion of chatbots, constant analysis of the voices of consumers, and FAQ improvement. In addition, it will support business at the center sites through a real-time Pop-Up function of FAQs, reduction of manhours for quality checks, retirement detection, and stress detection.

A press release concerning this initiative was issued in April 2021. The company will go on to pitch the initiative of voice data utilization even more proactively through press releases etc. to increase transactions.

Example 1: Automated response solution, ekubot

A product that automatically responds to inquiries from consumers by utilizing new technologies such as voice recognition, speech synthesis, and AI. The company has commercialized as a cloud service the elements that are most suitable for automating contact centers from among the dialog knowledge and innovative technologies that it has cultivated over the years.

The company is currently providing this service to 38 client companies.

In a case introduced to a life insurance company, the company responds to approximately 9,000 inquiries from consumers per month.

Example 2: Supporting client companies in data utilization

In April 2021, the company collaborated with BrainPad, Inc. and began supporting client companies in utilizing data.

While more than 80% of listed companies in Japan are only partially using data, 15% plan to invest more than 100 million yen per year (with the majority investing more than 10 million yen). Thus, although there is a willingness to utilize data, it is not actually being utilized effectively, and it is necessary to overcome issues such as vertical data infrastructure, lack of human resources, maintenance of unstructured data, and continuous operation of measures.

BrainPad, with its strengths in data specialist operation, data infrastructure engineering, and tool provision, will support the vertical data infrastructure and deal with the lack of human resources, while Bell System 24, with its strengths in operation and diverse human resources, will support the maintenance of unstructured data and continuous operation of measures. As a result, Bell System 24 will provide support from all directions to help client companies make the most of their data.

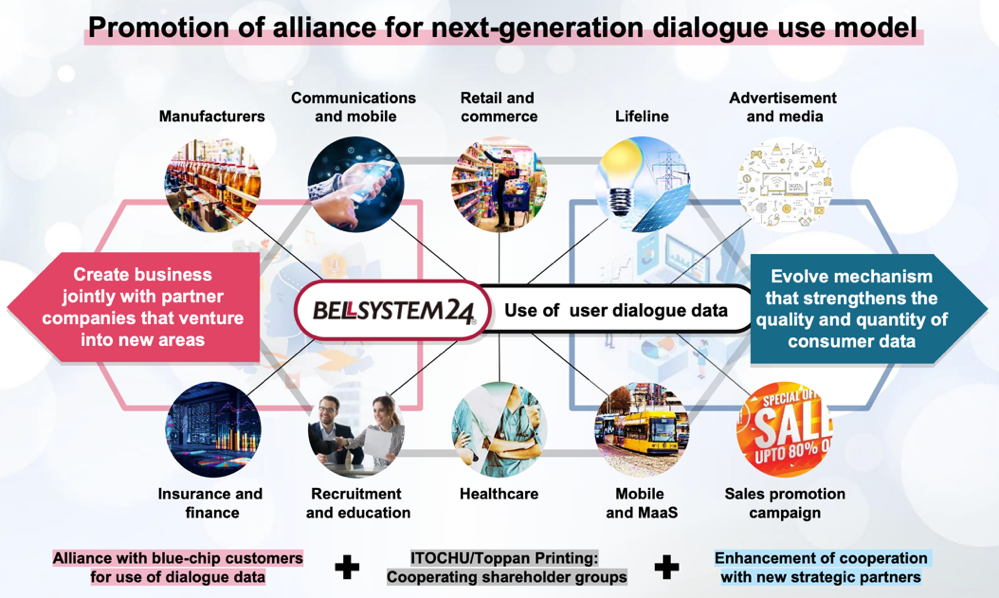

4-3 Growth of partnerships based on trust and joint creation (cooperation with partners)

The company will further elevate cooperation with strong partner enterprises.

They will take full advantage of the client infrastructure and business infrastructure, marketing capability, information related to new technologies, international networks, etc.

(1) Alliance partners

① Toppan Inc.

The company will expand its business with TB Next Communications Co., Ltd., a joint venture established in May 2020 with Toppan Inc. that specializes in the BPO domain to support corporate DX.

By combining Toppan's differentiation from other companies through its advanced security infrastructure, the expansion of business opportunities through its broad network, and the utilization of its business design capabilities with Bell System 24's knowledge accumulated through more than 30 years of contact center operations, Bell System 24 will be able to respond quickly to these social issues and develop next-generation BPO services.

② BrainPad, Inc.

As mentioned above, this is an example of the synergy between ITOCHU Corporation and the company.

③ New alliance

Likewise, the company will create a business in the advanced BPO area through synergy with ITOCHU Corporation.

④ True Touch (Thailand)

On September 1, 2021, Bell System 24 transferred 3,000 contact center workers from True Corporation, a major telecommunications service provider in Thailand, to True Touch, a leading Thai contact center, in which Bell System 24 has invested, with the aim of improving and increasing the efficiency of operations by utilizing Bell System 24's operational improvement methods. With a total of 5,000 communicators, the company will accelerate its business expansion in Thailand.

(2) Channel partners

The company is working with channel partners, including RevComm, a voice-analysis AI phone company, to (1) collaborate on packaged solutions and (2) acquire new clients by jointly holding webinars.

(3) Strategic clients

To create a new model of a contact center through client collaboration.

5. Conclusions

The progress rate in the first half is 52.6% for sales revenue and 59.0% for operating profit, which are high levels compared to the past few years.

The expansion of corona-related spot operations has contributed significantly.

Although the state of emergency has been lifted and the number of newly infected people announced daily has decreased significantly, corona-related spot operations will continue to occur steadily, with plans for the third vaccination progressing.

From the second half onward, I would like to see how much sales and profits will be accumulated.

Regarding the progress of the medium-term management plan 2022, we would like to pay attention to how the progress of the three priority measures will lead to results.

<Reference 1: Mid-Term Management Plan 2022 (FY2/21~FY2/23)>

Environmental Change Estimated in the Mid-term Management Plan

The current coronavirus crisis is bringing significant changes to daily life and the market is also changing greatly in reaction to this. Specifically, the decrease in face-to-face contact and the rise of online systems will lead to the accumulation of daily actions in the form of data, and from now on the success or failure of enterprises will be determined by how they can utilize this data. In this situation, the company will be expected to establish a new contact center with importance placed on BCP, utilize the data from consumers and become a true best partner who makes it possible to create a new business model along with the client who is not a mere outsourcer.

Concept

In accordance with its corporate philosophy “To support social affluence with innovation and communication”, the company supports social infrastructure, such as medical and elderly care, electricity, gas and water supply, politics and government, finance and insurance, telecommunications and mobile services, and food products and daily supplies. As going out was difficult in the coronavirus crisis, online communication with enterprises and individuals arose. The contact center, supporting an important part of the back office of those communications, was able to boost its performance and the company recognized once again that the contact center operations are indispensable. The company aims to assume the role of receiving the voices of worries and anxieties from consumers who use social infrastructure.

Three Priority Measures of the Mid-term Management Plan

(From the company’s materials)

Three priority measures stated as the pillars of the mid-term management plan are, (1) maximization of competence of 30,000 employees (strengthening human resources), (2) promotion of digital transformation (DX) by utilizing voice data, and (3) growth and cooperation with partners based on trust and co-creation.

With regard to the maximization of competence of 30,000 employees, the company will boost the service quality by creating a comfortable working environment for its 30,000 operators, raising the retention rate, and increasing the number of veteran employees. Furthermore, the company will make efforts to improve work efficiency by taking advantage of new technology such as AI. Until now, the company has been recruiting more communicators in response to the increase in sales, but from now on they will establish a system utilizing new technologies to efficiently carry out the work.

With regard to DX promotion by utilizing voice data, the company will develop solutions utilizing the direct opinions of consumers (voice data) which are its greatest asset. Specifically, a consulting team with extensive hands-on knowledge will discern issues among the direct opinions of consumers, prepare the optimal solution, and implement it on-site.

With regard to partner cooperation and growth, the company will further elevate the cooperation with strong partner companies such as ITOCHU Cooperation and Toppan Printing. Furthermore, thanks to the partnership with Sony Computer Science Laboratories, Inc., the company has also started to provide AI services specialized for contact center businesses.

The company will produce results through certain and quick implementation of these three priority measures.

Three Priority Measures and Mission

(From the company’s materials)

These three measures are not stand-alone, but closely intertwined. It seems that the promotion of the advancement of women, childcare support, LGBT initiatives, etc. in which the company has been engaged for the past several years has begun to garner critical acclaim from outside. The company will continue to create a comfortable working environment, including in-home work, and promoting workstyle innovation in order to improve staff retention rate, develop human resources with high-level skills, and provide high quality service to client companies.

Furthermore, based on the cooperation with partner companies such as Sony Computer Science Laboratories and start-up companies, the company plans to incorporate new technologies and promote DX mainly focused on the utilization of voice data, which is the company’s forte. The company plans to present the image of a new contact center, which will fuse high-grade human resources and new technology, within the period of this mid-term management plan.

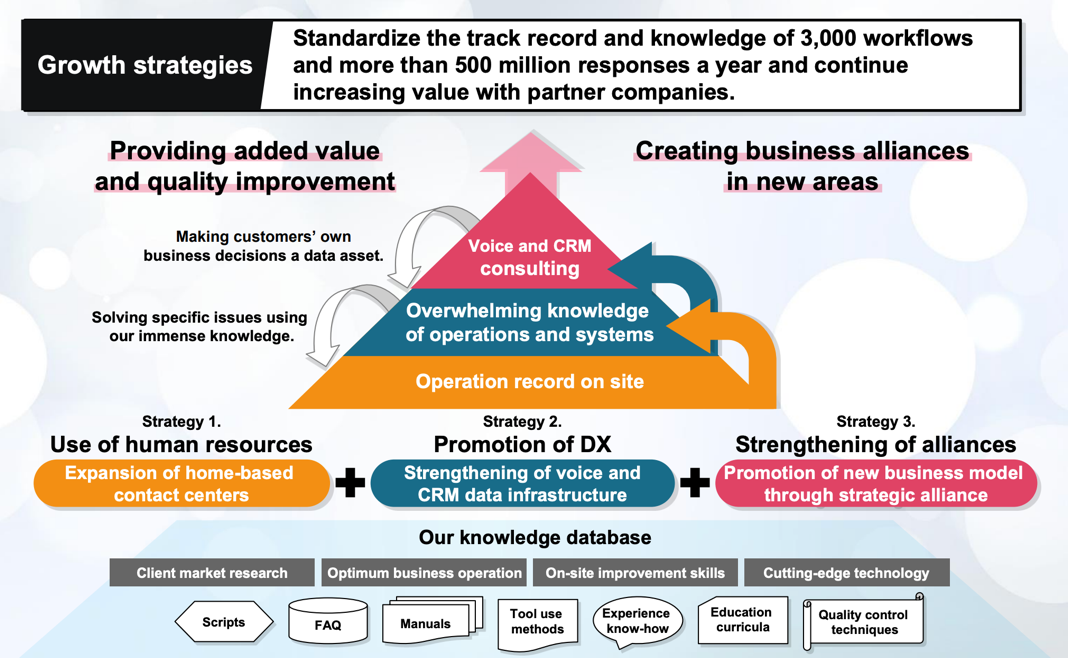

Growth Story for Quality Improvement and Business Creation

(From the company’s materials)

The company deals with 3,000 tasks and 500 million inquiries every year. From now on, it will utilize these as its original knowledge database. Furthermore, the company will aim for differentiation through spot operations which cannot be imitated by consulting companies, the development and operation of the optimal contact center system, and new proposals which take marketing and other activities into consideration. During the period of this mid-term management plan, the company plans to broaden the consulting range and start creating business in new areas with client companies.

Pivotal Initiatives of the Three Measures

Human resources utilization: Expanding in-home contact centers

(From the company’s materials)

The company will expand the number of in-home contact center seats in operation from 1,000 to 4,000 (accounting for over 10% of the whole). Amid the coronavirus crisis, the mindset of the client companies has changed, and in-home work has been on the rise from the viewpoint of BCP, but the company had been pushing for in-home contact centers since before the outbreak of the novel coronavirus to realize diverse workstyles. The company’s policy is to continuously promote in-home work and realize diverse workstyles for diverse human resources. Based on this, the company will establish advantages for recruitment, which will lead to securing outstanding human resources and improving retention rate.

DX promotion: Fortification of voice/CRM data infrastructure

(From the company’s materials)

The company is already in the progress of developing human resources to utilize data and within the period of the new mid-term management plan, it will release comprehensive services for acquisition, utilization, analysis, and consultation of the consumers’ voice data. This is data utilization in its true meaning, which could not be accomplished by conventional contact centers. Direct opinions of consumers or voice data received by the communicators are analyzed, and through consolidation with CRM data owned by the client companies, they are converted into data of expected actions required by consumers. This can be utilized to discern and grasp actual issues and solve those issues. By executing this chain process continuously at high speed and spiraling it up, the company aims for newer and advanced cooperation with client companies.

Alliance solidification: Promotion of a new business model in strategic cooperation

(From the company’s materials)

The company is currently making transactions with client companies from a wide range of industries and many of these are the leading companies in their respective fields. These companies consider the company to be a vital business partner who functions as the last one mile for direct contact with consumers. Client companies expect the company to establish a higher-level contact center utilizing new technology and in order to fulfil these expectations, the company will take advantage of the resources ITOCHU Cooperation and Toppan Printing have to the fullest, such as client infrastructure, business infrastructure, business power, information related to new technologies, international network, etc. Furthermore, the company will provide its data to ITOCHU Cooperation and Toppan Printing. The information acquired through utilizing these business networks will be feedbacked to client companies.

Quantitative Goals of the New Mid-term Management Plan

(From the company’s materials)

The company states its target for the term ending February 2023 to be 148 billion yen for sales, 14 billion yen for operating income (operating income margin of 9.5%), 9 billion yen for income after tax, an annual rate of 5.3% for sales growth, and an annual rate of 8.7% for income growth (income after tax). As for investments, the company is planning over 10 billion yen in total in following three years, and in cases where synergy can be expected in strategic fields, it will also proactively invest in venture firms and M&A.

Initiatives Regarding Societal Challenges

(From the company’s materials)

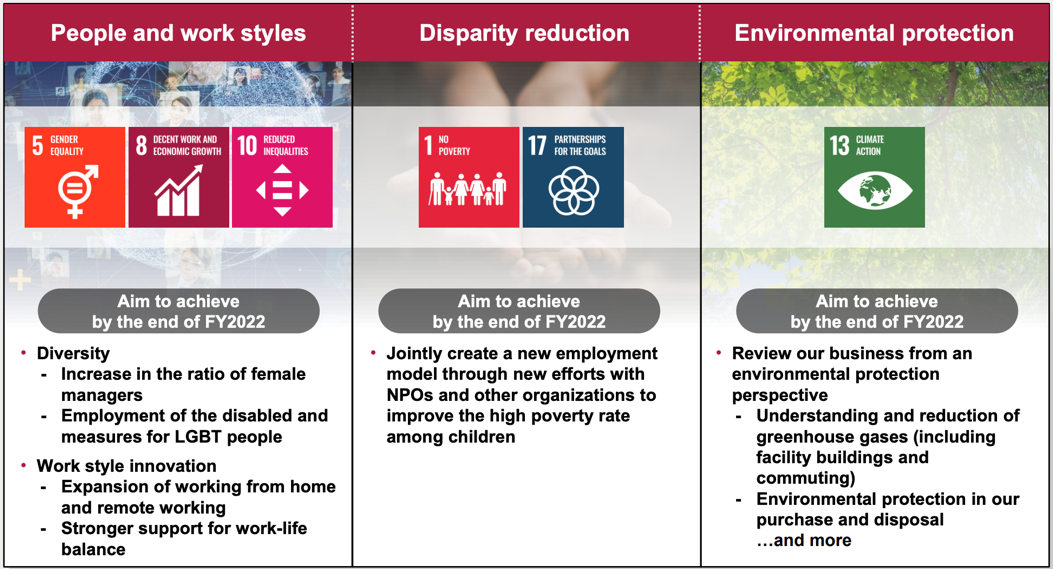

Taking into the account their corporate philosophy and important issues as well as SDGs, the company will engage in activities to solve societal challenges. With regard to SDGs, the company will contribute to achieve goals under three themes, which is, (1) people and workstyle (initiatives related to Goals 5, 8 and 10 of the SDGs17), (2) inequality reduction (initiatives related to Goals 1 and 17 thereof), and (3) environment protection (initiatives related to Goal 13 thereof).

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 9 directors, including 5 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on May 28, 2021

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. Furthermore, on respective stock which does not have dividends or with sluggish performance, we examine whether we should keep holding or reduce their shares for capital efficiency improvement every year, by analyzing expected business performance and recoverability from the viewpoints of economic reasonability.

As for strategically held shares of listed companies, the Board of Directors discussed whether or not to keep holding the shares of a company (balance sheet amount 19 million yen) and decided to continuously hold it.

We have not specified concrete criteria for exercising the voting rights of strategically held shares, but our basic policy is to comprehensively judge whether the synergy, which is the purpose of investment, will be exerted to the maximum degree and contribute to the improvement in value of our corporate group, discuss proposed bills, and exercise voting rights.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-11-3: Analysis and evaluation of the effectiveness of the entire Board of Directors】

The Board of Directors analyzed and evaluated the effectiveness of the Board of Directors as a whole based on the self-evaluation of each director and each corporate auditor through questionnaires this fiscal year, again. A summary of the results is disclosed on our website.

https://www.bell24.co.jp/ja/company/governance/corporategovernance/index.html

Based on the results of the current fiscal year, the Company will devise ways to facilitate online meetings of the Board of Directors to make the most of the knowledge of outside directors, share more information on risk and crisis management, such as infection prevention measures in light of the expected further spread of the novel coronavirus infection due to its mutation. In addition, the Company will implement effective performance monitoring through explanations that contribute to a better understanding of the actual situation with respect to competitors and medium- to long-term issues, discuss opinions and requests obtained through dialogue with shareholders at meetings of the Board of Directors, and deepen discussions to make information, including non-financial information, more useful to stakeholders when it is disclosed and provided.

Furthermore, the Board of Corporate Auditors also conducted an evaluation of the effectiveness of the Board of Corporate Auditors this year.

Three corporate auditors (one full-time and two external) reviewed the current year, discussed the activities of the corporate auditors, and evaluated and analyzed the results. The results are disclosed on our website.

https://www.bell24.co.jp/ja/company/governance/corporategovernance/index.html

After reviewing the audit activities in the term ended February 2021, verifying the effectiveness of the activities, and exchanging opinions among the three auditors on major issues to improve the effectiveness of the audit activities in the term ending February 2022, they concluded that the audit activities in the term ended February 2021 were functioning effectively.

In the term ending February 2022, the Board of Corporate Auditors will strive to improve the comprehensiveness and effectiveness of audits by establishing a corporate group audit system, and to monitor and verify the development and operation of the internal control system and risk management system by strengthening the three-way audit collaboration with the accounting auditor and the internal audit division.

In addition, we will work together with the Board of Directors to play a role in the supervisory function of the Company to realize the sound and sustainable growth of the corporate group and the creation of corporate value over the medium and long term, and to establish a high-quality corporate governance system that will live up to the trust of society.

[Principle 5-1 Policy for constructive dialogue with shareholders]

In order to achieve sustainable growth and improve mid/long-term corporate value, our company will conduct constructive dialogues with shareholders within an appropriate range and an appropriate method in accordance with the following policies.

(1) Directors in charge of IR will be designated and said Directors will manage all dialogues with shareholders.

(2) The IR division will be established under the supervision of Directors in charge of IR and promote the appropriate exchange of information and organic cooperation among the management planning division, the accounting/financial division, and other related divisions.

(3) In order to enrich the means of dialogues with shareholders, a session for briefing financial results will be held at the time of announcement of interim and full-year results.

(4) Shareholders’ opinions, etc. grasped through dialogues will be reported to the Directors in charge of IR and relevant divisions and shared with the Board of Directors when necessary.

(5) We will conduct dialogues with shareholders pursuant to the regulations for preventing insider trading, which stipulate the prohibition of information transmission and promotion of transactions, and necessary measures for limiting the forwarding of insider information

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Reports (BELLSYSTEM24 Holdings, Inc.:6183) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/