Bridge Report:(6183)BELLSYSTEM24 Fiscal Year ended February 2022

President Shunsuke Noda | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE Prime Section |

Industry | Service business |

President | Shunsuke Noda |

Address | 6F Kamiyacho Trust Tower 4-1-1, Toranomon, Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,521 | 73,715,734 shares | 112,121million | 16.0% | 100 shares | |

DPS Est | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥60.00 | 3.9% | ¥125.08 | 12.2x | ¥801.91 | 1.9x |

*The share price is the closing price on April 11. Each figure is from the financial results for fiscal year February 2022.

Earnings Trend(IFRS)

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income | EPS | DPS |

February 2018 Act. | 115,618 | 9,319 | 8,502 | 5,604 | 76.39 | 36.00 |

February 2019 Act. | 121,113 | 8,580 | 7,944 | 5,397 | 73.37 | 36.00 |

February 2020 Act. | 126,663 | 11,105 | 10,534 | 7,006 | 95.29 | 42.00 |

February 2021 Act. | 135,735 | 11,799 | 11,305 | 7,252 | 98.64 | 42.00 |

February 2022 Act. | 146,479 | 13,234 | 13,463 | 8,943 | 121.65 | 54.00 |

February 2023 Est. | 148,000 | 14,000 | 13,900 | 9,200 | 125.08 | 60.00 |

* The forecast was made by the company. Unit: million yen, yen. Net income is profit attributable to owners of parent. Hereinafter the same applies.

This Bridge Report overviews the business performance for Fiscal Year ended February 2022 and others for BELLSYSTEM24 Holdings, Inc.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended February 2022 Earnings Results

3.Fiscal Year ending February 2023 Earnings Forecasts

4.Progress of Mid-Term Management Plan 2022 (FY2/21~FY2/23)

5. Conclusions

<Reference1: Mid-Term Management Plan 2022 (FY2/21~2/23)>

<Reference2: Regarding Corporate Governance>

Key Points

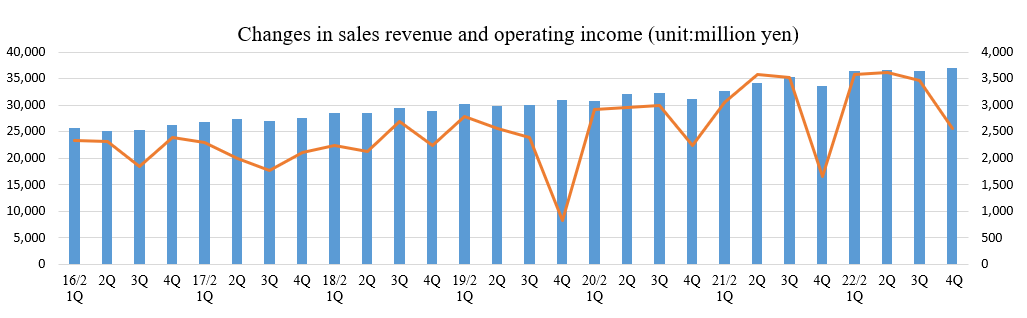

- In the term ended February 2022, sales revenue was 146,479 million yen, up 7.9% from the previous term. The sales of spot operations related to the novel coronavirus, including tasks for vaccination and benefits for coping with the novel coronavirus, grew considerably by 96.8% from the previous term. The sales of continuing existing operations and normal spot operations were also firm and increased 900 million yen and 1.38 billion yen, respectively, for a total of 2.27 billion yen or 1.8% from the previous term. Operating income rose 12.2% from the previous term to 13.2 billion yen. The augmentation of costs for upfront investment in the CRM business (for DX, relocation of the headquarters, etc.) and SG&A were offset by the sales growth and profitability improvement. Operating income margin rose 0.3 points from the previous term. Net income increased 23.3% from the previous term to 8.9 billion yen, achieving double-digit growth, as the investment profit on equity method of TB Next Communications, which is a joint venture with Toppan Inc., was added. Sales and profit increased for six consecutive terms and three consecutive terms, respectively, exceeding the forecasts.

- For the term ending February 2023, it is expected that sales revenue will increase 1.0% year on year to 148 billion yen and operating income will rise 5.8% year on year to 14 billion yen. The reactionary decline in sales of operations related to the novel coronavirus is assumed, but sales and profit are expected to grow, thanks to the strong demand for outsourcing from clients. The company plans to pay a dividend of 60.00 yen/share, up 6.00 yen/share from the previous term. The expected payout ratio is 48.0%. The company aims to steadily increase their dividends, to achieve a payout ratio of 50%.

- Regarding DX promotion utilizing voice data, the company offered solutions utilizing voice data to a life insurance company, significantly contributing to the increases in the number of appointments for visit and the number of customers. This track record was highly evaluated, so other life insurance and non-life insurance companies started adopting the solutions of BELLSYSTEM24, and the company plans to actively approach other industries. The strengthening of their customer base is progressing steadily.

- This term, the sales of business operations related to the novel coronavirus are projected to decline about 20% year on year, but there is a possibility that the period of the project for benefits will be extended, and a plan for the fourth vaccination campaign is emerging, so actual sales may exceed the initial forecast. This term, which is the final term of the mid-term management plan 2022 (FY2/21 to FY2/23), we would like to pay attention to the progress toward the goal of achieving sales revenue of 148 billion yen and an operating income of 14 billion yen. We would also like to see what kind of vision they will set in the next mid-term management plan, which is a year later.

1. Company Overview

The company, which is the holding company, and its 3 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services. The company’s subsidiaries are the following: BELLSYSTEM24, Inc., which engages in operation of contact centers and auxiliary tasks, CTC First Contact Corporation (capital contribution rati 51%) specializing in IT service desks and Business Process Outsourcing (BPO), POCKE INC., which sells contents, BELL SOLEIL INC., a special subsidiary aimed at raising employment of people with disabilities, and BELLSYSTEM24 – HOA SAO (capital contribution rati 49%), which engages in the contact center business in Vietnam, True Touch Co., Ltd., in Thailand, (capital contribution ratio:49.9%) etc.

ITOCHU Corporation holds 40.79% of the company’s voting rights and deems the company as a company accounted for using the equity method (The company group accepted 13 temporary loaned workers). In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

【Corporate Philosophy】

Our mission

To support social affluence with innovation and communication

Code of conduct

・We will develop a comfortable workplace (community) where each employee can keep working happily with peace of mind while constantly taking on new challenges.

・We will fulfill corporate social responsibility, and aim to achieve sustainable healthy growth.

・We will return the value we would create to society, to contribute to the development of a beautiful future.

1-1 Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales. Other businesses include the sale of contents of POCKE INC.

Sales by segment

| FY2/22 |

CRM business | 145,460 |

Other | 1,019 |

Consolidated sales revenue | 146,479 |

* Unit: million yen

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up slightly over 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for slightly over 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

1-2 ESG

(1) Initiatives

The company engages in activities for solving social issues, while considering its corporate ethos, important missions, and ESG.

E | * Formulation of a Policy for Coping with Climate Change * Announcement of goals for achieving carbon neutrality |

S | * Empowerment of women • To raise the ratio of female managers • Received the second-place award in the advance section at 2022 J Win Diversity Award * Initiatives for diversity • Opened a café operated by disabled people in a center in Fukuoka • Received the Gold award, the highest rank of PRIDE Index for evaluating LGBTQ activities, for three consecutive years * Local activities and job creation * Revised the Policy for Human Rights |

G | * Response to the amended Corporate Governance Code (CGC), including TCFD * Strengthened human capital by evolving the business model * Revised the Basic Policy for Preventing Bribery and Corruption * Formulated Guidelines for Handling Personal Data |

The company appointed directors in charge of the policy for coping with climate change, the policy for human rights, the basic policy for preventing bribery and corruption, and the guidelines for handling personal data, respectively.

Since there was no recipient of the Grand Prix of 2022 J Win Diversity Award, the second-place award winners, BELLSYSTEM24 and IBM Japan, are virtually top-ranked. The company received this award for the first time in the field of contact centers.

(2) Topics

In April 2022, the share price of the company was adopted for the first time in the calculation of FTSE Blossom Japan Sector Relative Index, a share price index of Japanese enterprises that satisfy the global standards of ESG.

FTSE Blossom Japan Sector Relative Index was established by FTSE Russell, which is a global index provider. It reflects the performance of Japanese enterprises that engage in excellent activities for the environment, society, and governance (ESG) in each sector, and it was designed to be sector-neutral.

The FTSE Blossom Japan Sector Relative Index is also adopted by Government Pension Investment Fund (GPIF), which manages and invests public pension funds in Japan, for making judgments about ESG investment.

2. Fiscal Year ended February 2022 Earnings Results

2-1 Consolidated Earnings

| FY 2/21 | Ratio to sales | FY 2/22 | Ratio to sales | YoY | Compared to the forecast |

Sales revenue | 135,735 | 100.0% | 146,479 | 100.0% | +7.9% | +5.4% |

Gross profit | 27,441 | 20.2% | 30,257 | 20.7% | +10.3% | - |

SG&A expenses | 14,930 | 11.0% | 16,571 | 11.3% | +11.0% | - |

Operating income | 11,799 | 8.7% | 13,234 | 9.0% | +12.2% | +8.5% |

Income before Income Taxes | 11,305 | 8.3% | 13,463 | 9.2% | +19.1% | +13.4% |

Net income | 7,252 | 5.3% | 8,943 | 6.1% | +23.3% | +14.7% |

*Unit: million yen

Sales and profit increased for six consecutive terms and three consecutive terms, respectively, exceeding the forecasts.

Sales revenue was 146,479 million yen, up 7.9% from the previous term. The sales of spot operations related to the novel coronavirus, including tasks for vaccination and benefits for coping with the novel coronavirus, grew considerably by 96.8% from the previous term. The sales of continuing existing operations and normal spot operations were also firm and increased 900 million yen and 1.38 billion yen, respectively, for a total of 2.27 billion yen or 1.8% from the previous term. Operating income rose 12.2% from the previous term to 13.2 billion yen. The augmentation of costs for upfront investment in the CRM business (for DX, relocation of the headquarters, etc.) and SG&A were offset by the sales growth and profitability improvement. Operating income margin rose 0.3 points from the previous term. Net income increased 23.3% from the previous term to 8.9 billion yen, achieving double-digit growth, as the investment profit on equity method of TB Next Communications, which is a joint venture with Toppan Inc., was added. Sales and profit increased for six consecutive terms and three consecutive terms, respectively, exceeding the forecasts.

2-2 Trends by segment

| FY 2/21 | Ratio to sales | FY 2/22 | Ratio to sales | YoY |

Sales revenue | 1,357.4 | 100.0% | 1,464.8 | 100.0% | +7.9% |

CRM business | 1,345.6 | 99.1% | 1454.6 | 99.3% | +8.1% |

└Continuing Operations | 1,171.1 | 86.3% | 1,180.0 | 80.6% | +0.8% |

└Spot Operations | 174.5 | 12.9% | 274.6 | 18.7% | +57.3% |

Related to the novel coronavirus | 89.2 | 6.6% | 175.4 | 12.0% | +96.8% |

Other Businesses | 11.8 | 0.9% | 10.2 | 0.7% | -13.4% |

*Unit: 100 million yen.。

The ratios to sales of continuing and spot operations mean the ratio to the sales revenue of the CRM business.

(1) CRM business

Despite the impact of the spread of the novel coronavirus, the spot demand for CRM as social infrastructure and sales of existing continuous transactions that began in the previous term grew, and the synergetic transactions were healthy thanks to the enhanced cooperation with ITOCHU and Toppan Printing. Profit rose, as personnel costs augmented due to the policy of equal pay for equal jobs, but sales grew and efforts for improving earnings paid off.

(2) Other businesses

The sales of contents declined. As a result of the impairment test of the goodwill that belongs to Pocke Inc., the company posted an impairment loss of 496 million yen.

2-3 Financial condition and Cash Flow (CF)

Financial condition

| Feb. 21 | Feb. 22 | Increase/ decrease |

| Feb. 21 | Feb. 22 | Increase/ decrease |

Current assets | 26,381 | 28,809 | +2,428 | Current liabilities | 48,952 | 67,403 | +18,451 |

Cash and deposits | 5,518 | 6,196 | +678 | Trade debt | 6,141 | 6,691 | +550 |

Trade Receivables | 19,644 | 21,181 | +1,537 | Loans payable | 20,235 | 37,481 | +17,246 |

Noncurrent assets | 146,507 | 149,503 | +2,996 | Noncurrent liabilities | 70,426 | 51,420 | -19,006 |

Tangible assets | 37,284 | 40,067 | +2,783 | Long-term loans payable | 42,907 | 21,971 | -20,936 |

Goodwill | 95,396 | 94,900 | -496 | Total liabilities | 119,378 | 118,823 | -555 |

Total assets | 172,888 | 178,312 | +5,424 | Total capital | 53,510 | 59,489 | +5,979 |

|

|

|

| Equity capital | 53,113 | 58,986 | +5,873 |

|

|

|

| Total loans payable | 63,142 | 59,452 | -3,690 |

*Unit: million yen. Equity capital is total equity attributable to owners of the parent.

Total assets increased 5,424 million yen from the end of the previous term due to an increase in cash and deposits. Total liabilities decreased 555 million yen from the end of the previous term. Total capital increased 5,979 million yen from the end of the previous term due to an increase in retained earnings. Capital-to-asset ratio increased 2.4 points from the end of the previous term to 33.1%.

Cash Flow

| FY 2/21 | FY 2/22 | Increase/decrease |

Operating Cash Flow | 14,886 | 16,278 | +1,392 |

Investing Cash Flow | -3,177 | -2,431 | +746 |

Free Cash Flow | 11,709 | 13,847 | +2,138 |

Financing Cash Flow | -13,955 | -13,181 | +774 |

Cash and Equivalents at Term End | 5,518 | 6,196 | +678 |

*Unit: million yen

The increase in operating CF and free CF expanded due to an increase in net income before tax.

The cash position inclined.

3. Fiscal Year ending February 2023 Earnings Forecasts

3-1 Consolidated Earnings forecast

| FY 2/22 | Ratio to sales | FY 2/23 (Est) | Ratio to sales | YoY |

Sales revenue | 146,479 | 100.0% | 148,000 | 100.0% | +1.0% |

Operating income | 13,234 | 9.0% | 14,000 | 9.5% | +5.8% |

Income before Income Taxes | 13,463 | 9.2% | 13,900 | 9.4% | +3.2% |

Net income | 8,943 | 6.1% | 9,200 | 6.2% | +2.9% |

*Unit: million yen.

Forecasted increase in sales and profit

For the term ending February 2023, it is expected that sales revenue will increase 1.0% year on year to 148 billion yen and operating income will rise 5.8% year on year to 14 billion yen. The reactionary decline in sales of operations related to the novel coronavirus is assumed, but sales and profit are expected to grow, thanks to the strong demand for outsourcing from clients. The company plans to pay a dividend of 60.00 yen/share, up 6.00 yen/share from the previous term. The expected payout ratio is 48.0%. The company aims to steadily increase their dividends, to achieve a payout ratio of 50%.

Sales Breakdown

| FY 2/22 | FY 2/23 (Est) | YoY |

Sales revenue | 1,464.8 | 1,480.0 | +1.0% |

basic operations | 1,279.2 | 1,331.0 | +4.1% |

operations related to the novel coronavirus | 175.4 | 140.0 | -20.2% |

*Unit: 100 million yen.

Since many of conventional spot operations are continuous, so they decided to lump conventional continuing operations and ordinary spot operations into the same category called “basic operations.”

The sales of basic operations are projected to increase steadily, thanks to the growth of demand through the energization of corporate activities in parallel with the progress of anti-pandemic measures, the resumption of campaigns, etc.

On the other hand, the sales of operations related to the novel coronavirus are forecast to decline due to the recoil from the performance in the previous term.

4. Progress of Mid-Term Management Plan 2022 (FY 2/21 to FY 2/23)

(From the company’s materials)

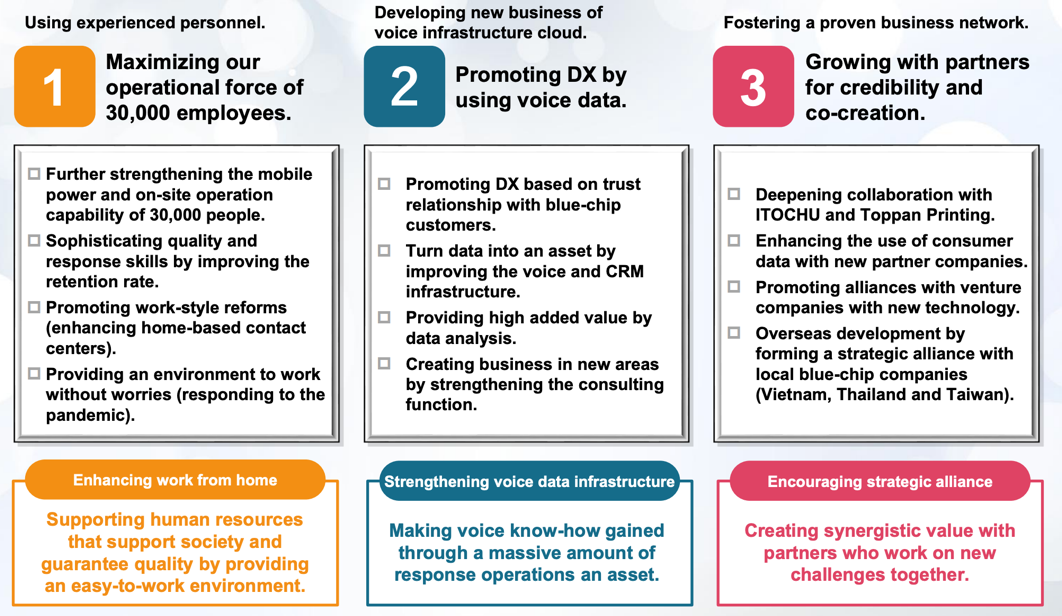

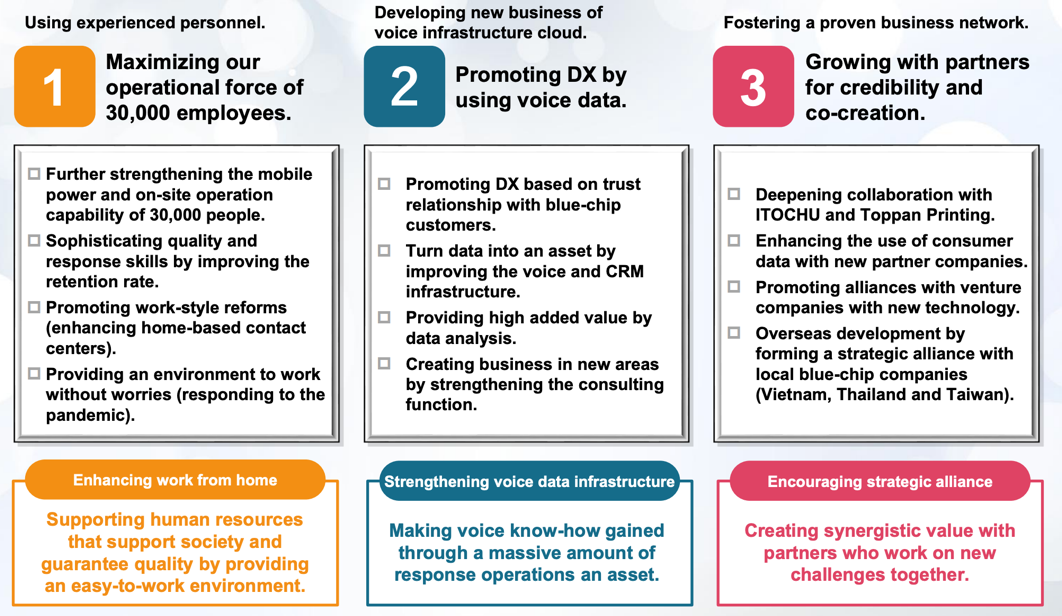

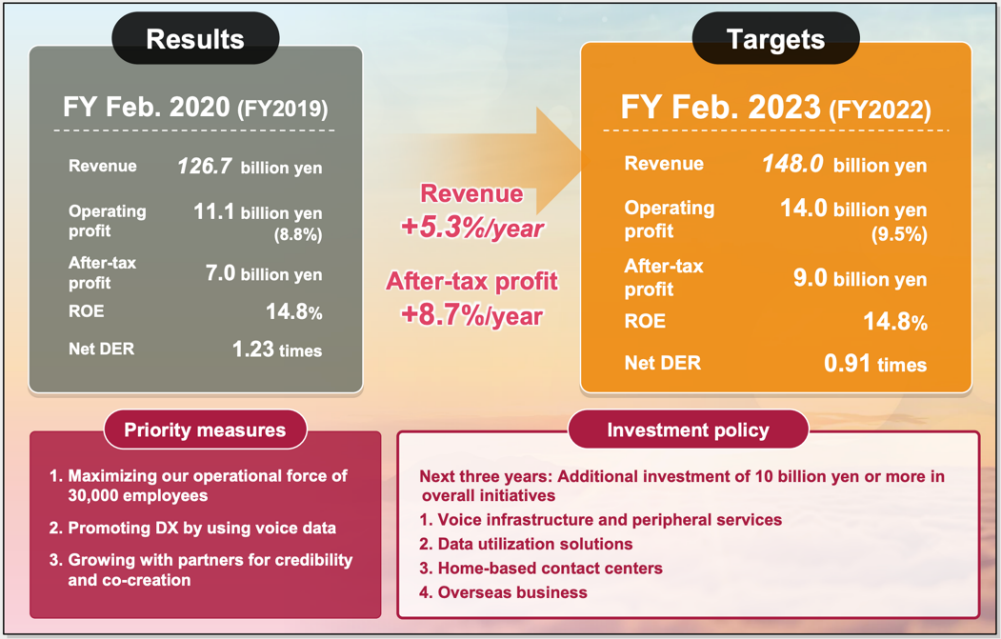

Three priority measures are stated as the pillars of the mid-term management plan: (1) Maximization of the performance of 30,000 employees (workforce strengthening), (2) DX promotion utilizing voice data, and (3) growth of partnerships based on trust and co-creation (cooperation with partners).

Examples of the progress of each measure are as follows.

4-1 Maximization of the performance of 30,000 employees

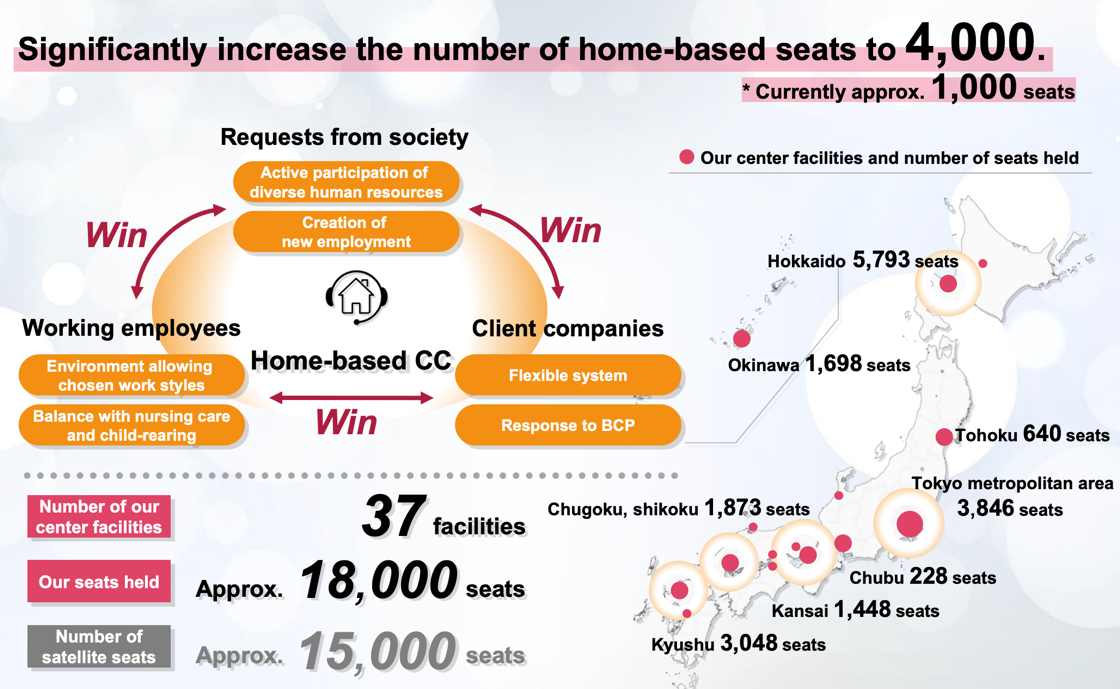

The number of seats of home-based contact centers increased from 1,300 at the end of February 2021 to over 2,000 at the end of February 2022. The company plans to increase it to 4,000 by the end of this term.

The company concentrates on the expansion of home-based contact centers, to support the BCP of client enterprises, increase job applications from young people, retain young employees, and reduce the costs of rents for contact centers.

The company realized completely online recruitment processes, including aptitude tests, job interviews, employment procedures, and training. As a result, it succeeded in enhancing its recruitment capability, dealing with about 700 job applicants per month, increasing job applicants, holding job interviews, and conducting recruitment in a broader range of regions.

While pursuing the improvement in employee engagement as a priority measure, the company holds a company-wide survey on employee engagement, and is renovating lounges for employees around Japan one after another.

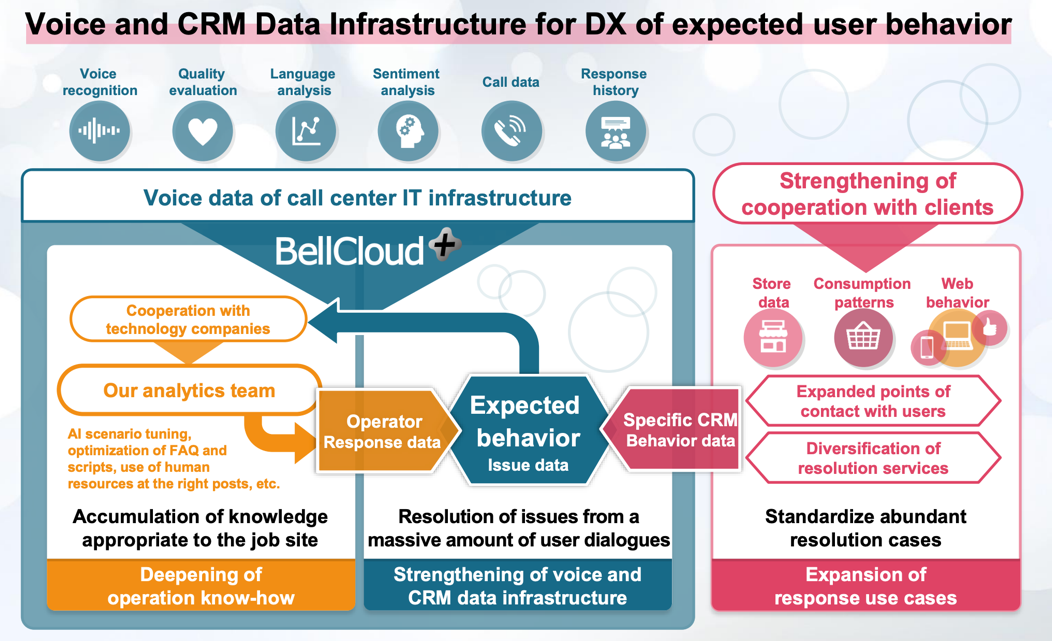

4-2 DX promotion utilizing voice data

To realize DX promotion utilizing voice data, the company will utilize voice recognition as an OS in all operations by using the cloud voice base BellCloud + and the voice recognition solution base AmiVoice.

The company plans to increase the number of seats in centers equipped with the voice recognition base to 7,000 by the end of the current term (the end of February 2023).

Concretely, the company had the following track record.

AI chatbots are utilized for dealing with an enormous number of inquiries regarding vaccination-related operations.

The company adopted chatbots for short-term large-scale projects, like operations related to the novel coronavirus, realizing contact points that are available 24/7, solving over 80% of problems with the chatbots, and reducing the number of in-person phone calls considerably.

To develop experts in date utilization, the company implements various measures, including the training program for experts in data utilization.

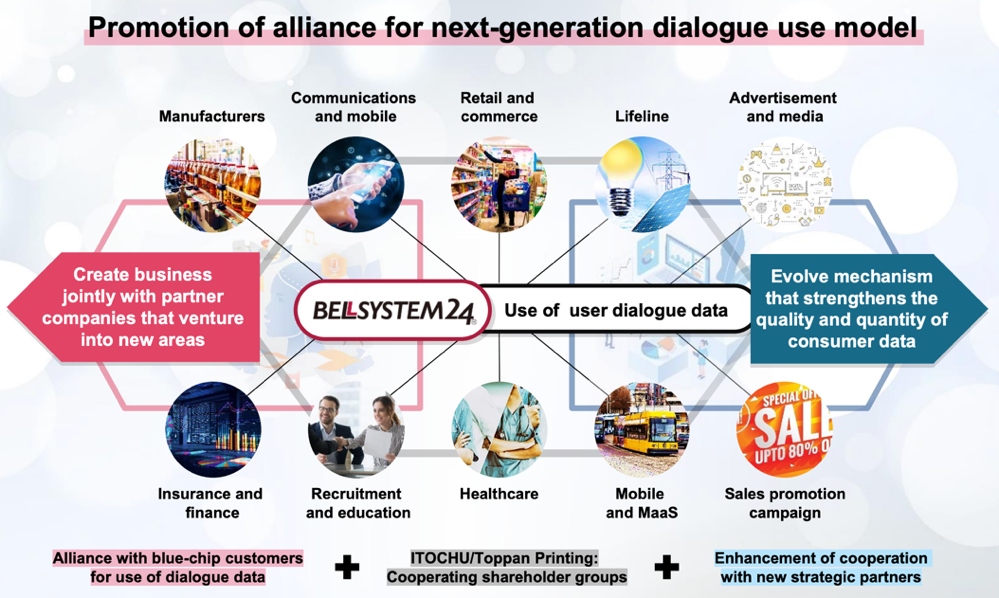

4-3 Growth of partnerships based on trust and joint creation (cooperation with partners)

The company will further elevate domestic and international cooperation with strong partner enterprises.

They will take full advantage of the client infrastructure and business infrastructure, marketing capability, information related to new technologies, international networks, etc.

① ITOCHU Corporation

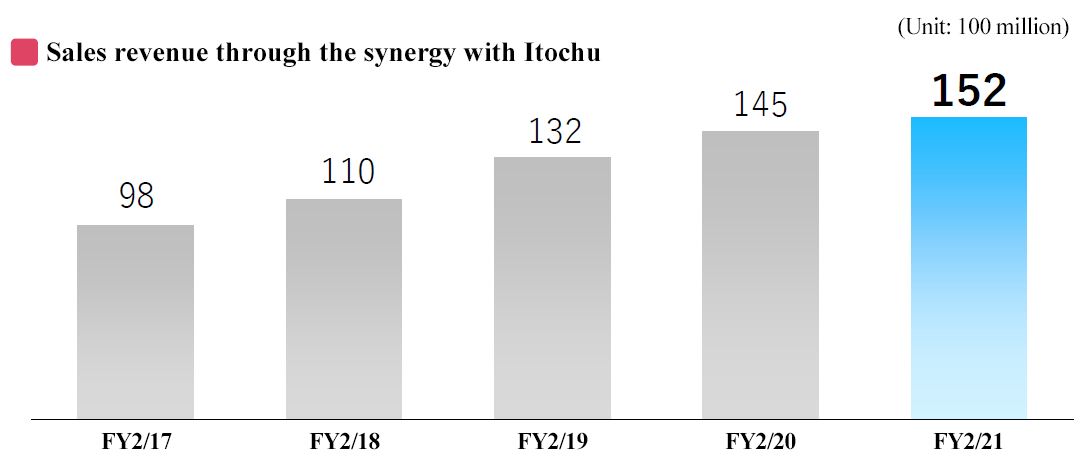

The sales revenue through the synergy with Itochu has steadily expanded to the scale of 15 billion yen.

Collaboration with BrainPad has started in DX utilizing voice data, thanks to the synergy with Itochu.

(From the company’s materials)

② Toppan Inc.

In addition to the business collaboration in the joint venture TB Next Communications, which contributed to the consolidated results in the previous term, the business synergy in the BPO field due to the direct cooperation with Toppan has been growing.

③ New alliance

*Layers Consulting

In March 2022, the company concluded a basic agreement with Layers Consulting Co., Ltd., which possesses technical knowledge of strategy design, streamlining of business operations through DX, and human resources and accounting, and consulting know-how for reskilling, etc. targeted at big corporations which have been accumulated for over 40 years, for establishing a joint venture for consulting and undertaking tasks in the fields of human resources and accounting, and established Horizon One.

The company offers upstream and downstream services, including the design of strategies, the streamlining of business operations, the utilization of technologies, reskilling, and business operation, in a one-stop manner, and undertakes specialized tasks that require qualifications for tax accountants and certified social insurance labor consultants.

* True Touch (Thailand)

For the purpose of improving and streamlining business operations by utilizing the operation improvement methods of BELLSYSTEM24, the company transferred over 3,000 employees in contact centers of True Corporation, which is a major provider of telecommunication services in Thailand, to True Touch, a major Thailand contact center, in which BELLSYSTEM24 invested, on September 1, 2021. The number of communicators increased about three times from 1,800 when the company started investment in 2019 to 5,500.

By sharing the methods of BELLSYSTEM24, the company will improve retirement rate, service levels, etc. considerably.

5. Conclusions

Regarding DX promotion utilizing voice data, the company offered solutions utilizing voice data to a life insurance company, significantly contributing to the increases in the number of appointments for visit and the number of customers. This track record was highly evaluated, so other life insurance and non-life insurance companies started adopting the solutions of BELLSYSTEM24, and the company plans to actively approach other industries. The strengthening of their customer base is progressing steadily.

This term, the sales of business operations related to the novel coronavirus are projected to decline about 20% year on year, but there is a possibility that the period of the project for benefits will be extended, and a plan for the fourth vaccination campaign is emerging, so actual sales may exceed the initial forecast. This term, which is the final term of the mid-term management plan 2022 (FY2/21 to FY2/23), we would like to pay attention to the progress toward the goal of achieving sales revenue of 148 billion yen and an operating income of 14 billion yen.

We would also like to see what kind of vision they will set in the next mid-term management plan, which is a year later.

<Reference 1: Mid-Term Management Plan 2022 (FY2/21~FY2/23)>

Environmental Change Estimated in the Mid-term Management Plan

The current coronavirus crisis is bringing significant changes to daily life and the market is also changing greatly in reaction to this. Specifically, the decrease in face-to-face contact and the rise of online systems will lead to the accumulation of daily actions in the form of data, and from now on the success or failure of enterprises will be determined by how they can utilize this data. In this situation, the company will be expected to establish a new contact center with importance placed on BCP, utilize the data from consumers and become a true best partner who makes it possible to create a new business model along with the client who is not a mere outsourcer.

Concept

In accordance with its corporate philosophy “To support social affluence with innovation and communication”, the company supports social infrastructure, such as medical and elderly care, electricity, gas and water supply, politics and government, finance and insurance, telecommunications and mobile services, and food products and daily supplies. As going out was difficult in the coronavirus crisis, online communication with enterprises and individuals arose. The contact center, supporting an important part of the back office of those communications, was able to boost its performance and the company recognized once again that the contact center operations are indispensable. The company aims to assume the role of receiving the voices of worries and anxieties from consumers who use social infrastructure.

Three Priority Measures of the Mid-term Management Plan

(From the company’s materials)

Three priority measures stated as the pillars of the mid-term management plan are, (1) maximization of competence of 30,000 employees (strengthening human resources), (2) promotion of digital transformation (DX) by utilizing voice data, and (3) growth and cooperation with partners based on trust and co-creation.

With regard to the maximization of competence of 30,000 employees, the company will boost the service quality by creating a comfortable working environment for its 30,000 operators, raising the retention rate, and increasing the number of veteran employees. Furthermore, the company will make efforts to improve work efficiency by taking advantage of new technology such as AI. Until now, the company has been recruiting more communicators in response to the increase in sales, but from now on they will establish a system utilizing new technologies to efficiently carry out the work.

With regard to DX promotion by utilizing voice data, the company will develop solutions utilizing the direct opinions of consumers (voice data) which are its greatest asset. Specifically, a consulting team with extensive hands-on knowledge will discern issues among the direct opinions of consumers, prepare the optimal solution, and implement it on-site.

With regard to partner cooperation and growth, the company will further elevate the cooperation with strong partner companies such as ITOCHU Cooperation and Toppan Printing. Furthermore, thanks to the partnership with Sony Computer Science Laboratories, Inc., the company has also started to provide AI services specialized for contact center businesses.

The company will produce results through certain and quick implementation of these three priority measures.

Three Priority Measures and Mission

(From the company’s materials)

These three measures are not stand-alone, but closely intertwined. It seems that the promotion of the advancement of women, childcare support, LGBT initiatives, etc. in which the company has been engaged for the past several years has begun to garner critical acclaim from outside. The company will continue to create a comfortable working environment, including in-home work, and promoting workstyle innovation in order to improve staff retention rate, develop human resources with high-level skills, and provide high quality service to client companies.

Furthermore, based on the cooperation with partner companies such as Sony Computer Science Laboratories and start-up companies, the company plans to incorporate new technologies and promote DX mainly focused on the utilization of voice data, which is the company’s forte. The company plans to present the image of a new contact center, which will fuse high-grade human resources and new technology, within the period of this mid-term management plan.

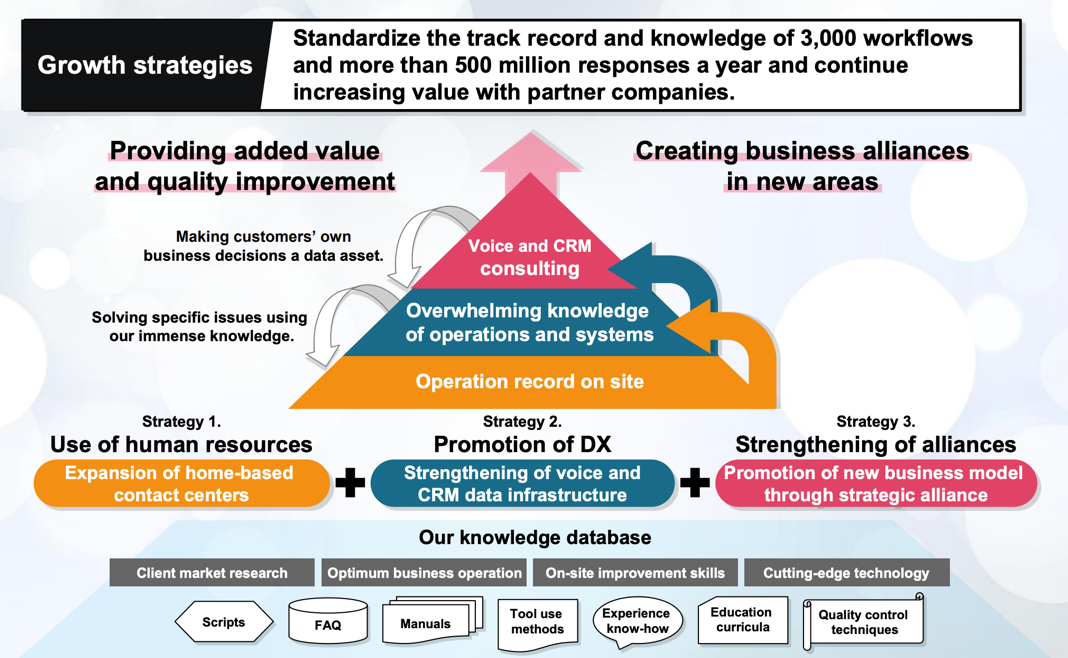

Growth Story for Quality Improvement and Business Creation

(From the company’s materials)

The company deals with 3,000 tasks and 500 million inquiries every year. From now on, it will utilize these as its original knowledge database. Furthermore, the company will aim for differentiation through spot operations which cannot be imitated by consulting companies, the development and operation of the optimal contact center system, and new proposals which take marketing and other activities into consideration. During the period of this mid-term management plan, the company plans to broaden the consulting range and start creating business in new areas with client companies.

Pivotal Initiatives of the Three Measures

Human resources utilization: Expanding in-home contact centers

(From the company’s materials)

The company will expand the number of in-home contact center seats in operation from 1,000 to 4,000 (accounting for over 10% of the whole). Amid the coronavirus crisis, the mindset of the client companies has changed, and in-home work has been on the rise from the viewpoint of BCP, but the company had been pushing for in-home contact centers since before the outbreak of the novel coronavirus to realize diverse workstyles. The company’s policy is to continuously promote in-home work and realize diverse workstyles for diverse human resources. Based on this, the company will establish advantages for recruitment, which will lead to securing outstanding human resources and improving retention rate.

DX promotion: Fortification of voice/CRM data infrastructure

(From the company’s materials)

The company is already in the progress of developing human resources to utilize data and within the period of the new mid-term management plan, it will release comprehensive services for acquisition, utilization, analysis, and consultation of the consumers’ voice data. This is data utilization in its true meaning, which could not be accomplished by conventional contact centers. Direct opinions of consumers or voice data received by the communicators are analyzed, and through consolidation with CRM data owned by the client companies, they are converted into data of expected actions required by consumers. This can be utilized to discern and grasp actual issues and solve those issues. By executing this chain process continuously at high speed and spiraling it up, the company aims for newer and advanced cooperation with client companies.

Alliance solidification: Promotion of a new business model in strategic cooperation

(From the company’s materials)

The company is currently making transactions with client companies from a wide range of industries and many of these are the leading companies in their respective fields. These companies consider the company to be a vital business partner who functions as the last one mile for direct contact with consumers. Client companies expect the company to establish a higher-level contact center utilizing new technology and in order to fulfil these expectations, the company will take advantage of the resources ITOCHU Cooperation and Toppan Printing have to the fullest, such as client infrastructure, business infrastructure, business power, information related to new technologies, international network, etc. Furthermore, the company will provide its data to ITOCHU Cooperation and Toppan Printing. The information acquired through utilizing these business networks will be feedbacked to client companies.

Quantitative Goals of the New Mid-term Management Plan

(From the company’s materials)

The company states its target for the term ending February 2023 to be 148 billion yen for sales, 14 billion yen for operating income (operating income margin of 9.5%), 9 billion yen for income after tax, an annual rate of 5.3% for sales growth, and an annual rate of 8.7% for income growth (income after tax). As for investments, the company is planning over 10 billion yen in total in following three years, and in cases where synergy can be expected in strategic fields, it will also proactively invest in venture firms and M&A.

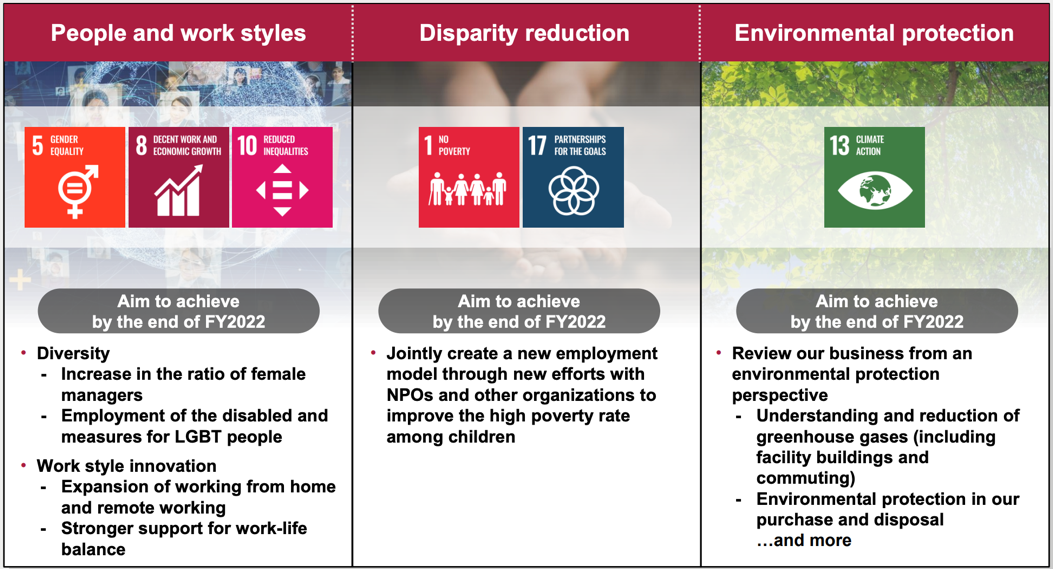

Initiatives Regarding Societal Challenges

(From the company’s materials)

Taking into the account their corporate philosophy and important issues as well as SDGs, the company will engage in activities to solve societal challenges. With regard to SDGs, the company will contribute to achieve goals under three themes, which is, (1) people and workstyle (initiatives related to Goals 5, 8 and 10 of the SDGs17), (2) inequality reduction (initiatives related to Goals 1 and 17 thereof), and (3) environment protection (initiatives related to Goal 13 thereof).

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 8 directors, including 3 outside ones |

Auditors | 3 auditors, including 1 outside ones |

◎ Corporate Governance Report Updated on November 24, 2021

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code>

The following information is based on the Corporate Governance Code revised in June 2021:

[Supplementary Principle 1-2-4 Electronic exercise of voting rights and translation of convocation notices into English]

Our company began use of the electronic voting platform operated by ICJ, Inc. (Investor Communications Japan) at the general shareholder meeting held in May 2021. We do not prepare English versions of convocation notices at the moment; however, we will discuss our future action by taking into account changes in the situation surrounding voting rights exercised and the ratio of overseas investors.

[Supplementary Principle 4-1-3 Appropriate supervision of succession plans for the CEO and other top executives]

Although our board of directors has not formulated any succession plan for the CEO and executive officer who concurrently serves as the president that is the highest managerial position, the board recognizes the importance of the roles that stakeholders expect the president to play.

The nominating committee exercises comprehensive judgment about such matters as whether candidates satisfy the criteria for selection of candidates for the president, which are specified in the criteria for the appointment and dismissal of directors, including the ability to make business decisions, courage as a corporate manager, multifaceted vision and foresight, and makes proposal to the board of directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. Furthermore, on respective stock which does not have dividends or with sluggish performance, we examine whether we should keep holding or reduce their shares for capital efficiency improvement every year, by analyzing expected business performance and recoverability from the viewpoints of economic reasonability.

As for strategically held shares of listed companies, the Board of Directors discussed whether or not to keep holding the shares of a company (balance sheet amount 19 million yen) and decided to continuously hold it.

With regard to exercise of the voting rights for strategically held shares, our company basically makes comprehensive judgment for individual proposals about such matters as whether or not doing so will boost the corporate value and the shareholder return of the companies in which we invest for the medium- and long-term, and whether or not doing so will contribute to enhancing our corporate group’s value through maximization of synergy that is our company’s goal of investment.

[Supplementary Principle 2-4-1 Ensuring diversity in the promotion to core human resources]

(1) Ensuring diversity

Following our corporate philosophy, our company respects the diversity in our employees and makes proactive efforts, including development of an environment that allows people with all attributes to work enthusiastically, establishment of a flexible personnel system, and provision of educational opportunities that support autonomous growth of our employees.

https://positive-ryouritsu.mhlw.go.jp/positivedb/detail?id=11012

(2) Women

Our company has been taking proactive action for promoting active participation of women, and our efforts have gained recognition of outside organizations through various awards and certificates that we have received. We will continue our efforts, such as improvement of our workplace environment, provision of opportunities for broadening experience, and support for autonomous career development, and conduct activities aimed at building pipelines at each hierarchical level and increasing the ratio of female workers in various positions to raise the number of female workers who will be involved in business decision-making processes.

<<Target ratio of female workers in managerial positions: Database regarding Promotion of Women’s Participation and Advancement by the Ministry of Health, Labour and Welfare>>

Visit the following website concerning the general employer action plans pursuant to the Women’s Advancement Promotion Law

https://positive-ryouritsu.mhlw.go.jp/positivedb/detail?id=11012

Our company promotes employment of human resources from all over the world regardless of nationality, and about 170 regular and non-regular employees with foreign nationalities are currently working at our company inside and outside Japan. While we are doing business mainly in Japan, we will promote human resources to managerial positions based not on their nationalities or genders, but on their abilities and business performance according to our business expansion overseas in the future.

(4) Employment of mid-career workers

Our company proactively employs mid-career workers (including workers whose employment status is changed from the contract employee to the regular employee) so as to secure work-ready human resources, and mid-career workers account for about 75% of all of our employees and make up about 80% of the employees in managerial positions, playing active roles in every level and post. We will continuously endeavor to further expand diversity in our company through proactive mid-career employment.

[Supplementary principle 3-1-3 Initiatives on sustainability]

In the medium-term management plan that our company disclosed on October 7, 2020, we have presented social issues to be addressed, and our image of achievement against the issues as of the end of fiscal year 2022 based on our corporate philosophy, important issues, and policies to focus on.

In addition, regarding investment in human capital, we not only secure skilled human resources by changing the contract type from fixed-term employment to the permanent employment, but also enhance our human capital by providing support to them so that they can work for a long period of time with a sense of security through opportunities of special pre-employment training that enable them to acquire necessary skills in advance.

Concerning investment in intellectual property, we make strategic investment in such items as AI and systems based on the objective of promoting digital transformation (DX) that we have defined in our medium-term management plan.

We expect that risks and revenue opportunities associated with climate change will have negligible impact on our company’s business activities and earnings, and the environmental burdens that our business activities impose will also be limited.

We will identify risks and opportunities and set numerical targets after assessing the impact and risks that climate change issues may cause on our company’s business, based on an understanding of the current situation and scenario analysis according to the framework of the Task Force on Climate-related Financial Disclosures (TCFD). Furthermore, we will strengthen our governance systems that are related to policy formulation and implementation, and apply them to our medium- and long-term strategies and roadmaps as appropriate.

[Supplementary Principle 4-11-1 Views on appropriate balance between knowledge, experience, and skills of the board of directors as a whole, and on the diversity and size of the board]

Our Articles of Incorporation specify that the maximum number of directors shall be 15. Our board of directors currently consists of nine members, which we consider to be in an optimal range that enables the board and our corporate group to function effectively and efficiently at their current sizes.

We have decided to appoint multiple independent outside directors and outside corporate auditors from the perspective of ensuring the diversity and objectivity of the board of directors and the board of corporate auditors, and currently, three out of the nine directors are independent outside directors and one out of the three corporate auditors is an independent outside auditor.

Our company selects candidates for directors and corporate auditors from individuals who have extensive experience, profound insight, and advanced expertise from the inside and outside of our company regardless of gender, age, or nationality, and independent outside directors and outside corporate auditors, in particular, shall be selected from those who fulfill the criteria for independence that our company has formulated based on the standards for independence of outside directors set forth by the Tokyo Stock Exchange (TSE) and are capable of giving opinions from independent and professional viewpoints by using their knowledge and experience in their fields of expertise. Our directors shall include at least one person who has experience with corporate management, and our corporate auditors shall contain at least one person with a considerable degree of knowledge regarding financial affairs and accounting.

Our policy on appointment of candidates for directors and corporate auditors is to take into account diversity including gender and internationality, and attain a proper balance between knowledge, experience, and skills of the board of directors and the board of corporate auditors as a whole, and the nominating committee develops proposal for candidates and obtains approval of the board of directors. We started to disclose the knowledge, experience, and skills of the board of directors and the board of corporate auditors as a skill matrix in the convocation notice of the general shareholder meeting held in May 2021.

Currently, two out of the 12 members of the board of directors and the board of corporate auditors are women at our company.

[Principle 5-1 Policy for constructive dialogue with shareholders]

In order to achieve sustainable growth and improve mid/long-term corporate value, our company will conduct constructive dialogues with shareholders within an appropriate range and an appropriate method in accordance with the following policies.

(1) Directors in charge of IR will be designated and said Directors will manage all dialogues with shareholders.

(2) The IR division will be established under the supervision of Directors in charge of IR and promote the appropriate exchange of information and organic cooperation among the management planning division, the accounting/financial division, and other related divisions.

(3) In order to enrich the means of dialogues with shareholders, a session for briefing financial results will be held at the time of announcement of interim and full-year results.

(4) Shareholders’ opinions, etc. grasped through dialogues will be reported to the Directors in charge of IR and relevant divisions and shared with the Board of Directors when necessary.

(5) We will conduct dialogues with shareholders pursuant to the regulations for preventing insider trading, which stipulate the prohibition of information transmission and promotion of transactions, and necessary measures for limiting the forwarding of insider information

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Reports (BELLSYSTEM24 Holdings, Inc.:6183) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/