Bridge Report: (6184) Kamakura Shinsho

Representive Director, President and Chairman Hirotaka Shimizu | Kamakura Shinsho, Ltd. (6184) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service business |

President | Hirotaka Shimizu |

HQ Address | 7F, Yaesu Center Bldg., 1-6-6, Yaesu, Chuo-ku, Tokyo |

Year-end | January |

Homepage |

Stock Information

Share price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,588 | 37,437,424 shares | ¥59,450 million | 16.0% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥3.00 | 0.2% | ¥15.63 | 101.5x | ¥69.50 | 22.8x |

* Stock price as of the close on March 15, 2019. The number of shares issued is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter. ROE and BPS are taken from the previous term’s results.

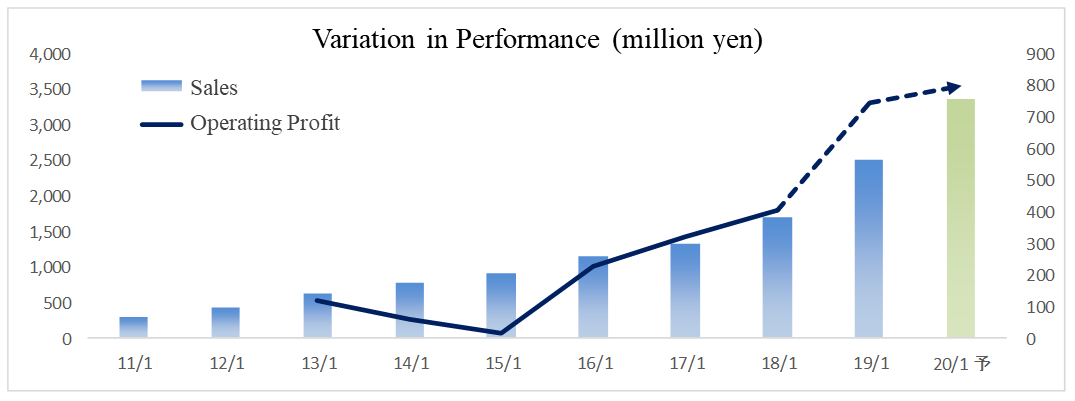

Consolidated Earnings Trends

Fiscal Year | Sales | Operating profit | Recurring profit | Net income | EPS | DPS |

January 2015 (Act.) | 917 | 12 | 27 | 10 | 1.49 | - |

January 2016 (Act.) | 1,147 | 225 | 211 | 125 | 4.35 | - |

January 2017 (Act.) | 1,332 | 327 | 324 | 206 | 6.34 | - |

January 2018 (Act.) | 1,709 | 405 | 360 | 254 | 7.23 | 6.00 |

January 2019 (Act.) | 2,503 | 744 | 728 | 415 | 11.18 | 3.00 |

January 2020 (Est.) | 3,360 | 800 | 790 | 585 | 15.63 | - |

*Unit: million yen, yen

*The forecasted values were provided by the company. It undertook a 1:200 stock split in August 2015, a 1:4 stock split in October 2016, and a 1:4 stock split in September 2018 (EPS revised retroactively)

* Consolidated accounting from the term ended January 2019. From this term, net income means the profit attributable to owners of parent. Hereinafter the same applies.

We will present the outline of Kamakura Shinsho’s settlement of accounts for the fiscal year (FY) ended January 2019, forecasts and initiatives for FY ending 2020 in this Bridge Report.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended January 2019 Earnings Results

3. Fiscal Year ending January 2019 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended January 2019, sales rose 46.5% from the non-consolidated sales in the previous term, and operating profit grew 83.7% from the non-consolidated operating profit in the previous term. The rate of expansion of the graves, funerals, and Buddhist altars businesses was accelerated through a variety of such efforts as strengthening of the call center functions. Productivity improved following a relative reduction in fixed costs, allowing sales, operating and other profits to hit record highs. The company propelled forward the creation of a service development system across the board by setting up a product development department. The term-end dividend is to be 3 yen/share (Given the 4-for-1 share split that was carried out in September 2018, the dividend increased by 1.5 yen. The estimated payout ratio is 27%).

- In the term ending January 2020, sales and operating profit are estimated to go up 34.2% and 7.5%, respectively, year on year. Amid expectations for ongoing growth in the existing businesses, the company will keep making upfront investments in cementing relationships with service partners, performing more intense marketing activities aimed to raise public awareness of the company (investments in medium- and long-term marketing and public relations activities), and enriching the services related to the end-of-life market. Operating loss, and medium- and long-term marketing and public relations investments in a new business will be recouped, and the company is expected to continue to mark record profits.

- Kamakura Shinsho aims to develop the memorial service mediator and introduction businesses by learning about users of the services and expanding the lineup of services it provides, and become an entity that is capable of offering services with true values to aged people and their family members for their end-of-life activities. In the services related to end-of-life activities, the company is seeking to provide services through which it understands what people of advanced ages and their family members require better than anybody else, listens to them about “what they wish to do,” “what they feel they should do,” and “their troubles,” cuddles up with them, and settles issues together with them. We would like to keep an eye on the approaches of Kamakura Shinsho that strives to not only expand business, but also contribute to building a rich society.

1. Company Overview

Based on the concept of “helping people connect with other people,” the company is pursuing business development focusing on the end-of-life market. The end-of-life market is a market related to preparation for after-death, funeral, altar, grave and reconstruction of the lives of the bereaved families. The company operates portal websites including “Good Funeral,” a site to provide information about funeral homes, funeral halls and crematorium, “Good Grave,” a site to provide cemetery and tombstone stores, and “Good Altar,” a site to provide information about stores for Buddhist altar and its fittings. Furthermore, it is engaged in production and sales of monthly “Butsuji,” which is the only business magazine for the memorial service industry, and books related to the end of life.

1-1 Corporate Philosophy

The corporate philosophy is “We contribute toward the creation of a bountiful society by helping to provide settings that engender a sense of thankfulness for interpersonal connections.”

Under the idea that the exchange of “kindness” and “thankfulness” is the foundation for forming a rich society, Kamakura Shinsho aims to be the company which contributes to society furthermore by increasing the moment of feeling “thankfulness” in various stages of life in the society.

1-2 Corporate History

In April 1984, it was established with the aim to publish books for the Buddhist altar and its fittings industry. However, when Mr. Hirotaka Shimizu assumed the representative director of the company, he redefined the corporate strategy by stating that “the value we provide is ‘information’” under the idea that “People who buy books are not seeking printed materials but looking for information that is written in books.” From the viewpoint of the information processing industry, the company launched a website “Good Funeral” that provides information concerning the funeral companies nationwide, funeral manners etc. in October 2000, as a new business field being “an information business including Internet business”. The company started operating an additional two portal websites, “Good Grave” and “Good Altar,” in December 2003.

1-3 Business Description

The company’s businesses are divided into the Web Services Business focusing on management of portal websites, including matching platform for graves, funerals, Buddhist altar and its fixtures, and the Publications, Others Business for planning, production, and sales of books concerning the end of life and holding seminars. In FY ended January 2019, the sales composition ratio was 93% for the Web Services Business (89% in FY ended January 2018) and 7% for the Publications, Others Business (11% in FY ended January 2018).

1-3-1 Web Services Business

The company disseminates information on services and products through portal websites covering the entire end-of-life fields including preparation for death, funeral, altar, grave, and inheritance. It also supports website users’ decision making by responding to inquiries and providing consultation at the customer center. Meanwhile, the company provides sales support services and introduces prospective customers to business operators of funeral companies, stores of Buddhist altar and its fittings, tombstone stores, and temples and cemeteries that are on the company’s websites. The website users receive services for free. The company receives a contract payment when the contract is settled between the prospective customer whom the company introduced and the business operator (about 10 to 20% of the contracted amount). It is a friendly system to the business operators, because it can be considered as “deferred advertisement expenditure.”

The competitors in the industry include, as for the funeral services, AEON LIFE Co., Ltd., a leading distribution company, and UNIQUEST ONLINE INC. which operates “Small Funeral” and “Funeral book.com.” As for tombstone, there are Metropolitan stone cooperatives that operate “Moshimo.dot.net,” Ohnoya of Memorial Art, and Nihon Butsuji Net. The scale of the market is 1.4 trillion yen for the funeral market and 163.9 billion yen for the market of Buddhist altar and its fittings.

Key Performance Indicators = Compensation when a contract is settled: Introductions × closing rate × Unit price × Commission rate

To increase compensation, the company has been making efforts to increase the introductions and improve the closing rate, and as a result, it is hoping to lead the market share expansion to raise the commission rate. To increase the introductions, it is necessary to enhance contents, improve leads, improve designs, and use advertisements. To improve the closing rate, it is necessary to strengthen communication with the website users and strengthen collaboration with the business operators.

Business domain and operation site

Overview of the major websites

| ・This portal site, established in October 2000, facilitates the choosing of funeral homes, funeral halls, and crematoria throughout Japan. ・Users can select funeral homes and funeral service plans based on their desired area, format, and budget.The site also provides information about funeral service arrangements and attendance. |

| ・This portal site, established in December 2003, facilitates the selection of Buddhist altars, fittings, and shops throughout Japan.・Users can set location and desired conditions and search for Buddhist altars, fittings, and shops based on word-of-mouth information from people who have made purchases in the past.・The site also contains information about repairing and restoring Buddhist altars |

| ・This portal site, established in December 2003, facilitates the search for cemeteries, graveyards, and grave plots throughout Japan.・Users can search for cemeteries and graveyards that meet such criteria as desired area, current location, and budget.The site also allows for searches with special conditions, such as cemeteries that also allow pets or that have ocean views. |

| ・One of the solutions proposed by Kamakura Shinsho for bidding farewell to the deceased while appreciating the kindness of those who have been acquainted with the deceased without using cookie-cutter methods. |

Publications, Others Business

The company issues various publications related to memorial services such as funerals, graves and altars by monthly “Butsuji” (annual subscription fee: 16,200 yen including tax), which is a business information magazine for business operators in the memorial service industry. Name recognition, trustworthiness, industry network, and content creation power as a publisher are also utilized for Internet services. It is a business with synergies that cannot be measured by sales or profit.

2. Fiscal Year ended January 2019 Earnings Results

2-1 Earnings

| FY Jan. 18 (Nonconsolidated) | Ratio to sales | FY Jan. 19 (Consolidated) | Ratio to sales | YoY | Forecast | Difference from the forecast |

Sales | 1,709 | 100.0% | 2,503 | 100.0% | +46.5% | 2,500 | +0.2% |

Gross Profit | 1,087 | 63.6% | 1,760 | 70.3% | +61.9% | - | - |

SG&A | 682 | 39.9% | 1,015 | 40.6% | +48.9% | - | - |

Operating profit | 405 | 23.7% | 744 | 29.7% | +83.7% | 740 | +0.6% |

Recurring profit | 360 | 21.1% | 728 | 29.1% | +102.2% | 710 | +2.6% |

Net income | 254 | 14.9% | 415 | 16.6% | +62.9% | 400 | +3.8% |

*Values in this table and other parts of this report include figures which have been calculated by Investment Bridge Co., ltd. as reference values, and may differ from actual figures.

* Unit: million yen

Sales and operating profit rose 46.5% and 83.7%, respectively, from the non-consolidated results in the previous term.

Sales were 2,503 million yen, up 46.5% from the non-consolidated sales in the previous term. With the results of such efforts as development of partner companies, measures related to search engine optimization (SEO), and enhancement of the outbound calls strategy, becoming evident, sales in the Web services business showed a 52% year-on-year growth.

Operating profit went up 83.7% from the non-consolidated operating profit in the previous term to 744 million yen. Selling, general and administrative (SG&A) expenses rose by 48.9% from the non-consolidated result in the previous term to 1,015 million yen due not only to the increasing expenses for advertising and outsourcing following a sales rise, but also to costs associated with the subsidiaries (two of the company’s subsidiaries were dissolved in the term ended December 2018 and they are scheduled to be liquidated by the end of fiscal December 2019), growth in communication costs pertaining to business expansion, and an increase in the number of offices (which is included in the Others section); however, these rising costs were recouped by the sales growth and the improved gross profit rate, resulting in a significant increase in operating profit.

Breakdown of sales

| FY Jan. 18 | Composition ratio | FY Jan. 19 | Composition ratio | YoY |

Graves business | 981 | 57% | 1,357 | 54% | +38% |

Funerals business | 400 | 23% | 715 | 29% | +78% |

Buddhist alters business | 146 | 9% | 260 | 10% | +79% |

Web services | 1,529 | 89% | 2,332 | 93% | +53% |

Publications, others (Seminar, etc.) | 180 | 11% | 171 | 7% | -5% |

Total | 1,709 | 100% | 2,503 | 100% | +46% |

* Unit: million yen

Breakdown of operating expenses

| FY Jan. 18 | Composition ratio | FY Jan. 19 | Composition ratio | YoY |

Personnel expenses | 651 | 50% | 673 | 38% | +22 |

Advertising expenses | 177 | 14% | 291 | 17% | +114 |

Business consignment expenses | 117 | 9% | 189 | 11% | +72 |

Cost of sales for publications, others | 74 | 6% | 67 | 4% | -7 |

Subsidiary expenses | - | - | 86 | 5% | +86 |

Others | 285 | 22% | 453 | 26% | +168 |

Total | 1,304 | 100% | 1,759 | 100% | +454 |

* Unit: million yen

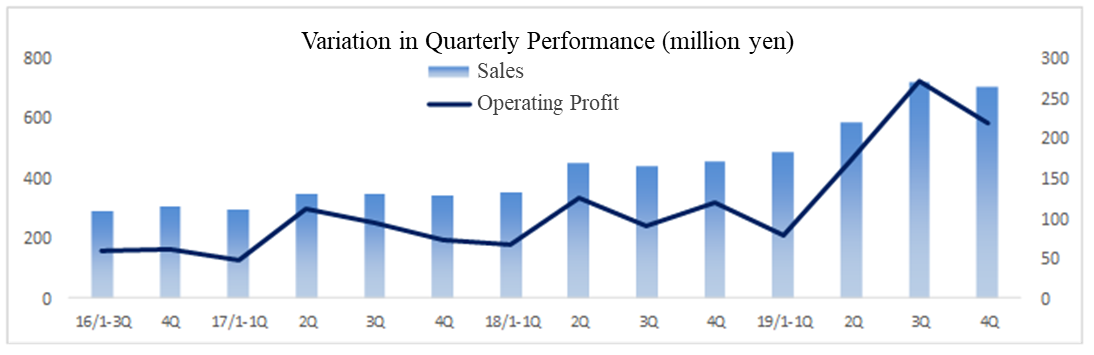

2-2 Trend of Each Business

Graves business | 1Q 1/18 | 2Q | 3Q | 4Q | 1Q 1/19 | 2Q | 3Q | 4Q |

Introductions | 7,440 | 7,909 | 8,983 | 7,342 | 9,997 | 9,161 | 11,156 | 9,251 |

Unit price (Yen) | 90,221 | 88,131 | 94,503 | 93,311 | 96,018 | 92,669 | 104,858 | 88,499 |

Closing rate* | 14.2% | 14.4% | 12.9% | 14.2% | 15.1% | 17.3% | 20.1% | 20.1% |

*“Closing rate” indicates introductions on which contracts are closed within three months. Due to scheduling issues, some measurements are incomplete.

In the fourth quarter (November to January), sales stood at 374 million yen, up 43% year on year. While the number of introductions increased by 26% year on year despite a 5% year-on-year decrease in the average spending per customer, the closing rate grew 78% year on year because the rate was maintained at a high level of 20.1%. A variety of efforts bore fruit, including enhancement of the graveyard tour service offered to those who have requested for brochures, improvement in customer reviews, and follow-up calls to prospective customers after their graveyard tours, resulting in increases in the number of introductions and the contract closing rate. Regarding graveyard tours, the company conventionally provided those who requested for brochures with information on graveyard tours after sending brochures to them; however, it has decided to introduce prospective customers to its graveyard tour service when it has received inquiries from them about brochures.

Funerals business | 1Q 1/18 | 2Q | 3Q | 4Q | 1Q 1/19 | 2Q | 3Q | 4Q |

Introductions | 2,136 | 2,153 | 2,313 | 2,693 | 2,951 | 3,157 | 3,519 | 4,393 |

Unit price (Yen) | 81,887 | 75,381 | 83,828 | 84,554 | 81,024 | 94,605 | 81,916 | 82,574 |

Closing rate* | 41.0% | 41.6% | 37.0% | 40.8% | 36.5% | 37.5% | 41.0% | 38.5% |

In the fourth quarter (November to January), sales were 208 million yen, up 87% year on year. While the number of introductions showed a significant increase of 63% year on year despite a 2% year-on-year decrease in the average spending per customer, the numbers of successful contracts grew 54% year on year because the contract closing rate was maintained at a high level of 38.5%. The factors behind the jump in the number of introductions are the company’s endeavors to prevent loss of opportunities, which were caused by the company’s inability to introduce funeral homes due to geographic reasons and capacity shortages, by setting up a dedicated team and redoubling the effort to prospect for funeral homes, increase the display speed on its portal websites by redesigning them, and enhance measures related to content marketing and SEO. The average spending per customer is more likely to fluctuate than that of the Graves or Buddhist altars business because the average spending per customer in this segment is influenced greatly by such factors as the rate of being accompanied by religious people (introduction by Buddhist monks) and use of options. Furthermore, the contract closing rate is difficult to control and easily fluctuates because the period that the company has to conclude contracts in this segment is shorter than that in the other two segments.

Buddhist altars business | 1Q 1/18 | 2Q | 3Q | 4Q | 1Q 1/19 | 2Q | 3Q | 4Q |

Introductions | 2,871 | 3,462 | 3,409 | 3,311 | 3,956 | 4,605 | 4,698 | 5,380 |

Unit price (Yen) | 22,295 | 21,155 | 23,622 | 24,965 | 21,673 | 24,614 | 25,539 | 26,889 |

Closing rate* | 36.6% | 35.9% | 33.5% | 29.8% | 31.6% | 31.6% | 30.8% | 28.2% |

*“Closing rate” indicates introductions on which contracts are closed within 60 days. Due to scheduling issues, some measurements are incomplete.

In the fourth quarter (November to January), sales grew 85% year on year to 75 million yen. The contract closing rate shrank 1.7 points year on year to 28.2%; however, the number of introductions showed a significant rise of 62% year on year, increasing the numbers of successful contracts by 54% year on year. The average spending per customer also grew 8% year on year. Although the closing rate is declining overall, the company entered into contracts at an accelerating rate each quarter because of growth in natural inflow of customers thanks to the re-enhanced SEO and the increasing number of introductions due to positive results of the effort to receive favorable customer reviews.

2-3 Financial Condition and Cash Flow

Financial Condition

| Jan. 2018 | Jan. 2019 |

| Jan. 2018 | Jan. 2019 |

Cash | 1,862 | 2,062 | Payables | 66 | 84 |

Current Assets | 2,229 | 2,757 | Taxes Payable | 100 | 269 |

Intangible Assets | 34 | 129 | Liabilities | 242 | 426 |

Investments, Others | 131 | 84 | Net Assets | 2,219 | 2,614 |

Noncurrent Assets | 231 | 282 | Total Liabilities, Net Assets | 2,461 | 3,040 |

* Unit: million yen

Cash Flow (CF)

| FY Jan. 18 (Nonconsolidated) | FY Jan. 19 (Consolidated) | YoY | |

Operating cash flow | 218 | 380 | +161 | +73.6% |

Investing cash flow | -112 | -147 | -34 | - |

Financing cash flow | 1,013 | -27 | -1,041 | - |

Cash, Equivalents at the end of term | 1,832 | 2,037 | +205 | +11.2% |

* Unit: million yen

3. Fiscal Year ending January 2020 Earnings Forecasts

3-1 Full-year Earnings Forecasts

| FY Jan. 19 Act. | Ratio to sales | FY Jan. 20 Est. | Ratio to sales | YoY |

Sales | 2,503 | 100.0% | 3,360 | 100.0% | +34.2% |

Operating profit | 744 | 29.7% | 800 | 23.8% | +7.5% |

Recurring profit | 728 | 29.1% | 790 | 23.5% | +8.5% |

Net income | 415 | 16.6% | 585 | 17.4% | +40.9% |

* Unit: million yen

Sales and operating profit are estimated to grow by 34.2% and 7.5%, respectively, year on year.

Amid expectations for ongoing growth in the existing businesses, the company will keep making upfront investments in cementing relationships with service partners, strengthening marketing activities for raising public awareness of the company (investments in medium- and long-term marketing and public relations), and enriching services related to end-of-life activities.

Sales are projected to go up 34.2% year on year to 3,360 million yen. In addition to a 32% year-on-year sales rise to 3,310 million yen in the existing businesses, it is anticipated that the company will generate sales of 50 million yen through a new business of inheritance tax-related services, such as introduction to taxation accountants. Operating profit is estimated at 800 million yen, up 7.5% year on year. While operating profit will grow 14.1% year on year to 1,050 million yen in the existing businesses, the company is expected to record an operating loss of 180 million yen in the new business. Furthermore, investments of 70 million yen in medium- and long-term marketing and public relations activities are taken into account.

Breakdown of Sales and Profits

| Existing Business | New Business | Marketing and PR investment in Mid to Long term | Total | |

Sales | 3,310 | 50 | - | 3,360 | |

Operating profit | 1,050 | -180 | -70 | 800 | |

Recurring profit | 1,040 | -180 | -70 | 790 | |

Net income | 750 | -120 | -40 | 585 | |

* Unit: million yen

3-2 Goals and Actions

3-2-1 Goals

Kamakura Shinsho aims to develop the memorial service mediator and introduction businesses by learning about users of the services and expanding the lineup of services it provides, and become an entity that is capable of offering services with true values to aged people and their family members for their end-of-life activities. In the services related to the end-of-life market, the company is seeking to provide services through which it understands what people of advanced ages and their family members require better than anybody else, listens to them about “what they wish to do,” “what they feel they should do,” and “their troubles,” cuddles up with them, and settles issues together with them.

3-2-2 Action Policies of Growth

Kamakura Shinsho has presented the following four action policies of growth with the aforementioned goals kept in mind.

Action Policy 1

In the three mainstay businesses, Kamakura Shinsho will realize high growth and large market share with a focus on “enhancing convenience and easing concerns for users of the services” and “strengthening the fields (such as web-based services and marketing) in which its service partners (funeral companies, Buddhist altar shops, and tombstone shops) are not specialized. In order for that, the company has formed a “clear ideal image” for each business based on which it will take new measures. In addition, it will lay a solid foundation across the board for all of the three businesses. Under the “strategy of becoming an overwhelming leading company,” in the graves business, the company will begin to offer a new type of “grave service” and enhance offline measures. In the funerals business, it will follow the “strategy of providing the best platforms,” launch a preliminary membership system, and fortify Customer Relationship Management (CRM) and peripheral services. In the Buddhist altars business, implementing the “Only One strategy,” the company plans to reform its business model and strive to increase the number of customers visiting its shops and the contract closing rate. It will also endeavor to maximize productivity by strengthening the aforementioned businesses in a cross-organizational manner. The company has cited the following items as measures to take: cementing relationships with business partners, propelling forward formation of new business alliances, promoting cross-selling of products across the three businesses, aggregating and enhancing customer center functions, evolving contents marketing, and rotating and developing human resources.

Action Policy 2

Kamakura Shinsho will thoroughly strengthen its capabilities to learn about and understand users of the services, and settle their issues. For that, it will work on expanding the touch point that is the direct point of contact with users, establishing a platform for knowledge and data based on the information of the service users, developing and attracting life-ending market experts, and expanding the touch point in the field of end-of-life activities.

Activities in the term ending January 2020

・Enhance call center functions and enrich marketing functions for the purpose of accurately grasping the genuine demand of users

・Adopt and establish a data infrastructure that is capable of unifying and analyzing the data of each business

・Further strengthen the survey system and set up a research body in order to have a better idea of the market

・Deal with users who are introduced through the end-of-life service of Japan Post Co., Ltd, which has advantages in offline services

Kamakura Shinsho expanded the area covered by the pilot “end-of-life introduction service,” which it is propelling forward in cooperation with Japan Post Co., Ltd., into the entire Tokyo Metropolitan area in February 2019. It plans to cope with various inquiries about end-of-life activities, grasp users’ demand and utilize the achievements of these efforts for developing future services. In addition, it will consider further expanding the area to cover with the service based on the results of the trial run in Tokyo.

Action Policy 3

Kamakura Shinsho will develop a business for providing the highest level of services to aged people and their family members for their end-of-life activities. As part of the approach, it will adopt new services that can be unsurpassed by any other firms, following the “Story” service (a service of producing parties for bidding the deceased farewells and ones for commemorating the deceased), and generate and develop services with true values in end-of-life activities. For this purpose, the company will strengthen the new business development team and establish a system that allows more proactive M&A and corporate planning.

Activities in the tern ending January 2020

・Newly forge a partnership with House Boat Club Co., Ltd. that is a pioneer of the service of scattering the ashes of the deceased over the sea, and strive for business growth together

・Integrate the financial services preparatory office and the business promotion office for the purpose of enriching and strengthening the new business development team

・Assign as many specialists as possible to the new businesses in order to thoroughly carry through service development

・Establish a corporate planning group that engages in more proactive M&A and other activities, and allocate members with professional skills to the group

As part of the aforementioned approach, Kamakura Shinsho has set up 4 departments in the Life Ending business as organizations in which the conventional “Story” service for wishing the deceased farewells and the operation of House Boat Club Co., Ltd, a pioneer of the service of scattering the ashes of the deceased over the sea, are combined in an attempt to enrich new end-of-life services.

With the service of scattering the ashes of the deceased in Tokyo Bay being the major service, House Boat Club Co., Ltd. engages in end-of-life and memorial services businesses, such as the operation of an end-of-life community, “Blue Ocean Café” (Koto-ku, Tokyo). Taking the diversifying styles of memorial services into consideration, Kamakura Shinsho plans to build a system for offering a wider range of options to new needs arising out of people.

Action Policy 4

The company aims to become an excellent company that has growth potential/profitability and social contribution/social nature by implementing awareness activities of seniors and their families through the end-of-life seminars, publishing “Social Contribution Organization Guidebook” (comparative information of social contribution organizations), and strengthening cooperation with “Tsunagu Inochi Foundation.” Furthermore, to achieve the goal, it will implement activities such as self-realization of seniors and work on social issues related to deceased people leaving no one to attend to their graves, lonely death, seniors in poverty, seniors providing nursing care of seniors, leaving jobs to provide nursing care to a family member, euthanasia and dignity death.

4. Conclusions

The latent demand in the life ending market, in which Kamakura Shinsho is operating, is expected to grow on a continuous basis on the back of the demographics in Japan. According to “Population Projection for Japan” by the National Institute of Population and Social Security Research, people over 65 years old and older will account for more than 38% in 2060. In addition, the utilization rate of “Good Tombstone” by people in their 40s to 60s shows an upward trend. These facts suggest that the rising rate of Internet usage by middle and old aged people that is attributable to their improved IT literacy is a tailwind for the company.

Under such circumstances, Kamakura Shinsho aims to develop the memorial service mediator and introduction businesses by learning about users of the services and expanding the lineup of services it provides, and become an entity that is capable of offering services with true values to aged people and their family members for their end-of-life activities. We would like to keep an eye on the approaches of Kamakura Shinsho that strives to not only expand business, but also contribute to building a rich society under its new business structure.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

◎ Corporate Governance Report

Updated on January 29, 2019

Basic approaches

The company recognizes that establishing corporate governance is indispensable to improve corporate value, maximize shareholder profits, and build good relationships with stakeholders. Specifically, it believes that it is important for the President and directors who have been entrusted with management of the company to discipline themselves, make appropriate management decisions based on their responsibilities, pursue profits through its businesses, secure soundness and improve its reliability, actively disclose information to fulfill accountability, and build an effective internal control system.

<Reasons for Non-compliance with the Principles of Corporate Governance Code (Excerpts)>

【Supplementary principle 4-1-2】

The life ending industry in which our company is operating has been changing dramatically recently, and under such circumstances, we consider that our flexibility and agility for dealing with changes in the environment might be deteriorated if we gave shareholders an absolute commitment on our medium- and long-term management plans. Therefore, our company does not make our medium- and long-term management plans publicly available.

【Supplementary principle 4-1-3】

Our company is developing human resources that have potential to become the successor to Chairman and President Hirotaka Shimizu in the medium and long term. Taking the age of Chairman and President Hirotaka Shimizu into account, we do not hold specific discussions over the plan to nurture successors as an urgent issue at meetings of the Board of Directors.

【Supplementary principle 4-11-3】

In our company, opinions on the effectiveness of the Board of Directors are exchanged as necessary after each director analyzes and assesses it. We will consider whether or not to disclose proper methods of carrying out analysis and assessment of the effectiveness of the Board of Directors as a whole, and an overview of the results.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

In terms of establishment of stable and long-term business relationships with partner companies, and enhancement of business alliances or cooperative business expansion, our company can acquire and possess shares of our partner companies and other companies when we judge that doing so contributes to improving our corporate value in the medium and long term. Regarding major shares among the shares that our company holds, we review the medium- and long-term economic rationality and the effect of possessing them from the perspective of maintaining and strengthening comprehensive relationships with partner companies, and review whether or not we should hold the shares that we have judged will no longer lead to improvement in our corporate value after reporting to the Board of Directors based on the trend of the share price.

Furthermore, regarding proposed bills, our company exercises the voting rights after determining whether to approve or disapprove a relevant bill by comprehensively judging if the exercise of the voting rights will result in deterioration of shareholder value, and whether or not a proposal contributes to our company’s sustainable growth and medium- and long-term increase in our corporate value, while respecting the management policy of each of our partner companies.

【Principle 5-1 Policy for constructive dialogue with shareholders】

At the company, the executive officer responsible for the management department supervises the departments related to IR activities such as Business planning department, Accounting finance department, etc. and develops the IR system. Furthermore, the company carries out dialogues (interviews) at the request of shareholders and investors. It also holds an explanatory meeting for settlement of accounts every six months for investors, and the President himself provides explanations.

TSE Corporate Governance Information Service:http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.

For back numbers of Bridge Reports on Kamakura Shinsho, Ltd. (6184) and Bridge Salon (IR seminar), please go to our website at the following URL.

www.bridge-salon.jp/