Bridge Report:(6191)Airtrip Corp Fiscal Year September 2020

President & CFO Yusuke Shibata | Airtrip Corp.(6191) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service industry |

President & CFO | Yusuke Shibata |

HQ Address | Atago Green Hills Mori Tower, 2-5-1 Atago, Minato-ku, Tokyo |

Year-end | End of September |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE (Actual) | Trading Unit | |

¥1,354 | 20,419,800 shares | 27,648 million | - | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

undecided | - | ¥11.75 | 115.2x | ¥110.44 | 12.3x |

*The share price is the closing price on December 4. Number of shares issued, ROE and BPS are based on earnings results for the fiscal year ended September 2020.

Earnings Trend

Fiscal Year | Sales | Operating Income | Profit before tax | Net Income | EPS | DPS |

September. 2017 Act. | 5,534 | 730 | 695 | 420 | 25.06 | 7.00 |

September 2018 Act. | 12,426 | 1,152 | 1,138 | 855 | 49.09 | 10.00 |

September 2019 Act. | 24,306 | 680 | 588 | 733 | 39.07 | 10.00 |

September 2020 Act. | 21,191 | -8,760 | -8,956 | -8,380 | -418.23 | 10.00 |

September 2021 Est. | 24,000 | 390 | 330 | 240 | 11.75 | - |

*Unit: yen, million yen. The forecast for this term is still to be determined. The Japanese accounting standards were used until FY 9/17. IFRS is discretionally applied from FY 9/18. Profit before tax is the ordinary income based on the Japanese standards. Net income is profit attributable to owners of parent. Hereinafter the same applies.

This report outlines Fiscal Year September 2020 earnings results and other information about Airtrip Corporation.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year September 2020 Earnings Results

3. Fiscal Year September 2021 Earnings Forecasts

4. "AirTrip 2021" Growth Strategy

5. Conclusions

Key Points

- The transaction volume for the fiscal year ended September 2020 was 74.7 billion yen, down 49% year on year. Sales revenue decreased 12.8% year on year to 21,191 million yen due to the impact of COVID-19 pandemic. Gross profit decreased 30.3% year on year to 7,861 million yen. The company reported an operating loss of 8,252 million yen, due to the posting of an impairment loss of 7,466 million yen. Excluding this impairment loss, the operating loss came to 786 million yen.

- For the fiscal year ending September 2021, the company forecasts a transaction volume of 45 billion yen, a sales revenue of 23.5 billion yen, and an operating income of 300 million yen. The company has positioned the term as the beginning of the second stage after listing, which it has dubbed “Restart.” It aims to restart the AirTrip Group through (1) the recovery of the AirTrip Travel Business, (2) steady growth of the other four business areas, and (3) the contribution of earnings from the healthcare business. The annual dividend is undecided, but the company is aiming for a dividend payout ratio of 20%. Demand picked up from October thanks to benefits from the GoTo Travel and Tokyo Citizens Discount campaigns. In October, profit moved into the black on a monthly basis.

- On November 30, the company upgraded its earnings outlook for the fiscal year ending September 2021. It lifted its sales revenue estimate from 23.5 billion yen to 24 billion yen, and its operating income estimate from 300 million yen to 390 million yen. With the GoTo Travel campaign acting as a tailwind, sales and profit are picking up more rapidly than expected, particularly in the domestic travel domain of the AirTrip Travel Business.

- However, while the recent earnings performance has been favorable, there is uncertainty in regards to the GoTo Travel campaign, such as the temporary exclusion of Osaka and Hokkaido and the request to refrain from unnecessary and non-urgent outings in Tokyo. We will be monitoring trends on this front going forward.

1. Company Overview

AirTrip Corp. conducts a variety of businesses centered on the AirTrip online travel business, which operates the comprehensive travel platform "AirTrip," boasting the largest Internet ticket trading volume. In the inbound travel business, the company provides various services to foreign visitors to Japan and private lodging management companies. As for the IT offshore development business, the company has about 1,000 IT engineers and is engaged in the largest lab-type offshore development among Japanese companies. Moreover, the company is focusing on life innovation business that provides services in peripheral areas with synergies under the theme of making customers' lives more convenient in a variety of situations. Their another focus is on the investment business, aiming to expand service lines and improve profits by pursuing synergies through collaborations with investee companies by investing in growing companies.

Their medium-term target is to achieve a trading volume of 500 billion yen.

【1-1 Corporate History】

In May 2007, Tabi Capital Co., Ltd. was established to provide online travel agency services.

Since then, the Company has been expanding its product line-up through M&A and business transfers.

In March 2012, the Company began IT offshore development business in Vietnam. Taking this opportunity, in order to clearly show the Company’s direction towards the integrated IT business, it changed its name to Evolable Asia Corp. in October 2013.

In March 2016, it was listed on the Mothers Section of the Tokyo Stock Exchange. One year later, in March 2017, it moved to the First Section of the Tokyo Stock Exchange.

In May 2018, the company achieved the largest Internet trading volume of airline tickets due to the reorganization of the former DeNA Travel into a subsidiary.

On January 1, 2020, as the operating company of "AirTrip," which has the largest Internet trading volume of airline tickets, the company unified its trade name and brand name to build a stronger business foundation and further improve the popularity of the "AirTrip" brand. Also, the company changed its name to AirTrip Corp. to demonstrate its stance of concentrating on various businesses centered on "AirTrip."

【1-2 Corporate Philosophy, etc.】

Corporate Philosophy | One Asia Becoming a Leading Company in the Golden Age of Asia

Asia is emerging as a single economic zone. Under this circumstance, through the movement of people and businesses, AirTrip will serve as a bridge linking Asia. AirTrip links Asia, and Asia becomes connected. |

Mission | We will continue to grow endlessly by grasping all the changes in the Asian economic area as business opportunities. |

Code of conduct | *Always put customers first! We are always aware of our customers’ point of view and work for the customers

*Conscientiousness, peace of mind and trust are more important than anything! It is the core of our business to provide detailed work, give peace of mind to our customers and respond to their trust.

*Continue to improve as professionals! We cannot grow unless we improve each and every aspect of our work.

*Swift response, fast implementation, speed! We respond to our customers faster than any other companies and develop a system faster than any other companies.

* Timesaving by restricting time for dealing with visitors in 30 minutes, and for meetings in 20 minutes. Achieve work-life balance. |

【1-3 Market Environment】

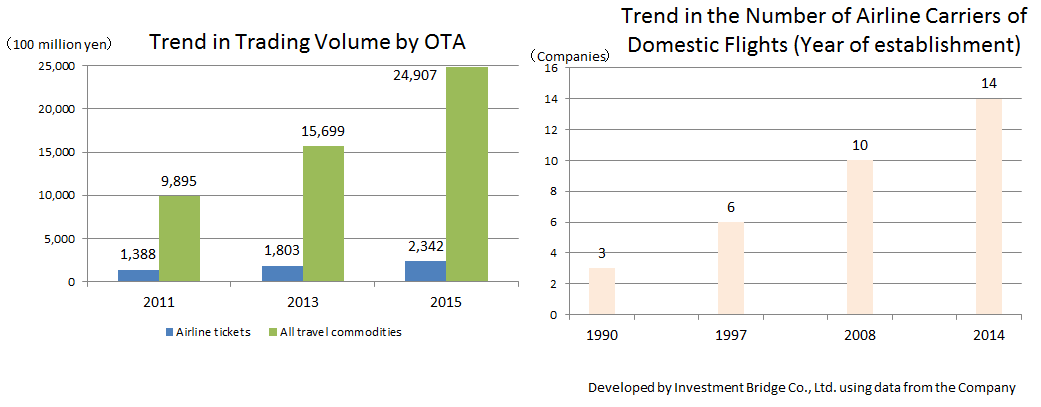

◎Online travel commodities sales continue to grow.

The number of airline companies providing domestic flights has increased due to the rapid growth of low-cost carriers (LCCs). This has resulted in an increase in OTA users due to growing demand for comparison searches. The trading volume of travel commodities by OTA in the Fiscal Year 2015 was 2.5 trillion yen with an annual growth rate of 26% since 2011. It is a rapidly growing industry.

The domestic accommodation market mainly supported this rapid growth. The trading volume of airline tickets was 230 billion yen, indicating a double-digit growth at an annual rate of 14%. Thus, in the future, following the domestic accommodation market, the domestic airline tickets market is expected to grow significantly.

However, the novel coronavirus's impact has forced travel demand to stagnate, and the future recovery trend is uncertain.

◎IT offshore development that has a large potential for growth

The outsourcing software development market in Japan is about 10 trillion yen, and the annual growth rate is about 3%. Among them, the offshore development is only about 1% (about 100 billion yen).

In the US, the rate is over 10%, indicating that the Japanese market can grow to the scale of 1 trillion yen (increase from current 1% to 10%).

Actually, the order amount from Japan to Vietnam is increasing at an annual rate of 17.8%.

【Business Description】

There are five business domains: AirTrip online travel business, Inbound travel agency business, IT offshore development business, Life innovation business, and Investment business.

With the company name change in January 2020, the online travel agency business name was changed to AirTrip online travel business, and life innovation business was separated from the online travel agency business.

(There have been no changes in the reporting business segments. They are divided into online travel agency business segment, IT offshore development business segment, and investment business segment. The inbound travel business is included in the online travel agency business segment.)

(1) Online Travel Agency Business

① AirTrip online travel Business

It sells travel products such as domestic airline tickets, domestic accommodations, overseas airline tickets and overseas accommodations through the comprehensive travel platform "AirTrip" and various sales channels.

Domestic airline tickets | ・Contracts signed with all domestic airline groups |

Domestic accommodations | ・Offering 1,400 facilities, mostly luxurious ryokans, in Japan. |

Overseas airline tickets / accommodations | ・Issuing international airline tickets as an authorized IATA agent (※). ・Offering about 40,000 overseas facilities. |

※IATA (International Air Transport Association): The IATA is a trade association of the world’s airlines.

Sales channels | Overview |

Direct managed site (B-to-C) | The Company operates integrated service platform at “AirTrip”. |

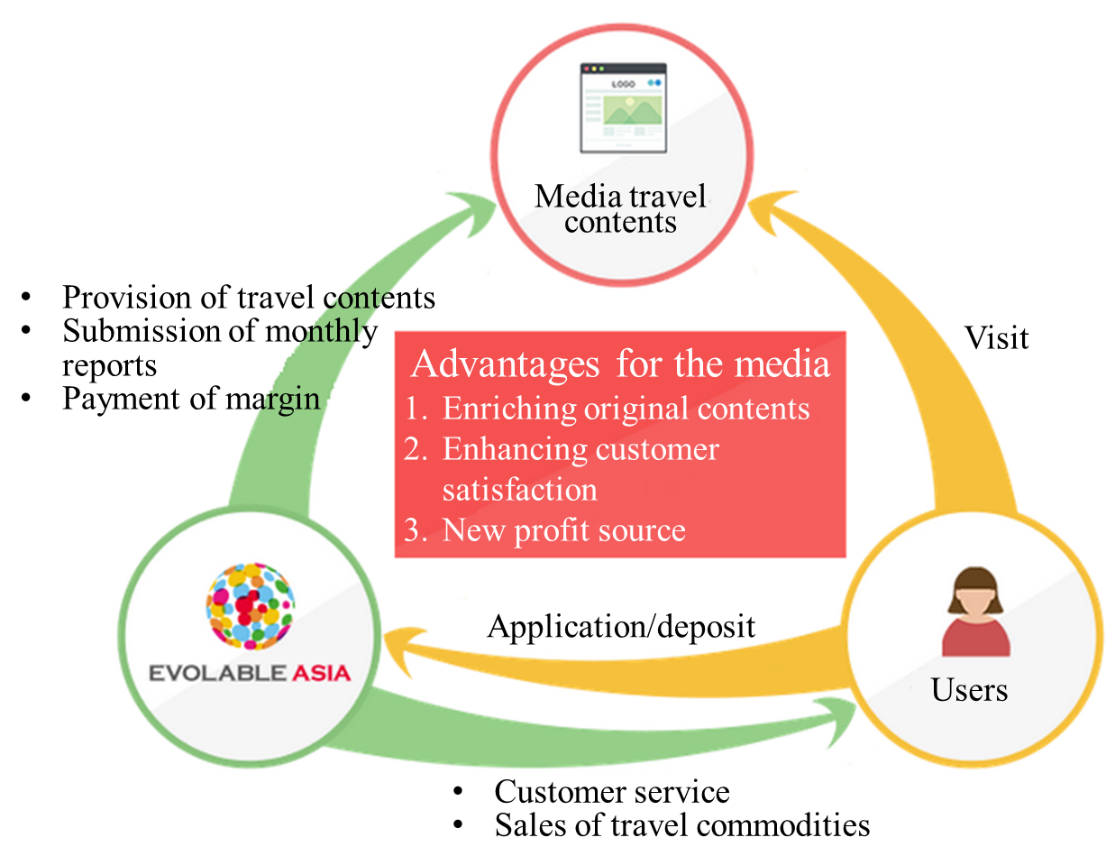

B-to-B-to-C | The Company provides travel content to the online media of over 500 companies. The media will enjoy benefits such as enriching original content, enhancing customer satisfaction, and creating new profit sources. |

Wholesale service (B-to-B) | The Company provides mainly domestic airline tickets and sales management systems to travel agencies. |

Business Travel Management (BTM) | The Company provides a free cloud-based service called “AirTrip BTM” for corporate business trip management. The company has contracts with 3,529 companies (as of September 2020). |

Initially, the comprehensive travel platform "AirTrip" mainly handled domestic airline tickets. Now, it is rapidly expanding its lineup including overseas airline tickets, hotels, domestic and overseas tours, buses, rental cars, and the Japanese bullet train (Shinkansen).

Moreover, the company steadily increased the number of users by actively developing various advertising activities such as TV commercial to raise awareness, operating various campaigns, and improving UI and UX on a daily basis.

The number of customers for Business Travel Management, which arranges business trips for corporate users, has steadily increased to 3,516 companies as of the end of March 2020.

(Strengths of business)

The Company has the largest trading volume of domestic airline tickets in the Japanese OTA industry.

The agreements with all domestic airline groups, a unique business condition enjoyed only by the Company, enable the Company to issue flight tickets. Advantageous procurement prices combined with self-issuing of tickets (no need to outsource) make its cost competitiveness overwhelmingly strong.

In addition, the Company has “competitive supply routes” based on strong relationships of trust with each airline company resulting from long-term business relationships, “diverse sales routes”, and “low-cost system development using its own offshore IT development capacity”. Because of these factors, the Company has created high barriers to entry.

② Inbound Travel Business

In order to respond to the demand from the inbound foreign travelers, the Company offers multilingual websites (currently 7 languages) to sell travel commodities directly to inbound travelers online and provide search/reservation engine of domestic travel content (mainly domestic flight tickets) on an OEM basis to the local travel agencies and media operators primarily in the Asian region.

In addition to starting Japanese first system collaboration in the domestic airline ticket field with Ctrip.com (the largest travel company in China), the company is promoting partnerships with other Chinese travel agencies.

(From the company's website)

(Strengths of business)

The Company’s expertise in OEM provision and its proprietary offshore development allow them to meet customers’ needs with inexpensive and speedy development.

(2) IT offshore development business

The Company hires about 1000 engineers in 3 locations (Ho Chi Minh, Hanoi, and Da Nang) in Vietnam as of March 2020.

It offers system development of web services, applications, etc. and business process outsourcing (BPO). The customers are mostly web service providers such as GREE, Inc.

(Strengths of business)

The Company has recruiting capabilities in Vietnam and expertise in starting development teams.

Against the backdrop of a shortage of IT engineers and rising wages for engineers in Japan, since its establishment in 2012, the Company has grown to have the largest number of employees among the Japanese offshore development companies in Southeast Asia.

The company does not offer entrusted development but is specialized in lab-style development services.

The operation rate is almost 100% because the Company forms a team with dedicated staff members for each customer to reflect the customer’s needs on a long-term (in principle, over a year) contract basis and the team operates under respective customer.

In addition, customers are billed engineers’ cost from the time of employment. Therefore, there is no risk for the Company in terms of delayed delivery or idle employees.

Because of its stock business model, scale expansion and significant increase in earnings can be expected.

(3) Investment business

It is positioned as the business having characteristics of CVC (corporate venture capital). The company will pursue a synergistic effect as well as opportunities for capital gains. The company also engages in investment incubation business.

As of September 2020, the company had invested in 64 companies, and the total investment amount was 2.3 billion yen.

2. Fiscal Year September 2020 Earnings Results

(1) Consolidated Business Results

| FY 9/19 | Ratio to sales | FY 9/20 | Ratio to sales | YoY |

Trading volume | 146,000 | - | 74,700 | - | -48.8% |

Sales revenue | 24,306 | 100.0% | 23,206 | 100.0% | -4.5% |

Gross profit | 11,285 | 46.4% | 7,861 | 33.9% | -30.3% |

Operating Income | 680 | 2.8% | -8,252 | - | - |

Net income for this period | 733 | 3.0% | -8,380 | - | - |

*Unit: million yen. IFRS is applied. Net income for this period means profit attributable to owners of parent. FY 9/20includes discontinued operations

The company fell into the red due to the decline in sales and impairment losses.

Transaction volume decreased 48.8% year on year to 74.7 billion yen, and sales decreased 4.5% year on year to 23.2 billion yen.

Sales declined amid a sharp drop in global travel demand caused by the COVID-19 pandemic. Gross profit fell 30.3% year on year, despite efforts to reduce advertising, variable, fixed, and other costs. In addition, the company recorded an operating loss of 8.25 billion yen due to the booking of an impairment loss of 7.46 billion yen. Excluding this loss, operating loss came to 780 million yen.

(Breakdown of the impairment losses)

The company decided to reduce some labor-intensive products (in the overseas tour field, etc.) in 2Q, as COVID-19 was causing their profitability to deteriorate. It thus recorded impairment losses on software and goodwill reflecting this plan.

Also, the company began considering selling some subsidiaries that had seen profitability worsen due to the pandemic. It thus recorded impairment losses based on their current income and future prospects.

In addition, in 4Q, the company recorded an impairment loss reflecting the loss of demand from inbound (foreign visitors to Japan) and outbound (Japanese people traveling abroad) travelers and a partial loss of domestic travel demand.

(2) Trends by segment

| FY 9/19 | Ratio to sales | FY 9/20 | Ratio to sales | YoY |

Sales |

|

|

|

|

|

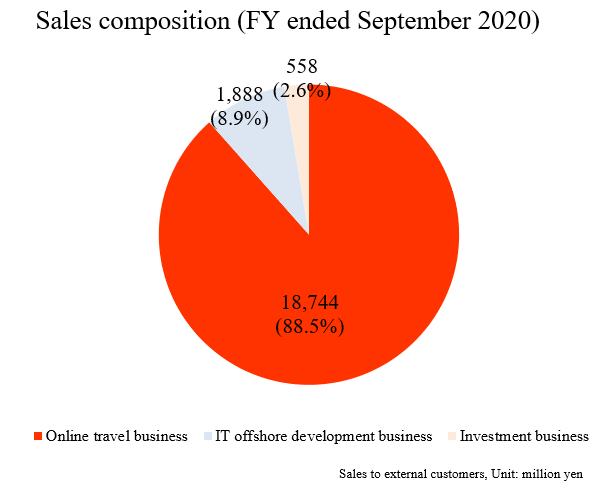

Online travel agency business | 21,505 | 88.5% | 18,744 | 88.5% | -12.8% |

IT offshore development business | 2,455 | 10.1% | 1,888 | 8.9% | -23.1% |

Investment business | 345 | 1.4 | 558 | 2.6% | +61.7% |

Total | 24,306 | 100.0% | 21,191 | 100.0% | -12.8% |

Operating Income |

|

|

|

|

|

Online travel agency business | 1,113 | 4.6% | ₋7,211 | - | - |

IT offshore development business | 172 | 0.7% | -24 | - | - |

Investment business | 332 | 1.4% | -257 | - | - |

Total | 680 | 2.8% | -8,760 | - | - |

*Unit: million yen. The composition ratio of operating income means operating income margin on sales.

① Online travel agency business

Sales decreased. Profit fell into the red.

Sales declined due to the impact from the spread of COVID-19 and measures to prevent the spread of infections implemented around the world. The segment saw an operating loss of 7,211 million yen due to the recording of an impairment loss caused by the spread of COVID-19.

② IT offshore development business

Sales decreased. Profit fell into the red.

Sales declined due to the spread of COVID-19 and measures to prevent the spread of infections implemented around the world, resulting in an operating loss of 24 million yen.

③ Investment business

Sales increased. Profit fell into the red.

Sales increased due to the sale of shares associated with initial public offerings (IPO) at three companies (AI CROSS, Cyber Security Cloud, and Headwaters) in which the company invested. The segment loss came to 257 million yen due to the recording of impairment losses at a subsidiary.

(3) Financial standing and cash flows

◎Summarized Balance Sheet

| End of Sep. 2019 | End of Sep. 2020 |

| End of Sep. 2019 | End of Sep. 2020 |

Current assets | 20,140 | 15,073 | Current liabilities | 15,717 | 11,483 |

Cash, etc. | 8,997 | 7,042 | Trade payables, etc. | 4,414 | 2,625 |

Trade receivables, etc. | 5,239 | 2,362 | Interest-bearing debts | 7,519 | 6,188 |

Other financial assets | 4,606 | 4,411 | Noncurrent liabilities | 5,436 | 8660 |

Noncurrent assets | 11,112 | 7,920 | Interest-bearing debts | 5,111 | 4,873 |

Tangible fixed assets | 1,324 | 379 | Total liabilities | 21,153 | 20,144 |

Intangible fixed assets | 2,628 | 1,210 | Capital | 10,099 | 2,849 |

Goodwill | 5,770 | 1,255 | Capital surplus | 4,175 | 4,887 |

Other financial assets | 1,103 | 970 | Retained earnings | 2,598 | -5843 |

Total assets | 31,253 | 22,994 | Total liabilities and net assets | 31,253 | 22,994 |

*Unit: million yen. “Cash, etc.” mean cash and cash equivalent. “Trade receivables, etc.” mean trade receivables and other credits. “Trade payables, etc.” mean trade payables and other liabilities. Interest-bearing debts include lease liabilities.

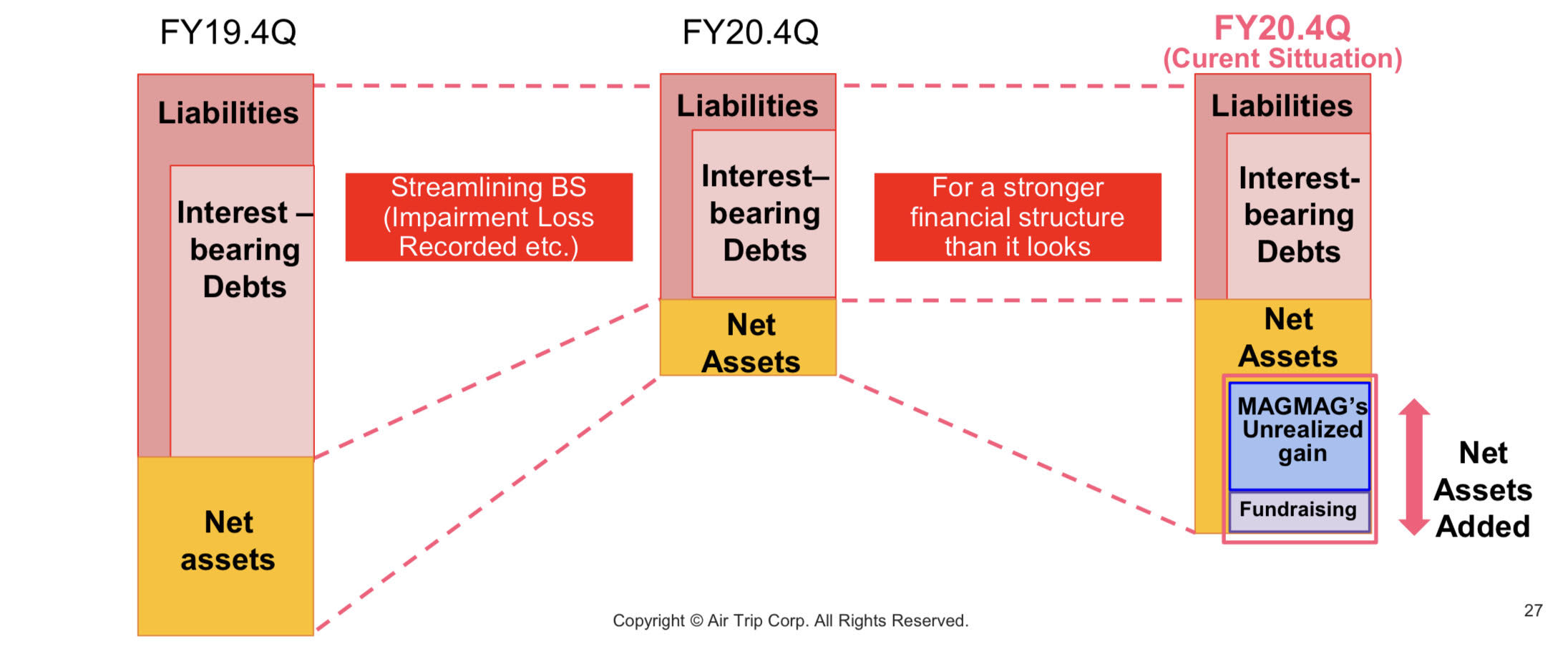

The company’s equity capital took a temporary hit due to the booking of an impairment loss of 7.41 billion yen.

As a result, equity ratio (equity ratio attributable to owners of the parent) decreased by 19.9 points from 32.3% at the end of the previous fiscal year to 12.4%.

◎Cash Flow

| FY 9/19 | FY 9/20 | Increase/decrease |

Operating Cash Flow | -76 | -199 | -123 |

Investing Cash Flow | -678 | -240 | +438 |

Free Cash Flow | -754 | -439 | +315 |

Financing Cash Flow | 4,459 | -1,501 | -5,960 |

Cash and equivalents | 8,997 | 7,042 | -1,955 |

*Unit: million yen

The deficit of operating CF (cash flow) expanded due partly to the booking of a pre-tax loss. Free CF improved due to curbed investments. Financing CF turned negative due to the disappearance of proceeds from the issuance of new shares. The company’s cash position declined.

3. Fiscal Year September 2021 Earnings Forecasts

(1) Earnings forecasts

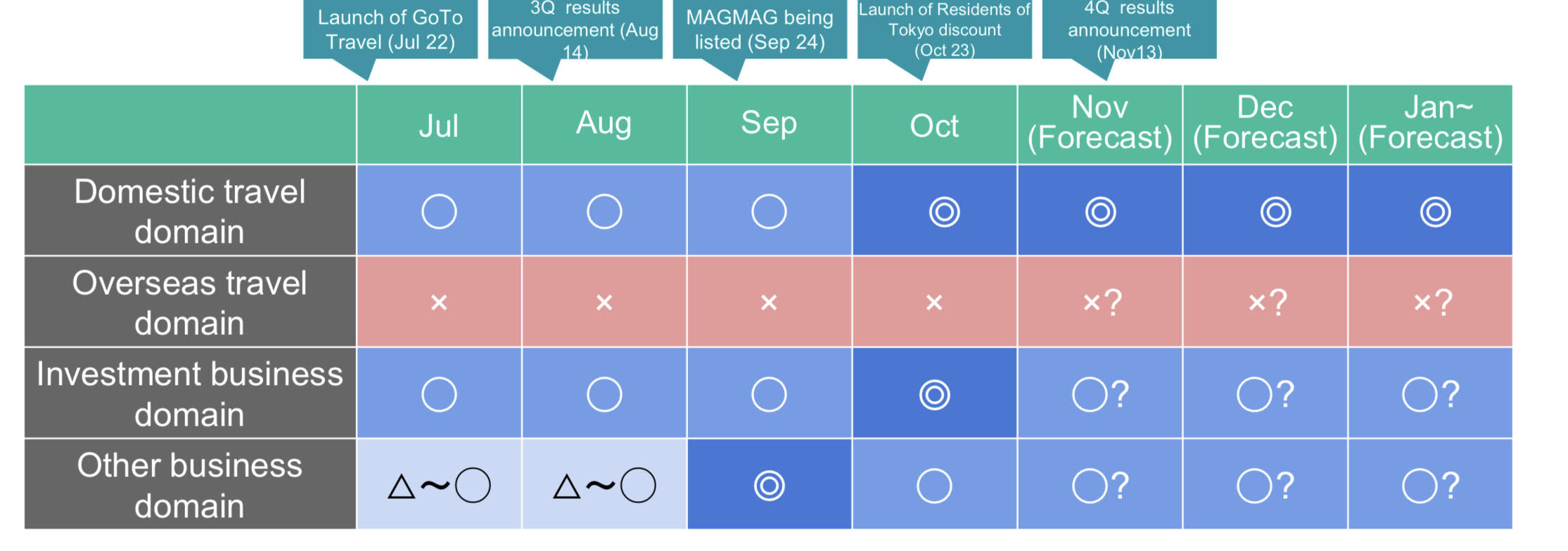

The company’s earnings projections, announced on November 13, 2020, call for a transaction volume of 45 billion yen, a sales revenue of 23.5 billion yen, and an operating income of 300 million yen in the fiscal year ending September 2021. They explained that demand has been recovering since October, thanks to benefits from the GoTo Travel and Tokyo Citizens Discount campaigns, and that monthly profit moved into the black in October.

After that, on November 30, the company upgraded its earnings outlook for said period. It raised its estimates for sales from 23.5 billion yen to 24 billion yen, for operating income from 300 million yen to 390 million yen, for pre-tax income from 240 million yen to 330 million yen, and for net income from 180 million yen to 240 million yen. The upward revisions reflect the swifter-than-expected recovery in sales and profit, particularly in the domestic travel domain of the AirTrip Travel Business, with the GoTo Travel campaign acting as a tailwind.

Consolidated Business Forecasts

| FY 9/20 | Ratio to sales | FY 9/21(Est) | Ratio to sales | YoY | Revisions |

Sales revenue | 21,191 | 100.0% | 24,000 | 100.0% | +13.3% | +500 |

Operating Income | -8,760 | - | 390 | 1.6% | - | +90 |

Profit before tax | -8,956 | - | 330 | 1.4% | - | +90 |

Net income for this period | -8,380 | - | 240 | 1.0% | - | +60 |

*Unit: million yen. IFRS is applied. Net income for this period means profit attributable to owners of parent. FY20/9 includes discontinued operations

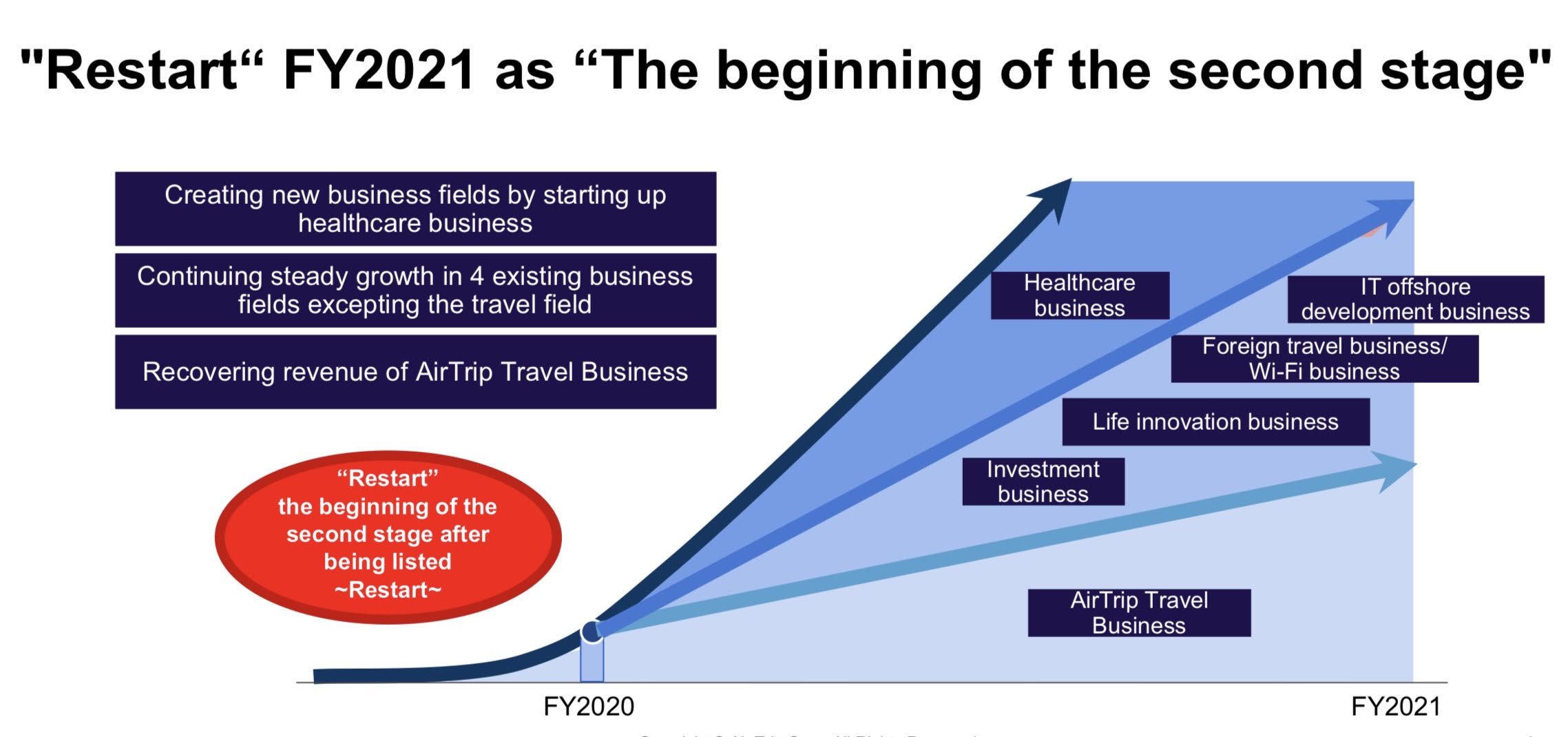

(2) “Restart”

① Initiatives for the current term

The company positioned the four and a half years after listing as the "first stage," and designated the fiscal year ending September 2021 as “Restart,” the beginning of the second stage. It continues to aim for "AirTrip 5000.”

(From the company's materials)

The recovery of earnings of the AirTrip travel business is attributable to measures carried out until the previous fiscal year bearing fruit, cost cut benefits, the tailwind from the GoTo Travel campaign, etc.

Growth remains steady for the four existing businesses excluding the travel business (IT Offshore Development Business, Japan Inbound Travel Business/Wi-Fi Business, Life Innovation Business [Magmag, etc.], and Investment Business).

The company will also work to create new business areas by starting up the Healthcare Business.

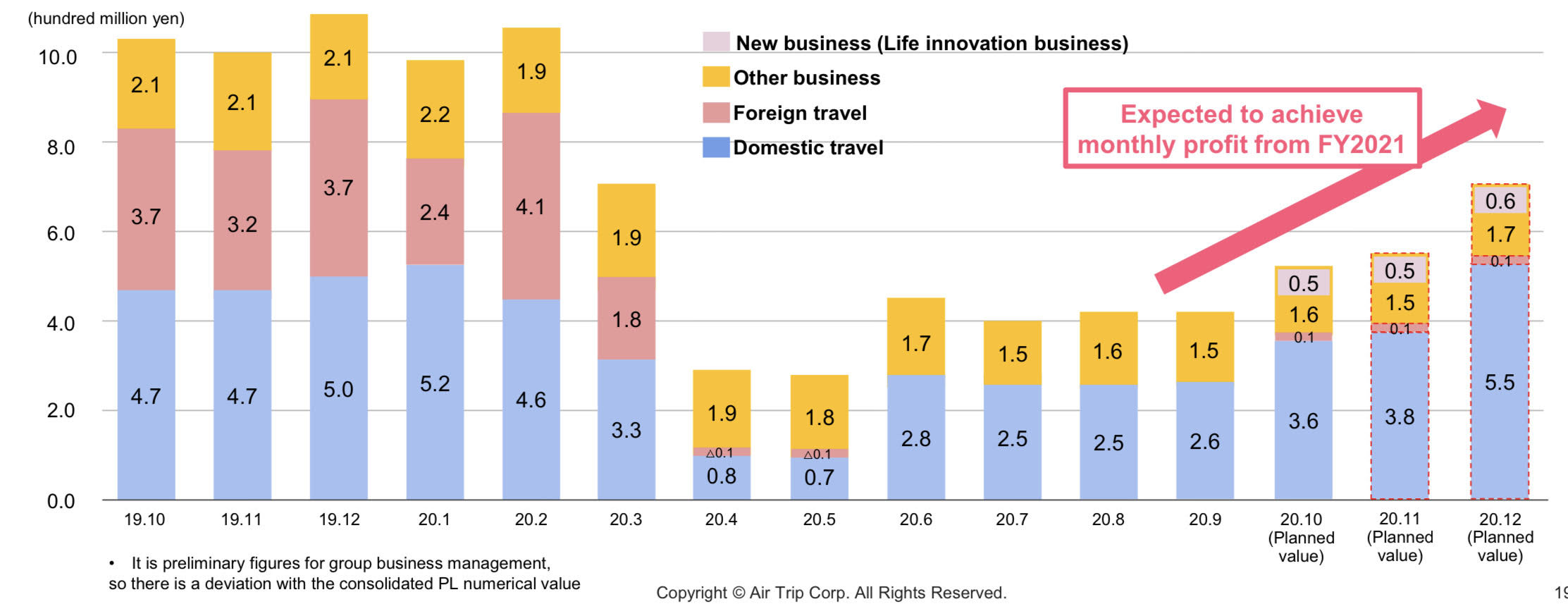

② Monthly profit moved into the black in October

Impairment losses booked in the previous fiscal year reduced such losses for the fiscal year ending September 2021. Compared to industry peers and similar enterprises, AirTrip’s fixed costs are considerably lower, and its break-even point has been reduced through large-scale cost reduction. Accordingly, profits are expected to recover and grow.

In October, profit moved into the black on a monthly and consolidated basis, partly thanks to the tailwind provided by the GoTo Travel campaign.

(From the company's materials)

② To optimize variable costs and advertising costs while continuing to reduce fixed costs

◎To reduce monthly SG&A expenses to around 450-600 million yen

AirTrip implemented cost control according to the operation volume during the GoTo Travel campaign period. It continued to optimize the ratio of advertising expenses ratio in gross profit.

By continuing the partial reduction of executives’ remunerations and utilizing employment adjustment subsidies, etc., the company reduced total personnel costs by about 120 million yen per month.

It is continuing the optimization of its system development framework, shift to working from home, and the reconsideration of outsourcing costs.

◎Gross profit expected to move into the black on a monthly basis

The company expects to swiftly achieve profitability in the life innovation field (Healthcare Business) and see earnings recover in the domestic travel field thanks to benefits from the GoTo travel campaign.

(From the company's materials)

4. “AirTrip 2021” Growth Strategy

The company announced its post-pandemic growth strategy “AirtTrip 2021,” under which it will pursue an earnings recovery in the AirTrip Travel Business by utilizing the GoTo Travel campaign, and also aim to expand the entire group by continuing to grow existing businesses and creating new businesses.

(1) Goals

1. Earnings recovery in the AirTrip Travel Business by utilizing the GoTo Travel campaign | Increased demand for domestic travel amid the COVID-pandemic is a business opportunity

To meet the post-pandemic demand for domestic travel by utilizing the GoTo Travel campaign and digital marketing |

2. To continue to achieve steady growth in the four existing business domains except the travel domain | To build a business portfolio for the post-pandemic era

Aim for continued growth in the four existing business domains, mainly in the Live Innovation Business and Investment Business. |

3. To create new business areas by starting up the Healthcare Business | To create new businesses in growing areas in the post-pandemic era

To grasp the business environment, which is expected to change in the post-pandemic era, and create new businesses in growing areas where the Group’s strengths can be utilized |

*: Go To Travel campaign

It is part of the Go To campaign project, which is a demand stimulating policy to create people's flow and bustle in the Japanese cities and revitalize the region after the novel coronavirus has subsided. From the supplementary budget, 1,679.4 billion yen has been allocated to the entire Go To campaign project.

Details of the Go To Travel campaign are being adjusted. However, it includes supporting half of the accommodation and day trip prices for domestic trips, up to 20,000 yen per person per night (up to 10,000 yen for day trips), 70% of the support amount is a discount on the travel price, and about 30% is given as a regional coupon that can be used at the travel destination, and no limits on numbers of days for staying and of times to use the campaign.

(2) Key measures

①AirTrip Travel Business

The company aims to meet the domestic travel demand through effective digital marketing centered on online video advertising.

◎Growth strategies

・In the domestic travel area, the company aims to increase earnings throughout the year by utilizing the GoTo Travel campaign to continue achieving high growth in 1-2Q, meeting the travel demand during the Golden Week holidays in 3Q, and meeting the travel demand during the summer in 4Q.

・In the overseas travel area, the company aims for an earnings recovery through PCR testing and cross-selling, assuming static demand in 1-2Q due to travel restrictions, a recovery in demand in 3Q due to the gradual relaxation of restrictions centered on business travel, and increased demand for overseas airline tickets in 4Q in connection with the Tokyo Olympics.

◎Action plan

Domestic travel: To utilize the GoTo travel campaign to expand earnings, thoroughly improve UI/UX to increase CVR, and meet demand through digital marketing

Overseas travel: To formulate an earnings recovery plan assuming the relaxation of travel restrictions.

② To build a diverse business portfolio for the post-pandemic era

The company will establish a diverse business portfolio by continuing to grow existing businesses centered on the Life Innovation Business and Investment Business, and launching the new Healthcare Business.

◎Growth strategies for the four existing businesses and new business

・Aim to increase new customers and expand earnings by revamping the functions of the live streaming service "Magmag! Live,” operated by Magmag, and enhancing the live streaming service by offering a variety of content.

・In the Healthcare Business (PCR test booking service) developed by PikaPaka, the company aims to meet the growing demand for PCR testing and establish an earnings structure by expanding inspection methods (test at hospital/home visit test/home test kit) and by various methods to attract customers/promote sales.

・ In other IT offshore development and inbound travel businesses, the company aims to build a business foundation focused on areas with prospects for medium/long-term growth by accurately meeting post-pandemic needs.

◎Action plan for the four existing businesses and new business

Live streaming service: To meet demand by revamping the live streaming service and providing a variety of content

Healthcare business: To expand services to meet growing demand for PCR testing

Other business foundations: To build a promising business portfolio

③ To continue to strategically and aggressively invest in growing areas

The company will continue to aggressively invest in growing areas, focusing on achieving synergies with the Group, by accurately predicting changes in the business environment in the post-pandemic era.

◎Growth strategies

・To accurately predict changes in the business environment in the post-pandemic era and strategically and aggressively invest in growing areas, placing focus on achieving synergies with the Group.

・Strategic investment decisions will be made while considering (1) the extent of synergy that can be expected within the Group, (2) whether there are prospects for medium/long-term growth, and (3) whether profit contributions can be expected at an early stage.

・The company aims to improve the accuracy of the entire process, including M&A target selection, DD (due diligence), negotiation, contract conclusion, and PMI (post merger integration), further systematize the process, and improve the growth rate after acquired businesses have joined the Group.

◎Action plan

Strategic and aggressive investment: To formulate an investment strategy for the post-pandemic era

Determine investment areas: To identify post-pandemic investment areas

Boost post-M&A growth: To pursue growth rate improvement after businesses have joined the Group via M&A

④Financial strategy

To maintain very healthy finances by improving liquidity.

The company’s financial health is expected to improve in the current term and beyond.

◎Financial strategy

・To maintain healthy finances by strategically increasing liquidity on hand amid a business environment in which the outlook for the post-pandemic era is becoming increasingly unclear.

・To increase liquidity on hand, the company aims to (1) reduce company-wide cash-out, (2) visualize the balance of cash and deposits on hand for the entire group, and (3) improve financial soundness, primarily by securing cash through various financing methods.

◎Action plan

・To formulate of a financial strategy: Formulation of a post-pandemic financial strategy

・Liquidity improvement measures: Measures to increase liquidity on hand geared toward maintaining healthy finance

・Medium/long-term measures: Medium/long-term measures geared toward increasing liquidity on hand

◎To achieve a stronger financial structure

The company streamlined the balance sheet by recording an impairment loss in the previous fiscal year. The balance sheet will become even stronger on the back of fund procurement and unrealized gains for Magmag.

(From the company's materials)

5. Conclusions

The company is aiming for an earnings recovery in the fiscal year ending September 2021, which it has positioned as “Restart.” Recent earnings performance has been favorable, with the company revising its earnings outlook upwardly. Meanwhile, there is uncertainty in regards to the GoTo Travel campaign, such as the temporary exclusion of Osaka and Hokkaido and the request to refrain from unnecessary and non-urgent outings in Tokyo. We will be monitoring trends on this front going forward.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with an audit and supervisory board |

Directors | 10 directors, including 3 outside ones |

Auditors | 4 auditors, including 2 outside ones |

◎Corporate Governance Report

Last updated on Dec. 27, 2019.

<Basic policy>

Our company group considers the swift decision-making in response to the changes in the business environment, lasting business development, and gaining trust from stakeholders as the most significant business challenges. To improve the health, transparency and efficiency of the operations, all of us are striving to enhance the structure of corporate governance, thorough compliance, and timely and appropriate disclosure (of information).

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

Supplementary Principle 1-2-2 | The Company currently refrains from dispatching the notice of an annual general meeting of shareholders early for the purpose of thoroughly considering the contents before dispatching it, but we will plan to develop a system which enables early dispatch in the future. As for uploading of the notice of an annual general meeting of shareholders onto websites, it is currently disclosed on TDnet and the IR page of our company, and we will consider disclosure before dispatching the notice. |

Supplementary Principle 4-1-2 | Our company has not disclosed our mid-term management plan, but the board of directors designs mid-term management plans and manages their progress. We will discuss the disclosure of our mid-term management plans. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 | Our company may hold shares strategically, if the shareholding is expected to strengthen business cooperation or contribute to the maintenance or improvement of our corporate value. |

Principle 5-1 | corporate strategy department is in charge of our IR activities, and the divisions of finance, accounting, publicity, general affairs, human resources, and management planning cooperate in promoting constructive dialogue with shareholders and investors. In addition, we hold results briefing session involving executives four times a year, and a company briefing session for individual investors, and deal with the request for individual interviews within a reasonable range. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are provided by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |