Bridge Report:(6232)Autonomous Control Systems Laboratory Fiscal Year March 2020

President Hiroaki Ohta | Autonomous Control Systems Laboratory Ltd. (6232) |

|

Corporate Information

Exchange | TSE Mothers |

Industry | Machinery (Manufacturing) |

Representative | Hiroaki Ohta |

Address | WBG Marive West 32F, 2-6-1 Nakase, Mihama-ku, Chiba-city, Chiba |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥3,185 | 10,742,721 shares | ¥34,215 million | 6.8% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

- | - | - | - | ¥468.56 | 6.8x |

*Share price as of closing on May 13. The number of shares issued at the end of the most recent quarter excludes its treasury shares. ROE and BPS are based on previous term earnings results

.

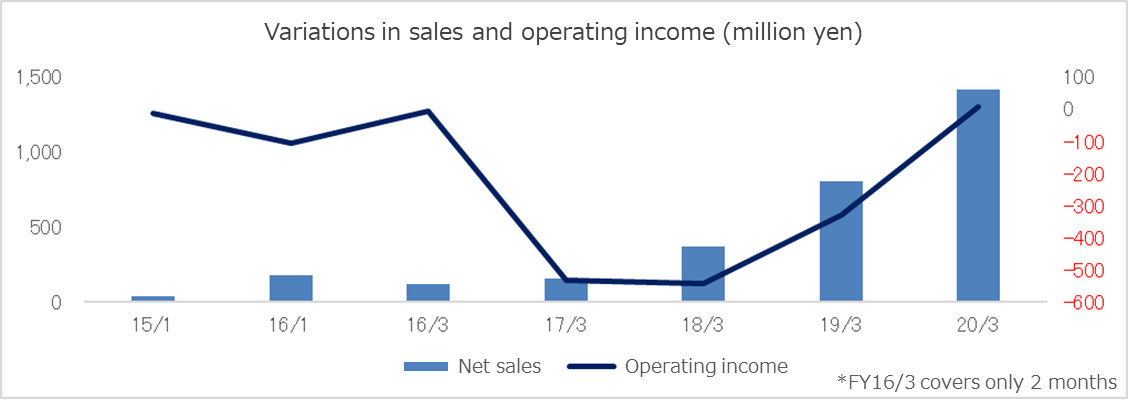

Non-consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2017 (Actual) | 156 | -533 | -486 | -488 | - | - |

Mar. 2018 (Actual) | 370 | -542 | -454 | -460 | - | - |

Mar. 2019 (Actual) | 807 | -330 | -176 | -183 | - | - |

Mar. 2020 (Actual) | 1,278 | 15 | 231 | 239 | 23.00 | - |

Mar. 2021 (Estimate) | - | - | - | - | - | - |

*The earnings forecast is to be disclosed. Unit: Million yen

This Bridge Report reviews fiscal year March 2020 earnings results and fiscal year March 2021 earnings estimates of Autonomous Control Systems Laboratory Ltd.

Table of Contents

Key Points

1. Company Overview

2. Overview of the Financial Results for The Fiscal Year ended March 2020

3. Fiscal Year Ending March 2021 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the term ended March 2020, operating income turned positive, as previously announced. The novel coronavirus did not affect the business performance so much, and sales grew 58.4% year on year, thanks to the development of solutions (STEPs 1 and 2). Operating income improved from negative 3.3 million yen in the previous term to positive 15 million yen, due to the improvement in gross profit rate thanks to large-scale projects and cost control. Due to the revenue from subsidies, the posting of deferred tax assets, etc., net income was 239 million yen (a loss of 183 million yen in the previous term), much larger than the initial estimate (119 million yen).

- For the term ending March 2021, it is assumed that the trend of customers’ demand and production systems will be affected by the novel coronavirus risk to some degree, but it is considered that the company can cope with it. Accordingly, it is estimated that sales will grow year on year and operating income and other incomes will be in the black, but the estimates in value terms are undisclosed, because of the novelty of the business and the difficulty in rationally forecasting the trend of customers’ demand.

- After moving into the black, the company aims to become a “drone manufacturer” while keeping profitability under the mid-term corporate strategy: From “Prototype Factory” To “Drone Manufacturer.” From the aspects of development and sales, the company will cement the cooperation with external partners, and concentrate its managerial resources on the development of autonomous control systems that can function like the cerebrum and the cerebellum, including SLAM, which is the core technology of the company. In addition, since the demand for made-in-Japan drones are growing because they are safe and reliable, the company will actively cooperate with industry associations, promote made-in-Japan drones, and enhance the company’s presence as a provider of the entire system including the autonomous control technology.

1. Company Overview

Autonomous Control Systems Laboratory develops and sells fully autonomous drones (which can fly based on a preset program or the like without being operated by a person), which do not require the operation with a controller and automatically take off and return. The company targets the fields of “infrastructure inspection,” “logistics and mail transportation,” and “disaster prevention and control,” in which high-level autonomous flying is frequently demanded. The drones of the company work on behalf of human workers in these fields. Accordingly, the business of the company is to not merely manufacture and sell machines, but also offer solutions for streamlining business operation, automating business processes, and adopting IoT. The company deals with tasks from planning, system development and installation, to after-sales services on a one-stop basis.

【Basic policy for business administration】

ACSL creates drone applications for the partner companies (core clients) that are anticipated to have a continuous business relationship in various fields to create actual economic benefits focusing on its autonomous control technology through the fee-charging proof of concept (PoC) projects by using original drones and system development capacities. It is also offering integrated services including PoC, system integration for implementation in customers’ operation, and mass production (production of customized industrial products for which the pressure of replacement is low). This way, it aims to establish a business model that can promote technological innovation by maintaining high levels of profit and continuing investment in development.

【Corporate History】

Autonomous Control Systems Laboratory has roots in Nonami Laboratory, Chiba University, which started developing the technology for fully autonomous drones in 1998. Nonami Laboratory accumulated research outcomes from fundamental research, and succeeded in actualizing autonomous control for the first time in the world in August 2001. Then, it was incorporated as Autonomous Control Systems Laboratory Ltd. (ACSL) in November 2013, so that its autonomous control technology could be used in a broad range of industries. In July 2016, Mr. Hiroaki Ohta (who is the present president) was appointed as COO, to establish management and development systems, and the company was listed in Mothers of Tokyo Stock Exchange in December 2018.

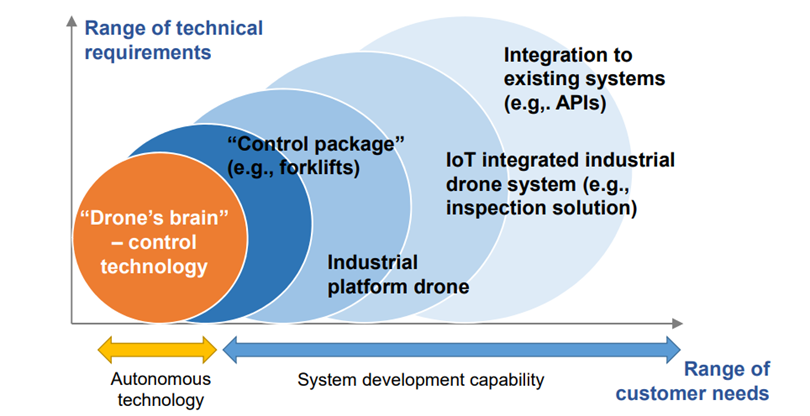

1-1 Platform technology

ACSL developed and commercialized necessary technologies for autonomous flying as platform technologies. They include the autonomous flying technology with GPS, the technology for estimating the drone’s location, which realizes autonomous flying without GPS with image processing (Visual SLAM), original communications and cloud systems for accumulating and analyzing flight logs and image data of drones, AI for flight control, which can recognize people, passages, etc., and parachutes for enhancing safety.

By integrating these technologies, the company developed the platform drone, and based on it, it offers drones customized for each application.

Core technology - “Autonomous control technology”

The company’s core technology is control technology, which is the brain of each drone. To achieve labor saving and automation, the company is pursuing “autonomous control.”

(Taken from the reference material of the company)

Cutting-edge cerebrum-like technologies - Autonomous flying technology “Visual SLAM” without GPS using image processing

The company’s drones can see and think by itself. Specifically, it is equipped with “SLAM monocular camera” that is set downwardly and “stereo cameras for distance control” mounted with two camera modules that are set forwardly. It estimates the location and direction of the drone with the “SLAM monocular camera” and measures the distance between the drone and target (horizontal and vertical direction) with the “stereo cameras for distance control.” The built-in GPU analyzes (calculates) images taken by these cameras in real time to recognize the environment in which the drone is placed (an environment recognition technology “Visual SLAM”). The autonomous flight is realized by linking this analysis results with attitude control and flight operation control.

The company’s strength is that it develops all necessary technologies including the environment recognition technology, attitude control, and flight motion control. Furthermore, while existing environment recognition technologies use GPS data (location information), a pressure sensor (measures barometric altitude) and a digital compass (measures azimuth), the company’s environment recognition technology “Visual SLAM” does not require them. Because it does not require GPS data, it can safely fly autonomously indoors or near structures where GPS data are not available. In other words, it is a revolutionary technology that enables fully autonomous flight in a non-GPS environment.

1-2 Business model

The services of the company can be classified into Step 1, which conducts Proof of Concept (PoC) according to customer needs, Step 2, which designs and develops customized drones based on PoC, and Steps 3 and 4, which produce a small number of drones and apply them to actual tasks.

STEP 1 | To meet customers’ needs for adoption of drones, the company conducts PoC using its test drones for solving problems while charging fees. PoC means an experiment using available technologies in order to study the feasibilities of new use cases. The company checks whether it is possible to streamline business operation, automate processes, and adopt IoT, etc. with the minimum system configuration of drones, which are the purposes of drone adoption of customers. The company demonstrates that concepts and theories can be put to practical use. |

STEP 2 | The company conducts the design and development of the entire customized systems, including the integration of drones into customers’ existing systems, and offers operation simulators required for installing drones safely and services of maintaining and inspecting drones (system installation and operation support). |

STEP 3 | The company carries out trial operation of customized systems developed at STEP 2 in customers’ facilities, sells them for commercial use, and offers maintenance support after selling drones. Through maintenance support, the company receives drone maintenance fees, which arise regularly after sale, prices of supplies, and charges for on-site consulting services. In addition, it is continuously improving the practical design for each customer. Examples of usage of drones include inspection of factory facilities, buildings, bridges, etc., investigation of enclosed environments such as sewer pipes, commodity distribution and mail delivery, and initial grasp of disaster sites. Incorporating a drone into such projects will enable more efficient, unmanned, and IoT-enabled operations. |

STEP 4 | Definition of STEP 4 is production and supply of 10 or more drones every fiscal year. It is different from STEP 3, in that full-blown incorporation of drones into specific operations is assumed. |

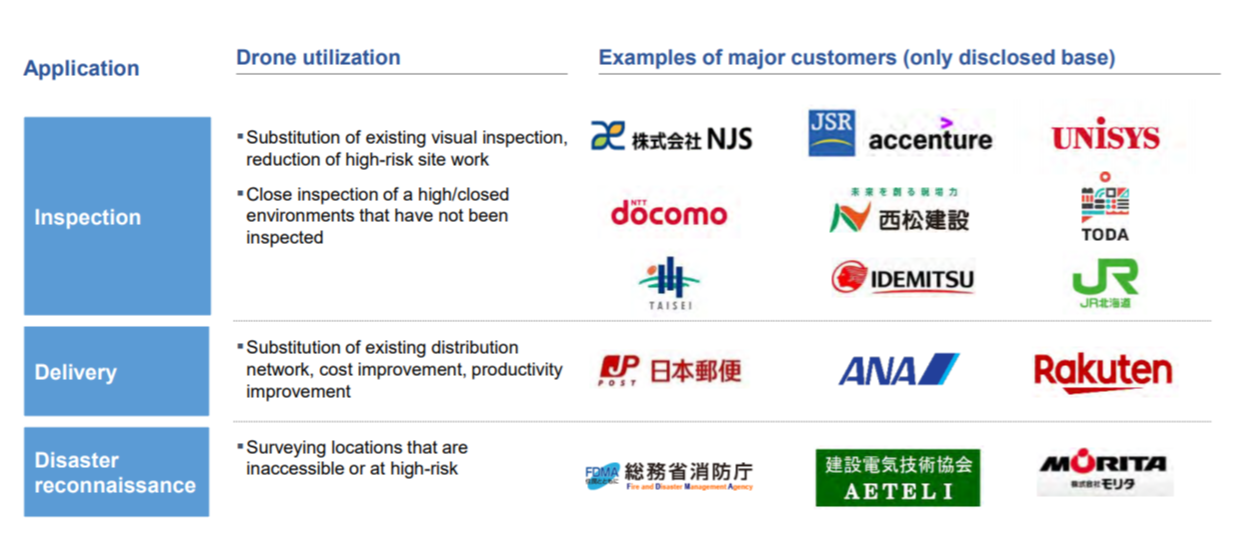

1-3 Firm customer base

The customer base, including leading companies, is expanding steadily. The number of client companies thinking of mass-produced drones amounts to about 80.

|

|

(Taken from the reference material of the company)

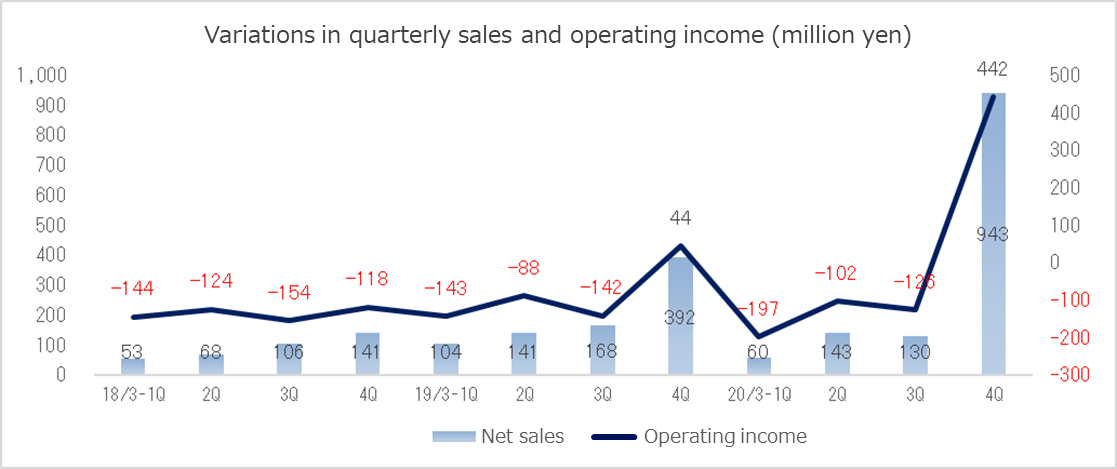

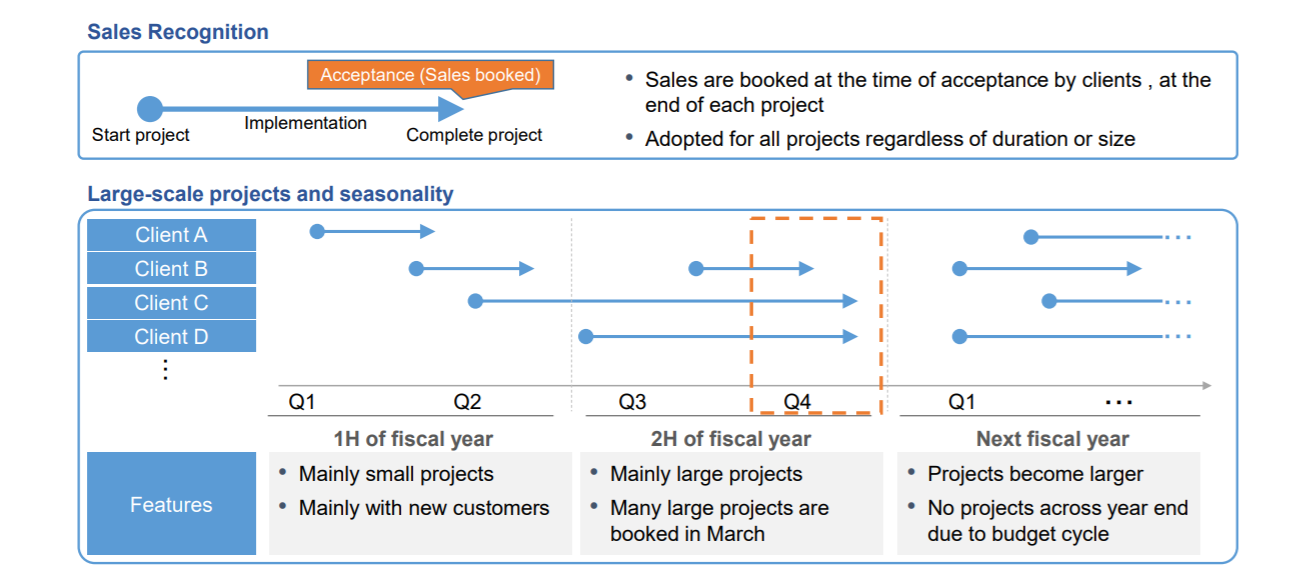

1-4 Revenue posting standards and concentration of sales in the second half

The company posts sales at the time of acceptance inspection (completion of projects) for all projects. As projects mainly for existing clients are getting larger, sales are more concentrated in the fourth quarter (there are no projects extending to the following term, according to clients’ budgetary cycles).

(Taken from the reference material of the company)

2. Overview of the Financial Results for The Fiscal Year ended March 2020

2-1 Non-consolidated Business Results

| FY3/19 | Ratio to sales | FY3/20 | Ratio to sales | YOY | Initial forecast | Ratio to forecast |

Net Sales | 807 | 100.0% | 1,278 | 100.0% | +58.4% | 1,418 | -9.8% |

Gross profit | 403 | 50.0% | 808 | 63.2% | +100.5% | 850 | -4.9% |

SG&A expenses | 733 | 90.9% | 792 | 62.0% | +8.0% | 841 | -5.7% |

Operating income | -330 | - | 15 | 1.2% | - | 9 | +75.8% |

Ordinary income | -176 | - | 231 | 18.1% | - | 187 | +23.2% |

Net Income Attributable to Owners of the Parent | -183 | - | 239 | 18.8% | - | 119 | +100.2% |

*Unit: Million yen

Sales grew 58.4% year on year, and operating income turned positive.

Sales were 1,278 million yen, up 58.4% year on year. As existing clients allocated their budgets to the development of solutions (STEPs 1 and 2), the sale of drones (STEPs 3 and 4) decreased, and the sales for national projects declined. However, the sales from solution development (STEPs 1 and 2) increased nearly three times year on year from 293 million yen to 866 million yen, due to the increase of new clients and the enhancement of existing clients’ activities for applying drones to actual tasks.

Operating income was 15 million yen. Partially thanks to the orders for large-scale solution projects, gross profit rate was 63.2%, exceeding the target 60%, and gross profit doubled year on year to 808 million yen, while the increase rate of SGA was only 8.0% due to the cost control while increasing employees. R&D costs amounted to 275 million yen, which is 22% of sales (in the previous term, it was 366 million yen, 45% of sales). While increasing employees, the company strived to streamline its business operation, and then the ratio of R&D costs to sales was within the target range of 20 to 25%. The company released the medium-sized model ACSL-PF2 as the next-generation model of the industrial platform, and developed the compact drone Mini, which is not compatible with GPS, as the demand for compact drones is expected to grow.

Ordinary income was 231 million yen. Non-operating income/loss improved, as there were no longer IPO-related expenses while the revenue from subsidies grew from 192 million yen to 221 million yen. Tax burdens were minor, because the loss was carried forward, and deferred tax assets were posted. Consequently, the company secured a net income of 239 million yen.

Sales for each STEP

| FY3/19 | Ratio | FY3/20 | Ratio | YOY |

Solution development (STEPs 1 and 2) | 293 | 36.4% | 866 | 67.7% | +194.7% |

Sale of mass-produced drones (STEPs 3 and 4) | 384 | 47.6% | 304 | 23.8% | -20.6% |

Other | 129 | 16.0% | 107 | 8.4% | -16.7% |

Total | 807 | 100.0% | 1,278 | 100.0% | +58.4% |

*Unit: Million yen

Reasons for the difference from the initial estimate

As for sales, more projects for solution development (STEPs 1 and 2) were continued or added, and the shift to the sale of mass-produced drones (STEPs 3 and 4) did not progress as expected, and the sales volume of mass-produced drones fell below the estimate. However, thanks to the improvement in profit rate through the receipt of orders for large-scale solutions, the decrease rate of gross profit was only 4.9%, and the augmentation of SGA was curtailed though cost control according to the scale of sales. Consequently, operating income exceeded the initial estimate. In addition, net income was 239 million yen, two times larger than the initial estimate, thanks to the curtailment of non-operating expenses, etc. for office relocation, the posting of deferred tax assets, etc.

2-2 Status by STEP

Development of solutions (STEP1, 2)

| FY3/17 | FY3/18 | FY3/19 | FY3/20 |

Sales (million yen) | - | 217 | 293 | 866 |

No. of projects (projects) | 12 | 60 | 81 | 112 |

In addition to the increase of new clients, existing clients, who had developed solutions, started demanding customized development for brushing up functions while considering practical application. Furthermore, the demand from existing clients for PoC of new purposes of use grew. As a result, solution development was conducted for 112 projects, earning sales of 866 million yen. The average spending per project rose from 362 million yen to 773 million yen.

Sales of mass-produced drones (STEP3, 4)

| FY3/17 | FY3/18 | FY3/19 | FY3/20 |

Sales (million yen) | - | 90 | 384 | 304 |

No. of drones (units) | 40 | 40 | 106 | 101 |

While the solution development (STEPs 1 and 2) for existing clients increased, the shift to sale of drones (STEPs 3 and 4) did not progress as expected. As solution development increased, the incorporation into clients’ systems progressed, enabling them to grasp needs and boost the possibility of selling drones (STEPs 3 and 4).

Others

| FY3/17 | FY3/18 | FY3/19 | FY3/20 |

Maintenance | - | 34 | 64 | 88 |

National Projects | - | 28 | 65 | 18 |

Total | - | 62 | 129 | 106 |

* Unit: Million yen

The company posted sales from the sale of drone parts, drone repair, and some national projects. Normally, subsidies for national projects are booked as non-operating income, but the revenue from the project of “NEDO performance evaluation standards,” whose primary purpose is to conduct entrusted experiments, is posted as other sales. In the term ended March 2020, the sales related to national projects declined, but the sales from maintenance services grew, reflecting the expansion of the business.

2-3 Financial Conditions and Cash Flow (CF)

Financial conditions

Term-end total assets were 5,268 million yen, up 341 million yen from the end of the previous term. In the debit side, accounts receivable increased as the sales in the fourth quarter grew, and the company invested in AutoModality in the U.S. for cementing the cooperation with external partners. As a result, investment securities increased 311 million yen. In the credit side, net assets grew. The ratio of liquidity on hand was 35.4 (66.3 in the previous term), and capital-to-asset ratio was 95.5% (95.4% in the previous term).

| Mar. 2019 | Mar. 2020 |

| Mar. 2019 | Mar. 2020 |

Cash and deposits | 4,465 | 3,775 | Accounts payable | 17 | 24 |

Trade receivables | 256 | 815 | Accrued expenses | 49 | 75 |

Current assets | 4,858 | 4,818 | Advances received, deposits | 110 | 12 |

Tangible assets | 23 | 27 | Current Liabilities | 225 | 233 |

Intangible assets | 13 | 35 | Shareholders’ equity | 4,700 | 5,029 |

Investment and other assets | 31 | 387 | Net Assets | 4,701 | 5,034 |

Noncurrent assets | 68 | 449 | Total Liabilities, Net assets | 4,926 | 5,268 |

*Unit: Million yen

Cash flows (CF)

Operating CF was negative 407 million yen, as pretax profit was 231 million yen, depreciation was 27 million yen, and accounts receivable decreased 559 million yen. Investing CF is mainly attributable to the acquisition of investment securities (investment in AutoModality in the U.S.) and tangible and intangible fixed assets. Financing CF is attributable to the issuance of shares through the exercise of share acquisition rights (in the previous term, there was revenue from the issuance of shares through IPO).

| FY3/19 | FY3/20 | YOY | |

Operating cash flow (A) | -176 | -407 | -231 | - |

Investing cash flow (B) | -58 | -369 | -311 | - |

Free cash flow (A+B) | -235 | -777 | -542 | - |

Financing cash flow | 2,631 | 87 | -2,543 | -96.7% |

Cash and Equivalents at Term End | 4,465 | 3,775 | -689 | -15.5% |

*Unit: Million yen

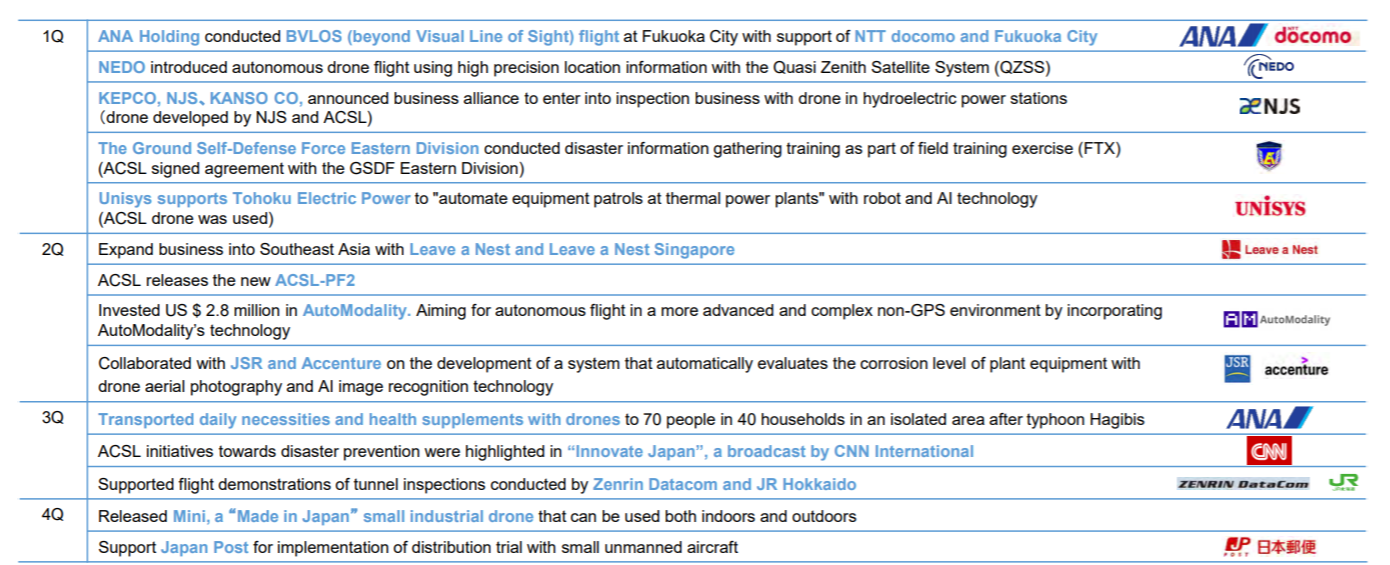

2-4 Business highlights

In the term ended March 2020, demonstration experiments and practical application of drones produced by ACSL progressed in the fields of infrastructure inspection, logistics, and disaster prevention, and the company produced some good results in selling new drones, investing in U.S. enterprises, and so on. For infrastructure inspection, demonstration experiments and practical application are carried out for the purposes of improving visual inspection methods, reducing the risk of high-place work, and actualizing closeup inspection of high-place and closed environments that have been impossible to inspect. The preparations for demonstration experiments and practical application are progressing, for logistics, for the purposes of upgrading distribution networks and improving costs and productivity, and for preventing disasters, for the purposes of swiftly grasping the situations of inaccessible and dangerous environments.

(Taken from the reference material of the company)

Infrastructure inspection

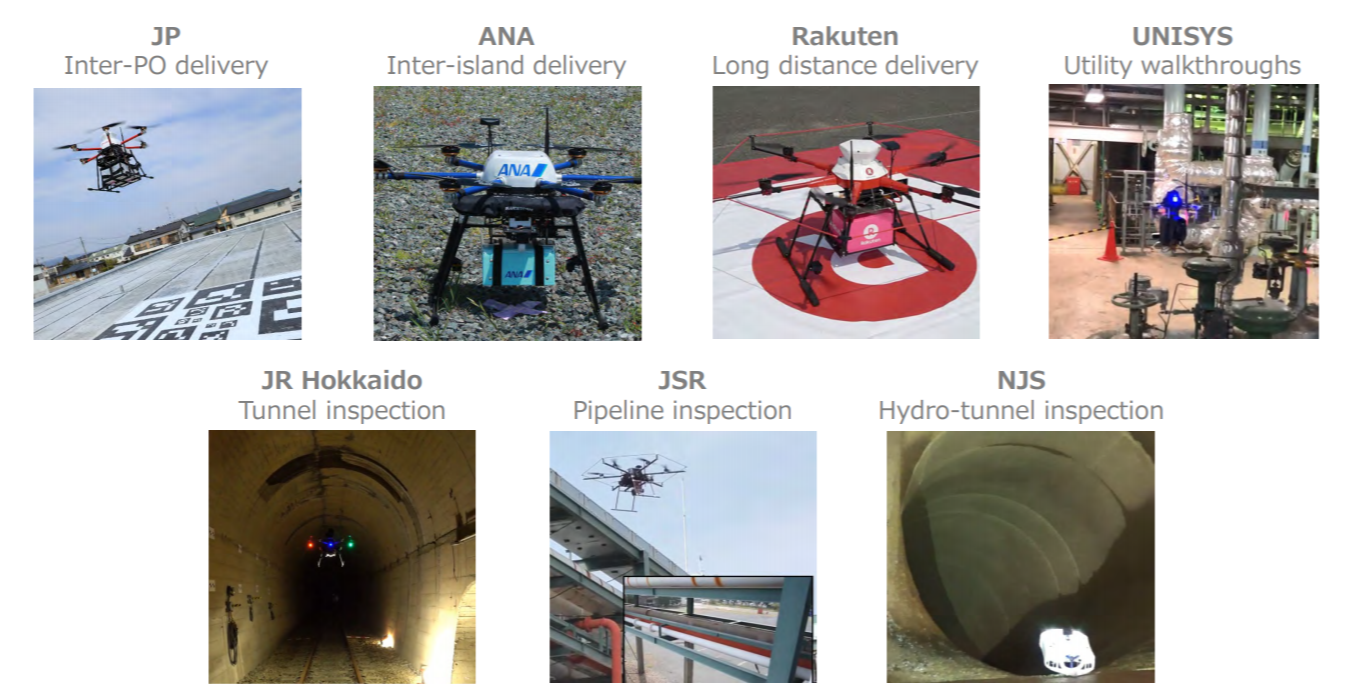

The company supports JSR and Accenture in developing corrosion judgment systems, supports Nihon Unisys in developing automatic equipment patrol systems, and conducts demonstration experiments, etc. for operating drones inside tunnels in cooperation with Zenrin-Datacom and JR Hokkaido. In cooperation with JSR and Accenture, the company is developing a system for automatically gauging the corrosion level of plant equipment by shooting photos from the air with drones and utilizing AI technology for image recognition. As for the development of automatic equipment patrol systems with Nihon Unisys, the company supports Nihon Unisys in the technology verification utilizing drones in Tohoku Electric Power’s “system for automating equipment patrol at thermal power plants with robots, AI technologies, etc.”

Supporting Zenrin-Datacom Co., Ltd. and Hokkaido Railway Company (JR Hokkaido) in demonstration experiments

Zenrin-Datacom Co., Ltd. and Hokkaido Railway Company (JR Hokkaido) are conducting demonstration experiments for autonomous flying of drones inside tunnels, where GPS cannot function, and ACSL supports the demonstration experiments by offering drones. JR Hokkaido is planning to use drones for some inspections that have been conducted by the naked eye or hand, for the purposes of streamlining the maintenance and management of equipment, in preparation for the shortage of manpower and improving the safety of work by decreasing the tasks that requires entering the railway tracks. As part of this project, they are conducting demonstration experiments. Drones provided by ACSL can fly stably without GPS, by using a laser sensor and a camera recognition technology, and grasp the cross-sectional shape of a tunnel and the position in each moment.

Logistics

In cooperation with ANA Holdings and other 3 companies, ACSL conducted out-of-sight flights for two routes at the same time without assistants for the first time in Japan, and succeeded in transporting seafood, including abalones, between remote islands. In addition, in Japan Post’s trial delivery of mails using a drone, they succeeded in delivering actual mails and packages to destinations (houses) in hilly and mountainous areas.

Disaster Prevention

The company transported daily necessities and health supplements by using drones to Okutama, where about 40 households (70 residents) were isolated after the collapse of Prefectural Route 204 in the wake of Typhoon No. 19. In addition, ACSL’s activities for developing drones and preventing disasters were covered by “CNN Innovate Japan,” a special program provided by CNN International. A theme is set for each episode in that program, and in the episode that introduced ACSL, anti-disaster drones of ACSL were featured as an example of “the cutting-edge anti-disaster technology” in Japan. The CTO Chris Raabe of ACSL gave comments about the latest human detection technology based on AI and the possibility of using drones for disasters.

Development of ACSL-PF2 and MINI as next-generation drones

Medium-sized drone ACSL-PF2

|

・ It can be used for various purposes of use, including inspection, transportation of goods, and wide-range aerial photo-shooting. ・ High scalability because it can be equipped with various sensors. ・ Top-class time of flight among medium-sized drones ・ Original control technology and quality control complying with ISO9001 |

Compact drone MINI

| ・ To meet the needs for bridge inspection, etc., it can be mounted on the upper part of a camera ・ As safety functions, it is equipped with sensors for avoiding collisions in 6 directors and a stereo camera at the front side ・ Top-class time of flight (48 min.) among compact drones ・ Original control technology and quality control complying with ISO9001 |

(Taken from the reference material of the company)

3. Fiscal Year Ending March 2021 Earnings Forecast

【Impact of the novel coronavirus】

In the term ended March 2020, there was no significant impact of the novel coronavirus. In the term ending March 2021, some risks are assumed regarding the trend of customers’ demand and production systems, but they consider that these can be coped.

The following table summarizes the assumed risks and countermeasures regarding customers’ trends, supply chains, operational systems and financial status of the company.

| Assumed risks | Countermeasures |

Customers’ trends | ・ In response to the worsening of economies and business performance, clients will reduce their budgets for investing in new technologies, including drones | ・ To visit each client, to survey the situation and discuss how to proceed ・ Confirmed that many existing clients will continue the drone business |

Supply chain | ・ Difficulty in procuring main parts and delay in production due to the delay in supply of parts from suppliers and suspension of manufacturing | ・ To discuss alternatives to major parts ・ There is some delay in procurement in the first half, but this problem is expected to be solved in the second half. |

Operational systems of the company | ・ Stagnation of marketing and business development activities ・ Suspension and slowdown of business activities due to the spread of COVID-19 | ・ In principle, all employees have been working from home from the second half of March. ・ To conduct development and production activities by allowing a limited number of employees to go to their office while monitoring the situation |

Financial state | ・ Decrease of cash due to the decline of sale ・ Risk of impairment loss due to the downturn of business activities of invested enterprises | ・ plenty of cash and deposits (about 3.8 billion yen) ・ To curtail costs at invested enterprises, and put importance on cash flows |

3-1 Policies and earnings forecast for the term ending March 2021

Due to the spread of COVID-19 and uncertainties, it is difficult to conduct rational estimation, so the earnings forecast is undisclosed, but the company plans to increase sales from the previous term and keep earning profit in accordance with the following policies.

Policies for the term ending March 2021

・To aim to grow sales and keep earning profit

・To continue the investment in main R&D for autonomous (flight), SLAM (self-location estimation and environmental map production), etc.

・Investment in security through national projects, etc.

・To evolve from “a prototype developer” to “a manufacturer,” releasing products for respective purposes of use.

・To keep increasing employees and establish a system for “operating business while coping with the novel coronavirus,” including teleworking

Sales

Since the company’s business has high novelty and there is the impact of the novel coronavirus, it is difficult to predict the trend of customers’ demand, but the company aims to increase sales from the previous term. As for solution development (STEPs 1 and 2), the company aims to secure almost the same number of transactions as that of the previous term, but the average sales per project is expected to decline due to the decrease of large-scale projects. As for the sale of drones (STEPs 3 and 4), sales volume is expected to grow, although average spending will decrease through the sale of MINI.

Operating income

The company aims to keep earning operating income through cost control. The company aims to achieve a gross profit rate of 60% or higher, and R&D costs, which is a major item of SGA, will be 20-25% of sales, so that the R&D budget will be efficiently used.

3-2 Business plan for the term ending March 2021

With the aim of evolving from a prototype developer to a manufacturer, the company will develop, produce, and sell mass-produced models that specialize in respective purposes of use and can be put to practical use. In addition, the company will enhance the cooperation with external partners, concentrate on the development of core technologies, and fortify in-company systems for improving the development capacity and management/governance systems.

Development, production, and sale of mass-produced models for respective purposes of use that can be put to practical use

In cooperation with major clients, the company will confirm requirements for practical use and reflect them in the development of mass-produced models. By utilizing the knowledge of PoC and the feedback from it, the company will evolve from a developer of prototypes for all purposes of use and proceed with the development, production, and sale of mass-produced models specializing in respective purposes of use. While mass-producing and selling high-security compact drones for aerial photo-shooting, including the new model MINI, at low prices, the company will invest in development of made-in-Japan security products through national projects, etc. and embody the most secure product in Japan.

Expansion of sales networks and concentration on development of core technologies through the enhancement of cooperation with external partners

The company will strengthen solution partners, actively cooperate with industry groups in sales promotion, and increase channels to reach customers, to reinforce the company’s presence in the market. As for development, the company will accelerate these activities, while focusing on the development of autonomous control, which functions like the cerebrum and the cerebellum, including SLAM, which is the core technology of the company. As for non-core parts, such as chassis and drive systems, the company will entrust external partners, and establish a production outsourcing system while utilizing their mass-production know-how.

Fortification of in-company systems for improving the development capacity and management/governance systems

The company will keep developing high-level development systems with diverse development staff, and tighten internal control, enhancing corporate governance by organizing a remuneration committee, etc.

4. Conclusions

In the term ended March 2020, the company moved into the black as announced. The sale of drones (STEPs 3 and 4) declined, falling below the estimate. This needs to be improved in the following terms, but it is unnecessary to become anxious. For example, in cooperation with NJS Co., Ltd. (2325), which offers consulting services regarding water supply and sewerage systems and is one of the major clients, the company has been developing customized inspection drones for closed space since 2016, and succeeded in developing a drone that can reduce the cost for sewerage inspection by about 20%. During the development process, there emerged needs for development of inspection drones for hydroelectric power plants (to check the inside of each hydraulic iron pipe). Accordingly, the company is proceeding with the practical use of drones for sewerage systems and applying them to the inspection of hydroelectric power plants. In such cases, budgets are allocated to mainly solution development (STEPs 1 and 2), so the sale of drones (STEPs 3 and 4) does not progress as expected. Nevertheless, purposes of use increased, including the inspection of hydraulic iron pipes at hydroelectric power plants in addition to sewerage inspection, and the latent market of mass-produced drones expanded, bringing some benefits to the company in the ultralong term.

From the term ending March 2021, the company will aim to become a “drone manufacturer” while staying in the black under the mid-term corporate strategy: “From a Prototype Factory to a Drone Manufacturer.” In order to effectively use funds and time, the company will cooperate with external partners in the aspects of development and sale, and concentrate its managerial resources onto the development of autonomous control, which functions like the cerebrum and cerebellum, including SLAM, which is the core technology of the company. As the demand for made-in-Japan drones is growing because customers want safety and reliability, the company plans to actively cooperate with industry groups to promote made-in-Japan drones and enhance the presence of the company, which can provide the entire system, including the autonomous control technology. The true value as a drone manufacturer is still to be tested, and the company is required to take action more speedily. We would like to expect their future advancement.

< Reference: Regarding Corporate Governance >

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones. |

◎Corporate Governance Report (Updated on June. 28, 2019)

Basic Policy

Our mission is “Liberate Humanity through Technology,” and our corporate value is “Pursue world-class autonomous technology and accomplish social implementation, to automate and unman human tasks and promote evolution of humanity.” Under this corporate value, we believe that our duty is to foster and maintain trusting relationships with all stakeholders (i.e. including shareholders, employees, business partners, clients, creditors, and local communities) and conduct business administration putting importance on the interest of every stakeholder. To do so, it is indispensable for our business to grow stably and lastingly, and we recognize that it is important to strengthen corporate governance for improving the soundness and transparency of business administration, which would be the foundation for the growth, and we actively work on it. Concretely, we are striving to enrich general meetings of shareholders, upgrade the functions of the boards of directors and auditors, carry out timely, appropriate information disclosure and IR activities, and tighten internal control systems, to enhance corporate governance further.

【Reasons for Non-compliance with the Principles of the Corporate Governance Code】

Autonomous Control Systems Laboratory Ltd. has implemented all the Basic Principles of the corporate governance code.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Autonomous Control Systems Laboratory Ltd. (6232) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/