Bridge Report:(6232)Autonomous Control Systems Laboratory the second quarter of fiscal year March 2021

CEO Hiroaki Ohta |

President Satoshi Washiya | Autonomous Control Systems Laboratory Ltd. (6232) |

|

Corporate Information

Exchange | TSE Mothers |

Industry | Machinery (Manufacturing) |

Representative | Hiroaki Ohta, Satoshi Washiya |

Address | Hulic Kasai Rinkai Building 2F, 3-6-4 Rinkaicho, Edogawa-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥2,953 | 10,894,596 shares | ¥32,171 million | 6.8% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

- | - | -21.23~4.62 | - | ¥468.56 | 6.3x |

*Share price as of closing on December 3.The number of shares issued at the end of the most recent quarter excludes its treasury shares. ROE and BPS are based on previous term earnings results

Non-consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2017 (Actual) | 156 | -533 | -486 | -488 | - | - |

Mar. 2018 (Actual) | 370 | -542 | -454 | -460 | - | - |

Mar. 2019 (Actual) | 807 | -330 | -176 | -183 | - | - |

Mar. 2020 (Actual) | 1,278 | 15 | 231 | 239 | 23.00 | - |

Mar. 2021 (Estimate) | 1,400~1,700 | -250~0 | -200~50 | -230~50 | -21.23~4.62 | - |

* The earnings forecast is that of the company. Unit: Million yen

This Bridge Report reviews the second quarter of fiscal year March 2021 earnings results and fiscal year March 2021 earnings estimate of Autonomous Control Systems Laboratory.

Table of Contents

Key Points

1. Company Overview

2. Progress with Mid-term Management Direction “ACSL Accelerate 2020”

3. Overview of the results for the second quarter of the term ending March 2021 and the full-year forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the first half of the term ending March 2021 were 78 million yen (200 million yen in the same period of the previous year), and ordinary loss was 360 million yen (82 million yen in the same period of the previous year). There was a delay in recording sales due to the spread of the novel coronavirus. However, losses increased due to the company's upfront investments in promoting collaborations with partners and continuous R&D activities related to core technologies for next year onward.

- The full-year forecast remains unchanged. Sales are projected to be between 1.4 billion and 1.7 billion yen, and operating income is expected to be between -250 million and 0 million yen. Due to the risks of postponement of projects and delay in making new deals due to the spread of the novel coronavirus, the company disclosed a range estimate rather than providing particular values in its forecast. The company plans to make upfront investments mainly in R&D for fields where growing demand is expected. R&D expenses of 410 million yen have been incorporated in the forecast. Sales are heavily concentrated in the fourth quarter. This tendency is stronger than usual in this term because the novel coronavirus suppressed activities in the first half.

- In August, the company announced the medium-term management policy "ACSL Accelerate 2020" (FY 3/21- FY 3/23), focusing on the future market. Significant changes in the market environment for industrial drones are likely to take place due to the lifting of the ban on non-visual flights in manned areas (areas including cities) and the need for drone security measures for photographic data, measurement data, location information, etc. The medium-term management policy anticipates such changes while showing the company's goals in ten years. The company plans to shift from an R&D-type company to a mass-production manufacturer that develops, produces, and sells application-specific drones. The company aims in the term ending March 2023 to achieve sales of 5.5 billion yen and an operating income of 750 million yen.

1. Company Overview

Autonomous Control Systems Laboratory develops and sells fully autonomous drones (which can fly based on a preset program or the like without being operated by a person), which do not require the operation with a controller and automatically take off and return. The company targets the fields of “infrastructure inspection,” “logistics and mail transportation,” and “disaster prevention and control,” in which high-level autonomous flying is frequently demanded. The drones of the company work on behalf of human workers in these fields. Accordingly, the business of the company is to not merely manufacture and sell machines, but also offer solutions for streamlining business operation, automating business processes, and adopting IoT. The company deals with tasks from planning, system development and installation, to after-sales services on a one-stop basis.

【Goals of ACSL】

MISSION | Liberate Humanity Through Technology |

VISION | Revolutionizing social infrastructure by pursuing cutting-edge robotics technology |

【”To-Be” state 10 years】

(1) Global pioneer in solving social infrastructure issues

(2) More than 100bn JPY sales, 10 bn JPY sales profit

(3) Mass production manufacturer that produces 30,000 units/year

(4) Supporting the country with de facto standards

(5) Developing cutting-edge technologies for autonomous control (cerebellar and cerebral)

(6) Nurturing the industry’s most advanced and talented human resources

(7) Constantly working to improve its corporate value and financial KPIs

【Mid-Term Management Direction “ACSL Accelerate 2020”】

Core areas of the drone business in the next 10 years

(Taken from the reference material of the company)

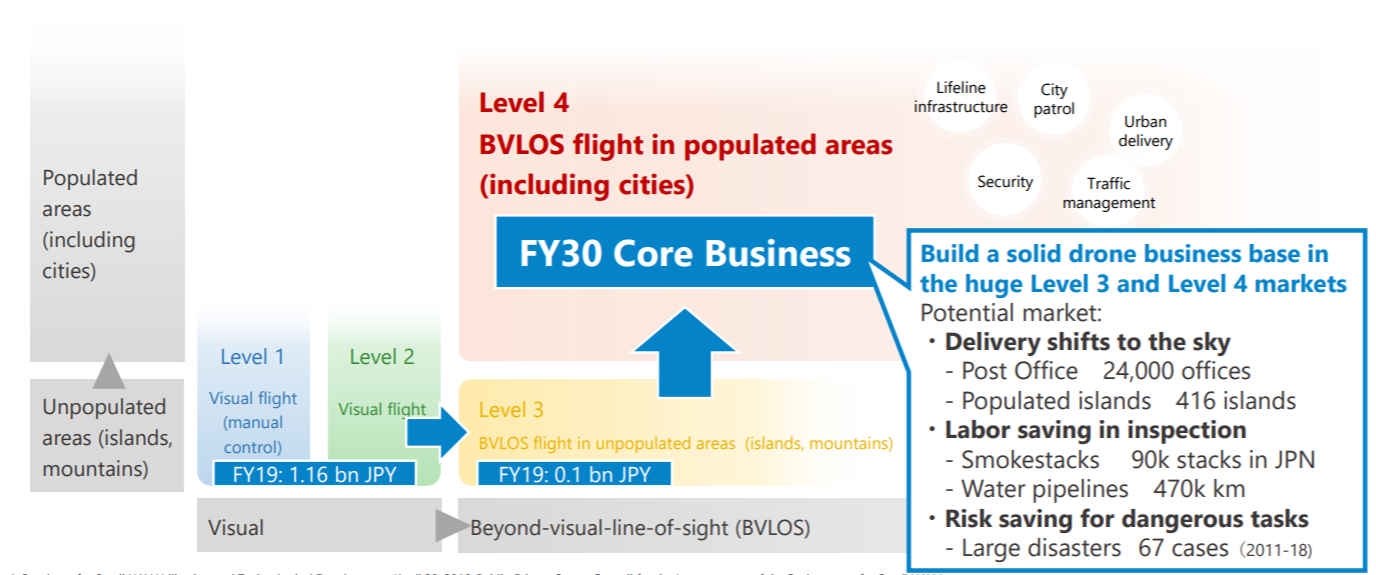

The plan for the drone business in 10 years' time is to shift the core business area from visual-line-of-sight flight (Levels 1 and 2), which generated 1.16 billion yen in FY19, to BVLOS (beyond-visual-line-of-sight) flight (Levels 3 and 4), which has a huge potential for growth.

Legal reform has been progressing for Levels 1, 2, and 3, expanding the area drones can fly over from unpopulated areas to populated areas, and allowing operators to fly drones out of their line of sight (assuming automatic and remote operation). In 2018, BVLOS flight became possible over unpopulated areas (uninhabited islands, mountainous regions, etc.)(Level 3). By 2022, a regulatory system is to be put in place allowing operators to fly drones out of their visual sight in areas where people live or work (Level 4).

For example, drones can be applied to postal services. Currently, the logistics network that connects the 24,000 post offices in Japan and 416 remote islands where people live are supported by people, but once Level 4 becomes possible, the Japanese government is aiming to use drones to transport packages across some of these remote routes.

Business strategy

In addition to the core business shift, the company aims to evolve from a prototype developer, which focused on demonstration testing and custom development, to a manufacturer that develops, produces, and sells mass-produced, application-specific drones.

In order to achieve this business strategy, the company will develop application-specific drones, introduce a subscription model, begin full scale business entry into the ASEAN region, and procure technology through CVC (corporate venture capital).

Development of application-specific drones | Commercialization of small aerial drones (for government procurement and the private sector), midsize logistic drones (Level 4-compliant), smokestack inspection drones, and enclosed environment inspection drones |

Introduction of a subscription model | Subscription-based fixed income/recurring sales model to be introduced to meet various customer needs, in addition to one-off drone sales |

Full scale entry into the ASEAN region | Establish an office for development and sales activities in Singapore, the core city in the ASEAN region, and hire local talents to begin full-scale overseas expansion |

Technology procurement through CVC | Establish a CVC (or equivalent function) and actively procure technologies with the potential for technology synergies, such as AI, blockchains, security, image processing, and sensors. |

For application-specific drone development, ACSL needs to overcome the challenges inherent in each application. For example, in delivery applications, drones are usually in forward flight (form of flight with directionality). In smokestack inspection, drones only fly up and down. Also, in enclosed environments (in sewers, etc.), it requires stable control, for example, by negating the effects of the wind created by the drone. Regarding the introduction of a subscription model, the company is planning to establish various models, including rental and lease services. Through these models, it aims to grow a business that generates recurring revenue.

In addition to the above, the company will accelerate business expansion in Singapore, where it established an office in the term ended March 2020, as well as separate production to be handled in-house and that to be handled externally. For technologies used in external production, the company aims to integrate technologies procured through CVC to accelerate technology development.

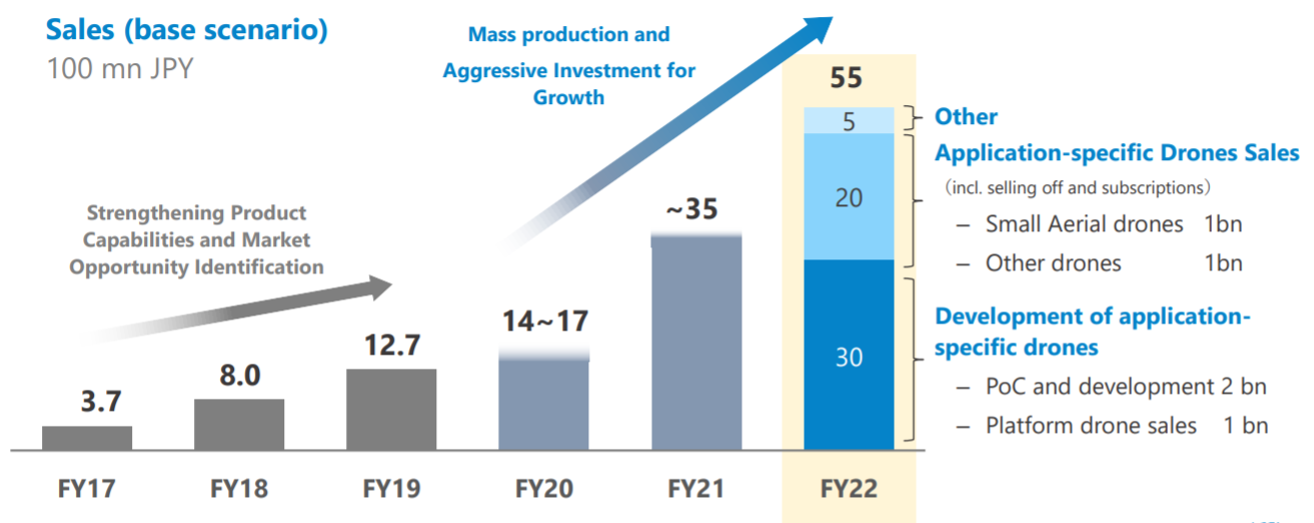

Base Scenario for Sales

(Taken from the reference material of the company)

ACSL is targeting sales of approximately 5.5 billion yen in FY22 in conjunction with the commercialization of application-specific drones from FY20, and aims to steadily build up a pipeline of application-specific drones from FY22. In FY22, it projects sales of 3 billion yen from solution development, 2 billion yen from the sale of mass-produced application-specific drones, and 0.5 billion yen from other areas.

Numerical targets (JPY)

| FY17 | FY18 | FY19 | FY20 |

| FY22 |

Revenue | 0.37 billion | 0.8 billion | 1.27 billion | 1.4 to 1.7 billion |

| 5.5 billion |

Gross profit | 48% | 53% | 63% | 57% |

| 50% |

R&D | 0.32 billion | 0.36 billion | 0.27 billion | 0.41 billion |

| 0.8 billion |

Sales profit | -0.54 billion | -0.3 billion | 0.01 billion | -0.25 to 0 billion |

| 0.75 billion |

In FY22, the company expects gross profit margin to decline due to a sharp increase in sales of small aerial drones, but is aiming to expand earnings, reaching sales of 5.5 billion yen and an operating income of 0.75 billion yen. The drop in gross profit margin to 50% in FY22 will be due to an increase in government procurement and sales of small aerial drones to the private sector. It expects that gross profit margin will improve due to the launch of drones for delivery and other applications.

Target KPIs for FY22

| Units | Value | |

Sales of application-specific drones | Small aerial photo (low average selling prices) | From 1,000 units | 1 billion yen |

Other (high average selling prices) | From 300 units | 1 billion yen | |

Development of application-specific drones | Proof of Concept and Development | - | 2 billion yen |

Sales of Platform/Evaluation drones | Up to 300 units | 1 billion yen | |

Other | - | 0.5 billion yen | |

2. Progress with Mid-term Management Direction “ACSL Accelerate 2020”

2-1 Changes in the market environment

Based on the view that drones present a cyber security risk as IoT devices, the government has announced a policy to procure drones that ensure security.

In February 2020, a bill was passed to promote the introduction of 5G and drones while ensuring cyber security. In June, NEDO, which is the supervisory body of the Ministry of Economy, Trade and Industry, allocated 1.61 billion yen for high-security, low-cost drone technology development for government procurement (ACSL was entrusted with this business). Then, in September, the government announced a policy to procure secure drones, limiting new procurement to drones with guaranteed security and requiring the swift replacement of drones already in place.

2-2 Steps toward the launch of application-specific drones and progress with commercialization

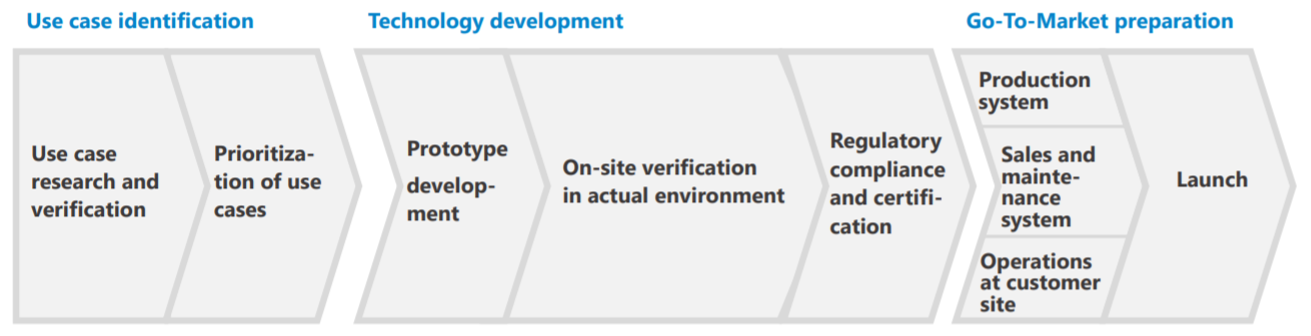

Steps toward the launch of application-specific drones

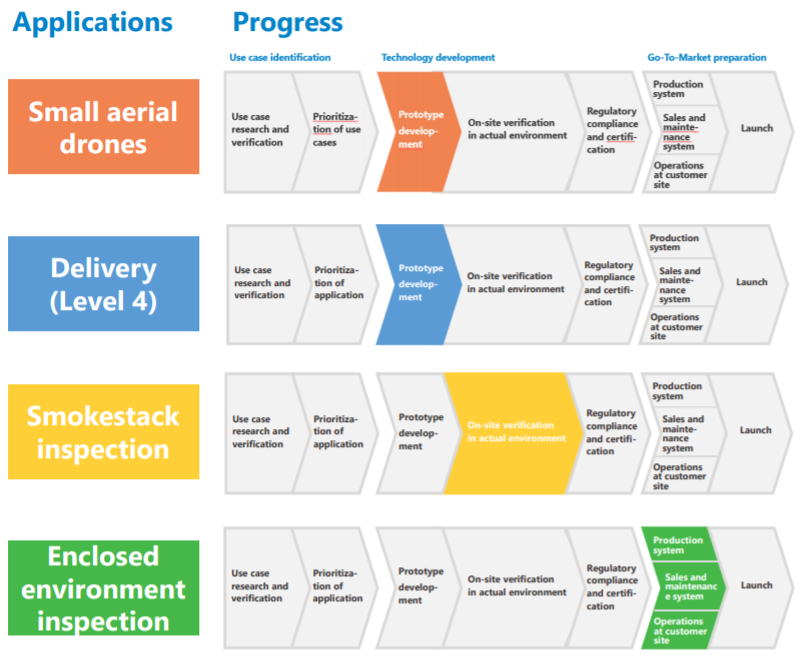

Under “ACSL Accelerate 2020,” the company is proceeding with the development of application-specific drones (small aerial, midsize delivery, smokestack inspection, and closed environment inspection drones) in collaboration with major customers based on use-case research and verification, and prioritization of use cases. For closed environment inspection in particular, it is making headway with plans to build production, sales, and operating systems, and is in the final stage of Go-to-market.

(Taken from the reference material of the company)

Currently, ACSL has narrowed down applications to four key areas, and these have been prioritized based on marketability and the speed of customer initiatives, among the huge number of applications it has identified. It has already prepared pipelines in addition to these. In the technology development phase, commercial sensors, etc., will be attached to existing drones and demonstrated on-site. The company will carry out many tests in actual environments and conduct the verification required for implementation. Based on verification results, ACSL will develop a specialized drone and proceed with the acquisition of certifications, such as those for technical suitability, environmental preservation, and international transportation of batteries. After that, it will begin preparations for Go-To-Market, and work in parallel to establish mass production, sales/maintenance (after-market support), and customer operating systems.

Progress with commercialization of application-specific drones

The company is making steady progress with efforts to launch all application-specific drones next fiscal year.

For small aerial drones (government procurement, etc.), development of a prototype that meets target specifications based on demand research has been completed, and improvement through on-site verification in actual environments is on going

For midsize delivery drones, a prototype is being developed based on input for target specifications from key prospective customers. In addition, since it is necessary to reflect the requirements of the Civil Aeronautics Law, which is slated for revision in 2022, the company is also building a system that can meet those requirements.

The company’s midsize delivery drone was selected for Tokyo Metropolitan drone delivery project. The project is based on the realization of Level 4 (BVLOS flight in populated areas, including cities) in 2022, aiming for rapid social adaption of drone delivery business in manned areas. Drone development is proceeding in collaboration with VFR, a subsidiary of VAIO.

For smokestack inspection, the company conducted on-site demonstrations in actual environments and received good results. Based on these results, development of drones for mass-production that meet final target specifications is already underway. The smokestack inspection drone flies straight up in a pitch-black space with a height of about 180 meters and a radius of about 6 meters, and was developed together with Kansai Electric Power. The company has also started efforts to develop human resources (operators) who can operate delivery drones. The smokestack inspection drone was displayed to the public at Japan Drone 2020, Japan’s largest international drone exhibition (at Makuhari Messe on September 29-30).

As for closed environment inspection drones (drones that fly in pipes, etc.), ACSL has already started development of mass-produced drones that meet final target specifications. It has also started building production, sales, and customer operating systems ahead of the Go-To-Market.

Applications and Progress

(Taken from the reference material of the company)

2-3 Topics

Start of continuous flight tests with Aerodyne Japan in ASEAN region

The company has begun continuous flight tests (flight time of 1,000 hours) in Malaysia with Aerodyne Japan with the aim of accumulating the sufficient flight time and testing necessary to meet regulatory requirements (obtain Level 4 certification, etc.). Aerodyne Japan is a Japanese corporation in the Aerodyne Group (Headquarters: Kuala Lumpur, Malaysia) that operates in Asia as a drone solutions provider. This alliance has enabled the company to conduct continuous flight tests in Malaysia’s wide open spaces and in various environments.

Selected for open and free satellite data demonstration project

The aim of the demonstration experiments is to verify the effectiveness of drones using SLAS (Sub-meter Level Augmentation Service) for the field where advanced flight is required, such as disaster response, infrastructure inspection, and monitoring and search. Specifically, the company aims to develop a prototype drone capable of SLAS positioning and verify positioning accuracy in takeoff and landing, and verify/compare the difference in landing accuracy between GPS and SLAS and how it changes mission achievability in each field. SLAS is a satellite radio wave that uses the frequency of the quasi-zenith satellite launched in Japan. By using SLAS, it is possible to decrease error compared with GPS, GNSS, American satellites, etc. (2 to 3 meters → within 1 meter).

Establishment of a corporate venture capital in the pursuit of technology synergies

ACSL decided to establish a corporate venture capital (CVC) to accelerate development. It is targeting investments in image processing, AI, blockchains, various authentication required for security, as well as companies carrying out sensor development, etc. The company plans to focus on control technology and incorporate peripheral technologies necessary for autonomous flight through CVC.

3. Overview of the results for the second quarter of the term ending March 2021 and the full-year forecast

[Impact of the spread of the novel coronavirus]

In the first quarter, sales bottomed out, and gradually recovered. There was a delay in recording sales in the second quarter due to a delay in implementing projects. In the medium to long term, demand for unmanned and labor-saving is expected to continue.

Customer trends

The company assumed some risks, which included delays in project implementation such as demonstration experiments for clients due to restrictions on employee attendance, clients postponing projects due to the uncertain business outlook, and clients reducing investment budgets for new technologies such as drones due to the worsening of economies and business performance.

In reality, many projects have been postponed or delayed, resulting in a decline in sales in the first half. However, demand itself continues. There are concerns about the spread of the novel coronavirus toward the fourth quarter when most sales will be booked, so the company will closely monitor the situation and consider taking countermeasures.

Operations

The company anticipated risks such as difficulty in procurement due to supply chain suspension and suspension and the slowdown of sales and business development activities due to the spread of the novel coronavirus. There was a partial delay in the supply chain, but the procurement delay has already been resolved. Sales activities were also affected by the pandemic. As for business operations, the company continued to take safety measures for business activities and reduce the number of employees who came to work.

Financial aspect

There were concerns about a possible decrease in cash due to a decline in sales and a risk of impairment due to the downturn of invested companies' business activities. However, as of the end of the second quarter, the company has sufficient cash (approximately 3.2 billion yen), and it continues to control costs at invested companies.

| Mar. 2020 | Sep. 2020 |

| Mar. 2020 | Sep. 2020 |

Cash and deposits | 3,775 | 3,173 | Advances received, deposits | 8 | 8 |

Trade receivables | 815 | 56 | Current Liabilities | 233 | 108 |

Current assets | 4,818 | 3,696 | Net Assets | 5,034 | 4,658 |

Noncurrent assets | 449 | 1,070 | Total Liabilities, Net assets | 5,268 | 4,767 |

*Unit: Million yen

3-1 Non-consolidated Results in the First Half

| 1H of FY3/20 | Ratio to sales | 1H of FY3/21 | Ratio to sales | YOY |

Net Sales | 204 | 100.0% | 78 | 100.0% | -61.4% |

Gross profit | 77 | 37.9% | -13 | - | - |

SG&A expenses | 377 | 184.5% | 404 | 512.5% | +7.2% |

Operating income | -299 | - | -417 | - | - |

Ordinary income | -82 | - | -360 | - | - |

Net Income Attributable to Owners of the Parent | -84 | - | -396 | - | - |

*Unit: Million yen

Sales were 78 million yen (200 million yen in the same period of the previous year), and ordinary loss was 360 million yen (loss of 82 million yen in the same period of the previous year)

While the planned projects were postponed due to the spread of COVID-19 and sales decreased, the company conducted R&D activities as scheduled (R&D expenses: 120 million yen → 137 million yen).

The company's sales can be divided into demonstration experiment sales, platform drone sales, and other sales. In the first half of this year, other sales such as national projects and maintenance (38 million yen → 39 million yen) remained flat. However, sales of demonstration experiments (93 million yen → 24 million yen) decreased because some projects were postponed, and platform drone sales (72 million yen → 14 million yen) also declined due to delays in shipping to clients because of the coronavirus crisis.

Demonstration experiments include closed proof-of-concept (PoC) to study the feasibility of drone application ideas and detailed test operation and design and customized development (customized drone design and development). The number of demonstration experiments conducted in the first quarter was only two (14 cases in the same period of the previous year), and the number of demonstration experiments cases in the first half decreased by 23 (36 cases in the previous year) to merely 13 cases.

Platform drone sales include sales of standard and general-purpose drones and production and sales of drones that have been improved for customers based on standard drones. In the first half of the year, the number of drones sold declined by 14 to only four.

In other sales, although sales of national projects increased (18 million yen → 21 million yen), sales of maintenance etc. (19 million yen → 16 million yen) fell.

3-2 Fiscal Year Non-Consolidated Business Results

| Results of FY 3/20 | Ratio to sales | Estimate for FY 3/21 | Ratio to sales | YOY |

Net Sales | 1,278 | 100.0% | 1,400~1,700 | - | +9.5%~+32.9% |

Gross profit | 808 | 63.2% | 800~ | - | -1.0%~ |

SG&A expenses | 792 | 62.0% | 1,050 | - | +32.6% |

Operating income | 15 | 1.2% | -250~0 | - | - |

Ordinary income | 231 | 18.1% | -200~50 | - | - |

Net Income Attributable to Owners of the Parent | 239 | 18.7% | -230~50 | - | - |

*Unit: Million yen

Sales hit a record high

The company has disclosed sales are projected to be between 1.4 and 1.7 billion yen, as it has estimated the risk of sales decrease due to the impact of the coronavirus crisis to be 300 million yen. The company anticipates the novel coronavirus to affect sales in the case of recording the forecasted minimum sales (1.4 billion yen). However, even in that case, sales are expected to exceed the previous year by 9.5%.

Nonetheless, regardless of whether the pandemic affects sales or not, the company has included R&D costs of 410 million yen. The company intends to make an upfront investment mainly in R&D required for business expansion from the next fiscal year onward. If the company achieves the forecasted maximum sales, sales are expected to absorb the R&D expenses, and operating income and loss will balance each other out. The target gross profit margin is 55-60%.

As for demonstration experiment (solution development: Steps 1 and 2), sales are expected to be between 750 million yen and 1 billion yen. Although the company is expected to maintain the same number of projects (112) as the previous term, the unit price of projects is projected to decrease due to the lack of large projects. Sales of platform drones (drone sales: Steps 3 and 4) are estimated to be 500 million yen. Due to the contribution of Mini, a general-purpose inspection drone, to sales, the number of units sold is expected to be higher than the previous year (up to about 200 units). However, the unit price will decrease because of changes in the drone configuration. Also, 150 million yen was included in forecasted sales of national projects and maintenance.

4. Conclusions

Even though progress against the full-year forecast has been delayed, there is no sense of concern at present. The company's earnings are heavily concentrated on the fourth quarter. However, earnings are expected to be more concentrated on the second half of this term than usual because the novel coronavirus crisis suppressed business activities in the first half. This is because the projects that were scheduled to be implemented in the first quarter have been pushed back to the second quarter, and the ones in the second quarter to the third quarter. Nevertheless, as the company incorporates the risk that acceptance inspections will not be completed by the end of the fiscal year, which is expected to result in a loss of around 300 million yen, it disclosed the range estimate for the earnings forecast and not particular figures.

Moreover, even if there is a temporary delay in budget execution, the demand for automation and labor-saving will increase in the medium to long term. It is expected that companies with abundant financial power will enter the market as the market expands. However, the company has three major advantages that financial resources alone cannot acquire.

One is the know-how and data. The main battlefield will be Level 4. The know-how and data accumulated through Levels 1, 2, and 3 and the proficiency in the customer's business know-how required for industrial drones cannot be attained through financial resources. It takes a long time to obtain the knowledge needed to understand the requirements and necessary features to apply the drone into customer operations. That is why the company is so particular about trial-and-error with customers and on-site verification.

The second is human resources and know-how required for obtaining Level 4 certification. Like Mitsubishi Heavy Industries' small passenger aircraft MRJ, the completion of aircraft does not mean that it can be certified immediately. Securing human resources with aviation knowledge is a challenge for Japan as a whole, but the company is ahead in this regard.

Furthermore, the third is drone control technologies. This part has many analog elements. Specifically, it includes analog tuning needed to decide which action to be taken in which scenario. It is a technology that the company has evolved through demonstration experiments, and it cannot be easily obtained even with financial resources.

< Reference: Regarding Corporate Governance >

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones. |

◎Corporate Governance Report (Updated on July. 7, 2020)

Basic Policy

Under the mission of "Liberate Humanity through Technology," we have a vision of " Revolutionizing social infrastructure by pursuing cutting-edge robotics technology ." Under this corporate value, we believe that our duty is to foster and maintain trusting relationships with all stakeholders (i.e., including shareholders, clients, business partners, employees, creditors, and local communities) and conduct business administration putting importance on the interest of every stakeholder. To that end, it is essential for our business to achieve stable and lasting development, and we recognize that enhancing corporate governance with the aim of improving management soundness and transparency is one of the most critical management challenges. Thus, we are working to improve and enhance our corporate governance. Concretely, we are striving to enrich general meetings of shareholders, upgrade the functions of the boards of directors and auditors, carry out timely, appropriate information disclosure and IR activities, and tighten internal control systems, to enhance corporate governance further.

【Reasons for Non-compliance with the Principles of the Corporate Governance Code】

Autonomous Control Systems Laboratory Ltd. has implemented all the Basic Principles of the corporate governance code.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Autonomous Control Systems Laboratory Ltd. (6232) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/