Bridge Report:(6232)ACSL second quarter of fiscal year December 2021

President Satoshi Washiya | ACSL Ltd. (6232) |

|

Corporate Information

Exchange | TSE Mothers |

Industry | Machinery (Manufacturing) |

Representative | Satoshi Washiya |

Address | Hulic Kasai Rinkai Building 2F, 3-6-4 Rinkaicho, Edogawa-ku, Tokyo |

Year-end | December |

URL |

Stock Information

Share Price | Shares Outstanding (End of term) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,739 | 12,318,600 shares | ¥21,422 million | -42.6% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

0.00 | - | ¥-86.49 | - | ¥325.92 | 5.3x |

*Share price as of closing on November 26. Shares outstanding, DPS and EPS are from the financial report of second quarter of FY 12/21. ROE and BPS are from the financial report of the previous term.

Non-consolidated Earnings Trends

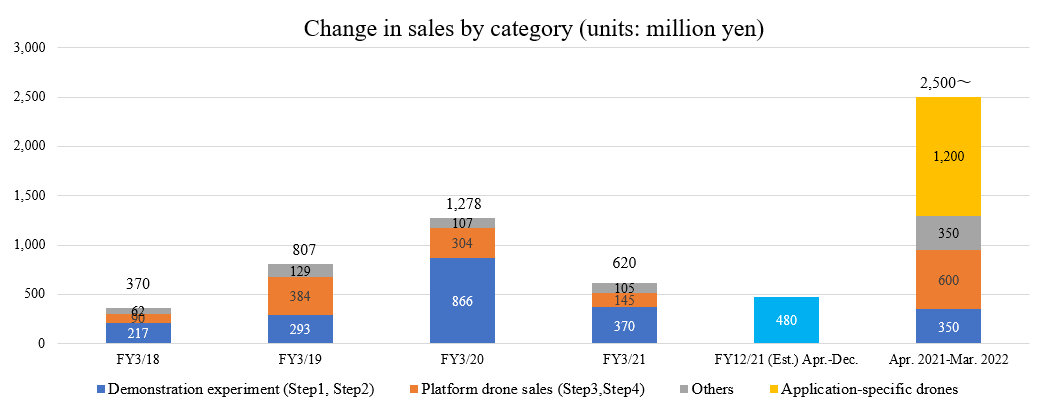

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2018 (Actual) | 370 | -542 | -454 | -460 | -72.02 | 0.00 |

Mar. 2019 (Actual) | 807 | -330 | -176 | -183 | -19.42 | 0.00 |

Mar. 2020 (Actual) | 1,278 | 15 | 231 | 239 | 23.00 | 0.00 |

Mar. 2021 (Actual) | 620 | -1,139 | -1,081 | -1511 | -139.54 | 0.00 |

Dec. 2021 (Estimate) | 480 | -980 | -1,020 | -1,020 | -86.49 | 0.00 |

* The earnings forecast is that of the company. Unit: Million yen

* The company has shifted to consolidated accounting from 3Q of FY 3/21.

* Fiscal year changed from FY 12/21, so FY 12/21 is a nine-month period.

This Bridge Report reviews second quarter of fiscal year December 2021 earnings results and so on of ACSL.

Table of Contents

Key Points

1. Company Overview

2. Medium-term Management Policy “ACSL Accelerate”

3. Overview of the results for second quarter of the term ending December 2021

4. Forecast of the result for the term ending December 2021

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The second quarter of the term ending December 2021 saw an increase in sales, with gross profit returning to profitability while operating loss increased. Sales increased 408.1% year on year to 400 million yen. Due to the national project expansion and other factors, the company achieved record-high figures for the second quarter. Gross profit reached 23 million yen, returning the company to profitability. Operating loss stood at 650 million yen. The company continued its aggressive investments in R&D, with the R&D portion of the SG&A expenses increasing by 130.6% year on year.

- Net sales for the term ending December 2021 are expected to be 480 million yen (due to the change in the accounting period, the forecast for the current term was calculated by dividing the forecast for the term ending March 2021, which was announced in May 2021). In addition to the usual demonstration experiment and platform drone sales, sales from the national project increased, and the forecast net sales was revised upwardly from 350 million yen, which had been estimated in the first quarter. As of the end of September 2021, the order backlog was about 230 million yen, including the orders for which acceptance inspection is scheduled in the next term. Already-realized sales and expected orders for this term total roughly 680 million yen. In the first quarter of the next term (ending December 2022), sales resulting from the sale of application-specific drones, such as small aerial photography drones, are expected to reach approximately 1.2 billion yen.

- The business environment is continuing to develop, with the Upper House plenary session passing a bill to amend the Civil Aeronautics Act in June 2021 with the goal of establishing systems for Level 4. Furthermore, the four priority strategies in the company’s Medium-Term Management Policy “ACSL Accelerate” are also making steady progress. Due to the change of the accounting term, sales from application-specific drones will be recorded next term for the first time (the term ending December 2022), but the forecast net sales are in line with the historical high for the entire company (1.28 billion yen in the term ended March 2020), meaning that the company's level of earnings will change considerably. Expectations are high.

1. Company Overview

A manufacturer of industrial drones, specializing in developing application-specific drones through on-site inspections, dialogues, and demonstrations in order to provide drones that replace and evolve the operations of its customers with proprietary control technologies as the core technologies.

The company targets the fields of “infrastructure inspection,” “logistics and mail transportation,” and “disaster prevention and control,” in which high-level autonomous flying is frequently demanded. The drones of the company work on behalf of human workers in these fields. Accordingly, the business of the company is to not merely manufacture and sell machines, but also offer solutions for streamlining business operation, automating business processes, and adopting IoT. The company’s main feature is dealing with tasks from planning, system development and installation, to after-sales services on a one-stop basis.

【1-1 Corporate Philosophy】

The following missions and visions are what ACSL is aiming to achieve.

MISSION | Liberate Humanity Through Technology |

VISION | Revolutionizing social infrastructure by pursuing cutting-edge robotics technology |

【1-2 Market environment】

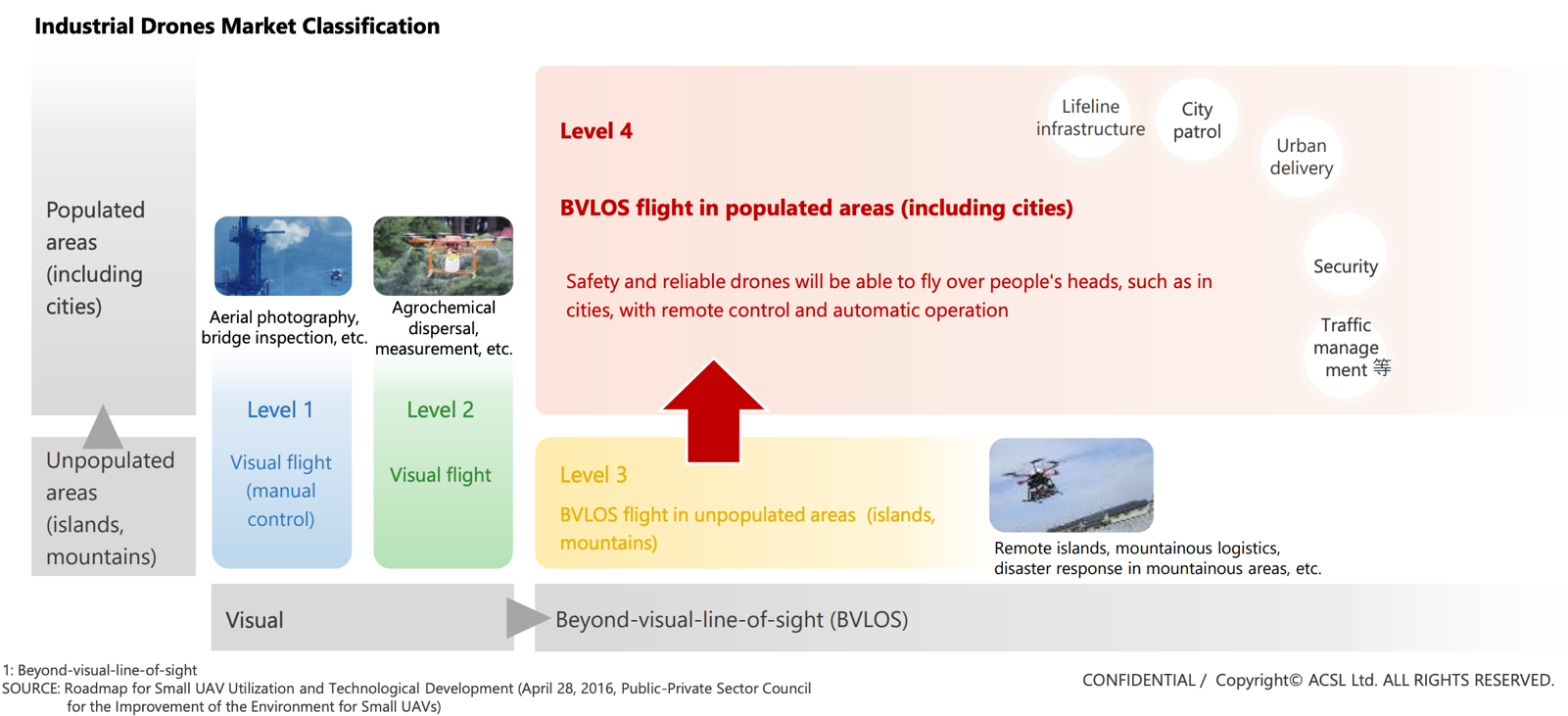

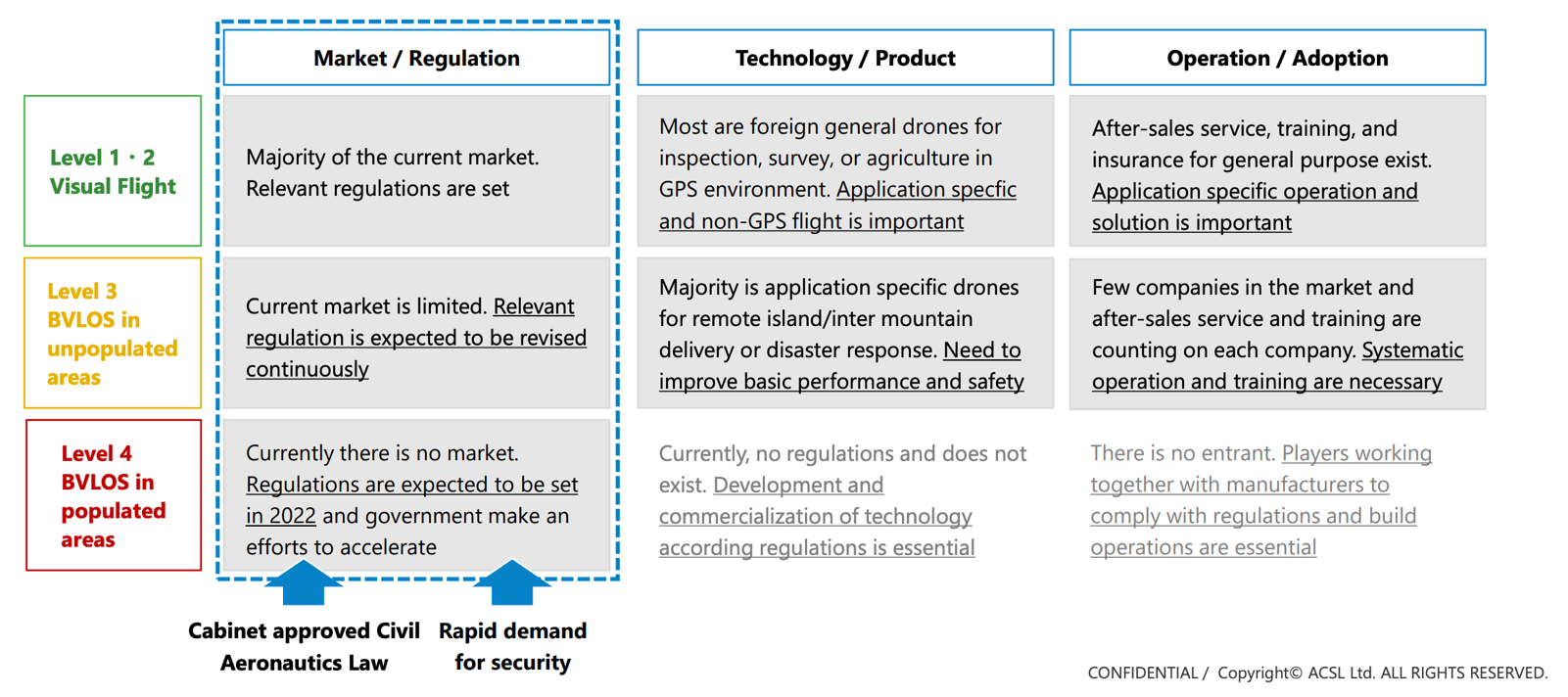

As for Levels 1 and 2, which have already been put into practical use and are driving the current market, the social implementation of drones is progressing as the requirements for market expansion are being prepared.

The necessary environment for Level 3 is also steadily developing. In addition to this, the regulations for out-of-visual flights (Level 4) in residential areas (including cities) are projected to be in place in 2022, which will finally create a huge space that can be used by drones and markets in Japan.

(Taken from the reference material of the company)

On the other hand, in order to make drones more popular, it is essential to improve the security environment.

In May 2017, the Japanese government released its first Roadmap for the Industrial Revolution in the Sky, and has launched an initiative to implement Level 4 by the end of 2022.

In May 2017, the Japanese government released its first Roadmap for the Industrial Revolution in the Sky, and has launched an initiative to implement Level 4 by the end of 2022.

In response to this, a bill was passed in February 2020 to promote the adoption of 5G and drones while ensuring cybersecurity. In June 2020, NEDO (New Energy and Industrial Technology Development Organization) budgeted about 1.6 billion yen for the development of a standard base for high-security, low-cost standard drone and flight controllers for the supposed government procurement.

The government also announced a security-enabled drone-procurement plan in September 2020. In response to this, ACSL announced that it will launch, in December 2021 or later, a small aerial photography drone for government procurement that was being promoted by the NEDO project in April 2021.

In addition, with the Cabinet having approved the revision of the Civil Aeronautics Act to achieve Level 4 in March 2021, the Upper House plenary session passed a bill to amend the Civil Aeronautics Act in June 2021.

The demand for secure is becoming apparent worldwide, as the U.S imposed the embargo on China’s DJI, the largest drone manufacturer. This will be to back up the spread of security-capable drones.

(Taken from the reference material of the company)

2. Medium-term Management Policy “ACSL Accelerate”

Under this business environment, in August 2020, ACSL formulated “ACSL Accelerate” – a “master plan” that establishes what to aim for in 10 years’ time – and in order to realize this, it produced the Medium-term Management Plan (FY 3/21 – FY 3/23) and is promoting the business to achieve the plan.

【“To-Be” state 10 years】

(1) Global pioneer in solving social infrastructure issues

(2) More than 100bn JPY sales, 10 bn JPY sales profit

(3) Mass production manufacturer that produces 30,000 units/year

(4) Supporting the country with de facto standards

(5) Developing cutting-edge technologies for autonomous control (cerebellar and cerebral)

(6) Nurturing the industry’s most advanced and talented human resources

(7) Constantly working to improve its corporate value and financial KPIs

【2-1 Business strategy】

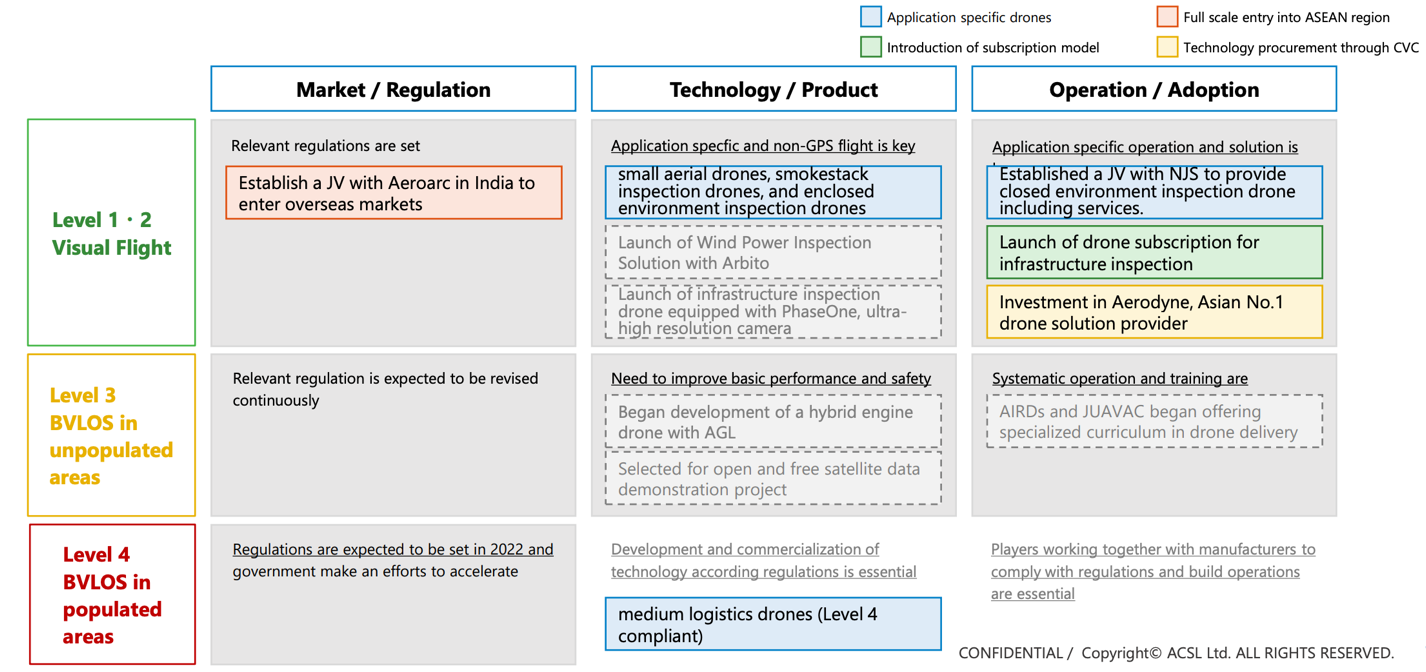

Along with the shifts in core business areas, the company has set out the following four business strategies with the goal of shifting from being a “prototype factory,” which was focused on conventional demonstration experiment and custom development, to a “mass production manufacturer” that develops, produces, and sells application-specific mass-produced drone.

Development of application-specific drones | Commercialization of small aerial drones (for government procurement and the private sector), midsize logistic drones (Level 4-compliant), smokestack inspection drones, and enclosed environment inspection drones |

Introduction of a subscription model | Subscription-based fixed income/recurring sales model to be introduced to meet various customer needs, in addition to one-off drone sales |

Full scale entry into the ASEAN region | Establish an office for development and sales activities in Singapore and India and expand overseas in earnest with hiring local talents. |

Technology procurement through CVC | Establish a CVC (or equivalent function) and actively procure technologies with the potential for technology synergies, such as AI, blockchains, security, image processing, and sensors. |

In addition to the measures set out in “ACSL Accelerate,” the Medium-term Management Policy, the company has implemented a wide range of measures and achieved results in order to meet the requirements for market and customer expansion. Going forward, the company will continue its strategic initiatives to bring its master plan to fruition.

Level 1 and 2 are driving the current market, and the practical application of drones is progressing. Regarding Level 3 and 4, the establishment of regulations and development of application-specific drones are steadily progressing. In the future, it is anticipated that a massive space and market will materialize where drones can operate.

(Taken from the reference material of the company)

The initiatives and progress of the four business strategies are as follows:

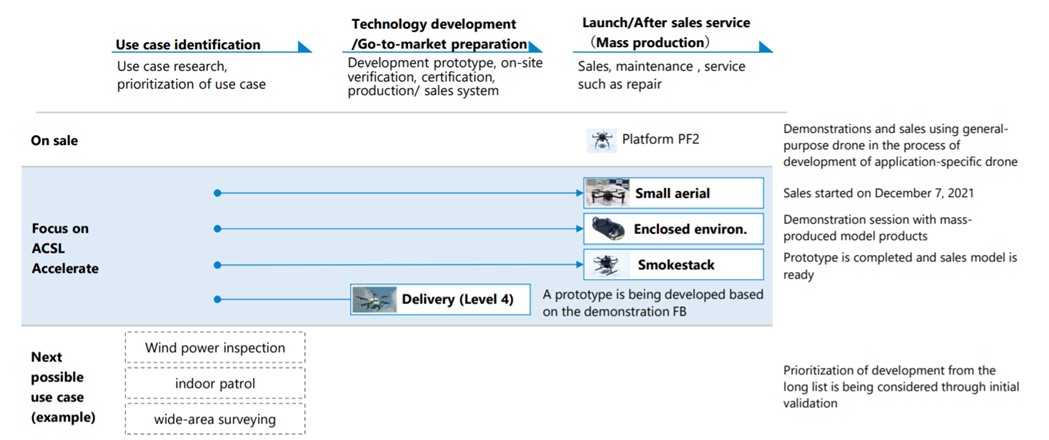

① Development of drone for each purpose of use

After unearthing and prioritizing a number of applications, the company is developing application-specific drone in cooperation with its major customers, and is building production, sales, and operation systems for launch.

Of the four types of application-specific drones listed in the medium-term management plan, that is, small aerial photography drones, closed environment inspection drones, chimney inspection drones, and medium-sized logistics drones, closed environment inspection drones and small aerial photography drones are scheduled to be released in December. Plan is smooth.

(Taken from the reference material of the company)

Progress in the development of each drone

*Small aerial photography

The NEDO project, in which the company is participating as a consortium leader, is developing a small aerial photography drone that ensures “safety and security.” The company released the prototype drone in April 2021 and announced that after the NEDO project, the drone would be on the market after December 2021. A teaser site has been published with an eye towards the product launch in December 2021.

The prototype weighs 1.7 kg and is about 65 cm wide, has excellent dustproof and waterproofing, and has a wide range of scalability, including one-touch switching of cameras and standard communication protocols. In addition, security measures against flight data, shooting data, communication, etc. are also fully implemented, and it is characterized by the user interface that adopts user feedback by agile development.

(Taken from the reference material of the company)

*Medium-sized logistics

In December 2020, in cooperation with ANAHD and others, the company conducted on-site demonstrations in the real environment of a medium-sized logistics drone principle prototype with a payload of 5 kg. In total, 65 flights were successfully made in four days, with a total length of more than 160 km.

The payload of conventional ACSL drones is about 3 kg, but for social implementation, it is important to transport about 5 kg and to have a flight distance of about 20 km.

Based on the results of this verification, the company will develop a medium-sized logistics drone prototype with a 5 kg payload. The company will continue the on-site verifications of its medium-sized logistics drone principle prototypes and aim to develop logistics drones that can be implemented in the society.

*Chimney inspection

In addition to the safety risks of high-level works, chimney inspection by human has other issues such as the need for several weeks to work.

In August 2020, the company provided its ACSL-PF2 as the base drone for autonomous flight drone development for inspection of the inside of chimneys at Kansai Electric Power’s thermal power plant and continues to demonstrate in the real world and obtain good results.

Both the prototype and the production model have been completed.

In addition, by applying chimney inspection drones, the company has developed a “non-GPS compatible autonomous flight drone” for pressure-controlled-tank inspection for Hokkaido Electric Power Company and hydroelectric power plants.

In order for the inspection of the walls inside the pressure-controlled tanks, the workers have to hang from the top and directly confirm the deterioration status, which can be problematic in terms of safety and work efficiency like the chimneys.

Using the structures in the pressure-controlled tanks as a landmark, the drone repeatedly flies horizontally as well as laterally while calculating its own position and photographs the entire inner-wall surfaces. The captured images then enable the workers to check the conditions of the inner walls.

*Closed-environment inspection

The company and NJS (TSE 1st Section, 2325), a water supply and sewerage consulting firm, established JV with an eye to full-scale mass production of closed environmental inspection drones in May 2021, which have been jointly developed since 2015 with NJS. ACSL has a 10% stake and NJS, 90%.

The total length of water supply and sewerage nationwide is about 480,000 km, and the burden of inspection work due to the aging infrastructure is becoming a serious problem.

With the aim of streamlining sewerage inspection works and promoting full-scale commercialization, and with an eye to mass production sales from 2Q of FY 3/22, the company established JV to provide services, including not only production but also support.

In June 2021, a new product called Fi4 was released on the market. Fi4 is a product package combining a drone that can withstand extreme exploratory environments with a dedicated operation app that improves usability.

At the same time, a data analysis service was launched, using images taken by the drone to assess problems such as levels of deterioration, along with a functional diagnosis service.

In addition, initiatives were implemented to demonstrate the drone’s practical, on-site uses, such as events in which customers could experience actual operation of the drone, witness demonstrations of the drone flying through acrylic pipes and listen to explanations of photographic methods and so on.

Going forward, the drone product lineup will be extended and the scenes of application will be expanded to include pipeline facilities with running water, external inspection of facilities, and more.

*Various demonstration experiment and so on

・Extended time flight test

From December 2020, the company partnered with Aerodyne Japan to conduct continuous flight tests reaching 1000 hours in Malaysia. The tests were concluded successfully and produced beneficial results for the development of drones that will comply with Level 4, for which legislation efforts will continue in the future.

・Succeeded in the test of small unmanned aerial vehicle autonomously avoiding collisions

In collaboration with Subaru, JRC Nihon Musen, Nippon Avionics, and Magellan Systems Japan, ACSL mounted a miniaturized, low-power-consuming sensor to a 10kg class unmanned aerial vehicle and tested whether it could autonomously avoid collisions when operating in the range of real-operation speeds, with relative speeds of 200 km/h. They were the first in the world to succeed.

Collision avoidance technology is an urgent topic for the safe operation of unmanned aerial vehicles, and it is considered an indispensable technology for the development of beyond visual line of sight (BVLOS) flight and flight over populated areas, which are necessary for the practical use of unmanned aerial vehicles. ACSL intends to build on its achievements to establish a collision avoidance system and propel the social implementation of unmanned aerial vehicles.

・Conducted a demonstration experiment of marine debris analysis and confirmed its effectiveness

The drone sub-team of the Debris Watchers, an academic-industrial partnership project working on marine debris reduction, conducted a demonstration experiment using drones and AI off the coast of Tsuruoka City in Yamagata Prefecture to analyze marine debris, and confirmed that it is possible to distinguish debris.

・Responding to the landslide disaster in Izusan, Atami City

Following the landslide that occurred in Izusan, Atami City in July 2021, ACSL flew its drones to gather information on the disaster situation as part of a disaster prevention agreement with the Japan Ground Self Defense Force and in cooperation with police forces.

② Adoption of subscriptions

In May 2021, in addition to the conventional sell-out model, the company launched a subscription service for inspection dronethat lowered the initial introduction hurdle for customers.

The initial costs for adopting infrastructure inspection drones can be greatly reduced. Cameras and other aspects can be selected according to the environment and application, and the available contract periods are 3 months, 6 months, and 12 months.

The company expects to gain a potential customer base.

③ Full-scale expansion into ASEAN countries

In September 2021, ACSL established the joint venture ACSL India (registration completed) with Aeroarc, its local partner in India, to capture the enormous Indian market, where there is an opportunity to displace Chinese-made drones. ACSL has a 49% stake, Aeroarc 51%.

Utilizing Aeroarc's client base, ACSL India aims to capture this enormous market by deploying aggressive marketing measures.

In addition, in August 2021, ACSL India was selected in the Project for Promotion and Support of Creating Digital Transformation (DX) and Other New Businesses in Asia (Project for Japan-India Economic and Industrial Cooperation), organized by the Japan External Trade Organization (JETRO).

④ Technical procurement by CVC

◎ Investment in Aerodyne (Malaysia)

In May 2021, CVC, which was established with the aim of accelerating its business, voted to invest in Aerodyne (Malaysia), the world’s second-largest drone service provider and Asia’s No. 1 drone service company.

Since its establishment in 2014, Aerodyne has been using drones to provide faster, lower-cost, high-quality, and safe infrastructure inspection and monitoring services. Aerodyne’s services have been deployed to leading infrastructure companies in a variety of industries, including Fortune Global 500-listed oil company Pertronas and Tnaga National Berhad, South East Asia’s largest publicly traded electric power company.

Through this investment, ACSL will further accelerate cooperation, including further improvement of its own control technology and overseas business development, including expansion in India.

◎ Concluded capital and business alliances with Japan Post Co., Ltd. and Japan Post Capital Co., Ltd.

In June 2021, ACSL concluded capital and business alliances with Japan Post Co., Ltd. and Japan Post Capital Co., Ltd. for the practical use of drones for deliveries.

ACSL has been working with Japan Post since 2017 on logistical innovations in Japan. Starting with the sophistication of delivery, ACSL will continually drive the improvement of delivery networks by means of innovative technology.

Japan Post Capital has invested approximately three billion yen in ACSL.

◎ Concluded capital and business alliances with Aeronext Inc. and Seino Holdings Co., Ltd.

In June 2021, ACSL concluded capital and business alliances with Aeronext and Seino Holdings. Through this alliance, ACSL launched a collaboration aimed at creating a market for drone logistics. ACSL invested in Aeronext via its CVC.

This collaboration seeks to combine Aeronext's capability to develop comprehensive drone logistic services, Seino Holdings’ track record and network in trunk line and last mile logistics, and ACSL’s extensive experience in Level 3 and in implementing secure and safe drones.

◎ Investment in WorldLink & Company and VFR

With the goal of accelerating the adoption of drone operations and strengthening product development partnerships, ACSL invested in WorldLink & Company in September 2021 and VFR in October 2021 via its CVC.

As one of ACSL’s solution partners, WorldLink & Company offers infrastructure inspection services. It aims to advance the development of various operational solutions that meet the needs of customers, thereby accelerating the practical application of drones.

VFR possesses advanced design and manufacturing technology developed in Vaio's PC business, and it has been entrusted with several projects to develop and manufacture industrial drones. With a focus on Level 4-compliant logistical drones, ACSL seeks to further strengthen its partnerships through joint development and so on.

3. Overview of the results for second quarter of the term ending December 2021

3-1 Non-consolidated Results

| FY3/21 2Q (Apr.-Sep.) | Ratio to sales | FY12/21 2Q (Apr.-Sep.) | Ratio to sales | YoY |

Net Sales | 78 | 100.0% | 400 | 100.0% | +408.1% |

Gross profit | -13 | - | 23 | 5.8% | - |

SG&A expenses | 404 | 512.5% | 674 | 168.2% | +66.7% |

Operating income | -417 | - | -650 | - | - |

Ordinary income | -360 | - | -691 | - | - |

Net Income | -396 | - | -693 | - | - |

*Unit: Million yen. From the third quarter of FY 3/21, the company has shifted to consolidated accounting. YoY is the ratio compared to the non-consolidated results and is for reference.

*The company changed its fiscal year end to January-December in order to increase the transparency of its full-year business outlook, as sales had been heavily weighted toward the previous fourth quarter (January-March). FY 12/21 is a nine-month period from April 1st 2021 to December 31st 2021.

An increase in sales, with gross profit returning to profitability while operating loss increased

Sales increased 408.1% year on year to 400 million yen. Due to the national project expansion and other factors, the company achieved record-high figures for the second quarter. Gross profit reached 23 million yen, returning the company to profitability. Operating loss stood at 650 million yen. The company continued its aggressive investments in R&D, with the R&D portion of the SG&A expenses increasing by 130.6% year on year.

3-2 Financial Conditions and Cash Flow

◎Main Balance Sheet Items

| End of March 2021 | End of September 2021 | Increase /Decrease |

| End of March 2021 | End of September 2021 | Increase /Decrease |

Current Assets | 3,257 | 4,974 | +1,716 | Current Liabilities | 432 | 167 | -265 |

Cash, Equivalents | 1,891 | 4,015 | +2,123 | Accounts payables | 139 | 2 | -136 |

Receivables | 349 | 50 | -299 | Total liabilities | 436 | 172 | -264 |

Fixed Assets | 751 | 1,129 | +378 | Net Assets | 3,572 | 5,932 | +2,359 |

Tangible Fixed Assets | - | - | 0 | Total Liabilities, Net Assets | 4,008 | 6,104 | +2,095 |

Intangible Fixed Assets | 75 | 108 | +32 | Equity Ratio | 88.6% | 96.6% |

|

Investments, Others | 675 | 1,021 | +345 |

|

|

|

|

Total Assets | 4,008 | 6,104 | +2,095 |

|

|

|

|

*Unit: million yen

Due to the issuance of new shares, cash & equivalents, total assets, and net assets increased by approximately two billion yen.

Equity ratio increased from 88.6% at the end of the previous term to 96.6%.

◎Cash Flow

| FY12/21 2Q |

Operating CF (A) | -501 |

Investment CF (B) | -340 |

Free CF (A+B) | -842 |

Financing CF | 2,965 |

Cash, Equivalents at the end of term | 4,015 |

*Unit: million yen

Due to the issuance of new shares, financing CF increased significantly.

4. Forecast of the result for the term ending December 2021

◎Earnings Results

| FY3/20 | FY3/21 | FY12/21 the revised estimate | FY12/21 the initial estimate | Reference FY3/22 (Est.) | Reference FY3/22 Jan.-Mar. (Est.) |

Net Sales | 1,278 | 620 | 480 | 350 | 2,500~3,000 | 2,150~2,650 |

Gross profit rate | 15 | -1,139 | -980 | -1,000 | -700~-300 | - |

Operating income | 231 | -1,081 | -1,020 | -1,000 | -680~-280 | 300~700 |

Ordinary income | 239 | -1,511 | -1,020 | -1,000 | -685~-285 | 320~720 |

*Unit: million yen

Sales revised upwardly

Net sales for the term ending December 2021 are expected to be 480 million yen (due to the change in the accounting period, the forecast for the current term was calculated by dividing the forecast for the term ending March 2021, which was announced in May 2021). In addition to the usual demonstration experiment and platform drone sales, sales from the national project increased, and the forecast net sales was revised upwardly from 350 million yen, which had been estimated in the first quarter. As of the end of September 2021, the order backlog was about 230 million yen, including the orders for which acceptance inspection is scheduled in the next term. Already-realized sales and expected orders for this term total roughly 680 million yen. In the first quarter of the next term (ending December 2022), sales resulting from the sale of application-specific drones, such as small aerial photography drones, are expected to reach approximately 1.2 billion yen.

5. Conclusions

The business environment is continuing to develop, with the Upper House plenary session passing a bill to amend the Civil Aeronautics Act in June 2021 with the goal of establishing systems for Level 4. Furthermore, the four priority strategies in the company’s Medium-Term Management Policy “ACSL Accelerate” are also making steady progress. Due to the change of the accounting term, sales from application-specific drones will be recorded next term for the first time (the term ending December 2022), but the forecast net sales are in line with the historical high for the entire company (1.28 billion yen in the term ended March 2020), meaning that the company's level of earnings will change considerably. Expectations are high.

< Reference: Regarding Corporate Governance >

◎Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, including 1 outside ones |

Auditors | 3 auditors, including 3 outside ones. |

◎Corporate Governance Report (Updated on June. 25, 2021)

Basic Policy

Under the mission of "Liberate Humanity through Technology," we have a vision of " Revolutionizing social infrastructure by pursuing cutting-edge robotics technology." Under this corporate value, we believe that our duty is to foster and maintain trusting relationships with all stakeholders (i.e., including shareholders, clients, business partners, employees, creditors, and local communities) and conduct business administration putting importance on the interest of every stakeholder. To that end, it is essential for our business to achieve stable and lasting development, and we recognize that enhancing corporate governance with the aim of improving management soundness and transparency is one of the most critical management challenges. Thus, we are working to improve and enhance our corporate governance. Concretely, we are striving to enrich general meetings of shareholders, upgrade the functions of the boards of directors and auditors, carry out timely, appropriate information disclosure and IR activities, and tighten internal control systems, to enhance corporate governance further.

【Reasons for Non-compliance with the Principles of the Corporate Governance Code】

Autonomous Control Systems Laboratory Ltd. has implemented all the Basic Principles of the corporate governance code.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on ACSL Ltd. (6232) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/