Bridge Report:(6232)ACSL fiscal year December 2021

President Satoshi Washiya | ACSL Ltd. (6232) |

|

Corporate Information

Exchange | TSE Growth |

Industry | Machinery (Manufacturing) |

Representative | Satoshi Washiya |

Address | Hulic Kasai Rinkai Building 2F, 3-6-4 Rinkaicho, Edogawa-ku, Tokyo |

Year-end | December |

URL |

Stock Information

Share Price | Shares Outstanding (End of term) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,814 | 12,318,600 shares | ¥22,345 million | -27.5% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

0.00 | - | ¥-52.77 | - | ¥436.03 | 4.2x |

*Share price as of closing on March 23. Each number is from the financial report of FY 12/21. EPS is the lower limit of the forecast.

Non-consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 | 807 | -330 | -176 | -183 | -19.42 | 0.00 |

Mar. 2020 | 1,278 | 15 | 231 | 239 | 23.00 | 0.00 |

Mar. 2021 | 620 | -1,139 | -1,081 | -1,511 | -139.54 | 0.00 |

Dec. 2021 | 501 | -1,188 | -1,213 | -1,225 | -103.94 | 0.00 |

Dec. 2022 (Estimate) | 2,500 | -650 ~-350 | -650 ~-350 | -650 ~-350 | -52.77 ~-28.41 | 0.00 |

* The earnings forecast is that of the company. Unit: Million yen

* The company has shifted to consolidated accounting from 3Q of FY 3/21.

* Fiscal year changed from FY 12/21, so FY 12/21 is a nine-month period.

This Bridge Report reviews fiscal year December 2021 earnings results, fiscal year December 2022 earnings forecasts and medium-term management plan policy “ACSL Accelerate FY22” of ACSL.

Table of Contents

Key Points

1. Company Overview

2. Medium-term Management Policy “ACSL Accelerate FY22”

3. Overview of the results for the term ended December 2021

4. Forecast of the result for the term ending December 2022

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended December 2021, the nine-month perioded term, sales rose 299.2% year on year to 501 million yen. It was the largest ever sales recorded in the same period, owing to the expansion of national projects. Operating loss was 1,188 million yen. R&D expenditure increased 126.2% year on year, because of continued proactive R&D investment. The backlog of orders reached a record 1,077 million yen at the end of December 2021. Combined with the 501 million yen in sales, total sales reached 1,578 million yen, exceeding the previous record high of 1,278 million yen (12-month period, the term ended March 2020).

- The forecasts for the term ending December 2022 are expressed by ranges, except sales. The reason for this is the high novelty of many areas in comparison to existing industries, the need for flexible development investment, and the difficulty in reasonably predicting the worldwide shortage of semiconductors and the resulting rise in prices of various electronic components and delivery delays. Sales are forecasted to be 2.5 billion yen. Of this, 1 billion yen worth of orders have been accepted. The mass production of small aerial photography drones, an application-specific drone, will begin.

- The lower end of the range is a projection based on the assumption that shortages of semiconductors and electronic components and the rise in prices will continue to a certain extent throughout the year. Based on this premise, the company plans to proactively invest in R&D for the development of new application-specific drones in addition to small aerial photography drones, closed environment inspection drones, chimney inspection drones, and logistics drones, for which the company is developing structure for development, sales, and manufacturing.

- The upper end of the range is a projection based on the lower end of the range, assuming that the global shortage of semiconductors and electronic components and the rise in prices will be resolved by the end of this year, stable procurement of components will be realized, and R&D activities will not be significantly affected. Based on this assumption, the company forecasts that profit margin will improve further than the lower end of the range.

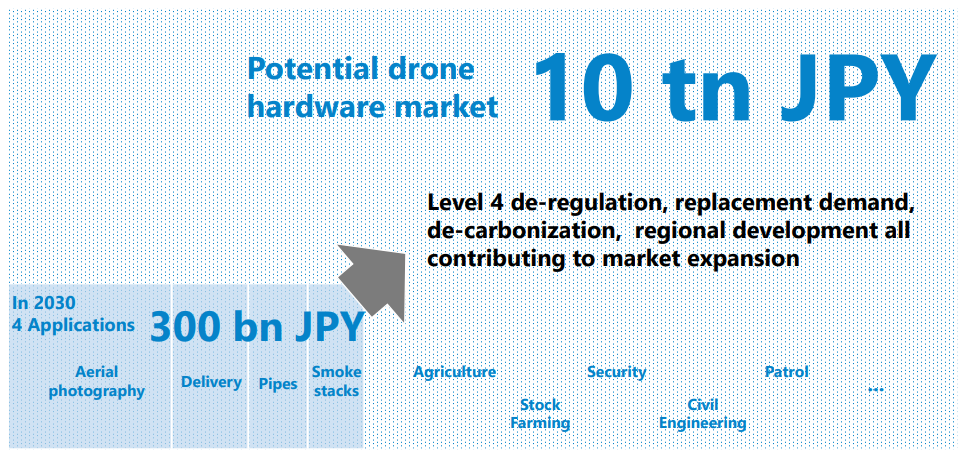

- In ACSL Accelerate FY22, a medium-term management policy based on the rolling plan system, the company aims to earn sales of 10 billion yen and a net income of 1 billion yen in 2025 and occupy a market share of 1/3 or more and earn sales of 100 billion yen by 2030, when the drone market size will exceed 300 billion yen.

- However, the company recognizes that the target of over 1/3 share and 100 billion yen in sales in 2030 is based only on mass production for the current four specific applications and that the potential market of 10 trillion yen is still in the process of being realized. Important keys for achieving further growth exceeding 100 billion yen in sales are the development of new application-specific drones, expansion into overseas markets, and the expansion of applications of autonomous control systems, which were developed in house and have matured in the challenging drone field, that is, the company's greatest competitive advantage, into robotics.

- The company is also considering M&A deals with domestic and foreign drone companies in the fields of logistics and agricultural machinery, where autonomous control systems have yet to be deployed. It will be interesting to see what projects will emerge in the future while continuing to invest proactively in R&D.

- From a short-term perspective, we will also pay attention to their quarterly progress toward achieving 2.5 billion yen in sales this term, which will see a significant step-up through the start of mass production.

1. Company Overview

A manufacturer of industrial drones, specializing in developing application-specific drones through on-site inspections, dialogues, and demonstrations in order to provide drones that replace and evolve the operations of its customers with proprietary control technologies as the core technologies.

The company targets the fields of “infrastructure inspection,” “logistics and mail transportation,” and “disaster prevention and control,” in which high-level autonomous flying is frequently demanded. The drones of the company work on behalf of human workers in these fields. Accordingly, the business of the company is to not merely manufacture and sell machines, but also offer solutions for streamlining business operation, automating business processes, and adopting IoT. The company’s main feature is dealing with tasks from planning, system development and installation, to after-sales services on a one-stop basis.

【1-1 Corporate Philosophy】

The following missions and visions are what ACSL is aiming to achieve.

MISSION | Liberate Humanity Through Technology |

VISION | Revolutionizing social infrastructure by pursuing cutting-edge robotics technology |

The company's mission is to close the gap as the demand for labor grows and the population declines.

The company recognizes that the business of solving social issues through robotics directly contributes to ESG and SDGs.

【1-2 Market environment】

◎Overview

The following environmental changes are underway to expand the drone market. The potential market size of drones is estimated to be 10 trillion yen, and its realization is expected to accelerate.

Economic Security | Awareness increasing around data security and technology leaks, leading to domestication and demand for secure drones. |

Decarbonization Clean Energy | Increase in clean energy investing creating more O&M demand . Trend to see drones as decarbonization technology. |

Digital Garden City Smart City | Increase in the use of drones for deliveries and inspections to achieve sustainable, regional development. |

Aviation Law revision Level 4 | Aviation Law revised to allow flight over manned areas and establish official drone pilot license in FY22. |

(Taken from the reference material of the company)

The demonstration phase has been completed. Major companies and the government have started making decisions on a full-scale deployment of drones, with Japan Post Capital Co., Ltd. investing 3 billion yen in ACSL, and the Fire and Disaster Management Agency deciding to adopt drones at 700 fire departments nationwide.

In addition, demand for replacement with domestic products is rapidly increasing, with major companies and the government having begun to switch to domestically produced drones to obtain secure drones, and the government announcing its procurement policy for drones with sufficient security. Demand for drones began to materialize in full-scale in 2022 as the "First Year of Drones."

◎ACSL’s position

The company is a domestic manufacturer capable of simultaneously offering the agile development (trial production of drones) desired in its early stage and the mass production desired in its mature stage and is the only listed company among approximately 700 drone-related companies.

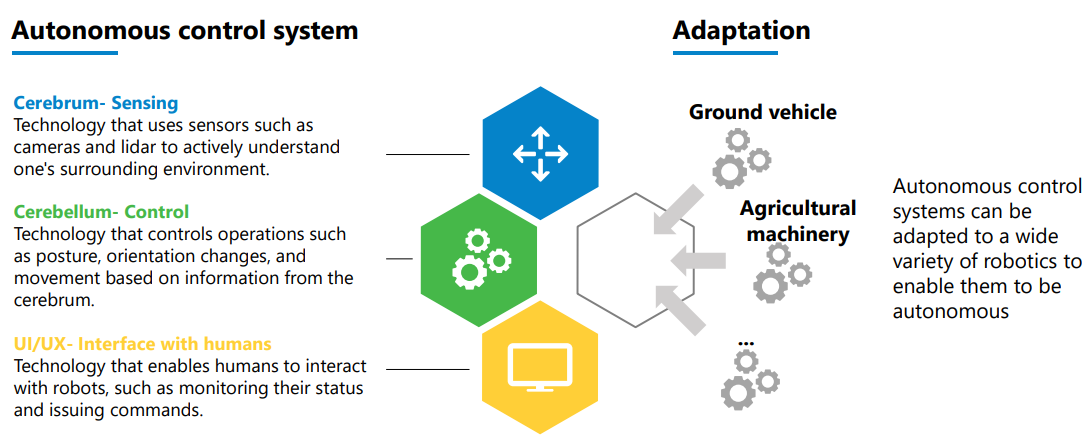

The autonomous control system developed by the company gives it a strong advantage.

2. Medium-term Management Policy “ACSL Accelerate FY22”

【2-1 Future Goal】

Under this business environment, in August 2020, ACSL formulated “ACSL Accelerate” – a “master plan” that establishes what to aim for in 10 years’ time.

【“To-Be” state 10 years】

(1) Global pioneer in solving social infrastructure issues

(2) More than 100 billion JPY sales, 10 billion JPY sales profit

(3) Mass production manufacturer that produces 30,000 units/year

(4) Supporting the country with de facto standards

(5) Developing cutting-edge technologies for autonomous control (cerebellar and cerebral)

(6) Nurturing the industry’s most advanced and talented human resources

(7) Constantly working to improve its corporate value and financial KPIs

【2 -2 Position of ACSL Accelerate】

ACSL Accelerate, a rolling plan-like medium-term management policy that adapts to the changing business environment, has been established to realize the company's vision.

The ACSL Accelerate FY20 marked a shift for the company from a prototype factory to a mass production manufacturer, while with ACSL Accelerate FY22 (2022-25), the company aims to become a sustainable global manufacturer.

【2-3 ACSL Accelerate FY2022】

(1) Strategy

While continuing the initiatives in the previous medium-term management policy ACSL Accelerate, the company will strengthen its ESG measures and business expansion into India to evolve into a sustainable global manufacturer and will examine the new applicability of core technologies.

Measures |

Development and commercialization of four application-specific drones |

Development of new application drones and compliance with security |

Full-scale launch into the Indian market |

Reinforce ESG initiatives |

Exploring potential adaptation of autonomous control systems to other fields |

① Development and commercialization of four application-specific drones

For the SOTEN and Fi4 drones already on the market, sales promotion will be strengthened with nationwide demonstrations and public bidding, and for the drones under development, the development for mass production systems will be accelerated.

Aerial photography (SOTEN) | Launched Dec. 2021 Secure small aerial photography drone for governments and private companies. Orders received for 600 units, while the target number of orders is 1,000. |

Pipe inspection (Fi4) | Launched May 2021 Drones to inspect pipe structures such as sewers and drains. Utilization of drones started in some areas. |

Smokestack inspection | Under development to be launched 2022 Drones capable of flying in GPS-denied cylinder structures, smokestacks and water-pressure towers. Problems with mass production have been identified and are being addressed. |

Delivery | Under development to be launched 2023 Specialized drones for delivery capable of carrying a 5 kg payload. Responding to the shift from Level 3 to Level 4. |

② Development of new application drones and compliance with security

The company will begin the development of new application-specific drones for various applications for which demonstrations have already been conducted and will ensure security compatibility for its entire product lineup.

These applications include automated inspection of the blades of wind farms, automated indoor patrols of construction sites and power plants, and inspection of holds of tankers and huge spaced cargo ships.

③ Full-scale launch into the Indian market

In India, where awareness of economic security is increasing, demand for the replacement of drones made in China, which holds 60% of the market, will be earnestly captured in cooperation with ACSL India, a local joint venture.

Specifically, the company will obtain certification for local sale (QCI) for SOTEN and PF2, which target security compatibility demand in Japan. It will also accelerate the creation of use cases with local companies through the exhibition of major drones and other advanced technologies in India and seek business collaboration.

In addition, the company will actively share information with regulators and accelerate deregulation and technological compatibility of Japanese drones.

④ Reinforce ESG initiatives

The company will strengthen ESG initiatives, work together with client companies to strengthen society, resolve social issues through business, and work to realize a sustainable world.

Technology for sustainability | Regional revitalization and development and reinforce disaster prevention/response and environmental initiatives |

Leveraging diversity to enhance ACSL’s competitiveness | Broaden diversity, diversify work styles and further enhance career development |

Adherence to Strong Governance | Maximize organizational robustness and boost governance as the foundation of ACSL’s corporate activities |

In the past, the company has provided free assistance with drones in the event of a natural disaster as a unique initiative to build national resilience. In addition, the company has been working on the use of drones for dealing with environmental issues by participating in projects aimed at solving the marine waste problem, as well as cooperating with the Fire and Disaster Management Agency and the Self-Defense Forces during disaster prevention and natural disasters.

In addition, the company has built a diverse development structure with around 15% of the staff being Ph.D. holders and around 50% of the staff being foreign nationals representing 17 nationalities. Because advanced technology information is in English, the company has created an environment in which bilingual discussions can be held, which it believes is also the source and essence of its competitive advantage.

⑤ Exploring potential adaptation of autonomous control systems to other fields

The company's core technology is a self-developed autonomous control system, which has reached maturity in the challenging drone field. Having refined this technology is another strong advantage for the company, and the company believes it can be applied to a variety of robotics beyond drones.

(Taken from the reference material of the company)

*Example of adaptation

By integrating the cerebrum and UI/UX into a robot that can operate in a restricted environment, such as Unmanned Ground Vehicle (UGV) or forklift truck, sophisticated and unmanned operations can be realized.

Saving labor and automating various machinery (like trolleys and maintenance vehicles) used in agriculture and logistics.

In both cases, autonomous control systems developed for industrial drones will be adapted and improved based on feedback from the market.

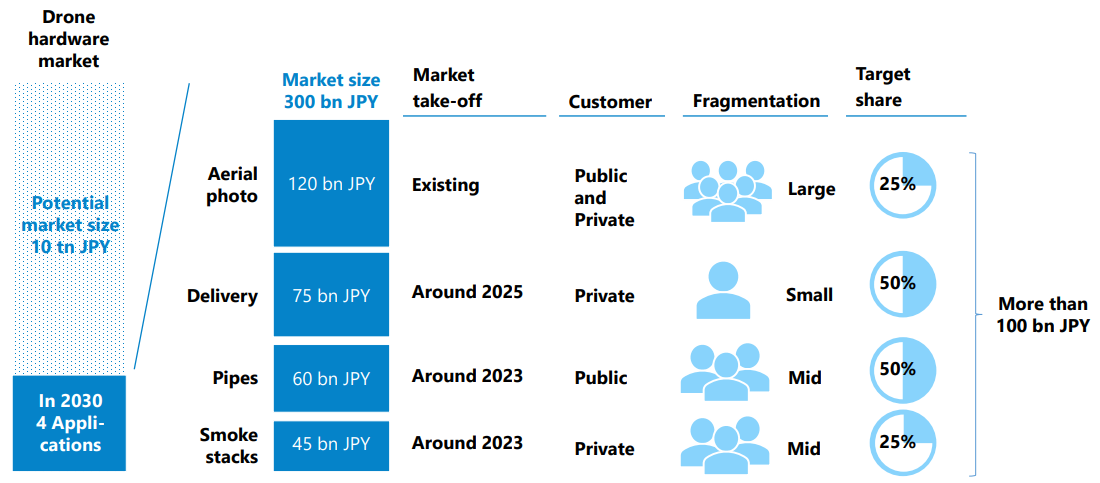

(2) Target for 2030

In 2030, when the size of the drone market reaches 300 billion yen or more, the company aims to achieve a market share of 1/3 or more and 100 billion yen in sales out of the estimated four applications' market size of 300 billion yen through mass production and adoption of the four applications specified in the business strategy.

The largest market is expected to be the market of aerial photography, which is already in full swing. Its customers are the government and the private sector. The company has established a nationwide agency network and aims to have a 25% market share.

The company aims to achieve a 50% market share in logistics by deepening ties with major logistics companies.

In addition to its conventional plans of entering overseas markets and developing new applications, as mentioned above, the company will explore other robotics fields where autonomous control technology can be applied and create further growth opportunities.

(Taken from the reference material of the company)

(3) Financial strategy of ACSL Accelerate FY2022

The company is aiming for a system which can pursue sustainable growth by achieving 10 billion yen in sales and 1 billion yen in net income in 2025.

The financial strategy for ACSL Accelerate FY2022 is as follows.

*Building a profit-earning structure for 2030.

* Through cooperation with subcontractors and construction of mass production systems, the company will not invest in the development of in-house production facilities.

*The company will continue to invest proactively in research and development, including mass production development and new applications. An investment of over 600 million yen is expected.

*The company will secure cash in accordance with sales volume for growth, including overseas expansion and M&As.

The net income for the term ending December 2022 is expected to be a loss of 350 million to 650 million yen. The range is a result of the soaring prices of semiconductors and electronic components.

3. Overview of the results for the term ended December 2021

【3-1 Non-consolidated Results】

| FY3/21 3Q (Apr.-Dec.) | Ratio to sales | FY12/21 (Apr.-Dec.) | Ratio to sales | YoY |

Net Sales | 125 | 100.0% | 501 | 100.0% | +299.2% |

Gross profit | -26 | - | 0 | 0.1% | - |

SG&A expenses | 719 | 573.1% | 1,189 | 237.4% | +65.4% |

Of which, R&D expenses | 267 | 213.6% | 604 | 120.6% | +126.2% |

Operating income | -745 | - | -1,188 | - | - |

Ordinary income | -668 | - | -1,213 | - | - |

Net Income | -812 | - | -1,226 | - | - |

*Unit: Million yen. From the third quarter of FY 3/21, the company has shifted to consolidated accounting. YoY is the ratio compared to the non-consolidated results and is for reference.

*The company changed its fiscal year end to January-December in order to increase the transparency of its full-year business outlook, as sales had been heavily weighted toward the previous fourth quarter (January-March). FY 12/21 is a nine-month period from April 1st 2021 to December 31st 2021.

Increases in income, operating loss increased due to higher sales and R&D expenses

In the term ended December 2021, the nine-month perioded term, sales rose 299.2% year on year to 501 million yen. It was the largest ever sales recorded in the same period, owing to the expansion of national projects. Operating loss was 1,188 million yen. R&D expenditure increased 126.2% year on year, because of continued proactive R&D investment. The backlog of orders reached a record 1,077 million yen at the end of December 2021. Combined with the 501 million yen in sales, total sales reached 1,578 million yen, exceeding the previous record high of 1,278 million yen (12-month period, the term ended March 2020).

【3-2 Financial Conditions and Cash Flow】

◎Main Balance Sheet Items

| End of March 2021 | End of December 2021 | Increase /Decrease |

| End of March 2021 | End of December 2021 | Increase /Decrease |

Current Assets | 3,257 | 4,177 | +919 | Current Liabilities | 432 | 287 | -145 |

Cash, Equivalents | 1,891 | 2,759 | +868 | Accounts payables | 139 | 37 | -101 |

Receivables | 349 | 69 | -280 | Total liabilities | 436 | 295 | -140 |

Fixed Assets | 751 | 1,537 | +786 | Net Assets | 3,572 | 5,419 | +1,846 |

Tangible Fixed Assets | - | - | 0 | Total Liabilities, Net Assets | 4,008 | 5,715 | +1,706 |

Intangible Fixed Assets | 75 | 132 | +56 | Equity Ratio | 88.6% | 94.0% | +5.4pt |

Investments, Others | 675 | 1,405 | +729 |

|

|

|

|

Total Assets | 4,008 | 5,715 | +1,706 |

|

|

|

|

*Unit: million yen

Total assets increased 1.7 billion yen from the end of March 2021 due to increases in cash and equivalents and investment and other assets. The issuance of new shares increased net assets by 1.8 billion yen in the same period.

Equity ratio rose to 94.0% from 88.6% at the end of the previous term.

◎Cash Flow

| FY12/21 |

Operating CF (A) | -1,345 |

Investment CF (B) | -751 |

Free CF (A+B) | -2,097 |

Financing CF | +2,965 |

Cash, Equivalents at the end of term | +2,759 |

*Unit: million yen

Due to the issuance of new shares, financing CF increased significantly.

【3-3 Business Highlights】

The company steadily implemented the four strategies set out in ACSL Accelerate FY20.

Strategy | Strategies in Medium-Term Management Policy | Status of Progress |

Development of application-specific drones | Commercialization in four areas: small aerial drones (for the government and the private sector), medium delivery drones (Level 4 compliant), smokestack inspection drones, and enclosed environment inspection drones. | Orders received for small aerial drone is on track. Closed environment inspection drone is launched and aim to expand sales. Medium-sized delivery drone being developed to be released in 2023 and beyond. |

Introduction of subscription model | Subscription-based fixed income/recurring sales model to be introduced to meet various customer needs, in addition to selling off the drones. | Announced the launch of a subscription model in May 2021 to lower initial adoption hurdles and reach a wider range of customers. On-going discussion with multiple clients. |

Full-scale expansion into ASEAN and other Asian countries | Establish an office in Singapore, the core city in the ASEAN region, and India and hire local talents to conduct development and sales activities. | Established a JV in India in September 2021 and initiated marketing activities to replace Chinese drones. Preparations are being also made in Singapore. |

Technology procurement through CVC | Establish CVC (or an equivalent function) and actively procure technologies with potential for technology synergies, such as AI, blockchain, security, image processing and sensors that are expected to generate technological synergies. | Established CVC in December 2020, and invested in several companies including overseas companies. |

◎ Results

* Launch of the small aerial photography drone, SOTEN

The company has been participating in the NEDO Project as a Consortium Leader, developing small aerial photography drones that are safe and secure. In December 2021, the company began accepting orders for a small high-security aerial photography drone called SOTEN. Shipment started in March 2022.

The company has already received orders for more than 600 units of the initial lot and has decided to produce additional units.

SOTEN achieves high security with data security, use of domestic products and highly reliable overseas parts, encryption, etc. It is also equipped with a one-touch switchable camera and a simple attached propeller for ease of use.

It also has high flight performance and expandability.

(Taken from the reference material of the company)

* Further sophisticating delivery through drones and UGVs with Japan Post

With Japan Post and Japan Post Capital, which signed a business alliance agreement in June 2021, the company is advancing the sophistication of its delivery network.

In December 2021, the company supplied ACSL PF2s with Japan Post's specifications in a trial delivery through coordination between drones and delivery robots in Okutama, Tokyo.

Anticipating the adoption in society, the company examined a labor-saving delivery model in hilly and mountainous areas, which included the transfer of mail from drones to delivery robots.

(Taken from the reference material of the company)

* First demonstration of food delivery with drones in Tokyo

In November 2021, in anticipation of Level 4 flight with East Japan Railway Company, KDDI, and others, the company conducted its first demonstration in an inhabited area within Tokyo.

The company is considering a business model, anticipating the reform of logistics in the post-pandemic period.

* Demonstration of a products delivery service with drones

In November 2021, the company demonstrated an instant delivery service with drones to four destinations with ANA HD and Seven-Eleven Japan.

The demonstration experiment was carried out on the assumption of full-scale operation in the future, with reception of delivery fees, launching drones from existing stores’ parking lots, having Seven-Eleven store employees load packages onto the drones, etc.

* Obtaining ISO27001 certification and strengthening third-party certification

To strengthen quality control and security management, which are essential in the phase of adopting drones in society, the company proactively obtained third-party certification and strengthened its internal governance system.

The company obtained the ISO/IEC27001:2013 certification for information security management in November 2021. In addition, the company renewed the ISO9001:2015 certification for quality management, which it acquired in 2018, and continues to improve product quality to achieve safety and security.

* Successful demonstration of indoor patrol, for which demand is emerging

The needs for indoor patrol are strong, so indoor patrol is a candidate for a new application-specific drone following the four applications currently being promoted. In November 2021, the company used an indoor autonomous flight system jointly developed with SENSYN ROBOTICS, to verify its utility in actual construction sites in cooperation with Takenaka Corporation, Kanamoto, and AKTIO.

Safety patrols and site checks conducted by construction management personnel at construction sites were demonstrated using autonomous drones, and favorable results were obtained.

4. Forecast of the result for the term ending December 2022

【4-1 Earnings Results】

| FY12/21 | FY12/22 Estimate |

Net Sales | 501 | 2,500 |

Operating income | -1,188 | -650~-350 |

Ordinary income | -1,213 | -650~-350 |

Net Income | -1,226 | -650~-350 |

*Unit: million yen

The forecasts are expressed by ranges, except sales. The reason for this is the high novelty of many areas in comparison to existing industries, the need for flexible development investment, and the difficulty in reasonably predicting the worldwide shortage of semiconductors and the resulting rise in prices of various electronic components and delivery delays. Sales are forecasted to be 2.5 billion yen. Of this, 1 billion yen worth of orders have been accepted. The mass production of small aerial photography drones, an application-specific drone, will begin.

The lower end of the range is a projection based on the assumption that shortages of semiconductors and electronic components and the rise in prices will continue to a certain extent throughout the year. Based on this premise, the company plans to proactively invest in R&D for the development of new application-specific drones in addition to small aerial photography drones, closed environment inspection drones, chimney inspection drones, and logistics drones, for which the company is developing structure for development, sales, and manufacturing.

The upper end of the range is a projection based on the lower end of the range, assuming that the global shortage of semiconductors and electronic components and the rise in prices will be resolved by the end of this year, stable procurement of components will be realized, and R&D activities will not be significantly affected. Based on this assumption, the company forecasts that profit margin will improve further than the lower end of the range.

◎Sales Composition

| Units | Amount (100 million yen) |

Sales of application-specific drones | 1,100~ | 12 |

Aerial photography | 1,000~ | 10 |

Other applications | 100~ | 2 |

Solution development | ~150 | 12 |

PoC and custom development | - | 7 |

Sales of platform/evaluation drones | ~150 | 5 |

Other | - | 1 |

5. Conclusions

In ACSL Accelerate FY22, a medium-term management policy, the company aims to occupy a market share of 1/3 or more and earn sales of 100 billion yen by 2030, when the drone market size will exceed 300 billion yen. However, the company recognizes that the target of over 1/3 share and 100 billion yen in sales in 2030 is based only on mass production for the current four specific applications and that the potential market of 10 trillion yen is still in the process of being realized. Important keys for achieving further growth exceeding 100 billion yen in sales are the development of new application-specific drones and the expansion of applications of autonomous control systems, which were developed in house and have matured in the challenging drone field, that is, the company's greatest competitive advantage, into robotics. The company is also considering M&A deals with domestic and foreign drone companies in the fields of logistics and agricultural machinery, where autonomous control systems have yet to be deployed. It will be interesting to see what projects will emerge in the future while continuing to invest proactively in R&D.

From a short-term perspective, we will also pay attention to their quarterly progress toward achieving 2.5 billion yen in sales this term, which will see a significant step-up through the start of mass production.

< Reference: Regarding Corporate Governance >

◎Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones. |

◎Corporate Governance Report (Updated on June. 25, 2021)

Basic Policy

Under the mission of "Liberate Humanity through Technology," we have a vision of " Revolutionizing social infrastructure by pursuing cutting-edge robotics technology." Under this corporate value, we believe that our duty is to foster and maintain trusting relationships with all stakeholders (i.e., including shareholders, clients, business partners, employees, creditors, and local communities) and conduct business administration putting importance on the interest of every stakeholder. To that end, it is essential for our business to achieve stable and lasting development, and we recognize that enhancing corporate governance with the aim of improving management soundness and transparency is one of the most critical management challenges. Thus, we are working to improve and enhance our corporate governance. Concretely, we are striving to enrich general meetings of shareholders, upgrade the functions of the boards of directors and auditors, carry out timely, appropriate information disclosure and IR activities, and tighten internal control systems, to enhance corporate governance further.

【Reasons for Non-compliance with the Principles of the Corporate Governance Code】

Autonomous Control Systems Laboratory Ltd. has implemented all the Basic Principles of the corporate governance code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on ACSL Ltd. (6232) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/