| YAMABIKO CORPORATION (6250) |

|

||||||||

Company |

YAMABIKO CORPORATION |

||

Code No. |

6250 |

||

Exchange |

TSE 1st Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Yoshiaki Nagao |

||

Address |

1-7-2, Suehiro-cho, Ome-shi, Tokyo, Japan |

||

Year-end |

End of March |

||

URL |

|||

* The share price is the closing price on November 17. The number of shares issued was taken from the latest brief financial report.

ROE is the actual values for the previous term. BPS is the actual values for the previous quarter. |

||||||||||||||||||||||||

|

|

* The forecast is from the company. It undertook a 1:4 stock split as of October 1, 2015. EPS and DPS have been retrospectively adjusted.

* From the FY 3/16, net income is profit attributable to owners of the parent. Hereinafter the same shall apply. This report introduces YAMABIKO CORPORATION's the first half of fiscal March 2017 and so on. |

| Key Points |

|

| Company Overview |

|

KIORITZ CORPORATION was established in 1947 in Tokyo and originally called KIORITZ AGRICULTURAL EQUIPMENT CORPORATION. It has been a leading company in both agricultural equipment business through which they developed "Japan's first speed sprayer" and outdoor power equipment business through which they developed "Japan's first motorized back pack trimmer" and "the world's first handheld power blower". Furthermore, since its establishment, it has been focusing on self-development of engines for outdoor power equipment. The accumulative number of engines produced in 2008, before the merger, was about 40 million. Shindaiwa Corporation was established in 1952 in Hiroshima and was originally called Asamoto Precision Manufacturer. It developed "Japan's first electric chain saw" for the outdoor power equipment business, and manufactured and sold engine generators and engine welders for the industrial machinery business. Its strength was high technological development capabilities, as can be seen in the development of the world's first mixed fuel 4-cycle engine. In the late 1990s, with growing concern about global warming caused by greenhouse effect gas, and as engine's emission gas control became stricter in the West, especially in the US, research and development expenses increased to comply with the new regulations. In the 2000s, the medium and small-sized companies that could not afford these expenses went through rapid industry restructuring on a global scale in the outdoor power equipment industry. Moreover, the business environment became further uncertain due to a flood of cheaper products from newly emerging countries and diversification of customers' needs. Under these circumstances, the two companies concluded a business and capital alliance agreement in May 2007 on the premise of future business integration in order to strengthen the vitality to survive and win the intensifying competition. In December 2008, YAMABIKO CORPORATION was established as a joint holding company to achieve better efficiency and expansion for all its businesses including development, manufacturing, logistics, sales and management. In October 2009, YAMABIKO CORPORATION conducted an absorption-type merger of Kioritz and Shindaiwa and became the current business entity. The company name "Yamabiko" derives from the mountain god, "Yamabiko". Its corporate philosophy is to "create the bridge that bonds people and nature with the future".This expresses the Company's willingness to contribute to the conservation and improvement of the nature and environment. "Essence", which incorporates both "Purpose of Existence" and "Code of Conduct", expresses in a single word what Yamabiko Group aims to be as a company, and the essence of its corporate activities. "Purpose of Existence" sets out the role and responsibilities of Yamabiko Group in society, and makes a commitment to this. "Code of Conduct" defines the attitude of each Yamabiko Group employee in relation to their work.   President Nagao disseminates messages that are based on "Essence", "Purpose of Existence" and "Code of Conduct" at various occasions. They are also making daily efforts so that the corporate philosophy would lead to each employee's actual activities in each workplace. * Profile of President Yoshiaki Nagao

President Yoshiaki Nagao was born in February 1953 (Age 63). Since his childhood, he enjoyed "creation" such as building plastic models. When he was in the middle school, his interest grew in automobiles, especially those made in the US. He majored in "combustion engineering" in graduate school, where he studied engines. He began working at KIORITZ CORPORATION in April 1978. At KIORITZ, he worked at the research department. He was involved with research and development of various engines, especially chain saw engines, under the corporate culture that supported the employees' spirit to find and work on the issues of their interest. Instead of focusing on his research only in the lab, he went out to the mountains and interviewed woodsmen who were the users of their products to hear opinions and identify the demands in detail. After working in the technology area for most of his time at KIORITZ, he was appointed as President and CEO of ECHO, Incorporated, an affiliate of KIORITZ in the US in February 2006. His focus at ECHO was to observe the actual situation of the emission gas control regulations in the US, to find measures to meet the regulations, and to enhance the users' satisfaction. During the merger process of KIORITZ and Shindaiwa, he facilitated fast and drastic organization of the local sales routes. He recalled, "It was an important step to diversify my work". After establishment of YAMABIKO CORPORATION, he managed to implement smooth integration as a board director / managing officer / industrial machinery division officer in Hiroshima where the head office of Shindaiwa Corporation was located. In June 2011, he was appointed CEO and President of YAMABIKO CORPORATION. The company recognizes that there are two global manufacturers of outdoor power equipment in Europe (Germany and Sweden). 1. Segment

Yamabiko group operates businesses in three sectors: Outdoor power equipment, Agricultural machinery and Industrial machinery. It also manufactures and sells accessories and parts of the equipment that they sell. (The reporting segments are "Outdoor power equipment/Agricultural machinery", "Industrial machinery" and "Others". Disclosed sales data, however, are divided into four: Outdoor power equipment business, Agricultural machinery business, Industrial machinery business, and Others.)  "Outdoor power equipment business"

Yamabiko manufactures and sells handheld or backpack-style forestry and landscape maintenance machinery powered by small internal combustion engines. The main products include chain saws, trimmers, power blowers, hedge trimmers, etc. Based on the accumulated experiences and know-how and excellent development capabilities that meet the customers' needs, Yamabiko continues to produce high performance, highly durable and high quality engines.  (Gasoline engine system)

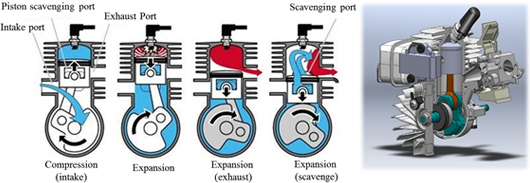

The engines for outdoor power equipment such as chain saws and trimmers are mainly 2-stroke gasoline engines. As described later, the Company's excellent capability to develop engines is one of their most important features/strengths. Brief information concerning the Company's engines is provided below because knowing the gasoline engine system and characteristics of each engine type helps to understand the business of the Company, Basically, a gasoline engine generates power by moving the piston down with the combustion of gasoline through the following 4 steps.  The gasoline engine is largely categorized in two types (2-stroke engine and 4-stroke engine), depending on the number of reciprocating motion by piston to complete "1 cycle" of the 4 steps. "2-stroke engine"

One power cycle is completed by 2-stroke. In other words, a power is generated by "1 piston reciprocating motion, 1 crankshaft revolution". First stroke (piston moving up): "Intake" and "compression" of air-fuel mixture occur. Second stroke (piston moving down): Piston moves down due to "expansion" of air-fuel mixture and "exhaustion" occurs later.  "4-stroke engine"

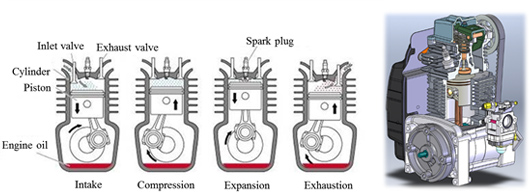

One power cycle is completed by 4-stroke. A power is generated by "2 piston reciprocating motions, 2 crankshaft revolutions". First stroke (piston moving down): "Intake" of air-fuel mixture occurs. Second stroke (piston moving up): "Compression" of air-fuel mixture occurs. Third stroke (piston moving down): Piston is rapidly moves down as a result of "expansion". Forth stroke (piston moving up): Combusted gas is "exhausted".  On the other hand, a 2-stroke engine has a larger ratio of burning engine oil and fuel in order to make smooth piston motion and blow-by of air-fuel mixture. This means it releases more harmful substances in the exhaust gas as compared with a 4-stroke engine. However, because of its simple structure and smaller number of parts, the 2-stroke engine can be smaller and lighter. The overhaul is also easier for the same reasons. Therefore, a 2-stroke engine is the most appropriate engine for outdoor power equipment. "Agricultural machinery business"

Yamabiko manufactures and sells pest control equipment for Japan and agricultural harvesting equipment for North America. Its major products include pest control equipment (speed sprayers, mounted equipment for cropland pest control management, boom sprayers), sloop mower, soy and potato harvesters, etc. The Company purchased a Belgian venture company, "Belrobotics SA" in November 2014. It is specialized in development, manufacturing and sales of robotic mowers for business use. Yamabiko's technological strengths in this business segment are KIORITZ's blowing, spraying, and pumping technology as well as technology to create small and light equipment. These technological capabilities have been built up over many years at KIORITZ.  "Industrial machinery business"

Yamabiko manufactures and sells equipment for construction, civil engineering and iron works. Its major products include generators, welders, lighting equipment, cutting machines and high-pressure washers. Technological strengths in this business segment are established by long years of R&D which began at the time when Yamabiko Corporation started business as Shindaiwa, and such strengths can be found in alternator designing capability improved by their efforts for alternative current motor development, as well as technologies for electronic control and noise prevention.  "Others"

The Company manufactures and sells accessories and the parts for after purchasing service for various machines and equipment. As shown in the graph on Page 5, the profitability in this segment is the highest in all segments.  2. Brand

Yamabiko was established based on the integration of two companies. The products of both companies are well recognized both in Japan and overseas for many years. Therefore, Yamabiko maintains the brand names as KIORITZ, Shindaiwa, and ECHO. Yamabiko is proactively investing in marketing as well as exploring new sales routes to enhance its brand values.  3. Development structure

Each business segment is working on development with a focus on the following priority issues.

In addition, the Company is conducting research on control technology in the field of electronic control. 4. Production structure

The Company has 3 plants (Yokosuka, Morioka, and Hiroshima) and 4 production related subsidiaries in Japan and a total of 7 production related subsidiaries in the USA, Belgium, China and Vietnam.

5. Sales route and sales methods

The Company supplies its products in over 90 countries for about 28,000 stores. More than 60% of the sales are from overseas sales.  <Domestic market>

7 sales subsidiaries sell the products to distributors, Zen-Noh (National Federation of Agricultural Cooperative Associations), home improvement retailers, and construction machinery rental companies, etc. Through them, the products are supplied to the end users including farmers/foresters, companies in the construction, civil engineering and iron industries and landscapers. The Company presents their products in exhibitions in collaboration with distributors and dealers and facilitates sales through demonstration and test drive. Furthermore, the Company accompanies dealers to visit end users to understand their needs and utilize the information for product development. <North American market>

ECHO, Incorporated Group, one of the Company's subsidiaries, sells the products to The Home Depot (*) and other distributors, through which the products are supplied to the end users such as landscapers, home owners, farmers/foresters, and companies in the construction/civil engineering industry.

*The Home Depot

The Home Depot, Inc. is the world's largest home improvement retailer and construction products and services. It was established in 1978. Sales in 2015 were US$88,500 million (approx. ¥9.7 trillion) and net income was US$7,000 million (approx. ¥770 billion). It has 2,274 stores in the US, Canada and Mexico. It is listed on the New York Stock Exchange. (Excerpted from the company's website) In the Central and South American market, ECHO, Incorporated, one of the Company's subsidiaries, sells the products to the distributors of each country, and then, the products are supplied to the end users through dealers. In Europe, Asia and other areas, Yamabiko sells the products to the distributors in each country. The overseas dealers display the products by brand, and salesperson conduct person-to-person sales while understanding the needs of the end users. The home improvement retailer also display the products by type and price. The end users purchase the products based on the needs, budget and image they have from advertisement, etc. (1) Unique production and technological capabilities and vertically integrated production capabilities

The most important characteristics and strengths of the Company are the "unique production and technological capabilities and vertically integrated production capabilities". Their mainstay 2-stroke engines that are mounted to the outdoor power equipment are manufactured by an integrated production system solely by the Company from development, procurement of aluminum, molding, parts production, processing to assembly, which is said to be unique anywhere in the world. The power sources for the agricultural machinery and industrial machinery are also engines, but they are mostly procured externally. The Company solves various issues with their unique technologies including iron plating and electric discharge processing. This is resulting in the quality improvement and production capacity improvement of the Company. Specifically, the Company has established the following technologies. <Example 1: Iron plating>

Plating is a surface covering method in which the surface of a metal is covered by a thin layer of another metal. For engine production, inside of the cylinder should be plated to avoid abrasion caused by friction with a piston. The conventional method is to use chrome plating from durability and cost perspectives. However, chrome plating gives negative impact on the environment. Its production efficiency is also low. Therefore, there was an increasing demand for different materials for plating. The Company has been working on "iron plating" since 1978 to reduce environmental load. Initially they could produce only hundreds per day. However, as a result of improved productivity, enhanced plating precision, and reduction of environmental load, the Company now has the iron plating technology that does not require finish processing. Their technology has drastically smaller environmental load. Furthermore, their daily production capacity increased significantly, reaching thousands. The Company holds patents related to iron plating. <Example 2: Electric discharge processing>

As described above, a 2-stroke engine requires less number of parts and has simpler structure as compared to a 4-stroke engine. Therefore, it is most suitable for the "handheld" and "backpack-style" outdoor power equipment. However, it releases some fuel mixed gas. In order to respond to the increasingly strict exhaust gas regulations globally, the Company was faced with a challenge to control the flow of the fuel mixed gas for efficient burning. In order to achieve it, the Company explored the production methods to modify the internal shape of the cylinder (by installing a wall between the fuel mixed gas passage and internal shape of the cylinder). A "wall" can be created by die-casting (*), but it requires a horizontal hole to lead the fuel mixed gas to a combustion chamber. With die-casting, it was impossible to create a horizontal hole. It was also difficult to carry out machining due to small space in the chamber. The Company came up with the idea of using "electric discharge processing (*)" to create a form while taking advantage of die-casting. Although electric discharge processing enabled to create complicated forms, it was costly due to long processing time and high electrode consumption. The Company conducted research on processing conditions for a large volume production and developed designs of special electrode form. As a result, it succeeded in producing a large volume of products, by shortening processing time, saving personnel, lowering the cost of electrode and enhancing efficiency. Having obtained three patents related to electrode processing, the Company has established the unique technology that cannot be imitated by other companies.

(*) Die-casting

Die-casting is one of the metal mold casting methods. By injecting melted metal in a metallic mold, a large amount of casting with high precision can be produced within a short period of time. It enables to create a thin product at low cost. (*) Electric discharge processing Electric discharge processing is a machine processing method to remove a part of the surface of a non-processed work piece through repeated electrode discharge at short cycles between electrode and the non-processed work piece. It enables to cut out complicated outline on extremely hard steel. While many companies in the world are forced to leave the industry because they cannot address these issues, Yamabiko continues to make further development as a leading manufacturer. (2) Unique research and development capabilities for each business segment

The Company's capability to address environmental issues is high. The Company possesses one of the highest number of US Environmental Protection Agency (EPA)-accredited engines in the world.Furthermore, not only for outdoor power equipment, the Company also has unique research and development capabilities for the agricultural machinery and industrial machinery. Based on the technological capacities that have been accumulated by KIORITZ and Shindaiwa for many years, the Company is further brushing up the capabilities. (3) Extensive product lineup and expansion of sales network

The Company has an extensive lineup of products that meet various needs of the customers in each of the three business segments. It also currently supplies the products to about 28,000 stores in more than 90 countries across the world. As a result of merging KIORITZ and Shindaiwa, Yamabiko's product lineup and sales network were further expanded. (4) Excellent technical support system

The Company also provides excellent technical support in order to enhance credibility of the products and strengthen the relationships with distributors and dealers. It has offered 128 service schools in 17 countries within 3 years from April 2013 to March 2016. (5) High product share

By demonstrating the above-mentioned characteristics and strengths (1) to (4) in an integrated manner, the Company is becoming highly competitive at a global level. For the outdoor power equipment business, the Company has the top market share (more than 30%) in Japan and is ranked high in North America, the largest market.

If the Company can achieve its aimed goal of "7% operating income margin" after the next FY, a further increase in ROE can be expected. |

| First Half of Fiscal Year March 2017 Earnings Results |

Increased sales and operating income

Sales were 61.3 billion yen, up 1.5% YoY. Due to the appreciation of the yen, the sales in the Americas remained the same level as the previous year, but sales were strong in Japan and Europe. The new sales channels were developed in the Chinese market. Sales were at a record high for the second quarter. Operating income was 5.6 billion yen, up 44.6% YoY. This rise was due to the increase in sales, improvement in the profit margin, control of SG&A expenses and a decrease in unrealized income for inventory. Operating income was also at a record high for the second quarter. Meanwhile, ordinary income was 4.3 billion yen, up 6.7% YoY. 160 million yen of gain on foreign exchange during the same period of the previous year became 1,300 million yen of loss on foreign exchange during this term. Net income was 2.7 billion yen, down 14.8% YoY as a result of the incorporation of reserve for product warranties (500 million yen) in the extraordinary loss due to the recall of products.   ◎ Outdoor power equipment

Sales were 36 billion yen, up 2.1% YoY. In Japan, the Company achieved revenue growth as it maintained a high level of sales especially for the home improvement reatailers market, even though bad weather negatively affected the sales of trimmers in some areas in Japan. As for Americas, sales volume of trimmers and power blowers increased in North America, which is the Company's largest market, as a result of the launch of new products and pricing policies for a limited period of time. However, sales remained at the same level as last year after the conversion of sales figures into Japanese currency due to unfavorable foreign exchange rate. As for overseas other than Americas, sales of a new type of chain saws were strong in West Europe. New sales channels were also developed in China. As a result, sales increased despite the appreciation of the yen.  ◎ Agricultural machinery

Sales were 10.1 billion yen, down 1.5% YoY. In Japan, sales of speed sprayers decreased in reaction to last-minute demand of products ahead of the enforcement of exhaust gas emission regulations. However, sales of mounted equipment for cropland pest control management, large sprayers and other pest control equipment increased. Sales of energy-saving and higher efficiency sloop mower and mowers also continued to show steady growth. In the overseas market, sales decreased drastically due to the sluggish sales of large harvesting machine as a result of the fall in the price of commodity and the appreciation of the yen.  ◎ Industrial machinery

Sales were 4.6 billion yen, up 6.5% YoY. In Japan, sales of welders were sluggish due to the delay in construction work. However, large diesel generators showed steady growth mainly for the infrastructure industry and sales of lighting equipment, which was sluggish in the previous term, recovered during this term. As a result, sales increased. In the overseas market, sales of generators showed steady an increase. As a result, sales increased.  ◎ Others

Sales were 10.6 billion yen, up 0.6% YoY. In Japan, although sales of parts and accessories were strong, sales of the other products were weak. As a result, sales decreased slightly. Overseas, although sales of parts and accessories were strong thanks to the good weather, total sales showed only a slight increase due to the appreciation of the yen.   Current liabilities increased by 810 million from the end of the previous year due to the increase in trade payables. Noncurrent liabilities decreased by 1,098 million yen from the end of the previous year as a result of the decrease in long-term interest-bearing debt. Total liabilities were 45,069 million yen, down 288 million yen from the end of the previous year. Although retained earnings increased, foreign currency translation adjustment became negative due to the appreciation of the yen. As a result, net assets were 44,600 million yen, down 1,482 million yen from the end of the previous year, and the equity ratio decreased by 0.6% to 49.7%. Balance of interest-bearing debts was 18,997 million yen, down 2,417 million yen from the end of the previous year.  Financial CF became negative due to the decrease in short-term debts and the decrease in proceeds from long-term loan payables. Cash position decreased. (4) Topics

The Company decided to change the last date of each fiscal term from March 31 to December 31 in order to streamline management and business operation (i.e. budgeting, operation control) with its overseas consolidated subsidiaries by unifying the fiscal term with them. ◎ Change of fiscal term The next fiscal term will be for 9 months from April 1, 2017, to December 31, 2017. The estimated earnings for FY December 2017 will be announced in the brief financial report for FY March 2017, which will be released in May 2017. ◎ Merger of sales affiliates

The Company decided to merge 7 sales affiliates in Japan on April 1, 2017, to create "YAMABIKO JAPAN CO., LTD". By integrating the management resources, the Company tries to streamline the domestic sales structure, strengthen sales capacities and improve customer services. ◎ Strengthening functions of affiliates in Europe

In order to strengthen sales functions in the European market, the Company added sales and marketing functions to its European office by dispatching some sales staff to the European office which used to provide only technical and service support and carry out marketing research. At the same time, the functions were transferred to Belrobotics SA, a consolidated subsidiary of the Company. As of January 1, 2017, it will change the name to "Yamabiko Europe SA". The Company is planning to expand the sales of outdoor power equipment to pursue synergetic effects with the sales of robotic mowers and aiming to strengthen the brand power. |

| Fiscal Year March 2017 Earnings Estimates |

There will be no change to earnings estimates. Sales will decrease while operating income will increase.

Although the sales and profit estimates remained the same as announced on August 10, the Company changed the exchange rates from "US$1 = 105 yen, 1 euro = 115 yen" to "US$1 = 100 yen, 1 euro = 115 yen". Sales will be 110 billion yen, down 3.0% YoY, and operating income will be 7.3 billion yen, up 8.5% YoY. (Major factors for sales increase/decrease) |

| Actions in the major markets |

|

<North American Market>

The Company is working on identification and creation of new demand as well as development and expansion of sales channels. Although the outdoor power equipment segment is growing, the agricultural machinery segment has been weak.

<European Market>

In Europe, the marketing department in Japan used to manage the European market. However, the Company decided to work with a marketing distributor in UK to strengthen the brand image for professional use. Sales volume of outdoor power equipment is steadily increasing. The Company is aiming to increase its share in the European market, which is larger than the Japanese market. [Improvement in profitability]

The Company is promoting automation of production facilities in order to respond to improving efficiency of production lines and increasing production amount. The Company also started operation of the West Japan Center which is a distribution warehouse in an effort to streamline distribution work, reduce external warehouse fees, and improve production efficiency. |

| Conclusions |

|

With the yen depreciation trend, the Company is likely to achieve the earnings estimates. The much higher share values as compared to the previous report is reflecting these positive factors. However, the investors will be focusing on the Company's future performance, instead of the immediate results of this year. Although it may be a bit too early to say, the goal and specific strategies to achieve the goal in the next medium-term business plan is a point of interest.  |

| <Reference: Concerning corporate governance> |

◎ Corporate Governance Report

The company submitted its latest corporate governance report on June 30, 2016.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |