| YAMABIKO CORPORATION (6250) |

|

||||||||

Company |

YAMABIKO CORPORATION |

||

Code No. |

6250 |

||

Exchange |

TSE 1st Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Yoshiaki Nagao |

||

Address |

1-7-2, Suehiro-cho, Ome-shi, Tokyo, Japan |

||

Year-end |

End of December |

||

URL |

|||

* The share price is the closing price on March 14. The number of shares issued, ROE and BPS were taken from the brief financial report of FY 12/17.

|

||||||||||||||||||||||||

|

|

*The forecast is from the company. It undertook a 1:4 stock split as of October 1, 2015. EPS and DPS have been retrospectively adjusted.

*From the FY 3/16, net income is profit attributable to owners of the parent. Hereinafter the same shall apply. * FY December 2017 was a 9-month one. The DPS of 40 yen for FY December 2018 includes the dividend for commemorating the 10th anniversary of the establishment of the company: 5 yen. This report introduces YAMABIKO CORPORATION's Earnings Results of the Fiscal Year December 2017 and so on. |

| Key Points |

|

| Company Overview |

|

KIORITZ CORPORATION was established in 1947 in Tokyo and originally called KIORITZ AGRICULTURAL EQUIPMENT CORPORATION. It has been a leading company in both agricultural equipment business through which they developed "Japan's first speed sprayers" and outdoor power equipment business through which they developed "Japan's first motorized backpack trimmers" and "the world's first handheld power blowers". Furthermore, since its establishment, it has been focusing on self-development of engines for outdoor power equipment. The accumulative number of engines produced in 2008, before the merger, was about 40 million. Shindaiwa Corporation was established in 1952 in Hiroshima and was originally called Asamoto Precision Manufacturer. It developed "Japan's first electric chain saws" for the outdoor power equipment business, and manufactured and sold engine generators and engine welders for the industrial machinery business. Its strength was high technological development capabilities, as can be seen in the development of the world's first mixed fuel 4-cycle engine. In the late 1990s, with growing concern about global warming caused by greenhouse effect gas, and as engine's emission gas control became stricter in the West, especially in the US, research and development expenses increased to comply with the new regulations. In the 2000s, the medium and small-sized companies that could not afford these expenses went through rapid industry restructuring on a global scale in the outdoor power equipment industry. Moreover, the business environment became further uncertain due to a flood of cheaper products from newly emerging countries and diversification of customers' needs. Under these circumstances, the two companies concluded a business and capital alliance agreement in May 2007 on the premise of future business integration in order to strengthen the vitality to survive and win the intensifying competition. In December 2008, YAMABIKO CORPORATION was established as a joint holding company to achieve better efficiency and expansion for all its businesses including development, manufacturing, logistics, sales and management. In October 2009, YAMABIKO CORPORATION conducted an absorption-type merger of Kioritz and Shindaiwa and became the current business entity. The company name "YAMABIKO" derives from the mountain god, "Yamabiko". Its corporate philosophy is to "create the bridge that bonds people and nature with the future". This expresses the Company's willingness to contribute to the conservation and improvement of the nature and environment. "Essence", which incorporates both "Purpose of Existence" and "Code of Conduct", expresses in a single word what YAMABIKO Group aims to be as a company, and the essence of its corporate activities. "Purpose of Existence" sets out the role and responsibilities of YAMABIKO Group in society, and makes a commitment to this. "Code of Conduct" defines the attitude of each YAMABIKO Group employee in relation to their work.   President Nagao disseminates messages that are based on "Essence", "Purpose of Existence" and "Code of Conduct" at various occasions. They are also making daily efforts so that the corporate philosophy would lead to each employee's actual activities in each workplace. * Profile of President Yoshiaki Nagao

President Yoshiaki Nagao was born in February 1953 (Age 65). Since his childhood, he enjoyed "creation" such as building plastic models. When he was in the middle school, his interest grew in automobiles, especially those made in the US. He majored in "combustion engineering" in graduate school, where he studied engines. He began working at KIORITZ CORPORATION in April 1978. At KIORITZ, he worked at the research department. He was involved with research and development of various engines, especially chain saws engines, under the corporate culture that supported the employees' spirit to find and work on the issues of their interest. Instead of focusing on his research only in the lab, he went out to the mountains and interviewed woodsmen who were the users of their products to hear opinions and identify the demands in detail. After working in the technology area for most of his time at KIORITZ, he was appointed as President and CEO of ECHO Incorporated, an affiliate of KIORITZ in the US in February 2006. His focus at ECHO Incorporated was to observe the actual situation of the emission gas control regulations in the US, to find measures to meet the regulations, and to enhance the users' satisfaction. During the merger process of KIORITZ and Shindaiwa, he facilitated fast and drastic organization of the local sales routes. He recalled, "It was an important step to diversify my work". After the establishment of YAMABIKO CORPORATION, he managed to implement smooth integration as a board director / managing officer / industrial machinery division officer in Hiroshima where the head office of Shindaiwa Corporation was located. In June 2011, he was appointed CEO and President of YAMABIKO CORPORATION. The company recognizes that there are two global manufacturers of outdoor power equipment in Europe (Germany and Sweden). 1. Segment

YAMABIKO Group operates businesses in three sectors: Outdoor power equipment, Agricultural machinery and Industrial machinery.The reporting segments are "Outdoor power equipment", "Agricultural machinery", "Industrial machinery". These of sales and income data are disclosed. From FY December 2017, the company uses new business segments as follows.  "Outdoor power equipment business"

YAMABIKO CORPORATION manufactures and sells handheld or backpack-style forestry and landscape maintenance machinery powered by small internal combustion engines. The main products include chain saws, trimmers, power blowers, hedge trimmers, etc.In Nov. 2014, the company acquired "Belrobotics SA," a Belgian venture company, which develops, manufactures, and sells robotic mowers for professional use. (In Jan. 2017, Belrobotics SA was renamed "Yamabiko Europe SA" for the purpose of enhancing sales in Europe.) Based on the accumulated experiences and know-how and excellent development capabilities that meet the customers' needs, YAMABIKO CORPORATION continues to produce high performance, highly durable and high-quality engines.  (Gasoline engine system)

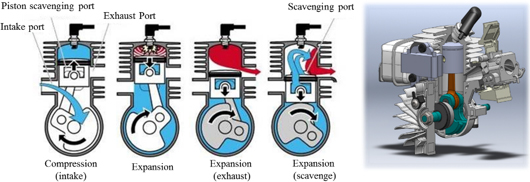

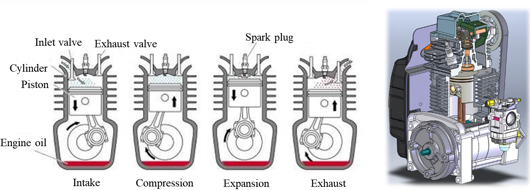

The engines for outdoor power equipment such as chain saws and trimmers are mainly 2-stroke gasoline engines. As described later, the Company's excellent capability to develop engines is one of their most important features/strengths. Brief information concerning the Company's engines is provided below because knowing the gasoline engine system and characteristics of each engine type helps to understand the business of the Company, Basically, a gasoline engine generates power by moving the piston down with the combustion of gasoline through the following 4 steps.  The gasoline engine is largely categorized in two types (2-stroke engine and 4-stroke engine), depending on the number of reciprocating motion by piston to complete "1 cycle" of the 4 steps. "2-stroke engine"

One power cycle is completed by 2-stroke. In other words, a power is generated by "1 piston reciprocating motion, 1 crankshaft revolution". First stroke (piston moving up): "Intake" and "compression" of air-fuel mixture occur. Second stroke (piston moving down): Piston moves down due to the "expansion" of air-fuel mixture and "exhaust" occurs later.  "4-stroke engine"

One power cycle is completed by 4-stroke. A power is generated by "2 piston reciprocating motions, 2 crankshaft revolutions".First stroke (piston moving down): "Intake" of air-fuel mixture occurs. Second stroke (piston moving up): "Compression" of air-fuel mixture occurs. Third stroke (piston moving down): Piston rapidly moves down as a result of "expansion". Fourth stroke (piston moving up): Combusted gas is "exhausted".  On the other hand, a 2-stroke engine has a larger ratio of burning engine oil and fuel in order to make smooth piston motion and blow-by of air-fuel mixture. This means it releases more harmful substances in the exhaust gas as compared with a 4-stroke engine. However, because of its simple structure and smaller number of parts, the 2-stroke engine can be smaller and lighter. The overhaul is also easier for the same reasons. Therefore, a 2-stroke engine is the most appropriate engine for outdoor power equipment. "Agricultural machinery business"

YAMABIKO CORPORATION manufactures and sells pest control equipment for Japan and agricultural harvesting equipment for North America. Its major products include pest control equipment (speed sprayers, mounted equipment for cropland pest control, power sprayers), sloop mower, soy and potato harvesters, etc. YAMABIKO CORPORATION's technological strengths in this business segment are KIORITZ's blowing, spraying, and pumping technology as well as technology to create small and light equipment. These technological capabilities have been built up over many years at KIORITZ.  "Industrial machinery business"

YAMABIKO CORPORATION manufactures and sells equipment for construction, civil engineering and iron works. Its major products include generators, welders, lighting equipment, cutting machines and high-pressure washers. Technological strengths in this business segment are established by long years of R&D which began at the time when YAMABIKO CORPORATION started business as Shindaiwa, and such strengths can be found in alternator designing capability improved by their efforts for alternative current motor development, as well as technologies for electronic control and noise prevention.  "Others"

The Company manufactures and sells accessories and the parts for after purchasing service for various machines and equipment.The profitability in this segment is the highest in all segments.  2. Brand

YAMABIKO CORPORATION was established based on the integration of two companies. The products of both companies are well recognized both in Japan and overseas for many years. Therefore, YAMABIKO CORPORATION maintains the brand names as KIORITZ, Shindaiwa, and ECHO. YAMABIKO CORPORATION is proactively investing in marketing as well as exploring new sales routes to enhance its brand values.  3. Development structure

Each business segment is working on development with a focus on the following priority issues.

In addition, the Company is conducting research on control technology in the field of electronic control. 4. Production structure

The Company has 3 plants (Yokosuka, Morioka, and Hiroshima) and 4 production related subsidiaries in Japan and a total of 8 production related subsidiaries in the USA, Belgium, China and Vietnam.

5. Sales route and sales methods

The Company supplies its products in over 90 countries for about 28,000 stores. More than 60% of the sales are from overseas sales.  <Domestic market>

7 sales subsidiaries were merged into YAMABIKO JAPAN CO., LTD in April 2017. YAMABIKO JAPAN CO., LTD sells the products to distributors, Zen-Noh (National Federation of Agricultural Cooperative Associations), home improvement retailers, and construction machinery rental companies, etc. Through them, the products are supplied to the end users including farmers/foresters, companies in the construction, civil engineering and iron industries and landscapers.

*For the purposes of unifying the management system and managing business assets in an integrated manner, the company integrated sales subsidiaries, which had been separated by region. The company aims to streamline managerial resources, strengthen its selling capability, and improve customer services.

The Company presents their products in exhibitions in collaboration with dealers and distributors and facilitates sales through demonstration and test drive. Furthermore, the Company accompanies dealers to visit end users to understand their needs and utilize the information for product development. <North American market>

ECHO Incorporated Group, one of the Company's subsidiaries, sells the products to The Home Depot (*) and other distributors, through which the products are supplied to the end users such as landscapers, homeowners, farmers/foresters, and companies in the construction/civil engineering industry.

*The Home Depot

The Home Depot, Inc. is the world's largest home improvement retailer and construction products and services. It was established in 1978. Sales in 2016 were US$100,900 million (approx. ¥10.6 trillion) and net income was US$8,600 million (approx. ¥960 billion). It has over 2,200 stores in the US, Canada and Mexico. It is listed on the New York Stock Exchange. (Excerpted from the company's website) In the Central and South American market, ECHO Incorporated, one of the Company's subsidiaries, sells the products to the distributors of each country, and then, the products are supplied to the end users through dealers. In Europe, Asia and other areas, YAMABIKO CORPORATION sells the products to the distributors in each country. The overseas dealers display the products by brand, and salesperson conducts person-to-person sales while understanding the needs of the end users. The home improvement retailer also displays the products by type and price. The end users purchase the products based on the needs, budget and image they have from advertisement, etc. (1) Unique production and technological capabilities and vertically integrated production

The most important characteristics and strengths of the Company are the "unique production and technological capabilities and vertically integrated production capabilities". Their mainstay 2-stroke engines that are mounted to the outdoor power equipment are manufactured by an integrated production system solely by the Company from development, procurement of aluminum, molding, parts production, processing to assembly, which is said to be unique anywhere in the world. The power sources for the agricultural machinery and industrial machinery are also engines, but they are mostly procured externally. The Company solves various issues with their unique technologies including iron plating and electric discharge processing. This is resulting in the quality improvement and production capacity improvement of the Company. Specifically, the Company has established the following technologies. <Example 1: Iron plating>

Plating is a surface covering method in which the surface of a metal is covered by a thin layer of another metal. For engine production, inside of the cylinder should be plated to avoid abrasion caused by friction with a piston. The conventional method is to use chrome plating from durability and cost perspectives. However, chrome plating gives negative impact on the environment. Its production efficiency is also low. Therefore, there was an increasing demand for different materials for plating. The Company has been working on "iron plating" since 1978 to reduce environmental load. Initially, they could produce only hundreds per day. However, as a result of improved productivity, enhanced plating precision, and reduction of environmental load, the Company now has the iron plating technology that does not require finish processing. Their technology has drastically smaller environmental load. Furthermore, their daily production capacity increased significantly, reaching thousands. The Company holds 5 patents related to iron plating. <Example 2: Electric discharge processing>

As described above, a 2-stroke engine requires less number of parts and has a simpler structure as compared to a 4-stroke engine. Therefore, it is most suitable for the "handheld" and "backpack-style" outdoor power equipment. However, it releases some fuel mixed gas. In order to respond to the increasingly strict exhaust gas regulations globally, the Company was faced with a challenge to control the flow of the fuel mixed gas for efficient burning. In order to achieve it, the Company explored the production methods to modify the internal shape of the cylinder (by installing a wall between the fuel mixed gas passage and internal shape of the cylinder). A "wall" can be created by die-casting (*), but it requires a horizontal hole to lead the fuel mixed gas to a combustion chamber. With die-casting, it was impossible to create a horizontal hole. It was also difficult to carry out machining due to small space in the chamber. The Company came up with the idea of using "electric discharge processing (*)" to create a form while taking advantage of die-casting. Although electric discharge processing enabled to create complicated forms, it was costly due to long processing time and high electrode consumption. The Company conducted research on processing conditions for a large volume production and developed designs of special electrode form. As a result, it succeeded in producing a large volume of products, by shortening processing time, saving personnel, lowering the cost of electrode and enhancing efficiency. Having obtained three patents related to electrode processing, the Company has established the unique technology that cannot be imitated by other companies.

(*) Die-casting

Die-casting is one of the metal mold casting methods. By injecting melted metal in a metallic mold, a large amount of casting with high precision can be produced within a short period of time. It enables to create a thin product at low cost. (*) Electric discharge processing Electric discharge processing is a machine processing method to remove a part of the surface of a non-processed workpiece through repeated electrode discharge at short cycles between electrode and the non-processed workpiece. It enables to cut out complicated outline on extremely hard steel. While many companies in the world are forced to leave the industry because they cannot address these issues, YAMABIKO CORPORATION continues to make further development as a leading manufacturer. (2) Unique research and development capabilities for each business segment

The Company's capability to address environmental issues is high. The Company possesses one of the highest number of US Environmental Protection Agency (EPA)-accredited engines in the world.Furthermore, not only for outdoor power equipment, the Company also has unique research and development capabilities for the agricultural machinery and industrial machinery. Based on the technological capacities that have been accumulated by KIORITZ and Shindaiwa for many years, the Company is further brushing up the capabilities. (3) Extensive product lineup and expansion of sales network and domestic services network

The Company has an extensive lineup of products that meet various needs of the customers in each of the three business segments. It also currently supplies the products to about 28,000 stores in more than 90 countries across the world. As a result of merging KIORITZ and Shindaiwa, YAMABIKO CORPORATION's product lineup and sales network were further expanded. With the aim of improving the satisfaction level of diversifying users, the company established "Yamabiko Service Shop" inside Japan in 2013, and is operating service systems for maintenance, repair a failure, etc., which are not offered by competitors, throughout Japan. The number of affiliated shops is 422 as of Mar. 2018. (4) Excellent technical support system

The Company also provides excellent technical support in order to enhance credibility of the products and strengthen the relationships with distributors and dealers. It has offered 154 service schools in 17 countries from April 2015 to December 2017. (5) High product share

By demonstrating the above-mentioned characteristics and strengths (1) to (4) in an integrated manner, the Company is becoming highly competitive at a global level. For the outdoor power equipment business, the Company has the top market share (more than 30%) in Japan and is ranked high in North America, the largest market.

|

| Fiscal Year December 2017 Earnings Results |

Sales grew, while operating income declined.

Sales were 102.9 billion yen, up 5.0% YoY. In North America, the demand for equipment for restoration (such as chain saws) grew steeply after the hurricane hit there, while in Japan, the performance of Agricultural machinery and Industrial machinery increased. In Europe, sales improved in Russia. Sales in China also grew. Operating income was 6.2 billion yen, down 21.2% YoY. Sales grew and the yen depreciation contributed, but unrealized gain due to inventory affected results, and the company was not able to offset the augmentation of SG&A expenses, including temporary expenses generated by the irregular accounting and the cost for integrating distributors. In this term, there was no extraordinary loss due to the dissolution of the employees' pension fund incurred in the previous term, which amounted to 3.3 billion yen. Accordingly, net income was 4.9 billion yen, up 57.6% YoY. Sales and profit were almost as estimated.   ◎ Outdoor power equipment

Sales were 74.4 billion yen, up 3.3% YoY.(Japan) Trimmers and power blowers sold well thanks to the lightweight campaign, and especially the sales of products for home improvement retailers increased, but the sales of spare parts were stagnant, and total sales were unchanged from the previous term. (Americas) In the North American market, which is the main target, the sales of trimmers dropped due to the effects of low temperatures and an excess of rain in the first half of the demand season, but the demand for chain saws to be used for restoration grew steeply after the hitting of the large-scale hurricane in late August onward, making sales comparable to those in the previous year. Taking into account the effect of the yen depreciation, sales in yen increased. (Overseas except Americas) The performance in western Europe declined due to unfavorable weathers, the lean crop of olives, etc., but sales in Russia recovered, and sales volume increased in China, where the company made efforts to expand sales channels. Also because of the effects of exchange rates, sales grew.  ◎ Agricultural machinery

Sales were 16.7 billion yen, up 9.5% YoY.(Japan) The sales of robotic mowers, including sloop mowers and other mowers, especially for fruit farmers were healthy, and the performance of speed sprayers, which was sluggish after the extraordinary demand due to the regulations on gas emissions in the previous year, recovered. Accordingly, sales grew. (Overseas) Grain price remained sluggish, but sales increased due to the release of new potato harvesters and sales promotion activities.   ◎ Industrial machinery

Sales were 10 billion yen, up 16.8% YoY.(Japan) Sales grew, as the sales of generators, which are main products, grew thanks to the infrastructure development project of the government, etc., the performance of welders recovered as the company implemented the campaign for supporting the replacement of welders, and new engine cutters were released. (Overseas) In North America, sales increased as the sales channels for generators were developed.  ◎ Other

Sales were 1.6 billion yen, down 16.2% YoY. The performance of tentatively produced auto parts, snow blowers, etc. was sluggish.  Total liabilities augmented 1,466 million yen from the end of the previous term to 49,325 million yen, due to the increase in trade payables, although debts decreased. Net assets rose 4,341 million yen from the end of the previous term to 51,825 million yen, due to the increase in retained earnings. As a result, equity ratio increased 1.4% from the end of the previous term to 51.2%. The balance of short and long-term debts declined 766 million yen to 17,587 million yen.  The cash position improved. |

| Fiscal Year December 2018 Earnings Estimates |

Sales and profit are estimated to grow.

Sales are forecasted to rise 2.6% YoY to 120 billion yen. The performance of outdoor power equipment is forecasted to recover in North America and Europe, and remain healthy in Japan. Operating income is projected to be 7.3 billion yen, up 22.3% YoY. Although there will be some effects of the yen appreciation, it is expected that sales will grow and temporary expenses incurred in the previous term will decrease. The assumed exchange rates are 1 US dollar = 110 yen (112 yen in the same period of the previous term) and 1 euro = 130 yen (125 yen in the same period of the previous term). As for dividends, the company plans to pay a dividend of 5 yen/share for commemorating the 10th anniversary of the establishment of the company, and an ordinary dividend of 35 yen/share, that is, a total of 40 yen/share per year. The estimated payout ratio is 31.8%. |

| 2019 Medium-term Management Plan-Activities in the major market |

(1) Activities in each market

In the field of outdoor power equipment, the sales via Home Depot were healthy due to the demand for recovery for disaster events in the second half of previous year. However, the sales via distributors dropped because of the unfavorable weathers in the first half of the demand season. This term, sales are estimated to grow thanks to the market recovery and the following sales promotion measures.(1) Enhancement of sales via distributors (Expansion of the network of distributors) The company will seek and improve dealers, including local retail chains and leading farm equipment stores in the U.S. (Brand popularization) The company will implement local sales promotion campaigns targeted at professional users, and distribute ads in the sports field, including MLB. (Improvement of products for professionals) In the previous term, the company decided to produce a series of high-end products for streamlining the work of professionals under the name of "X Series." This term, the company plans to add a trimmer "SRM-30X" to its lineup of trimmers, which is the main products of the company. (2) Enhancement of sales via the Home Depot The company will carry out pricing strategies in the spring, summer, and autumn, while expanding the sales through the chain saw "CS-490," etc. with the aim of increasing stores handling the products of the company. (3) Enhancement of sales of accessories The company will enhance the sale of highly profitable accessories, including fuel, oil, and nylon trimmer lines. Yamabiko Europe SA emphasizes the development of an environment where distributors can engage in marketing comfortably, designs sales strategies according to country and region, develop trainers in distributors for brushing up selling and service provision skills, collects and analyzes information of dealers, support exhibitions and dealers' meetings, and so on. We heard that the American sales promotion methods are being diffused little by little. As sales strategies, the company is promoting "X Series," products targeted at professionals, enriching the product lineup, and strengthening the sale of accessories, like in America. The company will pursue the maximization of synergetic effects, by utilizing the characteristics of local specialists that handle all brands and taking full advantage of a wide array of products and many sales channels. The Agency for Natural Resources and Energy, the Ministry of Economy, Trade and Industry is promoting the establishment of service stations (SS) for residents as footholds for supplying fuel at the time of disaster. The objective of the SS for residents is to secure a system for providing local citizens with fuel by private power generators at the time of disaster, and the ministry plans to establish 8,000 service stations for residents throughout Japan in four years. The company plans to deliver its products to these stations actively. In addition, the company will establish Production Reform Promotion Division, develop a new production method for the entire manufacturing organization in Japan by the next term to streamline production processes, and automate the processes of treating metal and assembling products and on-site distribution system at Yokosuka Factory. In order to enhance the production output of generators, the company plans to construct new Yamabiko Vietnam Factory (area: about 1,000 m2), almost twice the size of existing one. Its operation is to be started next term.     |

| Conclusions |

|

The business environment is favorable, because the business in Russia is recovering and performance in Japan remains healthy, and so the results for FY December 2018 are expected to be robust. Its share price has been somewhat sluggish recently, but in the 5-year term, it exceeds TOPIX considerably, and its growing trend seems to be still maintained. We expect the reevaluation of its share price in line with the progress of the business performance in this term.  |

| <Reference1: Regarding "2019 Medium-term Management Plan" > |

|

Outline of "2019 Medium-term Management Plan"

The company set two visions for clearly sharing what kind of company they should aim to develop in the medium to long term.

① Basic policy and vision   ② Key initiatives

In order to actualize the visions set in the above basic policy, the company will take the following key initiatives.

⑤ Regarding the return to shareholders

As the company will keep paying dividends stably and its consolidated financial standing is improving, the company has decided to change the target consolidated payout ratio from "about 25%" for the previous Medium-term Management Plan to "25% or higher" for the new Medium-term Management Plan.

|

| <Reference2: Concerning corporate governance> |

◎ Corporate Governance Report

Last updated: June 29, 2017.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |