Bridge Report:(6250)YAMABIKO Fiscal Year ended December 2021

President Hiroshi Kubo | YAMABIKO CORPORATION(6250) |

|

Company Information

Market | TSE Prime Market |

Industry | Machinery (Manufacturing) |

President | Hiroshi Kubo |

HQ Address | 1-7-2, Suehiro-cho, Ome-shi, Tokyo, Japan |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

¥1,355 | 44,108,428 shares | 59,766 million | 11.7% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥52.00 | 3.8% | ¥204.64 | 6.6x | ¥1,657.43 | 0.8x |

* The share price is the closing price on March 18. Each number was taken from the brief financial report.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2018 Act. | 118,049 | 6,290 | 5,957 | 4,188 | 101.39 | 40.00 |

December 2019 Act. | 120,922 | 6,203 | 5,917 | 4,164 | 100.46 | 35.00 |

December 2020 Act. | 131,972 | 9,643 | 9,402 | 6,635 | 159.90 | 40.00 |

December 2021 Act. | 142,328 | 9,330 | 9,913 | 7,500 | 180.58 | 45.00 |

December 2022 Est. | 150,000 | 11,700 | 11,400 | 8,500 | 204.64 | 52.00 |

*Unit: million yen or yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. The DPS of 40 yen for FY December 2018 includes the 5 yen dividend for commemorating the company’s 10th anniversary. The Accounting Standard for Revenue Recognition (Accounting Standards Statement No. 29), etc. have been applied from the beginning of the year ending December 2022.

This report introduces YAMABIKO CORPORATION’s earnings results for Fiscal Year ended December 2021 and other financial details.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended December 2021 Earnings Results

3.Fiscal Year ending December 2022 Earnings Forecasts

4.Carbon neutrality and the company's development strategies

5.Conclusions

<Reference 1:Outline and Key Initiatives of the Medium-term Management Plan 2022>

<Reference 2:Concerning Corporate Governance>

Key Points

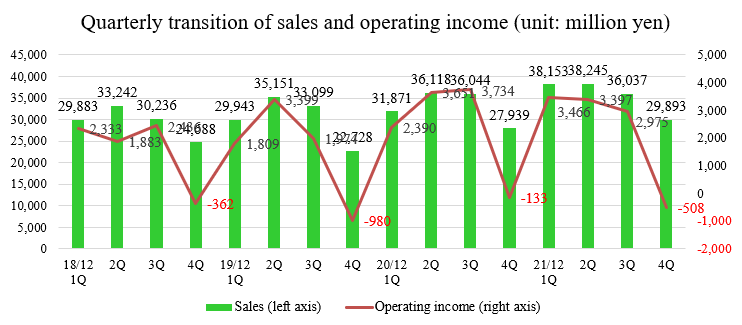

- In the term ended December 2021, sales increased 7.8% year on year to 142.3 billion yen. Domestic sales decreased 5.6%. The sales of agricultural machinery grew as they were driven by the government's business continuation subsidy. On the other hand, the sales of outdoor power equipment declined due to unseasonable weather. Moreover, industrial machinery sales were sluggish as large-scale exhibitions were canceled due to the spread of the novel coronavirus. Overseas sales increased 15.8% year on year. The sales of outdoor power equipment grew in the Americas and Europe, which are their main markets, as a result of the favorable weather and the increase in time spent at home due to the spread of the novel coronavirus. Operating income decreased 3.2% year on year to 9.3 billion yen. Gross profit increased 4.8% year on year, but it could not absorb the rise in SG&A expenses due to planned investment projects and increased labor costs, although prices were revised in some areas in response to soaring distribution costs and raw material prices.

- For the term ending December 2022, sales are expected to increase 5.4% year on year to 150 billion yen. Outside Japan, sales are forecasted to grow further as there will remain high demand for outdoor power equipment. In Japan, agricultural machinery sales are likely to decrease due to the recoil from the subsidy policy in 2021. Regarding industrial machinery, sales are projected to increase as it is expected to recover from the decline resulting from restrictions on sales activities due to the efforts to balance the novel coronavirus control measures and socio-economic activities. Operating income is expected to increase 25.4% year on year to 11.7 billion yen. Although soaring raw material prices and distribution costs will put pressure on profits like in 2021, profit is expected to increase thanks to the reflection of the cost increase in the selling prices and productivity improvement associated with the rise in sales volume. An interim dividend will be paid from this term. An interim dividend of 26 yen/share and a year-end dividend of 26 yen/share will be paid for a total of 52 yen/share. The expected dividend ratio is 25.5%.

- After the three upward revisions, both sales and profit exceeded expectations, and the company recorded favorable earnings. As a result, the company achieved the targets of the medium-term management plan 2022: "sales of 134 billion yen and an operating income of 8 billion yen for the term ending December 2022," one year ahead of schedule. Sales are expected to increase 5% and operating income is projected to rise 25% in this term as well, and the stock price is also steady in the unstable market due to the situation in Ukraine, etc. There are still many uncertainties, such as the global shortage of containers and materials, soaring raw material prices, and the spread of the novel coronavirus again in China. Thus, we would like to pay attention to whether the forecast for this term can be steadily achieved by the price revisions. We will also keep an eye on the market penetration of the company's products as the commercialization of DC products is accelerating worldwide.

1. Company Overview

YAMABIKO CORPORATION develops, manufactures and sells outdoor power equipment (e.g., trimmers, chain saws etc.), agricultural machinery (e.g., pest control equipment, sloop mower), industrial machinery (e.g., generators, welders etc.) in Japan and overseas. The overseas sales occupy about 60% of their total sales. In terms of manufacturing and selling outdoor power equipment, the company not only has the top share in Japan but also a large share in the US. Its strength is owning unique production technology, a variety of product line-ups, and an excellent technical support system.

1-1 Corporate History

YAMABIKO CORPORATION started as a joint holding company established in December 2008 through a merger between KIORITZ CORPORATION (listed in the first section of the Tokyo, Osaka and Nagoya Stock Exchanges), which dealt with agricultural machinery in Japan and outdoor power equipment overseas, and Shindaiwa Corporation (listed in the second section of the Tokyo Stock Exchange), which dealt with outdoor power equipment and industrial machinery globally. In October 2009, YAMABIKO CORPORATION established its current business entity by merging both KIORITZ and Shindaiwa.

KIORITZ CORPORATION was established in 1947 in Tokyo and originally called KIORITZ AGRICULTURAL EQUIPMENT CORPORATION. It has been a leading company in both agricultural equipment business through which they developed “Japan’s first speed sprayers” and outdoor power equipment business through which they developed “Japan’s first motorized backpack trimmers” and “the world’s first handheld power blowers”. Furthermore, since its establishment, it has been focusing on self-development of engines for outdoor power equipment. The accumulative number of engines produced in 2008, before the merger, was about 40 million.

Shindaiwa Corporation was established in 1952 in Hiroshima and was originally called Asamoto Precision Manufacturer. It not only developed “Japan’s first electric chain saws” for the outdoor power equipment business, but also manufactured and sold engine generators and engine welders for the industrial machinery business. Its strength was high technological development capabilities, as can be seen in the development of the world’s first mixed fuel 4-cycle engine.

In the late 1990s, with growing concern about global warming caused by greenhouse effect gas, and as engine’s emission gas control became stricter in the Western countries, especially in the US, research and development expenses increased to comply with the new regulations. In the 2000s, the medium and small-sized companies that could not afford these expenses went through rapid industry restructuring on a global scale in the outdoor power equipment industry.

Moreover, the business environment became further uncertain due to a flood of cheaper products from newly emerging countries and diversification of customers’ needs.

Under these circumstances, the two companies concluded a business and capital alliance agreement in May 2007 on the premise of future business integration in order to strengthen the vitality to survive and win the intensifying competition.

In December 2008, YAMABIKO CORPORATION was established as a joint holding company to achieve better efficiency and expansion for all its businesses including development, manufacturing, logistics, sales and management. In October 2009, YAMABIKO CORPORATION conducted an absorption-type merger of KIORITZ and Shindaiwa and became the current business entity.

The company name “YAMABIKO” derives from the mountain god, “Yamabiko”. Its corporate philosophy is to “create the bridge that bonds people and nature with the future”. This expresses the company’s willingness to contribute to the conservation and improvement of the nature and environment.

1-2 Corporate Philosophy, etc.

YAMABIKO Group’s corporate philosophy is formed from three elements: “Essence”, “Purpose of Existence” and “Code of Conduct”.

“Essence”, which incorporates both “Purpose of Existence” and “Code of Conduct”, expresses in a single word what YAMABIKO Group aims to be as a company, and the essence of its corporate activities.

“Purpose of Existence” sets out the role and responsibilities of YAMABIKO Group in society and makes a commitment to this.

“Code of Conduct” defines the attitude of each YAMABIKO Group employee in relation to their work.

(From the Company’s website)

<Essence>

*Create the bridge that bonds people and nature with the future. |

<Significant Beliefs>

*Offer the best products and service in the world. *Support people and companies committed to sustaining nature and the environment. *Lead the industry through the creation of new markets and customers, ultimately resulting in growth for tomorrow. *Provide a sense of fulfillment for all persons affiliated with YAMABIKO CORPORATION. |

<Principles>

*Observe change and anticipate the future. *Combine fact with theory. *Break the status quo through innovation and creativity. *Think and act with the spirit and vitality of a globally competitive company. *Conduct oneself with sincerity and grace. |

In addition, the company established 14 detailed measures that augment the Code of Conduct to facilitate the implementation of business activities in accordance with the corporate philosophy.

1-3 Market Environment

Although no detailed statistics about the outdoor power equipment market is available, it is known that the largest market is in North America including the US, followed by Europe. In Japan, about 1 million outdoor power equipment/tools are sold per year. The indicators that may impact the company’s trend in the earnings include “number of housing start”, “commodity (grain) price”, and “crude oil price” for the overseas market and “rice price” for the Japanese market.

The company recognizes that there are two global manufacturers of outdoor power equipment in Europe (Germany and Sweden).

1-4 Business Description

1. Segment

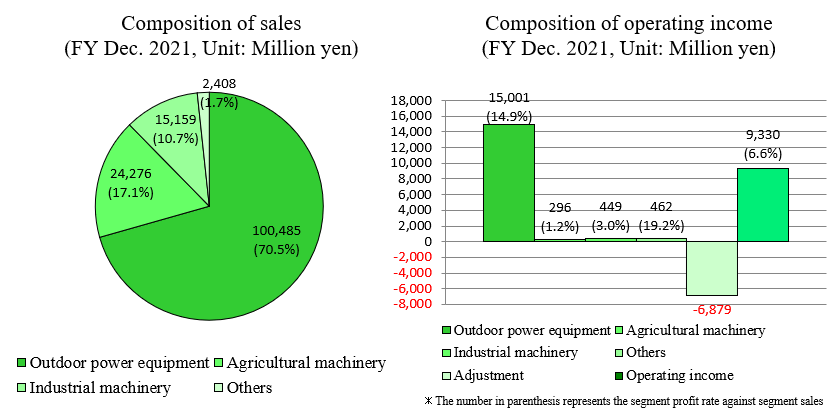

YAMABIKO Group operates businesses in three sectors: Outdoor power equipment, Agricultural machinery and Industrial machinery. These three segments are reported.

(Developed by us based on YAMABIKO CORPORATION’s financial report.)

“Outdoor Power Equipment Business”

YAMABIKO CORPORATION manufactures and sells handheld or backpack-style forestry and landscape maintenance machinery powered by small internal combustion engines. The main products include chain saws, trimmers, power blowers, hedge trimmers, etc.

In November 2014, the company acquired “Belrobotics SA,” a Belgian venture company, which develops, manufactures, and sells robotic mowers for professional use. (In Jan. 2017, Belrobotics SA was renamed “Yamabiko Europe SA” for the purpose of enhancing sales in Europe.)

Based on the accumulated experiences and know-how and excellent development capabilities that meet the customers’ needs, YAMABIKO CORPORATION continues to produce high performance, highly durable and high-quality engines.

<Chain saws>

| <Trimmers>

|

<Power blowers>

|

|

|

|

(Gasoline engine system)

The engines for outdoor power equipment such as chain saws and trimmers are mainly 2-stroke gasoline engines. As described later, the company’s excellent capability to develop engines is one of their most important features/strengths.

Brief information concerning the company’s engines is provided below because knowing the gasoline engine system and characteristics of each engine type helps to understand the business of the company,

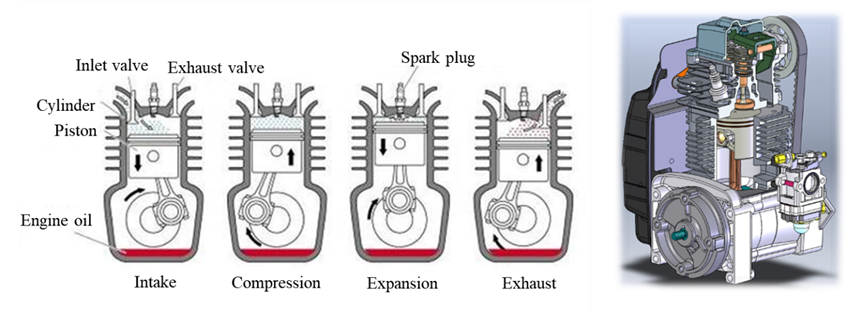

Basically, a gasoline engine generates power by moving the piston down with the combustion of gasoline through the following 4 steps.

Step | Overview |

1. Intake | The air-fuel mixture is sucked in a cylinder. |

2. Compression | The air-fuel mixture in the cylinder is compressed as the piston moves up. |

3. Expansion | When the air-fuel mixture is compressed the most, a spark will be generated to ignite. Expansion from burning pushes the piston down. |

4. Exhaust | The burned gas is discharged outside. |

Reciprocating motion of the piston is converted into revolution by a crankshaft. The rotating motion turns the rotating shaft of axel of a car or revolving shaft of chain saws.

The gasoline engine is largely categorized in two types (2-stroke engine and 4-stroke engine), depending on the number of reciprocating motions by piston to complete “1 cycle” of the 4 steps.

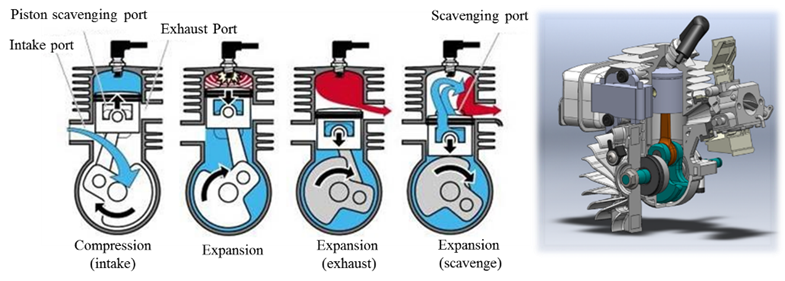

“2-stroke engine”

One power cycle is completed by 2-stroke. In other words, a power is generated by “1 piston reciprocating motion, 1 crankshaft revolution”.

First stroke (piston moving up): “Intake” and “compression” of air-fuel mixture occurs.

Second stroke (piston moving down): Piston moves down due to the “expansion” of air-fuel mixture and “exhaust” occurs later.

“4-stroke engine”

One power cycle is completed by 4-stroke. A power is generated by “2 piston reciprocating motions, 2 crankshaft revolutions”.

First stroke (piston moving down): “Intake” of air-fuel mixture occurs.

Second stroke (piston moving up): “Compression” of air-fuel mixture occurs.

Third stroke (piston moving down): Piston rapidly moves down as a result of “expansion”.

Fourth stroke (piston moving up): Combusted gas is “exhausted”.

The advantage of the 4-stroke engine is the easy control of intake and exhaust. However, its structure is complicated compared to a 2-stroke engine, because the intake/exhaust valves of a 4-stroke engine are installed at the cylinder head, while intake and exhaust of a 2-stroke engine occur at the port that is located on the body of the cylinder. Because of this structure, the weight of a 4-stroke engine is heavier than a 2-stroke engine.

On the other hand, a 2-stroke engine has a larger ratio of burning engine oil and fuel in order to make smooth piston motion and blow-by of air-fuel mixture. This means it releases more harmful substances in the exhaust gas as compared with a 4-stroke engine. However, because of its simple structure and smaller number of parts, the 2-stroke engine can be smaller and lighter. The overhaul is also easier for the same reasons. Therefore, a 2-stroke engine is the most appropriate engine for outdoor power equipment.

“Agricultural Machinery Business”

YAMABIKO CORPORATION manufactures and sells pest control equipment for Japan and agricultural harvesting equipment for North America.

Its major products include pest control equipment (speed sprayers, mounted equipment for cropland pest control, power sprayers), sloop mower, soy and potato harvesters, etc.

YAMABIKO CORPORATION’s technological strengths in this business segment are KIORITZ’s blowing, spraying, and pumping technology as well as technology to create small and light equipment. These technological capabilities have been built up over many years at KIORITZ.

<Mounted equipment for cropland pest control>

| <Speed sprayers>

|

<Sloop mowers>

|

|

“Industrial Machinery Business”

YAMABIKO CORPORATION manufactures and sells equipment for construction, civil engineering and iron works.

Its major products include generators, welders, lighting equipment, cutting machines and high-pressure washers.

Technological strengths in this business segment are established by the R&D knowledge accumulated since YAMABIKO CORPORATION started business as Shindaiwa, and such strengths can be found in alternator designing capability enhanced by their efforts for alternative current motor development, as well as technologies for electronic control and noise prevention.

<Generators>

| <Welders>

|

“Accessories and Parts”

The company manufactures and sells accessories and the parts for after purchasing service for various machines and equipment.

The profitability in this segment is the highest among all segments.

<Maintenance kit>

| <Nylon trimmer line>

| <Fuel/Oil>

|

2. Brand

YAMABIKO CORPORATION was established based on the integration of two companies. The products of both companies are well recognized both in Japan and overseas for many years. Therefore, YAMABIKO CORPORATION maintains the brand names as KIORITZ, Shindaiwa, and ECHO.

YAMABIKO CORPORATION is proactively investing in marketing activities as well as exploring new sales routes to enhance its brand values.

3. Development structure

Each business segment is working on development with a focus on the following priority issues.

Business | Priority issues for development |

Outdoor power equipment | *To comply with exhaust gas regulations at the global level *To comply with fuel permeability regulations in North America *To comply with noise and vibration regulations in Europe *To create smaller and lighter equipment with low noise, low fuel consumption and high durability *To enhance safety |

Agricultural machinery | *To achieve reduction of drift, proper quantity of spraying, high performance, and easy operation |

Industrial machinery | *To create smaller and lighter machinery with low noise, high performance, high function, and low fuel consumption |

The exhaust gas regulations are expected to be further tightened in the future. Therefore, addressing them is of paramount importance.

In addition, the company is conducting research on control technology in the field of electronic control.

4. Production structure

The company has 3 plants (Yokosuka, Morioka, and Hiroshima) and 4 production related subsidiaries in Japan and a total of 10 production related subsidiaries in the USA, Belgium, China and Vietnam.

5. Sales route and sales methods

The company supplies its products in over 90 countries for about 28,000 stores.

More than 60% of the sales are from overseas sales.

(Developed by us based on YAMABIKO CORPORATION’s financial report.)

<Domestic market>

Seven sales subsidiaries, which were separated mainly by region, were merged into YAMABIKO JAPAN CO., LTD. in April 2017, with the aim of allocating management resources in a more efficient manner, strengthening sales capabilities, and improving customer services through a unified management system and integral operation of business assets.

YAMABIKO JAPAN CO., LTD sells the products to distributors, ZEN-NOH (National Federation of Agricultural Cooperative Associations), home centers, and construction machinery rental companies, etc. Through them, the products are supplied to the end users including farmers/foresters, companies in the construction, civil engineering and iron industries and landscapers.

The company presents their products in exhibitions in collaboration with dealers and distributors and facilitates sales through demonstration and test drive.

Furthermore, the company accompanies dealers to visit end users to understand their needs and utilize the information for product development.

<North American market>

ECHO Incorporated Group, one of the company’s subsidiaries, sells the products to The Home Depot (*) and other distributors, through which the products are supplied to the end users such as landscapers, homeowners, farmers/foresters, and companies in the construction/civil engineering industry.

*The Home Depot: The Home Depot, Inc. is the world’s largest home center and construction products and services. It was established in 1978. Sales in 2021 were US$151.2 billion and net income was US$16.4 billion. It has over 2,296 stores in the US, Canada and Mexico. It is listed on the New York Stock Exchange. (Excerpted from the company’s website)

The Home Depot classifies their products into GOOD, BETTER and BEST in accordance with the quality. It is only YAMABIKO CORPORATION that supplies the high-quality BEST products to The Home Depot. This is one of the proofs that the company’s products are highly reputed in the North American market.

In the Central and South American market, ECHO Incorporated, one of the company’s subsidiaries, sells the products to the distributors of each country, and made their products supplied to the end users through dealers.

Yamabiko Europe SA in Europe and ECHO MACHINERY (SHENZHEN) Co., Ltd. in China, both of which are subsidiaries of Yamabiko, sell products to distributors in their respective countries. Asia and other areas, YAMABIKO CORPORATION sells the products to the distributors in each country.

The overseas dealers display the products by brand, and salesperson conducts person-to-person sales while understanding the needs of the end users.

The home center also displays the products by type and price. The end users purchase the products based on the needs, budget and image they have from advertisement, etc.

1-5 Characteristics and Strengths

①Unique production and technological capabilities and vertically integrated production

The most important characteristics and strengths of the company are the “unique production and technological capabilities and vertically integrated production capabilities”.

Their mainstay 2-stroke engines that are mounted to the outdoor power equipment are manufactured by an integrated production system solely by the company from development, procurement of aluminum, molding, parts production, processing to assembly, which is said to be unique anywhere in the world. The power sources for the products of agricultural machinery and industrial machinery are also engines, but they are mostly procured externally.

The company have solved various issues with their unique technologies including iron plating and electric discharge processing. This results in the quality improvement and production capacity improvement of the company.

Specifically, the company has established the following technologies.

<Example 1: Iron plating>

Plating is a surface covering method in which the surface of a metal is covered by a thin layer of another metal. For engine production, inside of the cylinder should be plated to avoid abrasion caused by dispute with a piston.

The conventional method is to use chrome plating from durability and cost perspectives. However, chrome plating gives negative impact on the environment. Its production efficiency is also low. Therefore, there was an increasing demand for different materials for plating.

The company has been working on “iron plating” since 1978 to reduce environmental load.

Initially, they could produce only hundreds per day. However, as a result of enhanced productivity, enhanced plating precision, and reduction of environmental load, the company now has the iron plating technology that does not require finish processing. Their technology has drastically smaller environmental load. Furthermore, their daily production capacity increased significantly, reaching thousands. The company holds 5 patents related to iron plating.

<Example 2: Electric discharge processing>

As described above, a 2-stroke engine requires a smaller number of parts and has a simpler structure as compared to a 4-stroke engine. Therefore, it is most suitable for the “handheld” and “backpack-style” outdoor power equipment. However, it releases some fuel mixed gas. In order to respond to the increasingly strict exhaust gas regulations globally, the company was faced with a challenge to control the flow of the fuel mixed gas for efficient burning.

In order to achieve it, the company explored the production methods to modify the internal shape of the cylinder (by installing a wall between the fuel mixed gas passage and internal shape of the cylinder).

A “wall” can be created by die-casting (*), but it requires a horizontal hole to lead the fuel mixed gas to a combustion chamber. With die-casting, it was impossible to create a horizontal hole. It was also difficult to carry out machining due to small space in the chamber.

The company came up with the idea of using “electric discharge processing (*)” to create a form while taking advantage of die-casting.

Although electric discharge processing enabled to create complicated forms, it was costly due to long processing time and high electrode consumption. The company conducted research on processing conditions for a large volume production and developed designs of special electrode form. As a result, it succeeded in producing a large volume of products, by shortening processing time, saving personnel, lowering the cost of electrode and enhancing efficiency.

Having obtained three patents related to electrode processing, the company has established the unique technology that cannot be imitated by other companies.

(*) Die-casting

Die-casting is one of the metal mold casting methods. By injecting melted metal in a metallic mold, a large amount of casting with high precision can be produced within a short period of time. It enables to create a thin product at low cost.

(*) Electric discharge processing

Electric discharge processing is a machine processing method to remove a part of the surface of a non-processed workpiece through repeated electrode discharge at short cycles between electrode and the non-processed workpiece. It enables to cut out complicated outline on extremely hard steel.

With “advanced capabilities for creation” such as the above-mentioned technologies, the Company not only complies with exhaust gas regulations but also responds to various needs including weight reduction, enhancing durability and cost reduction. It succeeded in developing and mass-producing “a light weight and highly durable 2-stroke engine that meets the exhaust gas regulations”.

While many companies in the world are forced to leave the industry because they cannot address these issues, YAMABIKO CORPORATION continues to make further development as a leading manufacturer.

②Unique research and development capabilities for each business segment

The company’s capability to address environmental issues is high. The company possesses one of the highest number of US Environmental Protection Agency (EPA)-accredited engines in the world.

Furthermore, not only for outdoor power equipment, the company also has unique research and development capabilities for the agricultural machinery and industrial machinery.

Based on the technological capacities that have been accumulated by KIORITZ and Shindaiwa for many years, the company is further brushing up the capabilities.

③Extensive product lineup and expansion of sales network and domestic services network

The company has an extensive lineup of products that meet various needs of the customers in each of the three business segments.

It also currently supplies the products to about 28,000 stores in more than 90 countries across the world.

As a result of merging KIORITZ and Shindaiwa, YAMABIKO CORPORATION’s product lineup and sales network were further expanded.

With the aim of improving the satisfaction level of diversifying users, the company established “Yamabiko Service Shop” inside Japan in 2013, and is operating service systems for maintenance, repair a failure, etc., which are not offered by competitors, throughout Japan. The number of affiliated shops is 342 as of Mar.2020.

④Excellent technical support system

The company also provides excellent technical support in order to enhance credibility of the products and strengthen the relationships with distributors and dealers.

In addition to offering about 40 service schools annually both in Japan and abroad, in 2018, the company started to provide a new e-learning course using its originally developed teaching materials targeted at overseas distributors in an attempt to enhance their repair skills and deepen their understanding of the mechanism of the engines.

Furthermore, the European subsidiaries of the company recently organize road show-style education and training sessions for nurturing trainers at distributors, and lecture classes designed for distributors’ salespersons, endeavoring to further fortify its service capabilities.

⑤High product share

By demonstrating the above-mentioned characteristics and strengths (1-5-1) to (1-5-4) in an integrated manner, the company is becoming highly competitive at a global level. For the outdoor power equipment business, the company has the top market share (more than 30%) in Japan and is ranked high in North America, the largest market.

1-6 Return on Equity (ROE) Analysis

| FY 3/13 | FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 | FY 12/21 |

ROE(%) | 8.7 | 14.5 | 12.4 | 10.4 | 5.1 | 9.9 | 7.9 | 7.6 | 11.4 | 11.7 |

Net income margin [%] | 2.72 | 4.48 | 4.67 | 4.15 | 2.12 | 4.79 | 3.55 | 3.44 | 5.03 | 5.27 |

Total asset turnover [times] | 1.13 | 1.28 | 1.18 | 1.21 | 1.20 | 1.05 | 1.18 | 1.18 | 1.23 | 1.24 |

Leverage [times] | 2.85 | 2.52 | 2.26 | 2.08 | 2.00 | 1.98 | 1.91 | 1.84 | 1.81 | 1.79 |

Thanks to margin improvement, ROE rose as well as previous year.

2. Fiscal Year ended December 2021 Earnings Results

2-1 Consolidated Business Results

| FY 12/20 | Ratio to sales | FY 12/21 | Ratio to sales | YoY | Compared to forecast |

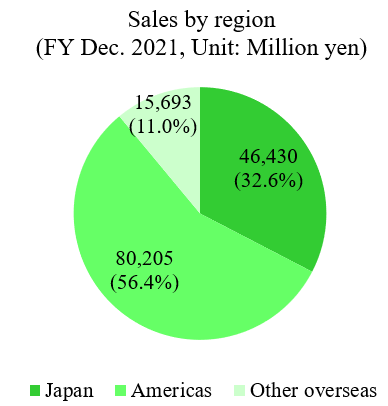

Sales | 131,972 | 100.0% | 142,328 | 100.0% | +7.8% | +1.7% |

Domestic | 49,188 | 37.3% | 46,430 | 32.6% | -5.6% | - |

Overseas | 82,783 | 62.7% | 95,898 | 67.4% | +15.8% | - |

The Americas | 70,650 | 53.5% | 80,205 | 56.4% | +13.5% | - |

Others Overseas | 12,133 | 9.2% | 15,693 | 11.0% | +29.3% | - |

Gross Profit | 37,640 | 28.5% | 39,447 | 27.7% | +4.8% | -0.1% |

SG&A | 27,997 | 21.2% | 30,117 | 21.2% | +7.6% | -1.3% |

Operating Income | 9,643 | 7.3% | 9,330 | 6.6% | -3.2% | +3.7% |

Ordinary Income | 9,402 | 7.1% | 9,913 | 7.0% | +5.4% | +6.6% |

Quarterly Net Income | 6,635 | 5.0% | 7,500 | 5.3% | +13.0% | +10.3% |

*Unit: million yen. Net income means profit attributable to owners of parent. Compared to forecast is to revised forecasts announced in November 2021.

Sales increased but operating profit decreased, and both exceeded forecasts

In the term ended December 2021, sales increased 7.8% year on year to 142.3 billion yen. Domestic sales decreased 5.6%. The sales of agricultural machinery grew as they were driven by the government's business continuation subsidy. On the other hand, the sales of outdoor power equipment declined due to unseasonable weather. Moreover, industrial machinery sales were sluggish as large-scale exhibitions were canceled due to the spread of the novel coronavirus.

Overseas sales increased 15.8% year on year. The sales of outdoor power equipment grew in the Americas and Europe, which are their main markets, as a result of the favorable weather and the increase in time spent at home due to the spread of the novel coronavirus. Operating income decreased 3.2% year on year to 9.3 billion yen. Gross profit increased 4.8% year on year, but it could not absorb the rise in SG&A expenses due to planned investment projects and increased labor costs, although prices were revised in some areas in response to soaring distribution costs and raw material prices.

Both sales and profits exceeded the forecasts announced in November 2021.

Accordingly, the year-end dividend forecast has been increased by 4 yen per share to 45 yen per share. The forecast dividend payout ratio is 25.0%.

2-2 Trends by Segment and Region

| FY 12/20 | Ratio to sales | FY 12/21 | Ratio to sales | YoY |

Outdoor Power Equipment | 90,954 | 68.9% | 100,485 | 70.6% | +10.5% |

Agricultural Machinery | 21,629 | 16.4% | 24,276 | 17.1% | +12.2% |

Industrial Machinery | 17,108 | 13.0% | 15,159 | 10.7% | -11.4% |

Others | 2,280 | 1.7% | 2,408 | 1.7% | +5.6% |

Sales | 131,972 | 100.0% | 142,328 | 100.0% | +7.8% |

Outdoor Power Equipment | 14,546 | 16.0% | 15,001 | 14.9% | +3.1% |

Agricultural Machinery | 86 | 0.4% | 296 | 1.2% | +243.2% |

Industrial Machinery | 860 | 5.0% | 449 | 3.0% | -47.8% |

Others | 441 | 19.3% | 462 | 19.2% | +4.8% |

Adjusted Amount | -6,290 | - | -6,879 | - | - |

Operating Income | 9,643 | 7.3% | 9,330 | 6.6% | -3.2% |

*Unit: million yen. The composition ratio for operating income means the ratio of operating income to sales.

◎Outdoor Power Equipment

| FY 12/21 | YoY |

Sales | 100,485 | +10.5% |

Japan | 14,682 | -2.7% |

Overseas | 85,802 | +13.1% |

*Unit: million yen

(Japan)

A reactionary decline in demand occurred due to the impact of cash handouts in the previous year. Moreover, the sales of mowers and chainsaws, which are the mainstay, decreased because of unseasonable weather, such as long rains in the summer in some areas.

(Overseas)

In North America and Europe, which are the company's major markets, the shortage of distributors and dealers continued due to the stagnation of international logistics. However, the demand for chainsaws, power blowers, and mowers continued to be high against the backdrop of the longer time spent at home due to the spread of the novel coronavirus, resulting in significant sales growth.

◎Agricultural Machinery

| FY 12/21 | YoY |

Sales | 24,276 | +12.2% |

Japan | 17,798 | +8.0% |

Overseas | 6,477 | +25.7% |

*Unit: million yen

(Japan)

Although there were factors negatively impacting the revenue, such as a supply shortage due to difficulty in procuring materials, the sales of high-performance pest control equipment and mowers increased due to the government's business continuity subsidies for farmers.

(Overseas)

In North America, the demand for agricultural machinery increased against the backdrop of rising market prices for agricultural products, and sales of soybeans and potato harvesters were strong, resulting in a significant increase in sales.

◎Industrial Machinery

| FY 12/21 | YoY |

Sales | 15,159 | -11.4% |

Japan | 11,543 | -24.8% |

Overseas | 3,615 | +104.9% |

*Unit: million yen

(Japan)

The demand for some products such as lighting equipment is recovering. Yet, the reactionary decline in demand for emergency generators for gas stations, which grew in the previous year, and the decrease in sales mainly of welding equipment due to the stagnation in sales activities such as the cancellation of large-scale exhibitions due to the spread of the novel coronavirus, resulted in a significant drop of sales.

(Overseas)

Due to the resumption of economic activities in North America, the demand for generators, which had been declining in the previous fiscal year, recovered, resulting in an increase in sales.

◎Others

| FY 12/21 | YoY |

Sales | 2,408 | +5.6% |

*Unit: million yen

The sales of snowplows were healthy.

2-3 Financial Standing and Cash Flows

◎Main Balance Sheet

| End of December 2020 | End of December 2021 | Increase/ Decrease |

| End of December 2020 | End of December 2021 | Increase/ Decrease |

Current Assets | 77,796 | 89,775 | +11,979 | Current Liabilities | 33,117 | 40,459 | +7,342 |

Cash | 13,243 | 12,167 | -1,076 | Payables | 21,849 | 26,246 | +4,397 |

Receivables | 27,294 | 27,938 | +644 | ST Borrowings | 3,330 | 3,784 | +454 |

Inventories | 35,141 | 46,346 | +11,205 | Noncurrent Liabilities | 14,221 | 13,236 | -985 |

Noncurrent Assets | 29,355 | 32,799 | +3,444 | LT Borrowings | 11,374 | 11,000 | -374 |

Property, plant and equipment | 22,635 | 24,169 | +1,534 | Total Liabilities | 47,338 | 53,695 | +6,357 |

Intangible Assets | 428 | 587 | +159 | Net Assets | 59,814 | 68,879 | +9,065 |

Investment, Other Assets | 6,291 | 8,042 | +1,751 | Retained earnings | 45,133 | 50,966 | +5,833 |

Total Assets | 107,152 | 122,574 | +15,422 | Total Liabilities and Net Assets | 107,152 | 122,574 | +15,422 |

*Unit: million yen. Payables include electronically recorded accounts payable.

Total assets increased by 15.4 billion yen from the end of the previous fiscal year to 122.5 billion yen, mainly due to an increase in receivables and inventories.

Total liabilities increased by 6.3 billion yen to 53.6 billion yen due to an increase in payable, etc.

Net assets increased by 9.0 billion yen to 68.8 billion yen due to an increase in retained earnings and foreign currency translation adjustments.

As a result, capital adequacy ratio increased by 0.4 points from the end of the previous fiscal year to 56.2%.

◎Cash Flow

| FY 12/20 | FY 12/21 | Increase / Decrease |

Operating Cash Flow | 11,883 | 5,916 | -5,967 |

Investing Cash Flow | -2,724 | -4,647 | -1,923 |

Free Cash Flow | 9,159 | 1,269 | -7,890 |

Financing Cash Flow | -2,127 | -2,507 | -380 |

Term End Cash and Equivalents | 13,243 | 12,110 | -1,133 |

*Unit: million yen

Due to an increase in inventories, etc. the surplus of operating CF and free CF positive margin decreased.

The cash position has declined.

2-4 Topics

◎ An interim dividend system was adopted.

In order to enhance opportunities for profit distribution to shareholders, the company has decided to adopt an interim dividend system in addition to the year-end dividend.

3. Fiscal Year ending December 2022 Earnings Forecasts

3-1 Earnings Forecasts

| FY 12/ 21 | Ratio to sales | FY 12/ 22 Est. | Ratio to sales | YoY |

Sales | 142,328 | 100.0% | 150,000 | 100.0% | +5.4% |

Gross Profit | 39,447 | 27.7% | 44,300 | 29.5% | +12.3% |

SG&A | 30,117 | 21.2% | 32,600 | 21.7% | +8.2% |

Operating Income | 9,330 | 6.6% | 11,700 | 7.8% | +25.4% |

Ordinary Income | 9,913 | 7.0% | 11,400 | 7.6% | +15.0% |

Net Income | 7,500 | 5.3% | 8,500 | 5.7% | +13.3% |

*Unit: million yen. The forecast was those released by the company.

*Exchange assumptions

| FY 12/21 | FY 12/22 Est. |

1 dollar | 110 yen | 110 yen |

1 euro | 130 yen | 130 yen |

*The dollar is based on a rate assumed by YAMABIKO CORPORATION

Forecast increase in sales and profits

For the term ending December 2022, sales are expected to increase 5.4% year on year to 150 billion yen.

Outside Japan, sales are forecasted to grow further as there will remain high demand for outdoor power equipment. In Japan, agricultural machinery sales are likely to decrease due to the recoil from the subsidy policy in 2021. Regarding industrial machinery, sales are projected to increase as it is expected to recover from the decline resulting from restrictions on sales activities due to the efforts to balance the novel coronavirus control measures and socio-economic activities.

Operating income is expected to increase 25.4% year on year to 11.7 billion yen. Although soaring raw material prices and distribution costs will put pressure on profits like in 2021, profit is expected to increase thanks to the reflection of the cost increase in the selling prices and productivity improvement associated with the rise in sales volume.

An interim dividend will be paid from this term. An interim dividend of 26 yen/share and a year-end dividend of 26 yen/share will be paid for a total of 52 yen/share. The expected dividend ratio is 25.5%.

3-2 Basic policies and priority measures in each segment

YAMABIKO Group reaffirms the "Essence: Create the bridge that bonds people and nature with the future" as the significance of the company's existence and aims to remain an indispensable company that creates the infrastructure that supports people's lives through the company's strengths that have not changed over time, including the research and development capabilities, provision of efficient machinery, and an integrated production system.

Based on this philosophy, the company set the following basic policies and priority measures for each segment for the term ending December 2022.

(1) Basic policy

* Expansion of sales and improvement of profitability

* Promotion of measures for carbon neutrality

(2) Priority measures in each segment

① Outdoor power equipment

Market | Market environment | Priority measures |

North America | ・ The demand for outdoor power equipment continues to be high against the backdrop of robust housing market conditions and lifestyle changes ・ Disruption of supply chains such as logistics and raw material procurement ・ California tightening its emission regulations | ・ To focus on expanding sales of the X series targeted at professionals, which remains in high demand ・ Full-scale sales of DC products ・ To prepare for the risk of supply shortages by increasing production, utilizing the U.S. warehouse purchased in the previous fiscal year, and strengthening logistics functions ・ Sales promotion through digital marketing |

Europe | ・ The European market continues to expand. ・ Distributor inventory is low due to continued high demand. ・ Sales of DC products to general users and others exceed the sales of engine products, mainly in North Europe | ・ To focus on expanding sales of the high-value-added X series for professionals ・ To handle a new DC product lineup from this term to meet the expanding demand for DC products |

Japan | ・ Demand from people staying for a longer time at home due to the spread of the novel coronavirus has subsided. ・Users are aging, and the number of agricultural and forestry workers is decreasing. | ・ To expand the sales of mainstay engine models ・ To strengthen the sales of high value-added products ・ To strengthen the sales of DC products |

②Agricultural machinery

Market | Market environment | Priority measures |

Japan | ・ Declining and ageing farming workforce and the need to improve farming efficiency and further security. ・ the incorporation of agriculture is growing. | ・ Ensuring safe and secure manufacturing ・ Urgent need to improve profitability. ⇒Reorganizations of development organization and establishment of Agricultural Machinery Reform Office. ⇒Review of lineups ・ Focus on developing new models ・ Boost sales of products for smart agriculture. |

③Industrial machinery

Market | Market environment | Priority measures |

Japan | ・ Resumption of sales activities, which were stagnant due to the novel coronavirus ・ Expo-related demand ・ Demand for resuming events associated with people going back to their normal lifestyles ・ Repeated disasters | ・ To work on new product development ⇒ Multi-phase generators ⇒ Hybrid welding equipment ・ To promote the sale of remote monitoring systems ・ To expand the sales of products that address disaster prevention, disaster mitigation, and national resilience |

Overseas | The recovery trend continues as a result of balancing the novel coronavirus control measures and socio-economic activities | ・ To focus on expanding the sales of high value-added products such as remote monitoring systems and hybrid welding equipment ・ To promote the sales of remote monitoring systems |

(3) Sales target

◎Outdoor power equipment

| FY 12/21 | FY 12/22 Est. | YoY |

Sales | 1,004 | 1,072 | +6.7% |

Japan | 146 | 147 | +0.7% |

Overseas | 857 | 925 | +7.9% |

*Unit: hundred million yen. Made by us based on YAMABIKO CORPORATION’s financial report.

◎Agricultural machinery

| FY 12/21 | FY 12/22 Est. | YoY |

Sales | 242 | 226 | -7.1% |

Japan | 177 | 159 | -10.2% |

Overseas | 63 | 66 | +4.8% |

*Unit: hundred million yen. Made by us based on YAMABIKO CORPORATION’s financial report.

◎Industrial machinery

| FY 12/21 | FY 12/22 Est. | 前期比 |

売上高 | 151 | 178 | +17.6% |

国内 | 115 | 140 | +21.7% |

海外 | 36 | 38 | +5.6% |

*Unit: hundred million yen. Made by us based on YAMABIKO CORPORATION’s financial report.

4. Carbon neutrality and the company's development strategies

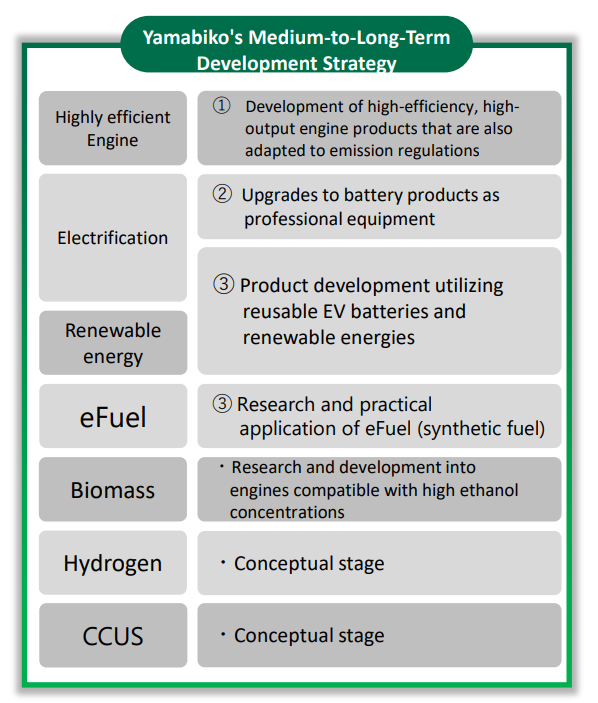

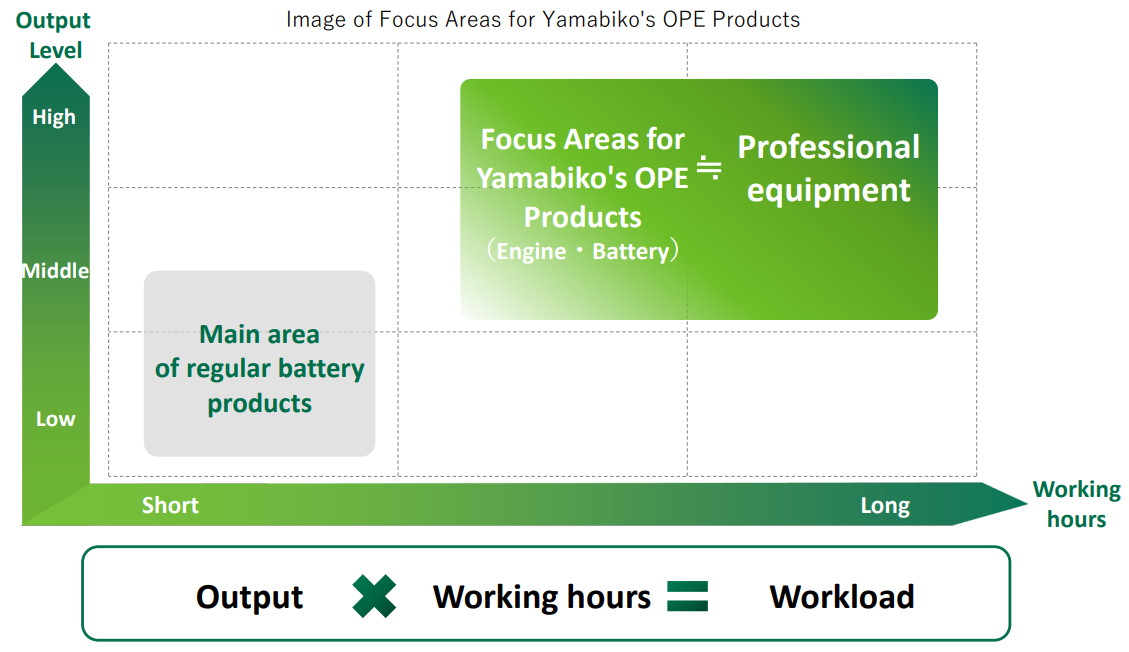

In the medium/long term, even though the demand for engine products might be impacted by emission regulations and technological innovation trends, the demand for products for professional users will remain strong. On the other hand, the commercialization of DC is accelerating, and the size of the market including engines and DC is expected to expand.

The company is establishing and promoting the following development strategies for this market environment.

(Extracts from the company material)

(1) Concrete Efforts

① Innovation in response to emission regulations

The standard values of emission regulations set by the EPA (the United States Environmental Protection Agency) required manufacturers to significantly reduce emissions by 80% in the four years from 2001 to 2005. However, many manufacturers were unable to comply with this, and they are being weeded out.

It is expected that the EPA will continue to lower the standard value.

Even in such a harsh environment, the company continues to comply with regulations by relying on its integrated production system for small engine manufacturing, which is rare in the world, from development to material procurement, casting, metal processing, machining, and assembly, as well as development and technical capabilities. The company is one of the leading companies with a high number of EPA certifications in the world.

② Battery product lineup

In the U.S., which is the company's main market, a battery R&D center was set up at the subsidiary ECHO Inc. The company will promote the development and manufacturing of global DC products and establish a global platform through this center.

From 2022, the company will develop new battery products that can be used as common batteries in the North American, European, and Japanese markets.

The company has provided two types, high output and medium output, to meet different work needs.

Efficient output is possible by managing the battery's heat, charge, and discharge with the company's unique control technology.

The company will develop two battery product series in each market in the X series, which have high performance and excellent durability and satisfy professional users. This was announced in 2021 at GIE + EXPO, the largest trade fair for garden machinery in the United States, held in Kentucky, USA.

Today's main area for batteries is “low and medium power and short working time.”

On the other hand, the company's focus is on machines that work efficiently to meet the needs of users and applications with a heavy workload that requires high and medium output and long working hours.

In the field of handheld and backpack-type power equipment, the company will promote the development and sale of outdoor power equipment that comply with carbon neutrality, such as emission regulations.

(Extracts from the company material)

③ Alliance initiatives

The company is promoting the following alliances.

Alliance | Overview |

Joining the eFuel Alliance (May 2021) | The company joined the eFuel Alliance, which aims to popularize environmentally friendly synthetic fuels, and started research |

Concluded a joint research and development agreement with eSep, Inc. | They aim to develop eFuel optimized for OPE engines |

Concluded a capital and business alliance with MIRAI-LABO Co., Ltd. | The company will enhance the collaborative system for achieving a low-carbon, recycling-oriented society through efforts such as developing and commercializing the hybrid autonomous energy systems and electrification of outdoor power equipment and mobile battery charging systems. |

* eFuel

Synthetic fuel is a fuel produced by synthesizing CO2 (carbon dioxide) and H2 (hydrogen). Since CO2 in the atmosphere is used as a material, the amount of CO2 in the atmosphere does not increase even if CO2 is emitted by fuel combustion. Also, the H2 used in eFuel is procured from renewable energy-derived electricity so that CO2 is not emitted even during the manufacturing process of H2.

* eFuel Alliance

It is an organization that aims to develop and distribute carbon-neutral synthetic fuels that would contribute to the prevention of global warming and use them worldwide. Its headquarter is in Germany. Companies, organizations, and individuals from various industries of petroleum, automobiles and automobile parts, machinery/plant engineering, aviation/marine transport, chemicals, and energy are members.

5. Conclusions

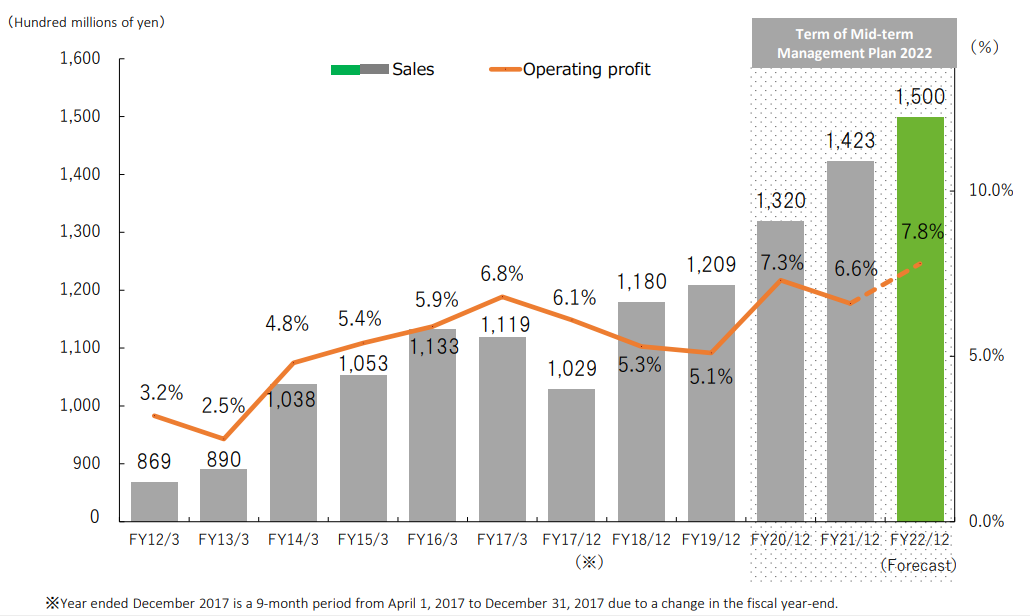

After the three upward revisions, both sales and profit exceeded expectations, and the company recorded favorable earnings. As a result, the company achieved the targets of the medium-term management plan 2022: "sales of 134 billion yen and an operating income of 8 billion yen for the term ending December 2022," one year ahead of schedule. Sales are expected to increase 5% and operating income is projected to rise 25% in this term as well, and the stock price is also steady in the unstable market due to the situation in Ukraine, etc.

There are still many uncertainties, such as the global shortage of containers and materials, soaring raw material prices, and the spread of the novel coronavirus again in China. Thus, we would like to pay attention to whether the forecast for this term can be steadily achieved by the price revisions. We will also keep an eye on the market penetration of the company's products as the commercialization of DC products is accelerating worldwide.

<Reference 1:Outline and Key Initiatives of the Medium-term Management Plan 2022>

(1) Policies and Key Initiatives Set in the Mid-term Management Plan 2022

① Basic policy

The basic policy set in the previous Mid-term Management Plan will be continued.

We will contribute to the development of society with our strong management foundation and sustainable growth, giving happiness to everyone connected to Yamabiko. |

|

We will enhance our corporate value by creating innovative products and expanding manufacturing, sales, and services globally, while also adapting to the diverse set of values of everyone connected to Yamabiko. |

② Goals and strategies in each segment

As to the major market environment, the demand for engine products is expected to remain strong in the professional market for outdoor power equipment where long-lasting products that can tolerate heavy loads are demanded, the company will shift to the professional market further.

As for agricultural machinery and industrial machinery, the Japanese agricultural and construction industries are seeing the shortage of manpower and the aging of workers, so labor-saving and energy-saving products are in demand.

◎Outdoor power equipment business

The priority measures are (1) to develop engine products ahead of the strict environmental regulations, (2) to monetize the robot business, and (3) to augment the lineup of DC products.

Market | Target Sales (FY12/22) |

Japan | 14.7 billion yen |

Overseas | 92.5 billion yen |

(North America)

The company will enhance marketing strategies targeted at professionals, strive to grow sustainably, expand its presence in the market of engine products, and aim to expand its market share, which has been increasing steadily.

As priority measures, the company will augment the lineup of “X Series,” which is a highly functional product lineup for professionals and continue to enhance digital marketing activities. The company will strive to enhance its brand recognition, by diffusing professionals’ comments on the latest products via social media, optimizing marketing activities for each generation, and posting ads in baseball (MLB) and football (MLS), which attract users.

At the Home Depot, which is the primary sales route, the company will concentrate on the sale of flagship products, expand sales area, and continue effective expansion of product sales for a limited period of time.

In addition, the company will put energy into the cultivation of the U.S. market for robot products.

(Europe)

The company will promote the sales of products –conforming to the needs of the market and enhance its brand recognition level.

As priority measures, the company will promote the sales of “X Series,” which is the lineup for professionals, and augment the lineups of battery products and engine products that comply with regulations on emissions, promote the sales of robot products, cultivate the relative market, and enhance the market recognition through digital marketing activities, etc.

(Japan)

As priority measures, the company will launch top handle chain saws as a new DC product, continue effective campaigns, promote the launch of labor-saving, efficient products (robotic mowers), and enhance the sales via home centers.

◎Agricultural Machinery Business

Market | Target Sales (FY12/22) |

Japan | 15.9 billion yen |

Overseas | 6.6 billion yen |

Specifically, the company will engage in efforts to reduce production costs and improve profitability by integrating development, production, and sales, expanding sales routes, continuing effective campaigns, and responding to smart agriculture.

◎Industrial Machinery Business

Market | Target Sales (FY12/22) |

Japan | 14.0 billion yen |

Overseas | 3.8 billion yen |

(Japan)

As there is the initiative of investment in infrastructure for preventing and mitigating natural disasters and promoting national resilience, the company will continue effective sales campaigns and enhance the sale to rental companies, so as to meet the increased demand adequately.

(Overseas)

The company will build a market on a full scale targeting at wide-area rental companies in North America, and build new sales networks in Asia and Africa.

③ Key initiatives

◎Total cost reduction and product quality improvement

The company will keep improving production efficiency for further cost reduction.

The company will aim to establish a new production system for shortening manufacturing lead time and reducing inventory of products and also improve quality control continuously for actualizing “absolute quality.”

◎Strengthening of service capabilities

The company will strive to enhance its service capabilities, which would lead to the improvement in profitability.

The company will concentrate on the augmentation and expansion of sales of highly profitable service parts and accessories, the augmentation promotion of service materials for each product, the strengthening of training systems, the reduction of total logistics costs, the decrease of inventory, etc.

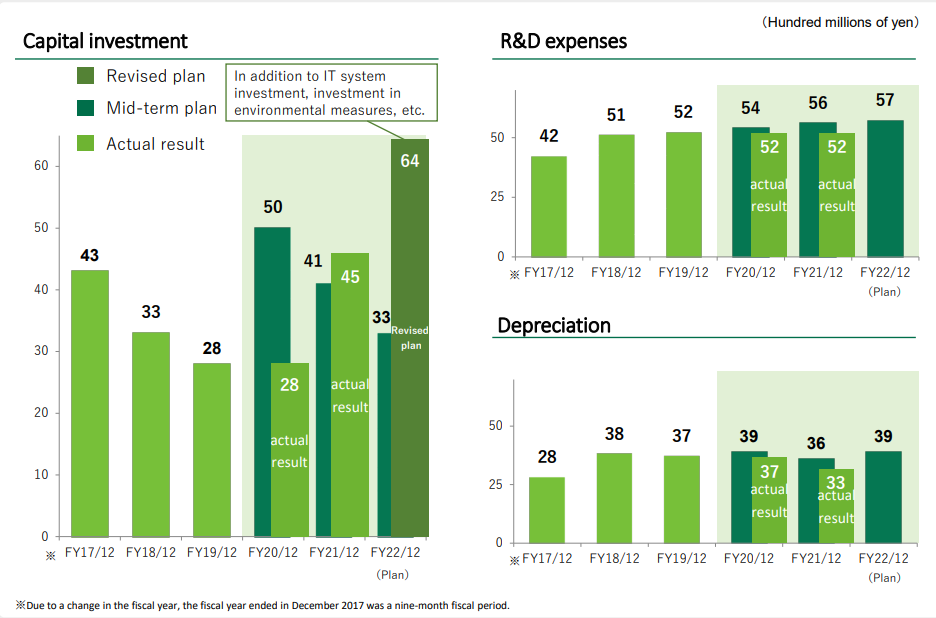

(2) Capital investment, R&D costs, and depreciation

(Extracts from the company material)

In terms of capital investment, a total of 9.1 billion was planned for the first two years. However, the actual result was not achieved at 7.3 billion yen, so the plan of 3.3 billion yen for the final year 2022 was revised to 6.4 billion yen. The three-year plan of 12.4 billion has been revised to 13.7 billion. In addition to investment in IT systems, focus on investment in environmental measures.

(3) Numerical goals

The company aims to achieve “sales of 150 billion yen and an operating income of 11.7 billion yen” in the term ending December 2022.

(Extracts from the company material)

<Reference 2:Concerning Corporate Governance>

*Composition of the organizational structure, directors and auditors

Organizational structure | Company with an auditor |

Directors | 8(including 4 outside director) |

Auditors | 4 (including 2 outside auditors) |

◎Corporate Governance Report

Last update date: March 31, 2022

<Basic policy>

YAMABIKO CORPORATION (“the company”) actively promotes various measures to enhance the corporate value of the entire Group, including an optimization strategy and supervision function at the Group level, as well as the allocation of resources in order to achieve the Group’s global management strategy and growth.

To realize these objectives, the company implements sound and highly transparent Group management in order to deliver value to all of its stakeholders, including regional companies, shareholders, customers and employees. We do this by building a robust corporate culture based on our Corporate Philosophy and Code of Conduct, while enhancing and strengthening a system of corporate governance focused on Group compliance and risk management.

Our board of directors is composed of 8 directors, including 4 outside ones, and makes important decisions regarding our group’s management policy and strategy, and the guidance and supervision for business administration of group companies. In the board of directors, directors monitor and oversee the work of other directors and report their own performance regularly at their meetings. In order to put resolutions of the board of directors into action accurately and swiftly, the management strategy council deliberates them to a sufficient degree.

Our company adopted the auditor system, organizing the board of auditors with a total of 4 auditors, composed of 2 corporate auditors and 2 outside ones.

Auditors participate in the meetings of the board of directors, the management strategy council, and operating officers, and other important in-house meetings, to audit the business execution of directors, and secure the effectiveness of audit in cooperation with accounting auditor and the internal audit section, in accordance with the regulations for the board of auditors and the standards for auditors’ audit.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

The information is based on the revised Code of June 2021 (including principles for the Prime Market applicable from 4 April 2022 onwards).

Principle | Reasons for not following the principle |

【Supplementary principle 3-1-3. Disclosure in accordance with the TCFD framework.】 | Recognizing that addressing climate change is one of our most important management issues, we are moving forward with efforts to realize carbon neutrality. In addition, we have begun formulating a basic policy to achieve carbon neutrality and are working to reduce our environmental burdens by developing products with low environmental burdens, expanding battery-powered products, and strengthening research on synthetic fuels such as eFuel. The Company is in the process of summarizing its domestic GHG emission targets and measures based on the TCFD framework, and will continue to enhance the quality and quantity of disclosures for the entire Group. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Principle 1-4 the strategically held shares] | (1) Policy Regarding Strategic Shareholding Our company conducts business in landscaping, agriculture, construction and civil engineering, and a variety of other fields inside and outside Japan. Therefore, it is required for our company to cooperate with a number of firms involved in each of our businesses. We will strategically hold shares when we have judged that doing so will contribute to improving our corporate value in the medium- and long-term. Meanwhile, when we have determined that the significance of strategically holding shares is not sufficient, we will have dialogue with a relevant company, and then sell or reduce all or part of the strategically held shares by comprehensively taking into account various factors, such as the impact on the market. Each year, regarding the strategically held shares of each listed company, our Board of Directors carefully verifies a multitude of matters, including the purposes of strategically holding the shares, such as maintenance and strengthening of partnerships, and economic rationality, and then determines whether or not our company will continue holding the shares and reviews the number of shares to hold strategically. Since the adoption of the Corporate Governance Code in 2015, our company has reduced the number of corporations in which we hold shares from 25 to 15 after verifying them. (2) Criteria for Exercising a Voting Right in Regard to Strategic Shareholding Our company properly exercises our voting rights on the strategically held shares after making comprehensive judgment by taking into consideration not only business performance, but also whether or not strategically holding shares will contribute to properly strengthening the corporate governance framework and improving shareholder value, and the impact on our company. Furthermore, we hold dialogue with a relevant company as necessary regarding the contents of a proposal. |

[Supplementary principle 2-4-1 Ensure diversity in the recruitment of core personnel, etc.] | <Ensuring Diversity> The Company has adopted various human resource promotion measures that allow employees to maximize their abilities regardless of gender, nationality, or employment status, and will continue to promote diverse workers to managerial positions. In terms of the advancement of women, we have positioned this as an important issue and have established an action plan with a deadline of March 2024, based on the Law for the Promotion of Women's Advancement, with the following three goals. Goal➀ Achieve a female ratio of more than 20% among regular and mid-career hires. Goal② More than double the number of female managers compared to 2018 Goal③ Pursue efficient work styles and foster an organizational culture that allows employees to balance work and family life. Regarding the progress of these goals, the Goal➀ is to achieve a ratio of 22% of female employees hired in 2020. The Goal② is 33% increase in the number of female managers in 2020 compared to 2018. As for goal (3), we conducted work-life balance seminars for line managers and formulated and promoted an action plan to help employees balance work and child rearing, which resulted in acquisition of the Kurumin Mark. Regarding foreign employees, we will further promote the recruitment of foreign employees to management positions in order to develop our business in the global market, including the appointment of the presidents of our overseas subsidiaries as our executive officers. In addition, with regard to mid-career hires, we have been actively recruiting people with diverse backgrounds, and mid-career hires have accounted for 33% of our total hires over the past three years. Furthermore, mid-career hires account for 36% of management positions, and we will continue our efforts to secure diverse human resources through mid-career hiring and actively promote them to management positions. <Human resource development policy and internal environment policy to ensure diversity> The Company is committed to human resource development through the creation of diverse work styles and a system to evaluate their achievements, as well as by providing learning opportunities and fostering an organizational culture that encourages learning. In addition, in order to create a comfortable working environment for employees, we are actively working to improve the environment by introducing a paid leave system on an hourly basis and a system to support employees with childcare, nursing care, etc. |

[Supplementary principle 3-1-3 Disclosure of Sustainability Approaches, etc.] | 1. Sustainability Initiatives We have continued to develop and provide products to support nature and the environment, and the activities of companies and people involved in them, throughout the world, including agriculture, forestry, and green space management. We believe that our business activities themselves, which are linked to our corporate philosophy of "connecting people, nature, and the future," contribute to solving problems in the natural and social environment. Furthermore, by addressing various customer issues and continuing to pursue the best manufacturing and service in the world, we will develop sustainability-oriented products that respond to social and economic conditions. 2. investment in human capital and intellectual property, etc. We consider the human resources of our company are our most important management resource. We will enhance our corporate value by proactively investing in human resource development, such as by strengthening the operation of our education system and conducting an awareness survey of all employees every three years to improve employee engagement. We regard intellectual property as an indispensable management resource for achieving stable growth. As priority areas where significant growth is expected in the future, we will actively promote the acquisition of rights for electric product-related technologies, robot work equipment, IoT technologies, etc. In addition, the Company is working to establish a quantitative value evaluation method for acquired intellectual property, and is efficiently operating and managing intellectual property. |

[Principle 5-1 Policies Regarding Constructive Dialogue with Shareholders] | Our company implements the following measures as policies for maintaining a framework and making efforts to promote constructive dialogue with shareholders and investors. (1) In order to promote the understanding of our company and contribute to the sustainable improvement of corporate value by disclosing company information fairly and in a timely manner, IR personnel (including corporate planning officers) actively engage in dialogue with shareholders and investors. (2) With the IR & Public Relations Section, Corporate Planning Department, Planning & Accounting Division at the helm, other relevant internal departments that assist in dialogue with investors, such as the general affairs, accounting, and sales departments, conduct their duties while actively collaborating with one another to create constructive dialogue, for example, by producing and reviewing materials to be disclosed and sharing necessary information. (3) As a means of dialogue other than individual meetings with shareholders and investors, we regularly hold briefings for financial highlights and plant tours for institutional investors and distribute booklets summarizing our company’s topics and business performance to shareholders. Furthermore, we use feedback and requests from shareholders and investors to improve the content of our website. We plan to improve our news releases page in the future. (4) For information sharing, we give the thoughts of shareholders understood in dialogue to directors and relevant departments as feedback via the distribution of reviews and reports in a meeting body. (5) Our company has set up the Insider Trading Management Regulation to prevent insider trading and thoroughly manage information on insider trading such as promoting the understanding and awareness within our company by posting articles on insider trading at new employee training program and in our company’s internal bulletin. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |