Bridge Report:(6310)ISEKI term ended Dec. 2020

President Shiro Tomiyasu | ISEKI & CO., LTD. (6310) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Shiro Tomiyasu |

HQ Address | 700 Umaki-cho, Matsuyama-shi, Ehime-ken |

Year-end | End of December |

Website |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE (Act.) | Trading Unit | |

¥1,650 | 22,984,993 shares | ¥37,925 million | -8.8% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

To be determined | - | ¥106.18 | 15.5 x | ¥2,683.14 | 0.6 x |

* The share price is the closing price as of March 26, 2021. Each figure was taken from the brief financial report for the term ended Dec. 2020.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Dec. 2017 Act. | 158,382 | 3,953 | 4,250 | 2,807 | 124.29 | 30.00 |

Dec. 2018 Act. | 155,955 | 3,179 | 2,629 | 1,090 | 48.29 | 30.00 |

Dec. 2019 Act. | 149,899 | 2,745 | 1,108 | 723 | 32.01 | 30.00 |

Dec. 2020 Act. | 149,304 | 2,084 | 1,702 | -5,641 | -249.58 | 0.00 |

Dec. 2021 Est. | 153,500 | 3,600 | 3,500 | 2,400 | 106.18 | To be determined |

* Unit: million-yen, yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines ISEKI & Co., Ltd. and the financial results for the term ended Dec. 2020, mentions the interview with President Tomiyasu, and so on.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended December 2020 Earning Results

3. Fiscal Year Ending December 2021 Earnings Forecasts

4. New Mid-term Management Plan

5. Interview with President Tomiyasu

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- ISEKI & Co., Ltd. is a general manufacturer of agricultural machinery founded in 1926. Under the long-term vision: “To be solution Provider for Agriculture & Landscape,” it operates business in North America, Europe, and Asia. Its characteristics and strengths are “advanced technology,” “abilities to propose and support agricultural management for farmers,” and “innovation based on collaboration.” According to the “new mid-term management plan (2021-2025),” the company is developing a business foundation for the coming 100 years with the aim of “actualizing an affluent society by offering products and services that satisfy customers.”

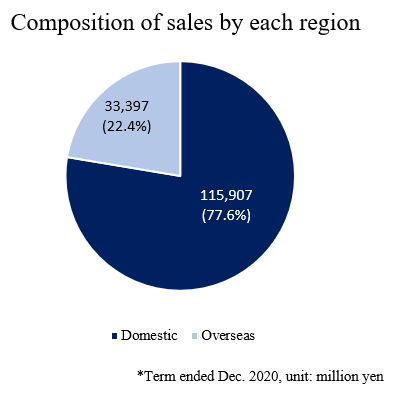

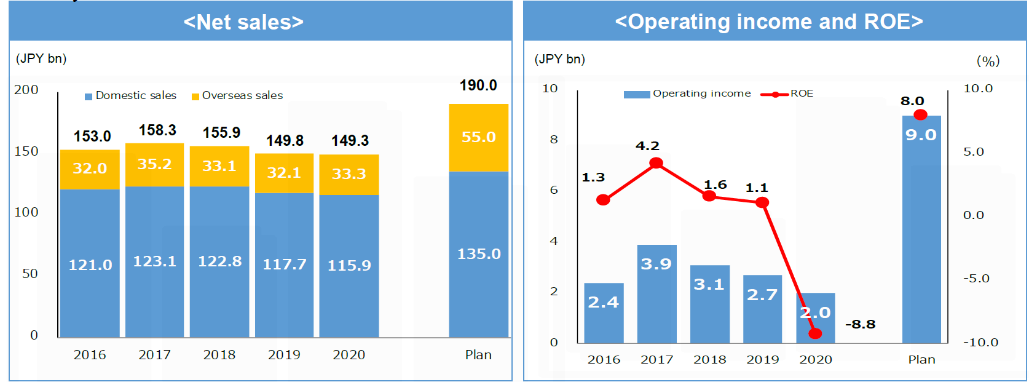

- The sales for the term ended Dec. 2020 were 149.3 billion yen, unchanged from the previous term. Domestic sales declined 1.5% year on year to 115.9 billion yen. Overseas sales rose 3.8% year on year to 33.3 billion yen. Operating income dropped 24.1% year on year to 2 billion yen. The company reduced SG&A, but it could not offset the decrease in gross income caused by the decline in sales. As an impairment loss of 9.3 billion yen was posted, net income fell into the red, being negative 5.6 billion yen. Both sales and profit exceeded the estimates announced in Aug. 2020.

- For the term ending Dec. 2021, it is estimated that sales will increase 2.8% year on year to 153.5 billion yen and operating income will rose 72.7% year on year to 3.6 billion yen. Domestic sales are projected to rise 1.7% year on year to 117.9 billion yen, while overseas sales are forecasted to increase 6.9% year on year to 35.6 billion yen. The effects of the novel coronavirus will linger inside and outside Japan, but it is assumed that the pandemic will subside gradually thanks to the distribution of vaccines, etc., and social and economic activities will recover gently this term. SG&A will augment, but profit is expected to increase thanks to the sales growth and company-wide efforts to reform its business structure and streamline its business administration. The dividend is still to be determined.

- The basic strategies set in the new mid-term management plan (2021-2025) are “Providing the best solutions” and “Increasing corporate value by strengthening profitability and governance.” For the former strategy, it will concentrate on the provision of “services” for intangible things rather than tangible things under the policy of selection and concentration. In Japan, it will engage in the increase of business scale, the change of crops, and the adoption of cutting-edge ICT technologies, and in other Asian countries, where markets are growing, it will mechanize rice production. For the latter strategy, the company will transform its business structure into a sturdy one for earning profit surely no matter whether sales fluctuate. The company aims to achieve an operating income margin of 5%. In order to achieve it, the company will procced with structural reform by establishing an optimal production system, the streamlining of business administration from the viewpoint of group-wide optimization, and appropriate financial and capital strategies. It will also concentrate on the enhancement of initiatives and the contribution to SDGs by reviewing the materiality of ESG.

- We interviewed President Tomiyasu about his mission, the company’s competitive advantage, future issues, his message toward shareholders and investors, etc. As for issues and his message, he mentioned, “The provision of agricultural machinery and services is an essential business for supporting ‘food.’ I recognize that growing this essential business in a sustainable manner is a socially important duty for us. Amid the rapidly changing business environment, we implement measures set in the mid-term management plan without fail, solve social issues, and improve our corporate value. Accordingly, we hope that shareholders and investors will support our company from the mid/long-term viewpoint.”

- In this term, which is the initial fiscal year of the mid-term management plan, we would like to pay attention to quarterly progress to see how operating income will bottom out or recover as it declined for the second consecutive term from the short-term viewpoint. From the mid/long-term viewpoint, we would like to pay attention to how speedily the company will “reform its business model” and “make a profitable corporate structure,” as President Tomiyasu mentioned in the interview. The Japanese agricultural market is considered to be not promising, due to the decrease of the population, but new demand is actually emerging. This is very interesting. We would like to expect that the company will meet demand by utilizing its forte. In addition, in the promising Asian market, we would like to keep watching how their mission to “free farmers from harsh labor” will bear fruit and offer social value.

1. Company Overview

ISEKI & Co., Ltd. is a general manufacturer of agricultural machinery founded in 1926. Under the long-term vision: “To be solution Provider for Agriculture & Landscape,” it operates business in North America, Europe, and Asia. Its characteristics and strengths are “advanced technology,” “abilities to propose and support agricultural management for farmers,” and “innovation based on collaboration.”

According to the “new mid-term management plan (2021-2025),” the company is developing a business foundation for the coming 100 years with the aim of “actualizing an affluent society by offering products and services that satisfy customers.”

【1-1 Corporate History】

In 1926, the founder Kunisaburo Iseki established “Iseki Farm Implement Trading Co.” in Aratama-cho, Matsuyama-shi, Ehime-ken, and started manufacturing automatic rice huller/graders. In 1936, it established ISEKI & Co., Ltd. with a capital of 500,000 yen, appointing Iseki Kunisaburo as president and starting the production of ISEKI rice hullers and automatic rice graders.

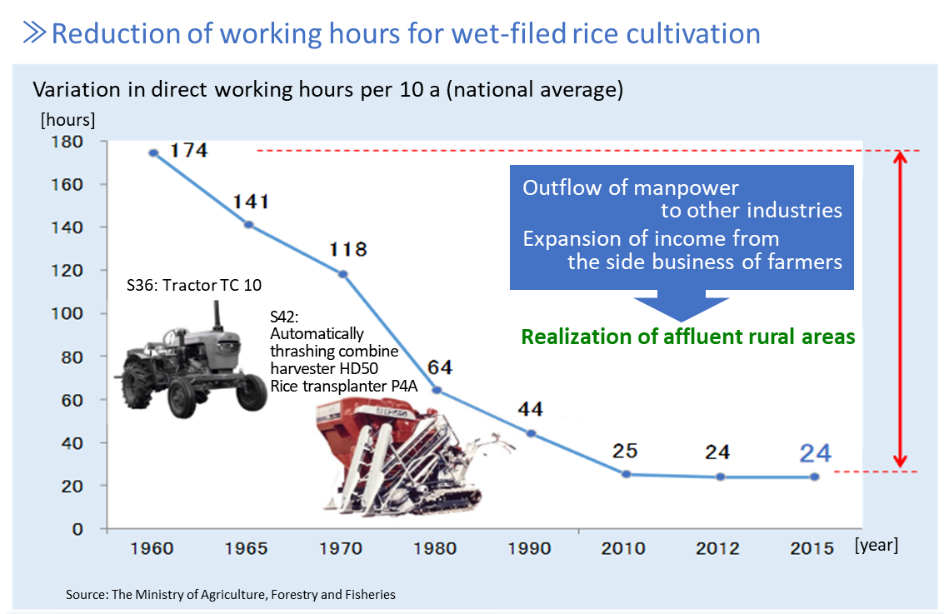

The founder’s ambition to “To free farmers from exhausting labor” has been inherited as the ethos of the company, and it has contributed to the advance of agriculture by providing easy-to-use, convenient agricultural machinery.

During the Second World War, its headquarters and factories were burned down, but after the war, it made inroads into Tokyo and Osaka, expanding its business. In 1961, it was listed in Tokyo Stock Exchange. Then, it established sales subsidiaries around Japan, to operate business nationwide.

In the 2000s, it made inroads into other Asian countries, including China and Indonesia on a full-scale basis by establishing subsidiaries and acquiring companies there, and started global business.

In this corporate history, ISEKI & Co., Ltd. started its business with automatic rice hullers/graders, released the world’s first “an automatically thrashing combine harvester” in 1966, a large-scale tractor made in Japan in 1978, a ridable rice transplanter in 1978, etc., setting the Japanese standards for agricultural machinery, and has significantly contributed to the improvement in productivity of agriculture in Japan.

(Taken from the reference material of the company)

【1-2 Corporate Philosophy, etc.】

Following the philosophy of the above-mentioned founder, the company upholds the ethos: “actualizing an affluent society by offering products and services that satisfy customers.,” with the aim of contributing to the development of agriculture and landscapes in Japan and around the world. The company concentrates on the provision of not only products, but also services, including information, things, and functions, and engages in activities as ISEKI that satisfies customers.

Company Motto

Our management philosophy is to provide: 1. Products that satisfy customers; 2. A stable workplace to the employees; 3. Appropriate dividend to the shareholders; and thereby we will fulfil our social mission. |

Goals of the ISEKI Group

The ISEKI Group’s long-term vision for 2030 is as follows: To be solution Provider for Agriculture & Landscape-Supporting "the farming full of dreams" and "beautiful landscape," Creating the sustainable future of "Agriculture and Landscape."

“Agriculture” protects “food” and “land,” making “people and society” affluent. The ISEKI Group supports such “agriculture” and “farmers,” and aims to solve related issues.

Based on such ethos and mission, the company is committed to ESG and SDGs according to its mid-term management plan.

【1-3 Market Environment】

The agricultural market environments inside Japan and around the world are as follows.

ISEKI & Co., Ltd. defined important issues, measures, and an ideal state in the “New Mid-term Management Plan (2021-2025),” which will be described later, while keeping the situation in mind.

(1) Domestic market environment viewed from agricultural administration

“Agricultural administration” is essential for seeing the current situation of domestic agriculture and the future market environment.

The government specified the mid/long-term policy for food, agriculture, and rural areas and announced it as the “basic plan for food, agriculture, and rural areas” in accordance with the Food, Agriculture and Rural Areas Basic Act.

This basic plan is updated every 5 years or so, and the major points of the plan announced in March 2020 is tabulated below.

Item | Outline (taken from the plan) |

Situations of food, agriculture, and rural areas | (Changes in domestic and overseas environments) ●Shrinkage of the domestic market and the expansion of the overseas market: Decline in the population and diversification of consumer needs

(Steady progress of reform of agricultural administration) ●Export amount of agricultural, forestry, and fishery products: 449.7 billion yen (2012) → 912.1 billion yen (2019) ●Agricultural earnings: 2.8 trillion yen (2014) → 3.5 trillion yen (2018) ●No. of new young farmers: 18,800/year (average in a period from 2009 to 2013) → 21,400/year (average in a period from 2014 to 2018) |

Basic policy | To implement industrial and regional measures concurrently, to stably supply indispensable food for the living of citizens, improve food self-sufficiency ratio and establish food security |

Goals, outlooks, etc. | (Target food self-sufficiency ratios) 【Calorie base】 37% (2018) → 45% (2030) 【Production amount base】 66% (2018) → 75% (2030) |

Issues to be solved and items to be dealt with intensively for improving food self-sufficiency ratio | (Agricultural production) a. Production and supply according to the change in demand inside and outside Japan “It is necessary to produce and supply livestock products, which are in high demand, vegetables for processing and professional use, high-quality fruit, wheat, for which the demand for domestic products rather than imported ones is expected to grow, soybeans, which are increasingly demanded, etc. while appropriately responding to the changes in demand inside and outside Japan.”

b. Fortification of the production base for domestic agriculture “In order to proceed with production to meet demand inside and outside Japan, it is necessary to strengthen the production base for domestic agriculture. Therefore, we need to develop and secure personnel for actualizing sustainable agricultural structures, accelerate the integration and consolidation of agricultural land, facilitate the advance of management and smooth business succession, improve productivity by developing the agricultural production base and accelerating the adoption of smart agriculture, solve problems with each item, reform production and distribution systems, and so on.” |

*The red parts were provided by Investment Bridge Co., Ltd.

The basic plan indicates the outlooks for food consumption and goals for production of major items in fiscal 2030, under the assumption that the public and private sectors will make collective efforts to raise food self-sufficiency ratio and solve the issues about food consumption.

While the production of rice as staple food will decline, the production volumes of vegetables, fruit, etc. are expected to increase.

| Estimated consumption | Target production volume | Issues to be dealt with (excerpts) | ||

FY 2018 | FY 2030 | FY 2018 | FY 2030 | ||

Rice as staple food | 799 | 714 | 775 | 723 | * To solve the problem of dispersed farmland lots and promote group farmland lots by integrating or consolidating agricultural land * To spread the high-yielding and labor-saving cultivation technologies using high-yielding varieties, smart agricultural technologies, etc. and reduce production costs by curtailing costs for materials |

Rice for fodder | 43 | 70 | 43 | 70 | *To streamline production by increasing harvest amount per unit area considerably |

Vegetables | 1,461 | 1,431 | 1,131 | 1,302 | *To increase production volume of vegetables for processing and industrial use by forming new production sites utilizing paddy fields, developing local business operators for stable supply in cooperation with the staff of multiple production sites, and so on *To improve productivity by adopting a mechanized system, environmental control technology, etc. |

Fruit | 743 | 707 | 283 | 308 | *To improve labor productivity by adopting labor-saving tree forms and a machine operation system and developing the foundation, including workers’ roads in orchards and irrigation facilities *To establish production and shipment systems according to overseas regulations and needs, and increase the production of fruit to be exported, by developing new production sites utilizing paddy fields, etc. |

Wheat | 651 | 579 | 76 | 108 | *To promote the transformation into housing complexes and block rotation, strengthen drainage measures, and improve productivity by utilizing smart agriculture |

Soybeans | 356 | 336 | 21 | 34 | * To promote the transformation into housing complexes and block rotation, strengthen drainage measures, and improve productivity by utilizing smart agriculture |

*Unit: 10,000 tons. The red parts were provided by Investment Bridge Co., Ltd.

“Future Investment Strategy 2018-Transformation into ‘Society 5.0’ and ‘Data-driven Society’” approved by the Cabinet in June 2018 set the following measures in the section titled “Actualization of the reform of the entire industry of agriculture, forestry and fisheries and a smart industry of them.”

Acceleration of agricultural reform | Improvement of production sites | Reform of rice measures

| To reform rice measures by offering detailed information and facilitating the utilization of paddy fields so that farmers can choose crops based on their own managerial judgment |

Actualization of globally top-level “smart agriculture” by taking full advantage of data and the cutting-edge technology | Adoption of the cutting-edge technology | To put together the energy of the government, research institutes, private enterprises, and farmers, proceed with open innovation, business-academia collaboration, etc. while considering on-site needs and viewing the entire value chain, and comprehensively conduct the R&D of cutting-edge technologies, such as AI, IoT, sensing technology, robots, and drones, the demonstration of systematic technologies in model farms, and swift distribution of technologies. |

As concrete measures for “smart agriculture,” they enumerated “actualization of a system for unmanned driving of agricultural machinery with remote monitoring by 2020,” “optimization of spraying of agricultural chemicals, fertilizer application, etc. through the combination of drones, sensing technology, and AI,” “promotion of land improvement projects for adopting and using autonomous driving agricultural machinery, etc.,” “utilization of ICT technology for using agricultural water more efficiently,” “installation of systems for managing cultivation and feeding with smartphones, etc.,” “improvement of productivity through the sharing of growth data among farmers based on the linkage of agricultural data and the utilization of detailed weather data,” etc.

From the above-mentioned policy for agricultural administration, it can be understood that the primary mid/long-term themes of the future Japanese agriculture for improving food self-sufficiency ratio and agricultural productivity are as follows:

* “Shift from rice to other crops, such as vegetables”

* “Acceleration of integration and consolidation of agricultural land”

* “Improvement in productivity through mechanization”

* “Actualization of smart agriculture”

In addition, we need to pay attention to the fact that the export volumes of agricultural, forestry, and fishery products and foods, earnings from production agriculture, and young farmers are increasing steadily.

(2) Global agricultural market

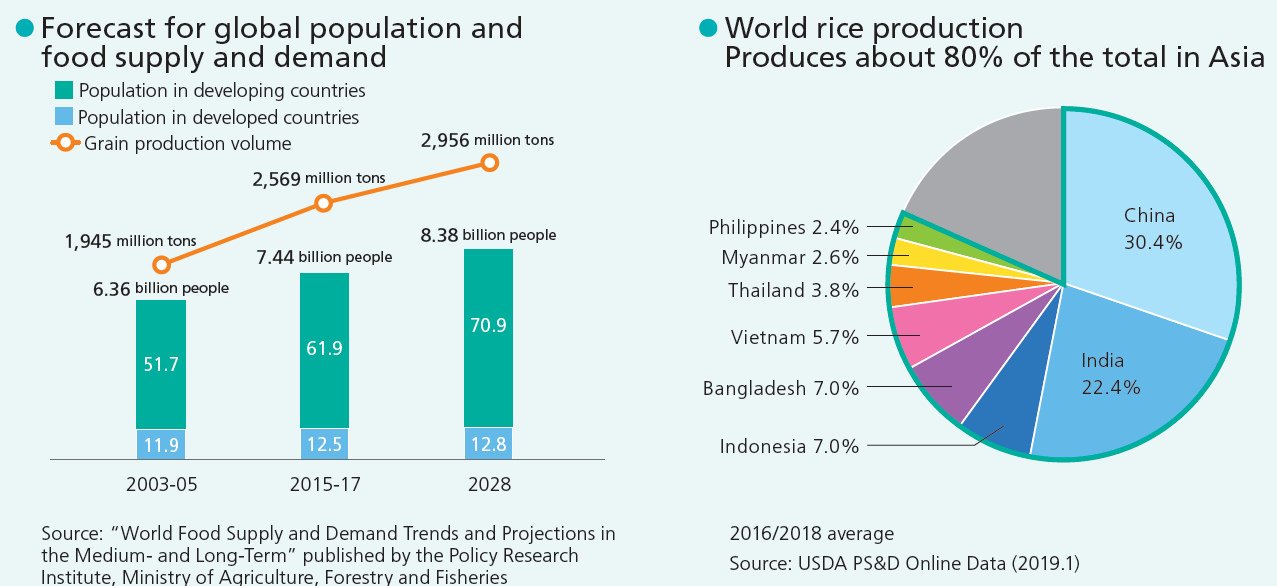

According to “White paper on food, agriculture, and rural areas in fiscal 2018,” “The world population is expected to increase to 9.77 billion people by 2050, as the populations of mainly developing countries will grow. In this situation, the global demand for cereals is estimated to augment, as the population growth mainly in developing countries will increase the demand for edible cereals and economic growth will lead to the significant increase in demand for meat, which requires a lot of cereals as fodder.”

That white paper also introduces “OECD-FAO Agricultural Outlook 2018-2027” and provides a forecast about countries supplying agricultural products, mentioning “Rice will be supplied by mainly Thailand, India, and Vietnam, while Cambodia and Myanmar will become new suppliers.”

That also points out a risk of the imbalance between demand and supply due to the climate change, restrictions on water resources, and soil degradation in addition to the population growth. A global challenge is the stable increase of production of agricultural products in Asian countries, mainly China.

(Taken from the reference material of the company)

(3) Situation of competition

Japanese competitors of ISEKI & Co., Ltd. include Kubota Corporation (6326, the 1st section of TSE) and Yanmar Holdings Co., Ltd. (unlisted).

There are no detailed data on their market shares, but it is said that ISEKI, Kubota, and Yanmar occupy a large portion of the market of agricultural machinery.

As mentioned in the corporate history section, ISEKI started business with the ambition “To free farmers from exhausting labor,” and differentiates its design policy and product development/provision by supporting farmers as a manufacturer specializing in agricultural machinery and meeting the true needs of users.

<Comparison with competitors>

|

| Sales | Sales growth rate | Operating income | Income growth rate | Operating income margin | Market cap | PER | PBR | ROE |

6310 | ISEKI | 153,500 | +2.8% | 3,600 | +72.7% | 2.3% | 37,925 | 15.5 | 0.6 | -8.8% |

6326 | Kubota | 2,050,000 | +10.6% | 220,000 | +25.5% | 10.7% | 3,004,522 | 19.0 | 2.0 | 8.8% |

*Unit: million yen. The figures of sales and operating income are the estimated ones of respective companies for this term. ROE is the result in the previous term. Market cap, PER, and PBR are the closing values on March 26, 2021.

【1-4 Business Contents】

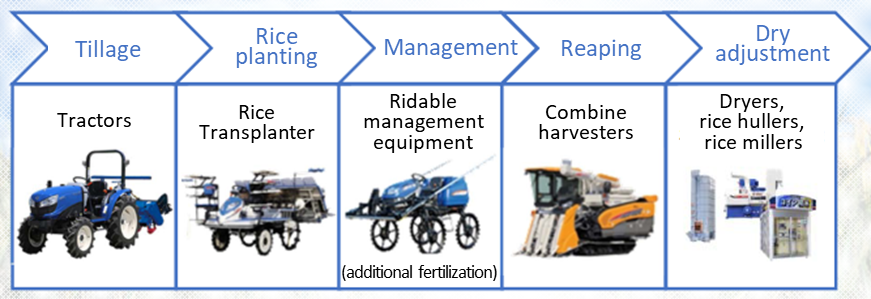

ISEKI engages in the development, manufacturing, and sale of machines for agriculture of rice, vegetables, etc. and landscaping, and offers related services.

(1) Product categories

Products, etc. of the company are classified as follows.

Product category | Major products | Composition ratio |

Machinery for Cultivating & Mowing | Tractors, tilling machines, ridable management machines, mowers, etc. | 31.8% |

Machinery for Planting | Rice transplanters, vegetable transplanters, etc. | 7.1% |

Machinery for harvesting & Processing | Combine harvesters, binders, harvesters, etc. | 12.9% |

Operating machines, components for repair, and repair/maintenance services | Operating machines, maintenance, repair, etc. | 30.3% |

Other businesses related to agriculture | Installation work, etc. | 17.9% |

*The composition ratios are those for the term ended Dec. 2020.

(2) Business overview in each region

The company operates business inside and outside Japan. For the term ended Dec. 2020, domestic sales accounted for about 80%, and overseas sales made up about 20%.

① Domestic business

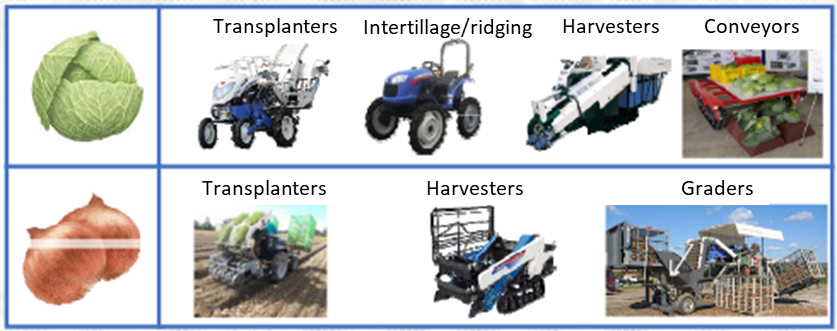

①-1 Products the company handles

The company has established a fully mechanized system for machinery for growing rice, vegetables, etc., and offers it to farmers.

*Machinery for growing rice

The company handles most of machines used for growing rice.

(Taken from the reference material of the company)

*Machinery for growing vegetables, etc.

While rice production is declining, many farmers concentrate on the production of vegetables and fruit with high added value. The company handles products suited for a broad range of vegetables.

(Taken from the reference material of the company)

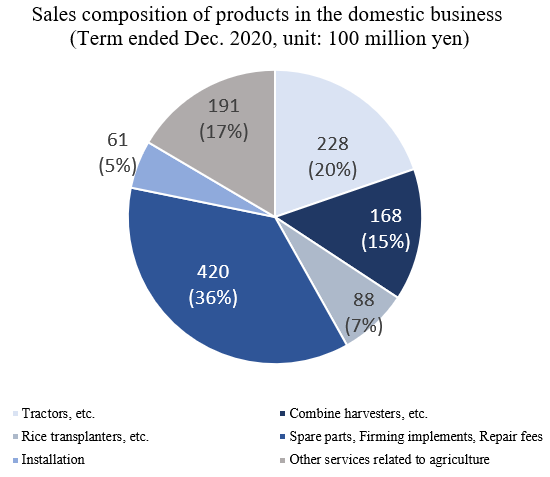

The sales composition for products in the term ended Dec. 2020 is as shown below. In recent years, the ratios of sales of highly profitable components, operating machines, and repair services have been increasing.

①-2 Business footholds and commercial distribution

A nationwide network has been established with 11 distributors of the corporate group. Six out of them are 100% subsidiaries. While considering the efficiency of marketing, the company is broadening its target area and provides products and services considering regional characteristics.

It also owns 4 manufacturing companies in Ehime, Kumamoto, and Niigata Prefectures. “Tsukubamirai Office” in Ibaraki Prefecture has “General Agricultural Laboratory with Dreams,” which researches ideal agriculture, ISEKI Global Training Center, and Technical Service Division.

As for the sale of products, direct sale to farmers, who are end users, accounts for about 70%, while the sale toward distributors, including agricultural cooperatives, makes up about 30%.

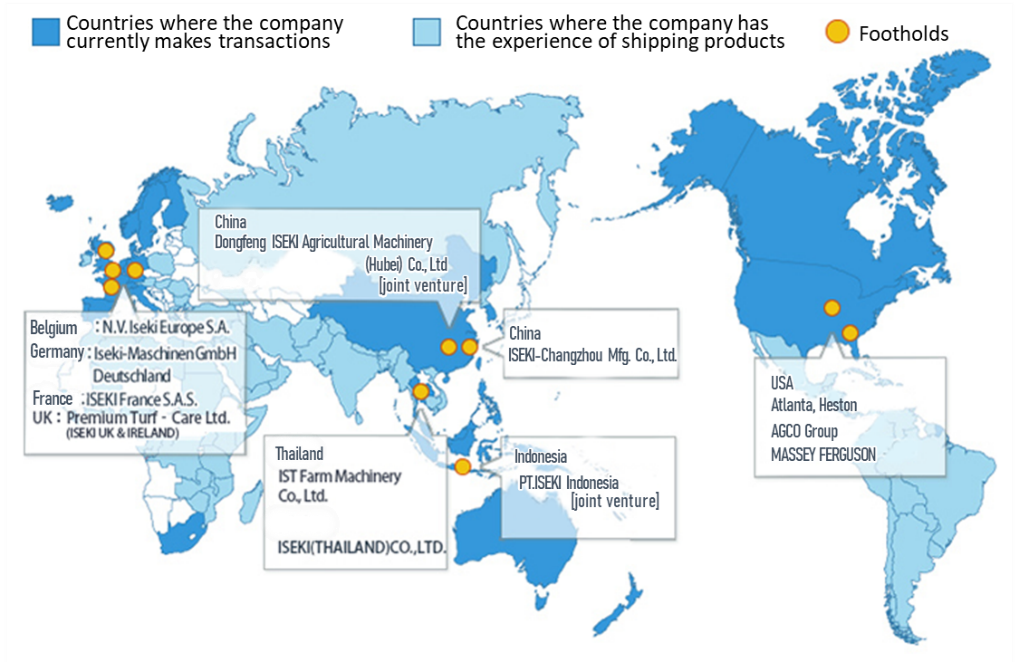

② Overseas business

The company operates business in North America, Europe, and Asia (ASEAN, East Asia, and China).

Business styles, products, and major customers vary from region to region as tabulated below.

There are three overseas production sites: PT ISEKI Indonesia and Dongfeng ISEKI Agricultural Machinery Co., Ltd. in China (Hubei and Jiangsu).

Region | Sales and business styles | Products | Major customers |

North America | OEM supply | Tractors | ・Individuals (hobby farmers) ・Landscaping and light-duty civil engineering firms ・Farmers (second tractors and management work) |

Europe | Distributorship (partially OEM) | Tractors, ridable mowers | ・Landscaping firms ・Small-scale farmers ・Individuals |

ASEAN | Distributorship (partially OEM) and manufacturing | Tractors, combine harvesters, rice transplanters | ・Farmers and contractors |

East Asia | Distributorship | Tractors, combine harvesters, rice transplanters, ridable management equipment, vegetable transplanters, etc. | |

China | Manufacturing and sale | Tractors, combine harvesters, rice transplanters, ridable management equipment, etc. |

◎ Business in North America

Since 1977, the company has been exporting tractors to North America.

At present, it supplies compact tractors, etc. to AGCO Corporation, which is a global agricultural machinery manufacturer, as an OEM.

◎ Business in Europe

In 1971, the company established ISEKI Europe in Belgium. It has expanded the target area for sales to the entire Europe.

It provides compact, high-performance products to meet needs mainly in the landscaping market (compact tractors and ridable mowers) and the agricultural tractor market.

◎ Business in Asia (China and ASEAN)

In China, since the enactment of “the Law for Promoting Agricultural Machinery” in 2004, the demand for rice transplanters and combine harvesters has grown, and agricultural machinery is being distributed rapidly. In response, the company established ISEKI - Changzhou Mfg. Co., Ltd. in 2003, and Dongfeng ISEKI Agricultural Machinery (Hubei) Co., Ltd. as a joint venture with Dongfeng Motor Corporation, which is a national automobile manufacturer in China, in 2011. They provide products suited for market needs, such as highly functional, high-quality rice transplanters and combine harvesters.

In ASEAN countries, the company established ISEKI SALES (THAILAND) CO., LTD. (present: IST Farm Machinery), a distributor, in Thailand in 2013, to operate business in Thailand and surrounding countries. In South Korea and Taiwan, where the scale of agriculture is growing like in Japan, the company provides large-scale, high-efficiency machines. In 2012, the company established PT ISEKI Indonesia as a manufacturer of tractors in Indonesia (which boasts the third largest wet-field rice production in the world).

(Taken from the reference material of the company)

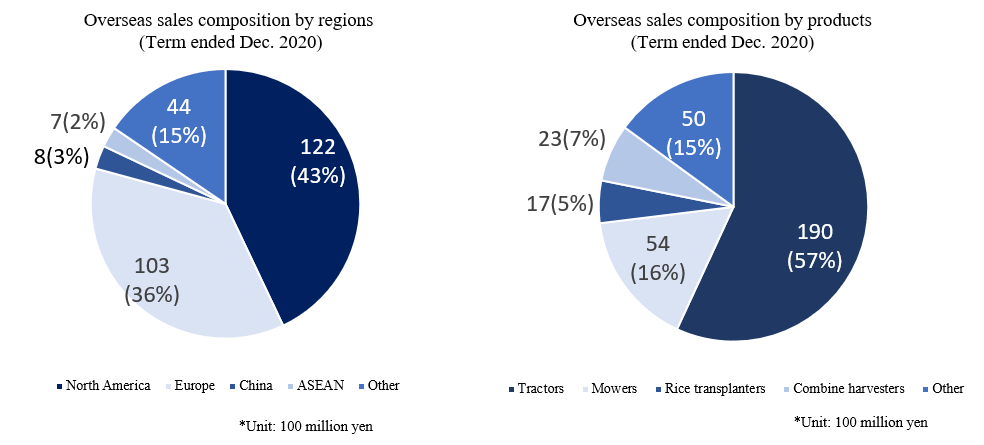

In North America and Europe, which account for a large portion of sales, main users are individuals who enjoy gardening as a hobby and landscaping firms that improve parks, etc.

Accordingly, tractors and mowers account for 70% of products for the overseas business.

【1-5 Characteristics and Strengths】

(1) Technology

Since the establishment in 1926, the company has developed epoch-making agricultural machinery before the rest of the world and triggered innovation in agriculture and society.

One example of the developed epoch-making agricultural machinery is the industry-first “soil sensor-mounted variable fertilizing rice transplanter,” which was released in 2016.

This rice transplanter measures “fertility level” and “depth” with 2 kinds of sensors and automatically controls the amount of fertilizers according to the soil of each field for planting rice seedlings. Through optimal fertilization, it is possible to prevent lodging, homogenize growth, and harvest crops in a planned way. It also contributes to the stability of quality, the reduction of fertilization cost by preventing excessive fertilizer application, environmental conservation, etc.

(Taken from the website of the company)

The company also focuses on intellectual property strategies, and strategically establishes rights for the core technologies for agricultural machinery and related products they created through intellectual efforts.

The number of its registered patents in the field of other special machinery was the largest from 2013 to 2017, the second largest in 2018, and the largest in 2019. In addition, patent evaluation rate ([No. of patent evaluation cases]/([No. of patent evaluation cases] + [No. of decisions of rejection] + [No. of withdrawal/abandonment cases])) fluctuates between 96% and 100%, being the highest or the second highest, which indicates the excellence of their technology.

By utilizing the “forte” backed by intellectual property, they make efforts to differentiate their products from competitors.

(2) Capability of giving a proposal for agricultural management and supporting it

They consider that in order to actualize agriculture that allows producers to hold a dream (make a fortune), it is important to comprehensively manage agriculture from the aspects of hardware, which is agricultural machinery for saving labor and enhancing productivity, and software, which includes production management and cutting-edge agricultural management technology. Then, the company gives a proposal for agricultural management and supports it in a comprehensive manner.

Such activities are led by “General Agricultural Laboratory with Dreams” in Tsukubamirai-shi, Ibaraki Prefecture.

This laboratory, which was built in 2015, researches, demonstrates, and diffuses smart agriculture by utilizing cutting-edge technologies and agricultural management methods while cementing the cooperation with the government, municipalities, research institutes, colleges, private enterprises, JA, etc. The company concentrates on the development of expert personnel in the corporate group, assigns the trained professional workers to distributors around Japan, and strengths support while giving a proposal for agricultural management to each local community. Furthermore, the company introduces the agricultural management and cultivation technologies, know-how, etc. developed in Japan to the outside of Japan, to diffuse them while mechanizing agriculture.

(Taken from the reference material of the company)

(Major initiatives)

* To promote the diffusion of smart agriculture

* To propose the utilization of paddy fields (to change crops to soybeans, wheat, and vegetables)

* To support farmers in obtaining the GAP* certification

* To propose cultivation technologies enterprises in other industries and new farmers

* To support the cultivation of traditional crops in each region

* To regenerate deserted fields and support regional revitalization in cooperation with municipalities, etc.

* To conduct a project for supporting female farmers with dreams

*GAP

It stands for Good Agricultural Practice. This is a framework for production process management for securing the sustainability of food safety, environmental conservation, labor safety, etc. in agriculture. Instructors of ISEKI support farmers in obtaining the certification.

(3) Innovation through collaboration

In order to adapt to the changing business environment, the company improves its technology and develops and provides epoch-making products and services based on the collaboration among industry, academia, and government and the cooperation with a broad range of partners without sticking to closed innovation.

Outside Japan, it forms tie-ups with competent strategic partners in each region, to accelerate global business operation, including the cultivation of new markets.

(In Japan)

Agreement for cooperation with a municipality for promoting agriculture utilizing cutting-edge technologies | Demonstration of smart agriculture in cooperation with Tsukubamirai City. The company aims to actualize sustainable agriculture while improving the rice growing technology, reducing costs, and enhancing quality based on sensing and smart technologies. |

Project for supporting “female farmers” with dreams | Development of products from the viewpoint of female farmers in cooperation with the Ministry of Agriculture, Forestry and Fisheries and local communities. The company trains female farmers by holding seminars on how to use agricultural machinery and so on in each region. |

(Outside Japan)

TAFE, Ltd. (India) | Tentative sale of ridable rice transplanters and guidance for growing seedlings in India |

AGCO Corporation (the U.S.) | Tentative sale utilizing its sales network in Latin America and new markets in Asia |

Toyo Bussan Group | Sale of high-performance agricultural machinery in South Korea |

【1-6 Return on Equity (ROE) Analysis】

| FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 |

ROE (%) | 4.2 | 1.6 | 1.1 | -8.8 |

Net income margin [%] | 1.77 | 0.70 | 0.48 | -3.78 |

Total asset turnover [times] | 0.78 | 0.77 | 0.75 | 0.78 |

Leverage [times] | 3.01 | 2.95 | 2.96 | 3.00 |

The mid-term management plan set a goal of achieving an ROE of 8%. Leverage is already high, so the remaining challenge is the improvement in profitability and assets efficiency.

2. Fiscal Year Ended December 2020 Earning Results

(1) Consolidated Business Results

| FY 12/19 | Ratio to sales | FY 12/20 | Ratio to sales | YoY | Ratio to forecast |

Sales | 149,899 | 100% | 149,304 | 100% | -0.4% | +3.3% |

Japan | 117,717 | 79% | 115,907 | 78% | -1.5% | +1.2% |

Overseas | 32,181 | 21% | 33,397 | 22% | +3.8% | +11.3% |

Gross profit | 44,507 | 30% | 43,476 | 29% | -2.3% | - |

SG&A | 41,761 | 28% | 41,392 | 28% | -0.9% | - |

Operating Income | 2,745 | 2% | 2,084 | 1% | -24.1% | +89.5% |

Ordinary Income | 1,108 | 1% | 1,702 | 1% | +53.6% | +751.0% |

Net Income | 723 | 0% | -5,641 | - | - | - |

*Unit: million yen. Net income means profit attributable to owners of parent. Ratio to forecast means the ratio to the forecast announced in August 2020.

Sales and profit declined, but exceeded the estimates.

Sales were 149.3 billion yen, roughly unchanged from the previous term. Domestic sales declined 1.5% year on year to 115.9 billion yen. The sales from parts for repair and repair work were healthy, but the sales of agricultural machinery dropped, due to the recoil from the rush demand before the consumption tax hike and the novel coronavirus. Overseas sales increased 3.8% year on year to 33.3 billion yen. While the sales in North America and ASEAN countries declined, the shipment to Taiwan and China was favorable. Operating income decreased 24.1% year on year to 2 billion yen. SG&A was curtailed, but could not offset the decline in gross profit due to the drop in sales. Ordinary income grew 53.6% year on year to 1.7 billion yen. Exchange loss and investment loss on equity method shrank. Regarding the land, buildings, and machinery of consolidated manufacturing subsidiaries, the company posted an impairment loss of fixed assets amounting to 9.3 billion yen in the wake of the drop in profitability due to the lowering of land prices and the production decrease caused by the novel coronavirus, so net income became negative 5.6 billion yen. Both sales and profit exceeded the estimates announced in August 2020.

(2) Trend in each region

① Japan

Sales | FY 12/19 | FY 12/20 | YoY | Ratio to forecast |

Agricultural Machinery |

|

|

|

|

Cultivating & Mowing Machinery | 253 | 228 | -9.8% | -3.8% |

Planting Machinery | 90 | 88 | -2.0% | +4.8% |

Harvesting & Processing Machinery | 185 | 168 | -9.2% | 0.0% |

Subtotal | 530 | 486 | -8.3% | -0.6% |

Farming Implements | 200 | 204 | +2.0% | +7.4% |

Spare Parts | 150 | 156 | +4.0% | +2.0% |

Repair Fees | 57 | 58 | +1.8% | -1.7% |

Subtotal | 408 | 420 | +2.9% | +4.5% |

Total sales related to agricultural machinery | 938 | 906 | -3.4% | +1.7% |

Construction of Facilities | 45 | 61 | +35.6% | -3.2% |

Other sales related to agriculture | 193 | 191 | -1.0% | 0.0% |

Total | 1,177 | 1,159 | -1.5% | +1.2% |

*Unit: 100 million yen. The ratio to forecast means the ratio to the forecast announced in Aug. 2020.

* The sales of agricultural machinery decreased, due to the recoil from the rush demand before the consumption tax hike and the cancellation of exhibitions and voluntary restraint of marketing due to the novel coronavirus.

* The sales of operating machines increased, thanks to the subsidy for continuing business administration.

* The sales of spare parts and repair fees remained healthy.

* Large-scale facilities were completed.

② Overseas

Sales | FY 12/19 | FY 12/20 | YoY | Ratio to forecast |

North America | 126 | 122 | -3.2% | +4.3% |

Europe | 102 | 103 | +1.0% | +10.8% |

China | 1 | 8 | +700.0% | +33.3% |

ASEAN | 16 | 7 | -56.3% | -12.5% |

Other | 34 | 44 | +29.4% | -2.2% |

Total sales of products | 282 | 286 | +1.4% | +6.3% |

Total sales of parts, etc. | 39 | 47 | +20.5% | +51.6% |

Total | 321 | 333 | +3.8% | +11.0% |

*Unit: 100 million yen. The ratio to forecast means the ratio to the forecast announced in Aug. 2020.

* In North America, sales dropped, as there was special demand from housebound consumers for compact tractors, but shipment volume declined due to the delay in procurement of engines until the first half.

* In Europe, there was the impact of the lockdown at the beginning of the spring, but performance is on a recovery track in the second half. Sales grew, due to the unification of the accounting periods of consolidated subsidiaries (15-month accounting period) and the effects of exchange rates.

* In China, sales increased due to the growth of shipment of half-finished products of rice transplanters.

* As for ASEAN countries, in Thailand, the effects of weather, such as drought, subsided gradually, but sales declined due to the decrease in farmers’ incomes amid the novel coronavirus pandemic. In Indonesia, sales dropped due to the decrease of bidding.

* Othe Sales grew, thanks to the increase of shipment to South Korea and Taiwan.

(3) Financial position and cash flows

◎Main Balance Sheet

| End of December 2019 | End of December 2020 | Increase/ decrease |

| End of December 2019 | End of December 2020 | Increase/ decrease |

Current Assets | 87,159 | 89,979 | +2,820 | Current liabilities | 89,735 | 86,147 | -3,588 |

Cash and Deposit | 8,404 | 10,787 | +2,383 | Trade Payables | 37,752 | 36,872 | -880 |

Trade Receivables | 19,675 | 21,780 | +2,105 | ST Interest Bearing Liabilities | 41,407 | 39,459 | -1,948 |

Inventories | 54,177 | 51,845 | -2,332 | Noncurrent liabilities | 38,524 | 38,861 | +337 |

Noncurrent Assets | 110,352 | 97,449 | -12,903 | LT Interest Bearing Liabilities | 27,915 | 29,890 | +1,975 |

Tangible Assets | 98,346 | 86,287 | -12,059 | Total Liabilities | 128,259 | 125,009 | -3,250 |

Intangible Assets | 1,288 | 1,967 | +679 | Net Assets | 69,252 | 62,419 | -6,833 |

Investment, Others | 10,717 | 9,193 | -1,524 | Shareholders’ Equity | 52,840 | 50,346 | -2,494 |

Total assets | 197,511 | 187,428 | -10,083 | Total liabilities and net assets | 197,511 | 187,428 | -10,083 |

|

|

|

| Balance of interest-bearing liabilities | 69,322 | 69,349 | +27 |

*Unit: million yen. Trade payables include electronically recorded accounts payable.

Total assets decreased 10 billion yen from the end of the previous term to 187.4 billion yen, as cash & deposits and trade receivable rose, while noncurrent assets declined due to the posting of impairment loss.

Total liabilities dropped 3.2 billion yen to 125 billion yen.

Net assets decreased 6.8 billion yen to 62.4 billion yen, due to the shrinkage of retained earnings caused by the posting of loss, etc.

Capital-to-asset ratio dropped 1.8 points from the end of the previous term to 32.4%.

◎Cash Flow

| FY 12/19 | FY 12/20 | Increase/decrease |

Operating Cash Flow | 10,509 | 9,694 | -815 |

Investing Cash Flow | -7,104 | -5,167 | +1,937 |

Free Cash Flow | 3,405 | 4,527 | +1,122 |

Financing Cash Flow | -2,396 | -2,179 | +217 |

Term End Cash and Equivalents | 8,369 | 10,752 | +2,383 |

*Unit: million yen

The surplus of operating CF shrank, as net income before taxes and other adjustments was in the red, but the surplus of free CF increased, due to the decline in purchase of property, plant, and equipment and intangible assets.

The cash position improved.

(4) Topics

◎ Listed as a noteworthy enterprise in “Report on companies where women have been empowered in 2020”

The company was introduced as a noteworthy enterprise that conducts unique initiatives for empowering women in “Report on companies where women have been empowered in 2020,” which was published by the Ministry of Economy, Trade and Industry.

That report introduces the company’s initiatives that help female farmers flourish through “Project for Female Farmers” organized by the Ministry of Agriculture, Forestry and Fisheries of Japan, as one of the cases in which women have been empowered in the entire society.

3. Fiscal Year Ending December 2021 Earnings Forecasts

(1) Earnings forecasts

| FY 12/20 | Ratio to sales | FY 12/21 Est. | Ratio to sales | YoY |

Sales | 1,493 | 100% | 1,535 | 100% | +2.8% |

Japan | 1,159 | 78% | 1,179 | 77% | +1.7% |

Overseas | 333 | 22% | 356 | 23% | +6.9% |

Gross profit | 434 | 29% | 464 | 30% | +6.9% |

SG&A | 413 | 28% | 428 | 28% | +3.6% |

Operating Income | 20 | 1% | 36 | 2% | +72.7% |

Ordinary Income | 17 | 1% | 35 | 2% | +105.6% |

Net Income | -56 | - | 24 | 2% | - |

*Unit: 100 million yen. The forecast was those released by the company.

* Assumed exchange rates

| FY 12/20 | FY 12/21 Forecast |

1 dollar | 107.0 yen | 105.0 yen |

1 euro | 121.5 yen | 123.0 yen |

Sales and profit are expected to grow.

Sales are estimated to rise 2.8% year on year to 153.5 billion yen, while operating income is projected to increase 72.7% year on year to 3.6 billion yen.

It is forecasted that domestic sales will grow 1.7% year on year to 117.9 billion yen and overseas sales will increase 6.9% year on year to 35.6 billion yen.

Inside and outside Japan, COVID-19 will linger, but the pandemic will subside gradually thanks to the distribution of vaccines, etc. and it is assumed that social and economic activities will recover gently by the end of this term.

Despite the augmentation of SG&A, profit is estimated to grow, due to the sales growth, group-wide structural reform and streamlining of business administration. The dividend is still to be determined.

(2) Trend in each region

① In Japan

Sales | FY 12/20 | FY 12/21 (Est.) | YoY |

Agricultural Machinery |

|

|

|

Cultivating & Mowing Machinery | 228 | 238 | +4.4% |

Planting Machinery | 88 | 93 | +5.7% |

Harvesting & Processing Machinery | 168 | 178 | +6.0% |

Subtotal | 486 | 509 | +4.7% |

Farming Implements | 204 | 201 | -1.5% |

Spare Parts | 156 | 157 | +0.6% |

Repair Fees | 58 | 61 | +5.2% |

Subtotal | 420 | 419 | -0.2% |

Total sales related to agricultural machinery | 906 | 928 | +2.4% |

Construction of Facilities | 61 | 55 | -9.8% |

Other sales related to agriculture | 191 | 196 | +2.6% |

Total | 1,159 | 1,179 | +1.7% |

*Unit: 100 million yen. The ratio to forecast means the ratio to the forecast announced in Aug. 2020.

Sales are expected to grow, thanks to large-sized machines and smart agricultural machinery developed in response to the structural change in agriculture, the promotion of services and support, and healthy revenues from parts and repair work.

② Overseas

Sales | FY 12/20 | FY 12/21 (Est.) | YoY |

North America | 128 | 138 | +7.8% |

Europe | 139 | 140 | +0.7% |

Asia | 62 | 74 | +19.4% |

Other | 3 | 4 | +33.3% |

Total | 333 | 356 | +6.9% |

*Unit: 100 million yen. From the term ending Dec. 2021, new classification of overseas sales is used. (1) Change in region categorization; Asi “China,” “ASEAN,” and “East Asia.”; Othe “Oceania” (2) The results of parts and others are summarized for each region.

Sales are projected to grow, as the demand from housebound consumers in North America amid the coronavirus crisis will remain and the distributors in ASEAN countries were acquired as consolidated subsidiaries in December 2020.

4. New Mid-term Management Plan

The company announced a new mid-term management plan (2021 to 2025), whose period is 5 years starting this term.

It set the long-term vision: “To be solution Provider for Agriculture & Landscape,” to establish a foundation for the coming 100 years.

(1) Review of the previous mid-term management plan

① Positioning

The company designed a first 5-year plan “the mid-term management plan (2016 to 2020)” as an important step for achieving an ideal state in 2025, in which it will commemorate the 100th anniversary of establishment. Its business performance was healthy in 2016 and 2017, but from 2018, the market environment changed more significantly than expected, and in 2020, the novel coronavirus spread around the world, affecting the business of the company to a significant degree.

② Changes in the market environment

In Japan, in addition to the COVID-19 pandemic, the recoil from the rush demand before the consumption tax hike was more serious than expected, although smart agriculture progressed more rapidly than expected through agricultural administration, including future investment strategies. Furthermore, the crop situation worsened due to bad weather and prolonged rain, and the damage caused by natural disasters, such as typhoons, was enormous.

As for overseas markets, in ASEAN countries, the Thai market was sagging and sales competition became fierce, while in China, the market of agricultural machinery was stagnant due to the change in the subsidy policy, the lowering of grain prices, etc. and the products of local manufacturers emerged, so that growth levelled off.

③ Regarding numerical goals

As the environment changed more considerably than assumed, neither sales nor profit reached the estimates.

However, the company considers that their measures progressed steadily, and recognizes the following issues.

(Taken from the reference material of the company)

| Major achievements | Remaining issues |

Strengthen responsiveness to drastic changes in agriculture in Japan | *Developed sales and services into a wider area Reorganized wide-area sales companies: 10 sites to 6 sites system *Overhauled revenue and cost structure Increased revenue from maintenance Improving profitability of sales companies. Enlargement of footholds according to the changes in the market | *Strengthen measures for large-size, hi-tech vegetable cultivation machinery *Further improve the profit structure of sales companies |

Expand overseas businesses | *Expanded business through enhanced cooperation with strategic partners in U.K. and India *Developed and launched products that match market needs Compliance with exhaust gas regulations, hi-tech, compact tractors, etc. | *Expanded business through further enhancement of cooperation *Develop products that meet changing needs (Europe: electrification; Chin high-end products, etc.) |

Strengthen profitability by optimizing development & production | *In-house manufacture of engines complying with exhaust gas regulations Reduced costs, increased competitiveness *Improved profitability of Indonesia business Kept PT. ISEKI INDONESIA profitable | *Improve profitability of unprofitable products in Japan and overseas, and thoroughly review low-cost designs *Optimize product categorization |

(2) Outline of the new mid-term management plan

① Basic philosophy, long-term vision, and keyword

◎ Basic philosophy

We strive to contribute to the creation the prosperous and sustainable society through "providing innovative products and higher quality of services to the customers." “Service” was added to the above-mentioned corporate ethos, with the aim of changing business models according to the business environment.

◎ Long-term vision

Solution Provider for Agriculture & Landscape

―Supporting "the farming full of dreams" and "beautiful landscape," Creating the sustainable future of "Agriculture and Landscape"

Under this vision, the company will make efforts to attain SDGs.

*Supporting resilient agriculture

*Landscaping for livable villages and towns

*Environmental conservation for a recycling-oriented society

◎ Keyword

Henkaku (Change)

“Toward the next 100 years...”

② Business environment and issues

◎ Environmental awareness

Domestic | Overseas |

*Decline in number of farm households and increase in scale of farming *Crop diversification *Transition to smart farming, regulatory reform (WAGRI, open API, digital transformation, etc.) *Price reduction | *Diverse environments according to each region *Enhancement of functionality and price reduction (Diverse needs) *Intensifying competition |

※WAGRI: A “base for linking agricultural data” mounted with the functions to link and provide data, in order to develop an environment in which farmers can improve productivity and management by using the data

※Open API: An interface for enabling the use of functions provided by an OS and software with an external application

In addition, it is indispensable to respond to “With- and Post-Covid era, global food issues, climate change risks,” “Change in business model (from products to services),” “Increased environmental awareness (exhaust gas, electric),” “Increasing demand for disclosure of non-financial information, SDGs,” and “Response to changes in laws and regulations, compliance.”

◎ Management missions

The company enumerated the following fou

*Response to changing demands and needs

*Realization of technological innovation

*Strengthening of ESG initiatives

*Improvement of financial position, expansion of earnings

③ Basic strategies

The plan is for “ISEKI's 100th anniversary in 2025 - laying the foundations for the next 100 years.”

The following two basic strategies will be implemented for fulfilling the management missions.

<1. Providing the best solutions>

The company will focus on providing not only products but also services from tangible to intangible.

In each field, the company will develop products and implement marketing strategies based on the collaboration among the domestic, overseas, and development/production sections, and engage in “selection and concentration.”

In addition, the company will change business models with the pillar being the provision of “services.” In new business models, it aims to promote digital transformation (DX) based on “information,” adapt to the new normal, and increase revenues from maintenance services further.

<2. Increasing corporate value by strengthening profitability and governance>

The company will make a profitable corporate structure that can surely raise profits beyond sales ups and downs. Assumed stakeholders are shareholders, employees, and business partners.

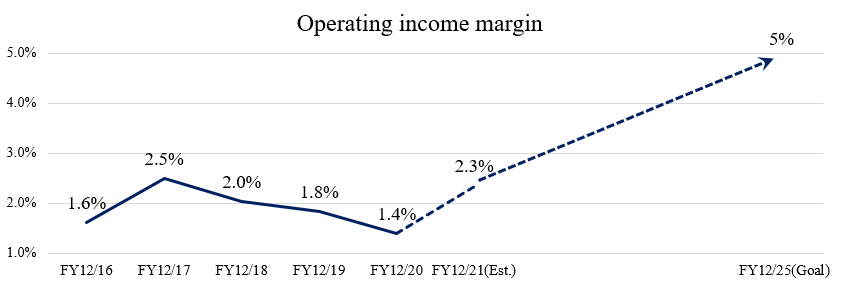

In order to achieve an operating income margin of 5%, the company will procced with structural reform by establishing an optimal production system, the streamlining of business administration from the viewpoint of group-wide optimization, and appropriate financial and capital strategies.

It will also concentrate on the enhancement of initiatives and the contribution to SDGs by reviewing the materiality of ESG.

For executing these basic strategies, it is indispensable to “visualize unprofitable businesses” by taking the viewpoint of each business and adopting an in-house company system and “optimally allocate personnel” by taking full advantage of human resources in the entire corporate group.

④ Concrete implementation of basic strategies

◎ Selection and concentration

(Domestic market strategy)

Three important measures are “Strengthen initiatives for large-scale farmers,” “Digital transformation, strengthen the smart strategy,” and “Accelerate reform of revenue & cost structure.”

For enhancing the marketing targeted at large-scale farmers, the company will introduce the ALL Japan series, smart agricultural machinery, vegetable growing equipment, and imported machines “to increase sales.” In 2020, the lineup of the ALL Japan series was completed. This term, the company will distribute robotic tractors on a full-scale basis and release low-priced products and vegetable growing machinery. Even after that, it will release the above-mentioned priority products.

The company will enhance DX and smart strategies, and aim to “improve its marketing and service provision capabilities.”

It will reform the income-and-expenditure structure at an accelerated pace, and “improve operating income margin.”

By transforming the domestic business and “selling” agricultural machinery and offering “services,” the company aims to enhance the presence of “ISEKI.”

(Overseas market strategy)

As a solution provider for "Agriculture and landscape," the company will contribute to the needs of local communities around the world through manufacturing.

The company will implement the following strategies and measures in three regions.

【North America】

* Recognition of the business environment

The compact machinery market in North America is steadily expanding. In fiscal 2020, the sales volume was over 210,000 units.

The temporary recoil from the special demand from housebound consumers is estimated, but the market is expected to be stable in the medium/long term.

* Strategies and measures

The company will cement the cooperation with the partner AGCO Corporation, and support the brand strategy of AGCO.

In order to expand sales and the share in the healthy market, it will enrich its product lineup and release economical machinery that would help reduce costs.

On the other hand, the company aims to improve less profitable products for improving profitability.

Through these measures, it aims to expand the market share while increasing profitability.

【Europe】

* Recognition of the business environment

The market of compact and diesel garden tractors is expected to grow in Europe, including Central and Eastern Europe.

Electrification will be accelerated, due to the enhancement of awareness of the environment.

* Strategies and measures

The company will reestablish the sales network in Europe. It will strengthen its systems for offering services and selling products, and aim to expand the revenues of the corporate group through the enhancement of efficiency.

In order to maintain or expand the share in the landscaping market, in which the popularity of the brand is high, the company will research and develop electrification and low-priced machines to compete with Indian ones.

The company will strive to improve profitability by streamlining the procurement of products for consumers and implements* and upgrading less profitable products.

*Implements: A variety of operating machines towed by tractors

【Asia】

* Recognition of the business environment

In ASEAN countries, the agricultural market is expected to grow.

In South Korea and Taiwan, the shortage of agricultural workers became apparent, as the workers became elderly.

In China, there are low-priced agricultural machinery and high-performance machinery, which produce the largest amount of rice in Asia.

* Strategies and measures

The company will accelerate the ASEAN business based on the newborn IST Farm Machinery in Thailand.

It will establish the presence in the market of large-sized high-performance agricultural machinery with South Korean and Taiwanese distributors, which are business partners.

It will operate business while mixing Japanese high-performance rice growing machinery and products made in China, which have a cost advantage.

(Product and development strategies)

The company will expand revenues by developing products while focusing on regions, products, and growing markets, in which it has advantages.

In Japan, the main theme is “to adapt to the trend of large-sized machinery.”

It will enrich the lineup of medium/large-sized, low-priced, smart, and vegetable growing machines.

In response to the changes in agricultural styles, it will diversify supply methods.

Outside Japan, the main theme is “to promote the brand.”

It will strengthen products in Europe and North America, where it is competent.

It will strive to gain a foothold by upgrading products in ASEAN countries.

It will establish the brand in China and East Asia.

The common themes inside and outside Japan are “safety and environmental measures” and “upfront development.”

The safety and environmental measures include the prevention of accidents during agricultural work, the distribution of self-manufactured engines that comply with regulations for exhaust gases, and the development of electric-powered products.

In upfront development (of Front Runner), the company aims to develop products for global strategies, environmentally friendly electricity/hydrogen-powered products, and realize automation, robotization, data utilization, etc.

The details of “Globally strategic machines,” “Electrification,” and “Automation, robotization, data utilization” are as follows.

Globally strategic machines | To develop main platforms for tractors, combine harvesters, and rice transplanters before the expansion of the demand for agricultural machinery due to the shortage of food, and release machines mounted with necessary devices at low prices for global strategies, while considering local regulations, durability, and design. |

Electrification | To release environmentally-friendly electrified products for professional use in the landscaping market in Europe, while utilizing the technologies nurtured through electrification and research. Targeting consumers, the company will handle products for private vegetable gardens and houses. |

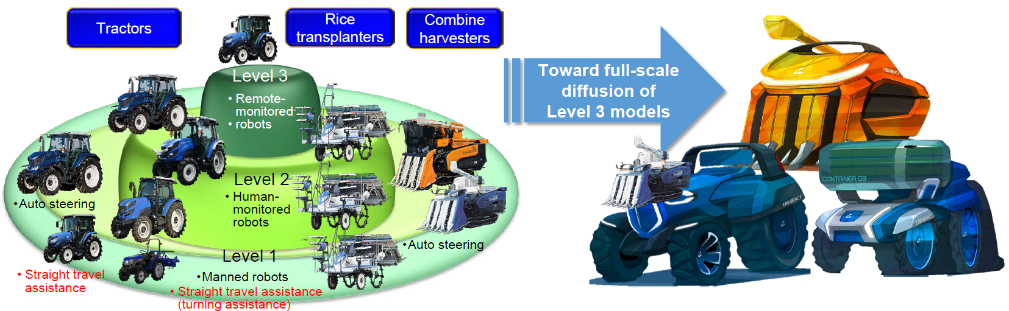

Automation, robotization, data utilization | To proceed with development for the full-scale distribution of totally unmanned machinery at Level 3, while releasing smart agricultural machinery for labor-saving and data-based agriculture one after another for expanding the scale of domestic farmers.

(Taken from the reference material of the company) |

◎ Change of business models

(Promotion of DX)

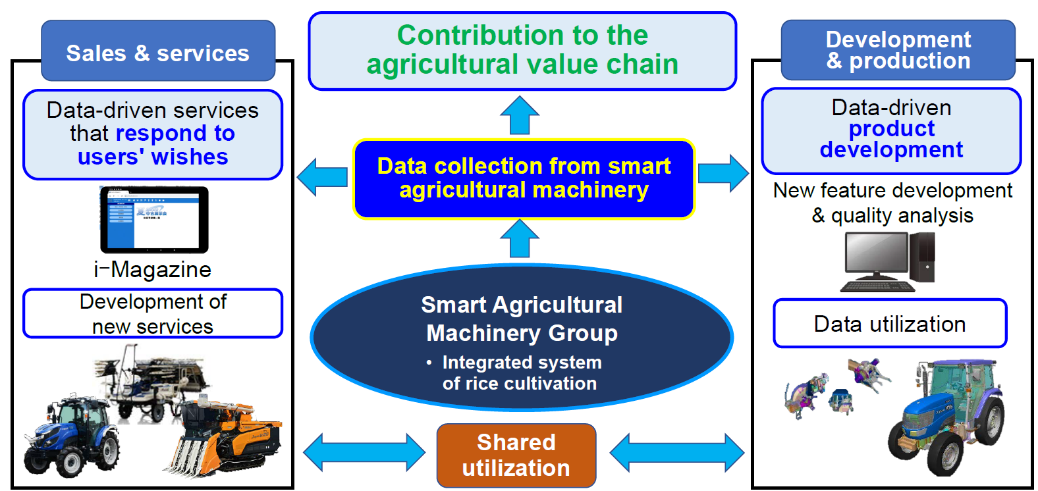

Smart agricultural machinery will become important.

Collected data will be used for the development of “services that can live up to the expectations of users by utilizing data.” In development and manufacturing, data will be used for developing new functions and analyzing quality.

The company will promote the DX of users and the company, and contribute to the advance of the agricultural value chain.

(Taken from the reference material of the company)

(New normal)

Due to the spread of COVID-19, people became more interested in food, and it is now important to strengthen the production base and improve food self-sufficiency ratio for the stable supply of food, and the preservation of the residential environment will contribute to the development of comfortable towns. Accordingly, it was recognized again that the agricultural and landscaping businesses are essential. Under the policy of supporting “agriculture and landscape,” the company will hold online demonstration sessions and small-scale long-run business talk sessions for marketing, support the start of production online, and promote the reform of workstyles, introducing telework and decentralization of tasks.

(Expansion of the service business)

The company will not only sell “products,” but also expand the business of offering services, including the commercialization of “information.”

Inside Japan, it will improve large-sized maintenance facilities, increase new products/services, including ICT, and increase/train staff for offering services, in order to expand the revenue from parts and maintenance and the sales of machineries.

In order to establish the business of providing parts and offering services outside Japan, too, the company will improve services by educating dealers and cement the cooperation with European distributors.

In addition, the company will plan and adopt new business styles other than the above mentioned.

◎ Improvement in profitability

(Structural reform)

The company will reform its production structure.

It will reorganize the production structure, including the facilities for producing components and units, assembling products, and shipping them, and improve productivity by taking advantage of the human resources and equipment of the corporate group.

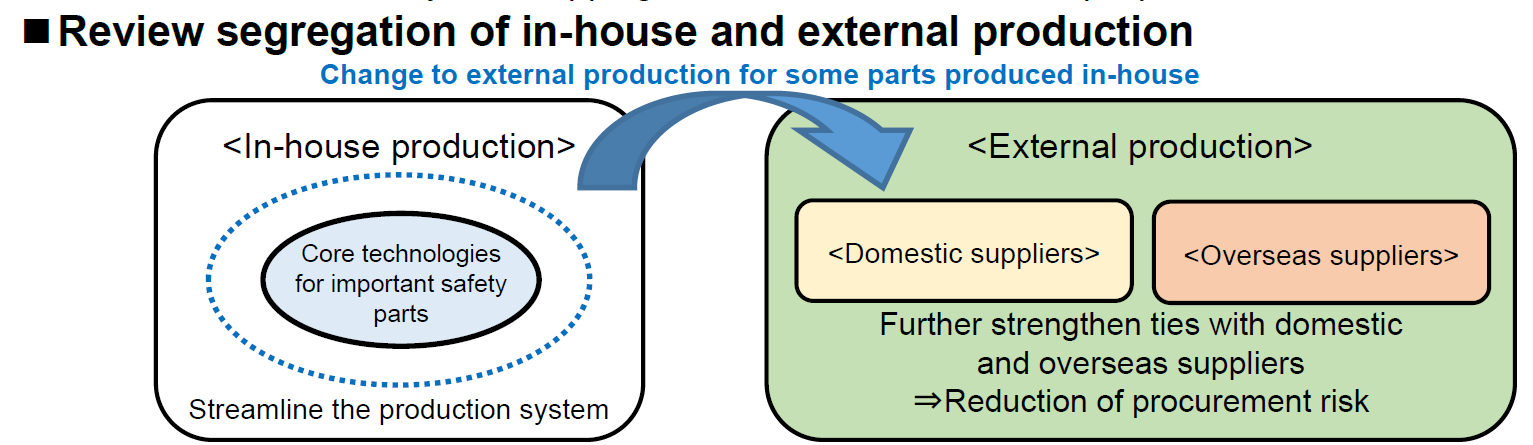

In addition, the classification of products produced inside and outside the company will be redefined.

For important parts for safety and the core technology that needs to be handed down to the next generation, the company will continue in-house production, but through the above-mentioned reform of the production structure, the production of some parts will be outsourced.

(Taken from the reference material of the company)

(Streamlining of business administration)

The company will strive to streamline it from each aspect.

Improve operational efficiency | *Increase development efficiency by tightening the development process *Streamline indirect departments by strengthening IT, RPA, and shared services |

Improve sales efficiency | *Use digital tools in sales activities *Reduce transportation costs and inventory by improving domestic product distribution |

Maximize investment efficiency | *Cut costs and reduce model types through global common designs *Restructure to achieve an optimal production system |

Maximize utilization of personnel | *Fully utilize personnel throughout the entire Group *Develop a diversity promotion system |

(Financial and capital strategies)

In the coming 5 years, the company aims to achieve an operating CF of 60 billion yen in total and a ROE of 8%.

The company will work on the improvement in operating income margin by raising gross profit margin, the increase in efficiency of assets by improving CCC, etc., the investment in equipment within depreciation, the reduction of interest-bearing liabilities, the continuation of stable dividends, etc.

The company set the goal of achieving an operating income margin of 5% and a D/E ratio of 0.8 times in 2025. For the investment in equipment, it will put importance also on the capital cost.

As for the previous mid-term plan, the results fell below the goals significantly, so it is considered indispensable “to make a profitable corporate structure that can surely raise profits beyond sales ups and downs.”

Concrete measures for achieving an operating income margin of 5% are the improvement in profit margin for each product, the reconsideration of less profitable products, the expansion of revenues from maintenance, the rise in gross profit margin through the launch of new businesses, the optimization of production classification, the disposal of excessive equipment, the strengthening of PRS shared, block strategies, and the improvement in fixed ratio through the discontinuation of unprofitable businesses.

◎ ESG

(SDGs)

Under the three themes, the company aims to achieve goals through business.

Supporting agriculture resilience |

|

|

Landscaping for livable villages and towns |

|

|

Environmental conservation for a recycling-oriented society |

|

|

(ESG)

The company will identify the following ESG materiality, and pursue the solution to social issues and the provision of value by creating business opportunities and reducing risks.

Field | Materiality (priority issues) | Value provided to society | Related SDGs |

Society | Improve brand value *Improving customer satisfaction and creating quality *Supply chain management *Social contribution and international cooperation | *Products and services that contribute to increased productivity, safety, and reduced environmental burden regarding agriculture and landscaping *Encouraging women to participate in farming (Project to support female farmers) *Revitalization and development of local communities |

|

Enhance engagement *Diversity *Creating a comfortable workplace *Occupational health and safety management | *Creating diverse personnel *Providing a safe and rewarding workplace |

| |

Environment | Environmental preservation *Environmental management *Environment-friendly design (eco products) *Reduction of environmental burden (CO2, etc.) | *Reducing greenhouse gas emissions *Contribution to formation of a recycling-oriented society |

|

Corporate governance | Increase corporate value *Strengthening governance *Risk management *Compliance *Information disclosure and constructive dialogue | *Increasing corporate value, stable dividends |

|

(Eco-friendly products and environmental management)

The environmental management system (EMS) has been adopted in the entire group, and all of production facilities (6 inside Japan and 3 outside Japan) have obtained certification. All of non-production facilities (9 domestic distributors) and other 9 facilities have obtained certification.

In addition, the company set mid/long-term goals for reducing environmental burdens, and is making efforts to attain them.

It aims to reduce CO2 emissions from production activities at domestic factories by 26% between fiscal 2013 and 2030, and increase the ratio of sales of eco-friendly products to domestic sales to 50% or higher by 2030. Furthermore, the company will discuss electrification, utilization of hydrogen, etc. and enhance its initiatives for realizing a decarbonized society by 2050.

(Reform of personnel management and engagement)

For the reform of personnel management, the company implement personnel measures based on business strategies and the optimal allocation of human resources. In addition, it will concentrate on the securing and training of personnel for conducting business strategies, including cutting-edge technologies and global personnel.

For the improvement of employees’ engagement, the company will conduct surveys on engagement and enrich the work-life balance for developing a comfortable, attractive workplace.

In addition, in order to produce personnel who will lead the coming 100 years, the company will enrich its training and educational programs, and promote diversity.

(Governance)

The company will proceed with reform, while taking into account the revision to the corporate governance code in 2021.

The current board of directors is composed of Japanese male directors only and 3 out of 10 are outside directors, so the company will “increase the ratio of outside directors and discuss diversification.” Other important tasks are “the design of a plan for successors and the revision to the remuneration system.”

The company plans to enhance compliance and risk management, improving the internal control of overseas subsidiaries, the protection of personal information inside and outside Japan, etc.

◎ Numerical goals

As one of the basic strategies is “to make a profitable corporate structure that can surely raise profits beyond sales ups and downs,” the company has not set a numerical goal for sales, but set a goal of “achieving an operating income margin of 5% in 2025.”

As mentioned above, it will work on the improvement in gross profit margin, the reduction of fixed costs, the streamlining of business administration, and structural reform.

5. Interview with President Tomiyasu

We asked President Tomiyasu about his mission, the company's competitive advantage, future challenges, and his message to shareholders and investors.

Q: "What do you think is your role and mission as the current president of the company, which will celebrate its 100th anniversary in 2025?"

A: "My mission is to lay the foundation for the 100th anniversary in 2025 and the next 100 years, and my role is to take the lead in the transformation needed for that purpose.

The most crucial role of a manager in a going concern is to "continue business for the next generation."

In addition to firmly continue business until 2025, which marks the 100th anniversary, ISEKI & Co. will not end there, so my mission is to lay the foundation for the next 100 years.

We have been committed to "transformation," which is the keyword in the medium-term management plan and has been pursued since the previous medium-term management plan. We will firmly work on the transformation again. I was not originally an employee of ISEKI & Co. I think that the meaning of appointing a person from outside the company to serve as president is precisely what "transformation" is.

Our company has a long tradition and history, but we must change what needs changing without being bound by conventional wisdom to continue to grow. I also call it "transformation similar to founding a new business." By that, I mean that it is necessary to have an attitude similar to the attitude of starting a new company as we approach the milestone of the 100th anniversary. So, in order to proceed with such transformation, I think someone from outside the company like me is perfect for the job.

This medium-term management plan calls for a transition to a business model of "providing services in addition to products." My role is to take the lead in this transformation.

Q: "Thank you. I understood your mission clearly. Next, I want to ask you what you think ISEKI & Co.'s strengths and competitive advantage are."

A: "I believe that the fact that we are a general manufacturer of agricultural machinery and the only specialized manufacturer allows us to continue to be closest to farmers. Also, we are creating products that are truly useful for farmers with our high technology."

At first glance, it seems to be the opposite of the idea of transformation that I have previously mentioned. However, what we must never change is the founder's desire to "free farmers from harsh labor." This is the most significant foundation of ISEKI & Co.'s 100-year history.

We are a general manufacturer of agricultural machinery and also the only specialized manufacturer. Our competitors are operating various businesses, but we believe that our greatest strength is that we continue to be closest to farmers by focusing solely on agriculture.

Because of this position, we have been able to develop various machines such as large tractors, rice transplanters and combine harvesters that form an integrated system of rice cultivation in Japan and are frontrunners in the industry.

We also believe that the high technological capabilities that enable us to deliver these products one after another are a major competitive advantage.

We are always in the first or second place in the number of patent registrations, and our patent approval rate is always 90% or higher. In other words, we are constantly producing original products that are not only large in quantity, but also high in quality.

Let me give you an example.

Rice transplanters are our biggest strength when it comes to agricultural machinery.

We have been developing various rice transplanters starting with "Sanae," released in 1971. Recently, the "soil sensor-equipped variable fertilizer rice transplanter" released in 2016 represents our company's characteristics that I just mentioned.

The development of this rice transplanter began with the farmers' complaints about needing to do something about the lodging of rice, which leads to the deterioration of work efficiency and quality. This rice transplanter measures "fertility (soil fertility)" and "depth" with two types of sensors and automatically controls the amount of fertilizer according to the soil at each planting site. This optimal fertilization can reduce rice lodging and unify growth, allowing farmers to carry out planned harvesting operations.

Other companies have the technology to control fertilizers based on past data. However, our unique technology can perform optimum fertilizer application in real time according to the soil condition at the time of rice planting. It took about seven years from the start of development to commercialization. I think that developing this technology was possible because we are the closest to farmers and want to create products that are really useful for them.

Q: "You can understand well about the characteristics of your company through this example. What are the mechanisms and efforts you are taking to continue to improve the characteristics and competitive advantage of your company?"

A: "I think it's all about training people. In the last five years or so, we have established three training centers and are promoting the transfer and development of various technologies and know-how. We are also actively working on open innovation with external parties to improve our technological capabilities. "

I think it's all about training people.

In the last five years or so, we have established three training centers.

IETC (ISEKI Engineering Training Center) provides basic technology and design training. ITTC (ISEKI Technical Training Center) provides skill training for production sites, and IGTC (ISEKI Global Training Center) provides service and maintenance guidance for sales companies. IGTC also offers training for overseas dealers, that's why we have added "G (global)" to the name.

All three centers are passing on and developing various technologies and know-how.

As part of the training, we hold technical research presentations, skill competitions for maintenance engineers, etc. By presenting their own achievements and seeing the achievements of their colleagues, the overall level and motivation improve.

(Source: ISEKI& Co.)

We are also actively engaged in open innovation with external parties to improve our technological capabilities.

The soil sensor-equipped variable fertilizer rice transplanter I mentioned earlier is an example of a significant contribution from our cooperation with testing institutions.

In addition to that, we are engaged in various activities with NARO (National Agriculture and Food Research Organization), an affiliated organization of the Ministry of Agriculture, Forestry and Fisheries, local governments, and private companies.

For example, tie-ups with local governments are indispensable for demonstrating advanced ICT in agriculture in large-scale farms to show whether it would actually function in the field.

Connections with start-up companies are also increasing.

Q: "I would like to ask you about the challenges your company faces next."

A: "The most important challenge is “responding to changes in demand and needs.” In Japan, it is indispensable to increase the scale of farms, switch cropping from rice to vegetables, and respond to this with advanced ICT technology. Overseas, we are taking advantage of our position as a Japanese company to penetrate the rice market in Asia. In each case, the most important thing to be addressed is "human resources," and we will work on it company-wide."

In this medium-term management plan, the four management challenges are "responding to changes in demand and needs," "achieving technological innovation," "enhancing ESG initiatives," and "improving our financial position and expanding profits."

The most important challenge is "responding to changes in demand and needs."

In Japan, the population is declining, and the number of farms is also going down. Under these circumstances, increasing the scale of farms and switching from growing rice to vegetables are progressing. Advanced ICT technology is becoming more and more indispensable for farm management, especially as the scale of farms increases. We must respond appropriately to these changes in demand.

On the other hand, when talking about future growth strategies, we need to expand overseas business, which should be our growth engine.

Given our history and track record at the European and North American markets, we expect that the sales will continue to grow relatively steadily due to landscape improvements and home gardening demand.

Increasing the sales in Asia is what we have to be serious about.

In China, local companies have grown in recent years, and the advantage of focusing on standard machines has diminished. We plan to focus on exporting high-performance and high-functioning products and providing technologies to meet food security demand and ICT and environmental needs.

Yet, I think there is much room for growth in rice cultivation in Asia. In particular, western agricultural machinery manufacturers naturally focus on upland cropping, so Japanese companies have a great advantage in paddy field farming.

In Asia, there are still many areas where rice is cultivated by direct sowing instead of rice cultivation, and mechanization has not progressed, so we would like to realize our founding desire to "free farmers from harsh labor" this time in Asia.

The center of expansion in Asia is Thailand as a sales base and Indonesia as a manufacturing base. Currently, shipments from the Indonesian factory are primarily for North America and Europe. However, we will use a local subsidiary in Thailand as our main factory to ship throughout Asia.

In India, which is the market with the most promising growth, we would like to expand more aggressively our alliance with the local company, TAFE.

"Human resources" are the most important thing to tackle upon implementing these measures.

It is a given to train our human resources in Japan, but more training will be required overseas, so we will promote human resource development company-wide, centered on the "IGTC" I mentioned earlier.