| Nippon Piston Ring (6461) |

|

||||||||

Company |

Nippon Piston Ring Co., Ltd. |

||

Code No. |

6461 |

||

Exchange |

TSE First Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Akira Yamamoto |

||

HQ Address |

5-12-10, Honmachi Higashi, Chuo-ku, Saitama City, Saitama, Japan |

||

Year-end |

March |

||

URL |

|||

* Share price as of close on October 15, 2015. Shares outstanding as of end of the most recent quarter.

EPS, DPS and PBR have been adjusted to reflect the impending reverse stock split expected to be implemented on October 1, 2015. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

EPS, DPS have been adjusted to reflect the impending reverse stock split expected to be implemented on October 1, 2015. |

| Key Points |

|

| Company Overview |

|

Nippon Piston Ring boasts of strengths in metallic materials, surface quality improvement and precision processing technologies. New products are being developed to expand the range of its business into the metal injection molding products, dental implants, and other products not related to automobile engines. <Corporate History>

Nippon Piston Ring was founded by Tomonori Suzuki in 1931 in Kawaguchi City, Saitama Prefecture just prior to the start of mass domestic production of automobiles by manufacturers such as Toyota and Nissan, following the Government program for "establishment of an automobile industry" adopted in August 1935. The company name Nippon Piston Ring Co., Ltd. was officially adopted along with the establishment of the factory in Kawaguchi City in 1934.During the Second World War, the Company began mass production of chrome plated rings for airplanes. At the end of the War in 1945, the factory was temporarily closed, but the company began operations along with the listing of its shares on the Tokyo Stock Exchange in 1949. Nippon Piston Ring's earnings expanded rapidly along with the rapid expansion in Japanese automobile exports, and the strong demand for vehicles due to economic growth in the post-war reconstruction within Japan. Beginning to provide products to German and American motor vehicle manufacturers in the 1970s, the Company has continued organizing a global manufacturing and sales structure, establishing overseas manufacturing facilities in Thailand, Indonesia, China and some other countries since 2000. The metal injection molding products business and dental implants business were acquired in 2014 as part of the strategy of expanding its product lineup outside of the motor vehicle engine parts realm.  <Market Environment>

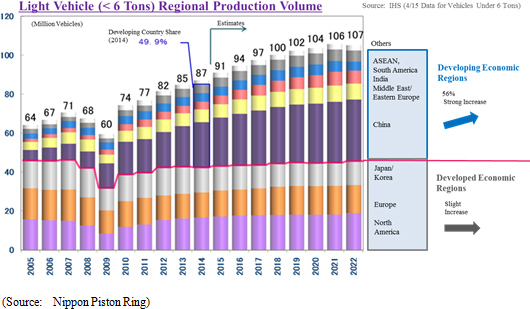

◎ Global Automobile Production Volume

According to the research company "IHS Automotive", the production volume of light vehicles of less than six tons in gross weight is expected to continue to increase from 87.00 million units in fiscal year 2014 to over 100 million in 2018, and to eventually reach 107 million in 2022.Looking at the details of these estimates, light vehicles manufactured in Europe, North America, Japan and other developed economic regions are expected to see only slight increases. However, stronger growth in China, ASEAN countries, South America, India and other developing economic regions is expected to allow their share of light vehicles to rise from 49.9% in 2014 to 56% in 2022. And while overall average growth is expected to be 2%, it is expected to reach 4% in developing markets.   * Sales, operating profit are estimates of the respective companies. ROE is based upon actual data from the previous year. Market capitalization, PER, and PBR are based upon closing share prices of the respective companies as of August 28, 2015.

Both Nippon Piston Ring and Riken have PBRs of less than one. Nippon Piston Ring needs to grow its earnings to rectify this undervaluation, while also increasing its brand recognition. <Business Description>

◎ Main Products

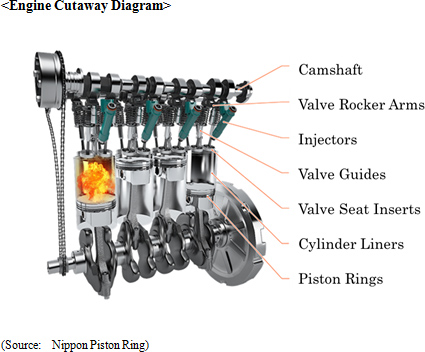

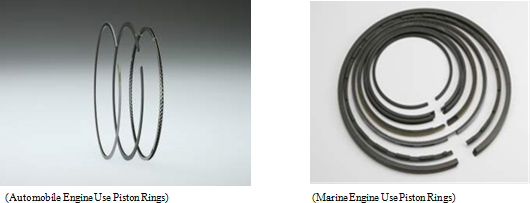

As reflected in the Company name, piston rings are one of the main products manufactured. In addition, valve seat inserts and various other automobile parts are manufactured and sold. In fiscal year March 2015, automobile related parts accounted for 86.6% of total sales.At the same time, metal injection molding products business and the dental implant products business were acquired in 2014. New product development is being promoted as a means of expanding its business in the non-automobile engine components realm. (Please Refer to "4. Sixth Midterm Business Plan" for further information about new businesses and products)    <Piston Rings>

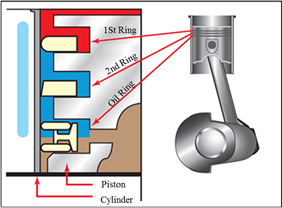

Smooth movement of pistons will be impeded and fuel consumption will be negatively impacted should the tensional force of the piston ring placed on pistons be too high. Conversely, loss of power and increased oil consumption will result if the tensional force of the piston ring placed on pistons is too low. Consequently, optimization of the tensional forces of piston rings is crucial in ensuring the optimum performance of internal combustion piston engines. Piston rings are required to provide wear resistance, material strength, heat resistance, heat conductivity, and oil retention capacity to ensure the optimal performance and durability of engines. In recent years, with the rapid rise in awareness of environment issues, a swift response is vital to adjust to a system that certifies vehicles with low output levels of nitrous oxides and hydrocarbons, and regulations to enforce reductions in a carbon dioxide emission. Consequently, the need for high performance piston rings that respond to these developments and the need for improvements in fuel consumption is on the rise. With regards to the characteristics required to piston rings, development of piston rings with low friction construction, thinner width, new surface treatment processes, highly durable and low- cost materials is being conducted. At the same time, development and proposal of optimal design technologies using its tuning technic is also being promoted. Nippon Piston Ring is one of only few companies that have the ability to stably manufacture and supply piston rings, which, as you may see, require extremely advanced technological capabilities, and are able to consistently develop revolutionary technologies.  <Valve Seat Inserts>

Valve seat inserts are parts which are press fitted into the valve seating portion of cylinder heads. Valve seat inserts are a very important part made from sintered alloys that boast of high resistance to wear and deterioration under high heat conditions, and ensure that a tight seal is formed for clean and efficient combustion. Nippon Piston Ring boasts of quality valve seat inserts that meet the needs of automobile manufacturers at a high level, using a wide range of material variation, leveraging its superior materials development capabilities. Consequently, the Company boasts of a top share of slightly less than 40% of valve seat inserts provided to Japanese automobile manufacturers, and it is expanding its sales to overseas motor vehicle manufacturers.

<Camshafts>

Camshafts are a part designed to open and close the valves for each cylinder in piston engines. Nippon Piston Ring has patented a special camshaft called assembled sintered camshafts, which are lightweight, high resistance to contact pressure and capable of adopting a wide variety of designs. They are used by Fuji Heavy Industries in all of its engines, as well as used by truck manufacturers, which require highly durable products.

◎ Customers

Nippon Piston Ring supplies piston rings and valve seat inserts to all Japanese automobile manufacturers.

The products supplied by the Company are extremely important in improving the performance of engines and require high levels of technical expertise. In recent years, the need to improve fuel consumption and to seek alternative fuels due to the growing importance of environmental issues has contributed to expanded sales to Audi, Volkswagen, Ford, General Motors and other non-Japanese automobile manufacturers.

<Manufacturing and Sales Facilities>

<Japan>

Nippon Piston Ring maintains four manufacturing facilities and seven sales offices (Sapporo, Sendai, Tokyo, Osaka, Nagoya, Hiroshima, Fukuoka) within Japan.

<Overseas>

Nippon Piston Ring maintains both manufacturing and sales facilities for piston rings, valve seat inserts and other products in the United States, China, ASEAN countries, and India.

<Characteristics and Strengths>

Nippon Piston Ring's highly advanced technologies and ability to consistently supply highly reliable functional automobile parts maintained throughout its 80 year history of operations has allowed it to become the choice of both Japanese and overseas automobile manufacturers. In recent years, development of major products, which can contribute to reductions in exhaust gases and the achievement of "over 50% thermal efficiency rates" in internal combustion engines, is being conducted.

In addition, automobile manufacturers, to whose business the Company's high levels of technological expertise are critical, are what the Company calls its "client assets," which are an important part of its corporate value.  However, profit margins have been identified as an issue for improvement and the 6th Midterm Business Plan calls for efforts to boost "operating profit margin of 7% or more." |

| Fiscal Year March 2015 Earnings Review |

Favorable Trends in Main Products Allow Both Sales And Profits to Grow

Sales rose by 2.4% year-on-year to ¥51.6 billion. Sales of the main products of piston rings and valve seat inserts supplied to both Japanese and overseas automobile manufacturers trended favorably. Also, the overseas sales ratio rose to 52% to exceed sales within Japan for the first time.The disappearance of fees associated with the tax refund claim suit that occurred in the previous term, cost reductions (¥0.8 billion) and higher production volume (¥0.31 billion) offset increases in depreciation (¥0.37 billion), labor (¥0.35 billion) and materials & fuel (¥0.25 billion) expenses and allowed current profits to rise by 25.4% year-on-year to ¥2.1 billion.   A decline in interest bearing liabilities of ¥1.287 billion contributed to a ¥1.023 billion decline in total liabilities to ¥35.938 billion. Increases in retained earnings resulting from higher profits and in foreign exchange translation account accompanying the weaker yen contributed to a rise in net assets of ¥6.214 billion to ¥31.325 billion. Consequent to these changes, equity ratio rose by 6.1% points from 39.6% at the end of the previous term to a record high of 45.7% at the end of the current term. As shown in the graph below, interest bearing liabilities and net interest bearing liabilities have been steadily reduced over time.   (4) Topics

Based upon the "Share Trading Unit Unification Action Plan" released by all of Japan's securities exchanges, all of the listed companies within Japan seek to align their minimum share trading unit at 100 shares.◎ Reverse Stock Split, Share Unit Number Change, Dividend Estimate Revision Furthermore, the stock exchanges have also issued directives requesting that publicly traded companies make adjustments to their shares so that the minimum trading lot falls between ¥50,000 and ¥500,000 as a means of increasing access to equity investment by individual investors. In keeping with these directives, Nippon Piston Ring has reduced its minimum trading share unit number from 1,000 to 100 by conducting a reverse stock split of 1 for 10 with the aim to adjust its outstanding shares to a more appropriate number. (A resolution was passed during the general shareholders' meeting held on June 25, 2015.) ① Reverse Stock Split Overview

A 1-for-10 reverse stock split effective on October 1, 2015 to officially registered shareholders as of September 30, 2015 was conducted.② Overview of Change in Minimum Trading Lot Share Number

Effective on the same day as the reverse stock split, the minimum trading lot share number was reduced from 1,000 to 100 shares.

③ Dividend Payment Revision

Along with the reverse stock split, the dividend payment for fiscal year March 2016 was revised from ¥6 to ¥60 per share.

④ Impact upon Shareholders

|

| Fiscal Year March 2016 Earnings Estimates |

Expansion in Overseas Sales Contribute to Higher Sales, Profits

Sales are expected to stay flat at ¥52.0 billion. Sales to Japanese automobile manufacturers in North America is expected to be robust. In addition, sales to Ford, Daimler and GM are also expected to grow. The overseas sales ratio is expected to rise by another 3% points from the previous year to 55%. Strong sales of piston rings to Ford, and valve seat inserts to Audi and GM are expected to be a contributing factor to this rise. Increases in labor expense, depreciation and fluctuation of products pricing of ¥0.51, ¥0.35 and ¥0.25 billion, respectively are expected to be offset by a reduction in cost of sales of ¥0.72 billion and an improvement in economies of scale deriving from higher production volumes of ¥0.19 billion, resulting in a 13.0% year-on-year increase in operating profit to ¥2.2 billion. However, expected contraction in foreign exchange translation gains from the ¥0.14 billion shall contribute to a 3.4% year-on-year decline in current profit to ¥2.1 billion. The disappearance of ¥0.72 billion in subsidies which occurred in the previous term is also expected to contribute to a 31.0% year-on-year decline in net profit contributable to parent company shareholders to ¥1.5 billion. Dividend is expected to be ¥6 per share, the same amount as the previous year when ¥1 was added to commemorate the 80th anniversary of Nippon Piston Ring's operations. The subsequent dividend payout ratio estimate is 32.9% (Dividend is expected to be raised to ¥60 per share after the reverse stock split is implemented). |

| 6th Midterm Business Plan |

|

① Reflecting upon the Fifth Midterm Business Plan

The Company has promoted various strategies of its 5th Midterm Business Plan including the main initiatives of "management based upon cash flow and balance sheet strategies," "promoting reforms of its cost structure," and "leveraging unique technologies to achieve commercialization of new products" under the basic policy of "promoting business structure reforms."The Company has been successful in achieving results in the realms of financial structure improvements, new product releases, and manufacturing foundation creation. However, it has fallen short of its numerical goals of achieving "sales of ¥52.0 billion or more and the current profit to total asset margin of 6% or more" with the actual sales of ¥51.6 billion and the current profit to total asset margin of 3.4% being recorded during fiscal year March 2015. With regards to sales, the metal injection molding products business has contributed to expansion in new realms and businesses. However, negative factors including changes in market conditions and changes in the vehicle production in some projects had an impact. With regards to the current profit to total asset ratio, Nippon Piston Ring has yet to adequately control inventories and total assets and reduce costs. ② 6th Midterm Business Plan Overview

Nippon Piston Ring celebrated its 80th year of operations in December 2014. At such milestone, efforts are being conducted to expand sales of existing products and cultivate new markets to "establish the foundations for Nippon Piston Ring to prosper for 100 years." These efforts include reflection upon the results of the previous midterm business plan to get a solid start to the current 6th Midterm Business Plan, which is scheduled to be completed in fiscal year March 2018.

The overseas sales ratio is expected to rise to 59% in the final year of the Plan based upon the outlook for increases in sales to overseas automobile manufacturers.  Sales of piston rings and valve seat inserts to overseas manufacturers are expected to rise from 8.1% in the previous term to 11.9% in the final year of the Plan.  Investments for rationalization are expected to be made within Japan with a goal of increasing profit margins. At the same time, investments for new product development promotion are also expected to be made. Investments for expansion of capacity are expected to amount to ¥8.8 billion, with ¥2.8 and ¥6.0 billion of this total spent within Japan and in our overseas manufacturing facilities, respectively. By the final year of the Plan, production capacity of piston rings within Japan and in our overseas manufacturing facilities is expected to be equal, with the ratio of production capacity of valve seat inserts expected to be 70% in our overseas manufacturing facilities.  ◎ Efforts in the Realm of Existing Business

<Expand Sales to Overseas Automobile Manufacturers>

As discussed earlier in this report, Nippon Piston Ring already supplies all of the Japanese automobile manufacturers, but the potential to begin supplying other overseas automobile manufacturers which it does not currently conduct business with is large.In many instances, piston rings are supplied to overseas engine manufacturers in modules assembled by tier one suppliers (Piston suppliers). Consequently development support and individual proposals are conducted to each tier one supplier on a project base. In particular, development support proposals to piston manufacturers that do not possess evaluation technologies to assess engines are considered to be an effective marketing strategy. <Gasoline Engine Use Piston Rings>

The automobile manufacturers' needs for "lighter parts" and "improved thermal efficiency" of engines are on the rise.While reducing friction and improving combustion are issues to be properly dealt with when enhancing thermal efficiency, and reductions in the distance between cylinders and various issues associated with material changes require detailed attention regarding lightening of engines, Nippon Piston Ring has effectively responded with its proprietary technologies to these issues, resulting in its expanding business with both Japanese and overseas automobile manufacturers. <Valve Seat Inserts>

Development of high output, low fuel consumption, and low exhaust gas output engines is being conducted against the backdrop of stricter exhaust gas regulations. Nippon Piston Ring's ability to provide thin and large diameter valve seat inserts have come to be regarded highly and consequently being further adopted by manufacturers.

◎ Efforts to Commercialize New Products

New technologies and technologies maintained by companies acquired through M&A activities have been added to the Company's own fundamental technologies. Various efforts to validate tentative theories and to leverage existing technologies to commercialize new products in non-automobile engine applications are being conducted.At the current point in time, efforts are being focused upon developing products for motors and dental applications. <Metal Injection Molding Products Business>

With the goal of expanding the non-automobile engine parts business, the metal injection molding products business of Sumitomo Metal Mining Co., Ltd. was acquired and sales of products began in May 2014.While Nippon Piston Ring had mass produced automobile engine parts made from various metallic materials by this metal injection molding technique, the acquisition of this business will allow it to expand its sales channels by fortifying its product lineup and strengthening its materials and production technologies. <Dental Implant Business>

Nippon Piston Ring acquired the dental implant business from Ishifuku Metal Industry Co., Ltd. in October 2014.

This IAT dental implant system uses electric discharge machining to improve the surface conditions for more favorable bone structure affinity and it received pharmaceutical law certification in October 2014 with subsequent shipments being started from November 2014.The metallic materials and precision processing technologies built up in the main automobile engine parts business will be leveraged in the dental implant business to develop various medical related products. In addition to the high levels of biological compatibility of the "Ti-Ta alloy" medical product materials currently being developed, it can be used in magnetic resonance imaging (MRI) because it is non-magnetic in character. Therefore, usage of this material in pace maker lead wires, electrodes, embolization coils, stents and other products which are placed in the body for prolonged periods of time is being considered. Furthermore, Nippon Piston Ring is participating in exhibitions to display its products as a means of cultivating the United States market, the world's largest market. |

| Interview with President Akira Yamamoto |

|

President Akira Yamamoto was born on February 9, 1958 and is 57 years old. After joining Nippon Piston Ring in 1981, he became responsible for production control and created production plans, managed plant financials, and conducted overseas deployment. Thereafter, he joined the corporate planning department and participated in management of the overall Company. He then became President of Nippon Piston Ring in June 2013. His efforts to optimize various tasks in each of his positions within the Company are a valuable asset. <President Akira Yamamoto's mission>

<Issues and Responses>

◎ Improving Profitability

◎ New Product Endeavors

◎ Other Business

<Message to Investors>

|

| Conclusions |

|

The Company recognizes the need to improve its profit margins to gain a higher valuation in the stock market and to see a recovery of its price to book ratio to 1.0 times or greater. An understanding of these conditions is reflected in our interview with President Akira Yamamoto. The market is likely to remain focused upon the efforts of Nippon Piston Ring to achieve the fiscal year 2018 targets of "¥55.0 billion or more in sales and operating profit margin of 7% or more" as identified in its sixth Midterm Business Plan , which has just started.  Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and/or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015, All Rights Reserved by Investment Bridge Co., Ltd. |