| Nippon Piston Ring (6461) |

|

||||||||

Company |

Nippon Piston Ring Co., Ltd. |

||

Code No. |

6461 |

||

Exchange |

TSE First Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Akira Yamamoto |

||

HQ Address |

5-12-10, Honmachi Higashi, Chuo-ku, Saitama City, Saitama, Japan |

||

Year-end |

March |

||

URL |

|||

* The share price is the closing price on June 23. The number of shares outstanding was taken from the latest brief financial report.

ROE and BPS are the values for the previous term.* A reserve stock split of 1 for 10 was conducted on October 1, 2015. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

* The definition for net profit has been changed to net profit attributable to parent company shareholders (Abbreviated as parent net profit) * EPS, DPS have been adjusted to reflect the reverse stock split of 1 for 10 conducted on October 1, 2015. * A commemorative dividend of ¥10.00 per share in addition to the normal dividend of ¥50.00 was conducted to commemorate the 80th year of Nippon Piston Ring's operations in FY March 2015. |

| Key Points |

|

| Company Overview |

|

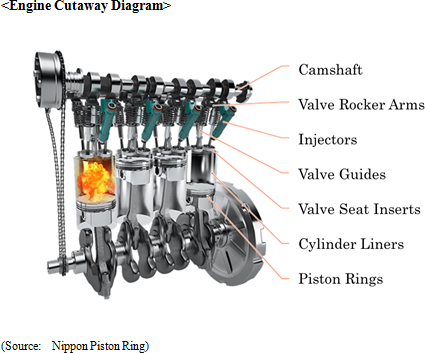

Nippon Piston Ring boasts of strengths in metallic materials, surface quality improvement and precision processing technologies. New products are being developed to expand the range of its businesses into the metal injection molding products, dental implant, and other realms not related to automobile engine parts. <Corporate History>

Nippon Piston Ring was founded by Tomonori Suzuki in 1931 in Kawaguchi City, Saitama Prefecture just prior to the start of mass domestic production of automobiles by manufacturers such as Toyota and Nissan, following the Government program for "establishment of an automobile industry" adopted in August 1935. The company name Nippon Piston Ring Co., Ltd. was officially adopted along with the establishment of the factory in Kawaguchi City in 1934.During the Second World War, the Company began mass production of chrome plated rings for airplanes. At the end of the War in 1945, the factory was temporarily closed, but the company began operations along with the listing of its shares on the Tokyo Stock Exchange in 1949. Nippon Piston Ring's earnings expanded rapidly along with the rapid expansion in Japanese automobile exports, and the strong demand for vehicles due to economic growth in the post-war reconstruction within Japan. Beginning to provide products to German and American motor vehicle manufacturers in the 1970s, the Company has continued organizing a global manufacturing and sales structure, establishing overseas manufacturing facilities in Thailand, Indonesia, China and some other countries since 2000. The metal injection molding products business and dental implants business were acquired in 2014 as part of the strategy of expanding its product lineup outside of the motor vehicle engine parts realm, and the Company has started to operate the business by its own facility since 2015.  <Market Environment>

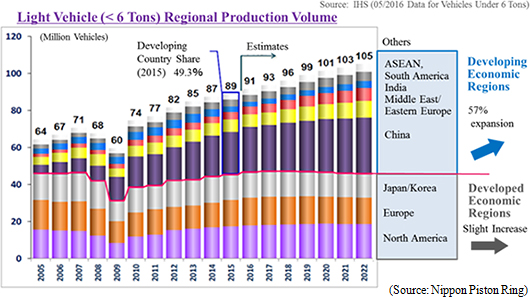

◎ Global Automobile Production Volume

According to the research company "IHS Automotive", the production volume of light vehicles of less than six tons in gross weight is expected to continue to increase from 89.00 million units in fiscal year 2015 to over 100 million in 2020, and to eventually reach 105 million in 2022.Looking at the details of these estimates, light vehicles manufactured in Europe, North America, Japan and other developed economic regions are expected to see only slight increases. However, stronger growth in China, ASEAN countries, South America, India and other developing economic regions is expected to allow their share of light vehicles to rise from 49.3% in 2015 to 57% in 2022. And while overall average growth is expected to be 2%, it is expected to reach 4% in developing markets.   * Sales, operating profit are estimates of the respective companies. ROE is based upon actual data. Market capitalization, PER, and PBR are based upon closing share prices of the respective companies as of May 19, 2016.

Nippon Piston Ring is the only one with increased profit estimation of this fiscal year, but its stock price index is at the lowest among them in addition to the operating profit margin and ROE. Improvement of both market awareness and profitability needs to be tackled. <Business Description>

◎ Main Products

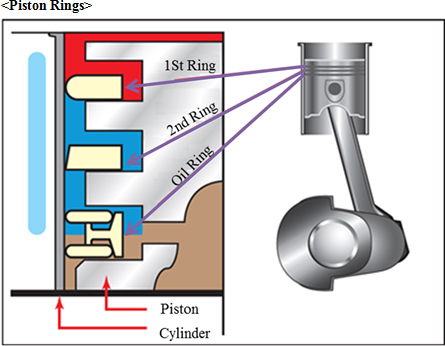

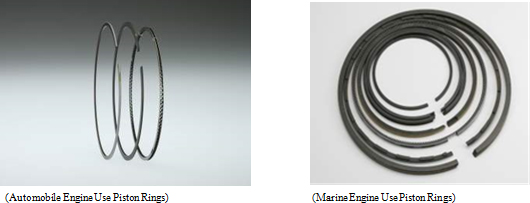

As reflected in the Company name, piston rings are one of the main products manufactured. In addition, valve seat inserts and various other automobile parts are manufactured and sold. In fiscal year March 2016, automobile related parts accounted for 86.3% of total sales.At the same time, metal injection molding products business and the dental implant products business were acquired in 2014. New product development is being promoted as a means of expanding its business in the non-automobile engine components realm. (Please Refer to "Reference. Sixth Midterm Business Plan" for further information about new businesses and products)     Smooth movement of pistons will be impeded and fuel consumption will be negatively impacted should the tensional force of the piston ring placed on pistons be too high. Conversely, loss of power and increased oil consumption will result if the tensional force of the piston ring placed on pistons is too low. Consequently, optimization of the tensional forces of piston rings is crucial in ensuring the optimum performance of internal combustion piston engines. An oil film is formed between the cylinder wall and pistons to reduce friction wear and baking, which could be caused by the high speed movement of pistons within a high-heat condition of cylinders. However, it's not thicker the better; piston oil rings need to be designed to ensure that an optimal thickness of oil film is formed. Piston rings are required to provide wear resistance, material strength, heat resistance, heat conductivity, and oil retention capacity to ensure the optimal performance and durability of engines. In recent years, with the rapid rise in awareness of environment issues, a swift response is vital to adjust to a system that certifies vehicles with low output levels of nitrous oxides and hydrocarbons, and regulations to enforce reductions in a carbon dioxide emission. Consequently, the need for high performance piston rings that respond to these developments and the need for improvements in fuel consumption are on the rise. With regards to the characteristics required to piston rings, development of piston rings with low friction construction, thinner width, new surface treatment processes, highly durable and low- cost materials is being conducted. At the same time, development and proposal of optimal design technologies using its tuning technic is also being promoted. Nippon Piston Ring is one of only few companies that have the ability to stably manufacture and supply piston rings, which, as you may see, require extremely advanced technological capabilities, and are able to consistently develop revolutionary technologies.  <Valve Seat Inserts>

Valve seat inserts are parts which are press fitted into the valve seating portion of cylinder heads. Valve seat inserts are a very important part made from sintered alloys that boast of high resistance to wear and deterioration under high heat conditions, and ensure that a tight seal is formed for clean and efficient combustion. Nippon Piston Ring boasts of quality valve seat inserts that meet the needs of automobile manufacturers at a high level, using a wide range of material variation, leveraging its superior materials development capabilities. Consequently, the Company boasts of a top share of slightly less than 40% of valve seat inserts provided to Japanese automobile manufacturers, and it is expanding its sales to overseas motor vehicle manufacturers.

<Camshafts>

Camshafts are a part designed to open and close the valves for each cylinder in piston engines. Nippon Piston Ring has the original technology for a special camshaft called assembled sintered camshafts, which are lightweight, high resistance to contact pressure and capable of adopting a wide variety of designs. They are used by Fuji Heavy Industries in all of its self-manufactured engines, as well as used by truck manufacturers, which require highly durable products. Most recently, Honda Motor Co., Ltd. has selected Nippon Piston Ring camshafts to be used in its new model of NSX sports car.

◎ Customers

Nippon Piston Ring supplies piston rings and valve seat inserts to all Japanese automobile manufacturers.The products supplied by the Company are extremely important in improving the performance of engines and require high levels of technical expertise. In recent years, the need to improve fuel consumption and to seek alternative fuels due to the growing importance of environmental issues has contributed to expanded sales to Audi/VW, Ford, General Motors and other non-Japanese automobile manufacturers.  <Manufacturing and Sales Facilities>

<Japan>

Nippon Piston Ring maintains four manufacturing facilities and seven sales offices (Tokyo [head office: Saitama City], Nagoya, Osaka, Hiroshima, Fukuoka, Sendai, Sapporo) within Japan.

<Overseas>

Nippon Piston Ring maintains both manufacturing and sales facilities for piston rings, valve seat inserts and other products in the United States, China, ASEAN countries, and India.

<Characteristics and Strengths>

Nippon Piston Ring's highly advanced technologies and ability to consistently supply highly reliable functional automobile parts maintained throughout its history over 80 years of operations has allowed it to become the choice of both Japanese and overseas automobile manufacturers. In recent years, development of major products, which can contribute to reductions in exhaust gases, low output levels of carbon dioxides and the achievement of "over 50% thermal efficiency rates" in internal combustion engines, is being conducted.

In addition, automobile manufacturers, to whose business the Company's high levels of technological expertise are critical, are what the Company calls its "client assets," which are an important part of its corporate value.  As stated in the aim of the 6th Midterm Business Plan, improvement of profitability will need to be pursued. |

| Fiscal Year March 2016 Earnings Overview |

Main products' steady sales rise led to profit rise. Both sales and profits exceeded the forecast.

The sales rose by 1.0% year-on-year to ¥52.1 billion, which reached an all-time high.The overseas sales grew by 8.5% year-on-year to ¥28.9 billion. Overseas sales ratio increased from 52% in fiscal year March 2015 to 55%. In addition to favorable sales to Japanese manufacturers in North America, sales of piston rings (Ford etc.) and valve seat inserts (Audi, GM etc.) to non-Japanese manufacturers also rose steadily. The sales ratio for non-Japanese manufacturers increased from 8.1% in fiscal year March 2015 to 10.3%. Expansion to overseas markets is progressing favorably. On the other hand, the domestic sales fell by 6.9% to ¥23,260 million. The company is building a system to secure profits from limited sales by shortening the manufacturing process etc. The operating profit rose by 30.9% to ¥2.5 billion. Effect of cost reduction activity through the improvement of defect ratio and increase in productivity in addition to the reduction of retirement benefits cost contributed. The ordinary profit grew by 12.4% to ¥2.4 billion. The net profit fell by 26.1% to ¥1.6 billion. This is due to extraordinary income of ¥1 billion was added up with gain on sales of investment securities and subsidy in the previous fiscal year. Additionally, the cost of capital investment in fiscal year March 2016 was ¥4.4 billion which was below the initial plan of ¥7.1 billion mainly due to schedule changes of the mass production launch by automobile manufacturers.   While current liabilities rose by ¥2,053 million following the augmentation of short-term interest-bearing liabilities, noncurrent liabilities dropped by ¥3,601 million to ¥10,560 million because of long-term interest-bearing Liabilities declined. Total short- and long-term interest-bearing liabilities decreased by ¥497 million to ¥17,205 million. While the shareholders' equity rose by ¥1,115 million following the rise of retained earnings, as valuation difference on available-for-sale securities dropped by ¥1,513 million, the net assets decreased by ¥1,968 million to ¥29,357 million. As a result, the equity ratio declined by 0.5% from 45.7% at the end of the previous fiscal year to 45.2%.   Purchase of property, plant and equipment decreased by ¥1,167 million, which caused an increase in investing cash flow. As a result, free cash flow decreased. Repayment of long-term loans payable decreased by ¥1,741 million and financing cash flow increased. The cash position stayed almost unchanged. (4) Topics

A company-owned plant for manufacturing valve seat inserts is being constructed near the rented plant in operation in Karnataka, India to increase production capacity, and operation will be transferred from the rented plant to this new plant. The plan is to complete the building by the end of 2016 and to start operations in the new plant at the beginning of 2017. After the operations are started, the product line in the rented facility will be transferred step by step.◎ Construction of a Company-owned Plant in India The rented facility in India where the local production commenced in 2013 has a capacity of manufacturing 2 million valve seat inserts in a regular operation per month. Meanwhile, the recent increase in demand from Japanese motorcycle manufacturers was higher than expected and the demand volume is 2.5 million to 2.6 million per month. Currently the production capacity is met by a help of the backup facility in Thailand. So the company decided to construct an owned plant in order to catch up with the increased production of new models and increase of supported models, and to prepare for the forecasted business expansion. The company plans to install a manufacturing line of a capacity of producing 3 million products per month in the new plant at the start of production, but it is designed to be mounted with more equipment to produce up to 7 million products per month. In addition, the company started manufacturing valve seat inserts in Indonesia in 2015. ◎ IAT Conference 2016

Aiming for market penetration of IAT ( |

| Fiscal Year March 2017 Earnings Estimates |

Cost reduction covers decreased sales due to fluctuation of exchange rate to increase profit

Sales are estimated to decrease by 2.3% year-on-year to ¥51 billion due to the strong yen, but in terms of sales volume it will increase. Exchange rates of 110 yen for dollar and 120 yen for euro were used for the estimates.Overseas sales are expected to increase year-on-year, and the share of overseas sales to total sales is expected to increase by 3 points to 58%. Continuous increase of the sales to non-Japanese automobile manufacturers is expected, and the share of sales to non-Japanese automobile manufacturers to total sales is forecasted to increase by 1.6 points year-on-year to 11.9%. Domestic sales are projected to decrease year-on-year. Operating profit is estimated to increase by 2.0% to ¥2.6 billion. In this fiscal year too, the cost reduction of main products will cover the increase in labor cost. Despite of the increased production, only slight increase in operating profit is forecasted due to the strong yen. Ordinary profit is estimated to grow by 2.4% to ¥2.5 billion. Net profit is estimated to increase by 12.1% to ¥1.8 billion. As for the first half and the second half, recovery is expected in the second half. Dividend is estimated to rise by ¥5 year-on-year to ¥65 per share and payout ratio 29.7%. The planned capital investment which includes the amount in transit from last fiscal year is ¥6.9 billion, whose breakdown focuses on production increase, maintenance, renewal and streamlining. |

| Interview with President Akira Yamamoto |

|

<The 6th Midterm Business Plan made a good start overall>

<Productivity has been increased by the improved PDCA>

*Processed amount = output - (raw material cost + subcontracting cost + supplies expenses + increase and decrease in works-in-process) <Manufacturing based on Cultivating Human Resources>

<New Product Business in a long-term perspective>

<Two attempts for more innovative manufacturing>

<Message to investors: "from a normal company to a more reliable company. The business focused on the quality.">

|

| Conclusions |

|

Profits for fiscal year March 2017 will have a modest growth, yet operating profit on sales will be over 5% due to the cost reduction which took effect. A careful look will be taken at the aim of achieving over 7% on operating profit on sales for fiscal year March 2018, the final year of the 6th Midterm business plan. The key points from the mid to long term perspective will be the sales promotion of existing products (automobile engine parts) and the timing of the profit contribution of new products business (non-automobile engine parts). |

| <Reference1:6th Midterm Business Plan> |

|

① 6th Midterm Business Plan Overview

Nippon Piston Ring celebrated its 80th year of operations in December 2014. At such milestone, efforts are being conducted to expand sales of existing products and cultivate new markets to "establish the foundations for Nippon Piston Ring to prosper for 100 years." These efforts include reflection upon the results of the previous Midterm business plan to get a solid start to the current 6th Midterm Business Plan, which is scheduled to be completed in fiscal year March 2018.

The overseas sales ratio is expected to rise to 59% in the final year of the Plan based upon the outlook for increases in sales to overseas automobile manufacturers.  Sales of piston rings and valve seat inserts to overseas manufacturers are expected to rise from 8.1% in March 2015 to 11.9% in March 2018, the final year of the Plan.  Domestic investment is for streamlining to raise profit rate and for development of new products. The production capacity of piston rings has balanced figure between domestic and overseas, while 70% of the figure is accounted by overseas for valve seat inserts.  ◎ Efforts in the Realm of Existing Business

Nippon Piston Ring already supplies all of the Japanese automobile manufacturers, but the potential to begin supplying other overseas automobile manufacturers which it does not currently conduct business with is large.<Expand Sales to Overseas Automobile Manufacturers> In many instances, piston rings used by non-Japanese automobile manufacturers are supplied to engine manufacturers in modules assembled through tier one suppliers (Piston suppliers). Consequently development support and individual proposals are conducted to each tier one supplier on a project base. In particular, development support proposals to piston manufacturers that do not possess evaluation technologies to assess engines are considered to be an effective marketing strategy. <Gasoline Engine Use Piston Rings>

The automobile manufacturers' needs for "lighter parts" and "improved thermal efficiency" of engines are on the rise.While reducing friction and improving combustion are issues to be properly dealt with when enhancing thermal efficiency, and reductions in the distance between cylinders and various issues associated with material changes require detailed attention regarding lightening of engines, Nippon Piston Ring has effectively responded with its proprietary technologies to these issues, resulting in its expanding business with both Japanese and overseas automobile manufacturers. <Valve Seat Inserts>

Development of high output, low fuel consumption, and low exhaust gas output engines is being conducted against the backdrop of stricter exhaust gas regulations. Nippon Piston Ring's ability to provide thin and large diameter valve seat inserts have come to be regarded highly and consequently being further adopted by manufacturers. The sales in fiscal year March 2016 exceeded ¥10 billion and reached ¥10.3 billion compared to ¥8.8 billion in fiscal year March 2015.

◎ Efforts to Commercialize New Products

New technologies and technologies maintained by companies acquired through M&A activities have been added to the Company's own fundamental technologies. Various efforts to validate tentative theories and to leverage existing technologies to commercialize new products in non-automobile engine applications are being conducted.At the current point in time, efforts are being focused upon developing products for metal injection molding products and dental implant products businesses, in addition to medical use materials and motors parts. <Metal Injection Molding Products Business>

With the goal of expanding the non-automobile engine parts business, the metal injection molding products business of Sumitomo Metal Mining Co., Ltd. was acquired and sales of products began in May 2014.While Nippon Piston Ring had mass produced automobile engine parts made from various metallic materials by this metal injection molding technique, the acquisition of this business will allow it to expand its sales channels by fortifying its product lineup and strengthening its materials and production technologies. <Dental Implant Business>

Nippon Piston Ring acquired the dental implant business from Ishifuku Metal Industry Co., Ltd. in October 2014.This IAT ( The metallic materials and precision processing technologies built up in the main automobile engine parts business will be leveraged in the dental implant business to develop various medical related products. In addition to the high levels of biological compatibility of the "Ti-Ta alloy" medical product materials currently being developed, it can be used in magnetic resonance imaging (MRI) because it is non-magnetic in character. Therefore, usage of this material in pace maker lead wires, electrodes, embolization coils, stents and other products which are placed in the body for prolonged periods of time is being considered. Furthermore, Nippon Piston Ring is participating in exhibitions to display its products as a means of cultivating the United States market, the world's largest market. Nippon Piston Ring acquired ISO13485 certification to ensure that products made within the dental implant products (highly regulated medical devices) business pass strict requirements for high quality levels. Subsequent to this certification, the Company established a Medical Device Center (MDC) within its Tochigi Plant and began operations. |

| <Reference2:Corporate Governance> |

◎ Corporate Governance Report

The company submitted the Corporate Governance Report on December 24, 2015 after the Corporate Governance Code was introduced.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and/or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016, All Rights Reserved by Investment Bridge Co., Ltd. |