Bridge Report:(6461)Nippon Piston Ring the first half of the fiscal year 2019

President Akira Yamamoto | Nippon Piston Ring CO., LTD. (6461) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Akira Yamamoto |

HQ Address | 5-12-10, Honmachi Higashi, Chuo-ku, Saitama City, Saitama, Japan |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE (Act.) | Trading Unit | |

1,433 yen | 8,374,157 shares | 12,000 million | 6.0% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

75.00 yen | 5.2% | 85.11 yen | 16.8 x | 3,697.86 yen | 0.4 x |

*The share price is the closing price on Nov 29, 2019. The number of shares outstanding, DPS, EPS and BPS were taken from the brief report of the first half of the fiscal year ending March 2020. ROE is the value for the previous term.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS(¥) | DPS(¥) |

Mar. 2016 (Actual) | 52,199 | 2,549 | 2,442 | 1,605 | 195.28 | 60.00 |

Mar. 2017 (Actual) | 52,121 | 3,238 | 2,898 | 2,415 | 293.66 | 65.00 |

Mar. 2018 (Actual) | 55,932 | 3,890 | 4,189 | 2,286 | 277.98 | 70.00 |

Mar. 2019 (Actual) | 57,066 | 3,420 | 3,363 | 1,888 | 229.65 | 75.00 |

Mar. 2020 (Forecast) | 55,500 | 1,500 | 1,500 | 700 | 85.11 | 75.00 |

*Unit: million yen. The forecast is from the Company. The definition for net income is net income attributable to owners of parent.

*A reverse stock split of 1 for 10 was conducted on October 1, 2015.

This Bridge Report provides Nippon Piston Ring Co., Ltd.’s earnings overview for the first half of the fiscal year 2019, as well as an interview with President Yamamoto and so on.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year 2019 Earnings Overview

3. Fiscal Year 2019 Earnings Forecast

4 Interview with President Yamamoto

5. Conclusions

<Reference1: Overview of the Seventh Mid-Term Business Plan >

<Reference2: Corporate Governance>

Key Points

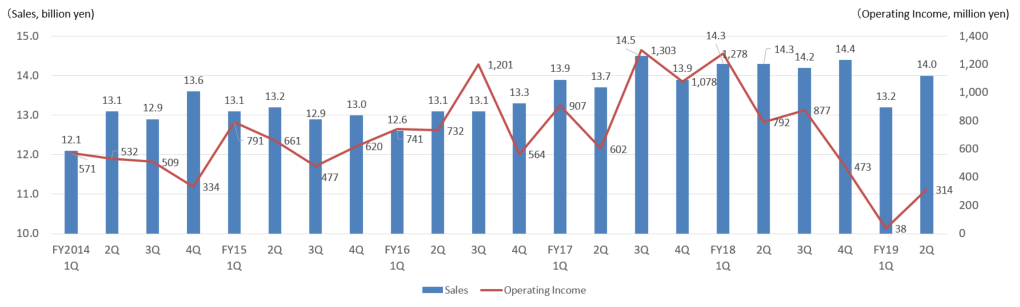

- The sales for the first half of the fiscal year 2019 were 27.3 billion yen, down 4.5% year on year. It is considered to be affected by a decrease in demand due to the slowdown of economies in emerging countries, especially in China and India. The Company’s order receipt environment was relatively strong amid a sharp decline in global automobile production. However, operating income decreased 83.0% year on year to 352 million yen due to the changes in product compositions and the fact that the company did not effectively respond to rapid changes in orders. In August 2019, the forecast for the first half and full year were revised. However, as a result of the sales recovery and progress in cost reduction measures thereafter, the first half results exceeded the revised forecast.

- According to the quarterly results, in the first quarter (April-June), both sales and profit dropped significantly due to the decrease in demand associated with the slowdown in economies in emerging countries such as China and India, as well as temporary changes in the order composition. However, in the second quarter (July-September), the performance has been getting normalized and recovered.

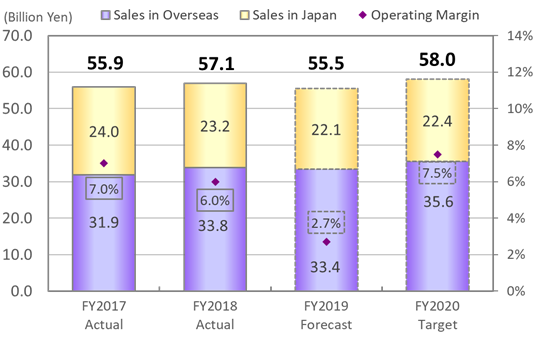

- The company revised the full-year forecast for the fiscal year 2019 and forecasted sales to be 55.5 billion yen, down 2.7% year on year. Domestic sales are estimated to decrease 5.0% year on year to 22.1 billion yen. Overseas sales, which grew in the previous fiscal year, are expected to decline 1.2% year on year to 33.4 billion yen. Operating income is estimated to decrease 56.2% year on year to 1.5 billion yen. Despite cost reduction to offset the rise in personnel expenses and fluctuation of the unit price, it will not cover the decline in profits in the first half. Although the rate of progress in profits against the full-year forecast is low at 20% range, the company is expected to achieve the full-year forecast based on the recovery trend from the second quarter (July to September). There is no change in the dividend estimates. The dividend amount is projected to be a total of 75 yen per share. Payout ratio is estimated at 87%.

- We asked President Yamamoto about the review of the performance in the first half of FY 2019, the forecast for FY 2019, the progress of the mid-term business plan, and efforts in the automotive industry that are entering a period of great change. “Based on the results of the first half, we will further leveraging our strengths in the second half to achieve the full-year forecast,” he said. “After accurately grasping the current situation of the automobile and automobile parts industries, we will always pursue the ideal form and take actions. My mission as the president is, instead of giving priority only to the pursuit of scale, to aim to steadily expand our business to cover every possible situation.”

- In the interview with President Yamamoto, we asked about the company’s positioning and initiatives in the rapidly changing automobile and automobile parts industries. The cars with the current engine will not be replaced by EV at a stretch, but it is difficult to read how long the time axis is. We would like to pay attention to the company’s efforts on how to respond to the changes by leveraging its greatest strength of “manufacturing” from a long-term perspective.

1. Company Overview

Nippon Piston Ring manufactures and sells piston rings and valve seat inserts which are considered to be important functional parts for automobile engines. The Company owns a market share around 30% of piston rings and 40% of valve seat inserts supplied among Japanese automobile manufacturers. It supplies its products not only to all Japanese automobile manufacturers but also to many prominent non-Japanese automobile manufacturers.

Nippon Piston Ring has strengths in metallic materials, surface quality improvement and precision processing technologies. Development of new products and business expansion to non-automobile engine parts realms such as METAMOLD (metal injection molding products) and medical products are recently focused and strengthened.

【1-1 Corporate History】

Nippon Piston Ring was founded by Tomonori Suzuki in 1931 in Kawaguchi City, Saitama Prefecture just prior to the start of mass domestic production of automobiles by manufacturers such as Toyota and Nissan, following the Government program for “establishment of an automobile industry” adopted in August 1935. The company name Nippon Piston Ring Co., Ltd. was officially adopted along with the establishment of the factory in Kawaguchi City in 1934.

During the Second World War, the Company began mass production of chrome plated piston rings for airplanes. At the end of the War in 1945, the factory was temporarily closed, but the Company began operations along with the listing of its shares on Tokyo Stock Exchange in 1949.

Nippon Piston Ring’s earnings expanded rapidly along with the rapid expansion in Japanese automobile exports, and the strong demand for vehicles due to economic growth in the post-war reconstruction within Japan.

Beginning to provide products to German and American automobile manufacturers in the 1970s, the Company has continued organizing a global manufacturing and sales structure, establishing production bases in Thailand, Indonesia, United States, China and India since 2000.

The metal injection molding products business and dental implants business were acquired in 2014 as part of the strategy of expanding its product lineup outside of the automobile engine parts realm, and the Company has started to operate the business by its own facility since 2015.

【1-2 Corporate Philosophy】

Corporate Philosophy | 1. We pursue every business operation on the principle of placing the No. 1 priority on customers. 2. We respond with flexibility to changes in the environment and secure appropriate levels of profits to reflect our appreciation of our shareholders, suppliers, and business partners. 3. In harmony with society, we contribute to the progress of human beings by securing the position of a global comprehensive parts manufacturer. 4. We strive for the prosperity of the corporation and welfare of its employees through perpetual efforts for innovation and improvement in performance. |

Our Corporate Action Guideline | We strive for the prosperity of our company and our welfare by combining our ingenious attempts and diligence through close teamwork of the employees in the realms of manufacturing, sales, and engineering. |

【1-3 Market Environment】

◎Global Automobile Production Volume

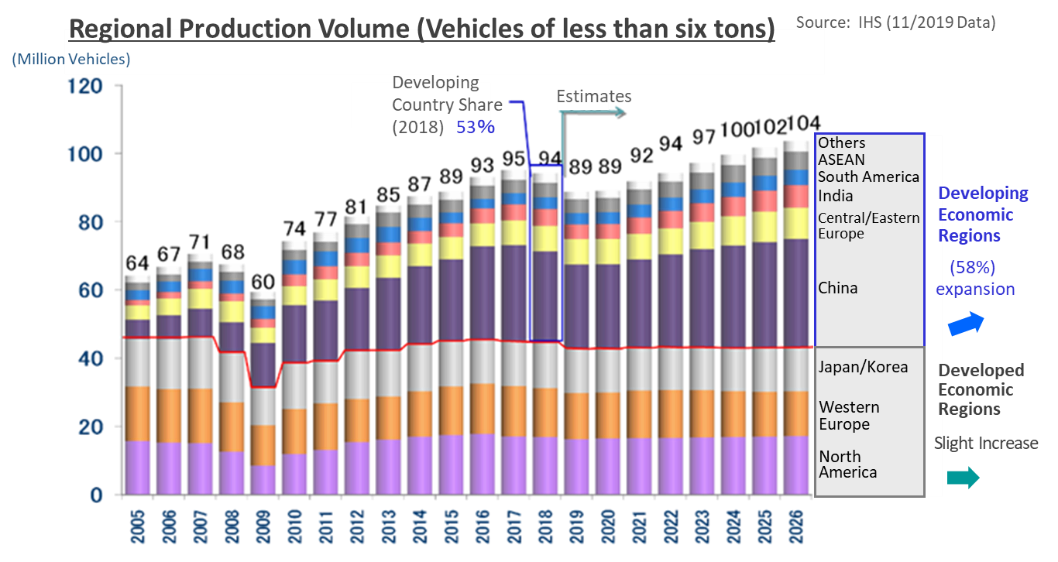

The worldwide number of manufactured vehicles of less than six tons will temporarily decrease during the period from 2018 to 2020 due to the recession in emerging markets such as China and India. However, it is considered that the number of produced vehicles will continue to increase from 2021 and will reach 104 million by 2026.

Looking at the details of these estimates, vehicles of less than six tons manufactured in Europe, North America, Japan and other economic developed regions are expected to show the same level. However, the share of vehicles of less than six tons manufactured in China, ASEAN countries, South America, India and other developing economic regions is expected to continue to expand gradually from 53% in 2018 to 58% in 2026.

(Source: Nippon Piston Ring)

◎ Production Volume by Powertrain (Drive System)

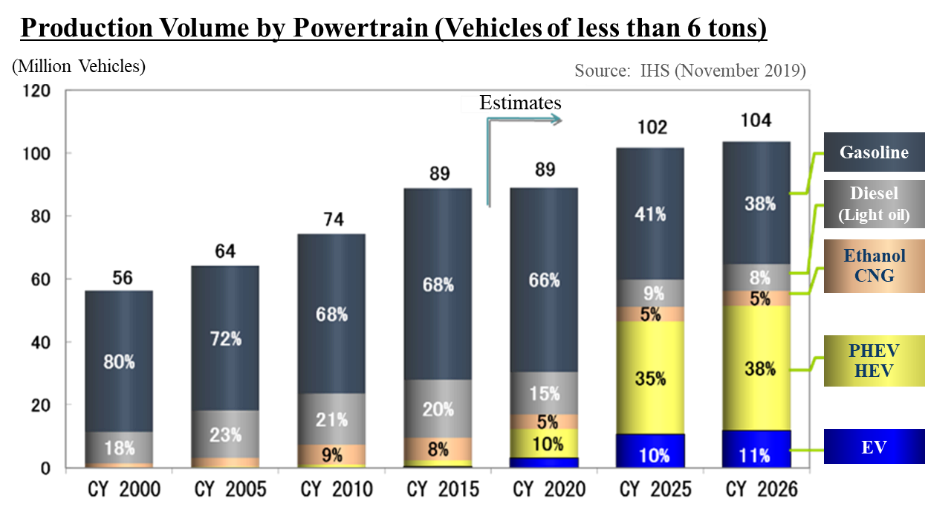

It is projected, regarding the production volume forecast by powertrain (drive system), the growing environmental awareness will result in a reduction in the share of gasoline and diesel engines, while the share of electric vehicles (EVs), which don’t require engines, is expected to account for 11% in 2026. On the other hand, the share of hybrid vehicles (PHEVs, HEVs) will increase significantly, mainly in developing economic regions, which means that demand for piston rings and valve seat inserts is expected to continuously grow.

(Source: Nippon Piston Ring)

◎ Competitor Comparisons

Stock Code | Company Name | Sales (¥mil) | YY Growth | Operating Income (¥mil) | YY Growth | Operating Margin | ROE | Market Cap (¥mil) | PER (x) | PBR (x) |

6461 | NPR Co., Ltd. | 55,500 | -2.7% | 1,500 | -56.2% | 2.7% | 6.0 | 12,000 | 16.8 | 0.4 |

6462 | Riken Corp. | 83,000 | -8.2% | 4,700 | -32.1% | 5.7% | 6.9 | 45,468 | 12.8 | 0.6 |

6463 | TPR Co., Ltd. | 187,700 | -2.6% | 15,400 | -15.9% | 8.2% | 11.0 | 75,052 | 6.8 | 0.7 |

* Sales and operating income are estimates of the respective companies. ROE is based upon actual data of the last year. Market capitalization, PER, and PBR are based upon closing share prices of the respective companies on November 29, 2019.

There are three publicly traded companies in Japan that manufacture piston rings, including Nippon Piston Ring. Riken Corporation (6462) boasts of a top share of the piston ring market close to 50%, but TPR Co., Ltd. (6463) boasts of much larger scale on earnings and market capitalization than the other two companies.

Sales and profit are estimated to decrease for the 3 companies in the current term. As of the second quarter, NPR and Riken Corporation have revised their full-year estimates downwardly. PBR is below 1, thus improving ROE and achieving a performance that exceeds the investors’ expectations are desirable.

【1-4 Business Description】

◎Main Products

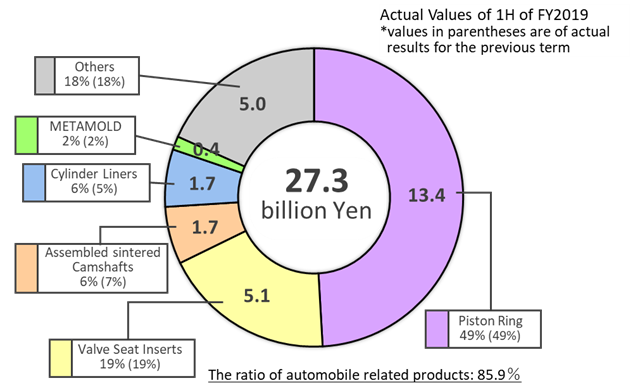

As reflected in the Company name, piston rings are one of the main products manufactured. In addition, valve seat inserts and various other automobile parts are manufactured and sold. In the first half of fiscal year 2019, automobile related parts accounted for 85.9% of total sales.

At the same time, development of new products and business expansion to non-automobile engine parts realms such as METAMOLD (metal injection molding products) and medical products including dental implant products, which got acquired in 2014 are being strengthened.

| |

(METAMOLD) |

(Dental Implant) |

(Source: Nippon Piston Ring)

<Product Sales Composition>

(Source: Nippon Piston Ring)

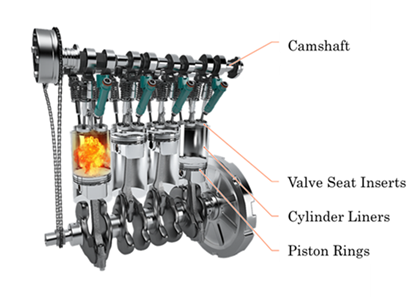

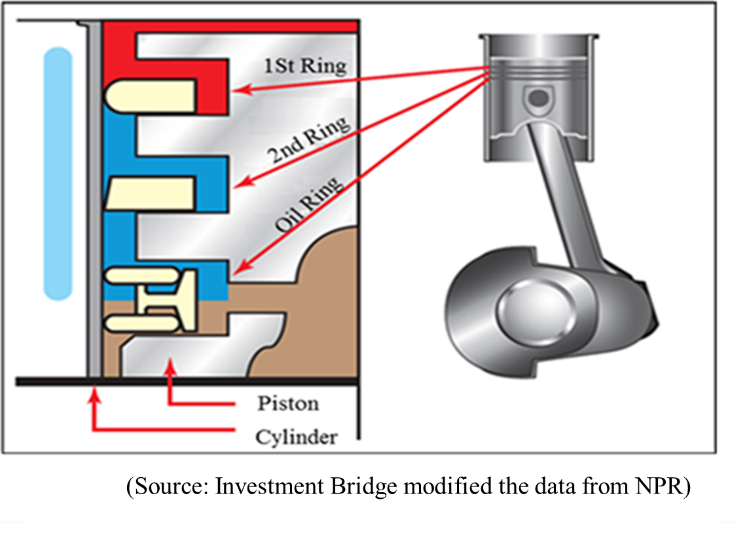

<Engine Cutaway Diagram>

(Source: Investment Bridge modified the data from NPR) |

<Piston Rings> Piston rings are fitted in grooves that run around the circumference of pistons and have spring-like characteristics to act as a seal for ideal combustion within the combustion chamber of the engine cylinders and control lubrication of the piston and cylinder walls by forming precise circles. Moreover, three piston rings are normally used, to form a seal to prevent leakage of oil, allow heat to escape and reduce both friction wear and baking. Smooth movement of pistons will be impeded and fuel consumption will be negatively impacted when the tensional force of the piston ring placed on pistons is too high. Conversely, loss of power resulting in increased oil consumption will happen if the tensional force of the piston ring placed on pistons is too low. Consequently, optimization of the tensional forces of piston rings is crucial in order to ensure the optimum performance of internal combustion piston engines.

An oil film is formed between the cylinder wall and pistons to reduce friction wear and baking, which could be caused by the high-speed movement of pistons within a high-heat condition of cylinders. However, it does not necessairly mean the oil is thicker the better. Piston oil rings need to be designed to ensure that an optimal thickness of oil film is formed. Piston rings are required to provide wear resistance, material strength, heat resistance, heat conductivity, and oil retention capacity to ensure the optimal performance and durability of engines. |

|

|

With regards to the characteristics required to piston rings, development of piston rings with low friction construction, thinner width, new surface treatment processes, highly durable and low-cost materials is being conducted. At the same time, development and proposal of optimal design technologies using its tuning technic are also promoted.

Nippon Piston Ring is one of only few companies that have the ability to stably manufacture and supply piston rings which requires extremely advanced technological capabilities. In addition, the company is also able to consistently develop revolutionary technologies.

<Valve Seat Inserts> Valve seat inserts are the parts which are press-fitted into the valve seating portion of cylinder heads. Valve seat inserts are the very important part made from sintered alloys with high resistance to wear and deterioration under high heat conditions, which can consequently ensure that a tight seal is formed for clean and efficient combustion. Nippon Piston Ring boasts of quality valve seat inserts that meet the needs of automobile manufacturers at a high level, using a wide range of material variation, leveraging its superior materials development capabilities. Consequently, the Company owns a top share of slightly around 40% of valve seat inserts provided to Japanese automobile manufacturers, and it is further expanding its sales on both Japanese and overseas motor vehicle manufacturers. |

(Valve Seat Inserts) |

<Camshafts> Camshafts are a part designed to open and close the valves for each cylinder in piston engines. Nippon Piston Ring has the original technology for a special camshaft called assembled sintered camshafts, which are lightweight, highly resistant to contact pressure and capable of adopting a wide variety of designs. They are used by SUBARU in all of its self-manufactured engines, as well as used by truck manufacturers, which require highly durable products. |

(Assembled Sintered Camshafts) |

< METAMOLD (Metal injection molding products) > In recent years, various processing technologies and methods, including machine processing, precision casting (lost wax), die casting, and press sintering, have been selected and used for molding metallic parts based on functions and costs required for parts. “METAMOLD,” which was developed as a completely new 5th-generation processing technology, is a resource-saving and energy-saving technology that was developed based on the metallurgical technology that the Company has cultivated over years. It has made it possible to manufacture the same complicated shape as plastic products and die-cast products. The Company has expanded the lineup of product groups by strengthening its material and manufacturing technology and expanded its business to not only automobile engine parts but also non-automobile engine parts including industrial mahcinery and office automation parts. Especially, demand for circulation piece for ball screws is increasing. |

(METAMOLD)

|

◎Customers

Nippon Piston Ring supplies piston rings and valve seat inserts to all Japanese automobile manufacturers.

The products supplied by the Company are extremely important in improving the performance of engines to require high levels of technical expertise. In recent years, the need to improve fuel consumption and to seek alternative fuels due to the growing importance of environmental issues has contributed to expanded sales to non-Japanese automobile manufacturers such as European, American and Chinese local automobile manufacturers.

Main Customers Japanese | Products Supplied |

| Main Customers Non-Japanese | Products Supplied | ||

Piston Rings | Valve Seat Inserts |

| Piston Rings | Valve Seat Inserts | ||

Toyota | ○ | ○ |

| Daimler | ○ | ○ |

SUBARU | ○ | ○ |

| BMW | ○ | ○ |

Isuzu Motors | ○ | ○ |

| Audi/VW |

| ○ |

Hino Motor | ○ | ○ |

| Renault | ○ | ○ |

Honda | ○ | ○ |

| FCA | ○ |

|

Nissan | ○ | ○ |

| GM | ○ | ○ |

Mazda | ○ | ○ |

| Ford | ○ |

|

Daihatsu | ○ | ○ |

| Harley Davidson | ○ |

|

Kubota | ○ | ○ |

| Hyundai Motor |

| ○ |

Suzuki | ○ | ○ |

| Hero MotoCorp |

| ○ |

Mitsubishi Fuso | ○ | ○ |

| Ashok Leyland |

| ○ |

Yamaha Motor | ○ | ○ |

| Guangzhou Automobile | ○ | ○ |

|

|

|

| Shanghai Automotive Industry | ○ | ○ |

|

|

|

| First Automobile Works |

| ○ |

|

|

|

| Dongfeng Motor Corp. | ○ |

|

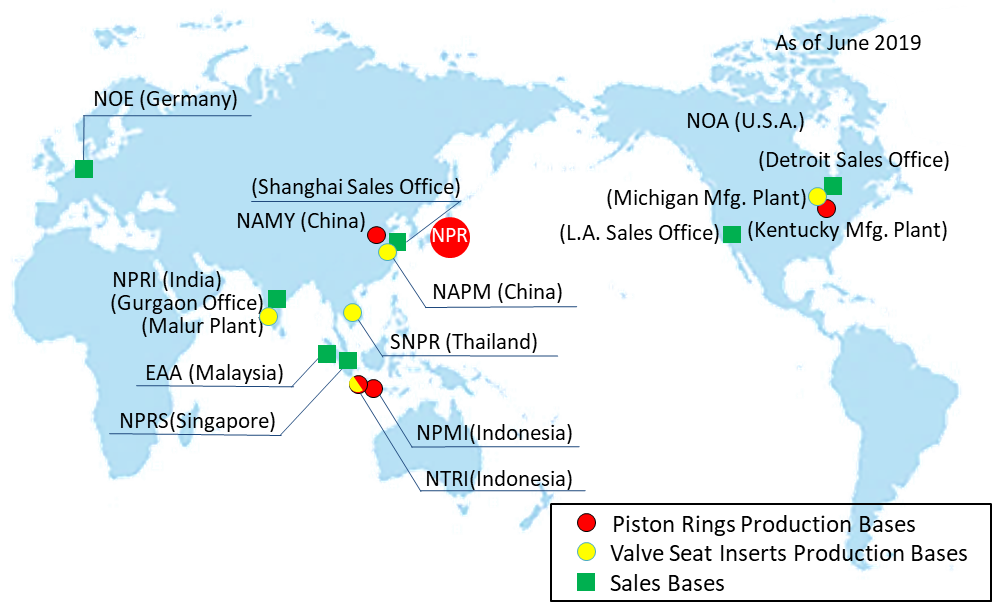

【1-5 Production and Sales Bases】

<Japan>

Nippon Piston Ring maintains four production bases and seven sales bases (Tokyo [head office: Saitama City], Nagoya, Osaka, Hiroshima, Fukuoka, Sendai, Sapporo) within Japan.

(Production Bases)

Facility, Plant Name | Main Products Manufactured |

NPR Iwate Co., Ltd., Ichinoseki Plant | Automobile, Land, Marine and Other Engine Use Piston Rings |

NPR Iwate Co., Ltd., Senmaya Plant | Automobile, Land, Marine and Other Engine Use Cast Piston Ring |

NPR Fukushima Works Co., Ltd. | Valve Seat Inserts, Cylinder Liners, etc. |

Nippon Piston Ring Co., Ltd., Tochigi Plant | Assembled Sintered Camshafts, Marine Engine Use Piston Rings, METAMOLD, etc. |

<Overseas>

Nippon Piston Ring maintains both manufacturing and sales bases for piston rings, valve seat inserts and other products in the United States, China, ASEAN countries, and India. The Company has sales bases in Germany, Singapore and Malaysia , too.

(Overseas Bases)

Facility, Plant Name | Location | Voting Rights Ratio | Main Products Manufactured |

NPR of America, Inc. (NOA) | US | 100% | (Kentucky Mfg. Plant) Piston Rings (Michigan Mfg. Plant) Valve Seat Inserts (Detroit Sales Office, L.A. Sales Office) Sales bases |

NPR Auto Parts Manufacturing (Yizheng) Co., Ltd. (NAMY) | China | 100% | Piston Rings (Shanghai Sales Office) Sales base |

NPR ASIMCO Powdered Metals Manufacturing (Yizheng) Co., Ltd. (NAPM) | China | 50% | Valve Seat Inserts |

PT. NT Piston Ring Indonesia (NTRI) | Indonesia | NPR Group 100% | Piston Rings, Valve Seat Inserts |

PT. NPR Manufacturing Indonesia (NPMI) | Indonesia | NPR Group 100% | Cast Piston Rings |

Siam NPR Co., Ltd. (SNPR) | Thailand | NPR Group 100% | Valve Seat Inserts |

NPR Auto Parts Manufacturing India Pvt. Ltd. (NPRI) | India | NPR Group 100% | (Malur Plant) Valve Seat Inserts (Gurgaon Office) Sales base |

NPR of Europe GmbH (NOE) | Germany | 70% | Sales base |

NPR Singapore Pte. Ltd. (NPRS) | Singapore | 90% | Sales base |

E.A Associates Sdn. Bhd (EAA) | Malaysia | NPR Group 81% | Sales base |

(Source: Nippon Piston Ring)

【1-6 Characteristics and strengths】

Nippon Piston Ring’s highly advanced technologies and ability to consistently supply highly reliable functional automobile parts maintained throughout its history for over 80 years of operations, which has also allowed it to become the choice of both Japanese and overseas automobile manufacturers. In recent years, development of major products, which can contribute to reductions in exhaust gases, low output levels of carbon dioxides and the achievement of “over 50% thermal efficiency rates” in internal combustion engines, is being conducted.

(Nippon Piston Ring’s Three Main Technology Categories)

Technologies | Details |

Metallic Materials | Technologies for developing materials with high functionality demanded for various automobile parts including wear resistant alloy cast iron, high functional steel and sintered alloy metal. Holding technology of titanium tantalum alloy as medical supplies having superiority in bio compatibility and corrosion resistance. |

Surface Processing (Surface Improvements) | Technologies for increasing the added value of materials by giving necessary functions including heat & wear resistance, lubricating property, and low friction such as thermal spray, plating, nitriding, PVD, DLC and other material surface processing. |

Precision Processing | Technologies for molding various precise forms and dimensions through machine processing, plastic forming and other processes. |

With regards to product development, the ability to combine the said technologies and its simulation technologies applied to engines is one of Nippon Piston Ring’s strengths.

In addition, automobile manufacturers, to whose business the Company’s high levels of technological expertise are critical, are what the Company calls its “client assets,” which are an important part of its corporate value.

【1-7 ROE Analysis】

| FY2014 | FY2015 | FY2016 | FY2017 | FY2018 |

ROE (%) | 7.9 | 5.4 | 8.2 | 7.4 | 6.0 |

Net Profit Margin (%) | 4.21 | 3.07 | 4.63 | 4.09 | 3.31 |

Total Asset Turnover (x) | 0.80 | 0.80 | 0.80 | 0.84 | 0.87 |

Leverage (x) | 2.34 | 2.20 | 2.21 | 2.14 | 2.09 |

Despite the rise in total asset turnover, the ratio of net income to sales declined, and ROE of FY 2018 fell behind that of FY 2017 by 1.4%.

The ratio of net income to sales in FY 2019 is expected to be 1.3%. We would like to expect ROE to grow, as profitability improves in the next year onwards.

2. First Half of Fiscal Year 2019 Earnings Overview

(1) Consolidated Business Overview

| 1H of FY2018 | Ratio to sales | 1H of FY2019 | Ratio to sales | YOY | Compared with the initial forecast | Compared with the revised forecasts |

Net Sales | 28,537 | 100.0% | 27,264 | 100.0% | -4.5% | -0.9% | +1.0% |

Gross margin | 6,844 | 24.0% | 5,325 | 19.5% | -22.2% | - | - |

SG&A expenses | 4,774 | 16.7% | 4,973 | 18.2% | +4.2% | - | - |

Operating income | 2,070 | 7.3% | 352 | 1.3% | -83.0% | -64.8% | +252.5% |

Ordinary income | 2,084 | 7.3% | 339 | 1.2% | -83.7% | -66.1% | +239.7% |

Net income | 1,194 | 4.2% | 41 | 0.2% | -96.5% | -91.8% | - |

* Unit: million yen. The definition for net income is net income attributable to owners of parent (Hereinafter the same apply). The definition for Compared with the revised forecasts is the ratio to the forecasts revised in August 2019.

Sales and profit decreased to a point that is below the initial forecasts.

Sales were 27.3 billion yen, down 4.5% year on year. It is considered to be caused by a decrease in demand due to the slowdown of economic growth in emerging countries, especially in China and India. Domestic sales decreased 6.6% year on year to 10.9 billion yen. Overseas sales decreased 3.0% year on year to 16.4 billion yen, and overseas sales ratio was 60%.

The Company’s order receipt environment was relatively strong amid a sharp decline in global automobile production. However, operating income decreased 83.0% year on year to 352 million yen due to the changes in product compositions and the fact that the company did not effectively respond to rapid changes in orders.

Ordinary income decreased 83.7% year on year to 339 million yen, due to foreign exchange losses in addition to the decline in operating income. Net income fell 96.5% year on year to 41 million yen.

In August 2019, the Company announced revisions of the earnings forecast. However, as a result of sales recovery and progress in cost reduction measures thereafter, the first half results exceeded the revised forecast.

On the quarterly basis, in the first quarter (April-June), sales and profit dropped significantly due to a decrease in demand associated with the slowdown of economic growth in emerging countries such as China and India, as well as temporary fluctuations in the order composition. However, in the second quarter (July-September), the performance has been getting normalized and recovered.

(2) Sales by Products

| 1H of FY2018 | 1H of FY2019 | YOY |

Piston Ring | 138 | 134 | -2.8% |

Valve Seat Insert | 55 | 51 | -8.5% |

Assembled Sintered Camshaft | 18 | 17 | -9.2% |

METAMOLD | 6 | 4 | -37.4% |

Others | 67 | 67 | -0.1% |

Total | 285 | 273 | -4.5% |

*Unit: 100 million yen.

Sales of piston rings and valve seat inserts, which are the company’s mainstay products, decreased. Although the composition ratio was low, sales of METAMOLD also decreased due to the sluggish demand for machine tools in China.

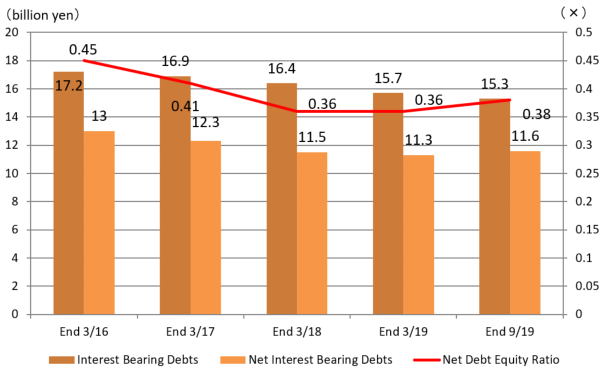

(3) Financial Condition and Cash Flow

◎Main BS

| End of March 2019 | End of September 2019 |

| End of March 2019 | End of September 2019 |

Current assets | 28,489 | 26,879 | Current liabilities | 23,001 | 23,548 |

Cash and deposits | 4,386 | 3,671 | Trade payables | 8,663 | 8,179 |

Trade receivables | 12,821 | 11,218 | Short-term interest-bearing debts | 8,277 | 9,292 |

Inventories | 9,983 | 10,591 | Non- current liabilities | 10,296 | 9,069 |

Non-current assets | 37,304 | 37,495 | Long-term interest-bearing debts | 7,395 | 5,983 |

Property, plant and equipment | 29,840 | 29,990 | Total liabilities | 33,298 | 32,618 |

Intangible assets | 815 | 873 | Net assets | 32,495 | 31,756 |

Investments and other assets | 6,648 | 6,631 | Shareholder’s Equity | 30,189 | 29,860 |

Total assets | 65,793 | 64,374 | Retained earnings | 14,599 | 14,270 |

| Total liabilities and net assets | 65,793 | 64,374 | ||

| Total interest-bearing debts | 15,672 | 15,275 | ||

*Unit: million yen. Trade payables include electronically recorded accounts payable.

*Interest-bearing debts includes lease obligations.

Current assets declined 1.6 billion yen from the end of the previous fiscal year, due to the decrease in trade receivables, etc. Non-current assets were almost unchanged, and total assets decreased to 64.4 billion yen, down 1.4 billion yen from the end of the previous fiscal year.

Total liabilities fell to 32.6 billion yen, down 700 million yen from the end of the previous fiscal year, as long-term interest-bearing debts, etc. decreased. Interest-bearing debts were 15.3 billion yen, down 400 million yen from the end of the previous fiscal year.

Equity ratio was 47.2%, a slight decrease from the end of the previous fiscal year.

Interest-bearing debts fell below those at the end of the previous term, while net interest-bearing debts and net debt-to-equity ratio exceeded those at the end of the previous term.

◎ Cash Flow

| 1H of FY2018 | 1H of FY2019 | Increase/decrease |

Operating Cash Flow | 3,497 | 2,260 | -1,237 |

Investing Cash Flow | -1,805 | -2,165 | -360 |

Free Cash Flow | 1,692 | 95 | -1,597 |

Financing Cash Flow | -1,372 | -748 | +624 |

Term End Cash and Equivalents | 5,083 | 3,671 | -1,412 |

*Unit: million yen

The surplus of Operating CF shrank due to the decline in net income before taxes and other adjustments, etc. Since the purchase of property, plant and equipment increased, the deficit of Investing CF grew. In total, the surplus of Free CF shrank.

The deficit of Financing CF shrank due to the increase in short-term loans payable, etc. The cash position declined.

(4) Topics

◎NPR received the Global Quality Award from Nissan Motor Corporation.

As stated in the main initiatives of the seventh mid-term business plan, in order to “Strive for the world’s highest quality,” NPR is working on reforming all employees’ awareness on quality, in addition to improving work quality and product quality. In recognition of such global quality initiatives, the Company received the “Global Quality Award” from Nissan Motor Corporation. This proves high recognition from 4 departments (i.e. Development, Production, Purchasing, Market Quality Improvement) of Nissan Motor Corporation, and the Company will continue to make efforts to maintain and improve quality.

|

|

3. Fiscal Year 2019 Earnings Forecast

(1) Consolidated Earnings Forecast

| FY 2018 | Ratio to sales | FY 2019 (forecast) | Ratio to sales | YOY | Revision rate | Progress rate |

Net Sales | 57,066 | 100.0% | 55,500 | 100.0% | -2.7% | -0.9% | 49.1% |

Operating income | 3,420 | 6.0% | 1,500 | 2.7% | -56.2% | -42.3% | 23.5% |

Ordinary income | 3,363 | 5.9% | 1,500 | 2.7% | -55.4% | -42.3% | 22.6% |

Net income | 1,888 | 3.3% | 700 | 1.3% | -62.9% | -56.3% | 5.9% |

*Unit: million yen. The forecasts are from the Company. The definition for net income is net income attributable to owners of parent.

*Revision rate is the ratio of changes in forecasts revised in August 2019 to the original forecast.

The forecast was revised downwardly. Sales and profit declined.

The forecast was revised downwardly in August 2019. Under the assumption of yen appreciation with foreign exchange rate being 105 yen per US dollar and 120 yen per euro, sales are forecasted to be 55.5 billion yen, down 2.7% year on year. Domestic sales are forecasted to be 22.1 billion yen, down 5.0% year on year. Overseas sales that performed well in the previous year is forecasted to be 33.4 billion yen, down 1.2% year on year.

Operating income is forecasted to be 1.5 billion yen, down 56.2% year on year. Despite cost reduction to offset the rise in personnel expenses and fluctuation of the unit price, it will not cover the decrease in profit in the first half. Although the rate of progress in profit against the full-year forecast is low at 20% range, the Company is expected to achieve the full-year forecast based on the recovery trend from the second quarter (July to September).

Ordinary income is forecasted to be 1.5 billion yen, down 55.4% year on year. Net income is forecasted to be 0.7 billion yen, down 62.9% year on year.

There is no change in the dividend estimates. The dividend amount is projected to be a total of 75 yen per share. Payout ratio is estimated at 87%.

4. Interview with President Yamamoto

We asked President Yamamoto about the review of the performance in the first half of FY 2019, the forecast for FY 2019, and the progress of the mid-term business plan.

Q: “How do you assess the financial results for the first half of FY 2019? Please also tell us about the outlook and initiatives for the second half.”

A: “Although sales and profit declined, the order receipt environment was relatively strong. I believe that the reason why we were able to win a certain number of orders while the global automobile production declined significantly was that we could demonstrate our strengths. Having said so, our response to sudden increases or decreases in production volume was not adequate, and profit was not satisfactory. Based on the results of the first half, we will further leveraging our strengths in the second half to achieve our full-year forecast.”

Sales and profit in the first quarter (April-June) dropped significantly due to the decline in demand in association with the slowdown of economies in emerging countries such as China and India, and sales and profit declined in the first half. However, they are on a gradual recovery trend from the second quarter.

We were able to win a certain number of orders in the midst of a significant decline in the number of automobiles produced around the world. This can be seen as a proof that our technical capabilities have been valued by customers, and we believe that we were able to demonstrate our strengths.

On the other hand, we did not effectively respond to the sudden decreases in manufacturing of existing products and the unexpected increases in manufacturing of newly launched products. Thus, profit did not meet our expectation at all.

While it is very difficult to forecast market trends both in Japan and overseas, there are challenges in efficiently responding to rapid fluctuations in orders. We will continue to strengthen manufacturing capabilities that are adapts well to changes, along with steady cost reduction activities.

Although profit was especially not so good in the first half, based on the results of the first half, we will leverage our strengths in the second half to achieve the full-year forecast.

Q: “Next, please tell us about the progress of the 7th mid-term business plan.”

A: “We will put more efforts on the sales that is oriented to making and using technical proposals both domestically and abroad. The pursuit of our innovative manufacturing is making steady progress. We will continue to work on strengthening new product development from a long-term perspective. As for human resource development, graduates from the NPR Internal College for Manufacturing are becoming the substantial part of workforce. We are also building a system that makes better environment for female employees to participate in the College.”

We continue to proactively carry out sales that is oriented to making and using technical proposals centered on technical exchanges with Japanese and non-Japanese automobile manufacturers.

From the perspective of protecting the global environment, reducing CO2 emissions is a challenge for every automobile manufacturer. Our products can contribute to reducing CO2 emissions of internal combustion engines through improved fuel efficiency including improved thermal efficiency. Automobile manufacturers must clear the hurdles of environmental regulations that will get more severe in the future, and we will further promote our sales that is oriented to making and using technical proposals to appeal our technical capabilities.

As for pursuing innovative manufacturing, we launched the second line of innovative production lines for piston rings in the Ichinoseki plant during this fiscal year. Also, at overseas bases, following North America in the previous fiscal year, we are planning to introduce an innovative production line in China in the next fiscal year. With innovative production lines, we can easily respond to slight changes in product specifications. They also have high production capacity, which will allow us to maintain cost competitiveness. We believe that pursuing innovative manufacturing is an opportunity to acquire new businesses and generate profits, and therefore, we will continue to focus on it.

Regarding the strengthening of new product development, we are currently discussing on business development with our business partners in the medical field, and we will foster them from a long-term perspective.

As for METAMOLD, although sales were sluggish in the first half due to the fluctuations in the market of machine tools, new orders for power steering components in non-automotive engines are confirmed, and demand is expected to increase in the future. Our customers are satisfied with the quality of our products, and currently, we are working on the issues toward the mass-production.

As for the human resource development, it will be 10 years since the establishment of “NPR Internal College for Manufacturing” in FY 2020. So far, the number of graduates exceeded 100, and each production site across Japan has about 30 graduates respectively. They are the central driving force and strength to solve issues at production sites, including cost reduction. They are a substantial part of our workforce and provide reassuring support.

We hope these employees, who started working as managers continue leading production sites.

In the past, there were only male students, but we are now building a system that makes better environment for female employees to participate in the College, and further promote human resources development.

Q: “As the word CASE (Connected, Autonomous Driving, Sharing and Service, Electrification) stands for, the automobile industry is entering a period of major change. Under these circumstances, what kind of position and what kind of initiatives do you intend to pursue?”

A:“After accurately grasping the current situation of the automobile and automobile parts industries, we will always pursue the ideal form and take actions. We recognize that collaboration and alliances are necessary to overcome this era of change. My mission as the president is, instead of giving priority only to the pursuit of scale, to aim to steadily expand our business to cover every possible situation.”

After accurately grasping the current situation of the automobile and automobile parts industries, we will always pursue the ideal form and take actions.

We recognize that collaboration and alliances are necessary to overcome this era of change. My mission as the president is, instead of giving priority only to the pursuit of scale, to aim to steadily expand our business to cover every possible situation based on our current customer bases and our own technologies, assuming that synergy effects can be obtained.

Q: “Please give messages to the shareholders and investors.”

A: “We are carrying out sales activities that respond quickly to market trends and customer needs. At the same time, we are strongly pursuing cost reduction through innovative manufacturing. As we are making efforts to responding to the expectations of our shareholders and investors, we would like to ask for your continuous support.”

In the first half, sales and profit declined, and we ended up revising full-year earnings forecast. However, both sales and profit are on a recovery track. To achieve the revised forecast, we will continue to carry out sales that is oriented to making and using technical proposals and make efforts to reduce costs.

We plan to pay a total dividend of 75 yen/share as expected at the beginning of the fiscal year.

We are carrying out sales activities that respond quickly to market trends and customer needs. At the same time, we are strongly pursuing cost reduction through innovative manufacturing. As we are making efforts to responding to the expectations of our shareholders and investors, we would like to ask for your continuous support.”

5. Conclusions

The rate of progress in profits against the full-year forecast is low and there are uncertainties on the trends of car-sales. However, the order receipt environment was relatively strong and the company is expected to achieve the full-year forecast.

In an interview with President Yamamoto, we asked about the company’s positioning and initiatives in the rapidly changing automobile and automobile parts industries. The cars with the current engine will not be replaced by EV at a stretch, but it is difficult to read how long the time axis is. We would like to pay attention to the company’s efforts on how to respond to the changes by leveraging its greatest strength of “manufacturing” from a long-term perspective.

<Reference1: Overview of the Seventh Mid-Term Business Plan >

◎Overview of the Seventh Mid-Term Business Plan (FY 2018 to FY 2020)

The basic policy, main initiatives and targets of the Seventh Mid-Term Business Plan, which started in 2018, are as follows:

Basic Policy | Improve corporate value through “manufacturing that adapts well to change” ~Establish the foundation for Nippon Piston Ring to prosper for 100 years, through marketing and innovation~ |

Main Initiatives | (1) Increase sales that is oriented to making and using technical proposals, both domestically and abroad (2) Strive for innovative manufacturing (3) Strengthen new product development (4) Strive for the world’s highest quality, by strengthening human resources development (5) Continue to promote Corporate Social Responsibility activities |

Targets (FY2020) | Net Sales of 58.0 billion yen or more and Operating Margin of 7.5% or more |

◎Sales and Operating Margin

(Source: Nippon Piston Ring)

Despite of a temporary decline in global automobile production by 2020 due to the slowdown in economies in emerging countries such as China and India, the company’s order recipt environment is relatively strong. The target for net sales of over 58 billion yen in the fiscal year 2020, which is the final year of the mid-term business plan, has not been changed. Regarding profit, the Company aims to achieve an operating margin of 7.5% or more by promoting cost reduction activities including innovative manufacturing.

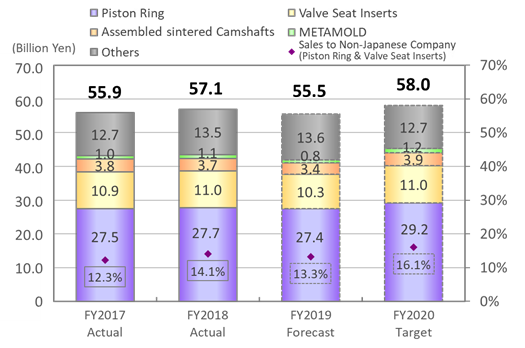

◎Sales by Product

(Source: Nippon Piston Ring)

The company expects sales decline in the fiscal year 2019, but the sales of piston rings and valve seat inserts are estimated to recover by the fiscal year 2020 due to the effect of expanding sales to non-Japanese automobile manufacturers.

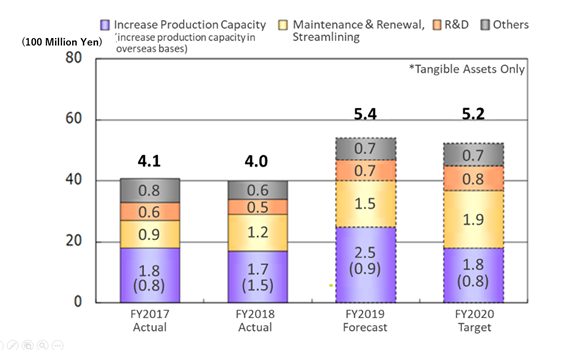

◎Capital Investment

(Source: Nippon Piston Ring)

There is no change in the capital investment plan.

The company strives to improve profitability by responding to increased new production through the development of innovative production lines domestically and overseas, investment for streamlining, etc.

◎Production Capacity of Piston Ring and Valve Seat Inserts

<Piston Ring Production Capacity Comparison>

(Source: Nippon Piston Ring)

< Valve Seat Inserts Production Capacity Comparison>

(Source: Nippon Piston Ring)

More Innovative production lines for piston rings will be established in Japan by FY 2020, and the production capacity is expected to exceed the initial estimates. Furthermore, the company will continue to verify the production capacity of each production base and work to achieve overall optimization.

<Reference2: Corporate Governance>

◎Organization Form, Directors and Auditors

Organization type | Company with auditors |

Directors | 8 including 2 externals |

Auditors | 5 including 3 externals |

◎ Corporate Governance Report

Last modified: June 28, 2019

<Principles Not Conducted and the Main Reasons>

Principle | Reason of Not Conducting |

【1.2.4 The Electronic Voting Platform, English translations of the convening notices of general shareholder meeting】 | With regard to the electronic exercise of voting rights, while paying close attention to the shareholder ratio of foreign corporations, we will continue to examine the creation of an environment where it is easier for foreign shareholders to exercise their voting rights. |

【3.1.2 Publishing and providing information in English】 | The Company considers about publishing and providing information in English while monitoring foreign shareholders ratio. |

The Company appreciates the need for foreign investors to understand the business models better and continues to plan to proceed with more active publishing in English.

<Main Published Principles>

Principle | Details |

【 1.4 Cross-Shareholdings】 | 1. Policy on Cross-Shareholdings The Company considers that it is indispensable to develop cooperative relations with various enterprises in order to continue sustainable growth. Therefore, in order to operate business smoothly from the mid/long-term viewpoint, the company holds the so-called cross-shareholdings if the company judges that this would contribute to its corporate value while taking into account transaction relations, cooperative relations for business, etc. At the board of directors’ meeting, the company checks the necessity of shareholding under the above policy every year, and examine the appropriateness of shareholding while considering benefits, risks, market evaluation of the shares concerned, etc. Subsequently, it considers cutting down securities deemed inappropriate for shareholding. 2. Policy for exercising voting rights The Company makes appropriate decisions about the exercise of voting rights from the viewpoint of mid/long-term corporate value, while respecting the managerial policy and strategy of each issuing company. |

【5.1 Policy for Constructive Dialogue with Shareholders】 | The Corporate Planning Department serves as IR Department and the Company establishes the system for constructive dialogue with stakeholders by holding the IR meeting and smaller meetings, etc. for them. The Company’s basic principles of the Corporate Governance are “Increasing Business Transparency,” “Conducting Accountability for Stakeholders” and “Expediting of the Business.”, and the Company discloses them in the Corporate Governance Report. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |