Bridge Report:(6461)Nippon Piston Ringthe first half of the fiscal year 2020

President Teruo Takahashi | Nippon Piston Ring (6461) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Teruo Takahashi |

HQ Address | 5-12-10, Honmachi Higashi, Chuo-ku, Saitama City, Saitama, Japan |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE (Act.) | Trading Unit | |

968 yen | 8,374,157 shares | 8,106 million | 1.6% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

Undecided | - | -248.01 yen | - | 3,352.50 yen | 0.3 x |

*The share price is the closing price on Nov 27, 2020. The number of shares outstanding, DPS, EPS and BPS were taken from the brief report of the second quarter of the fiscal year ending March 2021. ROE is the value for the previous term.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

Mar. 2017 (Actual) | 52,121 | 3,238 | 2,898 | 2,415 | 293.66 | 65.00 |

Mar. 2018 (Actual) | 55,932 | 3,890 | 4,189 | 2,286 | 277.98 | 70.00 |

Mar. 2019 (Actual) | 57,066 | 3,420 | 3,363 | 1,888 | 229.65 | 75.00 |

Mar. 2020 (Actual) | 54,881 | 1,829 | 1,776 | 490 | 59.96 | 75.00 |

Mar. 2021 (Forecast) | 43,500 | -1,400 | -1,000 | -2,000 | -248.01 | - |

*Unit: million yen. The forecast is from the Company. The definition for net income is net income attributable to owners of parent.

*A reverse stock split of 1 for 10 was conducted on October 1, 2015.

This Bridge Report provides Nippon Piston Ring Co., Ltd.’s earnings overview for the first half of the fiscal year 2020, as well as an interview with President Takahashi and so on.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year 2020 Earnings Overview

3. Fiscal Year 2020 Earnings Forecast

4 Interview with President Takahashi

5. Conclusions

<Reference Corporate Governance>

Key Points

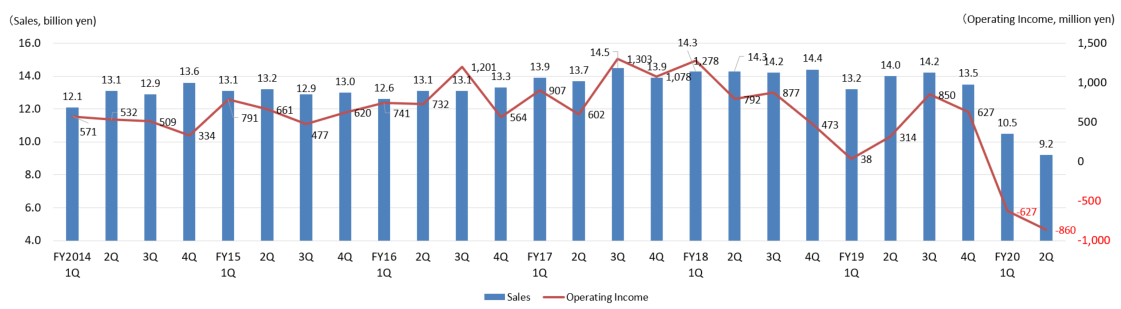

- The sales in the first half of the fiscal year 2020 were 19.6 billion yen, down 28.0% year on year. Due to the spread of the novel coronavirus, the number of automobiles produced has decreased significantly worldwide. Sales of all products declined. Domestic sales dropped 28.2% year on year to 7.8 billion yen. Overseas sales fell 27.8% year on year to 11.8 billion yen, and overseas sales ratio was 60%. Along with the continuous promotion of cost reduction, the company promoted operation adjustment and to reduce fixed costs. Nonetheless, the impact of production cut was substantial, and operating income and ordinary income turned to a loss of 1.5 billion yen and 1.2 billion yen, respectively. Net income was a loss of 1.9 billion yen due to a temporary increase in income taxes-deferred, in addition to the decrease in ordinary income.

- The full-year earnings forecast was revised in November 2020. The annual sales of the fiscal year 2020 are expected to decrease 20.7% year on year to 43.5 billion yen, and operating income is expected to be a loss of 1.4 billion yen. It is predicted that sales and profit will exceed the latest forecast values announced in August 2020, due to the recovery of demands in China and other countries, which resumed economic activities ahead of other countries and regions after the spread of the novel coronavirus, as well as the improvement of productivity, and the effect of reducing fixed costs. The dividend forecast remains undecided.

- We asked the new president Takahashi about his mission, future initiatives, and message to investors. He stated that “the impact of the novel coronavirus is substantial, and we forecast that we will record a loss this fiscal year, but we are aiming to become a strong company that can generate stable profits even if the top-line growth is small, by pushing ahead with structural reforms including shortening lead times, reducing inventories, and reducing fixed costs. In addition, we will establish new businesses as soon as possible in the medium to long term, to work towards our vision for what we want to be in 2030. The current situation is severe and remains uncertain, but I would like shareholders and investors to continue to support us from a medium- to long-term perspective.”

- In the first half of this fiscal year, the company worked to reduce fixed costs such as labor cost and expenses. It also promoted fine-tuned man-hour management and steady cost reductions. As a result, the productivity has been improving even in lower operating rate. The outlook for the business environment remains uncertain, as the novel coronavirus infections have expanded again. Still, the second half shows a recovery trend overall, and the company is working on various measures to exceed the annual forecast.

- The company is now under the leadership of the new president Takahashi, who took over during the novel coronavirus crisis, and we want to pay close attention to how the 8th Medium-Term Management Plan, which will be announced next year, will reflect the path toward The Next NPR 2030. The Next NPR 2030 draws a vision of how the company wants to be after ten years amid the significant changes in the business environment due to the progress of electrification.

1. Company Overview

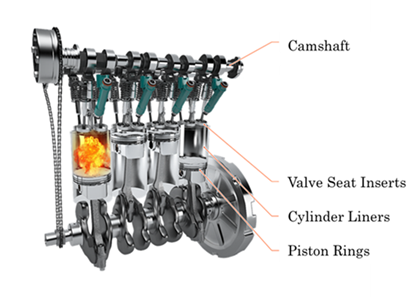

Nippon Piston Ring manufactures and sells piston rings and valve seat inserts which are considered to be important functional parts for automobile engines. The Company owns a market share around 30% of piston rings and 40% of valve seat inserts supplied among Japanese automobile manufacturers. It supplies its products not only to all Japanese automobile manufacturers but also to many prominent non-Japanese automobile manufacturers.

Nippon Piston Ring has strengths in metallic materials, surface quality improvement and precision processing technologies. Development of new products and business expansion to non-automobile engine parts realms such as METAMOLD (metal injection molding products) and medical products are recently focused and strengthened.

【1-1 Corporate History】

Nippon Piston Ring was founded by Tomonori Suzuki in 1931 in Kawaguchi City, Saitama Prefecture just prior to the start of mass domestic production of automobiles by manufacturers such as Toyota and Nissan, following the Government program for “establishment of an automobile industry” adopted in August 1935. The company name Nippon Piston Ring Co., Ltd. was officially adopted along with the establishment of the factory in Kawaguchi City in 1934.

During the Second World War, the Company began mass production of chrome plated piston rings for airplanes. At the end of the War in 1945, the factory was temporarily closed, but the Company began operations along with the listing of its shares on Tokyo Stock Exchange in 1949.

Nippon Piston Ring’s earnings expanded rapidly along with the rapid expansion in Japanese automobile exports, and the strong demand for vehicles due to economic growth in the post-war reconstruction within Japan.

Beginning to provide products to German and American automobile manufacturers in the 1970s, the Company has continued organizing a global manufacturing and sales structure, establishing production bases in Thailand, Indonesia, United States, China and India since 2000.

The metal injection molding products business and dental implants business were acquired in 2014 as part of the strategy of expanding its product lineup outside of the automobile engine parts realm, and the Company has started to operate the business by its own facility since 2015.

【1-2 Corporate Philosophy】

Corporate Philosophy | 1. We pursue every business operation on the principle of placing the No. 1 priority on customers. 2. We respond with flexibility to changes in the environment and secure appropriate levels of profits to reflect our appreciation of our shareholders, suppliers, and business partners. 3. In harmony with society, we contribute to the progress of human beings by securing the position of a global comprehensive parts manufacturer. 4. We strive for the prosperity of the corporation and welfare of its employees through perpetual efforts for innovation and improvement in performance. |

Our Corporate Action Guideline | We strive for the prosperity of our company and our welfare by combining our ingenious attempts and diligence through close teamwork of the employees in the realms of manufacturing, sales, and engineering. |

【1-3 Market Environment】

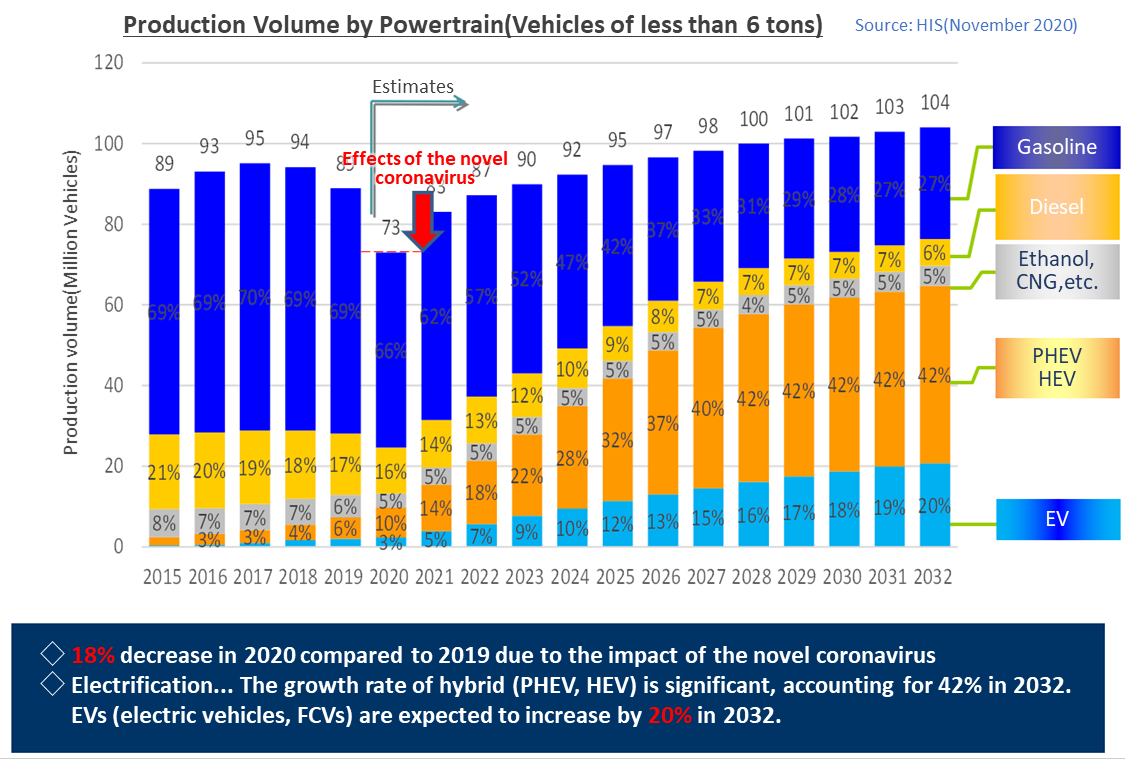

◎Forecast of Global Automobile Production Volume

Global production of vehicles weighing less than 6 tons has been affected by the spread of the novel coronavirus. It will decrease by 18% in 2020 from 2019, but it will gradually recover from 2021 onward and is expected to reach 100 million units in 2028.

When looking at production volume by powertrain (drive system), the ratios of gasoline engines and diesel engines will drop due to heightened environmental awareness, and hybrid (PHEV, HEV) and EV ratios will increase. However, the composition ratio of pure electric vehicles (EV) without an engine will remain at 20% even in 2032, and the composition ratio of hybrid electric vehicles (PHEV, HEV) will rise to 42%. Thus, the demands for piston rings and valve seat inserts are expected to remain strong.

(Source: Nippon Piston Ring)

◎ Competitor Comparisons

Stock Code | Company Name | Sales (¥mil) | YoY Growth | Operating Income (¥mil) | YoY Growth | Operating Margin | ROE | Market Cap (¥mil) | PER (x) | PBR (x) |

6461 | NPR Co., Ltd. | 43,500 | -20.7% | -1,400 | - | - | 1.6 | 8,106 | - | 0.3 |

6462 | Riken Corp. | 67,000 | -20.7% | 100 | -98.1% | 0.1% | 5.0 | 24,608 | - | 0.3 |

6463 | TPR Co., Ltd. | 142,400 | -20.2% | 4,500 | -67.7% | 3.2% | 6.8 | 50,576 | 17.1 | 0.5 |

* Sales and operating income are estimates of the respective companies. ROE is based upon actual data of the last year. Market capitalization, PER, and PBR are based upon closing share prices of the respective companies on November 27, 2020.

There are three publicly traded companies in Japan that manufacture piston rings, including Nippon Piston Ring. Riken Corporation (6462) boasts of a top share of the piston ring market close to 50%, but TPR Co., Ltd. (6463) boasts of much larger scale on earnings and market capitalization than the other two companies.

Sales and profit are estimated to decrease for the 3 companies in the current term. PBR is below 1, thus improving ROE and achieving a performance that exceeds the investors’ expectations are desirable.

【1-4 Business Description】

◎Main Products

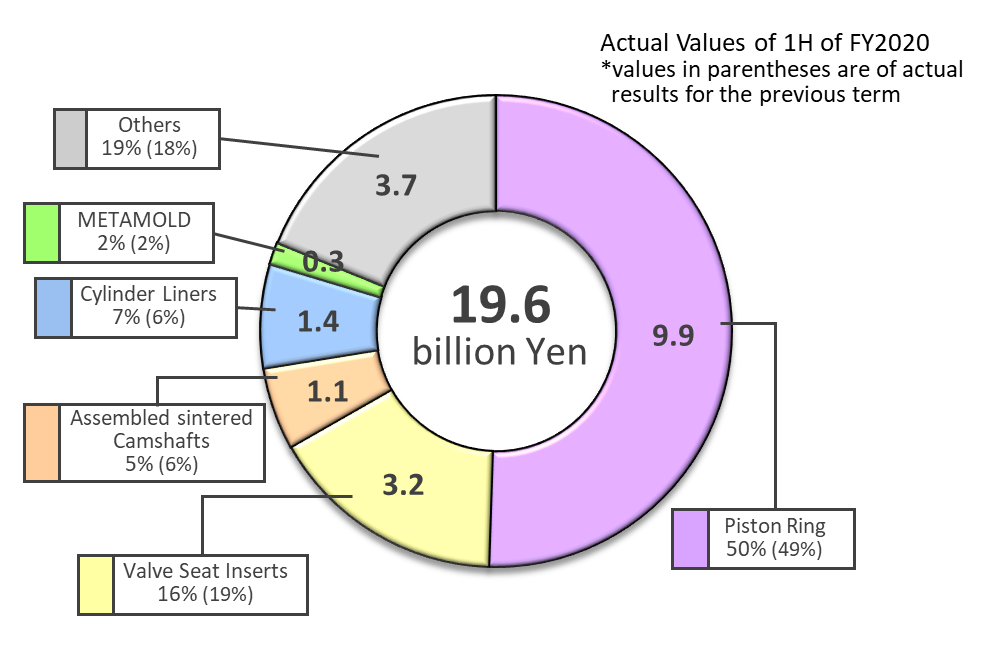

As reflected in the Company name, piston rings are one of the main products manufactured. In addition, valve seat inserts and various other automobile parts are manufactured and sold. In the first half of fiscal year 2020, automobile related parts accounted for 84.9% of total sales.

At the same time, development of new products and business expansion to non-automobile engine parts realms such as METAMOLD (metal injection molding products) and medical products including dental implant products, which got acquired in 2014 are being strengthened.

| |

(METAMOLD) |

(Dental Implant) |

(Source: Nippon Piston Ring)

<Product Sales Composition>

(Source: Nippon Piston Ring)

(Source: Investment Bridge modified the data from NPR) |

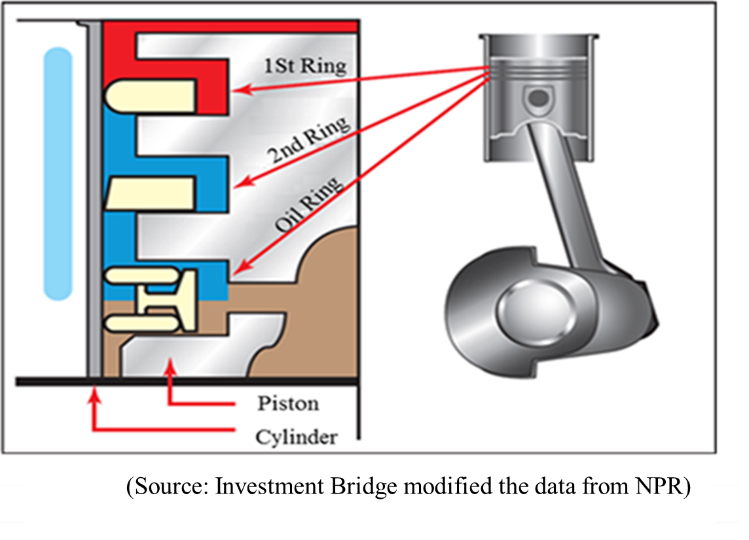

<Piston Rings> Piston rings are fitted in grooves that run around the circumference of pistons and have spring-like characteristics to act as a seal for ideal combustion within the combustion chamber of the engine cylinders and control lubrication of the piston and cylinder walls by forming precise circles. Moreover, three piston rings are normally used, to form a seal to prevent leakage of oil, allow heat to escape and reduce both friction wear and baking. Smooth movement of pistons will be impeded and fuel consumption will be negatively impacted when the tensional force of the piston ring placed on pistons is too high. Conversely, loss of power resulting in increased oil consumption will happen if the tensional force of the piston ring placed on pistons is too low.

|

|

Consequently, optimization of the tensional forces of piston rings is crucial in order to ensure the optimum performance of internal combustion piston engines.

An oil film is formed between the cylinder wall and pistons to reduce friction wear and baking, which could be caused by the high-speed movement of pistons within a high-heat condition of cylinders. However, it does not necessairly mean the oil is thicker the better. Piston oil rings need to be designed to ensure that an optimal thickness of oil film is formed.

Piston rings are required to provide wear resistance, material strength, heat resistance, heat conductivity, and oil retention capacity to ensure the optimal performance and durability of engines.

|

|

With regards to the characteristics required to piston rings, development of piston rings with low friction construction, thinner width, new surface treatment processes, highly durable and low-cost materials is being conducted. At the same time, development and proposal of optimal design technologies using its tuning technic are also promoted.

Nippon Piston Ring is one of only few companies that have the ability to stably manufacture and supply piston rings which requires extremely advanced technological capabilities. In addition, the company is also able to consistently develop revolutionary technologies.

<Valve Seat Inserts> Valve seat inserts are the parts which are press-fitted into the valve seating portion of cylinder heads. Valve seat inserts are the very important part made from sintered alloys with high resistance to wear and deterioration under high heat conditions, which can consequently ensure that a tight seal is formed for clean and efficient combustion. Nippon Piston Ring boasts of quality valve seat inserts that meet the needs of automobile manufacturers at a high level, using a wide range of material variation, leveraging its superior materials development capabilities. Consequently, the Company owns a top share of slightly around 40% of valve seat inserts provided to Japanese automobile manufacturers, and it is further expanding its sales on both Japanese and overseas motor vehicle manufacturers. |

(Valve Seat Inserts) |

<Camshafts> Camshafts are a part designed to open and close the valves for each cylinder in piston engines. Nippon Piston Ring has the original technology for a special camshaft called assembled sintered camshafts, which are lightweight, highly resistant to contact pressure and capable of adopting a wide variety of designs. They are used by SUBARU in all of its self-manufactured engines, as well as used by truck manufacturers, which require highly durable products. |

(Assembled Sintered Camshafts) |

< METAMOLD (Metal injection molding products) > In recent years, various processing technologies and methods, including machine processing, precision casting (lost wax), die casting, and press sintering, have been selected and used for molding metallic parts based on functions and costs required for parts. “METAMOLD,” which was developed as a completely new 5th-generation processing technology, is a resource-saving and energy-saving technology that was developed based on the metallurgical technology that the Company has cultivated over years. It has made it possible to manufacture the same complicated shape as plastic products and die-cast products. The Company has expanded the lineup of product groups by strengthening its material and manufacturing technology and expanded its business to not only automobile engine parts but also non-automobile engine parts including industrial mahcinery and office automation parts. Especially, demand for circulation piece for ball screws is increasing. |

(METAMOLD)

|

◎Customers

Nippon Piston Ring supplies piston rings and valve seat inserts to all Japanese automobile manufacturers.

The products supplied by the Company are extremely important in improving the performance of engines to require high levels of technical expertise. In recent years, the need to improve fuel consumption and to seek alternative fuels due to the growing importance of environmental issues has contributed to expanded sales to non-Japanese automobile manufacturers such as European, American and Chinese local automobile manufacturers.

Main Customers Japanese | Products Supplied |

| Main Customers Non-Japanese | Products Supplied | ||

Piston Rings | Valve Seat Inserts |

| Piston Rings | Valve Seat Inserts | ||

Toyota | ○ | ○ |

| Daimler | ○ | ○ |

SUBARU | ○ | ○ |

| BMW | ○ | ○ |

Isuzu Motors | ○ | ○ |

| Audi/VW |

| ○ |

Hino Motor | ○ | ○ |

| Renault | ○ | ○ |

Honda | ○ | ○ |

| FCA | ○ |

|

Nissan | ○ | ○ |

| GM | ○ | ○ |

Mazda | ○ | ○ |

| Ford | ○ |

|

Daihatsu | ○ | ○ |

| Harley Davidson | ○ |

|

Kubota | ○ | ○ |

| Hyundai Motor |

| ○ |

Suzuki | ○ | ○ |

| Hero MotoCorp |

| ○ |

Mitsubishi Fuso | ○ | ○ |

| Ashok Leyland |

| ○ |

Yamaha Motor | ○ | ○ |

| Guangzhou Automobile | ○ | ○ |

|

|

|

| Shanghai Automotive Industry | ○ | ○ |

|

|

|

| First Automobile Works |

| ○ |

|

|

|

| Dongfeng Motor Corp. | ○ |

|

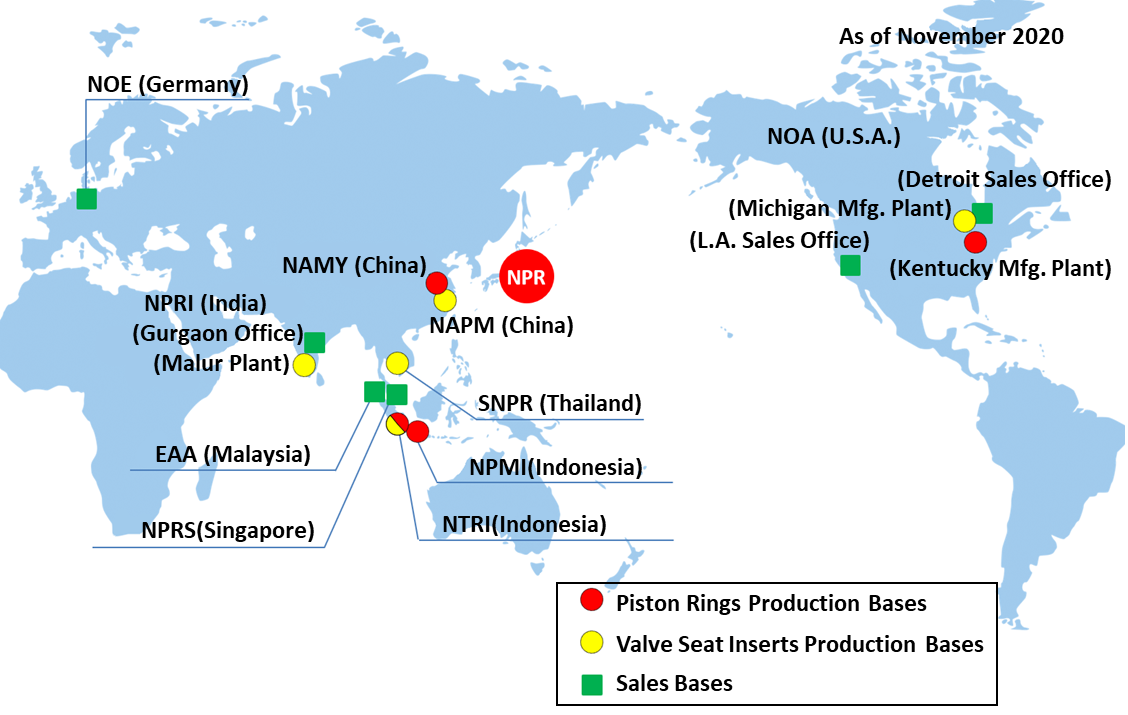

【1-5 Production and Sales Bases】

<Japan>

Nippon Piston Ring maintains four production bases and seven sales bases (Tokyo [head office: Saitama City], Nagoya, Osaka, Hiroshima, Fukuoka, Sendai, Sapporo) within Japan.

(Production Bases)

Facility, Plant Name | Main Products Manufactured |

NPR Iwate Co., Ltd., Ichinoseki Plant | Automobile, Land, Marine and Other Engine Use Piston Rings |

NPR Iwate Co., Ltd., Senmaya Plant | Automobile, Land, Marine and Other Engine Use Cast Piston Ring |

NPR Fukushima Works Co., Ltd. | Valve Seat Inserts, Cylinder Liners, etc. |

Nippon Piston Ring Co., Ltd., Tochigi Plant | Assembled Sintered Camshafts, Marine Engine Use Piston Rings, METAMOLD, etc. |

<Overseas>

Nippon Piston Ring maintains both manufacturing and sales bases for piston rings, valve seat inserts and other products in the United States, China, ASEAN countries, and India. The Company has sales bases in Germany, Singapore and Malaysia , too.

(Overseas Bases)

Facility, Plant Name | Location | Voting Rights Ratio | Main Products Manufactured |

NPR of America, Inc. (NOA) | US | 100% | (Kentucky Mfg. Plant) Piston Rings (Michigan Mfg. Plant) Valve Seat Inserts (Detroit Sales Office, L.A. Sales Office) Sales bases |

NPR Auto Parts Manufacturing (Yizheng) Co., Ltd. (NAMY) | China | 100% | Piston Rings |

NPR ASIMCO Powdered Metals Manufacturing (Yizheng) Co., Ltd. (NAPM) | China | 50% | Valve Seat Inserts |

PT. NT Piston Ring Indonesia (NTRI) | Indonesia | NPR Group 100% | Piston Rings, Valve Seat Inserts |

PT. NPR Manufacturing Indonesia (NPMI) | Indonesia | NPR Group 100% | Cast Piston Rings |

Siam NPR Co., Ltd. (SNPR) | Thailand | NPR Group 100% | Valve Seat Inserts |

NPR Auto Parts Manufacturing India Pvt. Ltd. (NPRI) | India | NPR Group 100% | (Malur Plant) Valve Seat Inserts (Gurgaon Office) Sales base |

NPR of Europe GmbH (NOE) | Germany | 70% | Sales base |

NPR Singapore Pte. Ltd. (NPRS) | Singapore | 90% | Sales base |

E.A Associates Sdn. Bhd (EAA) | Malaysia | NPR Group 81% | Sales base |

(Source: Nippon Piston Ring)

【1-6 Characteristics and strengths】

Nippon Piston Ring’s highly advanced technologies and ability to consistently supply highly reliable functional automobile parts maintained throughout its history for over 80 years of operations, which has also allowed it to become the choice of both Japanese and overseas automobile manufacturers. In recent years, development of major products, which can contribute to reductions in exhaust gases, low output levels of carbon dioxides and the achievement of “over 50% thermal efficiency rates” in internal combustion engines, is being conducted.

(Nippon Piston Ring’s Three Main Technology Categories)

Technologies | Details |

Metallic Materials | Technologies for developing materials with high functionality demanded for various automobile parts including wear resistant alloy cast iron, high functional steel and sintered alloy metal. Holding technology of titanium tantalum alloy as medical supplies having superiority in bio compatibility and corrosion resistance. |

Surface Processing (Surface Improvements) | Technologies for increasing the added value of materials by giving necessary functions including heat & wear resistance, lubricating property, and low friction such as thermal spray, plating, nitriding, PVD, DLC and other material surface processing. |

Precision Processing | Technologies for molding various precise forms and dimensions through machine processing, plastic forming and other processes. |

With regards to product development, the ability to combine the said technologies and its simulation technologies applied to engines is one of Nippon Piston Ring’s strengths.

In addition, automobile manufacturers, to whose business the Company’s high levels of technological expertise are critical, are what the Company calls its “client assets,” which are an important part of its corporate value.

【1-7 ROE Analysis】

| FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | FY2019 |

ROE(%) | 7.9 | 5.4 | 8.2 | 7.4 | 6.0 | 1.6 |

Net Profit Margin (%) | 4.21 | 3.07 | 4.63 | 4.09 | 3.31 | 0.89 |

Total Asset Turnover (x) | 0.80 | 0.80 | 0.80 | 0.84 | 0.87 | 0.85 |

Leverage (x) | 2.34 | 2.20 | 2.21 | 2.14 | 2.09 | 2.12 |

2. First Half of Fiscal Year 2020 Earnings Overview

(1) Consolidated Business Overview

| 1H of FY2019 | Ratio to sales | 1H of FY2020 | Ratio to sales | YOY |

Net Sales | 27,264 | 100.0% | 19,629 | 100.0% | -28.0% |

Gross margin | 5,325 | 19.5% | 2,725 | 13.9% | -48.8% |

SG&A expenses | 4,973 | 18.2% | 4,213 | 21.5% | -15.3% |

Operating income | 352 | 1.3% | -1,487 | - | - |

Ordinary income | 339 | 1.2% | -1,249 | - | - |

Net income | 41 | 0.2% | -1,944 | - | - |

* Unit: million yen. The definition for net income is net income attributable to owners of parent (Hereinafter the same apply).

Sales and profit decreased to a point that is below the initial forecasts.

The sales in the first half of the fiscal year 2020 were 19.6 billion yen, down 28.0% year on year. Due to the spread of the novel coronavirus, the number of automobiles produced has decreased significantly worldwide. Sales of all products declined. Domestic sales dropped 28.2% year on year to 7.8 billion yen. Overseas sales fell 27.8% year on year to 11.8 billion yen, and overseas sales ratio was 60%. Along with the continuous promotion of cost reduction, the company promoted operation adjustment and to reduced fixed costs. Nonetheless, the impact of production cut was substantial, and operating income and ordinary income turned to a loss of 1.5 billion yen and 1.2 billion yen, respectively. Net income was a loss of 1.9 billion yen due to a temporary increase in income taxes-deferred, in addition to the decrease in ordinary income.

(2) Sales by Products

| 1H of FY2019 | 1H of FY2020 | YoY |

Piston Ring | 134 | 99 | -26.6% |

Valve Seat Insert | 51 | 32 | -36.4% |

Assembled Sintered Camshaft | 17 | 11 | -36.8% |

METAMOLD | 4 | 3 | -21.8% |

Others | 67 | 52 | -22.8% |

Total | 273 | 196 | -28.0% |

*Unit: 100 million yen.

Sales of all products declined.

(3) Financial Condition and Cash Flow

◎Main BS

| End of March 2020 | End of September 2020 |

| End of March 2020 | End of September 2020 |

Current assets | 27,623 | 25,655 | Current liabilities | 22,050 | 19,060 |

Cash and deposits | 3,514 | 3,678 | Trade payables | 7,481 | 4,141 |

Trade receivables | 11,342 | 9,033 | Short-term interest- bearing debts | 8,527 | 9,556 |

Inventories | 10,940 | 11,563 | Non-current liabilities | 10,269 | 14,018 |

Non-current assets | 35,985 | 35,596 | Long-term interest- bearing debts | 6,974 | 9,850 |

Property, plant and equipment | 29,638 | 29,001 | Total liabilities | 32,319 | 33,078 |

Intangible assets | 867 | 915 | Net assets | 31,289 | 28,172 |

Investments and other assets | 5,479 | 5,679 | Shareholder’s Equity | 29,950 | 27,469 |

Total assets | 63,608 | 61,251 | Retained earnings | 14,554 | 12,148 |

| Total liabilities and net assets | 63,608 | 61,251 | ||

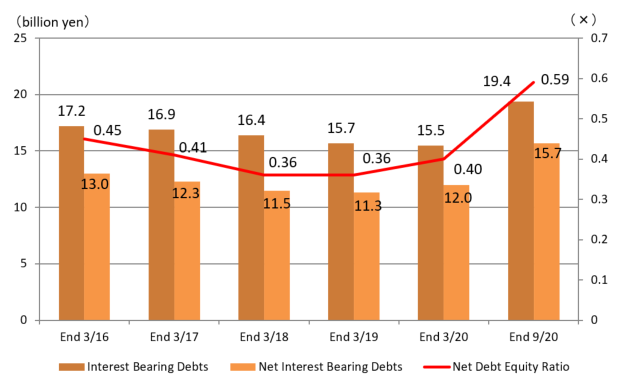

| Total interest-bearing debts | 15,501 | 19,406 | ||

*Unit: million yen. Trade payables include electronically recorded accounts payable.

*Interest-bearing debts includes lease obligations.

Current assets declined 1.9 billion yen from the end of the previous fiscal year, due to the decrease in trade receivables, etc. Non-current assets decreased 0.3 billion yen, and total assets decreased to 61.2 billion yen, down 2.3 billion yen from the end of the previous fiscal year.

Total liabilities rose to 33.0 billion yen, up 700 million yen from the end of the previous fiscal year, as long-term interest-bearing debts, etc. increased. Interest-bearing debts were 19.4 billion yen, up 3.9 billion yen from the end of the previous fiscal year.

Equity ratio was 43.7%, down 3.2 points from the end of the previous fiscal year.

Interest-bearing debt balance, net interest-bearing debt balance and net debt-to-equity ratio exceeded those at the end of the previous term.

◎ Cash Flow

| 1H of FY2019 | 1H of FY2020 | Increase/decrease |

Operating Cash Flow | 2,260 | -870 | -3,130 |

Investing Cash Flow | -2,165 | -2,194 | -29 |

Free Cash Flow | 95 | -3,064 | -3,159 |

Financing Cash Flow | -748 | 3,316 | +4,064 |

Term End Cash and Equivalents | 3,671 | 3,678 | +7 |

*Unit: million yen

Operating CF and free CF turned negative due to net loss before tax adjustment.

Financing CF turned positive due to an increase in long-term debt. The cash position is almost unchanged.

(4) Topics

◎ Started Importing and Selling Radiological Medical Devices

The company is focusing on expanding its business into the field of non-automotive engine parts. On September 10, 2020, it started importing and selling radiological medical devices as the sole agent in Japan for the American company Radiation Products Design Inc.

The company handles tungsten eye shields used for radiodiagnosis and treatment of eyelid tumors, brass mesh bolus, a metal bolus used for radiotherapy of affected areas close to the body surface such as skin cancer, and other products.

In the future, the company will continue to collaborate with medical institutions to provide products that capture on-site needs, and aim to expand its business in the medical field by developing medical components that utilize the company’s unique technology.

(Tungsten eye shields) |

(Brass mesh bolus) |

3. Fiscal Year 2020 Earnings Forecast

(1) Consolidated Earnings Forecast

| FY 2019 | Ratio to sales | FY 2020 (forecast) | Ratio to sales | YoY | Difference | Progress rate |

Net Sales | 54,881 | 100.0% | 43,500 | 100.0% | -20.7% | +500 | 45.1% |

Operating income | 1,829 | 3.3% | -1,400 | - | - | +600 | - |

Ordinary income | 1,776 | 3.2% | -1,000 | - | - | +700 | - |

Net income | 490 | 0.9% | -2,000 | - | - | +500 | - |

*Unit: million yen. The forecasts are from the Company. The definition for net income is net income attributable to owners of parent.

*Difference is the difference between the forecasts revised in November 2020 and the original forecast announced in August 2020.

The full-year earnings forecast was revised upward. Sales and profit decreased.

The full-year earnings forecast was revised in November 2020. The annual sales of the fiscal year 2020 are expected to decrease 20.7% year on year to 43.5 billion yen, and operating income is expected to be a loss of 1.4 billion yen. It is predicted that sales and profit will exceed the latest forecast values announced in August 2020, due to the recovery of demands in China and other countries, which resumed economic activities ahead of other countries and regions after the spread of the novel coronavirus, as well as the improvement of productivity, and the effect of reducing fixed costs. The dividend forecast remains undecided.

4. Interview with President Takahashi

We asked President Takahashi, who was appointed as President and Representative Director in June 2020, about his mission, future initiatives, and message to investors.

President Takahashi was born in February 1959 and is 61 years old. Since joining the company in 1981, he has successively built his record as an engineer, was appointed as a managing director in 2016, and has been in charge of technical planning, product development, and the new product business development department.

Q: What do you think is your mission as the President of NPR?

A: To establish new product businesses in the once-in-a-century revolutionary phase of the automobile industry. We have also made major structural reforms and started to shorten the total lead time and to raise awareness of employees.

In the automobile industry, which is undergoing a once-in-a-century major revolutionary phase, NPR’s business environment is changing drastically and rapidly. Under such circumstances, I think that the mission assigned to me is to establish new product businesses in the field of non-automotive engine parts. We will utilize our core technologies, such as material technology, surface treatment technology, powder metallurgy technology, and precision processing technology that we have cultivated through developing engine parts, to expand our business in the field of non-automotive engine parts such as motor cores and medical components. We also want to build alliances, collaborations, and M&A actively.

Furthermore, in order for the NPR Group to survive the rapidly changing conditions, we must build a supply chain management that includes reducing total lead time starting from sales and development activities to orders, production, and shipment, as well as speeding up information transmission, decision-making, and implementation of measures. Therefore, we carried out a major structural reform on October 1. One of these reforms is the reorganization of the sales department. We integrated the domestic sales departments, and transferred the technology-related negotiation operation from the development department to the sales department. We will change the sales team’s awareness and promote more aggressive sales operation than before, by positioning this department as the forefront of the sales that is oriented to making and using technical proposals, centered on providing solutions related to marketing, market development, project development, etc.

Q: What kind of initiatives are you taking, from the perspective of developing employees and cultivating their motivation?

A: We would like to improve employees’ motivation and work engagement by evaluating voluntary ideas and activities.

In recent years, work style reform has been touted, and improvement activities such as QC circles, which were previously carried out as voluntary efforts during non-working hours, have become formal activities within the working hours. I was concerned that these activities had become a mere formality.

Therefore, we have created a system to evaluate voluntary ideas and activities, such as changing evaluation method of such improvement activities to focus on the content, and establishing a small award system in each section.

Having each employee take initiative in such activities will improve their motivation and enhance their work engagement, which will build employees’ loyalty to the company and deeper ties among them to grow together.

If we can raise each person’s motivation little by little, it will generate great power for the company as a whole. Not only some leaders, but all members will participate in management reform.

We are also considering to review the curriculum of NPR internal college for manufacturing to increase the number of human resources who can play an active role at overseas bases.

Q: What are your thoughts on the trend of electrification?

A: Although there remain many issues related to the spread of electric vehicles, we are focusing on new products development to expand in the field of non-automotive engine parts in preparation for that phase.

There are still many issues to be solved before all automobiles becoming electric vehicles. However, based on the policies in many countries to reduce greenhouse gas emissions to substantially none, and the trend of automobile manufacturers toward EVs, we believe that we need to raise sales of non-automotive engine parts to at least 30% by 2030. As I have mentioned earlier, we are currently focusing on the following three fields to expand in the field of non-automotive engine parts, based on our core technologies and by integrating in-house and external technologies through open innovation.

The first is METAMOLD (metal injection molding) products. We have worked on metal injection molding products for engine parts, but to further expand the business, we took over the business from another company in the fiscal year 2014. Recently, our PR’s impact is gradually permeating as we have received inquiries from such as the engine field, robot sensor parts, and non-automotive engine parts for example, power steering.

The second is NiFreeT, titanium tantalum alloy used as medical supplies. In addition to being nickel-free and highly biocompatible, it is non-magnetic, so the image in MRI examinations will not be distorted. Another significant features of NiFreeT are that it does not damage the inner surface of blood vessels, and has an appropriate shape restoration ability. We are currently joining the development of some medical devices including electrode materials for treating Parkinson’s disease.

The third is the motor core. We have developed a 3D-shaped powder core by applying our powder metallurgy technology. It features high torque and thinness. We are aiming to adopt the motor core in niche fields without tracking the quantity, to meet the needs of AGVs (Automatic Guided Vehicles) or electric vehicles used in harsh environments with sharp ups and downs.

Q: I think you are currently formulating the next Medium-Term Management Plan. What points do you plan to put emphasize on?

A: We will draw a picture of what we want to be in ten years to bring about reforms that anticipate market changes. Based on this, we will formulate the 8th Medium-Term Management Plan through back casting.

We are currently formulating The Next NPR 2030 as a premise for the 8th Medium-Term Management Plan, which will start in April 2021. To bring about reforms that anticipate market changes, we will draw a picture of what we want to be in ten years. Based on this, we will formulate the 8th Medium-Term Management Plan through back casting. A project team consisting of members who will lead the next generation is preparing The Next NPR 2030, which includes the following three elements.

The first is the pursuit of residual profits through the evolution of existing internal combustion engine components. As mentioned above, policies aimed at popularizing electric vehicles are being promoted in many countries. Still, we acknowledge the need for internal combustion engines, mainly HVs (hybrid), will continue through further evolution to environmentally friendly engines. We will continue our efforts to produce differentiated products at a low cost that meet functional requirements such as engine weight reduction, wear resistance, thermal conductivity, and high toughness to achieve a thermal efficiency of 50% to bolster competitiveness.

The second is to strengthen new products development. To prepare for the EV era, we will focus on new products development and aim to expand in the field of non-automotive engine parts.

The third is making partners. This point will lead to the strengthening of new products development mentioned above. I think it is necessary to make partners to achieve the vision of what we want to be, including M&A and technical and capital tie-ups.

We are studying what we should do to show our presence in the trend of getting rid of internal combustion engines, while maintaining a certain presence as a manufacturer of functional parts for internal combustion engines. To become a company that continues to be needed by society, we are also keeping an eye on the 100th anniversary of our founding and the future beyond, and consider measures for realizing a sustainable society. Moreover, we would like to incorporate environmental contributions through our products, and raising employees’ environmental awareness as part of the goals of the Medium-Term Management Plan.

Q: Lastly, please give a message to investors.

A: The current situation is severe and remains uncertain, but I would like shareholders and investors to continue to support us from a medium- to long-term perspective.

The impact of the novel coronavirus is substantial, and we forecast that we will record a loss this fiscal year. Still, we are aiming to become a strong company that can generate stable profits even if the top-line growth is small, by pushing ahead with structural reforms including shortening lead times, reducing inventories, and reducing fixed costs. We will also establish new businesses as soon as possible in the medium to long term to work towards our vision for what we want to be in 2030.

The current situation is severe and remains uncertain, but I would like shareholders and investors to continue to support us from a medium- to long-term perspective.

5. Conclusions

In the first half of this fiscal year, the company worked to reduce fixed costs such as labor cost and expenses. It also promoted fine-tuned man-hour management and steady cost reductions. As a result, the productivity has been improving even in lower operating rated. The outlook for the business environment remains uncertain, as the novel coronavirus infections have expanded again. Still, the second half shows a recovery trend overall, and the company is working on various measures to exceed the annual forecast.

The company is now under the leadership of the new president Takahashi, who took over during the novel coronavirus crisis, and we want to pay close attention to how the 8th Medium-Term Management Plan, which will be announced next year, will reflect the path toward The Next NPR 2030. The Next NPR 2030 draws a vision of how the company wants to be after ten years amid the significant changes in the business environment due to the progress of electrification.

<Reference: Corporate Governance>

◎Organization Form, Directors and Auditors

Organization type | Company with auditors |

Directors | 9 including 3 externals |

Auditors | 5 including 3 externals |

◎ Corporate Governance Report

Last modified: June 30, 2020

<Basic Policy>

We regard strengthening corporate governance as one of the critical management issues and are actively working on it.

Our management philosophy is as follows.

“We pursue every business operation on the principle of placing the No. 1 priority on customers.

We respond with flexibility to changes in the environment, and secure appropriate levels of profits to reflect our appreciation of our shareholders and other related parties.

In harmony with society, we contribute to the progress of human beings by securing the position of a global comprehensive parts manufacturer.

We strive for the prosperity of the corporation and welfare of its employees through perpetual efforts for innovation and improvement in performance.”

In other words, it is necessary to respect the position of the various stakeholders related to our company, such as shareholders, business partners, local communities, and employees, and to fulfill the company’s obligation as a member of society. We believe that these will be the driving force for the company’s sustainable growth, and ultimately bring long-term benefits to our shareholders. Therefore, our basic policy for corporate governance is to enhance management transparency, fulfill accountability to stakeholders, and speed up the management process.

<Principles Not Conducted and the Main Reasons>

Principle | Reason of Not Conducting |

【1.2.4 The Electronic Voting Platform, English translations of the convening notices of general shareholder meeting】 | With regard to the electronic exercise of voting rights, while paying close attention to the shareholder ratio of foreign corporations, we will continue to examine the creation of an environment where it is easier for foreign shareholders to exercise their voting rights. As part of improving the environment for exercising voting rights, we have translated the Notice of Convocation of the General Meeting of Shareholders into English and posted it on our website. |

【3.1.2 Publishing and providing information in English】 | The Company considers about publishing and providing information in English while monitoring foreign shareholders ratio. |

[Supplementary Principle 4-8-2 Cooperation between Independent Outside Executives and the Management and Audit Board] | We have appointed three highly independent outside directors. They cooperate with our management and audit board at the Board of Directors and Management Strategy Meetings based on their abundant experience and objective perspectives. Also, the independent outside directors cooperate with each other to obtain necessary information, and we believe that we do not need to appoint a lead independent outside director currently. |

<Main Published Principles>

Principle | Details |

【 1.4 Cross-Shareholdings】 | 1. Policy on Cross-Shareholdings The Company considers that it is indispensable to develop cooperative relations with various enterprises in order to continue sustainable growth. Therefore, in order to operate business smoothly from the mid/long-term viewpoint, the company holds the so-called cross-shareholdings if the company judges that this would contribute to its corporate value while taking into account transaction relations, cooperative relations for business, etc. At the board of directors’ meeting, the company checks the necessity of shareholding under the above policy every year, and examine the appropriateness of shareholding while considering benefits, risks, market evaluation of the shares concerned, etc. Subsequently, it considers cutting down securities deemed inappropriate for shareholding. As a result of the verification, in the fiscal year 2019, we have deemed it appropriate to continue holding listed shares held as strategically held shares.

2. Policy for exercising voting rights The Company makes appropriate decisions about the exercise of voting rights from the viewpoint of improving mid/long-term corporate value, while respecting the managerial policy and strategy of each issuing company. |

【5.1 Policy for Constructive Dialogue with Shareholders】 | The Corporate Planning Department serves as IR Department and the Company establishes the system for constructive dialogue with stakeholders by holding the IR meeting and smaller meetings, etc. for them. The Company’s basic principles of the Corporate Governance are “Increasing Business Transparency,” “Conducting Accountability for Stakeholders” and “Expediting of the Business.”, and the Company discloses them in the Corporate Governance Report. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |