Bridge Report:(6498)KITZ CORPORATION

President Yasuyuki Hotta | KITZ Corporation (6498) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Yasuyuki Hotta |

HQ Address | 1-10-1 Nakase, Mihama-ku, Chiba, Japan |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥768 | 95,241,317 shares | ¥73,145 million | 7.4% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥24.00 | 3.1% | ¥68.49 | 11.2x | ¥793.74 | 1.0x |

*Share price is as of closing on June 7.

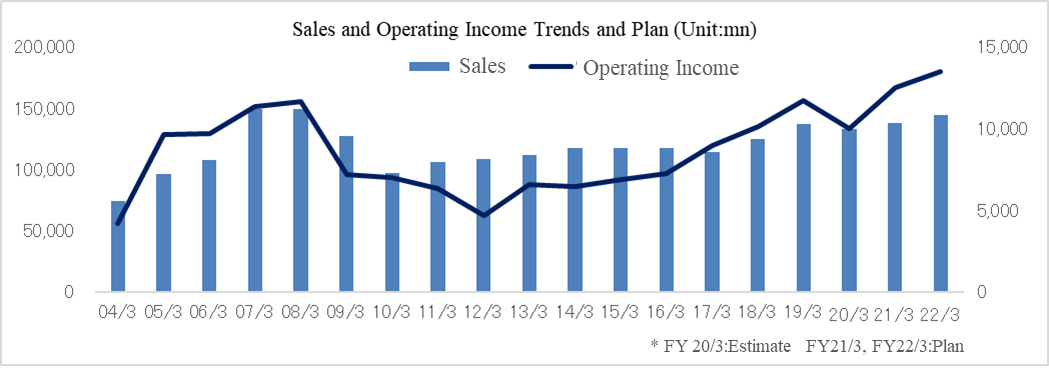

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | Dividend (¥) |

March 2016 Act | 117,278 | 7,245 | 7,300 | 4,915 | 45.50 | 13.00 |

March 2017 Act | 114,101 | 8,929 | 8,799 | 5,400 | 51.43 | 13.00 |

March 2018 Act | 124,566 | 10,117 | 9,733 | 6,518 | 65.50 | 17.00 |

March 2019 Act | 136,637 | 11,713 | 11,883 | 5,625 | 58.50 | 20.00 |

March 2020 Est. | 133,000 | 10,000 | 9,700 | 6,400 | 68.49 | 24.00 |

*Unit: million yen

*Estimates are those of the Company

*The company has decided to acquire treasury stock with a maximum limit of 2,500,000 shares during the period from March 19, 2019 to September 18, 2019. The above-mentioned EPS is calculated based on the interim average number of shares with the assumption of completely acquiring the maximum number of shares during the term. However, BPS or the market capitalization do not reflect the acquisition of treasury stock.

This Bridge Report presents details and analysis of KITZ Corporation’s earnings results for the fiscal year ended March 2019 and earnings estimates for the fiscal year ending March 2020.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended March 2019 Earnings Results

3. Fiscal Year Ending March 2020 Earnings Estimates

4.The 4th Medium-Term Management Plan (FY 3/20~FY 3/22)

5. Conclusions

<Reference: Regarding corporate governance>

Key Points

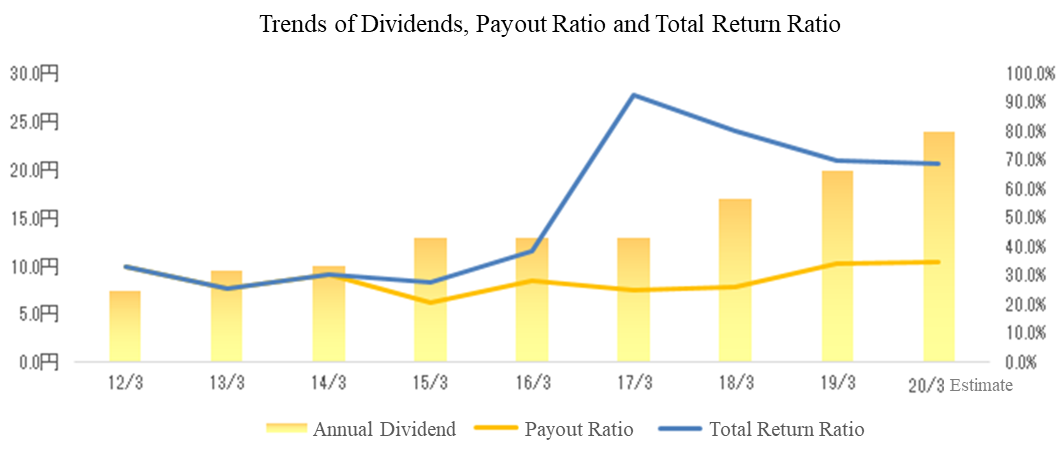

- In the fiscal year ended March 2019, sales and operating income grew 9.7% and 15.8%, respectively, year on year. The operating income and ordinary income have hit a record high thanks to profitability improvements focused around the valve manufacturing business, sales of the valve manufacturing business reached over 100 billion yen for the first time. The term-end dividend was 12 yen/share, while the interim dividend was 8 yen/share. Namely, the annual dividend was 20 yen/share (dividend payout ratio is 34.2%). Total shareholder returns are 70.1% as the company acquired treasury shares during the period.

- The forecasts for the fiscal year ending March 2020 indicate that sales will decrease by 2.7% and operating income will decrease by 14.6%. Sales of the valve manufacturing business are estimated to decline due to the decline in sales of valves for semiconductor manufacturing equipment, etc. inside and outside Japan. Investments in the new IT system and upgrading the copper products manufacturing facilities will increase depreciation costs, which will be a burden. The annual dividend is expected to be 24 yen/share (interim dividend at 10 yen/share, term-end dividend at 14 yen/share), which is a 4 yen/share increase for the annual dividend. The estimated payout ratio increased from around 25% to around 35%.

- The 3rd Medium-term Management Plan (FY 3/17 to FY 3/19) finished with sales and profit that exceeded plans and the 4th Medium-term Management Plan has started. The company will work to improve the profitability of the brass bar manufacturing business, and expand sales of focused products for the valve manufacturing business such as the domestic butterfly valves and ductile iron valves in domestic market, cultivate overseas market focusing on ASEAN, and focus on MRO of the plant market. In the fiscal year ending March 2022, the company aims to achieve sales of 144 billion yen and an operating income of 13.5 billion yen.

1. Company Overview

KITZ is an integrated manufacturer of valves and other fluid control equipment and devices. In valve manufacturing, it ranks highest in Japan and within the top 10 worldwide. Valves are made of various materials depending on their application, including bronze, brass, cast iron, ductile cast iron (cast iron with greater strength and ductility) and stainless steel. KITZ in principle assumes integrated production (casting, processing, assembling, inspecting, packaging and shipping) of products from raw materials. The KITZ Group consists of 36 domestic and overseas subsidiaries. In addition to the production and sale of brass bars used for valves, water faucets and gas equipment (KITZ is ranked among the top manufacturers of brass bars within Japan), the Group also operates a hotel business.

<Corporate Philosophy: To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services>

KITZ believes that corporate value is equivalent to shareholder value from a medium- to long-term perspective. To continue increasing this value, it says that it must achieve sustained growth accompanied by earnings through earning the trust of customers.

And by improving corporate value, the Company desires to help create a more prosperous and fulfilling society by providing many types of benefits to its shareholders, customers, employees, business partners, and society. Setting these goals in the KITZ Statement of Corporate Mission, the Company seeks to further progress in the future.

KITZ’ Statement of Corporate Mission |

To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services. |

<Overview of KITZ’s Business Segments>

KITZ’s businesses consist of the valve manufacturing, brass bar manufacturing and other (including hotel and restaurant management) segments. During the fiscal year ended March 2019, these segments accounted for 80.5%, 17.3%, and 2.2% of total sales, respectively.

Valve Manufacturing Business

Valves are used to pass, stop and adjust the flow of fluids in various pipe systems (water, air, gas and other substances). They are used in building facilities, residential utility systems, water supply facilities, fresh water and sewer systems, fire prevention equipment, machinery and industrial equipment manufacturing facilities, chemical, medical, and petrochemical product manufacturing facilities, semiconductor manufacturing facilities, oil refineries and other industrial complexes, among other applications. The Company operates an integrated production system that begins with the casting process (KITZ was the first Japanese company to acquire ISO 9001 international quality standard certification). The Company’s product offerings include commercial valves, which are made of corrosion-resistant bronze and highly economical brass for use in the building construction sector, including building facilities and residential utility systems, and industrial stainless steel valves such as high-value-added ball valves. The Company has a high share of the domestic market in these mainstay product areas. In terms of sales, the company covers the country nationwide by expanding marketing bases in the domestic major cities and a elaborate network of distributors. As for overseas, the company has a global sales network where the company did not only establish representative offices in India and U.A.E but also marketing bases in China, Hong kong, South Korea, Singapore, Malaysia, Thailand, Vietnam, the U.S., Brazil, Germany, and Spain. Regarding the manufacturing, the company has a production network that helps achieve global cost and optimal production locations as the company has deployed production bases in China, Taiwan, Thailand, India, Germany, Spain, and Brazil in addition to the domestic factories.

<Sales by Region>

| FY3/18 | Composition | FY3/19 | Composition | YoY Change |

Japan | 64,202 | 65.4% | 69,379 | 63.1% | +8.1% |

Overseas | 33,960 | 34.6% | 40,589 | 36.9% | +19.5% |

Total | 98,162 | 100.0% | 109,969 | 100.0% | +12.0% |

*Unit: million yen

Brass Bar Manufacturing Business

Copper alloy can take many different shapes, including sheets, strips, pipes, bars and wires through hot or cold deformation processing such as dissolution, casting, rolling, extruding, and forging. It can be made with a range of different materials, including brass (copper with zinc), phosphor bronze (copper with tin and phosphorous), and nickel silver (copper with nickel and zinc). The KITZ Group's brass bar manufacturing business is led by KITZ Metal Works Corporation and Hokutoh Giken Kogyo Corporation. These companies manufacture and sell brass bars, which are used not only as material for valves, but also in the manufacture of water faucets, gas equipment, electrical appliances, and other brass-derived items.

Other

KITZ subsidiary Hotel Beniya Co., Ltd., operates a resort hotel in the city of Suwa, Nagano Prefecture. The hotel is located in a highly picturesque setting close to Lake Suwa with hot spring bathing facilities with sunset views and has a number of small and large banquet halls. The hotel also has a large convention hall, giving it the capacity to hold international conferences.

2. Fiscal Year Ended March 2019 Earnings Results

(1) Consolidated Earnings Results

| FY3/18 | Composition | FY3/19 | Composition | YoY Change | 3Q Est | Divergence |

Sales | 124,566 | 100.0% | 136,637 | 100.0% | +9.7% | 136,000 | +0.5% |

Gross Income | 34,106 | 27.4% | 38,449 | 28.1% | +12.7% | - | - |

SG&A | 23,989 | 19.3% | 26,735 | 19.6% | +11.4% | - | - |

Operating Income | 10,117 | 8.1% | 11,713 | 8.6% | +15.8% | 11,700 | +0.1% |

Ordinary Income | 9,733 | 7.8% | 11,883 | 8.7% | +22.1% | 11,600 | +2.4% |

Net Income | 6,518 | 5.2% | 5,625 | 4.1% | -13.7% | 5,300 | +6.1% |

*Unit: million yen

Sales and operating income grew 9.7% and 15.8%, respectively, year on year.

Operating income and ordinary income have hit a record high thanks to profitability improvements focused around the valve manufacturing business. As for sales, while it wasn’t on par with the performance of the fitness business, etc., which had received contribution from service businesses in FY 3/2007 (a record high at 149.5 billion yen), and even with the steep increase in copper price (approx. 1 million yen/ton, then), sales of the valve manufacturing business went beyond 100 billion yen for the first time, practically hitting a record high. Overseas sales ratio was 30.3% (27.9% in the same period of the previous year).

Non-operating income improved thanks to posting foreign exchange gains (-208 million yen in FY 3/2018 to 122 million yen in FY 3/2019), etc. However, net income was 5,625 million yen, down 13.7% from the same period of the previous year due to the reversal effect of posting profit on sale of investment securities in the previous term (869 million yen in FY 3/2018 to 0 yen in FY 3/2019), posting extraordinary losses of 2,787 million yen including 2,483 million yen of impairment loss on the butterfly valves manufacturer in South Korea, Cephas Pipelines Corp., etc.

| FY3/18 | FY3/19 | FY3/19 Estimate |

Yen / US Dollar | 112.04 | 110.37 | 109.50 |

Yen / Euro | 127.19 | 130.00 | 128.00 |

Electrolytic Copper, Yen / Ton | 757,000 | 748,000 | 745,000 |

(2) Business Segment Sales, Operating Income

| FY3/18 | Composition | FY3/19 | Composition | YoY Change | 3Q Est | Divergence |

Valve Manufacturing | 98,162 | 78.8% | 109,969 | 80.5% | +12.0% | 109,600 | +0.3% |

Brass Bar Manufacturing | 23,535 | 18.9% | 23,643 | 17.3% | +0.5% | 23,400 | +1.0% |

Other | 2,867 | 2.3% | 3,025 | 2.2% | +5.5% | 3,000 | +0.8% |

Total Sales | 124,566 | 100.0% | 136,637 | 100.0% | +9.7% | 136,000 | +0.5% |

Valve Manufacturing | 12,798 | 13.0% | 14,938 | 13.6% | +16.7% | 15,000 | -0.4% |

Brass Bar Manufacturing | 699 | 3.0% | 287 | 1.2% | -58.9% | 300 | -4.3% |

Other | -28 | - | 90 | 0.0% | - | 50 | +80.4% |

Adjustments | -3,351 | - | -3,602 | - | - | -3,650 | - |

Total Operating Income | 10,117 | 8.1% | 11,713 | 8.6% | +15.8% | 11,700 | +0.1% |

*Unit: million yen

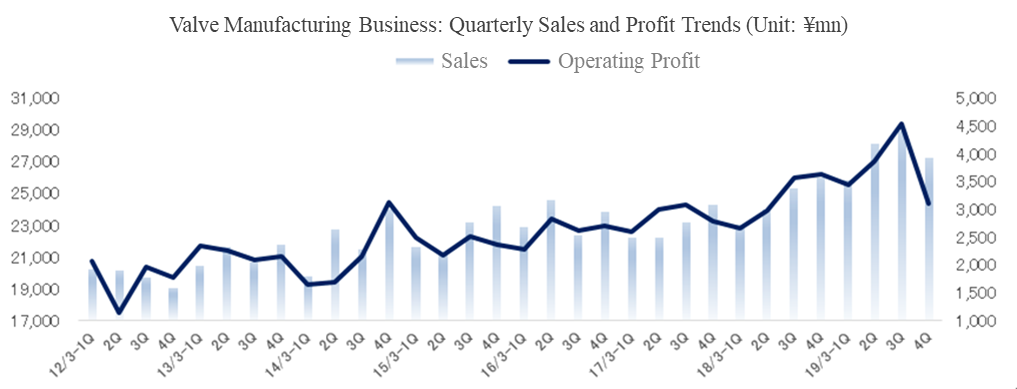

Valve Manufacturing Business

Sales of the domestic market were 69,379 million yen, up 5,177 million yen (8.1%) from the previous year. Sales of valves for building facilities, which are a mainstay, increased 7.3% year-on-year, thanks to redevelopment projects in the Tokyo Metropolitan Area and the progression of price revisions. While sales of industrial valves rose by 15.1% year-on-year, thanks to the demand for maintenance and renewal and the investment in capability enhancement by general manufacturers, however, sales of valves for the water market declined 1% year-on-year due to the downturn in sales to Tokyo (sales of the 4th quarter recorded a nearly 20% decline compared to the previous quarter). Sales of valves for semiconductor manufacturing equipment increased 7.5% year-on-year, however, from the third quarter onwards the market conditions have changed and sales of the 4th quarter were 20% to 30% down compared to the previous quarter and the same period of the previous year.

Overseas sales increased by 6,629 million yen (19.5%) to 40,589 million yen year-on-year offsetting the 399 million yen of the foreign exchange rate, which is a factor that contributes to decreasing sales. Commercial valves for data centers and industrial valves performed well in China and increased by 20% year-on-year. Sales in the Middle East increased 3 times thanks to the contribution of large-scale projects, furthermore, the orders from distributors to replenish the stock in the U.S., and Europe has been increasing. On the other hand, valves for semiconductor manufacturing equipment in China and South Korea has slowed down from the second half onwards due to the equipment manufacturer’s postponing investments.

Operating income was 14,938 million yen, up 2,140 million yen (16.7%) compared to the previous year. The increase in sales including the effect of price revision (+3,670 million yen) and cost reductions (+1,300 million yen) have offset the factors in decreasing the profit including the market conditions of raw materials (-150 million yen), the increase of SG&A for human resources, R&D, M&A, and South Korea subsidiaries (-2,670 million yen), and foreign exchange rate (-10 million yen).

*In the 4th quarter of the fiscal year ended March 2019, sales and profit declined especially for valves for the water domestic market, and valves for semiconductor manufacturing equipment, in the domestic market and overseas.

Brass Bar Manufacturing Business

The selling price of brass bar products declined due to the worsening of market prices of raw materials (price decline), however, it was offset by the increase in sales volume, and sales were 23,643 million yen, up 107 million yen (0.5%) year-on-year. Due to the profit setbacks caused by the decline in selling prices, the operating income was 287 million yen, down 412 million yen (58.9%) year-on-year. Due to the above-mentioned decline in copper prices, the accumulated inventory for casting equipment renewal has suffered from profitability deterioration.

Other

As for the hotel business, sales increased by 157 million yen (5.5%) year-on-year to 3,025 million yen, as the company attracted domestic individual tourists in the second quarter, which is a busy season, and operating income increased by 118 million yen year-on-year to 90 million yen, thanks to sales growth and cost reduction (the previous term recorded a loss of 28 million yen).

(3) Financial Conditions and Cash Flows

Financial Conditions

| 3/18 | 3/19 |

| 3/18 | 3/19 |

Cash | 23,429 | 13,660 | Payables | 7,098 | 6,625 |

Receivables | 29,304 | 30,199 | Unpaid Corporate Tax, Unpaid Consumption tax, etc. | 2,826 | 1,969 |

Inventories | 22,153 | 24,465 | Bonus and Bonus Reserve for Directors | 2,498 | 2,735 |

Current Assets | 77,400 | 71,226 | Allowance for retirement benefits for directors and retirement benefit liabilities | 821 | 1,111 |

Tangible Assets | 36,799 | 41,677 | Interest-bearing Liabilities | 34,302 | 33,457 |

Intangible Assets | 8,951 | 9,420 | Liabilities | 56,154 | 54,827 |

Investments, Others | 10,394 | 9,332 | Net Assets | 77,391 | 76,829 |

Noncurrent Assets | 56,145 | 60,430 | Total Liabilities, Net Assets | 133,545 | 131,657 |

*Unit: million yen

In the debit side, inventory assets and tangible assets have increased due to the acquisition of Cephas Pipelines Corp., furthermore, the intangible assets increased thanks to the investment in the new IT system, while cash and deposits decreased due to the acquisition of treasury stock, etc. (from August 6 to September 12, the company acquired approx. 2,000,000 shares at approx. 1,949 million yen), in addition, the investment securities decreased due to selling off shares and the decline in share prices. In the credit side, interest-bearing liabilities and net assets declined. The equity ratio was 57.4% (57.1% at the end of the previous term).

Acquisition of treasury stock according to the resolution of the board of directors meeting held on March 14, 2019.

In the period from March 19, 2019 to September 18, 2019, the upper limit for the repurchase of treasury stock was set to 2.5 million shares (2.62% of the total number of shares issued) and 2,200 million yen. The company acquired 100,200 shares as of the end of the fiscal year ended March 2019 and acquired 1,420,700 shares as of the end of May 2019.

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 |

Outstanding share (thousand shares) | 108,216 | 107,215 | 101,396 | 97,342 | 95,241 |

Cash Flows

| FY3/18 | FY3/19 | YoY Change | |

Operating Cash Flow (A) | 6,941 | 10,069 | +3,128 | +45.1% |

Investing Cash Flow (B) | -7,066 | -9,264 | -2,198 | - |

Free Cash Flow (A+B) | -125 | 804 | +930 | - |

Financing Cash Flow | 5,267 | -9,702 | -14,970 | - |

Cash and Equivalents at Term End | 22,019 | 12,876 | -9,143 | -41.5% |

*Unit: million yen

Profit before taxes was 9,108 million yen, depreciation costs were 4,636 million yen, impairment loss on goodwill, etc. was 2,675 million yen, and the company secured an operating cash flow of 10,069 million yen. It increased by 3,128 million yen (45.1%) year-on-year due to the decrease in working capital. Investing cash flow came from capital investments, investments in the core system, and the acquisition of Cephas Pipelines Corp., while the financing cash flow came from repayment of debts, acquisition of treasury stock, and payment of cash dividends.

<Reference: ROE analysis>

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 |

ROE | 9.83% | 6.58% | 7.26% | 8.69% | 7.41% |

Net Profit Margin | 5.88% | 4.19% | 4.73% | 5.23% | 4.12% |

Asset Turnover Ratio | 1.05x | 1.00x | 0.96x | 0.99x | 1.03x |

Leverage | 1.60x | 1.57x | 1.60x | 1.68x | 1.75x |

*ROE = Net Profit Margin × Asset Turnover Ratio × Leverage

*Total assets and equity are averages of the balance during the term (average of balance at the end of previous term and current term).

In the fiscal year ended March 2019, ROE declined due to the decline in the ratio of net income to net sales caused by recording extraordinary losses. However, the company estimates ROE to improve to 8.3% in the fiscal year ending March 2020.

3. Fiscal Year Ending March 2020 Earnings Estimates

(1) Consolidated Earnings

| FY3/19 Act. | Composition | FY3/20 Est. | Composition | YoY Change |

Sales | 136,637 | 100.0% | 133,000 | 100.0% | -2.7% |

Operating Income | 11,713 | 8.6% | 10,000 | 7.5% | -14.6% |

Ordinary Income | 11,883 | 8.7% | 9,700 | 7.3% | -18.4% |

Net Income | 5,625 | 4.1% | 6,400 | 4.8% | +13.8% |

*Unit: million yen

Sales and operating income are forecast to decrease 2.7% and 14.6% year on year, respectively

Sales are estimated to be 133 billion yen, down 2.7% year-on-year. Sales of the valve manufacturing business are estimated to decrease by 3.6% year-on-year due to the decline of valves for semiconductor manufacturing equipment inside and outside Japan, the recoil of valves for a large-scale project in the Middle East, and the effects of the trade friction between the U.S. and China. On the other hand, sales of the brass bar manufacturing business are projected to increase by 1.5% year-on-year due to the productivity improvements after starting operation of upgraded equipment. The operating income is expected to be 10 billion yen, down 14.6% year-on-year. In addition to the effects of the sales decline, commencing operation of the new IT system and starting operation of new plant in the brass bar manufacturing business caused the depreciation costs to increase by about 1.3 billion and 0.2 billion yen, respectively.

The interim dividend is estimated to be 10 yen/share (8 yen/share in the same period the previous year), and the term-end dividend will be 14 yen/share (12 yen/share the previous term) with an annual dividend of 24 yen/share. Thanks to the increase of the profit attributable to owners of the parent and the increased prospects of the dividend payout ratio from around 25% to around 35%, the annual dividend will increase by 4 yen/share.

| FY3/18 Actual | FY3/19 Actual | FY3/20 Estimate |

Yen / US Dollar | 112.04 | 110.37 | 110.00 |

Yen / Euro | 127.19 | 130.00 | 130.00 |

Electrolytic Copper, Yen / Ton | 757,000 | 748.000 | 750,000 |

(2) Sales and Operating Income by Segment

| FY3/19 Actual | Composition | FY3/20 Estimate | Composition | YoY Change |

Valve Manufacturing | 109,969 | 80.5% | 106,000 | 79.7% | -3.6% |

Brass Bar Manufacturing | 23,643 | 17.3% | 24,000 | 18.0% | +1.5% |

Other | 3,025 | 2.2% | 3,000 | 2.3% | -0.8% |

Total Sales | 136,637 | 100.0% | 133,000 | 100.0% | -2.7% |

Valve Manufacturing | 14,938 | 13.6% | 13,500 | 12.7% | -9.6% |

Brass Bar Manufacturing | 287 | 1.2% | 500 | 2.1% | +74.2% |

Other | 90 | 3.0% | 50 | 1.7% | -44.4% |

Adjustments | -3,602 | - | -4,050 | - | - |

Total Operating Income | 11,713 | 8.6% | 10,000 | 7.5% | -14.6% |

Valve Manufacturing Business

Sales of the domestic market will be 68 billion yen, down 1.4 billion yen (2.0%) compared to the previous year. Sales of valves for building facilities is expected to increase by 1.7% year-on-year thanks to redevelopment projects in the Tokyo Metropolitan Area and demand for valves for facilities related to the Olympics, and a healthy performance is expected as a whole. Furthermore, Industrial valves are forecasted to sell well focusing on the demand for maintenance and renewal of existing plants. However, while the company expects a recovery in the second half, the performance of valves for semiconductor manufacturing equipment will substantially decline by 25% year-on-year (SPE manufacturers are expected to make orders in advance to secure parts in response to recovery of the semiconductor market)

Sales of the overseas market will be 38 billion yen, down 2.6 billion yen (6.4%) compared to the previous year. In North America, investments related to Oil&Gas is regaining momentum due to the recovery of crude oil prices, however, the US-China trade friction effects are causing some concerns. As for ASEAN, capital investments have been slowing down, and elections continued to run in each country, thus the company is keeping an eye for infrastructure investments. In China, private capital investment slowed down and demand for real-estate has reached its peak, while the digital industry expanded. Although the future of the semiconductor market is opaque in South Korea, Cephas Pipelines Corp., which had posted impairment losses in the fiscal year ended March 2019, is expected to turn to profitability. Also, exports are not very strong in Europe, however domestic demand is stable and orders from distributors to replenish stock were resumed. Sales will decrease in reaction to the large-scale projects in the Middle East.

The operating income is expected to be 13.5 billion yen, down 1,438 million yen (9.6%) year-on-year. As materials costs are expected to decline (1.5 billion yen), the market conditions of raw materials and foreign exchange rate will slightly be factors in increasing the profit, however, due to the effects of sales decline (factors in decreasing the operating profit of 650 million yen) SG&A, especially the depreciation costs, will increase by 2.3 billion yen.

Brass Bar Manufacturing Business

The copper price is assumed to be 750 thousand yen/ton. The domestic demand for brass bars is in a downward trend. The company is making efforts to achieve broad productivity improvements by starting the operation of new plant and provide a supportive work environment. In addition, it aims to expand the margins of the products through a unique material development. In terms of profitability, while the depreciation costs increase, the company will offset it by boosting production capacity and yield, reducing costs, and expanding special materials business, etc.

【Capital investment and depreciation expenses】

The global new IT system (a total invested amount of about 7 billion yen) commenced operation in May 2019. Also, the construction for investments (expected total amount: approx. 5.5 billion yen) to update the facilities of the brass bar manufacturing business (KITZ Metal Works Corporation) is progressing well and mass production is expected to start in the second half. The major capital investment of the fiscal year ending March 2020 includes the KITZ Micro Filter Corporation's new factory with approx. 1 billion yen, updating the facilities of KITZ Metal Works Corporation with approx. 3 billion yen (it was planned in FY 3/2019 but it was partially carried over), etc. On per segment basis, the valve manufacturing business was 6.7 billion yen (6.2 billion yen in FY 3/2019), the brass bar manufacturing business 3.4 billion yen (3.7 billion yen in the previous term), and other 100 million yen (100 million yen in the previous term), with a total of 10.2 billion yen (10 billion yen in the previous term). The depreciation expenses and the amortization of goodwill made a total of 6.7 billion yen (5.1 billion yen in the previous term).

4. The 4th Medium-Term Management Plan (FY 3/20~FY 3/22)

Review of third Mid-Term plan (FY3/17~FY3/19)

| FY 3/17 Plan | Result | FY 3/18 Plan | Result | FY 3/19 Plan | Result |

Valve Manufacturing | 92,000 | 91,766 | 95,000 | 98,162 | 100,000 | 109,969 |

Brass Bar Manufacturing | 16,400 | 19,333 | 16,500 | 23,535 | 16,500 | 23,643 |

Other | 3,100 | 3,002 | 3,500 | 2,867 | 3,500 | 3,025 |

Total Sales | 111,500 | 114,101 | 115,000 | 124,566 | 120,000 | 136,637 |

Valve Manufacturing | 11,000 | 11,444 | 11,900 | 12,798 | 13,150 | 14,938 |

Brass Bar Manufacturing | 250 | 831 | 350 | 699 | 100 | 287 |

Other | 100 | 59 | 150 | -28 | 150 | 90 |

Adjustments | -3,350 | -3,405 | -3,400 | -3,351 | -3,400 | -3,602 |

Total Operating Income | 8,000 | 8,929 | 9,000 | 10,117 | 10,000 | 11,713 |

ROE | 6.6% | 7.3% | 7.2% | 8.7% | 7.7% | 7.4% |

The target of both sales and operating income were achieved earlier than the plan.Sales of the valve manufacturing business, which acted as the main driver, has increased and its profitability was improved thanks to the good domestic and overseas market environment, the healthy performance of valves for semiconductors, and the price revisions that continued for 2 years. Moreover, the company did not simply peruse profitability as the 3rd Medium-term Management Plan was characterized by focusing on cash flow together with profitability, which led the company to achieve its target of "ROE of 8% or more” (8.7% in FY 3/2018).

In addition to the aforementioned quantitative goals, the company also aimed at “concentrating resources on priority market sectors that take advantage of its strengths”. The priority market sectors, in which the company released new products and concentrated capital and R&D investments are “building facilities”, ”petrochemistry and general chemistry”, and “clean energy” sectors. Additionally, the company reinforced the strategy promoting system that goes through headquarters and applied the PDCA cycle, which is a key strategy. While the company achieved a level of accomplishments, it plans to continue the initiatives of the 4th Medium-Term Management Plan.

Additionally, it maintained a high level of total shareholder returns (total shareholder returns: 92.5% in FY 3/2017, 80% in FY 3/2018, 70.1% in FY 3/2019) thanks to its initiatives to increase shareholders returns, pay cash dividends of more than the target dividend payout ratio of 25%, and treasury stock acquisition.

Review by segment

Valve Manufacturing Business

Increase in earnings in the domestic market | Commercial valves for building facilities in the Tokyo Metropolitan Area and industrial valves for chemicals and semiconductors are healthy. The price revision conducted for the 2nd consecutive year contributed to the performance. |

Narrowing down of target market fields and regions | In ASEAN countries, which are target regions, new bases were established in Vietnam, Malaysia, the Philippines and Indonesia. In China, Changshu Branch Office was established as a combined functionality (sales, marketing, development, manufacturing) base. In the Americas, a global trunnion valve was developed, stocks were enriched and the order receipt system was strengthened. In South Korea, Cephas Pipelines Corp. was acquired to expand product lineup of butterfly valve. In preparation for commercialization, a hydrogen station which utilizes compact package units was constructed in the Nagasaka factory. Regarding semiconductors, aggressive capital investment in response to a rapid increase in demand greatly contributed to the performance. |

Promotion of a matrix system, group business strategy and new product development | Product Management Center (PMC) was established and a system was constructed in which a new product goes from marketing to selling on the market in one go. The large-scale project centered around the Middle East demonstrated synergy due to a cooperative industry system with Europe. |

Cost reduction | Reduction in manpower due to automation, insourcing, promotion of global procurement, and reorganization and modularization of products progressed. |

In the domestic market, the demand for commercial valves for building facilities, including redevelopment projects in the Tokyo Metropolitan Area, stayed at a high level, and regarding industrial valves, the equipment upgrading and investment for increase in production was actively carried out in the entire manufacturing industry including chemicals, equipment and devices, so the business environment continued to be favorable. In overseas markets, while the ASEAN market continued steady growth, the market in the Americas recovered due to the increase in the price of crude oil, but the harsh conditions in European markets continued. In China, products for data centers sold well and in the Middle East, valves were supplied for the largest project on record. In addition, sales of products for semiconductors greatly increased both domestically and internationally. Regarding profits, there was a sharp increase in the price of raw materials, components, indirect materials and distribution cost, as well as an increase in labor cost and R&D expenditure, but in addition to an increase in sales and products for semiconductors performing well, the price revision conducted for the 2nd consecutive year steadily penetrated the market. This had a cost reduction effect and performance exceeded the initial plan greatly.

Points of reflection and challenges

・ Strengthening of combined functionality in overseas markets and promotion of a strategy of local production and consumption (already in progress in China and India) required.

・ Constructing a system which connects industrial valves for manufacturing plants to MRO (Maintenance, Repair and Operations) business will be a challenge.

・ Improving productivity through the newly developed and adopted PLM (Product Lifecycle Management) will be a challenge.

・ Expansion of the butterfly valve lineup was implemented after the acquisition of Cephas Pipelines Corp., but due to the slowdown of the South Korean economy, an impairment loss of assets was posted. Support will be provided, mainly for manufacturing.

Brass Bar Manufacturing Business

During FY 3/2018, when the market price of copper was on an upward trend, the company recorded sales and profits far exceeding the initial plan (increase in sales and profits year on year). During FY 3/2019, sales and profits exceeded the initial plan, but due to the effects of a fluctuating market price, while sales increased year on year, profits decreased year on year. Starting from FY 3/2020, a significant increase in productivity is expected due to the operation of new casting plant. Initiatives will be taken to expand margins through the development of characteristic raw materials.

Other

While the difficult situation continued due to a reduction in the number of tourist groups, attracting individual tourists and strengthening cost reduction resulted in sales and profit exceeding the initial plan and a profit surplus was acquired during FY 3/2019 (deficit in operating profits during the previous term). In the future, initiatives will be taken to establish a business constitution and cost structure that can produce earnings with stability.

Capital Investment

Construction of a new IT system (Total Investment: Approximately 7 billion yen)

The “KITZ Innovation Global System (KInGS)” project for the development and installation of a global IT system, which has been developed since 2015, was completed and began operation in May 2019.

Large-scale capital investment in brass bar manufacturing business (Total Investment: Approximately 5.5 billion yen)

Investment for renewal of worn-out equipment of KITZ Metal Works, Co., Ltd was completed in the new factory building with new casting equipment. After the trial run, mass production using the new equipment is expected to begin in the second half of FY 3/2020.

Investment for increasing production capacity and Cost Reduction

In the Ina factory, as part of the improvement in production lines, painting robots were brought in and the production capacity for butterfly valves, which is expected to increase in demand, was strenghend. Further, in order to respond to the increase in demand from semiconductor production equipment manufacturers, KITZ SCT Corporation expanded Building B of the Niita SC Factory (Gunma Prefecture) and constructed a factory exclusively for unit products. In addition, a second factory was constructed in KITZ SCT Corporation Kunshan in China, which manufactures commercial products.

Restoration of Balance Sheet and Strengthening of Governance

For the sale of cross-held shares, focusing on the corporate governance code, the importance of held shares was reconsidered and in order to improve capital efficiency, investment securities (approximately 30 kinds of securities) were sold. For the setup and transfer of trust beneficiary rights to fixed assets (headquarters building), in order to improve the financial standing, the trust beneficiary rights were setup and transferred to the real estate of the headquarters building (posting extraordinary losses). A “remuneration committee” where a majority of members are outside directors and which will make decisions on the remuneration of executives, and a “nomination committee” which will select candidates for directors, auditors and executive officers from a multilateral point of view, were created voluntarily. Further, in order to secure a supervision system with high management efficiency, the number of outside directors was increased from 2 to 3.

KITZ Group’s Ideal State and Middle and Long-Term Numerical Goals

Ideal state for 2030 (FY 3/2031)

1. Offering world class technology and engineering to customers and contributing to lowering of environmental burdens by responding to the energy shift and a move towards a recycling-oriented society.

2. Reforming the business model and strengthening product development capacity through ICT and building a strong position in the growing market.

3. Supporting the development of global societal infrastructure along with the growth of local economies in various countries.

4. Aiming for a company where employees can improve their lifestyles and work safely and healthily under fair and transparent rules.

Ideal Ways of Management

1. Global synchronization of management information and execution of evolved consolidated management.

2. Distribution and utilization of personnel, property and capital from the point of view of overall group optimization.

3. “Visualization” of global supply chains and incorporating simple decision-making into management and increasing labor saving investment and labor productivity.

Mid/long-term numerical goals

The target for growth is “an annual sales growth rate of 4%”, the target for profitability is “an annual EPS growth rate of 7%” and the efficiency target is “an ROE of 12%.” Further, the sales and profit targets for FY 3/2031 are sales of 200 billion yen (165 billion yen from valves business, 32 billion yen from copper and brass bar manufacturing business and 3 billion from other).

The 4th Medium-Term Management Plan

Market Conditions

The Japanese market, after reaching its peak before the consumer tax raise in 2019, will continue slow growth for the middle and long-term. There will be a fall in reaction after Tokyo Olympics, but demand is expected to return afterwards. The capital investment trend in the manufacturing industry is expected to show a downward trend, partly due to the business cycle, so the market price of industrial valves is expected to go down. In the markets of the Americas, the trade war between United States and China is a cause for concern, but crude oil price has been on an upward trend and the company’s capital investment is stable as well. In the European markets, there has been a lack in export strength, but with domestic demand healthy, there are no significant changes. However, the effects of BREXIT are a cause for concern. The Chinese economy will continue to slow down. The manufacturing industry is being cautious due to the risk of prolongation of the U.S.-China trade war. Real estate demand has reached its peak, but with national policies, the digital industry is expected to grow. Regarding ASEAN, the slowing Chinese economy and an outward flow of capital from emerging nations are causes for concern, but stable growth is expected for the middle term. The semiconductor market has entered an adjustment phase in the second half of FY 3/2019 due to the postponement of capital investment by equipment manufacturers, but a recovery is expected starting from the second half of FY 3/2020.

Numerical goal (Precondition 1US$=110yen, electrolytic copper750,000 yen/ton)

| 3/19 Actual | 3/20 Plan | 3/21 Plan | 3/22 Plan |

Valve Manufacturing | 1,099 | 1,060 | 1,100 | 1,150 |

Brass Bar Manufacturing | 236 | 240 | 250 | 260 |

Other | 30 | 30 | 30 | 30 |

Consolidated sales | 1,366 | 1,330 | 1,380 | 1,440 |

Valve Manufacturing | 149.0 | 135.0 | 155.0 | 163.0 |

Brass Bar Manufacturing | 2.9 | 5.0 | 10.0 | 12.0 |

Other | 0.9 | 0.5 | 0.5 | 0.5 |

Headquarters expenses | -36.0 | -40.5 | -40.5 | -40.5 |

Consolidated Operating income | 117 | 100 | 125 | 135 |

The depreciation expenses & The amortization of goodwill | 51 | 67 | 75 | 80 |

EBITDA | 168 | 167 | 200 | 215 |

EPS | 56.50 Yen | 68.49 Yen | 85.00 Yen | 95.00 Yen |

ROE | 7.4% | 8.3% | 9.5% | 10.0% |

*Unit: billion yen

Growth Strategy

Valve Manufacturing

Aiming for Global Strong No.2. Specifically, the company is now one of the top 3 valve manufacturers (there are only 3 companies including the company that are in the sales range of 110-120 billion yen) but will be aiming for the second place after the world top American valve manufacturer (sales from business related to valves approximately 350 billion yen (the company’s estimate)). Initiatives will be taken in the domestic markets, overseas markets and plant markets in order to achieve this goal.

In the domestic market, butterfly valves, ductile valves and automatic valves will be marked as focused valve types and the distribution market, along with chemicals, electricity, iron and steel, and water treatment will be treated as important markets and will be strategically dealt with. In chemicals, electricity, iron and steel, and water treatment markets, improvements will be made for the constitution based on marketing activities aimed at end users. Further, the variety of products will be strategically increased. Regarding development and manufacturing, efforts will be made to reduce loss of opportunity, cost and delays in payment by controlling demand and making swift responses, and through reorganization and modularization of products, their price, management and storage will be reduced.

In overseas markets, initiatives will be taken to approach Asia’s middle class (volume zone = commercial valves) and the sales promotion of quarter-turn valves in Europe and America. For this purpose, along with reconsidering the distribution channels strategy and price strategy in Asia, the release of new brand products will also be considered. Efforts will also be made to expand the product lineup and reduce the lead time. Initiatives will be taken to introduce industrial-use butterfly valves in European and American markets and to promote sales of the MGA brand and KITZ brand in Latin American markets.

In plant markets, the aim is to increase earnings through MRO (Maintenance, Repair and Operations). To achieve this aim, key users will be narrowed down and strategically dealt with by focusing on the fields of general chemistry, petrochemistry and the environment. Further, the project business will be reconstructed, the information from the initial order to MRO will be visualized and cooperation with group companies like KITZ Engineering Services Inc. will be continued.

Brass Bar Manufacturing

The aim will be to reach the high earning position of No. 2. The new plant will begin operation in September and compared to the old equipment which had been operated for many years, productivity will significantly increase and with automation and reduction of manual workers by incorporating robots, an environment that is easier to work in will develop. Further, by engaging in margin expansion through the development of characteristic raw materials, tie-ups with other companies will be expeditiously responded to and initiatives will be taken in the development of advanced materials and accumulation of technology through collaboration with industry, government and academia.

Other (Hotel business)

By sensitively responding to changes in the times and the environment, the business constitution and cost structure will be established for producing earnings with stability.

Initiatives Towards ESG

Environment Contributing to the Global Environment through Business

Along with making efforts to develop and present products and services with consideration to the environment, the reduction, recycling and reuse of industrial waste will also be promoted. Efforts are also being made to prevent and avoid environmental pollution both in group and globally.

Social Giving Importance to Personnel, Safety and Local Communities

Along with promoting a variety of personnel (diversity), efforts will also be made to cultivate a corporate culture that gives importance to safety, health and human rights. Further, initiatives will be taken to make contributions through business activities and social activities.

Governance Implementing Fair and Just Management

Along with establishing a healthy corporate governance system, efforts will be made to improve transparency in management, strengthen the management surveillance system and strengthen the effectiveness of the board of directors.

Management Strategy

Global Consolidated Management

Based on the operation of the new mission-critical task system, the unification of the accounting periods of all group companies will be considered. Further, along with distinctively operating the organization (virtual organization) and report lining that straddles over the company, the global funds management will be enhanced and strengthened.

Activation of the Growth Investment Proposal

By recognizing growth opportunities and bottlenecks, aggressive investment will be made to remove such bottlenecks.

Strengthening of Group Personnel and Nurturing of Global Personnel

Along with supporting the nurturing of group management staff, diversity will also be promoted. Further, efforts will be made to make fair evaluations.

Dividend Policy

As per the decisions made in the 4th medium-term management plan, in order to further increase profit returns through shareholder dividends, the desirable standard for dividend payout ratio will be raised by 10%, from profit attributable to owners of parent of around 25% to around 35%. Accordingly, the annual dividend amount for FY 3/2020 is expected to be a record high of 24 yen/share.

Further, after considering the investment amount required for middle and long-term growth, and after taking into consideration the stock market, stock price tendency and the circumstances of the capital currently at hand, the acquisition of treasury stocks will be considered when necessary.

5. Conclusion

The 3rd Medium-term Management Plan finished with sales and profit that exceeded plans. However, the company has many areas with potential for growth that the company needs to address to expand major products such as the domestic butterfly valves and ductile iron valves, cultivate overseas market focusing on ASEAN, and focus on MRO of the plant market. Therefore, the company plans to embrace the 4th Medium-term Management Plan as well as improving the profitability of the brass bar manufacturing business, of which production capacity has widely improved due to starting the operation of new equipment and providing a supportive work environment.

Furthermore, according to the press, Kawasaki Heavy Industries, Ltd. is supporting the widespread of using hydrogen, which is hailed as the next generation energy and is working towards commercializing facilities to liquefy hydrogen by 2020 (a first for a domestic manufacturer). It is said that if it can transport hydrogen efficiently and establish distribution channels including storage, the expansion of hydrogen stations and fuel-cell vehicles (FCV) that use hydrogen can be achieved, and there will be more opportunities for utilizing power generated with hydrogen. The company is operating a hydrogen station using a compact package unit in the Nagasaka Plant (Hokuto City in Yamanashi Prefecture) and it's developing technologies to make valves for hydrogen. The company is considering introducing a compact, feature-packed, and low-cost compact package units to the market. Moreover, the company uses fuel-cell vehicles and fuel-cell forklifts as company cars. Thus, the company aims to focus on developing business related to hydrogen while proceeding with the 4th Medium-Term Management Plan.

<Reference: Regarding Corporate Governance>

◎ Organizational structure, Composition of board of directors and company auditors

Organizational structure | Company with board of company auditors |

Board of directors | 6 directors (3 are outside directors) |

Company auditors | 4 auditors (2 are outside auditors) |

Corporate governance report (Updated on:November 22 2018)

Basic policy

Our corporate ethos is to continuously improve our corporate value by offering creative, high-quality products and services. Under this ethos, we strive to achieve business administration that takes care of the interests of shareholders and all other stakeholders as a socially responsible company. Moreover, in order to increase business administration efficiency and enhance our compliance with laws, we will listen to requests from stakeholders and consider the social trends, etc. in order to swiftly and efficiently achieve a sound and highly transparent business administration by implementing a variety of measures, and intend to enrich corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

We undertake all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

11. Policy for Constructive Dialogue with Shareholders (Principle 5-1)

We recognize that, in order to achieve sustainable growth and enhance medium- to long-term corporate values, it is important to be aware of the accountability as a trustee of management, disclose information to stakeholders such as shareholders and investors in a timely and appropriate manner, and maintain fairness and transparency in management. We also believe that it is important to provide necessary information on an ongoing basis and also to conduct IR activities to utilize opinions and requests from external viewpoints for management improvement. Therefore, in order to promote constructive dialogue with shareholders and gain their understanding regarding management strategies and plans, the Company has established an IR system centered around the representative director and IR executive officer, and is implementing the following policies:

(1) The company appoints an executive officer to be in charge of IR and holds financial results meeting every quarter aimed at institutional investors and analysts. In addition, the company holds a company information session every year aimed at individual investors. As a rule, the head of the IR department responds to shareholders' requests for consultations, but either the representative director or IR executive officer may respond depending on the purpose of the consultation and the number of shares held.

(2) With a focus on IR executive officers, the Company seeks to coordinate and collaborate with its departments, and holds meetings with the IR department, management planning department, accounting department, general affairs and human resources department, legal department, etc. as necessary.

(3) The Company conducts meetings for institutional investors and analysts each quarter, with financial results briefings in March (end of the term) and September (2nd quarter), and analyst meetings regarding financial results in the 1st and 3rd quarters. In addition, company briefings for individual investors are held every year. At these company briefings, explanations are given by the president himself. In addition to information regarding financial results, such as summary of financial results and securities report, other information is also disclosed on the Company website, regarding IR topics such as management information, information on shares and shareholders meetings, and reports on corporate governance.

(4) The Company periodically reports opinions gathered from dialogue with institutional investors and analysts to the representative director and IR executive officer. If necessary, the representative director will inform the Board of Directors and management committee.

(5) The Company pays close attention to managing insider information, and considers the executive officer in charge of the accounting department to be responsible for handling information. The accounting executive officer, IR department, and management planning department discuss details regarding information disclosure prior to opening a dialogue with institutional investors and analysts.

(6) The Company examines the status of practical shareholders from the shareholder registry at the end of March and September every year, and uses this information for IR activities.

(7) As the company aims to achieve sustainable growth and improve corporate value in the medium to long term, the company drew up a long-term management plan, medium-term management plan, and management plan for each fiscal year for the realization of business administration focused on capital cost. In addition, it established target figures for items such as sales, operating income, ordinary income, the ratio of overseas sales, the amount of interest-bearing debt, equity ratio, and return on equity (ROE) and reviews them regularly. Moreover, the company makes decisive business decisions such as changing the business portfolio for new businesses according to the management strategies, the management plan, etc. and after firmly grasping the environment surrounding the business as well as the business risks.

(8) Regarding the investment strategy, the company makes planned and strategic capital investments, R&D investments, investments in human resources, etc. to achieve sustainable growth and corporate value improvements in the mid-and-long-term, from the perspective of increasing returns that are commensurate with the mid-and-long-term capital cost and efficiently utilizing the management resources. As for the financial strategy, the company sets financial management policies including capital structure focused on capital cost, and utilization of cash on hand, then, applies them accordingly while considering the management strategies, the management plan, etc. The company discloses information about the management policy, the management plan, etc. on its website, and explains them at the financial results briefings and general meetings of shareholders.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved.

|

For back numbers of Bridge Reports on KITZ Corporation (6498) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/