Bridge Report:(6498)KITZ the Fiscal Year March 2020

President Yasuyuki Hotta | KITZ Corporation (6498) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Yasuyuki Hotta |

HQ Address | 1-10-1 Nakase, Mihama-ku, Chiba, Japan |

Year-end | December |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥723 | 92,221,903 shares | ¥66,676 million | 6.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

- | - | - | - | ¥819.49 | 0.9 x |

*Share price is as of closing on May 20. The number of issued shares is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter. ROE and BPS are the results of the previous term.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | Dividend (¥) |

March 2017 Act | 114,101 | 8,929 | 8,799 | 5,400 | 51.43 | 13.00 |

March 2018 Act | 124,566 | 10,117 | 9,733 | 6,518 | 65.50 | 17.00 |

March 2019 Act | 136,637 | 11,713 | 11,883 | 5,625 | 58.50 | 20.00 |

March 2020 Act | 127,090 | 6,950 | 7,241 | 4,937 | 53.06 | 20.00 |

December 2020 Est. | - | - | - | - | - | - |

(Units: ¥mn)

*The full-year earnings forecast is still to be disclosed.

This Bridge Report presents details and analysis of KITZ Corporation’s earnings results for the fiscal year ended March 2020, future outlook, and initiatives.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2020 Earnings Results

3. Fiscal Year ending December 2020 Earnings Estimates

4. Conclusions

<For reference: Initiatives based on ESG and SDGs>

<Reference: Regarding Corporate Governance>

Key Points

- For the fiscal year ended March 2020, sales declined 7.0% year on year, and operating income dropped 40.7% year on year. While 3 business segments saw a decrease in sales, operating income rate worsened, due to the decline in sales of highly profitable products and the temporary turmoil through the operation of new IT systems in the valve manufacturing business, the establishment of a new factory and the decrease of selling prices in the brass bar manufacturing business, and the augmentation of depreciation in the two businesses.

- Since the account closing month will be changed from March to December, the fiscal year ending December 2020 will be 9 months. Since “it is difficult to predict the impact of the spread COVID-19,” the earnings forecast for the fiscal year ending December 2020 and dividends are still to be determined. The company plans to disclose them at the right timing. On the other hand, the company resolved to acquire treasury shares (up to 3,200,000 shares worth 2,000 million yen) in March 2020.

- In the fiscal year ended March 2020, there were many negative factors. As the positive side, we can expect the rebound from it in the fiscal year ending December 2020. The impact of the novel coronavirus is unpredictable, and the overseas business remains stagnant, except the semiconductor-related business, but in Japan, the semiconductor-related business has started recovering, and the outlook for other markets, too, is not so bleak. The noteworthy point in the fiscal year ending December 2020 is the progress of their activities under the basic policy, rather than numerical target. Their activities will determine the mid/long-term growth potential, and the activities include the fortification of the organizational structure for the valve manufacturing business, the implementation of product strategies for industrial filters in domestic and overseas markets, IT strategies, management strategies, the integration of production to the new factory in the brass bar manufacturing business, and the development and commercialization of new materials that comply with environmental regulations. We would like to pay attention to how much these activities will produce good results.

1. Company Overview

KITZ is an integrated manufacturer of valves and other fluid control equipment and devices. In valve manufacturing, it ranks highest in Japan and within the top 10 worldwide. Valves are made of various materials depending on their application, including bronze, brass, cast iron, ductile cast iron (cast iron with greater strength and ductility) and stainless steel. KITZ in principle assumes integrated production (casting, processing, assembling, inspecting, packaging and shipping) of products from raw materials. The KITZ Group consists of 36 domestic and overseas subsidiaries. In addition to the production and sale of brass bars used for valves, water faucets and gas equipment (KITZ is ranked among the top manufacturers of brass bars within Japan), the Group also operates a hotel business.

[Corporate Philosophy: To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services.]

KITZ believes that corporate value is equivalent to shareholder value from a medium- to long-term perspective. To continue increasing this value, it says that it must achieve sustained growth accompanied by earnings through earning the trust of customers.

And by improving corporate value, the Company desires to help create a more prosperous and fulfilling society by providing many types of benefits to its shareholders, customers, employees, business partners, and society. Setting these goals in the KITZ Statement of Corporate Mission, the Company seeks to further progress in the future.

KITZ’ Statement of Corporate Mission |

To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services. |

1-1 Overview of KITZ’s Business Segments

KITZ’s businesses consist of the valve manufacturing, brass bar manufacturing and other (including hotel and restaurant management) segments. During the fiscal year ended March 2020, these segments accounted for 81.1%, 16.6%, and 2.3% of total sales, respectively.

Valve Manufacturing Business

Valves are used to pass, stop and adjust the flow of fluids in various pipe systems (water, air, gas and other substances). They are used in building facilities, residential utility systems, water supply facilities, fresh water and sewer systems, fire prevention equipment, machinery and industrial equipment manufacturing facilities, chemical, medical, and petrochemical product manufacturing facilities, semiconductor manufacturing facilities, oil refineries and other industrial complexes, among other applications. The Company operates an integrated production system that begins with the casting process (KITZ was the first Japanese company to acquire ISO 9001 international quality standard certification). The Company’s product offerings include commercial valves, which are made of corrosion-resistant bronze and highly economical brass for use in the building construction sector, including building facilities and residential utility systems, and industrial stainless steel valves such as high-value-added ball valves. The Company has a high share of the domestic market in these mainstay product areas.

Building facilities Valves, etc. used for air-conditioning, sanitary, and anti-disaster equipment when constructing hotels, hospitals, office buildings, and so on | Water supply/water supply facilities Devices and equipment for pipes for water supply and sewage systems, valves used for facilities for treating water and sludge, products for water supply equipment for detached house, housing complexes, etc. |

Gas/energy facilities Valves, etc. used for liquefied natural gas (LNG) production facilities, pipelines, and so on | Industrial machinery/production equipment All kinds of valves used for industrial machinery and production equipment |

Oil refining and oil complex facilities Valves, etc. used for the processing lines of oil refineries, petrochemical facilities, and chemical plants | Semiconductor manufacturing equipment Valves and joints for semiconductor manufacturing equipment (manufactured and sold by its group company, KITZ SCT Corporation) |

Brass Bar Manufacturing Business

Copper alloy can take many different shapes, including sheets, strips, pipes, bars and wires through hot or cold deformation processing such as dissolution, casting, rolling, extruding, and forging. It can be made with a range of different materials, including brass (copper with zinc), phosphor bronze (copper with tin and phosphorous), and nickel silver (copper with nickel and zinc). The KITZ Group's brass bar manufacturing business is led by KITZ Metal Works Corporation and Hokutoh Giken Kogyo Corporation. These companies manufacture and sell brass bars, which are used not only as material for valves, but also in the manufacture of water faucets, gas equipment, electrical appliances, and other brass-derived items.

Other

KITZ subsidiary Hotel Beniya Co., Ltd., operates a resort hotel in the city of Suwa, Nagano Prefecture. The hotel is located in a highly picturesque setting close to Lake Suwa with hot spring bathing facilities with sunset views and has a number of small and large banquet halls. The hotel also has a large convention hall, giving it the capacity to hold international conferences.

Business Segment Sales

| FY 16/3 | FY 17/3 | FY 18/3 | FY 19/3 | FY 20/3 |

Valve Manufacturing | 93,579 | 91,766 | 98,162 | 109,969 | 103,114 |

Brass Bar Manufacturing | 20,557 | 19,333 | 23,535 | 23,643 | 21,061 |

Other | 3,141 | 3,002 | 2,867 | 3,025 | 2,914 |

Total Sales | 117,278 | 114,101 | 124,566 | 136,637 | 127,090 |

(Units: ¥mn)

2.Fiscal Year Ended March 2020 Earnings Results

2-1 Consolidated Business Results

| FY 3/19 | Composition | FY 3/20 | Composition | YoY Change | Initial Est. | Divergence |

Sales | 136,637 | 100.0% | 127,090 | 100.0% | -7.0% | 124,000 | +2.5% |

Gross Income | 38,449 | 28.1% | 33,530 | 26.4% | -12.8% | - | - |

SG&A | 26,735 | 19.6% | 26,580 | 20.9% | -0.6% | - | - |

Operating Income | 11,713 | 8.6% | 6,950 | 5.5% | -40.7% | 6,500 | +6.9% |

Ordinary Income | 11,883 | 8.7% | 7,241 | 5.7% | -39.1% | 6,300 | +14.9% |

Net Income | 5,625 | 4.1% | 4,937 | 3.9% | -12.2% | 4,300 | +14.8% |

(Units: ¥mn)

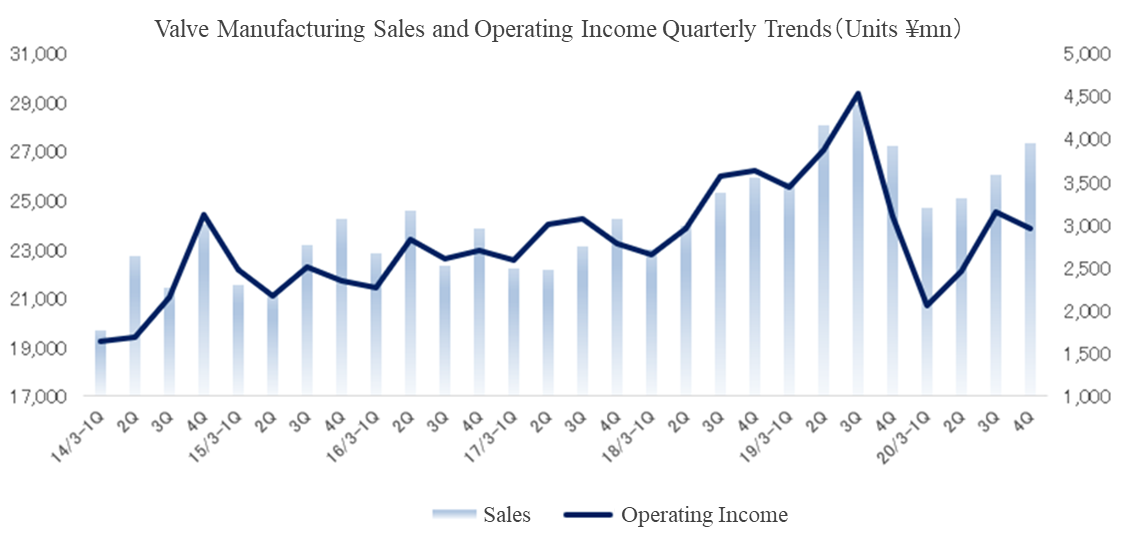

Sales and operating income dropped 7.0% and 40.7%, respectively, year on year.

Sales were 127,090 million yen, down 7.0% year on year. The sales of the valve manufacturing business decreased 6.2% year on year, as its sales dropped inside and outside Japan. The sales of the brass bar manufacturing business dropped 10.9% year on year, due to the fall in the market prices of raw materials, etc. The sales of other business, including the hotel business, declined 3.7% year on year, due to the typhoons and the novel coronavirus. Namely, all of the 3 businesses saw a drop in sales. The ratio of overseas sales was 30.6% (That for the valve manufacturing business: about 37%).

As for profits, operating income decreased 40.7% year on year to 6,950 million yen, due to the decline in sales of highly profitable products and the temporary turmoil through the operation of new IT systems in the valve manufacturing business, the establishment of a new factory and the decrease of selling prices in the brass bar manufacturing business, and the augmentation of depreciation in the two businesses. However, net income decreased only 12.2% year on year to 4,937 million yen, thanks to the improvement in non-operating income/loss due to the increase in revenue from subsidies and the improvement in extraordinary income/loss due to the posting of gain on sale of investment securities (355 million yen) and the decline in impairment loss (the posting of an impairment loss of 2,485 million yen for a subsidiary in South Korea in the previous term).

Exchange and raw materials

| FY 3/19 | FY 3/20 | 3/20 Estimate |

Yen / US Dollar | 110.37 | 109.25 | 109.00 |

Yen / Euro | 130.00 | 122.15 | 120.00 |

Electrolytic Copper, Yen / Ton | 748,000 | 682,000 | 660,000 |

2-2 Business Segment Sales, Operating Income

| FY 3/19 | Composition | FY 3/20 | Composition | YoY Change | Initial Est. | Divergence |

Valve Manufacturing | 109,969 | 80.5% | 103,114 | 81.1% | -6.2% | 100,200 | +2.9% |

Brass Bar Manufacturing | 23,643 | 17.3% | 21,061 | 16.6% | -10.9% | 20,900 | +0.8% |

Other | 3,025 | 2.2% | 2,914 | 2.3% | -3.7% | 2,900 | +0.5% |

Total Sales | 136,637 | 100.0% | 127,090 | 100.0% | -7.0% | 124,000 | +2.5% |

Valve Manufacturing | 14,938 | 13.6% | 10,627 | 10.3% | -28.9% | 10,200 | +4.2% |

Brass Bar Manufacturing | 287 | 1.2% | -6 | - | - | 200 | - |

Other | 90 | 3.0% | -11 | - | - | 0 | - |

Adjustments | -3,602 | - | -3,658 | - | - | -3,900 | - |

Total Operating Income | 11,713 | 8.6% | 6,950 | 5.5% | -40.7% | 6,500 | +6.9% |

(Units: ¥mn)

Valve Manufacturing Business

Domestic sales were 64,974 million yen, down 4,404 million yen (6.3%) year on year. The turmoil caused by the operation of the new IT system subsided, but the delay in delivery of some products is lingering. The sales of valves for building facilities were relatively healthy around the end of the term, but annual sales declined from the previous term, due to the significant inventory in the market, while the delivery of valves for redevelopment projects in the Tokyo Metropolitan Area was finished. The sales of industrial valves decreased from the previous term, but their performance, mainly for MRO, was healthy. On the other hand, the sales of valves for the water market (water supply and sewage) increased from the previous term, because they sold well mainly in Tokyo and the revision of prices produced good results. The sales of valves for semiconductor manufacturing equipment bottomed out in the first quarter and started recovering gently in the second quarter.

Overseas sales were 38,139 million yen, down 2,450 million yen (6.0%) year on year. The performance of valves for semiconductor manufacturing equipment in China and South Korea bottomed out, and both the number of orders and sales are increasing in South Korea. As for the performance in each region, the sales of commercial and industrial valves in China were healthy until December, and the sales in ASEAN countries, South Korea, etc. increased slightly (The sales of Cephas, a subsidiary in South Korea, grew year on year). Due to the drop in the crude oil price in the Americas and Europe, the investment for oil & gas was sluggish, but restocking orders from distributors increased in Europe.

Operating income was 10,627 million yen, down 4,311 million yen (28.9%) year on year. The main factor in decreasing the profit is the decrease of the sales quantities of bronze and brass valves and the valves for semiconductor manufacturing equipment, which are highly profitable, and another factor is the augmentation of depreciation through the operation of the new IT system. In addition, amid the turmoil due to the operation of the new IT system, cost reduction did not progress as expected.

Brass Bar Manufacturing Business

Sales were 21,061 million yen, down 2,581 million yen (10.9%) year on year, and operating loss was 6 million yen (in the previous term, a profit of 287 million yen was posted). The market price of copper, which affects selling prices, decreased considerably throughout the term (from approx. 750,000 yen/ton to less than 600,000 yen/ton). Sales volume, too, declined, while selling prices dropped due to the fall of the market prices of raw materials.

As for profits, the improvement in productivity did not progress as expected, due to the augmentation of depreciation after the commencement of mass production at a new factory (5.5 billion yen invested) and the delay in the integration of two old factories into a new factory. As a result, an operating loss of 6 million yen was posted, but the company posted non-operating income including the hedge gain from fluctuations in market prices of raw materials (97 million yen) and the subsidy from NEDO (101 million yen) (related expenses were posted in the cost of sales and SGA of the brass bar manufacturing business). The adjusted operating income was 135 million yen.

Other

Sales were 2,914 million yen, down 110 million yen (3.7%) year on year. While tourist groups decreased, the huge typhoon hit Japan in October 2019 and COVID-19 spread, so hotel stay cancellations increased steeply in March 2020. The company made efforts to reduce expenses, but posted an operating loss of 11 million yen (in the previous term, an operating income of 90 million yen was posted).

2-3 Financial Conditions and Cash Flows

Financial Conditions

| 3/19 | 3/20 |

| 3/19 | 3/20 |

Cash | 13,660 | 18,696 | Payables | 6,625 | 7,289 |

Receivables | 30,199 | 27,562 | Unpaid Corporate Tax, Unpaid Consumption tax, etc. | 1,969 | 1,057 |

Inventories | 24,465 | 23,975 | Bonus and Bonus Reserve for Directors | 2,735 | 2,393 |

Current Assets | 71,226 | 73,351 | Allowance for retirement benefits for directors and retirement benefit liabilities | 1,235 | 1,264 |

Tangible Assets | 41,677 | 44,241 | Interest-bearing Liabilities | 33,672 | 39,147 |

Intangible Assets | 9,420 | 7,639 | Liabilities | 54,827 | 58,184 |

Investments, Others | 9,332 | 9,831 | Net Assets | 76,829 | 76,879 |

Noncurrent Assets | 60,430 | 61,712 | Total Liabilities, Net Assets | 131,657 | 135,063 |

(Units: ¥mn)

Term-end total assets were 135,063 million yen, up 3,405 million yen from the end of the previous term. In the debit side, cash and deposits increased, as the company secured cash on hand through short-term borrowing for coping with the novel coronavirus, tangible assets grew due to the change in the accounting standards (IFRS No. 16: With regard to the lease transactions of overseas group companies, lease assets and lease obligations were posted in the balance sheet) and equipment investment, and investment securities increased through the acquisition of shares of Unimech Group Berhad in Malaysia. In the credit side, payables and debts augmented, and net assets were almost unchanged from the end of the previous term, due to the payment of dividends and the acquisition of treasury shares. As a result of procurement of funds, the ratio of liquidity on hand was 1.87 months, significantly increasing from 1.20 months at the end of the previous term. Equity ratio was 56.0% (57.4% at the end of the previous term).

Cash Flows

| FY 3/19 | FY 3/20 | YoY Change | |

Operating Cash Flow | 10,069 | 13,329 | +3,260 | +32.4% |

Investing Cash Flow | -9,264 | -8,040 | +1,224 | - |

Free Cash Flow | 805 | 5,289 | +4,484 | +557.0% |

Financing Cash Flow | -9,702 | -167 | +9,535 | - |

Cash and Equivalents at Term End | 12,876 | 17,920 | +5,044 | +39.2% |

(Units: ¥mn)

The company secured an operating CF of 13,329 million yen, as pretax profit was 7,387 million yen (9,108 million yen in the previous term), depreciation was 6,558 million yen (4,636 million yen in the previous term), receivables decreased 2,628 million yen (increased 767 million yen in the previous term), and income taxes amounting to 3,094 million yen (4,464 million yen in the previous term) were paid. Investing CF is attributable to the acquisition of tangible assets and investment securities (Unimech Group Berhad in Malaysia, etc.), while financing CF is due to the change in interest-bearing liabilities, the acquisition of treasury shares, the payment of dividends, etc.

Changes in ROE

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 |

ROE | 6.58% | 7.26% | 8.69% | 7.41% | 6.53% |

Net Income Margin | 4.19% | 4.73% | 5.23% | 4.12% | 3.88% |

Total Assets Turnover | 1.00 times | 0.96 times | 0.99 times | 1.03 times | 0.94 times |

Leverage | 1.57 x | 1.60 x | 1.68 x | 1.75 x | 1.76 x |

*ROE = Net income margin x total assets turnover x leverage

3. Fiscal Year Ending December 2020 Earnings Estimates

The fiscal year of KITZ and the domestic group companies ends in March, while for the majority of overseas group companies, it ends in December. Up until now, they consolidated their earnings with a three-month gap, but from the fiscal year 2020, the companies which used to settle their accounts in March will the account settlement month to December, and all the companies will have the same account settlement month. By eliminating the three-month gap and consolidating the earnings in the same month, KITZ will accurately grasp the performance of the entire group and increase management transparency. For this reason, the fiscal year ending December 2020 will cover the business results for nine months, from April to December. The profits and losses of overseas subsidiaries from January to March 2020 will be adjusted using retained earnings on the balance sheet at the beginning of the fiscal year ending December 2020. However, changing the account settlement month is subject to approval at the general meeting of shareholders in June. Moreover, only the Indian subsidiary will continue to announce its business results in March based on the local law, but it will be consolidated in December using provisional financial statements.

[Earnings Forecast and Dividend Estimate for the Fiscal Year Ending December 2020 are Undetermined]

Considering the numerous large-scale capital investments (a new IT system, a new brass bar factory, etc.) in recent years, the company believes that the fiscal year ending December 2020 is the year for reaping a profit on a full-scale basis. However, as it is difficult to predict the impact of the spread of the novel coronavirus, the earnings forecast and the dividend estimate for the fiscal year ending December 2020 have not been determined. The company intends to disclose them in the appropriate timing. Furthermore, KITZ will steadily conduct the investments necessary for growth, including M&A domestically and overseas. Nonetheless, the company will go into an emergency mode where it will review its investment plan and reduce SG&A, as well as have a large amount of cash on hand.

3-1 Impact of the Novel Coronavirus

Domestic Market

Concerning the construction market and the water-related market, the major manufacturing bases (in Japan and Thailand) are operating normally. As for the customer demand, the company was worried that there would be a delay in the delivery time due to the suspension of the construction work of major general contractors and that demand would fall, but the demand is not expected to decrease drastically. Demand is expected to recover to its original level gradually as the economic activity resumes. As for the industrial market, the Chinese production bases temporarily stopped production in February and March, but returned to regular operations at the end of March. The company is making production adjustments in response to the decrease in demand. However, there is a delay in the delivery of some products, so the company is increasing its production. Regarding customer demand, although there is uncertainty about new capital investments in the manufacturing industry after the cancellation of the emergency declaration, large-scale periodic repair work for plants is expected to be conducted as planned. Therefore, robust demand for maintenance services is forecasted. As for semiconductors, the production base in China temporarily stopped production in February and March, but the impact was limited since the company produced valves in Japan instead. Furthermore, the demand for 5G and data centers is strong, so SPE’s' capital investment plans do not change. Hence, the recovery is expected to continue.

Overseas Market

As for the market in the Americas, sales bases in the U.S. have been teleworking, and Brazil MGA (acquired in 2015) began to scale down operations by switching to a shift work system. In terms of customer demand, oil and gas-related investments are declining due to the impact of US-China trade friction and sluggish crude oil prices in addition to the damage inflicted by the coronavirus. As long as crude oil prices remain sluggish, the outlook is bleak. As for the production bases in Europe, operations in Germany have been running without stopping, and Spain, which had stopped operations, resumed it. However, customer demand is similar to the demand in the Americas. In respect of ASEAN countries, Thailand, which is the main production base for bronze/brass valves, is operating without interruption. However, due to the lockdown, countries other than Thailand suffered from stagnation in logistics, and demand has fallen substantially. As for South Korea, Cephas (acquired in 2018), a valve manufacturer specializing in butterfly valves, is operating and aims to move into the black by improving production. In terms of demand, the demand for semiconductors is recovering like in Japan, and sales are expected to remain healthy. As for China and Taiwan, Taiwan has been operating without interruption, and China, which has four factories in Jiangsu Province, has returned to normal operations as the spread of the coronavirus has stopped. In addition to favorable demand for semiconductors, the demand in China, which fell significantly in February, has been recovering substantially since March. It is expected that the recovery for the semiconductors market will continue in the future, and a solid demand for data centers in China is expected.

Brass Bar Products and Others

For the 100% domestically produced brass bar products, the company is adjusting the production according to the decrease in demand, but it is operating as usual. Demand for housing and gas appliances is also low, but not estimated to fall as much as that of automobile-related products. The outlook for the future is dim, so the company will strive to improve productivity by consolidating the production of the former two plants into a new plant (completely integrating the brass rod extruders into the new facilities).

As for other businesses, Hotel Beniya is closed due to the emergency declaration, but the service areas (two locations) are still open except for some parts. Most group accommodation reservations at Hotel Beniya were canceled in March. Also, the Suwa Lake Fireworks Festival in August, which was the hotel's high season, was cancelled. The hotel plans to resume operations partially in June, but for the time being, it will implement operational adjustments according to the reservation status, and will thoroughly reduce costs.

3-2 Basic Policy for Fiscal Year ending December 2020

In the valve manufacturing business, the company will strengthen the organizational structure and develop product strategies for domestic and overseas products as well as industrial filters. Also, the company will push ahead with IT strategies and management strategies. Moreover, in the brass bar manufacturing business, the company will consolidate production at the new plant and develop and commercialize new materials that comply with environmental regulations.

Valve Manufacturing Business

Strengthening the organizational structure

KITZ relocated the Asia Commercial Valve Strategy Office established in the previous term to Singapore to formulate, verify and prioritize country strategies for the ASEAN region, and to achieve synergies with Unimech as early as possible. Furthermore, the company will establish a Sales Promotion Department to follow up with the high priority end-users of industrial valves from receiving the order to after-sales services (maintenance after receiving the order). Also, KITZ established Building Facility General Management Department that integrates the management of the market for domestic building facilities. The Sales Promotion Department will accumulate and utilize customer contact information regarding switching from competitors, reflecting customer needs in new product development, and using customer relationship data as the group shared assets as well as visualize customer share and income and expenditure by customer. On the other hand, the Construction Facility General Management Department will pursue further synergies between KITZ and Toyo Valve to increase its market share. Specifically, it will handle marketing, vendor lock-in activities, new product development proposals, and sales.

Product Strategy

In the domestic market, KITZ will strive to continue to increase its market share by expanding sales of butterfly valves, ductile valves, and automatically operated valves, which are the valve types that are considered as top priority in the mid-term management plan. Moreover, the company will utilize the information acquired on end-users from valve maintenance to develop new products that meet user needs. In overseas markets, KITZ will restructure its strategy for the global model and the developing countries' model of trunnion ball valves. Also, in South Korea, the company will promote the development of Cryogenic (ultra-low temperature) valves at Cephas Pipelines Corp., and will utilize KITZ's sales channels to expand sales of industrial butterfly valves. In the industrial filter business, the KITZ Micro Filter Corporation's second factory, which was constructed in the previous term, will promptly establish a mass production system for its main product for semiconductors, Polyfix.

IT Strategy

KITZ will visualize global management information by utilizing data from the new core business system. This will enable the digitization of production and management of manufacturing facilities using IoT. The company will also strive to train engineers who are knowledgeable about AI and deep learning. Moreover, as part of its work style reform, KITZ will renovate communication and collaboration tools for employees and adopt RPA (automation of routine tasks) to improve work efficiency and shift to value-added work.

Management Strategy

Along with globalizing human resources and organizational culture, KITZ will gradually develop global talent management and personnel and evaluation systems. Also, it will strengthen risk management. Specifically, the company will create a system that enables business continuity in emergencies by identifying risks in the group, including the prevention and spread of the novel coronavirus, assessing all risks, identifying priority risks, and implementing necessary measures.

Brass Bar Manufacturing Business

KITZ Metal Works Corporation's brass/bronze bar factory, which started mass production in October 2019, continued to operate in parallel with the old facilities. However, in the fiscal year ending December 2020, the company will consolidate production at the new factory (latest production facility utilization can be expected to improve material yield and significantly enhance productivity). Also, KITZ will work on the development and commercialization of new materials that comply with environmental regulations.

Financial Strategies and Capital Policy

There are no changes in the financial strategies and capital policy in the 4th mid-term management plan. However, the company will prioritize business continuity and financial stability during the emergency mode and will review the selection and priority order of capital investments and strategic investments. KITZ plans to maintain high liquidity on hand while keeping in mind the liquidity ratio of about three months for consolidated monthly sales, including the commitment line.

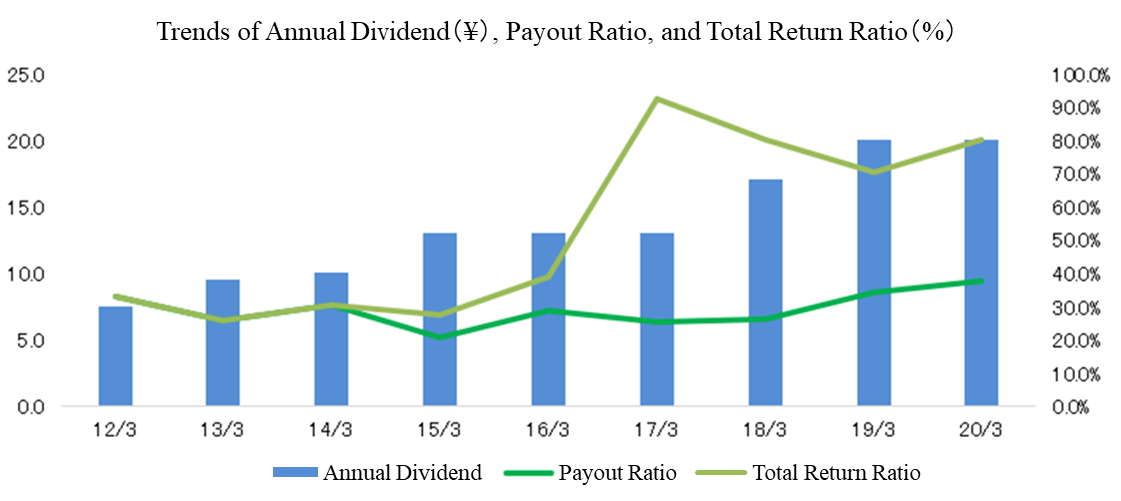

Shareholder Return Policy

There are no changes to the shareholder return policy. In the 4th mid-term management plan, around 35% of profit attributable to owners of parent is set as the desired dividend payout ratio. Also, regarding the acquisition of treasury shares, KITZ will thoroughly study the matter after considering the amount of investment necessary for medium- to long-term growth, and taking into account the stock market and share price trends, the status of cash on hand, etc.

The dividend forecast for the fiscal year ending December 2020 is undecided because it is difficult to forecast full-year results. As for the acquisition of treasury shares, which was resolved on March 13, 2020 (upper limit: 2,000 million yen, 3,200,000 shares, 3.45% of the number of issued shares excluding treasury shares), as of April 30, 1,022,000 shares were acquired for a total of 611,528,200 yen. If the treasury shares are acquired up to the upper limit, the total acquisition amount for the fiscal year ending December 2020 is expected to be approximately 1,756 million yen.

4. Conclusions

In Japan, real gross domestic product (GDP) in the period from January to March dropped 3.4% year on year, but that in the period from April to June is estimated to drop around 20% year on year. Even if the state of emergency is lifted, some consider that it will take one year or longer for the Japanese economy to recover to the pre-pandemic level. In the U.S., it is forecasted (by Congressional Budget Office [CBO]) that GDP will decrease 37.7% year on year in the second quarter and then recover 21.5% in the third quarter, but it will be 2022 or later when the U.S. economy will recover to the pre-pandemic level.

The economic environments inside and outside Japan are estimated to be severe for the foreseeable future, and the outlook is quite unclear, but the company’s performance can be expected to rebound in the fiscal year ending December 2020 from the stagnation in the fiscal year ended March 2020, in which there were many unfavorable factors. The overseas market remains severe, except the semiconductor-related market, but in Japan, the semiconductor-related business has started recovering, and the outlook for other markets, too, is not so bleak and we do not need to become pessimistic. The noteworthy point in the fiscal year ending December 2020 is the progress of their activities under the basic policy, rather than numerical data. Their activities will determine the mid/long-term growth potential, and the activities include the fortification of the organizational structure for the valve manufacturing business, the implementation of product strategies for industrial filters in domestic and overseas markets, IT strategies, management strategies, the integration of production systems in the new factory in the brass bar manufacturing business, and the development and commercialization of new materials that comply with environmental regulations. We would like to pay attention to how much these activities will produce good results.

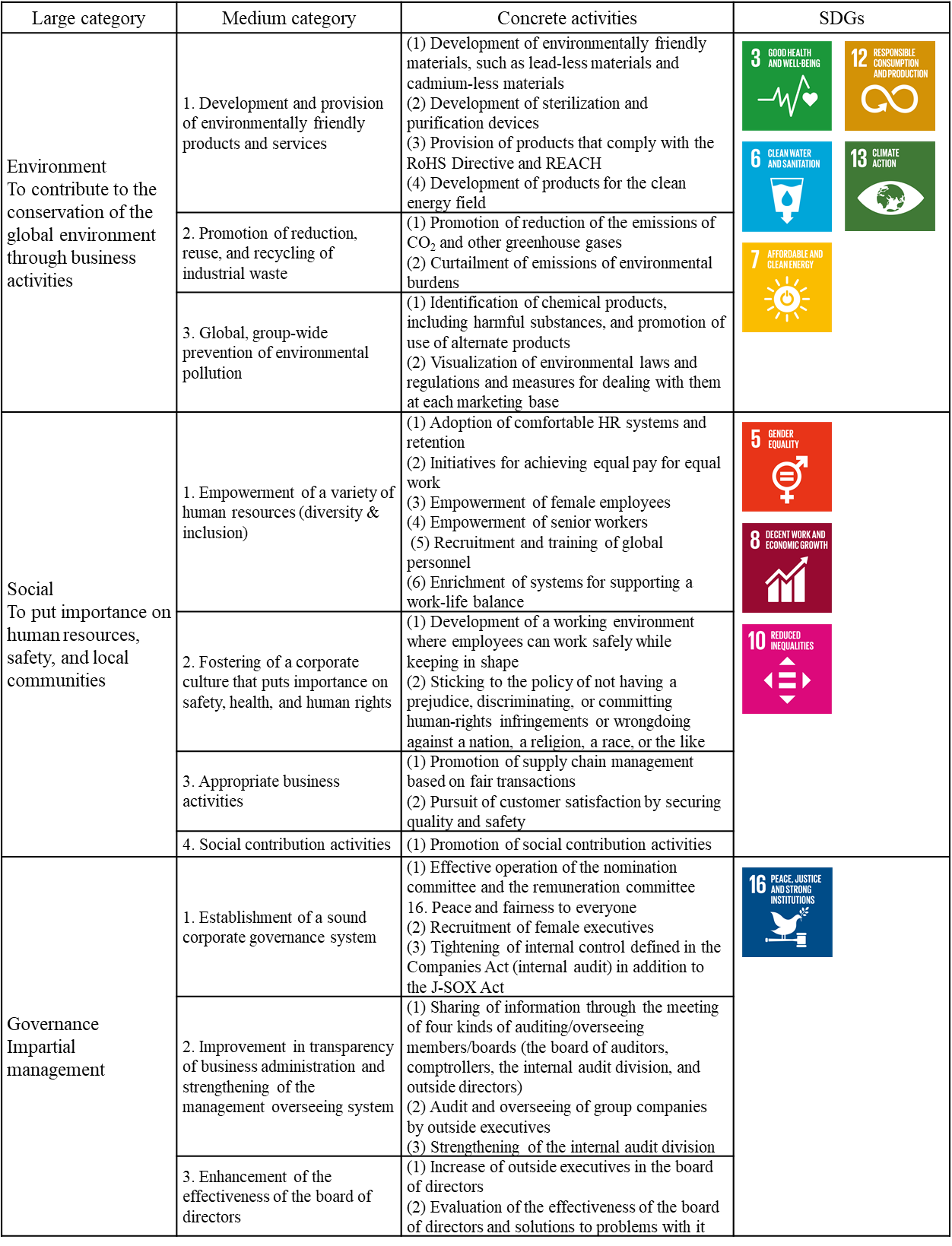

<For reference: Initiatives based on ESG and SDGs>

In the 4th mid-term management plan, whose initial year is fiscal 2019, “further enhancement of ESG” is one of important themes, and in March 2020, the company visualized the SDGs that are closely related to its important initiatives. The company plans to intensify ongoing initiatives and speed up sustainable business administration, to contribute to the attainment of SDGs.

Furthermore, the company agreed with “Nagano Prefecture’s system for registering enterprises that pursue SDGs,” and Ina and Chino Plants were registered by the prefecture as business establishments that pursue SDGs.

(Taken from the website of the company)

<Reference: Regarding Corporate Governance>

◎ Organizational structure, Composition of board of directors and company auditors

Organizational structure | Company with board of company auditors |

Board of directors | 7 directors (3 are outside directors) |

Company auditors | 5 auditors (3 are outside auditors) |

Corporate governance report (Updated on:October 24 2019)

Basic policy

Our corporate ethos is to continuously improve our corporate value by offering creative, high-quality products and services. Under this ethos, we strive to achieve business administration that takes care of the interests of shareholders and all other stakeholders as a socially responsible company. Moreover, in order to increase business administration efficiency and enhance our compliance with laws, we will listen to requests from stakeholders and consider the social trends, etc. in order to swiftly and efficiently achieve a sound and highly transparent business administration by implementing a variety of measures, and intend to enrich corporate governance.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

1. Cross-held shares (Principle 1-4)

(1) Basic policy on cross-held shares

We established the “Policy on cross-held shares” and do not hold cross-held shares for the purpose of forming stable shareholders. However, our main business, the valve manufacturing business, is a business for which the comprehensive strength of technologies from materials to products is needed, and it is essential to maintain good cooperative relationships with business partners in all processes including product development, manufacturing, sales and logistics. Therefore, we may hold some shares of business partners for that purpose.

(2) Verification regarding cross-held shares

We review our cross-held shares annually based on the “Policy on cross-held shares”. We will proceed with appropriate sale of shares that are deemed insignificant to hold and, for those we hold, we will make efforts to reduce cross-held shares as much as possible.

(3) Criteria for exercising voting rights for cross-held shares

Based on the “Policy on cross-held shares”, we determine the pros and cons of each cross-held share based on a comprehensive view including the issuing company’s management status, governance structure, presence of appropriate decision making that leads to medium- to long-term increase in corporate value, and whether or not they will lead to enhancement of our Group’s corporate value.

11. Policy for Constructive Dialogue with Shareholders (Principle 5-1)

We recognize that, in order to achieve sustainable growth and enhance medium- to long-term corporate values, it is important to be aware of the accountability as a trustee of management, disclose information to stakeholders such as shareholders and investors in a timely and appropriate manner, and maintain fairness and transparency in management. Therefore, sincere and constructive dialogues are held so that we can gain understanding of shareholders on our management strategies and plans, and we use their opinions and requests obtained through such dialogues to improve our management. We are implementing the following measures to vigorously carry out IR activities.

(1) In addition to appointing an executive officer in charge of IR, we established the IR Department to actively promote constructive dialogues with shareholders.

(2) The Company conducts meetings for institutional investors and analysts each quarter, with financial results briefings in March (end of the term) and September (2nd quarter), and analyst meetings regarding financial results in the 1st and 3rd quarters. In addition, company briefings for individual investors are held every year. At these company briefings, explanations are given by the president himself. In addition to information regarding financial results, such as summary of financial results and securities report, other information is also disclosed on the Company website, regarding IR topics such as management information, information on shares and shareholders meetings, and reports on corporate governance.

(3) The Company periodically reports opinions gathered from dialogue with institutional investors and analysts to the representative director and IR executive officer. If necessary, the representative director will inform the Board of Directors and management committee.

(4) The Company pays close attention to managing insider information and considers the executive officer in charge of the accounting department to be responsible for handling information. The accounting executive officer, IR department, and management planning department discuss details regarding information disclosure prior to opening a dialogue with institutional investors and analysts.

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on KITZ Corporation (6498) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/