Bridge Report:(6498)KITZ Second quarter of the Fiscal Year ending December 2021

President Makoto Kohno | KITZ Corporation (6498) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Makoto Kohno |

HQ Address | 1-10-1 Nakase, Mihama-ku, Chiba, Japan |

Year-end | December |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding (End of period) | Market Cap. | ROE (Act.) | Trading Unit | |

¥826 | 90,396,511 shares | ¥74,667 million | 2.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥18.00 | 2.2% | ¥50.75 | 16.3x | ¥866.16 | 1.0x |

*Share price is as of closing on August 16. Shares Outstanding, DPS, EPS, and BPS are based on the consolidated earnings results for the second quarter of the fiscal year ending December 2021.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | Dividend (¥) |

March 2018 Act | 124,566 | 10,117 | 9,733 | 6,518 | 65.50 | 17.00 |

March 2019 Act | 136,637 | 11,713 | 11,883 | 5,625 | 58.50 | 20.00 |

March 2020 Act | 127,090 | 6,950 | 7,241 | 4,937 | 53.06 | 20.00 |

December 2020 Act | 84,245 | 3,751 | 3,169 | 2,113 | 23.38 | 9.00 |

December 2021 Est. | 130,500 | 8,100 | 8,000 | 4,550 | 50.75 | 18.00 |

*The estimated values are based on the forecasts made by the company. Unit: million-yen, yen. The fiscal year ended December 2020 was a nine-month period due to the change of the closing month. Net income is net income attributable to shareholders of the parent company. Same as below.

This Bridge Report presents details and analysis of KITZ Corporation’s earnings results for the second quarter of the Fiscal Year ending December 2021, etc.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of the Fiscal Year ending December 2021 Earnings Results

3. Fiscal Year ending December 2021 Earnings Estimates

4. Conclusions

<Reference1: Initiatives based on ESG and SDGs>

<Reference:2 Regarding Corporate Governance>

Key Points

- Both sales and profit increased in the second quarter of the fiscal year ending December 2021. Sales grew 5.8% year on year to 63,117 million yen. In the Valve Manufacturing Business, domestic sales were unchanged from the previous year, while overseas sales increased. Sales in the Brass Bar Manufacturing Business rose due to higher sales prices resulting from the rises of raw material prices and larger sales volume. Operating income increased 23.5% year on year to 3,902 million yen. The Valve Manufacturing Business saw a slight improvement in profit. The Brass Bar Manufacturing Business moved into the black due to larger sales and improved productivity. Regarding companywide results, both sales and profit were almost in line with the forecast.

- The company upwardly revised its full-year earnings forecast for the fiscal year ending December 2021 in August, following the revision in May. Sales are projected to increase 13.3% year on year to 130.5 billion yen and operating income is forecast to rise 52.0% year on year to 8.1 billion yen. In the mainstay Valve Manufacturing Business, sales are expected to rise due to the effect of the second price revision implemented this year for shipments from August 2, 2021, in response to the soaring prices of raw materials, as well as a partial recovery trend in overseas markets, especially in the U.S. and China. The company also forecasts higher profits due to higher sales in overseas markets and cost reductions. There will be no revision to estimated sales and profit in the Brass Bar Manufacturing Business. Forecasted sales and profit of the other segment have been revised downwardly. The company has not revised its dividend forecast and plans to pay an annual dividend of 18.00 yen per share. The payout ratio is expected to be 35.5%.

- The company upwardly revised the earnings forecast twice during the first half of the year. We expect to see how the second round of price revisions, which were first implemented in March and then in August, will produce effects on the business performance from the third quarter onward. On the other hand, both sales and profit are on a recovery trend after bottoming out. Although the impact of the novel coronavirus crisis has once again became unclear, a full-fledged recovery is anticipated to be led by sales growth not only in the semiconductor industry, which is performing well in Japan and overseas, but also in other fields such as construction equipment. Thus, we will keep a close eye on trends in each sector and in each area.

1.Company Overview

KITZ is an integrated manufacturer of valves and other fluid control equipment and devices. In valve manufacturing, it ranks highest in Japan and within the top 10 worldwide. Valves are made of various materials depending on their application, including bronze, brass, cast iron, ductile cast iron (cast iron with greater strength and ductility) and stainless steel. KITZ in principle assumes integrated production (casting, processing, assembling, inspecting, packaging and shipping) of products from raw materials. The KITZ Group consists of 36 domestic and overseas subsidiaries. In addition to the production and sale of brass bars used for valves, water faucets and gas equipment (KITZ is ranked among the top manufacturers of brass bars within Japan), the Group also operates a hotel business.

1-1 Corporate Philosophy

KITZ's corporate philosophy is “KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services.”

KITZ believes that corporate value is equivalent to shareholder value from a medium- to long-term perspective. To continue increasing this value, it says that it must achieve sustained growth accompanied by earnings through earning the trust of customers.

And by improving corporate value, the Company desires to help create a more prosperous and fulfilling society by providing many types of benefits to its shareholders, customers, employees, business partners, and society. Setting these goals in the KITZ Statement of Corporate Mission, the Company seeks to further progress in the future.

KITZ’ Statement of Corporate Mission |

To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services. |

1-2 Overview of KITZ’s Business Segments

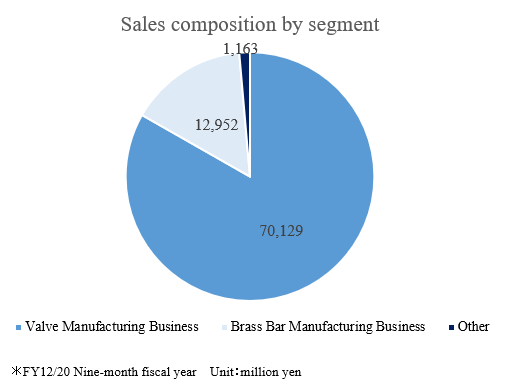

KITZ’s businesses consist of the valve manufacturing, brass bar manufacturing and other (including hotel and restaurant management) segments. During the fiscal year ended December 2020, these segments accounted for 83.2%, 15.4%, and 1.4% of total sales, respectively.

(1) Valve Manufacturing Business

Valves are used to pass, stop and adjust the flow of fluids in various pipe systems (water, air, gas and other substances). They are used in building facilities, residential utility systems, water supply facilities, fresh water and sewer systems, fire prevention equipment, machinery and industrial equipment manufacturing facilities, chemical, medical, and petrochemical product manufacturing facilities, semiconductor manufacturing facilities, oil refineries and other industrial complexes, among other applications. The Company operates an integrated production system that begins with the casting process (KITZ was the first Japanese company to acquire ISO 9001 international quality standard certification). The Company’s product offerings include commercial valves, which are made of corrosion-resistant bronze and highly economical brass for use in the building construction sector, including building facilities and residential utility systems, and industrial stainless-steel valves such as high-value-added ball valves. The Company has a high share of the domestic market in these mainstay product areas.

In terms of sales, the company covers the country nationwide by expanding marketing bases in the domestic major cities and an elaborate network of distributors. As for overseas, the company has a global sales network where the company did not only establish representative offices in India and U.A.E but also marketing bases in China, Hong Kong, South Korea, Singapore, Malaysia, Thailand, Vietnam, the U.S., Brazil, Germany, and Spain. Regarding the manufacturing, the company has a production network that helps achieve global cost and optimal production locations as the company has deployed production bases in China, Taiwan, Thailand, India, Germany, Spain, and Brazil in addition to the domestic factories.

Building facilities Valves, etc. used for air-conditioning, sanitary, and anti-disaster equipment when constructing hotels, hospitals, office buildings, and so on | Water supply/water supply facilities Devices and equipment for pipes for water supply and sewage systems, valves used for facilities for treating water and sludge, products for water supply equipment for detached house, housing complexes, etc. |

Gas/energy facilities Valves, etc. used for liquefied natural gas (LNG) production facilities, pipelines, and so on | Industrial machinery/production equipment All kinds of valves used for industrial machinery and production equipment |

Oil refining and oil complex facilities Valves, etc. used for the processing lines of oil refineries, petrochemical facilities, and chemical plants | Semiconductor manufacturing equipment Valves and joints for semiconductor manufacturing equipment (manufactured and sold by its group company, KITZ SCT Corporation) |

(2) Brass Bar Manufacturing Business

Copper alloy can take many different shapes, including sheets, strips, pipes, bars and wires through hot or cold deformation processing such as dissolution, casting, rolling, extruding, and forging. It can be made with a range of different materials, including brass (copper with zinc), phosphor bronze (copper with tin and phosphorous), and nickel silver (copper with nickel and zinc). The KITZ Group's Brass Bar Manufacturing Business is led by KITZ Metal Works Corporation and Hokutoh Giken Kogyo Corporation. These companies manufacture and sell brass bars, which are used not only as material for valves, but also in the manufacture of water faucets, gas equipment, electrical appliances, and other brass-derived items.

(3) Other

KITZ subsidiary Hotel Beniya Co., Ltd., operates a resort hotel in the city of Suwa, Nagano Prefecture. The hotel is located in a highly picturesque setting close to Lake Suwa with hot spring bathing facilities with sunset views and has a number of small and large banquet halls. The hotel also has a large convention hall, giving it the capacity to hold international conferences.

2. The second quarter of the Fiscal Year ending December 2021 Earnings Results

2-1 Consolidated Business Results

| Same term of the previous year(Jan – Jun 2020) | Ratio to Sales | 2Q of FY12/21 | Ratio to Sales | YoY Change | Plan | Divergence |

Sales | 59,637 | 100.0% | 63,117 | 100.0% | +5.8% | 62,900 | +0.3% |

Operating Income | 3,158 | 5.3% | 3,902 | 6.2% | +23.5% | 3,600 | +8.4% |

Ordinary Income | 3,566 | 6.0% | 3,958 | 6.3% | +11.0% | 3,550 | +11.5% |

Net Income | 2,091 | 3.5% | 2,063 | 3.3% | -1.3% | 2,100 | -1.7% |

* Unit: million yen. Since FY12/20 is a nine-month accounting period, the figures are compared with reference figures (unaudited) calculated using the January-June period of FY12/20 as the same tern of the previous year.

Sales and Operating income increased, which is in line with the plan

Sales grew 5.8% year on year to 63,117 million yen. In the Valve Manufacturing Business, domestic sales were unchanged from the previous year, while overseas sales increased. Sales in the Brass Bar Manufacturing Business rose due to higher sales prices resulting from the rises of raw material prices and larger sales volume. Operating income increased 23.5% year on year to 3,902 million yen. The Valve Manufacturing Business saw a slight improvement in profit. The Brass Bar Manufacturing Business moved into the black due to larger sales and improved productivity. Regarding companywide results, both sales and profit were almost in line with the forecast.

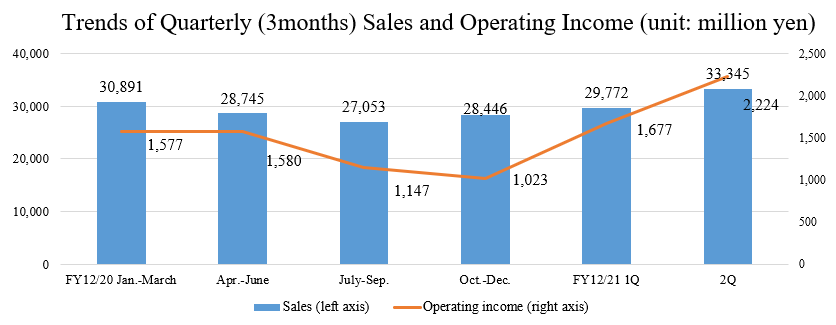

On a quarterly basis, sales bottomed out in the period from July to September 2020 and operating income bottomed out in the period from October to December 2020, and both are on a recovery trend.

Exchange and raw materials

| Same term of the previous year(Jan – Jun 2020) | 2Q of FY 12/21 | 2Q of FY 12/21 Plan |

Yen / US Dollar | 108.25 | 108.47 | 109.00 |

Yen / Euro | 119.40 | 130.47 | 131.00 |

Electrolytic Copper, Yen / Ton | 638,000 | 1,019,500 | 1,050,000 |

2-2 Business Segments’ results

| Same term of the previous year(Jan – Jun 2020) | 2Q of FY 12/21 | 2Q of FY 12/21 Plan | YoY Change | Divergence |

Sales |

|

|

|

|

|

Valve Manufacturing | 49,529 | 49,757 | 49,800 | +0.5% | -0.1% |

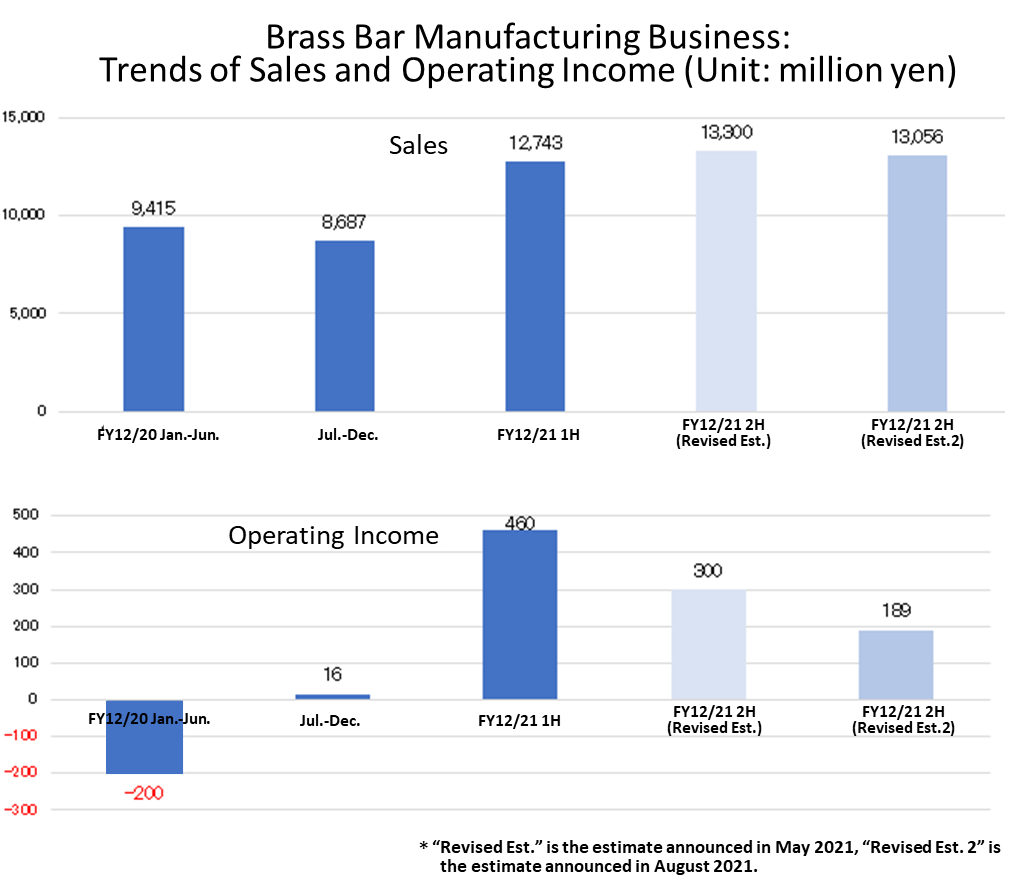

Brass Bar Manufacturing | 9,415 | 12,743 | 12,500 | +35.3% | +2.0% |

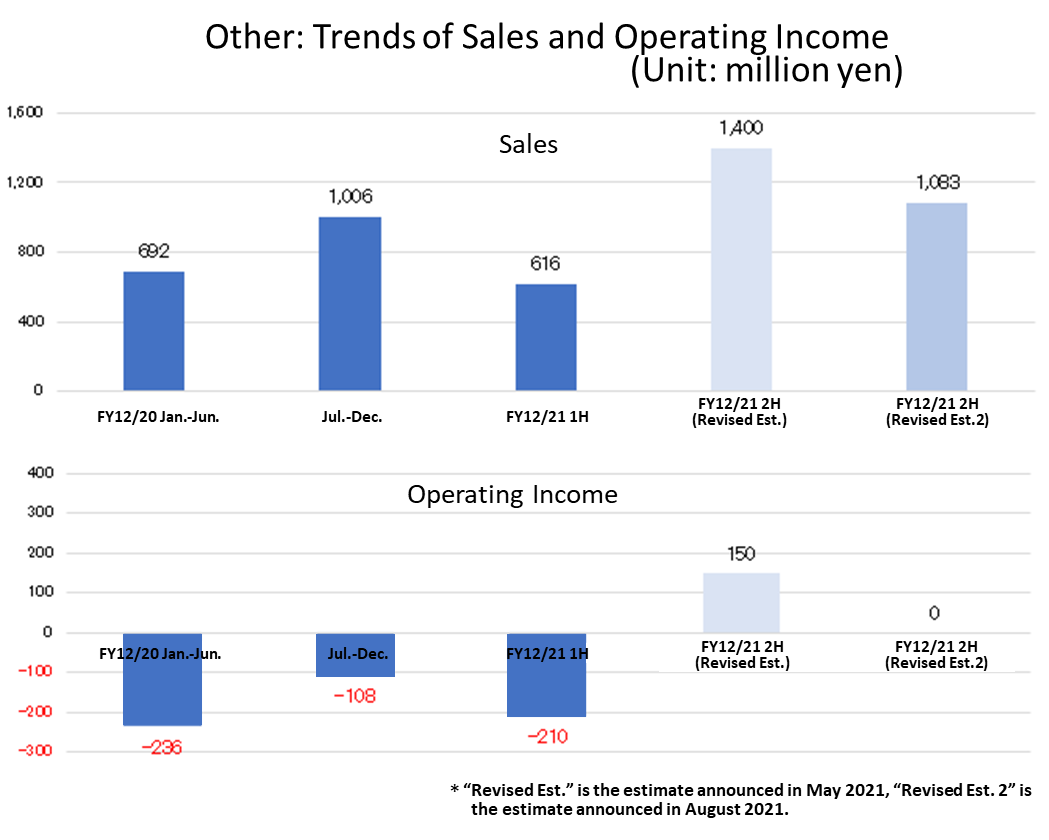

Other | 692 | 616 | 600 | -11.0% | +2.7% |

Segment profit |

|

|

|

|

|

Valve Manufacturing | 5,338 | 5,348 | 5,200 | +0.2% | +2.8% |

Brass Bar Manufacturing | -200 | 460 | 350 | - | +31.7% |

Other | -236 | -210 | -150 | - | - |

* Unit: million yen.

(1) Valve Manufacturing Business

Sales and profit were unchanged from the previous year, almost in line with the forecast.

Domestic sales decreased 0.6% year on year to 32,021 million yen.

Due to the impact of the spread of the novel coronavirus, actual demand in both the construction equipment and industrial sectors remained low. However, it recovered to almost the same level as that in the same period last year. Sales of standard products, mainly for the construction equipment sector, were steady in the second quarter, partly because deliveries for meeting expected demand in response to the price revision announced in March began in April. In the water-related business, sales of water supply and sewerage systems and filters continued to be strong, mainly driven by public-sector demand. Sales in the semiconductor-related sector, where prices remained high, remained strong.

Overseas sales increased 2.5% year on year to 17,736 million yen.

Although vaccination is progressing in each area, the impact of the spread of the novel coronavirus continues in all regions except China. In ASEAN countries, South Korea, and other regions, economic activities remained stagnant, due to lockdowns in the wake of the reemergence of the novel coronavirus in ASEAN countries. In China, sales in the construction equipment sector, mainly for data centers, and the industrial sector, were strong. Sales in semiconductors-related industries in China and South Korea continued to be robust, as in Japan. Investment in the oil and gas market in the Americas was weak. In South America, sales of MGA remained strong. The business in Europe, which mainly focuses on oil and gas, stayed in a difficult situation due to the novel coronavirus spreading again.

Operating income in the Valve Manufacturing Business was unchanged from the same period last year. This was due to positive factors such as cost reduction (+350 million yen), expenses cutting (+460 million yen), and foreign exchange impact (+210 million yen), offsetting the unfavorable factors such as volume and mix difference (-320 million yen) and high raw material prices (-700 million yen).

(2) Brass Bar Manufacturing Business

Sales increased, and the business moved into the black. Both sales and profit exceeded the forecasts.

Raw material prices, which have an impact on selling prices, continued to rise. Production and sales volumes recovered to pre-pandemic levels. Operating income moved to the black due to the upward trend of raw material prices.

(3) Other

Sales decreased, and loss was at the same level as that in the previous year.

The hotel business continues to be affected by the spread of COVID-19.

2-3 Financial Conditions and Cash Flows

◎BS

| 12/20 | 6/21 |

| 12/20 | 6/21 |

Cash | 33,720 | 27,881 | Payables | 5,693 | 7,841 |

Receivables (Including Electronically Recorded Monetary Claims) | 24,226 | 27,094 | Bonus and Bonus Reserve for Directors | 1,425 | 2,256 |

Inventories | 22,236 | 25,151 | Retirement Benefit Related | 1,144 | 1,133 |

Current Assets | 81,765 | 81,947 | Interest-bearing Liabilities | 49,352 | 41,853 |

Tangible Assets | 42,303 | 42,099 | Liabilities | 65,514 | 61,297 |

Intangible Assets | 6,211 | 5,418 | Net Assets | 75,167 | 78,468 |

Investments, Others | 10,401 | 10,301 | Total Liabilities, Net Assets | 140,681 | 139,766 |

Noncurrent Assets | 58,916 | 57,819 | Equity ratio | 52.8% | 55.6% |

* Unit: million yen.

Total assets decreased 900 million yen from the end of the previous fiscal year to 139.7 billion yen due to a decline in cash despite the increases in receivables and inventories. Total liabilities decreased 4.2 billion yen to 61.2 billion yen due to a decline in interest-bearing liabilities. Net assets increased 3.3 billion yen to 78.4 billion yen due to the rise in retained earnings and the shrinkage of deficit in foreign currency translation adjustment.

The equity ratio increased 2.8 points from the end of the previous fiscal year to 55.6%.

◎CF

| 2Q of FY 12/21 |

Operating Cash Flow(A) | 3,897 |

Investing Cash Flow(B) | -1,860 |

Free Cash Flow(A+B) | 2,036 |

Financing Cash Flow | -8,330 |

Cash and Equivalents at Term End | 27,611 |

* Unit: million yen.

Operating CF and free CF increased due to the rise in net income before taxes, depreciation expenses, and accounts payables.

Financing CF decreased due to the repayment of short-term and long-term debts, the redemption of corporate bonds, and payment of dividends.

2-4 Topics

(1) Compliance with the New Market Category "Prime Market"

On July 9, 2021, the company received the preliminary judgment results regarding its compliance with the listing maintenance standard in the new market category from the Tokyo Stock Exchange, Inc. The results confirmed that the company conforms to the listing maintenance standard of the "Prime Market".

Based on these results, the Board of Directors will deliberate and select the new market segment and proceed with the prescribed procedures.

(2) Absorption-type merger with the wholly owned subsidiary Miyoshi Valve

In August 2021, the company announced that it would absorb its wholly owned subsidiary Miyoshi Valve Co., Ltd.

Miyoshi Valve joined the company group in November 1999 and has been in charge of the manufacturing and sales of valves for construction equipment, machinery, and refrigerator under the "Miyoshi Brand." The company was merged with KITZ through steps such as transferring production to the KITZ factory in 2011 and moving part of the sales of commercial valves for the construction equipment sector to the KITZ sales department in 2014.

KITZ concluded that the best way to effectively utilize the group's management resources and improve management efficiency is to absorb Miyoshi Valve and operate the business as one organization. However, the "Miyoshi Brand" will continue to exist.

An absorption-type merger with KITZ as the surviving company and Miyoshi Valve as the extinct company is scheduled to be conducted on January 1, 2022.

(3) Launching Health Management Initiatives

The KITZ Group launched health management initiatives to realize its goal of becoming "an enterprise whose employees can live richer, safer and healthier lives in line with fair and transparent rules" in 2030.

The company has established the following initiatives, "The KITZ Group’s Health Management Statement" and "Policy on health management policy: Five pillars."

The KITZ Group’s Health Management Statement | We will aim to be a company where employees can work in good health and vitality, demonstrating their own abilities and individuality, through improving employee mental and physical health. |

Policy on health management initiatives: Five pillars | 1. Releasing a sound work-life balance 2. Building workplace environments grounded in promoting health and safety 3. Countering lifestyle-relating conditions with an emphasis on prevention 4. Implementing mental-health measures and measures to counter stress on the job 5. Employee education to improve health literacy |

"Health management" is a medium to long-term initiative to improve the health and vitality of employees. It is one of the crucial elements of sustainability-oriented management centered on ESG, which the KITZ Group promotes.

3.Fiscal Year Ending December 2021 Earnings Estimates

3-1 Full Year Consolidated Earnings Forecast

| FY 12/20 | Ratio to Sales | FY 12/21 Est. | Ratio to Sales | YoY Change | Correction rate | Progress rate |

Sales | 115,138 | 100.0% | 130,500 | 100.0% | +13.3% | +0.8% | 48.4% |

Operating Income | 5,328 | 4.6% | 8,100 | 6.2% | +52.0% | +5.2% | 48.2% |

Ordinary Income | 5,372 | 4.7% | 8,000 | 6.1% | +48.9% | +6.7% | 49.5% |

Net Income | 3,366 | 2.9% | 4,550 | 3.5% | +35.2% | +3.4% | 45.3% |

Units: million yen. FY20/12 is the same period of the previous year, January-December 2020, unaudited. Change is from the same period of the previous year. Same as below.

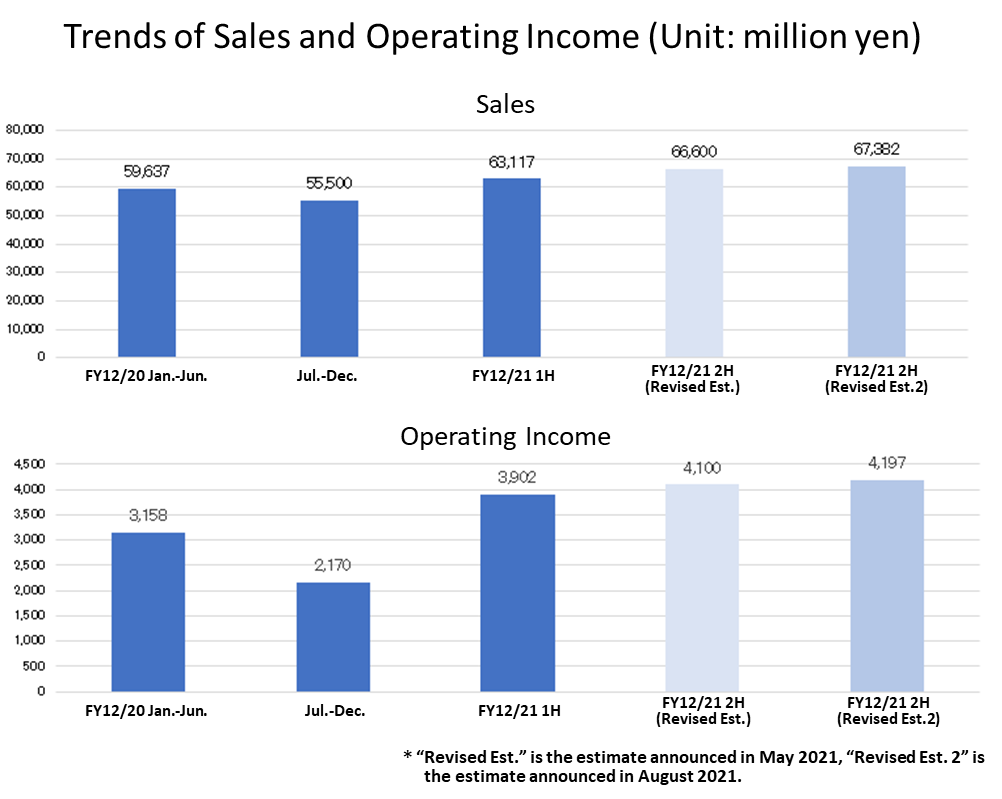

Earnings estimate was upwardly revised again

The company upwardly revised its full-year earnings forecast for the fiscal year ending December 2021 in August, following the revision in May. Sales are projected to increase 13.3% year on year to 130.5 billion yen and operating income is forecast to rise 52.0% year on year to 8.1 billion yen. In the mainstay Valve Manufacturing Business, sales are expected to rise due to the effect of the second price revision implemented this year for shipments from August 2, 2021, in response to the soaring prices of raw materials, as well as a partial recovery trend in overseas markets, especially in the U.S. and China. The company also forecasts higher profits due to higher sales in overseas markets and cost reductions. There will be no revision to estimated sales and profit in the Brass Bar Manufacturing Business. Forecasted sales and profits of the other segment have been revised downwardly. The company has not revised its dividend forecast and plans to pay an annual dividend of 18.00 yen per share. The payout ratio is expected to be 35.5%.

Exchange and raw materials assumptions

| FY 12/20 | FY 12/21 Est. |

Yen / US Dollar | 106.4 | 109.0 |

Yen / Euro | 122.0 | 131.0 |

Electrolytic Copper, Yen / Ton | 700,000 | 1,050,000 |

There is no change in the assumptions of exchange rates and raw material prices.

3-2 Sales and Operating Income by Segment

| FY 12/20 | Composition /Ratio to Sales | FY 12/21 Est. | Composition /Ratio to Sales | YoY | Correction rate |

Valve Manufacturing | 95,335 | 82.8% | 103,000 | 78.9% | +8.0% | +1.3% |

Brass Bar Manufacturing | 18,102 | 15.7% | 25,800 | 19.8% | +42.5% | 0.0% |

Other | 1,699 | 1.5% | 1,700 | 1.3% | +0.0% | -15.0% |

Total Sales | 115,138 | 100.0% | 130,500 | 100.0% | +13.3% | +0.8% |

Valve Manufacturing | 9,306 | 9.8% | 11,500 | 11.2% | +23.6% | +6.5% |

Brass Bar Manufacturing | -184 | - | 650 | 2.5% | - | 0.0% |

Other | -344 | - | -210 | - | - | - |

Adjustments | -3,449 | - | -3,840 | - | - | - |

Total Operating Income | 5,328 | 4.6% | 8,100 | 6.2% | +52.0% | +5.2% |

Units: million yen. FY20/12 is the same period of the previous year, January-December 2020, unaudited. Change is from the same period of the previous year.

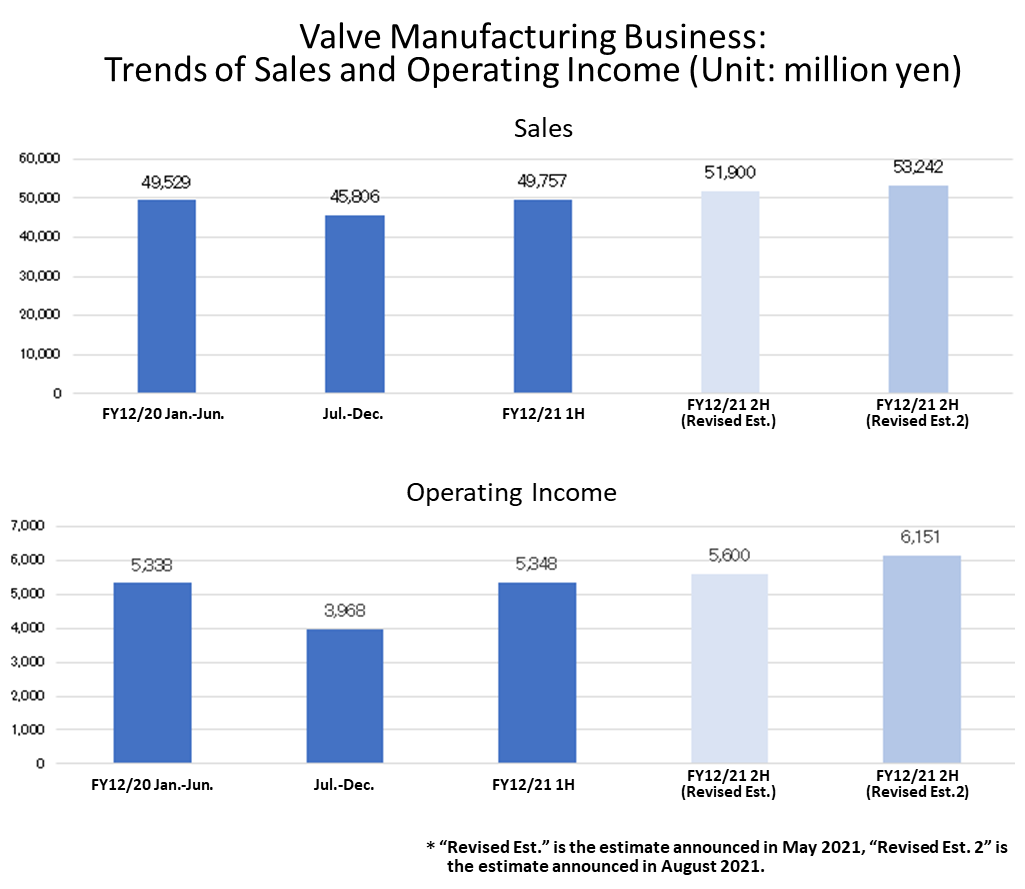

(1) Valve Manufacturing Business

Sales will increase, and profit will grow by double digits. The earnings forecast was upwardly revised.

Domestic sales are expected to rise 6% year on year to 66.4 billion yen, and overseas sales are projected to improve 12% year on year.

Regarding operating income, the raw material market is considered as a negative factor like in the first half. However, operating income is expected to rise 23.6% year on year to 11.5 billion yen due to the price revision effect (1.83 billion yen [full year]) and the cost reduction (+1.18 billion yen).

(Domestic)

Sales of products for construction equipment will be strong due to the deliveries for meeting expected demand after price revisions. The effect of price revisions is expected to begin in full scale in the third quarter. Regarding the actual demand, it is expected to continue its slow recovery pace.

Regarding the sales of products for the industrial sector, there will be small projects, but large projects will be insufficient. Demand for maintenance of plants will be relatively strong, and the company will expand the MRO business by selling parts and expanding sales of control valves.

Sales of products for semiconductor-related industries are expected to continue to be robust both in Japan and overseas. Investment against the backdrop of digital demand, including data centers, 5G communication facilities, and logistics facilities that have undergone EC expansion, is expected to increase.

In the water-related market, sales of water supply and sewage systems will remain steady mainly due to the public demand. Sales will increase in the second half due to seasonality. Valves and industrial filters used in semiconductor-related fields are also expected to perform well.

(Overseas)

Although the business in North America is on a recovery trend, it will not return to the pre-pandemic levels, and the oil and gas market's recovery will be delayed. South America will continue to perform well, mainly in sales for general industries.

Europe anticipates that the market will recover as vaccination progresses. However, there will be differences among countries as the novel coronavirus infection spreads once again.

In China, where the economy recovered quickly, it will continue to perform well. The company will focus on meeting the demand for data centers.

In ASEAN countries, economic activity will continue to stagnate due to the novel coronavirus spreading again. Vaccination will be also slower than in other regions. Thus, the difficult situation is expected to continue.

The semiconductor market in China and South Korea is forecast to continue to perform well like in Japan and like in the first half.

(2) Brass Bar Manufacturing Business

Sales will increase, and the business will move into the black. The earnings forecast remains unchanged.

(3) Other

Sales will be unchanged from the previous year, and loss will increase. Both estimated sales and profit were downwardly revised.

4.Conclusions

The company upwardly revised the earnings forecast twice during the first half of the year. We expect to see how the second round of price revisions, which were first implemented in March and then in August, will produce effects on the business performance from the third quarter onward. On the other hand, both sales and profits are on a recovery trend after bottoming out. Although the impact of the novel coronavirus crisis has once again became unclear, a full-fledged recovery is anticipated to be led by sales growth not only in the semiconductor industry, which is performing well in Japan and overseas, but also in other fields such as construction equipment. Thus, we will keep a close eye on trends in each sector and in each area.

<Reference1: Initiatives based on ESG and SDGs>

In the 4th mid-term management plan, whose initial year is fiscal 2019, “further enhancement of ESG” is one of the important themes, and in March 2020, the company visualized the SDGs that are closely related to its important initiatives. The company plans to intensify ongoing initiatives and speed up sustainable business administration, to contribute to the attainment of SDGs.

Furthermore, the company agreed with “Nagano Prefecture’s system for registering enterprises that pursue SDGs,” and Ina and Chino Plants were registered by the prefecture as business establishments that pursue SDGs.

Major item | Sub-item | Specific implementation item | SDGs | |

Environment Contributing to the conservation of the global environment through business activities | Measures against global warming | 1. Maximize contribution to environment through products and services | ① Develop, manufacture, and sell brass bar materials (lead-free materials and cadmium-free materials) that are friendly to both people and the environment ② Expand disinfection and purification equipment that realizes safe water treatment ③ Supply products that are compliance with the RoHS directive and REACH regulation ④ Development of products that are compliant with the field of clean energy |

|

2. Minimize environmental burden in business activities | ① Promotion of activities to reduce the volume of greenhouse gas emissions such as CO2 ② Promote energy-saving activities through improvement of productivity ③ Promote reduction, reuse, and recycling of water resources and waste | |||

3. Prevent environment pollution on a group-wide and global basis | ① Identify chemical products that contain toxic substances and promote alternatives ② Promote risk reduction activities at production bases in Japan and overseas | |||

Social Valuing human resources, safety, and local communities | 1. Promote diversity and inclusion of human resources | ① Introduce and consolidate a personnel system that facilitates work ② Initiatives of equal pay for equal work ③ Promote active roles for female employees ④ Appoint and develop global human resources ⑤ Enhance systems that support work-life balance |

| |

2. Foster a corporate culture that values safety, health, and human rights | ① Create a work environment which is safe and healthy to work in ② Do not act in a manner that is prejudicial, discriminatory, a violation of human rights or unjust in relation to nationality, religion, or race, etc. | |||

3. Appropriate business activities | ① Promote supply chain management through fair trading ② Pursue customer satisfaction by securing quality and safety | |||

4. Social contribution activities | ① Promote social contribution activities | |||

Governance Fair management | 1. Establish a sound corporate governance system | ① Effective operation of a Nomination Committee and an Executive Compensation Committee ② Appoint female executives ③ Enhance internal controls (internal audit) under the Companies Act in addition to J-SOX |

| |

2. Improve management transparency and strengthen the management oversight system | ① Share information by implementing the Four-Party Audit and Supervision Meeting, which adds outside directors to the Tripartite Audit Assembly (Audit & Supervisory Board, Accounting Auditor, Internal Audit Office) ② Audit and supervision of Group companies by outside directors ③ Enhance Internal Audit Office | |||

3. Strengthen the effectiveness of the Board of Directors | ① Strengthen governance through the appointment of outside directors with wide-ranging knowledge and experience and stimulate the Board of Directors ② Implement evaluation of effectiveness of the Board of Directors and address issues | |||

(Taken from the website of the company)

*The company has published a webpage on sustainability on its website:

https://www.kitz.co.jp/english/sustainability/

<Reference2: Regarding Corporate Governance>

◎ Organizational structure, Composition of board of directors and company auditors

Organizational structure | Company with board of company auditors |

Board of directors | 8 directors (4 are outside directors) |

Company auditors | 5 auditors (3 are outside auditors) |

Corporate governance report (Updated on:April 1 2021)

Basic policy

Our corporate ethos is to continuously improve our corporate value by offering creative, high-quality products and services. Under this ethos, we strive to achieve business administration that takes care of the interests of shareholders and all other stakeholders as a socially responsible company. Moreover, in order to increase business administration efficiency and enhance our compliance with laws, we will listen to requests from stakeholders and consider the social trends, etc. in order to swiftly and efficiently achieve a sound and highly transparent business administration by implementing a variety of measures, and intend to enrich corporate governance.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code>

Kitz complies with all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

4. Full disclosure (Principle 3-1)

(3) We disclose our policies on determining the compensation of our directors and company auditors, etc., in our annual securities report, etc. Compensation for our directors (excluding outside directors) and executive officers is based on a performance-based stock compensation scheme. The compensation amount, methods of distribution and stock allocation are determined by internal rules. In addition, bonuses are paid if certain conditions required by the internal rules are met, and the company has secured enough profit. Regarding determining compensation, we have established a Compensation Committee, consisting mainly of outside directors, as a voluntary advisory body to the Board of Directors. The committee deliberates compensation policies and other matters of particular importance, and reports the results back to the Board of Directors.

(4) Regarding our policies for nominating director and company auditor candidates, dismissing directors and company auditors, and appointment or dismissal of officers, we have established a Nomination Committee, consisting mainly of outside directors, as a voluntary advisory body to the Board of Directors. Based on the “Policy on the composition of the Board of Directors and the Board of Company Auditors, and the appointment and dismissal of officers (directors, company auditors, CEO, executive officers),” determined by the company (hereinafter, “Officer Selection and Dismissal Policy”), candidates are examined from various perspectives such as personality, ability, insight, experience, expertise, achievements, fairness and age, as well as gender and internationality, and the Board of Directors makes a decision based on the Nomination Committee’s report.

Our Officer Selection and Dismissal Policy is disclosed on the company website.

(5) Regarding candidates for directors and company auditors, their brief histories and the reasons for their nomination are disclosed in the notice of convocation of shareholders’ meeting. When directors and company auditors are dismissed, these reasons will also be disclosed.

9. Details of initiatives to enhance the effectiveness of the Board of Directors (Supplementary principle 4-11-3)The company conducts a questionnaire survey on the effectiveness of the Board of Directors every year for the purpose of enhancing the effectiveness of corporate governance and improving the functions of the Board of Directors as a whole. The Board of Directors analyzes and evaluates these results. For the survey, the purpose of the evaluation is explained to all directors and company auditors in advance, and based on the principles of the Corporate Governance Code, a questionnaire on particularly important matters is handed out, in which respondents provide their name along with their answers. The Board of Directors analyzes and evaluates effectiveness based on the responses obtained, and also conducts open discussions on key issues. The survey on the effectiveness of the Board of Directors conducted in May 2020 asked about (1) the formulation and execution of management strategies, (2) the composition of the Board of Directors, (3) the nomination and compensation of directors, (4) encouraging lively discussion by company auditors, outside directors and the Board of Directors, and (5) meeting the interests of shareholders and other stakeholders. As a result, the Board of Directors was ensured to have its effectiveness overall. However, some constructive criticisms including areas for improvement were given in regards to the succession plan for the CEO and the diversity of the Board of Directors. As such, the Board of Directors will discuss these issues going forward and strive to ensure further effectiveness.

11. Policy for Constructive Dialogue with Shareholders (Principle 5-1)

We recognize that, in order to achieve sustainable growth and enhance medium- to long-term corporate values, it is important to be aware of the accountability as a trustee of management, disclose information to stakeholders such as shareholders and investors in a timely and appropriate manner, and maintain fairness and transparency in management.

We also believe that providing necessary information continuously, and conducting IR activities for improving management by utilizing the opinions and requests from outsiders are vital. As such, we have established an IR system centered on the President and the executive officer in charge of IR in order to promote constructive dialogue with shareholders so that they can understand our management strategies and plans, and are implementing the following measures.

(1) We have appointed an executive officer in charge of IR in order to realize constructive dialogue with shareholders.

(2) We are striving to achieve efficient coordination led by the executive officer in charge of IR, by holding meetings among the IR department, the corporate planning department, the accounting department, the general affairs personnel department, the legal department, etc., as necessary and such.

(3) The Company conducts meetings for institutional investors and analysts each quarter. At these company briefings, explanations are given by the president himself or the executive director of IR. In addition to information regarding financial results, such as summary of financial results and securities report, other information is also disclosed on the Company website, regarding IR topics such as management information, information on shares and shareholders meetings, and reports on corporate governance.

(4) The Company periodically reports opinions gathered from dialogue with institutional investors and analysts to the president and IR executive officer. If necessary, the president will inform the Board of Directors and management committee.

(5) The Company pays close attention to managing insider information and considers the executive officer in charge of the accounting department to be responsible for handling information. The accounting executive officer, IR department, and management planning department discuss details regarding information disclosure prior to opening a dialogue with institutional investors and analysts.

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on KITZ Corporation (6498) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/