Bridge Report:(6498)KITZ Fiscal Year ended December 2023

| KITZ Corporation (6498) |

|

Company Information

Market | TSE Prime Market |

Industry | Machinery (Manufacturing) |

President | Makoto Kohno |

HQ Address | Tokyo Shiodome Building, 1-9-1 Higashi-shinbashi, Minato-ku, Tokyo |

Year-end | December |

HOMEPAGE | https://www.kitz.com/en/ |

Stock Information

Share Price | Shares Outstanding (End of period) | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,257 | 90,396,511 shares | ¥113,809 million | 11.1% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥41.00 | 3.3% | ¥118.17 | 10.7x | ¥1,124.39 | 1.1x |

*Share price is as of closing on March 13. All figures are based on the financial report for the fiscal year ended December 2023.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

December 2020 (Act.) | 84,245 | 3,751 | 3,169 | 2,113 | 23.38 | 9.00 |

December 2021 (Act.) | 135,790 | 8,990 | 8,975 | 4,954 | 55.26 | 20.00 |

December 2022 (Act.) | 159,914 | 11,051 | 12,045 | 8,549 | 95.35 | 33.00 |

December 2023 (Act.) | 166,941 | 13,687 | 14,452 | 10,591 | 118.07 | 41.00 |

December 2024 (Est.) | 170,000 | 14,500 | 14,800 | 10,600 | 118.17 | 41.00 |

*The estimated values are based on the forecasts made by the company. Unit: million-yen, yen. The fiscal year ended December 2020 was a nine-month period due to the change of the closing month. Net income is net income attributable to the owner of the parent company. Same as below.

This Bridge Report presents KITZ Corporation’s financial results for the fiscal year ended December 2023 and forecast for the fiscal year ending December 2024, etc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended December 2023 Earnings Results

3. Fiscal Year ending December 2024 Earnings Forecasts

4. Measures for Realizing Business Administration Oriented for Capital Cost and Share Price

5. Conclusion

<Reference1: Long-term Management Vision, “Beyond New Heights 2030 – Change the ‘Flow’ ”>

<Reference2: First Medium-term Management Plan 2024>

<Reference3: Regarding Corporate Governance>

Key Points

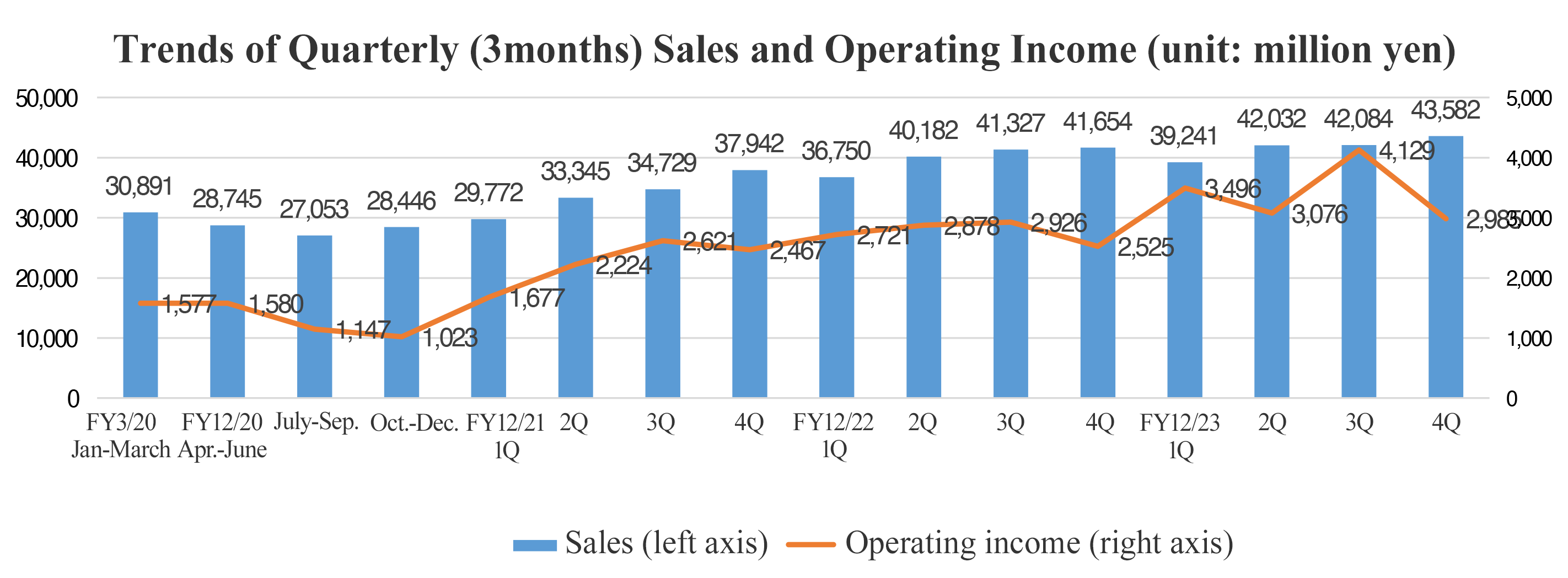

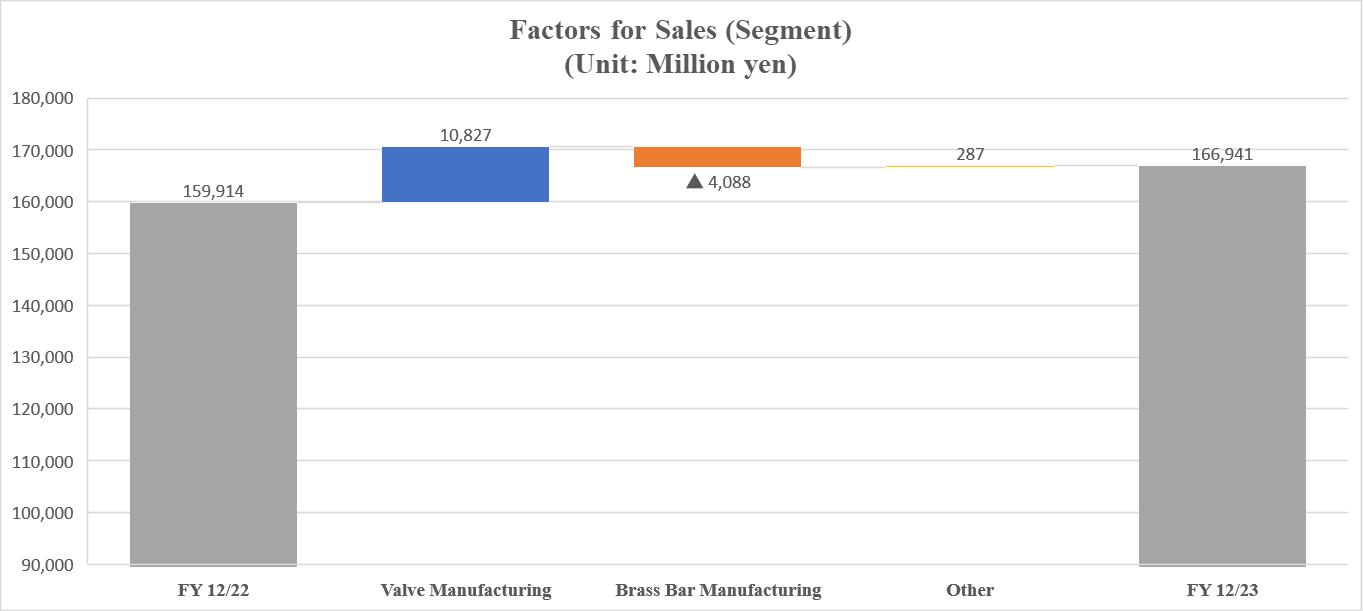

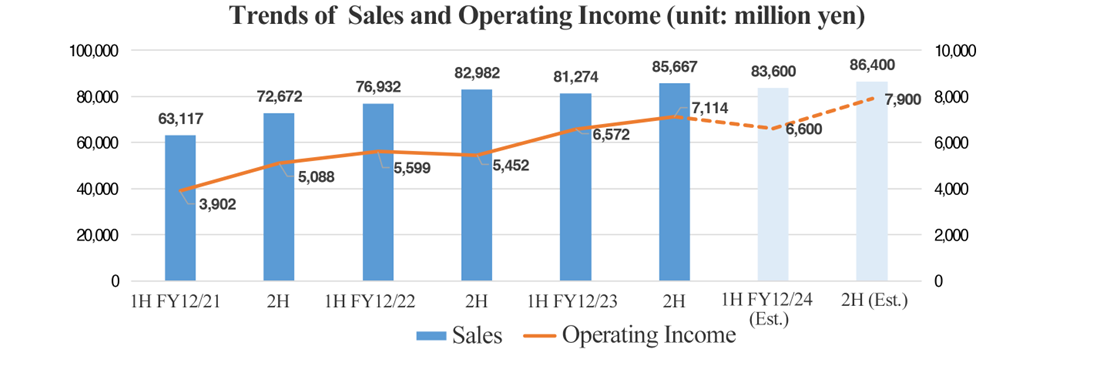

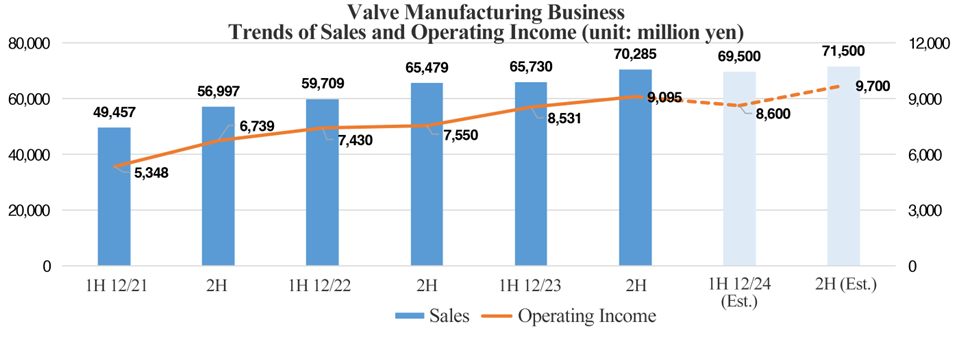

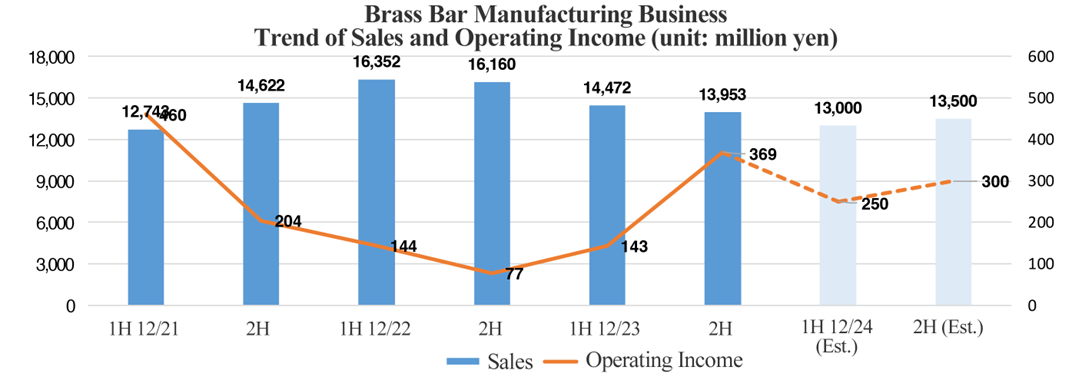

- In the fiscal year ended December 2023, sales grew 4.4% year on year to 166.9 billion yen, hitting a record high. The sales of the Valve Manufacturing Business increased 8.6% year on year. In the Japanese market, the sales of valves for semiconductor manufacturing equipment, too, grew, thanks to the price revisions conducted in FY 12/2022 and FY 12/2023. In the overseas market, the sales of valves for the Americas grew. The sales of the Brass Bar Manufacturing Business declined 12.6% year on year. The market prices of raw materials, which affect their selling prices, were unchanged from the previous year, but sales dropped due to the decrease in sales volume. Operating income rose 23.9% year on year to 13.68 billion yen. The operating income of the Valve Manufacturing Business rose 17.7% year on year, thanks to the sales growth. The operating income of the Brass Bar Manufacturing Business increased 130.6% year on year, as reduction in material waste although sales quantity dropped. Ordinary income rose 20.0% year on year to 14.45 billion yen, while net income increased 23.9% year on year to 10.59 billion yen. All kinds of profits exceeded the company’s forecasts, hitting a record high.

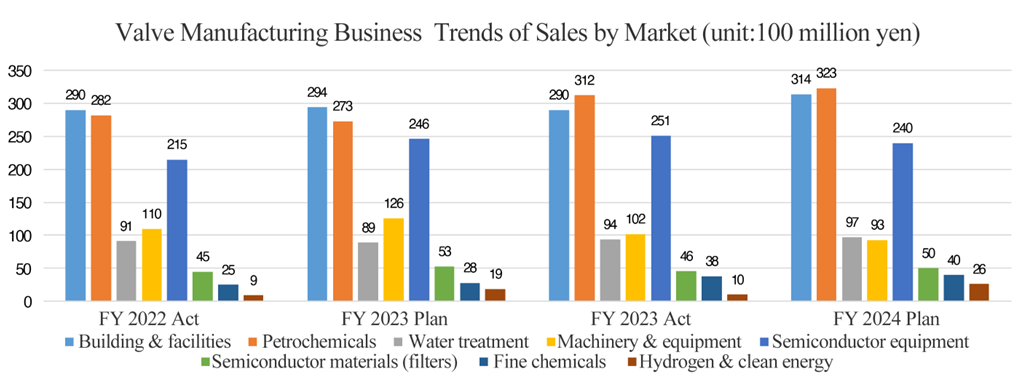

- For the fiscal year ending December 2024, sales are projected to increase 1.8% year on year to 170.0 billion yen, and operating income is expected to rise 5.9% year on year to 14.5 billion yen. The sales of the Valve Manufacturing Business are forecast to rise 3.7%. The sales of valves for the markets of building & facilities, petrochemicals, and hydrogen & clean energy are expected to grow considerably, but the sales of valves for semiconductor equipment are projected to decline due to the delay in recovery of the semiconductor market. The sales of the Brass Bar Manufacturing Business are forecast to decrease 6.8%. The company is expected to achieve the target sales of 170 billion yen set in the first Medium-term Management Plan. In terms of profit, operating income is forecast to increase, exceeding the target operating income of 13.0 billion yen set in the first Medium-term Management Plan by 11.5%, thanks to the plan for increasing the profits of the Valve Manufacturing Business and the Brass Bar Manufacturing Business. The forecast dividend is 41.00 yen/share (including the interim dividend of 19.00 yen/share), unchanged from the previous fiscal year. The expected payout ratio is 34.7%.

- As a basic policy for management, the company aims to achieve "profitability in both core businesses and growing fields." The company is promoting the "First Medium-term Management Plan 2024," which focuses on "active allocation of resources to growing fields and regions based on digitization and decarbonization," and "business developments that emphasize return on invested capital (ROIC)." Fiscal year ending December 2024 is the final fiscal year of the Medium-term Management Plan.

- In the fiscal year ended December 2023, they revised the forecast upwardly in May, and secured a double-digit increase in profit. Operating income reached the target in the Medium-term Management Plan one year earlier than expected, showing steady performance. In the Valve Manufacturing Business, sales increased significantly mainly for semiconductor equipment in the growing field, keeping operating income margin double-digit. In the Brass Bar Manufacturing Business, sales declined, but operating income grew significantly due to the improvement in yield rate. For the fiscal year ending December 2024, the business environment is not as bad as they assumed, and profit margin is expected to improve further if sales exceed the forecast. This time, they have announced their measures for realizing business administration oriented for capital cost and share price. Share price improved gradually, and PBR is now constantly over 1. Accordingly, we are looking forward to the next strategy after the medium-term plan is completed.

1.Company Overview

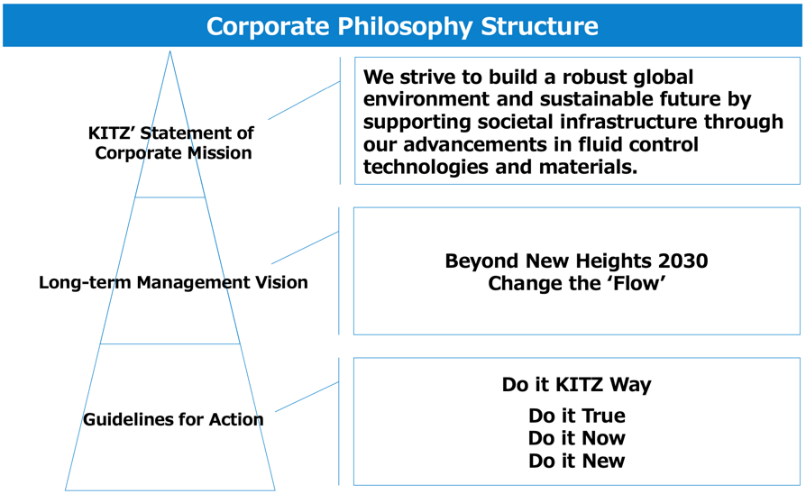

KITZ is an integrated manufacturer of valves and other fluid control equipment and devices. In valve manufacturing, it ranks highest in Japan and within the top 10 worldwide. Valves are made of various materials depending on their application, including bronze, brass, cast iron, ductile cast iron (cast iron with greater strength and ductility) and stainless steel. KITZ in principle assumes integrated production (casting, processing, assembling, inspecting, packaging, and shipping) of products from raw materials. The KITZ Group consists of 34 domestic and overseas subsidiaries. In addition to the production and sale of brass bars used for valves, water faucets and gas equipment (KITZ is ranked among the top manufacturers of brass bars within Japan), the Group also operates a hotel business.1-1 Corporate Philosophy

In 2021, on the occasion of the 70th anniversary of its founding, the company held a series of discussions on its purpose as a company and its contribution to society, and when announcing its long-term management vision, the company revised its corporate philosophy: the KITZ’ Statement of Corporate Mission. Recognizing that the creation of a prosperous global environment and a sustainable future is its mission to society, the company is deeply committed to continuing to support social infrastructure by further refining the fluid control technology and material development that the company has cultivated since its founding.

(Taken from the reference material of the company)

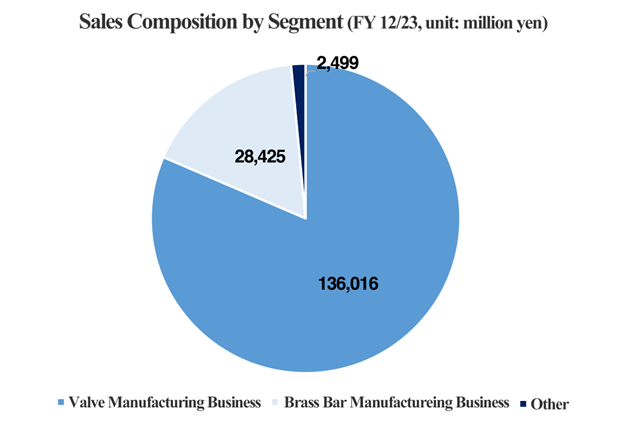

1-2 Overview of KITZ’s Business Segments

KITZ’s businesses consist of the valve manufacturing, brass bar manufacturing and other (including hotel and restaurant management) segments. During the fiscal year ended December 2023, these segments accounted for 81.5%, 17.0%, and 1.5% of total sales, respectively.

(1) Valve Manufacturing Business

Valves are used to pass, stop, and adjust the flow of fluids in various pipe systems (water, air, gas, and other substances). They are used in building facilities, residential utility systems, water supply facilities, fresh water and sewer systems, fire prevention equipment, machinery and industrial equipment manufacturing facilities, chemical, medical, and petrochemical product manufacturing facilities, semiconductor manufacturing facilities, oil refineries and other industrial complexes, among other applications. The Company operates an integrated production system that begins with the casting process (KITZ was the first Japanese company to acquire ISO 9001 international quality standard certification). The Company’s product offerings include commercial valves, which are made of corrosion-resistant bronze and highly economical brass for use in the building construction sector, including building facilities and residential utility systems, and industrial stainless-steel valves such as high-value-added ball valves. The Company has a high share of the domestic market in these mainstay product areas. In terms of sales, the company covers the country nationwide by expanding marketing bases in the domestic major cities and an elaborate network of distributors. As for overseas, the company has a global sales network where the company did not only establish representative offices in India and U.A.E but also marketing bases in China, Hong Kong, South Korea, Singapore, Malaysia, Thailand, Vietnam, the U.S., Brazil, Germany, and Spain. Regarding the manufacturing, the company has a production network that helps achieve global cost and optimal production locations as the company has deployed production bases in China, Taiwan, South Korea, Thailand, India, Germany, Spain, and Brazil in addition to the domestic factories.

| Building facilities Valves, etc. used for air-conditioning, sanitary, and anti-disaster equipment when constructing hotels, hospitals, office buildings, and so on | Water supply/water supply facilities Devices and equipment for pipes for water supply and sewage systems, valves used for facilities for treating water and sludge, products for water supply equipment for detached house, housing complexes, etc. |

| Gas/energy facilities Valves, etc. used for liquefied natural gas (LNG) production facilities, pipelines, and so on | Industrial machinery/production equipment All kinds of valves used for industrial machinery and production equipment |

| Oil refining and oil complex facilities Valves, etc. used for the processing lines of oil refineries, petrochemical facilities, and chemical plants | Semiconductor manufacturing equipment Valves and joints for semiconductor manufacturing equipment (manufactured and sold by its group company, KITZ SCT Corporation) |

(2) Brass Bar Manufacturing Business

Copper alloy can take many different shapes, including sheets, strips, pipes, bars, and wires through hot or cold deformation processing such as dissolution, casting, rolling, extruding, and forging. It can be made with a range of different materials, including brass (copper with zinc), phosphor bronze (copper with tin and phosphorous), and nickel silver (copper with nickel and zinc). The KITZ Group's Brass Bar Manufacturing Business is led by KITZ Metal Works Corporation and Hokutoh Giken Kogyo Corporation. These companies manufacture and sell brass bars, which are used not only as material for valves, but also in the manufacture of water faucets, gas equipment, electrical appliances, and other brass-derived items.

(3) Other

KITZ subsidiary “Hotel Beniya Co., Ltd.,” operates a resort hotel in the city of Suwa, Nagano Prefecture. The hotel is located in a highly picturesque setting close to Lake Suwa with hot spring bathing facilities with sunset views and has a number of small and large banquet halls. The hotel also has a large convention hall, giving it the capacity to hold international conferences.

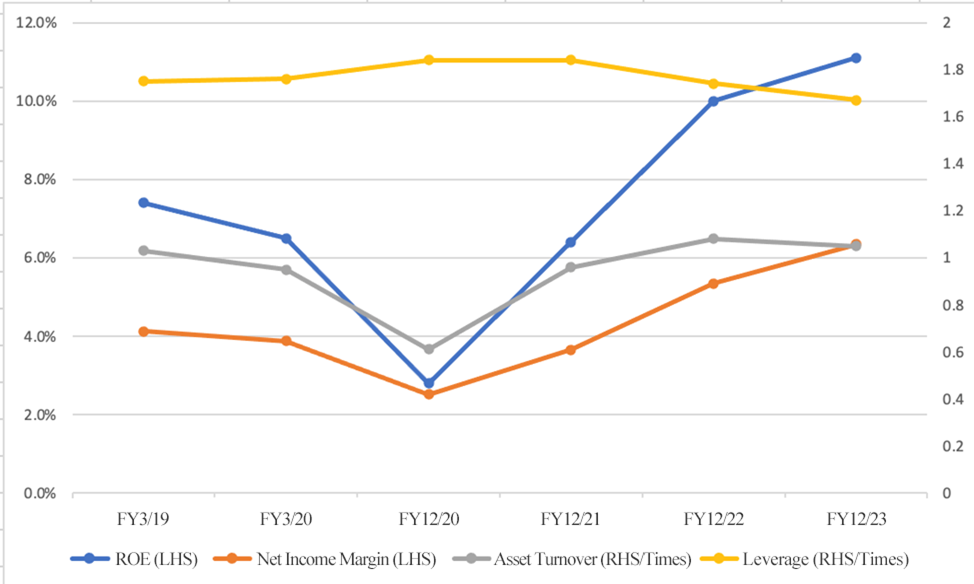

1-3 ROE Analysis

| FY3/19 | FY3/20 | FY12/20 | FY12/21 | FY12/22 | FY12/23 |

ROE (%) | 7.4 | 6.5 | 2.8 | 6.4 | 10.0 | 11.1 |

Net income margin (%) | 4.12 | 3.88 | 2.51 | 3.65 | 5.35 | 6.34 |

Total asset turnover [times] | 1.03 | 0.95 | 0.61 | 0.96 | 1.08 | 1.05 |

Leverage [times](x) | 1.75 | 1.76 | 1.84 | 1.84 | 1.74 | 1.67 |

*The fiscal year ended December 2020 was a nine-month period.

*Created by Investment Bridge based on disclosed material of the company.

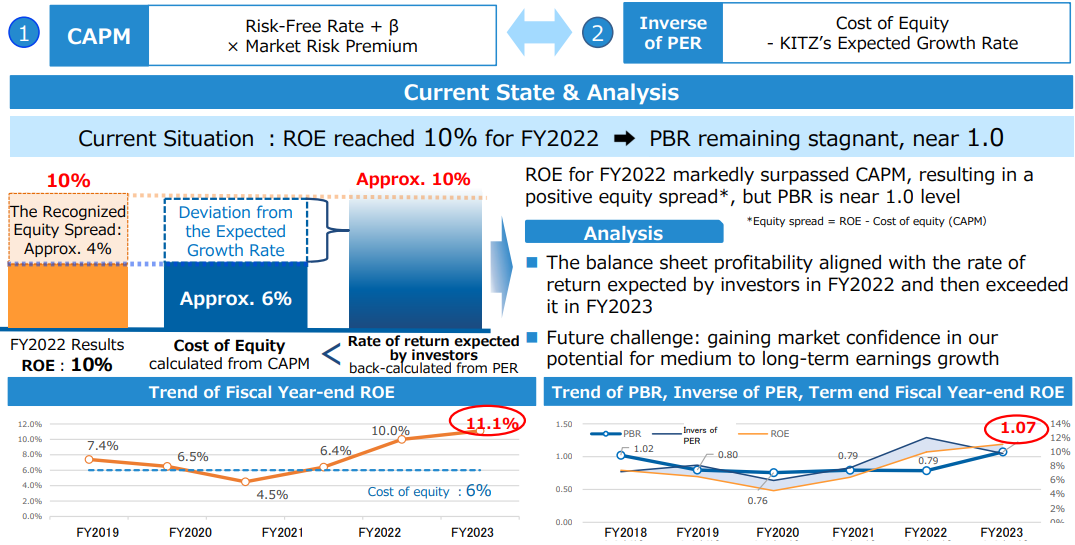

In fiscal year ended March 2023, ROE was 11.1%, exceeding the forecast by 2.1 points and being double-digit like in fiscal year ended March 2022. PBR is now constantly over 1, but further improvement can be expected thanks to the increase of profitability.

2. Fiscal Year ended December 2023 Earnings Results

2-1 Consolidated Business Results

| FY 12/22 | Ratio to Sales | FY 12/23 | Ratio to Sales | YoY | Ratio to Plan |

Sales | 159,914 | 100.0% | 166,941 | 100.0% | +4.4% | -1.2% |

Gross Profit | 38,819 | 24.3% | 43,537 | 26.1% | +12.2% | - |

SG&A | 27,768 | 17.4% | 29,849 | 17.9% | +7.5% | - |

Operating Income | 11,051 | 6.9% | 13,687 | 8.2% | +23.9% | +6.1% |

Ordinary Income | 12,045 | 7.5% | 14,452 | 8.7% | +20.0% | +8.7% |

Net Income | 8,549 | 5.3% | 10,591 | 6.3% | +23.9% | +9.2% |

* Unit: million yen. Net income is net income attributable to owners of the parent company, same as below. Ratio to plan is the ratio to company’s forecast.

Sales and profit grew, and all kinds of profits exceeded the forecasts.

Sales grew 4.4% year on year to 166.9 billion yen, hitting a record high, but falling below the forecast by 2 billion yen. The sales of the Valve Manufacturing Business increased 8.6% year on year. In the Japanese market, the sales of valves for semiconductor manufacturing equipment, too, grew, thanks to the price revisions conducted in FY 12/2022 and FY 12/2023. In the overseas market, the sales of valves for the Americas grew. The sales of the Brass Bar Manufacturing Business declined 12.6% year on year. The market prices of raw materials, which affect their selling prices, were unchanged from the same period of the previous year, but sales dropped due to the decrease in sales volume.

Operating income rose 23.9% year on year to 13.68 billion yen. The operating income of the Valve Manufacturing Business rose 17.7% year on year, thanks to the sales growth. The operating income of the Brass Bar Manufacturing Business increased 130.6% year on year, as reduction in material waste although sales quantity dropped. Regarding non-operating performance, exchange gain decreased, and ordinary income rose 20.0% year on year to 14.45 billion yen. Net income increased 23.9% year on year to 10.59 billion yen, as gain on sale of investment securities was posted as extraordinary income due to the sale of strategically held shares. All kinds of profits exceeded the company’s forecasts, hitting a record high.

Exchange and raw materials

| FY 12/22 | FY 12/23 Act | FY 12/23 Plan |

Yen / US Dollar | 132.09 | 141.20 | 145.00 |

Yen / Euro | 138.49 | 153.14 | 157.00 |

Electrolytic Copper, Yen / Ton | 1,194,750 | 1,246,000 | 1,240,000 |

2-2 Business Segments’ results

| FY 12/22 | Ratio to Sales | FY 12/23 | Ratio to Sales | YoY | Ratio to Plan |

Sales | 159,914 | 100.0% | 166,941 | 100.0% | +4.4% | -1.2% |

Valve Manufacturing | 125,189 | 78.3% | 136,016 | 81.5% | +8.6% | -0.6% |

Brass Bar Manufacturing | 32,513 | 20.3% | 28,425 | 17.0% | -12.6% | -4.6% |

Other | 2,212 | 1.4% | 2,499 | 1.5% | +13.0% | - |

Segment profit | 11,051 | 6.9% | 13,687 | 8.2% | +23.9% | +6.1% |

Valve Manufacturing | 14,980 | 12.0% | 17,626 | 13.0% | +17.7% | +1.6% |

Brass Bar Manufacturing | 222 | 0.7% | 512 | 1.8% | +130.6% | +19.3% |

Other | 68 | 3.1% | 105 | 4.2% | +54.4% | - |

* Unit: million yen. Composition of operating income is the ratio of profit to sales. Ratio to plan is the ratio to company’s forecast.

*Created by Investment Bridge based on disclosed material of the company.

(1)Valve Manufacturing Business

Sales grew from the previous fiscal year, but slightly fell below the forecast. Operating income exceeded both the result in the previous fiscal year and the forecast.

The sales of valves for semiconductor equipment, fine chemicals, and petrochemicals in North America were healthy. In terms of profit, energy cost augmented, but price revisions, the settlement of the raw material market, and cost reduction contributed to the growth of profit.

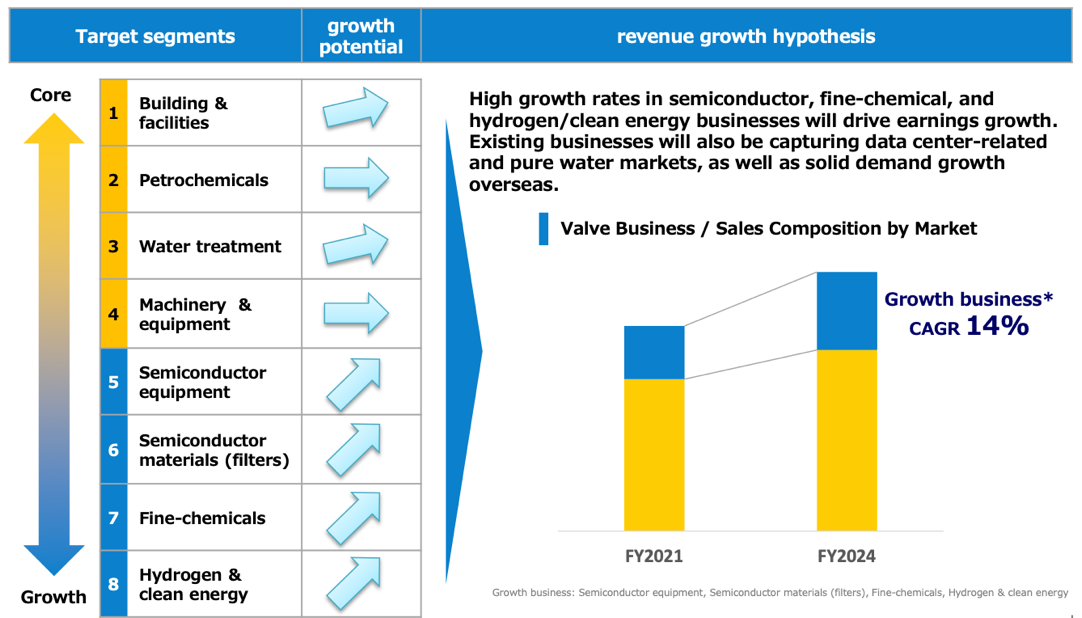

(Performance in each market) The medium- and long-term target markets have been divided into eight market segments. Based on the current core businesses (building & facilities, petrochemicals, water treatment, machinery & equipment), the company plans to promote the transfer of resources to growing and new fields (semiconductor equipment, semiconductor materials (filters), fine chemicals, hydrogen & clean energy) and change its revenue composition.

The sales and profit of valves for building & facilities and water treatment facilities were healthy. The valves for petrochemicals performed well in the North American market. The sales of valves for semiconductor equipment grew as the order backlog as of the end of the previous fiscal year led to the posting of sales. The valves for fine chemicals performed well thanks to pharmaceutical projects in Japan. In the hydrogen & clean energy field, the expected posting of sales of package units was postponed until fiscal year ending December 2024, so sales growth was slight.

(Performance in each region)

Domestic sales account for 59%, while overseas sales make up 41%. Domestic sales grew 10% year on year and overseas sales grew 7% year on year.

* In the Americas, industrial valves and general-purpose valves performed well in North America. Regarding valves for the oil industry, etc., the group company in Brazil recorded sales growth, so sales increased 8% year on year.

* In ASEAN countries, sales declined 5% year on year, because the market conditions remained harsh due to the downturn of the Chinese economy, etc.

*In China, the real estate industry remained in recession, but the sales increased 14% year on year, as industrial valves grew

*In India, the group company Micro Pneumatics started handling valves for plants, expanding its business domain, and sales increased 43% year on year.

(2)Brass Bar Manufacturing Business

Sales fell below the result in the previous fiscal year and the forecast, but profit grew significantly, exceeding the forecast.

The market prices of raw materials, which affect selling prices, were unchanged year on year, but demand weakened, decreasing sales quantity. Accordingly, sales dropped 12.6% year on year. Operating income increased 130.6% year on year, as yield rate improved although sales quantity declined.

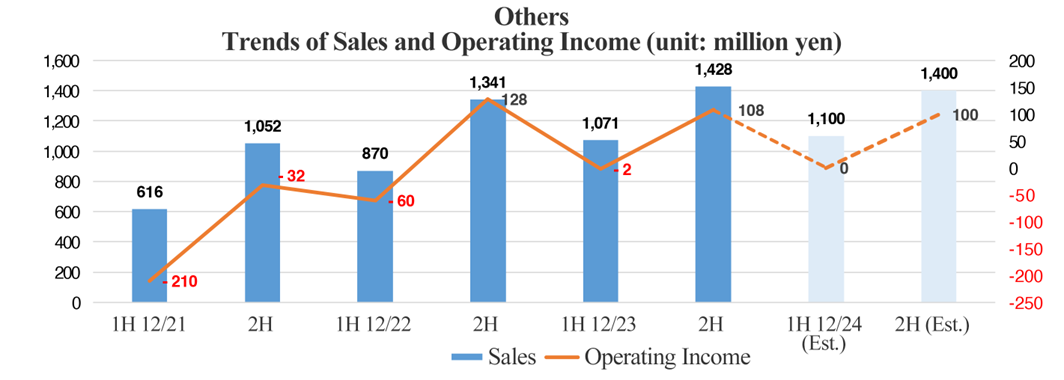

(3)Other

Sales and profit rose significantly.

In the hotel business, the restrictions on activities for coping with COVID-19 were lifted, so the number of hotel guests increased. Also, the fireworks event in the Lake Suwa Festival held as scheduled contributed.

2-3 Financial Conditions and Cash Flows

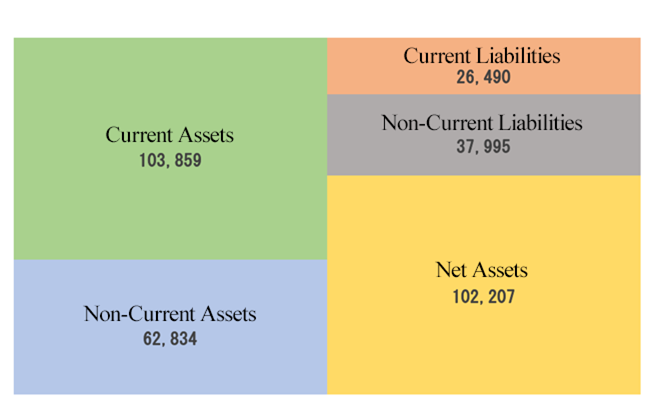

◎BS

| Dec. 2022 | Dec. 2023 | Increase and Decrease |

| Dec. 2022 | Dec. 2023 | Increase and Decrease |

Current Assets | 93,177 | 103,859 | +10,682 | Current Liabilities | 23,335 | 26,490 | +3,155 |

Cash | 24,370 | 29,002 | +4,632 | Payables | 8,975 | 8,935 | -40 |

Receivables | 33,539 | 34,282 | +743 | Short-Term Debt | 3,153 | 2,804 | -349 |

Inventories | 33,006 | 37,045 | +4,039 | Noncurrent Liabilities | 38,190 | 37,995 | -195 |

Noncurrent Assets | 59,392 | 62,834 | +3,442 | Long-Term Debt | 33,766 | 33,757 | -9 |

Tangible Assets | 45,200 | 49,932 | +4,732 | Total Liabilities | 61,526 | 64,486 | +2,960 |

Intangible Assets | 3,164 | 1,964 | -1,200 | Net Assets | 91,042 | 102,207 | +11,165 |

Investments, Other | 11,027 | 10,937 | -90 | Retained Earnings | 57,911 | 65,258 | +7,347 |

Total Assets | 152,569 | 166,693 | +14,124 | Total Liabilities, Net Assets | 152,569 | 166,693 | +14,124 |

* Unit: million yen. Receivables include electronically recorded receivables.

*Created by Investment Bridge based on disclosed material of the company.

Inventories and cash increased, so total assets grew 14.1 billion yen year on year to 166.6 billion yen. Total liabilities increased 2.9 billion yen year on year to 64.4 billion yen, mainly due to an increase in income tax payable. Net assets increased 11.1 billion yen year on year to 102.2 billion yen due to an increase in retained earnings. The equity ratio increased 1.5 points from the end of the previous fiscal year to 60.5%.

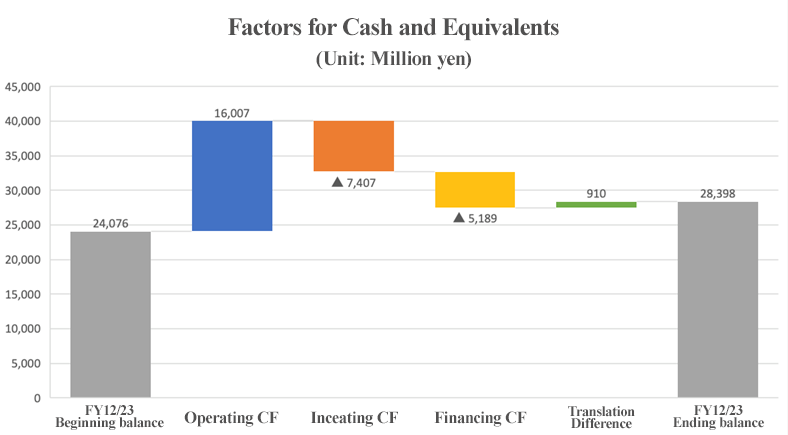

◎CF

| FY 12/22 | FY 12/23 | Increase and Decrease |

Operating Cash Flow(A) | 8,541 | 16,007 | +7,466 |

Investing Cash Flow(B) | -7,471 | -7,407 | +64 |

Free Cash Flow(A+B) | 1,070 | 8,600 | +7,530 |

Financing Cash Flow | -5,567 | -5,189 | +377 |

Cash and Equivalents at Term End | 24,076 | 28,398 | +4,321 |

* Unit: million yen.

*Created by Investment Bridge based on disclosed material of the company.

Operating CF grew significantly from the previous fiscal year, due to the increase in net income before taxes and other adjustments, the decrease in inventory assets, etc. Investment CF was flat, while free CF increased. The cash position, too, improved.

【2-4 Topics】

(1) Capital Investment in Growth Markets

Vietnam: Kitz Corporation of Vietnam Co., Ltd. Start of operation in 2025 Improvement in the capacity of producing valves for high-purity gases for semiconductor equipment

Investment amount: approx. 4.5 billion yen Increased production capacity: Approx. 30% increase | Brazil: Metalúrgica Golden Art's Ltda. Start of operation in 2024 Expanding casting facilities for the Brazilian market

Investment amount: approx. 400 million yen Increased production capacity: Approx. 30% increase |

(taken from the reference material of the company)

(2) Emergency aid to areas hit by the 2024 Noto Peninsula Earthquake

■ The fastest provision of bathing services in the history of the Self-Defense Forces

The forces departed on January 4, arrived in Suzu City on January 5, and started supplying water. On January 6, the forces started providing bathing services at Ueto Elementary School in Suzu City.

■ Providing water for daily use by purifying river water to evacuation centers in Suzu City, Ishikawa Prefecture

Based on an agreement for emergency support in the event of a disaster, a truck carrying a portable membrane filtration device, Aqua Rescue, went to the site to provide water to the areas lacking water.

(3) Holding of the Headquarters Opening Ceremony and a Press Conference

Improved relations with reporters from 8 mass media companies

+

President Kohno explained his thoughts on the head office relocation

(4) Preparations for the KITZ Convention in May

(taken from the reference material of the company)

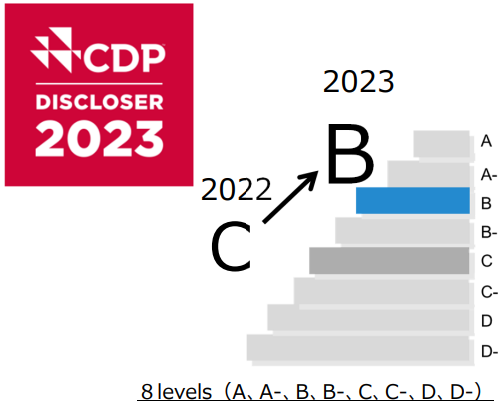

(5) Evaluation by ESG Rating Agencies in 2023

-Selected as a constituent of the FTSE Blossom Japan Sector Relative Index for the first time

-Received Score B of CDP "Climate Change"

(taken from the reference material of the company)

(6) Yui Susaki aims high to win her second consecutive title

Yui Susaki, a member of the company, won the Zagreb Open, a UWW ranking tournament, in January. After the final match, she said, "I was able to have the best start in 2024! I will definitely win a gold medal at the Paris Olympics, and I will do my best to share the joy and excitement with everyone at KITZ."

Paris Olympics in August

Paris, France

Tuesday, August 6, 18:00-20:30, the quarterfinals

Wednesday, August 7, 01:15-05:00, the semifinals (Midnight)

Thursday, August 8, 01:15-05:00, the final (Midnight)

3.Fiscal Year ending December 2024 Earnings Forecasts

3-1 Full Year Consolidated Earnings Forecast

| FY 12/23 | Ratio to Sales | FY 12/24 Est. | Ratio to Sales | YoY |

Sales | 166,941 | 100.0% | 170,000 | 100.0% | +1.8% |

Operating Income | 13,687 | 8.2% | 14,500 | 8.5% | +5.9% |

Ordinary Income | 14,452 | 8.7% | 14,800 | 8.7% | +2.4% |

Net Income | 10,591 | 6.3% | 10,600 | 6.2% | +0.1% |

Units: million yen.

Exchange and raw materials assumptions

| FY 12/23 | FY 12/24 Est. |

Yen / US Dollar | 141.20 | 145.00 |

Yen / Euro | 153.14 | 157.00 |

Electrolytic Copper, Yen / Ton | 1,246,000 | 1,240,000 |

It is expected that sales will grow 1.8% year on year and operating income will rise 5.9% year on year

For the fiscal year ending December 2024, sales are projected to increase 1.8% year on year to 170.0 billion yen, and operating income is expected to rise 5.9% year on year to 14.5 billion yen.

The sales of the Valve Manufacturing Business are forecast to rise 3.7%. The sales of valves for the markets of building & facilities, petrochemicals, and hydrogen & clean energy are expected to grow considerably, but the sales of valves for semiconductor equipment are projected to decline due to the delay in recovery of the semiconductor market. The sales of the Brass Bar Manufacturing Business are forecast to decrease 6.8%. The company is expected to achieve the target sales of 170 billion yen set in the first Medium-term Management Plan. In terms of profit, operating income is forecast to increase, exceeding the target operating income of 13 billion yen set in the first Medium-term Management Plan by 11.5%, thanks to the plan for increasing the profits of the Valve Manufacturing Business and the Brass Bar Manufacturing Business.

The forecast dividend is 41.00 yen/share (including the interim dividend of 19.00 yen/share), unchanged from the previous fiscal year. The expected payout ratio is 34.7%. The desirable payout ratio for the company is around 35%.

*Created by Investment Bridge based on disclosed material of the company.

Management Policy

The company aims to enhance corporate and social value under the "ROIC × ESG" management.

Basic Policy

■ To achieve the goals set for the final year of the first Medium-term Management Plan and formulate the next Medium-term Management Plan.

■ To rapidly develop the product lineup and prepare for the next wave of growth.

■ ROIC - Aggressively invest in growing and highly profitable areas and reap benefits swiftly - Aim to minimize inventory turnover by strengthening the control of supply and demand - Aim to promote the ROIC tree expansion to allow the employees to feel the impact of their contribution to the company |

× |

■ ESG (Sustainability Management) - Contribute to environmental conservation through the promotion of "Triple Zero" and the hydrogen and water business - Consider personnel as capital and invest in and create systems to improve job satisfaction and comfort - Deepen discussions on management risks, prioritize them, and reduce them appropriately - Aim for high transparency and speedy decision-making by establishing a management structure as a company with a nominating committee |

Business Environment

Economic Trends |

■ 2023 - Global energy costs soared, and the semiconductor market remained sluggish. - While inflation continued and economic conditions were firm in Europe and the U.S., China's economy remained stagnant due to the ongoing real estate recession. - In Japan, the economy is recovering, but the weak yen and high prices negatively impacted the business environment. ■ 2024 - Concerns about economic recession, mainly in the U.S., Europe, and China - The recovery of the semiconductor market is expected in the second half of the term or later, but uncertain. - There are concerns that the Japanese economy will cool down due to the decline in consumer sentiment caused by rising prices, and the labor shortage is also becoming serious. |

Medium-Term Business Environment |

■ Continued investment by Japanese users in ASEAN countries and solid growth in the Indian market ■ Continued high prices of raw materials and energy, economic instability due to conflicts and election results ■ In Japan, wage increases and labor mobility are accelerating, the clean energy market for decarbonization is expanding, and investment (in data centers, semiconductor factories, capital region redevelopment projects, etc.) is solid, but there is a concern about construction delays due to labor shortages. |

3-2 Sales and Operating Income by Segment

| FY 12/23 | Composition Ratio to Sales | FY 12/24 Est. | Composition Ratio to Sales | YoY |

Valve Manufacturing | 136,016 | 81.5% | 141,000 | 82.9% | +3.7% |

Brass Bar Manufacturing | 28,425 | 17.0% | 26,500 | 15.6% | -6.8% |

Other | 2,499 | 1.5% | 2,500 | 1.5% | +0.0% |

Total Sales | 166,941 | 100.0% | 170,000 | 100.0% | +1.8% |

Valve Manufacturing | 17,626 | 13.0% | 18,300 | 13.0% | +3.8% |

Brass Bar Manufacturing | 512 | 1.8% | 550 | 2.1% | +7.2% |

Other | 105 | 4.2% | 100 | 4.0% | -4.8% |

Adjustments | -4,556 | - | -4,450 | - | - |

Total Operating Income | 13,687 | 8.2% | 14,500 | 8.5% | +5.9% |

* Unit: million yen. The composition ratio of operating income is the ratio of profit to sales.

(1) Valve Manufacturing Business

Sales and profit are expected to grow. They will classify target markets into 8 categories, position the markets of building & facilities, petrochemicals, water treatment, and machinery & equipment, in which the company performs well, as core markets, and reinforce the business foundations in these markets, to lay the firm groundwork. They will position the growing or new markets of semiconductor equipment, semiconductor materials (filters), fine chemicals, and hydrogen & clean energy as growth markets, actively allocate resources to them, and change their revenue structure.

Created by Investment Bridge based on disclosed material of the company.

Sales plan by market

*Created by Investment Bridge based on disclosed material of the company.

Key measures for the fiscal year ending December 2024 in each market

| Business environment | Key measures | |

Building & Facilities | ●The data center market remains active worldwide. ●Continued demand from redevelopment projects in the Tokyo metropolitan area ●China is experiencing a real estate slump; thus, there are fewer projects and a desire to hold down costs. | [Globally]

[Japan]

[The U.S. and Europe]

[China and ASEAN countries]

| ■ Active order receipt and sales expansion for data center projects (Securing projects with an immediate delivery system based on strategic inventory)

■ To receive more orders from large-scale projects in the Tokyo metropolitan area

■ Expanding sales of valves for semiconductor equipment and facility market

■ Expanding the regional end-to-end business in China and ASEAN countries ■ Expanding sales of the KITAZAWA brand (ASEAN countries) ■ Strengthening relationships with local Japanese building equipment suppliers (ASEAN countries)

|

Petro-chemicals | ●Stable crude oil prices (The U.S. petrochemical market remains strong.) ●Increased investment by Japanese users in ASEAN countries ●Demand for maintenance due to aging of domestic plants and shortage of engineers | [Japan]

[The U.S. and Europe]

[ASEAN countries]

| ■ Expand sales of new-type actuators and explosion-proof actuators ■ Expand sales of high-value-added products by manufacturing Perrin products in Japan ■Expand MRO business and KISMOS business through the collaboration between KITZ and KESCO

■ Expand sales of ball valves for midstream and upstream applications ■ Entry into the general chemical market: Establishing a new commercial distribution network

■ Initiatives to local Japanese EPCs and users ■ Develop new customers in Malaysia, the Philippines, etc. |

Water Treatment | ●Continued investment in water purification and ultra-pure water equipment driven by semiconductor demand ●Measures for water pipe aging and seismic reinforcement ●Increased investment in environmental and sanitation measures, mainly in developing countries | [Japan]

[The U.S. and Europe]

[ASEAN countries]

| ■ Expand sales of water treatment systems (Pure Kireyzer/Aqua Rescue) in Japan and overseas and strengthen maintenance ■ Expand sales of butterfly valves for water treatment (PPS valve disc/aluminum PFA lining) ■ Expand sales of products equipped with an actuator for water treatment ■ Expand sales of products for waterworks (Shimizu Alloy)

■ Sales of chloramine-resistant sheet butterfly valves

■ Acquire the SIRIM/SPAN certification for water treatment in Malaysia |

Machinery & Equipment | ●Continued demand for machinery and equipment for semiconductor manufacturing equipment ●Increasing global demand for compliance with environmental regulations ●Decrease in projects and sluggish investment due to real estate recession in China | [Japan]

[The U.S. and Europe]

[China]

[ASEAN countries]

| ■ Expand sales of small automatic valves to meet customer needs ■ Increase products compliant with environmental regulations such as RoHS and REACH

■ Increase products compliant with environmental regulations

■ Expand sales of small automatic valves

■ Expand sales of Kitazawa products

|

Semiconductor Equipment | ●Demand for semiconductors is expected to recover from the second half of 2024. ●China's industrial policy is rapidly promoting domestic production ●The revitalization of investment in semiconductor factories in Europe (Germany, etc.) | [Japan]

[The U.S. and Europe]

[China]

[ASEAN countries]

| ■ Expand sales of valves for the processes of manufacturing semiconductor materials ■ Launch new products (valves that are high temperature and high corrosion resistant) ■ Development and deployment of SCT's original unit ■ Expansion of production capacity by adding clean rooms

■ Establish marketing and sales structure in Europe

■ Promotion of the model of local production for local consumption

■ Start the construction of a plant for manufacturing valves used in semiconductor equipment in Vietnam |

Semiconductor Materials (Filters) | ●The recovery of the sales of the hollow fiber membrane polyfix for semiconductor material processing is predicted to occur after the second half of 2024 ●Improved water quality in ASEAN will increase the distribution of water purifiers | [Japan]

[ASEAN countries]

[Korea]

| ■After demand recovers, the company will expand sales of semiconductor materials (filters) ■ Cultivation of the medical market ■ Promotion of EC sales of home-use water purifiers ■ CO2 separation membrane: Promotion of the NEDO business ■ Launch of new factory building and efforts to acquire user certification

■ Expand sales of water purifiers in ASEAN countries, especially in Vietnam

■ Expand sales of products for water purifiers, faucets, and showers

|

Fine Chemicals | ●Revitalize the functional materials market through huge investments by major semiconductor companies. ●The pharmaceutical and ultrapure water markets are thriving. ●Expansion of the rechargeable battery market for the EV industry | [Japan]

[China]

[Taiwan]

[India]

| ■ Strengthening efforts to enter the pharmaceutical, biotechnology, and sanitary markets ■ Development and sale of butterfly valves for pure water plants ■ Expanding sales of the PFA lining series

■ Expanding the sales of valves for the battery manufacturing equipment sector

■ Investment to increase the capacity of producing PFA lined valves

■ Expand the PFA-lined valves for the pharmaceutical and sanitary markets |

Hydrogen & Clean Energy

| ●The hydrogen (production, transportation, storage, utilization) market has expanded ●Acceleration of clean energy market expansion toward decarbonization ●Increased LNG demand and investment due to geopolitical risks | [Japan]

[The U.S. and Europe]

[ASEAN]

| ■ Receive more orders for packaged units for hydrogen stations for commercial/non-commercial projects ■ Acquire NEDO business investment projects (fuel ammonia, SAF, e-Gas, hydrogen, CCUS, etc.) ■ Focus on large-scale liquefied hydrogen plants and local energy consumption projects

■ Expand sales of cryogenic valves for North America ■ Expand sales of Perrin-made top-entry cryogenic ball valves

■ Focus on clean energy projects (geothermal/gas power generation) |

(2) Brass Bar Manufacturing Business

Sales are projected to drop, but profit is expected to rise. The company will invest in equipment for reducing the costs for materials and expand sales of high value-added products in growing markets, to improve profitability.

*Created by Investment Bridge based on disclosed material of the company.

(3) Other

Sales are expected to grow, but profit is projected to drop. As the business environment has improved, sales are forecast to increase, and they will strive to earn profit this fiscal year, too.

*Created by Investment Bridge based on disclosed material of the company.

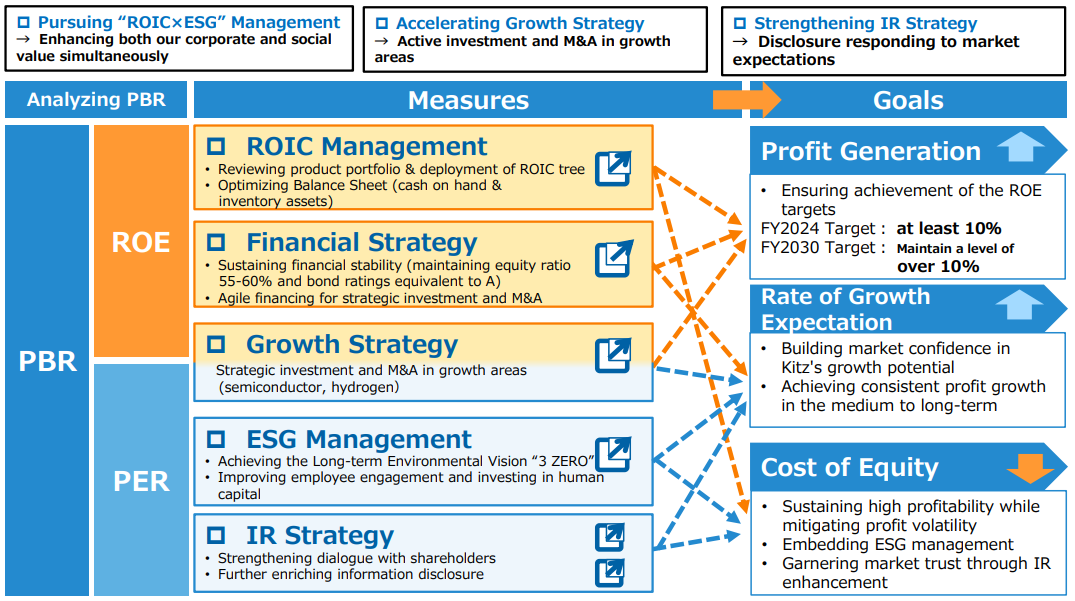

4. Measures for Realizing Business Administration Oriented for Capital Cost and Share Price

In December 2023, they announced their policies and concrete measures for evaluating and analyzing the current situation and improve corporate value, in order to realize business administration oriented for capital cost and share price.

1. Analysis of the current status of cost of shareholder’s equity

Analysis from two perspectives

① Cost of shareholder’s equity calculated with the CAPM method: around 6%

② Expected yield of investors estimated while taking into account the expected growth rate of KITZ (using the reciprocal of price-earnings ratio [PER]): It has been recently around 10%.

(Taken from the reference material of the company)

2. Policies and measures for improving corporate value

They aim to attain the target ROE set in the Medium-term Management Plan without fail and improve corporate value further.

(Taken from the reference material of the company)

5. Conclusions

In the fiscal year ended December 2023, they revised the forecast upwardly in May, and secured a double-digit increase in profit. Operating income reached the target in the Medium-term Management Plan one year earlier than expected, showing steady performance. In the Valve Manufacturing Business, sales increased significantly mainly for semiconductor equipment in the growing field, keeping operating income margin double-digit. In the Brass Bar Manufacturing Business, sales declined, but operating income grew significantly due to the improvement in yield rate. For the fiscal year ending December 2024, it seems that they forecast the business environment, including the semiconductor market, in a conservative manner. Accordingly, their forecast calls for a 1.8% increase in sales, but they plan to improve profit margin. The business environment is not as bad as they assumed, and profit margin is expected to improve further if sales exceed the forecast. This time, they have announced their action to implement management that is conscious of cost of capital and stock price. In the medium-term plan, the target operating CF in their financial strategy was raised. Share price improved gradually, and PBR is now constantly over 1. In the Valve Manufacturing Business, in addition to good condition in the semiconductor equipment business, the investment in semiconductors is projected to become more active as foreign enterprises have entered the Japanese market. The medium-term outlook is bright. We are looking forward to the next strategy after the medium-term plan is completed..

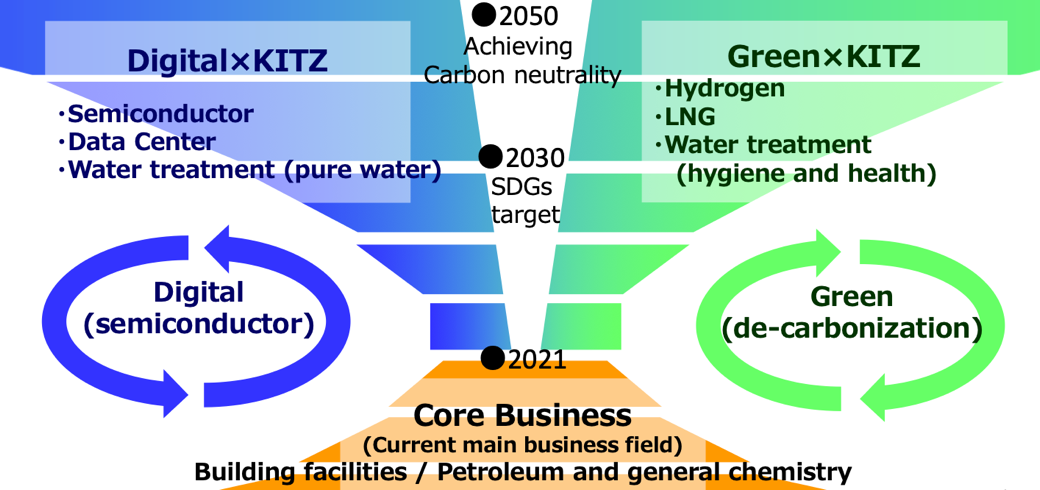

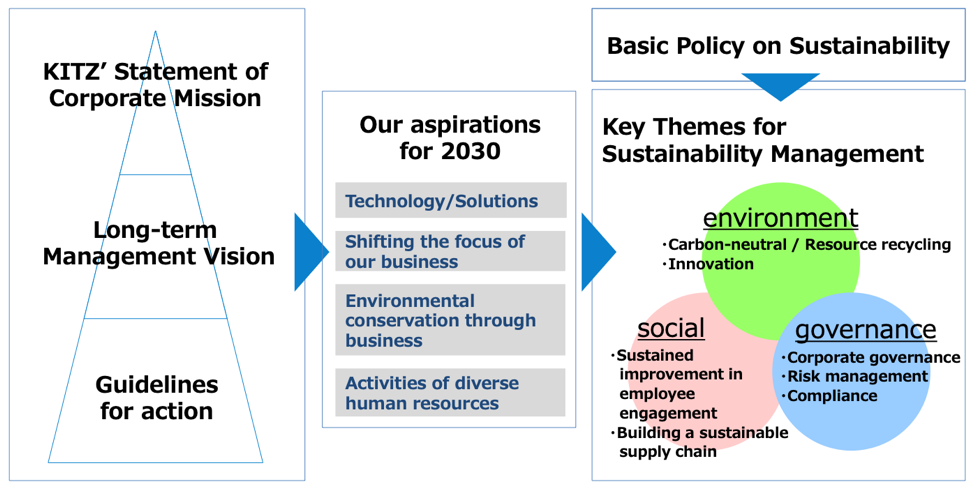

<Reference1: Long-term Management Vision, “Beyond New Heights 2030 – Change the ‘Flow’ ” >

In February 2022, in order to realize the new KITZ’ Statement of Corporate Mission, for the purpose of further long-term growth and enhancement of corporate value along with the contribution to the realization of a sustainable society, we have formulated our long-term management vision, “Beyond New Heights 2030 - Change the 'Flow',” as well as our first Medium-term Management Plan 2024.

(1) Our Aspirations for 2030

The following are the four ideals.

Technology/Solutions | KITZ will continue to challenge in Stream, Block and Squeeze by leveraging its one-of-a-kind technology and exceeding the user’s expectations through its powerful proposal capability. |

Core Business/Growth Business | KITZ will strengthen the foundation of its core business for the information and the sustainable society, while also accelerating its entry into growth businesses without fear of risk. |

Environmental Conservation Through Business | KITZ will garner favor of society by contributing to a sustainable future, pursuing environmentally friendly product and material development and production processes. |

Diverse Human Resources | KITZ will ensure each and every employee, regardless of gender, age, nationality, or culture, can work in high spirits of maximum performance as professionals. |

(2) Ideal Management Structure and Quantitative Goals

①Quantitative goals

The two goals for FY2030 are as follows.

☆ Average sales growth rate: 4% or higher (Consolidated sales of 200 billion yen for FY2030)

☆ ROE: 10% or higher (Consolidated net income of 10 billion yen for FY2030)

② Management structure

The company aims to expand the business domain toward the growing fields of semiconductors, fine chemicals, hydrogen, etc. based on its current core businesses such as building facilities and petroleum/general chemistry.

The company will proactively allocate resources to growing fields and regions against the backdrop of digitalization and de-carbonization with emphasis on return on invested capital (ROIC).

(3) Ideal State for 2030: Shift in Business Domains

They aim for two-sided management that can generate earnings in core businesses and growing areas.

(Taken from the reference material of the company)

① Long-term strategic investment policy

The total investment budget (for nine years) is set at 80 billion yen, of which approximately 60% will be for strategic investment in growing and new areas (including DX and M&A).

Management resources will be intensively allocated for shifting from core businesses.

(4) Basic Sustainability Policy

① Basic sustainability policy and sustainability slogan

The following are the basic sustainability policies and slogans.

◎ Basic sustainability policy

KITZ Group is committed to realizing its corporate philosophy, the KITZ’ Statement of Corporate Mission, through the following activities

① Work to solve social issues through our business and enhance our corporate value and social value

② Achieve efficient, fair, and transparent corporate management and become a company trusted by society.

③ Build strong trusting relationships through dialogue with all stakeholders

◎ Sustainability slogan

Create the Future, Preserve the Future

Create the Future

The KITZ Group will create a new future by acting with integrity and taking on challenges without fear of change, aiming to realize a recycling-oriented society that is friendly to the earth and people.

Preserve the Future

The KITZ Group will continue to protect the Earth's limited resources and human life and strive to realize a society that we can pass on to the next generation.

◎ Sustainability management

① Overall view

In our long-term strategy toward 2030, we have placed sustainability management at the core of our business strategy.

(Taken from the reference material of the company)

② Key themes for sustainability management

We will establish key management themes for each of E (Environment), S (Society), and G (Governance) and work on concrete measures to address them.

| Key Themes for Sustainability Management | Specific Initiatives |

E | Carbon Neutral/Resource Recycling | Development of KPI targets to achieve Triple Zero (CO2 reduction rate/water discharge/waste landfill disposal rate) |

Innovation | Development of Fluid Control Technology to Support a Decarbonized/Hydrogen Society Development of materials that contribute to reducing the environmental footprint | |

S | Sustainable Improvement in Employee Engagement | Instillation of corporate philosophy/vision To promote D&I and foster a culture of collaboration Human resource development and system reform to support global management Creating a work environment in which employees can work with enthusiasm |

Building a Sustainable Supply Chain | Emphasizing CSR procurement To establish a stable raw material and parts procurement system | |

G | Corporate Governance Risk Management Compliance | Further transparency in management decision-making Risk management focused on both risk reduction and opportunity creation Global Compliance for Sustainability Management |

◎ E (environment) The company aims to realize a sustainable, recycling-oriented society in FY2050 by promoting Triple-Zero initiatives: zero CO2 emissions, zero environmental impact, and zero risk. The goals for FY2030 are i) a CO2 reduction rate of 90%, ii) a waste to landfill ratio of less than 1.0%, and iii) 100% reduction of water resources discharge. (All figures are comparisons with FY2013 in the domestic group)

◎ S (society) To create an environment where each and every employee works professionally and energetically at their best performance, regardless of gender, age, nationality, culture, etc., with the aim of achieving the success of diversified human resources. ◎ G (governance) In terms of corporate governance, the Company will strengthen portfolio management by incorporating an evaluation yardstick for the cost of capital and enhance the monitoring function and strengthen the implementation system by establishing a Sustainability Committee. In risk management, we will identify and assess risks, and implement, verify, and continuously update countermeasures throughout the Group, as well as seek to discover new business opportunities by shifting our thinking from risks related to social needs and market changes. In the area of compliance, we will shift to a compliance program that meets the needs of society (strengthening our measures for human rights, labor, the environment, anti-corruption, etc.) and aim to spread autonomous compliance throughout the Group, with each employee taking responsibility for his or her own compliance.

(5) Toward DX

Achieve business transformation (BX) by linking DX and business innovation activities. They aim to transform into a customer-oriented and agile organization by thoroughly streamlining existing businesses and visualizing and mobilizing management resources in order to support the world's social infrastructure and create a prosperous future through fluid control and digital technology.<Refernce2: First Medium-term Management Plan 2024>

(1) Overview

① Basic management policy

The company aims for a two-pronged management approach that can generate earnings in both core businesses and growing fields.

*Actively allocate resources to growing fields and regions against a backdrop of digitalization and decarbonization.

*Business operation with emphasis on return on invested capital (ROIC).

② Quantitative targets

As mentioned above, the target financial KPIs for FY 2024 were revised. Non-financial KPIs were not revised.

Financial KPI | FY 2021 (results) | FY 2024 (targets) |

Sales | 1,357 | 1,700 |

Operating Income | 89 | 130 |

ROE | 6.4% | 9% or more |

Dividend Payout Ratio | 36.2% | About 35% |

Unit: 100 million yen

*Segments

| FY 2021 (results) | FY 2024 (targets) |

Valve Manufacturing Business | 1,067 | 1,366 |

Brass Bar Manufacturing Business | 273 | 310 |

Other | 16 | 24 |

Total Sales | 1,357 | 1,700 |

Valve Manufacturing Business | 120 | 170 |

Brass Bar Manufacturing Business | 6 | 8 |

Other | -2 | 1 |

Adjustment | -35 | -49 |

Total Operating Income | 89 | 130 |

Unit: 100 million yen

Non-financial KPIs | FY 2021 (results) | FY 2024 (targets) |

CO2 reduction rate | -28.1% | -90% |

Employee Engagement Score |

|

|

Worthwhile place to work | 48pt | 56pt |

Ease of working | 43pt | 55pt |

Ratio of female employees | 21.7% | 23% |

Ratio of female managers | 3.4% | 10% |

Ratio of male employees who took childcare leave | 29.0% | 80% |

CO2 reduction rate is the reduction amount of domestic group companies, compared to 2013. The results in FY 2020 replaced with those in FY 2021 (finalized value) (-26.9% → -28.1%), all numbers refer to KITZ alone.

*“Female managers” refers to women who hold positions as department heads.

(2) Mid-term Plan for Each Business

(2)-1 Valve Manufacturing Business

(2)-1-1 Strategy in Each Market

Medium- to long-term target markets were classified into eight market segments. Based on the current core businesses (building & facilities, petrochemicals, water treatment, and machinery & equipment), the company will shift resources to growing and new fields (semiconductor equipment, semiconductor materials [filters], fine chemicals, and hydrogen & clean energy) and change its profit-earning structure.

(Taken from the reference material of the company)

① Building & facilities

Although new housing starts are on a downward trend domestically, overseas markets will continue to grow, especially in ASEAN countries. In developed countries, the needs for simplified construction are increasing. Globally, demand for data centers is expected to grow rapidly.

(Key measures)

The company will promote the stocking of products to respond to the need for quick delivery in order to capture demand in the data center market.

In addition to the development of products with connection methods compatible with simplified installation, the company will develop products that are compatible with changes in piping construction methods and materials, as well as automation and smart construction.

② Petrochemicals

Global oil demand is expected to increase in emerging markets as they recover from the COVID-19 pandemic. Petrochemical demand is expected to remain strong in developed countries as well, despite the shift to clean energy.

(Key measures)

To develop products that follow user trends such as the shift to clean energy and environmental measures.

To improve services and MRO order rates for key account users, especially Japanese-affiliated companies.

To raise the implementation rate of the KITZ predictive diagnostic system.

To promote compliance with global standards and customer certifications.

③ Water treatment

Global demand for water infrastructure will increase, but price ranges and certification systems are barriers to entry. Investment in pure water/ultrapure water plants will increase due to rising demand for semiconductors.

(Key measures)

To develop marketing activities closely tied to pure water plant manufacturers and pure water equipment manufacturers.

To develop resin-based products and promote the compliance with the strict prohibition on the elution of metal ions.

To provide solutions for the water infrastructure field, focusing on purification equipment (Pureculaser, AquaRescue, etc.).

④ Machinery & equipment

The company will provide new customer value by accurately grasping the increasingly sophisticated environmental needs for RoHS/REACH, green refrigerants, etc. in the machinery and equipment sector.

(Key measures)

To establish a new Machinery & Equipment Sales Department.

To develop machinery and equipment that is smaller, lighter, and better suited to automation, and introduce them to the market.

To expand the number of products compliant with environmental regulations such as RoHS and REACH.

To capture demand for switching to next-generation (green) refrigerants.

⑤ Semiconductor equipment

Against the backdrop of the solid expansion of the semiconductor market, the company will expand its production capacity of clean valves for semiconductor equipment and promote the development of its research and development system.

(Key measures)

New building construction at the Nitta SC Plant to increase production capacity.

To implement DX (automation and labor saving) investment on the production side.

To reinforce the R&D system.

⑥ Semiconductor materials (filters)

Against the backdrop of strong semiconductor demand, the company also expects steady growth in semiconductor photoresist filters (Polyfix). Production capacity will be expanded to meet growing demand.

(Key measures)

To expand the production capacity of industrial filters such as Polyfix.

To work on the development of next-generation membranes compatible with semiconductor sub-nano.

To develop methods of applying precision filters to other fields (other than photoresists).

⑦Fine chemicals

Chemical companies, which are the company’s major customers, are focusing on high value-added fine chemical fields. The company will expand its product lineup to meet increasingly sophisticated process requirements and increase earnings.

(Key measures)

To expand its product lineup to meet the demand for high cleanliness and easy maintenance, such as diaphragm valves.

Form a cross-functional sales and engineering organization dedicated to fine chemicals and pursue synergies with KITZ SCT.

To build and strengthen process and production technology networks with fine chemical/equipment and machinery manufacturers, etc.

⑧Hydrogen & clean energy

Hydrogen energy-related market potential is expected to expand rapidly toward a decarbonized society. The company aims to expand its business by entering the hydrogen supply chain, which is being implemented in society.

(Key measures)

The company will capture the hydrogen station market with packaged units. Also, they will enter the small-scale, locally produced and consumed green hydrogen energy chain business.

Large-scale demonstration plant for liquefied hydrogen (shipping and receiving terminals, carriers), and research and development for entry into the hydrogen aircraft market (NEDO project) will be promoted.

To capture new hydrogen energy demand for hydrogen power generation, hydrogen pipelines, etc.

To expand the lineup of ultra-low temperature valves for LNG for overseas markets and strengthen sales.

(2)-1-2 Group Strategy

The company aims to increase revenues by focusing on three key areas: creating group synergies, strengthening user contact points, and global product and area strategies.

(2)-1-3 Area Business Strategy

① North American market

◎Key Target Markets

Building & facilities, petrochemicals, water treatment, semiconductor equipment, fine chemicals, and hydrogen & clean energy

◎ Business opportunities

*Expansion of oil, petrochemical, and gas markets in the oil-producing U.S.

*Trend of strengthening environmental regulations (decarbonization, lead-free, etc.)

◎ Key measures

The U.S. marketing base is positioned as a control tower for market strategies for oil and gas.

Aiming to develop and launch low-cost ball valves to enter the chemical market.

Regarding industrial use valves, the sale of three-piece trunnion ball valves and high-performance butterfly valves will be expanded.

Regarding general use commercial valves, the company aims to expand sales in the commercial valve market.

② Chinese market

◎ Key target markets

Building & facilities, petrochemicals, water treatment, machinery & equipment, semiconductor equipment, fine chemicals

◎ Business opportunities

*Expansion of the data center market, etc., against the backdrop of the new infrastructure policy.

*Expansion of ethylene and other production capacity in line with policy guidance (chemical shift) in the petroleum industry.

*Market expansion through policy-oriented domestic production of semiconductors.

◎ Key measures

*Building & facilities, petrochemical, and fine chemicals markets

In the area of general use commercial valves, the company will actively utilize its integrated system of design, production, and sales: it will strengthen its ability to respond to the speed of market demand.

Regarding industrial use valves, the company will expand sales of industrial products, which have a large market size, by utilizing its production plant in China.

For automatic valves, an assembly and inspection system will be established at the production base in China.

*Semiconductor Equipment Market

To increase local production capacity and expand sales.

③ ASEAN and Indian markets

◎ Key target markets

Building & facilities, petrochemicals, water treatment, machinery & equipment, fine chemicals, and hydrogen & clean energy

◎ Business opportunities

*Expansion of Middle-Zone economy in parallel with the growth of emerging middle-class markets, including urban infrastructure.

*Expanding key account marketing opportunities in parallel with the entry of Japanese users.

◎ Key measures

*ASEAN

To establish a network of key accounts with a focus on Japanese users.

To identify hot-selling products through community-based marketing and develop an integrated local supply system (development, production, and sales).

To maximize revenues through collaboration between local brands and Unimech, Inc.

*India

To establish a regional strategy for region completion following the domestic production policy.

(2)-2 Brass Bar Manufacturing Business

Although existing business domains are shrinking, the company will increase profitability through continuous cost reduction by cultivating growing areas (automotive, semiconductors, etc.), capturing demand for processed products in line with supply chain reviews, promoting manufacturing cost reduction and recycling, and improving operational efficiency through DX and other measures.

(2)-3 Other Business (Services: Hotel Beniya) To shift the sales policy to target individual customers and the nearby prefectures' trading areas to secure profits during the COVID-19 pandemic. To take the opportunity presented by environmental changes to drastically reform and establish service productivity.

(3) Digital Transformation (DX)

DX will be introduced in the areas of design and development, production and assurance, marketing, sales and customer service and back office. Reduction of operation ratio and shift to value-added operations will be promoted. DX improves EX (employee value) and CX (customer value).

(4) Financial Strategy and Capital Policy

The cornerstone of management: "medium- to long-term improvement of return on invested capital"

■ To manage targets while assuming ROE and ROIC as major KPIs externally and internally, respectively, with the aim of improving corporate value

■ To execute strategic investment and procure necessary funds for sustainable profit growth and ROE improvement

■ To achieve business administration oriented for capital cost and share price

① To keep PBR not less than 1 ② To disclose information to meet investors’ expectations

Target ROE 10% or higher in FY 12/24 10% or higher in FY 12/30 | ■ Adoption of ROIC-oriented management | ① Improvement in profitability (execution of pricing strategies and review of the product portfolio) ② Application of ROIC Tree and PDCA management ③ Improvement in CCC through the streamlining of use of assets |

■ Active strategic investment: Securing future growth and profitability | ||

■ To maintain the optimal capital composition and secure room for borrowing: flexible fund procurement and response to risks | ||

Operating CF: 42 billion yen (cumulative from 2022 to 2024))Up 38 billion yen from the initial forecast

Investment | Return to shareholders | Debt repayment and fund procurement |

■ Total investment budget: 44 billion yen (initial budget: 37 billion yen) including the strategic investment budget: 33 billion yen (initial budget: 24 billion yen) ・Semiconductors ・Fine chemicals ・Hydrogen ・DX ・Environment friendliness ・M&A | ■ Payout ratio Kept around 35% in the medium-term policy * They will discuss the acquisition of treasury shares when necessary, while considering financial stability, liquidity of cash reserves, and investment funds. | ■ For coping with the uncertain business environment ■ For strategic investment ・Selection of appropriate methods for procuring funds according to investment ・Sustainability-oriented financing, etc. |

Goal of realizing an optimal capital composition | ■ Response to risks: Capital-to-asset rati 55-60%; banks’ commitment line for short-term borrowing (currently 13.5 billion yen) | |

■ Corporate bond rating remains A. | ・ Current rating: R&I ➝ A- (May 2023); JCR ➝ A (April 2023) ・ Preliminary rating for issuing corporate bonds: (R&I): A- (20 billion yen; Oct. 2022 to Oct. 2024) | |

<Reference3: Regarding Corporate Governance>

◎ Organizational structure, Composition of board of directors and company auditors

Organizational structure | Company with board of company auditors |

Board of directors | 7 directors (4 are outside directors) |

Company auditors | 5 auditors (3 are outside auditors) |

◎ Corporate governance report (Updated on:December 13, 2023)

Basic policy

We recognize that a well-functioning corporate governance allows the company to fulfil their social responsibility, elevates the efficiency and transparency of the management and contributes to a sustainable improvement of the corporate value. That is why our group aims for an effective corporate governance system based on the KITZ’ Statement of Corporate Mission by placing importance on compliance and building and operating a precise and swift management system as well as a business execution system which can swiftly respond to changes in the management environment while living up to the trust of all kinds of stakeholders and fulfilling the social mission and responsibility as a company. In addition, our company has set Basic Policy for Corporate Governance, which is disclosed on the company website alongside Compliance Table of the Governance Code. We have established the Basic Policy on Corporate Governance, which can be accessed through our company website alongside the "Status of Implementation of the Corporate Governance Code" and the information on sustainability initiatives. https://www.kitz.com/en/sustainability/

https://www.kitz.com/en/ /sustainability/governance/

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code>

The Company implements all of the principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】 Cross-shareholdings

We have established a “Policy on Cross-shareholdings,” which stipulates that, in principle, any shares for the purpose of forming stable shareholders will not be held, and that we will reduce, as much as possible, the number of the shares that are deemed not to meet this policy.

In addition, at the meeting of the Board of Directors held every year at the beginning of the fiscal year, we scrutinize the purpose of holding individual strategically held shares, the quantitative economic rationality associated with holding, and the risks of holding such shares, etc. and check their appropriateness based on this policy.

Regarding the exercise of voting rights regarding strategically held shares, we comprehensively take into consideration the management situation and suitability of decision-making for improving the governance system and corporate value in a mid-to long-term of the share-issuing company, and whether an improvement of our company group’s corporate value can be expected or not and pass a judgement for or against in regard to each proposal.

Please refer to the “Basic Policy for Corporate Governance” and “Policy Regarding Cross-shareholdings” disclosed on our company’s website for the policy regarding Cross-shareholdings, and to the Financial Statements for the number of shares of each specific investment stock respectively.

【Supplementary Principle 2-4-1】 Human Resources Development Policy and In-house Environment Development Policy for Ensuring the Diversity of Core Human Resources, and the State of Achievement

[1]Policy for ensuring diversity in regard to promotion, etc. of core personnel

Our company has been promoting diversity since FY2015 as one of important strategies for management. We believe that it is the mission of a company to treat their employees as assets of the company (human resources), respect the individuality of employees with diverse characteristics (age, sex, nationality, occupation, position, workstyle, etc.) and values, recognize each other and build an environment where each employee can demonstrate their respective abilities.

Moreover, our company has been promoting personnel based on the individual, placing importance on their ability and achievements, regardless of sex or nationality. We believe that respecting diverse viewpoints and values is vital for the realization of sustainable growth and the improvement of corporate value, and alongside proactive recruitment of human resources with different experiences, skills, and careers, we are developing a workplace environment that allows such personnel to flourish.

[2]Promotion of women to managerial positions

Regarding the promotion of women to managerial positions, the current ratio of women in managerial positions is 3.4% and there is a difference between men and women in regard to promotion to positions that involve decision-making, such as managerial positions. Our company views this as an item to be addressed. We are working to increase the number of women in leadership positions (associate management level), which will be a source of candidates for the next management level, through measures such as further recruitment of female employees and enhancement of training programs for female employees. We aim to gradually raise the ratio of women in managerial positions to 10% by fiscal 2024, 16% by fiscal 2027 and 20% by fiscal 2030.

[3]Promotion of foreign nationals to managerial positions

Our company group has developed bases for manufacturing and sales in 18 countries, including Japan. Moreover, Foreign employees account for 53.7% of our company group's total workforce. However, while our company has been putting efforts into the recruitment of mid-career recruits and new graduates of foreign nationalities, the average number of recruited foreign employees in the last five years is 4.2 and the overall ratio of foreign employees stands at 1.7% as of the end of FY2022. In this situation, we have not quite reached the point where we could set a goal for the promotion of foreign nationals to managerial positions and our company recognizes this as a task to be addressed. From now on, we shall consider the promotion of foreign employees to managerial positions in the process of forging ahead with the recruitment of even more foreign employees.

Moreover, our corporate group believes that it is necessary to localize our global operation and further accelerate the streamlining of the business from the viewpoint of overall optimization as we move toward 2030, and that it is important to promote and train management personnel with a global perspective as well as local personnel who will support them, regardless of their country or region of origin. In order to accomplish this, we formulated the KITZ Group Global HR Policy and shall proactively promote the communication between human resources beyond the barriers of countries and regions and aim for realizing a globally optimal utilization of human resources alongside promoting outstanding personnel in each region who have a good understanding of the particular region’s characteristics, regardless of the nationality, race, sex, etc.,

[4]Promotion of mid-career hires to management positions

The ratio of promotion of mid-career recruits to managerial positions at our company has already reached a high level of 43%. Therefore, we shall strive to maintain the current ratio.

【Supplementary Principle 3-1-3】 Initiatives Concerning Sustainability (Investment in Human Capital, Investment in Intellectual Property, and Climate Change Risks)

Upgrading the quality and quantity of information disclosure based on frameworks such as TCFD

[1]Initiatives concerning the promotion of sustainability

Our company believes that sustainability management is important in order to realize both sustainable development of the society and mid-to long-term growth of our company group, and tackling challenges concerning ESG (environment, society, governance) can bring about an impulse for creating new corporate value. With regard to promoting sustainability management, our company has established Basic Policy on Sustainability and Slogan on Sustainability, and based on them, we have set the priority sustainability themes.

Moreover, regarding the system for promoting sustainability, we have set up Corporate Committee for the Promotion of Sustainability, where the head of the Management Planning Dept. serves as committee chairman, and the executives of our company as well as Presidents of the domestic group companies are involved as permanent members, alongside establishing Group for the Promotion of Sustainability within the Management Planning Dept.

The objective of the Corporate Committee for the Promotion of Sustainability is to powerfully boost sustainability management in the whole group by sharing priority challenges as well as KPIs (key performance indicators) concerning respective challenges, reflecting them on the formulation of KPIs in each company and corrections of the plan.

[2]Investment in human capital, intellectual property, etc.

The "KITZ Group Long-Term Management Vision" and "Medium-Term Management Plan" announced in February 2022 give the information on our strategies related to the allocation of management resources and business portfolios, including quantitative targets for growth, profitability, capital efficiency and payout ratio, as well as the investments related to human capital and development (including intellectual property investment) as the steps toward growth to realize the long-term management vision.

[3]Impact on business activities, income, etc. of the company brought about by risks and opportunities for gaining income related to climate changes

Our company set a mid-term environmental goal regarding the reduction of emissions of greenhouse gases such as CO2 by 2030 in FY2021. In order to upgrade gradual disclosure of information concerning the impact of climate changes on business activities in terms of financial affairs alongside quicker realization of the relevant mid-term environmental goals, we expressed our approval of the TCFD (Task Force on Climate-related Financial Disclosures) proposal in December 2021. Consequently, our policy is to conduct analysis based on data and upgrade the quality and quantity of information disclosure in step with TCFD, in addition to grasping risks and opportunities related to climate changes. In addition, the information on our responses to the climate change is disclosed on our website. https://www.kitz.com/en/sustainability/environment/env_warming/

1.Governance

Our corporate group promotes the initiatives of our long-term environmental vision “3 (triple) ZERO,” aiming for zero CO2 emissions, zero environmental burden and zero risk.

The progress and accomplishments regarding the main items of the long-term environmental vision are checked at a management meeting involving the executives, with decisions passed on the direction, challenges, and especially important measures. Furthermore, we share issues concerning sustainability management such as climate change, and deliberate on their direction at the meeting of the Group Sustainability Promotion Committee, which is held twice a year.

2.Strategy

Regarding strategies concerning climate change, we identified major risks, opportunities, etc., analyzed their financial impacts and formed “strategy pillars” while considering them, based on socioeconomic scenarios stated in the IPCC report. We shall promote initiatives in accordance with these strategy pillars.

Strategy pillars

Contribute to the mitigation of climate change by reducing our CO2 emissions and efficiently using resources and energy.

Contribute to the mitigation of climate change by promoting the reduction of CO2 emissions through our products.

Contribute to the creation of a sustainable future by taking measures to mitigate climate change in cooperation with local communities.

3.Risks and management

We use progress management tools to evaluate and manage risks based on the basic philosophy of group risk management in order to keep reducing risks related to climate change. We work on identifying important risks among expected risks pertaining to various business activities of the whole group, including risks related to climate change, at management meetings. Furthermore, our Board of Directors deliberates on and decides the policy for addressing risks which are especially important to our corporate group.

4.Indices and goals

Regarding the strategy pillar (1), which is “Contribute to the mitigation of climate change by reducing our CO2 emissions and efficiently using resources and energy,” we have stated the goal of reducing our CO2 emissions by over 90% from 2013 by 2030 and achieving carbon neutrality by 2050 (long-term environmental vision “3 (triple) ZERO”) and we engage in initiatives for achieving it.

【Principle 5-1】 Constructive Dialogue with Shareholders

Our company engages in following initiatives in order to promote dialogue with shareholders.

1.We establish IR department and nominate an executive officer in charge of IR in order to promote dialogue with shareholders.

2.We formulate Disclosure Policy and disclose it on our website to provide information to all shareholders and investors in a timely, accurate, impartial way.

https://www.kitz.com/english/ir/disclosure_policy.html

3.As a general rule, we hold a results briefing session targeted at institutional investors and analysts every quarter, and a company briefing session targeted at individual investors every year, with the President or executive in charge of IR taking care of the explanation. In addition, directors, including outside directors, and auditors participate if required and promote dialogue with shareholders.

4.In case of a request for an interview from a shareholder, the head of the division in charge of IR will deal with it as a general rule. Based on the intent of the interview, the number of held shares, etc., the President or the executive officer in charge of IR will take care of the interview.

5.In case of dialogue with shareholders, we appropriately manage information in order to prevent insider transactions.

6.We explain the group management vision, Medium-term Management Plan, etc. in a way that is easy to understand.

7.In order to support dialogue with shareholders, we work toward an organic cooperation of the Publicity and IR Promotion Office, the Corporate Planning Department, the Accounting and Finance Center, the Sustainability Promotion Office, the General Administration Department, the Legal Department, etc. as required.

8.We regularly report the opinions, requests, etc. earned from dialogue with institutional investors and analysts to the President and the executive officer in charge of IR. The President reports the contents thereof at the board of directors meeting as well as management meeting as required and utilizes them in improving management.

9.We disclose IR information regarding management information, shares, general meetings of shareholders, etc. on our website in addition to settlement information such as financial statements and Annual Securities Reports.

10.We organize the information on the shareholder structure every year at the end of June and the end of December.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on KITZ Corporation (6498) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/