Bridge Report:(6539)Matching Service Japan Fiscal Year ended March 2021

President Takahiro Arimoto | Matching Service Japan Co., Ltd. (6539) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service industry |

President | Takahiro Arimoto |

HQ Address | Iidabashi Grand Bloom 4F, 2-10-2 Fujimi, Chiyodaku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Share Outstanding (Term-end) | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,145 | 24,985,000 shares | ¥28,607 million | 11.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥15.00 | 1.3% | ¥39.56 | 28.9x | ¥374.65 | 3.1x |

*The share price is the closing price on July 19 2021. All figures are taken from the brief report on results of the fiscal year ended Mar. 2021.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 Act. | 3,117 | 1,170 | 1,304 | 910 | 36.67 | 11.25 |

March 2019 Act. | 3,828 | 1,690 | 1,770 | 1,197 | 48.17 | 15.00 |

March 2020 Act. | 4,098 | 1,704 | 2,023 | 1,374 | 55.16 | 15.00 |

March 2021 Act. | 3,369 | 1,239 | 1,612 | 1,082 | 43.37 | 15.00 |

March 2022 Est. | 3,928 | 1,549 | 1,486 | 988 | 39.56 | 15.00 |

*Units: million yen, yen. Unconsolidated financial results until FY 3/20. Consolidated financial results from FY 3/21 onward. The forecast is the company's one. Net income means profit attributable to owners of parent. The same applies hereafter. A 1:4 stock split was implemented on October 1, 2018. EPS and DPS for FY 3/18 were adjusted for the stock split.

This report provides an overview of Matching Service Japan Co., Ltd., its performance trends, growth strategies, and an interview with President Arimoto.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2021 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Growth Strategy

5. Interview with President Arimoto

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

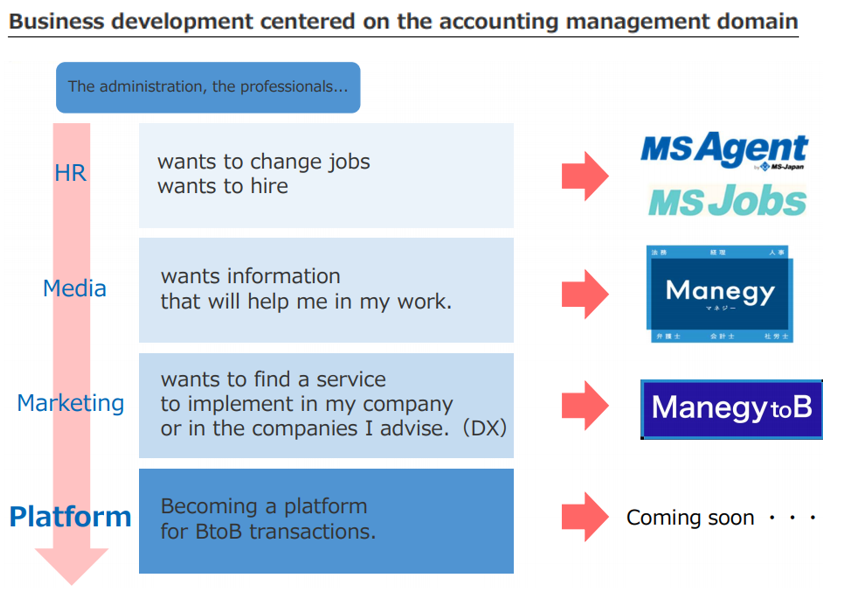

- The Company's core business is "MS Agent," an employment agency business specializing in corporate administrative departments and business management professionals such as lawyers, certified public accountants, and certified tax accountants as well as "MS Jobs," direct recruiting media, "Manegy," business media, and "Manegy to B," a service with BtoB platform functions. The company's strength lies in its high profitability based on its management policy of pursuing efficiency and its ability to come up with original ideas. Along with the growth of existing businesses, the company aims to achieve further growth with a view to developing a "BtoB transaction platform."

- Net sales for FY 3/21 decreased 17.8% YoY to 3,369 million yen. The employment agency business was affected by the spread of COVID-19. Sales increased in the media business. Operating income decreased 27.3% to 1,239 million yen. Despite the uncertain outlook, SG&A expenses decreased 11.0% YoY due to cost controls to match fluctuations in demand, such as stricter hiring criteria, and optimization of marketing costs, mainly to increase new registrations, but this was not enough to offset the decline in gross profit due to lower sales. Although sales and profits decreased from the previous fiscal year, both sales and profits exceeded the forecast. On a quarterly basis, sales are on a recovery trend thanks to the recovery of the employment agency business and growth of the media business.

- For FY 2022, the company is forecasting sales of 3,928 million yen, up 16.6% from YoY, and an operating income of 1,549 million yen, up 25.0% YoY. The sales of the employment agency business, which has been on a recovery trend since the second half of the previous fiscal year, is expected to increase 13.3% YoY, while the sales of the media business, which has entered the full-scale monetization phase, is estimated to increase significantly by 55.1% YoY, based on the assumption of existing services. Operating income margin is projected to rise 2.6 points to 39.4% through the promotion of even more highly efficient management. The dividend is to be 15.00 yen per share, unchanged from the previous fiscal year. The estimated payout ratio is 37.9%.

- We interviewed President Arimoto about his company's competitive advantage, growth strategy, challenges, and message to shareholders and investors. "We started out as an employment agency business specializing in the administrative and professional sectors, and have since released "Manegy," "Manegy to B," etc. to expand our business portfolio and grow in the business management field, but the real growth is about to begin. We will continue to build a database-based business management platform, and you can expect us to leap forward to become one of the leading companies not only in Japan but also in the world," he said.

- While investors may think that Matching Service Japan is the No. 1 employment agency in the administrative and professional fields, it is important to recognize that the company's strength lies not in its employment agency business itself, but in the database of human resources in the administrative and professional fields that the company has built since its founding. It will be interesting to watch the company's trends and business progress as it works to become an unparalleled platform provider in the world by expanding profit opportunities based on the further enhancement of its database.

1. Company Overview

In addition to “MS Agent,” an employment agency business specializing in a company’s management sections as well as professions in the business management domain such as lawyers, certified public accountants, and tax accountants, the company operates “MS Jobs,” which is direct recruiting media in the same domain. Further, through “Manegy,” business media aimed at users in the same domain, the company also operates “Manegy to B,” a service which has a BtoB platform feature that connects management section users and services together. In the management section and professional domains, the company offers its services beyond human resources related businesses.

【1-1 History】

Mr. Takahiro Arimoto (presently the Representative Director and President of Matching Service Japan Co., Ltd.), whose family had been running a business, and who wanted to start up a business ever since he was in high school, joined Recruit Co., Ltd. after graduating from college. After leaving outstanding results and displaying excellent marketing skills in the personnel recruitment domain, he became independent and founded Japan MS Center Co., Ltd. (present name: Matching Service Japan Co., Ltd.) in 1990.

Focusing on the fact that personnel recruitment at accounting firms was extremely inefficient, he started a personnel supporting business for accounting firms and produced high earnings from the first fiscal year.

As large companies were undergoing massive restructuring in their management sections in the wake of the collapse of the bubble economy in the 1990s, he started an employment agency specializing in companies’ management sections, foreseeing an increase in the demand for personnel replenishment.

After that, following the system reforms and legal revisions which accompanied the introduction of international standard accounting practices and the increase in IPO due to the creation of a new market, the recruiting needs of USCPA holders, IPO personnel etc. were also met. Further, as certified public accountants and law school graduates were facing difficulties in finding employment following the restructuring of audit corporations and the reform of systems for bar examinations, the agency would introduce financial, accounting and legal specialists to companies. The company created positions and markets such as in-house accountants and in-house lawyers, which are now commonplace.

By quickly grasping such changes and trends of the times and creating new markets, business operations steadily expanded, and in December 2016, the company’s stock was listed on the Mothers of the Tokyo Stock Exchange. In December 2017, the market was changed to the First Section of the Tokyo Stock Exchange.

【1-2 Corporate Philosophy】

The company’s aim is to “Create New Value Necessary for the Times and Become the Bridge to a New Era, to Create a Society where Independent and Autonomous Individuals and Organizations can Merge Together Organically in Harmony.”

Further, the business keywords that the company uses as its standard are the matching of “People” and “Information.”

The company contributes to the solution of various societal challenges by multilaterally grasping information necessary for people to live (weddings, births, self-development, post-retirement lives, nursing care, etc.) and information necessary for companies to develop (business matching: M&A, franchises, alliances, etc.) and offering them in a meaningful form.

(Taken from the company’s website)

The company’s symbol was created as “The color of the sky rising high up with the motif of a crossed heart.”

This symbol encapsulates the company’s desire to “Connect the hearts of everyone related to the company and make them happy.”

【1-3 Description of the Business】

(1) Overview

The company operates the following 3 businesses: “Agent Business,” an employment agency specializing in companies’ management sections and professions in the accounting and legal domains; “Media Platform Business,” which operates business media and platforms aimed at users in the same domain, and “HR-tech Business,” which operates direct recruiting media.

(Taken from the company’s website)

(2) Business Model

The company started as an employment agency specializing in companies’ management section and professions in the accounting and legal domains. While there is no change in the target domains of the company, it is creating a business model aimed at the expansion of earning opportunities in pursuit of further growth.

In the employment agency business, applicants desiring a job change register at “MS Agent.” The company then acts as an agent which matches each applicant to a recruiting company, but the earning opportunity (Monetization Point) occurs only during the “Job Change.”

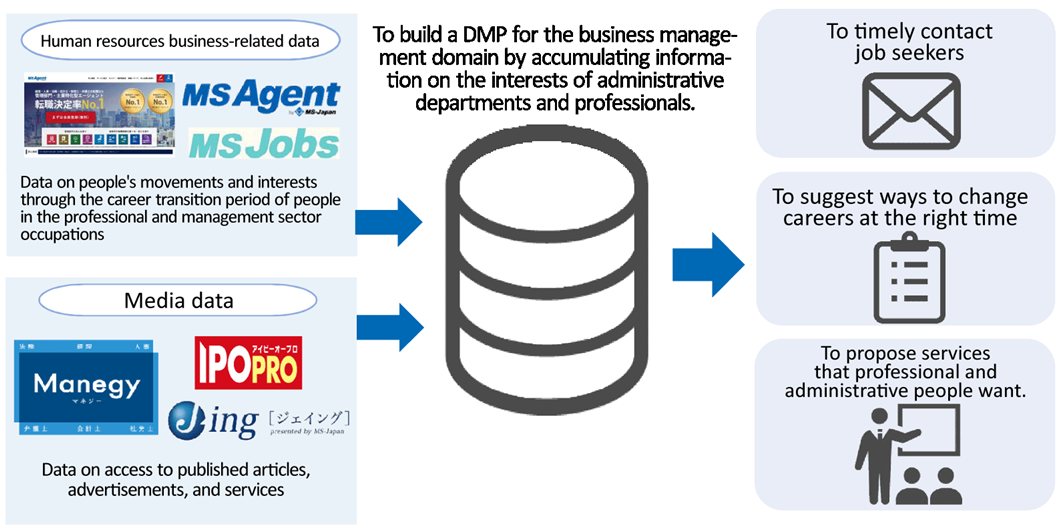

In order to further expand this earning opportunity, the company started a “Media Platform Business” in order to increase the company’s visibility among people employed in management sections and professions who are not considering changing jobs at present, and pool together and create a database for personnel in the same domains.

The communication platform site “Manegy” offers information on topics of interest to people in management sections and professions. “Manegy to B” offers a feature that lets them compare and consider various services that they might use on a daily basis.

By offering web-based marketing unique to the company, it will work toward guiding people to use its media and services, thereby increasing the number of registered users.

The strengthening of a personnel database will lead to the expansion and diversification of earning opportunities in the following ways.

The first way is to retain potential job change applicants, in order to procure earnings in the employment agency business once their needs for a job change emerge in the future.

In addition, through “Manegy,” the company will receive advertisement revenues from companies that primarily want to raise their visibility, and through “Manegy to B,” the company will receive revenues from companies that want to promote and sell their own products and services.

Further, as explained below in “4. Growth Strategy,” in addition to offering a new service by utilizing data which is interesting and relevant to people employed in management sections and professions, the company will aim for further growth by creating a “BtoB Transaction Platform” with a powerful database as its foundation.

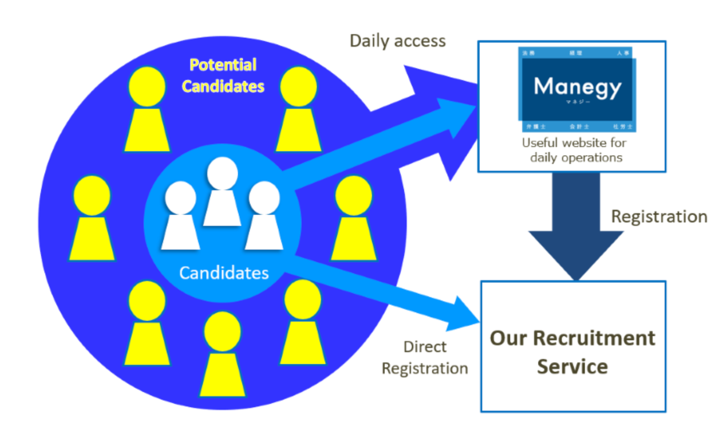

Synergy between Manegy and the Employment Agency Business/DRM Business

“Retaining potential job applicants in the management section and professions domain”

(Taken from the company’s website)

(Taken from the company’s website)

(3) Overview of Each Business

①Agent Business

An employment agency which targets occupations of the management section of a general business firm (accounting, finance, human resources, general affairs, legal affairs, corporate planning, etc.) and professions which have the qualifications of lawyers, certified public accountants, tax accountants, etc.

“MS Agent,” which is currently the central business of the company, is the No.1 domestic employment agency business specializing in occupations of the management section of a general business firm (accounting, finance, human resources, general affairs, judicial affairs, corporate planning, etc.) and various professions in business management (lawyers, certified public accountants, tax accountants, etc.).

(Taken from the company’s website)

It matches the needs of both sides by having job applicants desiring a job change register with the company and introducing new jobs to them through counselling, and by grasping the needs of necessary personnel for recruiting companies and introducing job applicants to them.

As a company specializing in professions related to the management domain, the company grasps the changes in regulations to reflect the times, such as the start of quarterly settlement of accounts, the adoption of a new standard accounting practice, the enactment of an enforcement standard for the assessment of internal controls related to financial reporting, the adoption of a law school system and the enactment of a corporate governance code, and offers various career plans for professions relevant to them.

Further, as for recruiting companies, the company not only offers personnel recruitment support for management sections of general business firms such as listed and unlisted domestic companies, start-up businesses, foreign-owned enterprises, financial institutions and venture capital firms, but also offers personnel recruitment support for specialized organizations such as accounting firms, auditors, law firms, consulting firms, etc., offering a wide variety of services regardless of the industry.

The company adopts a contingent fee model where it earns a commission from the recruiting company in case the recruitment of a registered job applicant is confirmed, and the job applicant accepts the job offer and joins the company.

② Media Platform Business

◎ Manegy

Since March 2017, the company has been operating “Manegy,” a communication platform website that support the tasks of professions and management sections of companies.

In addition to guidance regarding seminars and publishing news and topics that people employed in the management sections and professions, such as accounting, finance, human resources and general affairs, would be interested in, people can also ask questions regarding any trouble they might be facing at their tasks to experts with real names, at the “Teach me, Expert” section.

(Taken from the company’s website)

By not limiting itself to just job changes but providing contents which can be utilized by people in professions and management sections in their daily tasks and having them utilize the company’s services on a daily basis, the company is aiming to increase membership to the website by having potential job change applicants become members.

The average number of page views per month during FY 03/2021 exceeded 2 million and the average number of unique users per month increased to over 400,000. The value of the site as advertising media is also increasing, resulting in an increase in advertisement revenues. Retaining potential job change applicants will not only increase the number of registered users in the employment agency business and HR-tech business (direct recruiting media), but also lead to an increase of future earning opportunities.

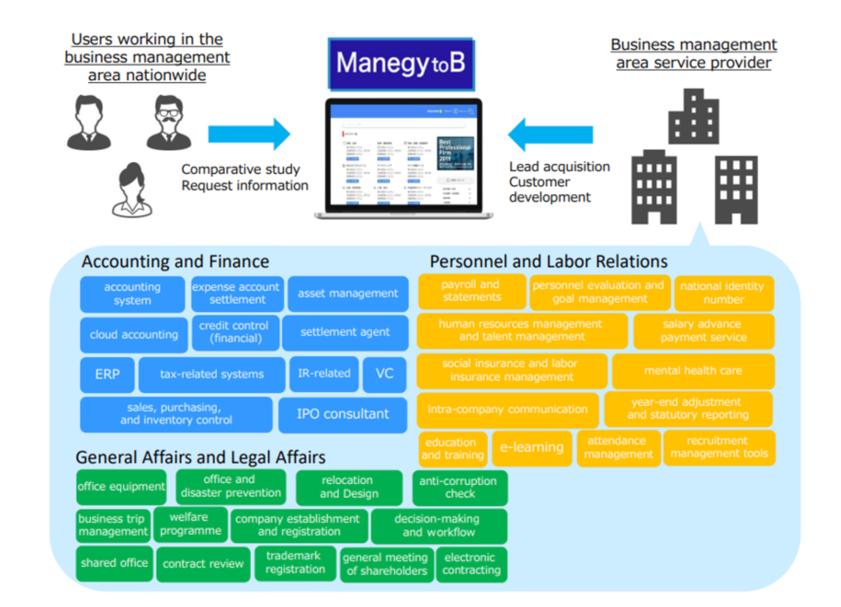

◎ Manegy to B

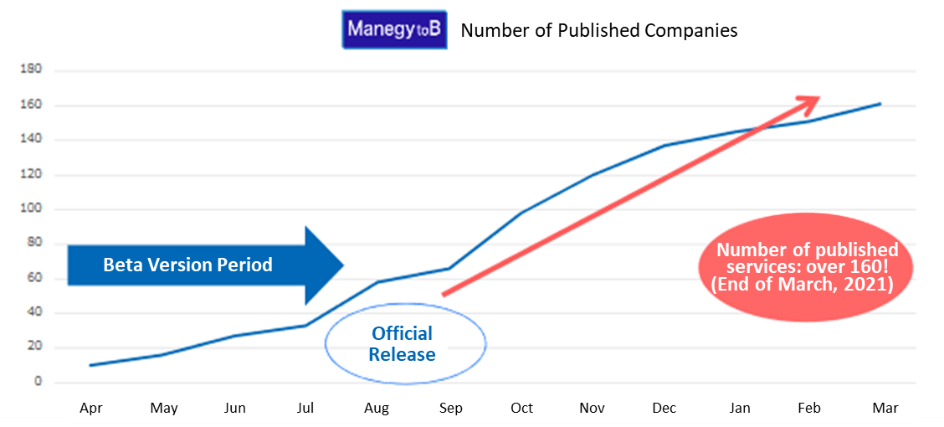

In August 2020, the company officially released “Manegy to B,” a service that allowed users to compare and consider various services used in management sections on a daily basis.

“Manegy to B” is the country’s leading BtoB Platform which encompasses all types of services related to the management domain, such as accounting, finance, human resources, labor management, legal affairs, etc.

(Taken from the company’s website)

For example, many software and services have been published in the Cloud Accounting, Accounting System and Expenditure Adjustment columns in the “Accounting / Finance” category; the Personnel Management, Personnel Evaluation, Objective Management, Attendance Management, Salary Calculation and Details columns in the “Human Resources” category; and Groupware, Employee Benefits and In-House Communication columns in the “General Affairs” category, and each user can download documents, send document requests to multiple companies and compare a variety of software and services at “Manegy to B.” It also allows users to download white papers and attend webinars.

Further, like “Manegy,” useful information and information on seminars are also published.

The company collects revenues for document requests and attracting customers to seminars, from service-providing companies that want to increase prospective customers and acquire new customers through “Manegy to B.”

The number of published services keep increasing day by day, exceeding 160 by the end of March 2021 and covering most major domestic services in Japan.

The first online event was organized in March 2021, attracting over 3500 management section users during the event period.

(Taken from the reference material of the company)

Together with “Manegy,” it is an important business for the expansion of earning opportunities based on the strengthening of the personnel database in the management section and profession domain.

◎ Other

The company also operates “IPO PRO,” a portal site that provides information on interviews and columns related to IPO as well as information on seminars; “J-ing,” a search engine for accounting firms and law firms; “KAIKEI FAN,” a portal site for accounting-related information for certified public accountants, tax accountants and others, along with information related to careers; and “LEGAL NET,” a portal site for law-related information for lawyers and law students, along with information related to careers.

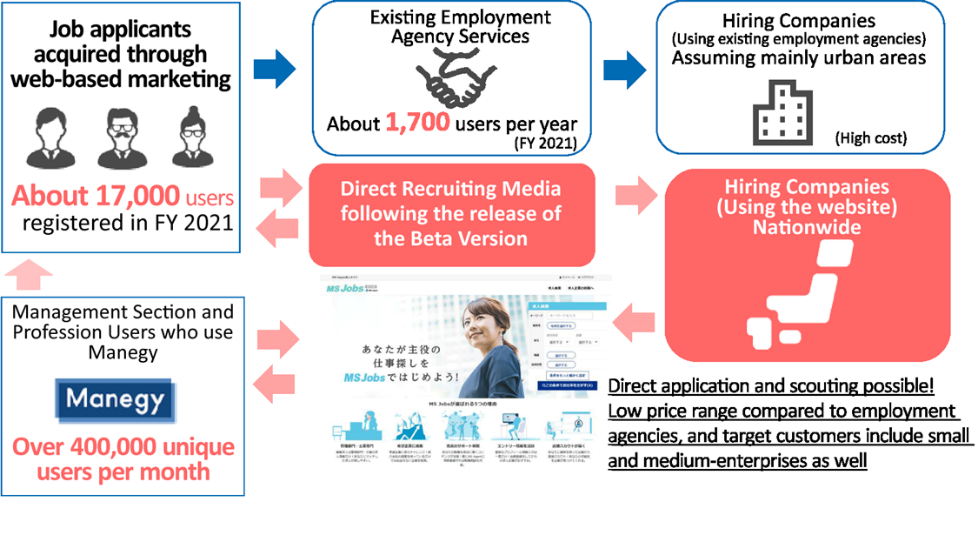

③ HR-tech Business

In May 2020, as a new service in the human resources domain, the company released a beta version of “MS Jobs,” a direct recruiting site which directly connects job applicants to recruiting companies. It is scheduled to be officially released in this term.

(Taken from the company’s website)

By utilizing the job applicants (approximately 17,000 users registered in FY 3/2021) acquired through its marketing power in the management domain, the company will be able to target customers all over Japan, as well as small and medium-enterprises, instead of limiting itself to being a high-cost urban employment agency, thus further expanding earning opportunities.

(Taken from the reference material of the company)

Since releasing the beta version, the number of job postings published have steadily increased, exceeding 1500. Working on an official release, the company will take initiatives toward website development focused on coordination with the employment agency business website “MS Agent,” and a further increase in the number of job postings.

【1-4 Specialties and Strengths】

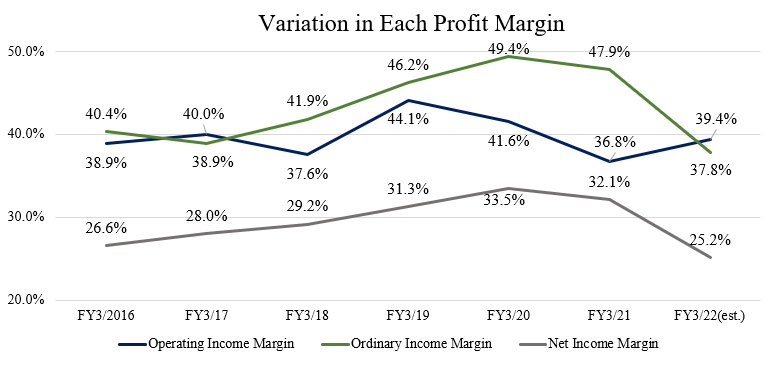

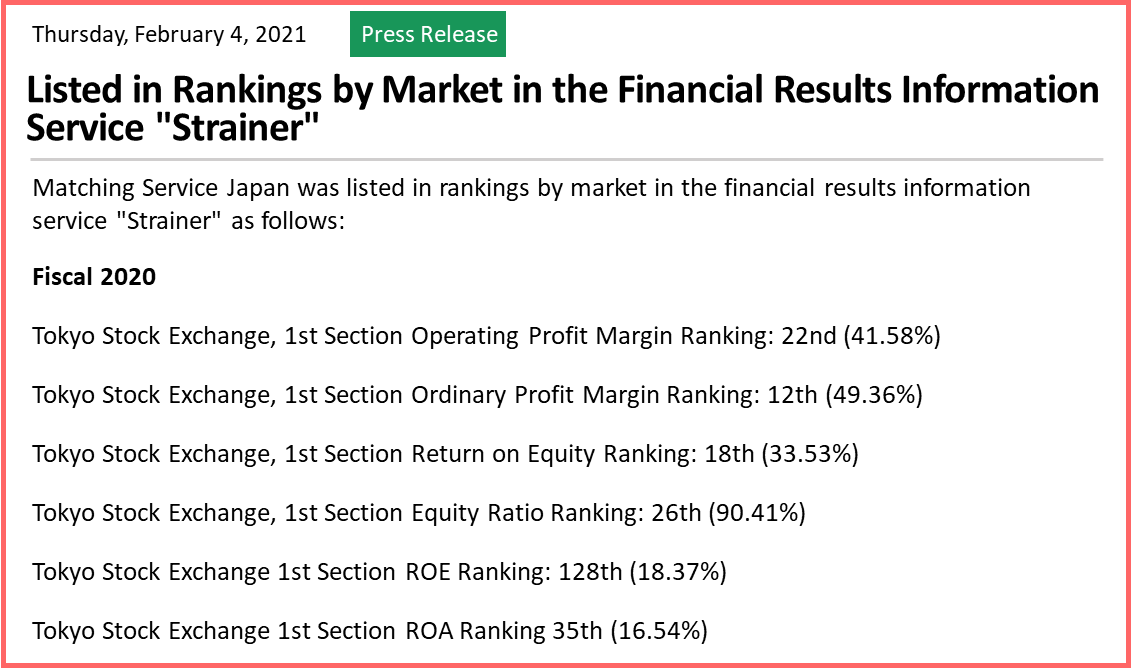

(1) High Profitability

Under a management policy of “Maximizing Sales and Minimizing Cost to Produce Maximum Profit” and pursuing optimization, the company has placed operating income, ordinary income, net income and their margins as valuable management indices, and has been successful in achieving high profitability.

(2) Marketing Power that Supports the Improvement of User Networks and Personnel Databases in the Fields of Accounting, Law, Human Resources and Labor Management

Based on the accomplishments built up since its foundation as an agent specializing in management sections and professions, the company has established an overwhelming user network in the fields of accounting, law, human resources and labor management. Using this as its strength, the company differentiates itself from other companies in the employment agency business by acquiring new registered users through its own resources.

Normally, the common practice in the employment agency business if there is a job offer is to use external media (a personnel database) to approach the appropriate job applicant and pay the media a usage fee for using its database.

However, this can lead to the media controlling the pricing policy, making it difficult to produce stable earnings. Further, the inability to accumulate the know-how on the creation of a personnel database is another major issue.

In response to this, the company has been using its own resources to retain applicants desiring a job change as well as potential job change applicants since its foundation in 1990, and the marketing power which has made that possible gives it a competitive edge over other companies.

For example, in web-based marketing, the company has been exhibiting that competitive edge in SEO (Search Engine Optimization).

The selection of search keywords is the key to having the company’s website displayed at the top of the user’s search results.

For the employment agency, “job change” is an important keyword, but in case of other integrated companies in the same industry, the user will necessarily have to use “job change” by searching for terms like “accounting job change.”

However, in case of the company, as it is specializing in the management section and professions, by setting keywords which will be of interest to those people and setting the contents associated with those keywords in “Manegy” and “Manegy to B,” it makes it possible to have the users temporarily visit those websites and then register at “MS Agent” if they are interested in changing jobs, thus extensively guiding users to the company’s website without being necessarily restricted by the keyword “job change.”

Further, in case of an integrated company, such content marketing requires the time and effort to have “Sales,” “Marketing” and “Engineering” sections each create those contents, making the process significantly inefficient, but as the company with a specialized domain, it can set contents efficiently and effectively, which is another huge advantage.

Such strong marketing power is a powerful weapon for the company as it aims to expand its earning opportunities and further grow, based on the strengthening of its personnel database in the management section and professions domain.

(3) Know-How and Strengths in the Employment Agency Business

The company possesses the following specialties and strengths in the employment agency business.

☆ | As the company specializes in a particular domain, the specialized knowledge regarding the contents and trends of the industry is accumulated by career counselors who give counseling to job applicants and recruiting advisors in charge of recruiting companies. |

☆ | The company can accomplish speedy recruitments through its mechanism which grasps the detailed technical needs of both job applicants and recruiting companies, making highly precise matching possible. |

☆ | The professional duties in the management domain require a lot of specialized knowledge, which is why the company is focusing on targeted market expansion policies in line with this era of declining birthrates and aging population, such as recommending senior personnel who possess plenty of such technical skill and experience and supporting the career path of women who possess technical skills in the management domain. |

For example, while it is common to use a compatible format for the registering sheet which is used to fill in the profiles of job applicants, the company uses separate sheets for accounting firms, accounting and law affairs.

As it can check the skills of candidates in each domain in detail, the recruiting company can also make prompt decisions and can quickly make a decision on the recruitment of suitable personnel.

【1-5 Dividend Policy / Shareholder Returns】

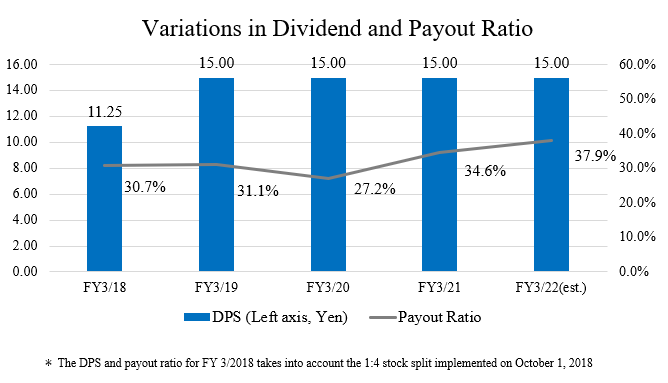

In order to create a long-term relationship of trust with its shareholders, the company recognizes returning profits as an important management issue. The company’s fundamental dividend policy is stable dividend payment, while securing necessary internal reserves for future business development and the strengthening of its management base.

Payout ratio has been over 30% over the last few years.

【1-6 ROE Analysis】

| FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 |

ROE (%) | 17.0 | 15.9 | 18.3 | 18.4 | 11.6 |

Net Income Margin (%) | 28.04 | 29.19 | 31.29 | 33.53 | 32.11 |

Total Assets Turnover (times) | 0.54 | 0.49 | 0.53 | 0.49 | 0.33 |

Leverage (x) | 1.13 | 1.11 | 1.11 | 1.11 | 1.09 |

While its leverage is low, the company has maintained a high level of ROE, owing to its uniquely high profit ratio.

2. Fiscal Year ended March 2021 Earnings Results

【2-1 Overview of business results】

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY | Compared to forecasts |

Sales | 4,098 | 100.0% | 3,369 | 100.0% | -17.8% | +0.4% |

Gross profit | 4,096 | 99.9% | 3,368 | 100.0% | -17.8% | - |

SG&A | 2,391 | 58.4% | 2,128 | 63.2% | -11.0% | - |

Operating Income | 1,704 | 41.6% | 1,239 | 36.8% | -27.3% | +1.8% |

Ordinary Income | 2,023 | 49.4% | 1,612 | 47.9% | -20.3% | +8.6% |

Net Income | 1,374 | 33.5% | 1,082 | 32.1% | -21.3% | +9.0% |

*Unit: Million yen. The forecast was announced in February 2021. Non-consolidated financial results for FY 3/2020, consolidated financial results for FY 3/2021. YoY changes are for reference only.

Sales and profits dropped but exceeded forecasts.

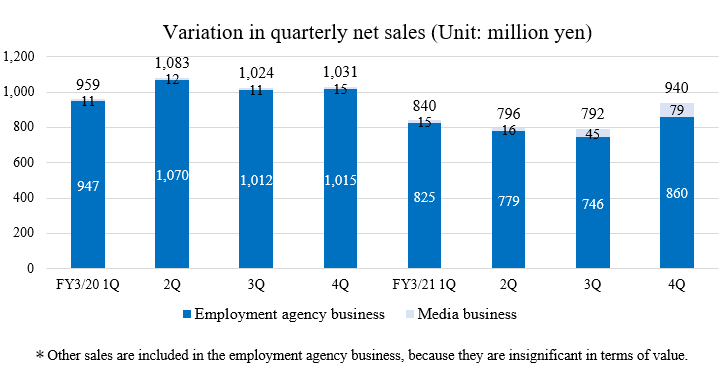

Net sales decreased 17.8% YoY to 3,369 million yen. The employment agency business was affected by the spread of COVID-19. Sales increased in the media business.

Operating income decreased 27.3% to 1,239 million yen. Despite the uncertain outlook, SG&A expenses decreased 11.0% YoY due to cost controls to match fluctuations in demand, such as stricter hiring criteria, and optimization of marketing costs, mainly to increase new registrations, but this was not enough to offset the decline in gross profit due to lower sales.

Although sales and profits decreased from the previous fiscal year, both sales and profits exceeded the forecast.

On a quarterly basis, sales are on a recovery trend thanks to the recovery of the employment agency business and the growth of the media business.

【2-2 Trend in Each Business Segment】

(1) Employment Agency Business

Due to the impact of COVID-19, both specialized organizations and general companies had to suspend or postpone their recruiting activities, and subsequently, hiring criteria became stricter, so sales decreased.

The number of newly registered users is 16,139. The average cost for increasing registrations per user improved from the previous term.

(2) Media Business

Manegy's annual sales increased significantly to 156 million yen, up 200.1% from the previous term.

The number of requests for information on Manegy to B, a BtoB service comparison platform officially released in August 2020, is also growing, and full-scale monetization has begun.

【2-3 Financial Position】

Main Balance Sheet

| End of Mar. 2020 | End of Mar. 2021 | Increase/ decrease |

| End of Mar. 2020 | End of Mar. 2021 | Increase/ decrease |

Current Assets | 7,088 | 7,648 | +560 | Current Liabilities | 844 | 565 | -279 |

Cash and Deposits | 6,371 | 6,380 | +9 | Noncurrent Liabilities | - | 213 | +213 |

Securities | 518 | 1,000 | +481 | Total Liabilities | 844 | 778 | -65 |

Noncurrent Assets | 1,718 | 2,509 | +791 | Net Assets | 7,961 | 9,380 | +1,418 |

Investment, Other Assets | 1,430 | 2,250 | +819 | Retained Earnings | 6,117 | 6,825 | +707 |

Investment Securities | 1,202 | 2,116 | +914 | Total Liabilities and Net Assets | 8,806 | 10,158 | +1,352 |

Total Assets | 8,806 | 10,158 | +1,352 |

|

|

|

|

* Unit: million yen. Unconsolidated for the end of March 31, 2020. Consolidated for the end of March 31, 2021. Changes are reference values calculated by Investment Bridge.

3. Fiscal Year ending March 2022 Earnings Forecasts

【3-1 Earnings Forecast】

| FY 3/21 | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY |

Sales | 3,369 | 100.0% | 3,928 | 100.0% | +16.6% |

Operating Income | 1,239 | 36.8% | 1,549 | 39.4% | +25.0% |

Ordinary Income | 1,612 | 47.9% | 1,486 | 37.8% | -7.8% |

Net Income | 1,082 | 32.1% | 988 | 25.2% | -8.7% |

* Unit: million yen.

| FY 3/21 | Composition ratio | FY 3/22 Est. | Composition ratio | YoY |

Sales | 3,369 | 100.0% | 3,928 | 100.0% | +16.6% |

Recruiting | 3,204 | 95.1% | 3,631 | 92.4% | +13.3% |

Media (Manegy) | 156 | 4.6% | 242 | 6.2% | +55.1% |

Other | 8 | 0.3% | 54 | 1.4% | +575.0% |

*Unit: million yen.

Sales and operating income are expected to increase.

Sales are estimated to increase 16.6% YoY to 3,928 million yen, and operating income is projected to rise 25.0% to 1,549 million yen.

The sales of the employment agency business, which has been on a recovery trend since the second half of the previous fiscal year, are expected to increase 13.3% YoY, while the sales of the media business, which has entered the full-scale monetization phase, are projected to increase considerably by 55.1% YoY, based on the assumption of existing services.

Operating income margin is estimated to rise 2.6 points to 39.4% through the promotion of even more highly efficient management.

The dividend is to be 15.00 yen per share, the same as the previous fiscal year. The estimated payout ratio is 37.9%.

The company is currently linking site development and databases through the integration of the databases of "MS Agent" and "MS Jobs," which have been operated separately, and plans to release new functions one after another during this fiscal year.

4. Growth Strategy

Based on the company's own business advantages, it will pursue the following growth strategies.

【4-1 Business advantage in the area of business management】

The company's business advantages in the area of business management are as follows.

* | Specializing in "administrative departments" that manage managerial resources such as people, goods, money, and information |

* | A client base composed of blue-chip companies that can afford to use expensive employment agency services. The number of client companies is approximately 23,500. Of these, about 2,700 companies are listed ones, accounting for about 70% of all listed companies. The company has approximately 2,500 clients, including accounting firms and law firms. |

* | By specializing in tax accountants and other professionals, the company can also reach out to their clients, that is, small and medium-sized companies. |

* | The average monthly PV for “Manegy” is over 2 million per year, and the average monthly UU is over 400,000 per year. Contact with users is rapidly expanding, not only when changing jobs, but also in their daily lives. |

Based on these advantages, the company is expanding its business by targeting an estimated 500,000 to 1,000,000 people on a career ladder and professional fields.

【4-2 Concepts and measures】

(1) Promoting the construction of Japan's largest business management DMP

In addition to the employment agency business, the company plans to accelerate and develop various businesses by utilizing the data on the interest of people in the professional and administrative fields accumulated through Manegy and other websites.

DMP stands for "Data Management Platform," which is a platform for managing various information data stored on the Internet.

The company builds the one and only DMP that specializes in the administrative and professional sectors and provides a variety of services.

(From the reference material of the company)

(2) Expanding the business portfolio with a focus on the business management domain: Evolution into a "BtoB transaction platform provider

The company, which started out by matching the career change needs of administrative and professional personnel with the hiring needs of companies, has since expanded its business portfolio with a focus on the business management field, releasing "Manegy," media that provide useful information for work, and "Manegy to B," which enables a comparative study of various services used daily by administrative departments.

In the future, the company plans to further strengthen its human resources database and build a "BtoB transaction platform" to develop new businesses, positioning this fiscal year as the first year to realize the platform concept.

(Taken from the company’s website)

(3) Establishment of a CVC fund

On January 19, 2021, the company established a corporate venture capital fund, MS-HAYATE No.1 Investment Limited Partnership, jointly with Hayate Investment Co.

Utilizing the network, it has built up in its employment agency and media businesses in the business management and professional services fields, the company intends to invest in a wide range of companies that develop new technologies and services in the business management field, as well as companies that have technologies that can be applied in the future. By supporting growth through people (introduction of personnel), customers (media), and capital (this fund), the company believes that it will be able to achieve non-continuous growth through synergies.

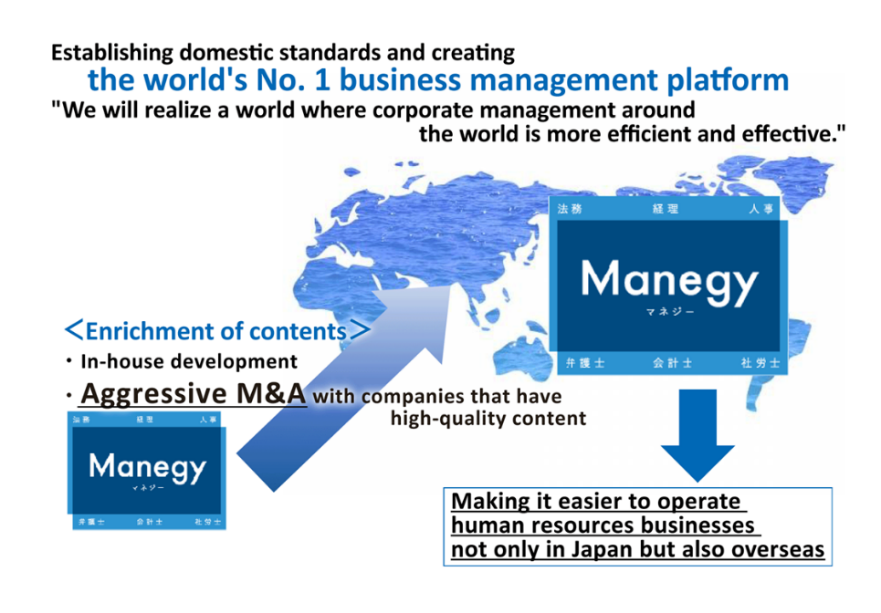

【4-3 Ideal state】

The goal is to build a "business management platform" that enables people involved in the business management domain to conduct all kinds of activities, including hiring, comparing, and introducing services, as well as executing commercial transactions, to name a few.

In addition to setting the standard in Japan, the company is expanding into the world. The company's goal is "to create a world where corporate management around the world is more efficient and effective.”

(From the reference material of the company)

5. Interview with President Arimoto

We interviewed President Arimoto about his company's strength, competitive advantage, growth strategy, challenges, and message to shareholders and investors.

Q: "First of all, please tell us about your company's strengths and competitive advantages.

One is the high profitability.

There are about 3,800 listed companies in Japan, and we are one of the most profitable companies.

This is a reflection of my way of thinking about running a company. In other words, it is the result of our thorough efforts to "generate maximum profits by maximizing sales and minimizing costs.”

Since it is an information industry, there is no concept of "purchase.” Our greatest strength is that we pursue efficiency in all of our corporate activities to achieve high profitability.

(Taken from the company’s website)

Another of our major strengths is our excellent web-based marketing capabilities.

When we receive a job offer from a company or other organization, we pick up candidates from our own database and do not use external media like other companies.

This allows us to maintain stable earnings without being affected by the pricing policies of external media. In addition, we are able to accumulate know-how for building a human resources database and this know-how gives us a strong competitive advantage in web-based marketing.

This marketing capability is also our powerful weapon to further strengthen our human resources database in the administrative and professional fields, and to expand profit opportunities and develop new services.

Q: "Then, could you explain your future growth strategy?”

Our company started out with the employment agency business "MS Agent," and has since expanded its business portfolio with a focus on the business management domain, releasing "Manegy," media that provide useful information for work, and "Manegy to B," which enables comparative study of various services used daily by administrative departments. In the process, we have also accumulated a database specializing in the administrative and professional sectors. Armed with the web-based marketing capabilities I mentioned earlier, we will continue to expand and enhance this database.

With the growth of "Manegy" and "Manegy to B," we have been able to make contact on a daily basis with people in the management and professional sectors, who were previously only able to make contact when changing jobs. This can create a variety of monetization points. In a sense, this database is a treasure trove of business opportunities, new businesses, and a powerful driver for future growth.

We are preparing for the development of a “BtoB transaction platform" using our database, and have positioned this fiscal year as the first year to realize the platform concept.

Unfortunately, I can't give you any details right now, but we are currently working on various projects.

Q: "What about issues and the ways to address them?"

In order to pursue growth as a "BtoB transaction platform provider" in the future, we still need excellent engineers.

We decided to strategically secure engineers, not only as full-time employees, but also as business partners, and we were able to attract many excellent IT engineers.

We have engineers who have extensive experience in Japan and the world's leading IT and tech companies, and they are very interested in the business model of a “BtoB transaction platform provider" that specializes in the administrative and professional sectors.

It is very encouraging for us that these talented people are willing to share and cooperate with us in creating a completely new model that has never existed before.

Using our vast database and technology, we will build a platform that is not limited to personnel introduction, but is essential for all BtoB businesses in the administrative and professional fields.

In that sense, we no longer see other employment agencies as our rivals.

We strongly believe that a " BtoB transaction platform specializing in administrative and professional fields = business management platform" is a business model that can be applied not only in Japan, but also in the world. Our goal is to create the world's best business management platform by establishing domestic standards and expanding our business field to the world.

Q: "Thank you very much. So in closing, please give us a message to your shareholders and investors.”

"We started out as an employment agency business specializing in the administrative and professional sectors, and have since released "Manegy" and "Manegy to B" to expand our business portfolio and grow in the business management field, but the real growth is about to begin.

The business management market we are targeting is extremely large. We will develop this huge market by setting up a variety of businesses with new ideas that no other company has.

At the same time, we will continue to pursue highly profitable and efficient management by conducting our business with ideas only without purchasing or storing products, and thoroughly reducing risks by specializing in administrative departments.

As we move forward with the establishment of the "business management platform" using databases, please look forward to our company making a leap forward to become one of the leading companies in the world, not just in Japan.

6. Conclusions

While investors may think that Matching Service Japan is the No. 1 employment agency business in the administrative and professional fields, it is important to recognize that the company's strength lies not in its employment agency business itself, but in the database of human resources in the administrative and professional fields that the company has built since its founding.

It will be interesting to watch the company's trends and business progress as it works to become an unparalleled platform provider in the world by expanding profit opportunities based on the further enhancement of its database.

<Reference: Regarding Corporate Governance>

◎Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 6 directors, including 3 outside ones |

Auditors | - |

◎Corporate Governance Report

Last updated on June 28, 2021.

<Basic policy>

Our company recognizes that the effective functioning of corporate governance is essential for the sustainable enhancement of corporate value in the employment agency industry, where the business environment is constantly changing, thus our company has positioned the strengthening and enhancement of its governance system as an important issue. Based on this recognition, we will strengthen our internal control system by establishing a division of duties and regulations, and review the system as necessary to improve our corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

[Supplemental Principle 1-2 (4) Exercise of rights at general meetings of shareholders] | Our company has not yet implemented the electronic exercise of voting rights, but will consider the timing of adoption in consideration of the requests from shareholders and other factors. As for the translation of the notice of convocation into English, we are not considering it at present in consideration of the ratio of overseas investors as of the end of March 2021, but we will consider it in the future as the need arises based on the ratio of our holdings. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4: Strategic shareholding> | As a general rule, we do not hold shares strategically. In cases where strategic shareholding is necessary, the Board of Directors will carefully examine whether the purpose of the shareholding is appropriate and whether the benefits and risks associated with the shareholding are commensurate with the cost of capital, etc. The Board of Directors will fully review the appropriateness of such shareholding, and the shareholding shall be limited to cases where it is judged to contribute to the enhancement of our corporate value over the medium to long term. |

【Principle 5-1 Policy on constructive dialogue with shareholders】 | Our company has designated the Director and General Manager of the Corporate Administration Department as the person responsible for IR. We are working to ensure opportunities for constructive dialogue with our shareholders and investors by holding financial results briefings or video distribution twice a year. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are provided by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Report (Matching Service Japan Co., Ltd.: 6539) and the contents of Bridge Salon (IR Seminar) can be viewed here: www.bridge-salon.jp/