Bridge Report:(6552)GameWith Fiscal Year May 2019

President Takuya Imaizumi | GameWith, Inc. (6552) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Business Services |

President | Takuya Imaizumi |

Address | Roppongi Hills Mori Tower 20F, 6-10-1 Roppongi, Minato-ku, Tokyo |

Fiscal Year-end | May |

URL |

Stock Information

Share Price | Shares Issued (Excluding Treasury Shares) | Total Market Capital | ROE (Act.) | Trading Unit | |

¥576 | 18,014,832 shares | ¥10,377 million | 23.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

- | - | ¥23.35 | 24.7x | ¥183.30 | 3.1x |

*Share price is closing price as of July 19. Shares issued at the end of the most recent quarter excluding treasury shares. ROE and BPS are based on previous term’s results.

Non-consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2016 (Actual) | 994 | 300 | 329 | 220 | 13.45 | 0.00 |

May 2017 (Actual) | 1,598 | 657 | 654 | 465 | 28.39 | 0.00 |

May 2018 (Actual) | 2,677 | 1,168 | 1,168 | 816 | 48.73 | 0.00 |

May 2019 (Actual) | 3,148 | 808 | 807 | 686 | 39.12 | 0.00 |

May 2020 (Forecast) | 3,217 | 616 | 616 | 420 | 23.35 | 0.00 |

*The forecasted values were provided by the company. Unit: EPS and DPS (yen), Others (million yen)

*The company conducted a 50-for-1 share split in April 2017 and a 2 for 1 share split in February 2018. EPS has been retroactively adjusted.

This Bridge Report reports GameWith’s financial results for Fiscal Year May 2019 and an outlook for Fiscal Year May 2020.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year May 2019 Earnings Results

3. Fiscal Year May 2020 Earnings Estimates

4. Med-term Business Strategy

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- Sales increased 17.6% year on year, and operating income plummeted 30.8% year on year in FY 5/2019. The satisfactory sales performance from tie-up advertisements grew the “Game Review” service by 77.5% year on year. In addition, sales from the “Video Streaming” service, which is offered by gamers under exclusive contracts with GameWith on YouTube, jumped 61.1% year on year as well. While the entire game industry is struggling to develop hit games, the improved unit price of programmatic advertisements kept sales from the “Game Guide” service at almost the same level as those in the previous term. Regarding profits, an increase in the personnel-related expenses based on the mid-term business strategy imposed a burden.

- For FY 5/2020, it is estimated that sales will rise 2.2% year on year and operating income will drop 23.7% year on year. While sales from “Game Guide” are projected to shrink year on year on the premise of the PV count as of the fourth quarter of the previous term, “Game Review” will show a sales increase, and sales from “Video Streaming” are expected to grow on a steady basis; however, amid the deteriorating gross profit margin owing to decreasing sales from “Game Guide,” increases in operating expenses will place burdens, including personnel-related expenses, such as rising personnel costs following GameWith’s effort to increase the number of workers in the previous term.

- GameWith, Inc. said that it did not expect at all the sales drop in the “Game Guide” service in FY 5/2019; however, the declining PV count for the websites of the major three game titles, which is the leading factor of the sluggish sales, resulted not from a reduction in the company’s market share, but from a reduction in needs themselves for tips for playing the three games. Although the struggle in FY 5/2019 has raised the bar for attaining the goals in the mid-term business strategy: sales of 5.5 billion yen and an operating income of 2 billion yen in FY 5/2021, the company would like to reach them by growing the “Game Review” service. GameWith, Inc. aims to realize year-on-year sales growth by offsetting shrinking sales from “Game Guide” by a sales rise in “Game Review” through enhancement of the app and promotions in FY 5/2020. When the company successfully grows the “Game Review” service as it plans, it will be able to get on the right track for business growth no matter whether or not it achieves the goals defined in the mid-term business strategy.

1. Company Overview

GameWith, Inc. (“GameWith”) operates a media business, offering game guides, game reviews, community function, and video streaming. By providing articles and functions for playing games, the company attracts users, and also provides advertisers with advertisement slots to earn revenue.

Mission “Create a more enjoyable gaming experience.”

"Get absorbed in games, be connected through games, and focus on games as a business." With this approach, we aim to create a more enjoyable gaming experience.

Vision “Go for the global gaming infrastructure”

For user playing games and for manufacturers developing games, GameWith provides experiences and values which cannot be provided without GameWith and we will be an infrastructure for all the people who are involved in enjoying games. We will advance to not only a media business but also all business areas in order to enjoy playing games more.

1-1 Business Description

By providing articles and functions for gaming through a game information medium, “GameWith”, the company attracts users and provides sponsors with advertisement slots to earn revenue. Both Internet and Smartphone Advertising markets currently continue to grow strongly.

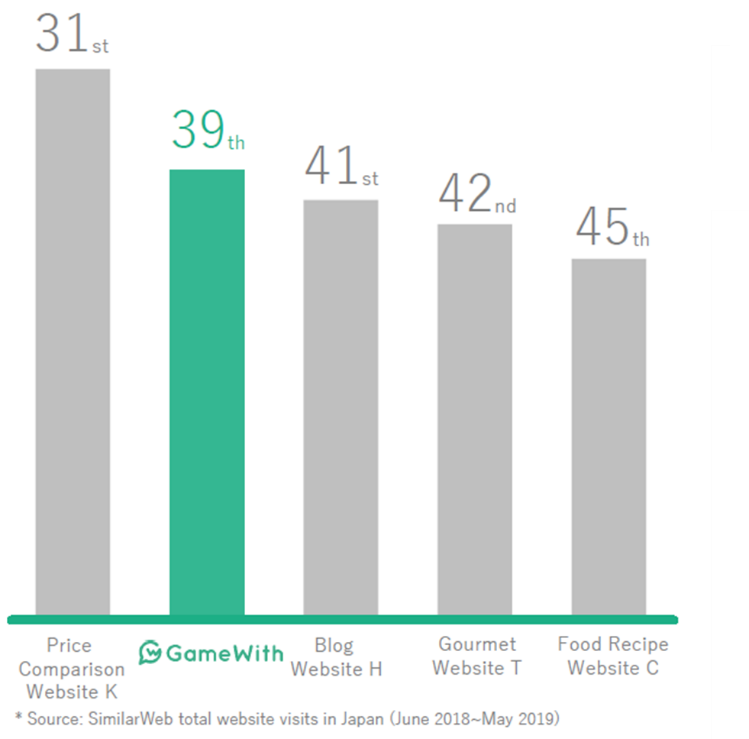

Rankings of Total Visits to the Website in Japan

|

GameWith Ranked 39th in Japan for the Total Visits to the Website in Japan

1st place : Search engine website G 2nd place : Portal site Y 4th place : Video streaming website Y

Game Medium 〇〇〇〇〇〇Ranked First in Japan.

|

(Source: the company)

1-2 Business Domain

The services that GameWith, Inc. provides are composed of the following four segments: “Game Guide,” which provides information that allows users to proceed with games advantageously, “Game Review,” which offers information with which users can find games, “Video Streaming,” in which gamers under exclusive contracts with GameWith stream videos of them playing games on such media as YouTube, and “New Business,” which includes services associated with electronic sports (e-sports), blockchain games, and comic books.

Game Guide

GameWith, Inc. engages in producing articles for game-playing tips predominantly for smartphone games, publishing such articles in a variety of media (such as its game information medium, “GameWith”) on consignment by game development companies, and operates websites containing tips for playing games on behalf of game development companies, recording income from advertisements placed on such media and revenue generated from the agency services. Through effective recruitment of players of popular games, training players as writers and methodically producing articles, GameWith developed a robust system for swiftly responding to events and producing high quality, game-related service. It offers articles as soon as information on events and update is exposed in video games.

Game Review

GameWith, Inc. prepares articles and videos introducing games to motivate users to start playing new games, and releases such articles and videos on various media, including GameWith and YouTube, recording income from advertisements placed on such media as revenue. When information on a new game is released, the writers of GameWith publish reviews (note: for some games, video is produced in-house) In addition to writing articles to introduce games, the company also provides unique ranking information with quick reporting for rating games as well as a comprehensive game database.

Video Streaming

GameWith, Inc. produces attractive video streaming content such as live game-play videos with its webcasters. These webcasters are also selected from the game guide writers employed by the company, or they are the creators who have exclusive management agreements with the company. Since September 2016, the company has been earning advertising revenues by inserting ads in the videos, and also selling the service in which the video performers not only promote the games, but also do sales promotion of products as an advertising commodity.

New Business

GameWith, Inc. works on developing new businesses, including services associated with e-sports, blockchain games, event production, and comic books. Regarding e-sports, the company has formed e-sports teams and participates in such games as real-time mobile card games, and one of the players on the team playing consumer fighting games, who has entered into an exclusive contract with the company, has taken part in international fighting game championships. As for blockchain games, in addition to a blockchain game “CryptoSpells” provided by Crypto Games, Inc., in which GameWith has invested, GameWith itself is propelling forward development of “EGGRYPTO” jointly with another company with the aim of releasing it by the end of 2019. Furthermore, aiming to accomplish the mission “Create a more enjoyable gaming experience” not only online but also in the real world, GameWith is devoted to event production.

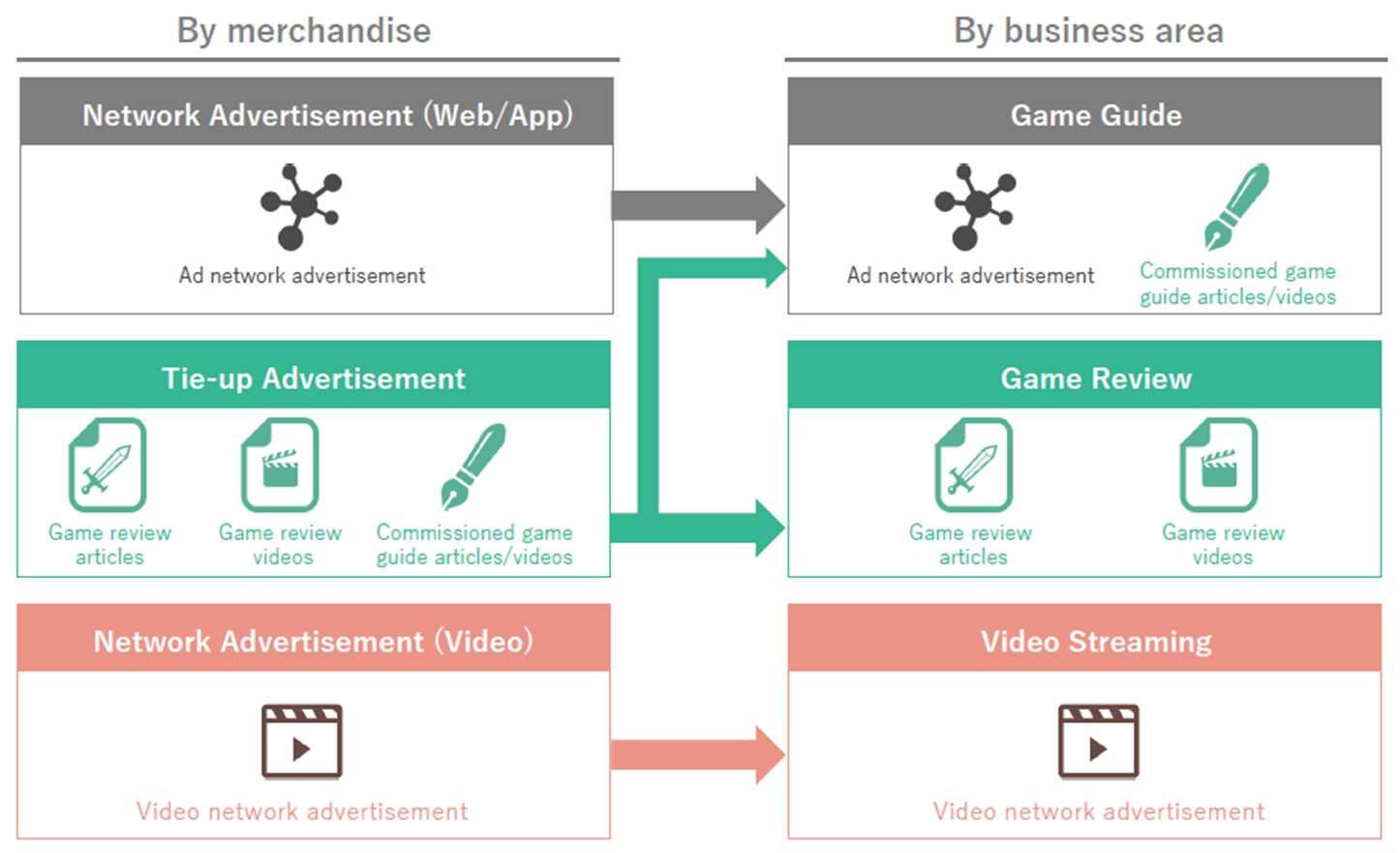

Earning Revenue from Online Advertisements

GameWith earns revenue by selling advertisement slots for its network or tie-up advertisements utilizing the network to sponsors and advertisement agencies whilst offering service.

In network advertisement, GameWith earns revenue by selling its internet advertisement slots, advertisements inside game guide smartphone applications, as well as advertisement slots in video streaming and game guide apps through its advertisement distribution network. On the other hand, tie-up advertisement is those negotiated mutually with the game providers, and they order these advertisements for an improvement in their app games’ recognition and retention rate of their users as part of their promotional activities.

1-3 Relationship between Main Merchandises and Business Areas

(Source: the company)

2. Fiscal Year May 2019 Earnings Results

2-1 Non-consolidated Business Results

| FY5/18 | Ratio to sales | FY5/19 | Ratio to sales | YoY | The initial forecasts | Compared with the initial forecasts |

Sales | 2,677 | 100.0% | 3,148 | 100.0% | +17.6% | 3,154 | -0.2% |

Gross profit | 1,811 | 67.7% | 1,801 | 57.2% | -0.6% | - | - |

SG&A expenses | 643 | 24.0% | 992 | 31.5% | +54.3% | - | - |

Operating income | 1,168 | 43.6% | 808 | 25.7% | -30.8% | 905 | -10.7% |

Ordinary income | 1,168 | 43.6% | 807 | 25.7% | -30.9% | 904 | -10.7% |

Net income | 816 | 30.5% | 686 | 21.8% | -15.9% | 623 | +10.1% |

*Unit: million yen

Sales increased 17.6% year on year while operating income plummeted 30.8% year on year.

Sales stood at 3,148 million yen, up 17.6% year on year. Sales from the “Game Review” service grew thanks to the satisfactory business results of tie-up advertisements that are placed on the websites of GameWith, Inc. on which highly value-added advertisement slots are provided to game development companies through over-the-counter negotiation with each of them. In addition, the “Video Streaming” service through which gamers under exclusive contracts with GameWith stream videos of them playing games on YouTube, too, showed a sales increase. Although sales from other businesses, including services associated with e-sports and blockchain games, also rose, sales from the “Game Guide” service which centers around Ad Network (programmatic advertisements) were almost flat. The unit price of advertisements was improved for the “Game Guide” service, but the PV count decreased while the game industry as a whole was struggling to develop hit games.

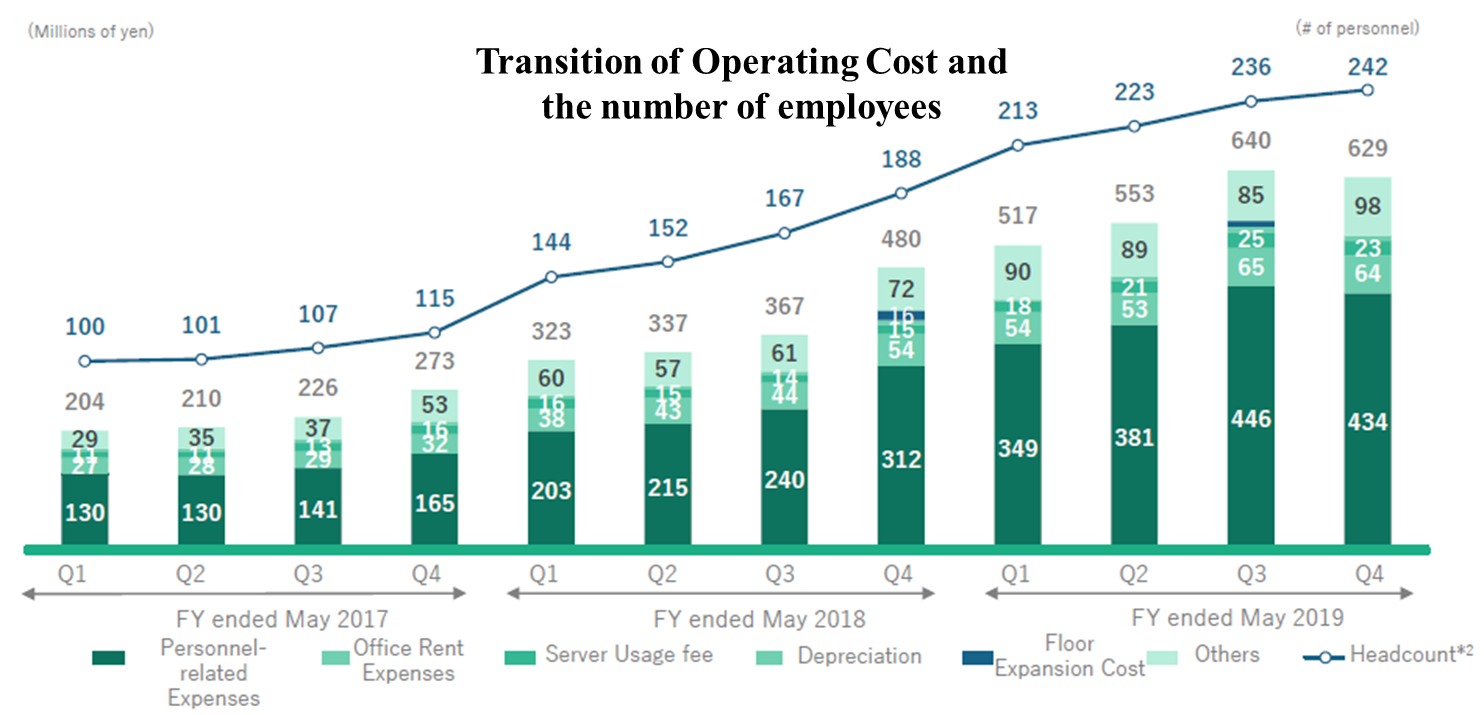

Operating income plummeted by 30.8% year on year to 808 million yen. Personnel-related expenses rose (from 970 million yen to 1,611 million yen) following the strategic investment based on the mid-term business strategy (a total expenditure associated with business strategies for new businesses, overseas development, organizations and human resources), resulting in operating expenses of 2,340 million yen, up 55.2% year on year.

Ordinary income, too, dropped by 30.9% year on year to 807 million yen; however, GameWith, Inc. recorded a consumption tax refund of 160 million yen, which resulted from the review of the consumption tax brackets, as extraordinary gain (the company posted a consumption tax refund of 84 million yen as sales in the fourth quarter of the term), causing net income to stand at 686 million yen, down 15.9% year on year. The review of the consumption tax brackets is to review the tax classes regarding how consumption taxes related to transactions with overseas corporations are handled, and the company received consumption tax refunds retrospectively (the refund of 84 million yen for this term was recorded as sales in the fourth quarter).

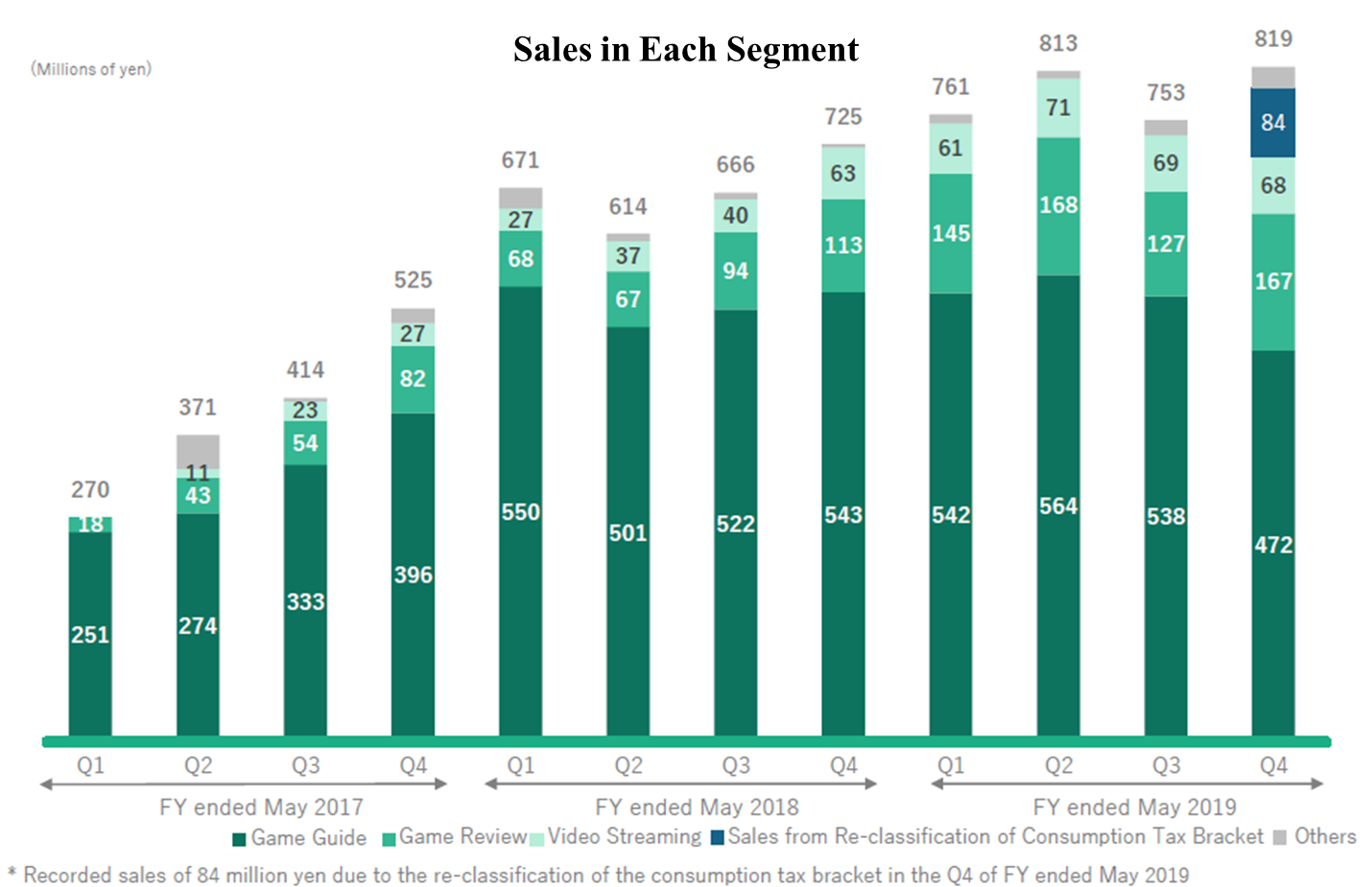

Sales in Each Segment (Approximate value)

| FY5/18 | Comparison ratio | FY5/19 | Comparison ratio | YoY Change |

Game Guide | 2,116 | 79.0% | 2,116 | 67.2% | +0.0% |

Game Review | 342 | 12.8% | 607 | 19.3% | +77.5% |

Video Streaming | 167 | 6.2% | 269 | 8.5% | +61.1% |

Others | 51 | 1.9% | 154 | 4.9% | +202.0% |

Total | 2,677 | 100.0% | 3,148 | 100.0% | +17.6% |

* Unit: million yen

*Total of the sales in each segment is a total amount of approximate values in million yen. Thus, there might be slight deference between the values and actual ones in comparison ratio and year on year change.

Sales Cost (Approximate value)

| FY5/18 | Ratio to sales | FY5/19 | Ratio to sales | YoY |

Human resource-related expense (*) | 970 | 36.2% | 1,611 | 51.2% | +66.1% |

Rents | 179 | 6.7% | 238 | 7.6% | +33.0% |

Server rental cost | 60 | 2.2% | 88 | 2.8% | +46.7% |

Depreciation | 23 | 0.9% | 22 | 0.7% | -4.3% |

Expenses for office floor expansion and shareholder benefit programs | 16 | 0.6% | 10 | 0.3% | -37.5% |

Others | 260 | 9.7% | 371 | 11.8% | +42.7% |

Total of operating expenses | 1,508 | 56.3% | 2,340 | 74.3% | +55.2% |

The number of employees | 188 |

| 242 |

| +28.7% |

*Unit: Million yen. The figures shown for each of the cost under the operating expenses for FY 5/2018 are approximate, and thus, they may differ from the actual values, including the ratio to sales for FY 5/2018 and the year-on-year values for FY 5/2019.

*Human resource-related expense = personnel cost + stock-based compensation cost + outsourcing cost + recruitment cost and personnel development cost

2-2 Non-Consolidated Business Results for Fourth Quarter

| 5/18-1Q | 2Q | 3Q | 4Q | 5/19-1Q | 2Q | 3Q | 4Q | YoY change | QoQ change |

Sales | 671 | 614 | 666 | 725 | 761 | 813 | 753 | 819 | +13.0% | +8.8% |

Gross profit | 483 | 409 | 452 | 467 | 473 | 493 | 391 | 442 | -5.3% | +13.1% |

SG&A expenses | 135 | 131 | 154 | 220 | 229 | 233 | 277 | 252 | +14.2% | -9.1% |

Operating income | 347 | 277 | 297 | 246 | 244 | 259 | 113 | 190 | -22.7% | +67.2% |

Ordinary income | 345 | 276 | 297 | 248 | 242 | 259 | 113 | 191 | -22.9% | +69.7% |

Quarterly net income | 246 | 197 | 212 | 159 | 170 | 178 | 68 | 268 | +68.7% | +289.4% |

Gross profit margin | 72.0% | 66.5% | 67.9% | 64.4% | 62.2% | 60.6% | 51.9% | 54.0% |

|

|

SG&A ratio | 20.2% | 21.4% | 23.2% | 30.5% | 30.1% | 28.7% | 36.8% | 30.8% |

|

|

Profit soared 67.2% quarter on quarter in fourth quarter.

Sales in the fourth quarter (from March to May) increased both from the same period last year and on a quarter-on-quarter basis, standing at 819 million yen. Compared from the same period of a year before, while sales from the Game Guide service dropped by 13.1%, the Game Review service showed a 47.6% increase. In addition, sales performance of the Video Streaming service was steadily satisfactory throughout the term. GameWith, Inc. posted a financial impact amounting to 84 million yen as sales following the consumption tax class review, but it achieved a sales rise from the same period of a year earlier even excluding this financial impact.

Operating income was 190 million yen. Although it dropped 22.7% from the same period of the previous year due to burdens put by the strategic investment, it jumped 67.2% quarter on quarter. The company recorded the financial impact accompanying the review of the consumption tax brackets as sales; additionally, recruitment activities reached their peak, and the company moved ahead with review of costs, including personnel-related expenses, all of which reduced the total cost on a quarter-on-quarter basis. The number of employees increased just six quarter on quarter, meaning that the company tends to slow down the rate of increasing the number of personnel.

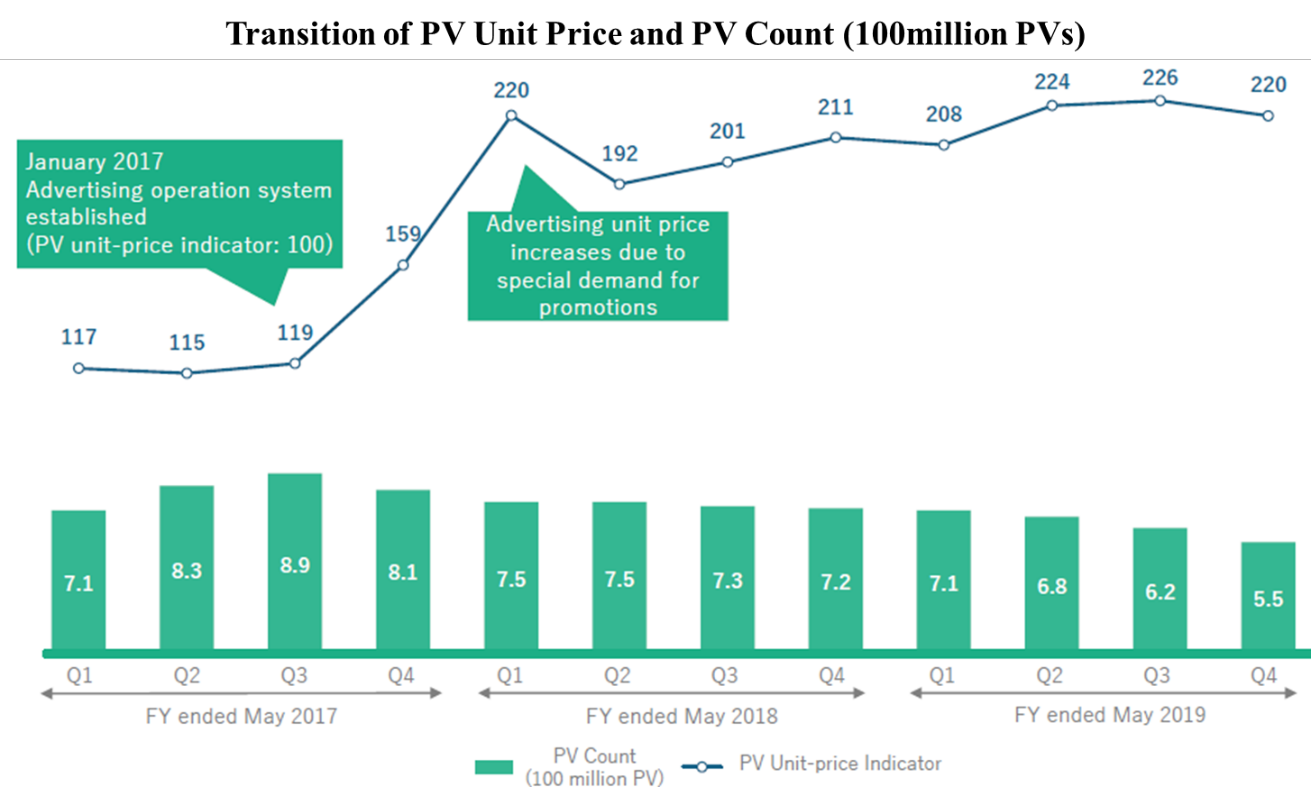

2-3 Overview of PV Count and PV Unit Price for Game Guide

* Presented based on the monthly average PV count calculated for each quarter

*The relative value is calculated with the monthly average PV unit price as of January 2017, in which GameWith established an advertising operation system, considered as the reference value of 100.

*GameWith started including the values from the overseas business into the PV count and PV unit price indicator in the second quarter of FY 5/2019.

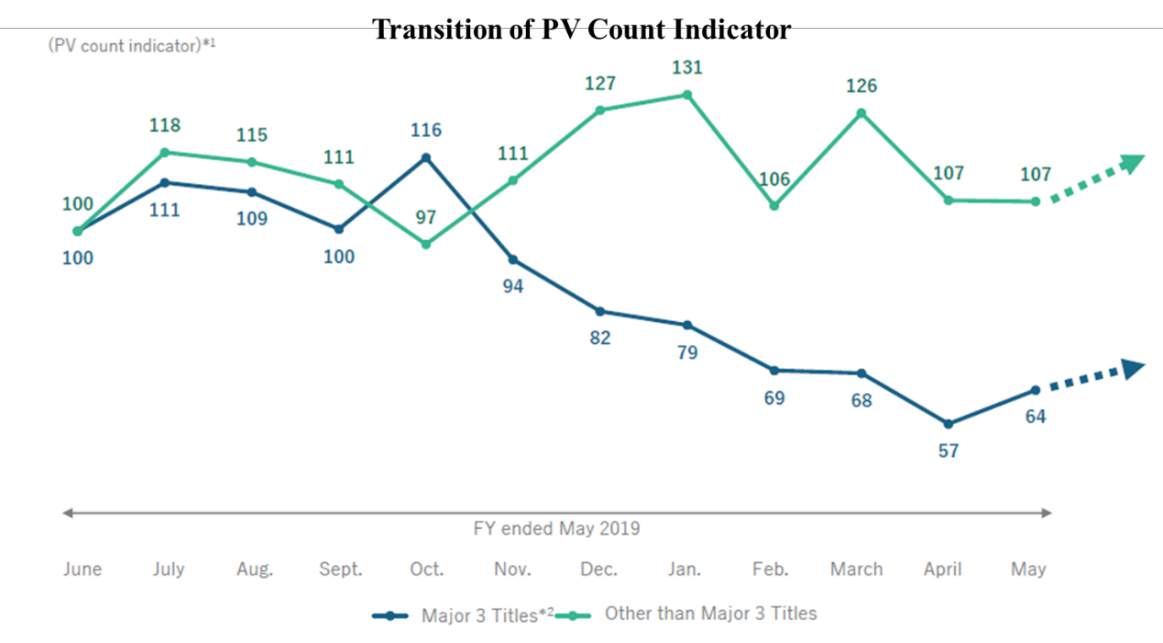

The monthly average page view (PV) unit price indicator for each quarter continued to be at a high level, but the monthly average PV count for each quarter kept going down, which stood at 550 million for the fourth quarter of FY 5/2019. A decrease in the overall PV count resulted mainly from the drops in the PV count of the leading three game titles, which earn the greatest PV counts in the Game Guide service. GameWith, Inc. had relied largely on the most popular smartphone games for the PV count, but users’ needs for tips for playing the top game titles have been significantly shrinking in the past six months. It has been five to six years since the company started operating the website for each of the most popular games. The decrease, however, seemed to have stopped around the end of the term, meaning that it has bottomed out. On the other hand, other game titles than the three games showed steady growth. The company will strive to raise the overall PV count, including not only the leading games but also other game titles.

* The relative value was calculated with the PV count as of June 2018, excluding the PV count related to Game Review, considered as the reference value of 100.

*The leading three game titles are the top three games that earned the greatest monthly PV counts as of June 2018.

2-4 Financial Situation and Cash Flow (CF)

Financial Situation

| May 2018 | May 2019 |

| May 2018 | May 2019 |

Cash and deposits | 2,414 | 2,708 | Accounts payable | 65 | 70 |

Trade receivables | 362 | 341 | Accrued expenses | 84 | 103 |

Current assets | 2,817 | 3,310 | Taxes Payable | 265 | 70 |

Property, plant, and equipment | 84 | 94 | Liabilities | 636 | 463 |

Other investment | 279 | 360 | Net Assets | 2,544 | 3,302 |

Fixed assets | 363 | 454 | Total Liabilities, Net Assets | 3,181 | 3,765 |

* Unit: million yen

Total assets at the end of the term rose 584 million yen from the end of the previous term to 3,765 million yen. Cash and deposits, and security deposits increased under debit while retained earnings was on the rise under credit. GameWith, Inc. has established a flexible and highly stable financial structure, with cash and deposits accounting for 71.9% of total assets (which was 75.9% at the end of the previous term) and equity ratio being 87.7% (which was 80.0% at the end of the previous term).

Cash Flow (CF)

| FY5/18 | FY5/19 | YoY Change | |

Operating Cash Flow (A) | 951 | 341 | -609 | -64.1% |

Investing Cash Flow (B) | -174 | -116 | +57 | - |

Free Cash Flow (A+B) | 776 | 224 | -552 | -71.1% |

Financing Cash Flow | 302 | 69 | -232 | -76.9% |

Cash and Equivalents at Term End | 2,414 | 2,708 | +294 | +12.2% |

* Unit: million yen

Although Operating Cash Flow shrank owing to a reduction in income before tax and an increasing amount of operating capital, including tax expenses, GameWith, Inc. successfully secured a Free Cash Flow of 224 million yen. The deficit in Investing Cash Flow resulted from such expenses as capital investment, cost of acquiring investment securities, and security deposits, and Financing Cash Flow declined because the company exercised the stock acquisition rights.

Reference: Transition of ROE

| FY5/15 | FY5/16 | FY5/17 | FY5/18 | FY5/19 |

ROE | 21.31% | 25.96% | 39.04% | 41.12% | 23.48% |

Net income | 24.22% | 22.18% | 29.43% | 30.48% | 21.79% |

Total assets turnover | 0.78 times | 0.96 times | 1.05 times | 1.07 times | 0.91 times |

leverage | 1.14 times | 1.21 times | 1.27 times | 1.26 times | 1.19 times |

*ROE = Net income × Total assets turnover × leverage.

*Net income, and total assets turnover are from interim period.

3. Fiscal Year May 2020 Earnings Estimates

3-1 Non-consolidated Earnings

| FY 5/19 Actual | Ratio to Sales | FY 5/20 (forecast) | Ratio to Sales | YoY |

Sales | 3,148 | 100.0% | 3,217 | 100.0% | +2.2% |

Operating Income | 808 | 25.7% | 616 | 19.2% | -23.7% |

Ordinary Income | 807 | 25.7% | 616 | 19.2% | -23.7% |

Net Income | 686 | 21.8% | 420 | 13.1% | -38.7% |

unit: million yen

It is projected that sales will increase 2.2% year on year while operating income will drop 23.7% year on year.

Sales are estimated at 3,217 million yen, up 2.2% year on year. While sales from the “Game Guide” service are expected to decline year on year on the premise of the PV count as of the fourth quarter of the previous term, the “Game Review” service will show a sales rise. In addition, sales from the “Video Streaming” service will grow on a steady basis as well.

Operating income is expected to shrink by 23.7% year on year to 616 million yen. Amid the deteriorating gross profit margin owing to decreasing sales from “Game Guide,” operating expenses are projected to grow, including rising personnel costs following the effort to increase the number of workers that GameWith, Inc. made in the previous term. The company does not plan to significantly raise the number of its employees.

Operation Cost (Approximate values)

| FY 5/19 Actual | Ratio to Sales | FY 5/20 (forecast) | Ratio to Sales | YoY |

Human resource related expense | 1,611 | 51.2% | 1,752 | 54.5% | +8.8% |

Rents | 238 | 7.6% | 269 | 8.4% | +13.0% |

Server rental cost | 88 | 2.8% | 104 | 3.2% | +18.2% |

Others | 403 | 12.8% | 476 | 14.8% | +18.1% |

Total | 2,340 | 74.3% | 2,601 | 80.9% | +11.2% |

unit: million yen

3-2 Strengthening of Management Structure

GameWith, Inc. plans to newly designate an internal director and an outside director, which will be officially approved at the sixth general meeting of shareholders scheduled for August 21, 2019, through which the company will shift its management structure to the one supervised by five directors. Mr. Shujiro Ito, who served as the executive officer and head of the corporate planning office, will be appointed as a new internal director to take charge of the administrative departments as a whole. Mr. Hirokazu Hamamura, who was Representative for Famitsu Group and currently serves as the vice president of Japan e-Sports Union, will be designated as a new outside director. GameWith will grow the “Game Review” service and the e-sports business by utilizing Mr. Hamamura’s network with gaming-related companies.

(Source: the company)

4. Med-term Business Strategy

【Mission and Vision】

Mission : “Create a more enjoyable gaming experience”

"Get absorbed in games, be connected through games, and focus on games proudly as a business." The mission of GameWith, Inc. is to “create a more enjoyable gaming experience.” This means that all of our company’s businesses are linked to the world where people can enjoy playing games more, and we do not have any plan of business expansion into fields irrelevant to games.

Vision : “Go for the global gaming infrastructure”

For user playing games and for manufacturers developing games, GameWith provides experiences and values which cannot be provided without GameWith, and we will be an infrastructure for all the people who are involved in enjoying games. For that, we will advance to not only a media business but also all business areas in order to enjoy playing games more.

Although our company has focused on the media business in Japan, we will expand our business overseas in order to realize the vision “Go for the global gaming infrastructure” at an accelerating rate. Furthermore, we will conduct business in other fields than the media one. For example, we plan business expansion into multifarious gaming-related fields, including e-sports and blockchain games.

4-1 Overview of Mid-Term Business Strategy

Working on generating sales through the media business in Japan and commercializing it, GameWith, Inc. has established a business model centering around the media business that includes Game Guide, Game Review, and Video Streaming services. In the mid-term business strategy, the company will strive to accelerate overseas development and create new businesses while increasing income from the existing businesses in order to realize the vision under the aforementioned mission.

Increase income from existing businesses | : | Focus on the Game Review service to develop a business pillar next to Game Guide |

Accelerate overseas development | : | Accelerate overseas development primarily in English-speaking countries |

Challenges into new business territory | : | Expand business to various gaming-related fields, other than the existing ones |

Focus on “Game Review” Service to Develop Next Business Pillar

The strategies of expanding the existing businesses focus on development of the “Game Review” service with the value of “motivating users to start playing new games,” and GameWith, Inc. will develop it as the next revenue pillar that outperforms the Game Guide service.

As part of this approach, GameWith will shift its business focus from website to apps. Although it has already provided an app, the app has been intended mainly to offer game-playing tips. The company will entice users who are looking for games by attaching weight to the “Game Review” service and investing in advertising for apps. Based on advertisements placed by game development companies, GameWith will match companies that hope to advertise their games and users who look for games to play through its app. The company’s approach to attract customers had been dependent on users’ searches for games through the search words such as “recommended games”, which has led to sales in the “Game Review” service, without any promotional activities. However, the company reached the limits of organic customer attraction efforts in the “Game Review” field. In addition, it has had difficulty in securing users that it had lured via its websites. Therefore, it will improve the app in order to keep attracting and maintain users through it. The company will require users to open the GameWith app every time they want to start playing new games. GameWith, Inc. will expand the “Game Review” service by holding the position as a so-called top-of-mind company that users will think of first when it comes to gaming.

As GameWith does not have experience in investing in advertising for reeling in customers, it will verify the effect by making investment in advertisement in FY 5/2020. To begin with, the company will examine the effect mainly of online promotions and then put together promotional activities as soon as the online promotion bears fruit in order to grow business.

Accelerate Overseas Development Primarily in English-speaking Countries

As for overseas development, the English version of the GameWith medium celebrated the first anniversary of release in July 2018. The issues with the medium are not only that there are a few challenges to tackle in terms of its structure but that the English version deals chiefly with video (console) games. Unlike the Japanese version of the websites for game-playing tips that offer information on sustainable and programmatic smartphone games, the number of viewers for console games nosedives once users have cleared games. Even if the number of viewers increases thanks to successful customer attraction efforts, it will sharply decline roughly in one to two weeks in general. In order to keep the number of viewers at a high rate, GameWith, Inc. needs to continue beating competitors with more search results. PV count has exceeded 13 million, but the company appears not to be at the stage of making an official announcement yet. As for its system, it is currently following the plan, do, check, and act (PDCA) cycle.

Expand Business to Various Gaming-related Fields

Management of e-sports teams

Currently, GameWith, Inc. manages three teams. One of them, which plays “Clash Royale” (a real-time mobile card game provided by Supercell Oy based in Finland), is taking part in the official league of “Clash Royale,” passed through the Asian league held in Seoul, South Korea (from April 25, 2019 to June 29, 2019), and has been qualified to participate in a global e-sports festival “World Cyber Games,” which will be held in Xian city, China, in July.

One of the gamers who have concluded exclusive contracts with GameWith, Inc., Nephrite, plays “FORTNITE” (a battle royale game provided by Epic Games, Inc. based in the United States), and the number of views of the videos of him playing the game, which is aired on YouTube, is rising on a steady basis. The Video Streaming website yields satisfactory results as demonstrated by the number of subscribers exceeding 75,000. According to the company, although the player Nephrite has not got results good enough in gaming tournaments, he has succeeded in attracting fans.

In addition to the aforementioned, a player, Zackray, who has under an exclusive contract with GameWith, Inc. and plays console fighting games, came in fifth in the world in an international fighting game tournament, “Genesis 6,” held in Oakland, the United States, in February. He plans to participate in an international fighting game event “EVO Championship Series” scheduled for August in Las Vegas, the United States.

Affiliated players for Clash Royale Division | Player Zackray |

|

|

(Source: the company)

Event production

Such events as e-sports tournaments and offline events organized by game development companies have recently been growing in number. Aiming to accomplish the mission “Create a more enjoyable gaming experience” not just online but in the real world as well, GameWith, Inc. started to engage in event production on consignment as part of the effort. In FY 5/2019, the company was entrusted with event production of “Shadowverse ES Regional Tournament” held in 10 cities in Japan (from May to July) and each of the tournament finished successfully. “Shadowverse” is a smartphone e-sport developed and operated by Cygames, Inc. (Shibuya Ward, Tokyo; President Koichi Watanabe).

Blockchain game “EGGRYPTO”

GameWith, Inc. is developing its first blockchain game, “EGGRYPTO,” jointly with another company. The game is a basic role-playing game (RPG) in which players manage rare characters using the blockchain technology. The company planned to release it in the spring of this year, but it put off the release in order to improve the quality. EGGRYPTO is scheduled to be released by the end of 2019.

Blockchain game “CryptoSpells”

Crypto Games Inc. (Setagaya Ward, Tokyo; CEO Kota Ozawa), in which GameWith, Inc. makes investment, released a blockchain game “CryptoSpells” in June. “CryptoSpells” is a trading card game (TCG)-based blockchain game. On the first day of release, the cumulative total of sales of the currency used exclusively in the game exceeded 600 ETH, which means that the game started off well.

5. Conclusions

GameWith, Inc. said that it did not expect at all the sales drop in the “Game Guide” service in FY 5/2019; however, the declining PV count for the websites of the major three game titles, which is the leading factor of the sluggish sales, resulted not from a reduction in the company’s market share, but from a reduction in needs themselves for tips for playing the three games. Although the struggle in FY 5/2019 has raised the bar for attaining the goals in the mid-term business strategy: sales of 5.5 billion yen and an operating income of 2 billion yen in FY 5/2021, the company would like to achieve them by growing the “Game Review” service.

The company has offered the “Game Review” service mainly online, but access to it is limited basically unless users perform search through search engines. Thus, only those who have acquired greater literacy and are aggressive in terms of gaming have used it. Therefore, the company will strengthen the functions of the “GameWith” medium and strive to make the app a top-of-mind service for game-playing information through promotional activities. This means that the company endeavors to raise user awareness in order to encourage them to “open GameWith first every time they want to play games,” which is similar to the apps and websites that come to people’s minds ahead of other services, including “tabelog” for restaurants and “HOT PEPPER Beauty” for hair salons.

GameWith, Inc. aims to realize year-on-year sales growth by offsetting shrinking sales from “Game Guide” by a sales rise in “Game Review” through enhancement of the app and promotions in FY 5/2020. When the company successfully grows the “Game Review” service as it plans, it will be able to get on the right track for business growth.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization Type | Company with an audit and supervisory board |

Directors | 3 directors, including 1 external |

Auditors | 3 auditors, including 3 externals |

◎Corporate Governance Report

The Latest Update : August 23, 2018

Basic policy

Under the motto “Create a more enjoyable gaming experience,” our company is working to establish a system which is robust and transparent, where rapid decision-making is made possible, as well as strengthening our internal control including stricter compliance and risk management, in order to develop a system of business operation to provide an optimal environment for all people and companies involved in gaming. Through these measures, we will strive to further enhance corporate governance and maximize our enterprise value.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code (Excerpt)>

Our company follows all of the principles of the Corporate Governance Code.

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 So-called strategically held shares】

Our company may acquire and possess shares of other corporations as a means of maintaining and enriching transactions and cooperative relationships with them. We do so basically when strategically holding shares improves our enterprise value, and we make judgment as to whether or not we should possess strategically held shares based on whether or not doing so contributes to maintenance and enhancement of medium- and long-term cooperative relationships between a share-issuing company and our company, facilitation of transaction and other relationships, and creation and development of business opportunities. Whether or not our company should exercise the voting rights on strategically held shares will be determined by the appropriate person with authority as stipulated in the “Regulations of Administrative Authority” after examination of the content of bills and the chance of medium- and long-term enterprise value improvement with the following taken into account comprehensively: (1) the company issuing relevant shares possesses purposes and businesses that satisfy our company’s strategic shareholding policy, (2) the relevant company discloses its business activities on a timely and proper manner, and (3) the relevant company has established a business foundation that leads to sustainable business growth.

【Principle 1-7 Related party transactions】

Our company properly monitors transactions by any of our company’s directors, over which a conflict of interest is suspected, if any, by obtaining approval of the board of directors in accordance with the laws and regulations, and our rules governing the board of directors. We will properly disclose important facts in accordance with the laws and regulations when a transaction suspected to cause conflicts of interest is conducted.

[Principle 5-1 Policy on constructive dialogue with shareholders]

Our company operates a system that ensures continued constructive dialogue with shareholders from the mid and long-term viewpoints, regarding such matters as corporate governance, business strategies, capital policies, business results and financial condition, and service contents and its risks, in order to maintain the continuous growth of our enterprise values and to build a strong relationship of trust with our shareholders.

- Dialogue with shareholders are supervised by the president, while individual interviews are held by the head of corporate planning, in consideration of purposes and effects of such meetings and the attributes of the shareholders, and the attendees for such events are carefully selected including the potential attendance by Representative Director and the executive administrative managers, where the strategies are discussed in depth beforehand.

- Our Investor Relations (IR) staff collects necessary information from each section within the company, especially the business and management sections, and develops explanations that are easy to understand through close internal cooperation in order to enrich our dialogue with shareholders.

- Our company continues activities to deepen understanding of shareholders regarding management policies, corporate governance, strategies, and the present condition of businesses.

- For dialogues with our institutional investors, our company holds individual interviews as well as financial results briefings, held each half term. Additionally, through the page dedicated to shareholders and investors on our website, we disclose information of such events to individual investors as well as hold company information sessions for individual investors.

- When the interests and concerns of shareholders emerge through dialogue with them, they will be duly communicated to the management (heads of departments or higher) and are reflected in our business analyses and the examination of our methods of information disclosure.

- In the course of dialogue with shareholders, insider information is appropriately controlled in compliance with internal regulations.

- Our company has set aside a “silence period” in which we do not engage in dialogue concerning financial results.

This report is intended solely for informative purposes, and is not intended as solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on GameWith, Inc. (6552) and Bridge Salon (IR seminar), please go to our website at the following URL www.bridge-salon.jp/