Bridge Report:(6722)A&T the fiscal year December 2019

Shigetaka Misaka President | A&T Corporation (6722) |

|

Company Information

Market | JASDAQ |

Industry | Electrical equipment (manufacturing industry) |

President | Shigetaka Misaka |

HQ Address | Yokohama Plaza Bldg. 2-6 Kinko-cho, Kanagawa-ku, Yokohama-shi |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,475 | 6,257,900 shares | ¥9,230million | 9.3% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥24.00 | 1.6% | ¥124.66 | 11.8x | ¥1,240.99 | 1.2x |

*The share price is the closing price on February 7, 2020.

Each figure is from the financial report for the fiscal year ended December, 2019.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2016 Act. | 10,234 | 1,015 | 1,004 | 651 | 104.14 | 20.00 |

December 2017 Act. | 10,371 | 773 | 757 | 678 | 108.41 | 20.00 |

December 2018 Act. | 10,430 | 774 | 768 | 518 | 82.80 | 24.00 |

December 2019 Act. | 11,049 | 958 | 943 | 695 | 111.21 | 24.00 |

December 2020 Est. | 11,400 | 1,020 | 1,000 | 780 | 124.66 | 24.00 |

* Estimates are those of the Company.Unit: million yen.

This report outlines A&T Corporation, briefly reports the earnings results for fiscal year ended December 2019, and so on.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended December 2019 Earnings Results

3.Fiscal Year ending December 2020 Earnings Forecasts

4.Medium-Term Management Plan (FY Dec. 2018 to FY Dec. 2020) Progress

5.Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- For the term ended Dec. 2019, sales grew 5.9% year on year to 11,049 million yen. The sales of diagnostic reagents dropped, but the sales of original products, mainly clinical testing devices and systems and supplies, were healthy, and sales hit a record high. Operating income was 958 million yen, up 23.8% year on year. Recruitment costs, personnel expenses, and R&D costs augmented, but the increase in SGA was slight. Net income rose 34.3% year on year to 695 million yen. The extraordinary loss posted in the previous term, including the cost for relocating equipment to the new building of Esashi Factory and the loss from cancellation of outsourcing, was not posted in the term ended Dec. 2019. The ratios of direct and virtual overseas sales, on which the company puts importance for growth, were 9.4% and 24.6%, respectively. The sales to China, which grew considerably in the previous term, were as sluggish as 532 million yen (780 million yen in the previous term), as there were the change in the Chinese financial environment and the inventory adjustment of Shanghai Runda Medical Technology Co.,Ltd. in China, which is an OEM.

- For the term ending Dec. 2020, sales are estimated to rise 3.2% year on year to 11.4 billion yen. In the IT and automation support business, the company will make large-scale transactions in Japan and expand the electrolyte OEM business. The business in China remains stagnant, but the company will keep concentrating on it. Due to the increase of sale of original products, etc., gross profit rate is projected to rise 0.5 points. Operating income is forecasted to increase 6.4% year on year to 1,020 million yen. It is estimated that SGA will augment 4.0% due to the increase in costs for recruitment and R&D for sustainable growth, but the augmentation will be offset by the rise in gross profit. The dividend is estimated to be 24 yen/share, unchanged from the previous term. The estimated payout ratio is 19.3%.

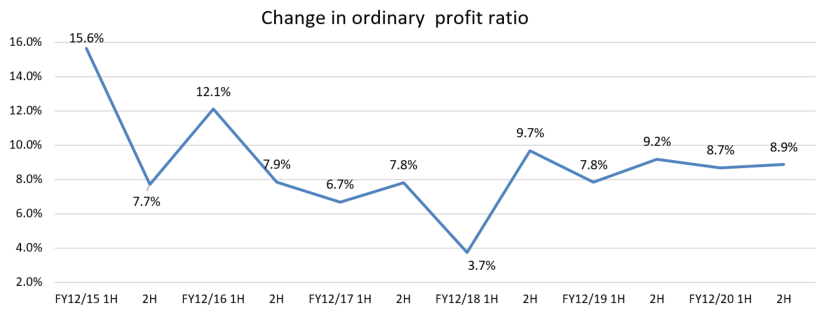

- This term, which is the final fiscal year of the medium-term management plan, it is unfortunately difficult to attain the goals. The previous report mentions “An important step is to achieve an ordinary income rate of 8.9% in the term ended Dec. 2019, for attaining the target ordinary income rate of 10% or higher,” but the ordinary income rate was 8.5%. However, it seems that the company is steadily increasing the ratio of original products for enhancing profitability, and the base is steadily growing from the half-year viewpoint.

- On the other hand, through the spread of the novel coronavirus, the importance of swiftly delivering examination data to the medical front has been recognized more deeply. Then, the company expects that the needs for examination systems will grow further in the medium term. Although it is difficult to predict how much the spread of the novel coronavirus will affect the business in China, we would like to hope that the business in China, which was stagnant in the previous term, will recover and progress toward the goal in the next medium-term plan.

1.Company Overview

The core businesses of A&T Corporation are the “blood testing business,” in which the company develops, manufactures, and sells IVD devices, reagents, etc. mainly for electrolyte and glucose tests, and the “IT and automation support business,” which facilitates the streamlining of clinical tests.

The company excels at proposing an optimal one-stop solution for preparing necessary products in a laboratory, installing and operating equipment while proposing a layout, and possesses advanced technologies that are highly evaluated by leading overseas OEM clients.

1-1 Corporate History

In the 1980s, the general chemical manufacturer Tokuyama Corporation (4043, 1st section of Tokyo Stock Exchange) was expanding its business scope from materials to fine chemicals. While taking inventory of various technologies and items, Tokuyama Corporation decided to develop latex (rubber material; one of the chemical products) reagents for testing antigen-antibody reactions.

In the development process, Tokuyama Corporation formed a business tie-up with Analytical Instruments Inc., which develops, manufactures, and sells clinical test equipment and had been leading the industry by releasing such products as fully automatic blood sugar analyzer in 1978, and in Apr. 1988, they founded a joint venture for distributing their products, A&T Corporation. (“A” of Analytical Instruments and “T” of Tokuyama were combined.)

In November 1990, the company established Esashi Factory, which is now the primary production site, in Iwate Prefecture.

In 1994, A&T Corporation underwent an absorption-type merger, integrating the diagnosis system division of Tokuyama Corporation. The period from the 1980s to the 1990s was the growth period of the clinical testing industry, in which many core technologies were developed, and the company expanded its business steadily while taking advantage of that trend.

In Jul. 2003, the company issued over-the-counter shares. It is now listed in the JASDAQ market of Tokyo Stock Exchange.

1-2 Management Philosophy, etc.

A&T Corporation upholds its corporate ethos: “Support medical care and contribute to people’s health around the world,” and aims to improve the quality of medical care and reduce cost, under following three management policies.

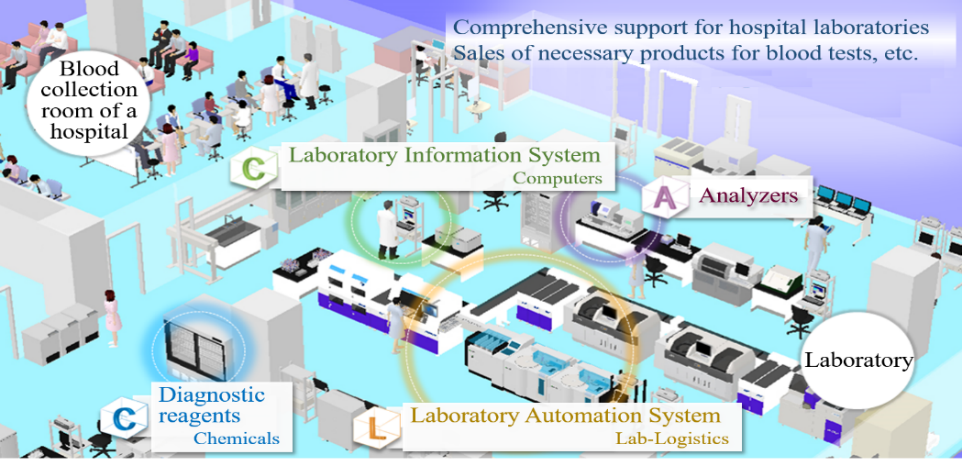

1. C.A.C.L. | Commit to research and development of unique products and technologies in all areas’ of “C.A.C.L.” in clinical laboratory testing. |

2.Consistent Framework | Increase market value and reduce the cost of products through an integrated system of development, manufacture, distribution and customer support. |

3.Alliance | Promote market expansion and quality improvement of products with business partners domestic and overseas. |

* C.A.C.L.: Acronym of “Chemicals (diagnostic reagents),” “Analyzers (Analyzers),” “Computers (laboratory information system),” and “Lab-Logistics (laboratory automation system)” in the field of products required for operating a clinical test room

1-3 Market Environment

◎ Market scale

(Domestic and global markets)

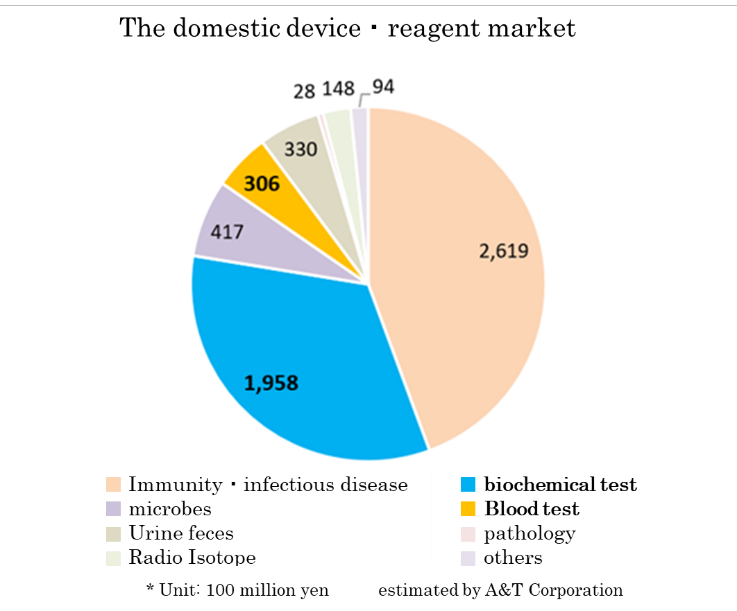

Based on the information in the website of the Japan Association of Clinical Reagents Industries, A&T Corporation estimated that the scale of the Japanese market of related devices and reagents is about 590 billion yen. The market scales of biochemical tests and hematology tests are 195.8 billion yen and 30.6 billion yen, respectively.

(Trend of IVD devices)

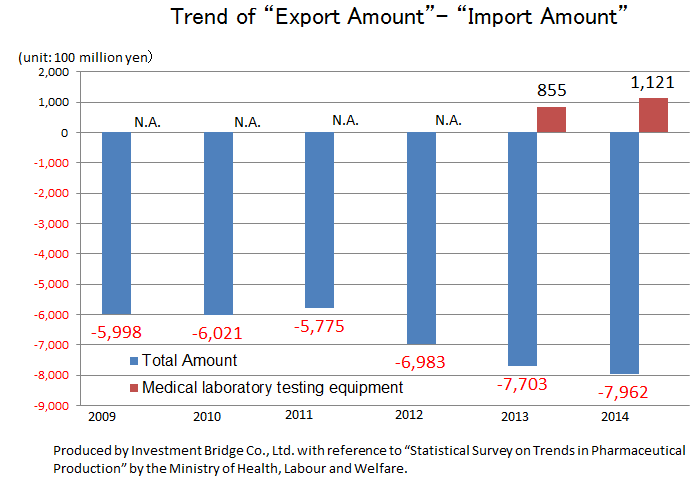

According to “Statistical Survey on Trends in Pharmaceutical Production” by the Ministry of Health, Labour and Welfare, the scale of the Japanese medical products market (domestic production amount) in 2015 was about 1.9 trillion yen. Products for medical treatment is dominant, and medical Analyzers, which is handled by A&T Corporation, has a market scale of about 180 billion yen.

While there is a significant excess of imports of the overall medical product, there is an excess of exports of IVD devices. This indicates how competitive Japanese companies are. Hitachi and Canon Medical Systems (former Toshiba) supply testing equipment to Roche in Switzerland and Abbott in the U.S., respectively. Likewise, A&T Corporation supplies OEM products to Siemens. Namely, testing equipment made in Japan is now indispensable in the global clinical testing field.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

Total amount |

|

|

|

|

|

|

|

Production | 15,760 | 17,130 | 18,080 | 18,950 | 19,050 | 19,890 | 19,450 |

Import | 10,740 | 10,550 | 10,580 | 11,880 | 13,000 | 13,680 | 14,240 |

Export | 4,750 | 4,530 | 4,800 | 4,900 | 5,300 | 5,720 | 6,220 |

Export - Import | -5,998 | -6,021 | -5,775 | -6,983 | -7,703 | -7,962 | -8,023 |

IVD devices |

|

|

|

|

|

|

|

Production | 1,100 | 1,030 | 1,450 | 1,580 | 1,470 | 1,690 | 1,800 |

Import | N.A. | N.A. | N.A. | N.A. | 210 | 200 | N.A. |

Export | 750 | 620 | 980 | 1,100 | 1,060 | 1,320 | 1,420 |

Export - Import | N.A. | N.A. | N.A. | N.A. | +855 | +1,121 | N.A. |

*Unit: 100 million yen. The import amounts of medical Analyzers from 2009 to 2012 and 2015 are N.A., because they were not in the top 10.

◎Companies in the same field

Code | Corporate name | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income margin | ROE | Market cap | PER | PBR |

4549 | Eiken Chemical | 36,800 | +2.9 | 4,350 | -5.7 | 11.8% | 10.3 | 101,016 | 25.2 | 2.3 |

6678 | Techno Medica | 10,000 | +7.2 | 1,400 | -7.8 | 14.0% | 8.2 | 18,098 | 17.7 | 1.3 |

6722 | A&T | 11,400 | +3.2 | 1,020 | +6.4 | 8.9% | 9.3 | 9,230 | 11.8 | 1.2 |

6869 | Sysmex | 310,000 | +5.6 | 60,000 | -2.1 | 19.4% | 16.3 | 1,716,029 | 44.5 | 6.5 |

6951 | JEOL | 119,000 | +6.9 | 7,100 | +6.4 | 6.0% | 15.0 | 179,063 | 35.4 | 4.0 |

8036 | Hitachi High-Technologies | 700,000 | -4.3 | 56,000 | -16.0 | 8.0% | 11.9 | 1,104,664 | 25.1 | 2.6 |

*The results for this term were forecasted by the company. The units are million yen, %, and times. Share price-related indices are based on the closing prices on February 7,2020.

* Sysmex, Hitachi High-Technologies adopted IFRS. Hitachi High-Technologies' operating income is "adjusted operating income" which is calculated by subtracting the cost of sales and selling, general and administrative expenses from sales revenue.

We compared major listed clinical testing device manufacturers.

As of the release of the previous report, only the company had a PBR of less than 1, but it exceeds 1 this time.

However, PER and PBR are both low, so it is hoped that the company will clearly state its strategies and promote understanding, so as to increase its popularity and expand its business in the future.

1-4 Business Description

In addition to the development, manufacturing, and sale of products, including testing devices and reagents used in the clinical testing rooms of hospitals, A&T Corporation offers customer support. The company also offers comprehensive consulting services, including the proposal for the layout of a laboratory, installation and operation.

(Source: the company)

What is clinical testing?

Clinical tests can be classified into “biopsies” for directly examining the body with medical equipment, such as X-ray equipment, CT, MRI, electrocardiographic and ultrasonic equipment, and “laboratory tests” for examining biological samples (specimens), such as blood, urine, stool, and cells, collected from patients.

A&T Corporation handles products used for laboratory testing, especially blood tests.

There are a variety of blood tests conducted at hospitals and in comprehensive medical checkups, including the tests of the hepatic system, the renal system, uric acid, the lipid system, glucose metabolism, blood cells, and infectious diseases. A&T Corporation mainly conducts business related to “electrolyte tests” and “glucose tests.”

“Electrolyte tests”

The water content constitutes about 60% of the human body, as body fluids, including intracellular fluid and blood plasma. Body fluids are classified into electrolytes, which are mineral ions that dissolve in water and conduct electricity (such as sodium, potassium, calcium, and chlorine), and non-electrolytes, which dissolve in water, but do not conduct electricity (such as glucose and urea).

Each electrolyte takes important roles for keeping human beings alive while maintaining a healthy balance - “sodium” adjusts the water content of the body, “potassium” controls muscles and nerves, “calcium” forms bones and teeth, conveys nervous stimuli, and coagulates blood, and “chlorine” supplies oxygen to the inside of the body. If the concentration of electrolytes in blood is abnormal, there is a possibility that the kidneys or hormones are malfunctioning.

The purpose of electrolyte tests is to measure the concentration of each electrolyte ion in body fluid, detect the disruption of a balance, and then diagnose a disorder in the body. Sampled blood and urine are examined with testing device.

*Major diseases

Sodium | Diabetic coma, dehydration, acute nephritis, chronic renal failure, nephrotic syndrome, heart failure, hypothyroidism, Addison disease, diabetic acidosis, etc. |

Potassium | Acute renal failure, chronic renal failure, respiratory insufficiency syndrome, etc. |

Calcium | Malignant tumor, multiple myeloma, hyperparathyroidism, renal failure, hypoparathyroidism, vitamin D deficiency, etc. |

Chlorine | Dehydration, renal failure, chronic nephritis, emphysema, etc. |

“Glucose tests”

The sugar in blood plasma (blood sugar) is composed mostly of glucose, which is the only energy source for the central nervous system, including the cerebrum. When the stomach is empty (over 5 hours after eating), the liver emits about 8 grams of glucose per hour, and the brain consumes about half of them, and muscles and red blood cells consume one fourth of them, respectively.

Blood sugar level in its normal condition is strictly controlled while keeping a balance between the increase through the absorption from the intestine and the generation in the liver and the decrease through the consumption in the muscles. If this control does not work properly, hyperglycemia or hypoglycemia will occur.

A glucose test is conducted for measuring the concentration of glucose in blood or urine.

*Major diseases

Hyperglycemia | Diabetes (insulin, which is a hormone secreted from the pancreas, does not work, and so cells cannot use glucose in blood), pancreatitis, thyroid disease, postgastrectomy dumping syndrome, etc. |

Hypoglycemia | Liver damage, hypopituitarism, adrenal hypofunction, etc. |

1.Business Field

The business of A&T Corporation is composed of the “blood testing business,” in which the company develops, manufactures, and sells clinical testing devices, reagents, supplies, etc. for blood tests, and the “IT and automation support business,” which facilitates the streamlining of manual work in hospital laboratories with IT and automated systems. The company comprehensively supports hospital laboratories.

(Since this company conducts this business only, neither its brief financial reports nor securities reports contain segment information. It should be noted that the company discloses the sales of each product series in reference materials for briefing results, etc., but not the sales of each type of business.)

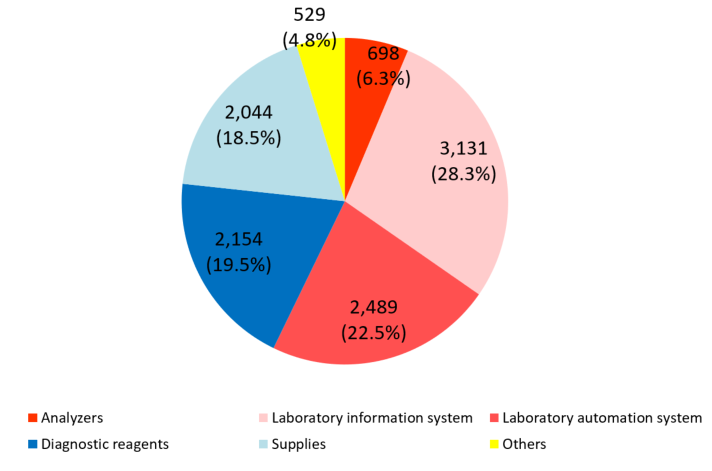

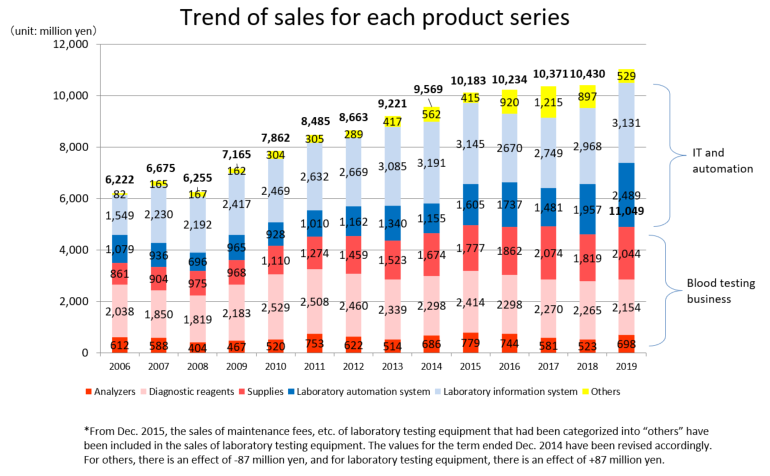

Product series | Results for FY Dec.19 | Ratio to total sales |

Clinical testing devices and systems | 6,320 | 57.2% |

Analyzers | 698 | 6.3% |

Laboratory information system | 3,131 | 28.4% |

Laboratory automation system | 2,489 | 22.5% |

Diagnostic reagents | 2,154 | 19.5% |

Supplies | 2,044 | 18.5% |

Others | 529 | 4.8% |

Total | 11,049 | 100.0% |

The red letters denote the “Blood testing business” (analyzers, diagnostic reagents, and supplies), while the blue letters denote the “IT and automation support business” (Laboratory Information System, Laboratory Automation System). The sales distribution ratio for the term ended December 2019 was 44.3% for the blood testing business, and 55.7% for the IT and automation support business.

1) Blood testing business

Outline

The company works on developing, manufacturing, and selling Analyzers for clinical tests such as “electrolyte tests” and “glucose tests,” reagents for clinical tests (for measuring the concentrations of electrolytes, blood sugar, etc.), and supplies (such as sensors installed in analyzer), and offers customer support.

Electrolyte analyzer | Glucose analyzer |

|

|

(Source: A&T’s website)

Commercial distribution

*Inside Japan

The company directly sells analyzers, reagents, and supplies to small and medium-sized hospitals via 8 branches nationwide. As of now, about 4,300 units of equipment are in operation.

*Outside Japan

The company sells analyzers as an OEM. It supplies electrolyte units, which are the specialty products of the company, to other Japanese manufacturers, including JEOL (6951, 1st section of TSE). The OEM clients combine the unit with large-size clinical chemistry analyzers and sell them. As an OEM, JEOL supplies products to Siemens, which is one of global enterprises handling large-size clinical chemistry analyzers.

Business model

Once Analyzers is newly installed, clinical reagents and supplies will be continuously delivered, and the maintenance service for the equipment will be offered.

Once adopted, it is rare for client hospitals to change manufacturers considering the continuity of test data and usability, and so it is difficult for new manufacturers to enter the market. 7 to 10 years later, upgraded models will replace them. This characterizes this business field.

Major enterprises in this field

Sysmex (6869, 1st section of TSE), Hitachi High-Technologies (8036, 1st section of TSE), JEOL (6951, 1st section of TSE), Fuji Film Wako Pure Chemical (unlisted), ARKRAY (unlisted)

2) IT and automation support business

Outline

In the case of blood tests, it is necessary to convey patient’s blood (specimen) sampled in a blood collection room to a clinical laboratory and manually set the specimen at testing equipment.

As several kinds of tests need to be conducted for many specimens at the same time, this work is extremely labor-intensive and inefficient, and the human error of taking a wrong specimen is difficult to avoid.

In these circumstances, A&T Corporation supports the streamlining of the testing process with the following 2 systems.

(Source: A&T’s website)

Laboratory Information System (LIS) | Software for a clinical laboratory, which receives requests for tests from medical doctors, sends a command for testing to Analyzers, and inputs test results in electronic medical charts, etc. accurately and swiftly. This also manages cost, etc. and serves as a core system of a laboratory. |

Laboratory Automation System (LAS) | The specimens delivered to a laboratory are automatically conveyed to Analyzers via a computer-controlled conveyor line, and then undergo measurement. Blood tests, which had been manually conducted, are fully automated, to streamline and speed up the testing process. |

It is expected that the installation of LAS will decrease the necessary number of workers from 7-8 to about 2, and the necessary time of testing from 90 min. to 30-40 min.

Through the introduction of LIS, it became possible to put together the data of test results, which had been printed out for each test item, and give feedback to medical doctors swiftly and accurately. In addition, the data mining function is helpful for reducing the number of times of abnormal value retesting and the duration of testing.

Commercial distribution

*Inside Japan

Targeting the laboratories of medium and large-sized hospitals, the sales division of A&T Corporation sells LIS in cooperation with hospital information system manufacturers, including Hitachi, IBM, and Fujitsu, and LAS in cooperation with large-size clinical chemistry and immunoassay analyzer manufacturers, including Hitachi, Toshiba, and JEOL, as comprehensive solutions *.

*For the details of comprehensive solutions, see the section “1-5 Characteristics and Strengths.”

*Outside Japan

Previously, the company has been selling LAS directly in Korea, China, etc., but in China it has started OEM supply. In the United States, OEM sales of blood aliquoting modules, which are the main components in LAS, are made to partner companies.

Business model

In addition to the maintenance service of LIS and LAS after their installation, the company can connect additional systems, customize the system, and so on for LIS, and can offer maintenance services, sell supplies, and so on for LAS. For both of the systems, stable sales can be expected.

Like Analyzers, clients are rarely motivated to shift to other manufacturer’s equipment, considering usability, data continuity, etc. The price range per transaction is 10 to 50 million yen for LIS, and 10 to 100 million yen for LAS.

Major enterprises in this field

LIS: Sysmex CNA (subsidiary of Sysmex), local vendors, etc.

LAS: IDS (unlisted), Hitachi-Aloka (unlisted), Siemens, etc.

2.Development systems

The company established development groups by product types in order to apply elementary technologies cultivated over many years to a wide range of product development. In addition, it places a chief technology officer for each field including electricity, machinery, and chemistry and promotes product development through management of a matrix organization structure.

90 staff members or more are employed at the headquarters and Shonan Office.

The research and development cost for the term ended December 2018 was 958 million yen. It will continue to actively promote research and development with a target sales of around 10%.

3.Production systems

There are two production sites: Shonan Factory, in Kanagawa Prefecture, for manufacturing some clinical reagents and supplies and Esashi Factory, in Iwate Prefecture, for producing equipment, Laboratory Automation System (LAS) and some clinical reagents.

The company manufactures high-quality, safe products with advanced equipment under rigorous management. In cooperation with the development section, the company is striving to improve quality and streamline operation.

In order to develop the foundation for expanding sales further, the company constructed a new building with a total floor area of 7,300 m2 at Esashi Factory by investing 1.7 billion yen in August 2017.The Company strengthens capabilities considerably through this construction.

4.Sales routes and methods

As mentioned above, A&T Corporation sells its products to client hospitals via 8 branches in Japan, by utilizing its capability of proposing comprehensive solutions.

Outside Japan, the company supplies products to overseas clients and dealers including Siemens through domestic OEM partners such as JEOL.

To expand its business scale by supplying products as an OEM like this is the basic strategy, and the company concentrates on the diversification of OEM clients.

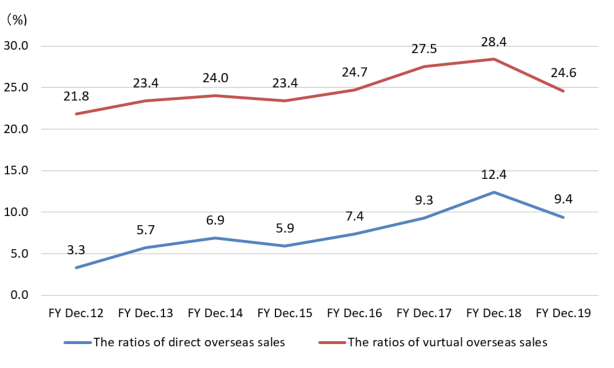

The direct overseas sales ratio that the company sells directly to overseas clients and dealers for the term ended December 2019 were 9.4.%.

But, as the ratio of virtual overseas sales, including the (estimated) overseas sales via domestic OEM clients, for the term ended Dec. 2015, Dec. 2016, Dec. 2017, and Dec. 2018 were 23.4%, 24.7%, 27.5%, 28.4% respectively, the ratio of overseas sales is in upward momentum.

Especially in the term ended Dec. 2018, sales to China soared to 780 million yen, more than doubled from 351 million yen in the previous fiscal year. In the first half of the term ended Dec. 2019, the performance was sluggish at 532 million yen (down 31.8% year on year) due to the changes in the Chinese financial environment, but the company will keep cultivating the Chinese market, with the aim of achieving a ratio of virtual overseas sales of over 50% in the medium-term.

(The ratio of overseas sales, unit: %)

| FY Dec.12 | FY Dec.13 | FY Dec.14 | FY Dec.15 | FY Dec.16 | FY Dec.17 | FY Dec.18 | FY Dec.19 |

Direct | 3.3 | 5.7 | 6.9 | 5.9 | 7.4 | 9.3 | 12.4 | 9.4 |

Virtual | 21.8 | 23.4 | 24.0 | 23.4 | 24.7 | 27.5 | 28.4 | 24.6 |

1-5 Characteristics and strengths

◎Capability of proposing comprehensive solutions

A&T Corporation handles products mainly for electrolyte and glucose tests, and does not handle large products for analyzing other tests. However, client hospitals need to install a variety of testing instruments in their clinical laboratories.

To meet their needs, the Laboratory Automation System (LAS) has an automatic conveyor line that is compatible with not only its own products, but also other manufacturers’ instruments.

There are few manufacturers that possess technologies for producing systems for connecting their own products and other manufacturers’ products freely and conveying them. Accordingly, the company occupies about 30% of the Japanese market.

The sales staff of the company not only delivers equipment, but also proposes a layout for the most efficient testing with 3D CAD or the like, while considering the area and shape of a laboratory.

All above, the company can offer optimal one-stop solutions for preparing necessary products in a laboratory, installing and operating equipment while proposing a layout. This is highly evaluated by client hospitals.

◎Advanced technologies in specific fields

A&T Corporation handles products mainly for “electrolyte tests” and “glucose tests.” Especially, its advanced technology for electrolyte analyzers can be verified by the fact that its products are supplied to JEOL, which is a leading manufacturer of measurement devices, including medical instruments, and Siemens, which is a large global company.

As mentioned in the section of the market environment, Japanese medical Analyzers is highly competent in the world, and A&T Corporation contributes to the competitiveness of Japanese products.

1-6 ROE analysis

| FY Dec.12 | FY Dec.13 | FY Dec.14 | FY Dec.15 | FY Dec.16 | FY Dec.17 | FY Dec.18 | FY Dec.19 |

ROE (%) | 12.2 | 10.7 | 9.5 | 15.7 | 10.9 | 10.4 | 7.4 | 9.3 |

Ratio of net income to sales [%] | 5.60 | 5.11 | 4.76 | 8.28 |

6.37 |

6.54 |

4.97 |

6.30 |

Total asset turnover ratio [times] | 1.02 | 0.98 | 1.00 | 1.04 |

1.03 |

0.92 |

0.84 |

0.90 |

Leverage [times] | 2.14 | 2.13 | 1.99 | 1.83 | 1.67 | 1.73 | 1.79 | 1.64 |

Since there was no longer an extraordinary loss, which was posted in the term ended Dec. 2018, the ROE in the term ended Dec. 2019 exceeded 8%, which is said to be a common goal for Japanese enterprises suggested by Ito Review, etc. For the term ending Dec. 2020, the ratio of net income to sales is estimated to be 6.8%.

2.Fiscal Year ended December 2019 Earnings Results

(1) Consolidated Business Results

| FY 12/ 18 | Ratio to sales | FY 12/ 19 | Ratio to sales | YoY | Compared with the initial forecasts |

Sales | 10,430 | 100.0% | 11,049 | 100.0% | +5.9% | -1.3% |

Gross profit | 4,446 | 42.6% | 4,735 | 42.9% | +6.5% | -0.7% |

SG&A | 3,671 | 35.2% | 3,777 | 34.2% | +2.9% | +0.5% |

Operating Income | 774 | 7.4% | 958 | 8.7% | +23.8% | -5.1% |

Ordinary Income | 768 | 7.4% | 943 | 8.5% | +22.7% | -5.7% |

Net Income | 518 | 5.0% | 695 | 6.3% | +34.3% | -3.4% |

*Unit: million yen

Sales and profit grew. Sales hit a record high.

Sales were 11,049 million yen, up 5.9% year on year. The sales of diagnostic reagents dropped, but the sales of original products, including clinical testing devices and systems and supplies, were healthy, and the sales in the first half hit a record high.

Operating income was 958 million yen, up 23.8% year on year. Recruitment costs, personnel costs, and R & D costs increased, but the augmentation of SG & A expenses was not significant.

Net Income was 695 million yen, up 34.3% year on year. The extraordinary loss posted in the previous term, including the cost for relocating equipment to the new building of Esashi Factory and the loss from cancellation of outsourcing, was not posted in the term ended Dec. 2019.

The ratios of direct and virtual overseas sales, on which the company puts importance for growth, were 9.4% and 24.6%, respectively.

The sales to China, which grew considerably in the previous term, were as sluggish as 532 million yen (780 million yen in the previous term), due to the changes in the Chinese financial environment and the inventory adjustment of Runda, which is an OEM client, in China. This affected the results.

(2) Sales of each product series

Product series | FY 12/18 | Composition Ratio | FY 12/ 19 | Composition Ratio | YoY | Compared with the initial forecasts |

Clinical Testing devices and Systems | 5,448 | 52.2% | 6,320 | 57.2% | +16.0% | +0.8% |

Analyzers | 523 | 5.0% | 698 | 6.3% | +33.6% | -5.7% |

Laboratory Information System (LIS) | 2,968 | 28.4% | 3,131 | 28.4% | +5.5% | +0.7% |

Laboratory Automation System (LAS) | 1,957 | 18.8% | 2,489 | 22.5% | +27.2% | +2.9% |

Diagnostic reagents | 2,265 | 21.7% | 2,154 | 19.5% | -4.9% | -6.3% |

Supplies | 1,819 | 17.5% | 2,044 | 18.5% | +12.4% | +5.9% |

Others | 897 | 8.6% | 529 | 4.8% | -41.0% | -24.4% |

Total | 10,430 | 100.0% | 11,049 | 100.0% | +5.9% | -1.3% |

*Unit: million yen.

Clinical Testing devices and Systems

The sales of analyzers rose, due to the growth of overseas sales in the electrolyte business, direct sales in the glucose business, and OEM sales in the coagulation business.

The sales of laboratory information system grew as transactions for new and renewal increased by release of new products. The high quality, swift response, etc. are highly evaluated.

The sales of laboratory automation system increased as the company made large-scale transactions in Japan and Korea, although sales were reduced by the changes in the Chinese financial environment, the inventory adjustment of Runda, which is an OEM client, in China, etc.

Diagnostic reagents

The sales to some OEM clients in the electrolyte business, the OEM sales in the immunity business, and direct sales in each business decreased.

Supplies

In the laboratory automation system business, the sales of supplies increased thanks to the rise in the sales volume of the managed pre-analysis module (MPAM+). In addition, the sales of the electrolyte business increased, as the sales of sensors to existing OEM clients increased.

Others

Following the basic policy for increasing the ratio of sales of original products for enhancing profitability, the sales of other manufacturers’ products dropped, and sales declined.

(3) Financial standing and cash flows

Main Balance Sheet

| End of December 2018 | End of December 2019 |

| End of December 2018 | End of December 2019 |

Current Assets | 8,272 | 7,663 | Current liabilities | 4,656 | 3,643 |

Cash | 1,051 | 1,304 | Payables | 1,536 | 805 |

Receivables | 5,354 | 4,286 | ST Interest Bearing Liabilities | 2,100 | 1,700 |

Inventories | 1,795 | 1,994 | Noncurrent liabilities | 776 | 473 |

Noncurrent Assets | 4,339 | 4,218 | LT Interest Bearing Liabilities | 750 | 450 |

Tangible Assets | 3,794 | 3,642 | Total Liabilities | 5,432 | 4,117 |

Intangible Assets | 38 | 36 | Net Assets | 7,179 | 7,764 |

Investment, Others | 505 | 539 | Total liabilities and net assets | 12,611 | 11,881 |

Total assets | 12,611 | 11,881 | Total Interest-bearing Liabilities | 2,850 | 2,150 |

|

|

| Capital Adequacy Ratio | 56.9% | 65.3% |

*Unit: million yen

Current assets dropped 609 million yen from the end of the previous term, due to the decline in trade receivable, etc. Noncurrent assets decreased 120 million yen from the end of the previous term. Total assets decreased 730 million yen from the end of the previous term to 11,881 million yen.

Total liabilities dropped 1,315 million yen from the end of the previous term to 4,117 million yen, due to the repayment of debts, etc.

Net assets grew 585 million yen from the end of the previous term to 7,764 million yen, due to the increase in retained earnings, etc.

As a result, equity ratio rose 8.4% from 56.9% at the end of the previous term to 65.3%.

Cash Flow

| FY 12/ 18 | FY 12/ 19 | Increase/decrease |

Operating Cash Flow | 217 | 1,221 | +1,004 |

Investing Cash Flow | -177 | -118 | +58 |

Free Cash Flow | 39 | 1,103 | +1,063 |

Financing Cash Flow | -145 | -850 | -705 |

Term End Cash and Equivalents | 1,051 | 1,304 | +252 |

*Unit: million yen

The surpluses of operating CF and free CF increased, due to the growth of quarterly net profit before taxes, etc. The deficit of financing CF augmented due to the repayment of debts. The cash position rose.

3.Fiscal Year ending December 2020 Earnings Forecasts

(1) Consolidated earnings forecasts

| FY 12/ 19 | Ratio to sales | FY 12/ 20 Est. | Ratio to sales | YoY |

Sales | 11,049 | 100.0% | 11,400 | 100.0% | +3.2% |

Gross profit | 4,735 | 42.9% | 4,950 | 43.4% | +4.5% |

SG&A | 3,777 | 34.2% | 3,930 | 34.5% | +4.0% |

Operating Income | 958 | 8.7% | 1,020 | 8.9% | +6.4% |

Ordinary Income | 943 | 8.5% | 1,000 | 8.8% | +6.0% |

Net Income | 695 | 6.3% | 780 | 6.8% | +12.1% |

*The forecasted values were provided by the company. Unit: million yen

Sales and profit are estimated to grow.

Sales are estimated to be 11.4 billion yen, up 3.2% year on year. In the IT and automation support business, the company will make large-scale transactions in Japan and expand the electrolyte OEM business. The business in China remains stagnant, but the company will keep concentrating on it. The sales of original products, too, will increase. Gross profit is projected to rise 0.5% year on year, due to the settling-down in man-hours for new products of laboratory information system, the decrease of purchased products, etc.

Operating income is forecasted to rise 6.4% year on year to 1,020 million yen. Due to the recruitment of personnel for sustainable growth and the development of new products for laboratory automation system, etc., SG&A expenses are estimated to increase 4.0% year on year, but it will be offset by the rise in gross profit.

The dividend is estimated to be 24 yen/share, unchanged from the previous term. The estimated payout ratio is 19.3%.

(2) Sales for each product series

Product series | FY Dec. 19 | Composition rate | FY Dec. 20 Est. | Composition rate | YoY |

Clinical Testing devices and Systems | 6,320 | 57.2% | 6,580 | 57.8% | +4.1% |

Analyzers | 698 | 6.3% | 760 | 6.7% | +8.8% |

Laboratory Information System (LIS) | 3,131 | 28.4% | 3,540 | 31.1% | +13.1% |

Laboratory Automation System (LAS) | 2,489 | 22.5% | 2,280 | 20.0% | -8.4% |

Diagnostic reagents | 2,154 | 19.5% | 2,160 | 18.9% | +0.2% |

Supplies | 2,044 | 18.5% | 2,160 | 18.9% | +5.6% |

Others | 529 | 4.8% | 500 | 4.4% | -5.6% |

Total | 11,049 | 100.0% | 11,400 | 100.0% | +3.2% |

*Unit: million yen

*analyzers and diagnostic reagents

The sales to existing OEM clients in the electrolyte business are estimated to be on a plateau, while the sales to new OEM clients are projected to increase slightly.

*laboratory information system

The effects of sale of new products will be continued, and the demand for new products and update will be strong.

*laboratory automation system

While continuing the OEM sale to Shanghai Runda Medical Technology Co.,Ltd. in China, the company will plan the OEM sale to new Chinese manufacturers. Sales are estimated to decline, due to the decrease of large-scale transactions in Japan and South Korea, which were made in the previous term.

The company is developing a modified version of the managed pre-analysis module (MPAM+) for China, and plans to release it by the end of 2020.

*Supplies

The OEM sale of electrolyte sensors will increase, and the consumption of supplies will increase because of the increase of laboratory automation systems in operation.

*Others

The sales of purchased products increased, following large-scale transactions for laboratory information system and laboratory automation system.

4.Medium-Term Management Plan (FY Dec. 2018 to FY Dec. 2020) Progress

(1) Recognition of the business environment

There is no significant change from the time when the current medium-term management plan was formulated.

<Business environment analysis>

| Blood testing business | IT and automation support business |

Business environment | *Due to the change in the sales environment, the sales to some OEM clients may decline. *The domestic testing markets for electrolytes, glucose, etc. will reach a plateau. *The growth of the overseas market, especially China, is remarkable. | *The scale and competition of the domestic market have not changed significantly, and are on a plateau. Overseas demand is high. *The amount per order is large, but the period until the next update is as long as 5 to 10 years. *Once a product is installed, it tends to be adopted again at the time of the next update (relatively easy to defend). On the other hand, it is relatively difficult to reel in customers from competitors (difficult to attack). *Recently, the overseas demand for LAS has been strong. |

*The domestic test markets for electrolytes, glucose, etc. have reached a plateau, but in September 2018, the company signed a contract for business alliance in the field of the clinical test field with ARKRAY, Inc. (Kyoto City), which is a pioneer in diabetes testing, to pursue new business chances.

*While the Japanese market is estimated to grow by about 1%, the overseas market is projected to grow by 5-6%.

(2) Progress toward important objectives

1 | To deal with the fact that sales are concentrated on specific OEM clients |

2 | To compensate for the decline in sales to some OEM clients, and find new clients |

3 | To increase gross profit (increasing the sales of original products) |

4 | To reduce the cost for securing product quality |

5 | To put the business in the Chinese market, which is growing rapidly, on track as soon as possible |

6 | To reform ways of working and train personnel |

(3) Progress of Basic Policy

Basic Policy | Situation |

To increase the ratio of sales of original products, and improve profitability | The sales of original products are increasing as planned. For the term ended Dec. 2019, sales grew about 970 million yen year on year. |

To enhance business operation in China, and boost the ratio of overseas sales | The sales of LAS to China were sluggish, due to the change in the Chinese financial environment. The ratio of overseas sales was 9.4%, down 3 points from the term ended Dec. 2018. |

To cement the cooperation between development and manufacturing sections, and establish systems for developing and producing high-quality products stably | The company reduced the ratio of defective products for main sensors. |

To reform ways of working and train personnel thoroughly | The company implements a company-wide training program. |

(4) Numerical goals and progress status

| FY 12/ 18 | FY 12/ 19 | FY 12/ 20 | |||

Plan | Act. | Plan | Act. | Plan | Estimates | |

Sales | 10,500 | 10,430 | 11,200 | 11,049 | 12,000 | 11,400 |

Ordinary Income | 800 | 768 | 1,000 | 943 | 1,250 | 1,000 |

Ordinary margin to sales | 7.6% | 7.4% | 8.9% | 8.5% | 10.4% | 8.8% |

Direct sales rate in overseas | - | 12.2% | - | 9.4% | 10 % or more | Over 10% |

*Unit: million yen

*FY December 2018

Although the number of clinical testing devices and systems increased, OEM sales of sensors remained sluggish due to the response to overseas regulations and holding-off buying from price revision. Ordinary income did not reach the target due to a decrease in sales of sensors and initial costs for new products exceeding the plan. However, the ratio of overseas sales exceeded 10% for the first time with strong Chinese OEMs sales for the laboratory automation system. As a result, it reached the target a year ahead of the plan.

*FY December 2019

Following the basic policy, the sales of original products increased, but could not make up for the decline in sales in China and the sales to some OEM clients. Accordingly, overseas sales were sluggish. The company failed to achieve the target ordinary income, due to the increase of recruitment mid-career engineers and the augmentation of personnel expenses.

*FY December 2020

This medium-term management plan is the first disclosed one for the company, so all staff are aware of the responsibility.

There is no significant change in the recognition of the business environment. The company plans to steadily carry out the basic policy and intensive measures , pursue results exceeding earnings forecast value, and aim to increase sales and profit further.

The factors in the gap between planned figures and estimates for this term and measures for them are as follows.

| Main factor |

| Measures |

Sales ‐600 million yen | Laboratory automation system for China <Below the planned> | ☆

☆ ☆ | To release a new product for China within 2020, to form a product lineup that can meet needs → To release a successor to the managed pre-analysis module (MPAM+) (on a full-scale basis in 2021) To plan the OEM sale to new Chinese manufacturers To enhance local activities in China → To plan the incorporation of the office of expatriate employees in China |

OEM sales of electrolytes <Sales to some OEM clients fell below the planned> | ☆

☆ | To release modified models of electrolyte sensors → To supply high-quality products to existing OEM clients, so that the clients will keep using the products To increase OEM clients (a few companies) → To improve the quality and price competitiveness of mainly sensors, to expand the range of customers | |

Ordinary income -250 million yen | The above-mentioned sales dropped. <Especially, the sales of the laboratory automation system decreased> | ☆ | To implement the above-mentioned measure for sales growth, to increase ordinary income → To release a successor to MPAM+ and new models of electrolyte sensors → To reduce manufacturing costs and increase the ratio of original products, to enhance profitability |

Augmentation of R&D <Acceleration of development of a successor to MPAM+> | ☆

☆ | To transfer the authority of management of development projects, and enhance concentration and selection → To accelerate product development and release products at optimal timing To develop attractive products utilizing the characteristics of the company in the IT and automation business → To develop both the laboratory information system and the laboratory automation system, and develop a unique development structure while there are few companies that manufacture products in house | |

Ordinary income rate -1.4% | Drop in sales and augmentation of costs of sales and SGA | ☆ | To implement the above-mentioned measures, and aim to achieve an ordinary income rate of 10% or higher |

Ratio of overseas sales | Recovery of sales to some clients in China | ☆ | The sales of the laboratory automation system in China fell below the estimate, but the company aims to achieve a ratio of overseas sales of 10% by maintaining the cooperation with OEM clients and increasing OEM sales of electrolytes and overseas sales. |

<Current situation of the laboratory automation system (LAS) business and future activities>

The market scale of clinical testing systems is 10 billion yen in Japan, and as huge as 770 billion yen outside Japan. Especially, in the Chinese market, it is estimated that the scale will grow at an annual rate of 20%.

In the Chinese market, the company took a lead with “the close strategy,” which is to produce equipment, feeding systems, and reagents supplied to laboratories by major companies in Europe and the U.S., such as Beckman Coulter, Roche, and Abbott, all in house.

As the market is rapidly growing, many demand a system with a higher degree of freedom than the conventional close strategy, and the “open strategy,” in which not only equipment produced in house, but also equipment produced by other companies are adopted, is recognized increasingly.

In this situation, A&T takes the “open strategy” while utilizing the strength of offering optimal solutions, including layout, installation, and operation, on a one-stop basis, to meet a broad range of needs from hospitals and laboratories. In 2018, the company formed an alliance with Runda in China, and started OEM sales by utilizing its customer base and service-offering system.

At first, considering the efficiency, the company focused on the sale of packages composed of devices of some manufacturers, but as the lineup increased while the company tried to meet customer needs, the company decided to shift from the full-package strategy to the semi-package strategy in 2019, in order to satisfy needs surely and expand the business.

However, there are some problems of the change in the financial environment caused by the tightening of the Chinese financial market, the time-consuming diffusion of consultation-based sale in China, the necessity to educate sales staff and engineers for a certain period of time, and the necessity to respond to excessive requests for reduction of specs in China.

In 2020, the company will release a new product for China (a successor to the managed pre-analysis module (MPAM+)) and seek new OEM clients. In China, too, the recognition of feeding is improving, and candidate partners are reportedly increasing.

In order to achieve a ratio of direct overseas sales of 10% or higher, which is the medium-term goal, it is indispensable to expand the business in China. It plans to actively proceed with the cultivation of the Chinese market.

<Current situation of the alliance with Arkray Inc. and future activities>

The company carried out the following activities in 2019 with Arkray Inc. (Kyoto-shi), which is a pioneer in diabetes testing and with which the company formed an alliance in September 2018.

*Cooperation in the field of glucose testing

By utilizing the strengths of A&T, which operates the IT and automation support business for laboratories and has delivered a lot of systems to large-scale hospitals, and Arkray, which has broad sales networks inside and outside Japan as a pioneer in diabetes testing, they released a compact feeding device that is connected the glucose analyzer of A&T and the glycohemoglobin analyzer of Arkray in February 2019.

*Linkage of the laboratory information system

Concrete systems are being discussed at the meeting of top leaders.

*Supply of products and overseas sales in a broad range of fields

The company started the collaboration for coagulation analyzers for animals.

The company expects that these activities will contribute to revenue from the term ending Dec. 2020.

5.Conclusions

This term, which is the final fiscal year of the medium-term management plan, it is unfortunately difficult to attain the goals. The previous report mentions “An important step is to achieve an ordinary income rate of 8.9% in the term ended Dec. 2019, for attaining the target ordinary income rate of 10% or higher,” but the ordinary income rate was 8.5%. However, it seems that the company is steadily increasing the ratio of original products for enhancing profitability, and the base is steadily growing from the half-year viewpoint.

On the other hand, through the spread of the novel coronavirus, the importance of swiftly delivering examination data to the medical front has been recognized more deeply. Then, the company expects that the needs for examination systems will grow further in the medium term. Although it is difficult to predict how much the spread of the novel coronavirus will affect the business in China, we would like to hope that the business in China, which was stagnant in the previous term, will recover and progress toward the goal in the next medium-term plan.

<Reference: Regarding Corporate Governance >

Organization type and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 11 directors, including 2 external ones |

Corporate Governance Report

Last update date: March 29 2019

<Basic policy>

As a top priority, our company aims to secure the effectiveness of corporate governance and actualize fair business administration by putting importance on the transparency, fairness, and speed of decision making and business execution. In addition, we adopted the system of audit and supervisory committee in order to separate the supervision and execution of business administration, actualize highly transparent management, and streamline the decision-making process of the board of directors.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company fully follows the 5 items of basic principles of the corporate governance code.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on A&T Corporation (6722) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/